- ILLR Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Triller (ILLR) S-1IPO registration

Filed: 26 Apr 23, 5:17pm

As filed with the U.S. Securities and Exchange Commission on April 26, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

_________________

AGBA GROUP HOLDING LIMITED

(Exact name of registrant as specified in its charter)

_________________

British Virgin Islands | 6199 | N/A | ||

(State or other jurisdiction of | (Primary Standard Industrial | (IRS Employer |

AGBA Tower

68 Johnston Road

Wan Chai, Hong Kong SAR

+852 3601 8000

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

_________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(949) 361-1200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_________________

Copies to:

Lawrence Venick, Esq. | Ng Wing Fai |

_________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED APRIL 26, 2023 |

AGBA Group Holding Limited

17,772,847 Ordinary Shares Including

2,854,100 Ordinary Shares issuable upon the exercise of Warrants and Unit Purchase Option and

14,918,747 Ordinary Shares offered by Selling Securityholders

_________________

This prospectus relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”), or their permitted transferees, of up to 17,772,847 ordinary shares, $0.001 par value (“AGBA Shares” or “ordinary shares”), of AGBA Group Holding Limited (“our,” “we,” “us,” the “Company” or “AGBA”), consisting of (i) 2,189,834 AGBA Shares held by AGBA Holding Limited (the “Sponsor”) and certain former directors and officers of AGBA Acquisition Limited (“AAL”) including (a) 1,150,000 AGBA Shares issued in connection with AAL’s IPO (each as defined below) for approximately $0.02 per share (the “Founder Shares”) held by the Sponsor and directors and officers of AAL; (b) 225,000 AGBA Shares issued as part of placement shares in connection with AAL’s IPO at a price of $10.00 per placement share; (c) 22,500 AGBA Shares issued upon the conversion of the rights to receive one tenth (1/10) of one AGBA Share in connection with the Closing of the Business Combination; and (d) 792,334 AGBA Shares issued upon the conversion of payables in connection with the Closing of the Business Combination at a price of $10.00 per placement share; (ii) 2,728,913 AGBA Shares issued to Apex Twinkle Limited (“Apex”) at a share value of $3.50 per share; (iii) 10,000,000 AGBA Shares issued to TAG Holdings Limited at the Closing of the Business Combination at a share value of $10.00 per share; (iv) 2,300,000 AGBA Shares issuable upon exercise of 4,600,000 registered public warrants (the “Public Warrants”) at an exercise price of $11.50; (v) 112,500 AGBA Shares issuable upon exercise of 225,000 private warrants (the “Private Warrants” collectively with the “Public Warrants”, the “Warrants”) issued to the Sponsor at an exercise price of $11.50; (vi) 276,000 AGBA Shares issuable upon exercise of the representative’s unit purchase option (the “UPO”) issued to Maxim Group, LLC (“Maxim”); (vii) 138,000 AGBA Shares underlying the warrants included as part of the UPO; and (viii) 27,600 AGBA Shares to be issued to Maxim underlying the rights included as part of the UPO.

On November 14, 2022, AGBA Acquisition Limited, a British Virgin Islands corporation, consummated a series of transactions (the “Closing”) contemplated by the previously announced business combination agreement, dated as of November 3, 2021 (as amended on November 18, 2021, January 4, 2022, May 4, 2022, and October 21, 2022) (the “Business Combination Agreement”) by and among AGBA Acquisition Limited, AGBA Merger Sub I Limited, AGBA Merger Sub II Limited, TAG International Limited (“B2B”), TAG Asset Partners Limited, OnePlatform International Limited, OnePlatform Holdings Limited (“OPH”), TAG Asia Capital Holdings Limited (“Fintech”), and TAG Holdings Limited (“TAG”) (the “Business Combination”).

As described herein, the Selling Securityholders may sell from time to time an aggregate of 17,772,847 AGBA Shares, including up to 2,854,100 AGBA Shares issuable upon exercise of the Warrants and UPO. Given the fact that certain of the AGBA Shares being registered for resale herein were issued at effective prices below the closing market price of AGBA Shares on Nasdaq and also as of April 25, 2023, and all the shares being registered for resale under this prospectus represent approximately 24.16% of AGBA outstanding ordinary shares as of the date of this prospectus, the market price of AGBA Shares could drop significantly if the holders of such AGBA Shares sell them or are perceived by the market as intending to sell them. See “Risk Factors — Future sales of AGBA Shares could cause the market price of AGBA Shares to decline” and “— The Selling Securityholders can earn a positive rate of return on their investment, even if other shareholders experience a negative rate of return in the post- business-combination company.”

We will receive up to an aggregate of $32,366,750 if all of the Warrants registered hereby are exercised to the extent such Warrants are exercised for cash. However, we will only receive such proceeds if and when the Warrant holders exercise the Warrants. If the market price for AGBA Shares does not increase above the per-share exercise price, there is a small likelihood that any of the Warrants will be exercised. We expect to use any proceeds we do receive from the exercise of the Warrants for general corporate purposes and to implement our business plan. We will bear all costs, expenses and fees in connection with the registration of AGBA Shares and will not receive any proceeds from the sale of AGBA Shares. The Selling Securityholders will bear all the costs of commissions and discounts, if any, attributable to their respective sales of AGBA Shares.

Our registration of the AGBA Shares covered by this prospectus does not mean that either we or the Selling Securityholders will issue, offer or sell, as applicable, any of the AGBA Shares. The Selling Securityholders may offer and sell the AGBA Shares covered by this prospectus in a number of different ways and at varying prices, subject to, in certain circumstances, applicable lock-up restrictions, or they may not offer or sell any AGBA Shares at all. As described above, certain of the Selling Securityholders purchased the AGBA Shares covered by this prospectus for prices ranging from $0.02 to $11.50 and certain other Selling Securityholders may exercise Warrants at $11.50. The closing price of AGBA Shares on Nasdaq on April 25, 2023 was $1.90. Consequently, certain of the Selling Securityholders may realize a positive rate of return on the sale of their AGBA Shares covered by this prospectus even if the market price of AGBA Shares is below the most recent closing price.

We provide more information about how the Selling Securityholders may sell the AGBA Shares in this prospectus. See “Plan of Distribution.”

We are an “emerging growth company” under applicable federal securities laws and are subject to reduced public company reporting requirements.

Investing in our ordinary shares involves risks, including those set forth in the “Risk Factors” section of this prospectus beginning on page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April [•], 2023

TABLE OF CONTENTS

Page | ||

v | ||

vii | ||

viii | ||

1 | ||

7 | ||

8 | ||

10 | ||

41 | ||

42 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 43 | |

63 | ||

84 | ||

89 | ||

90 | ||

92 | ||

94 | ||

109 | ||

110 | ||

114 | ||

122 | ||

123 | ||

128 | ||

128 | ||

130 |

i

INTRODUCTORY NOTE AND FREQUENTLY USED TERMS

On November 14, 2022, AGBA Acquisition Limited, a British Virgin Islands’ company, consummated a series of transactions (the “Closing”) contemplated by the previously announced business combination agreement, dated as of November 3, 2021 (as amended on November 18, 2021, January 4, 2022, May 4, 2022, and October 21, 2022) (the “Business Combination Agreement”) by and among AGBA Acquisition Limited, AGBA Merger Sub I Limited, AGBA Merger Sub II Limited, TAG International Limited (“B2B”), TAG Asset Partners Limited, OnePlatform International Limited, OnePlatform Holdings Limited (“OPH”), TAG Asia Capital Holdings Limited (“Fintech”), and TAG Holdings Limited (“TAG”) (the “Business Combination”), as a result of the receipt of approval by the shareholders of AGBA Acquisition Limited at the special meeting of the shareholders of AGBA held on November 10, 2022 (the “Special Meeting”).

