Exhibit 99.1

Ameet Mallik, CEO January 11, 2023 J.P. Morgan Healthcare Conference

2 Forward - Looking Statements This presentation and any accompanying oral presentation have been prepared by ADC Therapeutics SA ("ADC Therapeutics“, “we” or “us”) for informational purposes only and not for any other purpose. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or AD C Therapeutics or any officer, director, employee, agent or advisor of ADC Therapeutics. This presentation does not purport to be all-inclusive or to contain all of the information you may desire. Information provi ded in this presentation and any accompanying oral presentation speak only as of the date hereof. This presentation contains statements that constitute forward - looking statements within the meaning of the safe harbor provision s of the Private Securities Litigation Reform Act of 1995. Forward - looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: the Company’s ability to continue to commercialize ZYNLONTA® in the United States and future revenue from the same; Swedish Orphan Biovitrum AB (Sobi®) ability to su ccessfully commercialize ZYNLONTA® in the European Economic Area and market acceptance, adequate reimbursement coverage, and future revenue from the same; our strategic partners’, including Mitsubishi Tan abe Pharma Corporation and Overland Pharmaceuticals, ability to obtain regulatory approval for ZYNLONTA® in foreign jurisdictions, and the timing and amount of future revenue and payments to us from such par tne rships; the Company’s ability to market its products in compliance with applicable laws and regulations; the timing and results of the Company’s or its partners’ research projects or clinical trials including LOTI S 2 , 5, 7 and 9, ADCT 901, 701, 601, 602 and 212, the timing and outcome of regulatory submissions and actions by the FDA or other regulatory agencies with respect to the Company’s products or product candidates; projected r eve nue and expenses , the Company’s indebtedness including Healthcare Royalty Management and Oak Tree facilities and the restrictions imposed on the Company’s activities by such indebtedness, the ability to repay such indebtedness and the significant cash required to service such indebtedness; the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activit ies and other statements regarding matters that are not historical facts, and involve predictions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, ac hievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward - looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding our f utu re catalysts, results of operations and financial position, business and commercialization strategy, market opportunities, reven ue, products and product candidates, research pipeline, ongoing and planned preclinical studies and clinical trials, regulatory submissions and approvals, research and development costs, timing and likelihood of success, as well as plans and objectives of management for future operations are forward - looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, per formance, achievements, or prospects to be materially different from any future results, performance, achievements, or prospects expressed or implied by such forward looking statements. In some cases, you can iden tif y forward looking statements by terminology such as “may”, “will”, “should”, “would”, “expect”, “intend”, “plan”, ”anticipate”, “believe”, “estimate”, “predict”, “potential”, “seem”, “seek”, “future”, “continue” , o r ”appear” or the negative of these terms or similar expressions, although not all forward - looking statements contain these words. Forward - looking statements are based on our management’s beliefs and assumptions and on information currently available to our m anagement. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward - looking statements due to various factors, including those described in the “Risk Factor” section of the Company’s annual report on Form 20 - F and in the Company’s other filings with the US Securities and Exchange Commission. No assurance can be given that such future resul ts will be achieved. Investors are cautioned not to place to undue reliance on the forward - looking statements contained in this presentation. Such forward - looking statements contained in this presentation speak only as of the date of this presentation. We expressly disclaim any obligation or undertaking to update these forward - looking statements contained in this presentation to reflect any change in our expectations or any change i n events, conditions, or circumstances on which such statements are based unless required to do so by applicable law. No representations or warranties (expressed or implied) are made about the accuracy of any such f orw ard - looking statements. Certain information contained in this presentation relates to or is based on studies, publications, surveys, and other data d eri ved from third - party sources and our own internal estimates and research. While we believe these third - party sources to be reliable as of the date of this presentation, we have not independently verified, and we make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third - party sources. In addition, all of the market data included in this presentation involve a number of assumpt ions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, although we believe our own internal research is reliable, such research has not been verified by any i nde pendent source.

3 About ADC Therapeutics Strong validated technology platform in highly - potent PBD - based ADCs and a growing toolbox to develop next - generation assets Fully - integrated organization with specialized capabilities unique to ADCs Cash runway into 2Q 2025 with multiple value - driving catalysts in the next 12 - 24 months Pioneer and leader in the ADC field as one of a few companies with product approval and multiple clinical - stage programs

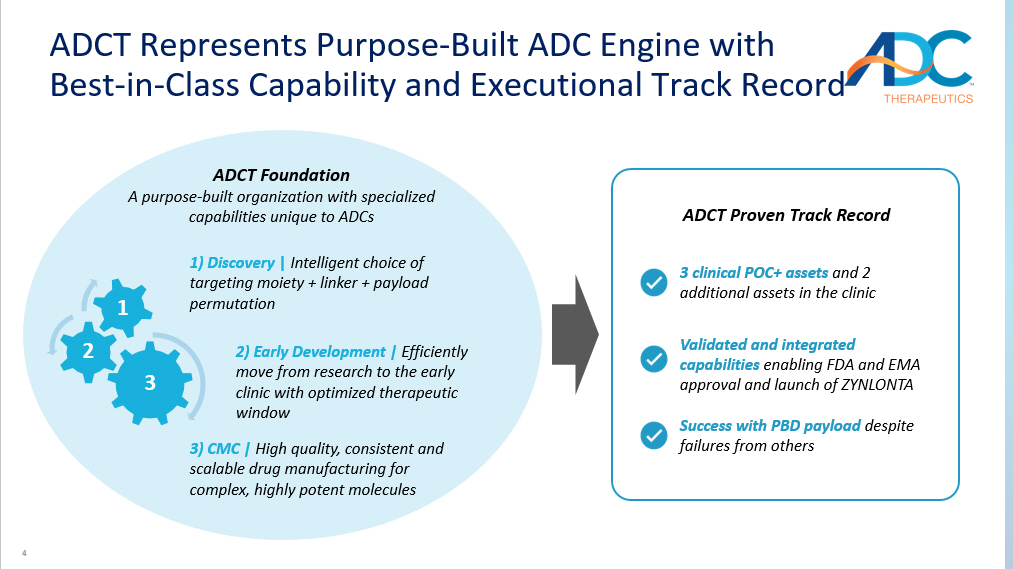

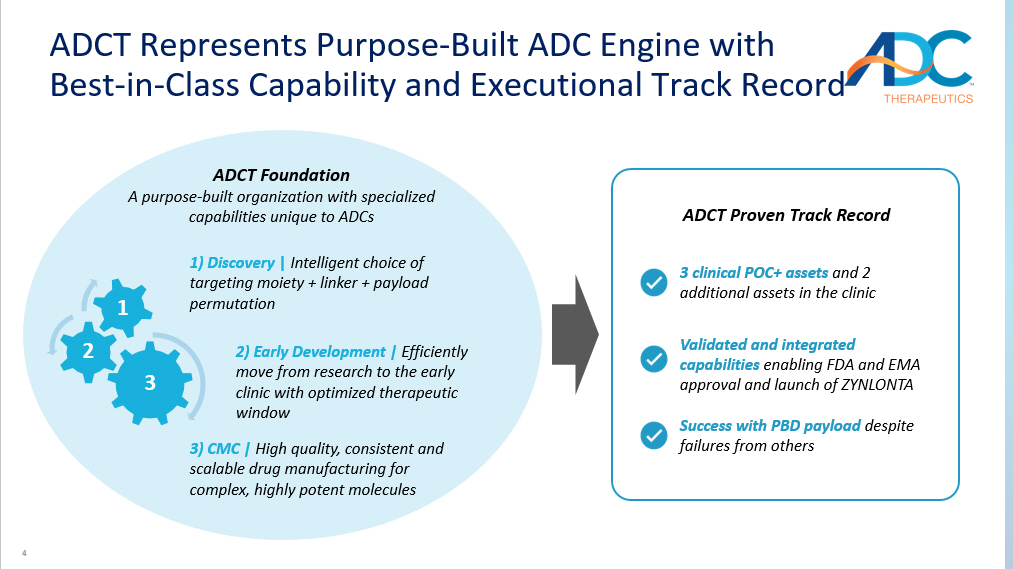

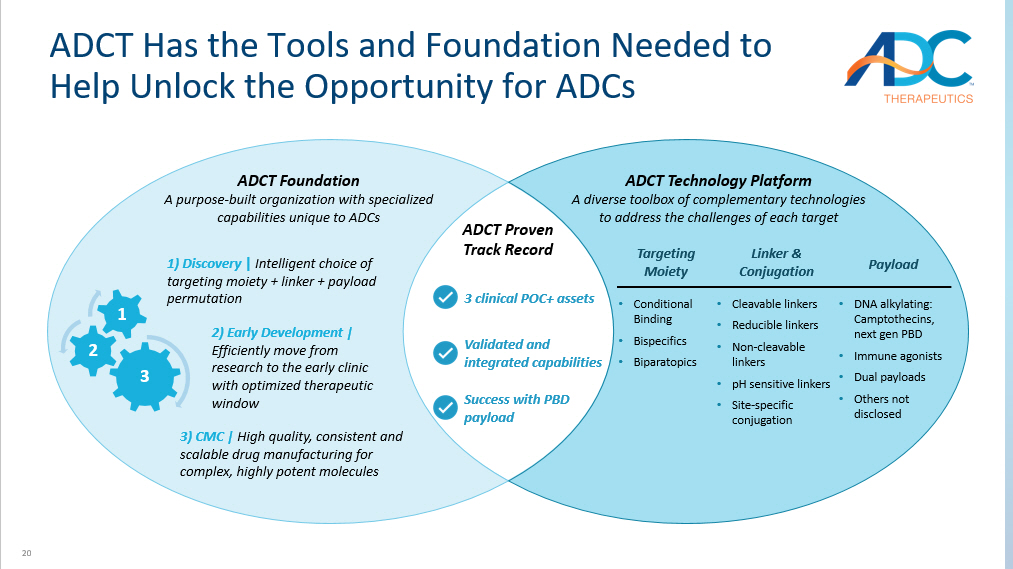

4 ADCT Foundation A purpose - built organization with specialized capabilities unique to ADCs 3 2 1 1) Discovery | Intelligent choice of targeting moiety + linker + payload permutation 3) CMC | High quality, consistent and scalable drug manufacturing for complex, highly potent molecules 2) Early Development | Efficiently m ove from research to the early clinic with optimized therapeutic window ADCT Represents Purpose - Built ADC Engine with Best - in - Class Capability and Executional Track Record ADCT Proven Track Record 3 clinical POC+ assets and 2 additional assets in the clinic Success with PBD payload despite failures from others Validated and integrated capabilities enabling FDA and EMA approval and launch of ZYNLONTA

