#22010118v16 March 18, 2020 Ron Squarer Boulder, Colorado Dear Ron, Exhibit 10.23 It is with great pleasure that we provide you with this offer of employment with ADC Therapeutics SA (the “Company”) and nomination to the Board of Directors of the Company as the “Chairman of the Board.” The entire Board of Directors is supportive and excited that you will be joining us, so we write now to memorialize the terms of your employment with the Company. To avoid any confusion, this letter supersedes all other discussions. Commencement Date Your employment will commence on March 17, 2020. Position You will be a non‐executive employee of the Company. During the period of your employment hereunder (excluding any Notice Period, as defined below) you will be invited to attend the meetings of the Company’s Executive Committee, in person or by phone, in an honorary, non‐voting capacity. The Company will convene a General Meeting of Shareholders to be held as soon as reasonably possible following commencement of your employment hereunder. At this general meeting and at each AGM (or other meeting at which directors will be elected) for as long as you remain an employee of the Company or a subsidiary, you will be nominated for election by the Company’s shareholders as a member of the Board of Directors with the title of “Chairman of the Board.” At each such meeting, the Company will use its commercially reasonable best efforts to promote your election. In addition to your authority as Chairman of the Board of Directors, as a non‐executive employee of the Company, you will make yourself reasonably available to advise and assist the Board and the Company’s CEO with: (a) the Company’s IPO process (including, but not limited to, structuring the offering, selecting and interfacing with investment bankers and participating in pre‐offering investor meetings), (b) investor relations, (c) commercialization of the Company’s products in the US and elsewhere, (d) evolution of Board composition if and when changes are to be made to the Board, and (e) business development activities. Place of Work Your principal work location will be in Boulder, Colorado, where the Company will provide you with a suitable office and reasonable administrative and technical support appropriate for a senior executive. Subject to the granting of applicable visa and work permit by the competent Swiss authorities, you will be required to engage in reasonable business travel from time to time, including to the Company’s headquarters in Epalinges, Switzerland, as reasonably agreed between you and the Company. The Company will directly pay or reimburse you for your

2 #22010118v16 travel expenses incurred in the performance of your duties, which expenses shall be reasonable in amount as determined by you in your good faith discretion, in accordance with the procedural but not substantive requirements of the Company’s expense reimbursement policy. For the avoidance of doubt, you may travel in business class or equivalent, as determined by you in your good faith discretion. Nature of Commitment During the period of your employment, you agree to devote, on average per year, not less than 50% of a standard full time business week of 40 hours to your duties under this letter. You agree that you will use your bestefforts, skill, knowledge, attention, and energies to the advancement of the Company’s business and interests, and to the performance of your duties and responsibilities as an employee and officer of the Company (it being understood that this sentence applies only to your actual work time for the Company and does not obligate you to commit more time to the Company than provided by the first sentence of this paragraph). You will notify the Nomination and Corporate Governance Committee of our Board of Directors (the “Governance Committee”) in advance of any material commercial personal service engagements that you undertake or any material changes to material commercial personal service engagements. In the event that you are not permitted to provide a complete description of a material commercial personal service engagement or a material change to such an engagement, you will notify the Governance Committee of the existence of such engagement or change to an engagement and provide sufficient information to the members of the Governance Committee (subject to each member’s entry into a confidentiality agreement not to disclose or discuss information you provide in this context outside of the committee) to allow each such member to make a reasonably informed judgement on whether the resulting engagement represents a risk of conflict with the interests of the Company. Following any such notice, the Governance Committee will have 7 days to notify you of whether it approves or disapproves of your undertaking such material commercial personal service engagement or material change. Approval from the Governance Committee will not be unreasonably withheld and will be granted for any material commercial personal service engagement with any entity that is not a “Competitive Business” (as defined in Schedule D). If the Governance Committee does not notify you of its decision within 7 days of your notification, approval will be deemed to have been granted. Subject to the preceding, if the Governance Committee timely notifies you of its disapproval, you will not engage in such material commercial personal service engagement while you are employed by the Company (provided that this sentence will not apply if you are employed with the Company for less than 4 hours per month). The Company hereby confirms approval for purposes of this provision of your service as a director of Deciphera Pharmaceuticals, Inc. (Nasdaq: DCPH), your service as a director of Retrophin, Inc. (Nasdaq: RTRX) and your service as an advisor to ProArc Medical Ltd, a private company. Notwithstanding the foregoing, you may acquire or hold less than five percent (5%) of the outstanding equity interests of any corporation or other entity; provided that, (x) such ownership represents a passive investment; (y) you are not a controlling person of, or a member of a group that controls, such corporation or other entity; and (z) such corporation or other entity in question is not a Competitive Business. Any material business travel in the course of your work for the Company (for example, travel to meetings at the Company’s headquarters) will count as timeworked. Salary Your gross annual base salary will be US $317,000 (three hundred seventeen thousand U.S. dollars), to be paid once a month in accordance with the standard payroll practices of the Company, net of all applicable taxes, social security charges, withholdings anddeductions.