Upon the Closing: (i) AGBA Acquisition Limited became, through an acquisition merger, the 100% owner of the issued and outstanding securities of each of TAG International Limited and TAG Asia Capital Holdings Limited, in exchange for 55,500,000 ordinary shares of AGBA Acquisition Limited, par value US$0.001 per share (the “Aggregate Stock Consideration”) to TAG (subject to certain indemnity holdback provisions in the Business Combination Agreement). This resulted in AGBA Acquisition Limited acquiring TAG International Limited, TAG Asia Capital Holdings Limited, and their collective subsidiaries (the “TAG Business”); (ii) the governing documents of AGBA Acquisition Limited were amended and restated, becoming the Fifth Amended and Restated Memorandum and Articles of Association as described in this registration statement; (iii) the number of AGBA’s authorized ordinary shares was increased from 100 million to 200 million, and (iv) AGBA Acquisition Limited’s name changed to “AGBA Group Holding Limited” which we also refer to “AGBA.”

Unless the context indicates otherwise, references in this prospectus to the “Company,” “AGBA,” “we,” “us,” “our” and similar terms refer to AGBA Group Holding Limited and its consolidated subsidiaries, including AGBA.

References to “AAL” refer to AGBA Acquisition Limited, our predecessor company prior to the consummation of the Business Combination. Upon consummation of the Business Combination, AAL, who was the legal acquirer, was treated as the “acquired” company for financial reporting purposes and TAG International Limited and TAG Asia Capital Holdings Limited were treated as the accounting predecessor of AAL for Securities and Exchange Commission (“SEC”) purposes. All references to historical financial information of AGBA in this prospectus prior to the Business Combination shall refer to the historical financial information of TAG International Limited and TAG Asia Capital Holdings Limited unless the context otherwise requires.