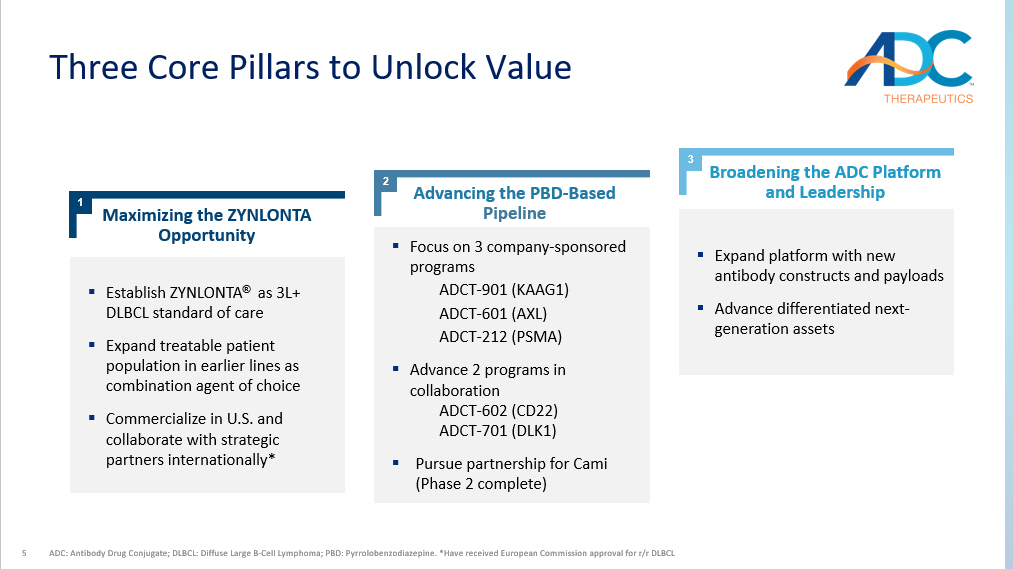

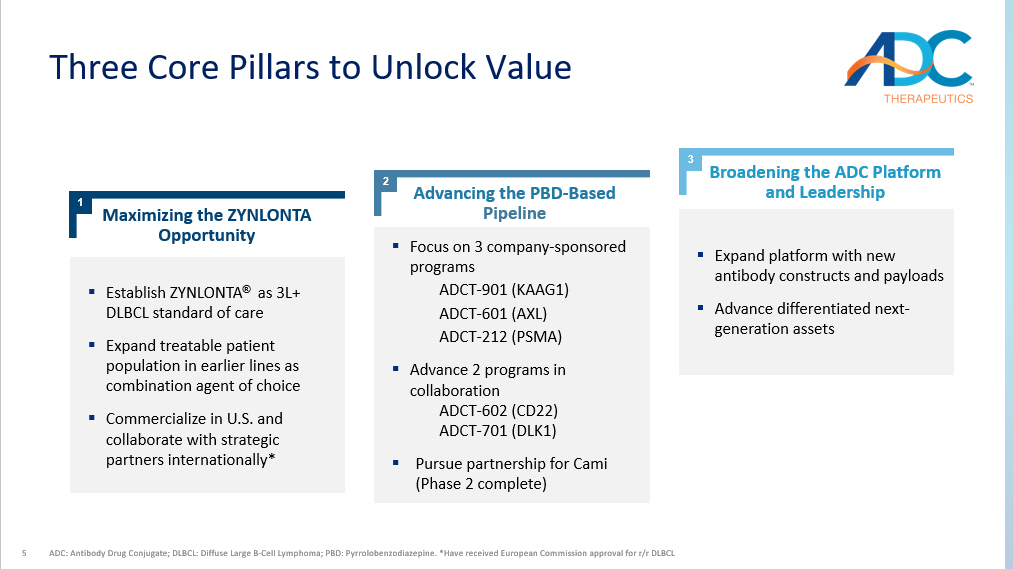

5 Three Core Pillars to Unlock Value ADC: Antibody Drug Conjugate; DLBCL: Diffuse Large B - Cell Lymphoma; PBD: Pyrrolobenzodiazepine. *Have received European Commissi on approval for r/r DLBCL Short - Mid Term Mid - long Term Maximizing the ZYNLONTA Opportunity Advancing the PBD - Based Pipeline Broadening the ADC Platform and Leadership ▪ Establish ZYNLONTA ® as 3L+ DLBCL standard of care ▪ E xpand treatable patient population in earlier lines as combination agent of choice ▪ Commercialize in U.S. and collaborate with strategic partners internationally* ▪ Focus on 3 company - sponsored programs ADCT - 901 (KAAG1) ADCT - 601 (AXL) ADCT - 212 (PSMA) ▪ Advance 2 programs in collaboration ADCT - 602 (CD22) ADCT - 701 (DLK1) ▪ Pursue partnership for Cami (Phase 2 complete) ▪ Expand platform with new antibody constructs and payloads ▪ Advance differentiated next - generation assets 1 2 3

6 Deep Pipeline in Hematology and Solid Tumors Anticipated milestones set forth in this chart are subject to further future adjustment based on, among other factors, the im pac t of the COVID - 19 pandemic. NTE: Non - Transplant Eligible ADCT - 212 | Targeting PSMA r/r Hodgkin Lymphoma Various Solid Tumors Various Solid Tumors Preclinical Phase 1a Phase 1b Phase 2 ZYNLONTA ® | Targeting CD19 Camidanlumab Tesirine (Cami) | Targeting CD25 ADCT - 602 | Targeting CD22 Acute Lymphoblastic Leukemia ADCT - 601 | Targeting AXL ADCT - 901 | Targeting KAAG1 ADCT - 701 | Targeting DLK1 Expected Milestones 2024: LOTIS - 5: Complete enrollment LOTIS - 7 and LOTIS - 9: Preliminary safety and efficacy data Exploring partnerships Complete Phase 1 single - agent dose expansion study in 1H 2024 Preliminary results of Phase 1 single - agent dose escalation study in 2H 2023 Preliminary results of Phase 1b combo study and single - agent dose escalation complete in 1H 2024 Initiate Phase 1 in 1H 2024 PBD - Based Phase 3 / Confirmatory* ZYNLONTA Confirmatory LOTIS - 5 with rituximab in 2L NTE DLBCL LOTIS - 2 in 3L+ patients with r/r DLBCL Multiple programs New clinical candidates Various Solid Tumors Initiate Phase 1 in 2H 2023 FDA approved LOTIS - 7 in non - Hodgkin Lymphoma LOTIS - 9 in 1L DLBCL unfit/frail Expanded platform Completed with positive results Single - agent arm Combination arm Metastatic Prostate Cancer

7 Three Horizons to Grow ZYNLONTA to $500m - $1B in Potential Peak Sales 1. Cerner Enviza's CancerMPact – Epi Database, Patient Metrics & Treatment Architecture, NH Lymphoma (2022) 2 . Clarivate's Disease Market Landscape & Forecast, Non - Hodgkin's Lymphoma and Chronic Lymphocytic Leukemia, Epidemiology (2022) 3. Francesco Merli, et. Al., Simplified Geriatric Assessment in Older Patients With Diffuse Large B - Cell Lymphoma: The Prospecti ve Elderly Project of the Fondazione Italiana Linfomi Journal of Clinical Oncology 39, no. 11(2021), https://ascopubs.org/doi/fu ll/10.1200/JCO.20.024653. ~4,000 1L frail and unfit patients in the U.S. 2, 3 ~5,000 2L SCT ineligible patients in the U.S. 1,2 >6,000 patients in the U.S. 1,2 ~12,000 (2L patients in the U.S.) 1,2 Level of Opportunity Total eligible patients for ZYNLONTA > 22,000 3L/3L+ monotherapy Approved Horizon 2 1L and 2L in chemo - free combination with rituximab In development Horizon 3 Early - line novel combinations In development Horizon 1 ▪ High unmet medical need remains ▪ ZYNLONTA is well - positioned for growth in both academic and community settings ▪ ZYNLONTA + rituximab chemo - free combination being studied in 1L frail and unfit and 2L SCT ineligible ▪ Rituximab - based combinations are most commonly - used regimen ▪ ZYNLONTA + newer therapies including BsAbs in development ▪ Potential for ZYNLONTA to add efficacy without additional toxicity MAXIMIZING THE ZYNLONTA OPPORTUNITY

