patents granted from these applications are expected to expire in 2038. For more information on the license agreements with Synaffix and Bergenbio, see “—License and Collaboration Agreements—Synaffix Commercial License Agreement” and “—License and Collaboration Agreements—Bergenbio License Agreement.”

Competition

The biotechnology industry, and the oncology subsector, are characterized by rapid evolution of technologies, fierce competition and strong defense of intellectual property. While we believe that our technology, intellectual property, know-how, scientific expertise and leadership team provide us with certain competitive advantages, we face potential competition from many sources, including major pharmaceutical and biotechnology companies, academic institutions and public and private research organizations. Many competitors and potential competitors have substantially greater scientific, research and product development capabilities, as well as greater financial, marketing and human resources than we do.

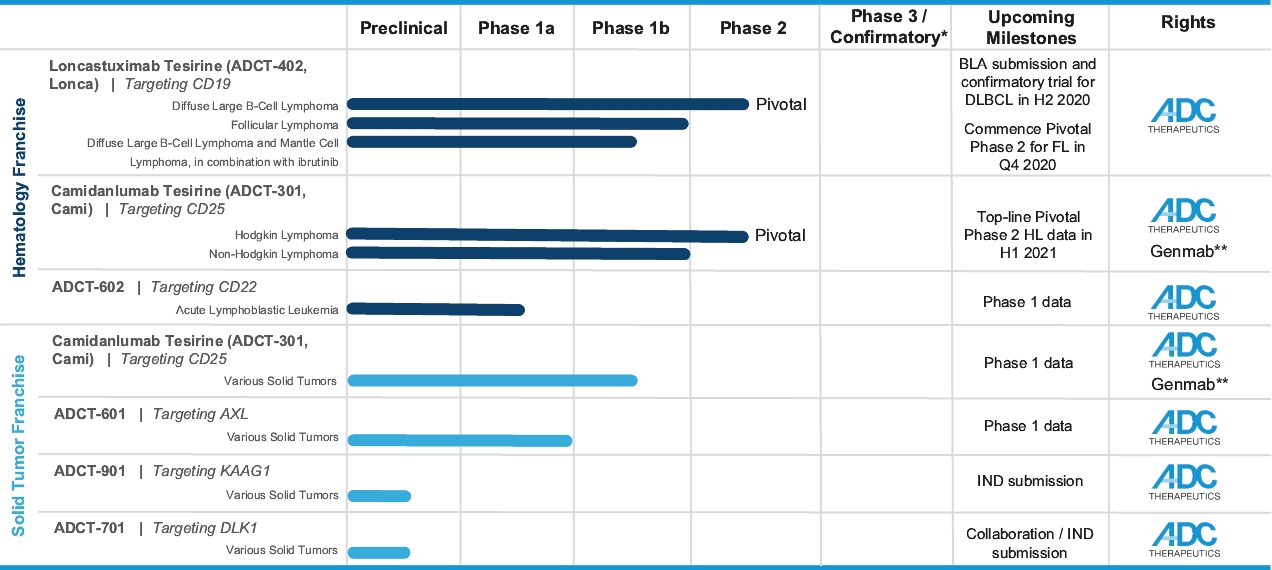

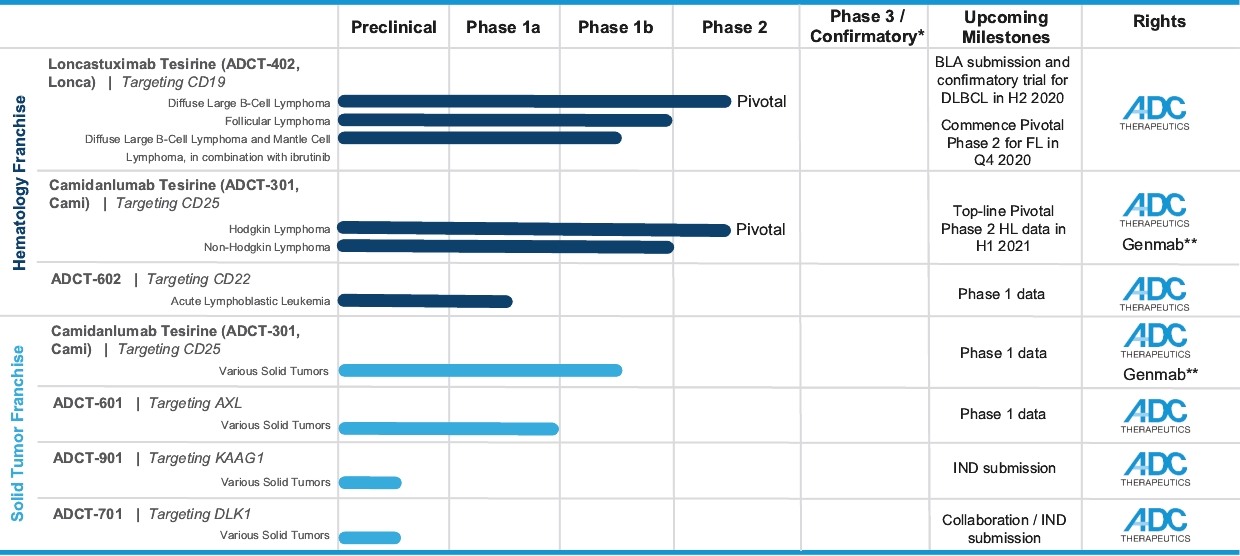

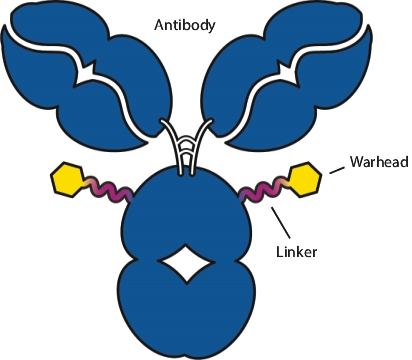

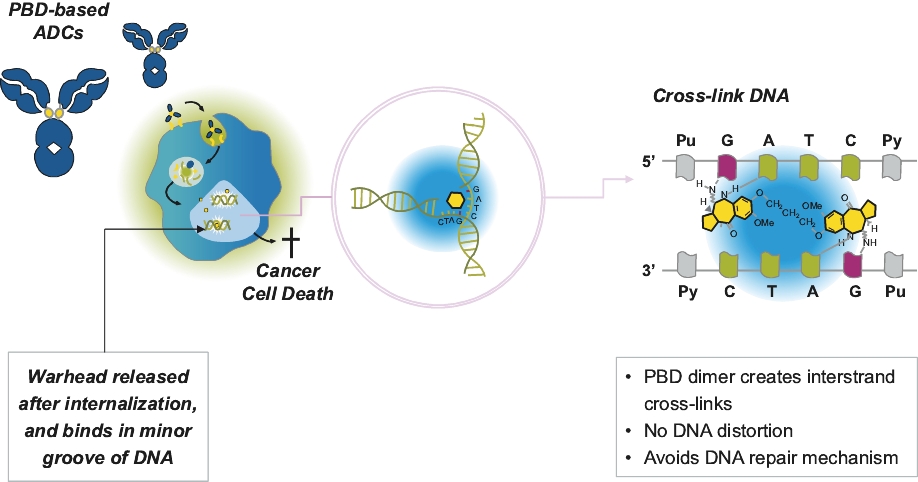

