SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2021

Commission File Number: 001-38954

_____________________

LINX S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

Avenida Doutora Ruth Cardoso, 7,221

05425-902 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: ý Form 40-F: o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)): o

1) Information on the agenda of the Special Meeting.

| 1.1. | Setting the limit for the amount of the annual global compensation of the Company's managers |

| 1.1.1. | Objectives of the compensation policy or practice |

The global compensation of the statutory board and members of the Board of Directors is set in Shareholders' Meeting, in the form of Article 152 of Law No. 6.404/76 and Paragraph 3 of Article 161 of Law No. 6.404/76.

The Company's compensation practice aims to recognize the performance of executives and add value to Shareholders. The practice adopted for annual compensation is in line with the Brazilian executive market. Salary studies are carried out annually, with the support of renowned international consultancies, such as Willis Towers Watson, in order to assess the competitiveness of the compensation practiced by the Company in relation to the market.

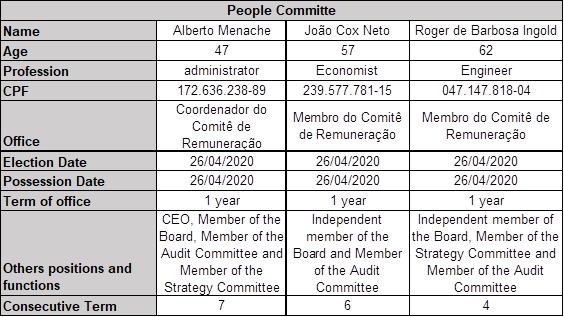

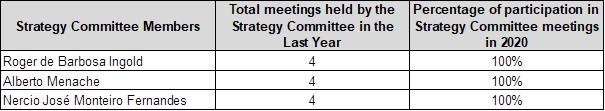

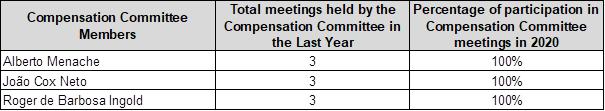

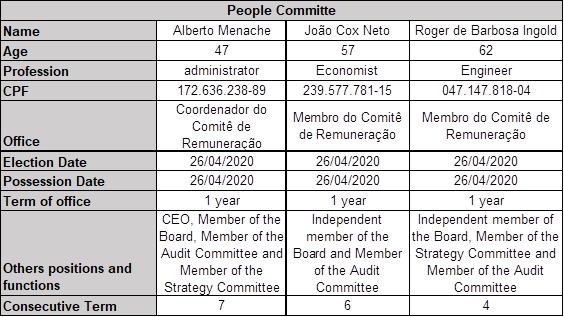

Management compensation proposals are prepared by the Company's People Committee, composed of three (3) members of the Board of Directors, two (2) of whom are independent members, guaranteeing exemption in the management's proposal and proposing corporate goals.

The corporate goals, on which the payment of the variable and stock-based compensation installments depend, consider the characteristics of the operations of each Executive Board, and seek to foster the indicators of customer satisfaction, employee satisfaction, profitability and revenue.

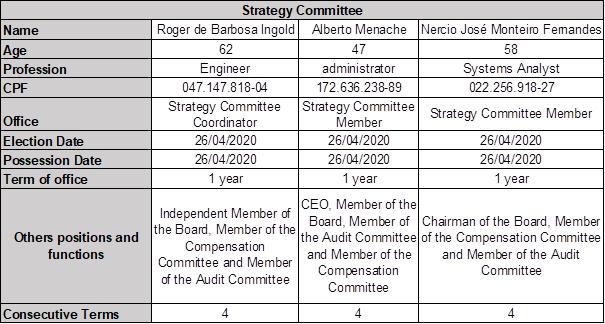

Further details on the organizational structure can be found in item 13.1. of Exhibit II of this Manual.

| 1.1.2. | Composition of the Company's management compensation |

Management's compensation consists of pro-labore, bonuses, benefits, ordinary granting of Stock Option Plans, ordinary granting of Deferred Stocks and, in specific cases, extraordinary granting of Deferred Stocks.

Any member of the Company's management may benefit from the Company's ordinary Stock Option and Deferred Stocks (Stock-Based Compensation) grant, and specific executives who impact the Company's long-term strategy may also receive grant extraordinary stock-based compensation.

| 1.1.2.1. | Stock-Based Compensation of the Company's management |

In 2020, the amount allocated to the Company for stock-based compensation was BRL 9,739,013.00 (nine million seven hundred and thirty-nine thousand and thirteen Brazilian Reais). The details of the grant can be seen in items 13.4 and following of Exhibit II of this Manual.

In the fiscal year 2021, the Company did not allocate amounts for stock-based compensation, the compensation being composed only of pro-labore (fixed compensation), bonus (variable compensation) and benefits.

1.1.3. Available documents

The Company presents the management compensation proposal below, as well as additional information contained in item 13 of the Company's Reference Form, in the form of Exhibit II to this Manual.

| 1.1.4. | Management Proposal |

The Management's proposal for the Special Meeting is to approve, for the fiscal year to end on December 31, 2021, the maximum global compensation for the Management (Board of Directors and Statutory Board), the total amount of BRL 26,578,847.00.

| 1.2. | Election of the members of the Board of Directors of the Company |

| 1.2.1. | Procedures for the election of members of the Board of Directors |

| 1.2.1.1. | How members of the Board of Directors can be elected |

The election of the members of the Board of Directors of the Company may be carried out through two (2) voting systems: (a) by slate (“Voting by Slate”) or (b) by multiple vote (“Multiple Voting Process”), as described below:

| 1.2.1.2. | Multiple Voting Definition |

The Multiple Voting process is a procedure whereby each share is assigned as many votes as there are positions to be filled on the Board of Directors, with the shareholder being recognized the right to cumulate the votes in a single candidate or distribute them among several candidates.

Company shareholders, representing at least 5% (five percent) of the capital stock, may request, in writing, the adoption of the Company's multiple voting process.

| 1.2.1.3. | Term for requesting the adoption of the Multiple Voting process |

According to the Brazilian Corporation Law, shareholders who intend to request the use of the multiple voting process must do so in writing to the Company within 48 (forty-eight) hours before the Meeting is held.

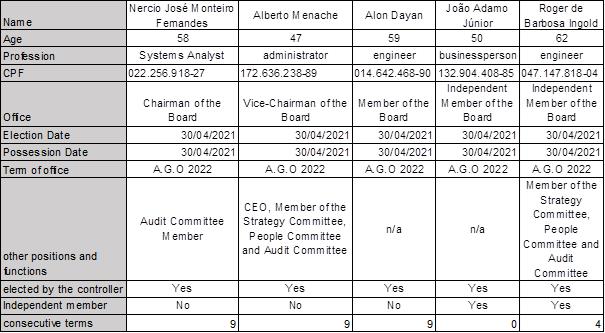

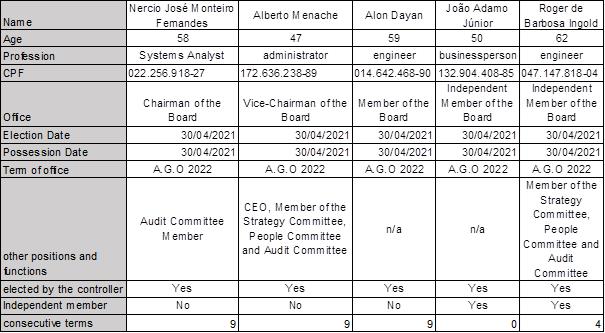

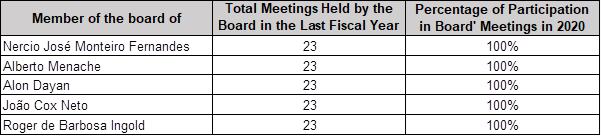

The following slate, made up of five (5) effective members, will be submitted to the shareholders' appreciation, with a term of office beginning immediately after their election (with the end of the term of the Directors currently in office) and until the Annual Meeting to be held in 2021.

Slate:

| (i) | Nercio José Monteiro Fernandes - Chairman of the Board of Directors |

| (ii) | Alberto Menache - Deputy Chairman of the Board of Directors |

| (iv) | João Adamo Junior (Independent Director) |

| (v) | Roger de Barbosa Ingold (Independent Director) |

The current term of office of the members of the Board of Directors ends at 2021 Annual Meeting that approves the financial statements of 12.31.2020. However, in view of the announcement contained in the material fact disclosed by the Company on 3.29.2021, which realizes that there will be a delay in the disclosure of the financial statements for the year ended on 12.31.2020, the management understands that, in compliance with the CVM's position on the matter, it gives the Company's shareholders the opportunity to elect the Board of Directors within the term originally established in the corporate calendar, that is, up to 4.30.2021. For this reason, at the special meeting to be held on 4.30.2021, the members of the Board of Directors will be elected and those elected will take office immediately after the election for a new term until the 2022 Annual Meeting that approves the financial statements of 12.31.2021.

| 1.2.2. | Available documents |

The documents containing the main information of each of the members of the proposed slate for the Board of Directors, including those contained in items 12.5 to 12.10 of the Reference Form attached to CVM Instruction 480, is contained in this Manual in its Exhibit III.

| 1.2.3. | Management Proposal |

The management recommends the aforementioned members to the Company's Board of Directors with a term of office beginning immediately after their election (with the end of the term of Directors currently in office) and until the Shareholders' Ordinary Meeting to be held in 2022, which will approve the management accounts for the fiscal year ended on December 31, 2022, as it understands that said members will be able to continue the general orientation of the Company's business and decide on strategic issues.

Exhibit I - Management compensation - Items 13.1 to 13.16 of the Linx S.A. Reference Form pursuant to CVM Instruction 481/09

13.1 - Description of the Compensation Policy or Practice, Including the Non-Statutory Board

a. objectives of the compensation policy or practice, informing whether the compensation policy has been formally approved, the body responsible for its approval, the date of approval and, if the issuer discloses the policy, locations on the World Wide Web where the document can be consulted

The Company does not have a formally approved compensation policy, but does adopt compensation practices that it considers to be adequate and are in line with that practiced in the market in general. In addition, the Company has a People Committee (formerly called the Compensation Committee), of a permanent nature, whose duties are described in item 12.1 of the Reference Form.

Among the objectives that govern the Company's compensation practice, the following can be highlighted:

| · | Reward the members of the Company's management in a competitive way compared to its competitors; |

| · | Align the interests of the Company's Management Members with those of the Shareholders; |

| · | Stimulate the search for high performance, applying meritocracy; and |

| · | Attract, retain and engage high-performance professionals who have personal values in line with the Company's culture. |

The Company uses as a reference to guide its total compensation practices, the third quartile of its selected market. In order to give greater consistency to the comparison with market practices, the Company used the GGS - Global Grading System methodology, by Willis Towers Watson, an international Human Resources consulting company, which was hired to describe, evaluate and organize the Company's positions in salary levels and compose its compensation table. Such methodology uses a mixed approach of job evaluation and ranking, which allows determining the relative value of jobs for the Company's business.

Based on interviews with key executives to understand the Company's business and strategy, as well as analysis of job descriptions, Willis Towers Watson carried out the application of two methodologies, through three steps:

| · | business evaluation: sales, number of employees, diversity of products and services, market complexity; |

| · | establishment of ranges: definition through a decision tree and identification of managerial careers and individual contribution; and |

| · | job classification / evaluation: functional knowledge, business specialization, leadership, problem-solving, impact of added value to the business and interpersonal skills. |

b. composition of the compensation, indicating:

| i. | description of elements of compensation and objectives of each one of them |

Board of Directors and Committees

The annual fixed compensation is the basic element of the compensation of the independent members of the Board of Directors and of the members of the Committees, being composed of a monthly compensation, as a pro-labore, defined according to the individual negotiation, oriented, among other factors; the time devoted to functions, competence and professional reputation and the value of services in the market of each member, as well as surveys of compensation of the sector of activity and of companies of similar size to ours. The independent members of the Board of Directors also participate in the Company's deferred share plans.

Non-independent members of the Board of Directors, including those who participate in Committees, do not receive compensation.

In addition, expenses spent by members of the Board of Directors and Committees, for transportation, accommodation, meals and/or other expenses related to attending specific meetings and collaborating in the provision of assistance to our practices, may be reimbursed, upon receipt of proof of said expense by the Director or members of the Committees.

Board

The total compensation of the officers is defined according to the individual negotiation, guided, among other factors, by the time dedicated to the functions, the competence and the professional reputation and the value of the services in the market of each member.

They are also eligible to participate in a short-term incentive plan linked to the achievement of financial indicators and operational performance (bonuses) or long-term incentive plan (ILP), the amounts of which are calculated on multiples of their monthly salary.

In addition, all Company officers are eligible to participate in the Company's stock-based compensation plans and deferred share grant plans. The grants are made annually, considering the monthly salary earned in the year in reference by such beneficiary. The purpose of the plans is to attract and retain the managers and employees of the Company and the companies that are under its direct or indirect control, giving them the opportunity, subject to certain conditions, to become shareholders of the Company, with a view to: (i) reward them for their positions and length of service at the Company; (ii) stimulate the achievement of the Company's objectives; (iii) align the interests of the Company's managers with those of the shareholders; and (iv) encourage performance and favor retention in the Company, insofar as their participation in the capital stock will allow them to benefit from the results to which they have contributed and are reflected in the appreciation of their share price.

Finally, all Company officers receive the following benefits:

| • | Medical and hospital assistance; |

| • | Vehicle designated according to hierarchical level. |

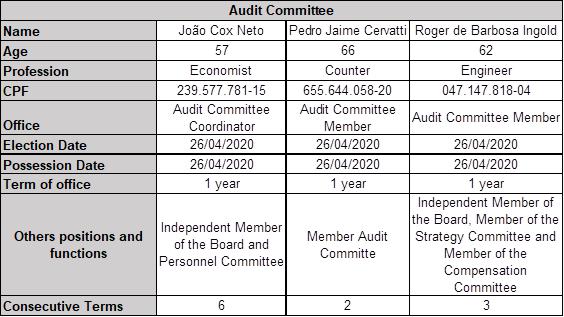

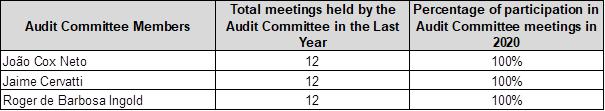

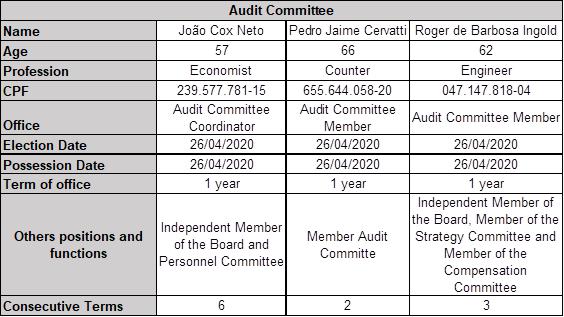

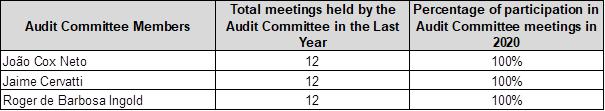

Audit Committee

The members of the Audit Committee, if and when installed, will have their compensation determined by the Shareholders' Meeting, in accordance with the applicable legislation.

