UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A

___________________

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 |

AGBA ACQUISITION LIMITED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | No fee required. | |

☒ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibits required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

OF AGBA ACQUISITION LIMITED,

WHICH WILL BE RENAMED “AGBA GROUP HOLDING LIMITED”

IN CONNECTION WITH THE BUSINESS COMBINATION DESCRIBED HEREIN

AGBA ACQUISITION LIMITED

Room 1108, 11th Floor, Block B

New Mandarin Plaza, 14 Science Museum Road

Tsimshatsui East, Kowloon, Hong Kong

Dear Shareholders:

You are cordially invited to attend the extraordinary general meeting of the shareholders of AGBA Acquisition Limited (“AGBA”, “we”, “our”, or “us”), which will be held at 10:00 a.m., local time, on November 10, 2022. The extraordinary general meeting will be at the offices of Loeb & Loeb LLP, 2206-19 Jardine House, 1 Connaught Place Central, Hong Kong SAR. Shareholders will be able to attend the extraordinary general meeting in-person. You will be able to attend the extraordinary general meeting in person and vote and submit questions during the extraordinary general meeting.

The board of directors of AGBA Acquisition Limited, a BVI company (“AGBA”), has unanimously approved the transactions (collectively, the “Business Combination”) contemplated by that certain Business Combination Agreement, dated November 3, 2021, as amended on November 18, 2021, January 4, 2022, May 4, 2022, and October 21, 2022, and as may be further amended, supplemented or otherwise modified from time to time, (the “Business Combination Agreement”), by and among AGBA, TAG Holdings Limited (“TAG”), and the other parties thereto, a copy of which is attached to this proxy statement as Annex A, Annex A-1, Annex A-2, Annex A-3, and Annex A-4. On behalf of the board of directors of AGBA, we are pleased to enclose the proxy statement relating to the proposed acquisition of OnePlatform Holdings Limited (“OPH”), TAG Asia Capital Holdings Limited (“Fintech”), TAG International Limited (“B2B”), TAG Asset Partners Limited (“B2BSub”), OnePlatform International Limited (“HKSub”), and their collective subsidiaries, and such other transactions contemplated by the Business Combination Agreement (OPH and Fintech together, prior to the OPH Merger, and B2B and Fintech together, after the OPH Merger, in each case including such entities’ respective subsidiaries, being the “TAG Business”).

