Exhibit 99.1

Public limited company with a Board of Directors with share capital of 32,764,700.60 euros

Registered office: 14 Avenue de l'Opéra – 75001 PARIS

Paris Commercial Register (RCS) 492 002 225

HALF-YEAR FINANCIAL REPORT

AS OF JUNE 30, 2022

Half-year financial report as of June 30, 2022

CONTENTS

| 1. | Statement by the person responsible for the half-year financial report | 4 | |

| 1.1 | Person responsible for the half-year financial report | 4 | |

| 1.2 | Statement by the person responsible | 4 | |

| 2. | Activity report as of June 30, 2022 | 5 | |

| 2.1 | Summary presentation of the financial statements | 5 | |

| 2.2 | Company activity and results | 6 | |

| 2.3 | Situation in Ukraine and its impact on the company’s business | 9 | |

| 2.4 | Subsequent events | 10 | |

| 2.5 | Evolution and outlook | 11 | |

| 2.6 | Risk factors and related party transactions | 11 | |

| 3. | UNAUDITED INTERIM CONDENSED consolidated financial statements under IFRS for the six-month period ended June 30, 2022 | 12 | |

| Statement of consolidated financial position | 12 | ||

| Statement of consolidated operations | 13 | ||

| Statement of consolidated comprehensive loss | 14 | ||

| Statement of changes in consolidated shareholders’ equity | 15 | ||

| Statement of consolidated cash flows | 16 | ||

| Notes to the unaudited interim condensed consolidated financial statements | 17 | ||

| 4. | Statutory Auditors' limited review report on the half-year condensed consolidated financial statements prepared in accordance with IFRS standards as adopted in the European Union | 49 | |

Page 2 of 49

Half-year financial report as of June 30, 2022

GENERAL NOTES

Definitions

In this half-year financial report, and unless otherwise indicated:

| • | The terms “Company” or “Biophytis” refer to Biophytis SA whose registered office is located at 14 Avenue de l'Opéra – 75001 PARIS, France, registered with the Paris Trade and Companies Registry under number 492 002 225 and its subsidiaries Instituto Biophytis do Brasil (Brazil) and Biophytis Inc (United States); |

| • | “Financial Report” means this half-year financial report as of June 30, 2022. |

About Biophytis

Biophytis SA is a clinical-stage biotechnology company focused on the development of therapeutics that slow the degenerative processes associated with aging and improve functional outcomes for patients suffering from age-related diseases, including severe respiratory failure in patients suffering from COVID-19.

Sarconeos (BIO101), our leading drug candidate, is a small molecule, administered orally, under development for the treatment of sarcopenia, as part of a Phase 2 clinical trial in the United States and Europe (SARA-INT). It is also being investigated in a two-part Phase 2-3 clinical trial (COVA) for the treatment of severe respiratory symptoms of COVID-19 in Europe, Latin America and the United States. A pediatric formulation of Sarconeos (BIO101) is being developed for the treatment of Duchenne muscular dystrophy.

The Company is based in Paris, France, and Cambridge, Massachusetts. The Company’s ordinary shares are listed on Euronext Growth Paris (Ticker: ALBPS - ISIN: FR0012816825) and its ADSs (American Depositary Shares) are listed on the Nasdaq (Ticker BPTS - ISIN: US09076G1040).

For more information: www.biophytis.com

Page 3 of 49

Half-year financial report as of June 30, 2022

1. Statement by the person responsible for the half-year financial report

1.1 Person responsible for the half-year financial report

Stanislas Veillet, Chairman and Chief Executive Officer

1.2 Statement by the person responsible

(Art. 222-3 - 4° of the General Regulations of the French financial markets authority (Autorité des marchés financiers – AMF))

“I certify, to the best of my knowledge, that the condensed financial statements for the past half-year have been prepared in accordance with applicable accounting standards and give a true and fair view of the assets, financial position and results of the Company and of all the companies included in the consolidation, and that this Financial Report presents an accurate picture of the significant events that occurred during the first six months of the financial year, their impact on the financial statements, the main transactions between related parties and that it describes the main risks and uncertainties for the remaining six months of the financial year”.

Paris, January 30, 2022

Stanislas Veillet, Chairman and Chief Executive Officer

Page 4 of 49

Half-year financial report as of June 30, 2022

2. Activity report as of June 30, 2022

2.1 Summary presentation of the financial statements

Statement of consolidated financial position

| (Amounts in thousands of euros) | December 31, 2021 (as restated) (1) | June 30, 2022 | ||||||

| NON-CURRENT ASSETS | 3,506 | 3,552 | ||||||

| Patents and software | 2,757 | 2,660 | ||||||

| Property, plant and equipment | 563 | 717 | ||||||

| Other non-current financial assets | 186 | 175 | ||||||

| CURRENT ASSETS | 31,366 | 30,334 | ||||||

| Other receivables | 6,536 | 10,181 | ||||||

| Other current financial assets | 904 | 407 | ||||||

| Cash and cash equivalents | 23,926 | 19,745 | ||||||

| TOTAL ASSETS | 34,872 | 33,886 | ||||||

| EQUITY | 5,803 | 2,961 | ||||||

| Share capital | 27,191 | 32,765 | ||||||

| Share premium | 27,781 | 8,410 | ||||||

| Other reserves | (124 | ) | (81 | ) | ||||

| Retained earnings | (49,013 | ) | (38,101 | ) | ||||

| Non-controlling interests | (32 | ) | (32 | ) | ||||

| NON-CURRENT LIABILITIES | 6,259 | 5,210 | ||||||

| Employee benefit obligations | 205 | 195 | ||||||

| Non-current financial liabilities | 5,518 | 5,015 | ||||||

| Non-current derivative financial instruments | 536 | 0 | ||||||

| CURRENT LIABILITIES | 22,810 | 25,716 | ||||||

| Current financial liabilities | 12,037 | 13,913 | ||||||

| Provisions | - | 75 | ||||||

| Trade payables | 7,606 | 10,089 | ||||||

| Accrued taxes and employee benefits payable | 1,998 | 1,288 | ||||||

| Current derivative financial instruments | 788 | 62 | ||||||

| Other creditors and miscellaneous liabilities | 381 | 289 | ||||||

| TOTAL EQUITY AND LIABILITIES | 34,872 | 33,886 | ||||||

(1) Refer to Note 2.7 “Restatement of Previously Issued Financial Statements” of the notes to the unaudited interim condensed financial statements for the six month period ended June 30, 2022 in part 3.

Page 5 of 49

Half-year financial report as of June 30, 2022

Statement of consolidated operations and comprehensive loss

| (Amounts in thousands of euros) | First half 2021 | First half 2022 | ||||||

| Revenue | - | - | ||||||

| Cost of sales | - | - | ||||||

| Gross margin | - | - | ||||||

| Research and development expenses, net | (7,594 | ) | (6,867 | ) | ||||

| General and administrative expenses | (2,919 | ) | (5,053 | ) | ||||

| Operating loss | (10,513 | ) | (11,920 | ) | ||||

| Net financial expense | (2,732 | ) | (478 | ) | ||||

| Income tax benefit (expense) | - | - | ||||||

| Net loss for the period | (13,245 | ) | (12,398 | ) | ||||

| Remeasurements of the defined benefit liability (asset) | 7 | 40 | ||||||

| Foreign currency translation adjustment | 3 | 46 | ||||||

| Other compehensive income | 10 | 86 | ||||||

| Total comprehensive loss for the period | (13,235 | ) | (12,312 | ) | ||||

| Total comprehensive loss for the period - attribuable to owners of the parent | (13,235 | ) | (12,312 | ) | ||||

Statement of consolidated cash flows

| (Amounts in thousands of euros) | First half 2021 | First half 2022 | ||||||

| Net cash (used in) provided by: | ||||||||

| Operating activities | (13,492 | ) | (10,261 | ) | ||||

| Investing activities | 12,474 | (10 | ) | |||||

| Financing activities | 18,156 | 6,032 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | 2 | 58 | ||||||

| Net increase (decrease) in cash and cash equivalents | 17,140 | (4,181 | ) | |||||

2.2 Company activity and results

2.2.1 Activity

First-half 2022 saw the continuation of the development strategy pursued by the Company over several years.

| A) | In operational terms, the Company continued to develop its main clinical programs while strengthening its pre-clinical assets: |

Development of Sarconeos (BIO101) for Sarcopenia – SARA program. Following the completion of the Phase 2b SARA-INT study in 2021, the Company has been working with experts and regulatory authorities to design Phase 3. Several meetings were held with these experts and the European (EMA) and US (FDA) regulatory authorities in the first half of the year, in relation to the design of the Phase 3 study, an overview of which was presented at the SCWD conference in June 2022.

Development of Sarconeos (BIO101) for the prevention of respiratory deterioration in COVID-19 patients – COVA program. The Company announced in early April 2022 that, in light of the evolving epidemic, it was halting patient enrollment in its Phase 2-3 study after the enrollment of the 237th patient and would work with CROs to report the study's results in the third quarter of 2022.

Page 6 of 49

Half-year financial report as of June 30, 2022

In June 2022, the Company announced that it was presenting new pre-clinical efficacy data for its product Sarconeos (BIO101) in SMA (Spinal Muscular Atrophy) at the SMA Cure 2022 conference in Anaheim, California, USA, from June 16 to 19, 2022. This strengthens the pre-clinical data available for Sarconeos (BIO101) as a treatment for orphan neuromuscular disorders.

| B) | Financially, the first half of the year was marked by the drawdown of two 4 million euros tranches of ORNANE bonds each under the new 32 million euros agreement signed with Atlas in 2021. |

2.2.2 Governance

The Combined General Meeting of Shareholders of the Company was unable to validly deliberate due to the lack of a quorum on June 3, 2022. The Combined General Meeting was held on the second call on June 21, 2022.

