Exhibit 99.1

VIA optronics AG

Nuremberg

ISIN DE000A2TSG37 / WKN A2TSG3

(Shares of VIA optronics AG)

ISIN US91823Y1091 / WKN A2QDG5

(American Depositary Shares of VIA optronics AG)

Invitation to the Annual General Meeting 2022

We hereby invite our shareholders to the Annual General Meeting to be held on

Thursday, December 29, 2022 at 15:00 hours CET (= 14:00 hours UTC (Coordinated Universal Time))

in the offices of the Company at Sieboldstraße 18, 90411 Nuremberg, Germany.

I. | Agenda |

1. | Presentation of the adopted annual financial statements of VIA optronics AG, the approved consolidated financial statements and the Group management report of VIA optronics AG, in each case for the financial year 2021, and the report of the Supervisory Board for the financial year 2021. |

The Supervisory Board has approved the annual financial statements prepared by the Management Board and the audited consolidated financial statements prepared in accordance with International Financial Reporting Standards (IFRS) and the additional requirements of German commercial law pursuant to Section 315e (1) of the German Commercial Code (HGB); the annual financial statements are thus adopted. In accordance with the statutory provisions, no resolution is planned or required for agenda item 1. From the time the Annual General Meeting is convened, the above documents are available on our website at:

https://investors.via-optronics.com/investors/annual-general-meeting/.

Furthermore, the documents will be available during the Annual General Meeting and will be explained in more detail.

2. | Resolution on the ratification of the acts of the Management Board for the fiscal year 2021 |

The Management Board and the Supervisory Board propose that the acts of the members of the Management Board holding office in the fiscal year 2021 be ratified for this period.

3. | Resolution on the ratification of the acts of the Supervisory Board for the fiscal year 2021 |

The Management Board and the Supervisory Board propose that the acts of the members of the Supervisory Board holding office in the fiscal year 2021 be ratified for this period.

- 1 -

4. | Election of the Auditor of the Consolidated Financial Statements for the fiscal year 2022 |

Based on the recommendation of the Audit Committee, the Supervisory Board proposes that PricewaterhouseCoopers GmbH Wirtschaftsprüfungsgesellschaft, Nuremberg, be elected as auditors of the consolidated financial statements for the fiscal year 2022.

5. | Resolution on the approval of the remuneration system of the members of the Management Board |

The Supervisory Board of VIA optronics AG resolved on October 5, 2022 a new remuneration system for the remuneration of the members of the Management Board in accordance with Section 87a (1) of the German Stock Corporation Act (AktG). The Act Implementing the Second Shareholders' Rights Directive (ARUG II), which was promulgated in the Federal Law Gazette on December 22, 2019, introduced a new Section 120a of the German Stock Corporation Act (AktG). The provision of Section 120a (1) of the German Stock Corporation Act (AktG) stipulates that the General Shareholders’ Meeting of a listed company shall resolve on the approval of the renumeration system for Management Board members presented by the Supervisory Board at least every four years and whenever there is a significant change to the renumeration system. The Company applies these regulations applicable to listed companies notwithstanding the fact that only the American Depositary Shares issued by it and not the shares issued by it are listed on the stock exchange.

The renumeration system for the members of the Management Board is presented below in Section II. under item II. A. and is available on the Company's website at

https://investors.via-optronics.com/investors/annual-general-meeting/ .

The Supervisory Board proposes that the following resolution be adopted:

The renumeration system for the members of the Management Board resolved by the Supervisory Board on October 5, 2022 is approved.

6. | Resolution on the compensation of the members of the Supervisory Board |

Pursuant to Section 113 (3) of the German Stock Corporation Act (AktG), as amended by the Act Implementing the Second Shareholders' Rights Directive (ARUG II) published in the Federal Law Gazette on December 22, 2019, resolutions on the renumeration of Supervisory Board members must be adopted at least every four years for listed companies. The Company applies these regulations applicable to listed companies notwithstanding the fact that only the American Depositary Shares issued by it and not the shares issued by it are listed on the stock exchange. Pursuant to Section 15 of the Articles of Association of VIA optronics AG, the compensation of the members of the Supervisory Board is determined by the General Shareholders’ Meeting.

The current renumeration of the members of the Supervisory Board was determined as follows by resolution of the General Shareholders’ Meeting on August 25, 2020:

"(a)The ordinary members of the Supervisory Board shall receive fixed compensation of €20,000 per year. The Chairman and Vice Chairman of the Supervisory Board receive fixed compensation of €40,000 per year and €30,000 per year respectively. The Chairman of the Audit Committee receives fixed compensation of €30,000 per year.

b)If more than four Supervisory Board meetings are held in a calendar year, the members of the Supervisory Board shall receive €5,000 for each additional meeting attended. Beyond this, the Company will not in principle compensate Supervisory Board members for attending Supervisory Board meetings.

- 2 -

c)Members of the Supervisory Board shall be entitled to reimbursement of their reasonable, documented expenses (including, but not limited to, travel, accommodation and telecommunications expenses).

(d)Value added tax payable on their compensation and expenses shall be added, if applicable. "

The renumeration of the Supervisory Board shall be adjusted taking into account the additional workload associated with the work on the Supervisory Board and its committees as well as the Supervisory Board renumeration granted by other, comparable companies.

The Management Board and the Supervisory Board propose that the following resolution be adopted:

The renumeration for the members of the Supervisory Board shall be newly determined on the basis of Section 15 of the Articles of Association, including the renumeration system for the members of the Supervisory Board described below, as follows:

"(a) The members of the Supervisory Board shall receive fixed compensation of EUR 40,000 per year. The Chairman of the Supervisory Board shall receive additional compensation of EUR 21,300 per year and the Deputy Chairman of the Supervisory Board shall receive additional compensation of EUR 5,000 per year. The Chairman of the Audit Committee shall receive additional compensation of EUR 14,500 per year. The Chairman of the Compensation and Nomination Committee shall receive additional compensation of EUR 12,000 per year. Ordinary members of the Audit Committee shall receive additional fixed compensation of EUR 9,000 per year, ordinary members of the Compensation and Nomination Committee shall receive additional fixed compensation of EUR 6,750 per year. Members of the Supervisory Board who are members of the Supervisory Board or a committee for only part of the financial year, or who chair or vice-chair the Supervisory Board or chair one of the committees, shall receive the respective compensation pro rata temporis.

b) The members of the Supervisory Board shall be entitled to reimbursement of their reasonable, documented expenses (including, but not limited to, travel, accommodation and telecommunications expenses).

(c) Sales tax payable on their compensation and expenses, if any, shall be added. "

The above compensation regulation shall be applied for the first time for the current fiscal year 2022.

The compensation system for the members of the Supervisory Board is presented below and is available on the Company's website at

https://investors.via-optronics.com/investors/annual-general-meeting/

and will also be available during the Annual General Meeting.

Compensation system for members of the Supervisory Board of VIA optronics AG

a)Objective of Supervisory Board renumeration

The system for the compensation of Supervisory Board members is based on the statutory requirements and takes into account the recommendations of the German Corporate Governance Code. The compensation of the members of the Supervisory Board shall be balanced overall and shall be in an appropriate relationship to the responsibilities and tasks of the members of the Supervisory Board and to the situation of the company, also taking into account the compensation regulations of other comparable companies. At the same time, the compensation system aims to be attractive in order to attract and retain outstanding candidates for office on the Supervisory Board of VIA optronics AG. This is a prerequisite for the best

- 3 -

possible supervision and advice of the Management Board, which in turn make a significant contribution to the long-term success of the company.

b) | Structure of Supervisory Board renumeration |

The members of the Supervisory Board receive purely fixed compensation in order to strengthen the independence of the Supervisory Board, enable it to perform its advisory and supervisory functions objectively and neutrally, and make independent personnel and renumeration decisions. This is also in line with the suggestion of the German Corporate Governance Code that Supervisory Board renumeration should consist of fixed compensation. In line with the recommendation of the German Corporate Governance Code, the higher time commitment of the Chairman and Deputy Chairman of the Supervisory Board and of the Chairmen and members of committees should be taken into account in an appropriate manner through corresponding additional compensation. Due to the special nature of Supervisory Board compensation, which is granted for Supervisory Board activities and differs fundamentally from the activities of employees of the Company and the Group, a so-called vertical comparison with employee renumeration is not considered.

c) | Review of Supervisory Board renumeration |

The compensation of the members of the Supervisory Board at VIA optronics AG is determined by the General Shareholders’ Meeting. The compensation and the compensation system of the members of the Supervisory Board are regularly reviewed for appropriateness by the Supervisory Board and Management Board, whereby external remuneration experts may also be consulted. When mandating external renumeration consultants, attention is paid to their independence.