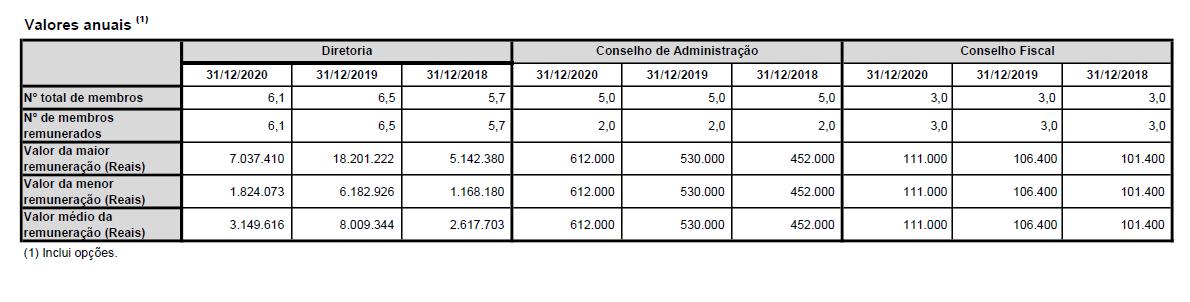

| ii. | in relation to the last three fiscal years, what is the proportion of each element in the total compensation |

The tables below show the proportion of each element in the composition of the total compensation for the last three fiscal years:

| Proportion of each element in the total compensation | Salary or pro-labore | Direct and indirect benefits | Bonus | Stock-based | Total | | |

| | |

| | |

| 2021E | | |

| Statutory Management | 33.0% | 1.2% | 65.8% | 0.0% | 100.0% | | |

| Board of Directors(1) | 100.0% | - | - | - | 100.0% | | |

| Audit Committee | 100.0% | - | - | - | 100.0% | | |

| 2020 | | |

| Statutory Management | 39.0% | 1.5% | 26.5% | 32.9% | 100.0% | | |

| Board of Directors(1) | 66.7% | 0.0% | 0.0% | 33.3% | 100.0% | | |

| Audit Committee | 100.0% | - | - | - | 100.0% | | |

| 2019 | | |

| Statutory Management | 13.7% | 0.6% | 9.1% | 76.5% | 100.0% | | |

| Board of Directors(1) | 67.9% | 0.0% | 0.0% | 32.1% | 100.0% | | |

| Audit Committee | 100.0% | 0.0% | 0.0% | 0.0% | 100.0% | | |

| 2018 | | |

| Statutory Management | 42.4% | 0.7% | 27.9% | 29.1% | 100.0% | | |

| Board of Directors(1) | 75.2% | 0.0% | 0.0% | 24.8% | 100.0% | | |

| Audit Committee | 100.0% | 0.0% | 0.0% | 0.0% | 100.0% | | |

| 1) The statutory officers who accumulate the position of members of the Board of Directors have waived their compensation. | |

The Company clarifies that in the last three fiscal years and in the current fiscal year, the managers who are members of the statutory committees have not received any specific compensation for their participation in the respective committees.

| iii. | calculation and adjustment methodology for each of the elements of compensation |

The maximum global amount to be paid to the managers and members of the audit committee as compensation is determined by the Shareholders' Meeting, the maximum global compensation being within the limits imposed by article 152 of the Brazilian Corporation Law.

The total individual compensation of statutory and non-statutory officers is based on market references for positions of similar complexity in a Company of a similar size to ours, whose information is obtained through independent research. The readjustment index for said compensation is determined by the Board of Directors.

| iv. | reasons that justify the composition of the compensation |

The Company recognizes that different types of compensation are necessary to achieve the objectives proposed by its policy, as described above and aiming at alignment and competitiveness vis-à-vis the market, in addition to a greater balance of total compensation, each of the compensation elements was determined in order to achieve the Company's goals, as well as aligning the interests of its managers and investors, with short- and long-term results.

| v. | the existence of unpaid members by the issuer and the reason for this fact |

As provided for in the Company's Articles of Incorporation, some members of the Board of Directors who are also members of the statutory or non-statutory board are entitled exclusively to the compensation received as officers. Some directors who have a relevant shareholding waived their compensation.

c. main performance indicators that are considered in determining each element of compensation

When determining the salary, the Company adopts criteria based on the values practiced in the market, without neglecting its results and the intention of making its compensation plan attractive compared to its competitors. The variable elements of compensation tend to reflect the Company's performance in the period and to consider the achievement of the individual objectives and goals of the managers and executives, including the achievement of goals proposed by the Board of Directors.

The individual goals consider the characteristics of the operations of each Executive Board, and seek to promote the indicators of customer satisfaction, employee satisfaction, profitability and revenue.

d. how compensation is structured to reflect the evolution of performance indicators

Compensation policies and practices are developed so that the total compensation is aligned with the market, with a good balance between fixed and variable compensation and that reflects the individual and Company results, in the short and long term and generating value to shareholders. The People Committee has the role of evaluating and monitoring market practices, as well as proposing eventual adjustments due to financial results and the achievement of operational goals, within the program of activities and respective budgets.

e. how the compensation policy or practice aligns with our short-, medium- and long-term interests

The Company's compensation policy aims to create a balance in compensation that allows attraction, retention and engagement and rewards its executives for performance, contribution and added value to the business.

The annual bonus policy allows the Company to reward its managers in the short term when it encourages the achievement of the proposed goals. Considering that the Company executives may become shareholders through stock option plans and deferred stock options, this perspective promotes the Company's sustainable development in the search for long-term growth and profitability. The union of these elements becomes an important tool in retaining managers and executives.

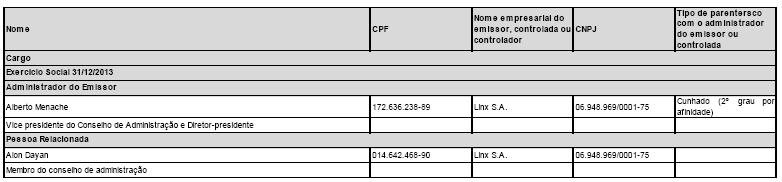

f. existence of compensation supported by subsidiaries, controlled companies or direct or indirect controllers

