Exhibit 99.4

Dear Valued Customer:

I am pleased to tell you about an investment opportunity and, just as importantly, to request your vote. Pursuant to a plan of conversion (the “Plan”), Eureka Homestead will convert from the mutual (meaning no stockholders) to the stock form of ownership. To accomplish the conversion, Eureka Homestead Bancorp, Inc., a newly formed Maryland corporation that will become the holding company for Eureka Homestead, is conducting an offering of its shares of common stock. Enclosed you will find a Prospectus, Proxy Materials and a Questions and Answers Brochure describing the conversion, the offering and the Plan.

THE PROXY VOTE:

Your vote is extremely important for us to complete the conversion. Although we have received conditional regulatory approval to

implement the Plan, we must receive the vote of Eureka Homestead customers in favor of the Plan.NOT VOTING YOUR ENCLOSED PROXY CARD(S) WILL HAVE THE SAME EFFECT AS VOTING “AGAINST” THE PLAN.Note that you may receive more than one Proxy Card, depending on the ownership structure of your accounts at Eureka Homestead. Please vote all the Proxy Cards you receive —none are duplicates!To cast your vote, please sign each Proxy Card and return the card(s) in the Proxy Reply Envelope provided. Alternatively, you may vote by Phone or Internet by following the simple instructions on the Proxy Card.

OUR BOARD OF DIRECTORS URGES YOU TO VOTE “FOR” THE PLAN.

Please note:

| • | The proceeds resulting from the sale of stock by Eureka Homestead Bancorp, Inc. will support our business strategy. |

| • | There will be no change to account numbers, interest rates or other terms of your deposit accounts or loans at Eureka Homestead. |

| • | Deposit accounts will not be converted to stock. Your deposit accounts will continue to be insured by the FDIC, up to the maximum legal limits. |

| • | You will continue to enjoy the same services with the same board of directors, management and staff. |

| • | Voting does not obligate you to purchase shares of common stock in our offering. |

THE STOCK OFFERING:

As an eligible Eureka Homestead customer, you have non-transferable rights, but no obligation, to purchase shares of common stock during our Subscription Offering before any shares are made available for sale to the general public.The common stock is being offered at $10.00 per share, and there will be no sales commission charged to purchasers during the offering. The enclosed Prospectus describes the stock offering in more detail.Please read the Prospectus carefully before making an investment decision.

If you are interested in purchasing shares of common stock, please complete the enclosed Stock Order Form and return it, with full payment. You may submit your Stock Order Form by overnight delivery to the indicated address on the Stock Order Form, by hand- delivery to Eureka Homestead’s office, located at 1922 Veterans Memorial Blvd., Metairie, LA, or by mail using the Stock Order Reply Envelope provided.Stock Order Forms and full payment must bereceived (not postmarked) before 2:00 p.m., Central Time, on June 18, 2019. If you are considering purchasing stock with funds you have in an IRA or other retirement account, please call our Stock Information Centerpromptly for guidance, because these orders require additional processing time.

I invite you to consider this opportunity to share in our future. Thank you for your continued support as a Eureka Homestead customer.

Sincerely,

Alan T. Heintzen

Chief Executive Officer

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

QUESTIONS?

Call our Information Center, toll-free, at (866) 806-1790,

from 10:00 a.m. to 4:00 p.m., Central Time, Monday through Friday, except bank holidays.

Dear Friend:

I am pleased to tell you about an investment opportunity. Eureka Homestead Bancorp, Inc., a newly formed Maryland corporation that will serve as the parent company of Eureka Homestead, is offering shares of its common stock for sale at a price of $10.00 per share. No sales commission will be charged to purchasers during the offering. The offering is being conducted pursuant to a plan of conversion adopted by Eureka Homestead that provides for the conversion of Eureka Homestead from the mutual (meaning no stockholders) to the stock form of ownership.

Our records indicate that you were a depositor of Eureka Homestead as of the close of business on December 31, 2017 or March 31, 2019, whose account(s) was/were closed thereafter. As such, you have non-transferable rights, but no obligation, to subscribe for shares of common stock during our Subscription Offering before any shares are made available for sale to the general public.

Please read the enclosed materials carefully before making an investment decision. If you are interested in purchasing shares of common stock, please complete the enclosed Stock Order Form and return it, with full payment. You may submit your Stock Order Form by overnight delivery to the indicated address on the Stock Order Form, by hand-delivery to Eureka Homestead’s office, located at 1922 Veterans Memorial Blvd., Metairie, LA, or by mail using the Stock Order Reply Envelope provided.Stock Order Forms and full payment must bereceived (not postmarked) before 2:00 p.m., Central Time, on June 18, 2019. If you are considering purchasing stock with funds you have in an IRA or other retirement account, please call our Stock Information Centerpromptly for guidance, because these orders require additional processing time.

