As confidentially submitted with the Securities and Exchange Commission on April 5, 2019

This draft registration statement has not been publicly filed with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VIA optronics AG

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

| Federal Republic of Germany (State or other jurisdiction of incorporation or organization) | 3674 (Primary Standard Industrial Classification Code Number) | Not Applicable (I.R.S. Employer Identification Number) |

Sieboldstrasse 18

90411 Nuremberg, Germany

+49 (0) 911 597 575-0

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Corporation Service Company

1090 Vermont Avenue N.W.

Washington, DC 20005

(800) 927-9800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

David S. Rosenthal, Esq. Federico G. Pappalardo, Esq. Gregory A. Schernecke, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 (212) 698-3500 | Ward A. Greenberg, Esq. Cleary Gottlieb Steen & Hamilton LLP Main Tower, Neue Mainzer Strasse 52 60311 Frankfurt Am Main, Germany +49 69 97 103 0 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ý

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

- †

- The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered(1) | Proposed maximum aggregate offering price(2)(3) | Amount of registration fee | ||

|---|---|---|---|---|

Ordinary shares, €1.00 notional value per share | $ | $ | ||

| ||||

- (1)

- American depositary shares, or ADSs, issuable upon deposit of the ordinary shares registered hereby will be registered under a separate Registration Statement on Form F-6. Each ADS will represent of an ordinary share.

- (2)

- Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

- (3)

- Includes ordinary shares represented by ADSs that may be purchased by the underwriters pursuant to an option to purchase additional ADSs.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2019

| PRELIMINARY PROSPECTUS |

American Depositary Shares

VIA optronics AG

Representing Ordinary Shares

$ per American Depositary Share

This is the initial public offering of VIA optronics AG, a German stock corporation. We are offering American Depositary Shares, or ADSs, and the selling shareholder identified in this prospectus is offering ADSs. We will not receive any proceeds from the sale of ADSs by the selling shareholder. Each ADS will represent of an ordinary share with a notional value of €1.00 per share. We anticipate that the initial public offering price will be between $ and $ per ADS.

We intend to apply to list the ADSs on The New York Stock Exchange under the symbol "VIAO."

We are both an "emerging growth company" as that term is defined in the Jumpstart Our Business Startups Act of 2012 and a "foreign private issuer" as defined under the U.S. federal securities laws, and as such may elect to comply with certain reduced public company reporting requirements for this and future filings. See "Prospectus Summary—Implications of Being an Emerging Growth Company" and "Prospectus Summary—Implications of Being a Foreign Private Issuer."

Investing in the ADSs involves risks. See "Risk Factors" beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Share | Per ADS | Total | |||

|---|---|---|---|---|---|---|

| Public offering price | $ | $ | $ | |||

| Underwriting discounts and commissions | $ | $ | $ | |||

| Proceeds to VIA optronics AG (before expenses) | $ | $ | $ | |||

| Proceeds to the selling shareholder (before expenses) | $ | $ | $ |

Corning Research & Development Corporation, one of our commercial partners, has agreed to purchase ADSs at an aggregate purchase price of $20 million in a separate concurrent private placement, that we expect will be completed shortly after the completion of this offering, at a price per ADS equal to 95% of the initial public offering price in this offering. The sale of such ADSs will not be registered under the Securities Act of 1933, as amended. The closing of this offering is not conditioned upon the closing of such concurrent private placement.

The underwriters have a 30-day option to purchase up to additional ADSs from the selling shareholder to cover over-allotments, if any. We will not receive any proceeds from the sale of ADSs by the selling shareholder.

Delivery of the ADSs will be made against payment in New York, New York on or about , 2019.

Neither the Securities and Exchange Commission nor any state securities commission has approved of anyone's investment in these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Citigroup | Stifel |

| Berenberg | William Blair | Needham & Company |

, 2019

TABLE OF CONTENTS

| | Page | |||

|---|---|---|---|---|

Prospectus Summary | 1 | |||

Risk Factors | 14 | |||

Special Note Regarding Forward-Looking Statements | 55 | |||

Use of Proceeds | 57 | |||

Dividend Policy | 58 | |||

Capitalization | 59 | |||

Dilution | 60 | |||

Selected Consolidated Financial and Other Data | 62 | |||

Management's Discussion and Analysis of Financial Condition and Results of Operations | 66 | |||

Business | 80 | |||

Management | 108 | |||

Related Party Transactions | 124 | |||

Principal and Selling Shareholders | 126 | |||

Description of Company History and Share Capital | 128 | |||

Description of American Depositary Shares | 146 | |||

Shares and ADSs Eligible for Future Sale | 154 | |||

Exchange Controls and Limitations Affecting Shareholders | 156 | |||

Taxation | 157 | |||

Underwriting | 168 | |||

Expenses Related to this Offering | 174 | |||

Legal Matters | 174 | |||

Experts | 174 | |||

Service of Process and Enforcement of Civil Liabilities | 174 | |||

Where You Can Find More Information | 175 | |||

Index to Financial Statements | F-1 | |||

You should rely only on the information contained in this prospectus or contained in any free writing prospectus we file with the Securities and Exchange Commission, or the SEC. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the SEC. We are offering to sell, and seeking offers to buy, the ADSs only in jurisdictions where offers and sales of these securities are legally permitted. The information contained in this prospectus or in any free writing prospectus we file is accurate only as of its date, regardless of the time of delivery of this prospectus or of any sale of the ADSs. Our business, financial condition, results of operation and prospects may have changed since that date.

Until 25 days after the date of this prospectus, federal securities laws may require all dealers that buy, sell, or trade the ADSs, whether or not participating in this offering, to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ADSs and the distribution of this prospectus outside of the United States.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We have historically conducted our business through VIA optronics GmbH and its consolidated subsidiaries, and therefore our historical consolidated financial statements present the result of operations of VIA optronics GmbH. Prior to the consummation of this offering, the shareholders of VIA optronics GmbH contributed the shares they held in VIA optronics GmbH to VIA optronics AG by way of a contribution in kind against issuance of new shares (Sacheinlage gegen Gewährung von neuen Aktien) to the newly established VIA optronics AG. Following this contribution, our financial statements will present the results of VIA optronics AG and its consolidated subsidiaries. VIA optronics AG's financial statements will be the same as VIA optronics GmbH's financial statements prior to this offering. Unless otherwise indicated or the context implies otherwise:

- •

- "VIA optronics," "VIA," "Company," "we," "us" and "our" refers to VIA optronics AG, its direct subsidiary VIA optronics GmbH and its indirect subsidiaries on a consolidated basis;

- •

- "shares" or "ordinary shares" refers to our ordinary shares;

- •

- "ADSs" refers to American Depositary Shares, each of which represents of an ordinary share; and

- •

- "ADRs" refers to American Depositary Receipts, which may evidence the ADSs.