3 #22010118v16 Your base salary will be reviewed annually and may be adjusted from time to time in the discretion of the Board of Directors. Bonus You will be eligible to be considered for an annual bonus with a target opportunity of 50% of your base salary, to be determined at the discretion of the Compensation Committee of the Board of Directors. Bonuses are awarded on a calendar year basis. For work done in calendar year 2020, the amount of any such bonus will be prorated from your startdate. Stock Options The Company has implemented an equity incentive plan (the “2019 Plan”) and will grant you a one‐time award of options (“Options”) under the 2019 Plan covering shares representing 2% of the then‐outstanding share capital of the Company (measured without the shares underlying such grant), with an exercise price of US $15 per share (the “Grant”), which price the Company believes is not less than 100% of the FMV of a share on the grant date. The Grant will be made and effective within 5 days after your election as a member of our Board of Directors by the Company’s shareholders. As soon as commercially practicable after your start date, the Company will obtain an independent valuation prepared for purposes of compliance with section 409A of the Internal Revenue Code and promptly provide you with a copy. As you are aware, the Company is in the process of negotiating the terms of a Series F financing and a facility under which the Company intends to issue convertible notes. For purposes of determining the outstanding share capital of the Company in connection with the Grant, any shares issued or to be issued in connection with this Series F financing will be taken into account and the actual or planned initial issuance of notes by the Company under this facility shall be deemed to have been made to the fullest extent of such initial issuance provided for under such agreement. The Grant will vest over three years: 33% one year from your start date and in twenty four equal monthly installments thereafter subject to: (a) the terms and conditions of the Plan; (b) the terms of the grant as set forth in your award agreement (a copy of which is attached to this letter as Schedule E); and (c) your being in continuous service with the Company through each relevant vesting date (except as otherwise provided in the award agreement or this letter). The Grant will be subject to the terms of the Plan (as modified by this letter) as in effect on the date of Grant, subject to any modifications to the Plan adopted within the year following the Grant at a time when you are Chairman of the Board. Subject in each case to the Compensation Committee’s determination in its absolute discretion (which may take into account your performance and the Company’s performance for a given period), the Company will issue one or more additional option grants to you in order to preserve your overall equity interest in the company at 2% of the then‐outstanding share capital of the Company (measured without the shares underlying such grant), with an exercise price to be determined by the Compensation Committee in its absolute discretion equal to the then fair value of the covered securities on the applicable date of grant. Notwithstanding any contrary provision of the preceding sentence, the Compensation Committee will exercise its power to issue you additional option grants in accordance with the preceding sentence in respect of the first IPO of the Company that occurs after your start date, which options will be issued as soon as practicable following the determination of the total number of shares to be issued in connection with the IPO (that is, after the amount of the greenshoe is determined) and intended

4 #22010118v16 to maintain your 2% equity interest (the “Incremental Option Grant”). In any event, the Compensation Committee also will consider you for additional grants each time that it makes grants to other directors or officers of the Company. In the event that a strategic transaction occurs during the term of your employment as Chairman that triggers a change of control for the Company (as defined in the 2019 Plan), all outstanding stock options at the time of that closing shall vest immediately and be deemed cashlessly exercised in determining the portion of transaction proceeds to which you are entitled (such arrangement, the “Option CoC Arrangement”). Benefits You may participate in any and all benefit programs that the Company establishes and makes available from time to time to its senior executives or members of the Board (excluding benefit plans for executives under the Swiss Federal Act on Occupational Retirement, Survivors' and Disability Benefits (Loi fédérale sur la