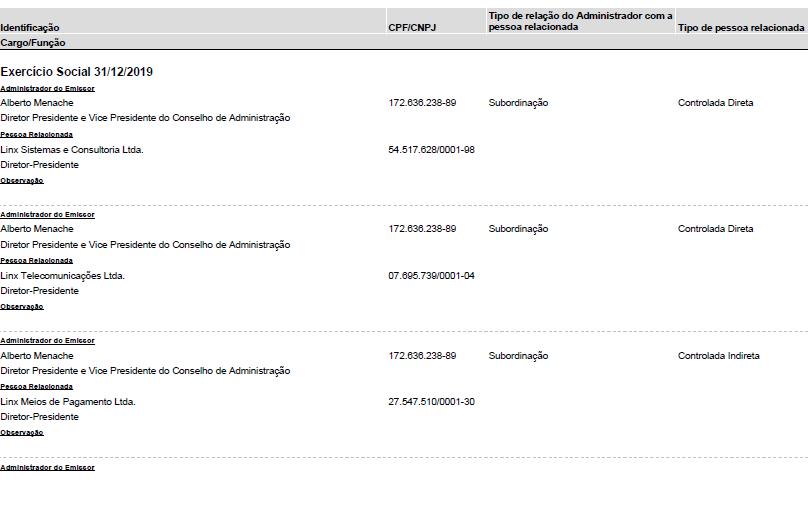

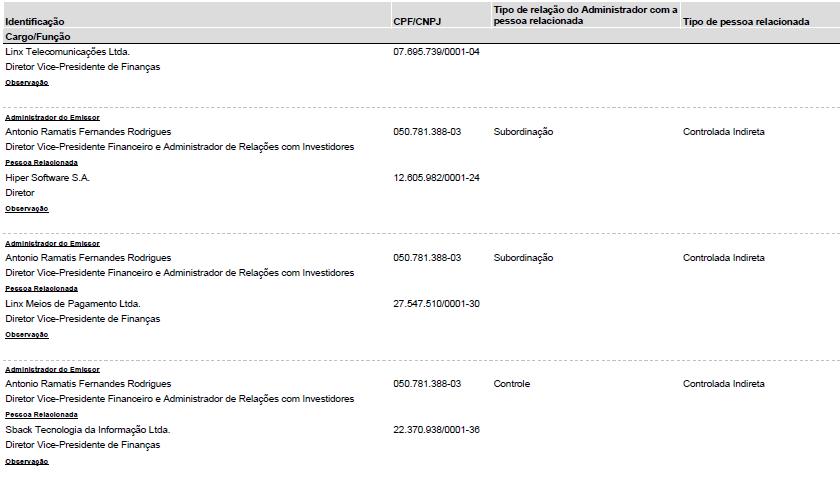

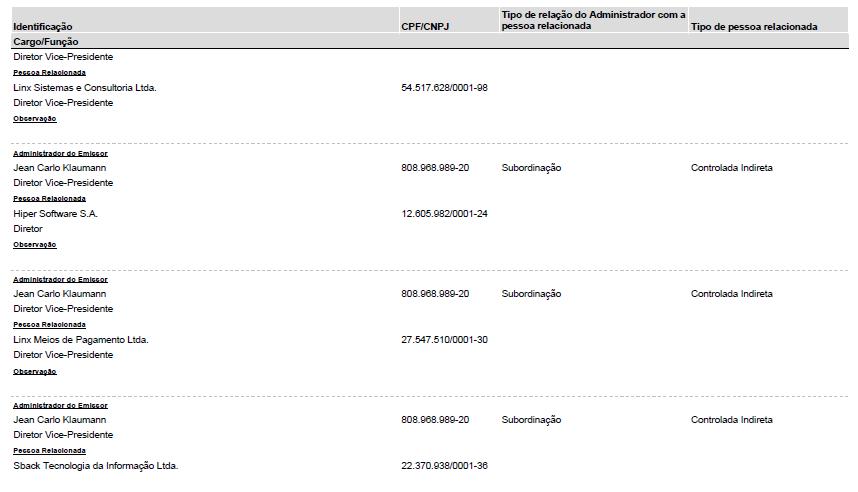

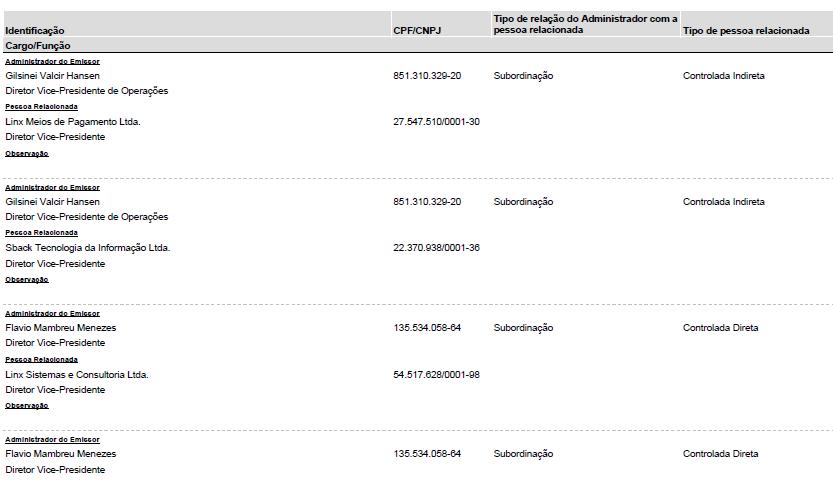

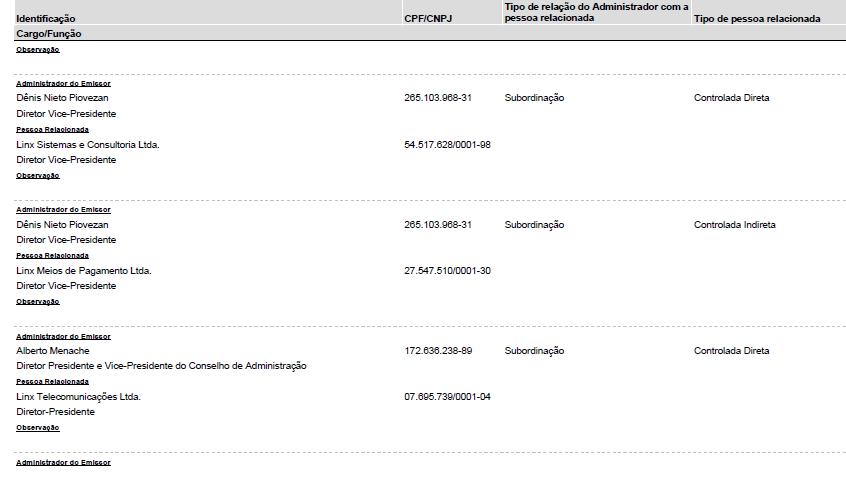

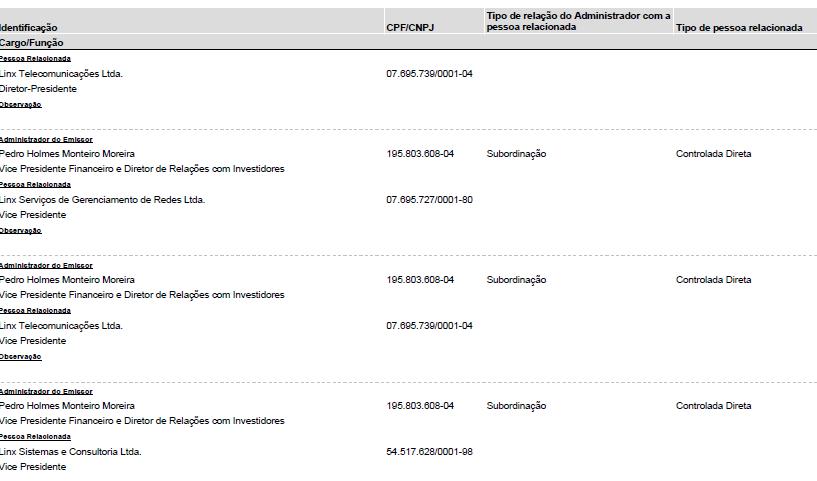

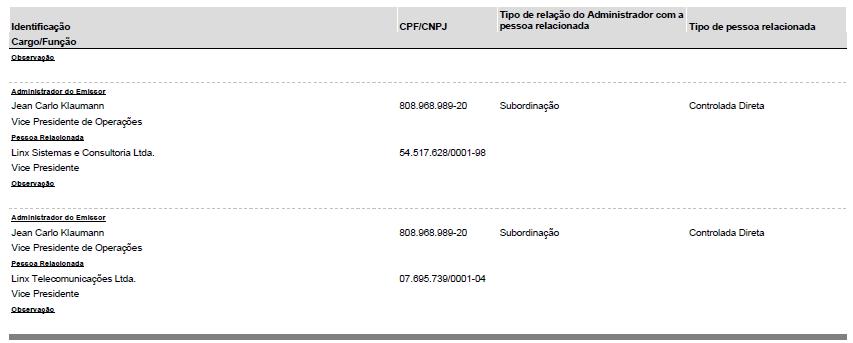

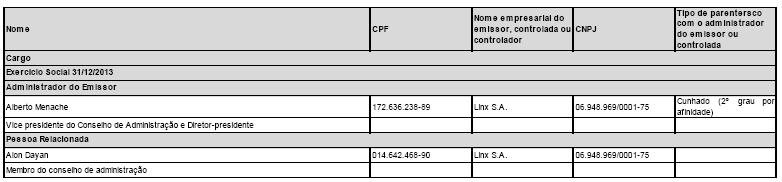

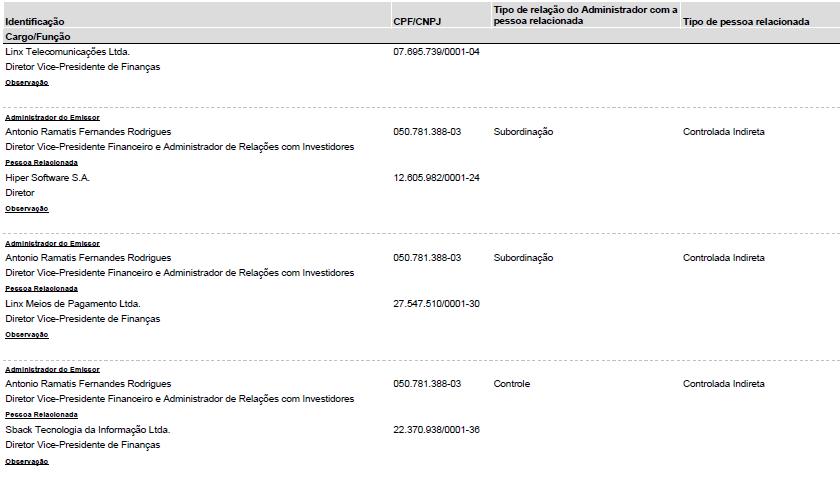

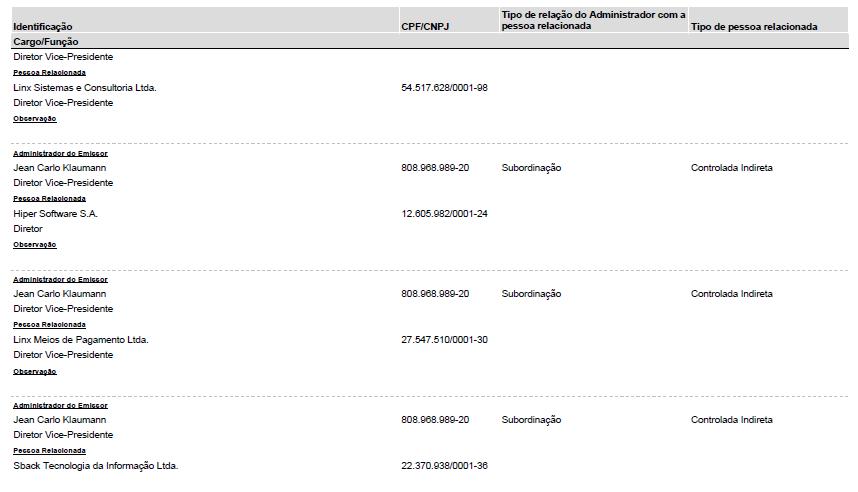

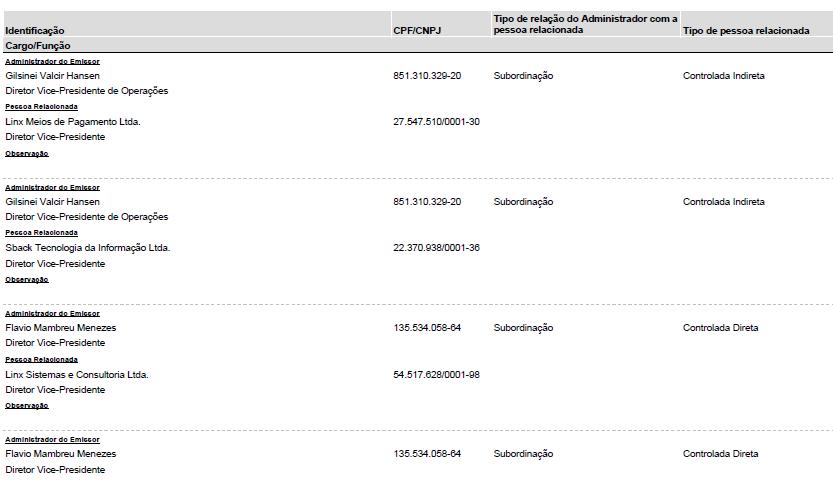

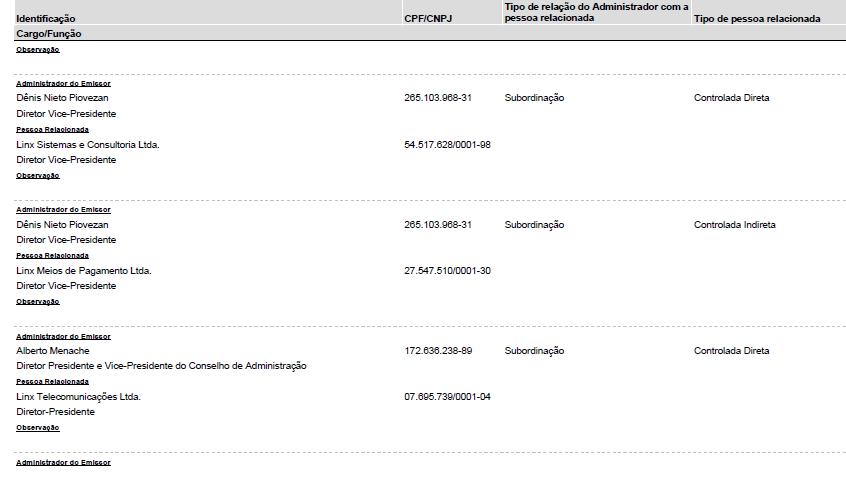

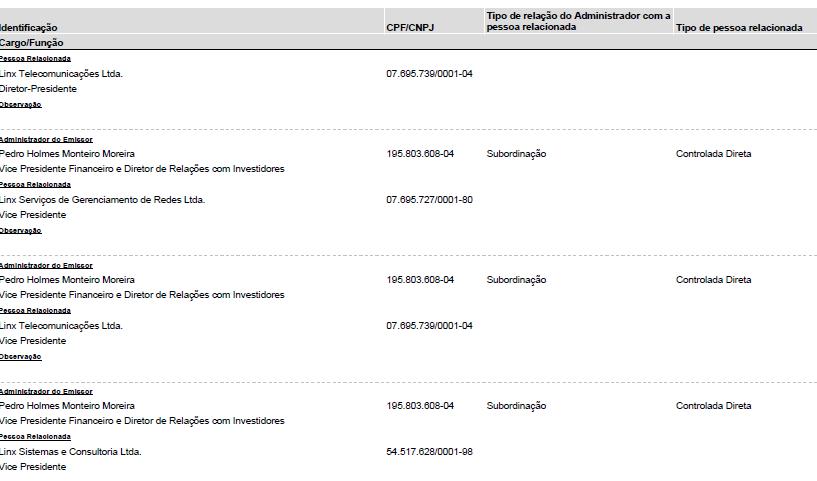

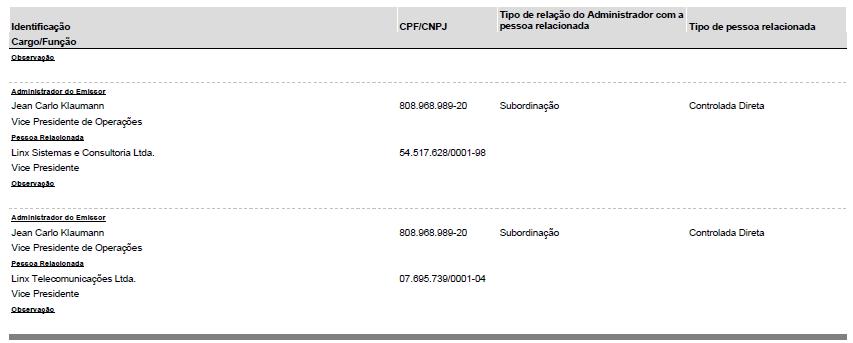

The compensation of the Company's statutory officers is paid by the subsidiary Linx Sistemas e Consultoria Ltda., as shown in item 13.15.

g. existence of any compensation or benefit linked to the occurrence of a specific corporate event, such as the sale of corporate control

As of this date, there is no compensation or benefit linked to the occurrence of a specific corporate event.

h. practices and procedures adopted by the Board of Directors to define the individual compensation of the Board of Directors and the board, indicating:

| i. | the issuer's bodies and committees that participate in the decision-making process, identifying how they participate |

The Shareholders' Meeting will fix, annually, the global compensation of the managers, and the Board of Directors will fix the global and individual compensation of the Officers.

| ii. | criteria and methodology used to determine individual compensation, indicating whether studies are used to verify market practices, and, if so, the comparison criteria and the scope of these studies |

The members of the Board of Directors and the Executive Board will receive a fixed monthly fee, defined according to individual negotiation, guided, among other factors, by salary surveys of the Company's activity segment.

The recommendations related to the compensation of the Company's managers and executives are prepared by the Personnel Committee, composed of three (3) members of the Board of Directors, two (2) of whom are independent members. This composition aims to guarantee the exemption in the preparation of proposals related to compensation, in particular the proposition of individual and corporate goals to which the portions of variable compensation and share-based compensation are related.

| iii. | how often and how the Board of Directors assesses the adequacy of the issuer's compensation policy |

The Board of Directors, with the support of internationally renowned consultancies, annually updates its studies on our compensation policy, assessing whether the compensation paid by the Company matches the position, responsibilities and workload of each member, considering, also, the Company's financial and economic situation and the economic context of its segment.

13.2 - Total compensation of the Board of Directors, statutory board and audit committee

| Total compensation foreseen for the current Fiscal Year 2021 - Annual Values |

| | Board of Directors | Statutory Management | Total |

| Total number of members(1) | 5.0 | 6.0 | 11.0 |

| Number of paid members(1) | 2.0 | 6.0 | 8.0 |

| Fixed annual compensation |

| Salary or pro-labore | 1,224,000 | 8,372,000 | 9,596,000 |

| Direct and indirect benefits | - | 306,847 | 306,847 |

| Participation in committees | - | - | - |

| Others | - | - | - |

| Variable compensation |

| Bonus | - | 16,676,000 | 16,676,000 |

| Profit sharing | - | - | - |

| Attendance in meetings | - | - | - |

| Commissions | - | - | - |

| Others | - | - | - |

| Post-employment | - | - | - |

| Position cancelation | - | - | - |

| Stock-based | - | - | - |

| Total compensation | 1,224,000 | 25,354,847 | 26,578,847 |

| The amounts presented already include the amounts paid by the Company's subsidiaries, as detailed in item 13.15 below. |

| |

(1) The Company pays the INSS on the payroll as a percentage of its revenue (rate of 4.5%), pursuant to Law No. 12.546. Therefore, there is no payment of INSS as a percentage of the individual share of Company executives. |

| |

(remainder of the page intentionally left blank)

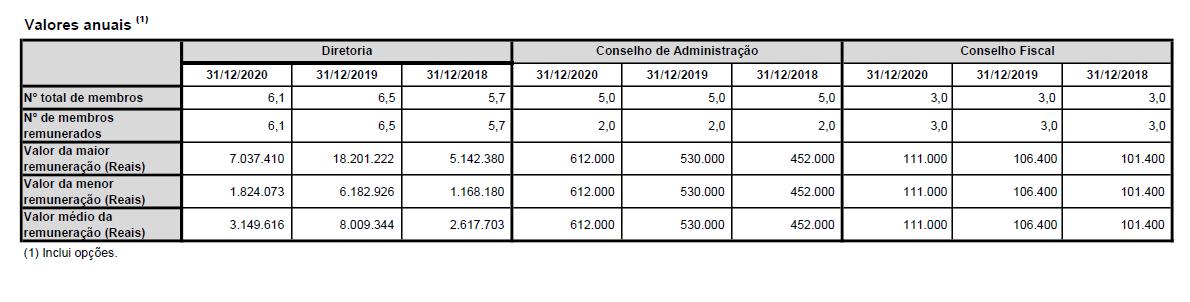

| Total compensation for the fiscal year 12/31/2020 - annual amounts |

| | Board of Directors | Statutory Management | Audit Committee(4) | Total |

| Total number of members(1) | 5.0 | 6.1 | 6.0 | 17.1 |

| Number of paid members(1) | 2.0 | 6.1 | 3.0 | 11.1 |

| Fixed annual compensation |

| Salary or pro-labore | 816,000 | 7,481,086 | 333,000 | 8,630,086 |

| Direct and indirect benefits | - | 291,188 | - | 291,188 |

| Participation in committees | - | - | - | - |

| Others | - | - | - | - |

| Variable compensation |

| Bonus | - | 5,083,891 | - | 5,083,891 |

| Profit sharing | - | - | - | - |

| Attendance in meetings | - | - | - | - |

| Commissions | - | - | - | - |

| Others (2) | - | - | - | - |

| Post-employment | - | - | - | - |

| Position cancelation | - | - | - | - |

| Stock-based | 408,000 | 6,304,000 | - | 6,712,000 |

| Total compensation | 1,224,000 | 19,160,166 | 333,000 | 20,717,166 |

The amounts presented already include the amounts paid by the Company's subsidiaries, as detailed in item 13.15 below. |