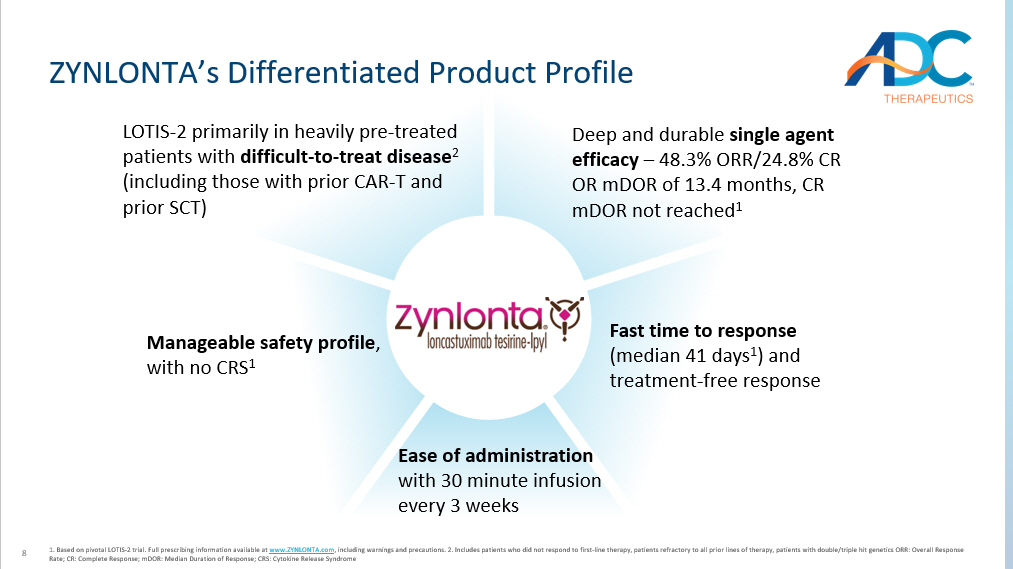

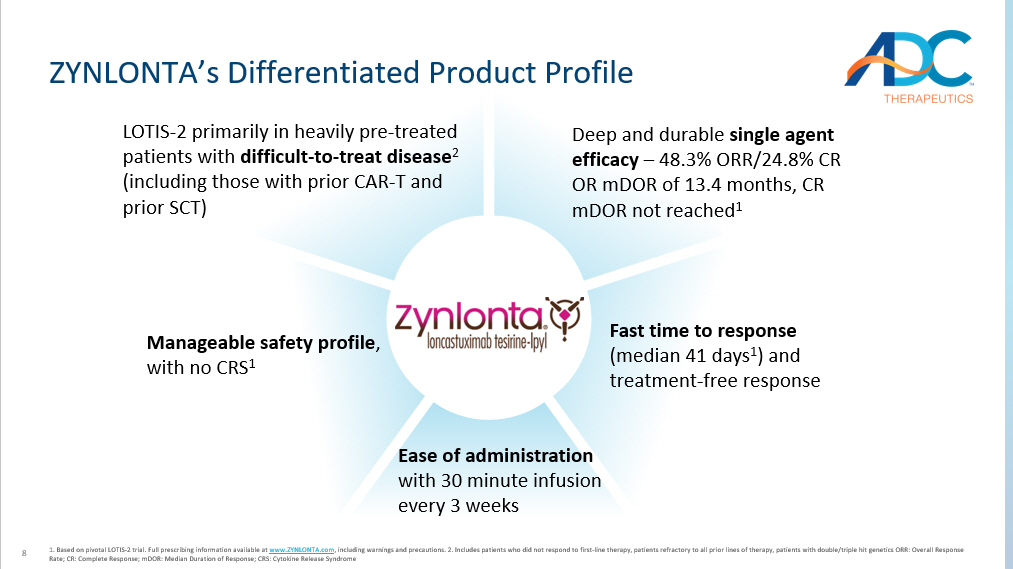

8 ZYNLONTA’s Differentiated Product Profile 1. Based on pivotal LOTIS - 2 trial. Full prescribing information available at www.ZYNLONTA.com , including warnings and precautions. 2. Includes patients who did not respond to first - line therapy, patients refractory to all prior lines of therapy, patients with double/triple hit genetics ORR: Overall Response Rate; CR: Complete Response; mDOR: Median Duration of Response; CRS: Cytokine Release Syndrome LOTIS - 2 primarily in heavily pre - treated patients with difficult - to - treat disease 2 (including those with prior CAR - T and prior SCT) Deep and durable single agent efficacy – 48.3% ORR/ 24.8% CR OR mDOR of 13.4 months, CR mDOR not reached 1 Fast time to response (median 41 days 1 ) and treatment - free response Manageable safety profile , with no CRS 1 Ease of administration with 30 minute infusion every 3 weeks

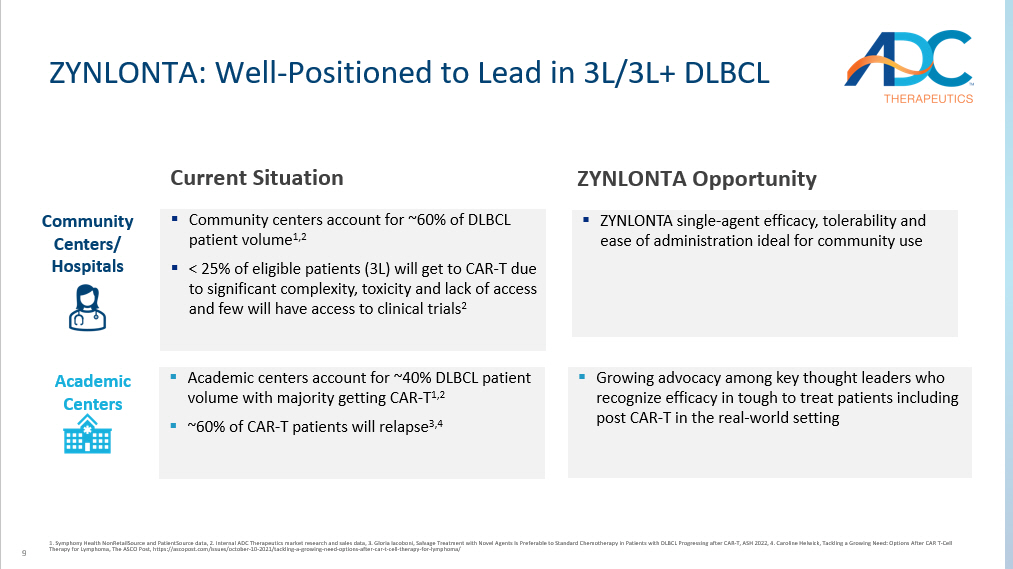

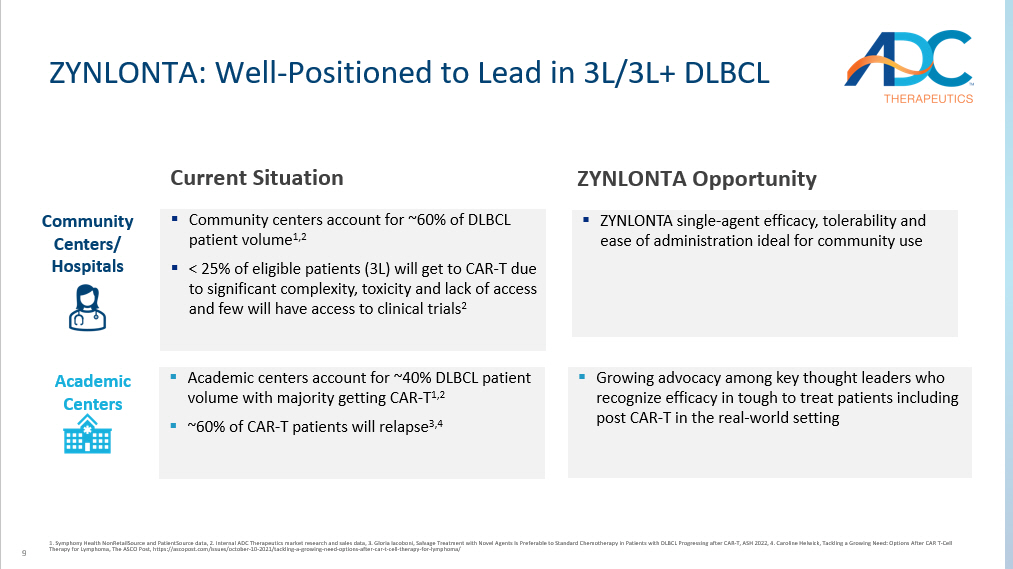

9 ZYNLONTA: W ell - Positioned to Lead in 3L/3L+ DLBCL 1. Symphony Health NonRetailSource and PatientSource data, 2. Internal ADC Therapeutics market research and sales data, 3. Gloria Iacoboni, Salvage Treatment with Novel Agents Is Preferable to Standard Chemotherapy in Patients with DLBCL Progressin g after CAR - T, ASH 2022, 4. Caroline Helwick, Tackling a Growing Need: Options After CAR T - Cell Therapy for Lymphoma, The ASCO Post, https://ascopost.com/issues/october - 10 - 2021/tackling - a - growing - need - options - after - car - t - cel l - therapy - for - lymphoma/ ▪ Community centers account for ~60% of DLBCL patient volume 1,2 ▪ < 25% of eligible patients (3L) will get to CAR - T due to significant complexity, toxicity and lack of access and few will have access to clinical trials 2 ZYNLONTA Opportunity ▪ ZYNLONTA single - agent efficacy, tolerability and ease of administration ideal for community use Community Centers/ Hospitals Academic Centers ▪ Academic centers account for ~40% DLBCL patient volume with majority getting CAR - T 1,2 ▪ ~60% of CAR - T patients will relapse 3,4 ▪ Growing advocacy among key thought leaders who recognize efficacy in tough to treat patients including post CAR - T in the real - world setting Current Situation