The shareholders approved all the resolutions presented by the Board of Directors to the Combined Shareholders' Meeting, and in particular those ratifying the delegations of powers to the Board of Directors to decide on the issue of shares and/or securities.

2.2.3 Operating expenses

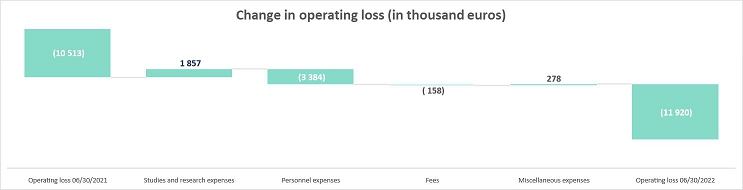

The Company’s operating loss was -11,920 thousand euros as of June 30, 2022 compared to -10,513 thousand euros as of June 30, 2021.

This change is mainly due to an increase of the personnel expenses for an amount of 3,384 thousand euros offset by a decrease of the studies and research expenses.

Page 7 of 49

Half-year financial report as of June 30, 2022

2.2.4 Net financial expense

| (Amounts in thousands of euros) | June 30, 2021 | June 30, 2022 | ||||||

| Interest and amortized cost of bonds (1) | (252 | ) | (1,024 | ) | ||||

| Changes in fair value of convertible bonds (1) | (691 | ) | 1,028 | |||||

| Negma financial indemnity | (187 | ) | - | |||||

| Provision related to Negma litigation | (1,508 | ) | (75 | ) | ||||

| Financial income related to the return of penalties by Negma | 20 | - | ||||||

| Other financial expenses | (80 | ) | (33 | ) | ||||

| Transaction costs related to the issuance of convertible bonds | (38 | ) | (380 | ) | ||||

| Other financial income | 3 | (14 | ) | |||||

| Foreign exchange gains (losses) | 1 | - | ||||||

| Total net financial expense | (2,732 | ) | (478 | ) | ||||

(1) see Note 12.2 “Bonds” of Notes to the consolidated half-year financial statements for the period ended June 30, 2022 in part 3.

The net financial expense amounted to -478 thousand euros as of June 30, 2022, compared to -2,732 thousand euros as of June 30, 2021. This change is mainly due to the incomes related to the changes in fair value of convertible bonds. This is partially offset by an increase of the financial interests.

Page 8 of 49

Half-year financial report as of June 30, 2022

2.2.5 Cash and liquid assets

The Company’s cash and cash equivalents amounted to 19,7 million euros as of June 30, 2022, compared to 23,9 million euros as of December 31, 2021. This change is mainly due to an improvement in the working capital requirement and the drawdown of the first two tranches of the ORNANE financing line set up with Atlas for 4 million euros in April 2022 and 4 million euros in June 2022.

| Selected items of the condensed consolidated half-year financial statements | ||||||||

| (Amounts in thousands of euros) | First half 2021 | First half 2022 | ||||||

| Cash flows (used in) from operating activities | (13,492 | ) | (10,261 | ) | ||||

| Operating cash flows before change in working capital requirements | (9,449 | ) | (8,296 | ) | ||||

| (-) Change in working capital requirements (net of depreciation of trade receivables and inventories) | 4,043 | (1,965 | ) | |||||

| Cash flows (used in) from investing activities | 12,474 | (10 | ) | |||||

| Acquisition of intangible assets and property, plant and equipment | (29 | ) | (22 | ) | ||||

| Interest on investment accounts | 3 | - | ||||||

| Sale of term deposit classified as other non-current financial assets | 12,500 | 12 | ||||||

| Cash flows (used in) from financing activities | 18,155 | 6,032 | ||||||

| Proceeds from share capital increases, net of bond conversions | 16,584 | - | ||||||

| Costs paid in relation to equity transactions | (2,253 | ) | - | |||||

| Negma indemnities paid | - | - | ||||||

| Negma compensation received (net) | (1,077 | ) | - | |||||

| Subscription of warrants (BSA) | - | - | ||||||

| Exercise of warrants (BSA) & founders’ warrants (BSPCE) | 738 | 7 | ||||||

| Sale of term deposit classified as other non-current financial assets | - | 344 | ||||||

| Reimbursement of prefinanced CIR receivables, net of guarantee deposit | - | - | ||||||

| Proceeds from conditional advances, net of repayments | 400 | 4 | ||||||

| Repayment of repayable advances | (136 | ) | (149 | ) | ||||

| Proceeds from subsidies | 153 | |||||||

| Repayment of borrowings | - | (1,259 | ) | |||||

| Issue of non-convertible bonds, net of repayments | 4,089 | 8,000 | ||||||

| financial interest paid | (190 | ) | (687 | ) | ||||

| Cost incurred in relation to the issuance of convertible and non-convertible bonds | - | (380 | ) | |||||

| Net effect of exchange rate changes on cash and cash equivalents | 2 | 58 | ||||||

| Increase (decrease) in cash | 17,140 | (4,181 | ) | |||||

2.3 Situation in Ukraine and its impact on the company’s business

As of February 24, 2022, Russia significantly intensified its military operations in Ukraine. In response, the European Union, the United States, and certain other countries have imposed significant sanctions and export controls on Russia, Belarus, and certain individuals and entities linked to Russian or Belarusian political, commercial, and financial organizations, and the European Union, the United States, and some other countries could impose additional sanctions, trade restrictions, and other retaliatory measures if the conflict continues or escalates.

Page 9 of 49

Half-year financial report as of June 30, 2022

During the first half of 2022, the situation in Ukraine did not have a significant impact on the Company's operations.

2.4 Subsequent events

COVA study results

On September 7, 2022, the company published the very promising results of the Phase 2-3 study of the COVA program to treat COVID-19-related respiratory failure. In the primary analysis, Sarconeos (BIO101) was shown to reduce the risk of respiratory failure or early death at 28 days (primary endpoint) by 39% compared to the placebo (15.8% versus 26.0%, adjusted difference of 11.8% in favor of treatment, p=0.07). Sarconeos (BIO101) reduced both the proportion of patients with respiratory failure (12.7% versus 21.5%) and early death (0.8% versus 2.8%). Sarconeos (BIO101) also significantly delayed (p=0.03) adverse progression to respiratory failure or early death over a maximum treatment period of 28 days.

ORNANE conversions - ATLAS contracts

Since June 30, 2022, the Company has converted 4 convertible bonds under Tranche 8 of the ATLAS 2020 Contract, the totality of the 160 convertible bonds of the Tranche 1 and 12 convertible bonds of the Tranche 2, both related to the ATLAS 2021 Contract, for a total amount of 4.7 million euros (100 thousand of euros for Tranche 8, 4 million euros for Tranche 1, and 600 thousand of euros for Tranche 2). The operations gave rise to the creation of 65,341,520 new Company shares (1,331,948 shares for Tranche 8, 57,506,246 shares for Tranche 1 and 13,721,104 shares for Tranche 2).

The Company has signed on October 20, 2022, a notification of exercise of Tranche for 160 new convertible bonds with a principal amount equal to 25,000€ in two instalments :

| • | first installment for 80 convertible bonds of tranche 3 with a principal amount equal to € 25,000 and received on November 10, 2022; and |

| • | second installment for 80 convertible bonds of tranche 3 with a principal amount equal to € 25,000 and received on January 11, 2023. |

Negma Group Ltd litigation

The Paris Court of Appeal has:

- confirmed the judgment of the Paris Commercial Court of March 16, 2021 (The Company has already executed in 2021 the entire judment);

- ordered Biophytis to pay Negma 75,000 euros under article 700 of the Code of Procedure civil as well as costs.

Page 10 of 49

Half-year financial report as of June 30, 2022

2.5 Evolution and outlook

Sarconeos (BIO101)

Given the progress of its clinical programs for its drug candidate, Sarconeos (BIO101), Biophytis intends to pursue the following activities:

Sarcopenia (SARA program)

The Company intends to finalize the design of the Phase 3 clinical trial and obtain the necessary approvals from the European and American regulatory authorities in the first half of 2023 in order to be able to initiate this trial. Given the size of the study and the potential market, Biophytis intends to conduct this Phase 3 study in partnership with pharmaceutical companies, either as part of a co-development project or as part of a transfer of commercial exploitation rights.

Severe respiratory failure related to COVID-19 (COVA program)

Equipped with the results of the Phase 2-3 trial, Biophytis can now finalize the analysis of the data. The next step is to present the results in the coming months to the regulatory agencies, health authorities and Biophytis' partners, particularly in Europe, the United States and Brazil, to determine under what conditions the Company can pursue the development of Sarconeos (BIO101) for COVID-19. At the same time, it is considering the possibility of amending and continuing the Early Access Program (EAP) authorized in Brazil and expanding it to other territories.

Duchenne muscular dystrophy (MYODA program)

Following IND (Investigational New Drug) Application approval from the FDA and clearance from the Belgian authorities, the study, which had been delayed due to the COVID-19 pandemic, has been resumed. Biophytis is proceeding with preparations for the launch of the MYODA Phase 1-2 study of Sarconeos (BIO101) for Duchenne muscular dystrophy (DMD), with the objective of enrolling the first patient in this study in the first half of 2023.

MACA program

The Company is continuing its pre-clinical development work on Macuneos (BIO201) and its backup, to develop its drug candidate for dry AMD. Depending on the results and available funding, the Phase 1 clinical trial for this indication could begin in 2023.

2.6 Risk factors and related party transactions

2.6.1 Risk factors

The risk factors are of those presented in the 2021 Annual Financial Report in Appendix 2 “Risks and uncertainties” to faced by the Company”.

2.6.2 Transactions between related parties

Transactions with related parties are as those presented in the 2021 Annual Financial Report in Note 20 “Related parties” of section 3: “Consolidated financial statements prepared in accordance with IFRS as of and for the year ended December 31, 2021” and in Note 19 “Related parties” of section 4: “Annual financial statements of BIOPHYTIS SA for the financial year ended December 31, 2021”.

