Exhibit 99.2

CSE: VREO OTCQX: VREOF Transaction Presentation December 18, 2024

Disclaimer || 2 Disclaimer CAUTIONARY NOTE REGARDING FORWARD - LOOKING INFORMATION : This document includes information, statements, beliefs and opinions which are forward - looking, and which reflect current estimates, expectations and projections about future events, referred to herein and which constitute “forward - looking statements” or “forward - looking information” within the meaning of Canadian and U . S . securities laws . Statements containing the words “believe”, “expect”, “intend”, “should”, “seek”, “anticipate”, “will”, “positioned”, “project”, “risk”, “plan”, “may”, “estimate” or, in each case, their negative and words of similar meaning are intended to identify forward - looking statements and include statements regarding the projected financial performance of the combined entities, the potential benefits of the merger transactions, the future business activity of Vireo and the merger targets, expected transaction terms for the mergers, the opportunity for future M&A activity, and the expected ownership percentage of Vireo security holders in the future, among others . By their nature, forward - looking statements involve a number of known and unknown risks, uncertainties and assumptions concerning, among other things, the Company’s anticipated business strategies, anticipated trends in the Company’s business and anticipated market share, risks related to the shareholder approval of the merger transactions ; risks related to regulatory approval of the merger transactions ; risks related to the accuracy of the financial projections related to the merger transactions ; the risk that Vireo may not realize the expected benefits of the Merger Transactions ; the inability to retain key employees of any acquired or merged businesses or hire enough qualified personnel to staff any new or expanded operations ; the impairment of relationships with key customers of the target companies due to changes in management and ownership of the acquired entities ; the inability to sublease on financially acceptable terms excess leased space or terminate lease obligations of acquired or merged businesses that are not necessary or useful for the operation of Vireo’s business ; the exposure to federal, state, local and foreign tax liabilities in connection with the merger transactions or the integration of any acquired or merged businesses ; the exposure to unknown liabilities or disputes with the former stakeholders or management or employees of target companies ; higher than expected merger and integration expenses that would cause Vireo’s quarterly and annual operating results to fluctuate ; increased amortization expenses if the merger transactions result in significant intangible assets ; combining the operations and personnel of the various entities, which would be difficult and costly ; disputes over rights to acquired or accessed technologies or with licensors or licensees of those technologies ; integrating or completing the development and application of any acquired or accessed technologies, which would disrupt Vireo’s business and divert management’s time and attention ; and the risk factors set out in Vireo's Form 10 - K for the fiscal year ended December 31 , 2023 , which is available on EDGAR with the U . S . Securities and Exchange Commission and filed with the Canadian securities regulators and available under Vireo's profile on SEDAR at www . sedar . com, that could cause actual results or events to differ materially from those expressed or implied by the forward - looking statements . These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein . In addition, even if the outcome and financial effects of the plans and events described herein are consistent with the forward - looking statements contained in this document, those results or developments may not be indicative of results or developments in subsequent periods . Although the Company has attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward - looking information, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended . Forward - looking information contained in this presentation is based on the Company’s current estimates, expectations and projections, which the Company believes are reasonable as of the current date . The Company can give no assurance that these estimates, expectations and projections will prove to have been correct . You should not place undue reliance on forward - looking statements, which are based on the information available as of the date of this document . Forward - looking statements contained in this document are made of the date of this presentation and, except as required by applicable law, the Company assumes no obligation to update or revise them to reflect new events or circumstances . Historical statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future . In this regard, certain financial information contained herein has been extracted from, or based upon, information available in the public domain and/or provided by the Company . In particular historical results should not be taken as a representation that such trends will be replicated in the future . No statement in this document is intended to be nor may be construed as a profit forecast . CAUTIONARY NOTE REGARDING FUTURE - ORIENTED FINANCIAL INFORMATION : To the extent any forward - looking information in this presentation constitutes “future - oriented financial information” or “financial outlooks” within the meaning of applicable Canadian securities laws, such information is being provided to demonstrate the anticipated market penetration and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future - oriented financial information and financial outlooks . Future - oriented financial information and financial outlooks, as with forward - looking information generally, are, without limitation, based on the assumptions and subject to the risks set out above under the heading “Cautionary Note Regarding Forward - Looking Information” . Vireo’s actual financial position and results of operations may differ materially from management’s current expectations and, as a result, Vireo’s revenue and expenses may differ materially from the revenue and expenses profiles provided in this presentation . Such information is presented for illustrative purposes only and may not be an indication of Vireo’s actual financial position or results of operations .

Disclaimer (Cont’d) || 3 Disclaimer (Cont’d) CANNABIS - RELATED ACTIVITIES ARE ILLEGAL UNDER U . S . FEDERAL LAWS : The U . S . Federal Controlled Substances Act classifies “marihuana” as a Schedule I drug . Accordingly, cannabis - related activities, including without limitation, the cultivation, manufacture, importation, possession, use or distribution of cannabis and cannabis products are illegal under U . S . federal law . Strict compliance with state and local laws with respect to cannabis will neither absolve the Company of liability under U . S . federal law, nor will it provide a defense to any federal prosecution which may be brought against the Company with respect to adult - use or recreational cannabis . Any such proceedings brought against the Company may adversely affect the Company’s operations and financial performance . Prospective investors should carefully consider the risk factors described under “Risk Factors” in this presentation before investing directly or indirectly in the Company and purchasing the securities described herein . NON - GAAP FINANCIAL INFORMATION : This communication includes certain “non - GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934 , as amended, including EBITDA, Net Debt, Net Leverage and Net Leverage including Taxes . These non - GAAP financial measures are included in this communication as the management of Vireo believe such measures are useful to investors in evaluating the companies’ operating performance . These non - GAAP financial measures are not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP by Vireo in their filings with the SEC . The non - GAAP financial measures also may not be comparable to similar measures disclosed by other companies because of differing methods used by other companies in calculating EBITDA, Net Debt, Net Leverage and Net Leverage including Taxes . DEFINITIONS : Vireo defines EBITDA as operating income plus depreciation, amortization, and depreciation included in costs of goods sold . Vireo defines Net Debt as total debt less cash and cash equivalents . Vireo defines Net Leverage as Net Debt divided by EBITDA . Net Leverage including Taxes as the sum of Net Debt, Taxes Payable and Uncertain Tax Positions divided by EBITDA .

Today’s Presenters Today’s Presenters || 4 John Mazarakis Chief Executive Officer & Co - Executive Chairman Amber Shimpa President of the Company and CEO of Minnesota, Maryland and New York Tyson Macdonald Chief Financial Officer

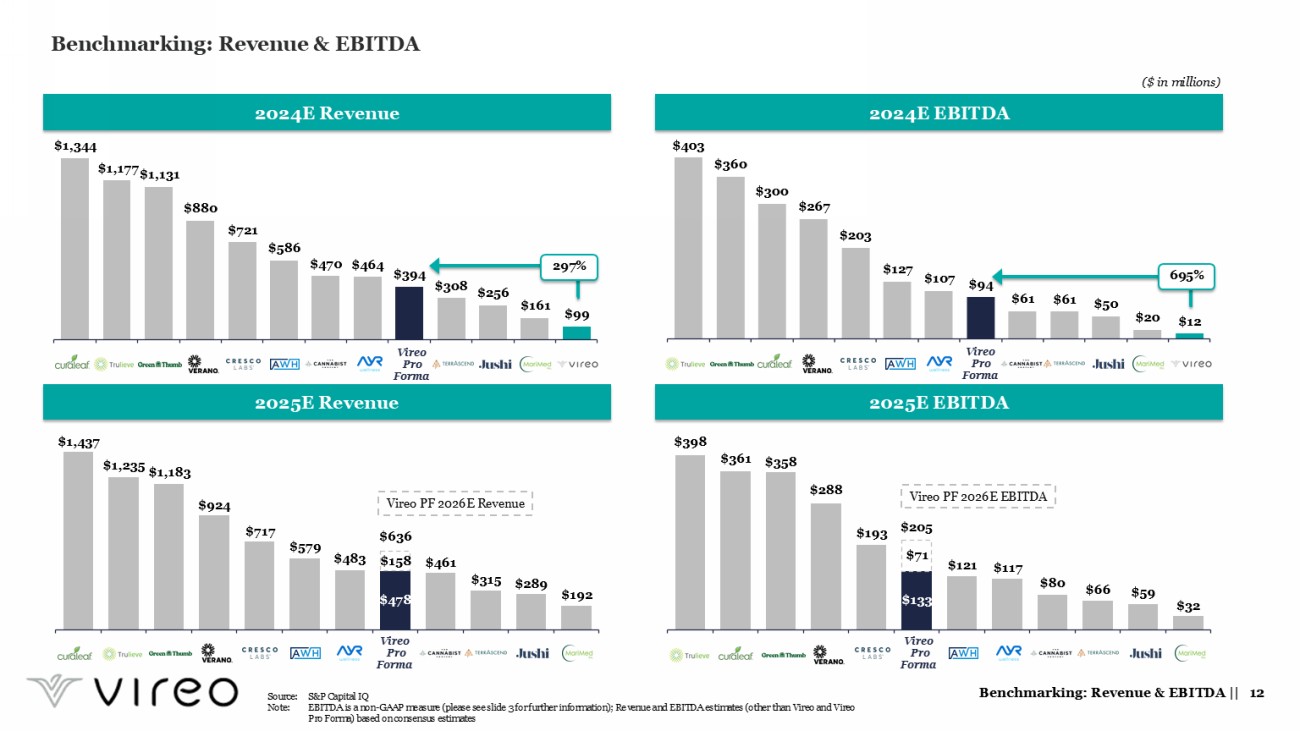

Executive Summary Executive Summary || 5 Transaction Highlights o Increased Scale and Portfolio Diversity – Creates the 8 th and 6 th largest operator by 2025E revenue and EBITDA respectively, addressing a population of ~67mm across a 7 - state footprint, which allows for a lower overall cost of capital vs. Vireo today o Fortress Balance Sheet – Pro forma net leverage of 0.8x 1 2024E EBITDA, supported by a significant cash position $99mm 1 and long - dated maturities provide Vireo with a dynamic capital structure to pursue organic and inorganic growth initiatives o Attractive Market Mix – Operator of a unique portfolio of state - level operations with a desirable mix of cash flowing and high - growth markets o Advanced Proprietary Technology – Arches omni - channel customer engagement and delivery capabilities to be leveraged across Vireo’s platform to enhance in - store, pickup and delivery distribution o Future M&A Opportunities – Geographic footprint with minimal overlap to peers creates an outsized opportunity for continued tuck - in M&A across the acquired markets o Experienced Management Team – Team with a diversity of expertise, supported by highly experienced local teams who have consistently delivered results across each market On December 18, 2024, Vireo Growth Inc. (“Vireo”) announced a series of transformational corporate events that it believes will greatly enhance its platform, positioning the company for profitable growth • Appointment of John Mazarakis as CEO and Co - Executive Chairman and Tyson Macdonald as CFO Leadership Update • Announced $75 million equity capital raise at $0.625 per share (149% premium to 12/17/2024 closing price) Strategic Equity Infusion • Signed three definitive documents and one binding Memorandum of Understanding (“MOU”) to acquire four single - state operators and the Arches technology platform in a series of all - stock transactions Transformative M&A 1 2 3 Note: EBITDA, net debt and net leverage are non - GAAP measures (please see slide 3 for further information) 1. Reflects 11/30/2024 pro forma figures net debt (debt – cash) figures inclusive of capital raise proceeds of $75 million and cont ribution from pending M&A; debt figures inclusive of the $10mm convertible note

Leadership Update Leadership Update || 6 Tyson Macdonald • Appointed Chief Financial Officer, effective immediately • Previously served as a Managing Partner at TrueRise Capital, CEO of Nova Net Lease REIT, CFO of Cloud Cannabis and an Executive Vice President of Corporate Development at Acreage Holdings • Brings over 20 years of strategy and investment experience, working with both startups and mature public companies, and is currently a Board Member of Avant Brands (TSX: AVNT) John Mazarakis • Appointed Chief Executive Officer and Co - Executive Chairman effective immediately • Co - founder of Chicago Atlantic Group, the largest credit and equity fund in the cannabis space with over ~$2 billion closed in debt and equity investments o Took public NASDAQ: REFI, a cannabis REIT, in December 2021 and led the acquisition of NASDAQ: SSIC to establish a $300 million+ cannabis BDC vehicle • Brings over 20 years of entrepreneurial, operational, and managerial experience in the real estate, retail and hospitality industries 1 CEO & Co - Executive Chairman Chief Financial Officer