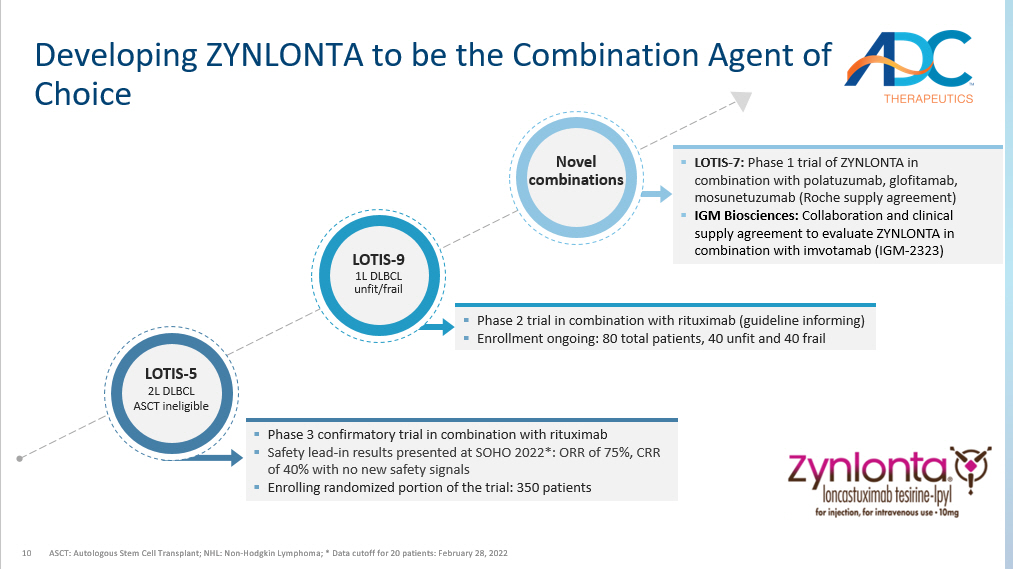

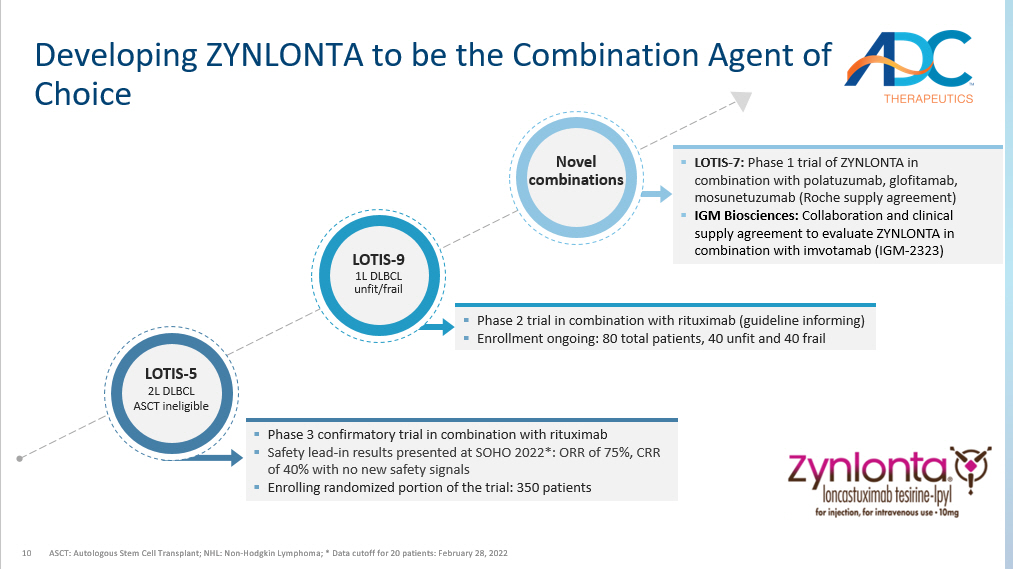

10 Developing ZYNLONTA to be the Combination Agent of Choice ASCT: Autologous Stem Cell Transplant; NHL: Non - Hodgkin Lymphoma; * Data cutoff for 20 patients: February 28, 2022 ▪ Phase 2 trial in combination with rituximab (guideline informing) ▪ Enrollment ongoing: 80 total patients, 40 unfit and 40 frail ▪ Phase 3 confirmatory trial in combination with rituximab ▪ Safety lead - in results presented at SOHO 2022*: ORR of 75%, CRR of 40% with no new safety signals ▪ Enrolling randomized portion of the trial: 350 patients ▪ LOTIS - 7: Phase 1 trial of ZYNLONTA in combination with polatuzumab, glofitamab, mosunetuzumab (Roche supply agreement) ▪ IGM Biosciences: Collaboration and clinical supply agreement to evaluate ZYNLONTA in combination with imvotamab (IGM - 2323) LOTIS - 5 2L DLBCL ASCT ineligible LOTIS - 9 1L DLBCL unfit/frail Novel combinations

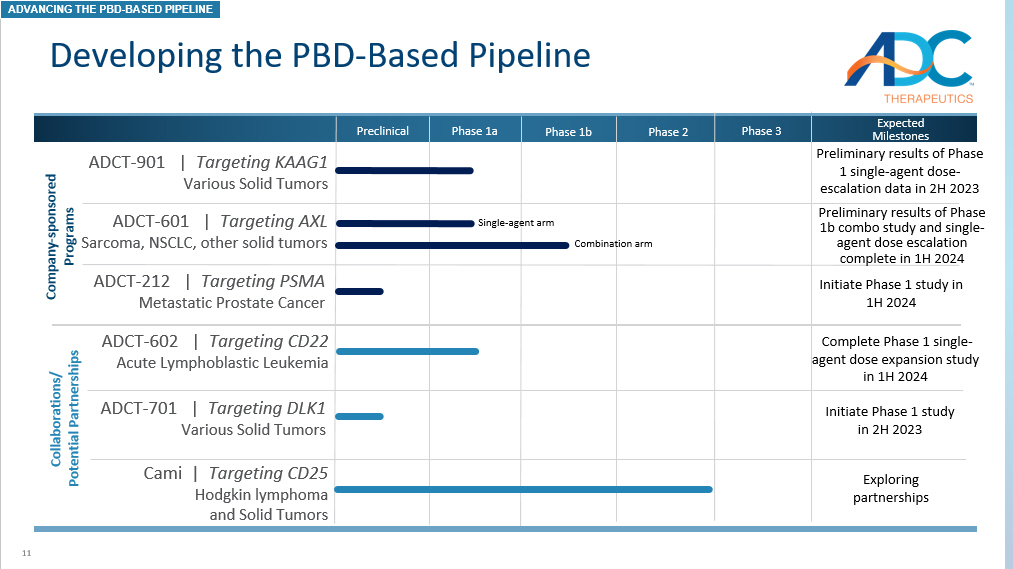

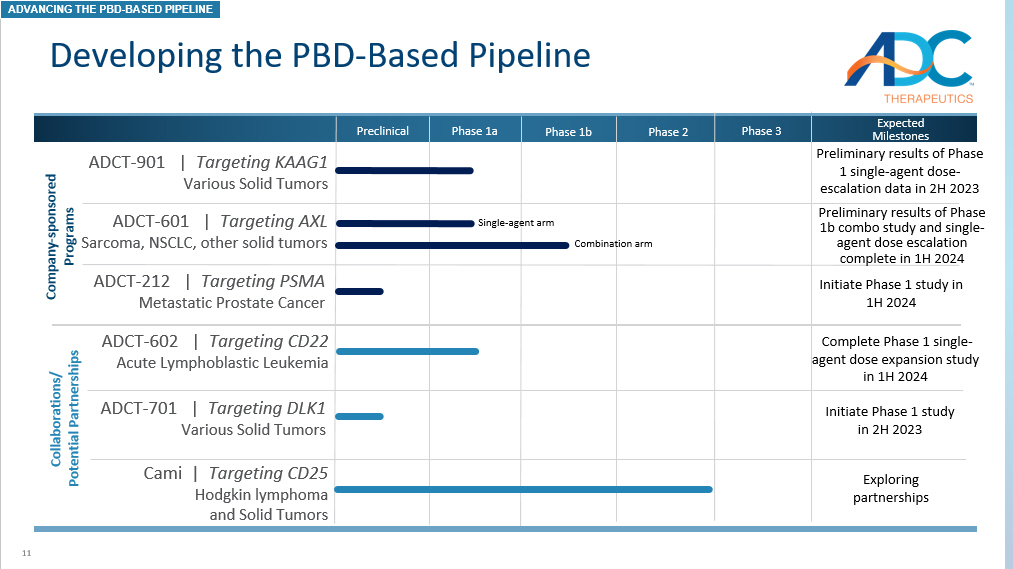

11 Developing the PBD - Based Pipeline ADCT - 212 | Targeting PSMA Metastatic Prostate Cancer Preclinical Phase 1a Phase 1b Phase 2 ADCT - 602 | Targeting CD22 Acute Lymphoblastic Leukemia ADCT - 901 | Targeting KAAG1 Various Solid Tumors ADCT - 701 | Targeting DLK1 Various Solid Tumors Expected Milestones Complete Phase 1 single - agent dose expansion study in 1H 2024 Preliminary results of Phase 1 single - agent dose - escalation data in 2H 2023 Preliminary results of Phase 1b combo study and single - agent dose escalation complete in 1H 2024 Initiate Phase 1 study in 2H 2023 Collaborations/ Potential Partnerships Phase 3 Company - sponsored Programs Initiate Phase 1 study in 1H 2024 ADCT - 601 | Targeting AXL Sarcoma, NSCLC, other solid tumors Cami | Targeting CD25 Hodgkin lymphoma and Solid T umors Exploring partnerships ADVANCING THE PBD - BASED PIPELINE Single - agent arm Combination arm

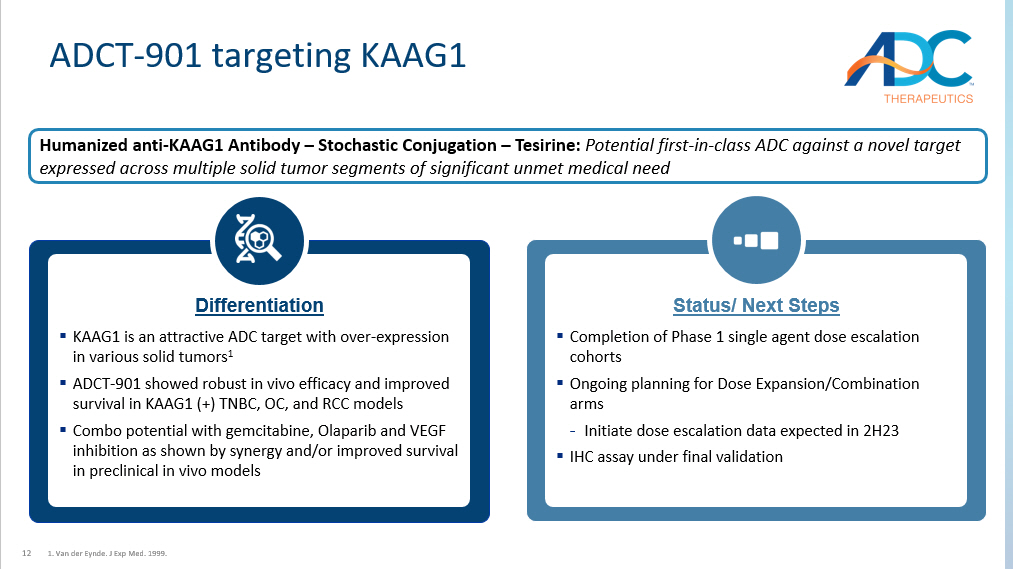

12 ADCT - 901 targeting KAAG1 1. Van der Eynde. J Exp Med. 1999. Differentiation ▪ KAAG1 is an attractive ADC target with over - expression in various solid tumors 1 ▪ ADCT - 901 showed robust in vivo efficacy and improved survival in KAAG1 (+) TNBC, OC, and RCC models ▪ Combo potential with gemcitabine, Olaparib and VEGF inhibition as shown by synergy and/or improved survival in preclinical in vivo models Status/ Next Steps ▪ Completion of Phase 1 single agent dose escalation cohorts ▪ Ongoing planning for Dose Expansion/Combination arms - Initiate dose escalation data expected in 2H23 ▪ IHC assay under final validation Humanized anti - KAAG1 Antibody – Stochastic Conjugation – Tesirine: Potential first - in - class ADC against a novel target expressed across multiple solid tumor segments of significant unmet medical need

