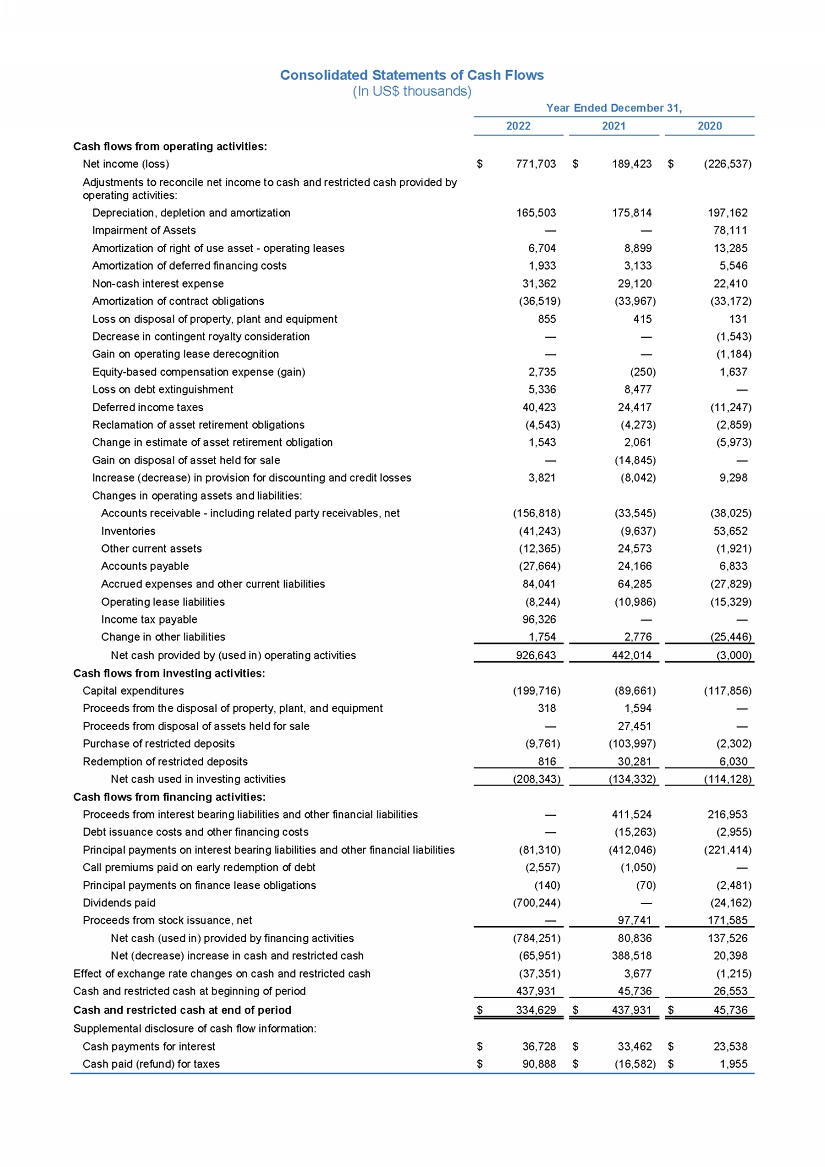

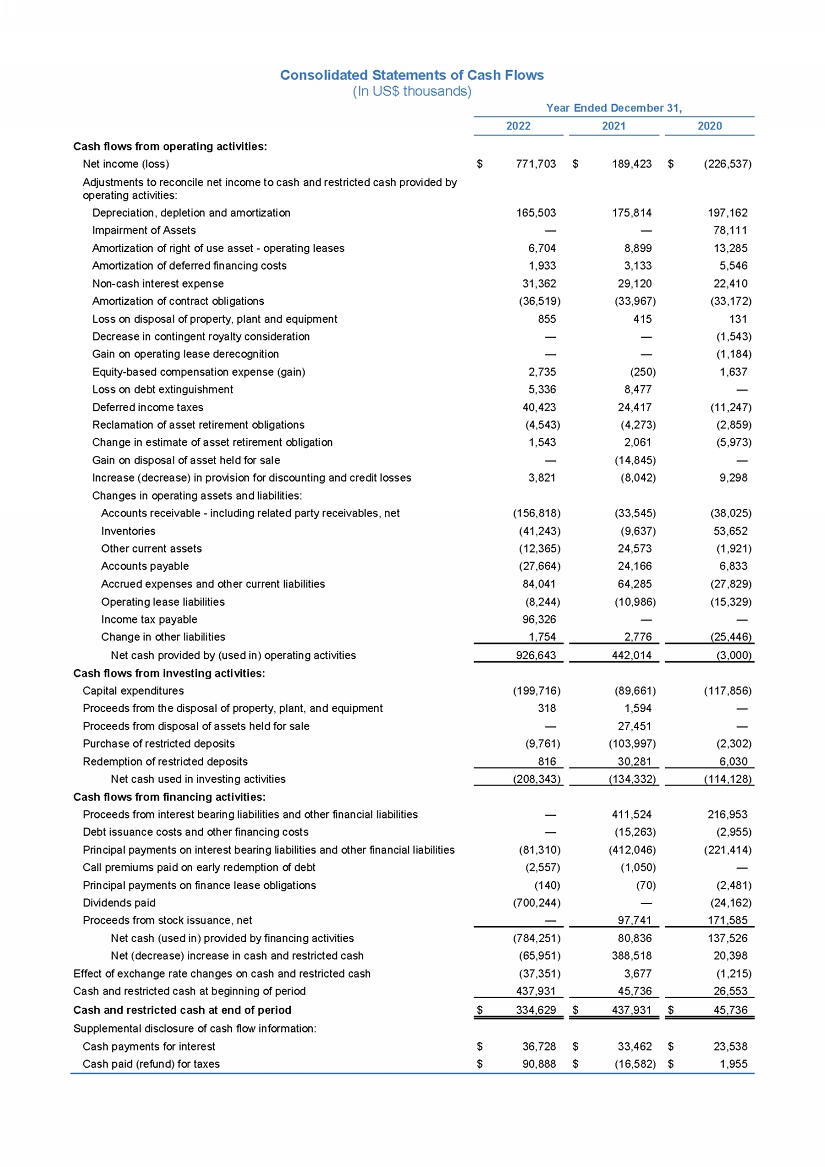

| Consolidated Statements of Cash Flows (In US$ thousands) Year Ended December 31, 2022 2021 2020 Cash flows from operating activities: Net income (loss) $ 771,703 $ 189,423 $ (226,537) Adjustments to reconcile net income to cash and restricted cash provided by operating activities: Depreciation, depletion and amortization 165,503 175,814 197,162 Impairment of Assets — — 78,111 Amortization of right of use asset - operating leases 6,704 8,899 13,285 Amortization of deferred financing costs 1,933 3,133 5,546 Non-cash interest expense 31,362 29,120 22,410 Amortization of contract obligations (36,519) (33,967) (33,172) Loss on disposal of property, plant and equipment 855 415 131 Decrease in contingent royalty consideration — — (1,543) Gain on operating lease derecognition — — (1,184) Equity-based compensation expense (gain) 2,735 (250) 1,637 Loss on debt extinguishment 5,336 8,477 — Deferred income taxes 40,423 24,417 (11,247) Reclamation of asset retirement obligations (4,543) (4,273) (2,859) Change in estimate of asset retirement obligation 1,543 2,061 (5,973) Gain on disposal of asset held for sale — (14,845) — Increase (decrease) in provision for discounting and credit losses 3,821 (8,042) 9,298 Changes in operating assets and liabilities: Accounts receivable - including related party receivables, net (156,818) (33,545) (38,025) Inventories (41,243) (9,637) 53,652 Other current assets (12,365) 24,573 (1,921) Accounts payable (27,664) 24,166 6,833 Accrued expenses and other current liabilities 84,041 64,285 (27,829) Operating lease