ii

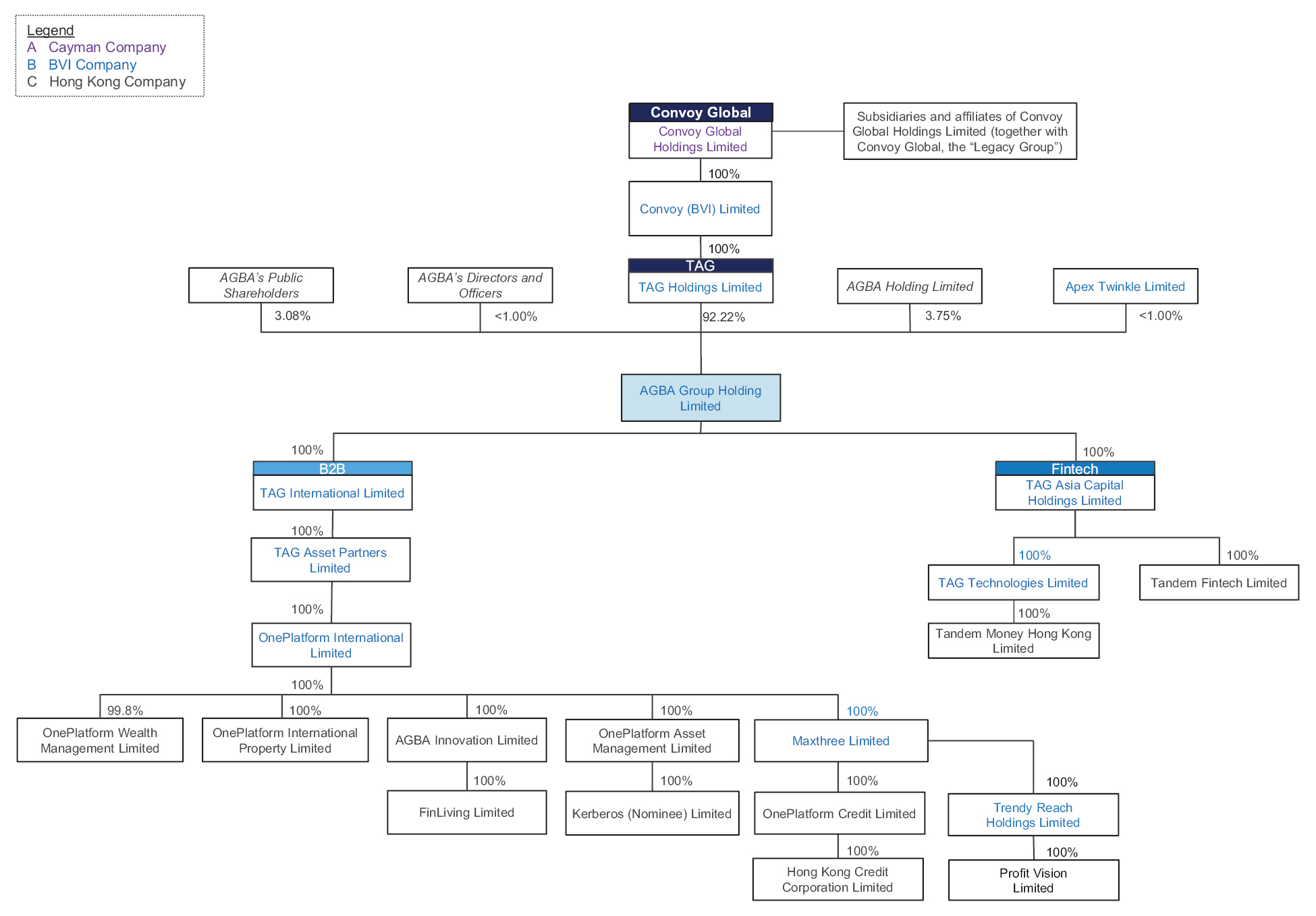

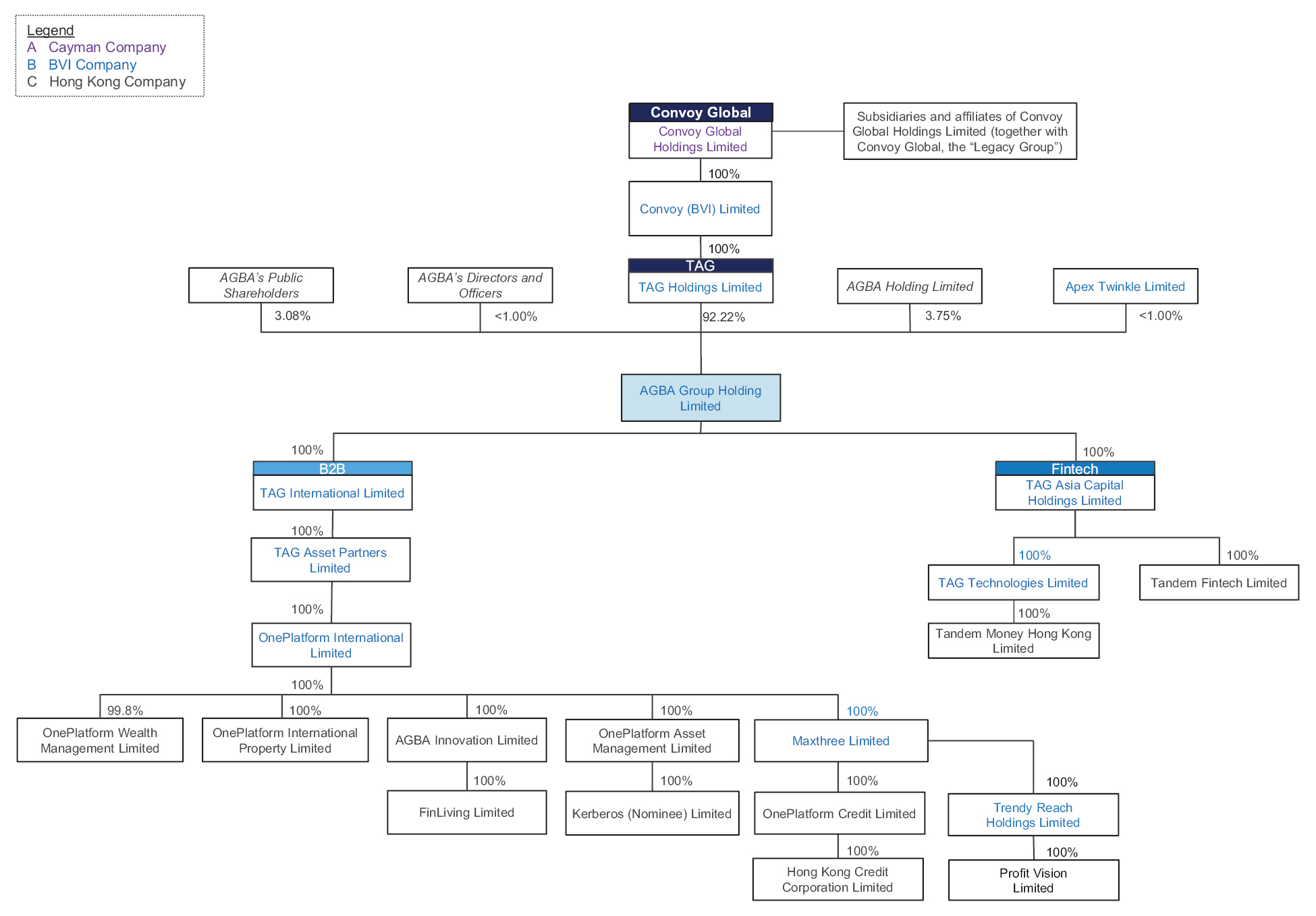

The following chart illustrates the corporate structure and ownership of AGBA upon the completion of the Business Combination and as of the date of this prospectus:

Unless otherwise stated in this registration statement or unless the context requires otherwise, references in this registration statement to:

• “AAL” means AGBA Acquisition Limited, our predecessor company prior to the consummation of the Business Combination;

• “AGBA,” “we,” “us,” “our,” “our company” and any similar term means AGBA Group Holding Limited;

• “B2B” means TAG International Limited, a BVI business company and wholly-owned subsidiary of AGBA;

• “B2BSub” means TAG Asset Partners Limited, a BVI business company and wholly-owned subsidiary of B2B;

• “Business Combination Agreement” means that certain Business Combination Agreement dated November 3, 2021 by and among AAL, B2B, B2BSub, HKSub, OPH, Fintech, and TAG, as amended on November 18, 2021, January 4, 2022, May 4, 2022, and October 21, 2022, and as may be further amended, supplemented or otherwise modified from time to time, and its schedules and exhibits thereto;

• “Business Day” means any day (except any Saturday, Sunday, or public holiday) on which banks in New York City, New York are open for business;

• “BVI” means the British Virgin Islands;

• “BVI Companies Law” means the BVI Business Companies Act, 2004 (as amended from time to time);

• “China,” “mainland China,” or the “PRC” means the People’s Republic of China;

• “Convoy Global” means Convoy Global Holdings Limited, TAG’s ultimate parent company;

• “COVID-19” means the novel coronavirus, SARS-CoV-2;

• “Exchange Act” means the Securities Exchange Act of 1934, as amended;

iii

• “Existing Charter” means AGBA’s Fifth Amended and Restated Memorandum and Articles of Association, as amended and restated on November 14, 2022;

• “fintech” means financial services technology;

• “Fintech” means TAG Asia Capital Holdings Limited;

• “Greater Bay Area” or “GBA” means the geographic region comprising Macau, Guangzhou, Shenzhen, and the surrounding area;

• “HKCC” means Hong Kong Credit Corporation Limited;

• “HKSub” means OnePlatform International Limited, a Hong Kong company and wholly-owned subsidiary of B2BSub;

• “Hong Kong” means the Hong Kong Special Administrative Region of the People’s Republic of China;

• “Hong Kong Dollars” or “HK$” means the lawful currency of Hong Kong;

• “IFA Restructuring” means the transfer of CFS’s independent financial advisors to OnePlatform Wealth

• “Initial Shareholders” means the Sponsor and the officers and directors of AAL who hold Insider Shares and 225,000 Private Placement Units;

• “Insider Shares” means the aggregate of 1,150,000 AGBA Shares sold to our Initial Shareholders in October 2018 and February 2019 for an aggregate purchase price of US$25,000;

• “IPO” means the initial public offering of AAL, completed on May 16, 2019;

• “Legacy Group” means Convoy Global Holdings Limited and its subsidiaries and affiliates, which do not include AGBA or any of its subsidiaries, B2B, B2BSub, and HKSub;

• “Nasdaq” means the Nasdaq Capital Market;

• “OIP” means OnePlatform International Property Limited;

• “OPH” means, as the context requires, OnePlatform Holdings Limited prior to the OPH Merger, and, B2B following the OPH Merger;

• “OPH Merger” means the merger of OPH with and into HKSub, with HKSub as the surviving entity, which completed on August 11, 2022;

• “ordinary shares” or “AGBA Shares” means the ordinary shares of AGBA, US$0.001 par value per share;

• “PCAOB” means the Public Company Accounting Oversight Board of the United States;

• “Private Placement Units” means private units held by the Sponsor, which were acquired by the Sponsor at the consummation of the IPO;

• “Private Warrants” means warrants sold as part of the Private Placement Units at the consummation of the IPO;

• “Public Warrants” means warrants sold as part of the AAL Units sold in the IPO;

• “SEC” or “Securities and Exchange Commission” means the Securities and Exchange Commission of the United States;

• “Securities Act” means the Securities Act of 1933, as amended;

• “Sponsor” means AGBA Holding Limited;

• “TAG” means TAG Holdings Limited;

• “TAG Business” means, B2B and Fintech together, in each case including each such entity’s respective subsidiaries;

• “Transfer Agent” or “Continental” means Continental Stock Transfer & Trust Company;

• “U.S. Dollars,” “USD,” and “US$” means the legal currency of the United States; and

• “U.S. GAAP” means the accounting principles generally accepted in the United States.

iv

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. All statements, other than statements of historical facts, may be forward-looking statements. These statements are based on the expectations and beliefs of our management in light of historical results and trends, current conditions and potential future developments, and are subject to a number of factors and uncertainties that could cause actual results to differ materially from forward-looking statements. These forward-looking statements include statements about our future performance and opportunities; benefits of the Business Combination; statements of the plans, strategies and objectives of management for future operations; and statements regarding future economic conditions or performance. Forward-looking statements may contain words such as “will be,” “will,” “expect,” “anticipate,” “continue,” “project,” “believe,” “plan,” “could,” “estimate,” “forecast,” “guidance,” “intend,” “may,” “plan,” “possible,” “potential,” “predict,” “pursue,” “should,” “target” or similar expressions, and include the assumptions that underlie such statements.