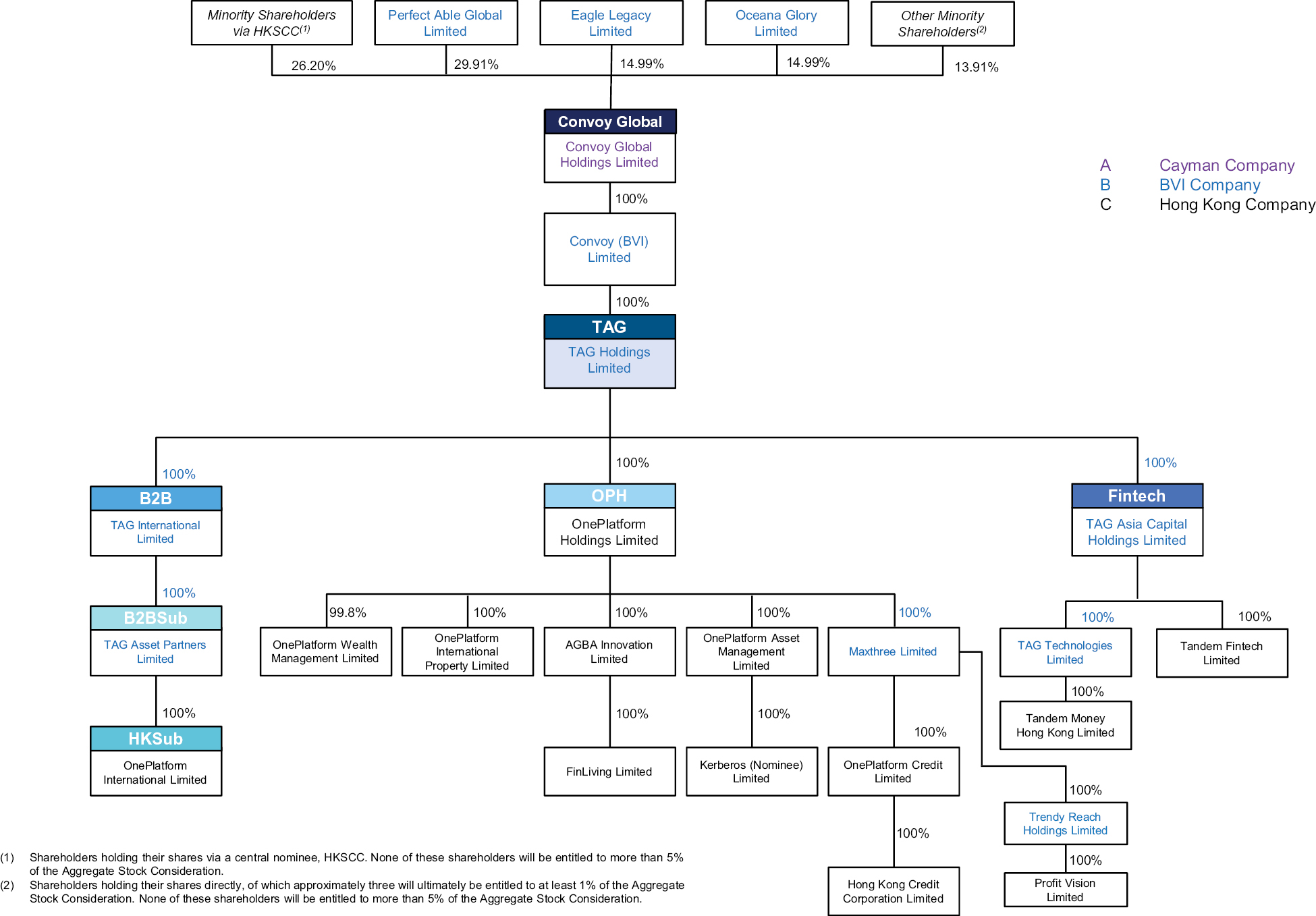

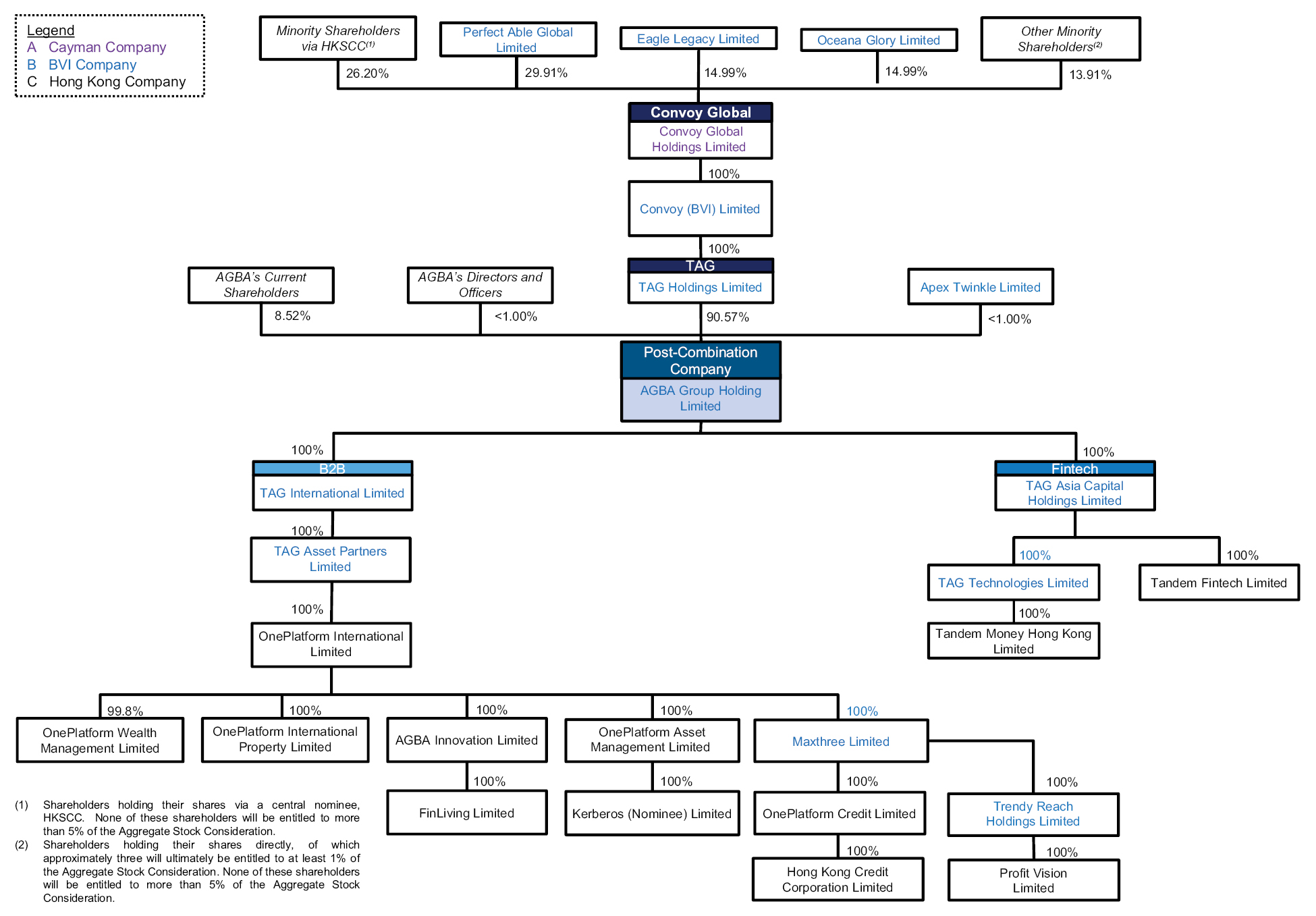

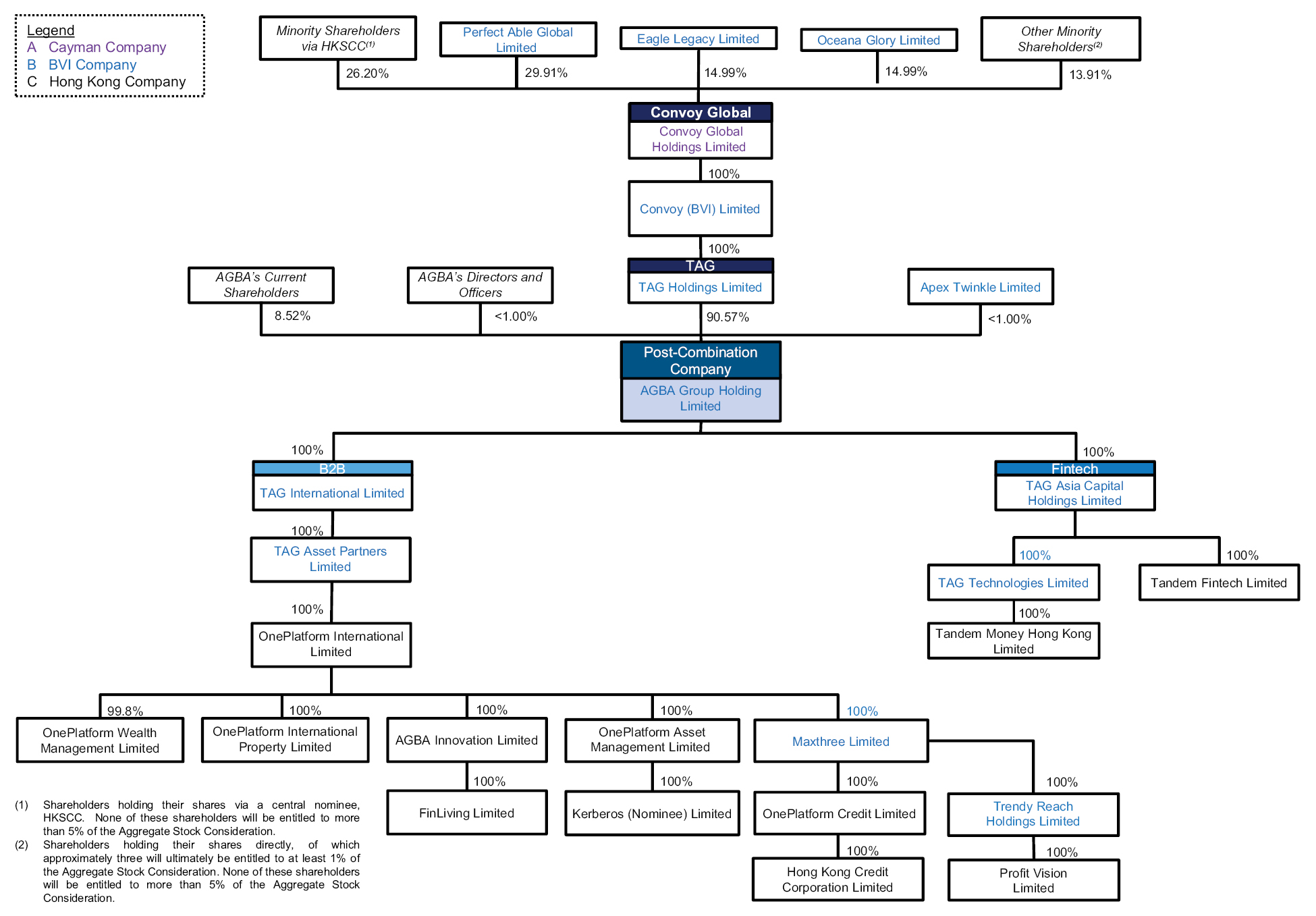

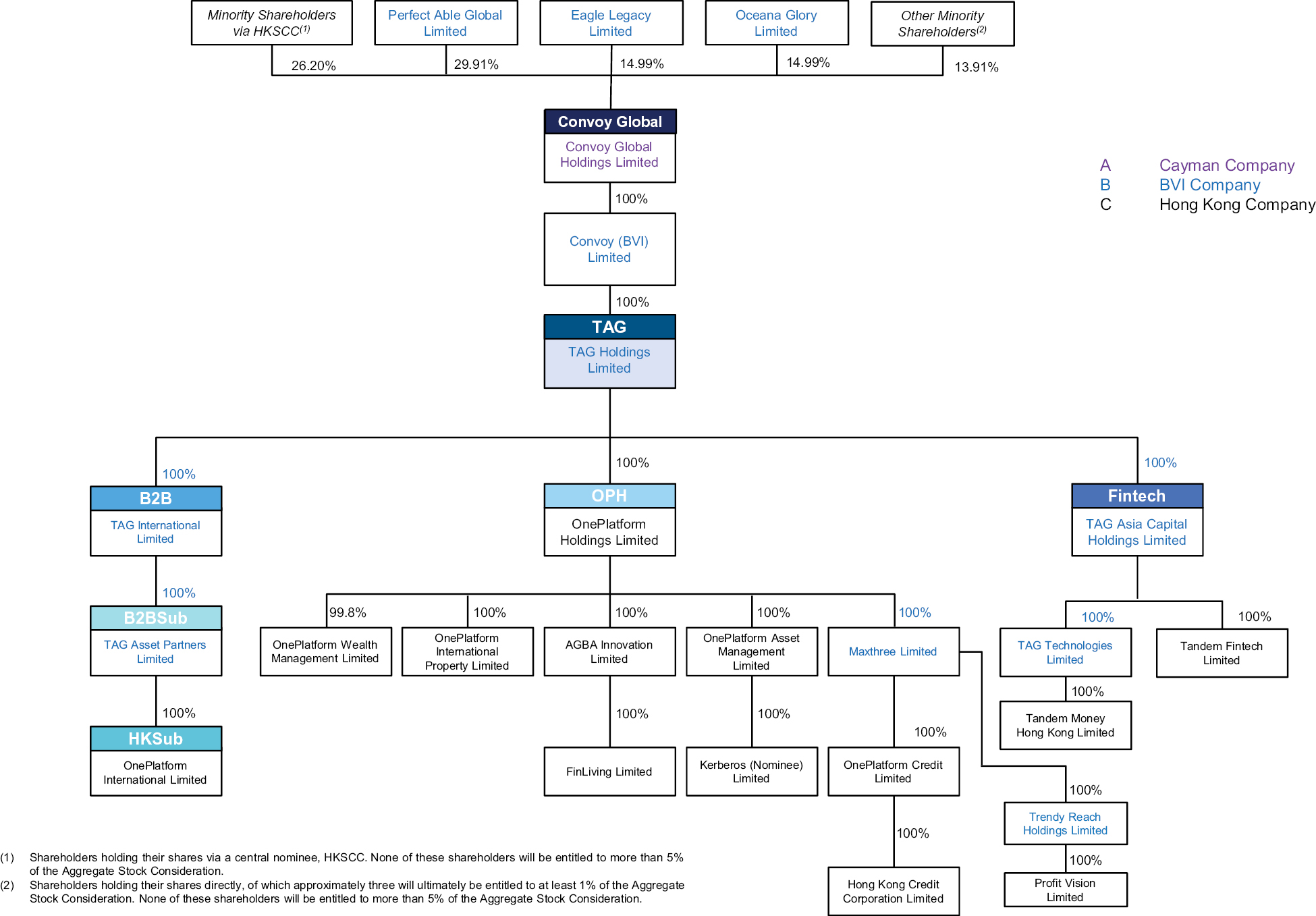

TAG is a British Virgin Islands incorporated holding company that does not conduct any material business operations. After the Business Combination, AGBA Group Holding Limited (the “Post-Combination Company”) will also be a British Virgin Islands incorporated holding company that does not conduct any material business operations. The TAG Business’s operations are, and will be, conducted by its Hong Kong-based operating subsidiaries. This offshore holding company structure may present certain risks to shareholders as described further in the section titled “Risk Factors — Risk Factors Relating to the Business Combination” beginning on page 97 of this proxy statement. Please also refer to the organization chart set out on pages 31–33, 118, and 177–178 of this proxy statement for further information on the TAG Business’s holding company structure both before and after the Business Combination.