All references in this prospectus to "U.S. dollars," "USD" or "$" are to the legal currency of the United States and all references to "€" or "euro" are to the currency introduced at the start of the third stage of the European economic and monetary union pursuant to the treaty establishing the European Community, as amended. Our consolidated financial statements are presented in euros. Throughout this prospectus and solely for convenience, we have converted euros to U.S. dollars at the noon buying rate of €1.00=US$[ ], as certified by the European Central Bank at [ ], 2019.

Unless otherwise indicated, the consolidated financial statements and related notes included in this prospectus have been prepared in accordance with International Accounting Standards and also comply with International Financial Reporting Standards, or IFRS, and interpretations issued by the International Accounting Standards Board, or IASB, which differ in certain significant respects from U.S. generally accepted accounting principles, or U.S. GAAP. Financial information in thousands or millions, and percentage figures in this prospectus have been rounded. Rounded total and sub-total figures in tables in this prospectus may differ marginally from unrounded figures indicated elsewhere in this prospectus or in the consolidated financial statements. Moreover, rounded individual figures and percentages may not produce the exact arithmetic totals and sub-totals indicated elsewhere in this prospectus.

MaxVU is a trademark of ours that we use in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert our rights, or the rights of the applicable licensor to our trademark and tradenames to the fullest extent under applicable law.

This prospectus contains estimates and other statistical data prepared by independent parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this prospectus from our own research as well as from industry and general publications, surveys and studies conducted by third parties, some of which may not be publicly available. This prospectus contains discussion of certain conclusions and analyses contained in a report by MarketsandMarkets that we commissioned.

ii

Industry publications, research, surveys, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under "Risk Factors." These and other factors could cause results to differ materially from those expressed in our forecasts or estimates or those of independent third parties.

iii

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. Before investing in the ADSs, you should read this entire prospectus carefully, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and VIA optronics GmbH's consolidated financial statements and related notes, for a more complete understanding of our business and this offering.

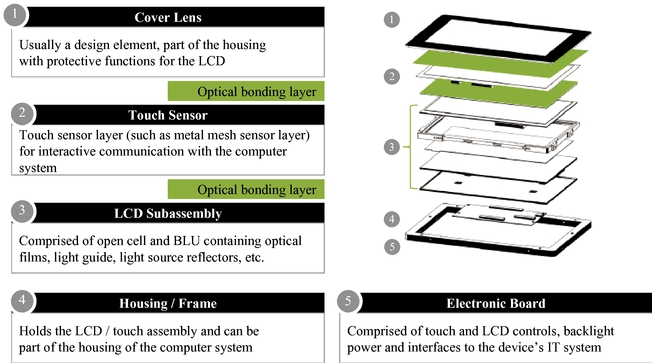

Our Company

We are a leading provider of enhanced display solutions for multiple end markets in which superior functionality or durability is a critical differentiating factor. Our technology is particularly well-suited for demanding environments that pose technical and optical challenges for displays, such as bright ambient light, vibration and shock, extreme temperatures and condensation. Our solutions combine our expertise in integrated display head assembly and proprietary bonding technologies. We also develop, manufacture and sell an array of customized metal mesh touch sensors and electrode base film materials for use in touch panels. Our portfolio of offerings enables thin display designs and high optical clarity, which decreases power consumption and increases readability. We provide a wide range of customized display solutions across a broad range of display sizes and shapes, including curved display panels and solutions integrating multiple displays under one cover lens.

Our differentiated technologies include our proprietary silicone-based bonding material, or VIA bond plus, our patented optical bonding processes, or MaxVU™, and our metal mesh touch sensor technology. Our optical bonding processes utilize VIA bond plus for display head assemblies, or DHAs, without using any potentially damaging mechanical force, and eliminate air gaps and other distorting features common to conventional technologies. Our metal mesh touch sensor technology enables high precision functionality and is based on a metal grid patterned on a transparent electrode base film that can be laminated to any type, size and shape of cover lens material. In addition to our proprietary technologies and processes, we leverage our customized equipment and manufacturing know-how to quickly clean, re-tool and ramp up our production lines to maximize utilization.

Our customers operate in the automotive, consumer electronics and industrial/specialized applications end markets. Our solutions can be found in the products of companies such as Alpine, BMW, Continental, Ferrari, Dell, HP, Lenovo, Sharp, 3M, Honeywell and John Deere. Our automotive applications include displays for navigation, instrument clusters, rear seat entertainment and infotainment systems. Our consumer applications include solutions for notebooks, tablets and all-in-one monitors. Our industrial/specialized applications include avionics and marine instrumentation, agricultural combines, digital signage, interactive conference room displays, industrial robotics and defense applications.

Our portfolio of offerings consists of enhanced display solutions, optical bonding and related services and licensing, and metal mesh touch sensors. We possess an extensive array of proprietary technologies related to optical bonding and metal mesh touch sensors which enables us to provide enhanced display solutions that are built to meet the specific needs of our customers. We believe our technologies and our related intellectual property, as well as our engineering expertise, give us a competitive edge and pose significant barriers to entry.

For the year ended December 31, 2018, we generated revenue of €[ ] million and profit of €[ ] million. We are headquartered in Nuremberg, Germany and had over 650 employees worldwide as of December 31, 2018. We maintain production facilities in Germany, China and Japan and, through our subsidiaries, operate sales offices in Taiwan and the United States. In 2018, we served over 70 customers around the world.

Our Industry

Digital displays have become pervasive in everyday life. Technological advancements, quality improvements and cost reductions have collectively helped to make displays ubiquitous in nearly every industry. In response to the growing demand and broadening applications of display technology, optical bonding and touch sensor technologies have become critical to achieving the diverse and highly specific requirements of customers in various end markets. We estimate that the addressable market for our products in 2018 was at least $42.3 billion, which was derived from MarketsandMarkets' estimate of global revenue from the sale of displays of approximately $130.0 billion in 2018. Within the total global display market, MarketsandMarkets attributed $87.7 billion in 2018 to TVs, smartphones, smart wearables, other display products such as E-readers and medical devices and other display technologies such as E-paper, which we do not address today nor expect to address in the future. MarketsandMarkets estimates that global revenue from the sale of displays will grow to approximately $163.3 billion in 2023.