The forward-looking statements are based on the current expectations of our management as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the SEC by us and the following:

• expectations regarding our strategies and future financial performance, including its future business plans or objectives, prospective performance and opportunities and competitors, revenues, products, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and our ability to invest in growth initiatives and pursue acquisition opportunities;

• the outcome of any legal proceedings that may be instituted against us following the consummation of the Business Combination;

• the risk that the Business Combination, recent acquisitions or any proposed transactions disrupt our current plans and/or operations, including the risk that we do not complete any such proposed transactions or achieve the expected benefit from them;

• the ability to recognize the anticipated benefits of the Business Combination, recent acquisitions or any proposed transaction, which may be affected by, among other things, competition, our ability to grow and manage growth profitably, and retain key employees;

• costs related to being a public company, acquisitions, commercial collaborations and proposed transactions;

• limited liquidity and trading of our ordinary shares;

• geopolitical risk and changes in applicable laws or regulations;

• the possibility that we may be adversely affected by other economic, business, and/or competitive factors;

• risks relating to the uncertainty of our projected financial information;

• risks related to the organic and inorganic growth of our business and the timing of expected business milestones;

• risk that the COVID-19 pandemic, and local, state, federal and international responses to addressing the pandemic may have an adverse effect on our business operations, as well as our financial condition and results of operations;

• litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on our resources; and

• the inability to maintain the listing of our ordinary shares on Nasdaq.

v

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning our business or other matters addressed in this prospectus and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus. Except to the extent required by applicable law or regulation, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

vi

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. By using a shelf registration statement, the Selling Securityholders may sell up to 17,772,847 AGBA Shares including 2,854,100 AGBA Shares issuable upon the exercise of the Warrants and UPO. We will not receive any proceeds from the sale of AGBA Shares by the Selling Securityholders.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any of the AGBA Shares, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

Neither we, nor the Selling Securityholders, have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to which we have referred you. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Securityholders will not make an offer to sell the AGBA Shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover thereof. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

vii

INDUSTRY AND MARKET DATA

Market data and certain industry data and forecasts used throughout this prospectus were obtained from sources we believe to be reliable, including market research databases, publicly available information, reports of governmental agencies and industry publications and surveys. We have relied on certain data from third-party sources, including internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the third-party forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

viii

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in AGBA Shares and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in AGBA Shares, you should read the entire prospectus carefully, including “Risk Factors” and the financial statements of AGBA and related notes thereto included elsewhere in this prospectus.

Our Company

AGBA Group Holding Limited, together with its wholly-owned subsidiaries (the “Company”, “we”, “our”, “us” and “AGBA”) is a leading wealth management and healthcare institution based in Hong Kong servicing over 400,000 individual and corporate customers.

We currently operate in four market-leading businesses: our Platform Business, Distribution Business, Healthcare Business, and Fintech Business.

Since 2019, we have implemented a strategy to expand and upgrade our long-standing broker-dealer business into a platform business and a distribution business. Today, we offer unique product and service offerings:

• B2B: tech-enabled broker management platform for advisors (“Platform Business”); and

• B2C: market leading portfolio of wealth and health products (“Distribution Business”).

We also have a market leadership in our healthcare business through our 4% stake in and a strategic partnership with HCMPS. It is one of the most reputed healthcare brands in Hong Kong. It has four self-operated medical centres and a network of over 700 healthcare service providers.

Finally, we are an established operator and successful investor in the finTech industry. We have carefully built out investment positions in FinTech, WealthTech and HealthTech businesses, applying lessons learned from our own distribution, platform and healthcare businesses.

History

On November 14, 2022, AGBA Acquisition Limited, or AAL, a British Virgin Islands’ company and a special purpose acquisition company, consummated a series of transactions contemplated by the Business Combination Agreement.

Upon the Closing of Business Combination: (i) AAL became, through an acquisition merger, the 100% owner of the issued and outstanding securities of each of TAG International Limited, TAG Asia Capital Holdings Limited, and their collective subsidiaries; (ii) the governing documents of AAL were amended and restated, becoming the Fifth Amended and Restated Memorandum and Articles of Association; (iii) the number of AAL’s authorized ordinary shares was increased from 100 million to 200 million, and (iv) AAL’s name changed from “AGBA Acquisition Limited” to “AGBA Group Holding Limited” which is our current name and which we also refer to, post-Business Combination, as “AGBA” or the “Group.”

Current Operations

We currently operate four major businesses:

1. Platform Business: we operate as a “financial supermarket” offering over 1,800 financial products to a large universe of retail and corporate customers.

2. Distribution Business: our powerful financial advisor business is the largest in the market, it engages in the personal financial advisory business (including advising and sales of a full range of financial services products including long-term life insurance, savings and mortgages), with additional internal and external channels being developed and added.

3. Healthcare Business: through our 4% stake in and a strategic partnership with HCMPS, operating as one of the largest healthcare management organizations in the Hong Kong and Macau region, with over 800 doctors in its network. Established in 1979, it is one of the most reputed healthcare brands in Hong Kong.

1

4. Fintech Business: we have an ensemble of leading fintech assets and businesses in Europe and Hong Kong. In addition to financial gains, we also derive substantial knowledge transfers from our investee companies, supporting our development and growth of new business models.

Our Strategic Growth Plans

• Overall Market Opportunities in the Greater Bay Area

• Cross-Border Wealth Management Connect

• Future expansion plan to China

• Strategic Enablers to Capture GBA Opportunities

• China B2B Partnership for Customer Acquisition

• Service Centre for Customer and Partner Servicing

• Creating an Ecosystem Empowered by Fintech

• Hong Kong’s fintech Landscape

• The Synergy to be Realized Leveraging on Existing Infrastructure and Partners

Corporate Information

AAL was incorporated on October 8, 2018 as a BVI limited company and incorporated for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business combination with one or more target businesses. Based on its business activities, AAL was considered a “shell company” as defined under the Exchange Act because it had no operations and nominal assets consisting almost entirely of cash. Until the consummation of the Business Combination, AAL did not engage in any operations nor generate any revenue.

On May 16, 2019, AAL consummated its initial public offering. On November 14, 2022, AAL consummated the Business Combination with AGBA pursuant to the Business Combination Agreement. In connection with the Business Combination, AAL changed its name to AGBA Group Holding Limited. Upon consummation of the Business Combination, AAL, who was the legal acquirer, was treated as the “acquired” company for financial reporting purposes and TAG International Limited and TAG Asia Capital Holdings Limited were treated as the accounting predecessor of AAL for SEC purposes.

The following chart illustrates AGBA’s shareholder ownership upon the completion of the Business Combination and as of the date of this prospectus:

2

Our principal executive office is located at AGBA Tower, 68 Johnston Road, Wan Chai, Hong Kong SAR and our telephone number is +852 3601 8000. We maintain a website at https://www.agba.com/. The information on our website is not incorporated by reference in this prospectus or any accompanying prospectus supplement, and you should not consider it a part of this prospectus or any accompanying prospectus supplement.

Summary Risk Factors

Risk Factors Relating to Future Resales

• Future sales of AGBA Shares, or the perception of future sales of AGBA Shares, could cause the market price of AGBA Shares to decline.

• The Selling Securityholders can earn a positive rate of return on their investment, even if other shareholders experience a negative rate of return.

Risk Factors Relating to AGBA’s Hong Kong Operations and Proximity to the PRC

• The business, financial condition, results of operations, and prospects of AGBA may be materially and adversely affected if certain laws and regulations of the PRC become applicable to AGBA or its subsidiaries. AGBA may be subject to the risks and uncertainties associated with the evolving laws and regulations in the PRC, their interpretation and implementation, and the legal and regulatory system in the PRC more generally, including with respect to the enforcement of laws and the possibility of changes of rules and regulations with little or no advance notice.

• The PRC government exerts substantial influence, discretion, oversight, and control over the manner in which companies incorporated under the laws of PRC must conduct their business activities. AGBA is a Hong Kong-based company with no operations in mainland China; however, there can be no guarantee that the PRC government will not seek to intervene or influence the operations of its or its subsidiaries at any time.