If you have questions about our organization or purchasing shares, please refer to the enclosed Prospectus and Questions and Answers Brochure, or call our Stock Information Center at the number shown below.

I invite you to consider this opportunity to share in our future as a Eureka Homestead Bancorp, Inc. stockholder.

Sincerely,

Alan T. Heintzen

Chief Executive Officer

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

QUESTIONS?

Call our Information Center, toll-free, at (866) 806-1790,

from 10:00 a.m. to 4:00 p.m., Central Time, Monday through Friday, except bank holidays.

Dear Friend:

I am pleased to tell you about an investment opportunity. Eureka Homestead Bancorp, Inc., a newly formed Maryland corporation that will serve as the parent company of Eureka Homestead, is offering shares of its common stock for sale at a price of $10.00 per share. No sales commission will be charged to purchasers during the offering. The offering is being conducted pursuant to a plan of conversion adopted by Eureka Homestead that provides for the conversion of Eureka Homestead from the mutual (meaning no stockholders) to the stock form of ownership.

Please read the enclosed materials carefully. If you are interested in purchasing shares of Eureka Homestead Bancorp, Inc. common stock, please complete the enclosed Stock Order Form and return it, with full payment. You may submit your Stock Order Form by overnight delivery to the indicated address on the Stock Order Form, by hand-delivery to Eureka Homestead’s office, located at 1922 Veterans Memorial Blvd., Metairie, LA, or by mail using the Stock Order Reply Envelope provided.Stock Order Forms and full payment must bereceived(not postmarked) before 2:00 p.m., Central Time, on June 18, 2019. If you are considering purchasing stock with funds you have in an IRA or other retirement account, please call our Stock Information Centerpromptlyfor guidance, because these orders require additional processing time.

If you have questions about our organization or purchasing shares, please refer to the enclosed Prospectus and Questions and

Answers Brochure, or call our Stock Information Center at the number shown below.

I invite you to consider this opportunity to share in our future as a Eureka Homestead Bancorp, Inc. stockholder.

Sincerely,

Alan T. Heintzen

Chief Executive Officer

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

QUESTIONS?

Call our Information Center, toll-free, at (866) 806-1790,

from 10:00 a.m. to 4:00 p.m., Central Time, Monday through Friday, except bank holidays.

Dear Valued Customer:

I am pleased to tell you that pursuant to a plan of conversion (the “Plan”), Eureka Homestead will convert from the mutual (meaning no stockholders) to the stock form of ownership. To accomplish the conversion, Eureka Homestead Bancorp, Inc., a newly formed Maryland corporation that will become the holding company of Eureka Homestead, is conducting an offering of its shares of common stock.

THE PROXY VOTE:

Enclosed are proxy materials to vote on the conversion. Your vote is extremely important for us to complete the conversion.Although we have received conditional regulatory approval to implement the Plan, we must receive the vote of Eureka Homestead’s members in favor of the Plan.NOT VOTING YOUR ENCLOSED PROXY CARD(S) WILL HAVE THE SAME EFFECT AS VOTING “AGAINST” THE PLAN.Note that you may receive more than one Proxy Card, depending on the ownership structure of your accounts at Eureka Homestead. Please vote all the Proxy Cards you receive —none are duplicates.To cast your vote, please sign each Proxy Card and return the card(s) in the Proxy Reply Envelope provided. Alternatively you may vote by telephone or Internet by following the simple instructions on the Proxy Card.

OUR BOARD OF DIRECTORS URGES YOU TO VOTE “FOR” THE PLAN.

Although you may vote on the Plan, we regret that Eureka Homestead Bancorp, Inc. is unable to offer its common stock to you because the small number of customers in your jurisdiction makes registration or qualification of the common stock under your state securities laws prohibitively expensive or otherwise impractical.

If you have any questions about the Plan or voting, please refer to the enclosed information or call our Information Center.

Sincerely,

Alan T. Heintzen

Chief Executive Officer

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

QUESTIONS?

Call our Information Center, toll-free, at (866) 806-1790,

from 10:00 a.m. to 4:00 p.m., Central Time, Monday through Friday, except bank holidays.