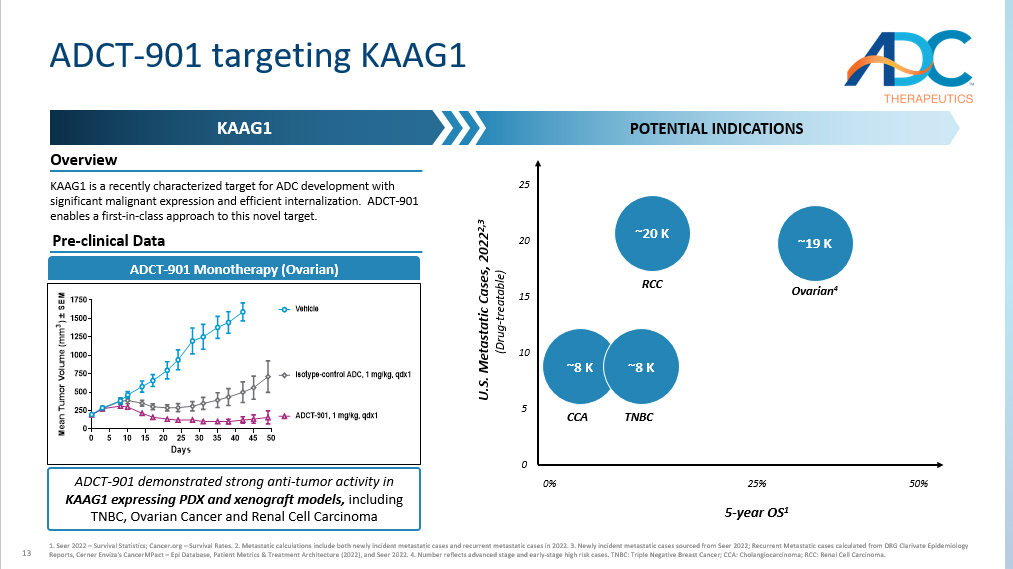

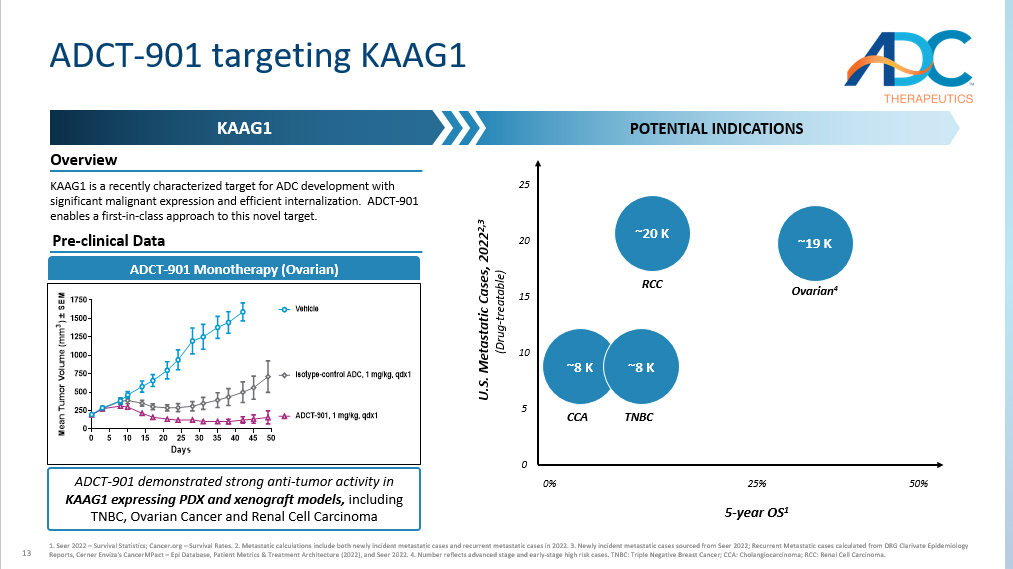

13 ADCT - 901 targeting KAAG1 KAAG1 POTENTIAL INDICATIONS ADCT - 901 Monotherapy (Ovarian) 0 5 10 15 20 25 30 35 40 45 50 0 250 500 750 1000 1250 1500 1750 Days M e a n T u m o r V o l u m e ( m m 3 ) ± S E M Vehicle ADCT-901, 1 mg/kg, qdx1 Isotype-control ADC, 1 mg/kg, qdx1 Overview KAAG1 is a recently characterized target for ADC development with significant malignant expression and efficient internalization. ADCT - 901 enables a first - in - class approach to this novel target. 1. Seer 2022 – Survival Statistics; Cancer.org – Survival Rates. 2. Metastatic calculations include both newly incident metastat ic cases and recurrent metastatic cases in 2022. 3. Newly incident metastatic cases sourced from Seer 2022; Recurrent Metasta tic cases calculated from DRG Clarivate Epidemiology Reports, Cerner Enviza's CancerMPact – Epi Database, Patient Metrics & Treatment Architecture (2022), and Seer 2022. 4. Number r eflects advanced stage and early - stage high risk cases. TNBC: Triple Negative Breast Cancer; CCA: Cholangiocarcinoma; RCC: Renal Cell Carcinoma. 5 - year OS 1 U.S. Metastatic Cases, 2022 2,3 (Drug - treatable) ~19 K Ovarian 4 ~20 K RCC 25% 0% 50% ~8 K CCA ~8 K TNBC 0 25 10 ADCT - 901 demonstrated strong anti - tumor activity in KAAG1 expressing PDX and xenograft models, including TNBC, Ovarian Cancer and Renal Cell Carcinoma Pre - clinical Data 5 20 15

14 ADCT - 601 targeting AXL Differentiation ▪ AXL is thought to be overexpressed in various solid tumors ▪ In a pancreatic PDX model, ADCT - 601 showed superior activity vs. Genmab’s ADC at the same dose ▪ Sensitivity to ADCT - 601 was increased in TKI resistant EGFR mutant NSCLC cell lines, confirming the role of AXL upregulation in EGFR TKI resistance Humanized anti - AXL Antibody – Site Specific Conjugation – PL1601: Potential best - in - class ADC against a target expressed across multiple solid tumor segments of significant unmet medical need Status/ Next Steps ▪ Recruitment ongoing for dose - escalation cohort - Arm A (gemcitabine combo in selected types of sarcoma) – preliminary results 1H24 - Arm B (Monotherapy in Sarcoma, NSCLC, and AXL gene amplified solid tumors ) – dose escalation complete 1H24 ▪ IHC assay under final validation

