Exhibit 99.1

Table of Contents

RISK FACTORS

An investment in our Class A Shares involves significant risks. You should carefully consider all of the information in this Introductory Document, including the risks and uncertainties described below, before making an investment in our Class A Shares. Any of the following risks could have a material adverse effect on our business, financial condition, and results of operations. In any such case, the market price of our Class A Shares could decline, and you may lose all or part of your investment.

Risks Relating to Our Business and Operations

We have a relatively short operating history of our current businesses compared to some of our globally established competitors and face significant risks and challenges in a rapidly evolving market, which makes it difficult to effectively assess our future prospects.

We have a relatively short operating history of our current businesses compared to some of our globally established competitors. We launched our investment banking business in 2015, after which we introduced our institutional asset management business and strategic investment business.

You should consider our business and prospects in light of the risks and challenges we encounter or may encounter given the rapidly evolving market in which we operate and our relatively short operating history. These risks and challenges include our ability to, among other things:

· | build a well-recognized and respected brand; |

| |

· | establish and expand our client base, win capital markets and advisory mandates, and increase our AUM; |

| |

· | maintain and enhance our relationships with our business partners; |

| |

· | attract, retain, and motivate talented employees; |

| |

· | anticipate and adapt to changing market conditions and competitive landscape; |

| |

· | manage our future growth; |

| |

· | ensure that the performance of our products and services meets client expectations; |

| |

· | maintain or improve our operational efficiency; |

| |

· | navigate a complex and evolving regulatory environment; |

| |

· | defend ourselves in any legal or regulatory actions against us; |

| |

· | enhance our technology infrastructure and maintain the security of our system and the confidentiality of the information provided and utilized across our system; |

| |

· | avoid and remedy operating errors as a result of human or system errors; |

| |

· | identify and address conflicts of interest; and |

| |

· | identify and appropriately manage our related party transactions. |

If we fail to address any or all of these risks and challenges, our business may be materially and adversely affected.

We have a relatively short history in serving our current institutional client base. As our business develops and as we respond to competition, we may continue to introduce new service offerings, make adjustments to our existing services, or make adjustments to our business operations in general. Any significant change to our business model that does not achieve expected results could have a material and adverse impact on our financial condition and results of operations. It is therefore difficult to effectively assess our future prospects.

Unfavorable financial market and economic conditions in Hong Kong, China, and elsewhere in the world could materially and adversely affect our business, financial condition, and results of operations.

As a financial services firm based in Hong Kong, our businesses are materially affected by conditions in the financial markets and economic conditions in Hong Kong, China, and elsewhere in the world. Financial markets and economic conditions could be negatively impacted by many factors beyond our control, such as inability to access capital markets, control of foreign exchange, changes in exchange rates, rising interest rates or inflation, slowing or negative growth rate, government involvement in allocation of resources, inability to meet financial commitments in a timely manner, terrorism, political uncertainty, civil unrest, fiscal or other economic policy of Hong Kong or other governments, and the timing and nature of any regulatory reform. The current trade frictions between the United States and China may also give rise to uncertainties in global economic conditions and adversely affect general investor confidence. Unfavorable financial market and economic conditions in Hong Kong, China, and elsewhere in the world could negatively affect our clients' business and materially reduce demand for our services and increase price competition among financial services firms seeking such engagements, and thus could materially and adversely affect our business, financial condition, and results of operations. In addition, our profitability could be adversely affected due to our fixed costs and the possibility that we would be unable to reduce our variable costs without reducing revenue or within a timeframe sufficient to offset any decreases in revenue relating to changes in market and economic conditions.

Revenue generated by our investment banking business is directly related to the volume and value of the transactions in which we are involved. Our investment bankers primarily serve clients in raising capital through IPOs and debt offerings. During periods of unfavorable market and economic conditions, our results of operations may be adversely affected by a decrease in the number and value of the IPOs and debt offerings that we underwrite.

During a market or general economic downturn, we may also derive lower revenue from our asset management and strategic investment businesses due to lower mark-to-market or fair value of the assets that we manage and the strategic investments that we made. In addition, due to uncertainty or volatility in the market or in response to difficult market conditions, clients or prospective clients may withdraw funds from, or hesitate to allocate assets to, our asset management business in favor of investments they perceive as offering greater opportunity or lower risk. Difficult market conditions can also materially and adversely affect our ability to launch new products or offer new services in our asset management business, which could negatively affect our ability to increase our AUM and our management fees that are based on the AUM.

The financial services industry is intensely competitive. If we are unable to compete effectively, we may lose our market share and our results of operations and financial condition may be materially and adversely affected.

The financial services industry is intensely competitive, highly fragmented, and subject to rapid change, and we expect it to remain so. We compete both in Hong Kong and globally, and on the basis of a number of factors, including the ability to adapt to evolving financial needs of a broad spectrum of clients, our ability to identify market demands and business opportunities to win client mandates, the quality of our advice, our employees, and deal execution, the range and price of our products and services, our innovation, our reputation, and the strength of our relationships. We expect to continue to invest capital and resources in our businesses in order to grow and develop them to a size where they are able to compete effectively in their markets, have economies of scale, and are themselves able to produce or consolidate significant revenue and profit. We cannot assure you that the planned and anticipated growth of our businesses will be achieved or in what timescale. There may be difficulties securing financing for investment for growth and in recruiting and retaining the skilled human resources required to compete effectively. If we fail to compete effectively against our competitors, our business, financial conditions, results of operations, and prospects will be materially and adversely affected.

Investment banking as our primary business generally requires us to react promptly to the evolving demand of our clients and be able to provide innovative financial solutions tailored to their needs. We may not be able to compete effectively with our competitors at all times and always be able to provide appropriate financial solutions that promptly and accurately address our clients' needs. If this were to happen, our ability to attract new or retain existing clients will suffer, which would materially and adversely affect our revenue and earnings.

We primarily compete with other investment banking firms. We have experienced and may continue to experience intense competition over obtaining investment banking service mandates. We may face pricing pressure as some of our competitors may seek to obtain higher market share by reducing fees and commissions. Some of our competitors include large global financial institutions or state-owned PRC financial institutions operating or headquartered in Hong Kong, many of which have longer operating histories, far broader financial and other resources, and significantly greater name recognition than us and have the ability to offer a wider range of products, which may enhance their competitive position. They also regularly support services we do not provide, such as commercial lending, margin lending and other financial services and products, which puts us at a competitive disadvantage and could result in pricing pressures or lost opportunities, which in turn could materially and adversely affect our results of operations. In addition, we may be at a competitive disadvantage with regard to some of our competitors that have larger customer bases, more professionals, and the ability to provide financing that are often a crucial component of investment banking deals on which we advise.

Historically, competition in the asset management market has been fierce. In recent years, the asset management market in Hong Kong had become more saturated. Banks and brokerage firms have offered low management fees, prolonged commission-free concessions, or extra-low fixed commissions as incentives to attract clients, thus further intensifying the competition in this market. We expect that competition in Hong Kong's asset management market will continue to be intense. We cannot assure you that we can compete effectively against our current and future competitors, or that competitive forces in the market will not alter the industry landscape such that our business objectives would become impractical or impossible. Under the foregoing circumstances, our business and financial condition would be adversely affected.