On May 20, 2020, the U.S. Senate passed the HFCA Act that requires a foreign company to certify it is not owned or controlled by a foreign government if the Public Company Accounting Oversight Board (“PCAOB”) is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB inspection. If the PCAOB is unable to inspect the company’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a national exchange. On December 2, 2020, the U.S. House of Representatives approved the HFCA Act, and on December 18, 2020, the HFCA Act was signed into law. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act. The bill, if enacted, would shorten the three-consecutive-year compliance period under the HFCA Act to two consecutive years. As a result, the time period before the Post-Combination Company’s securities may be prohibited from trading or delisted will be reduced. On December 2, 2021, the SEC adopted final amendments implementing congressionally mandated submission and disclosure requirements of the HFCA Act. The PCAOB has stated that currently it is unable to fully inspect or investigate registered public accounting firms headquartered in: (i) China, and (ii) Hong Kong. On December 16, 2021, the PCAOB issued a Determination Report finding that the PCAOB is unable to inspect or investigate with sufficient completeness registered public accounting firms headquartered in: (i) China, and (ii) Hong Kong. The management of the TAG Business believes that this determination does not impact the TAG Business, as the auditor of both AGBA and the TAG Business, Friedman LLP, (i) is headquartered in New York, U.S.A., (ii) is an independent registered public accounting firm with the PCAOB, and (iii) has been inspected by the PCAOB on a regular basis. The management of the TAG Business, therefore, believes that Friedman LLP is not subject to the determinations announced by the PCAOB on December 16, 2021 with respect

to PRC and Hong Kong-based auditors. Friedman LLP is not included in the list of determinations announced by the PCAOB on December 21, 2021 in their HFCAA Determination Report under PCAOB Rule 6100. On August 26, 2022, the China Securities Regulatory Commission, or CSRC, the Ministry of Finance of the PRC, and PCAOB signed a Statement of Protocol, or the Protocol, governing inspections and investigations of audit firms based in China and Hong Kong. Pursuant to the Protocol, the PCAOB has independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. However, uncertainties still exist whether this new framework will be fully complied with. If notwithstanding this new framework, the PCAOB was unable to fully inspect Friedman LLP (or any other auditor of the Post-Combination Company) in the future, the Post-Combination Company’s securities could be subject to certain consequences under the Holding Foreign Companies Accountable Act, including being delisted or prohibited from being traded “over-the-counter” which could have an adverse impact on the business and prospects of the Post-Combination Company. See “Risk Factors — Risk Factors Relating to the TAG Business’s Hong Kong Operations and Proximity to the PRC — The securities of the Post-Combination Company may be delisted or prohibited from being traded “over-the-counter” under the Holding Foreign Companies Accountable Act (and the Accelerating Holding Foreign Companies Accountable Act, if passed into law) if the PCAOB were unable to fully inspect the company’s auditor.”

OPH, a holding company incorporated in Hong Kong, is a direct wholly-owned subsidiary of TAG engaged in the operation of business-to-business or “B2B” and business-to-consumer or “B2C” financial services in each case through its subsidiary entities in Hong Kong. OPH’s subsidiary entities operate, respectively, insurance brokerage services (through OnePlatform Wealth Management Limited), asset management services (through OnePlatform Asset Management Limited and Kerberos (Nominee) Limited), property brokerage services (through OnePlatform International Property Limited) and money lending (through Maxthree Limited, OnePlatform Credit Limited, Trendy Reach Holdings Limited, Profit Vision Limited and Hong Kong Credit Corporation Limited). Fintech, a British Virgin Islands holding company, is a direct wholly-owned subsidiary of TAG engaged, through its subsidiaries, in financial technology or “fintech” businesses. It currently holds minority interests in several fintech investments through its wholly-owned subsidiary TAG Technologies Limited. Tandem Fintech Limited, another wholly-owned subsidiary of Fintech, operates a health and wealth digital platform. Please refer to the section of this proxy statement titled “Information About the TAG Business” for further information. B2B, B2BSub, and HKSub are newly formed companies incorporated for the purpose of effecting the acquisition mergers of OPH and Fintech contemplated by the Business Combination Agreement. TAG is the beneficial owner of each of OPH, Fintech, B2B, B2BSub, HKSub, and their collective subsidiaries.

Upon the closing of the transactions contemplated in the Business Combination Agreement (the “Closing”): (i) AGBA will become, through an acquisition merger, the 100% owner of the issued and outstanding securities of each of OPH and Fintech, in exchange for 55,500,000 ordinary shares of AGBA, par value US$0.001 per share (the “Aggregate Stock Consideration”); (ii) the governing documents of AGBA will be amended and restated and become the Fifth Amended and Restated Memorandum and Articles of Association as described in this proxy statement; and (iii) AGBA’s name will change to “AGBA Group Holding Limited” which we also refer to as “Post-Combination Company” in this proxy statement.

At the extraordinary general meeting, AGBA shareholders will be asked to consider and vote upon the following proposals:

• To approve the Business Combination Agreement between AGBA, TAG, OPH, Fintech, and the other parties thereto and the transactions contemplated thereunder, including but not limited to the acquisition by way of merger of all of the issued and outstanding shares of OPH and Fintech from TAG, as provided for in the Business Combination Agreement and the consideration paid to TAG by way of new issue of AGBA ordinary shares in accordance with the Business Combination Agreement, or the “Business Combination.” This proposal is referred to as the “Business Combination Proposal” or “Proposal No. 1.” A copy of the Business Combination Agreement is attached to this proxy statement as Annex A, Annex A-1, Annex A-2, Annex A-3, and Annex A-4.

• To approve the proposed amendment to the Existing Charter and adopt the Fifth Amended and Restated Memorandum and Articles of Association of AGBA as further described herein, a copy of which is attached to this proxy statement as Annex B. This proposal is referred to as the “Amendment Proposal” or “Proposal No. 2.”

• To approve, on a non-binding advisory basis, six separate governance proposals relating to certain material differences between the corporate governance provisions of the Existing Charter and those of the Fifth Amended and Restated Memorandum and Articles of Association of AGBA as further described herein, a copy of which is attached to this proxy statement as Annex B. These proposals are collectively referred to as the “Governance Proposals” or “Proposal No. 3.”

• To approve (x) the issuance of more than 20% of the issued and outstanding AGBA ordinary shares pursuant to the terms of the Business Combination Agreement, as required by Nasdaq Listing Rules 5635(a), (b), and (d); and (y) the issuance of securities under the AGBA Group Holding Limited Share Award Scheme, as required by Nasdaq Listing Rule 5635(c). This proposal is referred to as the “Nasdaq Proposal” or “Proposal No. 4.”

• To approve and adopt the AGBA Group Holding Limited Share Award Scheme. A copy of the form of the Share Award Scheme is attached to this proxy statement as Annex C. This proposal is called the “Share Award Scheme Proposal” or “Proposal No. 5.”

• To consider a proposal, if put, to approve the adjournment of the extraordinary general meeting in the event AGBA does not receive the requisite shareholder vote to approve the Business Combination. This proposal is called the “Business Combination Adjournment Proposal” or “Proposal No. 6.”

Proposals No. 1 through No. 6 are collectively referred to as the “Proposals.”

It is anticipated that, upon consummation of the Business Combination, AGBA’s existing shareholders, including AGBA’s sponsor, AGBA Holding Limited, (the “Sponsor”), will own approximately 8.52% of the issued Post-Combination Company’s ordinary shares, and TAG will own approximately 90.57% of the issued Post-Combination Company’s ordinary shares (comprising 100% of the Aggregate Stock Consideration). These relative percentages assume that (i) none of AGBA’s existing public shareholders exercise their redemption rights, as discussed herein, (ii) there is no exercise or conversion of AGBA Warrants (as defined below), (iii) none of the promissory note held by the Sponsor will be converted into ordinary shares, and (iv) all shares held back for indemnification purposes under the Business Combination Agreement (the “Holdback Shares”) will be released to TAG on the last day of the survival period (i.e. six months following the Closing). If any of AGBA’s existing public shareholders exercise their redemption rights, the anticipated percentage ownership of AGBA’s existing shareholders will be reduced. You should read “Summary of the Proxy Statement — The Business Combination Proposal” and “Unaudited Pro Forma Condensed Combined Financial Statements” for further information.

On August 29, 2022, the parties to the Business Combination Agreement entered into a waiver agreement, pursuant to which (i) the parties mutually agreed to waive as a condition to Closing (a) the effectiveness of a registration statement on Form S-1 for the AGBA Shares comprising the Aggregate Stock Consideration; (b) execution of certain employment agreements to be executed; (c) execution of certain lock-up agreements so that each person who receives 1% or more of the AGBA Shares comprising the Aggregate Stock Consideration will no longer be required to lock-up those shares for at least 180 days from Closing; and (ii) AGBA agreed to waive the requirement that certain legal opinions be provided by offshore counsel to B2B and Fintech as a condition to Closing.

Pursuant to the Business Combination Agreement, it was a condition to Closing that the Post-Combination Company receive an amount sufficient to fund the operations and agreed business plans of the Post-Combination Company in immediately available cash, net of expenses and liabilities, of at least US$35,000,000 (or such greater amount as determined by the parties) in a private placement or other financing to be consummated simultaneously with the Closing (the “PIPE Investment”). This condition to Closing was waived by the parties in the Business Combination Agreement Waiver and Amendment, dated October 21, 2022 (the “October Amendment”). Other than what is required of the Post-Combination Company to meet the initial listing requirements for Nasdaq Capital Market, there is no longer a minimum cash condition required for the Closing. The parties to the Business Combination Agreement also agreed in the October Amendment to extend the Outside Closing Date (defined in the Business Combination Agreement) from October 31, 2022 to December 31, 2022.

Notwithstanding TAG’s earlier intention to distribute the Aggregate Stock Consideration (including the Holdback Shares) received in connection with the Business Combination to its direct or indirect ultimate beneficial shareholders, TAG has, pursuant to the October Amendment, undertaken not to make any such distribution to its ultimate beneficial shareholders. Nothing in this undertaking, however, shall prevent TAG, subject to compliance with applicable Law, from pledging or encumbering the Aggregate Stock Consideration (including the Holdback Shares) or selling or otherwise disposing of any or all of the Aggregate Stock Consideration (including the Holdback Shares) to any other person or persons for value consideration.

Only shareholders who held AGBA Shares at the close of business on October 6, 2022 will be entitled to vote at the extraordinary general meeting and at any adjournments and postponements thereof. Holders of AGBA Shares will be asked to approve the Business Combination Agreement dated as of November 3, 2021 (as amended) and other related proposals.