Our Competitive Strengths

We believe the following key strengths will help us to maintain and enhance our competitive position:

Proprietary material, patented processes and metal mesh technology. We believe that our proprietary silicone-based bonding material, patented optical bonding processes and metal mesh touch sensor technology are key enablers of our success in our target markets. We are, to our knowledge, the only company that offers a combination of optical bonding and metal mesh touch sensor technology. We have an aggregate of 57 granted patents and 100 additional pending patent applications relating to our optical bonding processes, metal mesh touch sensor technology and component parts used in our customized production equipment. VIA bond plus is our proprietary silicone-based bonding material utilized for all of our bonding applications. In contrast to organic substances such as acrylates, VIA bond plus is fully repairable, non-shrinking, non-yellowing, environmentally friendly and stable at extreme temperatures. MaxVU is our patented dry-bonding process that enables display head assembly without potentially damaging mechanical force, thereby increasing production yield, eliminating potential LCD damage and preventing undesired optical side effects. In addition, our copper-based metal mesh touch sensor technology offers significantly higher conductivity that enhances touch performance, including stylus/pen sensitivity and glove functionality.

Technological expertise well-suited for demanding environments. We are a pioneer in designing and developing display solutions intended to satisfy the most demanding technological and environmental challenges. These challenges include bright ambient light, vibration and shock, extreme temperatures, condensation, dust and other specialized conditions, as well as the need for enhanced touch sensitivity and curved form factors. We continue to dedicate significant research and development, or R&D, resources to address these challenges. Further, we leverage the experience we gain in the high-end consumer market, which is generally characterized by early adoption of new technologies and shorter product life cycles, to anticipate industry trends and innovate solutions for our automotive and industrial/specialized applications markets.

Efficient global production with automated, scalable capacity. With our modern production sites in Germany, China and Japan, we have the ability to meet customers' specific requirements with regards to design, volume and manufacturing location. Our flexible production lines can provide solutions for a wide range of display screen sizes up to 100 inches. Our bonding facilities are equipped with manual, semi-automated and fully automated production lines capable of handling various production volumes, from specialized small-batch runs to high volume production. We leverage our customized equipment and manufacturing know-how to quickly clean, re-tool and ramp up our production lines to maximize utilization.

2

Early and deep design collaboration with Original Equipment Manufacturers. Because of the increasing integration of display and/or touch functionality into novel design assemblies, we often engage with Original Equipment Manufacturers, or OEMs, early in their design and development processes. We utilize our deep engineering and R&D resources and operating expertise to collaborate with OEMs on product design, qualification, manufacturing and testing in order to provide comprehensive and customized solutions. We believe this approach provides us with an understanding of the OEMs' technology roadmaps, allowing us to develop innovative and advanced solutions to meet their current and future needs. Our technological expertise in combination with our collaborative relationships allows us to develop new applications, such as touch enabled controls on an automotive center console, and enables us to be a sole source supplier for certain OEMs.

Proven engineering and experienced management team. We have assembled a team of talented technical professionals with significant knowledge and expertise in the area of optical bonding and touch sensor technology. We also have an experienced global management team with extensive expertise in enhanced display solutions, system integration and manufacturing, and a strong track record of management experience at companies including Aptiv, AU Optronics, Dell and Siemens.

Our Growth Strategy

The key elements of our strategy are:

Become an integrated display system provider. We aim to expand our capabilities to serve as an integrated display system provider in all of our markets by combining system design, interactive displays, software functionality and other hardware components. We plan to achieve this goal by utilizing our extensive intellectual property portfolio, process know-how, and optical bonding and metal mesh touch sensor technologies to expand our in-house technological capabilities. We also plan to expand our research and development efforts through increased investment in our engineering activities, including the hiring of additional personnel. We may also seek to augment our solutions by acquiring new technologies and expertise, including by acquiring other companies or assets, hiring technical teams or entering into strategic alliances.

Grow within our existing customer base. We plan to grow our position with existing customers by continuing to leverage our technological capabilities and engineering talents. We have become increasingly involved at earlier stages of the OEM design and development process, specifically within the automotive market, as display solutions continue to be differentiating factors for end user experience. We expect this close and early-stage collaboration to continue to facilitate strong and long-term customer relationships and increase our exposure to OEMs.

Continue to expand our customer base. We intend to expand our customer base within our core end markets. In particular, we believe we are well-positioned to further penetrate the automotive market given our success in the consumer electronics market, which has typically adopted newer technology more quickly due in part to shorter product life cycles, and our solutions' quality, performance, robustness and reliability. We also intend to acquire new customers within the industrial/specialized applications market, where enhanced display and touch sensor solutions are needed in a wide range of products for use in demanding environments. We believe our technological capabilities, production know-how and R&D expertise will enable us to continue to improve our products' functionality and performance and will facilitate our ability to develop products and enhancements, enable new applications and expand our customer base within our core end markets.

Leverage our full-service metal mesh touch sensor technology. We intend to accelerate the adoption of our recently acquired metal mesh touch sensor technology into more touch display applications across our end markets. Before our acquisition of a majority interest in VTS-Touchsensor Co., Ltd., or VTS, from Toppan Printing Co., Ltd., or Toppan, in April 2018, we purchased touch sensors from third-

3

party vendors for use in our display solutions. We believe our ability to produce both the electrode base film and related metal mesh touch sensors distinguishes us from our competitors by enabling us to be a one-stop touch solution provider. We expect that an increasing number of our customers will adopt our in-house metal mesh display touch sensor technology as high-precision touch functionality becomes more prevalent.

Concurrent Private Placement

Corning Research & Development Corporation, or Corning, one of our commercial partners, has agreed to purchase ADSs at an aggregate purchase price of $20 million in a separate concurrent private placement, that we expect will be completed shortly after the completion of this offering, at a price per ADS equal to 95% of the initial public offering price in this offering. The sale of ADSs to Corning will not be registered under the Securities Act of 1933, as amended, and is subject to limited conditions set forth in the investment agreement.

Company History

Our business is conducted through VIA optronics GmbH, registered in the commercial register of the local court (Amtsgericht) of Nuremberg under HRB 22650, and its subsidiaries. VIA optronics GmbH was established on May 12, 2006 with an initial share capital of €25,000. The company has its registered seat in Schwarzenbruck.

Because a company in the form of a GmbH cannot be used for an initial public offering, the shareholders of VIA optronics GmbH decided to create a new company in the form of a German stock corporation (Aktiengesellschaft or AG), VIA optronics AG, to serve as a new holding company for the VIA optronics group and as the vehicle issuing the ADS for the initial public offering and listing on the New York Stock Exchange following the contribution of all shares in the operating entity VIA optronics GmbH into VIA optronics AG.