Our businesses depend on key management executives and professional staff, and our business may suffer if we are unable to recruit and retain them.

Our businesses depend on the skills, reputation, and professional experience of our key management executives, the network of resources and relationships they generate during the normal course of their activities, and the synergies among the diverse fields of expertise and knowledge held by our senior professionals. Therefore, the success of our business depends on the continued services of these individuals. If we lose their services, we may not be able to execute our existing business strategy effectively, and we may have to change our current business direction. These disruptions to our business may take up significant energy and resources of our Company, and materially and adversely affect our future prospects.

Moreover, our business operations depend on our professional staff, our most valuable assets. Their skills, reputation, professional experience, and client relationships are critical elements in obtaining and executing client engagements. We devote considerable resources and incentives to recruiting and retaining these personnel. However, the market for quality professional staff is increasingly competitive. We expect to face significant competition in hiring such personnel. Additionally, as we mature, current compensations scheme to attract employees may not be as effective as in the past. The intense competition may require us to offer more competitive compensation and other incentives to our talent, which could materially and adversely affect our financial condition and results of operations. As a result, we may find it difficult to retain and motivate these employees, and this could affect their decisions about whether or not they continue to work for us. If we do not succeed in attracting, hiring and integrating quality professional staff, or retaining and motivating existing personnel, we may be unable to grow effectively.

We make strategic investments using our own capital, and may not be able to realize any profits from these investments for a considerable period of time, or may lose some or all of the principal amounts of these investments.

We derived a significant portion of our revenue from our strategic investment business. Our dividend and gain related to disposed investment accounted for 6.7%, 13.7% and 9.6% of our total revenue for the years ended 31 December 2017 and 2018 and the nine months ended 30 September 2019, respectively, and our net fair value changes on stock loan, derivative financial instrument and financial assets at fair value through profit or loss accounted for 66.3%, 35.5%, and 49.9% of our total revenue for the corresponding periods, respectively. Our strategic investment portfolio primarily consist of investments in equity and equity-linked securities of public and private companies. Making a sound investment decision requires us to carefully identify and select a target company based on its business, financial condition, operations, and the industry in which it operates. In general, this process involves analytical assessment and estimation of the target company's profitability and sustainability. We may make unsound investment decisions due to fraudulent and concealed, inaccurate or misleading statements from a target company in the course of our due diligence, which could lead us to mistakenly estimate the value of the target company and affect our ability to derive profit from such investments. In addition, our understanding of and judgment on the target company's business and prospects, and the industry in which the target company operates may deviate and result in inaccurate investment decisions.

We make strategic investments in financial and new economy sectors in Asia and are subject to concentration risks. Our investment portfolio may be concentrated in certain sectors, geographic regions, individual investments, or types of securities that may or may not be listed. As at the date of this Introductory Document, we hold investments primarily in four (4) companies under our strategic investment business. Any significant decline in the value of our investment portfolio may therefore adversely impact our business, results of operations, and financial condition.

We also make strategic investments in the highly regulated banking sector in China. Any change in PRC laws, regulations, or policies may adversely affect our equity holding as a foreign investor, our ability to exit from the investment, or the fair value of our equity investment.

In addition, we have limited control over all of our investee companies. Even if we have a board seat in certain investee companies, we do not have the necessary power to mandate or block material corporate actions. If these investee companies fail to carry out business in a compliant manner, incur overly excessive amount of debt or go bankrupt, or the business operations decline, the fair value of our investment in these companies may deteriorate or, in extreme cases, decrease to zero. We are subject to the risk that the majority shareholders or the management of these investee companies may act in a manner that does not serve the investee companies' interests. The general operational risks, such as inadequate or failing internal control of these investee companies, the compliance risks, such as any lack of requisite approvals for investee companies' businesses, and legal risks, such as violation of laws and regulations or fraudulent or otherwise improper activities, may also expose our investments to risks. Furthermore, these investee companies may fail to abide by their agreements with us, for which we may have limited or no recourse. These investee companies may not declare dividend, or even if they do, we may not be able to secure liquidity conveniently until we receive such dividend. If any of the foregoing were to occur, our business, reputation, financial condition and results of operations could be materially and adversely affected.

In recent years, there has been increasing competition for private equity investment opportunities, which may limit the availability of investment opportunities or drive up the price of available investment opportunities, and, as a result, our financial condition and results of operations may be materially and adversely affected.

Our strategic investment business is subject to liquidity risks.

Some of our strategic investments are in the form of securities that are not publicly traded. In many cases, there may be prohibition by contract or by applicable laws from selling such securities for a period of time or there may not be a public market for such securities. Even if the securities are publicly traded, large holdings of securities can often be disposed of only over a substantial length of time, exposing the investment returns to risks of downward movement in market prices during the disposition period. Accordingly, under certain conditions, we may be forced to either sell securities at lower prices than we had expected to realize or defer, potentially for a considerable period of time, sales that we had planned to make. Investing in these securities can involve a high degree of risk, and we may lose some or all of the principal amount of such strategic investments.

Our results of operations and financial condition may be materially affected by fluctuations in the fair value of our equity investments in our investee companies.

Our investments are long-term, strategic in nature to reinforce our ecosystem. We have made significant equity investments in public and private companies and recognize dividend and gain related to disposed investment and net fair value changes on stock loan, derivative financial instrument and financial assets at fair value through profit or loss on our consolidated statements of profit or loss and other comprehensive income. For the years ended 31 December 2017 and 2018 and the nine months ended 30 September 2019, dividend and gain related to disposed investment accounted for 6.7%, 13.7% and 9.6% and net fair value changes on stock loan, derivative financial instrument and financial assets at fair value through profit or loss accounted for 66.3%, 35.5%, and 49.9%, of our total revenue, respectively. Since we intend to hold our investments on a long-term basis, fair value of our equity investments is subject to market fluctuations due to changes in the market prices of securities, interest rates, or other market factors, such as liquidity, or regulatory factors, such as changes in policies affecting the businesses of our investee companies.

Technology has been one of our key sectors of focus and the fair value of our investments in technology companies may be subject to significant valuation fluctuations. For our equity investments in private companies, we measure their fair value based on an assessment of each underlying security, considering rounds of financing, third-party transactions, and market-based information, including comparable company transactions, trading multiples, and changes in market outlook. As at 30 September 2019, the aggregate fair value of our strategic investment portfolio was HK$3.9 billion. Although we do not intend to make frequent trades on investments for profit, the nature of investment and significance of our investment holdings could adversely affect our results of operations and financial condition.

Our investment in Bank of Qingdao is subject to liquidity, concentration, and regulatory risks.