• The securities of AGBA may be delisted or prohibited from being traded “over-the-counter” under the Holding Foreign Companies Accountable Act (as amended by the Accelerating Holding Foreign Companies Accountable Act) if the PCAOB were unable to fully inspect the company’s auditor.

• Although not currently subject, AGBA may become subject to the PRC laws and regulations regarding offerings that are conducted overseas and/or foreign investment in China-based issuers, and any failure to comply with applicable laws and obligations could have a material and adverse effect on the business, financial condition, results of operations, and AGBA’s prospects of AGBA and may hinder AGBA’s ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

• Governments in the jurisdictions AGBA operates or intends to operate may restrict or control to varying degrees the ability of foreign investors to invest in businesses located or operating in such jurisdictions.

• AGBA is subject to many of the economic and political risks associated with emerging markets, particularly China, due to its operations in Hong Kong. Adverse changes in Hong Kong’s or China’s economic, political, and social conditions as well as government policies could adversely affect AGBA’s business and prospects.

• AGBA’s potential expansion of activities in China is subject to various risks.

• AGBA’s financial services revenues are highly dependent on macroeconomic conditions as well as Hong Kong, China, and global market conditions. Disruptions in the global financial markets and economic conditions could adversely affect AGBA and its institutional clients and customers.

• Recent litigation, increased SEC disclosure requirements and negative publicity surrounding China-based companies listed in the United States may result in increased regulatory scrutiny of the Company and negatively impact the trading price of its shares, which could have a material adverse effect upon its business, including its results of operations, financial condition, cash flows, and prospects.

3

• Failure to comply with existing or future laws and regulations related to data protection or data security could lead to liabilities, administrative penalties, or other regulatory actions, which could negatively affect AGBA’s operating results, business, and prospects.

• The M&A Rules and certain PRC regulations establish complex procedures for acquisitions of some Chinese companies by foreign investors, which could make it more difficult for AGBA to pursue growth through acquisitions in China.

• The PRC may prevent the cash maintained by AGBA in Hong Kong from leaving, or the PRC could restrict deployment of such cash for AGBA’s business purposes or for the payment of dividends

Risk Factors Relating to AGBA’s Business

• The ability of AGBA to continue as a going concern is dependent upon its ability to raise additional funds and implement its business plan.

• The success and growth of AGBA will depend, in part, upon its ability to be a leader in technological innovation in its industries.

• The technologies that AGBA uses may contain undetected errors, which could result in customer dissatisfaction, damage to AGBA’s reputation, or loss of customers.

• AGBA relies on its business relationships with product issuers and the success of those product issuers, and AGBA’s future development depends, in part, on the growth of such product issuers and their continued collaboration with AGBA.

• The property agency segment of the Platform Business has historically operated on thin margins, which expose it to risk of non-profitability and recent trends have caused the segment to be loss-making.

• AGBA relies on third parties for various aspects of its business and the services and solutions that it offers thereby. AGBA’s business, results of operations, financial condition, and reputation may be materially and adversely affected if these third parties do not continue to maintain or expand their relationship with AGBA, or if they fail to perform in accordance with the terms of their relevant contracts.

• Failure to maintain and enlarge the customer base of AGBA or to strengthen customer engagement may adversely affect its business and results of operations.

• A number of AGBA’s business partners are commercial banks and other financial institutions that are highly regulated, and the tightening of laws, regulations, or standards in the financial services industry could harm its business.

• Significant increases and decreases in the number of transactions by AGBA’s clients can have a material negative effect on AGBA’s profitability and its ability to efficiently process and settle transactions.

• We operate in a competitive and evolving industry; if AGBA is unable to compete effectively, it may lose market share.

• If AGBA is unable to protect or promote its brand and reputation, its business may be materially and adversely affected.

• Breach of AGBA’s security measures or those of any third-party cloud computing platform provider, or other third-party service providers, may result in AGBA’s data, IT systems, and services being perceived as not being, or actually not being, secure.

• Unexpected network interruptions, security breaches, or computer virus attacks and failures in AGBA’s information technology systems could have a material adverse effect on its business, financial condition, and results of operations.

• AGBA’s inability to use software licensed from third parties, including open-source software, could negatively affect its ability to sell its solutions and subject it to possible litigation.

4

• AGBA’s business in the credit industry requires sufficient liquidity to maintain its business activities, and it may not always have access to sufficient funds.

• AGBA’s business is impacted by interest rates, and its profitability could be negatively impacted by a low or a negative interest rate environment.

• AGBA is subject to credit risk due to the nature of the transactions it processes for its clients.

• Restrictions imposed by the outstanding indebtedness and any future indebtedness of AGBA may limit its ability to operate its business and to finance its future operations or capital needs or to engage in acquisitions or other business activities necessary to achieve growth.

• AGBA’ performance depends on key management and personnel. Any failure to attract, motivate and retain staff could severely hinder AGBA’s ability to maintain and grow its business.

• The Legacy Group has experienced significant reputational damage in the past in connection with its previous management, which could adversely affect the market prospects and reputation of AGBA, and/or the scope and quality of services rendered by the Legacy Group to AGBA.

• If AGBA cannot maintain its corporate culture, it could lose the innovation, collaboration, and focus on the mission that contribute to its business.

• Substantially all of AGBA’s operations are housed in one location. If the facilities are damaged or rendered inoperable by natural or man-made disasters, AGBA’s business may be negatively impacted.

• AGBA may not be able to identify or pursue suitable acquisition or expansion opportunities or achieve optimal results in future acquisitions or expansions, and it may encounter difficulties in successfully integrating and developing acquired assets or businesses.

• AGBA and its directors, management, and employees currently are and may in the future be subject to litigation and regulatory investigations and proceedings, and any adverse findings may have a material adverse effect on AGBA’s business, results of operations, financial condition, and prospects and harm its reputation.

• AGBA may not have sufficient insurance coverage to cover its business risks.

• Any failure to protect the intellectual property rights of AGBA or its subsidiaries or to ensure the continuing right to own, use or license all intellectual property required for its operations could impair its ability to protect its proprietary technology and its brand.

• AGBA may not be able to prevent others from unauthorized use of its intellectual property, which could harm its business and competitive position.

• AGBA may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt its business and operations.

• We are party to a number of related party transactions, which may result in interdependence or potential conflicts of interest.

• AGBA operates in a variety of heavily regulated industries in Hong Kong and globally, which exposes its business activities to risks of noncompliance with an increasing body of complex laws and regulations.

• AGBA is subject to evolving regulatory requirements, and failure to comply with these regulations or to adapt to regulatory changes could materially and adversely affect its operations, business, and prospects.

• AGBA may be adversely affected by the complexity, uncertainties, and changes in regulation of internet-related businesses and companies, and any lack of requisite approvals, licenses, or permits applicable to AGBA’s business may have a material adverse effect on its business and results of operations.

• Uncertainties in the interpretation and enforcement of Hong Kong laws and regulations could limit the legal protections available to AGBA and its investors.

5

• Fluctuations in exchange rates could have a material adverse effect on AGBA’s results of operations and the price of the Company’s shares.

• AGBA faces risks related to natural disasters, health epidemics, civil and social disruption and other outbreaks, which could significantly disrupt its operations.

• Russia’s invasion of Ukraine may present risks to AGBA’s operations and investments.

Risk Factors Relating to Our Shares

• Our share price has been, and could continue to be, volatile.

• Shareholders could experience substantial dilution of their investment as a result of future sales of our equity, subsequent exercises of our outstanding warrants and options, or the future grant of equity by us.