Page 11 of 49

Half-year financial report as of June 30, 2022

| 3. | UNAUDITED INTERIM CONDENSED consolidated financial statements under IFRS for the six-month period ended June 30, 2022 |

Statement of consolidated financial position

| AS OF | ||||||||||||

| (amounts in thousands of euros) | NOTES | DECEMBER 31, 2021 (as restated) (1) | JUNE 30, 2022 | |||||||||

| ASSETS | ||||||||||||

| Patents and software | 3 | 2,757 | 2,660 | |||||||||

| Property, plant and equipment | 4 | 563 | 717 | |||||||||

| Other non-current financial assets | 5, 9 | 186 | 175 | |||||||||

| Total non-current assets | 3,506 | 3,552 | ||||||||||

| Other receivables | 7, 9 | 6,536 | 10,181 | |||||||||

| Other current financial assets | 6, 9 | 904 | 407 | |||||||||

| Cash and cash equivalents | 8, 9 | 23,926 | 19,745 | |||||||||

| Total current assets | 31,366 | 30,334 | ||||||||||

| TOTAL ASSETS | 34,872 | 33,886 | ||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||||||

| Shareholders' equity | ||||||||||||

| Share capital | 10 | 27,191 | 32,765 | |||||||||

| Premiums related to the share capital | 27,781 | 8,410 | ||||||||||

| Treasury shares | (51 | ) | (54 | ) | ||||||||

| Foreign currency translation adjustment | (73 | ) | (27 | ) | ||||||||

| Retained earnings - attributable to owners of the parent | (17,851 | ) | (25,704 | ) | ||||||||

| Net loss - attributable to owners of the parent | (31,163 | ) | (12,398 | ) | ||||||||

| Shareholders' equity - attributable to owners of the parent | 5,835 | 2,993 | ||||||||||

| Non-controlling interests | (32 | ) | (32 | ) | ||||||||

| Total shareholders' equity | 5,803 | 2,961 | ||||||||||

| Liabilities | ||||||||||||

| Employee benefit obligations | 13 | 205 | 195 | |||||||||

| Non-current financial liabilities | 9, 12 | 5,743 | 5,015 | |||||||||

| Non-current derivative financial instruments | 12 | 412 | 0 | |||||||||

| Total non-current liabilities | 6,361 | 5,210 | ||||||||||

| Current financial liabilities | 9, 12 | 12,037 | 13,913 | |||||||||

| Provisions | - | 75 | ||||||||||

| Trade payables | 9, 14.1 | 7,606 | 10,089 | |||||||||

| Accrued taxes and employee benefits payable | 14.2 | 1,998 | 1,288 | |||||||||

| Current derivative financial instruments | 788 | 62 | ||||||||||

| Other creditors and miscellaneous liabilities | 14.3 | 381 | 289 | |||||||||

| Total current liabilities | 22,810 | 25,716 | ||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | 34,872 | 33,886 | ||||||||||

(1) Refer to note 2.7 “Restatement of Previously Issued Financial Statements”

Page 12 of 49

Half-year financial report as of June 30, 2022

Statement of consolidated operations

FOR THE SIX-MONTH PERIOD ENDED JUNE 30, | ||||||||||||

| (amounts in thousands of euros, except share and per share data) | NOTES | 2021 | 2022 | |||||||||

| Revenue | - | - | ||||||||||

| Cost of sales | - | - | ||||||||||

| Gross margin | - | - | ||||||||||

| Research and development expenses, net | 15.1 | (7,594 | ) | (6,867 | ) | |||||||

| General and administrative expenses | 15.2 | (2,919 | ) | (5,053 | ) | |||||||

| Operating loss | (10,513 | ) | (11,920 | ) | ||||||||

| Financial expenses | (2,064 | ) | (1,492 | ) | ||||||||

| Financial income | 23 | (14 | ) | |||||||||

| Change in fair value of convertible notes | (691 | ) | 1,028 | |||||||||

| Net financial expense | 16 | (2,732 | ) | (478 | ) | |||||||

| Loss before taxes | (13,245 | ) | (12,398 | ) | ||||||||

| Income taxes | - | - | ||||||||||

| Net loss for the period | (13,245 | ) | (12,398 | ) | ||||||||

| Attributable to owners of the company | (13,245 | ) | (12,398 | ) | ||||||||

| Non-controlling interests | - | - | ||||||||||

| Basic and diluted weighted average number of shares outstanding | 110,680,727 | 147,803, 141 | ||||||||||

| Basic loss per share (€/share) | 17 | (0.12 | ) | (0,08 | ) | |||||||

| Diluted loss per share (€/share) | 17 | (0.12 | ) | (0,08 | ) | |||||||

Page 13 of 49

Half-year financial report as of June 30, 2022

Statement of consolidated comprehensive loss

| FOR THE SIX-MONTH PERIOD ENDED JUNE 30, | ||||||||

| (amounts in thousands of euros) | 2021 | 2022 | ||||||

| Net loss for the period | (13,245 | ) | (12,398 | ) | ||||

| Items that will not be reclassified to profit or loss | ||||||||

| Remeasurements of the defined benefit liability (asset) | 7 | 40 | ||||||

| Items that will be reclassified to profit or loss | ||||||||

| Foreign currency translation adjustment | 3 | 46 | ||||||

| Other comprehensive income | 10 | 86 | ||||||

| Total comprehensive loss | (13,235 | ) | (12,312 | ) | ||||

| Attributable to owners of the company | (13,235 | ) | (12,312 | ) | ||||

| Non-controlling interests | - | |||||||

Page 14 of 49

Half-year financial report as of June 30, 2022

Statement of changes in consolidated shareholders’ equity

(amounts in thousands of euros, except share data) | Notes | Share capital – number of shares | Share capital | Premiums related to the share capital | Accumulated deficit and net loss | Foreign currency translation adjustment | Share based payment | Split accounting impact related to convertible notes and warrants attached to non- convertible bonds | Treasury Shares | Shareholders' equity - Attributable to owners of the company | Non- controlling interests | Shareholders' equity | ||||||||||||||||||||||||||||||||||||

| As of January 1, 2021 | 100,757,097 | 20,151 | 22,538 | (46,739 | ) | (72 | ) | 5,521 | 944 | (42 | ) | 2,299 | (31 | ) | 2,268 | |||||||||||||||||||||||||||||||||

| Net loss for the period | - | - | - | (13,245 | ) | - | - | - | - | (13,245 | ) | - | (13,245 | ) | ||||||||||||||||||||||||||||||||||

| Other comprehensive income | - | - | - | 7 | 3 | - | - | - | 10 | - | 10 | |||||||||||||||||||||||||||||||||||||

| Total comprehensive income (loss) | - | - | - | (13,238 | ) | 3 | - | - | - | (13,235 | ) | - | (13,235 | ) | ||||||||||||||||||||||||||||||||||

| Conversion of convertible notes | 12 | 1,199,868 | 240 | 860 | - | - | - | - | - | 1,100 | - | 1,100 | ||||||||||||||||||||||||||||||||||||

| Share capital increase | 10 | 12,000,000 | 2,400 | 14,184 | - | - | - | - | - | 16,584 | - | 16,584 | ||||||||||||||||||||||||||||||||||||

| Exercise of warrants | 10 | 1,852,276 | 370 | 368 | - | - | - | - | - | 738 | - | 738 | ||||||||||||||||||||||||||||||||||||

| Treasury shares movements, net | 10 | - | - | - | - | - | - | - | (6 | ) | (6 | ) | - | (6 | ) | |||||||||||||||||||||||||||||||||

| Allocation of premiums to retained earnings | - | - | (17,505 | ) | 17,505 | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||

| Gains and losses, net related to treasury shares | - | - | - | 20 | - | - | - | - | 20 | - | 20 | |||||||||||||||||||||||||||||||||||||

| Equity settled share-based payments | 11 | - | - | �� | - | - | - | 754 | - | - | 754 | - | 754 | |||||||||||||||||||||||||||||||||||

| Costs incurred in relation to equity transactions | 10 | - | - | (2,253 | ) | - | - | - | - | - | (2,253 | ) | - | (2,253 | ) | |||||||||||||||||||||||||||||||||

| As of June 30, 2021 | 115,809,241 | 23,162 | 18,191 | (42,453 | ) | (69 | ) | 6,275 | 944 | (48 | ) | 6,001 | (31 | ) | 5,970 | |||||||||||||||||||||||||||||||||

| As of January 1, 2022 (as restated) (1) | 135,953,657 | 27 191 | 27,781 | (58,852 | ) | (72 | ) | 8,943 | 896 | (51 | ) | 5,835 | (32 | ) | 5,803 | |||||||||||||||||||||||||||||||||

| Net loss for the period | - | - | (12,398 | ) | - | - | - | - | (12,398 | ) | (0 | ) | (12,398 | ) | ||||||||||||||||||||||||||||||||||

| Other comprehensive income | - | - | 40 | 46 | - | - | - | 86 | - | 86 | ||||||||||||||||||||||||||||||||||||||

| Total comprehensive income (loss) | - | - | (12,358 | ) | 46 | - | - | - | (12,312 | ) | (0 | ) | (12,312 | ) | ||||||||||||||||||||||||||||||||||

| Conversion of convertible notes | 12 | 27,847,526 | 5,570 | 374 | - | - | - | - | 5,943 | - | 5,943 | |||||||||||||||||||||||||||||||||||||

| Share capital increase | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Exercise of warrants | 10 | 22,320 | 4 | 2 | - | - | - | - | 7 | - | 7 | |||||||||||||||||||||||||||||||||||||

| Treasury shares movements, net | 10 | - | - | - | - | - | (3 | ) | (3 | ) | - | (3 | ) | |||||||||||||||||||||||||||||||||||

| Allocation of premiums to retained earnings | - | (19,748 | ) | 19,748 | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||

| Gains and losses, net related to treasury shares | (29 | ) | (29 | ) | (29 | ) | ||||||||||||||||||||||||||||||||||||||||||

| Equity settled share-based payments | 11 | - | - | - | - | 3,553 | - | - | 3,533 | - | 3,533 | |||||||||||||||||||||||||||||||||||||

| Costs incurred in relation to equity transactions | 10 | |||||||||||||||||||||||||||||||||||||||||||||||

| IFRS 16 impact | - | - | 18 | - | - | - | - | 18 | - | 18 | ||||||||||||||||||||||||||||||||||||||

| As of June 30, 2022 | 163 823 503 | 32,765 | 8,410 | (51,474 | ) | (27 | ) | 12,477 | 896 | (54 | ) | 2,993 | (32 | ) | 2,961 | |||||||||||||||||||||||||||||||||