As at 30 September 2019, our strategic investment portfolio reached an aggregate fair value of HK$3.9 billion, of which our investment in the Hong Kong and Shenzhen-listed Bank of Qingdao accounted for 91.9%. As at 30 September 2019, we hold an approximate 8.91% interest in the Bank of Qingdao. We hold a significant stake in Bank of Qingdao and expect it to be a long-term investment, and our Chairman of the Board and Chief Executive Officer also serves as a director of Bank of Qingdao. Given our significant stake in, and affiliation with, Bank of Qingdao, our investment in Bank of Qingdao is subject to liquidity and concentration risk. There may not be a readily available market to sell the shares of Bank of Qingdao. We will need to gradually sell down our holdings subject to market conditions, if we want to liquidate our position in Bank of Qingdao. In addition, the banking sector in China is highly regulated and any change in PRC laws, regulations, or policies may adversely affect our holding in Bank of Qingdao as a foreign investor, our ability to exit from the investment, or the fair value of our equity investment in Bank of Qingdao. Any adverse impact on our investment in Bank of Qingdao could materially and adversely affect our business, results of operations, and financial condition.

A substantial portion of our revenue is derived from investment banking business, which is not a long-term contracted source of revenue and is subject to intense competition, and declines in these engagements could materially and adversely affect our financial condition and results of operations.

We historically have earned a substantial portion of our revenue from fees and commissions paid by our investment banking clients, which usually are payable upon the successful completion of particular transactions. Revenue derived from our investment banking business accounted for 20.1%, 39.9%, and 31.7% of our total revenue for the years ended 31 December 2017 and 2018 and the nine months ended 30 September 2019, respectively. We expect that we will continue to rely on investment banking business for a substantial portion of our revenue for the foreseeable future, and a decline in our engagements could materially and adversely affect our financial condition and results of operations.

In addition, investment banking business typically is not a long-term contracted source of revenue. Each revenue-generating engagement typically is separately awarded and negotiated. Furthermore, many of our clients do not routinely require our services. As a consequence, our engagements with many clients are not likely to be predictable. We may also lose clients each year, including as a result of the sale or merger of a client, or due to a change in a client's senior management and competition from other investment banking firms. As a result, our engagements with clients are constantly changing and our total revenue could fluctuate or decline quickly due to these factors.

Our investment banking business depends on our ability to identify, execute, and complete projects successfully and is subject to various risks associated with underwriting and financial advisory services. We cannot assure you that the income level of our investment banking business can be sustained.

We underwrite securities offerings in Hong Kong, the United States, and other jurisdictions, and are exposed to uncertainties in the regulatory requirements in these jurisdictions. Securities offerings are subject to review and approval by various regulatory authorities, the results and timing of which are beyond our control and may cause substantial delays to, or the termination of, the offering. We receive the payment of fees and commissions in most securities offerings only after the successful completion of the transactions. If a transaction is not completed as scheduled, or at all, for any reason, we may not receive fees and commissions for services that we have provided in a timely manner, or at all, which could materially and adversely affect our results of operations.

Market fluctuations and changes in regulatory policies may adversely affect our investment banking business. Negative market and economic conditions may adversely affect investor confidence, resulting in significant industry-wide decline in the size and number of securities offerings, and market volatility may cause delays to, or even termination of, securities offerings that we underwrite, either of which could adversely affect our revenue from the investment banking business.

In addition, in acting as an underwriter in a securities offering, we may be subject to litigation, securities class action, claims, administrative penalties, regulatory sanctions, fines, or disciplinary actions, or may be otherwise legally liable in Hong Kong, the United States, and other jurisdictions. Our reputation may be affected due to inadequate due diligence, fraud or misconduct committed by issuers or their agents or our staff, misstatements and omissions in disclosure documents, or other illegal or improper activities that occur during the course of the underwriting process, which may adversely affect our business, financial condition, and results of operations. Our investment banking business may also be affected by new rules and regulations, changes in the interpretation or enforcement of existing rules and regulations relating to the underwriting of securities offerings.

As a result, we cannot assure you that the income level of our investment banking business can be sustained.

If we cannot identify or effectively control the various risks involved in the asset management products that we offer or manage under our asset management business or otherwise achieve expected investment returns for our asset management clients, our reputation, client relationships, and asset management business will be adversely affected.

We offer our asset management clients a broad selection of third-party products, including fixed income products and equity products, for which we derive revenue through management fees, performance fees, and brokerage fees. These products often have complex structures and involve various risks, including default risks, interest rate risks, liquidity risks, market volatility and other market risks. In addition, we are subject to risks arising from any potential misconduct or violation of law by the product providers or corporate borrowers. Although the product providers or corporate borrowers of the asset management products we offer are typically directly liable to our clients in the event of a product default, these incidences could adversely affect the performance of the applicable products that we distribute and our reputation. Our success in maintaining our brand image depends, in part, on our ability to effectively control the risks associated with these products. Our asset management team not only needs to understand the nature of the products but also needs to accurately describe the products to, and evaluate them for, our clients. Although we enforce and implement strict risk management policies and procedures, they may not be fully effective in mitigating the risk exposure of our clients in all market environments or against all types of risks. If we fail to identify and effectively control the risks associated with the products that we offer or manage, or fail to disclose such risks to our clients in a sufficiently clear and timely manner, or to timely dispose of such investments in the clients' investment portfolios, our clients may suffer financial loss or other damages. Poor performance of these products and services, negative perceptions of the institutions offering these products and services or failure to achieve expected investment return may impact client confidence in the products we offer them, may impede the capital-raising activities in connection with our asset management business, and reduce our asset under management and revenue generated under this segment.

For discretionary account service we offer to our clients, we have a higher level of discretion in making investments. If we are unable to generate sufficient returns from our investments, including managing leverage risks on behalf of our clients, or even incur losses, our clients may become unwilling to continue to use our services, and our reputation, client relationship, business, and prospects will be materially and adversely affected.

We are subject to extensive and evolving regulatory requirements, non-compliance with which may result in penalties, limitations, and prohibitions on our future business activities or suspension or revocation of our licenses, and consequently may materially and adversely affect our business, financial condition, and results of operations. In addition, we may, from time to time, be subject to regulatory inquiries and investigations by relevant regulatory authorities or government agencies in Hong Kong or other applicable jurisdictions.

The Hong Kong and U.S. financial markets in which we primarily operate are highly regulated. Our business operations are subject to applicable Hong Kong and U.S. laws, regulations, guidelines, circulars, and other regulatory guidance, and many aspects of our businesses depend on obtaining and maintaining approvals, licenses, permits, or qualifications from the relevant regulators. Serious non-compliance with regulatory requirements could result in investigations and regulatory actions, which may lead to penalties, including reprimands, fines, limitations, or prohibitions on our future business activities or, if significant, suspension or revocation of our licenses. Failure to comply with these regulatory requirements could limit the scope of businesses in which we are permitted to engage. Furthermore, additional regulatory approvals, licenses, permits, or qualifications may be required by relevant regulators in the future, and some of our current approvals, licenses, permits, or qualifications are subject to periodic renewal. Although we have not been found by any relevant regulators to be in material non-compliance with any regulatory requirements since we commenced our current businesses in 2015, any such finding or other negative outcome may affect our ability to conduct business, harm our reputation and, consequently, materially and adversely affect our business, financial condition, results of operations, and prospects.