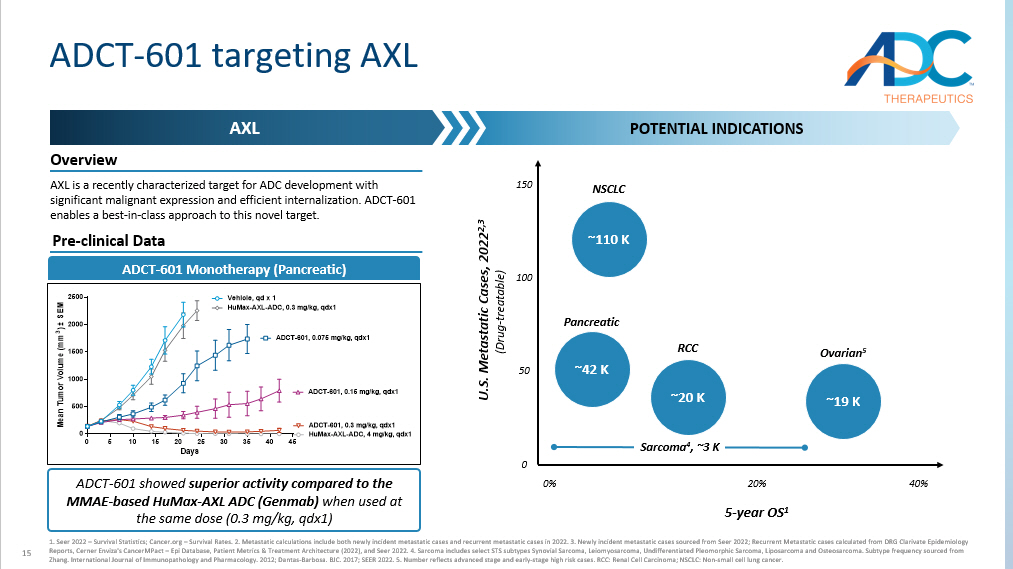

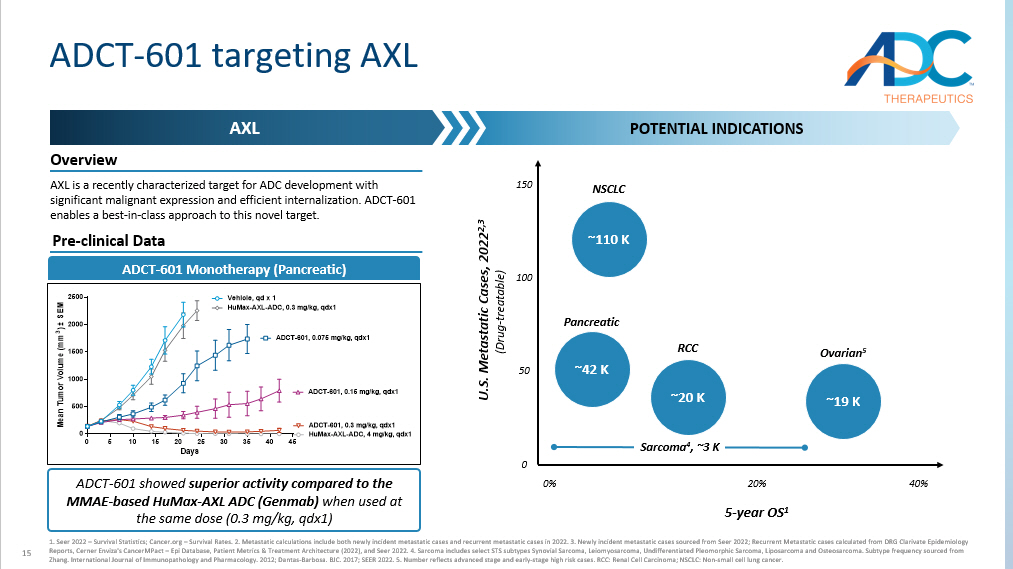

15 ADCT - 601 targeting AXL AXL POTENTIAL INDICATIONS AXL is a recently characterized target for ADC development with significant malignant expression and efficient internalization. ADCT - 601 enables a best - in - class approach to this novel target. 1. Seer 2022 – Survival Statistics; Cancer.org – Survival Rates. 2. Metastatic calculations include both newly incident metastat ic cases and recurrent metastatic cases in 2022. 3. Newly incident metastatic cases sourced from Seer 2022; Recurrent Metasta tic cases calculated from DRG Clarivate Epidemiology Reports, Cerner Enviza's CancerMPact – Epi Database, Patient Metrics & Treatment Architecture (2022), and Seer 2022. 4. Sarcoma includes select STS subtypes Synovial Sarcoma, Leiomyosarcoma, Undifferentiated Pleomorphic Sarcoma, Liposarcoma and Osteosar com a. Subtype frequency sourced from Zhang. International Journal of Immunopathology and Pharmacology. 2012; Dantas - Barbosa. BJC. 2017; SEER 2022. 5. Number reflects advanced stage and early - stage high risk cases. RCC: Renal Cell Carcinoma; NSCLC: Non - small cell lung cancer. ADCT - 601 showed superior activity compared to the MMAE - based HuMax - AXL ADC (Genmab) when used at the same dose (0.3 mg/kg, qdx1) 0 5 10 15 20 25 30 35 40 45 0 500 1000 1500 2000 2500 Days M e a n T u m o r V o l u m e ( m m 3 ) ± S E M Vehicle, qd x 1 ADCT-601, 0.075 mg/kg, qdx1 ADCT-601, 0.15 mg/kg, qdx1 ADCT-601, 0.3 mg/kg, qdx1 HuMax-AXL-ADC, 0.3 mg/kg, qdx1 HuMax-AXL-ADC, 4 mg/kg, qdx1 5 - year OS 1 ~20 K RCC 20% 0% 40% 150 50 ~110 K NSCLC ~42 K Pancreatic ~19 K Ovarian 5 100 Sarcoma 4 , ~3 K Pre - clinical Data ADCT - 601 Monotherapy (Pancreatic) Overview U.S. Metastatic Cases, 2022 2,3 (Drug - treatable) 0

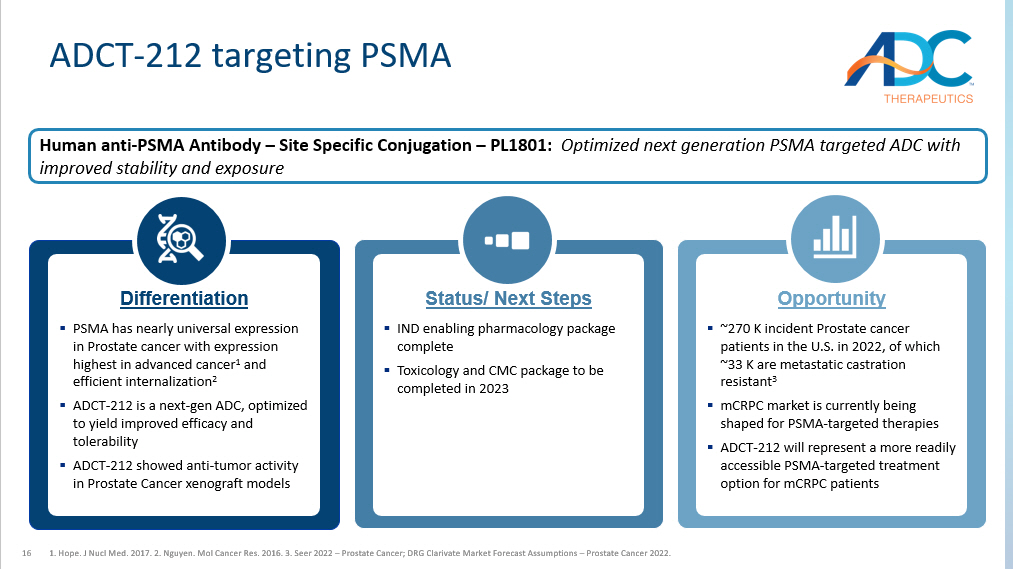

16 ADCT - 212 targeting PSMA 1. Hope. J Nucl Med. 2017. 2. Nguyen. Mol Cancer Res. 2016. 3. Seer 2022 – Prostate Cancer; DRG Clarivate Market Forecast Assumptio ns – Prostate Cancer 2022. Differentiation ▪ PSMA has nearly universal expression in Prostate cancer with expression highest in advanced cancer 1 and efficient internalization 2 ▪ ADCT - 212 is a next - gen ADC, optimized to yield improved efficacy and tolerability ▪ ADCT - 212 showed anti - tumor activity in Prostate Cancer xenograft models Status/ Next Steps ▪ IND enabling pharmacology package complete ▪ Toxicology and CMC package to be completed in 2023 Opportunity ▪ ~270 K incident Prostate cancer patients in the U.S. in 2022, of which ~33 K are metastatic castration resistant 3 ▪ mCRPC market is currently being shaped for PSMA - targeted therapies ▪ ADCT - 212 will represent a more readily accessible PSMA - targeted treatment option for mCRPC patients Human anti - PSMA Antibody – Site Specific Conjugation – PL1801: Optimized next generation PSMA targeted ADC with improved stability and exposure