If the Management Board and Supervisory Board see a need to adjust the renumeration or the renumeration system, they will submit a corresponding resolution proposal to the General Shareholders’ Meeting; in any case, a resolution proposal on the compensation, including the underlying renumeration system, will be submitted to the General Shareholders’ Meeting no later than every four years. The General Shareholders’ Meeting may confirm the respective existing system of Supervisory Board renumeration or adopt a resolution to amend it.

The above proposal for the renumeration of the members of the Supervisory Board was discussed in detail by the Management Board and the Supervisory Board. An independent external renumeration experts were consulted in advance for an appropriate analysis and concept development.

The regulations applicable to dealing with conflicts of interest are also observed in the procedure for establishing and implementing the renumeration system.

7. | Presentation of the renumeration report for fiscal year 2021 for discussion |

Pursuant to the Act Implementing the Second Shareholders' Rights Directive (ARUG II), which was published in the Federal Law Gazette on December 22, 2019, the Management Board and Supervisory Board of a listed company must prepare an annual renumeration report in accordance with Section 162 of the German Stock Corporation Act (AktG) and submit it to the General Shareholders’ Meeting for approval pursuant to Section 120a (4) of the German Stock Corporation Act (AktG) or for discussion under the conditions of Section 120a (5) of the German Stock Corporation Act (AktG). The Company applies these regulations applicable to listed companies notwithstanding the fact that only the American Depositary Shares issued by it and not the shares issued by it are listed on the stock exchange. The Management Board and Supervisory Board have prepared a renumeration report pursuant to Section 162 of the German Stock Corporation Act (AktG) on the renumeration granted and owed to each member of the Management Board and Supervisory Board for the first time in the financial year 2021. The renumeration report was formally audited by the auditor in accordance with Section 162 (3) of the German Stock Corporation Act (AktG) and issued with an audit opinion.

- 4 -

Since the Company, as a small corporation within the meaning of Section 267 (1) of the German Commercial Code, meets the requirements of Section 120a (5) of the German Stock Corporation Act (AktG), the renumeration report will not be submitted to the General Shareholders’ Meeting for resolution on approval but will be discussed under a separate agenda item. A resolution of the General Shareholders’ Meeting on item 7 of the agenda is therefore not required.

The renumeration report for the financial year 2021, prepared and audited in accordance with Section 162 of the German Stock Corporation Act (AktG), and the auditor's report on its audit are printed in Section II. under item II. B. and are available from the time the General Shareholders’ Meeting is convened and during the General Shareholders’ Meeting on the Company's website at

https://investors.via-optronics.com/investors/annual-general-meeting/

and will also be available during the General Shareholders’ Meeting.

8. | Resolution on amendments to the Articles of Association for the purpose of holding virtual General Shareholders' Meetings and updating Articles 16, 17, and 19 of the Articles of Association |

On July 27, 2022, the Act on the Introduction of Virtual General Shareholders' Meeting of Stock Corporations and Amendment of Provisions under Cooperative, Insolvency and Restructuring Law (Bundesgesetzblatt (Federal Law Gazette) of July 26, 2022, page 1166 et seq.) entered into force. The new Section 118a of the German Stock Corporation Act (AktG) introduced by the Act allows the Articles of Association to authorize the Management Board to provide for the holding of a virtual General Shareholders' Meeting. A corresponding authorization must be limited in time, with a maximum period of five years from entry of the corresponding amendment to the Articles of Association in the Company's commercial register.

The Management Board and the Supervisory Board are of the opinion that the option of holding General Shareholders’ Meetings also virtually is required, also in view of the global shareholder base and the listing on the New York Stock Exchange. In order to maintain sufficient flexibility, it seems reasonable not to stipulate directly in the Articles of Association that a virtual General Shareholders’ Meeting be convened, but to authorize the Management Board to decide in advance of each General Shareholders’ Meeting whether the meeting is to be held as a virtual or a presence meeting. In individual cases, there may be General Shareholders’ Meetings with agenda items for which a meeting with the shareholders and their proxies present in person seems more suitable than a virtual format.

In addition, the provisions of the Articles of Association relating to the convening of and participation in and transmission of the General Shareholders' Meeting are to be updated and supplemented, and the rights of the Chairman of the General Shareholders' Meeting in the General Shareholders' Meeting are to be clarified in the Articles of Association.

The Management Board and the Supervisory Board propose that the following resolution be adopted:

8.1 | Section 16 of the Articles of Association (Venue and Convening of Meeting) shall be repealed and reworded as follows: |

"(1)The general shareholders’ meeting shall be convened by the management board, unless otherwise required by law. At the discretion of the convening body, it shall be held at the registered office of the Company, at the seat of a German stock exchange or in a German city with more than 100,000 inhabitants.

(2)The general shareholders’ meeting shall be convened at least with the statutory notice period.

- 5 -

(3)The management board is authorized for a period of five years after registration of the amendment to the Articles of Association introducing this paragraph 3 in the commercial register of the company to provide for the general shareholders’ meeting to be held without the physical presence of the shareholders or their proxies at the venue of the general shareholders’ meeting (virtual general shareholders’ meeting). In the case of a virtual general shareholders’ meeting, Section 16 (1) sentence 2 and Section 17 (2) and (4) of the Articles of Association shall not apply."

8.2 | Section 17 of the Articles of Association (Participation in/ Transmission of General Shareholders’ Meeting) shall be repealed and reworded as follows: |

"(1)Shareholders who are registered in the share register of the company and whose notification of participation is received by the company or another body designated in the notice of the respective general shareholders’ meeting at least six days before the general shareholders’ meeting in text form (Section 126b of the German Civil Code (BGB)) in German or English are entitled to participate in the general shareholders’ meeting and exercise the voting rights. The day of the general shareholders ’meeting and the day of receipt are to be disregarded when calculating such period. The notice of the general shareholders’ meeting may provide for a shorter period for notification of participation to be measured in days.

(2)The chairman of the general shareholders’ meeting is authorized to allow the audiovisual transmission of the general shareholders’ meeting via electronic media in a manner to be determined by him.

(3)The members of the management board and the supervisory board shall attend the general shareholder meeting at the venue of the general shareholders’ meeting. The chairman of the general shareholders’ meeting must participate at the venue of the general shareholders’ meeting. Supervisory board members who do not chair the general shareholders’ meeting may also participate in the general shareholders’ meeting by means of video and audio transmission if physical attendance does not appear justifiable due to health risks, for example in the event of an ongoing pandemic situation, or if disproportionately high travel expenses would arise for a supervisory board member resident abroad, or if the general shareholders’ meeting is held as a virtual general shareholders’ meeting.

(4)The management board is authorized to determine that shareholders may also participate in the general shareholders’ meeting without being present at its venue and without an authorized proxy and exercise all or some of their rights in full or in part by means of electronic communication. The management board shall also determine the further details of the procedure and announce them in the notice of the general shareholders’ meeting."