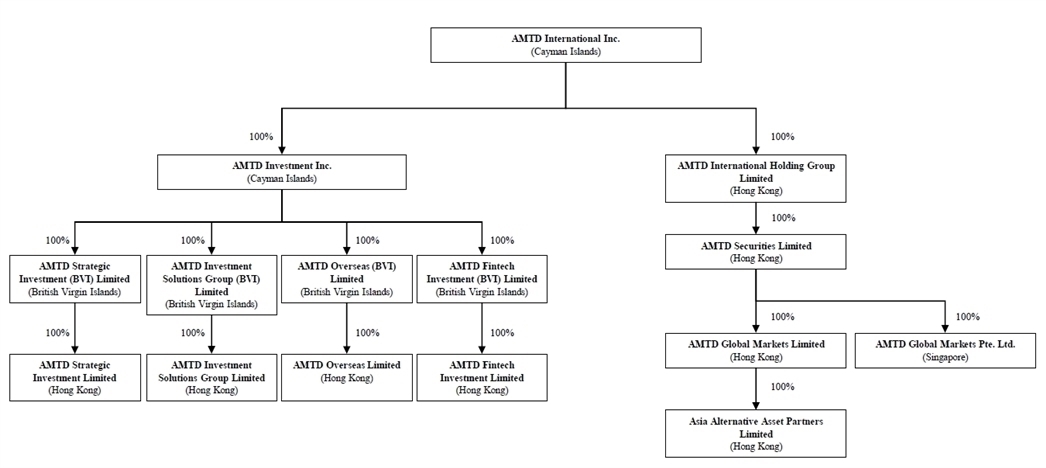

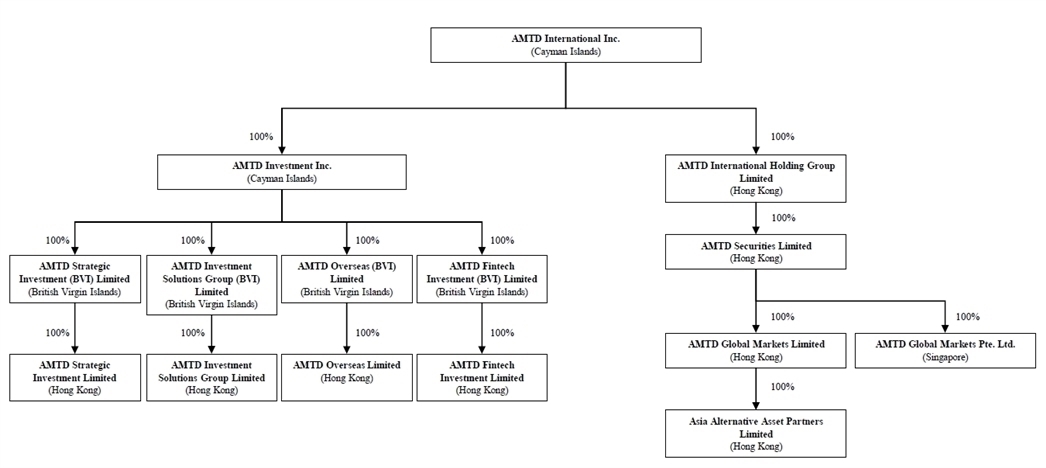

Two of our subsidiaries, AMTD Global Markets Limited and Asia Alternative Asset Partners Limited, are HKSFC-licensed companies subject to various requirements, such as remaining fit and proper at all times, minimum liquid and paid-up capital requirements, notification requirements, submission of audited accounts, submission of financial resources returns and annual returns, continuous professional training, under the Securities and Futures Ordinance (Cap. 571) of Hong Kong and its subsidiary legislation and the codes and the guidelines issued by the HKSFC. If any of these HKSFC licensed companies fails to meet the regulatory capital requirements in Hong Kong, the local regulatory authorities may impose penalties on us or limit the scope of our business, which could, in turn, have a material adverse effect on our financial condition and results of operations. Moreover, the relevant capital requirements may be changed over time or subject to different interpretations by relevant governmental authorities, all of which are out of our control. Any increase of the relevant capital requirements or stricter enforcement or interpretation of the same may adversely affect our business activities. In addition, AMTD Global Markets Limited is a licensed principal intermediary under the Mandatory Provident Fund Schemes Ordinance (Cap. 485) of Hong Kong, a licensed insurance broker company under the Insurance Ordinance (Cap. 41) of Hong Kong. Any non-compliance with applicable regulatory requirements by our Company or any of our subsidiaries may result in penalties, limitations, and prohibitions on our future business activities and thus may materially and adversely affect our business, financial condition, and results of operations.

From time to time, AMTD Global Markets Limited and Asia Alternative Asset Partners Limited may be subject to or required to assist in inquiries or investigations by relevant regulatory authorities or government agencies in Hong Kong or other jurisdictions, including the HKSFC and the SEC, relating to its own activities or activities of third parties such as its clients. The HKSFC conducts on-site reviews and off-site monitoring to ascertain and supervise our business conduct and compliance with relevant regulatory requirements and to assess and monitor, among other things, our financial soundness. We, our Directors, our Executive Officers or our employees, may be subject to such regulatory inquiries and investigations from time to time, regardless of whether we are the target of such regulatory inquiries and investigations. If any misconduct is identified as a result of inquiries, reviews or investigations, the HKSFC may take disciplinary actions that would lead to revocation or suspension of licenses, public or private reprimand or imposition of pecuniary penalties against us, our responsible officers, licensed representatives, directors, or other officers. Any such disciplinary actions taken against us, our responsible officers, licensed representatives, directors, or other officers may have a material and adverse impact on our business operations and financial results. In addition, we are subject to statutory secrecy obligations under the Securities and Futures Ordinance (Cap. 571) of Hong Kong whereby we may not be permitted to disclose details on any HKSFC inquiries, reviews or investigations without the consent of the HKSFC. For further details, see the section entitled "Appendix B – Regulatory Overview —Disciplinary Power of the HKSFC".

Our revenue and profits are highly volatile, and fluctuate significantly from quarter to quarter, which may result in volatility of the price of our Class A Shares.

Our revenue and profits are highly volatile and could fluctuate significantly. For example, the revenue generated from investment banking business is highly dependent on market conditions, regulatory environment and policies, and the decisions and actions of our clients and interested third parties. As a result, our results of operations will likely fluctuate from quarter to quarter based on the timing of when those fees are earned. It may be difficult for us to achieve steady earnings growth on a quarterly basis, which could, in turn, lead to large adverse movements in the price of our Class A Shares or increasing volatility in our Class A Shares price generally.

The due diligence that we undertake in the course of our business operations is inherently limited and may not reveal all facts and issues that may be relevant in connection with such businesses.

In the course of providing investment banking services, asset management services, and making strategic investments, we endeavor to conduct due diligence review that we deem reasonable and appropriate based on relevant regulatory expertise and market standards as well as the facts and circumstances applicable to each deal. When conducting due diligence, we are often required to evaluate critical and complex business, financial, tax, accounting, environmental, regulatory, and legal issues. Outside consultants, such as legal advisors, and accountants may be involved in the due diligence process in varying degrees depending on the transaction type. Nevertheless, when conducting due diligence work and making an assessment, we are limited to the resources available, including information provided by the target company or the issuer and, in some circumstances, third-party investigations. The due diligence work that we conduct with respect to any investment opportunity may not reveal or highlight all relevant facts that may be necessary, helpful, or accurate in evaluating potential risks, which may subject us to potential penalties in the case of securities underwriting, or failure of investment in the case of strategic investment. We may be provided with information that is misleading, false, or inaccurate as a result of mistake, misconduct, or fraud of our employees or third parties. Moreover, such due diligence work will not necessarily result in the successful completion of a transaction, which may adversely affect the performance of our business.

