AMTD IDEA Group

April 14, 2022

Page 12

| 6. | At the onset of Part I., please revise to provide prominent disclosure of the specific consequences to you and your investors if you, or your subsidiaries: (i) do not receive or maintain such permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, or (iii) applicable laws, regulations, or interpretations change and you are required to obtain such permissions or approvals in the future. |

The Company respectfully advises the Staff that it will, in response to the Staff’s comment, add the following disclosure at the outset of Part I of its future annual report on Form 20-F, starting with its 2021 Form 20-F, subject to necessary updates and adjustments in connection with any material development of the subject matter being disclosed:

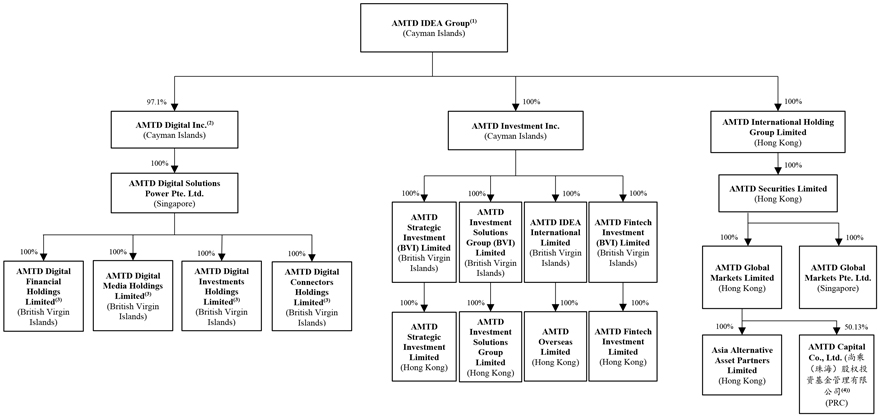

“Permissions Required from the PRC Authorities for Our Operations

We believe that we and our subsidiaries, to the extent applicable, have obtained the requisite licenses and approvals that are material for our operations in China as of the date of this annual report. Specifically, AMTD Capital Co., Ltd., or AMTD Capital, is a PRC company in which we currently hold 50.13% of equity interest. AMTD Capital is not a significant subsidiary pursuant to Rule 1-02(w) of Regulation S-X. Further, as of the date of this annual report, we do not have any material operation in Mainland China and we have not collected, stored, or managed any personal information in Mainland China. As such, we believe we are not required to obtain any permission from PRC authorities to operate and issue our securities to foreign investors as of the date of this annual report, including permissions from the China Securities Regulatory Commission, or the CSRC, or the Cyberspace Administration of China, or the CAC. If (i) we do not receive or maintain any permission or approval required of us, (ii) we inadvertently concluded that certain permissions or approvals have been acquired or are not required, or (iii) applicable laws, regulations, or interpretations thereof change and we become subject to the requirement of additional permissions or approvals in the future, we may have to expend significant time and costs to procure them. If we are unable to do so, on commercially reasonable terms, in a timely manner or otherwise, we may become subject to sanctions imposed by the PRC regulatory authorities, which could include fines and penalties, proceedings against us, and other forms of sanctions, and our ability to conduct our business, invest into Mainland China as foreign investments or accept foreign investments, or list on a U.S. or other overseas exchange may be restricted, and our business, reputation, financial condition, and results of operations may be materially and adversely affected. See also “Item 3. Key Information— D. Risk Factors—Risks Relating to Doing Business in Mainland China and Hong Kong—The PRC government’s significant authority to intervene in or influence the Mainland China operations of an offshore holding company at any time could limit our ability to transfer or use our cash outside of PRC, and could otherwise result in a material adverse change to our business operations, including our Hong Kong operations and cause the ADSs to significantly decline in value or become worthless,” “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in Mainland China and Hong Kong—Uncertainties arising from the legal system in China, including uncertainties regarding the interpretation and enforcement of PRC laws and the possibility that regulations and rules can change quickly with little advance notice, could hinder our ability to offer or continue to offer the ADSs, result in a material adverse change to our business operations, and damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause the ADSs to significantly decline in value or become worthless,” and “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in Mainland China and Hong Kong—If we were to be required to obtain any permission or approval from the CSRC, the CAC, or other PRC authorities in connection with our overseas offering under PRC law, we may be fined or subject to other sanctions, and our business, reputation financial condition, and results of operations may be materially and adversely affected.””

12