(1) Refer to note 2.7 “Restatement of Previously Issued Financial Statements

Page 15 of 49

Half-year financial report at June 30, 2022

Statement of consolidated cash flows

| FOR THE SIX-MONTH PERIOD ENDED JUNE 30, | ||||||||||||

| (amounts in thousands of euros) | NOTES | 2021 | 2022 | |||||||||

| Cash flows from operating activities | ||||||||||||

| Net loss for the period | (13,245 | ) | (12,398 | ) | ||||||||

| Adjustments to reconcile net loss to cash flows used in operating activities | ||||||||||||

| Amortization and depreciation of intangible and tangible assets | 3, 4 | 130 | 150 | |||||||||

| Additions of provisions, net of reversals | 1,529 | 43 | ||||||||||

| Expenses associated with share-based payments | 11 | 754 | 3,533 | |||||||||

| Gross financial interest paid | 17 | 190 | 1,219 | |||||||||

| Changes in fair value of convertible notes | 17 | 691 | (1,028 | ) | ||||||||

| Financial indemnity, net, Negma | 17 | 167 | - | |||||||||

| Proceeds from grants | 260 | - | ||||||||||

| Interests on investment accounts | (3 | ) | - | |||||||||

| Unwinding of conditional advances and other financial expenses | 16 | 15 | ||||||||||

| Amortized cost of convertible notes and non-convertible bonds | 17 | 62 | 169 | |||||||||

| Operating cash flows before change in working capital requirements | (9,449 | ) | (8,296 | ) | ||||||||

| (+) Change in working capital requirements (net of depreciation of trade receivables and inventories) | (4,041 | ) | (1,965 | ) | ||||||||

| (Increase) decrease in other non-current financial assets | - | - | ||||||||||

| (Increase) decrease in other receivables | (3,971 | ) | (3,646 | ) | ||||||||

| Increase (decrease) in trade payables | (48 | ) | 2,483 | |||||||||

| Increase (decrease) in tax and social security liabilities | 9 | (711 | ) | |||||||||

| Increase (decrease) in other creditors and miscellaneous liabilities | (32 | ) | (92 | ) | ||||||||

| Cash flows (used in) from operating activities | (13,491 | ) | (10,261 | ) | ||||||||

| Cash flows used in investing activities | ||||||||||||

| Acquisition of intangible and tangible assets | 3, 4 | (29 | ) | (22 | ) | |||||||

| Interests on investment accounts | 3 | |||||||||||

| Sale of term deposit classified as other current financial assets | 6,7 | 344 | ||||||||||

| Sale of term deposit classified as other non-current financial assets | 5 | 12,500 | 12 | |||||||||

| Cash flows (used in) from investing activities | 12,474 | 333 | ||||||||||

| Cash flows from financing activities | ||||||||||||

| Proceeds from share capital increase, net of Negma indemnity (1) | 10 | 16,584 | - | |||||||||

| Costs paid in relation to equity transactions | (2,253 | ) | - | |||||||||

| Net contractual penalties received from (paid to) Negma | (1,077 | ) | - | |||||||||

| Subscription of warrants (BSA) | - | - | ||||||||||

| Exercise of warrants (BSA) and founders’ warrants (BSPCE) | 10 | 738 | 7 | |||||||||

| Reimbursement of the prefinanced CIR receivables, net of guarantee deposit | 12 | - | 153 | |||||||||

| Proceeds from conditional advances | 12.1 | 400 | 4 | |||||||||

| Repayment of conditional advances | 12.1 | (136 | ) | (149 | ) | |||||||

| Financial interest paid | (190 | ) | (687 | ) | ||||||||

| Proceeds from the issuance of non-convertible bonds and convertible notes | 12.2 | 5,820 | 8,000 | |||||||||

| Repayment of non-convertible bonds | 12.2 | (1,731 | ) | (1,259 | ) | |||||||

| Repayment of lease liabilities | - | |||||||||||

| Cost incurred in relation to the issuance of convertible notes and non-convertible bonds | 17 | - | (380 | ) | ||||||||

| Change in short-term bank overdrafts | - | - | ||||||||||

| Cash flows (used in) from financing activities | 18,155 | 5,689 | ||||||||||

| Net effect of exchange rate changes on cash and cash equivalents | 2 | 58 | ||||||||||

| Decrease in cash and cash equivalents | 17,140 | (4,181 | ) | |||||||||

| Cash and cash equivalents at the beginning of the period | 8 | 5,847 | 23,926 | |||||||||

| Cash and cash equivalents at the end of the period | 8 | 22,987 | 19,745 | |||||||||

Page 16 of 49

Half-year financial report at June 30, 2022

Notes to the unaudited interim condensed consolidated financial statements

(Unless otherwise noted, the condensed consolidated half-year financial statements are presented in thousands of euros. Some amounts may be rounded for the calculation of financial information contained in the Financial Statements. Accordingly, the totals in some tables may not be the exact sum of the preceding figures.)

Note 1: General information about the Company

Incorporated in September 2006, Biophytis is a clinical-stage biotechnology company focused on the development of therapeutics that slow the degenerative processes associated with aging and improve functional outcomes for patients suffering from age-related diseases, including severe respiratory failure in patients suffering from COVID - 19.

Sarconeos (BIO101), the Company’s leading drug candidate, is a small molecule, administered orally, currently in clinical Phase 2b in sarcopenia (SARA-INT) in the United States and Europe. A pediatric formulation of Sarconeos (BIO101) is being developed for the treatment of Duchenne Muscular Dystrophy (DMD).

Since April 2020, Sarconeos (BIO101) is also being developed as a treatment for patients with COVID-19 related respiratory failure in a Phase 2/3 clinical study (COVA) in the United States, Europe and Latin America.

Biophytis is a French joint stock company (société anonyme) and has its registered office located at 14, avenue de l’Opéra, 75001 Paris, France (register Number at the Company’s house: 492 002 225 RCS PARIS). The Company's ordinary shares are listed on the Euronext Growth Paris market (Ticker: ALBPS -ISIN: FR0012816825) and ADSs (American Depositary Shares) are listed on the Nasdaq (Ticker BPTS - ISIN: US09076G1040).

Biophytis and its subsidiaries are referred to hereinafter as “Biophytis,” or the “Company.”

The following information constitutes the Notes to the condensed interim financial statements for the six-month period ended June 30, 2022 with comparative information required under IAS 34 Interim Financial Reporting.

The unaudited condensed consolidated interim financial statements of Biophytis, or the “Financial Statements”, have been prepared under the responsibility of management of the Company and were approved and authorized for issuance by the Company’s Board of Directors on January 26, 2023.

Note 2: Accounting principles, rules and methods

2.1 Statement of compliance

The Company has prepared its Financial Statements for the six-month periods ended June 30, 2022 and June 30, 2021 in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Boards, or IASB. The term “IFRS” refers collectively to international accounting and financial reporting standards (IASs and IFRSs) and to interpretations of the interpretations committees (IFRS Interpretations Committee, or IFRS IC, and Standing Interpretations Committee, or SIC), whose application is mandatory for the periods presented.

The Financial Statements for the six-month period ended June 30, 2022 have been prepared in accordance with the international accounting standard IAS 34 Interim financial reporting. The financial information may not be indicative of other periods or results to be expected for the full year.

Page 17 of 49

Half-year financial report at June 30, 2022

Due to the listing of ordinary shares of the Company on Euronext Growth Paris (formerly known as Alternext Paris) and in accordance with the European Union’s regulation No. 1606/2002 of July 19, 2002, the Financial Statements of the Company are also prepared in accordance with IFRS as adopted by the European Union, or EU, whose application is mandatory for the periods presented.

As of June 30, 2022, all IFRS that the IASB has published and that are mandatory are the same as those endorsed by the EU and mandatory in the EU. As a result, the Financial Statements comply with IFRS as issued by the IASB and as adopted by the EU.

2.2 Going concern

The Board of Directors approved the Financial Statements on a going concern basis despite the loss of 12 million euros for the six-month period ended June 30, 2022. This analysis takes into account:

Cash and cash equivalents as of June 30, 2022 amounted to 19,7 million euros; and

The potential use of a funding line of convertible notes established in June 2021 with Atlas that could generate up to 24 million euros of additional funding (8 tranches with a nominal value of 4 million euros each, the first and the second tranches have been issued in April and June 2022, respectively).

2.3 Accounting methods

The accounting principles adopted for the Financial Statements as of and for the six-month period ended June 30, 2022 are the same as for the year ended December 31, 2021 with the exception of the following new standards, amendments and interpretations whose application was mandatory for the Company as of January 1, 2022:

| • | Amendments to IAS 37 - Provisions, contingent liabilities and contingent assets – Onerous contracts, concept of costs directly linked to the contract Amendments applicable from January 1, 2022 |

| • | Amendment to IAS 16 Property, plant and equipment – income generated before intended use |

| • | Amendment to IFRS 3 reference conceptual framework. |

| • | IFRIC interpretation relating to the recognition of configuration or customization costs in the context of a SaaS-type contract (IAS 38 Intangible assets) |

Adoptions of these standards have not had a material impact on the Financial Statements.