FIG Partners, LLC

Dear Sir/Madam:

FIG Partners, LLC has been retained by Eureka Homestead Bancorp, Inc., as selling agent in connection with the offering of Eureka Homestead Bancorp, Inc., common stock.

At the request of Eureka Homestead Bancorp, Inc., we are enclosing materials regarding the offering of Eureka Homestead Bancorp, Inc. shares of common stock. Included in this package is a Prospectus describing the stock offering. We encourage you to read the enclosed information carefully, including the “Risk Factors” section of the Prospectus.

Sincerely,

FIG Partners, LLC

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation, or any other government agency.

READ THIS FIRST

Office of the Comptroller of the Currency Guidance for

Account Holders

Your financial institution is in the process of selling stock to the public in a mutual-to-stock conversion transaction. As an account holder at this institution, you have certain priority subscription rights to purchase stock in the offering. These priority subscription rights are non-transferable. If you subscribe for stock, you will be asked to sign a statement that the purchase is for your own account, and that you have no agreement or understanding regarding the subsequent sale or transfer of any shares you receive.

On occasion, unscrupulous people attempt to persuade account holders to transfer subscription rights, or to purchase shares in the offering based on the understanding that the shares will subsequently be transferred to others. Such arrangements violate federal regulations. If you participate in these schemes, you are breaking the law and may be subject to prosecution. If someone attempts to persuade you to participate in such a scheme, please contact the Office of the Comptroller of the Currency (OCC) Customer Assistance Group, toll-free, at (800) 613-6743. The OCC is very interested in ensuring that the prohibitions on transfer of subscription rights are not violated.

How will you know if you are being approached illegally? Typically, a fraudulent opportunist will approach you and offer to “loan” you money to purchase a significant amount of stock in the offering. In exchange for that “loan” you most likely will be asked either to transfer control of any stock purchased with that money to an account the other person controls, or sell the stock and give the majority of the profits to the other person. You may be told, untruthfully, that there is no risk to you, that the practice is common, and even if you are caught, that your legal expenses will be covered.

On the back of this page is a list of some key concepts that you should keep in mind when considering whether to participate in a mutual-to-stock conversion offering. If you have questions, please contact the Stock Information Center at the telephone number listed elsewhere in the literature you are receiving. Alternatively, you can contact the OCC at: The Southern District Office located at 500 North Akard Street, Suite 1600, Dallas, Texas 75201.

(over)

What Investors Need to Know

Key concepts for investors to bear in mind when considering whether to participate in a conversion offering include the following:

| • | Know the Rules — By law, account holders cannot sell or transfer their priority subscription rights, or the stock itself, prior to the completion of a financial institution’s conversion. Moreover, account holders cannot enter into agreements or arrangements to sell or transfer either their subscription rights or the underlying conversion stock. |

| • | “Neither a Borrower nor a Lender Be” — If someone offers to lend you money so that you can participate — or participate more fully — in a conversion, be extremely wary. Be even more wary if the source of the money is someone you do not know. The loan agreement may make you unable to certify truthfully that you are the true holder of the subscription rights and the true purchaser of the stock and that you have no agreements regarding the sale or transfer of the stock. |

| • | Watch Out for Opportunists — The opportunist may tell you that he or she is a lawyer — or a consultant or a professional investor or some similarly impressive tale — who has experience with similar conversion transactions. The opportunist may go to extreme lengths to assure you that the arrangement you are entering into is legitimate. They might tell you that they have done scores of these transactions and that this is simply how they work. Or they might downplay the warnings or restrictions in the prospectus or stock order form, telling you that “everyone” enters into such agreements or that the deal they are offering is legitimate. They may also tell you that you have no risk in the transaction. The cold, hard truth is that these are lies, and if you participate, you are breaking the law. |

| • | Get the Facts from the Source — If you have any questions about the securities offering, ask your financial institution for more information. If you have any doubts about a transaction proposed to you by someone else, ask the financial institution whether the proposed arrangement is proper. You may be able to find helpful resources by visiting your financial institution. |

The bottom line for investors is always to remember that if an opportunity sounds too good to be true, it probably is too good to be true.