• Because we do not intend to pay cash dividends, our shareholders will benefit from an investment in our ordinary shares only if it appreciates in value.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our share price and trading volume could decline.

6

THE OFFERING

Issuer | AGBA Group Holding Limited | |

Issuance of AGBA Shares | ||

AGBA Shares to be issued Upon exercise of all Warrants | 2,412,500 | |

AGBA Shares to be issued Upon exercise of the UPO | 441,600 | |

Resale of AGBA Shares | ||

AGBA Shares offered by the Sponsor, TAG, Apex, and former directors and officers of AAL |

| |

Use of proceeds | We will receive up to an aggregate of $32,366,750 if all of the Warrants and UPO are exercised to the extent such Warrants and UPO are exercised for cash. However, we will only receive such proceeds if and when the Warrant and UPO holders exercise the Warrants and UPO. If the market price for AGBA Shares does not increase above the per share exercise price of the Warrants, there is a small likelihood that any of the Public Warrants or Private Warrants will be exercised. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes and to implement our business plan. We will not receive any proceeds from the sale of the AGBA Shares to be offered by the Selling Securityholders. | |

Liquidity | This offering involves the potential sale of up to 17,772,847 AGBA Shares, including 2,854,100 AGBA Shares issuable upon exercise of the Warrants and UPO, which represent 27.51% of our total outstanding AGBA Shares giving effect to the additional shares that would be outstanding upon conversion and exercise assuming all are exercised for cash. Once this registration statement is effective and during such time as it remains effective, the Selling Securityholders will be permitted, subject to the lock-up and escrow restrictions described under “Plan of Distribution” to sell the AGBA Shares. The resale, or expected or potential resale, of a substantial number of AGBA Shares in the public market could adversely affect the market price for AGBA Shares and make it more difficult for our other shareholders such as you to sell their AGBA Shares at times and prices that they feel are appropriate. | |

NASDAQ Capital Market symbols | Our ordinary shares and warrants are listed on Nasdaq under the symbols “AGBA” and “AGBAW”, respectively. |

7

AGBA GROUP HOLDING LIMITED

SUMMARY FINANCIAL INFORMATION

The data below as for the years ended December 31, 2022 and 2021 has been derived from the audited consolidated financial statements of the Company for such years, which are included in this prospectus. The Company’s consolidated financial statements are prepared and presented in accordance with U.S. GAAP.

The Company’s historical results are not necessarily indicative of results to be expected for any future period. The information is only a summary and should be read in conjunction with the Company’s consolidated financial statements and related notes, and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of AGBA” contained elsewhere herein. The historical results included below are not indicative of the future performance of the Company.

The following table represents the Company’s selected consolidated balance sheet data as of December 31, 2022 and 2021:

Selected Consolidated Balance Sheet Data:

As of | ||||||

2022 | 2021 | |||||

USD | USD | |||||

Current assets | $ | 55,756,165 | $ | 83,779,515 | ||

Non-current assets |

| 45,465,168 |

| 38,730,785 | ||

Total assets |

| 101,221,333 |

| 122,510,300 | ||

Total liabilities |

| 97,071,054 |

| 61,364,728 | ||

Total shareholders’ equity | $ | 4,150,279 | $ | 61,145,572 | ||

The following table represents the Company’s selected consolidated statements of operations and comprehensive (loss) income for the years ended December 31, 2022 and 2021:

Selected Consolidated Statements of Operations and Comprehensive (Loss) Income:

For the Years Ended | ||||||||

2022 | 2021 | |||||||

USD | USD | |||||||

Operating revenues | $ | 31,080,227 |

| $ | 11,468,603 |

| ||

Operating expenses |

| (59,431,324 | ) |

| (19,915,726 | ) | ||

Loss from operations |

| (28,351,097 | ) |

| (8,447,123 | ) | ||

Other (expenses) income, net |

| (16,044,933 | ) |

| 128,416,091 |

| ||

Provision for income taxes |

| (124,605 | ) |

| (23,505,445 | ) | ||

Net (loss) income |

| (44,520,635 | ) |

| 96,463,523 |

| ||

Other comprehensive loss |

| (205,477 | ) |

| (393,601 | ) | ||

Comprehensive (loss) income | $ | (44,726,112) |

| $ | 96,069,922 |

| ||

8

The following table represents the Company’s selected consolidated cash flow data for the years ended December 31, 2022 and 2021:

For the Years Ended | ||||||||

2022 | 2021 | |||||||

USD | USD | |||||||

Net cash used in operating activities | $ | (19,304,399 | ) | $ | (2,154,059 | ) | ||

Net cash (used in) provided by investing activities |

| (14,188,835 | ) |

| 177,494,053 |

| ||

Net cash provided by (used in) financing activities |

| 12,135,441 |

|

| (163,871,706 | ) | ||

Effect of exchange rate on cash and cash equivalents |

| (429,542 | ) |

| (155,154 | ) | ||

Change in cash, cash equivalents and restricted cash |

| (21,787,335) |

|

| 11,313,134 |

| ||

Cash, cash equivalents and restricted cash, beginning of year |

| 73,081,407 |

|

| 61,768,273 |

| ||

Cash, cash equivalents and restricted cash, end of year | $ | 51,294,072 |

| $ | 73,081,407 |

| ||

9

RISK FACTORS

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks set forth herein. If any of these risks actually occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment. Additionally, the risks and uncertainties described in this prospectus or any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

Risk Factors Relating to Future Resales

Future sales of AGBA Shares, or the perception of future sales of AGBA Shares, could cause the market price of AGBA Shares to decline.

We have agreed, at our expense, to prepare and file this registration statement with the SEC registering the resale of up to up to 17,772,847 AGBA Shares, which include (i) 2,189,834 AGBA Shares held by the Sponsor and former directors and officers of AAL including (a) 1,150,000 AGBA Shares issued in connection with AAL’s IPO for approximately $0.02 per share; (b) 225,000 AGBA Shares issued as part of placement shares in connection with AAL’s IPO at a price of $10.00 per placement share; (c) 22,500 AGBA Shares issued upon the conversion of the rights to receive one tenth (1/10) of one AGBA Share in connection with the Closing of the Business Combination; and (d) 792,334 AGBA Shares issued upon the conversion of payables in connection with the Closing of the Business Combination; (ii) 2,728,913 AGBA Shares issued to Apex at a share value of $3.50 per share; (iii) 10,000,000 AGBA Shares issued to TAG Holdings Limited at the Closing of the Business Combination at a share value of $10.00 per share; (iv) 2,300,000 AGBA Shares issuable upon exercise of 4,600,000 Public Warrants at an exercise price of $11.50; (v) 112,500 AGBA Shares issuable upon exercise of 225,000 Private Warrants issued to the Sponsor at an exercise price of $11.50; (vi) 276,000 AGBA Shares issuable upon exercise of the UPO; (vii) 138,000 AGBA Shares underlying the warrants included as part of the UPO; and (viii) 27,600 AGBA Shares underlying the rights included as part of the UPO.

The shares registered pursuant to this registration statement represent 27.51% of the ordinary shares outstanding, including those issuable upon exercise of the Warrants and UPO. After it is effective and until such time that it is no longer effective, the registration statement will permit the resale of these shares, of which certain shares are subject to a six-month escrow period pursuant to an escrow agreement dated May 14, 2019 entered into by certain Selling Securityholders and Continental Stock Transfer & Trust Company. The resale, or expected or potential resale, of a substantial number of AGBA Shares in the public market could adversely affect the market price for AGBA Shares and make it more difficult for you to sell your AGBA Shares at times and prices that you feel are appropriate. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate. Furthermore, we expect that, because there will be a large number of shares registered pursuant to this registration statement, the Selling Securityholders will continue to offer the securities covered by this registration statement for a significant period of time, the precise duration of which cannot be predicted. Accordingly, the adverse market and price pressures resulting from an offering pursuant to a registration statement may continue for an extended period of time.