On January 4, 2019, the shareholders of VIA optronics GmbH incorporated VIA optronics AG, which was registered in the commercial register of the local court of Nuremberg under HRB 36200 on March 18, 2019 with an initial share capital of €100,000. Subsequently, the shareholders of VIA optronics GmbH contributed all shares they held in VIA optronics GmbH to VIA optronics AG by way of a contribution in kind against issuance of shares (Sachkapitalerhöhung). As a result of this contribution, VIA optronics AG became the holding company for VIA optronics GmbH and its subsidiaries.

Our website is www.via-optronics.com. This website address is included in this prospectus as an inactive textual reference only. The information and other content appearing on our website are not part of this prospectus. Our agent for service of process in the United States is Corporation Service Company, located at 1090 Vermont Avenue, N.W., Washington, DC 20005, telephone number (800) 927-9800.

4

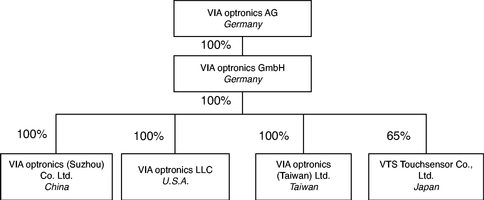

Organizational Chart

The following chart shows our organizational structure of VIA optronics AG and its direct and indirect subsidiaries. See "Description of Company History and Share Capital—Incorporation of the Company."

Office Location

Our principal executive offices are located at Sieboldstrasse 18, 90411 Nuremberg, Germany, and our telephone number is +49 (0) 911 597 575-0.

Our Risks and Challenges

You should carefully consider all of the information set forth in this prospectus prior to making an investment in the ADSs. Our ability to implement our business strategy is subject to numerous risks and uncertainties. Actual results could differ materially from our forward-looking statements due to a number of factors, including, without limitation, risks related to:

- •

- our ability to meet customers' requirements for quality and performance or their demands as to timing or quantity;

- •

- our dependence upon sales to certain customers;

- •

- our dependence upon our relationships with our strategic partners;

- •

- our ability to win business;

- •

- the length of the product development cycle for our OEM, Tier-1 Supplier and other customers;

- •

- our dependence upon a limited number of suppliers for a number of our raw materials and equipment, including the silicone material used in VIA bond plus;

- •

- volatility in the prices or availability of certain components and raw materials used in our business;

- •

- our ability to protect our know how, trade secrets and other intellectual property;

- •

- our ability to manage the expansion of our operations effectively;

- •

- our ability to attract and retain key management or other key personnel;

- •

- our ability to raise additional capital on attractive terms, or at all, if needed; and

- •

- the other risks described in the "Risk Factors" section of this prospectus and elsewhere in this prospectus.

5

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue for our fiscal year ended December 31, 2018, we qualify as an "emerging growth company" as defined in Section 2(a) of the U.S. Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to:

- •

- not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the SOX Act;

- •

- reduced disclosure obligations regarding executive compensation; and

- •

- not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements.

We may choose to take advantage of some or all of the available exemptions and have taken advantage of some of these exemptions in this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold shares. We do not know if some investors will find the ADSs less attractive as a result of our use of these or other exemptions. The result may be a less active trading market for the ADSs and increased volatility in the price of the ADSs.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of some accounting standards until the date those standards apply to companies that are not publicly traded. We currently prepare our financial statements in accordance with IFRS, as issued by the IASB, which does not have separate provisions for publicly traded and private companies.

We will remain an emerging growth company until the earliest of (a) the last day of our fiscal year during which we had total annual gross revenue of at least $1.07 billion; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of ADSs in this offering; (c) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or (d) the date on which we are deemed to be a "large accelerated filer" under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided to emerging growth companies in the JOBS Act.

Implications of Being a Foreign Private Issuer

Upon consummation of this offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

- •

- the rules under the Exchange Act requiring domestic filers to issue financial statements prepared under U.S. GAAP;

- •

- the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

6

- •

- the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

- •

- the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q, containing unaudited financial and other specified information, and current reports on Form 8-K, upon the occurrence of specified significant events.

We will file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC, an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain more extensive executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from the more extensive compensation disclosure requirements for companies that are neither an emerging growth company nor a foreign private issuer and will continue to be permitted to follow our home country practice on such matters.

7

The Offering

American Depositary Shares offered: | ||

By VIA optronics AG | ADSs | |

By Jürgen Eichner, our Chief Executive Officer, as selling shareholder | ADSs | |

ADSs to be sold to Corning in the concurrent private placement | ADSs | |

ADSs to be outstanding immediately after this offering and the concurrent private placement | ADSs | |

Ordinary shares to be outstanding immediately after this offering and the concurrent private placement | ordinary shares | |

Offering price | We currently estimate that the initial public offering price per ADS will be between $ and $ . | |

Over-allotment option | ADSs from the selling shareholder. | |

The ADSs | Each ADS represents of an ordinary share. | |

The depositary, the custodian or any of their respective nominees will hold the ordinary shares and any other rights or property underlying your ADSs. You will have rights as provided in the deposit agreement. You may cancel your ADSs and withdraw the underlying ordinary shares as provided, and pursuant to the limitations set forth in, the deposit agreement. The depositary will charge you fees for, among other acts, any such cancellation. We and the depositary may amend the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the terms of the deposit agreement then in effect. | ||

To better understand the terms of the ADSs, you should carefully read the "Description of American Depositary Shares" section of this prospectus. You should also read the deposit agreement, which is an exhibit to the Registration Statement of which this prospectus forms a part. | ||

Depositary | The Bank of New York Mellon | |

Custodian | The Bank of New York Mellon SA/NV, and any other custodian as may be appointed pursuant to the deposit agreement. |

8

Use of proceeds | We expect to receive total net proceeds from this offering of approximately $ million, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, assuming an initial offering price of $ per ADS, the midpoint of the price range set forth on the cover page of this prospectus. We will also receive net proceeds of approximately $ million from the sale of ADSs in the concurrent private placement to Corning. We intend to use the net proceeds of this offering and the concurrent private placement for the following purposes: (i) potential acquisitions of targets that could enhance our integrated solutions offerings within the automotive and/or industrial/specialized markets; (ii) improvements in and expansion of our existing production capabilities, including with respect to the production of large display sizes and improvement in automation in our facilities in Germany and Japan and expansion of our clean room capacity in our Chinese facilities; (iii) research and development, including research and development relating to camera-enhanced displays, three dimensional displays, new sensor technologies, software enhancements and embedded computing; (iv) expansion of our sales, marketing and distribution teams; and (v) general corporate purposes, including, without limitation, working capital. See "Use of Proceeds." | |

We will not receive any proceeds from the sale of ADSs offered by the selling shareholder. | ||

Dividend policy | We have no present intention of declaring or paying any dividends in the foreseeable future. See "Dividend Policy." | |

Risk factors | You should carefully read the information set forth in the "Risk Factors" section of this prospectus beginning on page [·] and the other information set forth in this prospectus before deciding to invest in the ADSs. | |

Proposed NYSE Global Market Symbol | "VIAO" |

The number of our ordinary shares to be outstanding after this offering and the concurrent private placement is based on the number of ordinary shares outstanding as of , 2019. Unless otherwise indicated, all information in this prospectus assumes that the underwriters do not exercise their over-allotment option. Unless otherwise noted, the information in this prospectus assumes the issuance and sale of ADSs in the concurrent private placement to Corning at 95% of the assumed initial public offering price. The number of ordinary shares outstanding after this offering is dependent on the number of ADSs sold to Corning in the concurrent private placement, which will change based on the initial public offering price per ADS in this offering.