We face additional risks as we offer new products and services, transact with a broader array of clients and counterparties and expose ourselves to new asset classes and geographical markets.

We are committed to providing new products and services in order to strengthen our market position in the financial services industry and client relationships. We expect to expand our product and service offerings as permitted by relevant regulatory authorities, transact with new clients not in our traditional client base and enter into new markets. For further details, see the section entitled "Business—Our Growth Strategies". These activities expose us to new and increasingly challenging risks, including, but not limited to:

· | we may have insufficient experience or expertise in offering new products and services and dealing with inexperienced counterparties and clients may harm our reputation; |

| |

· | we may be subject to stricter regulatory scrutiny, or increasing tolerance of credit risks, market risks, compliance risks, and operational risks; |

| |

· | we may be unable to provide clients with adequate levels of service for our new products and services; |

| |

· | our new products and services may not be accepted by our clients or meet our profitability expectations; |

| |

· | our new products and services may be quickly copied by our competitors so that its attractiveness to our clients may be diluted; and |

| |

· | our internal information technology infrastructure may not be sufficient to support our product and service offerings. |

If we are unable to achieve the expected results with respect to our offering of new products and services, our business, financial condition, and results of operations could be materially and adversely affected.

In addition, we also intend to further expand our business geographically through establishing branch offices in key financial centers in the United States and Southeast Asia, such as New York City and Singapore. See the section entitled "Business—Our Growth Strategies—Expand our footprint globally". Operating business internationally may expose us to additional risks and uncertainties. As we have limited experience in operating our business in United States and other overseas markets, we may be unable to attract a sufficient number of clients, fail to anticipate competitive conditions, or face difficulties in operating effectively in these markets. We may also fail to adapt our business models to the local market due to various legal requirements and market conditions. Compliance with applicable foreign laws and regulations, especially financial regulations, increases the costs and risk exposure of doing business in foreign jurisdictions. In addition, in some cases, compliance with the laws and regulations of one country could nevertheless cause violation of the laws and regulations of another country. Violations of these laws and regulations could materially and adversely affect our brand, international growth efforts, and business.

We may undertake acquisitions, investments, joint ventures, or other strategic alliances, which could present unforeseen integration difficulties or costs and may not enhance our business as we expect.

Our strategy includes plans to grow both organically and through possible acquisitions, joint ventures, or other strategic alliances. Joint ventures and strategic alliances may expose us to new operational, regulatory, and market risks, as well as risks associated with additional capital requirements. We may not be able, however, to identify suitable future acquisition targets or alliance partners. Even if we identify suitable targets or partners, the evaluation, negotiation, and monitoring of the transactions could require significant management attention and internal resources and we may be unable to complete an acquisition or alliance on terms commercially acceptable to us. The costs of completing an acquisition or alliance may be costly and we may not be able to access funding sources on terms commercially acceptable to us. Even when acquisitions are completed, we may encounter difficulties in integrating the acquired entities and businesses, such as difficulties in retention of clients and personnel, challenge of integration and effective deployment of operations or technologies, and assumption of unforeseen or hidden material liabilities or regulatory non-compliance issues. Any of these events could disrupt our business plans and strategies, which in turn could have a material adverse effect on our financial condition and results of operations. Such risks could also result in our failure to derive the intended benefits of the acquisitions, strategic investments, joint ventures, or strategic alliances, and we may be unable to recover our investment in such initiatives. We cannot assure you that we could successfully mitigate or overcome these risks.

Volatile securities market may result in margin sales under our margin loan arrangements for our strategic investment business, which could materially and adversely affect our financial condition and results of operations.

We maintain certain margin loans to finance some of our investments. These margin loan arrangements contain provisions that may not work to our advantage when we encounter difficulties in certain circumstances. For example, these margin loans allow lenders to dispose of the securities at a margin price to stop their losses when the price of the securities we purchased declined to the margin price. Selling the securities at the margin price typically causes significant loss to our investment as the margin price is generally lower than the security price we paid and we no longer have the chance to profit from future rises of security prices. As at 30 September 2019, the aggregate amount of our outstanding margin loans was HK$321.8 million. The securities market in Hong Kong and the United States have recently been volatile, which heightened the risk associated with our margin loan arrangements. Under certain circumstances, we may attempt to renegotiate the terms and conditions of our existing margin loans or to obtain additional financing. We cannot assure you that our renegotiation efforts would be successful or timely or that we would be able to refinance our obligations on acceptable terms or at all. If margin sales happen, our financial condition and results of operations could be materially and adversely affected.

Any negative publicity with respect to us, our Directors, officers, employees, shareholders, or other beneficial owners, our peers, business partners, or our industry in general, may materially and adversely affect our reputation, business, and results of operations.

Our reputation and brand recognition play an important role in earning and maintaining the trust and confidence of our existing and prospective clients. Our reputation and brand are vulnerable to many threats that can be difficult or impossible to control, and costly or impossible to remediate. Negative publicity about us, such as alleged misconduct, other improper activities, or negative rumors relating to our business, shareholders, or other beneficial owners, affiliates, directors, officers, or other employees, can harm our reputation, business, and results of operations, even if they are baseless or satisfactorily addressed. For example, a number of media reported that during his previous employment at a global investment banking firm, our Chairman of the Board and Chief Executive Officer was alleged to have not adhered to such firm's internal policies concerning the disclosure of potential conflicts of interest. We believe that these allegations are based on inaccurate facts and are unfounded and meritless. These allegations, even if unproven or meritless, may lead to inquiries, investigations, or other legal actions against us by any regulatory or government authorities. Any regulatory inquiries or investigations and lawsuits against us, and perceptions of conflicts of interest, inappropriate business conduct by us or perceived wrong doing by any key member of our management team, among other things, could substantially damage our reputation regardless of their merits, and cause us to incur significant costs to defend ourselves. As we reinforce our ecosystem and stay close to our clients and other "AMTD SpiderNet" stakeholders, any negative market perception or publicity on our business partners that we closely cooperate with, or any regulatory inquiries or investigations and lawsuits initiated against them, may also have an impact on our brand and reputation, or subject us to regulatory inquiries or investigations or lawsuits. Moreover, any negative media publicity about the financial services industry in general or product or service quality problems of other firms in the industry in which we operate, including our competitors, may also negatively impact our reputation and brand. If we are unable to maintain a good reputation or further enhance our brand recognition, our ability to attract and retain clients, third-party partners, and key employees could be harmed and, as a result, our business, financial position, and results of operations would be materially and adversely affected.

Our operations may be subject to transfer pricing adjustments by competent authorities.

We may use transfer pricing arrangements to account for business activities between us and our Controlling Shareholder, the different entities within our consolidated group, or other related parties. We cannot assure you that the tax authorities in the jurisdictions where we operate would not subsequently challenge the appropriateness of our transfer pricing arrangements or that the relevant regulations or standards governing such arrangements will not be subject to future changes. If a competent tax authority later finds that the transfer prices and the terms that we have applied are not appropriate, such authority may require us or our subsidiaries to re-assess the transfer prices and re-allocate the income or adjust the taxable income. Any such reallocation or adjustment could result in a higher overall tax liability for us and may adversely affect our business, financial condition, and results of operations.