Further, the Selling Securityholders acquired or will acquire their AGBA Shares at effective prices ranging from $0.02 to $11.50. Therefore, in some instances, they may realize a positive rate of return on their investment even if the AGBA Shares are trading below $11.50 per share. If the Selling Securityholders decided to sell their shares to realize this return, it could have a material adverse effect on the price of AGBA Shares. Additionally, certain Selling Securityholders who are subject to a six-month escrow period pursuant to an escrow agreement dated May 14, 2019 entered into by certain Selling Securityholders and Continental Stock Transfer & Trust Company, may choose to sell their shares in accordance with the restrictions. Such sales could have a material adverse effect on the price of AGBA Shares.

10

The Selling Securityholders can earn a positive rate of return on their investment, even if other shareholders experience a negative rate of return.

The Selling Securityholders acquired or will acquire their AGBA Shares at prices ranging from $0.02 to $11.50. The public offering price in the AAL IPO was $10.00 per unit, which consisted of AGBA ordinary share, one warrant, each whole warrant exercisable for one AGBA Share at a price of $11.50 per share, and one right to receive one-tenth (1/10) of an AGBA Share. Consequently, the Selling Securityholders may realize a positive rate of return on the sale of their AGBA Shares covered by this prospectus even if the market price per AGBA Share is below $10.00 per share, even though the public shareholders may experience a negative rate of return on their investment. In addition, because the current market price of AGBA Shares is higher than the price certain Selling Securityholders paid for their AGBA Shares or the exercise price of their Warrants, there is more likelihood that Selling Securityholders holding AGBA Shares or Warrants that are not subject to a six-month escrow period pursuant to an escrow agreement dated May 14, 2019 entered into by certain Selling Securityholders and Continental Stock Transfer & Trust Company, will sell their AGBA Shares as soon as this registration statement is declared effective.

Sales of substantial amounts of AGBA Shares in the public market, or the perception that such sales will occur, could adversely affect the market price of AGBA Shares and make it more difficult for us to raise funds through securities offerings in the future. Further, the Selling Securityholders acquired or will acquire their AGBA Shares at prices ranging from $0.02 to $11.50. Therefore, they may realize a positive rate of return on their investment even if the AGBA Shares is trading at a low price. If the Selling Securityholders decided to sell their shares to realize this return, it could have a material adverse effect on the price of AGBA Shares. Additionally, certain Selling Securityholders who are subject to lock-up restrictions may choose to sell their shares in accordance with the restrictions. Such sales could have a material adverse effect on the price of AGBA Shares.

Risks Relating to AGBA’s Hong Kong Operations and Proximity to the PRC

The business, financial condition, results of operations, and prospects of AGBA may be materially and adversely affected if certain laws and regulations of the PRC become applicable to AGBA or its subsidiaries. AGBA may be subject to the risks and uncertainties associated with the evolving laws and regulations in the PRC, their interpretation and implementation, and the legal and regulatory system in the PRC more generally, including with respect to the enforcement of laws and the possibility of changes of rules and regulations with little or no advance notice.

AGBA currently does not have operations in mainland China. Although AGBA and its subsidiaries do service Chinese clients, all sales of financial products offered by the TAG Business and its subsidiaries occur in Hong Kong. AGBA does not sell any financial products in mainland China, and all of the TAG Business’s customer data is maintained outside of mainland China. Accordingly, none of AGBA or its subsidiaries are regulated by any regulatory authorities in mainland China. Pursuant to the Basic Law of the Hong Kong Special Administrative Region (the “Basic Law”), which is a national law of the PRC and the constitutional document for Hong Kong, national laws of the PRC shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law and applied locally by promulgation or local legislation. The Basic Law expressly provides that the national laws of the PRC which may be listed in Annex III of the Basic Law shall be confined to those relating to defense and foreign affairs as well as other matters outside the autonomy of Hong Kong. While the National People’s Congress of the PRC has the power to amend the Basic Law, the Basic Law also expressly provides that no amendment to the Basic Law shall contravene the established basic policies of the PRC regarding Hong Kong. As a result, national laws of the PRC not listed in Annex III of the Basic Law do not apply to Hong Kong-based businesses.

However, the laws and regulations in the PRC are evolving, and their enactment timetable, interpretation, and implementation involve significant uncertainties. To the extent that any PRC laws and regulations become applicable to AGBA, AGBA may be subject to the risks and uncertainties associated with the evolving laws and regulations of the PRC, their interpretation and implementation, and the legal and regulatory system in the PRC more generally, including with respect to the enforcement of laws and the possibility of changes of rules and regulations with little or no advance notice. If certain PRC laws and regulations, including existing laws and regulations and those enacted or promulgated in the future, were to become applicable to companies such as AGBA or its subsidiaries in the future, the application of such laws and regulations may have a material adverse impact on the business, financial condition, results of operations, and prospects of AGBA and its ability to offer securities to investors, any of which may, in turn, cause the value of AGBA’s securities to significantly decline or become worthless.

11

Relevant organs of the PRC government have made recent statements or recently taken regulatory actions related to data security, anti-monopoly, and overseas listings of mainland China businesses. For example, in addition to the PRC Data Security Law and the Measures for Cybersecurity Review issued by the Cyberspace Administration of China which became effective on February 15, 2022 (the “Measures”), relevant PRC government agencies have recently taken anti-trust enforcement action against certain mainland China-based businesses. The management of AGBA understands that such enforcement action was taken pursuant to the PRC Anti-Monopoly Law which applies to monopolistic activities in domestic economic activities in mainland China and monopolistic activities outside mainland China which eliminate or restrict market competition in mainland China. In addition, in July 2021, the PRC government provided new guidance on PRC-based companies raising capital outside of the PRC, including through arrangements called variable interest entities (“VIEs”). In light of such developments, the SEC has imposed enhanced disclosure requirements on China-based companies seeking to register securities with the SEC.

While AGBA currently does not have any operations in mainland China, there is no guarantee that the recent statements or regulatory actions by the relevant organs of the PRC government, including statements relating to the PRC Data Security Law, the PRC Personal Information Protection Law, and VIEs as well as the anti-monopoly enforcement actions will continue not to apply to AGBA. Should such statements or regulatory actions apply to companies such as AGBA or its subsidiaries in the future, it could have a material adverse impact on the business, financial condition, results of operations, and prospects of AGBA, AGBA’s ability to accept foreign investments, and AGBA’s ability to offer or continue to offer securities to investors on a U.S. or other international securities exchange, any of which may, in turn, cause the value of AGBA’s securities to significantly decline or become worthless. AGBA cannot predict the extent of such impact if such events were to occur.

AGBA may also become subject to the laws and regulations of the PRC to the extent that the TAG Business commences business and customer facing operations in mainland China as a result of any future partnership, acquisition, expansion, or organic growth.

The PRC government exerts substantial influence, discretion, oversight, and control over the manner in which companies incorporated under the laws of PRC must conduct their business activities. AGBA is a Hong Kong-based company with no operations in mainland China; however, there can be no guarantee that the PRC government will not seek to intervene or influence the operations of its business or its subsidiaries at any time.