(1) The decimal place (0.5) refers to the position of Investor Relations Officer. |

| (2) The Company pays the INSS on the payroll as a percentage of its revenue (rate of 4.5%), pursuant to Law No. 12.546. Therefore, there is no payment of INSS as a percentage of the individual share of Company executives. |

| |

(remainder of the page intentionally left blank)

| Total compensation for the fiscal year 12/31/2019 - annual amounts |

| | Board of Directors | Statutory Management | Audit Committee | Total |

| Total number of members(1) | 5.0 | 6.5 | 6.0 | 17.5 |

| Number of paid members(1) | 2.0 | 6.5 | 3.0 | 11.5 |

| Fixed annual compensation |

| Salary or pro-labore | 720,000 | 7,121,471 | 319,200 | 8,160,671 |

| Direct and indirect benefits | - | 312,502 | - | 312,502 |

| Participation in committees | - | - | - | - |

| Others (3) | - | - | - | - |

| Variable compensation |

| Bonus | - | 4,682,510 | - | 4,682,510 |

| Profit sharing | - | - | - | - |

| Attendance in meetings | - | - | - | - |

| Commissions | - | - | - | - |

| Others (2) | - | - | - | - |

| Post-employment | - | - | - | - |

| Position cancelation | - | - | - | - |

| Share-based (3) | 340,000 | 39,944,256 | - | 40,284,256 |

| Total compensation | 1,060,000 | 52,060,739 | 319,200 | 53,439,939 |

| The amounts presented already include the amounts paid by the Company's subsidiaries, as detailed in item 13.15 below. |

| (1) The decimal place (0.5) refers to the election and resignation of Mr. Andelaney Carvalho dos Santos and Alexandre Kelemen, election of Mr. Antonio Ramatis, Denis Piovezan and dismissal of Mr. Pedro Holmes |

| (2) The Company pays the INSS on the payroll as a percentage of its revenue (rate of 4.5%), pursuant to Law No. 12.546. Therefore, there is no payment of INSS as a percentage of the individual share of Company executives. |

| (3) The share-based compensation was calculated considering: deferred ordinary stocks granted on January 22, 2019 and deferred stocks related to Linx Pay ILP that were granted on May 13, 2019. For more information, see items 13.05 and 13.16. |

| Total compensation for the current fiscal year 12/31/2018 - annual values |

| | Board of Directors | Statutory Management | Audit Committee | Total |

| Total number of members(1) | 5.0 | 5.7 | 6.0 | 16.7 |

| Number of paid members(1) | 2.0 | 5.7 | 3.0 | 10.7 |

| Fixed annual compensation |

| Salary or pro-labore | 680,000 | 6,322,975 | 304,200 | 7,307,175 |

| Direct and indirect benefits | - | 103,079 | - | 103,079 |

| Participation in committees | - | - | - | - |

| Others (3) | - | - | - | - |

| Variable compensation |

| Bonus | - | 4,155,603 | - | 4,155,603 |

| Profit sharing | - | - | - | - |

| Attendance in meetings | - | - | - | - |

| Commissions | - | - | - | - |

| Others (3) | - | - | - | - |

| Post-employment | - | - | - | - |

| Position cancelation | - | - | - | - |

| Stock-based(2) (3) | 224,000 | 4,339,250 | - | 4,563,250 |

| Total compensation | 904,000 | 14,920,906 | 304,200 | 16,129,106 |

| The amounts presented already include the amounts paid by the Company's subsidiaries, as detailed in item 13.15 below. |

| (1) The increase in the number of statutory officers of Linx S.A. refers to the election of Mr. Pedro Holmes Monteiro Moreira at a meeting of the Board of Directors held on 10/16/2017 and the decimal place (0.7) refers to the resignation of Mr. Dennis Herskowicz on 9/17/2018. |

| (2) The amount disclosed as "share-based compensation" consists of the total of stocks options and deferred stocks granted based on their fair value on the date of the grant, that is, based on the competence regime. The net effect of the exercise of the options vested by the Company's management (cash regime) in 2018 was BRL 151,405.92. The difference between the budgeted amount and the real is explained by the resignation of Mr. Dennis Herszkowicz in September 2018. |

| (3) The Company pays the INSS on the payroll as a percentage of its revenue (rate of 4.5%), pursuant to Law No. 12.546. Therefore, there is no payment of INSS as a percentage of the individual share of Company executives. |

13.3 - Variable Compensation of the Board of Directors, Statutory Board and Audit Committee

| 2021 | Board of Directors | Statutory Management | Audit Committee | Total |

| Total number of members | 5.0 | 6.0 | - | 17.0 |

| Number of members receiving compensation | 2.0 | 6.0 | - | 11.0 |

| Short-term variable compensation (in BRL thousand) |

| Minimum amount estimated in the compensation plan | - | - | - | - |

| Maximum amount estimated in the compensation plan | - | 16,676,000 | - | 16,676,000 |

| Amount foreseen in the compensation plan - goals achieved | - | 16,676,000 | - | 16,676,000 |

| Amount effectively recognized | - | - | - | - |

| Long-term variable compensation (in BRL thousand) |

| Minimum amount estimated in the compensation plan | - | - | - | - |

| Maximum amount estimated in the compensation plan | - | - | - | - |

| Amount foreseen in the compensation plan - goals achieved | - | - | - | - |

| Amount effectively recognized | - | - | - | - |

| 2020 | Board of Directors | Statutory Management | Audit Committee | Total |

| Total number of members | 5.0 | 6.1 | 6.0 | 17.1 |

| Number of members receiving compensation | 2.0 | 6.1 | 3.0 | 11.1 |

| Short-term variable compensation (in BRL thousand) |

| Minimum amount estimated in the compensation plan | - | - | - | - |

| Maximum amount estimated in the compensation plan | - | 5,083,891 | - | 5,083,891 |

| Amount foreseen in the compensation plan - goals achieved | - | 5,083,891 | - | 5,083,891 |

| Amount effectively recognized | - | - | - | - |

| Long-term variable compensation (in BRL thousand) |

| Minimum amount estimated in the compensation plan | - | - | - | - |

| Maximum amount estimated in the compensation plan | - | - | - | - |

| Amount foreseen in the compensation plan - goals achieved | - | - | - | - |

| Amount effectively recognized | - | - | - | - |

| 2019 | Board of Directors | Statutory Management | Audit Committee | Total |

| Total number of members | 5.0 | 6.5 | 6.0 | 17.5 |

| Number of members receiving compensation | 2.0 | 6.5 | 3.0 | 11.5 |

| Short-term variable compensation (in BRL thousand) |

| Minimum amount estimated in the compensation plan | - | - | - | - |

| Maximum amount estimated in the compensation plan | - | 4,682,510 | - | 4,682,510 |

| Amount foreseen in the compensation plan - goals achieved | - | 4,682,510 | - | 4,682,510 |

| Amount effectively recognized | - | - | - | - |

| Long-term variable compensation (in BRL thousand) |

| Minimum amount estimated in the compensation plan | - | - | - | - |

| Maximum amount estimated in the compensation plan | - | - | - | - |

| Amount foreseen in the compensation plan - goals achieved | - | - | - | - |

| Amount effectively recognized | - | - | - | - |

| 2018 | Board of Directors | Statutory Management | Audit Committee | Total |

| Total number of members | 5.0 | 5.7 | 6.0 | 16.7 |

| Number of members receiving compensation | 2.0 | 5.7 | 3.0 | 10.7 |

| Short-term variable compensation (in BRL thousand) |

| Minimum amount estimated in the compensation plan | - | - | - | - |

| Maximum amount estimated in the compensation plan | - | 4,155,603 | - | 4,155,603 |

| Amount foreseen in the compensation plan - goals achieved | - | 4,155,603 | - | 4,155,603 |

| Amount effectively recognized | - | - | - | - |

| Long-term variable compensation (in BRL thousand) |

| Minimum amount estimated in the compensation plan | - | - | - | - |

| Maximum amount estimated in the compensation plan | - | - | - | - |

| Amount foreseen in the compensation plan - goals achieved | - | - | - | - |

| Amount effectively recognized | - | - | - | - |

13.4 - Stock-Based Compensation Plan of the Board of Directors and Statutory Board

a. general terms and conditions

The Company approved its stock option plan (“Stock Option Plan”) at a Special Meeting held on December 4, 2012, April 27, 2016 and January 23, 2019 and its stock option plan deferred stocks (“Deferred Stock Plan”) in a Special Meeting held on April 27, 2016 and January 23, 2019. The Plans are managed by the Company's Board of Directors, assisted by the Personnel Committee, which has broad powers to take all necessary and appropriate measures for the management of the Plans, including:

(a) the creation and application of general rules related to the granting of stock options and deferred stocks under the terms of the Plans and the resolution of doubts regarding the interpretation of the Plans;

(b) the establishment of goals related to the performance of the Company's top executives, in order to establish objective criteria for the appointment of employees and managers who will receive purchase options or deferred stocks, under the terms of the respective Plans (“Beneficiaries”);

(c) the election of the Beneficiaries and the authorization to grant options to purchase stocks and deferred stocks in their favor, establishing all the conditions of the stock options and deferred stocks to be granted, as well as the modification of such conditions when necessary to adapt the options and actions deferred to the terms of the law, rule or supervening regulation; and (d) the issuance of new stocks of the Company within the limit of the authorized capital or the sale of stocks held in treasury, to satisfy the exercise of stock options and deferred stocks granted under the terms of the Plans.

The Board of Directors may approve, within the scope of the Plans, annually or at another periodicity or special occasion that it deems appropriate, Stock Option Programs and Deferred Stock Programs (“Programs”), in which the Participants, the number of Stock Options and/or Deferred Stocks, the calculation of the exercise price, the distribution of Stock Options and/or Deferred Stocks among the Participants, the effective date and the other respective specific rules of each Program, subject to the general terms and conditions established in the Plans.

Among the officers and employees of the Company and its subsidiaries, the following are eligible for the Plans (i) officers; (ii) senior managers; or (iii) other Company employees, at the discretion of the Board of Directors. In the case of the Deferred Stock Plan, the Company's External Directors are also eligible.

The granting of stock options for deferred stocks and stocks under the terms of the Plans is carried out by entering into agreements between the Company and the Beneficiaries, which shall specify, without prejudice to other conditions determined by the Board of Directors or the Personnel Committee (depending on the case): (a) the number of stocks that are the subject of the grant; (b) the terms and conditions for acquiring the right to exercise the option; (c) the deadline for exercising the stock option; and (d) the exercise price and payment terms (“Agreement”).

The Board of Directors of the Company, within the discretion granted to it under the Plans, with the objective of reinforcing the retention of key Company executives and ensuring compliance with Linx Pay business plan, the People Committee, recommended to the Company's Board of Directors the approval of a long-term incentive program (ILP) based on deferred actions for the Company's managers (the Linx Pay Long-Term Incentive Plan).

One of the main compensation consultants in the market, Towers Watson, was hired to support the People Committee in building the model for this ILP Program, based on the best market practices.

Objectives:

b. main objectives of the plans

The Plans aim to attract and retain the managers and employees of the Company and the companies that are under its direct or indirect control, granting to the managers and employees of the Company the opportunity, subject to certain conditions, to become shareholders of the Company, with a view to: (i) reward them for their positions and length of service at the Company or its subsidiaries; (ii) stimulate the achievement of the Company's corporate objectives; (iii) align the interests of the Company's shareholders with those of the Company's or its Subsidiaries' managers; and (iv) encourage performance and favor the retention of the Company, insofar as their participation in the institution's capital stock will allow them to benefit from the results to which they have contributed and are reflected in the appreciation of their stock price.

In the specific case of Linx Pay's Long-Term Incentive Plan, it has a fundamental role in retaining the Company's key executives who have been harassed by several companies in the market, mainly after the launch of Linx Pay. We compete for these executives with large, more capitalized companies with aggressive compensation packages and other privately held ones that have a lower governance structure than Linx and that, therefore, can make proposals far above the current packages of these executives. The proposed ILP program is in line with the above objective, translated into annual revenue and contribution margin targets over five years that release the annual vesting according to the criteria below:

c. how plans contribute to these goals

By enabling the managers and employees of the Company and the other companies of the Company and Subsidiaries to become shareholders of the Company, it is expected that they will have strong incentives to effectively commit to the creation of value and exercise their functions in order to integrate the interests of shareholders, corporate objectives and the Company's growth plans, thus maximizing its profits. The offering of stock options and deferred stocks also encourages the Beneficiaries, through the commitment of their own resources, to seek the appreciation of the stocks, without, however, compromising the growth and future appreciation of the stocks, which are equally relevant in view of the models adopted. The adopted models hope to be effective as mechanisms for retaining managers and employees, mainly due to the sharing of the appreciation of the Company's stocks.

d. how plans fit into the Company's compensation policy

The Company has a policy of valuing the individual merit of employees, based on the achievement of operational and financial goals and individual performance. The Plans are instruments that encourage good individual performance and commitment to business goals.

e. how the plans align the interests of managers and the Company in the short, medium and long term

The Plans align the interests of the Company and its managers through benefits according to the performance of the Company's stocks. Through the Plans, the Company seeks to encourage improvements in its management and the permanence of its executives and employees, aiming at gains through the commitment to long-term results and short-term performance. In addition, the Plans aim to enable the Company to obtain and maintain the services of high-level executives, offering such executives, as an additional advantage, to become shareholders thereof, under the terms and conditions set forth in the Plans.

f. maximum number of stocks covered

The Plans are limited to a maximum Reference Corporate Dilution of up to 5% (five percent) of the Company's capital stock on the date of approval of each Program. The “Referential Corporate Dilution” corresponds to the percentage represented by the maximum number of stocks covered by the Stock Options, deferred stocks and other outstanding rights arising from all the Company's stock-based incentive plans, on the date of approval of each Program, already exercisable or not yet exercisable, by the total number of stocks issued by the Company.

g. maximum number of stock options and deferred stocks to be granted

Each Stock Option and Deferred Stock assures the Beneficiary the right to acquire a common stock of the Company. Therefore, the number of rights granted is linked to the dilution limit described in item “f” above.

h. conditions for the acquisition of stocks

Whenever deemed convenient, the Company's Board of Directors will determine the Beneficiaries in favor of which options to purchase of stocks and deferred stocks will be granted under the terms of the Plans, the number of stocks that may be acquired with the exercise, the exercise price and the terms of its payment, the terms and conditions of exercise and any other conditions.

i. criteria for setting the acquisition or exercise price

The price to be paid by the Beneficiary to the Company for the exercise of eachStock Option shall correspond to the weighted average price per financial volume of the Company's common stocks in B3's trading sessions, which occurred in the two (2) months immediately preceding the month of the approval date of each Program.