9

Summary Consolidated Financial and Other Data

We present below summary consolidated historical financial and other data of VIA optronics GmbH, our former holding company that is now a wholly-owned subsidiary of VIA optronics AG. The financial data as of and for the years ended December 31, 2018 and 2017 have been derived from VIA optronics GmbH's audited consolidated financial statements and the related notes, which are included elsewhere in this prospectus and which have been prepared in accordance with IFRS as issued by the IASB and audited in accordance with the standards of the PCAOB.

The historical results presented below are not necessarily indicative of the financial results to be expected for any future periods. You should read this information in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Selected Consolidated Financial and Other Data" and VIA optronics GmbH's consolidated financial statements and related notes, each included elsewhere in this prospectus.

| | | Year Ended December 31, | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Consolidated Statement of Comprehensive Income: | | 2018 | | 2018 | | 2017 | | |||||

| | | ($ in thousands)(1) | | (€ in thousands) | | |||||||

Revenue | | | $ | | | € | | € | 131,031 | | ||

Cost of sales | | | | | | (113,232 | ) | |||||

| | | | | | | | | | | |||

Gross profit | | | | | | 17,799 | | |||||

Selling expenses | | | | | | (3,735 | ) | |||||

General administrative expenses | | | | | | (7,988 | ) | |||||

Research and development expenses | | | | | | (798 | ) | |||||

Other operating income (expenses), net(2) | | | | | | 33 | | |||||

| | | | | | | | | | | |||

Operating income | | | | | | 5,311 | | |||||

| | | | | | | | | | | |||

Financial result | | | | | | (696 | ) | |||||

| | | | | | | | | | | |||

Profit before tax | | | | | | 4,615 | | |||||

Income tax expense | | | | | | (1,262 | ) | |||||

| | | | | | | | | | | |||

Net profit | | | | | | 3,353 | | |||||

| | | | | | | | | | | |||

| | | | | | | | | | | |||

| | | | | | | | | | | |||

Exchange differences on translation of foreign operations | | | | | | (165 | ) | |||||

| | | | | | | | | | | |||

| | | | | | | | | | | |||

| | | | | | | | | | | |||

Comprehensive income | | | | | | 3,188 | | |||||

| | | | | | | | | | | |||

| | | | | | | | | | | |||

| | | | | | | | | | | |||

| | | As of December 31, | | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Selected Consolidated Statement of Financial Position Data: | | 2018 (As Adjusted)(3) | | 2018 (Actual) | | 2018 | | 2017 | | ||||||||

| | | (€ in thousands) | | ($ in thousands)(1) | | (€ in thousands) | | ||||||||||

Cash and cash equivalents | | | € | | | | $ | | | € | | € | 6,623 | | |||

Working capital | | | | | | | | | 3,683 | | |||||||

Total assets | | | | | | | | | 48,713 | | |||||||

Total liabilities | | | | | | | | | 40,109 | | |||||||

Shareholders' equity | | | | | | | | | 8,604 | | |||||||

10

| | | Year Ended December 31, | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Other Data: | | 2018 | | 2018 | | 2017 | | |||||

| | | ($ in thousands)(1) | | (€ in thousands) | | |||||||

Gross Margin(4) | | | % | | % | 13.6 | % | |||||

EBITDA(5) | | | $ | | | € | | € | 5,940 | | ||

Adjusted EBITDA(5) | | | | | | 6,436 | | |||||

Adjusted Net Profit(5) | | | | | | 3,713 | | |||||

Adjusted EBITDA Margin(5) | | | % | | % | 4.9 | % | |||||

- (1)

- Amounts in this column are not audited and have been converted from euros to U.S. dollars solely for the convenience of the reader at the noon buying rate of €1.00=US$[ ], as certified by the European Central Bank at [ ], 2019.

- (2)

- Amount is shown on a net basis solely for convenience of the reader. Please refer to VIA optronics GmbH's consolidated financial statements and related notes, each included elsewhere in this prospectus, for a presentation of Other operating income and Other operating expense on a gross basis.

- (3)

- Gives effect to the sale of ADSs by us in this offering and the sale of ADSs in the concurrent private placement to Corning at 95% of the initial public offering price, in each case assuming an initial public offering price of $ per ADS, the midpoint of the price range set forth on the cover page of this prospectus. A $1.00 increase or decrease in the assumed initial public offering price of $ per ADS, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease the as adjusted amount of each of cash and cash equivalents, total assets and shareholders' equity by $ million, assuming the number of ADSs offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each increase or decrease of 1.0 million in the number of ADSs offered by us at the assumed initial public offering price would increase or decrease the as adjusted amount of each of cash and cash equivalents, total assets and shareholders' equity by $ million, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

- (4)

- We define gross margin as gross profit stated as a percentage of revenues.

- (5)

- Our management and supervisory boards utilize both IFRS and non-IFRS measures in a number of ways, including to facilitate the determination of our allocation of resources, to measure our performance against budgeted and forecasted financial plans and to establish and measure a portion of management's compensation.

- The non-IFRS measures used by our management and supervisory boards include:

- •

- EBITDA, which we define as net profit (loss) calculated in accordance with IFRS before financial result, taxes, depreciation and amortization; for purposes of our EBITDA calculation, we define "financial result" to include financial result as calculated in accordance with IFRS and foreign exchange gains (losses) on intercompany indebtedness;

- •

- Adjusted EBITDA, which we define as net profit (loss) calculated in accordance with IFRS before financial result, taxes, depreciation and amortization, acquisition-related costs incurred in connection with our acquisition of a 65% interest in VTS, including the effect of any acquisition fair value adjustment to revenue, and costs relating to this offering; for purposes of our Adjusted EBITDA calculation, we define "financial result" to include financial result as calculated in accordance with IFRS and foreign exchange gains (losses) on intercompany indebtedness;

11

- •

- Adjusted EBITDA Margin, which we define as Adjusted EBITDA stated as a percentage of revenue; and

- •

- Adjusted Net Profit, which we define as net profit (loss) calculated in accordance with IFRS before the after tax impacts of acquisition related costs incurred in connection with our acquisition of a 65% interest in VTS, including the effect of any acquisition fair value adjustment to revenue, and costs relating to this offering; for purposes of our calculation of Adjusted Net Profit, we calculate the tax impacts assuming application of an effective tax rate to VIA optronics GmbH of [ ]% and 27.4% for fiscal years ended December 31, 2018 and 2017, respectively, representing the German statutory income tax rate, plus any applicable German solidarity surcharges plus any applicable municipal trade taxes.