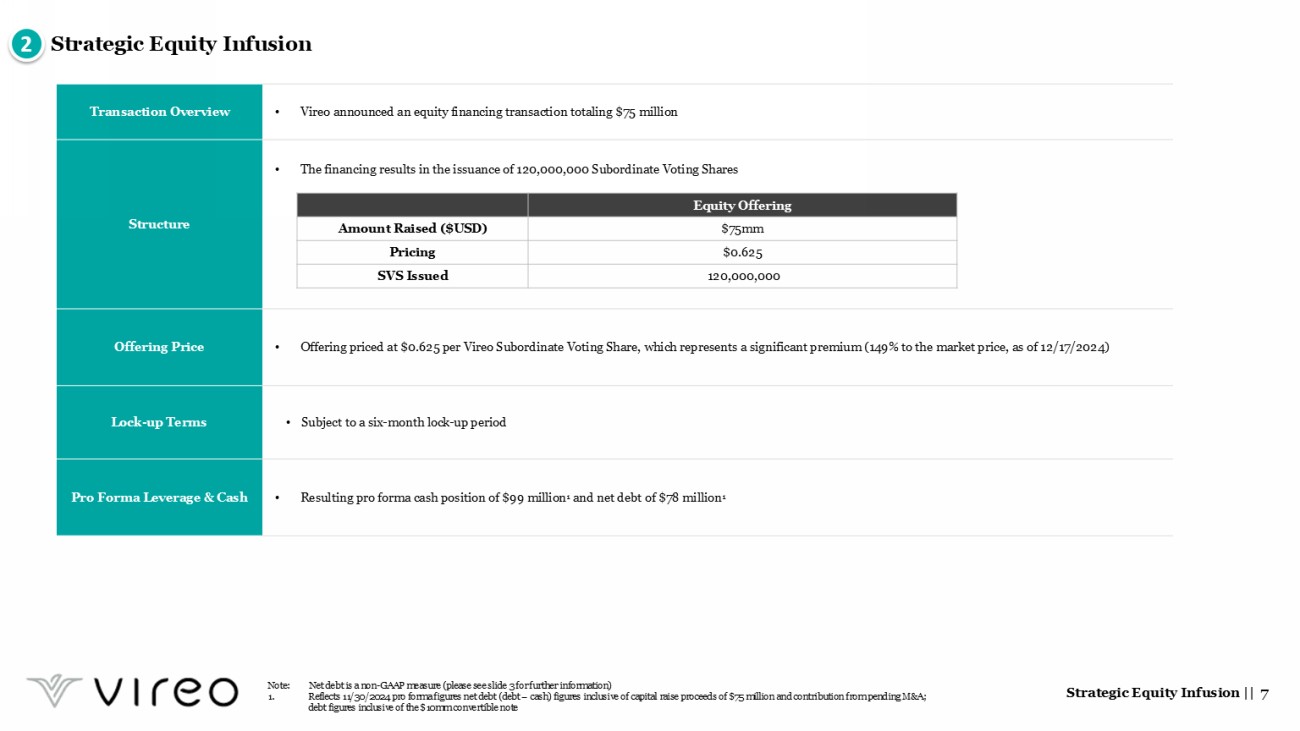

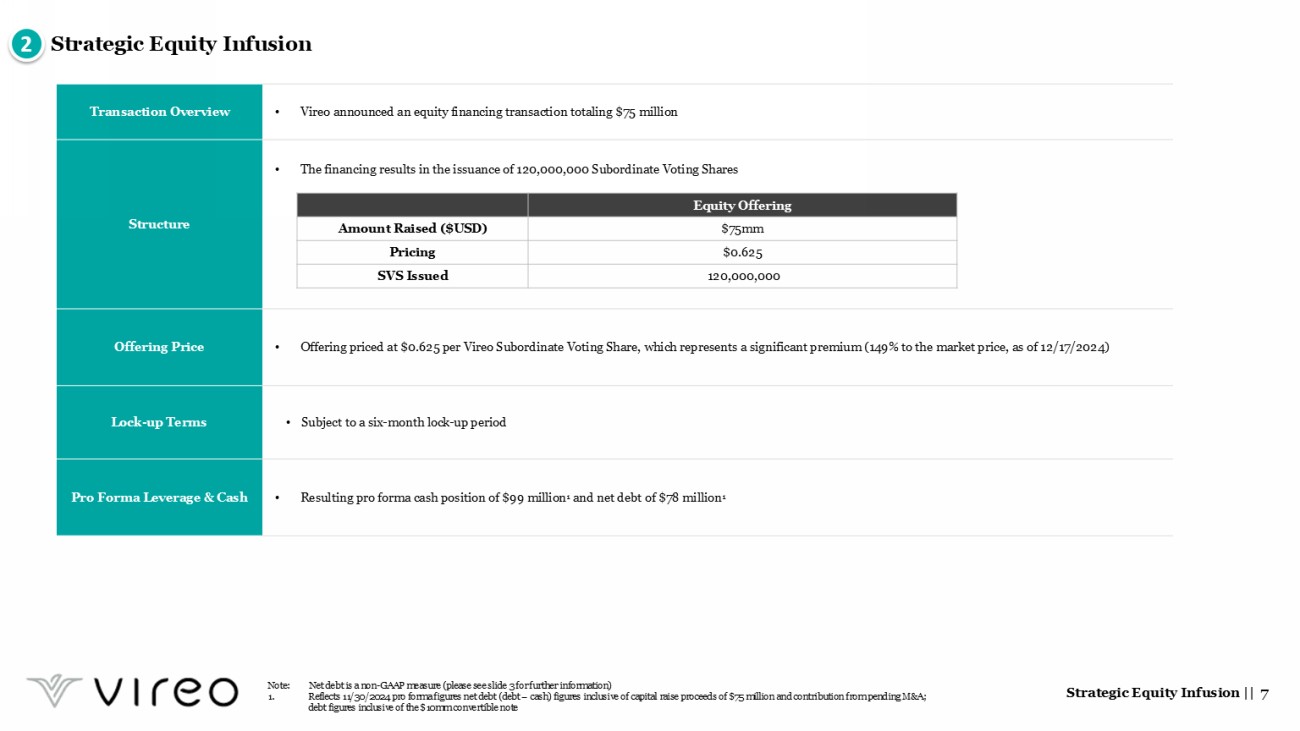

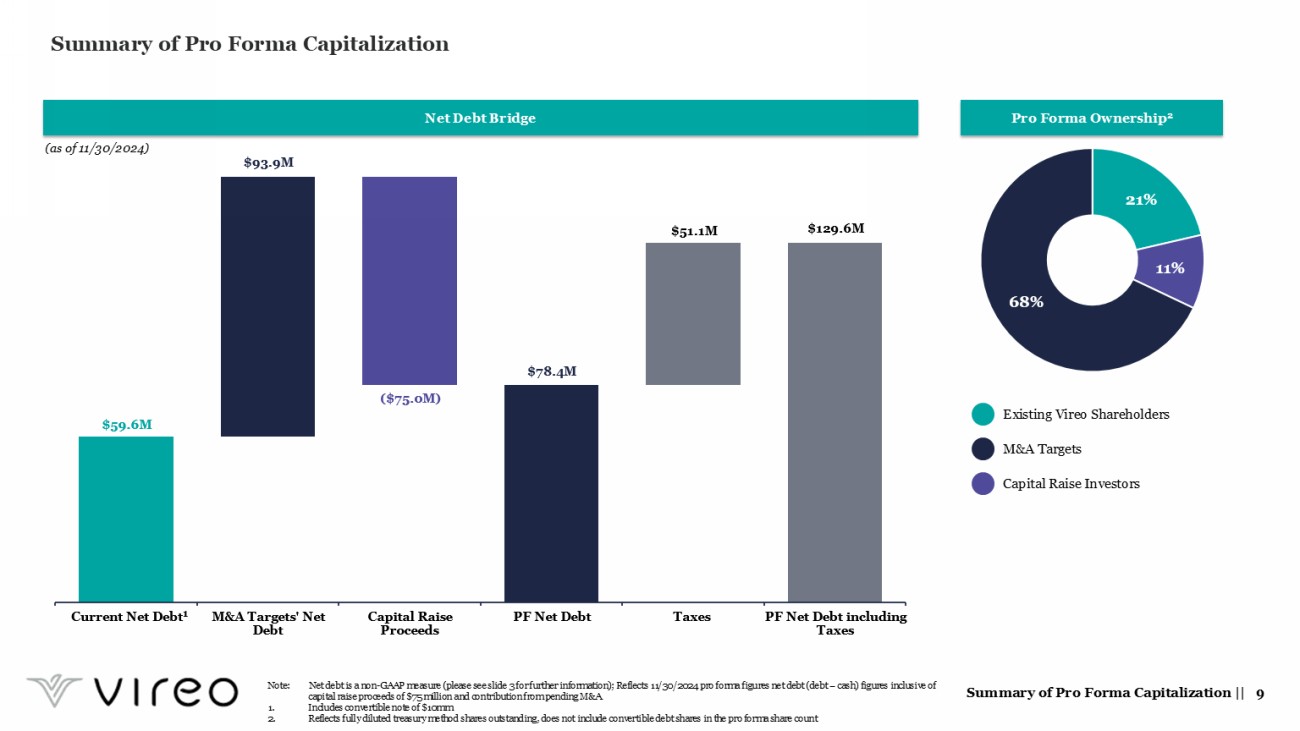

Strategic Equity Infusion Strategic Equity Infusion || 7 2 • Vireo announced an equity financing transaction totaling $75 million Transaction Overview • The financing results in the issuance of 120,000,000 Subordinate Voting Shares Structure • Offering priced at $0.625 per Vireo Subordinate Voting Share, which represents a significant premium (149% to the market pric e, as of 12/17/2024) Offering Price • Subject to a six - month lock - up period Lock - up Terms • Resulting pro forma cash position of $99 million 1 and net debt of $78 million 1 Pro Forma Leverage & Cash Equity Offering $75mm Amount Raised ($USD) $0.625 Pricing 120,000,000 SVS Issued Note: Net debt is a non - GAAP measure (please see slide 3 for further information) 1. Reflects 11/30/2024 pro forma figures net debt (debt – cash) figures inclusive of capital raise proceeds of $75 million and cont ribution from pending M&A; debt figures inclusive of the $10mm convertible note