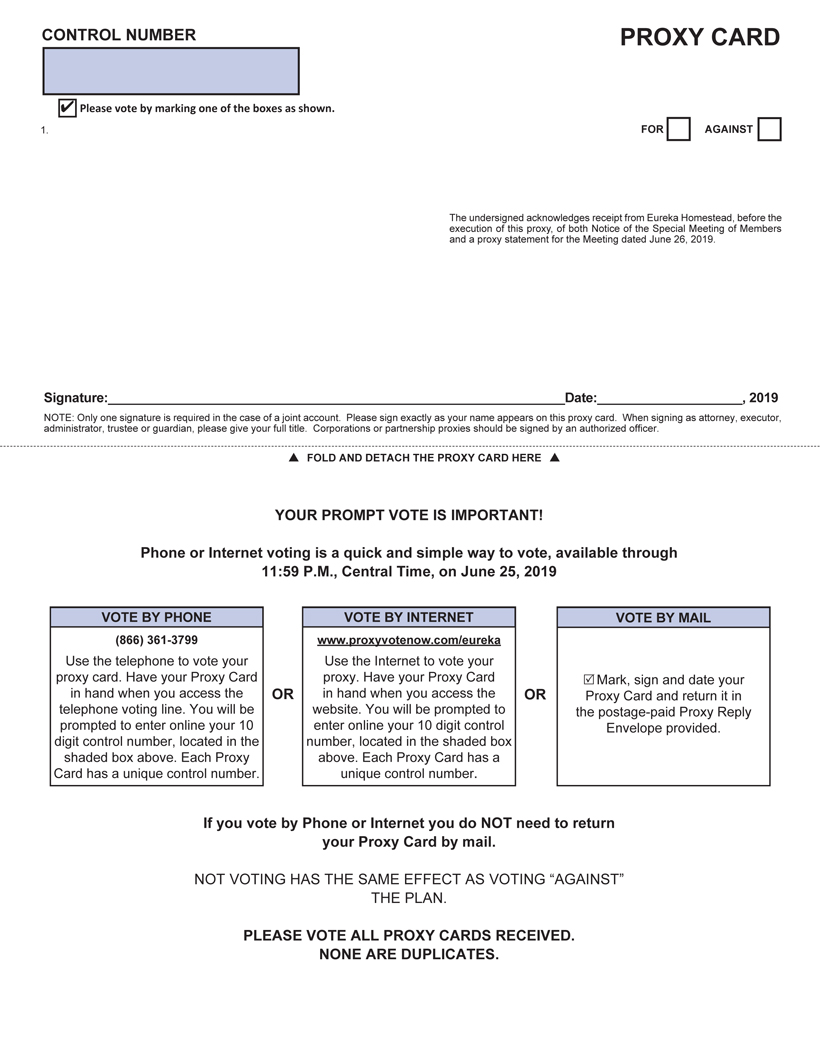

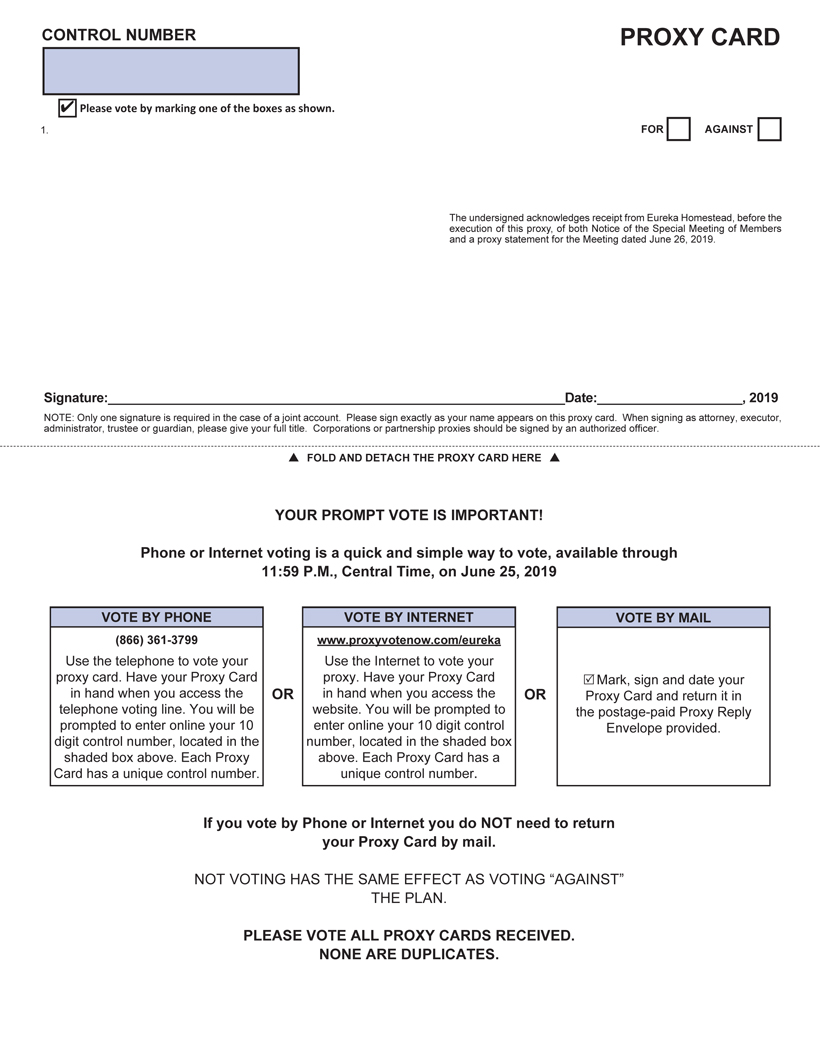

CONTROL NUMBER PROXY CARD 3 Please vote by marking one of the boxes as shown. 1. FOR AGAINST The undersigned acknowledges receipt from Eureka Homestead, before the execution of this proxy, of both Notice of the Special Meeting of Members and a proxy statement for the Meeting dated June 26, 2019. Signature: Date: , 2019 NOTE: Only one signature is required in the case of a joint account. Please sign exactly as your name appears on this proxy card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. Corporations or partnership proxies should be signed by an authorized officer. FOLD AND DETACH THE PROXY CARD HERE YOUR PROMPT VOTE IS IMPORTANT! Phone or Internet voting is a quick and simple way to vote, available through 11:59 P.M., Central Time, on June 25, 2019 VOTE BY PHONE VOTE BY INTERNET VOTE BY MAIL (866) 361-3799 www.proxyvotenow.com/eureka Use the telephone to vote your Use the Internet to vote your proxy card. Have your Proxy Card proxy. Have your Proxy Card Mark, sign and date your in hand when you access the OR in hand when you access the OR Proxy Card and return it in telephone voting line. You will be website. You will be prompted to the postage-paid Proxy Reply prompted to enter online your 10 enter online your 10 digit control Envelope provided. digit control number, located in the number, located in the shaded box shaded box above. Each Proxy above. Each Proxy Card has a Card has a unique control number. unique control number. If you vote by Phone or Internet you do NOT need to return your Proxy Card by mail. NOT VOTING HAS THE SAME EFFECT AS VOTING “AGAINST” THE PLAN. PLEASE VOTE ALL PROXY CARDS RECEIVED. NONE ARE DUPLICATES.