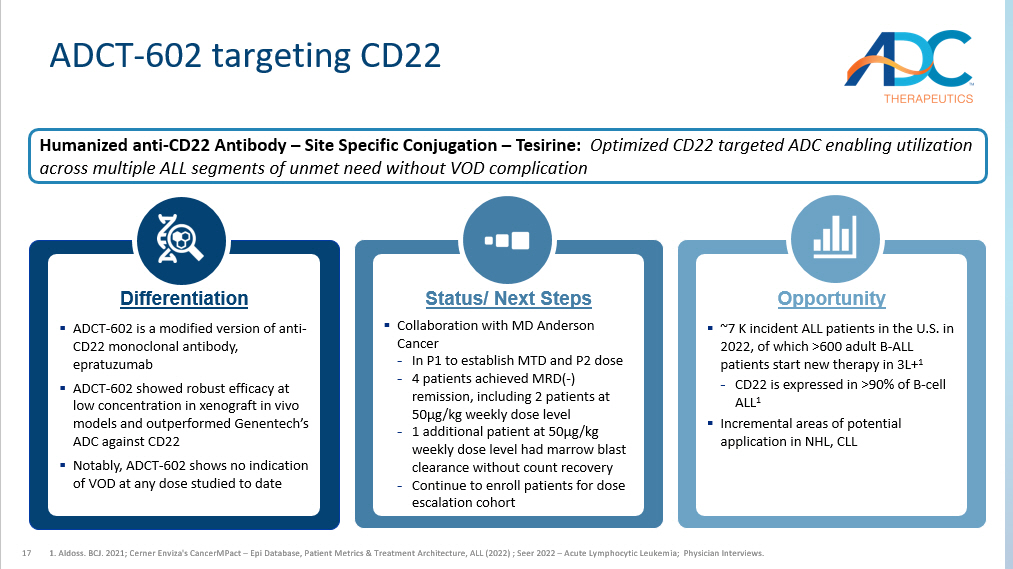

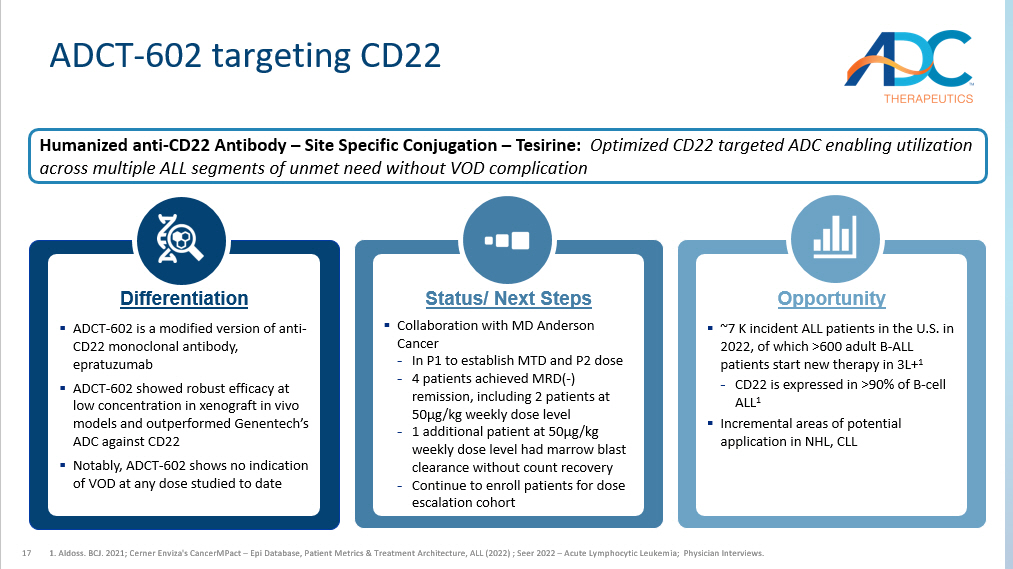

17 ADCT - 602 targeting CD22 1. Aldoss. BCJ. 2021; Cerner Enviza's CancerMPact – Epi Database, Patient Metrics & Treatment Architecture, ALL (2022) ; Seer 2022 – Acute Lymphocytic Leukemia; Physician Interviews. Differentiation ▪ ADCT - 602 is a modified version of anti - CD22 monoclonal antibody, epratuzumab ▪ ADCT - 602 showed r obust efficacy at low concentration in xenograft in vivo models and outperformed Genentech’s ADC against CD22 ▪ Notably, ADCT - 602 shows no indication of VOD at any dose studied to date Status/ Next Steps ▪ Collaboration with MD Anderson Cancer - In P1 to establish MTD and P2 dose - 4 patients achie ved MRD( - ) remission, including 2 patients at 50µg/kg weekly dose level - 1 additional patient at 50µg/kg weekly dose level had marrow blast clearance without count recovery - Continue to enroll patients for dose escalation cohort Opportunity ▪ ~7 K incident ALL patients in the U.S. in 2022, of which >600 adult B - ALL patients start new therapy in 3L+ 1 - CD22 is expressed in >90% of B - cell ALL 1 ▪ Incremental areas of potential application in NHL, CLL Humanized anti - CD22 Antibody – Site Specific Conjugation – Tesirine: Optimized CD22 targeted ADC enabling utilization across multiple ALL segments of unmet need without VOD complication

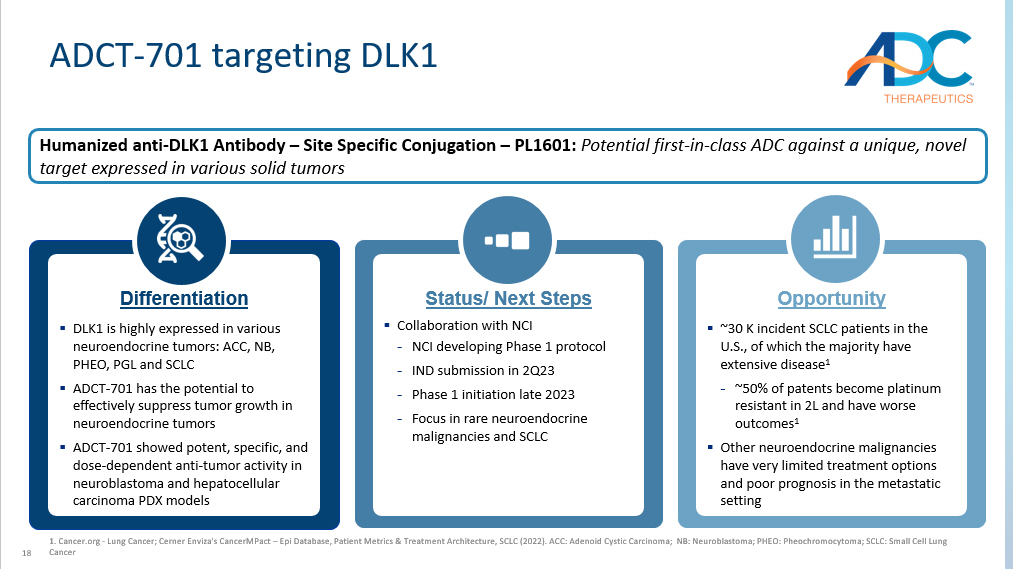

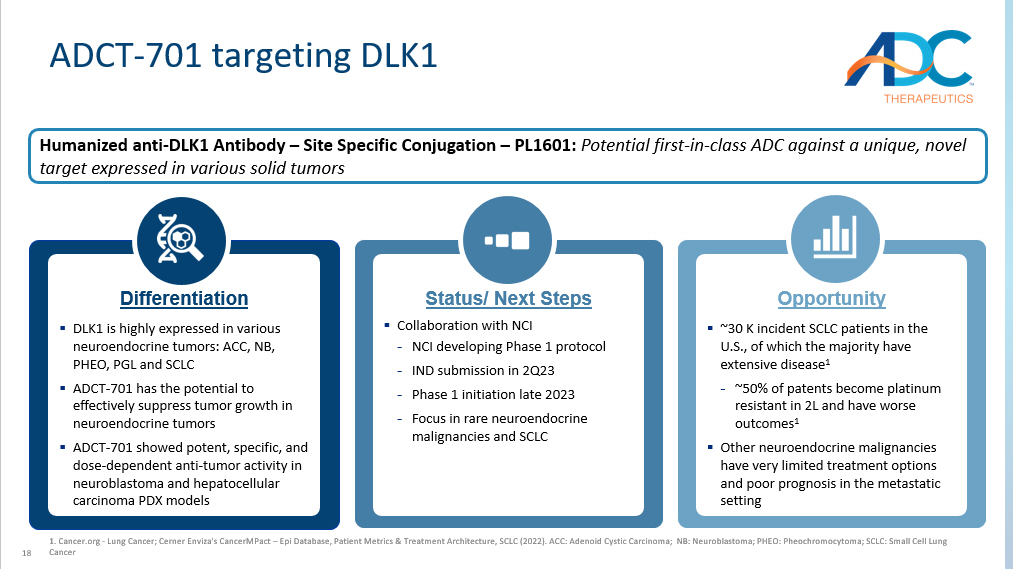

18 ADCT - 701 targeting DLK1 1. Cancer.org - Lung Cancer; Cerner Enviza's CancerMPact – Epi Database, Patient Metrics & Treatment Architecture, SCLC (2022). ACC: Adenoid Cystic Carcinoma ; NB: Neuroblastoma; PHEO: Pheochromocytoma; SCLC: Small Cell Lung Cancer Differentiation ▪ DLK1 is highly expressed in various neuroendocrine tumors: ACC, NB, PHEO, PGL and SCLC ▪ ADCT - 701 has the potential to effectively suppress tumor growth in neuroendocrine tumors ▪ ADCT - 701 showed potent, specific, and dose - dependent anti - tumor activity in neuroblastoma and hepatocellular carcinoma PDX models Status/ Next Steps ▪ Collaboration with NCI - NCI developing Phase 1 protocol - IND submission in 2Q23 - Phase 1 initiation late 2023 - Focus in rare neuroendocrine malignancies and SCLC Opportunity ▪ ~30 K incident SCLC patients in the U.S., of which the majority have extensive disease 1 - ~50% of patents become platinum resistant in 2L and have worse outcomes 1 ▪ Other neuroendocrine malignancies have very limited treatment options and poor prognosis in the metastatic setting Humanized anti - DLK1 Antibody – Site Specific Conjugation – PL1601: Potential first - in - class ADC against a unique, novel target expressed in various solid tumors