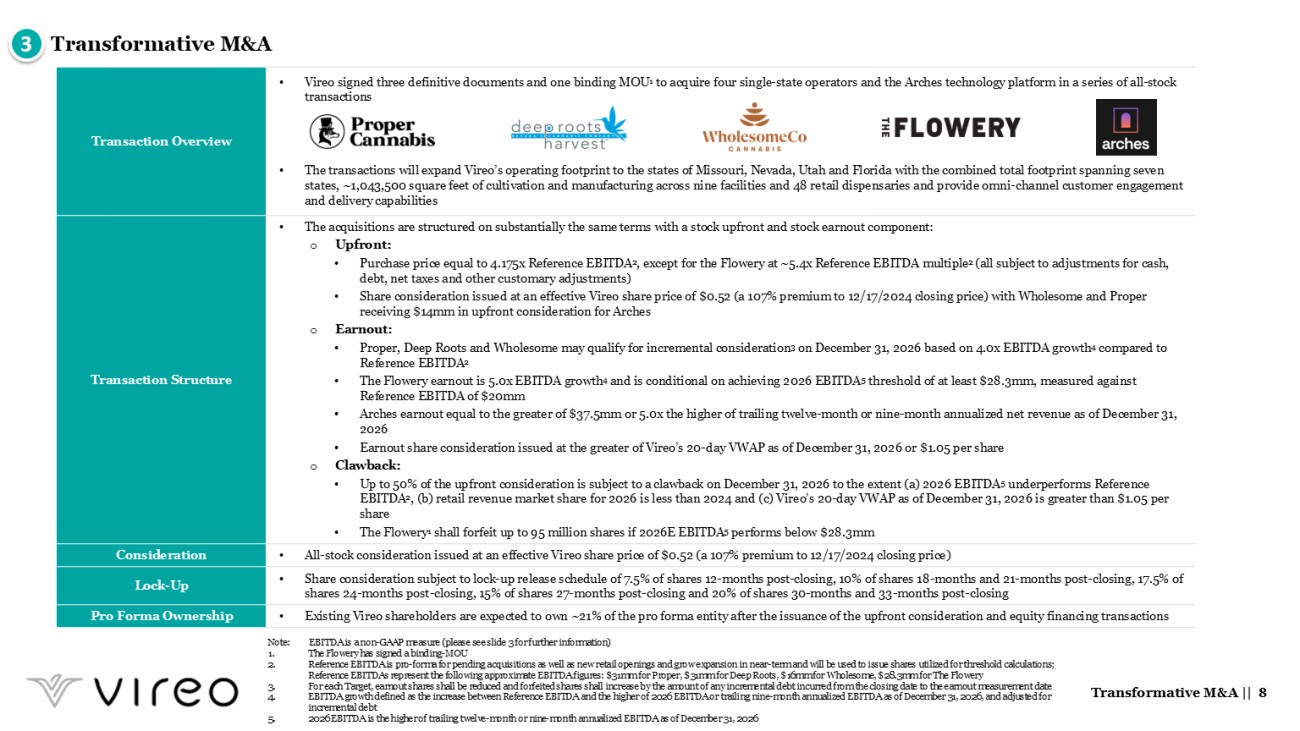

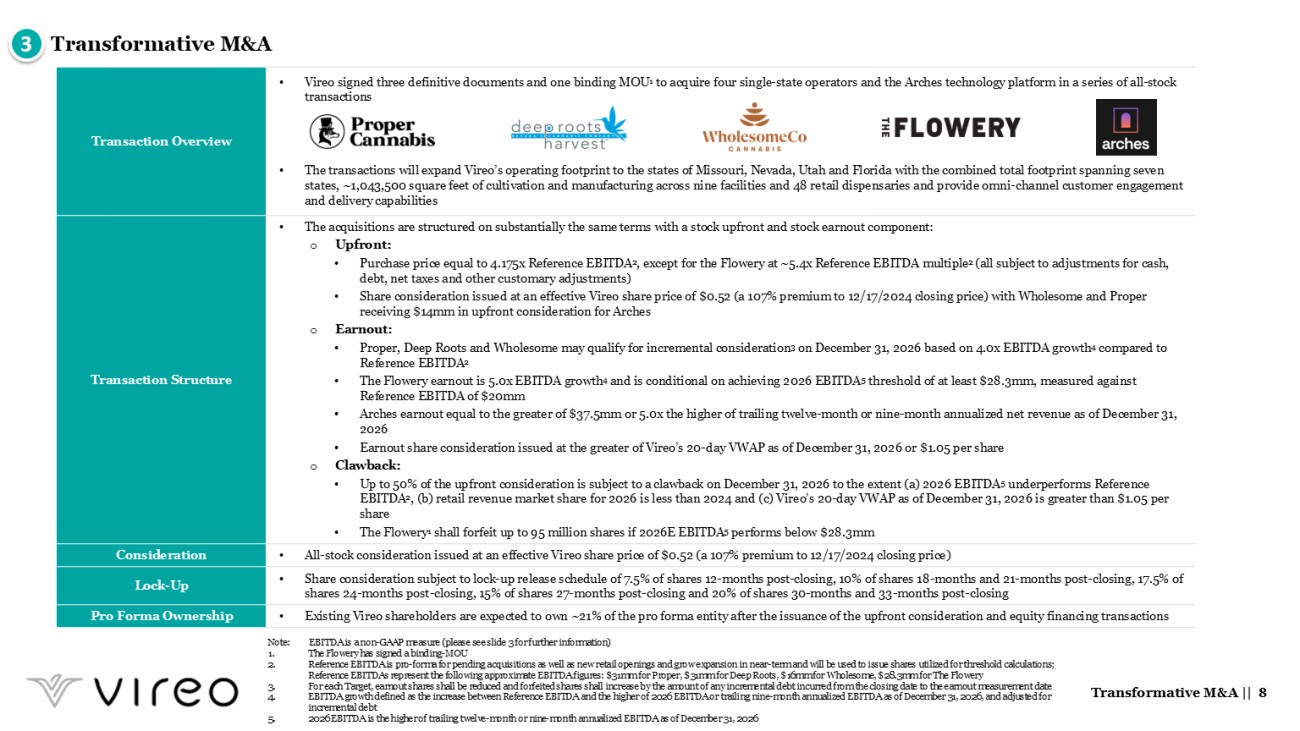

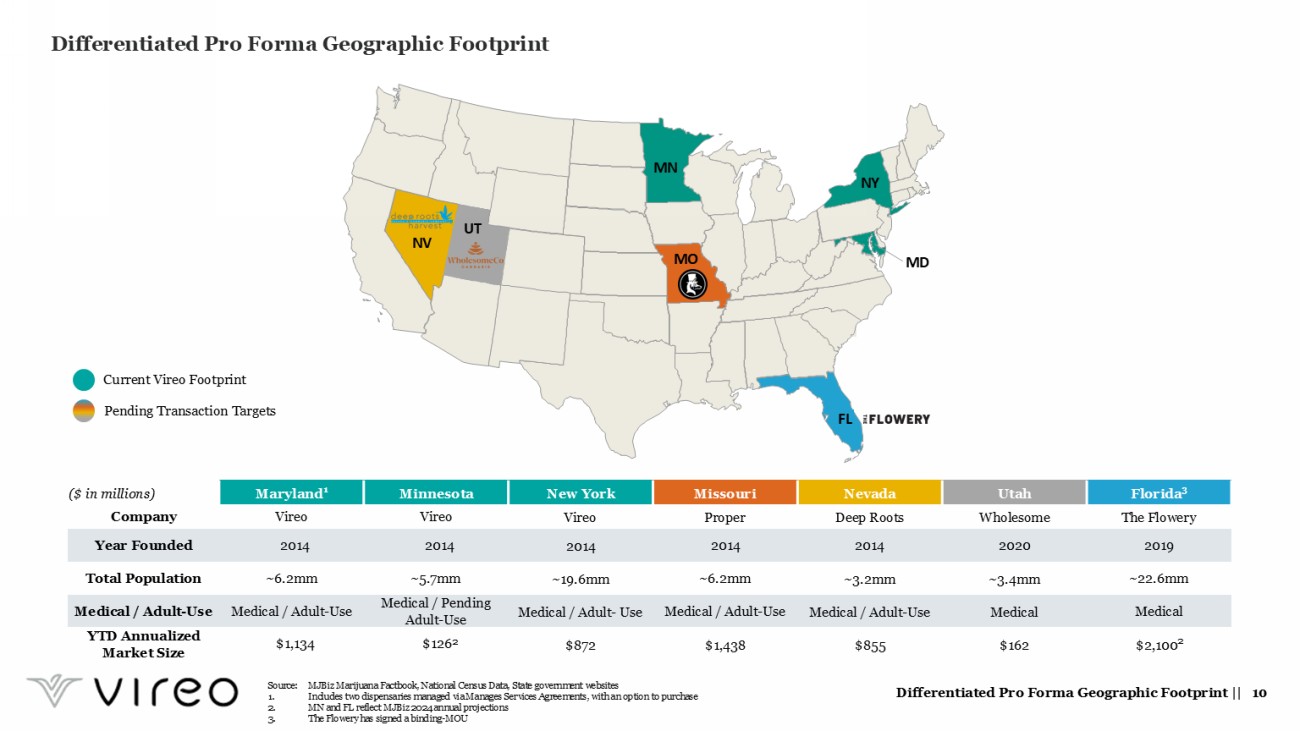

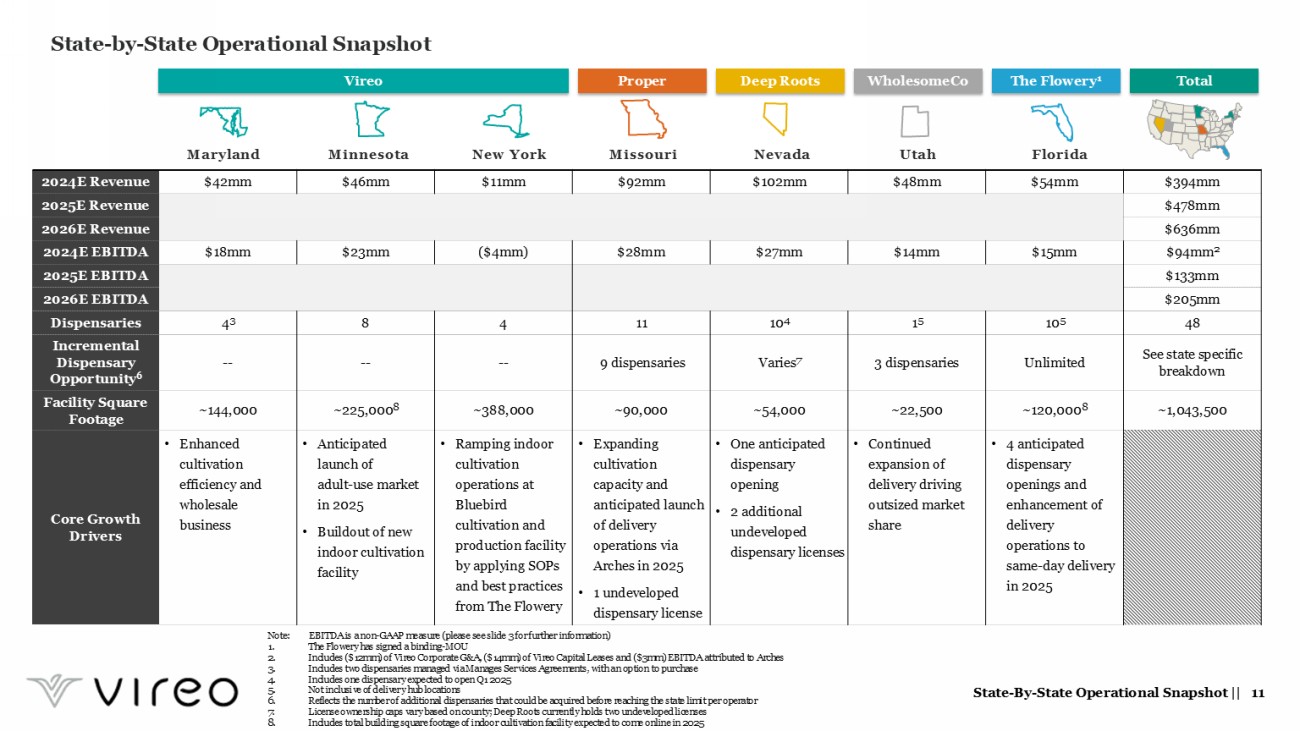

Transformative M&A Transformative M&A || 8 3 • Vireo signed three definitive documents and one binding MOU 1 to acquire four single - state operators and the Arches technology platform in a series of all - stock transactions • The transactions will expand Vireo’s operating footprint to the states of Missouri, Nevada, Utah and Florida with the combine d t otal footprint spanning seven states, ~1,043,500 square feet of cultivation and manufacturing across nine facilities and 48 retail dispensaries and provide om ni - channel customer engagement and delivery capabilities Transaction Overview • The acquisitions are structured on substantially the same terms with a stock upfront and stock earnout component: o Upfront: • Purchase price equal to 4.175x Reference EBITDA 2 , except for the Flowery at ~5.4x Reference EBITDA multiple 2 (all subject to adjustments for cash, debt, net taxes and other customary adjustments) • Share consideration issued at an effective Vireo share price of $0.52 (a 107% premium to 12/17/2024 closing price) with Whole som e and Proper receiving $14mm in upfront consideration for Arches o Earnout: • Proper, Deep Roots and Wholesome may qualify for incremental consideration 3 on December 31, 2026 based on 4.0x EBITDA growth 4 compared to Reference EBITDA 2 • The Flowery earnout is 5.0x EBITDA growth 4 and is conditional on achieving 2026 EBITDA 5 threshold of at least $28.3mm, measured against Reference EBITDA of $20mm • Arches earnout equal to the greater of $37.5mm or 5.0x the higher of trailing twelve - month or nine - month annualized net revenue as of December 31, 2026 • Earnout share consideration issued at the greater of Vireo’s 20 - day VWAP as of December 31, 2026 or $1.05 per share o Clawback : • Up to 50% of the upfront consideration is subject to a clawback on December 31, 2026 to the extent (a) 2026 EBITDA 5 underperforms Reference EBITDA 2 , (b) retail revenue market share for 2026 is less than 2024 and (c) Vireo’s 20 - day VWAP as of December 31, 2026 is greater than $1.05 per share • The Flowery 1 shall forfeit up to 95 million shares if 2026E EBITDA 5 performs below $28.3mm Transaction Structure • All - stock consideration issued at an effective Vireo share price of $0.52 (a 107% premium to 12/17/2024 closing price) Consideration • Share consideration subject to lock - up release schedule of 7.5% of shares 12 - months post - closing, 10% of shares 18 - months and 21 - months post - closing, 17.5% of shares 24 - months post - closing, 15% of shares 27 - months post - closing and 20% of shares 30 - months and 33 - months post - closing Lock - Up • Existing Vireo shareholders are expected to own ~21% of the pro forma entity after the issuance of the upfront consideration and equity financing transactions Pro Forma Ownership Note: EBITDA is a non - GAAP measure (please see slide 3 for further information) 1. The Flowery has signed a binding - MOU 2. Reference EBITDA is pro - forma for pending acquisitions as well as new retail openings and grow expansion in near - term and will b e used to issue shares utilized for threshold calculations; Reference EBITDAs represent the following approximate EBITDA figures: $31mm for Proper, $31mm for Deep Roots, $16mm for Wholesome, $28.3mm for The Flowery 3. For each Target, earnout shares shall be reduced and forfeited shares shall increase by the amount of any incremental debt in cur red from the closing date to the earnout measurement date 4. EBITDA growth defined as the increase between Reference EBITDA and the higher of 2026 EBITDA or trailing nine - month annualized E BITDA as of December 31, 2026, and adjusted for incremental debt 5. 2026 EBITDA is the higher of trailing twelve - month or nine - month annualized EBITDA as of December 31, 2026