8.3 | Section 19 (3) of the Articles of Association (Chair of the General Shareholders’ Meeting) shall be repealed and reworded as follows: |

"(3)The chairman is authorized to impose reasonable time limits on the shareholder's right to ask questions, follow-up questions and to speak. In particular, he is authorized, at the beginning of the general shareholders’ meeting or during its course, to set a reasonable time limit for the entire course of the general shareholders’ meeting, for the individual item on the agenda or for the individual question, follow-up question or speaking contribution."

- 6 -

9. | Resolution on the authorization to grant subscription rights to members of the Management Board of the Company, to members of the management of affiliated companies and to selected employees of the Company and of affiliated companies in Germany and abroad (Stock Program 2022) and creation of Conditional Capital 2022/I and corresponding amendment to the Articles of Association |

It is intended to resolve on a stock program of the Company in order to be able to grant subscription rights for up to 220,000 shares of the Company to members of the Management Board of the Company, members of the management of affiliated companies of the Company and selected employees of the Company and of affiliated companies of the Company.

For this purpose, an authorization to grant subscription rights to members of the Management Board of the Company, to members of the management of affiliated companies and to selected employees of the Company and affiliated companies in Germany and abroad ("Stock Program 2022") and corresponding conditional capital ("Conditional Capital 2022/I") are to be resolved. The program serves to provide a targeted incentive and at the same time is intended to achieve a bonding effect of the participants to the Group.

In contrast to conventional stock option programs, the Stock Program 2022 provides that the new shares are not issued at an issue price that is at least equal to the stock market price of the Company's share at the time the stock options or subscription rights are granted. Instead, they will be issued at the lowest issue price permitted under stock corporation law, which is currently EUR 1.00 per share. Compared to stock options, this enables a more predictable valuation of the share-based renumeration component with lower fluctuations in value, thus promoting incentives for a steady and sustainable increase in the value of the Company. Participants in the Stock Program 2022 receive the full value of the shares less the lowest issue price, which is already taken into account in the calculation of the number of subscription rights granted.

The Management Board and the Supervisory Board propose that the following resolution be adopted:

a)Authorization to issue subscription rights to shares

The Management Board with the approval of the Supervisory Board and - with regard to the members of the Management Board of the Company - the Supervisory Board are authorized until the expiry of December 28, 2027 ("authorization period") to issue subscription rights ("subscription rights") on one or more occasions to a total of up to 220,000 no-par value registered shares of the Company with a notional share in the share capital of a total of up to EUR 220.000.00 to members of the Management Board of the Company, members of the management of affiliated companies of the Company and to selected employees of the Company and of affiliated companies of the Company (the "beneficiaries") in accordance with the more detailed conditions of the plan (Stock Program 2022).

The shareholders of the Company have no subscription rights. The authorization shall become effective upon registration of the Conditional Capital 2022/I to be resolved under lit. b) below in the Commercial Register.

The key points for the issue of subscription rights under the Stock Program 2022 are determined as follows:

(1) Allocation of Subscription Rights

Under the Stock Program 2022, subscription rights may only be issued to members of the Management Board, to members of the management of affiliated companies of the Company, and to selected employees of the Company and of affiliated companies of the Company. The exact group of beneficiaries and the scope of the subscription rights allocated to them in each case will be determined by the Management Board. Insofar as members of the Management Board are to receive subscription rights, this determination and the issue of the subscription rights shall be the sole responsibility of the Supervisory Board.

The maximum total volume issuable under the Stock Program 2022 is distributed among the beneficiaries as follows:

- | Members of the Company's Management Board may receive a total of up to 80,000 subscription rights, |

- | Members of the management of affiliated companies of the Company may receive a total of up to 55,000 subscription rights, and |

- 7 -

- | Employees of the Company and of affiliated companies may receive a total of up to 85,000 subscription rights. |

If the beneficiaries belong to more than one group, they shall receive subscription rights solely on the basis of their membership of one group (no double subscriptions). Group membership is determined by the Management Board of the Company and - insofar as members of the Management Board of the Company are concerned - by the Supervisory Board of the Company.

To the extent that subscription rights granted expire due to (a) the beneficiaries leaving the employment or service relationship with the Company or an affiliated company of the Company or (b) the termination of the office as member of the Management Board of the Company or as member of the management of an affiliated company of the Company within the authorization period, a corresponding number of subscription rights may additionally be issued to beneficiaries of the same group.

(2) Issue of Subscription Rights (issue periods)

Subscription rights may be issued in tranches once or several times a year within the authorization period in accordance with a program to be launched once or repeatedly. Subscription rights may be issued at the earliest after Conditional Capital 2022/I has been entered in the Commercial Register.

The issue of subscription rights is limited to the following annual periods, each of which lasts four weeks ("issue period" or "issue periods"): The issue periods shall commence in each case on the day after the Annual General Meeting, after the publication of the consolidated financial statements (in accordance with 20-F rules or IFRS, whichever is published first) and after the publication of quarterly announcements or comparable financial reports (in particular half-yearly reports, quarterly reports and/or interim announcements). In order to simplify the calculations and administration of the subscription rights, the Management Board of the Company and, insofar as subscription rights of the Management Board are concerned, the Supervisory Board may in the plan conditions for the Stock Program 2022 specify in each case one day within an issue period uniformly as the issue date ("issue date").

Provisions of insider law, other applicable legal provisions in Germany or abroad, applicable rules of the trading venues on which the shares or rights or certificates of the Company representing them are admitted to trading, if any, as well as all internal Company requirements for share trading shall remain unaffected.

The relevant provisions shall be determined by the Management Board or - insofar as an issue of subscription rights concerns members of the Management Board - by the Supervisory Board of the Company.

(3) Content of the Share Program

A subscription right grants the right to subscribe for one share in the Company, provided that the relevant subscription conditions are met in accordance with the plan conditions.

The plan conditions may provide that, in order to service the Stock Program 2022, the Company may optionally grant treasury shares to the beneficiaries instead of new shares from conditional capital or satisfy the subscription rights in whole or in part by cash settlement. The acquisition and use of treasury shares for the alternative fulfillment of subscription rights must comply with the statutory requirements; no authorization to acquire and use treasury shares has been granted by this resolution. The decision as to which alternative is chosen by the Company in each individual case shall be made by the Management Board of the Company or, insofar as members of the Management Board of the Company are concerned, by the Supervisory Board of the Company.

(4) Waiting period and term

Subscription rights may be exercised by the beneficiaries for the first time after the expiry of a waiting period of four years after the respective issue date ("waiting period").

- 8 -

The subscription rights may be exercised no later than twelve months after expiry of the waiting period; thereafter they forfeit without replacement.

(5) Exercise period and exercise price

After expiry of the waiting period, the subscription rights from a tranche may only be exercised once until the end of the term (i.e. within twelve months after expiry of the waiting period) and only in the following exercise periods, each of which lasts four weeks ("exercise period" or "exercise periods"): The exercise periods shall begin in each case on the day after the Annual General Meeting and after publication of the consolidated financial statements (in accordance with 20-F rules or IFRS, whichever is published first) and after publication of quarterly reports or comparable financial reports (in particular half-yearly reports, quarterly reports and/or interim reports).

Provisions of insider law, other applicable legal provisions in Germany or abroad, applicable rules of the trading venues on which the shares or rights or certificates of the Company representing them are admitted to trading, if any, as well as all internal Company requirements for share trading shall remain unaffected.

The relevant provisions shall be determined by the Management Board or - insofar as subscription rights of the Management Board are concerned - by the Supervisory Board of the Company.

The exercise price per share to be paid upon exercise of subscription rights corresponds to the pro rata amount of the share capital attributable to the individual no-par value share at the time of exercise of the subscription rights, which is currently EUR 1.00.

