If Carvana made errors in developing or validating its credit scoring models, trained or validated its models on incomplete, inaccurate, or biased data sets, or used model development or validation techniques that result in bias or instability, Carvana may fail to gauge credit risk as expected and make credit decisions that result in higher delinquencies and credit losses.

Carvana’s credit scoring models are generally developed and validated on samples of consumer data and loan performance pertaining to a distinct period of time in the past. Changes in the macroeconomy, consumer behavior, creditor reporting behavior, and third party data reporting methods between a model’s development and validation periods and between a model’s development period and when the model is used by Carvana could materially impact the relationship between inputs to Carvana’s models and expected credit outcomes, resulting in a reduction of the ability of Carvana’s credit scoring models to assess credit risk as expected.

Carvana’s credit scoring models rely heavily on data obtained from third parties, including credit bureaus. If the data Carvana obtains from third parties for use in its models is incomplete, inaccurate, biased, or not provided consistent with the methods and practices used by such third parties during the time period of the sample upon which Carvana built or validated our models, the output of Carvana’s models may be unreliable and fail to properly quantify credit risk, resulting in it making credit decisions that result in higher delinquencies and credit losses.

Further, Carvana’s credit scoring models were built prior to the global outbreak of COVID-19, and consequently may not adequately take into account the longer-term impact of social, economic and financial disruptions caused by the pandemic.

Information provided to Carvana by customers, credit data partners, and others may be incorrect or fraudulent, and Carvana’s Verification Process may fail to ensure that reliable information is incorporated into the extension of credit offers to Carvana’s customers, resulting in higher than anticipated delinquencies and credit losses on the Receivables

In deciding whether to extend credit to customers and the parameters of such credit offers, Carvana relies heavily on information furnished to it by customers, credit data partners, and others, and such data may be incorrect or fraudulent. Carvana has developed a Verification Process that attempts to ensure that information considered by its proprietary financing technology belongs to the customer(s) receiving a credit offer, and that such information is reasonably accurate. There is no guarantee that Carvana’s Verification Process will perform as expected, detect fraudulent or incorrect data, or otherwise achieve its goals, which may result in credit loss and delinquency rates on the Receivables being higher than anticipated.

Further, Carvana utilizes identity and fraud checks based on customer provided documents and inputs, as well as data provided by external databases to authenticate each customer’s identity. There have been instances in the past in which these checks have failed or been ineffective, and there is a risk that these checks could also fail or be ineffective in the future, which could result in significant losses related to fraud being borne by investors in the Securities. Fraudulent activity or significant increases in fraudulent activity could also lead to regulatory intervention, negatively impacting the operating results and reputation of both Carvana and the Servicer.