REVOCABLE PROXY EUREKA HOMESTEAD SPECIAL MEETING OF MEMBERS JUNE 26, 2019 _:00 a.m. Central Time THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF EUREKA HOMESTEAD FOR USE AT A SPECIAL MEETING OF MEMBERS TO BE HELD ON JUNE 26, 2019, AND ANY ADJOURNMENTS OF THAT MEETING, FOR THE PURPOSES SET FORTH IN THE FOREGOING NOTICE OF SPECIAL MEETING. YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR APPROVAL OF THE PLAN OF CONVERSION. The above-signed being a member of Eureka Homestead (the “Bank”), hereby authorizes the full board of directors of the Bank, and each of them, with full powers of substitution, to represent the undersigned at the Special Meeting of Members (the “Meeting”) of the Bank to be held on Wednesday, June 26, 2019 at _:00 a.m., Central Time, at the Bank’s main office located at 1922 Veterans Memorial Blvd., Metairie, LA, and at any adjournment of the Meeting, to act with respect to all votes that the undersigned would be entitled to cast if then personally present, as set forth above. Any member giving a proxy may revoke it at any time before it is voted by delivering to the Corporate Secretary of the Bank either a written revocation of the proxy, or a duly executed proxy bearing a later date, or by voting in person at the Meeting. (CONTINUED ON REVERSE SIDE) FOLD AND DETACH THE PROXY CARD HERE THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PLAN. NOT VOTING IS THE EQUIVALENT OF VOTING “AGAINST” THE PLAN. PLEASE VOTE ALL CARDS THAT YOU RECEIVE. NONE ARE DUPLICATES. VOTING DOES NOT REQUIRE YOU TO PURCHASE SHARES OF EUREKA HOMESTEAD BANCORP, INC. COMMON STOCK IN THE OFFERING.

This pamphlet answers questions about our conversion and stock offering. Investing in shares of common stock involves certain risks. Before making an investment decision, please read the enclosed Prospectus carefully, including the “Risk Factors” section.