(6) Performance target

The subscription rights of a tranche can only be exercised after the end of the waiting period if the performance target ADS price development is achieved (as defined below):

For the achievement of the performance target, the respective share price development within four annual consecutive performance periods (as defined below) is considered. The relevant price is the price of the American Depositary Shares (ADS) representing the shares of the Company listed on the New York Stock Exchange ("ADS price"), averaged over one year (365 calendar days).

"Performance Period" means each of the four consecutive calendar years beginning with the year in which the respective tranche of subscription rights is issued.

"ADS price performance target": To achieve the performance target, the average ADS price must increase by at least 15% (arithmetic mean over the entire performance period) in the respective performance period compared to the average ADS price in the respective preceding calendar year (arithmetic mean over the entire calendar year).

If the ADS performance target is not achieved in a performance period, 25% of the subscription rights of the respective tranche will expire. In order to be able to exercise all subscription rights of a tranche after the end of the waiting period, the performance target must be achieved in all four performance periods of the respective tranche.

In addition to the fulfillment of the performance target, the plan conditions may stipulate further requirements for the full or partial exercise of subscription rights.

(7) Limitation option (cap)

For subscription rights granted to members of the Management Board of the Company, the Supervisory Board shall provide for a possibility of limitation (cap) for extraordinary developments and may also provide for further possibilities of limitation (e.g. with regard to requirements by a relevant renumeration system for the Management Board members). The plan conditions may provide for further cap options.

- 9 -

(8) Vesting

Issues relating to the forfeiture of the subscription rights granted upon termination of the service or employment relationship and the (possibly staggered) vesting of the subscription rights after the expiry of certain waiting periods shall be regulated by the Management Board with the approval of the Supervisory Board and, insofar as members of the Management Board of the Company are concerned, by the Supervisory Board within the framework of the plan conditions. Special arrangements may be made for special cases of retirement of beneficiaries, in particular for retirement due to reduction in earning capacity or termination for operational reasons or due to a change of control, and for the retirement of operations or parts of operations from the Company. In any case, the subscription rights may no longer be exercised if the service or employment relationship has ended for an important reason set by the beneficiary.

(9) Authorization to determine further details

Further details of the issuance and fulfillment of subscription rights, for the issuance of shares from Conditional Capital 2022/I, the technical requirements and procedures for a possible conversion into ADS for sale via a stock exchange as well as the further plan conditions including customary anti-dilution clauses shall be determined by the Supervisory Board as far as the members of the Management Board of the Company are concerned and otherwise by the Management Board of the Company.

Further provisions include in particular the decision on the one-time or repeated issuance of annual tranches to utilize the authorization to issue subscription rights, provisions on the transferability of subscription rights, provisions on the implementation of the Stock Program 2022 and the annual tranches and the procedure for the allocation and exercise of subscription rights, the allocation of subscription rights to individual beneficiaries, and provisions on a subsequent reduction in whole or in part of the number of subscription rights granted in the event of certain breaches of duty or in other justified cases (claw back or malus), and the exercisability in special cases, in particular in the event of the retirement of beneficiaries from the service or employment relationship, in the event of death, in the event of the retirement of an affiliated company, an operation or part of an operation from the VIA optronics Group or in the event of a change of control, the conclusion of an inter-company agreement or a delisting, as well as to meet legal requirements. In implementing this resolution, the Company is also entitled to deviate from the provisions of this resolution to the extent that the content of this resolution does not mandatorily fall within the resolution competence of the General Shareholders’ Meeting under stock corporation law or to the extent that this resolution goes beyond minimum requirements under stock corporation law.

b) Conditional Capital 2022/I

The share capital of the Company shall be conditionally increased by up to EUR 220,000.00 by issuing up to 220,000 new no-par value registered shares of the Company (Conditional Capital 2022/I). The Conditional Capital 2022/I shall serve exclusively to secure subscription rights issued by the Company on the basis of the authorization pursuant to lit. a) to members of the Management Board of the Company, to members of the management of affiliated companies and to selected employees of the Company and of affiliated companies in Germany and abroad in the period from registration of the Conditional Capital 2022/I in the commercial register until December 28, 2027.

The conditional capital increase will only be carried out to the extent that subscription rights are issued and the holders exercise their subscription rights to shares in the Company and the Company does not satisfy the subscription rights in accordance with the plan conditions by delivering treasury shares or by a cash settlement. The shares from Conditional Capital 2022/I will be issued at the exercise price determined in accordance with lit. a) of the authorization. The new shares shall carry dividend rights from the beginning of the financial year for which, at the time the subscription right is exercised, no resolution has yet been adopted by the General Shareholders’ Meeting on the appropriation of net income.

- 10 -

The Management Board with the approval of the Supervisory Board and, insofar as members of the Management Board of the Company are concerned, the Supervisory Board are authorized to determine the further details of the conditional capital increase and its implementation, including the technical requirements and procedures for a possible conversion into ADS for sale on a stock exchange.

The Supervisory Board is also authorized to amend the wording of the Articles of Association in accordance with the respective utilization of Conditional Capital 2022/I by issuing subscription shares. The same applies in the event of non-utilization of the authorization to issue subscription rights after expiry of the authorization period and in the event of non-utilization of Conditional Capital 2022/I after expiry of the periods for exercising subscription rights.

c) Amendment of the Articles of Association

Section 6 of the Articles of Association (Conditional Capital) shall be amended to read as follows:

"§ 6.

Conditional capital

The share capital of the Company is conditionally increased by up to EUR 220,000.00 by issuing up to 220,000 new no-par value registered shares of the Company (Conditional Capital 2022/I). The Conditional Capital 2022/I serves exclusively to secure subscription rights issued by the Company on the basis of the authorization of the General Shareholders’ Meeting of December 29, 2022 pursuant to agenda item 9 lit. a) to members of the Management Board of the Company, to members of the management of affiliated companies and to selected employees of the Company and of affiliated companies in Germany and abroad in the period from registration of the Conditional Capital 2022/I in the commercial register until December 28, 2027.

The conditional capital increase will only be carried out to the extent that subscription rights are issued and the holders exercise their subscription rights to shares in the Company and the Company does not satisfy the subscription rights in accordance with the plan conditions by delivering treasury shares or by a cash settlement. The shares from Conditional Capital 2022/I will be issued at the exercise price determined in accordance with lit. a) of the authorization of the General Shareholders’ Meeting of December 29, 2022 under agenda item 9. The new shares shall carry dividend rights from the beginning of the financial year for which, at the time the subscription right is exercised, no resolution has yet been adopted by the General Shareholders’ Meeting on the appropriation of net income. The Management Board with the approval of the Supervisory Board and, insofar as members of the Management Board of the Company are concerned, the Supervisory Board are authorized to determine the further details of the conditional capital increase and its implementation, including the technical requirements and procedures for a possible conversion into ADS for sale on a stock exchange. The Supervisory Board is authorized to amend the wording of the Articles of Association in accordance with the respective utilization of Conditional Capital 2022/I by issuing subscription shares. The same applies in the event of non-utilization of the authorization to issue subscription rights after expiry of the authorization period and in the event of non-utilization of Conditional Capital 2022/I after expiry of the periods for exercising subscription rights."

- 11 -

II. | Further Information on Agenda Items and Reports |

A. | System for the remuneration of the members of the Management Board of VIA optronics AG (agenda item 5) |

1. System for the remuneration of the members of the Management Board of VIA optronics AG

The renumeration system adopted by the Supervisory Board will be submitted to the General Shareholders’ Meeting for approval in order to comply with the provisions of Sections 87a and 120a of the German Stock Corporation Act (AktG) as a precautionary measure.

The Supervisory Board regularly reviews the Management Board renumeration system and adjusts it as necessary. In the event of significant changes, but at least every four years, the renumeration system is again submitted to the General Shareholders’ Meeting for approval. If an external consultant is engaged, care is taken to ensure that he or she is independent and that there is an occasional change of consultant.