Our risk management and internal control systems, as well as the risk management tools available to us, may not fully protect us against various risks inherent in our business.

We follow our comprehensive internal risk management framework and procedures to manage our risks, including, but not limited to, reputational, legal, regulatory, compliance, operational, market, liquidity, and credit risks. We have in place various guidelines, policies and procedures which formed the basis of the risk management framework, including our Code of Business Conducts and Ethics, Insider Trading Policy, Anti-Corruption Compliance Policy, Policy and Procedures in relation to Related Persons Transactions, Disclosure Controls and Procedures. All these guidelines, policies and procedures set out the required standards which we expect our employees to adhere to. However, our risk management policies, procedures, and internal controls may not be adequate or effective in mitigating our risks or protecting us against unidentified or unanticipated risks. In particular, some methods of managing risks are based upon observed historical market behaviour and our experience in the financial industry. These methods may fail to predict future risk exposures, which could be significantly greater than those indicated by our historical measures. Other risk management methods depend upon an evaluation of available information regarding operating and market conditions and other matters, which may not be accurate, complete, up-to-date, or properly evaluated. In addition, the capital markets are constantly developing, the information and experience that we rely on for our risk management methods may become quickly outdated as capital markets and regulatory environment continue to evolve. If we experience any material deficiencies or failure in our risk management and internal control systems and procedures, such deficiencies or failure may adversely affect our ability to identify or report our deficiencies or non-compliance. Further, if we fail to maintain an effective system of internal control over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations, or prevent fraud. In addition, failure of our employees to effectively enforce such risk management and internal controls procedures, or any of the foregoing risks, may have a material and adverse effect on our business, financial condition and operating results.

Our business is subject to various cyber-security and other operational risks.

We face various cyber-security and other operational risks relating to our businesses on a daily basis. We rely heavily on financial, accounting, communication and other data processing systems as well as the people who operate them to securely process, transmit, and store sensitive and confidential client information, and communicate globally with our staff, clients, partners, and third-party vendors. We also depend on various third-party software and cloud-based storage platforms as well as other information technology systems in our business operations. These systems, including third-party systems, may fail to operate properly or become disabled as a result of tampering or a breach of our network security systems or otherwise, including for reasons beyond our control.

Our clients typically provide us with sensitive and confidential information as part of our business arrangements. We are susceptible of attempts to obtain unauthorized access of such sensitive and confidential client information. We also may be subject to cyber-attacks involving leak and destruction of sensitive and confidential client information and our proprietary information, which could result from an employee's or agent's failure to follow data security procedures or as a result of actions by third parties, including actions by government authorities. Although cyber-attacks have not had a material impact on our operations to date, breaches of our or third-party network security systems on which we rely could involve attacks that are intended to obtain unauthorized access to and disclose sensitive and confidential client information and our proprietary information, destroy data or disable, degrade, or sabotage our systems, often through the introduction of computer viruses and other means, and could originate from a wide variety of sources, including state actors or other unknown third parties. The increase in using mobile technologies can heighten these and other operational risks.

We cannot assure you that we or the third parties on which we rely will be able to anticipate, detect, or implement effective preventative measures against frequently changing cyber-attacks. We may incur significant costs in maintaining and enhancing appropriate protections to keep pace with increasingly sophisticated methods of attack. In addition to the implementation of data security measures, we require our employees to maintain the confidentiality of the proprietary information that we hold. If an employee's failure to follow proper data security procedures results in the improper release of confidential information, or our systems are otherwise compromised, malfunctioning or disabled, we could suffer a disruption of our business, financial losses, liability to clients, regulatory sanctions, and damage to our reputation.

We operate in businesses that are highly dependent on proper processing of financial transactions. In our asset management business, we have to reliably obtain securities and other pricing information, properly execute and process client transactions, and provide reports and other customer service to our clients. The occurrence of trade or other operational errors or the failure to keep accurate books and records can render us liable to disciplinary action by regulatory authorities, as well as to claims by our clients. We also rely on third-party service providers for certain aspects of our business. Any interruption or deterioration in the performance of these third parties or failures of their information systems and technology could impair our operations, affect our reputation, and adversely affect our businesses.

Fraud or misconduct by our Directors, officers, employees, agents, clients, or other third parties could harm our reputation and business and may be difficult to detect and deter.

It is not always possible to detect and deter fraud or misconduct by our Directors, officers, employees, agents, clients, business partners, or other third parties. The precautions that we take to detect and prevent such activity may not be effective in all cases. Fraud or misconduct by any of these persons or entities may cause us to suffer significant reputational harm and financial loss or result in regulatory disciplinary actions. The potential harm to our reputation and to our business caused by such fraud or misconduct is impossible to quantify.

We are subject to a number of obligations and standards arising from our businesses. The violation of these obligations and standards by any of our Directors, officers, employees, agents, clients, or other third parties could materially and adversely affect us and our investors. For example, our businesses require that we properly handle confidential information. If our Directors, officers, employees, agents, clients, or other third parties were to improperly use or disclose confidential information, we could suffer serious harm to our reputation, financial position, and existing and future business relationships. Although we have not identified any material fraud or misconduct by our Directors, officers, employees, agents, clients, or other third parties since we commenced our current businesses in 2015, if any of these persons or entities were to engage in fraud or misconduct or were to be accused of such fraud or misconduct, our business and reputation could be materially and adversely affected.

We may be subject to litigation and regulatory investigations and proceedings and may not always be successful in defending ourselves against such claims or proceedings.

Although we have not been subject to any material lawsuits and arbitration claims in relation to our current business since the commencement in 2015, operating in the financial services industry may subject us to significant risks, including the risk of lawsuits and other legal actions relating to compliance with regulatory requirements in areas such as information disclosure, sales or underwriting practices, product design, fraud and misconduct, and protection of sensitive and confidential client information. From time to time we may be subject to lawsuits and arbitration claims in the ordinary course of our business brought by external parties or disgruntled current or former employees, inquiries, investigations, and proceedings by regulatory and other governmental agencies. Any such claims brought against us, with or without merits, may result in administrative measures, settlements, injunctions, fines, penalties, negative publicities, or other results adverse to us that could have material adverse effect on our reputation, business, financial condition, results of operations, and prospects. Even if we are successful in defending ourselves against these actions, the costs of such defence may be significant.

In market downturns, the number of legal claims and amount of damages sought in litigation and regulatory proceedings may increase. In addition, our affiliates may also encounter litigation, regulatory investigations, and proceedings for the practices in their business operations. Our clients may also be involved in litigation, investigation, or other legal proceedings, some of which may relate to transactions that we have advised, whether or not there has been any fault on our part.

We may not be able to fully detect money laundering and other illegal or improper activities in our business operations on a timely basis or at all, which could subject us to liabilities and penalties.