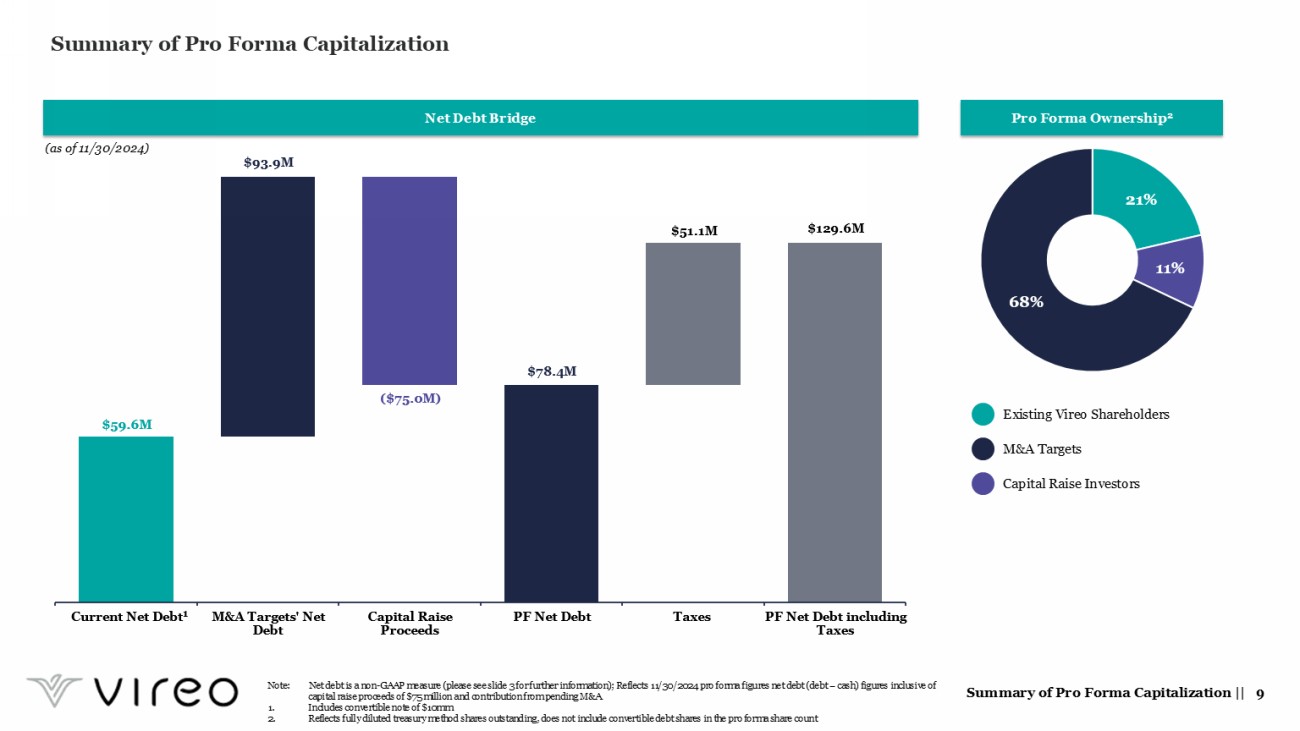

Summary of Pro Forma Capitalization Summary of Pro Forma Capitalization || 9 Net Debt Bridge &XUUHQW1HW'HEW 0 $7DUJHWV 1HW 'HEW &DSLWDO5DLVH 3URFHHGV 3)1HW'HEW 7D[HV 3)1HW'HEWLQFOXGLQJ 7D[HV Pro Forma Ownership 2 Existing Vireo Shareholders M&A Targets Capital Raise Investors 1 (as of 11/30/2024) Note: Net debt is a non - GAAP measure (please see slide 3 for further information); Reflects 11/30/2024 pro forma figures net debt (debt – cash) figures inclusive of capital raise proceeds of $75 million and contribution from pending M&A 1. Includes convertible note of $10mm 2. Reflects fully diluted treasury method shares outstanding, does not include convertible debt shares in the pro forma share co unt

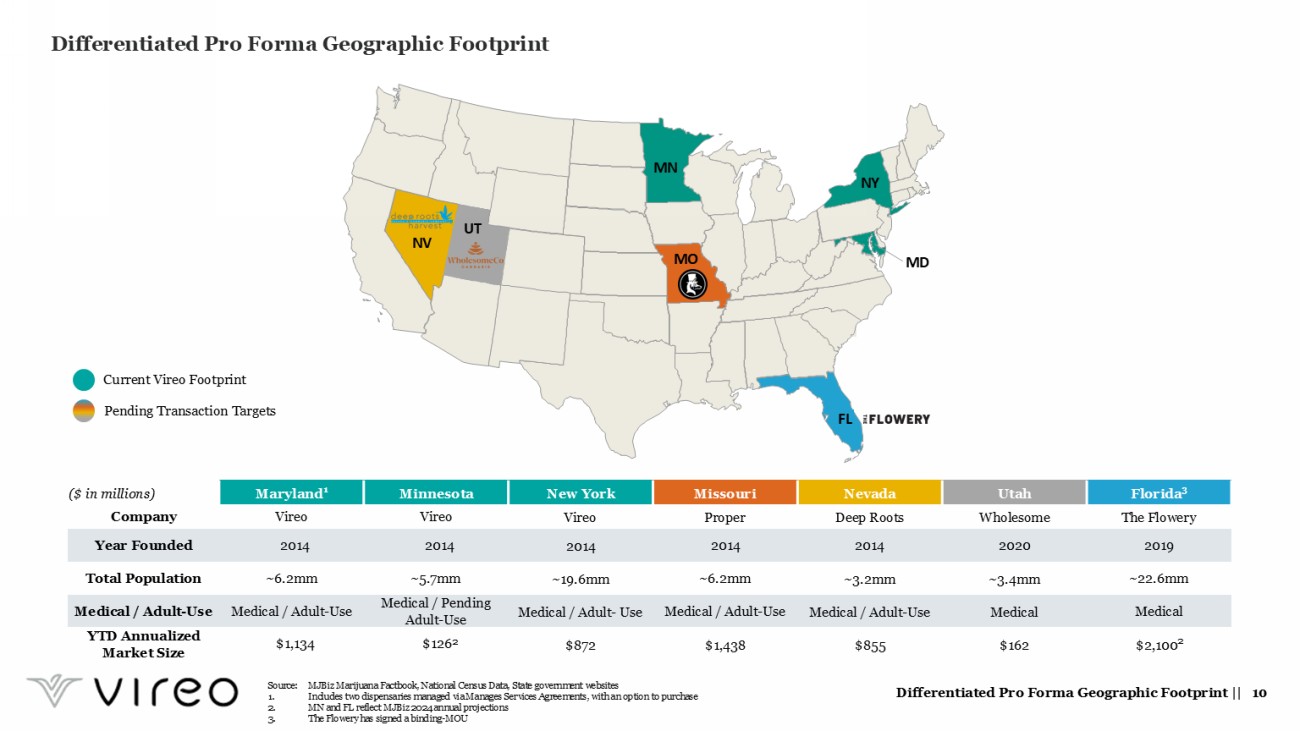

Pending Transaction Targets Current Vireo Footprint Differentiated Pro Forma Geographic Footprint Differentiated Pro Forma Geographic Footprint || 10 NY MN MD NV UT MO FL Florida 3 Utah Nevada Missouri New York Minnesota Maryland 1 ($ in millions) The Flowery Wholesome Deep Roots Proper Vireo Vireo Vireo Company 2019 2020 2014 2014 2014 2014 2014 Year Founded ~22.6mm ~3.4mm ~3.2mm ~6.2mm ~19.6mm ~5.7mm ~6.2mm Total Population Medical Medical Medical / Adult - Use Medical / Adult - Use Medical / Adult - Use Medical / Pending Adult - Use Medical / Adult - Use Medical / Adult - Use $2,100 2 $162 $855 $1,438 $872 $126 2 $1,134 YTD Annualized Market Size Source: MJBiz Marijuana Factbook, National Census Data, State government websites 1. Includes two dispensaries managed via Manages Services Agreements, with an option to purchase 2. MN and FL reflect MJBiz 2024 annual projections 3. The Flowery has signed a binding - MOU