- Our management and supervisory boards believe these non-IFRS measures are helpful tools in understanding certain aspects of our financial performance and are important supplemental measures of operating performance because they eliminate items that may have less bearing on our operating performance and highlight trends that may not otherwise be apparent when relying solely on IFRS financial measures. As an example, our VTS acquisition-related costs, such as costs attributable to the consummation of the transaction and integration of VTS as a consolidated subsidiary (composed substantially of professional services fees, including legal, accounting and other consultants) and any transition compensation costs, are not considered to be related to the continuing operation of VTS's business and are generally not relevant to assessing or estimating the long-term performance of VTS. We also believe that these non-IFRS measures are useful to investors and other users of our financial statements in evaluating our performance because these measures are the same measures used by our management and supervisory boards for these purposes.

- While we use non-IFRS measures as a tool to enhance our understanding of certain aspects of our financial performance, we do not believe that these non-IFRS measures are a substitute for, or are superior to, the information provided by IFRS results. As such, the presentation of non-IFRS measures is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitations associated with the use of non-IFRS measures as compared to IFRS results are that non-IFRS measures may not be comparable to similarly titled measures used by other companies in our industry and that non-IFRS measures may exclude financial information that some investors may consider important in evaluating our performance. Because of these and other limitations, you should consider our non-IFRS measures alongside the directly comparable IFRS-based financial performance measures, including our net profit (loss), net profit margin and our other IFRS financial results. Management addresses the inherent limitations associated with using non-IFRS measures through disclosure of such limitations, presentation of our financial statements in accordance with IFRS and reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Profit to the most directly comparable IFRS measure, net profit (loss). Further, management also reviews IFRS measures and measures such as our level of capital expenditures, research & development expenditures, and interest expense, among other items.

12

- Set forth below are reconciliations of each non-IFRS measure to the most directly comparable financial measure prepared in accordance with IFRS, in order to enable investors to perform their own analysis of our operating results.

| | | | Year Ended December 31, | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | 2018 | | 2018 | | 2017 | | |||||

| | | | ($ in thousands)(A) | | (€ in thousands) | | |||||||

| | Net profit | | | $ | | | € | | € | 3,353 | | ||

| | Adjustments: | | | | | | | ||||||

| | Financial result | | | | | | 696 | | |||||

| | Foreign exchange gains (losses) on intercompany indebtedness | | | | | | 87 | | |||||

| | Income tax expense | | | | | | 1,262 | | |||||

| | Depreciation and amortization | | | | | | 542 | | |||||

| | | | | | | | | | | | |||

| | EBITDA | | | | | | 5,940 | | |||||

| | Adjustments: | | | | | | | ||||||

| | Acquisition-related costs | | | | | | 496 | | |||||

| | Offering costs | | | | | | — | | |||||

| | | | | | | | | | | | |||

| | Adjusted EBITDA | | | | | | 6,436 | | |||||

| | Revenue | | | | | | 131,031 | | |||||

| | | | | | | | | | | | |||

| | Adjusted EBITDA Margin | | | | | | 4.9 | % | |||||

| | Net profit | | | | | | € | 3,353 | | ||||

| | Adjustments: | | | | | | | ||||||

| | Acquisition-related costs | | | | | | 360 | | |||||

| | Offering costs | | | | | | — | | |||||

| | | | | | | | | | | | |||

| | Adjusted Net Profit | | | | | | 3,713 | | |||||

- (A)

- Amounts in this column are not audited and have been converted from euros to U.S. dollars solely for the convenience of the reader at the noon buying rate of €1.00=US$[ ], as certified by the European Central Bank at [ ], 2019.

13

Investing in the ADSs involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, including "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and related notes, before making an investment decision. If any of the following risks actually occurs, our business, financial condition and operating results could be harmed. In that case, the trading price of the ADSs could decline and you might lose all or part of your investment.

Risks Related to Our Business and Industry

Our solutions may not meet our customers' requirements, which could result in a loss of customers or business.

Our products must meet our customers' exacting standards for quality and performance. We design our solutions, usually in conjunction with our customers, on a project-by-project basis to meet specific customer specifications. By way of example, each metal mesh touch sensor must be customized to reflect the sensor pattern specified by our customer. Even for those projects where we have the autonomy to select certain components for integration into a finished display, we must select components that satisfy our customers' technical requirements. We have in the past, and may in the future, have products that do not meet our customers' requirements due to production deficiencies, inability to produce the requested amount of products on time or other reasons. Any failure to satisfy our customers' requirements could result in customers reducing or ceasing their business with us, which would have a material adverse effect on our business, financial condition and results of operations.

Our failure to develop and introduce new products and solutions or enhancements to existing products and solutions on a timely basis, at sufficient quality or quantity, or at competitive prices, could harm our ability to attract and retain customers.

We and our customers often operate in intensely competitive industries that are characterized by rapidly evolving technology, frequent product introductions and ongoing demands for greater performance and functionality. New products based on new or improved technologies, such as the three dimensional glass-on frame cold formed products being developed by Corning, or new industry standards in the end-user markets can render existing products and services of our customers obsolete and unmarketable and motivate them to seek our support or the support of others in designing and manufacturing new products. We therefore must continually identify, design, develop and introduce new and updated solutions for a variety of industries with improved features to remain competitive. To do this, we must:

- •

- design innovative and performance-improving features that differentiate our products and solutions from those of our competitors, such as application to curved surfaces, enhanced touch sensitivity, thinner display sizes, infrared and facial recognition and seamless system integration, such that our OEM customers are able to offer products that are differentiated from their competition;

- •

- accurately define and design new products and solutions to meet market needs, such as electronic rearview mirror replacement systems;

- •

- anticipate changes in end-user preferences with respect to end products, such as widespread use of touch functionality;

- •

- rapidly develop and produce our products and solutions at competitive prices;

- •

- anticipate and respond effectively to technological changes or product announcements by others; and

14

- •

- provide effective post-sales support to our direct customers for defects in our new products and solutions following deployment.