We are required to comply with applicable anti-money laundering and anti-terrorism laws and other regulations in the jurisdictions where we operate. Although we have adopted policies and procedures aimed at detecting, and preventing being used for, money-laundering activities by criminals or terrorist-related organizations and individuals or improper activities (including but not limited to market manipulation and aiding and abetting tax evasion), such policies and procedures may not completely eliminate instances where our networks may be used by other parties to engage in money laundering and other illegal or improper activities. Furthermore, we primarily comply with applicable anti-money laundering laws and regulations in Hong Kong and we may not fully detect violations of anti-money laundering regulations in other jurisdictions or be fully compliant with the anti-money laundering laws and regulations in other jurisdictions to which we are required. As a publicly listed company in the United States, we are subject to the U.S. Foreign Corrupt Practices Act of 1977 and other laws and regulations in the United States, including regulations administered by the U.S. Department of Treasury's Office of Foreign Asset Control. Although we have not identified any failure to detect material money laundering activities since we commenced our current businesses in 2015, if we fail to fully comply with applicable laws and regulations, the relevant government agencies may impose fines and other penalties on us, which may adversely affect our business.

We regularly encounter potential conflicts of interest, and failure to identify and address such conflicts of interest could adversely affect our business.

We face the possibility of actual, potential, or perceived conflicts of interest in the ordinary course of our business operations. Conflicts of interest may exist between (i) our different businesses; (ii) us and our clients; (iii) our clients; (iv) us and our employees; (v) our clients and our employees, or (vi) us and our Controlling Shareholder and other beneficial owners. As we expand the scope of our business and our client base, it is critical for us to be able to timely address potential conflicts of interest, including situations where two or more interests within our businesses naturally exist but are in competition or conflict. We have put in place extensive internal control and risk management procedures that are designed to identify and address conflicts of interest. However, appropriately identifying and managing actual, potential, or perceived conflicts of interest is complex and difficult, and our reputation and our clients' confidence in us could be damaged if we fail, or appear to fail, to deal appropriately with one or more actual, potential, or perceived conflicts of interest. It is possible that actual, potential, or perceived conflicts of interest could also give rise to client dissatisfaction, litigation, or regulatory enforcement actions. Regulatory scrutiny of, or litigation in connection with, conflicts of interest could have a material adverse effect on our reputation, which could materially and adversely affect our business in a number of ways, including a reluctance of some potential clients and counterparties to do business with us. Any of the foregoing could materially and adversely affect our reputation, business, financial condition, and results of operations.

The current tensions in international economic relations may negatively affect the demand for our services, and our results of operations and financial condition may be materially and adversely affected.

Recently there have been heightened tensions in international economic relations, such as the one between the United States and China. Amid these tensions, the U.S. government has imposed and may impose additional measures on entities in China, including sanctions. As a financial services firm based in Hong Kong, our businesses are materially affected by the financial markets and economic conditions in Hong Kong, China, and elsewhere in the world. Escalations of the tensions that affect trade relations may lead to slower growth in the global economy in general, which in turn could negatively affect our clients' businesses and materially reduce demand for our services, thus potentially negatively affect our business, financial condition, and results of operations.

We may be subject to legal and financial liabilities in connection with the retail financial advisory and insurance brokerage businesses we engaged in previously.

Prior to 2015, we engaged in retail financial advisory and insurance brokerage businesses, which were regulated by the Hong Kong Confederation of Insurance Brokers and the HKSFC. On 23 September 2019, the Hong Kong Insurance Authority took over the regulation of insurance intermediaries from the Hong Kong Confederation of Insurance Brokers.Majority of the operations under such legacy businesses began to terminate in 2015 and the businesses were ultimately disposed of in 2018. Although we no longer carry out retail financial advisory and insurance brokerage businesses, we may be subject to regulatory complaints or claims lodged against us by previous clients in relation to the past services provided by us under the legacy businesses as we were the named insurance broker in certain insurance arrangements between our previous clients and the insurance company under these past businesses. Any action brought against us, with or without merits, may result in administrative measures, settlements, injunctions, fines, penalties, negative publicities, or other results adverse to us, which could have a material adverse effect on our reputation, business, financial condition, results of operations, and prospects. Even if we are successful in defending ourselves against these actions, the costs of such defence may be significant.

We may need additional funding but may not be able to obtain it on favorable terms or at all.

We may require additional funding for further growth and development of our business, including any investments or acquisitions we may decide to pursue. If our existing resources are insufficient to satisfy our requirements, we may seek to issue additional equity or debt securities or obtain new or expanded credit facilities. Our ability to obtain external financing in the future is subject to a variety of uncertainties, including our future financial condition, results of operations, cash flows, share price performance, liquidity of international capital and lending markets, and the Hong Kong financial industry. Pursuant to the terms of the medium term notes issued by our Controlling Shareholder, so long as the notes remain outstanding, our Controlling Shareholder will not and will ensure that none of its subsidiaries, including us, create or have outstanding any mortgage, charge, lien, pledge, or other security interest, upon the whole or any part of its present or future undertaking, assets, or revenues to secure any indebtedness in the form of bonds, notes, debentures, loan stock, or other securities that are, or are intended to be, listed or traded on any stock exchange or over-the-counter or other securities market. This provision may affect our ability to obtain external financing through the issuance of debt securities in the public market. In addition, incurring indebtedness would subject us to increased debt service obligations and could result in operating and financing covenants that would restrict our operations. We cannot assure you that we will be able to secure financing in a timely manner or in amounts or on terms favorable to us, or at all. Any failure to raise needed funds on terms favorable to us, or at all, could severely restrict our liquidity as well as have a material adverse effect on our business, financial condition, and results of operations. Moreover, any issuance of equity or equity-linked securities could result in significant dilution to our existing shareholders.

We may be exposed to legal or regulatory liabilities if we are unable to protect the personal and sensitive data and confidential information of our clients.

We collect, store, and process certain personal and sensitive data from our clients, particularly under our asset management business. We are required to protect the personal and sensitive data and confidential information of our clients under applicable laws, rules, and regulations. While we have taken steps to protect the personal and sensitive data and confidential information of clients that we have access to, our security measures could be breached. The relevant authorities may impose sanctions or issue orders against us if we fail to protect the personal and sensitive data and confidential information of our clients, and we may have to compensate our clients if we fail to do so. We routinely transmit and receive personal and sensitive data and confidential information of our clients through the internet and other electronic means. Any misuse or mishandling of such personal and sensitive data and confidential information could result in legal liabilities, regulatory actions, reputational damage to us, which could in turn materially and adversely affect our business, financial condition, and results of operations.

If our insurance coverage is insufficient, we may be subject to significant costs and business disruption.

Although we carry office, computer, and vehicle insurance for our properties, professional indemnity insurance for certain of our regulated activities, directors and officers insurance, employee compensation insurance, and license holders insurance in connection with our securities dealing business covered by the Type 1 license granted by the HKSFC against fidelity and crime risks, we cannot assure you that we have sufficient insurance to cover all aspects of our business operations. We are in the process of purchasing key-man insurance coverage, and we consider our insurance coverage to be reasonable in light of the nature of our business, but we cannot assure you that our insurance coverage is sufficient to prevent us from any loss or that we will be able to successfully claim our losses under our current insurance policies on a timely basis, or at all. If we incur any loss that is not covered by our insurance policies, or the compensated amount is significantly less than our actual loss, our business, financial condition, and results of operations could be materially and adversely affected.