In the event of the distribution of dividends, interest on own capital, capital refund or other cash earnings, the Exercise Price will be adjusted on the day that the stock starts to be traded “EX” in the spot market, deducting the value of the cash proceeds net of the Exercise Price, with settlement being made with “EX” securities.

j. criteria for setting the exercise period

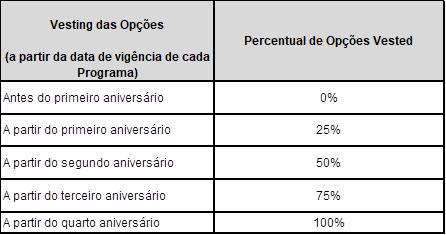

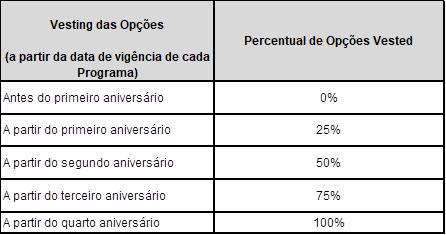

The acquisition of the right to exercise the Stock Options (“Vesting”) will occur as from the fulfillment of the grace periods of each Program, when the Stock Options will become exercisable by the Participant (“Vested Stock Options”). The Vesting of the Stock Options will occur in four annual installments of 25% (twenty-five percent), the first installment from the first anniversary of the Program's effectiveness and the remaining installments from the subsequent anniversaries, as indicated in the table below:

The Board of Directors, also, when approving each Program, will establish a lock-up period, which should cover, at least, 10% (ten percent) of the stocks acquired through the exercise of the stock options, and whose term cannot be less than one (1) month, counted from the settlement date of the exercise of the options.

The Board of Directors may, at its sole discretion, change the rules of Vesting of the Stock Option applicable to each Program, always in favor of the Beneficiary, as well as exceptionally waiving the fulfillment of the grace periods for the Stock Options.

Until 2019, the full Vesting of Deferred Stocks granted to Beneficiaries, except for external Directors[1], occurred until the 4th (fourth) anniversary of the Program's effectiveness. For grants from 2020 onwards, Vesting will be carried out under the same conditions as the Stock Options Program mentioned above. The Beneficiaries will be able to exercise Vested Stock Options during the decadent term of eight (8) years, starting from the effective date of each Program, and the exercise will be done through delivery of the competent Stock Option Exercise Term duly completed and signed by the Participant.

The Linx Pay Long-Term Incentive Plan lasts for five years with annual and proportional vesting released according to the achievement of staggered targets for gross revenue and contribution margin of Linx Pay and two-year lock-up after vesting.

k. settlement method

In order to satisfy the exercise of stock options to purchase deferred stocks and stocks granted under the terms of the Plan, the Company may, at the discretion of the Board of Directors: (a) issue new stocks within the authorized capital limit; or (b) dispose of stocks held in treasury.

l. restrictions on transfer of stocks

The Stock Options and the Deferred Stocks granted under the terms of the Plan are personal and non-transferable, and the Beneficiary may not, under any circumstances, assign, transfer or in any way alienate to any third parties, nor the rights and obligations inherent to them. The Beneficiary may not, directly or indirectly, sell, assign, exchange, dispose of, transfer, confer on the capital of another company, grant an option, or even enter into any act or agreement that results, or may result, in the sale, directly or indirectly, onerous or free of charge, the Stocks acquired through the exercise of the Stock Options, in percentage and term, to be defined by the Board of Directors when the approval of each Program (“Lock-up”).

[1]Due to the term of their mandates, the vesting of deferred stocks by independent directors is one year, with a lockup period of one more year.

m. criteria and events that, when verified, will cause the suspension, alteration or extinction of the plan

The Board of Directors, the Personnel Committee or the Investor Relations Officer (as the case may be) may determine the suspension of the right to exercise stock options and deferred stocks, whenever situations that, under the terms of the law or regulation in force, are verified, restrict or prevent the trading of stocks by the Beneficiaries.

The Company's Board of Directors and the companies involved in such operations may, at its discretion, determine, without notwithstanding other measures that decide for equity: (a) replacement of the Stock Options with stock options issued by the Company's successor company, with the appropriate adjustments in the number of Stock Options and the Exercise Price; (b) the anticipation of the Vesting of the Stock Options, so that the Stock Options can be exercised by the Participants in a timely manner to allow the inclusion of the Stocks resulting from the settlement of the exercise of the Stock Options in the operation in question; and/or (c) the redemption of the Stock Options, upon payment in cash of the amount to which the Participant would be entitled under the Plan if the Stock Options were exercised on the date of the redemption. The adjustments made to the Plan will be binding and Participants who disagree with these adjustments will have the right to waive their Stock Options.

n. effects of the manager's dismissal from the Company's bodies on his/her rights provided for in the stock-based compensation plan

As a rule, in the event of dismissal of the Beneficiary due to resignation, with or without cause, resignation or dismissal from office, retirement, permanent disability or death, the rights conferred on it under the Plans may be extinguished or modified, subject to the provided below.

If, at any time during the term of the Plans, the Beneficiary:

a) in the case of voluntary or unjustified termination, the participant will have the right to exercise Vested Stock Options, within the decadential term of 30 (thirty) days, counted from the termination date. All Stock Options not yet exercisable (“Unvested Stock Options”) will automatically be extinguished, in full right, regardless of prior notice or indemnity, any exceptions to this rule must be approved by the Board of Directors.

For the purposes of the stock-based compensation plan, the term “Voluntary Termination or Without Cause” means the termination of the Participant's legal relationship with the Company or its subsidiaries in the event of voluntary termination, dismissal, resignation, replacement or non-reelection as statutory officer and termination without cause of employment contract.

b) in the event of Termination for Cause, all Stock Options that have been granted, whether Vested Stock Options or Unvested Stock Options, will automatically be extinguished, in full right, regardless of prior notice or indemnity, any exceptions to this rule must be approved by the Board of Directors.

c) For the purposes of the stock-based compensation plan, the term “Termination for Cause” means the termination of the legal relationship of the Stock Option holder with the Linx group for cause, in the cases provided for in the Consolidation of Labor Laws, as per the wording in force at the time, in the case of Beneficiaries who are employed and, in the case of Beneficiaries who are non-employed statutory officers, the following hypotheses: (i) the Participant's negligence in the exercise of the duties arising from his or her mandate as a manager; (ii) criminal conviction related to intentional crimes; (iii) the practice, by the Beneficiaries, of dishonest or fraudulent acts against the Company or its subsidiaries or affiliates; (iv) any act or omission resulting from intent or fault of the Beneficiary and which is detrimental to the Company's business, image, or financial situation, as long as it is duly proven; (v) significant violation of the instrument that regulates the exercise of the mandate of statutory officer; (vi) non-compliance with the Articles of Incorporation, Code of Ethics and Conduct and other corporate provisions applicable to the Participant, as a manager; and (vii) non-compliance with the obligations set forth in the Brazilian Corporation Law, applicable to the managers of public limited companies, including, but not limited to, those provided for in articles 153 to 157 of the aforementioned Law, in the case of Participant Retirement, all Vested Stock Options may be exercised within the decadential term of 30 (thirty) days, counted from the date of Retirement, and all Unvested Stock Options may be exercised within their normal terms and rules of Vesting, subject to the condition that the Participant does not act in a competing company and any additional conditions established by the Board of Directors.

For the purposes of the stock-based compensation plan, “Retirement” is considered to be the end of the Stock Option holder's legal relationship with the Company for the effective termination of the Beneficiary's career and retirement, subject to case-by-case approval by the Board of Directors, in its sole discretion. If the Retirement request is initiated by the Beneficiary, when evaluating the request, the Board of Directors will take into consideration (i) the advance of the request, to be formulated at least six (6) months in advance; (ii) the eventual post-termination professional activity plan of the Beneficiary, which should not include any performance in activities competing with those of the Linx Group; (iii) other circumstances applicable to the case. The Board of Directors' decision will be discretionary and disconnected from the rules for retirement for length of service or age, under the terms of the rules of the official social security (INSS) or the rules for supplementing the retirement of any private plan eventually sponsored by the Company. In the event that the Beneficiary's performance in activities competing with those of the Company will be verified, the Board of Directors may declare, in full right, extinguished, regardless of prior notice or indemnity, all outstanding Unvested Stock Options that have been granted to the Beneficiary.

d) in the event of the Participant's death, all Unvested Stock Options will become exercisable in advance. Vested or Unvested Stock Options will be extended to their heirs and successors, by legal succession or by testamentary imposition, and may be exercised in whole or in part by the beneficiary's heirs, successors or spouses of the Beneficiary, for a period of 12 (twelve) months from the date of death.

e) in the event of the Beneficiary's permanent disability, all Unvested Stock Options will become exercisable in advance. The Beneficiary or his/her legal guardian will have the right to exercise Vested or Unvested Stock Options within the decadential term of six (6) months, counted from the date on which permanent disability was found.

Notwithstanding the situations provided for above, the Board of Directors or the Personnel Committee may establish different terms and conditions for each Contract, without the need to apply any rule of equality or analogy between the Beneficiaries, even if they are in similar or identical situations.