The process of developing new products and solutions and enhancing existing products and solutions is complex, lengthy, costly and uncertain. If we fail to anticipate our customers' changing needs or emerging technological trends, our market share and results of operations could materially suffer. We must make long-term investments in our research and development capabilities, including product development and equipment customization, develop or obtain appropriate know-how and intellectual property and commit significant resources, including to enhance and prepare our production capacity, before knowing whether our predictions will accurately reflect customer demand for our products and solutions. If we are unable to adapt our products to new technological industry standards, including with respect to the incorporation of enhanced features (such as integrated camera technology or facial recognition) or functionality (such as glove functionality and software interactivity), the market's acceptance of our products and solutions could decline and our results would suffer. Furthermore, even if we are able to develop new products and solutions or enhance our existing products to meet our customers' expectations, if we are unable to achieve such developments on a cost effective basis or at sufficient quality or quantity, our customers may elect not to purchase our products or solutions and we may lose market share.

There are numerous potential alternatives to our display and touch technologies and materials.

Optically bonded displays are more expensive than organically bonded (or air-gapped) displays and, as a result, may not be best suited for applications, specifically within the consumer electronics market, in which the highest quality performance characteristics (such as highly responsive touch functionality, sunlight readability and shock and temperature resistance) are not required. A number of companies produce organically bonded displays that do not have these high quality performance characteristics, but can compete with our display offerings. In addition, our optically bonded displays must compete with displays that are optically bonded using different techniques than the ones we employ, including liquid or dry optical bonding using epoxy or polyurethane. Companies are making substantial investments in, and conducting research to, improve the characteristics of these alternative optical bonding techniques that may improve functionality or lower the cost of their optically bonded displays. This could cause our customers to choose such products over our offerings. In addition, our metal mesh touch sensor technology is subject to competition from other producers of metal mesh touch sensors that use copper as the conductive material, as well as from silver mesh sensor and nano layer technologies that facilitate touch-enabled display capability. Advances in these technologies may result in market acceptance for alternatives to our metal mesh touch sensor technology, the impact of which may be compounded as enhanced touch-enabled displays replace existing conventional displays.

We face intense competition within our industry and our competitors may introduce new display or touch sensor solutions and specifications faster than we do, at lower prices or with better performance characteristics, may manage to reduce their costs at a greater rate than we do, or may benefit from support from corporate parents. Our failure to compete effectively with them could materially adversely affect our business, net assets, financial condition and results of operations.

We face global competition in the market for display solutions and competition for our touch sensor solutions. Some of our current and potential competitors may have a number of advantages over us, including:

- •

- a longer operating history;

- •

- greater name recognition and marketing power;

- •

- preferred vendor status with our existing and potential customers;

15

- •

- significantly greater financial, technical, personnel, sales and marketing and other resources, including benefiting from support from corporate parents;

- •

- the ability to respond more quickly to new or changing opportunities, technologies and customer requirements;

- •

- broader product and services offerings to provide more complete solutions; and

- •

- lower cost structures.

Consolidation among our competitors could also result in the formation of larger competitors with greater market share and greater financial and technological resources than us, further increasing competition in the markets we serve. Furthermore, in some cases, our customers for certain products or services, such as consigned optical bonding services, may also be our competitors with respect to other aspects of our business, such as producing enhanced display solutions, and they could cease purchasing products or services from us.

Despite our planned investments in research and development and engineering, our products and process technologies may fail to keep pace with our competitors' ability to produce higher quality display solutions at a lower cost, and our competitors may be able to offer their products on a more price-competitive basis than we can. If our development fails to keep pace, and as a result of the intense competition in the market for display solutions and competition for touch sensor solutions, we may encounter significant pricing pressure and/or suffer losses in market share. For example, our competitors have in the past and may again in the future lower prices in order to increase their market share, which would ultimately reduce the prices we may realize from our customers. If we are unable to defend our market share by continually developing new products and solutions and/or reducing our own cost base, the pricing pressure exerted by our competitors could cause us to lose important customers or lead to falling average selling prices and declining margins. We may not be able to offset the effects of any price reductions with an increase in the number of products sold, cost reductions or otherwise, which could adversely affect our revenue and financial condition. See "Business—Competition" for more information on competition in our business.

A limited number of customers account for a significant portion of our revenue. These customers can exert a significant amount of negotiating leverage over us, and revenue from them can be volatile. The loss of, or a substantial decline in sales to, one or more of these customers could have a material adverse effect on our revenue and profitability.

For 2018 and 2017, we derived approximately [ ]% and 90%, respectively, of our revenue from our five largest customers, and approximately [ ]% and 41%, respectively, of our revenue from our largest customer. We expect this concentration to continue for the foreseeable future, and our results of operations may fluctuate materially as a result of changes in these larger customers' buying patterns. The loss of any significant customer (or customers that in the aggregate represent a significant portion of our revenue) or a material reduction in the amount of business we undertake with such customers could have a material adverse effect on our revenue and profitability. Our top customers may decide not to continue to purchase products from us at current levels or at all.

In addition, our customers can demand and have in the past demanded reduced prices or other pricing, quality or delivery commitments as a condition to their purchasing from us or increasing their purchase volume, which can, among other things, result in reduced gross margins in order to maintain or expand our market share. If we are unable to retain and expand our business with our customers on favorable terms, or if we are unable to achieve gross margins that are similar to or more favorable than the gross margins we have historically achieved, our business, financial condition and results of operations may be materially adversely affected.

16

Our customers' negotiating leverage can also result in customer arrangements that may contain liability risk to us. For example, some of our customers require that we provide them with indemnification against certain liabilities, including claims of losses by their customers caused by our products. Any increase in our customers' negotiating leverage, including with respect to indemnification, may expose us to increased liability risk, which, if realized, may have a material adverse effect on our business, financial condition and results of operations.

Because we do not generally have long-term agreements with our customers and our customers generally are not obligated to purchase a minimum quantity of products or services from us, we could fail to match our production with our customers' demand. Our results may suffer if we are not able to adequately forecast demand for our products.

It is not industry practice to enter into firm, long-term purchase commitments. Sales to our customers are generally governed by framework agreements that do not include minimum purchase quantity requirements. Although we consult with major customers, who typically provide us with forecasts of their product requirements, customers may not contract for products as forecasted, may cancel orders that they do place or reduce the quantities ordered from us for a number of reasons. They may also discontinue their relationship with us at any time. If we are unable to predict accurately the amount of products needed to meet customer requirements, or if customers were to unexpectedly cancel or reduce a large number of orders simultaneously, our production could significantly exceed our customers' demand. This could materially and adversely affect our business, financial condition and results of operations.