If we fail to maintain an effective system of internal control over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations, or prevent fraud.

We are a public company in the United States and subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act of 2002 and the rules and regulations of the NYSE. Section 404 of the Sarbanes-Oxley Act, or Section 404, will require us to include a report from management on the effectiveness of our internal control over financial reporting in our annual report on Form 20-F beginning with our annual report for the fiscal year ending 31 December 2020. In addition, once we cease to be an "emerging growth company" as such term is defined in the JOBS Act, our independent registered public accounting firm must attest to and report on the effectiveness of our internal control over financial reporting. Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing, may issue an adverse report if it is not satisfied with our internal control or the level at which our control is documented, designed, operated, or reviewed, or if it interprets relevant requirements differently from us.

In addition, our internal control over financial reporting will not prevent or detect all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system's objectives will be met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud will be detected.

During the course of documenting and testing of our internal control procedures, in order to satisfy the requirements of Section 404, we may identify other weaknesses and deficiencies in our internal control over financial reporting. In addition, if we fail to maintain proper and effective of our internal control over financial reporting, as these standards are modified, supplemented, or amended from time to time, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404. If we fail to achieve and maintain an effective internal control environment, we could suffer material misstatements in our financial statements and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial information. This could in turn limit our access to capital markets, harm our results of operations, and lead to a decline in the trading price of our Class A Shares. Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the stock exchange on which we list, regulatory investigations, and civil or criminal sanctions. We may also be required to restate our financial statements from prior periods.

We may face intellectual property infringement claims, which could be time-consuming and costly to defend and may result in the loss of significant rights by us.

Although we have not been subject to any litigation, pending or threatened, alleging infringement of third parties' intellectual property rights, we cannot assure you that such infringement claims will not be asserted against us in the future. Third parties may own copyrights, trademarks, trade secrets, ticker symbols, internet content, and other intellectual properties that are similar to ours in jurisdictions where we currently have no active operations. If we expand our business to or engage in other commercial activities in those jurisdictions using our own copyrights, trademarks, trade secrets, and internet content, we may not be able to use these intellectual properties or face potential lawsuits from those third parties and incur substantial losses if we fail to defend ourselves in those lawsuits. We have policies and procedures in place to reduce the likelihood that we or our employees may use, develop, or make available any content or applications without the proper licenses or necessary third-party consents. However, these policies and procedures may not be effective in completely preventing the unauthorized posting or use of copyrighted material or the infringement of other rights of third parties.

Intellectual property litigation is expensive and time-consuming and could divert resources and management attention from the operation of our business. If there is a successful claim of infringement, we may be required to alter our services, cease certain activities, pay substantial royalties and damages to, and obtain one or more licenses from third parties. We may not be able to obtain those licenses on commercially acceptable terms, or at all. Any of those consequences could cause us to lose revenues, impair our client relationships and harm our reputation.

Any failure to protect our intellectual property could harm our business and competitive position.

We maintain a number of registered domain names and, although we do not currently own any registered trademarks, we may in the future acquire new intellectual property such as trademarks, copyrights, domain names, and know-how. We will rely on a combination of intellectual property laws and contractual arrangements to protect our intellectual property rights. It is possible that third parties may copy or otherwise obtain and use our trademarks without authorization or otherwise infringe on our rights. We may not be able to successfully pursue claims for infringement that interfere with our ability to use our trademarks, website, or other relevant intellectual property or have adverse impact on our brand. We cannot assure you that any of our intellectual property rights would not be challenged, invalidated, or circumvented, or such intellectual property will be sufficient to provide us with competitive advantages. In addition, other parties may misappropriate our intellectual property rights, which would cause us to suffer economic or reputational damages.

The audit report included in this Introductory Document is prepared by an auditor whose work may not be inspected fully by the Public Company Accounting Oversight Board and, as such, you may be deprived of the benefits of such inspection.

Our independent registered public accounting firm that issues the audit report included in this Introductory Document, as auditors of companies that are traded publicly in the United States and a firm registered with the U.S. Public Company Accounting Oversight Board, or the PCAOB, is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards.

Our auditors have many clients with substantial operations in China, and the PCAOB has been unable to conduct inspections of the work of our auditors and their affiliated independent registered public accounting firms in China, without the approval of the PRC authorities. Thus, our auditors and their affiliated independent registered public accounting firms in China and their audit work are not currently inspected fully by the PCAOB. In May 2013, the PCAOB announced that it had entered into a Memorandum of Understanding on Enforcement Cooperation with the China Securities Regulatory Commission, or the CSRC, and the PRC Ministry of Finance, which establishes a cooperative framework between the parties for the production and exchange of audit documents relevant to investigations undertaken by the PCAOB, the CSRC, or the PRC Ministry of Finance in the United States and China, respectively. The PCAOB continues to be in discussions with the CSRC and the PRC Ministry of Finance to permit joint inspections in China of audit firms that are registered with the PCAOB and audit China-based, U.S.-listed companies. On 7 December 2018, the SEC and the PCAOB issued a joint statement highlighting continued challenges faced by the U.S. regulators in their oversight of financial statement audits of U.S.-listed companies with significant operations in China. However, it remains unclear what further actions, if any, the SEC and PCAOB will take to address the problem.

Inspections of other firms that the PCAOB has conducted outside of China have identified deficiencies in those firms' audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The lack of PCAOB inspections in China prevents the PCAOB from regularly evaluating our auditors' audit procedures and quality control procedures as they relate to their work, and their affiliated independent registered public accounting firms' work, in China. As a result, investors may be deprived of the benefits of such regular inspections.

The inability of the PCAOB to conduct full inspections of auditors in China makes it more difficult to evaluate the effectiveness of our auditors' audit procedures and quality control procedures as compared to auditors who primarily work in jurisdictions where the PCAOB has full inspection access. Investors may lose confidence in our reported financial information and procedures and the quality of our financial statements.

Fluctuations in the value of Renminbi and regulatory controls on the convertibility and offshore remittance of Renminbi may adversely affect our results of operations and financial condition.

Many of our clients are Chinese nationals, institutions, or corporates, and they are subject to the relevant controls of the PRC government as well as risks relating to foreign currency exchange rate fluctuations. The change in value of Renminbi against Hong Kong dollars and other currencies is affected by various factors, such as changes in political and economic conditions in China. Any significant revaluation of Renminbi may materially and adversely affect the cash flows, revenues, earnings, and financial position of our Chinese clients. In addition, the PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, currency remittance out of China. Since 2016, the PRC government has tightened its foreign exchange policies and stepped up its scrutiny of outbound capital movement. In addition, under the existing regulations on offshore investment, approval from or registration with appropriate government authorities is required when Renminbi is to be converted into foreign currency for the purpose of offshore investment. Revaluation of the Renminbi and PRC laws and regulations in connection with the convertibility of the Renminbi into foreign currencies or offshore remittance of the Renminbi may limit the ability of our Chinese clients to engage our services, especially in our asset management business, which may in turn have a material adverse effect on our results of operations and financial condition.

We may be affected by the currency peg system in Hong Kong.