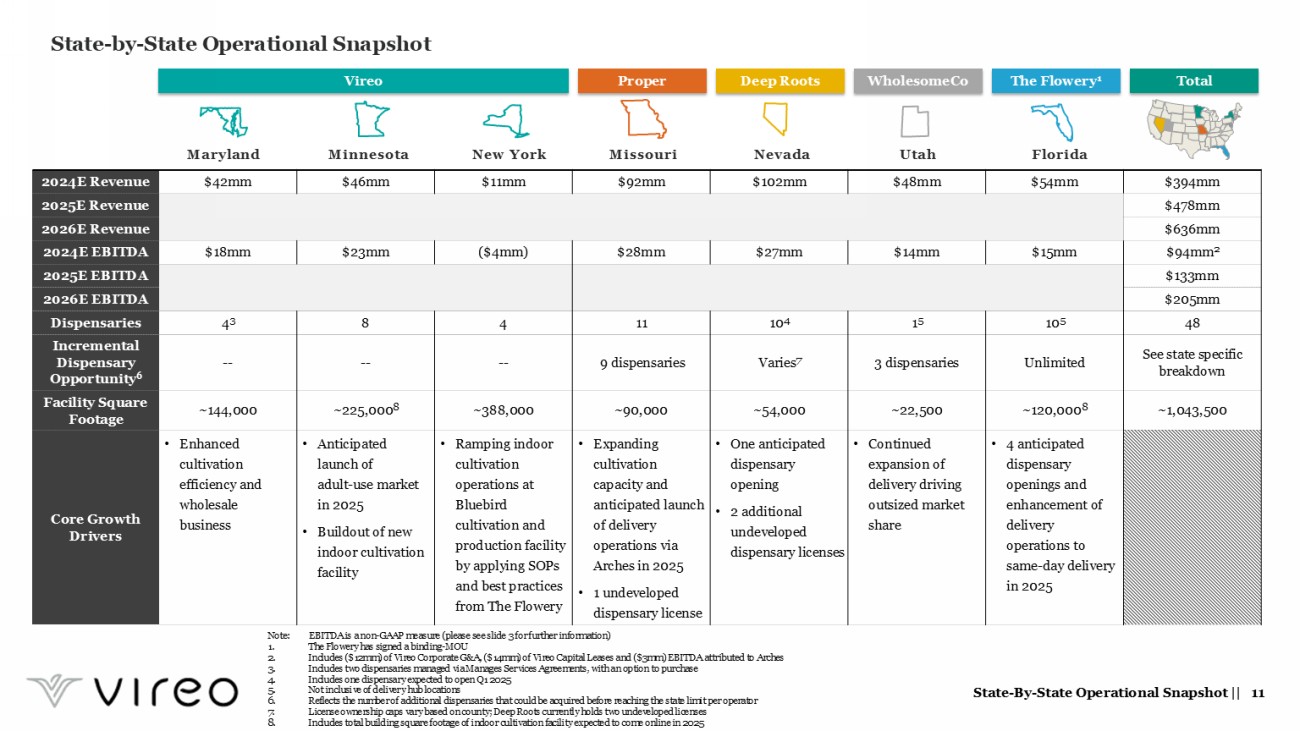

$394mm $54mm $48mm $102mm $92mm $11mm $46mm $42mm 2024E Revenue $478mm 2025E Revenue $636mm 2026E Revenue $94mm 2 $15mm $14mm $27mm $28mm ($4mm) $23mm $18mm 2024E EBITDA $133mm 2025E EBITDA $205mm 2026E EBITDA 48 10 5 1 5 10 4 11 4 8 4 3 Dispensaries See state specific breakdown Unlimited 3 dispensaries Varies 7 9 dispensaries -- -- -- Incremental Dispensary Opportunity 6 ~1,043,500 ~120,000 8 ~22,500 ~54,000 ~90,000 ~388,000 ~225,000 8 ~144,000 Facility Square Footage • 4 anticipated dispensary openings and enhancement of delivery operations to same - day delivery in 2025 • Continued expansion of delivery driving outsized market share • One anticipated dispensary opening • 2 additional undeveloped dispensary licenses • Expanding cultivation capacity and anticipated launch of delivery operations via Arches in 2025 • 1 undeveloped dispensary license • Ramping indoor cultivation operations at Bluebird cultivation and production facility by applying SOPs and best practices from The Flowery • Anticipated launch of adult - use market in 2025 • Buildout of new indoor cultivation facility • Enhanced cultivation efficiency and wholesale business Core Growth Drivers State - by - State Operational Snapshot State - By - State Operational Snapshot || 11 Minnesota New York Maryland Nevada Florida Missouri Utah Vireo The Flowery 1 Proper Deep Roots WholesomeCo Note: EBITDA is a non - GAAP measure (please see slide 3 for further information) 1. The Flowery has signed a binding - MOU 2. Includes ($12mm) of Vireo Corporate G&A, ($14mm) of Vireo Capital Leases and ($3mm) EBITDA attributed to Arches 3. Includes two dispensaries managed via Manages Services Agreements, with an option to purchase 4. Includes one dispensary expected to open Q1 2025 5. Not inclusive of delivery hub locations 6. Reflects the number of additional dispensaries that could be acquired before reaching the state limit per operator 7. License ownership caps vary based on county; Deep Roots currently holds two undeveloped licenses 8. Includes total building square footage of indoor cultivation facility expected to come online in 2025 Total

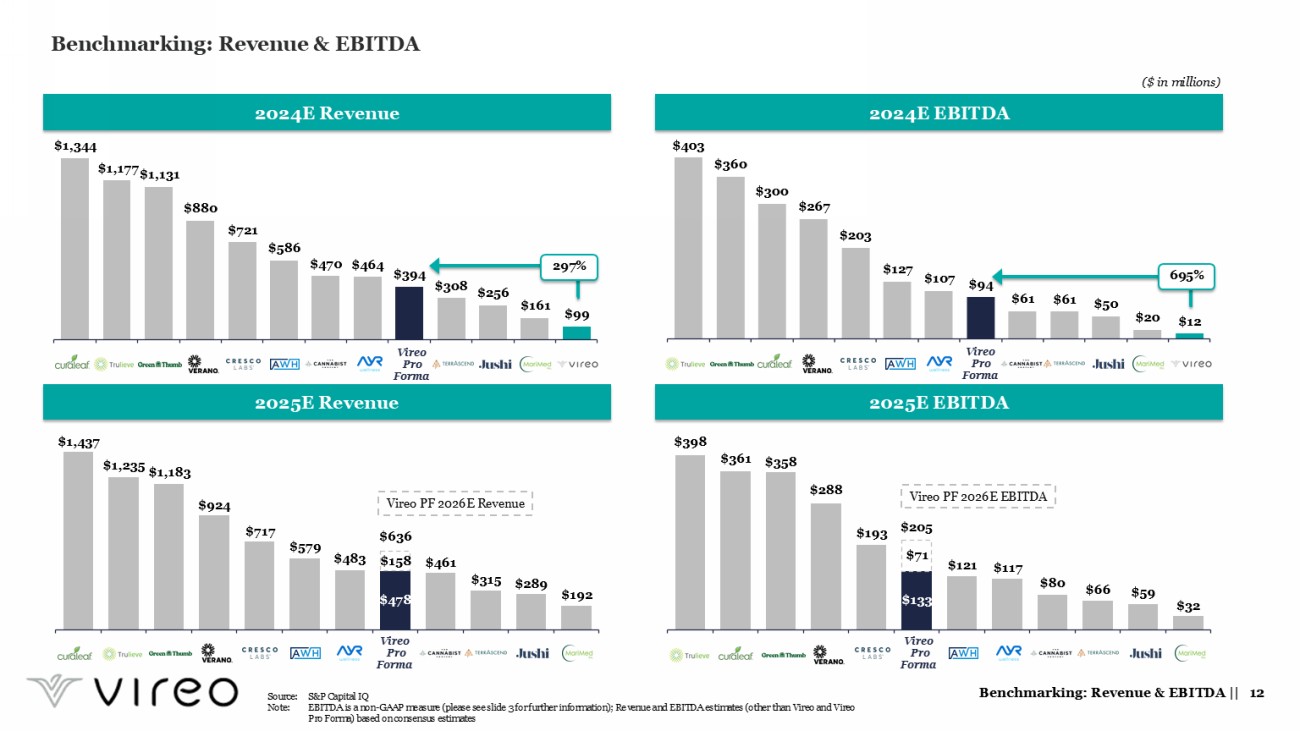

Benchmarking: Revenue & EBITDA Benchmarking: Revenue & EBITDA || 12 2024E Revenue 2024E EBITDA Vireo Pro Forma Vireo Pro Forma Source: S&P Capital IQ Note: EBITDA is a non - GAAP measure (please see slide 3 for further information); Revenue and EBITDA estimates (other than Vireo and Vireo Pro Forma) based on consensus estimates 2025E Revenue 2025E EBITDA 297% 695% Vireo Pro Forma Vireo Pro Forma Vireo PF 2026E Revenue Vireo PF 2026E EBITDA ($ in millions)

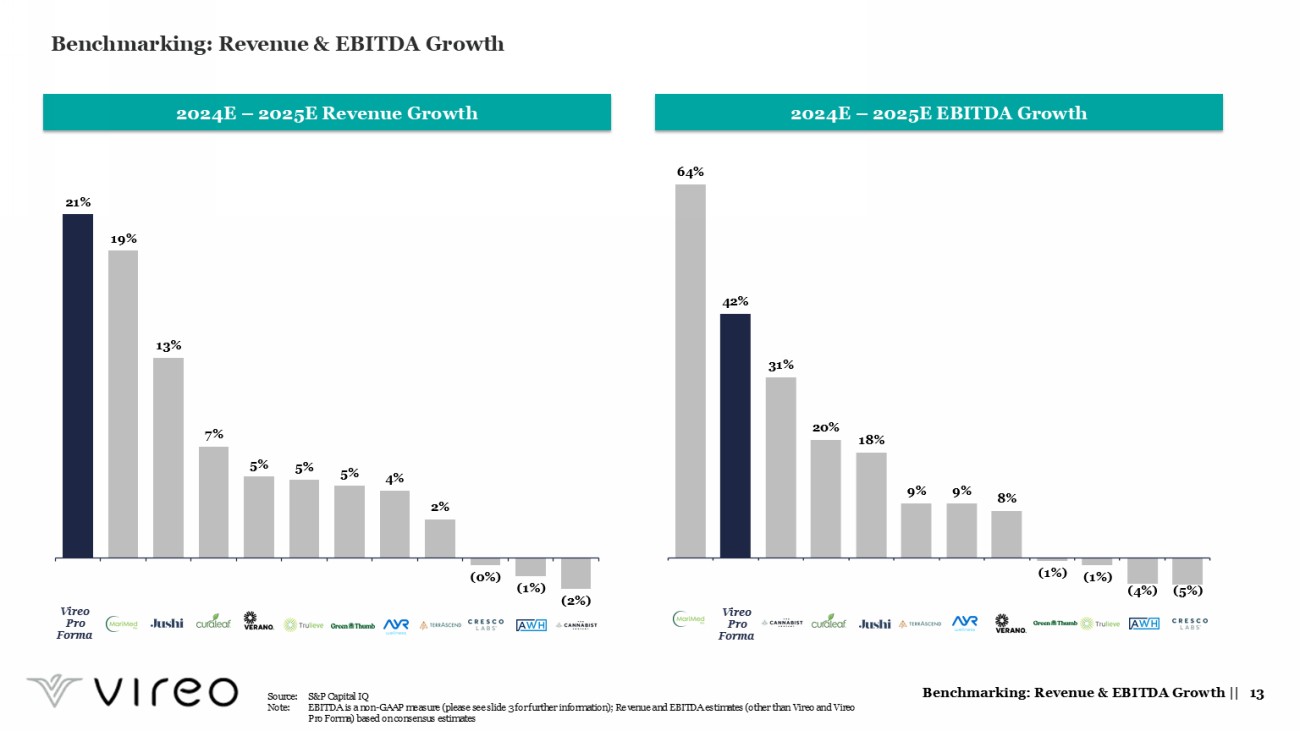

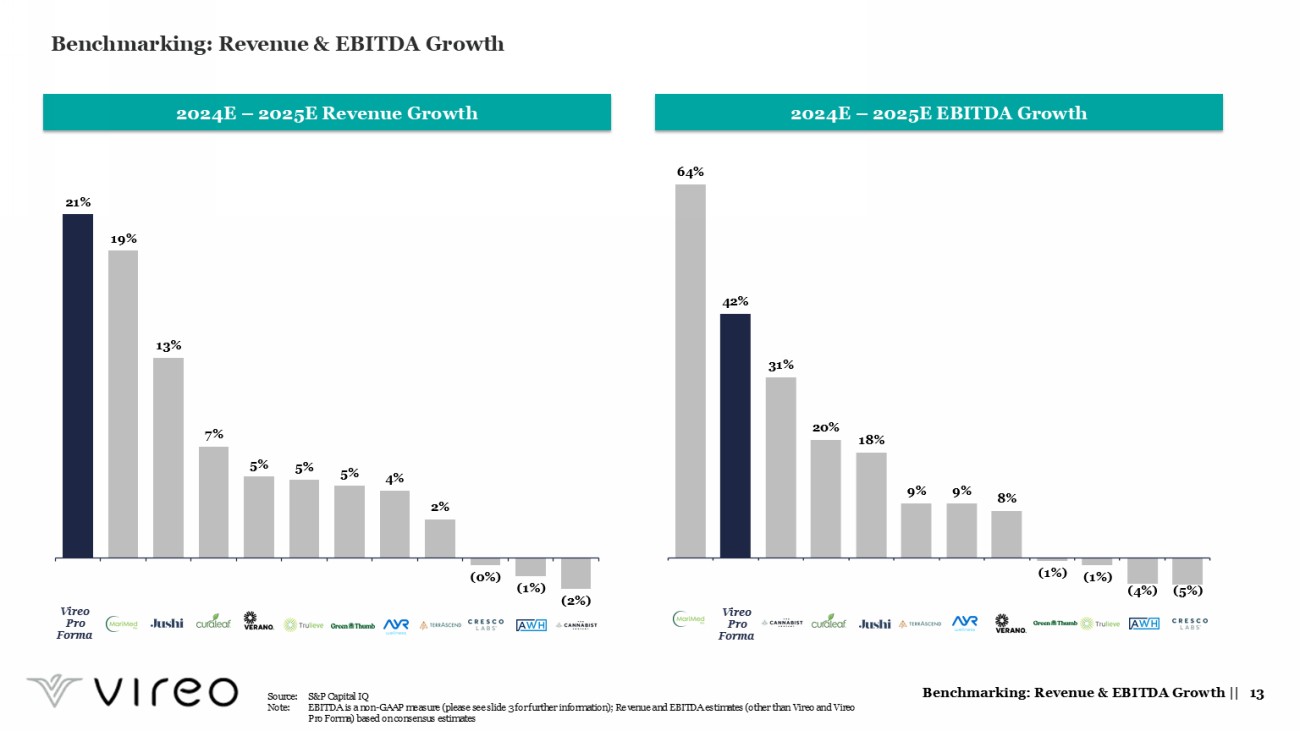

Benchmarking: Revenue & EBITDA Growth Benchmarking: Revenue & EBITDA Growth || 13 2024E – 2025E Revenue Growth 2024E – 2025E EBITDA Growth Vireo Pro Forma Vireo Pro Forma Source: S&P Capital IQ Note: EBITDA is a non - GAAP measure (please see slide 3 for further information); Revenue and EBITDA estimates (other than Vireo and Vireo Pro Forma) based on consensus estimates