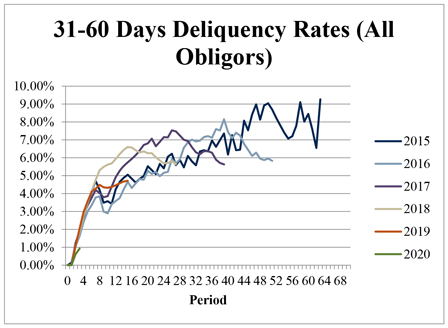

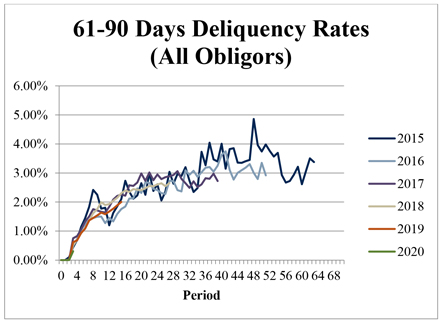

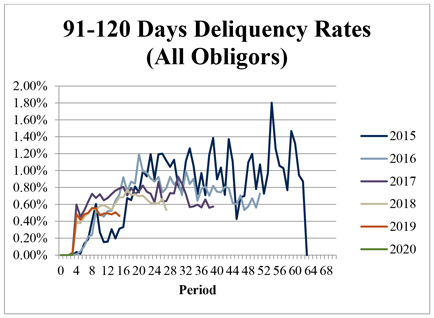

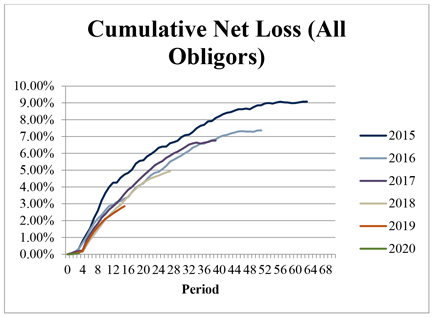

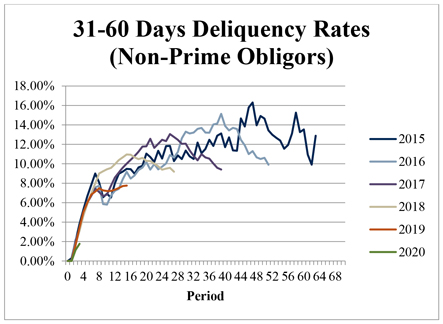

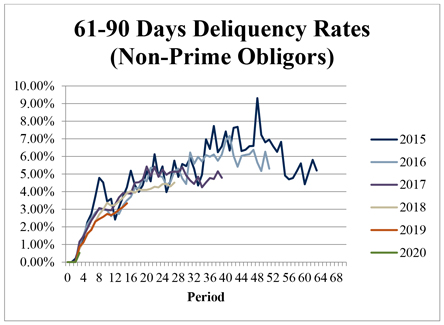

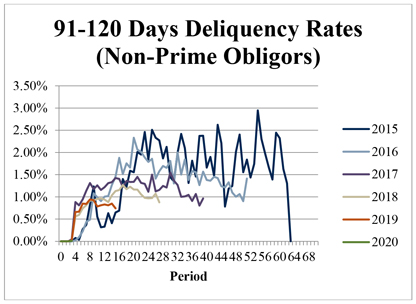

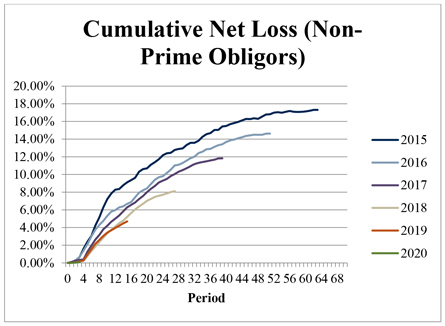

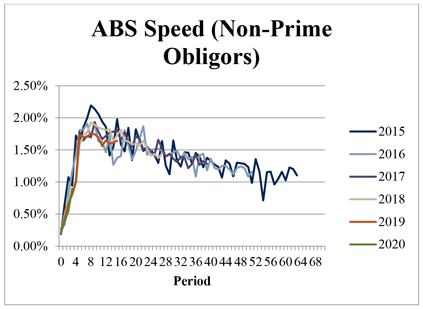

Historical loss experience may not accurately predict the likelihood of delinquencies, defaults and losses on the Receivables

Historical loss and delinquency information as set forth in this Prospectus under “Historical Performance” are affected by several variables, including general economic conditions and market interest rates, that are expected to differ in the immediate future, and are likely to differ in the longer term future. Consequently, the net loss experience calculated and presented in this Prospectus with respect to Carvana’s managed portfolio may not reflect actual experience with respect to the Receivables in the Pool. Further, the prices of used vehicles, including the prices at which the Servicer is able to sell repossessed vehicles, are variable, and such prices declined following the outbreak of COVID-19 and may decline again in the future, resulting in increased credit losses on defaulted Receivables. In addition, future delinquency rates, rates of repossession, recovery rates on repossessed vehicles or loss experience with respect to the Receivables may be better or worse than that set forth in the static pool information and historical delinquency and loss information contained in this Prospectus. Consequently, payments on the Notes could be adversely affected.

Economic developments may adversely affect the performance of the Receivables and the market value of your Securities

The United States has entered into a recession of unknown length and severity, which may adversely affect the performance of the Receivables and the performance and market value of your Notes. Periods of economic slowdown or recession are often characterized by high unemployment and diminished availability of credit, generally resulting in increases in delinquencies, defaults, repossessions and losses on automobile loans.

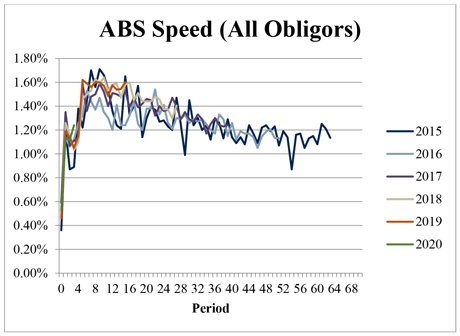

If an economic downturn is experienced for a prolonged period of time, it is expected that delinquencies will increase and losses on the Receivables could increase, which could result in losses on your Securities. An improvement in economic conditions could result in prepayments by the obligors of their payment obligations under the Receivables, either because obligors elect to make payments more frequently or in larger-than-required amounts or because obligors sell the financed vehicles more frequently in connection with the purchase of new vehicles. As a result, you may receive principal payments of your Notes earlier than anticipated.

Market factors may reduce the value of used vehicles, which could result in increased losses on the Receivables

Vehicles that are repossessed are typically sold at vehicle auctions. The pricing of used cars is affected by the supply and demand for those cars, which, in turn, is affected by consumer demand and tastes, recalls, economic factors (including the price of gasoline and closure of dealerships), the introduction and pricing of new car models and other factors, including legislation related to emissions and fuel efficiency. Decisions by a manufacturer with respect to new vehicle production and brands, pricing and incentives may affect used

8