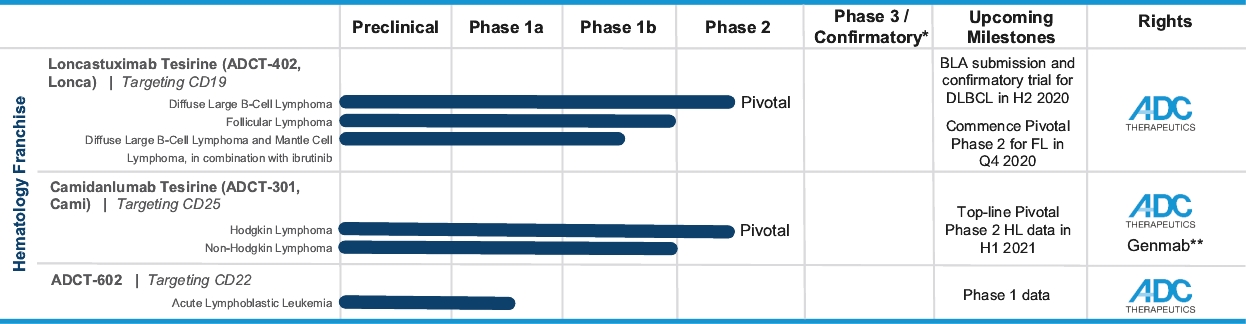

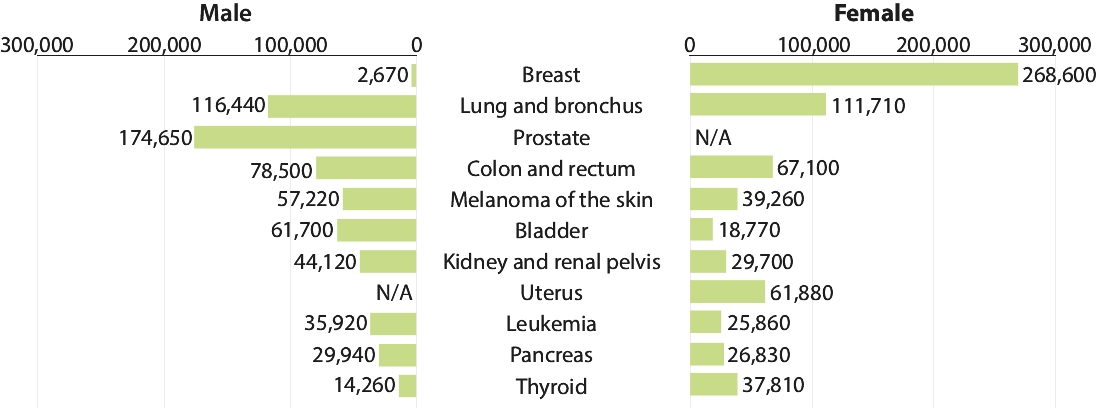

Many companies are active in the oncology market and are developing or marketing products for the specific therapeutic markets that we target, including both antibody and non-antibody-based therapies. Similarly, we also face competition from other companies and institutions that continue to invest in innovation in the ADC field including new payload classes, new conjugation approaches and new targeting moieties. Specifically, we are aware of multiple companies with ADC technologies that may be competitive to our product candidates, including, but not limited to, AbbVie, Inc., Astellas Pharma Inc., AstraZeneca plc, BioAtla, LLC, Bristol-Myers Squibb Company, CytomX Therapeutics, Daiichi Sankyo Company, Eli Lilly and Company, Genentech, Inc., Genmab A/S, ImmunoGen, Inc., Immunomedics, Inc., Mersana Therapeutics Inc., Millennium Pharmaceuticals, Inc., MorphoSys AG, Novartis International AG, Pfizer Inc., F. Hoffmann-La Roche AG, Sanofi S.A., Seattle Genetics, Inc., Sutro Biopharma, Inc., Takeda Pharmaceutical Company Ltd and Wyeth Pharmaceuticals, Inc. Currently, there are five approved ADCs: (i) brentuximab vedotin (Adcetris®), marketed by Seattle Genetics, Inc. and Takeda Pharmaceutical Company Ltd, (ii) ado-trastuzumab emtansine (Kadcyla®), marketed by Genentech, Inc., (iii) inotuzumab ozogamicin (Besponsa®), marketed by Pfizer Inc., (iv) gemtuzumab ozogamicin (Mylotarg®), marketed by Pfizer Inc., (v) polatuzumab vedotin (Polivy®), marketed by Genentech, Inc., (vi) enfortumab vedotin (Padcev®), marketed by Astellas Pharma Inc., and (vii) trastuzumab deruxtecan (Enhuertu®), marketed by Daiichi Sankyo Company. In addition, as of 2018, there were approximately 175 ADCs in development, the vast majority of which were being developed for the treatment of cancer.

In the relapsed or refractory DLBCL setting, for which we are developing Lonca, current third-line treatment options include CAR-T, allogeneic stem cell transplant and chemotherapy using small molecules. Recently, Polivy® was approved for third-line use in combination with bendamustine and a rituximab product. In addition, we expect new competitors, including tafasitamab (MOR208) and bispecific antibodies, to enter the market as treatment options for such patients.