Recently issued accounting pronouncements that may be relevant to the Company’s operations but have not yet been adopted are as follows:

| • | Amendments to IAS 1 Presentation of Financial Statements: Classification of Liabilities as Current or Non-current and Classification of Liabilities as Current or Non-current – Deferral of Effective Date issued on January 23, 2020 and July 15, 2020 respectively and whose application is for annual reporting periods beginning on or after January 1, 2023; |

| • | Amendments to IAS 1 Presentation of Financial Statements and IFRS Practice Statement 2: Disclosure of Accounting policies issued on February 12, 2021 and whose application is for annual reporting periods beginning on or after January 1, 2023; |

Page 18 of 49

Half-year financial report at June 30, 2022

| • | Amendments to IAS 8 Accounting policies, Changes in Accounting Estimates and Errors: Definition of Accounting Estimates issued on February 12, 2021 and whose application is for annual reporting periods beginning on or after January 1, 2023; and |

| • | Amendments to IAS 12 Income Taxes: Deferred Tax related to Assets and Liabilities arising from a Single Transaction issued on May 7, 2021 and whose application is for annual reporting periods beginning on or after January 1, 2023. |

The Company is currently assessing whether the adoption of these standards, amendments to standards and interpretations will have a material impact on its financial statements at the date of adoption.

Moreover, the accounting treatment for the Kreos 2021 contracts as of and for the six-month period ended June 30, 2022 is not the same as for the year ended December 31, 2021 previously issued (see Note 2.7).

Page 19 of 49

Half-year financial report at June 30, 2022

2.4 Translation of the financial statements of foreign subsidiaries

The financial statements of entities whose functional currency is not the euro are translated as follows:

| • | assets and liabilities are translated using the closing rate of the period; |

| • | income statement items are translated using the average rate of the period as long as it is not called into question by significant changes in rate; and |

| • | equity items are translated using the historical rate. |

The exchange differences arising on translation are recognized in Other Comprehensive Income.

The exchange rates used for the preparation of the Financial Statements are as follows:

Closing rate AS OF | Average rate for the Six-month period ended | |||||||||||||||

| EXCHANGE RATE | DECEMBER 31, 2021 | JUNE 30, 2022 | JUNE 30, 2021 | JUNE 30, 2022 | ||||||||||||

| BRL | 6.3101 | 5.4229 | 6.4902 | 5.5565 | ||||||||||||

| USD | 1.1326 | 1.0387 | 1.2053 | 1.0934 | ||||||||||||

2.5 Use of judgments and estimates

To prepare the financial statements in accordance with the IFRS, the main judgements and estimates made by the Company’s management as well as the main assumptions are consistent with those applied in preparing the annual financial statements as of December 31, 2021 previously issued, with the exception of the judgments and estimates related to Kreos 2021 contracts (see Note 2.7).

Such estimates are based on the assumption of going concern and are based on the information available at the time of their preparation.

The pandemic linked to COVID-19 and the situation in Ukraine did not lead to the use of new estimates or significant new judgments in the first half of 2022.

2.6 Impact of the Covid-19 health crisis on the June 30, 2022 accounts

Neither the Covid-19 health crisis nor the situation in Ukraine had a significant impact on the Company's operations.

2.7 Restatement of previously issued financial statements

In connection with the preparation of those unaudited interim condensed consolidated financial statements, the Company identified an error in the accounting for the venture loan agreement and bonds issue agreement signed with Kreos on November 19, 2021 in the consolidated financial statements for the year ended December 31, 2021. Pursuant to the provisions of IAS 8, the Company has decided that it is necessary to restate the Company’s previously issued consolidated financial statements for the 2021 financial year in order to make certain restatements required to reflect the proper accounting treatment of these agreements.

Page 20 of 49

Half-year financial report at June 30, 2022

At the initial recognition of this transaction, a “Day One Loss” of €1,444 million was calculated and reported as a financial asset on the Company’s balance sheet. The Day One Loss was deferred and amortised over the term of the contract in financial expenses for the difference between the fair value of the convertible bonds plus the fair value of the attached warrants as estimated by the Company on the one hand, and the corresponding transaction prices (i.e., proceeds received) on the other hand, assuming that the contractual interest of the straight bonds was a market rate for Biophytis at the transaction date.

The Company reconsidered all the characteristics listed in the Kreos financing contract, which includes various instruments (straight bonds, convertible bonds, and warrants) in view of the way negotiations conducted with Kreos took place.

Initially the Company considered that the interest rate applied to the straight bonds was a market rate, leading to a Day One Loss on convertible bonds and warrants which was not offset by a Day One Gain on straight bonds. Reconsidering this assessment, the Company concluded that all instruments negotiated at the same time with Kreos should have been analysed together and the amount of cash received on November 19, 2021 (before transaction costs) was deemed to correspond to the fair value of all the instruments contracted with Kreos. As a result, the Company revised the credit spread used at issuance date so that Day One Losses and Day One Gains identified on each financial instrument that was part of the transaction with Kreos offset each other at the inception of the agreement, except for the third tranche (C) of the straight bonds which was subject to specific negotiation with Kreos and issued in December 2021.

In the course of the restatement, the various instruments (straight bonds, convertible bonds and warrants) were recognized at inception on the balance sheet for the fair value estimated by the Company which corresponds as a whole to the consideration received (before transaction costs). At the level of each instrument, value differences are identified between i) the nominal value of the instruments entered in the contract and ii) their fair value estimated by the Company based on unobservable inputs: these value differences are individually analyzed as Day One Losses and Day One Gains, which are required to be deferred under IFRS 9. Since the instruments are linked to each other, traded as a whole, the Company considered that the recognition of all of these gains and losses by the end of the reporting period is a reflection of the economics of the transaction.

The following table summarizes the impact of the restatement on the various instruments of the Kreos financing contract.

| As of November 19, 2021 | As of December 31, 2021 | |||||||||||||||||||||||

| (amounts in thousands of euros) | As filed | Restatements | As restated | As filed | Restatements | As restated | ||||||||||||||||||

| Convertible bonds | 2,198 | (566 | ) | 1,632 | 2,215 | (568 | ) | 1,647 | ||||||||||||||||

| Straight bonds | 3,153 | (538 | ) | 2,615 | 3,865 | (540 | ) | 3,325 | ||||||||||||||||

| Conversion options | 819 | (355 | ) | 464 | 916 | (380 | ) | 536 | ||||||||||||||||

| Warrants | 708 | 2 | 710 | 788 | - | 788 | ||||||||||||||||||

| Day one loss | (1,444 | ) | 1,444 | - | (1,390 | ) | 1,390 | - | ||||||||||||||||

Page 21 of 49

Half-year financial report at June 30, 2022

The following presents a reconciliation of the impacted financial statement line items as previously filed to the restated amounts as of and for the year ended December 31, 2021. The previously reported amounts reflect those included in the annual report as of and for the year ended December 31, 2021. These amounts are labelled as “As filed” in the tables below. The amounts labelled “As previously issued” represent the effects of this restatement due to the corrections required to reflect the proper accounting treatment of these agreements.

See note 12.

Year ended December 31, 2021

Statement of Consolidated Financial Position

| AS OF DECEMBER 31, 2021 | ||||||||||||

| (amounts in thousands of euros) | As previously issued | Restatements | As restated | |||||||||

| ASSETS | ||||||||||||

| Patents and software | 2,757 | 2,757 | ||||||||||

| Property, plant and equipment | 563 | 563 | ||||||||||

| Other non-current financial assets | 1,251 | (1,065 | ) | 186 | ||||||||

| Total non-current assets | 4,571 | (1,065 | ) | 3,506 | ||||||||

| Other receivables | 6,536 | 6,536 | ||||||||||

| Other current financial assets | 1,229 | (325 | ) | 904 | ||||||||

| Cash and cash equivalents | 23,926 | 23,926 | ||||||||||

| Total current assets | 31,691 | (325 | ) | 31,366 | ||||||||

| TOTAL ASSETS | 36,262 | (1,390 | ) | 34,872 | ||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||||||

| Shareholders' equity | ||||||||||||

| Share capital | 27,191 | - | 27,191 | |||||||||

| Premiums related to the share capital | 27,781 | - | 27,781 | |||||||||

| Treasury shares | (51 | ) | - | (51 | ) | |||||||

| Foreign currency translation adjustment | (73 | ) | - | (73 | ) | |||||||

| Accumulated deficit - attributable to shareholders of Biophytis | (17,865 | ) | 15 | (17,850 | ) | |||||||

| Net income (loss) - attributable to shareholders of Biophytis | (31,246 | ) | 83 | (31,163 | ) | |||||||

| Shareholders' equity - attribuable to shareholders of Biophytis | 5,737 | 98 | 5,835 | |||||||||

| Non-controlling interests | (32 | ) | - | (32 | ) | |||||||

| Total shareholders' equity | 5,705 | 98 | 5,803 | |||||||||

| Employee benefit obligations | 205 | - | 205 | |||||||||

| Non-current financial liabilities | 6,293 | (775 | ) | 5,518 | ||||||||

| Derivative liabilities | 916 | (380 | ) | 536 | ||||||||

| Total non-current liabilities | 7,414 | (1,153 | ) | 6,259 | ||||||||

| Current financial liabilities | 12,370 | (333 | ) | 12,036 | ||||||||

| Provisions | - | - | - | |||||||||

| Trade payables | 7,606 | - | 7,606 | |||||||||

| Tax and social liabilities | 1,998 | - | 1,998 | |||||||||

| Current derivative financial instruments | 788 | 788 | ||||||||||

| Other creditors and miscellaneous liabilities | 381 | - | 381 | |||||||||

| Total current liabilities | 23,143 | (333 | ) | 22,810 | ||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | 36,262 | (1,390 | ) | 34,872 | ||||||||