If the renumeration system presented is not approved by the General Shareholders’ Meeting, a revised renumeration system shall be put to the vote at the latest at the following Annual General Meeting.

The Supervisory Board obtained factual and legal support in specific areas when drawing up the Management Board's compensation.

The new renumeration system applies to all new or renewed Management Board service contracts. Existing Management Board service contracts are only affected by the new renumeration system if they already contain a reference to a long-term bonus system. For those, the rules of the renumeration system will apply from fiscal year 2022.

2. Objectives of the Remuneration System

The Management Board renumeration system makes a significant contribution to the long-term positive development of the Company. The business strategy of VIA optronics AG is focused on profitable growth. Through the variable renumeration components and targets, the Management Board renumeration system contributes to the effective implementation of the business strategy.

The capital market orientation of the long-term performance-related renumeration component aligns Management Board renumeration with shareholder interests.

The renumeration system sets incentives for value-creating and long-term development of the company while avoiding disproportionate risks. In structuring the renumeration system, the Supervisory Board was guided by the following guidelines:

| • | Promotion of sustainable profitable development and long-term business strategy |

| • | Linkage with shareholder and stakeholder interests |

| • | Adequate remuneration in line with the market |

| • | Long-term oriented performance criteria |

| • | Clearly understandable system |

| • | Conformity with the legal requirements |

Within the aforementioned guidelines, the Supervisory Board intends to offer Management Board members a competitive renumeration package that is in line with the market, promotes the sustainable management of the Management Board, and makes it possible to attract and retain the best available candidates for an Management Board position.

- 12 -

3. Overview of the Remuneration System

The following table provides an overview of all the main components of the renumeration system:

| | |

Fixed | Fixed renumeration | Fixed contractually agreed remuneration, paid in twelve equal monthly installments |

| Fringe benefits | Contractual commitments to (partially) cover expenses, e.g. cell phone, company car, travel expenses |

Variable | Short-term variable renumeration | Target: 50% of fixed salary Cap: 100% of fixed salary Performance Criteria: - Performance (EBITDA) - Growth (sales) - Share price Payment: In the year following the end of the fiscal year for which the bonus is relevant |

| Long-term variable renumeration (LTI) | Value at allocation: 50% of fixed salary Cap: 100% of fixed salary Performance criteria: Share price increase 15%p.a. Waiting period: 4 years |

Maximum remuneration | The maximum renumeration (incl. fringe benefits, STI and LTI) per fiscal year is limited to €1,250,000 per Management Board member | |

Malus/Clawback | Partial or complete reduction or recovery of variable remuneration possible | |

The target total renumeration for each Management Board member is the sum of fixed and variable renumeration assuming a 100 percent target achievement.

The Supervisory Board ensures that the target total renumeration is commensurate with the tasks and performance of the respective Management Board member. The Supervisory Board pays particular attention to ensuring that the target total renumeration is in line with the market. It uses both a horizontal and a vertical comparison to assess whether the renumeration is in line with the market.

In addition, the Supervisory Board considers the development of the Management Board remuneration in relation to the remuneration of the workforce of the entire VIA optronics Group

- 13 -

in an internal (vertical) comparison. In this comparison, the remuneration of the Management Board is set in relation to the remuneration of the senior management as well as to the wider workforce and subjected to a market comparison. This ratio is also taken into account in the development over time. To this end, a vertical comparison of renumeration is carried out annually in accordance with the Supervisory Board's definition of the relevant senior executives and the relevant workforce as a whole.

4. Components of the Management Board renumeration system

The total renumeration of the members of the Management Board comprises fixed and variable renumeration components. The fixed, non-performance-related renumeration comprises the basic renumeration and fringe benefits. The performance-related and thus variable renumeration comprises the short-term variable renumeration ("Short Term Incentive", "STI") and the long-term variable renumeration ("Long Term Incentive", "LTI"). The long-term variable renumeration is granted exclusively in shares.

The possible total renumeration is limited to a maximum amount for the respective Management Board members (the maximum compensation).

5. Structure of the target total renumeration

The renumeration system provides for function-specific differentiation at the due discretion of the Supervisory Board based on the criteria of experience, function, area of responsibility and market circumstances of the Management Board member. In accordance with the requirements of the German Stock Corporation Act (AktG) and the recommendations of the German Corporate Governance Code "DCGK", care is taken when structuring target renumeration to ensure that the variable renumeration resulting from the achievement of long-term targets exceeds the share resulting from short-term targets.

The relative shares of the respective renumeration components in the target total renumeration (in %) for all Management Board members are approximately:

Compensation structure of target total renumeration

| | |

Remuneration | Compensation component | Share in percent |

Remuneration not linked to performance | Fixed renumeration in the form of a fixed salary, incl. fringe benefits | Approx. 40% |

| Fringe benefits | Approx. 5% |

Performance-related remuneration | Short-term variable remuneration, STI | Approx. 20% |

| Long-term variable compensation, LTI | Approx. 35% |

The share of non-performance-related renumeration (fixed salary and regular fringe benefits) is currently around 45% of total target compensation.

The share of short-term variable remuneration (STI) in total target remuneration is currently around 20%, assuming 100% target achievement, and the share of long-term variable remuneration is currently around 35%, assuming 100% target achievement. These ratios may vary due to functional differentiations or as part of the review of renumeration and alignment with market practice. However, the Supervisory Board always ensures that the variable

- 14 -

renumeration resulting from the achievement of long-term targets exceeds the share resulting from short-term targets.

5.1 Individual remuneration components

5.1.1 Fixed remuneration components

The fixed renumeration ensures an appropriate basic income for the members of the Management Board. It comprises the fixed salary and fringe benefits.

(a) | Fixed salary |

Each Management Board member receives a fixed salary based on the responsibility and experience of the respective Management Board member, paid in twelve monthly installments.

(b) | Fringe benefits |

Fringe benefits are defined for each Management Board member. The fringe benefits include in particular the cost or non-cash value of benefits in kind granted by the Company and other fringe benefits such as the provision of a company car, insurance allowances, and reimbursement of necessary travel expenses and other necessary expenses, including any taxes paid on these.

In individual cases, the Supervisory Board may grant a payment on the occasion of the assumption of office of a new Management Board member in the year of entry or the second year of appointment. Such a payment can, for example, compensate for losses of variable remuneration suffered by a member of the Management Board due to the change to VIA optronics at a previous employer.

5.1.2 Variable renumeration components

The variable renumeration of the Management Board members is linked to the performance of the Company. They comprise short-term oriented variable renumeration (STI) and long-term oriented variable renumeration (LTI).

The variable renumeration component serves to provide incentives to act in the best interests of shareholders, customers, employees and other stakeholders and to achieve long-term goals.

a) | Short Term Incentive |

The STI is a performance-related bonus with a one-year assessment period. It amounts to 50% of the gross annual fixed salary if targets are met and is capped at 100% of the gross annual fixed salary. It depends on financial performance criteria of the company and is granted entirely in cash.

The STI takes into account the Company's performance in the respective past fiscal year. It is linked to the following financial performance criteria; output (33%), sales (34%) and share price performance (33%). The achievement of the financial performance criteria is based on medium-term targets and is generally also the subject of external financial reporting. This enables maximum transparency of the STI and takes into account the overall responsibility of the Management Board and the performance of VIA optronics AG as a whole.

The following financial performance criteria are applied to the STI:

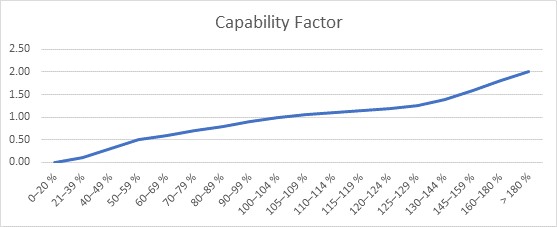

(1) | " Capability" |

Consolidated results of the VIA Group according to IFRS (HB II) to determine the Capability Factor. This is defined as earnings before interest, taxes, depreciation and amortization (EBITDA), as presented in the approved budget, compared to the audited financial statements.

- 15 -

If the capability factor (CF) achieved in the financial year is equal to the target value, the CF is "1.00". A higher CF achieved results in a CF > 1 (capped at 2.00); a lower value results in a CF < 1. If EBITDA is negative, the performance criterion is not achieved (CF = 0).

The achievement of the value is converted into the factor in gradations on the basis of the following table

EBITDA compared to budget | Capability Factor | |

0-20 % | 0,00 | |

21-39 % | 0,10 | |

40-49 % | 0,30 | |

50-59 % | 0,50 | |

60-69 % | 0,60 | |

70-79 % | 0,70 | |

80-89 % | 0,80 | |

90-99 % | 0,90 | |

100-104 % | 1,00 | |

105-109 % | 1,05 | |

110-114 % | 1,10 | |

115-119 % | 1,15 | |

120-124 % | 1,20 | |

125-129 % | 1,25 | |

130-144 % | 1,40 | |

145-159 % | 1,60 | |

160-180 % | 1,80 | |

> 180 % | 2,00 | |

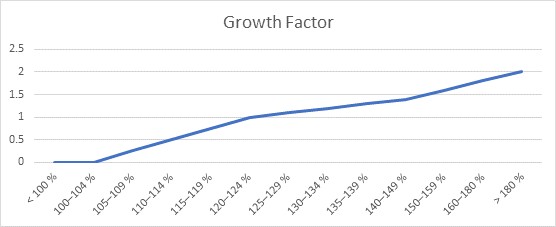

(2) | "Growth Factor" |

Consolidated sales of the VIA Group according to IFRS (HB II). This Growth Factor (GF) is defined as all attributable sales recognized in the financial statements compared to audited

- 16 -

sales in the previous year and reflects the company's target of achieving annual sales growth of 20%.

If the GF achieved in the fiscal year corresponds to the value of the previous year plus 20%, the GF is "1". A higher achieved GF leads to a GF > 1 (capped at 2.00); a lower value compared to the target value leads to a GF < 1.

The achievement of the value is converted into the factor in gradations based on the following table:

Sales | Growth factor | |

< 104 % | 0,0 | |

105-109 % | 0,25 | |

110-114 % | 0,50 | |

115-119 % | 0,75 | |

120-124 % | 1,00 | |

125-129 % | 1,10 | |

130-134 % | 1,20 | |

135-139 % | 1,30 | |

140-149 % | 1,40 | |

150-159 % | 1,60 | |

160-180 % | 1,80 | |

> 180 % | 2,00 | |

< 104 % | 0,0 | |

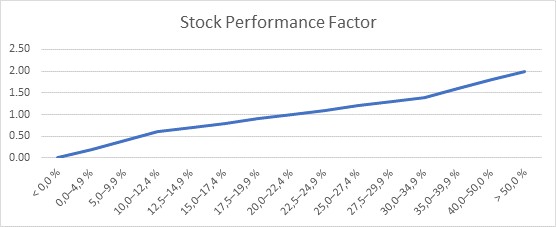

(3) | "Stock Performance: |

The development of the ADS share price in the relevant financial year compared to the previous year is used to determine the stock performance factor (PF). The PF cannot be negative. The baseline is defined as 0.0 and is capped at 2.0.

The year-on-year performance is examined based on the stock price in the 60-day average before the end of the year compared to the 60-day average of the previous year in the same period to determine the overall PF.

- 17 -

Share price | Stock Performance | |

< 0,0 % | 0,00 | |

0,0-4,9 % | 0,20 | |

5,0-9,9 % | 0,40 | |

10,0-12,4 % | 0,60 | |

12,5-14,9 % | 0,70 | |

15,0-17,4 % | 0,80 | |

17,5-19,9 % | 0,90 | |

20,0-22,4 % | 1,00 | |

22,5-24,9 % | 1,10 | |

25,0-27,4 % | 1,20 | |

27,5-29,9 % | 1,30 | |

30,0-34,9 % | 1,40 | |

35,0-39,9 % | 1,60 | |

40,0-50,0 % | 1,80 | |

> 50,0 % | 2,00 | |

Each of the above STI indicators can have a target achievement of between 0% and 200% (cap). After the end of the fiscal year, the actual target achievement for each indicator is determined and taken into account according to its weighting. Payment is made 30 days after the auditors have certified the annual financial statements. If a member leaves the Management Board during the year or joins the Management Board during the year, the STI is calculated after the end of the fiscal year (pro rata temporis) and paid out on the usual payment date.

b)Long-term variable Renumeration

The focus of the LTI is to increase the value for the shareholders of VIA optronics AG, thus incentivizing profitable and efficient management.

Each year, the members of the Management Board are allocated a number of share subscription rights depending on the average ADS price in the year of activity. The shares can only be subscribed after 4 years and only if the target is achieved (pro rata). The target is an annual average share price increase of 15%. If the share price does not increase by 15% within a performance year compared to the average ADS price (arithmetic mean) of the previous calendar year, 25% of the allocated shares of the respective tranche are forfeited. In the event of premature termination of the contract, section 5.3.2 shall apply accordingly.

- 18 -

Performance | Performance | Performance | Performance | ||

Year of | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

25%* | 25%* | 25%* | 25%* | ||

Waiting period | Subscription | ||||

* 25% value of the allocated tranche upon target achievement (share price increase 15%)

5.1.3 Maximum limit

Both short-term and long-term variable renumeration are capped in each case by setting a maximum amount and can fall to zero.

In addition, in accordance with Section 87a (1) sentence 2 no. 1 of the German Stock Corporation Act (AktG), the Supervisory Board has set a maximum renumeration for the members of the Management Board, which includes all fixed and variable renumeration components. The maximum renumeration is the upper limit in terms of amount and thus the actual maximum inflow for the relevant financial year in which the Management Board member was active, irrespective of the time of inflow, taking into account fixed renumeration (including basic compensation, fringe benefits and pension commitments), short-term variable renumeration (STI) and long-term variable renumeration (LTI). In addition, the maximum renumeration includes, among other things, possible additional benefits promised under individual contracts. It is not relevant when the respective renumeration element was paid out, but for which financial year it was granted.

The maximum annual renumeration per Management Board member is €1,250,000 as of the 2022 financial year. The Supervisory Board points out that these amounts are not the target total renumeration deemed appropriate by the Supervisory Board, but merely an absolute upper limit that could at best be reached by the Management Board member if the targets were optimally achieved and the share price increased significantly.

5.2 Claw-back and retention/reduction (malus)

Service contracts of Management Board members to be newly concluded or extended contain so-called malus and clawback provisions entitling the Company to withhold or demand repayment of variable renumeration components in full or in part in the event of a breach by the Management Board member concerned of the Company's internal code of conduct or statutory obligations. Furthermore, future service contracts of Management Board members will contain a provision obliging Management Board members to repay any variable renumeration already paid out if it transpires after payment that the basis for calculating the amount paid out was incorrect.

5.3 Management Board Service Agreements

5.3.1 Terms of Management Board contracts

The service contracts of the Management Board members are concluded for the duration of the appointment and are extended in each case for the duration of the reappointment. As a rule, the initial appointment is for a period of three years.

- 19 -

5.3.2 Benefits upon termination of employment

In the event of termination of the Management Board service contract, any outstanding variable renumeration components attributable to the period up to termination of the contract are granted in accordance with the originally agreed targets. If an Management Board service contract ends during the course of a fiscal year and the Management Board member leaves the Company, the STI and LTI are granted pro rata to the length of service in that fiscal year. An exercise of the subscription right before the end of the waiting period is not permitted.

This does not apply in cases where the service contract is terminated without notice for a reason attributable to the Management Board member; in such a case, variable renumeration (STI and LTI) will not be granted for the year in which the termination takes effect.

In the event of premature termination of the Management Board mandate due to revocation of the appointment, the Management Board member receives a severance payment in the amount of the renumeration expected to be owed by the Company for the remaining term of the employment contract, up to a maximum of two years' renumeration (severance payment cap).

In the event of premature termination of the Management Board mandate due to a mutually agreed cancellation of the employment contract, the total value of the benefits promised by the Company to the Management Board member under such an agreement shall not exceed the amount of the renumeration expected to be owed by the Company for the original remaining term of the employment contract, but shall not exceed the value of two years' compensation.

There are no commitments for benefits due to premature termination of Management Board activities as a result of a change of control.

B. | Compensation Report Pursuant to Section 162 of the German Stock Corporation Act (AktG), including Auditor's Report (Agenda Item 7) |

The following renumeration report pursuant to Section 162 of the German Stock Corporation Act (AktG) explains the renumeration granted and owed to the current and former members of the Management Board and Supervisory Board of VIA optronics AG by the Company and - where applicable - by companies of the Group.

According to the wording of the law, the renumeration granted and owed must be reported. In accordance with the legislative materials for the revised Section 162 of the German Stock Corporation Act (AktG), no precise regulation of the time of accrual has been made. The disclosures made in this renumeration report follows the payment-oriented approach, i.e. renumeration is stated at the time at which it actually accrues to the recipient.

COMPENSATION REPORT 2021

The Management Board of VIA optronics AG is composed of a Chief Executive Officer (CEO) and a Chief Financial Officer (CFO).

By resolution of January 11, 2020, the Supervisory Board of VIA optronics AG appointed Mr. Jürgen Eichner (CEO) as Chief Executive Officer and Mr. Daniel Jürgens as Chief Financial Officer (CFO). In September 2020, VIA optronics AG concluded service agreements with the two members of the Management Board expiring on December 31, 2022.

Furthermore, both members of the Management Board served as managing directors of VIA optronics GmbH. The service contracts (Managing Director Agreement) for this ended on March 09, 2021.

By resolution dated July 01, 2021, Dr. Markus Peters was appointed Chief Financial Officer (CFO). The service contract has a fixed term until June 30, 2024.

Mr. Daniel Jürgens left the Company as of September 30, 2021.

- 20 -

(1) Basic Features of the Remuneration System for the Management Board

The remuneration system of VIA optronics AG for the members of the Management Board consists of an annual fixed salary and a variable remuneration component, the payment of which depends on the achievement of pre-agreed financial and non-financial targets by the company.

The aim of the renumeration components is to bind the Management Board members to the Company and to contribute to the achievement of the Company's objectives. The objective of the non-performance-related basic renumeration is to align the performance of the Management Board member with the interests of the Company and the duties of a prudent businessman, uninfluenced by short- and medium-term performance targets. Through an appropriate variable renumeration depending on financial corporate targets as well as the development of the share price, effective incentives are to be created to contribute to the development and success of VIA optronics AG. The financial targets are supplemented by a process compliance component.

With the contribution of VIA optronics GmbH to VIA optronics AG, the management service contracts of Mr. Eichner and Mr. Jürgens were completely replaced by new management service contracts at the level of VIA optronics AG.

Under the new Management Board service agreements, neither Mr. Eichner nor Mr. Jürgens received separate renumeration for services rendered in their capacity as managing directors of VIA optronics GmbH until March 2021. Instead, the services rendered in their capacity as managing directors of VIA optronics GmbH were covered by the remuneration from the Management Board service agreements with our Company. Since March 2021, of the members of the Management Board of VIA optronics AG, only Mr. Eichner still exercises an executive function at another Group company - VIA LLC.

We have concluded service agreements with the current members of our Management Board, the content of which is explained in more detail below.

(2) Remuneration of the members of the Management Board

The total renumeration of the Management Board members consists of the following components:

| |

Compensation component | Share of target Total compensation |

Fixed base salary | 53 % - 72 % |

Variable compensation | 28 % - 47 % |

The members of the Management Board of VIA optronics AG receive a fixed basic salary and a variable renumeration component.

The sum of the fixed base salary and the variable renumeration component results in an annual target salary that is determined in the course of the agreement of the service contracts between the Management Board member and the Company.

At the beginning of the reporting year, the following target renumeration was set for the Management Board members for the reporting year:

| | | |

in EUR | Jürgen Eichner | Daniel Jürgens ( | Dr. Markus Peters |

Fixed remuneration | 380.000 | 139.000 | 113.000 |

thereof basic salary VIA optronics AG | 325.000 | 132.000 | 100.000 |

thereof base salary VIA LLC | 21.000 | - | - |

thereof fringe benefits | 30.000 | 7.000 | 13.000 |

thereof pension contributions | 4.000 | - | - |

STI target | 325.000 | 59.000 | 50.000 |

Target total compensation | 705.000 | 198.000 | 163.000 |

- 21 -

(2.1) Composition of the fixed remuneration

The annual base salary is composed of twelve monthly salaries to be granted in the fiscal year. Mr. Eichner's fixed base salary is adjusted at the time of the annual collective pay increases for employees in the Bavarian metal industry by a percentage equal to the percentage by which the salaries of employees in the highest pay scale level for employees in the Bavarian metal industry are increased. Otherwise, the fixed basic salary is adjusted in accordance with individual agreement between the Company, the Supervisory Board and the respective Management Board member.

In addition, fringe benefits include the use of a company car and a cell phone, as well as the reimbursement of necessary and reasonable expenses, including travel costs, accommodation and entertainment expenses, the cost of appropriate term life insurance, and allowances for health and long-term care insurance and retirement benefits. Our Company has taken out D&O insurance for the benefit of our Management Board members covering the legal liability arising from their activities in this function.

(2.2) Composition of variable remuneration

The bonus payments of the members of the Management Board relate exclusively to annual assessment periods and have been defined in the form of a Short-Term Incentive (STI) plan. 75% of the bonus payments depend on business performance - measured in the form of the Corporate Performance Indicator (CPI) - and 25% on the Process Compliance Factor (PCF). The CPI in turn comprises the Capability Factor (CF), the Growth Factor (GF) and the Stock Performance Factor (PF). These factors are decisive for target achievement within the defined period.

The objective of the CPI is to adequately reflect the business success and market success of VIA optronics AG. The individual factors of the CPI are defined as follows:

· | Capability factor (CP): The capability factor is defined as earnings before interest, taxes, depreciation and amortization (EBITDA), as presented in the budget, compared with the audited consolidated financial statements. The basis in each case is the values determined in accordance with International Financial Reporting Standards (IFRS). |

· | Growth factor (GF): The growth factor is defined as all attributable sales recognized in the consolidated financial statements according to IFRS compared to the audited sales according to the consolidated financial statements according to IFRS of the previous year. |

· | Stock Performance Factor (PF): The Stock Performance Factor is defined as the development of the VIAO share price compared to its own underlying. |

In addition, the bonus payments of the Management Board members depend on the compliance of the entire Group with the corporate processes, which are determined as part of a process audit. (Process Compliance Factor).

The following performance targets were used to measure the STI in the reporting year:

| | |

Target | Share in the measurement of | |

| CF | 25 % |

CPI | GF | 25 % |

| PF | 25 % |

PCF | 25 % | |

- 22 -

The performance targets are corporate goals and are therefore set by the company, approved by the company's Supervisory Board and explained in a guideline. The expected capability factor is determined during the annual budget process.

The annual bonus target under the STI for Mr. Jürgens is 33.3% and for Mr. Dr. Peters 50% of the respective annual fixed base salary. The target achievement factor calculated from the CPI and PCF is applied to this bonus target in accordance with the weighting described above. The bonus target for Mr. Jürgen Eichner is based on EBITDA.