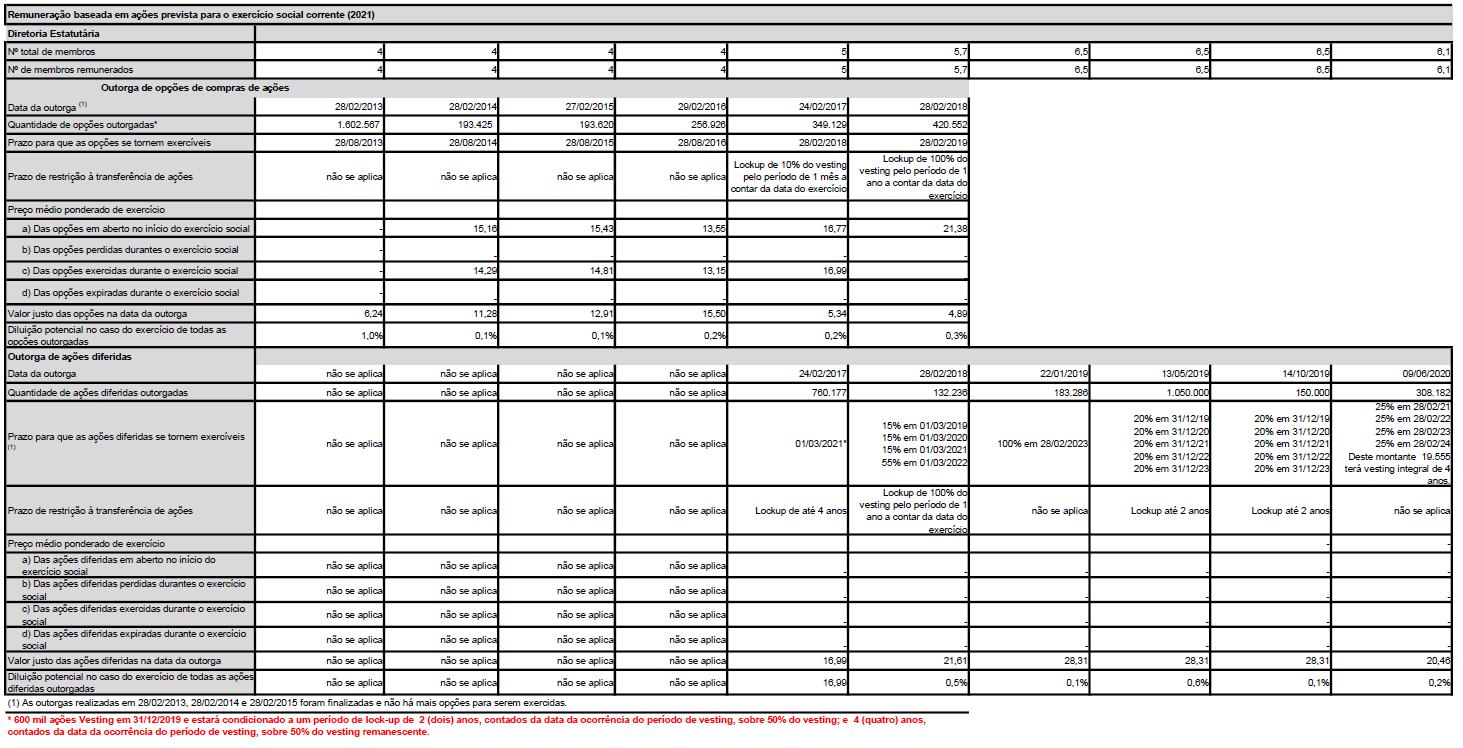

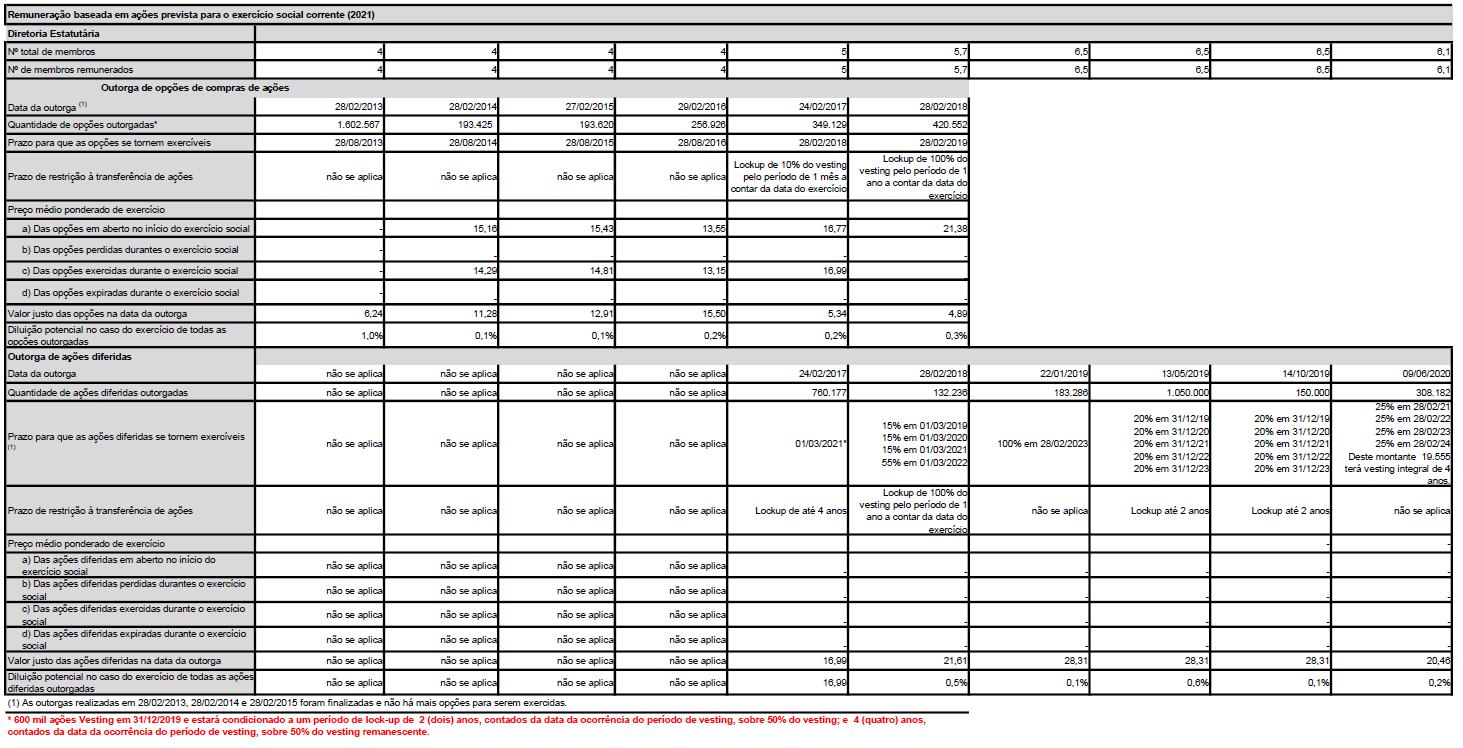

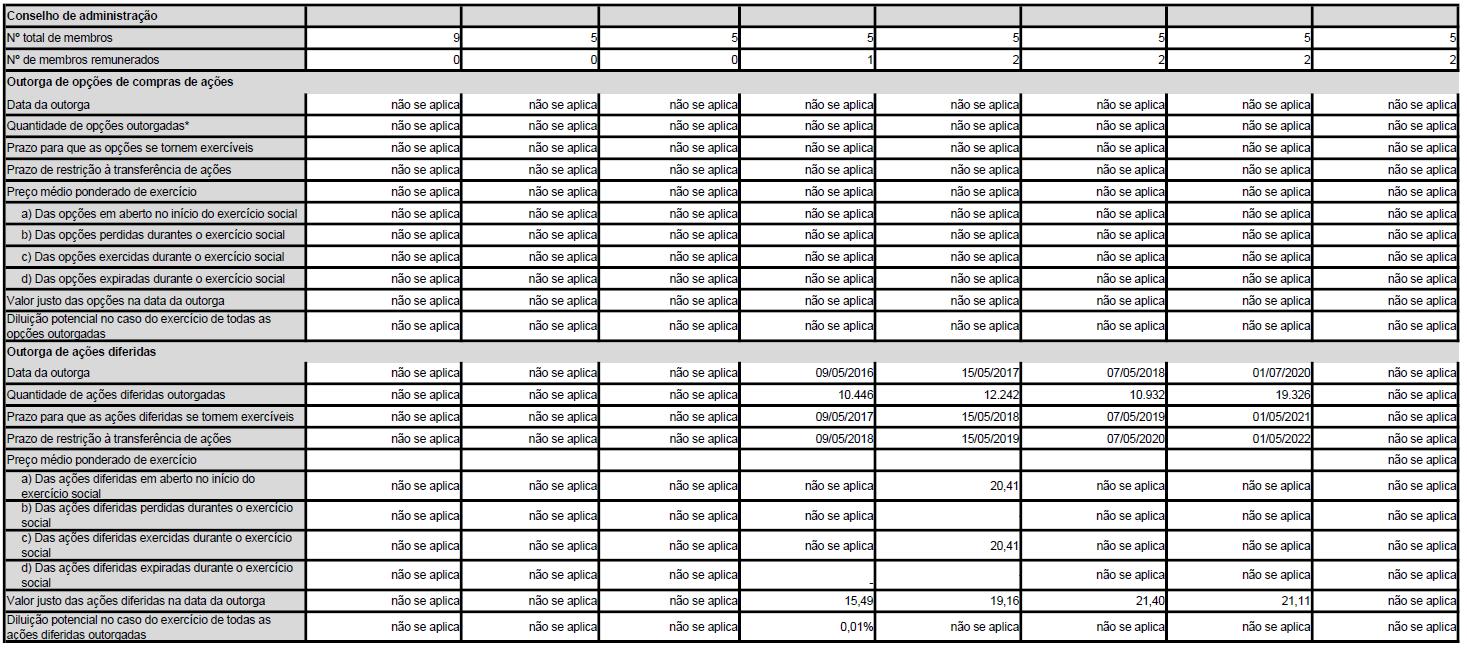

13.5 - Stock-Based Compensation

*** There was no ILP grant (deferred stock or stock options), due to the 2020 fiscal year, given that the executives did not reach the targets set for the period.

| Board of Directors |

| Total number of members | 9 | 5 | 5 | 5 | 5 | 5 | 5 | 5 |

| Number of members receiving compensation | 0 | 0 | 0 | 1 | 2 | 2 | 2 | 2 |

| Grant of stock options |

| Grant date | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Number of options granted* | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Term for stock options to become exercisable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Weighted average price of the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| a) The outstanding options at the beginning of the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| b) Of the stock options lost during the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| c) Of stock options exercised during fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| d) Of stock options expired during fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Fair value of stock options on grant date | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Potential dilution in case of exercise of all stock options granted | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Granting of deferred stocks |

| Grant date | not applicable | not applicable | not applicable | 05/09/2016 | 05/15/2017 | 05/07/2018 | 05/13/2019 | 06/30/2020 |

| Number of deferred stocks granted | not applicable | not applicable | not applicable | 10,446 | 12,242 | 10,932 | 9,990 | 19,442 |

| Term for deferred stocks to become exercisable | not applicable | not applicable | not applicable | 05/09/2017 | 05/15/2018 | 05/07/2019 | 05/13/2020 | 06/30/2020 |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | 05/09/2018 | 05/15/2019 | 05/07/2020 | 05/13/2021 | 06/30/2021 |

| Weighted average price of the fiscal year | | | | | | | | |

| a) Deferred stocks outstanding at the beginning of the fiscal year | not applicable | not applicable | not applicable | not applicable | 20.41 | not applicable | not applicable | not applicable |

| b) Deferred stocks lost during the fiscal year | not applicable | not applicable | not applicable | not applicable | - | not applicable | not applicable | not applicable |

| c) Deferred stocks exercised during the fiscal year | not applicable | not applicable | not applicable | not applicable | 20.41 | not applicable | not applicable | not applicable |

| d) Deferred stocks expired during the fiscal year | not applicable | not applicable | not applicable | - | - | not applicable | not applicable | not applicable |

| Fair value of deferred stocks on the grant date | not applicable | not applicable | not applicable | 15.49 | 19.16 | 21.40 | not applicable | 20.46 |

| Potential dilution in the case of the exercise of all deferred stocks granted | not applicable | not applicable | not applicable | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

STOCK-BASED COMPENSATION SCHEDULED FOR THE FISCAL YEAR ENDED ON DECEMBER 31, 2019

| Stock-based compensation scheduled for the fiscal year ended on December 31, 2019 | | | | | | |

| Statutory Management | | | | | | | | | |

| Total number of members | 4 | 4 | 4 | 4 | 5 | 5.7 | 6.5 | 6.5 | 6.5 |

| Number of members receiving compensation | 4 | 4 | 4 | 4 | 5 | 5.7 | 6.5 | 6.5 | 6.5 |

| Grant of stock options |

| Grant date (1) | 02/28/2013 | 02/28/2014 | 02/27/2015 | 02/29/2016 | 02/24/2017 | 02/28/2018 | - | - | - |

| Number of options granted* | 1,602,567 | 193,425 | 193,620 | 256,926 | 349,129 | 420,552 | - | - | - |

| Term for stock options to become exercisable | 08/28/2013 | 08/28/2014 | 08/28/2015 | 08/28/2016 | 02/28/2018 | 02/28/2019 | - | - | - |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | not applicable | Lockup of 10% of vesting for a period of 1 month from the date of exercise | 100% vesting lockup for a period of 1 year from the date of exercise | - | - | - |

| Weighted average price of the fiscal year | | | | | | | - | - | - |

| a) The outstanding options at the beginning of the fiscal year | - | 15.16 | 15.43 | 13.55 | 16.77 | 21.38 | - | - | - |

| b) Of the stock options lost during the fiscal year | - | - | - | - | - | - | - | - | - |

| c) Of stock options exercised during fiscal year | - | 14.29 | 14.81 | 13.15 | 16.99 | - | - | - | - |

| d) Of stock options expired during fiscal year | - | - | - | - | - | - | - | - | - |

| Fair value of stock options on grant date | 6.24 | 11.28 | 12.91 | 15.50 | 5.34 | 4.89 | - | - | - |

| Potential dilution in case of exercise of all stock options granted | 1.0% | 0.1% | 0.1% | 0.2% | 0.2% | 0.3% | - | - | - |

| Granting of deferred stocks |

| Grant date | not applicable | not applicable | not applicable | not applicable | 02/24/2017 | 02/28/2018 | 01/22/2019 | 05/13/2019 | 10/14/2019 |

| Number of deferred stocks granted | not applicable | not applicable | not applicable | not applicable | 760,177 | 132,236 | 183,286 | 1,050,000 | 150,000 |

| Term for deferred stocks to become exercisable (1) | not applicable | not applicable | not applicable | not applicable | 92% on 03/01/2020

8% on 03/01/2021 | 15% on 03/01/2019

15% on 03/01/2020

15% on 03/01/2021

55% on 03/01/2022 | 100% on 02/28/2023 | 20% on 12/31/19

20% on 12/31/20

20% on 12/31/21

20% on 12/31/22

20% on 12/31/23 | 20% on 12/31/19

20% on 12/31/20

20% on 12/31/21

20% on 12/31/22

20% on 12/31/23 |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | not applicable | Lockup up to 4 years | not applicable | not applicable | Lockup up to 2 years | Lockup up to 2 years |

| Weighted average price of the fiscal year | | | | | | | | | - |

| a) Deferred stocks outstanding at the beginning of the fiscal year | not applicable | not applicable | not applicable | not applicable | - | - | - | - | - |

| b) Deferred stocks lost during the fiscal year | not applicable | not applicable | not applicable | not applicable | - | - | - | - | - |

| c) Deferred stocks exercised during the fiscal year | not applicable | not applicable | not applicable | not applicable | - | - | - | - | - |

| d) Deferred stocks expired during the fiscal year | not applicable | not applicable | not applicable | not applicable | - | - | - | - | - |

| Fair value of deferred stocks on the grant date | not applicable | not applicable | not applicable | not applicable | 16.99 | 21.61 | 28.31 | 28.31 | 28.31 |

| Potential dilution in the case of the exercise of all deferred stocks granted | not applicable | not applicable | not applicable | not applicable | 0.5% | 0.5% | 0.1% | 0.6% | 0.1% |

| (1) The grants made on 02/28/2013, 02/28/2014 and 02/28/2015 have been finalized and there are no more options to be exercised. | |

| | | | | | | | | TOTAL STOCKS 12/31/2019 |

| Board of Directors | | | | | | | | | |

| Total number of members | 9 | 5 | 5 | 5 | 5 | 5 | 5 | | |

| Number of members receiving compensation | 0 | 0 | 0 | 1 | 2 | 2 | 2 | | |

| Grant of stock options | | |

| Grant date | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| Number of options granted* | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| Term for stock options to become exercisable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| Weighted average price of the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| a) The outstanding options at the beginning of the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| b) Of the stock options lost during the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| c) Of stock options exercised during fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| d) Of stock options expired during fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| Fair value of stock options on grant date | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| Potential dilution in case of exercise of all stock options granted | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable | | |

| Granting of deferred stocks | | |

| Grant date | not applicable | not applicable | not applicable | 05/09/2016 | 05/15/2017 | 05/07/2018 | 05/13/2019 | | |

| Number of deferred stocks granted | not applicable | not applicable | not applicable | 10,446 | 12,242 | 10,932 | 9,990 | | |

| Term for deferred stocks to become exercisable | not applicable | not applicable | not applicable | 05/09/2017 | 05/15/2018 | 05/07/2019 | 05/13/2020 | | |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | 05/09/2018 | 05/15/2019 | 05/07/2020 | 05/13/2021 | | |

| Weighted average price of the fiscal year | | | | | | | | | |

| a) Deferred stocks outstanding at the beginning of the fiscal year | not applicable | not applicable | not applicable | not applicable | 20.41 | not applicable | not applicable | | |

| b) Deferred stocks lost during the fiscal year | not applicable | not applicable | not applicable | not applicable | - | not applicable | not applicable | | |

| c) Deferred stocks exercised during the fiscal year | not applicable | not applicable | not applicable | not applicable | 20.41 | not applicable | not applicable | | |

| d) Deferred stocks expired during the fiscal year | not applicable | not applicable | not applicable | - | - | not applicable | not applicable | | |

| Fair value of deferred stocks on the grant date | not applicable | not applicable | not applicable | 15.49 | 19.16 | 21.40 | not applicable | | |

| Potential dilution in the case of the exercise of all deferred stocks granted | not applicable | not applicable | not applicable | 0.01% | not applicable | not applicable | not applicable | | |