Page 22 of 49

Half-year financial report at June 30, 2022

STATEMENT OF CONSOLIDATED OPERATIONS

| FOR THE YEAR ENDED DECEMBER 31, 2021 | ||||||||||||||||

| (amounts in thousands of euros) | Note | As previously issued | Restatements | As restated | ||||||||||||

| Gross margin | - | - | - | |||||||||||||

| Research and development expenses, net | (19,665 | ) | - | (19,665 | ) | |||||||||||

| General and administrative expenses | (7,150 | ) | - | (7,150 | ) | |||||||||||

| Operating loss | (26,815 | ) | - | (26,815 | ) | |||||||||||

| Financial expenses | (2,581 | ) | 64 | (2,517 | ) | |||||||||||

| Financial income | 24 | - | 24 | |||||||||||||

| Change in fair value of convertible notes | (1,875 | ) | 19 | (1,856 | ) | |||||||||||

| Net Financial expense | (4,432 | ) | 83 | (4,349 | ) | |||||||||||

| Loss before taxes | (31,247 | ) | 83 | (31,164 | ) | |||||||||||

| Income taxes benefit | - | - | - | |||||||||||||

| Net loss | (31,247 | ) | 83 | (31,164 | ) | |||||||||||

| Attributable to shareholders of Biophytis | (31,247 | ) | 83 | (31,163 | ) | |||||||||||

| Non-controlling interests | (1 | ) | - | (1 | ) | |||||||||||

| Basic and diluted weighted average number of shares outstanding | 118,282,679 | - | 118,282,679 | |||||||||||||

| Basic loss per share (€/share) | (0,26 | ) | - | (0,26 | ) | |||||||||||

| Diluted loss per share (€/share) | (0,26 | ) | - | (0,26 | ) | |||||||||||

STATEMENT OF CONSOLIDATED COMPREHENSIVE LOSS

| FOR THE YEAR ENDED DECEMBER 31, 2021 | ||||||||||||

| (amounts in thousands of euros) | As previously issued | Restatements | As restated | |||||||||

| Net loss for the year | (31,247 | ) | 83 | (31,164 | ) | |||||||

| Items that will not be reclassified to profit or loss | ||||||||||||

| Actuarial gains and losses | 23 | - | 23 | |||||||||

| Items that will be reclassified to profit or loss | ||||||||||||

| Foreign currency translation adjustment | - | |||||||||||

| Other comprehensive income (loss) | 23 | - | 23 | |||||||||

| Total comprehensive loss | (31,224 | ) | 83 | (31,141 | ) | |||||||

| Attributable to shareholders of Biophytis | (31,223 | ) | 83 | (31,140 | ) | |||||||

| Non-controlling interests | (1 | ) | - | (1 | ) | |||||||

Page 23 of 49

Half-year financial report at June 30, 2022

STATEMENT OF CHANGES IN CONSOLIDATED SHAREHOLDERS’ EQUITY

| FOR THE YEAR ENDED DECEMBER 31, 2021 | ||||||||||||

As previously issued | Restatements | As restated | ||||||||||

| (amounts in thousands of euros) | Shareholders’ equity - Attributable to shareholders of Biophytis | |||||||||||

| As of January 1, 2021 | 2,266 | 2,266 | ||||||||||

| Net loss for the period | (31,247 | ) | 83 | (31,164 | ) | |||||||

| Other comprehensive income (loss) | 23 | - | 23 | |||||||||

| Total comprehensive income (loss) | (31,224 | ) | 83 | (31,141 | ) | |||||||

| Conversion of convertible notes | 10,940 | - | 10,940 | |||||||||

| Share capital increase | 20,204 | - | 20,204 | |||||||||

| Exercise of warrants (BSA) and founders' warrants (BSPCE) | 742 | - | 742 | |||||||||

| Subscription of warrants (BSA) | (62 | ) | 15 | (47 | ) | |||||||

| Allocation of premiums to retained earnings | 1,521 | - | 1,521 | |||||||||

| Treasury shares movements, net | - | - | - | |||||||||

| Gains and losses, net related to treasury shares | (9 | ) | - | (9 | ) | |||||||

| Equity settled share-based payments | 2 | - | 2 | |||||||||

| Biophytis shares to be received from Negma | 3,422 | - | 3,422 | |||||||||

| Cost incurred in relation to public offering on the NASDAQ | (2,099 | ) | - | (2,099 | ) | |||||||

| As of December 31, 2021 | 5,705 | 98 | 5,803 | |||||||||

Page 24 of 49

Half-year financial report at June 30, 2022

Statement of Consolidated Cash flows

| FOR THE YEAR ENDED DECEMBER 31, 2021 | ||||||||||||

| (amounts in thousands of euros) | As previously issued | Restatements | As restated | |||||||||

| Net loss for the period | (31,247 | ) | 83 | (31,164 | ) | |||||||

| Amortization and depreciation of intangible and tangible assets | 311 | - | 311 | |||||||||

| Additions of provisions, net of reversals | 39 | - | 39 | |||||||||

| Expenses associated with share-based payments | 3,422 | - | 3,422 | |||||||||

| Financial interests and conversion settled with cash payment | 562 | - | 562 | |||||||||

| Spread of the deferred loss | 54 | - | 54 | |||||||||

| Changes in fair value of convertible notes | 1,875 | (19 | ) | 1,856 | ||||||||

| Financial indemnity, net, NEGMA | 1,675 | - | 1,675 | |||||||||

| Interest on investment accounts | (4 | ) | - | (4 | ) | |||||||

| Unwinding of conditional advances and other financial expenses | 397 | - | 397 | |||||||||

| Amortized cost of non-convertible bonds | 132 | (64 | ) | 68 | ||||||||

| Operating cash flows before change in working capital requirements | (22,785 | ) | - | (22,785 | ) | |||||||

| (-) Change in working capital requirements (net of depreciation of trade receivables and inventories) | (1,010 | ) | - | (1,010 | ) | |||||||

| Cash flows from operating activities | (23,795 | ) | - | (23,795 | ) | |||||||

| Cash flows used in investing activities | 12,160 | - | 12,160 | |||||||||

| Cash flows from financing activities | 29,715 | - | 29,715 | |||||||||

| - | ||||||||||||

| Net effect of exchange rate changes on cash and cash equivalents | (1 | ) | - | (1 | ) | |||||||

| Increase (decrease) in cash and cash equivalents | 18,079 | - | 18,079 | |||||||||

| - | ||||||||||||

| Cash and cash equivalents at the beginning of the period (including bank overdrafts) | 5,847 | - | 5,847 | |||||||||

| Cash and cash equivalents at the end of the period (including bank overdrafts) | 23,926 | - | 23,926 | |||||||||

The adjustments presented above have been reported to the notes to the financial statements. Therefore, in the tables of the Notes, the amounts that are presented as of December 31, 2021 are the amounts that are labelled “As restated” in the tables above.

Page 25 of 49

Half-year financial report at June 30, 2022

Note 3: Patents and software

| (amounts in thousands of euros) | Patents | Software | Total | |||||||||

| GROSS AMOUNT | ||||||||||||

| As of January 1, 2022 | 3,652 | 32 | 3,684 | |||||||||

| Addition | - | - | - | |||||||||

| Disposal | (2 | ) | - | (2 | ) | |||||||

| As of June 30, 2022 | 3,650 | 32 | 3,682 | |||||||||

| AMORTIZATION | ||||||||||||

| As of January 1, 2022 | 895 | 32 | 927 | |||||||||

| Increase | 95 | - | 95 | |||||||||

| Decrease | - | - | - | |||||||||

| As of June 30, 2022 | 990 | 32 | 1,022 | |||||||||

| NET BOOK VALUE | ||||||||||||

| As of January 1, 2022 | 2,757 | - | 2,757 | |||||||||

| As of June 30, 2022 | 2,660 | - | 2,660 | |||||||||

No impairment was recognized on the intangible assets of the Company during the six-month periods ended June 30, 2022 and 2021, respectively. The Company determined that there was limited impact of the COVID-19 pandemic on the Company’s assets.

The Company co-owns certain patents with state-owned partners.

As part of the Intellectual Property agreement signed with the Company's CEO (see Note 19.2) and its amendment, the total patent rights acquired from the Company's CEO as of June 30, 2022 amounted to 1,350 thousand euros and are amortized over a 19-year period.

During the six-months period ended June 30, 2022, the change in intangible assets is mainly due to the amortization of the patents.

Page 26 of 49

Half-year financial report at June 30, 2022

Note 4: Property, plant and equipment

| (Amounts in thousands of euros) | Equipment and tooling | Equipment and tooling (right of use) | Fixture and fittings | Office, IT equipment, furniture | Buildings | Total | ||||||||||||||||||

| GROSS AMOUNT | ||||||||||||||||||||||||

| As of January 1, 2022 | 340 | 181 | 114 | 96 | 500 | 1,232 | ||||||||||||||||||

| Addition | 1 | 271 | - | 21 | - | 293 | ||||||||||||||||||

| Disposal | - | - | - | - | - | - | ||||||||||||||||||

| Exchange effect | (0 | ) | - | 8 | 1 | - | 8 | |||||||||||||||||

| As of June 30, 2022 | 341 | 452 | 123 | 117 | 500 | 1 533 | ||||||||||||||||||

| DEPRECIATION | ||||||||||||||||||||||||

| As of January 1, 2022 | 250 | 181 | 106 | 75 | 56 | 669 | ||||||||||||||||||

| Increase | 22 | 3 | 4 | 4 | 111 | 143 | ||||||||||||||||||

| Decrease | - | - | - | - | - | - | ||||||||||||||||||

| Exchange effect | (0 | ) | - | 4 | 1 | - | 5 | |||||||||||||||||

| As of June 30, 2022 | 273 | 184 | 178 | 79 | 167 | 817 | ||||||||||||||||||

| NET BOOK VALUE | ||||||||||||||||||||||||

| As of January 1, 2022 | 90 | - | 8 | 21 | 444 | 563 | ||||||||||||||||||

| As of June 30, 2022 | 68 | 268 | 9 | 39 | 333 | 716 | ||||||||||||||||||

No impairment was recognized on property, plant and equipment of the Company during the six-month periods ended June 30, 2022, and 2021, respectively.