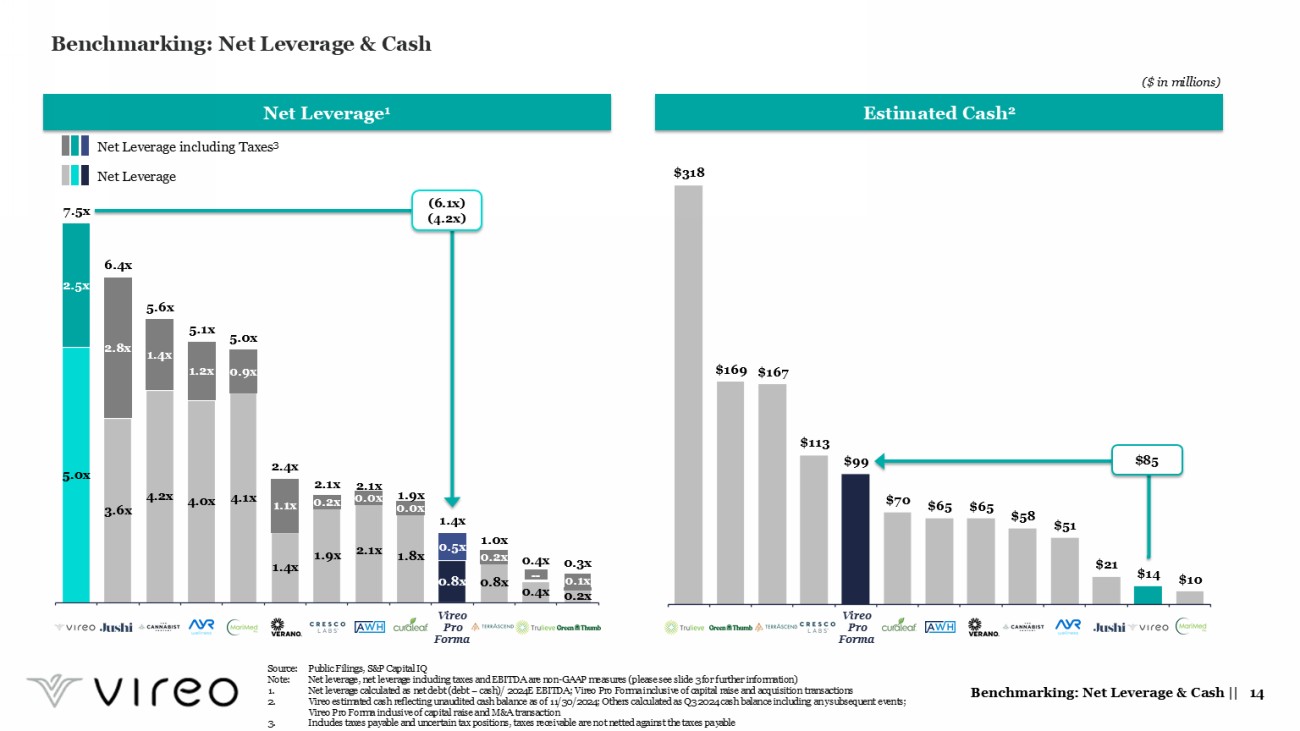

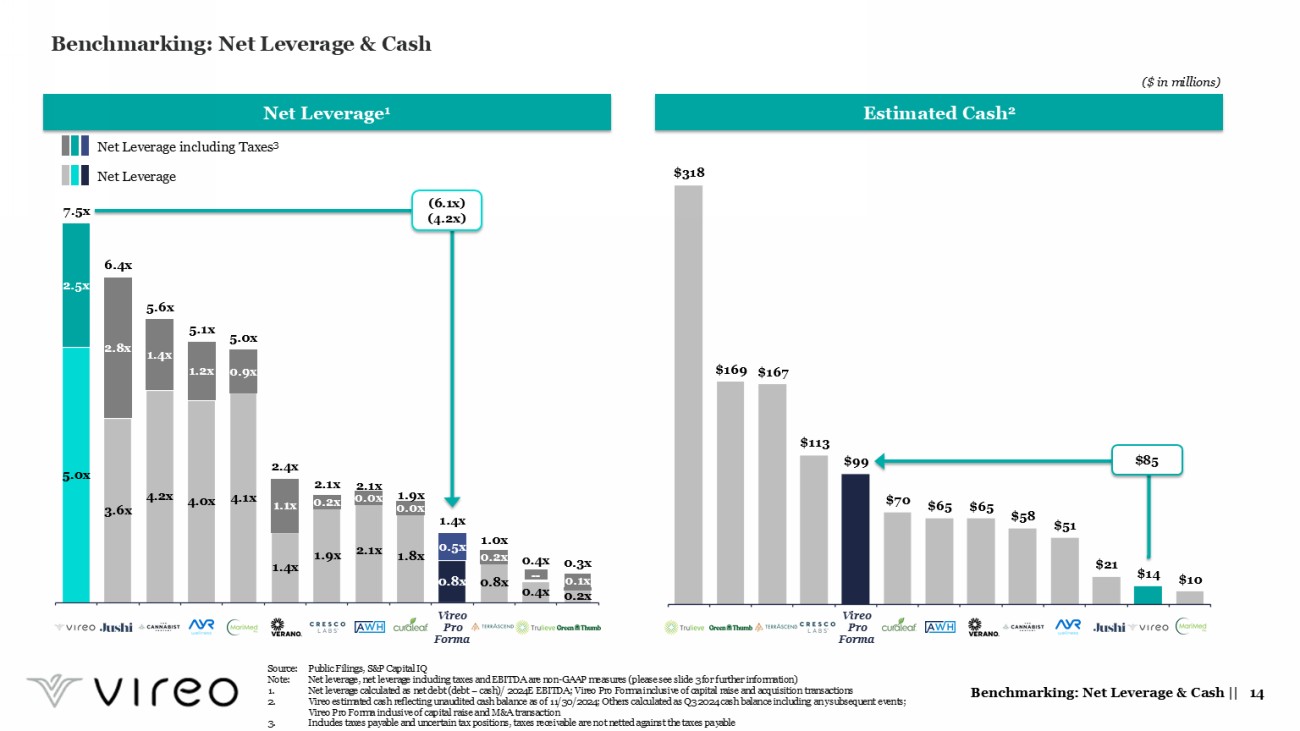

Benchmarking: Net Leverage & Cash Benchmarking: Net Leverage & Cash || 14 Net Leverage 1 Estimated Cash 2 [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ [ Vireo Pro Forma Vireo Pro Forma (6.1x) (4.2x) $85 Net Leverage Net Leverage including Taxes 3 Source: Public Filings, S&P Capital IQ Note: Net leverage, net leverage including taxes and EBITDA are non - GAAP measures (please see slide 3 for further information) 1. Net leverage calculated as net debt (debt – cash)/ 2024E EBITDA; Vireo Pro Forma inclusive of capital raise and acquisition tran sactions 2. Vireo estimated cash reflecting unaudited cash balance as of 11/30/2024; Others calculated as Q3 2024 cash balance including any subsequent events; Vireo Pro Forma inclusive of capital raise and M&A transaction 3. Includes taxes payable and uncertain tax positions, taxes receivable are not netted against the taxes payable ($ in millions)