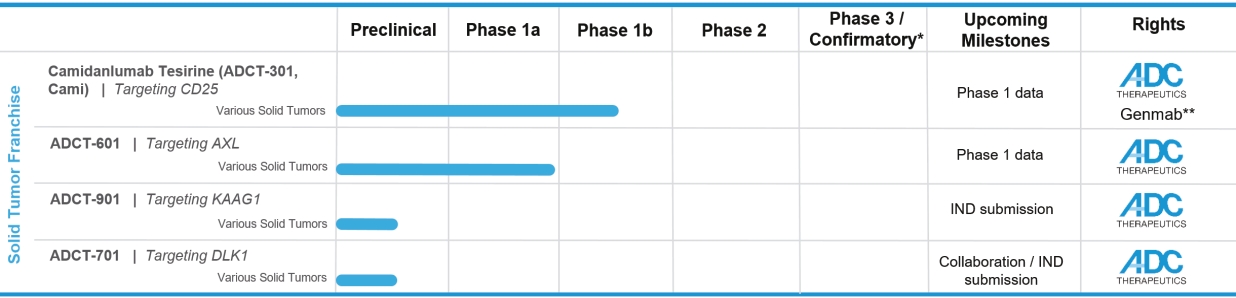

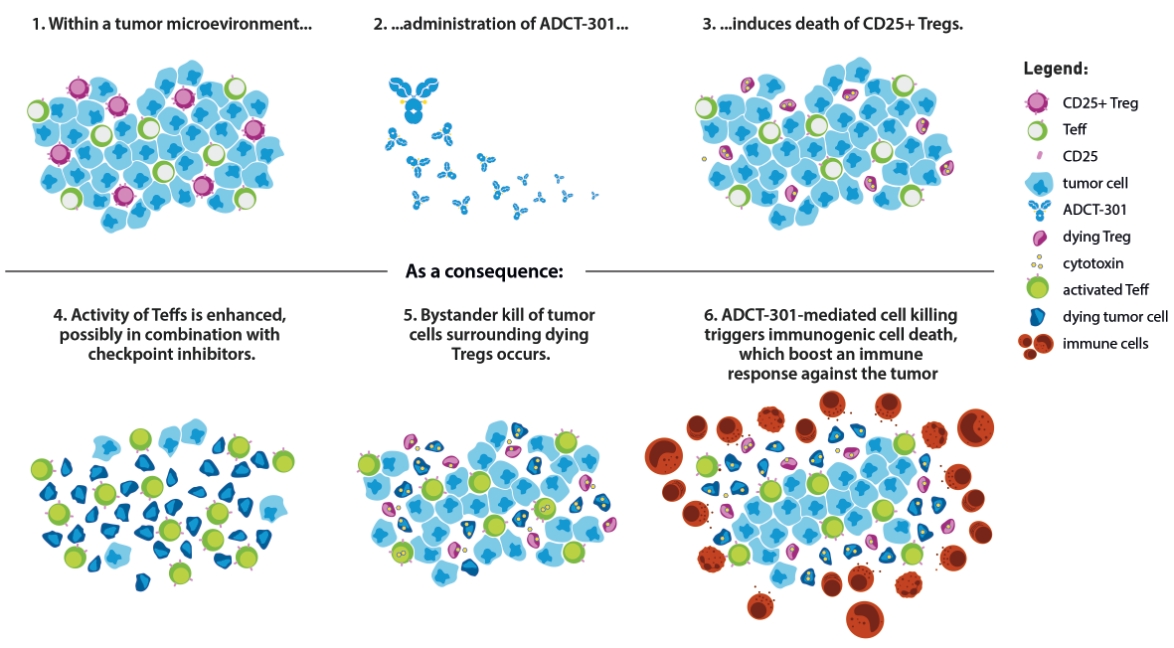

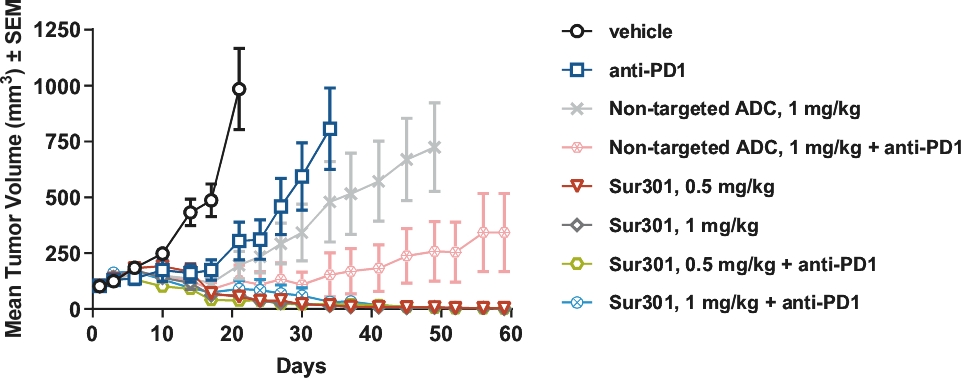

In the relapsed or refractory HL setting, for which we are developing Cami, current third-line treatment options include chemotherapy, immunotherapy and Adcetris®. In addition, we expect changes to the treatment paradigm, such as the movement of Adcetris® to earlier lines of therapy and the potential expanded use of checkpoint inhibitors, and new entrants such as bispecific antibodies.

Any product candidates that we successfully develop and commercialize may compete directly with approved therapies and any new therapies that may be approved in the future. Competition will be based on their safety and effectiveness, the timing and scope of marketing approvals, the availability and cost of supply, marketing and sales capabilities, reimbursement coverage, price levels and discounts offered, patent position and other factors. Our competitors may succeed in developing competing products before we do, obtaining marketing approval for products and gaining acceptance for such products in the same markets that we are targeting.

Government Regulation

Government authorities in the United States at the federal, state and local level and in other countries and jurisdictions, including the European Union, extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of drug and biological products, such as our investigational medicines and any future investigational medicines. Generally, before a new drug or biologic can be marketed, considerable data demonstrating its quality, safety and efficacy must be obtained, organized into a format specific for each regulatory authority, submitted for review and approved by the regulatory authority.