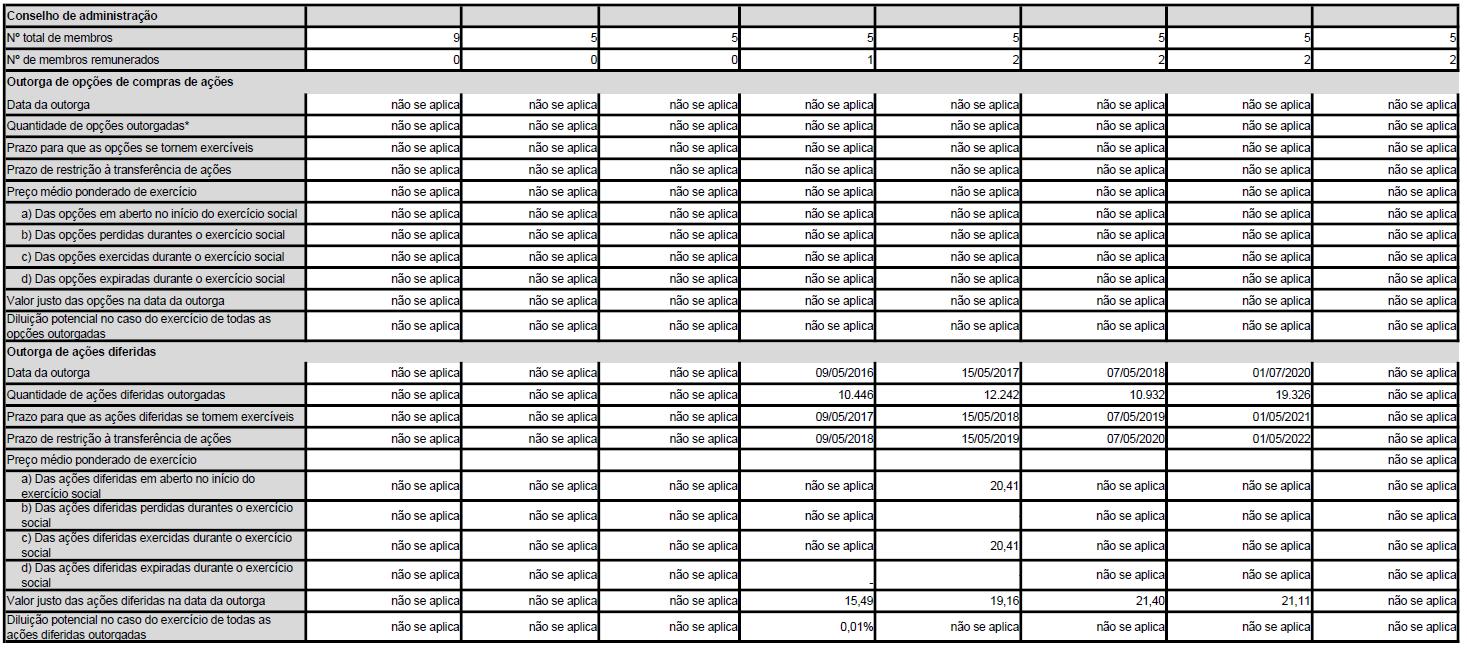

STOCK-BASED COMPENSATION SCHEDULED FOR THE FISCAL YEAR ENDED ON DECEMBER 31, 2018

| Stock-Based Compensation Scheduled for The Fiscal Year Ended on December 31, 2018 |

| Statutory Management | | | | | | |

| Total number of members | 4 | 4 | 4 | 4 | 5 | 6 |

| Number of members receiving compensation | 4 | 4 | 4 | 4 | 5 | 6 |

| Grant of stock options |

| Grant date (1) | 02/28/2013 | 02/28/2014 | 02/27/2015 | 02/29/2016 | 02/24/2017 | 02/28/2018 |

| Number of options granted* | 1,602,567 | 193,425 | 193,620 | 256,926 | 349,129 | 420,552 |

| Term for stock options to become exercisable | 08/28/2013 | 08/28/2014 | 08/28/2015 | 08/28/2016 | 02/28/2018 | 02/28/2019 |

| Restriction term on transfer of stocks | non-transferable | non-transferable | non-transferable | non-transferable | non-transferable | non-transferable |

| Weighted average price of the fiscal year | | | | | | |

| a) The outstanding options at the beginning of the fiscal year | - | 14.18 | 14.44 | 12.84 | 16.99 | - |

| b) Of the stock options lost during the fiscal year | - | - | - | - | - | - |

| c) Of stock options exercised during fiscal year | - | 14.29 | 14.55 | 12.93 | 16.99 | - |

| d) Of stock options expired during fiscal year | - | - | - | - | - | - |

| Fair value of stock options on grant date | 6.24 | 11.28 | 12.91 | 15.50 | 5.34 | 4.89 |

| Potential dilution in case of exercise of all stock options granted | 1.0% | 0.1% | 0.1% | 0.2% | 0.2% | 0.3% |

| Granting of deferred stocks |

| Grant date | not applicable | not applicable | not applicable | not applicable | 02/24/2017 | 02/28/2018 |

| Number of deferred stocks granted | not applicable | not applicable | not applicable | not applicable | 760,177 | 132,236 |

| Term for deferred stocks to become exercisable (1) | not applicable | not applicable | not applicable | not applicable | 92% on 12/31/2019

8% on 03/01/2021 | 15% on 03/01/2019

15% on 03/01/2020

15% on 03/01/2021

55% on 03/01/2022 |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | not applicable | Lockup up to 4 years | Not applicable |

| Weighted average price of the fiscal year | | | | | | |

| a) Deferred stocks outstanding at the beginning of the fiscal year | not applicable | not applicable | not applicable | not applicable | - | - |

| b) Deferred stocks lost during the fiscal year | not applicable | not applicable | not applicable | not applicable | - | - |

| c) Deferred stocks exercised during the fiscal year | not applicable | not applicable | not applicable | not applicable | - | - |

| d) Deferred stocks expired during the fiscal year | not applicable | not applicable | not applicable | not applicable | - | - |

| Fair value of deferred stocks on the grant date | not applicable | not applicable | not applicable | not applicable | 16.99 | 21.61 |

| Potential dilution in the case of the exercise of all deferred stocks granted | not applicable | not applicable | not applicable | not applicable | 0.5% | 0.1% |

| (1) The grant made on 02/28/2013 has been finalized and there are no more options to be exercised | |

| | | | | | | |

| Board of Directors | | | | | | |

| Total number of members | 9 | 5 | 5 | 5 | 5 | 5 |

| Number of members receiving compensation | 0 | 0 | 0 | 1 | 2 | 2 |

| Grant of stock options |

| Grant date | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Number of options granted* | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Term for stock options to become exercisable | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Weighted average price of the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| a) The outstanding options at the beginning of the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| b) Of the stock options lost during the fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| c) Of stock options exercised during fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| d) Of stock options expired during fiscal year | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Fair value of stock options on grant date | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Potential dilution in case of exercise of all stock options granted | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| Granting of deferred stocks |

| Grant date | not applicable | not applicable | not applicable | 05/09/2016 | 05/15/2017 | 05/07/2018 |

| Number of deferred stocks granted | not applicable | not applicable | not applicable | 10,446 | 12,242 | 10,932 |

| Term for deferred stocks to become exercisable | not applicable | not applicable | not applicable | 05/09/2017 | 05/15/2018 | 05/07/2019 |

| Restriction term on transfer of stocks | not applicable | not applicable | not applicable | 05/09/2018 | 05/15/2019 | 05/07/2020 |

| Weighted average price of the fiscal year | | | | | | |

| a) Deferred stocks outstanding at the beginning of the fiscal year | not applicable | not applicable | not applicable | 15.93 | not applicable | not applicable |

| b) Deferred stocks lost during the fiscal year | not applicable | not applicable | not applicable | - | not applicable | not applicable |

| c) Deferred stocks exercised during the fiscal year | not applicable | not applicable | not applicable | 15.93 | not applicable | not applicable |

| d) Deferred stocks expired during the fiscal year | not applicable | not applicable | not applicable | - | not applicable | not applicable |

| Fair value of deferred stocks on the grant date | not applicable | not applicable | not applicable | 15.93 | 19.28 | 21.40 |

| Potential dilution in the case of the exercise of all deferred stocks granted | not applicable | not applicable | not applicable | 0.01% | not applicable | not applicable |

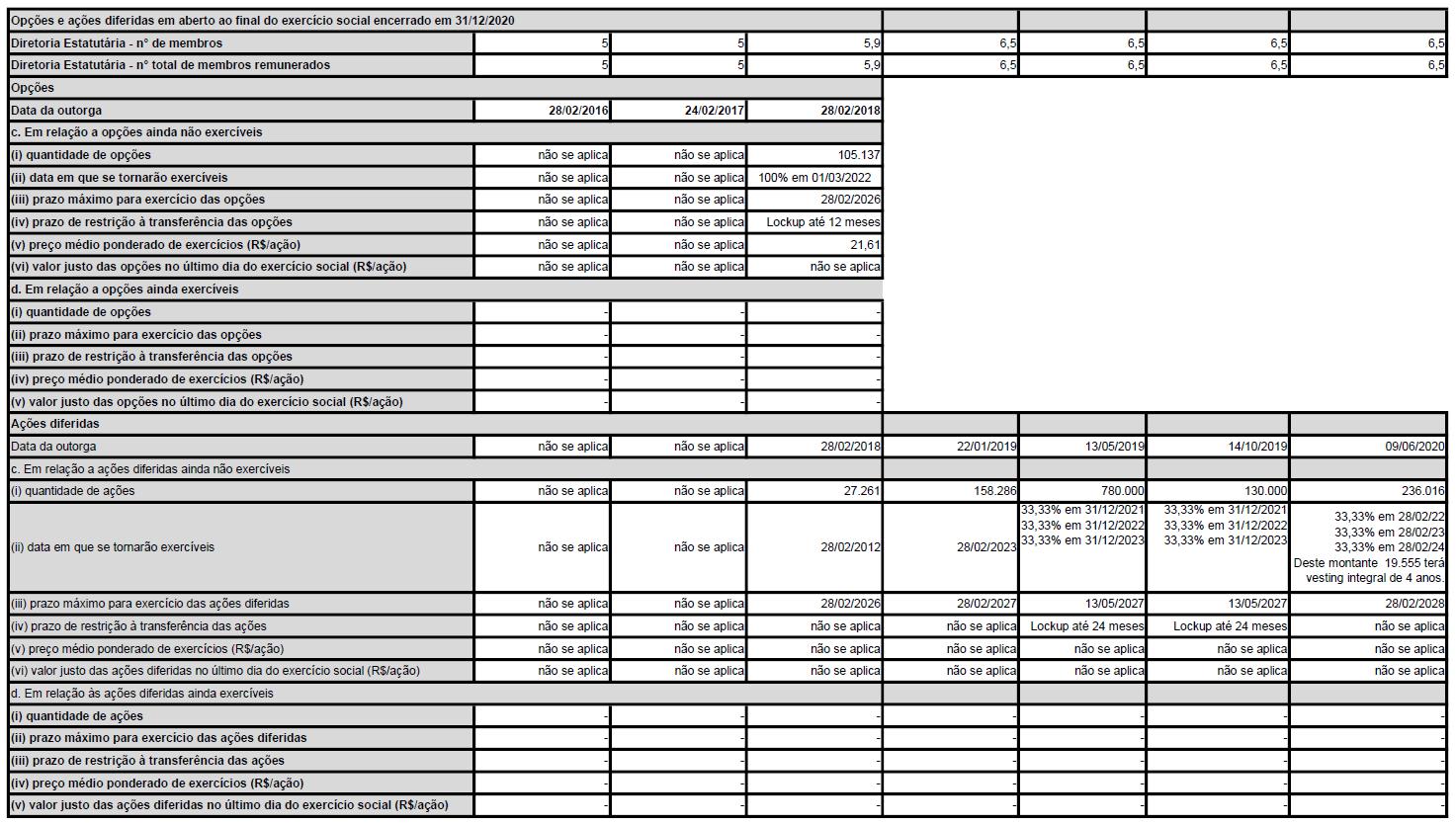

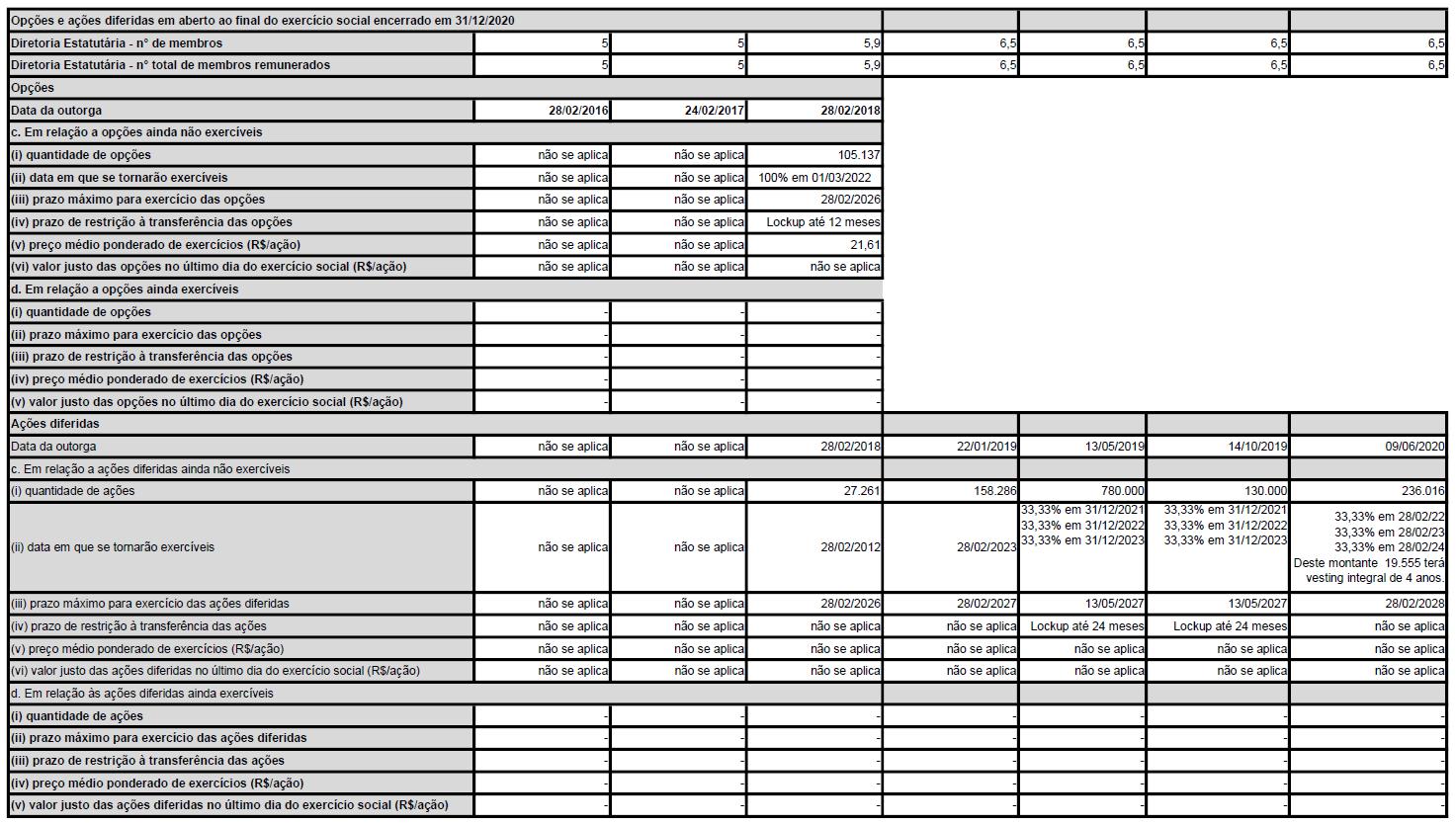

13.6 - Open Options

| Stock options and deferred stocks outstanding at the end of the fiscal year ended on 12/31/2019 |

| Statutory Executive Board - number of members | 5 | 5 | 5.9 | 6.5 | 6.5 | 6.5 |

| Statutory Executive Board - total number of paid members | 5 | 5 | 5.9 | 6.5 | 6.5 | 6.5 |

| Stock Options | | | | | | |

| Grant date | 02/28/2016 | 02/24/2017 | 02/28/2018 | | - | - |

| c. Regarding options not yet exercisable | | | | | | |

| (i) number of options | 21,642 | 149,946 | 315,411 | | - | - |

| (ii) date when they will become exercisable | 02/28/2020 | 50% on 02/28/2020

50% on 02/28/2021 | 25% on 02/28/2020

25% on 02/28/2021

25% on 02/28/2022

25% on 02/28/2023 | | - | - |

| Maximum Term for Exercise of Stock Options | 02/28/2024 | 02/28/2025 | 02/28/2026 | | - | - |

| (iv) restriction period for transferring stock options | not applicable | Lockup of 10% of vesting for a period of 1 month from the date of exercise | Lockup up to 12 months | | - | - |

| (v) weighted average exercise price (BRL/stock) | 13.55 | 16.77 | 21.38 | | - | - |

| (vi) fair value of stock options on the last day of the fiscal year (BRL/stock) | 13.15 | 16.99 | - | | - | - |

| d. Regarding stock options not yet exercisable | | | | | | |

| (i) number of options | - | 105,100 | 105,141 | | - | - |

| (ii) maximum term for exercise of stock options | - | 02/28/2025 | 02/28/2026 | | - | - |

| (iii) restriction period for transferring stock options | - | Lockup up to 1 month | Lockup up to 12 months | | - | - |

| (iv) weighted average exercise price (BRL/stock) | - | 21.38 | | | - | - |

| (v) fair value of stock options on the last day of the fiscal year (BRL/stock) | - | - | - | | - | - |

| Deferred stocks | | | | | | |

| Grant date | not applicable | not applicable | not applicable | 01/22/2019 | 05/13/2019 | 10/14/2019 |

| c. In relation to deferred stocks not yet exercisable | | | | | | |

| (i) Number of stocks | not applicable | not applicable | not applicable | 183,286 | 780,000 | 130,000 |

| (ii) date when they will become exercisable | not applicable | not applicable | not applicable | 02/28/2023 | 25% on 12/31/2020

25% on 12/31/2021

25% on 12/31/2022

25% on 12/31/2023 | 25% on 12/31/2020

25% on 12/31/2021

25% on 12/31/2022

25% on 12/31/2023 |

| (iii) maximum term for the exercise of deferred stocks | not applicable | not applicable | not applicable | 02/28/2027 | 05/13/2027 | 05/13/2027 |

| (iv) restriction term on transfer of stocks. | not applicable | not applicable | not applicable | not applicable | Lockup up to 24 months | Lockup up to 24 months |

| (v) weighted average exercise price (BRL/stock) | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| (vi) fair value of deferred stocks on the last day of the fiscal year (BRL/stock) | not applicable | not applicable | not applicable | not applicable | not applicable | not applicable |

| d. Regarding the deferred stocks still exercisable | | | | | | |

| (i) Number of stocks | - | - | - | - | - | - |

| (ii) maximum term for the exercise of deferred stocks | - | - | - | - | - | - |

| (iii) restriction term on transfer of stocks. | - | - | - | - | - | - |

| (iv) weighted average exercise price (BRL/stock) | - | - | - | - | - | - |

| (v) fair value of deferred stocks on the last day of the fiscal year (BRL/stock) | - | - | - | - | - | - |

| |

| Board of Directors - total number of members | 5 | 5 | 5 | 5 | 5 | |

| Board of Directors - number of paid members | 2 | 2 | 2 | 2 | 2 | |

| Stock Options | | | | | | |

| Grant date | not applicable | not applicable | not applicable | not applicable | not applicable | |

| c. Regarding options not yet exercisable | | | | | | |

| (i) number of options | not applicable | not applicable | not applicable | not applicable | not applicable | |

| (ii) date when they will become exercisable | not applicable | not applicable | not applicable | not applicable | not applicable | |

| Maximum Term for Exercise of Stock Options | not applicable | not applicable | not applicable | not applicable | not applicable | |

| (iv) restriction period for transferring stock options | not applicable | not applicable | not applicable | not applicable | not applicable | |

| (v) weighted average exercise price (BRL/stock) | not applicable | not applicable | not applicable | not applicable | not applicable | |

| (vi) fair value of stock options on the last day of the fiscal year (BRL/stock) | not applicable | not applicable | not applicable | not applicable | not applicable | |

| d. Regarding stock options not yet exercisable | | | | | | |

| (i) number of options | not applicable | not applicable | not applicable | not applicable | not applicable | |

| (ii) date when they will become exercisable | not applicable | not applicable | not applicable | not applicable | not applicable | |

| Maximum Term for Exercise of Stock Options | not applicable | not applicable | not applicable | not applicable | not applicable | |

| (iv) restriction period for transferring stock options | not applicable | not applicable | not applicable | not applicable | not applicable | |

| (v) weighted average exercise price (BRL/stock) | not applicable | not applicable | not applicable | not applicable | not applicable | |

| (vi) fair value of stock options on the last day of the fiscal year (BRL/stock) | not applicable | not applicable | not applicable | not applicable | not applicable | |

| Deferred stocks | | | | | | |

| Grant date | 05/01/2016 | 05/15/2017 | 05/07/2018 | 05/13/2019 | | |

| c. In relation to deferred stocks not yet exercisable | | | | | | |

| (i) Number of stocks | - | - | - | 9,990 | | |

| (ii) date when they will become exercisable | 05/09/2017 | 05/15/2018 | 05/07/2019 | 05/13/2020 | | |

| (iii) maximum term for the exercise of deferred stocks | 05/09/2024 | 05/15/2025 | 05/07/2026 | 05/13/2027 | | |

| (iv) restriction term on transfer of stocks. | up to 1 year from the exercise date | up to 1 year from the exercise date | up to 1 year from the exercise date | up to 1 year from the exercise date | | |

| (v) weighted average exercise price (BRL/stock) | - | - | - | - | | |

| (vi) fair value of deferred stocks on the last day of the fiscal year (BRL/stock) | - | - | - | - | | |

| d. Regarding the deferred stocks still exercisable | | | | | | |

| (i) Number of stocks | - | - | 5,446- | - | - | - |

| (ii) maximum term for the exercise of deferred stocks | - | - | 05/07/2026- | - | - | - |

| (iii) restriction term on transfer of stocks. | - | - | 1-year lock-up- | - | - | - |

| (iv) weighted average exercise price (BRL/stock) | - | - | Not applicable- | - | - | - |

| (v) fair value of deferred stocks on the last day of the fiscal year (BRL/stock) | - | - | - | - | - | - |

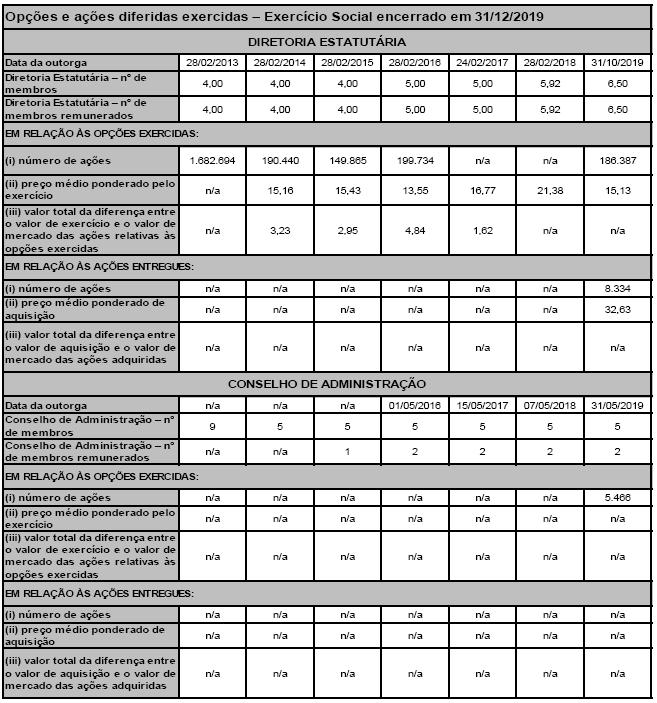

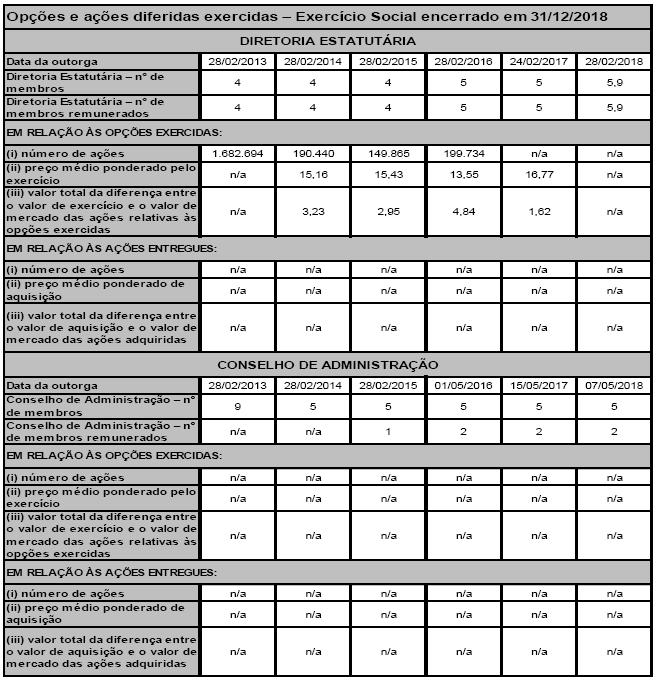

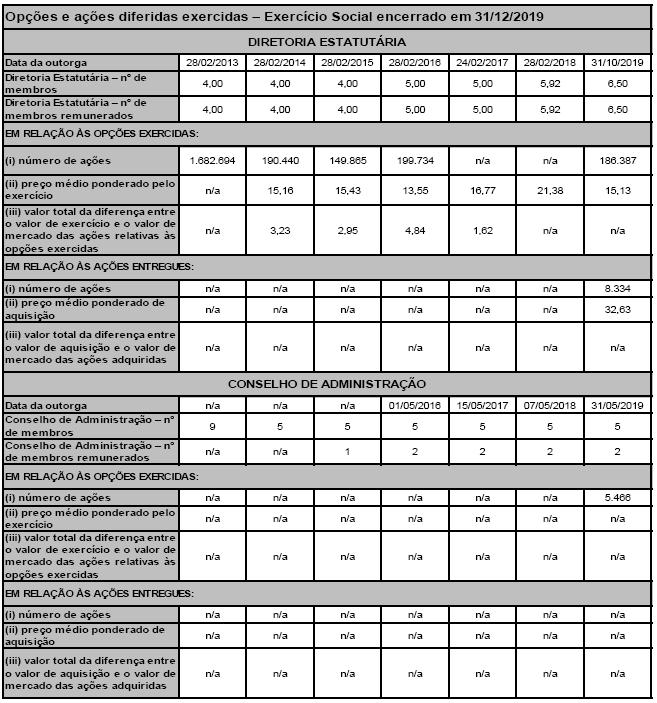

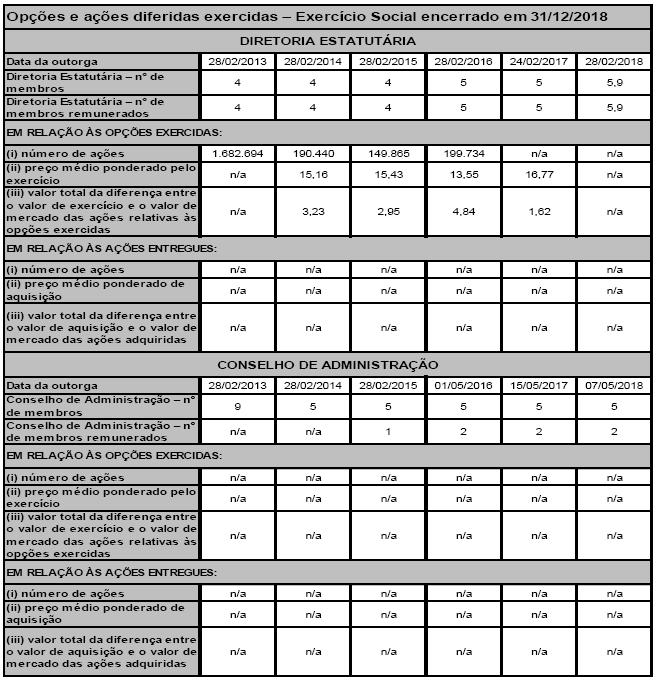

13.7 Stock Options exercised and delivered

13.8 - Pricing of stocks/options

a) pricing model:

The stock options granted were priced using the Black & Scholes model. As the options can be exercised over a four-year period, this amount is recognized over the four years.