In addition, in the automotive end market, we may be required to deliver products over a long period of time without having any commitments from our customers to purchase minimum volumes of such products throughout that period. This means that our production facilities need to maintain the capability to produce such products over a long period of time, including through reserving or re-tooling machines which could be used for other projects, in order to meet demands for our products over time. In addition, until we are awarded a project and the relevant operating procedures are determined, changes in design, product specification, quantities and materials may occur which could make it difficult for us to meet the customer's demand on the schedule the customer requires. Failure to meet the demands of our customers in the automotive end market could materially and adversely affect our business, financial condition and results of operations, as well as harm our reputation and relationships with our automotive customers.

We are highly dependent on the success of our customers and their sales to certain end markets.

Our customers are not the end users of our product offerings, but rather they use our products and solutions as a part of their products, which are ultimately sold to an end user. In the case of metal mesh touch sensors, we usually function as a component supplier selling touch sensors to third parties for incorporation into their own finished products which are subsequently sold to OEMs, Tier-1 suppliers and other suppliers for inclusion in end-user products. Our success depends in large part on the ability of our customers to market and sell their end products that incorporate our products. If any of our customers' end product marketing efforts are unsuccessful or if our customers experience a decrease in demand for such products, our sales and/or profitability will be reduced. Some of the end markets in which our customers operate are characterized by intense competition, rapid technological change and economic uncertainty, and as such we may be unable to replace the revenue associated with the loss of any one key customer with new business relationships. If we are unable to collaborate with and secure design wins with successful OEMs, we may not create meaningful demand for our products. Moreover, if any of our customers choose to focus their efforts on programs and end products that do not incorporate our products and solutions, we may experience decreased demand for our products. Any of these circumstances may adversely affect our results of operations.

17

We are dependent upon our relationship with Toppan Printing Co. Ltd., or Toppan, the minority owner of VTS, with respect to the production and sale of our metal mesh touch sensor technology.

We produce and sell our metal mesh touch sensors and films through VTS, our subsidiary in which Toppan is the minority investor. In 2018, [ ]% of our revenue was generated by VTS. VTS's business operations were established through a series of commercial agreements between us (or VTS) and Toppan. These agreements include: a shareholder agreement, an intellectual property transfer agreement, an intellectual property license agreement, facility lease agreements, employee secondment agreements and a business assistance agreement. Pursuant to these agreements, Toppan transferred patents and patent applications relating to its sensor technologies to VTS. Additionally, Toppan agreed to provide VTS with the premises to produce VTS's products, including plant buildings for two manufacturing operation sites in Japan, as well as the majority of plant employees. VTS's research and development activities are delegated to Toppan under an R&D and consignment agreement. The shareholders agreement also includes certain non-competition, lock-up and deadlock put/call provisions that govern certain of our and Toppan's rights and obligations with respect to VTS. The lock-up provision prohibits us from disposing of our interest in VTS to a third party until March 23, 2020, unless such sale is pursuant to a sale of the entirety of VTS that has been approved by Toppan. The deadlock put/call provisions additionally provide that in the event of a deadlock between us and Toppan, we could be entitled to or become obligated to acquire all of Toppan's interest in VTS at certain pre-negotiated price thresholds. Under the commercial agreements with Toppan, if Toppan ceases to own an equity interest in VTS, Toppan is permitted to terminate these commercial agreements without our consent.

Accordingly, the continuation and success of our metal mesh business is highly dependent on Toppan and on our agreements with Toppan. There can be no assurance that we will be able to complete the registration process for any patent applications transferred by Toppan to VTS to perfect VTS's rights in such intellectual property or that VTS will have access to the most qualified Toppan personnel for purposes of carrying out its operations. If any of the commercial agreements with Toppan were to terminate, our relationship with Toppan were to deteriorate or if Toppan elected to prioritize its wholly-owned business over that of VTS, VTS' business operations would be materially and adversely impacted and it would have a material adverse effect on our ability to produce and sell metal mesh touch sensors and recognize the related revenue. This would have a material adverse effect on our business, results of operations and financial condition.

We may not be able to maximize the benefits of our strategic partnership with Toppan or effectively collaborate with them in the future.

In April 2018, we acquired a 65% interest in VTS from Toppan. We have only jointly operated VTS with Toppan for a limited period of time and continue to develop our strategic relationship. We may not be able to maximize the benefits of our strategic partnership with Toppan in the future or may not collaborate with them effectively, and our failure to do so successfully may have a material adverse effect on our financial condition and results of operations, including, among other things, through disruption of operations at facilities we lease from Toppan, loss of Toppan employees providing services to VTS, failure to successfully execute on and maximize the benefits to us under ongoing agreements with Toppan, potential infringement of third-party intellectual property rights by products manufactured by VTS based on intellectual property rights licensed/obtained from Toppan or those developed by VTS with the assistance of Toppan and issues relating to regulatory compliance in production processes operated by Toppan employees.

18

Winning business is often subject to a competitive selection process that can be lengthy and requires us to incur significant expense, and we may not be selected.

In many cases, we must win competitive selection processes, resulting in so-called "design wins," before we can supply customers with our products and solutions. These selection processes can be lengthy and can require us to incur significant design and development expenditures. We may not win the competitive selection process and may never generate any revenue despite incurring significant design and development expenditures. The new product selection processes we seek to enter are determined by our sales team based on their judgment and experience. Even if we are successful in obtaining design wins, there is no guarantee that our sales team will have identified and pursued the most lucrative selection processes or those that will lead to the development of industry-leading technologies. Because we typically focus on only a few customers in a given product area, the loss of a design win may result in our failure to have our technologies added to new generation products in that area. This can result in lost sales and could hurt our position in future competitive selection processes to the extent we are not perceived as being a technology leader.

After winning a product design for one of our customers, we may still experience delays in generating revenue as a result of lengthy customer development and design cycles. In addition, a change, delay or cancellation of a customer's plans could significantly adversely affect our financial results, as we may have incurred significant expense and generated no revenue. Finally, even if a design is introduced, if our customers fail to successfully market and sell their products, it could materially adversely affect our business, financial condition, and results of operations.

We may not realize our goal of becoming a design partner to OEMs.

Our goal is to become a leading supplier to Tier-1 suppliers and a direct design partner to OEMs, specifically within the automotive market, to further our goal of becoming an integrated system provider. However, we may be unsuccessful in achieving this goal. We may be unable to develop sufficient design capabilities in time or deliver relevant system know-how in a timely manner.

Furthermore, even if we are able to collaborate with key OEMs as a design partner to incorporate our products and solutions into their end products, we may not be successful in meeting the OEMs' product specifications, which could result in OEMs reducing their use of our products and solutions or ceasing their collaborations with us entirely.