Note 5: Other non-current financial assets

| (amounts in thousands of euros) | AS OF DECEMBER 31, 2021 (As restated) (1) | AS OF JUNE 30, 2022 | ||||||

| Cash reserve related to the liquidity agreement | 72 | 40 | ||||||

| Guarantee deposit related to the 2021 Kreos loan contract (see note 12.2.3) | 104 | 126 | ||||||

| Miscellaneous | 10 | 9 | ||||||

| Total other non-current financial assets | 186 | 175 | ||||||

(1) Refer to note 2.7 “Restatement of Previously Issued Financial Statements”

Page 27 of 49

Half-year financial report at June 30, 2022

Note 6: Other current financial assets

| (amounts in thousands of euros) | AS OF DECEMBER 31, 2021 (As restated) (1) | AS OF JUNE 30, 2022 | ||||||

| Guarantee deposit as part of the research tax credit prefinancing from NEFTYS (see Note 12) | 584 | 407 | ||||||

| Guarantee deposit related to the non-convertible bonds (Kreos 2018 contract) | 320 | - | ||||||

| Short term deposits | - | - | ||||||

| Total other current financial assets | 904 | 407 | ||||||

(1) Refer to note 2.7 “Restatement of Previously Issued Financial Statements”

Note 7: Other receivables

| (amounts in thousands of euros) | AS OF DECEMBER 31, 2021 | AS OF JUNE 30, 2022 | ||||||

| Research tax credit (1) | 3,941 | 6,555 | ||||||

| Value added tax | 1,008 | 845 | ||||||

| Prepaid expenses (2) | 1,418 | 1,818 | ||||||

| Suppliers - advances payment and debit balance | 125 | 947 | ||||||

| Receivable from CACEIS in relation with the exercises of BSA/BSPCE | 2 | 4 | ||||||

| Miscellaneous | 42 | 12 | ||||||

| Total other receivables | 6,536 | 10,181 | ||||||

(1) French Research Tax Credit (“CIR”)

CIR recorded as of June 30, 2022 includes the CIR estimated for the six-month period ended June 30, 2022 (2,475 thousand euros) and the CIR for the year ended December 31, 2021 (4,080 thousand euros). The CIR is estimated on the basis of the expenses that meet the eligibility criteria.

In December 2021, a portion of the CIR receivables for 2020 was prefinanced by Neftys (see note 12).

(2) Prepaid expenses mainly relate to annual insurance premium paid in February 2021 following the Company’s US IPO and listing on Nasdaq and research and studies expenses.

Note 8: Cash and cash equivalents

Cash and cash equivalents are broken down as follows:

| (amounts in thousands of euros) | AS OF DECEMBER 31, 2021 | AS OF JUNE 30, 2022 | ||||||

| Bank accounts | 16,926 | 13,745 | ||||||

| Short-term deposits | 7,000 | 6,000 | ||||||

| Total cash and cash equivalents | 23,926 | 19,745 | ||||||

As of December 31, 2021, the Company owned two short-term deposits with an initial maturity of one month:

| • | A short-term deposit of 2,000 thousand euros with a maturity on January 1, 2022, and an interest rate of 0.03%. |

| • | A short-term deposit of 5,000 thousand euros with a maturity on January 26, 2022, and an interest rate of 0.03%. |

Page 28 of 49

Half-year financial report at June 30, 2022

As of June 30, 2022, the Company owned two short-term deposits:

| • | A short-term deposit of 5,000 thousand euros with a maturity on July 26, 2022, and an interest rate of 0.03%; and |

| • | A short-term deposit of 1,000 thousand euros with a maturity on July 8, 2022, and an interest rate of 0.03%. |

In accordance with IAS 7, these short-term deposits were recorded under cash and cash equivalents.

Note 9: Financial assets and liabilities and impacts on consolidated statement of profit or loss

The Company’s financial assets and liabilities are measured as follows as of December 31, 2021:

| AS OF DECEMBER 31, 2021 (As restated) (1) | ||||||||||||||||

| Value - Statement of financial position (IFRS 9) | ||||||||||||||||

| (amounts in thousands of euros) |

Value - | Fair value | Fair value through profit or loss | Amortized cost | ||||||||||||

| Non-current financial assets | 186 | 186 | - | 186 | ||||||||||||

| Other receivables | 5,119 | 5,119 | - | 5,119 | ||||||||||||

| Other current financial assets | 904 | 904 | - | 904 | ||||||||||||

| Cash and cash equivalents | 23,926 | 23,926 | 23,926 | - | ||||||||||||

| Total financial assets | 30,134 | 30,134 | 23,926 | 6,208 | ||||||||||||

| Non-current financial liabilities | 5,518 | 5,618 | 5,518 | |||||||||||||

| Non-current derivative financial instruments | 536 | 536 | 536 | - | ||||||||||||

| Current financial liabilities | 12,037 | 12,037 | 6,627 | 5,409 | ||||||||||||

| Current derivative financial instruments | 788 | 788 | 788 | - | ||||||||||||

| Trade payables | 7,606 | 7,606 | - | 7,606 | ||||||||||||

| Tax and social liabilities | 1,998 | 1,998 | - | 1,998 | ||||||||||||

| Miscellaneous liabilities | 381 | 381 | - | 381 | ||||||||||||

| Total financial liabilities | 28,863 | 28,963 | 7,951 | 20,912 | ||||||||||||

(1) Refer to note 2.7 “Restatement of Previously Issued Financial Statements”

The Company’s financial assets and liabilities are measured as follows as of June 30, 2022:

| AS OF JUNE 30, 2022 | ||||||||||||||||

| Value - Statement of financial position (IFRS 9) | ||||||||||||||||

| (amounts in thousands of euros) |

Value - | Fair value | Fair value through profit or loss | Amortized cost | ||||||||||||

| Non-current financial assets | 175 | 175 | - | 175 | ||||||||||||

| Other receivables | 10,181 | 10,181 | - | 10,181 | ||||||||||||

| Other current financial assets | 407 | 407 | - | 407 | ||||||||||||

| Cash and cash equivalents | 19,745 | 19,745 | 19,745 | - | ||||||||||||

| Total financial assets | 30,509 | 30,509 | 19,745 | 10,764 | ||||||||||||

| Non-current financial liabilities | 5,015 | 4,906 | 5,015 | |||||||||||||

| Non-current derivative financial instruments | - | - | - | - | ||||||||||||

| Current financial liabilities | 13,913 | 13,913 | 8,917 | 4,996 | ||||||||||||

| Current derivative financial instruments | 62 | 62 | 62 | - | ||||||||||||

| Trade payables | 10,089 | 10,089 | - | 10,089 | ||||||||||||

| Tax and social liabilities | 1,288 | 1,288 | - | 1,288 | ||||||||||||

| Miscellaneous liabilities | 289 | 289 | - | 289 | ||||||||||||

| Total financial liabilities | 30,656 | 30,547 | 8,979 | 21,568 | ||||||||||||

| Page 29 of 49 |

Half-year financial report at June 30, 2022

The impact of the Company’s financial assets and liabilities on the consolidated statement of profit or loss are as follows for the six-month period ended June 30, 2021 and 2022:

| AS OF JUNE 30, 2021 | AS OF JUNE 30, 2022 | |||||||||||||||

| (amounts in thousands of euros) | Interest | Change in fair value | Interest | Change in fair value | ||||||||||||

| Profit or loss impact of liabilities | ||||||||||||||||

| Derivative financial instruments | 1,262 | |||||||||||||||

| Liabilities at amortized cost: non-convertible bonds | (289 | ) | (1,004 | ) | ||||||||||||

| Liabilities at fair value: convertible notes | (691 | ) | 1,028 | |||||||||||||

| Liabilities at amortized cost: advances | (16 | ) | (15 | ) | ||||||||||||

Note 10: Share capital

| AS OF DECEMBER 31, 2021 | AS OF | |||||||

| Share capital (in thousands of euros) | 27,191 | 32,765 | ||||||

| Number of outstanding shares | 135,953,657 | 163,823,503 | ||||||

| Nominal value per share (in euros) | 0.20 | € | 0,20 | € | ||||

Share capital

As of June 30, 2022, the share capital of the Company was 32 764 700,60 euros, divided into 163 823 503 fully subscribed ordinary shares with a nominal value of 0.20 euros per share.

Outstanding shares exclude warrants (“BSA”) granted to certain investors, free shares and founders’ warrants (“BSPCE”) granted to certain employees and members of the Board of Directors that have not yet vested (free shares) or been exercised (BSA and BSPCE).

As of June 30, 2022, the premiums of the Company were 9,671 thousand euros. This included the allocation of the premiums to retained earnings for an amount of 19,748 thousand euros decided at the Shareholders Meeting of April 29, 2022.

Changes in share capital

During the six months ended June 30, 2022, 220 bonds held by Atlas were converted into new shares generating the issue of 27,847,526 shares with a par value of 0.20 euros, representing a capital increase of 5,570 thousand euros and an issue premium of -70 thousand euros (based on the fair value of the shares issued on the date of conversion).

Following the exercise of warrants during the period, the share capital was increased by 4 thousand euros through the issue of 22,320 new shares, with an issue premium of a total amount of 2 thousand euros.

| Page 30 of 49 |

Half-year financial report at June 30, 2022

Note 11: Warrants and founders’ warrants

BSA warrants issued to Kreos Group

See Note 12.2

BSA warrants issued to investors

On April 3, 2020, the Company launched a public offering of share subscription warrants. The main objective of the transaction was to allow existing shareholders the ability to participate in the COVA program and the future development of the Company, and eventually to consolidate its equity.