GENERAL — THE CONVERSION

Our board of directors has determined that the conversion is in the best interests of our organization, our customers and the communities we serve.

| Q. | What is the conversion? |

| A. | Under our plan of conversion (the “Plan”), Eureka Homestead will convert from a mutual (meaning no stockholders) to the stock form of ownership, through the sale of shares of Eureka Homestead Bancorp, Inc. common stock. Upon completion of the conversion, 100% of the common stock of Eureka Homestead Bancorp, Inc. will be owned by stockholders, and Eureka Homestead Bancorp, Inc. will own Eureka Homestead. |

| Q. | What are the reasons for the conversion and offering? |

| A. | Our primary reasons for converting and raising additional capital through the offering are to: increase capital to support future growth and profitability; retain and attract qualified personnel by establishing stock-based benefit plans for management and employees; and offer our customers and employees an opportunity to purchase our stock. |

| Q. | Is Eureka Homestead considered “well-capitalized” for regulatory purposes? |

| A. | Yes. As of December 31, 2018, Eureka Homestead was considered “well-capitalized” for regulatory purposes. |

| Q. | Will customers notice any change in Eureka Homestead, day-to-day activities as a result of the conversion and offering? |

| A. | No. It will be business as usual. The conversion is an internal change in our corporate structure. There will be no change to our board of directors, management, and staff as a result of the conversion. Eureka Homestead will continue to operate as an independent savings bank. |

| Q. | Will the conversion and offering affect customers’ deposit accounts or loans? |

| A. | No. The conversion and offering will not affect the balance or terms of deposits or loans, and deposits will continue to be federally insured by the Federal Deposit Insurance Corporation up to the maximum legal limits.Deposit accounts will not be converted to stock. |

THE PROXY VOTE

Although we have received conditional regulatory approval, the Plan and is also subject to approval by our eligible customers.

| Q. | Why should I vote “FOR” the Plan? |

| A. | Your vote “For” the Plan is extremely important to us. Each Eureka Homestead depositor as of April 30, 2019 received a Proxy Card attached to a Stock Order Form. These packages also include a Proxy Statement describing the Plan which cannot be implemented without customer approval.Voting does not obligate you to purchase shares of common stock during the offering. |

| Q. | What happens if I don’t vote? |

| A. | Your vote is very important. Proxy Cards not voted will have the same effect as voting ‘‘Against’’ the Plan. |

Without sufficient favorable votes, we cannot complete the conversion and the related stock offering.

| A. | Mark your vote, sign and date each Proxy Card enclosed and return the card(s) in the enclosed Proxy Reply Envelope. Alternatively, you may vote by Phone or Internet by following the simple instructions on the Proxy Card.PLEASE VOTE PROMPTLY. NOT VOTING HAS THE SAME EFFECT AS VOTING ‘‘AGAINST’’ THE PLAN. Phone or Internet voting is available 24 hours a day. |

| Q. | How many votes are available to me? |

| A. | Depositors at the close of business on April 30, 2019 are entitled to one vote for each $100 or fraction thereof on deposit. However, no customer may cast more than 1,000 votes. Proxy Cards are not imprinted with your number of votes; however, votes will be automatically tallied by computer. |

| Q. | Why did I receive more than one Proxy Card? |

| A. | If you had more than one deposit account on April 30, 2019, you may have received more than one Proxy Card, depending on the ownership structure of your accounts.There are no duplicate cards — please promptly vote all the Proxy Cards sent to you. |

| Q. | More than one name appears on my Proxy Card. Who must sign? |

| A. | The name(s) reflect the title of your account. Proxy Cards for joint accounts require the signature of only one of the account holders. Proxy Cards for trust or custodian accounts must be signed by the trustee or the custodian, not the listed beneficiary. |

THE STOCK OFFERING AND PURCHASING SHARES

| Q. | How many shares are being offered and at what price? |

| A. | Eureka Homestead Bancorp, Inc. is offering for sale between 1,360,000 and 1,840,000 shares of common stock (subject to increase to 2,116,000 shares) at $10.00 per share. No sales commission will be charged to purchasers. |

| Q. | Who is eligible to purchase stock during the stock offering? |

| A. | Pursuant to our Plan, non-transferable rights to subscribe for shares of Eureka Homestead Bancorp, Inc. common stock in theSubscription Offering have been granted in the following descending order of priority: |

Priority #1 — Depositors of Eureka Homestead with aggregate balances of $50 or more at the close of business on December 31, 2017;

Priority #2 — Our tax-qualified employee benefit plans;

Priority #3 — Depositors of Eureka Homestead with aggregate balances of $50 or more at the close of business on March 31, 2019; and

Priority #4 — Depositors of Eureka Homestead at the close of business on April 30, 2019.