Because (i) AGBA currently does not have operations in mainland China, (ii) all sales of financial products offered by AGBA and its subsidiaries, including those to PRC citizens, occur in Hong Kong, and (iii) the TAG Business does not sell any financial products in mainland China, the PRC government currently does not directly govern the manner in which AGBA conducts its business activities outside of mainland China. However, the PRC legal system is evolving quickly, and PRC laws, regulations, and rules may change quickly with little advance notice, including with respect to Hong Kong-based businesses. As a result, there can be no assurance that AGBA will not be subject to direct influence or discretion over its business from organs of the PRC government in the future, due to changes in laws or other unforeseeable reasons or due to AGBA’s expansion or acquisition of operations in or involving mainland China.

The PRC government has exercised and continues to exercise substantial control over many sectors of the PRC economy, including through regulation and/or state ownership. PRC government actions have had, and may continue to have, a significant effect on economic conditions in the PRC and the businesses which are subject to them. If AGBA became subject to the direct intervention or influence of the PRC government at any time due to changes in laws or other unforeseeable reasons or as a result of AGBA’s development, expansion, or acquisition of operations in the PRC, AGBA may be required to make material changes in its operations, which may result in increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply, or both. AGBA cannot be assured that the PRC government will not, in the future, release regulations or policies regarding other industries, which, if applicable to AGBA or its subsidiaries, may adversely affect the business, financial condition and results of operations of AGBA.

In addition, the various segments of AGBA are regulated by a number of Hong Kong regulators, including, the Hong Kong Insurance Authority and the Mandatory Provident Fund Schemes Authority. PRC government influence or oversight over such Hong Kong regulators may have an indirect but material impact on AGBA, including but not limited to with respect to capital requirements, its ability to operate certain businesses, its operations in certain jurisdictions

12

(including the markets in which AGBA or its subsidiaries may operate in the future) and/or the implementation of certain controls and procedures in relation to risk management or cybersecurity. Furthermore, the market prices and/or liquidity of the securities of AGBA could be adversely affected as a result of anticipated negative impacts of any such government actions, as well as negative investor sentiment towards Hong Kong-based companies subject to direct PRC government oversight and regulation, regardless of actual operating performance. There can be no assurance or guarantee that the PRC government would not intervene in or influence the operations of AGBA, directly or indirectly, at any time.

The securities of AGBA may be delisted or prohibited from being traded “over-the-counter” under the Holding Foreign Companies Accountable Act (as amended by the Accelerating Holding Foreign Companies Accountable Act) if the PCAOB were unable to fully inspect the company’s auditor.

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted into U.S. law on December 18, 2020. The HFCA Act states that if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the Public Company Accounting Oversight Board of the United States (the “PCAOB”) for three consecutive years beginning in 2021, the SEC shall prohibit its securities from being traded on a national securities exchange or in the over-the-counter trading market in the U.S. On December 16, 2021, the Public Company Accounting Oversight Board of the United States (the “PCAOB”) issued a Determination Report which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (i) China, and (ii) Hong Kong. The management of AGBA believes that this determination does not impact AGBA, as the auditor of AGBA, WWC, P.C., (i) is headquartered in California, U.S.A., (ii) is an independent registered public accounting firm with the PCAOB, and (iii) has been inspected by the PCAOB on a regular basis. Nonetheless, there can be no assurance that future changes in laws or regulations will not impact AGBA, WWC, P.C., or any future auditor of AGBA. Accordingly, there can be no assurance that WWC, P.C. will be able to meet the requirements of the HFCA Act and that AGBA will not suffer the resulting material and adverse impact on its stock performance, as a company listed in the United States.

On December 2, 2021, the SEC adopted final amendments implementing congressionally mandated submission and disclosure requirements of the HFCA Act. On December 23, 2022 the Accelerating Holding Foreign Companies Accountable Act (AHFCA Act) was enacted, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. As a result, the time period before the Company’s securities may be prohibited from trading or delisted has been reduced accordingly.

Lack of access to PCAOB inspections prevents the PCAOB from fully evaluating audits and quality control procedures of the accounting firms headquartered in mainland China or Hong Kong. As a result, investors in companies using such auditors may be deprived of the benefits of such PCAOB inspections. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong in 2022, and the PCAOB Board vacated its previous determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. The PCAOB is continuing to demand complete access in mainland China and Hong Kong moving forward and is already making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has indicated that it will act immediately to consider the need to issue new determinations with the HFCA Act if needed.

WWC, P.C. is headquartered in California and has been inspected by the PCAOB on a regular basis. The management of AGBA believes, therefore, that WWC, P.C. is not subject to the determinations announced by the PCAOB on December 16, 2021 with respect to PRC and Hong Kong-based auditors. WWC, P.C. is not included in the list of determinations announced by the PCAOB on December 21, 2021 in their HFCA Act Determination Report under PCAOB Rule 6100. On August 26, 2022, the China Securities Regulatory Commission, or CSRC, the Ministry of Finance of the PRC, and PCAOB signed a Statement of Protocol, or the Protocol, governing inspections and investigations of audit firms based in China and Hong Kong. Pursuant to the Protocol, the PCAOB has independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. However, uncertainties still exist whether this new framework will be fully complied with. If notwithstanding

13

this new framework, the PCAOB was unable to fully inspect WWC, P.C. (or any other auditor of the Company) in the future, or if PRC or American authorities further regulate auditing work of Chinese or Hong Kong companies listed on the U.S. stock exchanges in a manner that would restrict WWC, P.C. (or any future auditor of the Company) from performing work in Hong Kong, AGBA may be required to change its auditor. Furthermore, there can be no assurance that the SEC, Nasdaq, or other regulatory authorities would not apply additional and more stringent criteria to AGBA in connection with audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of AGBA’s financial statements. The failure to comply with the requirement in the HFCA Act, as amended by the AHFCA Act, that the PCAOB be permitted to inspect the issuer’s public accounting firm within two years, would subject AGBA to consequences including the delisting of AGBA in the future if the PCAOB is unable to inspect AGBA’s accounting firm (whether WWC, P.C. or another firm) at such future time.

Our former auditor, Friedman LLP (“Friedman”), the independent registered public accounting firm that issues the audit report included elsewhere in this prospectus is subject to laws in the U.S., pursuant to which the PCAOB conducts regular inspections to assess their compliance with the applicable professional standards. Effective September 1, 2022, Friedman combined with Marcum LLP (“Marcum”) and continued to operate as an independent registered public accounting firm. Friedman and Marcum are both headquartered in Manhattan, New York, and have been inspected by the PCAOB on a regular basis, with the last inspections in 2020, and neither Friedman nor Marcum is subject to the determinations announced by the PCAOB on December 16, 2021. However, the recent developments would add uncertainties to our offering and we cannot assure you whether the national securities exchange we apply for listing or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditors’ audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach, or experience as it relates to our audit. In addition, the HFCA Act, as amended by the AHFCA Act, which requires that the PCAOB be permitted to inspect an issuer’s public accounting firm within two years, may result in the delisting of our Company or prohibition of trading in our ordinary shares in the future if the PCAOB is unable to inspect our accounting firm at such future time.

Although not currently subject, AGBA may become subject to the PRC laws and regulations regarding offerings that are conducted overseas and/or foreign investment in China-based issuers, and any failure to comply with applicable laws and obligations could have a material and adverse effect on the business, financial condition, results of operations, and AGBA’s prospects of AGBA and may hinder AGBA’s ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Recently, the PRC government has initiated a series of regulatory actions and statements to regulate business operations in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On June 10, 2021, the Standing Committee of the National People’s Congress enacted the PRC Data Security Law, which took effect on September 1, 2021. The law requires data collection to be conducted in a legitimate and proper manner, and stipulates that, for the purpose of data protection, data processing activities must be conducted based on data classification and hierarchical protection system for data security.

On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws.