UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-23439 |

| Exact name of registrant as specified in charter: | ETF Opportunities Trust |

| Address of principal executive offices: | 8730 Stony Point Parkway, Suite 205 Richmond, VA 23235 |

| Name and address of agent for service | The Corporation Trust Co., Corporation Trust Center, 1209 Orange St., Wilmington, DE 19801 With Copy to: Practus, LLP 11300 Tomahawk Creek Parkway, Suite 310 Leawood, KS 66211 |

| Registrant's telephone number, including area code: | (804) 267-7400 |

| Date of fiscal year end: | August 31 |

| Date of reporting period: | August 31, 2024 |

| | |

| | |

| | Tuttle Capital Daily 2X Inverse Regional Banks ETF |

| | |

ITEM 1.(a). Reports to Stockholders.

Tuttle Capital Daily 2X Inverse Regional Banks ETF Tailored Shareholder Report

annual Shareholder Report August 31, 2024 Tuttle Capital Daily 2X Inverse Regional Banks ETF Ticker: SKRE (Listed on the NASDAQ Stock Market®) |

This annual shareholder report contains important information about the Tuttle Capital Daily 2X Inverse Regional Banks ETF for the period of January 4, 2024 (commencement of operations) to August 31, 2024. You can find additional information about the Fund at www.shortregionalbanks.com/fund-info. You can also request this information by contacting us at (833) 759-6110.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Tuttle Capital Daily 2X Inverse Regional Banks ETF | $41¹ | 0.75%² |

¹ Costs are for the period of January 4, 2024 to August 31, 2024. Costs for a full annual period would be higher.² Annualized

How did the fund perform?

For the period January 4, 2024 to August 31, 2024, the Tuttle Capital 2x Inverse Regional Banks ETF (the ''Fund'') returned a negative 32.37% vs. the S&P 500® Index, which recorded positive 21.17%.

What key factors affected the Fund’s performance?

In general, regional banks financial results are often helped by lower interest rates. The Federal Reserve lowering rates and providing commentary about the path of lower interest rates going forward is a positive for regional banks, and therefore was a negative for the Fund during the period. The Fund performed as intended with an inverse return of about two times the daily return of SPDR® S&P® Regional Banking EFT (“KRE”). The Fund was almost right on target for the period, as the KRE was up almost 15% and the Fund down a little over 30%. Where the Fund’s return really deviated from the S&P 500® Index was in July when it became apparent the Federal Reserve would consider rates cuts going forward.

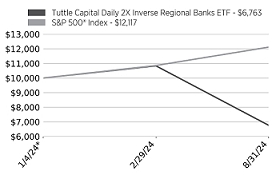

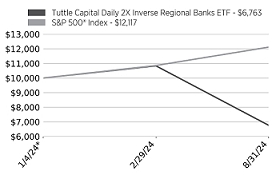

Cumulative Performance

(based on a hypothetical $10,000 investment)

Date | Tuttle Capital Daily 2X Inverse Regional Banks ETF - $6,763 | S&P 500® Index - $12,117 |

1/4/24 | 10000 | 10000 |

2/29/24 | 10835 | 10858 |

8/31/24 | 6763 | 12117 |

* Inception

Annual Performance

| Returns Since Inception (1/4/24) |

|---|

Tuttle Capital Daily 2X Inverse Regional Banks ETF - NAV | -32.37% |

Tuttle Capital Daily 2X Inverse Regional Banks ETF - Market | -32.08% |

S&P 500 Index® | 21.17% |

The market price used to calculate the market return is determined by using the midpoint between the bid/ask spread on the exchange on which the shares of a Fund are listed for trading, as of the time that a Fund's NAV is calculated. Market returns do not include brokerage commissions. If brokerage commissions were included market returns would be lower.The S&P 500® Index is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of Fund shares.

Tuttle Capital Daily 2X Inverse Regional Banks ETF Tailored Shareholder Report

Tuttle Capital Daily 2X Inverse Regional Banks ETF Tailored Shareholder Report

Sector Breakdown

Financials: 100.00%

Portfolio Composition | |

|---|

Cash | 176.90% |

Derivatives | -6.00% |

Liabilities in Excess of Other Assets | -70.90% |

Key Fund Statistics

(as of August 31, 2024)

| |

|---|

Fund Net Assets (Thousands) | $5,241 |

Number of Holdings | 0³ |

Total Advisory Fee Paid | $31,407 |

Portfolio Turnover Rate | 0% |

³ Excludes derivatives held by the Fund

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, visit www.shortregionalbanks.com/fund-info. Distributed by Foreside Fund Services, LLC.

What did the Fund invest in?

(% of Net Assets as of August 31, 2024)

Tuttle Capital Daily 2X Inverse Regional Banks ETF Tailored Shareholder Report

ITEM 1.(b). No notice transmitted to stockholders in reliance on Rule 30e-3 under the Investment Company Act of 1940 contained disclosures specified by paragraph (c)(3) of that rule.

(a) The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(c) There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics description.

(d) The registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions.

(e) Not applicable.

(f) The code of ethics is attached hereto as exhibit 19(a)(1).

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

(a)(1) The registrant does not have an audit committee financial expert serving on its audit committee.

(a)(2) Not applicable.

(a)(3) At this time, the registrant believes that the collective experience provided by the members of the audit committee together offer the registrant adequate oversight for the registrant’s level of financial complexity.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are $13,500 for 2024 and $0 for 2023.

(b) Audit-Related Fees. The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item are $0 for 2024 and $0 for 2023.

(c) Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are $3,300 for 2024 and $0 for 2023. The nature of the services comprising these fees include preparation of excise filings and income tax returns and assistance with calculation of required income, capital gain and excise distributions.

(d) All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are and $0 for 2024 and $0 for 2023.

(e)(1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

Pursuant to its charter, the registrant’s Audit Committee must pre-approve all audit and non-audit services to be provided to the registrant. The Audit Committee also pre-approves any non-audit services provided by the registrant’s principal accountant to the adviser or any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, if the engagement relates directly to the operations and financial reporting of the registrant.

(e)(2) The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows:

(f) The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was zero percent (0%).

(g) The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant was $0 for 2024 and $0 for 2023.

(h) Not applicable.

(i) Not applicable.

(j) Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

| (a) | The registrant has an audit committee which was established by the Board of Trustees of the registrant in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. Each of the registrant’s Trustees serves as a member of its Audit Committee. |

| (a) | The Registrant’s Schedule of Investments is included as part of the Financial Statements and Financial Highlights filed under Item 7 of this Form. |

| ITEM 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

FINANCIAL STATEMENTS

For the period ended August 31, 2024*

* Commencement of operations January 4, 2024

TUTTLE CAPITAL

DAILY 2X INVERSE REGIONAL BANKS ETF

1

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Schedule of InvestmentsAugust 31, 2024

See Notes to Financial Statements

| | |

Other Assets In Excess of Liabilities - 100.00%(a) | | $5,240,981

|

TOTAL NET ASSETS - 100.00% | | $5,240,981

|

SWAP CONTRACTS

TOTAL RETURN SWAP CONTRACTS

Counterparty: Clear Street Derivatives LLC

| | | | | | | |

Reference Entity/

Obligation | Pay/

Receive Equity on Reference Entity | Financing Rate | Pay/

Receive Frequency | Termination Date | Notional Amount | Value | Unrealized Appreciation (Depreciation) |

SPDR® S&P® Regional Banking ETF | Pay | (OBFR01(b) +97bps) | Monthly | 2/7/2025 | $(10,501,986) | $(10,187,861) | $(314,125) |

| | | | | | | |

TOTAL RETURN SWAP CONTRACTS | $(10,501,986) | $(10,187,861) | $(314,125) |

(a)Includes cash which is being held as collateral for total return swap contracts.

(b)OBFR01 - Overnight Bank Funding Rate, 5.33% as of August 31, 2024.

2

FINANCIAL STATEMENTS | august 31, 2024

See Notes to Financial Statements

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Statement of Assets and LiabilitiesAugust 31, 2024

| | | |

ASSETS | | | |

Cash collateral held for open total return swap contracts (Note 1) | | $8,740,000

|

|

Cash | | 531,275 | |

TOTAL ASSETS | | 9,271,275 |

|

| | | |

LIABILITIES | | |

|

Accrued advisory fees (Note 2) | | 4,783 | |

Net unrealized depreciation on total return swap contracts | | 314,125 | |

Due to counterparty on total return swap contracts | | 3,711,386 | |

TOTAL LIABILITIES | | 4,030,294 | |

NET ASSETS | | $5,240,981

| |

| | | |

Net Assets Consist of: | | | |

Paid-in capital | | $8,823,440

|

|

Distributable earnings (accumulated deficits) | | (3,582,459 | ) |

Net Assets | | $5,240,981

| |

| | | |

NET ASSET VALUE PER SHARE | | | |

Net Assets | | $5,240,981

| |

Shares Outstanding (unlimited number of shares of beneficial interest authorized without par value) | | 310,000 | |

Net Asset Value and Offering Price Per Share | | $16.91

| |

3

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Statement of OperationsPeriod Ended August 31, 2024*

See Notes to Financial Statements

| | | |

INVESTMENT INCOME | | | |

Investment income | | $—

| |

Total investment income | | — | |

| | | |

EXPENSES | | | |

Investment Advisory fees (Note 2) | | 31,407 | |

Total expenses | | 31,407 | |

Net investment income (loss) | | (31,407 | ) |

| | | |

REALIZED AND UNREALIZED GAIN (LOSS) | | | |

Net realized gain (loss) on total return swap contracts | | (3,488,214 | ) |

Net change in unrealized appreciation (depreciation)

on total return swap contracts | | (314,125 | ) |

Total net realized and unrealized gain (loss)

on total return swap contracts | | (3,802,339 | ) |

| | | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | | $(3,833,746

| ) |

*The Fund commenced operations on January 4, 2024.

4

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Statement of Changes in Net AssetsPeriod Ended August 31, 2024*

See Notes to Financial Statements

| | | |

INCREASE (DECREASE) IN NET ASSETS FROM | | | |

| | | |

OPERATIONS | | | |

Net investment income (loss) | | $(31,407

| ) |

Net realized gain (loss) on total return swap contracts | | (3,488,214 | ) |

Net change in unrealized appreciation (depreciation)

of total return swap contracts | | (314,125 | ) |

Increase (decrease) in net assets from operations | | (3,833,746 | ) |

| | | |

CAPITAL STOCK TRANSACTIONS (NOTE 5) | | | |

Shares issued | | 30,353,994 | |

Shares redeemed | | (21,279,267 | ) |

Increase (decrease) in net assets from capital stock transactions | | 9,074,727 | |

| | | |

NET ASSETS | | | |

Increase (decrease) during period | | 5,240,981 | |

Beginning of period | | — | |

End of period | | $5,240,981

| |

*The Fund commenced operations on January 4, 2024.

5

FINANCIAL STATEMENTS | august 31, 2024

See Notes to Financial Statements

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Financial HighlightsSelected Per Share Data Throughout the Period

| | | |

| | January 4, 2024*

through

August 31, 2024 | |

Net asset value, beginning of period | | $25.00

| |

Investment activities | | | |

Net investment income (loss)(1) | | (0.12 | ) |

Net realized and unrealized gain (loss)

on total return swap contracts | | (7.97 | ) |

Total from investment activities | | (8.09 | ) |

Net asset value, end of period | | $16.91

| |

| | | |

Total Return(2) | | (32.37 | %) |

Ratios/Supplemental Data | | | |

Ratios to average net assets(3) | | | |

Expenses | | 0.75 | % |

Net investment income (loss) | | (0.75 | %) |

Portfolio turnover rate(4) | | 0.00 | % |

Net assets, end of period (000’s) | | $5,241

| |

(1)Per share amounts calculated using the average shares outstanding during the period.

(2)Total return is for the period indicated and has not been annualized.

(3)Ratios to average net assets have been annualized.

(4)Ratio is zero due to the Funds not holding any long term securities at any month end during the period.

*Commencement of operations.

6

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial StatementsAugust 31, 2024

NOTE 1 – ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Tuttle Capital Daily 2X Inverse Regional Banks ETF (the “Fund”) is a non-diversified series of ETF Opportunities Trust, a Delaware statutory trust (the “Trust”) which was organized on March 18, 2019 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund commenced operations on January 4, 2024.

The Fund’s investment objective is to seek 200% of the inverse (or opposite) of the daily performance of the SPDR® S&P® Regional Banking ETF (the “KRE ETF”).

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies”.

Security Valuation

The Fund records its investments at fair value. Generally, the Fund’s domestic securities (including underlying ETFs which hold portfolio securities primarily listed on foreign (non-U.S.) exchanges) are valued each day at the last quoted sales price on each security’s primary exchange. Securities traded or dealt in upon one or more securities exchanges for which market quotations are readily available and not subject to restrictions against resale shall be valued at the last quoted sales price on the primary exchange or, in the absence of a sale on the primary exchange, at the mean between the current bid and ask prices on such exchange. Other assets for which market prices are not readily available are valued at their fair value under procedures set by the Board of Trustees (the “Board”). Although the Board is ultimately responsible for fair value determinations under Rule 2a-5 of the 1940 Act, the Board has delegated day-to-day responsibility for oversight of the valuation of the Fund’s assets to Tuttle Capital Management, LLC (the “Advisor”) as the Valuation Designee pursuant to the Fund’s policies and procedures. Securities that are not traded or dealt in any securities exchange (whether domestic or foreign) and for which over-the-counter market quotations are readily available generally shall be valued at the last sale price or, in the absence of a sale, at the mean between the current bid and ask price on such over-the-counter market.

7

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

Certain securities or investments for which daily market quotes are not readily available may be valued, pursuant to methodologies established by the Board. Debt securities not traded on an exchange may be valued at prices supplied by a pricing agent(s) approved by the Board based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics, such as rating, interest rate and maturity. Short-term investments having a maturity of 60 days or less may be generally valued at amortized cost when it approximates fair value.

Exchange traded options are valued at the last quoted sales price or, in the absence of a sale, at the mean between the current bid and ask prices on the exchange on which such options are traded. Futures and options on futures are valued at the settlement price determined by the exchange, or, if no settlement price is available, at the last sale price as of the close of business prior to when a Fund calculates Net Asset Value (“NAV”). Other securities for which market quotes are not readily available are valued at fair value as determined in good faith by the Valuation Designee (as defined below). Swap agreements and other derivatives are generally valued daily depending on the type of instrument and reference assets based upon market prices, the mean between bid and asked price quotations from market makers, provided by a pricing service, at a price received from the counterparty to the swap, or by the Valuation Designee in accordance with the valuation procedures approved by the Board.

Accounting standards establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs used to develop the measurements of fair value, which are summarized in the three broad levels listed below.

Various inputs are used in determining the value of the Fund’s investments. GAAP established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

8

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

The following is a summary of the level of inputs used to value the Fund’s investments as of August 31, 2024:

| | | | | | | | | |

| | Level 1

Quoted Prices | | Level 2

Other Significant Observable Inputs | | Level 3

Significant Unobservable Inputs | | Total | |

Liabilities | | | | | | | | | |

Unrealized Depreciation on Total Return Swap Contracts | | $—

| | $(314,125

| ) | $—

| | $(314,125

| ) |

| | $—

| | $(314,125

| ) | $—

| | $(314,125

| ) |

Refer to the Fund’s Schedules of Investments for a listing of the securities by type.

The Fund held no Level 3 securities at any time during the period ended August 31, 2024.

Security Transactions and Income

Security transactions are accounted for on the trade date. The cost of securities sold is determined generally on specific identification basis. Realized gains and losses from security transactions are determined on the basis of identified cost for book and tax purposes. Dividends are recorded on the ex-dividend date. Interest income is recorded on an accrual basis.

Accounting Estimates

In preparing financial statements in conformity with GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of investment income and expenses during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes

The Fund has complied and intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that they will not be subject to excise tax on undistributed income and gains. Therefore, no federal income tax or excise provision is required.

9

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

Management has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken in the Fund’s tax returns. The Fund has no examinations in progress and management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Interest and penalties, if any, associated with any federal or state income tax obligations are recorded as income tax expense as incurred.

Reclassification of Capital Accounts

GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. During the period ended August 31, 2024, such reclassifications were due to the write-off of net operating losses.

| | | |

Distributable earnings | | $251,287

| |

Paid-in capital | | (251,287 | ) |

Dividends and Distributions

Dividends from net investment income, if any, are declared and paid annually by the Fund. The Fund distributes it’s net realized capital gains, if any, to shareholders annually. The Fund may also pay a special distribution at the end of a calendar year to comply with federal tax requirements. All distributions are recorded on the ex-dividend date.

Creation Units

The Fund issue and redeem shares to certain institutional investors (typically market makers or other broker-dealers) only in large blocks of at least 10,000 shares known as “Creation Units.” Purchasers of Creation Units (“Authorized Participants”) will be required to pay to Citibank, N.A. (the “Custodian”) a fixed transaction fee (“Creation Transaction Fee”) in connection with creation orders that is intended to offset the transfer and other transaction costs associated with the issuance of Creation Units. The standard Creation Transaction Fee will be the same regardless of the number of Creation Units purchased by an investor on the applicable Business Day. The Creation Transaction Fee charged by the Custodian for each creation order is $250. Authorized Participants wishing to redeem shares will be required to pay to the Custodian a fixed transaction fee (“Redemption Transaction Fee”) to offset the transfer and other transaction costs associated with the redemption of Creation Units. The standard Redemption Transaction Fee will be the same regardless of the number of Creation Units redeemed by an investor on the applicable Business Day. The Redemption Transaction Fee charged by the Custodian for each redemption order is $250.

10

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

Except when aggregated in Creation Units, shares are not redeemable securities. Shares of the Fund may only be purchased or redeemed by Authorized Participants. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company (“DTC”) participant and, in each case, must have executed an agreement with the Fund’s principal underwriter (the “Distributor”) with respect to creations and redemptions of Creation Units (“Participation Agreement”). Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Fund. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees. The following table discloses the Creation Unit breakdown based on the NAV as of August 31, 2024:

| | | | | | |

| | Creation

Unit Shares | | Creation Transaction Fee | | Value |

Tuttle Capital Daily 2X Inverse Regional Banks ETF | | 10,000 | | $250 | | $169,100 |

To the extent contemplated by a participant agreement, in the event an Authorized Participant has submitted a redemption request in proper form but is unable to transfer all or part of the shares comprising a Creation Unit to be redeemed to the Distributor, on behalf of the Fund, by the time as set forth in a participant agreement, the Distributor may nonetheless accept the redemption request in reliance on the undertaking by the Authorized Participant to deliver the missing shares as soon as possible, which undertaking shall be secured by the Authorized Participant’s delivery and maintenance of collateral equal to a percentage of the value of the missing shares as specified in the participant agreement. A participant agreement may permit the Fund to use such collateral to purchase the missing shares, and could subject an Authorized Participant to liability for any shortfall between the cost of the Fund acquiring such shares and the value of the collateral. Amounts are disclosed as Segregated Cash Balance from Authorized Participants for Deposit Securities and Collateral Payable upon Return of Deposit Securities on the Statements of Assets and Liabilities, when applicable.

Derivatives

The Fund may enter into total return swaps, which may be used either as economically similar substitutes for owning the reference asset specified in the swap, such as the securities that comprise a given market index, particular securities or commodities, or other assets or indicators. They also may be used

11

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

as a means of obtaining exposure in markets where the reference asset is unavailable or it may otherwise be impossible or impracticable for the Fund to own that asset. “Total return” refers to the payment (or receipt) of the total return on the underlying reference asset, which is then exchanged for the receipt (or payment) of an interest rate. Total return swaps provide a Fund with the additional flexibility of gaining exposure to a market or sector index in a potentially more economical way.

Most swaps entered into by the Fund provide for the calculation and settlement of the obligations of the parties to the agreement on a “net basis” with a single payment. Consequently, the Fund’s current obligations (or rights) under a swap will generally be equal only to the net amount to be paid or received under the agreement based on the relative values of the positions held by each party to the agreement (the “net amount”). Other swaps may require initial premium (discount) payments as well as periodic payments (receipts) related to the interest leg of the swap or to the return on the reference entity. The Fund’s current obligations under the types of swaps that the Funds expect to enter into (e.g., total return swaps) will be accrued daily (offset against any amounts owed to the Fund by the counterparty to the swap) and any accrued but unpaid net amounts owed to a swap counterparty will collateralized by the Fund posting collateral to a tri-party account between the Fund’s custodian, the Fund, and the counterparty. However, typically no payments will be made until the settlement date. Swap agreements do not involve the delivery of securities or other underlying assets. Accordingly, if a swap is entered into on a net basis and if the counterparty to a swap agreement defaults, the Fund’s risk of loss consists of the net amount of payments that the Fund is contractually entitled to receive, if any.

The following table presents the Fund’s gross derivative assets and liabilities by counterparty and contract type, net of amounts available for the offset under a master netting agreement and the related collateral received or pledged by the Fund as of August 31, 2024.

| | | | | | | |

| Derivative Assets | | Derivative Liabilities | | |

Counterparty | Total | | Total

Return Swaps* | Total | Net Derivative Assets (Liabilities) | Collateral Pledged (Received)** | Net

Amount |

Clear Street | $ — | | $314,125 | $314,125 | $(314,125) | $314,125 | $ — |

*Statement of Assets and Liabilities location: Net unrealized depreciation on total return swap contracts.

**The actual collateral pledged (received) may be more than the amounts shown.

12

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

The average monthly notional amount of the swap contracts during the period ended August 31, 2024 was $(13,343,985).

At the period ended August 31, 2024, the Fund was invested in derivative contracts, which are reflected in the Statement of Assets and Liabilities, as follows:

| | | |

| | Derivative Liabilities |

Risk | Derivative Type | Statement of Assets and Liabilities Location | Fair Value Amount |

Equity | Total

return swap

contracts | Net unrealized

depreciation on total

return swap contracts | $(314,125) |

The effect of derivative instruments on the Statement of Operations and whose underlying risk exposure is equity price risk for the period ended August 31, 2024 is as follows:

| |

Realized Gain (Loss)

on Derivatives

Recognized in Income* | Change in

Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income** |

$(3,488,214) | $(314,125) |

*Statement of Operations location: Net realized gain (loss) on total return swap contracts.

**Statement of Operations location: Net change in unrealized appreciation (depreciation) on total return swap contracts.

Officers and Trustees Indemnification

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

NOTE 2 – INVESTMENT ADVISORY AND DISTRIBUTION AGREEMENTS AND OTHER TRANSACTIONS WITH AFFILIATES

The Advisor currently provides investment advisory services pursuant to an investment advisory agreement (the “Advisory Agreement”). Under the terms of the Advisory Agreement, the Advisor is responsible for the day-to-day

13

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

management of the Fund’s investments. The Advisor also: (i) furnishes the Fund with office space and certain administrative services; and (ii) provides guidance and policy direction in connection with its daily management of the Fund’s assets, subject to the authority of the Board. Under the Advisory Agreement, the Advisor has agreed, at its own expense and without reimbursement from the Fund, to pay all expenses of the Fund, except for: the fee paid to the Advisor pursuant to the Advisory Agreement, interest expenses, taxes, acquired fund fees and expenses, brokerage commissions and any other portfolio transaction related expenses and fees arising out of transactions effected on behalf of the Fund, credit facility fees and expenses, including interest expenses, and litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business.

For its services with respect to the Fund, the Advisor is entitled to receive an annual advisory fee, calculated daily and payable monthly as a percentage of the Fund’s average daily net assets, at a rate of 0.75%.

Fund Administrator

Commonwealth Fund Services, Inc. (“CFS”) acts as the Fund’s administrator. As administrator, CFS supervises all aspects of the operations of the Fund except those performed by the Advisor. For its services, fees to CFS are computed daily and paid monthly. The Advisor pays these fees.

Custodian and Transfer Agent

Citibank, N.A. serves as the Fund’s Custodian and Transfer Agent pursuant to a Global Custodial and Agency Services Agreement. For its services, Citibank N.A. is entitled to a fee. The Advisor pays these fees monthly.

Fund Accountant

Citi Fund Services, Ohio, Inc. serves as the Fund’s Fund Accountant pursuant to a Services Agreement. The Advisor pays these fees monthly.

Distributor

Foreside Fund Services, LLC serves as the Fund’s principal underwriter pursuant to an ETF Distribution Agreement. The Advisor pays the fees for these services monthly.

14

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

Trustees and Officers

Each Trustee who is not an “interested person” of the Trust receives compensation for their services to the Fund. Each Trustee receives an annual retainer fee, paid quarterly. Trustees are reimbursed for any out-of-pocket expenses incurred in connection with attendance at meetings. The Advisor pays these fees.

Certain officers of the Trust are also officers and/or directors of CFS. Additionally, Practus LLP, serves as legal counsel to the Trust. John H. Lively, Secretary of the Trust, is Managing Partner of Practus LLP. J. Stephen King, Jr., Assistant Secretary of the Trust, is a Partner of Practus LLP. Neither the officers and/or directors of CFS, Mr. Lively or Mr. King receive any special compensation from the Trust or the Fund for serving as officers of the Trust.

The Fund’s Chief Compliance Officer and Assistant Chief Compliance Officer are not compensated directly by the Fund for their service. However, the Assistant Chief Compliance Officer is the Managing Member of Watermark Solutions, LLC (“Watermark”), which provides certain compliance services to the Fund, including the provision of the Chief Compliance Officer and the Assistant Chief Compliance Officer. The Assistant Chief Compliance Officer is the Managing Member of Watermark, and the Chief Compliance Officer is the Managing Member of Fit Compliance, LLC, which has been retained by Watermark to provide the Chief Compliance Officer’s services.

NOTE 3 – INVESTMENTS

During the period ended August 31, 2024, there were no purchases or sales of long term securities, or purchases or sales of in-kind transactions associated with creations and redemptions.

NOTE 4 – DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL

Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

15

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

There were no distributions paid by the Fund during the period ended August 31, 2024.

As of August 31, 2024 the components of distributable earnings (accumulated deficits) on a tax basis were as follows:

| | | |

Accumulated net investment income | | $—

| |

Accumulated net realized gain (loss) | | (3,582,459 | ) |

Net unrealized appreciation (depreciation) | | — | |

| | $(3,582,459

| ) |

As of August 31, 2024, the Fund had a capital loss carryforward of $3,582,459, all of which is considered short term. This loss may be carried forward indefinitely.

Cost of securities for Federal Income tax purpose and the related tax-based net unrealized appreciation (depreciation) consists of:

| | | |

Cost | Gross Unrealized

Appreciation | Gross Unrealized

Depreciation | Total Unrealized

Appreciation

(Depreciation) |

$— | $— | $— | $— |

The difference between book basis and tax basis net unrealized appreciation (depreciation) is attributable to primarily to the tax treatment of total return swap contracts.

NOTE 5 – TRANSACTIONS IN SHARES OF BENEFICIAL INTEREST

Shares of the Fund are listed for trading on the NASDAQ Stock Market®, and trade at market prices rather than at NAV. Shares of the Fund may trade at a price that is greater than, at, or less than NAV. The Fund will issue and redeem Shares at NAV only in large blocks of 10,000 shares (each block of shares is called a “Creation Unit”). Creation Units are issued and redeemed for cash and/or in-kind for securities. Individual shares may only be purchased and sold in secondary market transactions through brokers. Except when aggregated in Creation Units, the shares are not redeemable securities of the Fund.

All orders to create Creation Units must be placed with the Fund’s distributor or transfer agent either (1) through the Continuous Net Settlement System of the NSCC (“Clearing Process”), a clearing agency that is registered with the Securities and Exchange Commission (“SEC”), by a “Participating Party,” i.e., a broker-dealer or other participant in the Clearing Process; or (2) outside the Clearing Process by a DTC Participant. In each case, the Participating Party or the DTC Participant

16

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Notes to Financial Statements - continuedAugust 31, 2024

must have executed an agreement with the Distributor with respect to creations and redemptions of Creation Units (“Participation Agreement”); such parties are collectively referred to as “APs” or “Authorized Participants.” Investors should contact the Distributor for the names of Authorized Participants. All Fund shares, whether created through or outside the Clearing Process, will be entered on the records of DTC for the account of a DTC Participant.

Shares of beneficial interest transactions for the Fund were:

| | |

Shares sold | 1,210,000 | |

Shares redeemed | (900,000 | ) |

Net increase (decrease) | 310,000 | |

NOTE 6 – RISKS OF INVESTING IN THE FUND

An investment in the Fund entails risk. The Fund may not achieve its leveraged investment objective and there is a risk that you could lose all of your money invested the Fund. The Fund is not a complete investment program. In addition, the Fund presents risks not traditionally associated with other mutual funds and ETFs. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any government agency. A complete description of the principal risks is included in the Fund’s prospectus under the heading “Principal Risks.”

NOTE 7 – SUBSEQUENT EVENTS

Management has evaluated all transactions and events subsequent to the date of the Statement of Assets and Liabilities through the date on which these financial statements were issued. Except as already included in the notes to these financial statements, no additional items require disclosure.

17

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Report of Independent Registered Public Accounting Firm

To the Shareholders Tuttle Capital Daily 2X Inverse Regional Banks ETF and Board of Trustees of ETF Opportunities Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Tuttle Capital Daily 2X Inverse Regional Banks ETF (the “Fund”), a series of ETF Opportunities Trust, as of August 31, 2024, the related statements of operations, changes in net assets, and the financial highlights for the period January 4, 2024 (commencement of operations) through August 31, 2024, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2024, the results of its operations, the changes in net assets, and the financial highlights for the period January 4, 2024 (commencement of operations) through August 31, 2024, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2024, by correspondence with the custodian and broker. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Tuttle Capital Management, LLC since 2019.

COHEN & COMPANY, LTD.

Cleveland, Ohio

October 29, 2024

18

FINANCIAL STATEMENTS | august 31, 2024

TUTTLE CAPITAL DAILY 2X INVERSE REGIONAL BANKS ETF

Supplemental Information (unaudited)

Changes in and disagreements with accountants for open-end management investment companies.

Not applicable.

Proxy disclosures for open-end management investment companies.

The Trustees of the Trust authorized a Special Meeting of Shareholders that was held on August 15, 2024 (the “Special Meeting”). The Special Meeting was called for the purpose of electing Trustees to the Trust. Because the Special Meeting involved a matter that affected the Trust as a whole, the proposal was put forth for consideration by shareholders of each series of the Trust, including the Fund. A quorum of shareholders was not achieved and the Special Meeting was adjourned without action.

Remuneration paid to Trustees, Officers, and others of open-end management investment companies.

For the period ended August 31, 2024, the Advisor paid the following remuneration to Trustees and Officers:

| | |

Trustee compensation | | $6,497

|

Chief Compliance Officer’s services | | 5,903 |

Statement Regarding Basis for Approval of Investment Advisory Contract.

Not applicable.

| ITEM 8. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 9. | PROXY DISCLOSURES FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Reference Item 7 which includes proxy disclosures for open-end management investment companies in the Supplemental Information.

| ITEM 10. | REMUNERATION PAID TO DIRECTORS, OFFICERS, AND OTHERS OF OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Reference Item 7 which includes remuneration paid to the Trustees and Officers in the Supplemental Information.

| ITEM 11. | STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY CONTRACT. |

Not applicable.

| ITEM 12. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable because it is not a closed-end management investment company.

| ITEM 13. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable because it is not a closed-end management investment company.

| ITEM 14. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable because it is not a closed-end management investment company.

| ITEM 15. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant's board of trustees.

| ITEM 16. | CONTROLS AND PROCEDURES. |

(a) The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the "1940 Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d- 15(b)).

(b) There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

| ITEM 17. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable because it is not a closed-end management investment company.

| ITEM 18. | RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION. |

Not applicable.

| (a)(2) | Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act of 1934 - Not applicable. |

(a)(3)(1) Any written solicitation to purchase securities under Rule 23c-1 under the Investment Company Act of 1940 – Not applicable.

(a)(3)(2) Change in the registrant’s independent public accountant – Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant: ETF Opportunities Trust

| By (Signature and Title)*: | /s/ Karen Shupe |

| | Karen Shupe Principal Executive Officer |

| Date: November 7, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)*: | /s/ Karen Shupe |

| | Karen Shupe Principal Executive Officer |

| Date: November 7, 2024 | |

| | |

| By (Signature and Title)*: | /s/ Ann MacDonald |

| | Ann MacDonald Principal Financial Officer |

| Date: November 7, 2024 | |

* Print the name and title of each signing officer under his or her signature.