Regardless of how many shares you own, your vote is very important. Whether or not you plan to attend the extraordinary general meeting, please vote as soon as possible by following the instructions in the accompanying proxy statement to make sure that your shares are represented at the extraordinary general meeting.

AGBA is a blank check company incorporated on October 8, 2018 as a BVI limited company and incorporated for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business combination with one or more target businesses. AGBA’s units, ordinary shares, rights and warrants are traded on the Nasdaq Capital Market (“Nasdaq”) under the symbols “AGBAU,” “AGBA,” “AGBAR,” and “AGBAW,” respectively. At the Closing, the AGBA rights will automatically convert into shares so that the rights will no longer trade under “AGBAR.” AGBA will apply for listing, to be effective at the time of the Business Combination, of the Aggregate Stock Consideration on Nasdaq under the proposed symbol “AGBA.” It is a condition of the consummation of the Business Combination that the listing application for the Aggregate Stock Consideration shall have been approved by Nasdaq, but there can be no assurance such listing condition will be met. If such listing condition is not met, the Business Combination will not be consummated unless the Nasdaq condition set forth in the Business Combination Agreement is waived by TAG.

On March 30, 2022, the SEC issued proposed rules (the “SPAC Rule Proposals”) relating to SPACs. The SPAC Rule Proposals relate, among other matters, to the circumstances in which SPACs such as the Company could potentially be subject to the Investment Company Act of 1940, as amended (the “Investment Company Act”) and the regulations thereunder. The SPAC Rule Proposals would provide a safe harbor for such companies from the definition of “investment company” under Section 3(a)(1)(A) of the Investment Company Act, provided that a SPAC satisfies certain criteria, including a limited time period to announce and complete a de-SPAC transaction. Specifically, to comply with the safe harbor, the SPAC Rule Proposals would require a company to file a report on Form 8-K announcing that it has entered into an agreement with a target company for an initial business combination no later than 18 months after the effective date of its registration statement for its IPO (the “IPO Registration Statement”). The company would then be required to complete its initial business combination no later than 24 months after the effective date of the IPO Registration Statement.

There is currently uncertainty concerning the applicability of the Investment Company Act to a SPAC, including a company like AGBA, that did not complete its initial business combination within 24 months after the effective date of the IPO Registration Statement. As a result, it is possible that a claim could be made that we have been operating as an unregistered investment company.

If AGBA is deemed to be an investment company under the Investment Company Act, AGBA’s activities would be severely restricted and AGBA would be subject to burdensome compliance requirements. If AGBA is deemed to be an investment company and subject to compliance with and regulation under the Investment Company Act, AGBA would be subject to additional regulatory burdens and expenses for which it has not allotted funds and for which it would not have sufficient time to comply with prior to the expiration of its time to complete a business combination. As a result, if AGBA were deemed to be an investment company, AGBA would expect to abandon its efforts to complete an initial business combination and instead to liquidate and dissolve. If AGBA is required to liquidate and dissolve, its investors would not be able to realize the benefits of owning shares in the post-business combination company, including the potential appreciation in the value of AGBA’s shares, rights and warrants following such a transaction. In addition, in the event of AGBA’s liquidation and dissolution, AGBA’s warrants and rights would expire worthless.

The TAG Business is centered in Hong Kong and does not have any operations in mainland China (“China” or the “PRC”). Pursuant to the Basic Law of the Hong Kong Special Administrative Region (the “Basic Law”), which is a national law of the PRC and the constitutional document for Hong Kong, national laws of the PRC shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law (which shall be confined to laws relating to defense and foreign affairs as well as other matters outside the autonomy of Hong Kong). AGBA and TAG expect that, immediately following the Business Combination, the Post-Combination Company will not have operations in mainland China.

Notwithstanding, the PRC legal system is evolving rapidly, and PRC laws, regulations, and rules may change quickly with little advance notice. As many of these laws, rules, and regulations are relatively new, and because of the limited number of published decisions and the non-precedential nature of these decisions, the interpretation of these laws, rules, and regulations may be inconsistent and they may be subject to inconsistent enforcement. The PRC government has exercised and continues to exercise substantial control over many sectors of the PRC economy, including through regulation and/or state ownership. PRC government actions have had, and may continue to have, a significant effect on economic conditions in the PRC and the businesses which are subject to them.

If certain PRC laws and regulations were to apply to the TAG Business or its subsidiaries in the future, the application of such laws and regulations may have a material adverse impact on the business, financial condition, results of operations, and prospects of the TAG Business, which, in turn, may cause the value of the Post-Combination Company’s securities to significantly decline or become worthless. For example, if the PRC Data Security Law were to apply to the TAG Business’s Hong Kong-based businesses, the Post-Combination Company could become subject to data security and privacy obligations, including the need to conduct a national security review of data activities that may affect the national security of the PRC, and could be prohibited from providing data stored in Hong Kong to foreign judicial or law enforcement agencies without approval from relevant PRC regulatory authorities. Compliance with such or similar requirements could have a chilling effect on the business, financial condition and results of operations of the Post Combination Company.

As well as these operational risks arising out of the potential application of such PRC laws and regulations to the Post Combination Company, transactional risk may arise if the Measures for Cybersecurity Review issued by the Cyberspace Administration of China which became effective on February 15, 2022 (the “Measures”), which relates to data security and overseas listing of mainland Chinese businesses, were to apply to the TAG Business’s Hong Kong-based businesses. Although, as of the date of this proxy statement, and as advised by TAG’s PRC counsel AnJie Law, the Measures do not apply to the TAG Business, if they did apply, the affected companies could be required to apply for a cybersecurity review by the Cybersecurity Review Office of the PRC prior to completing the Business Combination and the listing of the Post-Combination Company’s shares on the Nasdaq. See “Risk Factors — Risk Factors Relating to the TAG Business’s Hong Kong Operations and Proximity to the PRC” in this proxy statement.

There can be no guarantee that the recent statements or regulatory actions by the relevant organs of the PRC government, including those in relation to the PRC Data Security Law, the Measures, the PRC Personal Information Protection Law and variable interest entities, and the anti-monopoly enforcement actions taken by relevant PRC government authorities, will continue not to apply to the TAG Business, or that the organs of the PRC government will not seek to intervene or influence the operations of the TAG Business at any time in the future. Should certain laws and regulations applicable to PRC companies apply to the TAG Business or its subsidiaries in the future, the TAG Business may become subject to increased control or oversight by PRC government organs, which, depending on the nature of such potential oversight or control or which laws or regulations apply, may have a material adverse impact on the business, financial condition, results of operations, and prospects of the Post-Combination Company, the Post-Combination Company’s ability to accept foreign investments, and the Post-Combination Company’s ability to offer or continue to offer securities to investors on a U.S. or other international securities exchange, any combination of which may, in turn, cause the value of the Post-Combination Company’s securities to significantly decline or become worthless. Neither AGBA nor TAG can predict the extent of such impact, if any or if at all, if such events were to occur. See “Risk Factors — Risk Factors Relating to the TAG Business’s Hong Kong Operations and Proximity to the PRC” for additional information on these risks.

Until recently, neither OPH nor Fintech had previously declared any dividends or made any distributions between it and TAG, it and its subsidiaries, it and any other entities, or it to investors. On January 18, 2022, however, Fintech approved, declared, and distributed a special dividend of US$47 million to TAG. This one-off special dividend distribution was made solely due to the investment gain from the sale of Fintech’s investment in Nutmeg Saving and Investment Limited in September 2021. The dividends were paid by offsetting a receivable due from the Legacy Group and the remaining balance was paid by cash. Please refer to the financial statements of OPH and Fintech including “Note 13 — shareholder’s deficit” at page F-82 for further details. Apart from this one-off special dividend distribution, the management of the TAG Business intends to retain all available funds and future earnings, if any, for operation and business developments and does not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to the TAG Business’s dividend policy will be made at the discretion of the TAG Business’s board of directors after considering the TAG Business’s financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

The entities comprising the TAG Business currently transfer cash through their organization for daily business and operating activities, commercial transactions, and related party transactions on an arms-length basis following appropriate approvals and governance processes. Please refer to the section of this proxy statement entitled “Related Party Transactions — Certain Transactions of the TAG Business” for further details of the TAG Business’s related party transactions. These fund transfers are made in accordance with the TAG Business’s cash management policies

and payment policy and procedure, with established delegation and signing authority processes to ensure appropriate corporate approvals are obtained before execution. The management of the TAG Business anticipates that these practices will continue after the Business Combination. Please refer to the section of this proxy statement titled “Summary of the Proxy Statement — The TAG Business’s Cash Flows and Transfers of Other Assets” for further information.

Investing in the Post-Combination Company’s securities involves a high degree of risk. We encourage you to read this proxy statement carefully. In particular, you should review the matters discussed under the section entitled “Risk Factors.”

As of September 30, 2022, there was approximately US$38.9 million in AGBA’s trust account. On October 25, 2022, the last sale price of AGBA ordinary shares was US$11.50 per share.

Pursuant to AGBA’s Fourth Amended and Restated Memorandum and Articles of Association, as amended and restated on May 3, 2022 (the “Existing Charter”), AGBA is providing its public shareholders with the opportunity to redeem all or a portion of their shares of AGBA Shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in AGBA’s trust account as of two Business Days prior to the consummation of the Business Combination, including interest, less taxes payable, divided by the number of then outstanding AGBA Shares that were sold as part of the AGBA Units in AGBA’s initial public offering (“IPO”), subject to the limitations described herein. AGBA estimates that the per-share price at which public shares may be redeemed from cash held in the trust account will be approximately US$11.57 at the time of the extraordinary general meeting. AGBA’s public shareholders may elect to redeem their shares even if they vote for the Business Combination Proposal or do not vote at all. AGBA has no specified maximum redemption threshold under AGBA’s Existing Charter. Holders of outstanding AGBA Warrants and AGBA Rights do not have redemption rights in connection with the Business Combination. There is a possibility that AGBA’s Sponsor or its affiliates may purchase securities in open market or private transactions outside of the redemption process, for purposes of ensuring that certain Nasdaq initial listing requirements will be met and therefore, increasing the likelihood that the Business Combination will close.

AGBA is providing this proxy statement and accompanying proxy card to its shareholders in connection with the solicitation of proxies to be voted at the extraordinary general meeting and at any adjournments or postponements of the meeting. The Initial Shareholders, who own approximately 29.0% of AGBA Shares as of the Record Date, have agreed to vote all shares they own in favor of the Business Combination Proposal, and intend to vote for each of the other Proposals as well, although there is no agreement in place with respect to voting on those proposals.

On October 6, 2022, the record date for the extraordinary general meeting (the “Record Date”), the last sale price of AGBA Shares was US$11.45.

Each shareholder’s vote is very important. Whether or not you plan to attend the extraordinary general meeting in person, please submit your proxy card without delay. Shareholders may revoke proxies at any time before they are voted at the meeting. Voting by proxy will not prevent a shareholder from voting in person if such shareholder subsequently chooses to attend the extraordinary general meeting.

The accompanying proxy statement provides shareholders of AGBA with detailed information about the Business Combination and other matters to be considered at the extraordinary general meeting of AGBA. We encourage you to read the entire accompanying proxy statement, including the Annexes and other documents referred to therein, carefully and in their entirety.

AGBA’s board of directors unanimously recommends that AGBA shareholders vote “FOR” approval of each of the proposals.

/s/ Gordon Lee | ||

Gordon Lee | ||

October 28, 2022 |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the Business Combination or otherwise or passed upon the adequacy or accuracy of this proxy statement. Any representation to the contrary is a criminal offense.

HOW TO OBTAIN ADDITIONAL INFORMATION

This proxy statement incorporates important business and financial information about AGBA that is not included or delivered herewith. If you would like to receive additional information or if you want additional copies of this document, agreements contained in the appendices or any other documents filed by AGBA with the Securities and Exchange Commission, such information is available without charge upon written or oral request. Please contact the following:

Advantage Proxy

P.O. Box 13581

Des Moines, WA 98198

Toll Free: (877) 870-8565

Collect: (206) 870-8565

Email: ksmith@advantageproxy.com

If you would like to request documents, please do so no later than November 3, 2022 to receive them before AGBA’s extraordinary general meeting. Please be sure to include your complete name and address in your request. Please see the section entitled “Where You Can Find Additional Information” to find out where you can find more information about AGBA and the TAG Business. You should rely only on the information contained in this proxy statement in deciding how to vote on the Business Combination. Neither AGBA nor TAG has authorized anyone to give any information or to make any representations other than those contained in this proxy statement. Do not rely upon any information or representations made outside of this proxy statement. The information contained in this proxy statement may change after the date of this proxy statement. Do not assume after the date of this proxy statement that the information contained in this proxy statement is still correct.

i

This document contains references to trademarks, trade names, and service marks belonging to other entities. Solely for convenience, trademarks, trade names, and service marks referred to in this proxy statement may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

ii

This proxy statement includes industry and market data obtained from periodic industry publications, third-party studies and surveys. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this proxy statement, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Each publication, study and report speaks as of its original publication date (and not as of the date of this proxy statement). Certain of these publications, studies and reports were published before the COVID-19 pandemic and therefore do not reflect any impact of COVID-19 on any specific market or globally. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. We have not independently verified this third-party information. The industry in which the TAG Business and its subsidiaries operate is subject to a high degree of uncertainty and risk. As a result, the estimates and market and industry information provided in this proxy statement are subject to change based on various factors, including those described in the sections entitled “Special Note Regarding Forward-Looking Statements” beginning on page 106 of this proxy statement and “Risk Factors” beginning on page 58 of this proxy statement and elsewhere in this proxy statement.

iii

Unless otherwise stated in this proxy statement or unless the context requires otherwise, references in this proxy statement to:

• “AGBA,” “we,” “us” or “our company” means AGBA Acquisition Limited;

• “AGBA Group Holding Limited” or the “Post-Combination Company” means AGBA following the consummation of the Business Combination;

• “AGBA Holding” or the “Sponsor” means AGBA Holding Limited;

• “AGBA Rights” means the rights to receive one-tenth (1/10) of one AGBA Share upon the consummation of an initial business combination by AGBA;

• “AGBA Shares” means the ordinary shares of AGBA, US$0.001 par value per share;

• “AGBA Units” means the units issued in the IPO, consisting of one AGBA Share, one AGBA Warrant, and one AGBA Right;

• “AGBA Warrants” means the redeemable warrants entitling the holder thereof to purchase one-half of one AGBA Share;

• “Aggregate Stock Consideration” means the 55,500,000 AGBA Shares, with a deemed price of US$10.00 per share, to be issued to TAG, in its capacity as sole shareholder of B2B and Fintech, in accordance with the terms of the Business Combination Agreement;

• “B2B” means TAG International Limited, a BVI business company and wholly-owned subsidiary of TAG;

• “B2BSub” means TAG Asset Partners Limited, a BVI business company and wholly-owned subsidiary of B2B;

• “Business Combination” means the transactions contemplated by the Business Combination Agreement;

• “Business Combination Agreement” means that certain Business Combination Agreement dated November 3, 2021 by and among AGBA, B2B, B2BSub, HKSub, OPH, Fintech, and TAG, as amended on November 18, 2021, January 4, 2022, May 4, 2022, and October 21, 2022, and as may be further amended, supplemented or otherwise modified from time to time, and its schedules and exhibits thereto;

• “Business Day” means any day (except any Saturday, Sunday, or public holiday) on which banks in New York City, New York are open for business;

• “BVI” means the British Virgin Islands;

• “BVI Companies Law” means the BVI Business Companies Act, 2004 (as amended from time to time);

• “CFS” means Convoy Financial Services Limited, a member of the Legacy Group;

• “China,” “mainland China,” or the “PRC” means the People’s Republic of China;

• “Closing” means closing of the Business Combination in accordance with the terms of the Business Combination Agreement;

• “Convoy Global” means Convoy Global Holdings Limited, TAG’s ultimate parent company;

• “COVID-19” means the novel coronavirus, SARS-CoV-2;

• “DTC” means Depository Trust Company;

• “Exchange Act” means the Securities Exchange Act of 1934, as amended;

• “Existing Charter” means AGBA’s Fourth Amended and Restated Memorandum and Articles of Association, as amended and restated on May 3, 2022;

iv

• “extraordinary general meeting” means the meeting of the shareholders of AGBA that is the subject of this proxy statement;

• “fintech” means financial technology;

• “Fintech” means TAG Asia Capital Holdings Limited;

• “Fifth Amended and Restated Memorandum and Articles of Association” means the Fifth Amended and Restated Memorandum and Articles of Association of AGBA, substantially in the form as set forth at Annex B;

• “Governance Proposals” means, collectively, Proposals 3A, 3B, 3C, 3D, 3E and 3F of this proxy statement as set forth in the section entitled “Proposal No. 3 — The Governance Proposals”;

• “Group Parties” means, collectively, B2B, B2BSub, HKSub, OPH, Fintech, and their respective subsidiaries, and each a “Group Party”;

• “HKCC” means Hong Kong Credit Corporation Limited;

• “HKSub” means OnePlatform International Limited, a Hong Kong company and wholly-owned subsidiary of B2BSub;

• “Hong Kong” means the Hong Kong Special Administrative Region of the People’s Republic of China;

• “Hong Kong Dollars” or “HK$” means the lawful currency of Hong Kong;

• “Hong Kong Exchange” or “HKEx” means the Stock Exchange of Hong Kong Limited;

• “Holdback Shares” means all shares (three percent (3%) of the Aggregate Stock Consideration) held back for indemnification purposes under the Business Combination Agreement;

• “IFA” means the Legacy Group’s independent financial advisory business, conducted by CFS;

• “IFA Restructuring” means the transfer of CFS’s independent financial advisors to OnePlatform Wealth Management Limited;

• “Initial Shareholders” means the Sponsor and the officers and directors of AGBA who hold Insider Shares and 225,000 Private Placement Units;

• “Insider Shares” means the aggregate of 1,150,000 AGBA Shares sold to our Initial Shareholders in October 2018 and February 2019 for an aggregate purchase price of US$25,000;

• “IPO” means the initial public offering of AGBA, completed on May 16, 2019, pursuant to which the AGBA Units were listed on Nasdaq;

• “Legacy Group” means, prior to the Closing, Convoy Global Holdings Limited and its subsidiaries and affiliates, and after the Closing, Convoy Global Holdings Limited and its subsidiaries and affiliates, excluding the TAG Business, its subsidiaries, B2B, B2BSub, and HKSub;

• “Merger Sub I” means AGBA Merger Sub I Limited, a BVI business company and wholly-owned subsidiary of AGBA;

• “Merger Sub II” means AGBA Merger Sub II Limited, a BVI business company and wholly-owned subsidiary of AGBA;

• “Merger Subs” means, together Merger Sub I and Merger Sub II;

• “Nasdaq” means the Nasdaq Capital Market;

• “OAM” means OnePlatform Asset Management Limited;

• “OIP” means OnePlatform International Property Limited;