Deviations from the respective defined target values of the individual relevant factors are reflected as follows:

· | Capability Factor (CP): If the EBITDA achieved in the financial year corresponds to the target value (budget value), the CF is "1.00". A higher EBITDA achieved leads to a CF > 1, but is capped at a CF of "2.00". A lower EBITDA achieved leads to a CF < 1, but is capped at a CF of "0". |

· | Growth factor (GF): If the sales generated in the financial year correspond to the value of the previous year plus 20%, the GF is "1.00". A higher increase in sales leads to a GF > 1, but is capped at a GF of "2.00". A lower increase in sales leads to a GF < 1, but is capped at a GF of "0". |

· | Stock Performance Factor (PF): The stock performance factor is derived from a single comparison: the development of the VIAO share in the relevant fiscal year compared to the previous year. The PF cannot be negative. The baseline is defined as "0.00" and is capped at "2.00". |

The year-on-year performance is examined on the basis of the 60-day average stock price before the end of the year compared to the 60-day average stock price of the previous year in the same period to determine the PF.

- 23 -

Once the individual factors have been determined, they are aggregated to form the CPI by multiplying the respective factor by the weighting explained above.

The current renumeration system does not provide for any claw-back provisions in respect of variable compensation.

(2.3) Further agreements on remuneration - benefits upon termination of the contract

The service contracts of the members of the Management Board of VIA optronics AG provide for a two-year non-competition clause after termination of the service contract. During the term of the non-competition clause, the respective Management Board member is entitled to continued salary payment (non-competition clause) in the amount of 50% of the average remuneration (fixed basic salary plus variable remuneration) received by the Management Board member in the period of 36 months prior to termination of the service agreement.

The amount of the non-competition clause shall be paid pro rata in equal monthly installments during the term of the agreement. The Company, represented by the Supervisory Board, has the right to waive this non-competition clause prior to termination of the service agreement by means of a unilateral written declaration to the Management Board member, with the consequence that no continued salary payment is to be made either.

If the Company terminates Mr. Eichner's employment contract for a reason other than a material breach of duty, Mr. Eichner is entitled to a lump-sum severance payment equal to one month's basic salary for each year of service since June 1, 2006. The basic monthly salary is determined on the basis of the basic monthly salary applicable at the time of retirement.

If the service of a member of the Management Board ends prematurely because he dies during the term of his service contract, the fixed monthly renumeration shall continue to be paid to his heirs for a period of six months. The Company has no defined benefit pension commitments for members of the Management Board in office in fiscal year 2021.

(2.4) Compensation granted and owed to current and former members of the Management Board for the reporting year

The basic salary is paid out in the reference year divided into twelve monthly salaries or, in the case of later entry, divided accordingly into the number of months since entry. The variable renumeration under the STI is paid out in cash in the following financial year once the necessary information for determining the CPI is available and the Supervisory Board has passed a resolution on the determination of the variable compensation.

For the reporting year 2021, the renumeration components granted and owed are shown in the following table:

- 24 -

| | | | | | |

in EUR | Jürgen Eichner | Daniel Jürgens ( | Dr. Markus Peters | |||

Fixed remuneration | 486.000 | 85,7 % | 139.000 | 70,2 % | 113.000 | 100,0 % |

thereof basic salary VIA optronics AG | 325.000 | 57,3 % | 132.000 | 66,7 % | 100.000 | 88,5 % |

thereof base salary VIA LLC | 21.000 | 3,7 % | - | - | - | |

thereof fringe benefits | 30.000 | 5,3 % | 7.000 | 3,5 % | 13.000 | 11,5 % |

thereof vacation compensation | 106.000 | 18,7 % | - | - | - | |

thereof pension contributions | 4.000 | 0,7 % | - | - | _ | _ |

STI 2020 | 81.000 | 14,3 % | 49.000* | 24,8 % | - | |

Total compensation | 567.000 | | 188.000 | | 113.000 | |

* Fiscal 2020 and 2021 pro rata

With the exception of the basic salary paid by VIA LLC to Mr. Eichner, no further renumeration from affiliated companies or third parties was granted to or owed to the members of the Management Board for the reporting year 2021 with regard to their Management Board activities.

The amounts spent on retirement benefits for the reporting year 2021 for Mr. Eichner amount to €4,000.

At the end of September 30, 2021, Mr. Jürgens has terminated his employment with VIA optronics AG. In this context, no separate benefits have been promised to him and granted to him in the course of fiscal year 2021; in particular, no salary continuation payments have been or will be made due to the non-competition clause.

The performance criteria for the STI agreed with the respective Management Board on the basis of the renumeration system described were applied as follows for the reporting year:

| | | | | | | | |

| | | Jürgen Eichner (CEO) | Daniel Jürgens | Dr. Markus Peters | |||

Share of target amount 2021 | target | maximum | reached | |||||

| in % | in % | in EUR | in % | in EUR | in % | in EUR | in % |

STI 2020 | 100 | 200 | 81.000 | 25,0 | 49.000* | 83,0 | | |

* Fiscal 2020 and 2021 pro rata

Against the backdrop of the company's performance in fiscal 2020, the Supervisory Board and Management Board have decided to set the bonus factor at 0.5 for all employees in relation to the STI for this year. The aim of this decision is to further improve employee retention and to bind qualified employees to the company in the long term for the future growth phase. The variable remuneration for all employees included in the STI, including the members of the Management Board, was determined and paid on this basis.

In deviation from this, the Supervisory Board has set Mr. Eichner's variable renumeration for fiscal year 2020 at the bonus factor 0.25. Mr. Eichner's performance-related renumeration was aligned with the renumeration system applicable to all employees, taking into account the bonus target on an adjusted basis.

In addition to the variable renumeration for the 2020 financial year determined as above, Mr. Daniel Jürgens was granted variable renumeration amounting to two-thirds of the variable renumeration for 2020 due to his retirement from the Company for the 2021 financial year.

- 25 -

(2.5) Appropriateness of Management Board compensation

The annual salaries and the variable renumeration component (STI) to be granted for the past financial year of the members of the Management Board are compared in total with the annual salaries and the variable renumeration component (STI) to be granted for the past financial year of all employees on average and evaluated according to their development. A comparative presentation of renumeration and earnings development can be found in section 5.

(3) Basic Features of the Compensation System for the Supervisory Board

On August 25, 2020, the General Shareholders’ Meeting adopted the following renumeration system for the members of our Supervisory Board, which has applied since then:

· | The ordinary members of the Supervisory Board receive fixed renumeration of €20,000 per year. |

· | The Chairman and Vice Chairman of the Supervisory Board receive fixed renumeration of €40,000 and €30,000 per year, respectively. |

· | The Chairman of the Audit Committee receives fixed renumeration of €30,000 per year. |

The fixed renumeration and the waiver of performance-related renumeration are intended to support the independence of the Supervisory Board members. The long-term development of the Company is to be promoted through the appropriate exercise of the Supervisory Board's supervisory and advisory activities.

If more than four Supervisory Board meetings are held in a calendar year, the members of the Supervisory Board receive €5,000 for each additional meeting attended. Beyond this, Supervisory Board members receive no remuneration for their attendance at Supervisory Board meetings.

Members of the Supervisory Board are entitled to reimbursement of their reasonable, documented expenses (including travel, accommodation and telecommunications costs).

This renumeration system remains in force until it is amended or cancelled by our General Shareholders’ Meeting. The renumeration is paid on a pro rata temporis basis.

(4) Compensation of the members of the Supervisory Board

The renumeration of the Supervisory Board in the reporting year consisted exclusively of the respective fixed compensation, which was granted in full to all members of the Supervisory Board, and is as follows:

Fixed remuneration | Fixed remuneration | |||

| in TEUR | in % | in TEUR | in % |

Dr. Heiko Frank (Chairman of the Supervisory Board as of December 31, 2021) | 40 | 100 | 50 | 100 |