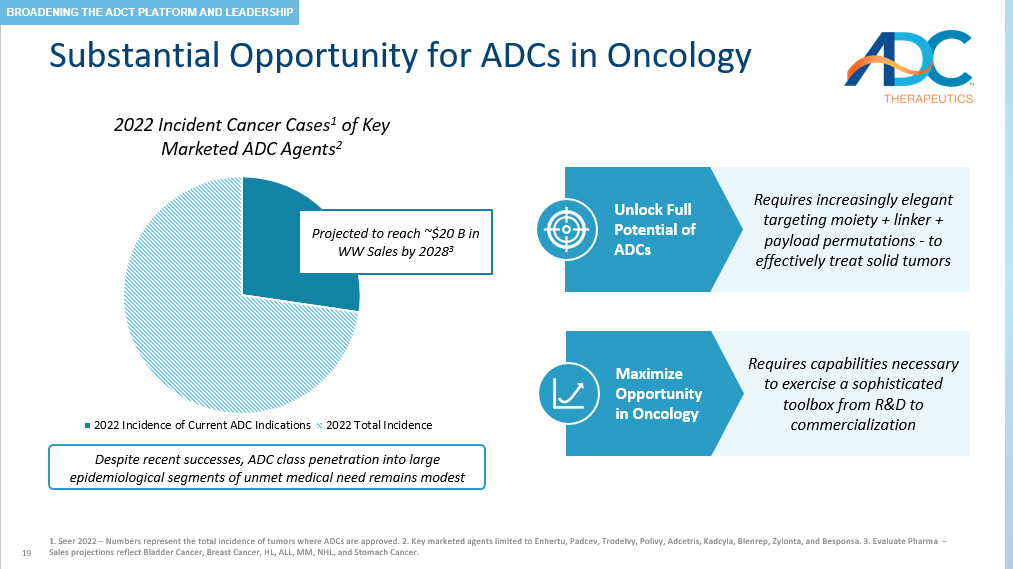

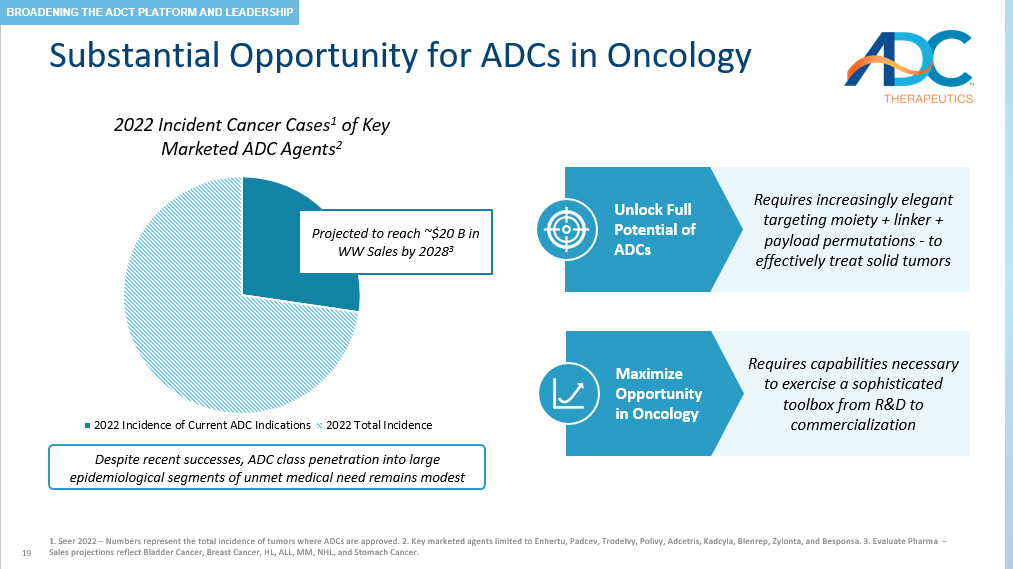

19 Substantial Opportunity for ADCs in Oncology 1. Seer 2022 – Numbers represent the total incidence of tumors where ADCs are approved. 2. Key marketed agents limited to Enhert u, Padcev, Trodelvy, Polivy, Adcetris, Kadcyla, Blenrep, Zylonta, and Besponsa. 3. Evaluate Pharma – Sales projections reflect Bladder Cancer, Breast Cancer, HL, ALL, MM, NHL, and Stomach Cancer. 2022 Incident Cancer Cases 1 of Key Marketed ADC Agents 2 2022 Incidence of Current ADC Indications 2022 Total Incidence Projected to reach ~$ 20 B in WW Sales by 2028 3 Requires increasingly elegant targeting moiety + linker + payload permutations - to effectively treat solid tumors Requires capabilities necessary to exercise a sophisticated toolbox from R&D to commercialization Unlock Full Potential of ADCs Maximize Opportunity in Oncology Despite recent successes, ADC class penetration into large epidemiological segments of unmet medical need remains modest BROADENING THE ADCT PLATFORM AND LEADERSHIP

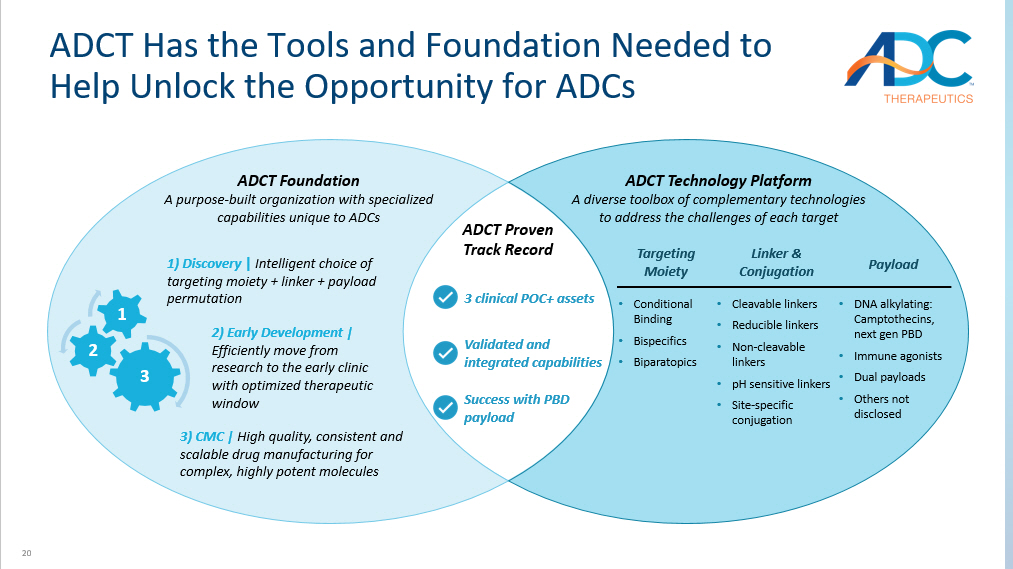

20 ADCT Proven Track Record 3 clinical POC+ assets Success with PBD payload ADCT Foundation A purpose - built organization with specialized capabilities unique to ADCs 3 2 1 1) Discovery | Intelligent choice of targeting moiety + linker + payload permutation 3) CMC | High quality, consistent and scalable drug manufacturing for complex, highly potent molecules 2) Early Development | Efficiently m ove from research to the early clinic with optimized therapeutic window ADCT Technology Platform A diverse toolbox of complementary technologies to address the challenges of each target • Conditional Binding • Bispecifics • Biparatopics • Cleavable linkers • Reducible linkers • Non - cleavable linkers • pH sensitive linkers • Site - specific conjugation • DNA alkylating: Camptothecins, next gen PBD • Immune agonists • Dual payloads • Others not disclosed Linker & Conjugation Targeting Moiety Payload ADCT Has the Tools and Foundation Needed to Help Unlock the Opportunity for ADCs Validated and integrated capabilities

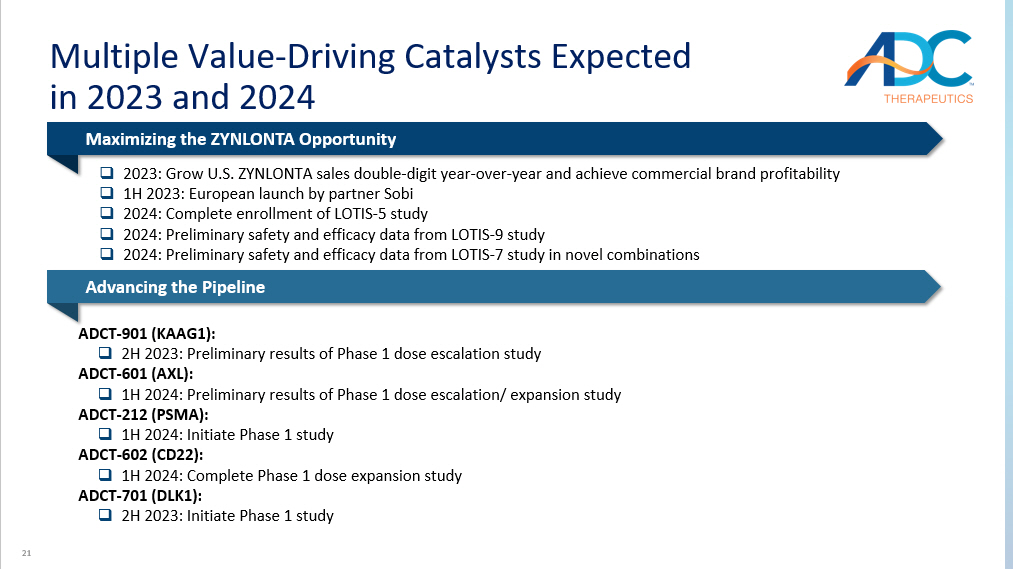

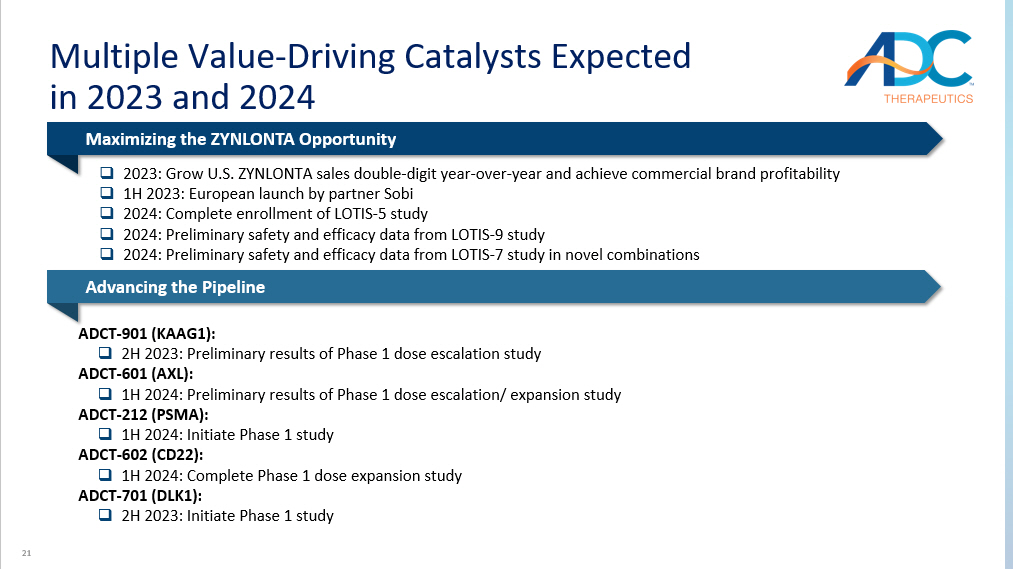

21 Multiple Value - Driving Catalysts Expected in 2023 and 2024 Advancing the Pipeline Maximizing the ZYNLONTA Opportunity ADCT - 901 (KAAG1): □ 2H 2023: Preliminary results of Phase 1 dose escalation study ADCT - 601 (AXL): □ 1H 2024: Preliminary results of Phase 1 dose escalation/ expansion study ADCT - 212 (PSMA): □ 1H 2024: Initiate Phase 1 study ADCT - 602 (CD22): □ 1H 2024: Complete Phase 1 dose expansion study ADCT - 701 (DLK1): □ 2H 2023: Initiate Phase 1 study □ 2023: Grow U.S. ZYNLONTA sales double - digit year - over - year and achieve commercial brand profitability □ 1H 2023: European launch by partner Sobi □ 2024: Complete enrollment of LOTIS - 5 study □ 2024: Preliminary safety and efficacy data from LOTIS - 9 study □ 2024: Preliminary safety and efficacy data from LOTIS - 7 study in novel combinations

Thank you