• “OPH” means, as the context requires, OnePlatform Holdings Limited prior to the OPH Merger, and, with respect to the entities that comprise the TAG Business, B2B following the OPH Merger;

v

• “OPH Merger” means the merger of OPH with and into HKSub, with HKSub as the surviving entity, which completed on August 11, 2022;

• “OWM” means OnePlatform Wealth Management Limited;

• “PCAOB” means the Public Company Accounting Oversight Board of the United States;

• “Post-Combination Company” means AGBA following the consummation of the Business Combination;

• “Private Placement Units” means private AGBA Units held by the Sponsor, which were acquired by the Sponsor at the consummation of the IPO;

• “Private Warrants” means warrants sold as part of the Private Placement Units at the consummation of the IPO;

• “Public Warrants” means warrants sold as part of the ABGA Units sold in the IPO;

• “Record Date” means October 6, 2022;

• “SEC” or “Securities and Exchange Commission” means the Securities and Exchange Commission of the United States;

• “Securities Act” means the Securities Act of 1933, as amended;

• “Share Award Scheme” means the Post-Combination Company’s Share Award Scheme, the form of which is attached to this proxy statement as Annex C;

• “Sponsor” means AGBA Holding Limited, the sponsor of AGBA;

• “TAG” means TAG Holdings Limited, a member of the Legacy Group;

• “TAG Business” means, as the context requires, OPH and Fintech together, prior to the OPH Merger, and B2B and Fintech together, after the OPH Merger, in each case including such entities’ respective subsidiaries;

• “Transfer Agent” or “Continental” means Continental Stock Transfer & Trust Company;

• “trust account” means the trust account of AGBA that holds the proceeds of the IPO;

• “U.S. Dollars,” “USD,” and “US$” means the legal currency of the United States; and

• “U.S. GAAP” means the accounting principles generally accepted in the United States.

Reporting Currency

The reporting currency of AGBA is the U.S. Dollar. This proxy statement also contains translations of certain foreign currency amounts into U.S. Dollars for the convenience of the reader. The reporting currency of the TAG Business is the U.S. Dollar and the accompanying combined and consolidated financial statements have been expressed in U.S. Dollars. In addition, the TAG Business and its subsidiaries operating in Hong Kong maintain their books and record in their local currency, Hong Kong Dollars, which is a functional currency being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not U.S. Dollars are translated into U.S. Dollars, in accordance with ASC Topic 830-30, “Translation of Financial Statements”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the year. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statements of changes in shareholder’s equity. We make no representation that the Hong Kong Dollar or U.S. Dollar amounts referred to in this proxy statement could have been or could be converted into U.S. Dollars or Hong Kong Dollars, as the case may be, at any particular rate or at all.

vi

AGBA ACQUISITION LIMITED

Room 1108, 11th Floor, Block B

New Mandarin Plaza

14 Science Museum Road

Tsimshatsui East

Kowloon, Hong Kong

Attn: Gordon Lee

Tel: (852) 6872 0258

NOTICE OF EXTRAORDINARY GENERAL MEETING OF

AGBA ACQUISITION LIMITED SHAREHOLDERS

To Be Held on November 10, 2022

To AGBA Acquisition Limited (“AGBA”) Shareholders:

NOTICE IS HEREBY GIVEN that you are cordially invited to attend an extraordinary general meeting of shareholders of AGBA (“AGBA,” “we,” “our,” or “us”) to be held at the offices of Loeb & Loeb LLP, 2206-19 Jardine House, 1 Connaught Place Central, Hong Kong SAR, on November 10, 2022, at 10:00 a.m. local time (the “extraordinary general meeting”). Attendees of the meeting are required to adhere to the then prevailing COVID-19 measures and regulations implemented by the venue provider and local authorities, including, but not limited to, with respect to vaccination, mask-wearing and testing. The extraordinary general meeting will be held for the following purposes:

• To approve the business combination agreement dated as of November 3, 2021 (as amended on November 18, 2021, January 4, 2022, May 4, 2022, and October 21, 2022, and as may be amended or supplemented from time to time, the “Business Combination Agreement”) between AGBA, TAG International Limited, TAG Asset Partners Limited, OnePlatform International Limited, OnePlatform Holdings Limited (“OPH”) and TAG Asia Capital Holdings Limited (“Fintech”), and TAG Holdings Limited (“TAG”) and the transactions contemplated thereunder, including but not limited to the acquisition, by way of merger, of all of the issued and outstanding shares of each of OPH and Fintech, as provided for in the Business Combination Agreement, and the consideration paid to TAG by way of new issue of ordinary shares in accordance with the Business Combination Agreement, or the “Business Combination.” A copy of the Business Combination Agreement is attached to this proxy statement as Annex A, Annex A-1, Annex A-2, Annex A-3, and Annex A-4. This proposal is referred to as the “Business Combination Proposal” or “Proposal No. 1.”

• To approve the proposed amendment to the Existing Charter and adopt the Fifth Amended and Restated Memorandum and Articles of Association of AGBA as further described herein, a copy of which is attached to this proxy statement as Annex B. This proposal is referred to as the “Amendment Proposal” or “Proposal No. 2.”

• To approve, on a non-binding advisory basis, six separate governance proposals relating to certain material differences between the corporate governance provisions of the Existing Charter and those of the Fifth Amended and Restated Memorandum and Articles of Association of AGBA as further described herein, a copy of which is attached to this proxy statement as Annex B. These proposals are collectively referred to as the “Governance Proposals” or “Proposal No. 3.”

• To approve (x) the issuance of more than 20% of the issued and outstanding AGBA ordinary shares pursuant to the terms of the Business Combination Agreement, as required by Nasdaq Listing Rules 5635(a), (b), and (d); and (y) the issuance of securities under the AGBA Group Holding Limited Share Award Scheme, as required by Nasdaq Listing Rule 5635(c). This proposal is referred to as the “Nasdaq Proposal” or “Proposal No. 4.”

• To approve and adopt the AGBA Group Holding Limited Share Award Scheme. A copy of the form of the Share Award Scheme is attached to this proxy statement as Annex C. This proposal is called the “Share Award Scheme Proposal” or “Proposal No. 5.”

vii

• To consider a proposal, if put, to approve the adjournment of the extraordinary general meeting in the event AGBA does not receive the requisite shareholder vote to approve the Business Combination. This proposal is called the “Business Combination Adjournment Proposal” or “Proposal No. 6.”

The Business Combination Proposal is conditioned upon the approval of the Amendment Proposal and the Nasdaq Proposal. The Amendment Proposal, the Governance Proposals, the Nasdaq Proposal, and the Share Award Scheme Proposal are dependent upon the approval of the Business Combination Proposal. In the event that the Business Combination Proposal is not approved, AGBA will not consummate the Business Combination. If AGBA does not consummate the Business Combination and fails to complete an initial business combination by November 16, 2022, AGBA will be required to dissolve and liquidate.

Proposals No. 1 through No. 6 are sometimes collectively referred to herein as the “Proposals.”

As of the date of this proxy statement, there were 4,737,871 AGBA Shares issued and outstanding and entitled to vote. Only AGBA shareholders who hold shares of record as of the close of business on October 6, 2022 are entitled to vote at the extraordinary general meeting or any adjournment of the extraordinary general meeting. This proxy statement is first being mailed to shareholders on or about October 28, 2022. Approval of the Business Combination Proposal, the Amendment Proposal, and the Governance Proposals will each require 65% of the issued and outstanding ordinary shares present in person or represented by proxy and entitled to vote at the extraordinary general meeting. Further, approval of the Nasdaq Proposal, the Share Award Scheme Proposal, and the Business Combination Adjournment Proposal will each require the affirmative vote of the holders of a majority of the outstanding ordinary shares present in person or represented by proxy and entitled to vote at the extraordinary general meeting. Attending the extraordinary general meeting in person or represented by proxy and abstaining from voting will have the same effect as voting against all the proposals and, assuming a quorum is present, broker non-votes will have no effect on the Business Combination Proposal, the Amendment Proposal, the Governance Proposals, the Nasdaq Proposal, the Share Award Scheme Proposal, and the Business Combination Adjournment Proposal.

AGBA currently is authorized to issue 100,000,000 ordinary shares, US$0.001 par value per share.

Whether or not you plan to participate in the extraordinary general meeting, please date, sign, and return your proxy card without delay, or submit your proxy through the Internet or by telephone as promptly as possible in order to ensure your representation at the extraordinary general meeting no later than the time appointed for the meeting or adjourned meeting. Voting by proxy will not prevent you from voting your shares online if you subsequently choose to participate in the extraordinary general meeting in person. If you fail to return your proxy card and do not participate in the meeting, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the extraordinary general meeting.

You may revoke a proxy at any time before it is voted at the extraordinary general meeting by executing and returning a proxy card dated later than the previous one, by participating in the extraordinary general meeting in person and casting your vote by hand or by ballot (as applicable) or by submitting a written revocation to Advantage Proxy, P.O. Box 13581, Des Moines, WA 98198 Attention: Karen Smith, Telephone: 877-870-8565 (“Advantage Proxy”), that is received by Advantage Proxy before we take the vote at the extraordinary general meeting. If you hold your shares through a bank or brokerage firm, you should follow the instructions of your bank or brokerage firm regarding revocation of proxies.