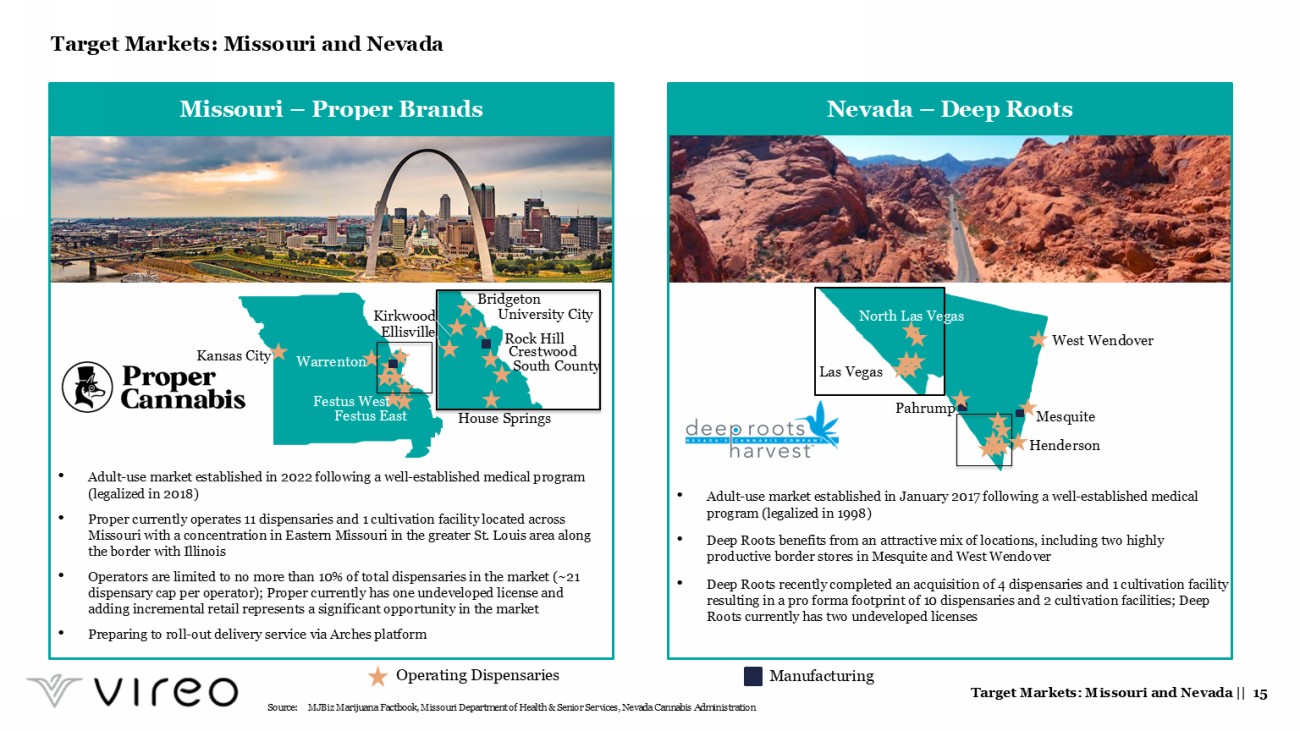

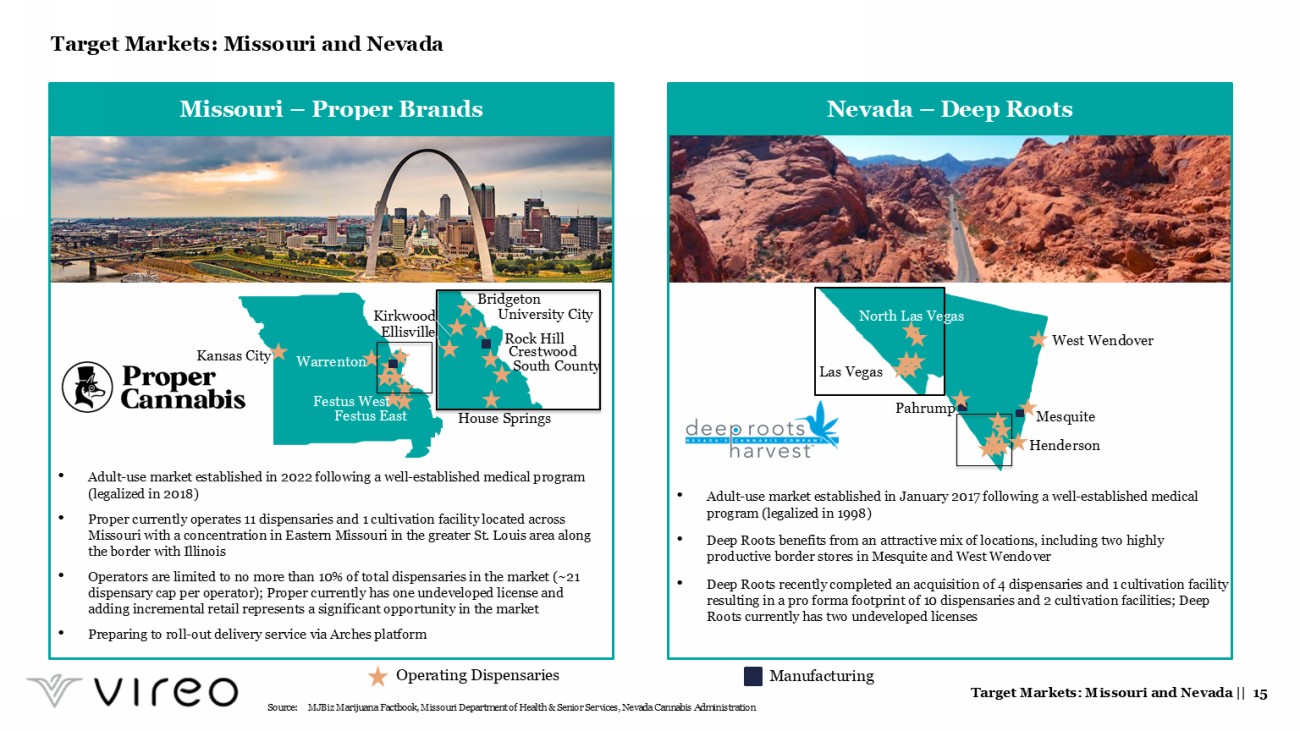

Target Markets: Missouri and Nevada Target Markets: Missouri and Nevada || 15 Missouri – Proper Brands Moorhead Otsego • Adult - use market established in 2022 following a well - established medical program (legalized in 2018) • Proper currently operates 11 dispensaries and 1 cultivation facility located across Missouri with a concentration in Eastern Missouri in the greater St. Louis area along the border with Illinois • Operators are limited to no more than 10% of total dispensaries in the market (~21 dispensary cap per operator); Proper currently has one undeveloped license and adding incremental retail represents a significant opportunity in the market • Preparing to roll - out delivery service via Arches platform Kansas City Warrenton Festus West Festus East House Springs Ellisville Bridgeton University City Rock Hill South County Crestwood Kirkwood Manufacturing Operating Dispensaries Source: MJBiz Marijuana Factbook, Missouri Department of Health & Senior Services, Nevada Cannabis Administration Nevada – Deep Roots Moorhead Otsego • Adult - use market established in January 2017 following a well - established medical program (legalized in 1998) • Deep Roots benefits from an attractive mix of locations, including two highly productive border stores in Mesquite and West Wendover • Deep Roots recently completed an acquisition of 4 dispensaries and 1 cultivation facility resulting in a pro forma footprint of 10 dispensaries and 2 cultivation facilities; Deep Roots currently has two undeveloped licenses West Wendover Mesquite Pahrump North Las Vegas Las Vegas Henderson

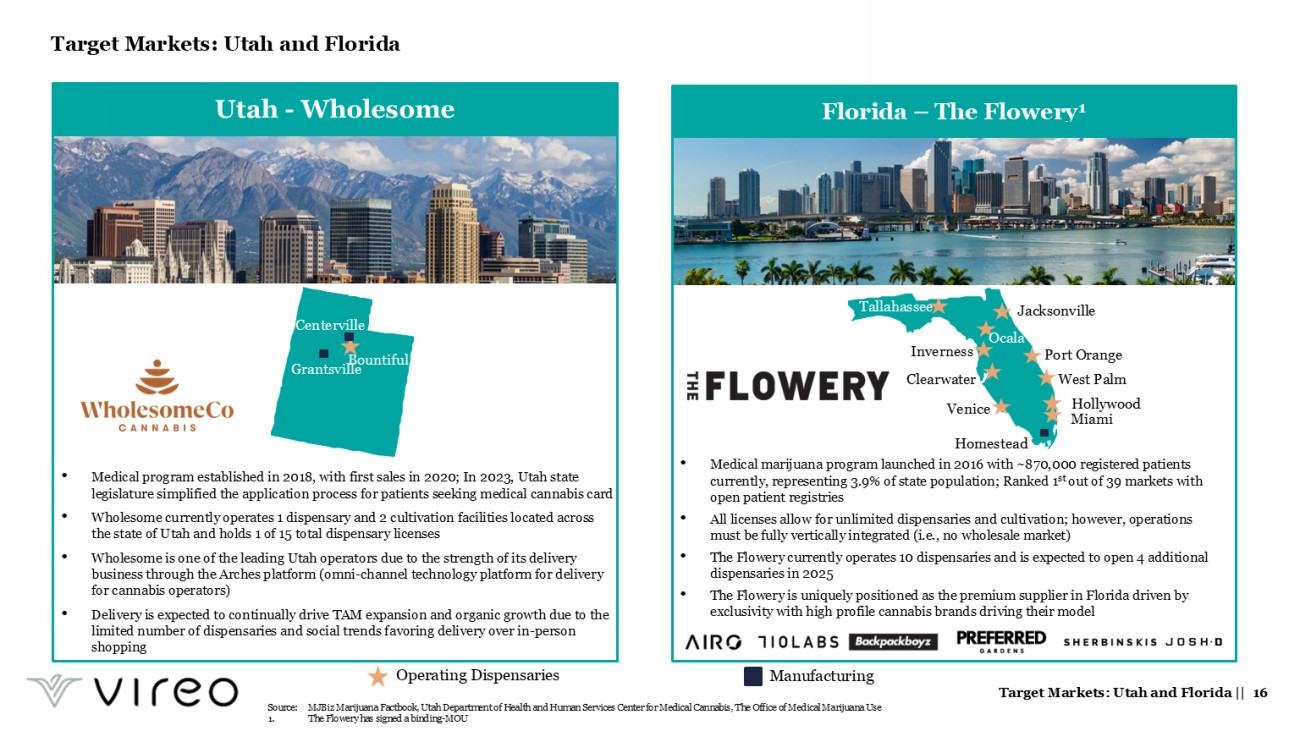

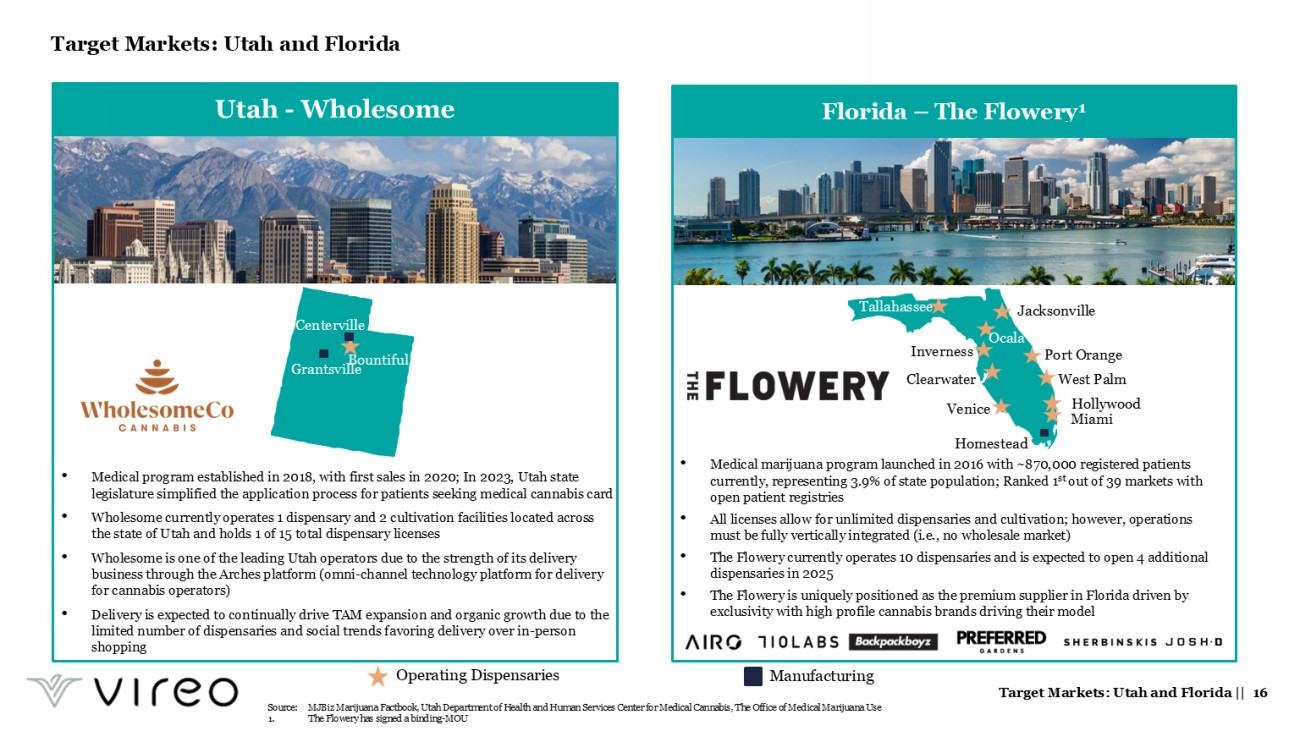

Target Markets: Utah and Florida Target Markets: Utah and Florida || 16 Utah - Wholesome Moorhead Otsego • Medical program established in 2018, with first sales in 2020; In 2023, Utah state legislature simplified the application process for patients seeking medical cannabis card • Wholesome currently operates 1 dispensary and 2 cultivation facilities located across the state of Utah and holds 1 of 15 total dispensary licenses • Wholesome is one of the leading Utah operators due to the strength of its delivery business through the Arches platform (omni - channel technology platform for delivery for cannabis operators) • Delivery is expected to continually drive TAM expansion and organic growth due to the limited number of dispensaries and social trends favoring delivery over in - person shopping Grantsville Centerville Bountiful Source: MJBiz Marijuana Factbook, Utah Department of Health and Human Services Center for Medical Cannabis, The Office of Medical Marijuana U se 1. The Flowery has signed a binding - MOU Operating Dispensaries Manufacturing Florida – The Flowery 1 Moorhead Otsego • Medical marijuana program launched in 2016 with ~870,000 registered patients currently, representing 3.9% of state population; Ranked 1 st out of 39 markets with open patient registries • All licenses allow for unlimited dispensaries and cultivation; however, operations must be fully vertically integrated (i.e., no wholesale market) • The Flowery currently operates 10 dispensaries and is expected to open 4 additional dispensaries in 2025 • The Flowery is uniquely positioned as the premium supplier in Florida driven by exclusivity with high profile cannabis brands driving their model Tallahassee Ocala Jacksonville Inverness Clearwater Venice Port Orange West Palm Hollywood Miami Homestead