Shares not sold in theSubscription Offering may be offered for sale to the public in aCommunity Offering, with a preference given to natural persons and trusts of natural persons residing in the Louisiana parishes of Orleans, Jefferson, Plaquemines, St. Bernard and St. Tammany.

Shares not sold in the Subscription and Community Offerings may be offered for sale to the general public through aSyndicated Community Offering.

| Q. | I am eligible to subscribe for shares of common stock in the Subscription Offering but am not interested in investing. May I allow someone else to use my Stock Order Form to take advantage of my priority as an eligible account holder? |

| A. | No. Subscription rights are non-transferable! Only those eligible to subscribe in theSubscription Offering, as listed above, may purchase shares in the Subscription Offering. To preserve subscription rights, the shares may only be registered in the name(s) of eligible account holder(s). On occasion, unscrupulous people attempt to persuade account holders to transfer subscription rights, or to purchase shares in the offering based on an understanding that the shares will be subsequently transferred to others. Participation in such schemes is against the law and may subject involved parties to prosecution. If you become aware of any such activities, please notify our Stock Information Center promptly so that we can take the necessary steps to protect our eligible account holders’ subscription rights in the offering. |

| Q. | How may I buy shares during the Subscription and Community Offerings? |

| A. | Shares can be purchased by completing a Stock Order Form and returning it, with full payment, so that it is received (not postmarked) before the offering deadline. You may submit your Stock Order Form by overnight delivery to the indicated address on the Stock Order Form, by mail using the Stock Order Reply Envelope provided, or by hand-delivery to Eureka Homestead’s office, located at 1922 Veterans Memorial Blvd., Metaine, LA.Please do not mail Stock Order Forms to Eureka Homestead. |

| Q. | What is the deadline for purchasing shares? |

| A. | To purchase shares in the Subscription Offering, you must deliver a properly completed, signed Stock Order Form, with full payment, so that it is received (not postmarked) before 2:00 p.m., Central Time, on June 18, 2019. Acceptable methods for delivery of Stock Order Forms are described above. |

| Q. | How may I pay for the shares? |

| A. | Payment for shares can be remitted in two ways: |

(1)By personal check, bank check or money order,made payable to Eureka Homestead Bancorp, Inc. These will be deposited upon receipt. We cannot accept wires or third party checks. Please do not mail cash!

(2)By authorized deposit account withdrawal of funds

from your Eureka Homestead deposit account(s). The Stock Order Form section titled “Method of Payment — Deposit Account Withdrawal” allows you to list the account number(s) and amount(s) to be withdrawn. Funds designated for direct withdrawal must be in the account(s) at the time the Stock Order Form is received. You may not authorize direct withdrawal from accounts with check-writing privileges. Please submit a check instead. If you request direct withdrawal from such accounts, we reserve the right to interpret that as your authorization to treat those funds as if we had received a check for the designated amount, and we will immediately withdraw the amount from your checking account(s). Also, IRA or other retirement accounts held at Eureka Homestead may not be listed for direct withdrawal. See information on retirement accounts below.

| Q. | Will I earn interest on my funds? |

| A. | Yes. If you pay by personal check, bank check or money order, you will earn interest at Eureka Homestead’ statement savings rate, which is subject to change at any time and is currently 0.20% per annum, from the date we process your payment until the completion of the conversion and offering. At that time, you will be issued a check for interest earned on these funds. If you pay for shares by authorizing a direct withdrawal from your Eureka Homestead deposit account(s), your funds will continue earning interest within the account at the contract rate. The interest will remain in your account(s) when the designated withdrawal is made, upon completion of the conversion and offering. |

| Q. | Are there limits to how many shares I can order? |

| A. | Yes. The minimum order is 25 shares ($250). The maximum number of shares that may be purchased by a person or group of persons exercising subscription rights through a single deposit account held jointly is 10,000 shares ($100,000). Additionally, no person or entity, together with any associate or group of persons acting in concert, may purchase more than 15,000 shares ($150,000) in all categories of the offering combined. |

More detail on purchase limits, including the definition of “associate” and “acting in concert”, can be found in the Prospectus section entitled “The Conversion and Offering — Limitations on Common Stock Purchases”.