AGBA is providing the accompanying proxy statement and accompanying proxy card to AGBA’s shareholders in connection with the solicitation of proxies to be voted at the extraordinary general meeting and at any adjournments of the extraordinary general meeting. Information about the extraordinary general meeting, the Business Combination and other related business to be considered by AGBA’s shareholders at the extraordinary general meeting is included in the accompanying proxy statement. Whether or not you plan to attend the extraordinary general meeting in person, all of AGBA’s shareholders should read the accompanying proxy statement, including the Annexes and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 58 of the accompanying proxy statement.

viii

After careful consideration, the board of directors of AGBA has unanimously approved the Business Combination Agreement and the transactions contemplated thereby, and unanimously recommends that shareholders vote “FOR” the adoption of the Business Combination Agreement and approval of the transactions contemplated thereby, and “FOR” all other proposals presented to AGBA’s shareholders in the accompanying proxy statement. When you consider the recommendation of these proposals by the board of directors of AGBA, you should keep in mind that AGBA’s directors and officers have interests in the Business Combination that may conflict with your interests as a shareholder. See the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of AGBA’s Directors and Executive Officers in the Business Combination” in the accompanying proxy statement for a further discussion of these considerations.

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST (I) IF YOU: (A) HOLD PUBLIC ORDINARY SHARES, OR (B) HOLD PUBLIC ORDINARY SHARES THROUGH PUBLIC UNITS AND YOU ELECT TO SEPARATE YOUR PUBLIC UNITS INTO THE UNDERLYING PUBLIC ORDINARY SHARES PRIOR TO EXERCISING YOUR REDEMPTION RIGHTS WITH RESPECT TO THE PUBLIC ORDINARY SHARES; AND (II) (A) DEMAND, NO LATER THAN 5:00 P.M., EASTERN TIME ON NOVEMBER 7, 2022 (TWO BUSINESS DAYS BEFORE THE EXTRAORDINARY GENERAL MEETING), THAT AGBA REDEEM YOUR SHARES INTO CASH; AND (B) SUBMIT YOUR REQUEST IN WRITING TO AGBA’S TRANSFER AGENT, AT THE ADDRESS LISTED AT THE END OF THIS SECTION AND DELIVERING YOUR SHARES TO AGBA’S TRANSFER AGENT PHYSICALLY OR ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DEPOSIT/WITHDRAWAL AT CUSTODIAN (“DWAC”) SYSTEM TWO BUSINESS DAYS PRIOR TO THE VOTE AT THE EXTRAORDINARY GENERAL MEETING. YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATE (IF ANY) TO THE TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC SYSTEM. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN THESE SHARES WILL BE RETURNED TO YOU OR YOUR ACCOUNT. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

By order of the Board of Directors, | ||

/s/ Gordon Lee | ||

Gordon Lee | ||

October 28, 2022 |

ix

x

xi

QUESTIONS AND ANSWERS ABOUT THE PROPOSALS FOR AGBA SHAREHOLDERS

The questions and answers below highlight only selected information from this document and only briefly address some commonly asked questions about the proposals to be presented at the extraordinary general meeting, including with respect to the proposed Business Combination. The following questions and answers do not include all the information that is important to AGBA’s shareholders. Shareholders should read this proxy statement, including the Annexes and the other documents referred to herein, carefully and in their entirety to fully understand the proposed Business Combination and the voting procedures for the extraordinary general meeting, which will be held in-person at 10:00 a.m. local time at the offices of Loeb & Loeb LLP, 2206-19 Jardine House, 1 Connaught Place Central, Hong Kong SAR, on November 10, 2022. If you hold your shares through a bank, broker, or other nominee, you will need to take additional steps to participate in the meeting, as described in this proxy statement. Attendees of the meeting are required to adhere to the then prevailing COVID-19 measures and regulations implemented by the venue provider and local authorities, including, but not limited to, with respect to vaccination, mask-wearing and testing.

Q: Why am I receiving this proxy statement?

A: AGBA Acquisition Limited, a BVI business company, or “AGBA,” TAG International Limited, a BVI business company, or “B2B,” TAG Asset Partners Limited, a BVI business company, or “B2BSub,” OnePlatform International Limited, a Hong Kong company, or “HKSub”, OnePlatform Holdings Limited, a Hong Kong company, or “OPH”, TAG Asia Capital Holdings Limited, a BVI business company, or “Fintech,” and TAG Holdings Limited, a BVI business company, or “TAG”, have agreed to a business combination under the terms of a business combination agreement, dated as of November 3, 2021, as amended on November 18, 2021, January 4, 2022, May 4, 2022, October 21, 2022, and as may be further amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement”, and the other related proposals. The consummation of the transactions contemplated by the Business Combination Agreement relating to the business combination with the TAG Business are referred to as the Business Combination and the proposal to approve the Business Combination is referred to as the Business Combination Proposal. The Business Combination Agreement is attached to this proxy statement as Annex A, Annex A-1, Annex A-2, Annex A-3, and Annex A-4 and is incorporated into this proxy statement by reference. You are encouraged to read this proxy statement, including the section titled “Risk Factors” and all the Annexes hereto. See the section titled “Proposal No. 1 — The Business Combination Proposal” for more information.

AGBA shareholders are being asked to consider and vote upon a proposal to adopt the Business Combination Agreement pursuant to which AGBA will become, through an acquisition merger, the beneficial owner of all of the issued and outstanding shares and other equity interests of the TAG Business from TAG, and related proposals.

The units that were issued in AGBA’s initial public offering, or the “AGBA Units”, each consist of one ordinary share of AGBA, US$0.001 par value per share, or the “AGBA Shares”, one redeemable warrant, each redeemable warrant entitling the holder thereof to purchase one-half of one AGBA Share, or the “AGBA Warrants”, and one right to receive one-tenth (1/10) of one AGBA Share upon the consummation of an initial business combination, or the “AGBA Rights”. AGBA shareholders (except for Initial Shareholders or officers or directors of AGBA) will be entitled to redeem their AGBA Shares for a pro rata share of the trust account (currently anticipated to be no less than approximately US$11.57 per share for shareholders) net of taxes payable. The AGBA Units, AGBA Shares, AGBA Warrants, and AGBA Rights are currently listed on Nasdaq.

The provisions of the Fifth Amended and Restated Memorandum and Articles of Association will differ in certain material respects from the Existing Charter. Please see “What amendments will be made to the current constitutional documents of AGBA?” below.

This proxy statement contains important information about the proposed Business Combination and the other matters to be acted upon at the extraordinary general meeting of AGBA shareholders. You should read it carefully.

Your vote is important. You are encouraged to submit your proxy as soon as possible after carefully reviewing this proxy statement and its Annexes.

1

Q: What is being voted on?

A: Below are the proposals on which AGBA shareholders are being asked to vote:

• To approve the Business Combination Agreement and the transactions contemplated thereunder, including but not limited to the acquisition by way of merger of all of the issued and outstanding shares of each of OPH and Fintech from TAG, as provided for in the Business Combination Agreement, and the consideration paid to TAG by way of new issue of ordinary shares in accordance with the Business Combination Agreement, or the “Business Combination.” The Business Combination Agreement is attached to this proxy statement as Annex A, Annex A-1, Annex A-2, Annex A-3, and Annex A-4. This proposal is referred to as the “Business Combination Proposal” or “Proposal No. 1.”

• To approve the proposed amendment to the Existing Charter and adopt the Fifth Amended and Restated Memorandum and Articles of Association of AGBA as further described herein, a copy of which is attached to this proxy statement as Annex B. This proposal is referred to as the “Amendment Proposal” or “Proposal No. 2.”

• To approve, on a non-binding advisory basis, six separate governance proposals relating to certain material differences between the corporate governance provisions of the Existing Charter and those of the Fifth Amended and Restated Memorandum and Articles of Association of AGBA as further described herein, a copy of which is attached to this proxy statement as Annex B. These proposals are collectively referred to as the “Governance Proposals” or “Proposal No. 3.”

• To approve (x) the issuance of more than 20% of the issued and outstanding AGBA ordinary shares pursuant to the terms of the Business Combination Agreement, as required by Nasdaq Listing Rules 5635(a), (b), and (d); and (y) the issuance of securities under the AGBA Group Holding Limited Share Award Scheme, as required by Nasdaq Listing Rule 5635(c). This proposal is referred to as the “Nasdaq Proposal” or “Proposal No. 4.”

• To approve and adopt the Share Award Scheme (the form of which is attached to this proxy statement as Annex C). This proposal is called the “Share Award Scheme Proposal” or “Proposal No. 5.”

• To consider a proposal, if put, to approve the adjournment of the extraordinary general meeting in the event AGBA does not receive the requisite shareholder vote to approve the Business Combination. This proposal is called the “Business Combination Adjournment Proposal” or “Proposal No. 6.”

Proposals No. 1 through No. 6 are collectively referred to as the “Proposals.”

If our shareholders do not approve each of the Proposals, then unless certain conditions in the Business Combination Agreement are waived by the applicable parties to the Business Combination Agreement, the Business Combination Agreement could terminate and the Business Combination may not be consummated. For more information, please see “Proposal No. 1 — The Business Combination Proposal,” “Proposal No. 2 — The Amendment Proposal,” “Proposal No. 3 — The Governance Proposals” “Proposal No. 4 — The Nasdaq Proposal,” “Proposal No. 5 — The Share Award Scheme Proposal”, and “Proposal No. 6 — The Business Combination Adjournment Proposal.”

AGBA will hold the extraordinary general meeting to consider and vote upon these proposals. This proxy statement contains important information about the Business Combination and the other matters to be acted upon at the extraordinary general meeting. Shareholders of AGBA should read it carefully.

After careful consideration, AGBA’s board of directors has determined that the Business Combination Proposal, the Amendment Proposal, the Governance Proposals, the Nasdaq Proposal, the Share Award Scheme Proposal, and the Business Combination Adjournment Proposal are in the best interests of AGBA and its shareholders and unanimously recommends that you vote or give instruction to vote “FOR” each of those proposals.