Upon completion of the public offering, the Company issued 7,475,708 share subscription warrants, after full exercise of the extension clause.

The subscription price was 0.06 euros per warrant. The warrants can be exercised for a period of 5 years from April 30, 2020, at an exercise price of 0.27 euros per new share.

Each warrant gives its holder the right to subscribe for one new Biophytis share.

Activity for BSA warrants issued to investors that were outstanding during the six-month period ended June 30, 2022 is summarized in the table below:

| Number of outstanding warrants | |||||||||||||||||||||||||||

| Type | Grant date | As of | Granted | Exercised | Lapsed | As of June 30, 2022 | Number of shares which can be subscribed | ||||||||||||||||||||

| Warrants2020 | 04/07/2020 | 2,492,871 | - | (15,865 | ) | 2,477,006 | 2,477,006 | ||||||||||||||||||||

| Total | 2,492,871 | - | (15,865 | ) | 2,477,006 | 2,477,006 | |||||||||||||||||||||

BSA warrants issued pursuant to equity-compensation plan

The following table summarizes the data related to the warrants issued pursuant to equity-compensation plans as well as the assumptions adopted for valuation in accordance with IFRS 2:

| Characteristics | Assumptions | |||||||||||||||||||||||||

| Type | Grant date | Number of warrants granted | Maturity date | Exercise price | Volatility | Risk-free rate | IFRS2 Initial valuation (Black- Scholes) in thousands of euros | |||||||||||||||||||

| Warrants2021 | 17/06/2022 | 398,476 | 17/06/2026 | € | 0.097 | 63 | % | 0.62 | % | 17 | ||||||||||||||||

On June 17, 2022, the Company allocated 398,476 warrants giving the right to subscribe to one new ordinary share with a nominal value of twenty-euro cents (€0.20). The issue price is €0.0048 and the strike price is €0.0967.

| Page 31 of 49 |

Half-year financial report at June 30, 2022

The exercise of BSA 2020 is possible from the 1st anniversary date of the subscription and up to 4 years later (i.e. between June 17, 2023 and June 17, 2026).

Activity for BSA warrants issued pursuant to equity-compensation plans that were outstanding during the six-month period ended June 30, 2022 are summarized in the table below:

| Number of outstanding warrants | |||||||||||||||||||||

| Type | Grant date | As of | Granted | Exercised | Lapsed | As of | Number of shares which can be subscribed | ||||||||||||||

| BSA 2020 | 07/04/2020 | 2 492 871 | (15 865 | ) | 2 477 006 | 2 477 006 | |||||||||||||||

| BSA 2021 | 17/06/2022 | - | 398 476 | 398 476 | 398 476 | ||||||||||||||||

| Total | 2 492 871 | 398 476 | (15 865 | ) | 2 875 482 | 2 875 482 | |||||||||||||||

Founders’ warrants (“BSPCE”)

The following table summarizes the data related to BSPCE founder’s warrants issued as well as the assumptions used for valuation in accordance with IFRS 2:

| Characteristics | Assumptions | |||||||||||||||||||||

| Type | Grant date | Number of warrants granted | Maturity date | Exercise price | Volatility | Risk-free rate | IFRS 2 Initial valuation (Black-Scholes) in thousands of euros | |||||||||||||||

| Founders' warrants2019 | 03/04/2020 | 2 000 000 | 03/04/2026 | 0,27 | € | 48,36 | % | -0,62 | % | 674 | ||||||||||||

| Founders' warrants2020 | 22/12/2020 | 1 499 089 | 22/12/2026 | 0,47 | € | 57,80 | % | -0,77 | % | 508 | ||||||||||||

| Founders' warrants2021 | 15/09/2021 | 4 379 122 | 15/09/2027 | 0,73 | € | 79,11 | % | -0,73 | % | 677 | ||||||||||||

Activity for BSPCE founder’s warrants that were outstanding during the six-month period ended June 30, 2022 are summarized in the table below:

| Number of outstanding warrants | ||||||||||||||||||||

| Type | Grant date | As of January 1, 2022 | Granted | Exercised | Lapsed | As of | Number of shares which can be subscribed | |||||||||||||

| Founders' warrants2019 | 03/04/2020 | 1 470 218 | (40 071) | 1 432 299 | 837 754 | |||||||||||||||

| Founders' warrants2020 | 22/12/2020 | 1 087 875 | (80 143) | 1 049 955 | 287 532 | |||||||||||||||

| Founders' warrants2021 | 15/09/2021 | 4 310 654 | (370 096) | 4 187 289 | 1 313 520 | |||||||||||||||

| Total | 6 868 747 | (490 309) | 6 669 543 | 2 438 806 | ||||||||||||||||

The vesting period of these BSPCE founder’s warrants are summarized in the table below:

| Type | Vesting period | ||||||||||||

| Founders' warrants2019 | 1/3 as of 04/10/2020 | 1/3 as of 04/10/2022 | 1/3 as of 04/10/2024 | ||||||||||

| Founders' warrants2020 | 1/3 as of 12/22/2020 | 1/3 as of 12/22/2022 | 1/3 as of 12/22/2024 | ||||||||||

| Founders' warrants2021 | 1/3 as of 09/15/2021 | 1/3 as of 09/15/2022 | 1/3 as of 09/15/2023 | ||||||||||

| Page 32 of 49 |

Half-year financial report at June 30, 2022

Free shares

| Characteristics | Assumptions | ||||||||||||||||||

| Type | Grant date | Number of free shares granted | Maturity date | Exercise price | Volatility | Risk-free rate | IFRS 2 Initial valuation (Black- Scholes) in thousands of euros | ||||||||||||

| Free shares2020 | 12/22/2020 | 2,500,911 | N/A | N/A | N/A | N/A | 2,311 | ||||||||||||

| Free shares2021-1 | 09/15/2021 | 6,631,068 | N/A | N/A | N/A | N/A | 4,936 | ||||||||||||

| Free shares2021-2 | 04/25/2022 | 1,591,334 | N/A | N/A | N/A | N/A | 271 | ||||||||||||

Activity for the unvested free shares that were outstanding during the six-month period ended June 30, 2022 are summarized in the table below:

| Number of unvested free shares | |||||||||||||||

| Type | Grant date | Unvested free | Granted | Vested | Cancelled | Unvested free | |||||||||

| Free shares2020 | 12/22/2020 | 2,500,911 | 2,500,911 | ||||||||||||

| Free shares2021-1 | 09/15/2021 | 6,631,068 | 6,631,068 | ||||||||||||

| Free shares2021-2 | 04/25/2022 | 1 591 334 | 1 591 334 | 1,591,334 | |||||||||||

| Total | 9,131,979 | 10,723,313 | |||||||||||||

The vesting period of these free shares are summarized in the table below:

| Type | Vesting period | ||

| Free shares2020 | Vesting period of 2 years followed by a holding period of 2 years | ||

| Free shares2021 | Vesting period of 1 year followed by a holding period of 1 year |

Stock-based compensation expense recognized for the periods presented

(amounts in thousands of euros)

| SIX-MONTH PERIOD ENDED JUNE 30, 2021 | SIX-MONTH PERIOD ENDED JUNE 30, 2022 | ||||||||||||||||||||||||||||||||

| Type | Probabilistic cost of the plan | Cumulative expenses - beginning of period | Expense for the period | Cumulative expense to date | Probabilistic cost of the plan | Cumulative expenses - beginning of period | Expense for the period | Cumulative expense to date | |||||||||||||||||||||||||

| BSA 2020-2021 | 17 | ||||||||||||||||||||||||||||||||

| Founders’ warrants2019 | 1,008 | 498 | 103 | 601 | 961 | 684 | 130 | 814 | |||||||||||||||||||||||||

| Founders’ warrants2020 | 751 | 258 | 78 | 336 | 653 | 384 | 81 | 465 | |||||||||||||||||||||||||

| Founders’ warrants2021 | - | - | - | - | 1,257 | 508 | 266 | 774 | |||||||||||||||||||||||||

| Free shares2020 | 2,311 | 28 | 573 | 601 | 2,311 | 1,184 | 565 | 1,749 | |||||||||||||||||||||||||

| Free shares2021-1 | 4,936 | 1,447 | 2,425 | 3,872 | |||||||||||||||||||||||||||||

| Free shares2021-2 | 271 | - | 49 | 49 | |||||||||||||||||||||||||||||

| Total | 4,070 | 784 | 754 | 1,538 | 10,389 | 4,207 | 3,533 | 7,723 | |||||||||||||||||||||||||

| Page 33 of 49 |

Half-year financial report at June 30, 2022

Note 12: Borrowings and financial liabilities

| (amounts in thousands of euros) | AS OF DECEMBER 31, 2021 (As restated) (1) | AS OF JUNE 30, 2022 | ||||||

| Conditional advances | 906 | 711 | ||||||

| Non-convertible bonds | 2,740 | 4,670 | ||||||

| Convertible bonds | 1,647 | (695 | ) | |||||

| Non-current lease obligations | 225 | 329 | ||||||

| Non-current financial liabilities | 5,518 | 5,015 | ||||||

| Non-current derivative financial instruments | 536 | - | ||||||

| Conditional advances | 377 | 439 | ||||||

| Non-convertible bonds | 1,524 | 202 | ||||||

| Convertible notes | 6,627 | 9,631 | ||||||

| Financial liabilities related to the prefinancing of a portion of the research tax credit receivables (2) | 3,287 | 3,367 | ||||||

| Current lease obligations | 221 | 275 | ||||||

| Current financial liabilities | 12,036 | 13,913 | ||||||

| Current derivative financial instruments | 788 | 62 | ||||||