| Q. | May I use my Eureka Homestead individual retirement account (“IRA”) to purchase shares? |

| A. | You may use funds currently held in retirement accounts with Eureka Homestead. However, before you place your stock order, the funds you wish to use must be transferred to a self-directed retirement account maintained by an independent trustee or custodian, such as a brokerage firm. If you are interested in using IRA or any other retirement funds held at Eureka Homestead or elsewhere, please call our Stock Information Center as soon as possible for guidance, but preferably at least two weeks before the June 18, 2019 offering deadline. Your ability to use such funds for this purchase may depend on time constraints, because this type of purchase requires additional processing time, and may be subject to limitations imposed by the institution where the funds are held. |

| Q. | May I change my mind after I place an order to subscribe for stock? |

| A. | No. After receipt, your executed Stock Order Form cannot be modified or revoked without our consent or unless the offering is terminated or is extended beyond August 2, 2019 or the number of shares of common stock to be sold is increased to more than 1,360,000 shares or decreased to less than 2,116,000 shares. |

| Q. | Are directors and executive officers of Eureka Homestead planning to purchase stock? |

| A. | Yes! Directors and executive officers, together with their associates, are expected to subscribe for an aggregate of 52,500 shares ($525,000) or approximately 3.9% of the shares to be sold at the minimum of the offering range. |

| Q. | Will the stock be insured? |

| A. | No. Like any common stock, Eureka Homestead Bancorp, Inc.’s stock will not be insured by the Federal Deposit Insurance Corporation. |

| Q. | Will dividends be paid on the stock? |

| A. | Following completetion of the offering, our board of directors will have the authority to declare dividends on our common stock. However, no decision has been made with respect to the payment of dividends. The payment and amount of any dividend payments will depend upon a number of factors, including the following: regulatory capital requirements; our financial condition and results of operations; our other uses of funds for the long-term value of stockholders; tax considerations; statutory and regulatory limitations; and general economic conditions. |

| Q. | How will the shares of Eureka Homestead Bancorp, Inc. trade? |

| A. | Upon completion of the conversion and offering, Eureka Homestead Bancorp, Inc.’s shares will be quoted on the OTC Pink Marketplace. Once the shares have begun trading, you may contact a firm offering investment services in order to buy or sell Eureka Homestead Bancorp, Inc. shares of common stock. |

| Q. | If I purchase shares during the offering, when will I receive my shares? |

| A. | All shares of Eureka Homestead Bancorp, Inc. common stock sold in the stock offering will be issued in book-entry form on the books of our transfer agent, through the Direct Registration System. Paper stock certificates will not be issued. As soon as practicable after completion of the stock offering, our transfer agent will send, by first class mail, a statement reflecting your stock ownership. |

WHERE TO GET MORE INFORMATION

| Q. | How can I get more information? |

| A. | For more information, refer to the enclosed Prospectus or call our Stock Information Center, toll-free, at (866) 806-1790, from 10:00 a.m. to 4:00 p.m., Central Time, Monday through Friday. The Stock Information Center is not open on bank holidays. |

This brochure is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other government agency.

IMPORTANT NOTICE

THIS PACKAGE INCLUDES

PROXY CARD(S)

REQUIRING YOUR PROMPT VOTE.

IF MORE THAN ONE PROXY

CARD IS ENCLOSED,

PLEASE VOTE EACH CARD.

THERE ARE NO DUPLICATE CARDS!

THANK YOU!

PLEASE VOTE

THE ENCLOSED PROXY CARD!

If you have not yet voted the Proxy Card(s) we recently mailed to you

in a large white package,

please vote the enclosed replacement Proxy Card.

You may vote by mail using the enclosed envelope or follow the

Phone or Internet voting instructions on the Proxy Card.

PLEASE JOIN YOUR BOARD OF DIRECTORS IN VOTING

“FOR” THE PLAN OF CONVERSION.

NOT VOTING HAS THE SAME EFFECT AS VOTING

“AGAINST” THE PLAN.

VOTING DOES NOT OBLIGATE YOU TO PURCHASE

COMMON STOCK DURING THE OFFERING.

THE CONVERSION WILL CHANGE OUR FORM OF

CORPORATE ORGANIZATION, BUT WILL NOT RESULT IN

CHANGES TO OUR STAFF, MANAGEMENT OR YOUR

DEPOSIT ACCOUNTS OR LOANS AT EUREKA HOMESTEAD. DEPOSIT

ACCOUNTS WILL NOT BE CONVERTED TO COMMON STOCK.

If you receive more than one of these reminder mailings,

please voteeach Proxy Card received. None are duplicates!

QUESTIONS?

Please call our Information Center, toll-free, at (866) 806-1790,

from 10:00 a.m. to 4:00 p.m., Central Time, Monday through Friday, except bank holidays.