The existence of financial and personal interests of one or more of AGBA’s directors may result in conflicts of interest on the part of such director(s) between what he, she or they may believe is in the best interests of AGBA and its shareholders and what he, she or they may believe is best for himself, herself or themselves in determining to recommend that shareholders vote for the proposals. In addition, AGBA’s officers have interests

2

in the Business Combination that may conflict with your interests as a shareholder. See the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of AGBA’s Directors and Executive Officers in the Business Combination” for a further discussion of these considerations.

Q: Why is AGBA proposing the Business Combination?

A. AGBA was organized to effect a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination, with one or more businesses or entities.

Based on its due diligence investigations of the TAG Business, its subsidiaries, and the industry in which they operate, including the financial and other information provided by TAG in the course of AGBA’s due diligence investigations, the AGBA board of directors believes that the Business Combination with AGBA is in the best interests of AGBA and its shareholders and presents an opportunity to increase shareholder value. However, there is no assurance of this. See “Proposal No. 1 — The Business Combination Proposal — AGBA’s Board of Directors’ Reasons for the Approval of the Business Combination” for additional information. Although AGBA’s board of directors believes that the Business Combination with the TAG Business presents a unique business combination opportunity and is in the best interests of AGBA and its shareholders, the board of directors did consider the following potentially material negative factors in arriving at that conclusion:

• Macroeconomic Risks. Macroeconomic uncertainty, including the potential impact of the COVID-19 pandemic, and the effects they could have on the combined company’s revenues.

• Benefits May Not Be Achieved. The risk that the potential benefits of the Business Combination may not be fully achieved, or may not be achieved within the expected timeframe.

• Growth Initiatives May Not be Achieved. The risk that the growth initiatives may not be fully achieved or may not be achieved within the expected timeframe.

• No Third-Party Valuation. The risk that AGBA did not obtain a third-party valuation or fairness opinion in connection with the Business Combination.

• Liquidation of AGBA. The risks and costs to AGBA if the Business Combination is not completed, including the risk of diverting our officer’s and directors’ focus and resources from other business combination opportunities, which could result in AGBA being unable to effect a business combination by November 16, 2022, forcing AGBA to liquidate and the warrants to expire worthless.

• Closing Conditions. The fact that completion of the Business Combination is conditioned on the satisfaction of certain closing conditions that are not within AGBA’s control.

• Regulatory Approval. The fact that completion of the Business Combination is conditioned on obtaining regulatory approvals (both foreign and domestic), including SEC review and approval of this proxy statement, that are not within AGBA’s control and can take a significant amount of time to obtain, which provides the parties with the ability to extend closing and delay the consummation of the transactions contemplated by the Business Combination until certain of such approvals have been obtained.

• Litigation. The possibility of litigation challenging the Business Combination or that an adverse judgment granting permanent injunctive relief could indefinitely enjoin consummation of the Business Combination.

• Fees and Expenses. The fees and expenses associated with completing the Business Combination.

• Other Risks. Various other risks associated with the Business Combination, the business of AGBA, and the business of the TAG Business described under the section of this proxy statement entitled “Risk Factors”.

In addition to considering the various foregoing factors, the AGBA board also considered:

• Interests of Certain Persons. The Sponsor and certain officers and directors of AGBA may have interests in the Business Combination as individuals that are in addition to, and that may be different from, the interests of AGBA’s shareholders (see the section entitled “Proposal No. 1 — The Business Combination Proposal — Interests of Certain Persons in the Business Combination”). AGBA’s independent directors on

3

the AGBA audit committee reviewed and considered these interests during the negotiation of the Business Combination and in evaluating and unanimously approving, as members of the AGBA audit committee, the Business Combination Agreement, and the transactions contemplated therein.

These factors are discussed in greater detail in the section entitled “Proposal No. 1 — The Business Combination Proposal — AGBA’s Board of Directors’ Reasons for the Approval of the Business Combination”, as well as in the section entitled “Risk Factors”.

Q: Did the ABGA board obtain a third-party valuation or fairness opinion in determining whether or not to proceed with the Business Combination?

A. No. The ABGA board did not obtain a third-party valuation or fairness opinion in connection with its determination to approve the Business Combination. Accordingly, investors will be relying solely on the judgment of the AGBA board in valuing the TAG Business’s business and assuming the risk that the AGBA board may not have properly valued such business.

Q: How was the implied TAG Business’s equity value of US$555,000,000 determined?

A. The AGBA Board considered the implied TAG Business’s equity value of approximately US$555 million based on the sum of the equity value of OPH and IFA, its major distribution channel, derived from a comparable company approach, plus the value of Fintech’s investment portfolio. See “Proposal No. 1 — The Business Combination Proposal — AGBA’s Board of Directors’ Reasons for Approval of the Business Combination.”

Q: What is the value of the consideration to be received in the Business Combination?

A. The aggregate value of the Aggregate Stock Consideration to be paid by AGBA in the Business Combination is approximately US$555,000,000 (calculated as follows: 55,500,000 AGBA Shares to be issued to TAG, multiplied by US$10.00 per share (the deemed value of the shares in the Business Combination Agreement)).

Q: What is the TAG Business’s corporate structure?

A. TAG is a British Virgin Islands incorporated holding company that does not conduct any material business operations. After the Business Combination, the Post-Combination Company will also be a British Virgin Islands incorporated holding company that does not conduct any material business operations. The TAG Business’s operations are, and will be, primarily conducted by its Hong Kong-based operating subsidiaries. This offshore holding company structure may present certain risks to shareholders as described further in the section titled “Risk Factors — Risk Factors Relating to the Business Combination” beginning on page 97 of this proxy statement. Please also refer to the organization chart set out on pages 31-33, 118, and 177-178 of this proxy statement for a description of the TAG Business’s holding company structure both before and after the Business Combination.

Q: What are the TAG Business’s dividend, distribution, and cash management policies?

A: Until recently, neither OPH nor Fintech had previously declared any dividends or made any distributions between it and TAG, it and its subsidiaries, it and any other entities, or it to investors. On January 18, 2022, however, Fintech approved, declared, and distributed a special dividend of US$47 million to TAG. The one-off special dividend distribution was made solely due to the investment gain from the sale of Fintech’s investment in Nutmeg Saving and Investment Limited in September 2021. The dividends were paid by offsetting a receivable due from the Legacy Group, and the remaining balance was paid by cash. Please refer to the financial statements of OPH and Fintech including “Note 13 — shareholder’s deficit” at page F-82 for further details. Apart from this one-off special dividend distribution, the management of the TAG Business intends to retain all available funds and future earnings, if any, for operations and business developments and does not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to the TAG Business’s dividend policy will be made at the discretion of the TAG Business’s board of directors after considering the TAG Business’s financial condition, results of operations, capital requirements, contractual requirements, business prospects, and other factors that the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

The entities that comprise the TAG Business currently transfer cash through their organization for daily business and operating activities, commercial transactions, and related party transactions on an arms-length basis following appropriate approvals and governance processes. Please refer to the section of this proxy statement

4

entitled “Related Party Transactions — Certain Transactions of the TAG Business” for further details of the TAG Business’s related party transactions. These fund transfers are made in accordance with the TAG Business’s cash management policies and payment policy and procedure, with established delegation and signing authority processes to ensure appropriate corporate approvals are obtained before execution. The management of the TAG Business anticipates that these practices will continue after the Business Combination.

Q: Will the Post-Combination Company be required to obtain new financing in connection with the Business Combination?

A. No. The original condition to Closing that the Post-Combination Company receives at least US$35,000,000 in immediately available cash, net of expenses and liabilities, at Closing was waived by the parties in the October Amendment. Accordingly, other than what is required of the Post-Combination Company to meet the initial listing requirements for Nasdaq Capital Market, there is no longer a minimum cash condition required for the Closing. There can be no guarantee that following the Closing, the Post-Combination Company will be able to obtain any PIPE Investment or any other form of financing.

Q: What is the maximum number of AGBA shares that may be redeemed, and is there a minimum cash condition?

A. AGBA has no specified maximum redemption threshold under its Existing Charter. However, AGBA will not redeem its public shares in an amount that would cause its net tangible assets of the Post-Combination Company to be less than US$5,000,001. Pursuant to the October Amendment, there is no minimum cash condition. As of the close of business on the Record Date for the extraordinary general meeting, there were 4,737,871 ordinary shares issued and outstanding, of which 3,362,871 were issued and outstanding public shares. Under the maximum redemption scenario, all of the 3,362,871 public shares will be redeemed. There is a possibility that AGBA’s Sponsor or its affiliates may purchase securities in open market or private transactions outside of the redemption process, for purposes of ensuring that certain Nasdaq initial listing requirements will be met and therefore, increasing the likelihood that the Business Combination will close.

Q: How will the combined company be managed following the Business Combination?

A. Effective as at Closing, the board of directors of AGBA will consist of the following five (5) members, designated by TAG in accordance with the Business Combination Agreement: Ng Wing Fai, Wong Suet Fai Almond, Brian Chan, Thomas Ng, and Felix Wong. Two of these directors (Mr. Brian Chan and Mr. Thomas Ng) are currently on AGBA’s board of directors and qualify as independent directors under Nasdaq rules. AGBA and TAG expect Mr. Felix Wong to also qualify as an independent director under those rules. Ng Wing Fai will be the Chairman and an Executive Director and Wong Suet Fai Almond will be an Executive Director of the Post-Combination Company after the consummation of the Business Combination. Mr. Lee Jin Yi will serve as a senior advisor. See “Directors, Executive Officers, and Corporate Governance — Directors and Executive Officers after the Business Combination.”

Q: What equity stake will current AGBA shareholders and current equityholders of the TAG Business hold in the Post-Combination Company after the consummation of the Business Combination?