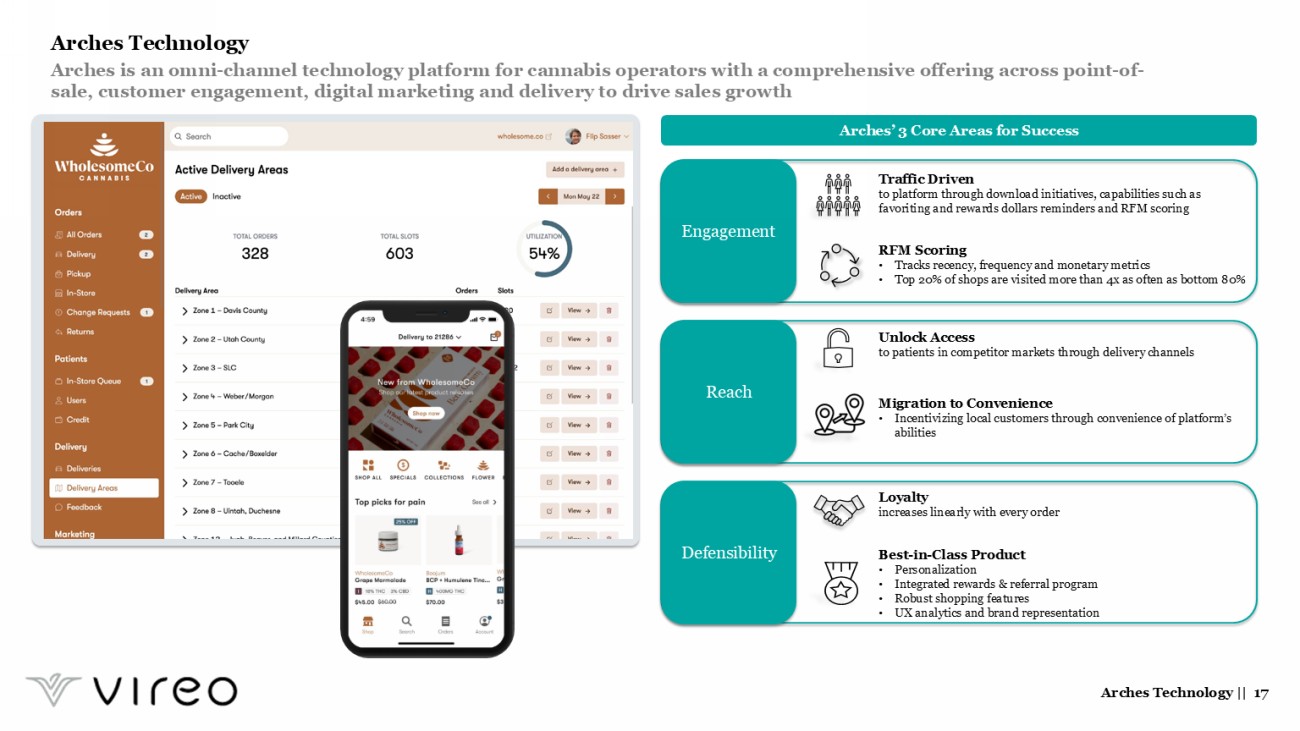

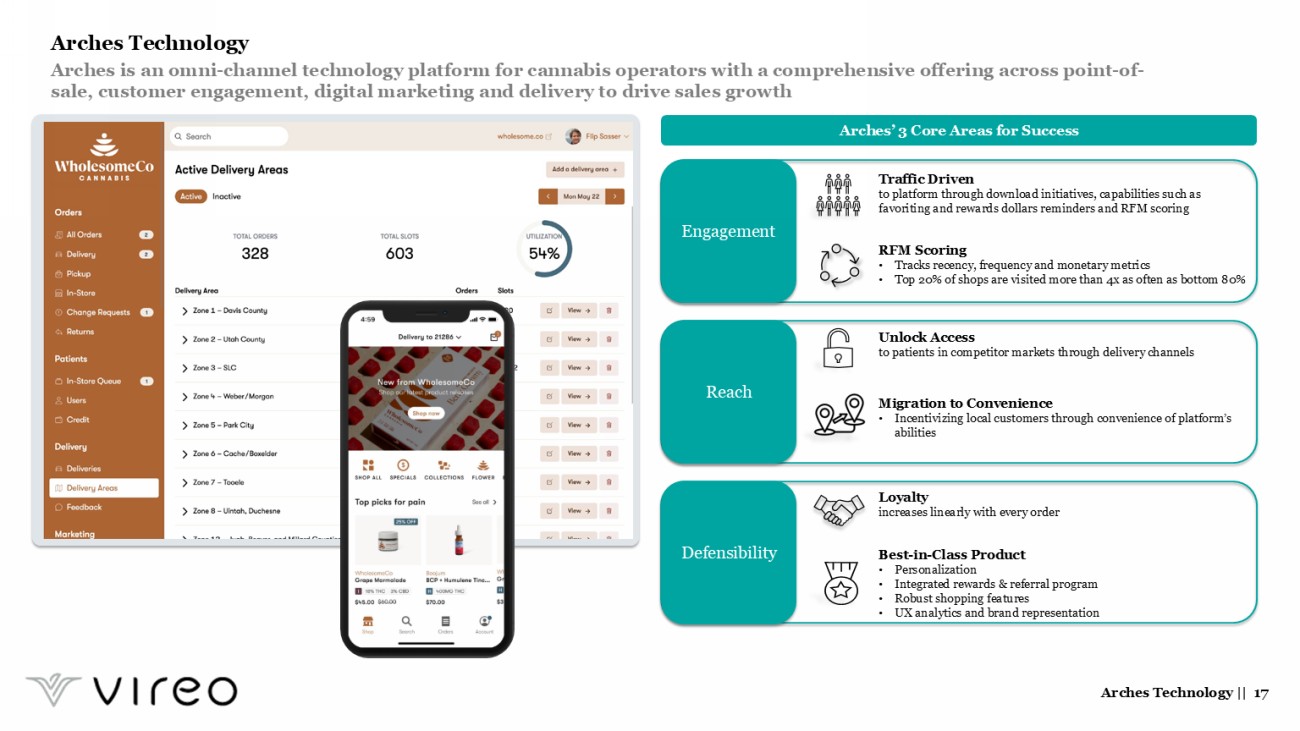

Arches Technology || 17 Arches’ 3 Core Areas for Success Engagement Defensibility Traffic Driven to platform through download initiatives, capabilities such as favoriting and rewards dollars reminders and RFM scoring Reach RFM Scoring • Tracks recency, frequency and monetary metrics • Top 20% of shops are visited more than 4x as often as bottom 80% Unlock Access to patients in competitor markets through delivery channels Migration to Convenience • Incentivizing local customers through convenience of platform’s abilities Best - in - Class Product • Personalization • Integrated rewards & referral program • Robust shopping features • UX analytics and brand representation Loyalty i ncreases linearly with every order Arches Technology Arches is an omni - channel technology platform for cannabis operators with a comprehensive offering across point - of - sale, customer engagement, digital marketing and delivery to drive sales growth

Q&A || 18 Q&A

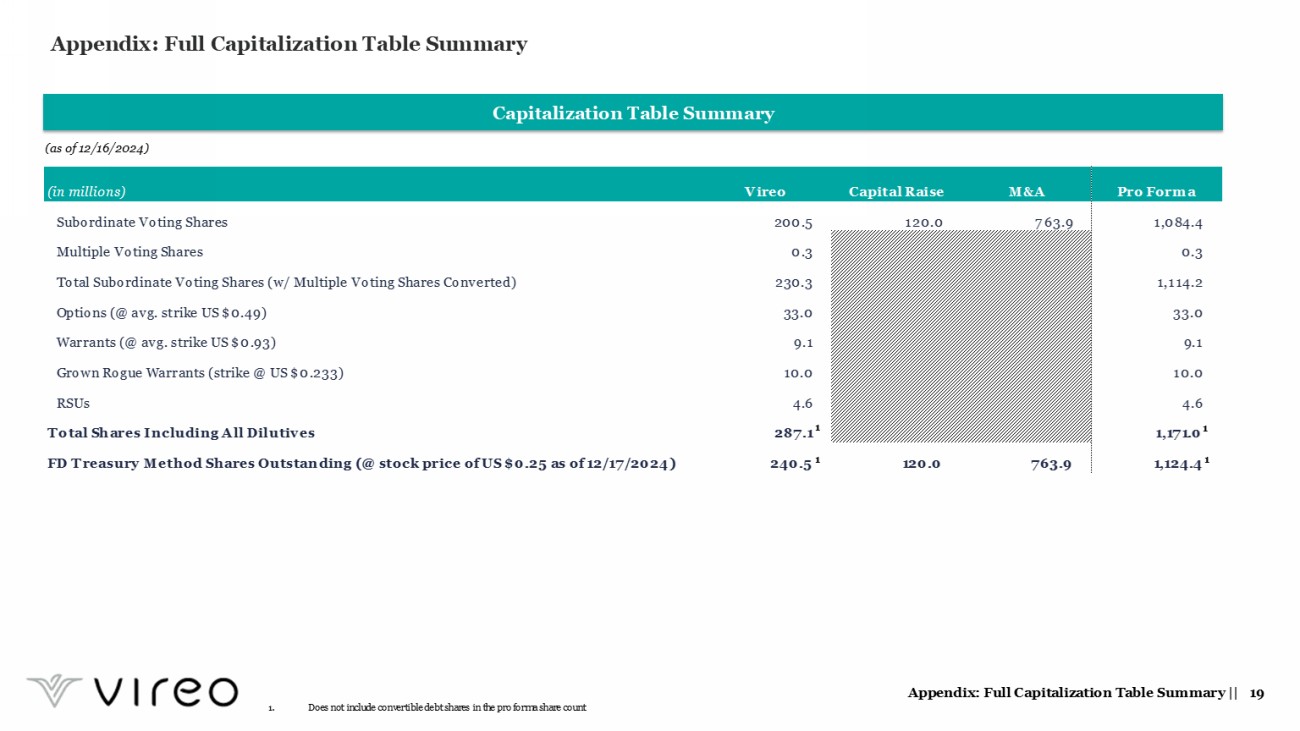

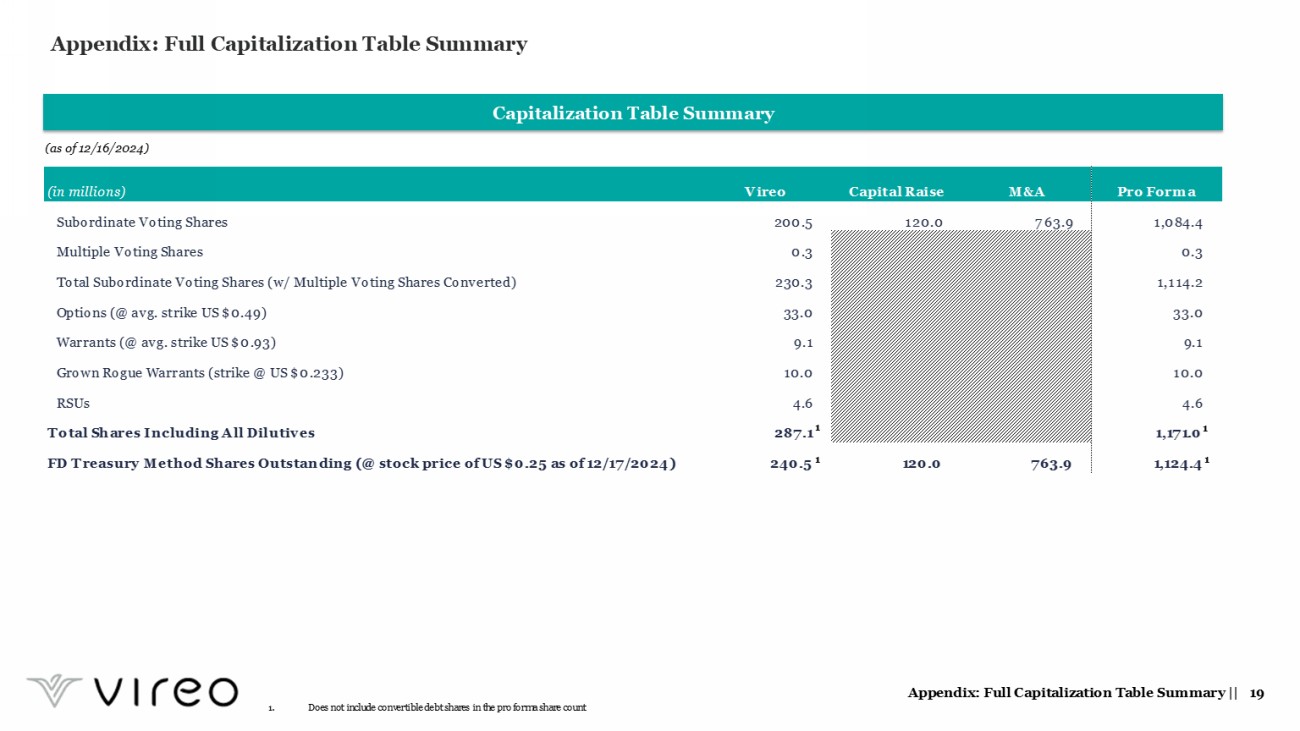

Appendix: Full Capitalization Table Summary Appendix: Full Capitalization Table Summary || 19 (in millions) Vireo Capital Raise M&A Pro Forma Subordinate Voting Shares 200.5 120.0 763.9 1,084.4 Multiple Voting Shares 0.3 0.3 Total Subordinate Voting Shares (w/ Multiple Voting Shares Converted) 230.3 1,114.2 Options (@ avg. strike US $0.49) 33.0 33.0 Warrants (@ avg. strike US $0.93) 9.1 9.1 Grown Rogue Warrants (strike @ US $0.233) 10.0 10.0 RSUs 4.6 4.6 Total Shares Including All Dilutives 287.1 1,171.0 FD Treasury Method Shares Outstanding (@ stock price of US $0.25 as of 12/17/2024) 240.5 120.0 763.9 1,124.4 Capitalization Table Summary 1. Does not include convertible debt shares in the pro forma share count 1 1 1 1 (as of 12/16 /2024)

CSE: VREO OTCQX: VREOF