liabilities (8,244) (10,986) (15,329) Income tax payable 96,326 — — Change in other liabilities 1,754 2,776 (25,446) Net cash provided by (used in) operating activities 926,643 442,014 (3,000) Cash flows from investing activities: Capital expenditures (199,716) (89,661) (117,856) Proceeds from the disposal of property, plant, and equipment 318 1,594 — Proceeds from disposal of assets held for sale — 27,451 — Purchase of restricted deposits (9,761) (103,997) (2,302) Redemption of restricted deposits 816 30,281 6,030 Net cash used in investing activities (208,343) (134,332) (114,128) Cash flows from financing activities: Proceeds from interest bearing liabilities and other financial liabilities — 411,524 216,953 Debt issuance costs and other financing costs — (15,263) (2,955) Principal payments on interest bearing liabilities and other financial liabilities (81,310) (412,046) (221,414) Call premiums paid on early redemption of debt (2,557) (1,050) — Principal payments on finance lease obligations (140) (70) (2,481) Dividends paid (700,244) — (24,162) Proceeds from stock issuance, net — 97,741 171,585 Net cash (used in) provided by financing activities (784,251) 80,836 137,526 Net (decrease) increase in cash and restricted cash (65,951) 388,518 20,398 Effect of exchange rate changes on cash and restricted cash (37,351) 3,677 (1,215) Cash and restricted cash at beginning of period 437,931 45,736 26,553 Cash and restricted cash at end of period $ 334,629 $ 437,931 $ 45,736 Supplemental disclosure of cash flow information: Cash payments for interest $ 36,728 $ 33,462 $ 23,538 Cash paid (refund) for taxes $ 90,888 $ (16,582) $ 1,955 |