prévoyance professionnelle vieillesse, survivants et invalidité)) on terms no less favorable than as for any other Company officer or member of the Board. If you are not eligible under the plan documents governing any of those programs, the Company will make separate arrangements that provide substantially equal benefits on an after‐tax basis. To the extent that your employment with (and compensation from) the Company requires you to pay taxes or related costs and/or to comply with immigration, employment or related laws or rules of any jurisdiction other than the United States or Colorado, the Company will arrange for professional assistance (for example, without limitation, legal advice, accounting services, and tax preparation services) to facilitate your compliance and will pay any additional taxes or other costs related to any such laws or rules (on a tax‐neutral basis to you, with the result that you are in the same economic position as if you were subject only to the tax laws of the United States and Colorado). To the extent that you incur additional taxes or other costs under Section 409A of the Internal Revenue Code or a similar law due to an assertion or determination that the per share exercise price of the Options is less than the fair market value of a share on the grant date of the Options, the Company will pay any additional taxes and other costs related to any such assertion or determination (on a tax‐neutral basis to you, with the result that you are in the same economic position as if the Options were exempt from Section 409A of the Internal Revenue Code). Your rights under this paragraph will survive your termination of employment (notwithstanding any contrary provision of this letter). All payments and benefits under this letter will be provided in an Internal Revenue Code Section 409A and Section 457A compliant manner and the Company will implement procedures and/or policies in furtherance of such compliance (including, without limitation, paying any amounts under the preceding three sentences by the deadline specified under Section409A). Vacation You will accrue the equivalent of 25 days of paid vacation per year pro rated for your 50% time commitment throughout the course of your employment at the Company, subject to accrual and use in accordance with the vacation policy of the Company as in effect from time totime. At‐Will Employment The Company may terminate the employment relationship at any time, for any reason or no reason, with or without cause. The Company agrees to give you no less than twelve (12) months prior written notice of its intention to terminate you other than for “Cause” (as defined in Schedule D). However, if termination is for Cause, it may take immediate effect. If you resign from the Company other than with “Good Reason” (as defined in Schedule D), you agree to give the Company a minimum of one (1) month of prior written notice (it being

5 #22010118v16 understood that, to the extent commercially practicable, you will endeavor to give longer verbal or written notice to the Board). If (i) you provide written notice of your intent to resign from the Company with Good Reason, and the Company has failed to cure all applicable grounds for such Good Reason within 30 days of your initial notice, or (ii) the Company gives you written notice of its intention to terminate you other than for Cause, then the effective date of your termination will be the last day of the calendar month including the 12‐month anniversary of the notice date (the “Notice Period”). During the Notice Period, you will (a) immediately cease to be an officer of the Company and a member of the Board, (b) only have the duties of a senior strategic advisor to the Board whowill be reasonably available for telephone and email consultation for up 3 hours per month at mutually agreeable times, and (c) to the extent permitted by Swiss law, be entitled to continued payment of your annual base salary (ignoring any reduction that could constitute Good Reason), annual bonus at target, vesting of equity awards (including, but not limited to, the Options), and participation in the programs and rights described above under Benefits. Although your job duties, title, compensation and benefits, as well as the Company’s personnel policies and procedures, may change from time to time, the “at‐will” nature of your employment may only be changed by a written agreement signed by you and an authorized senior officer of the Company with approval of the Board of Directors which expressly states the intention to modify the at‐will nature of your employment. Similarly, nothing in this letter shall be construed as an agreement, either express or implied, to pay you any compensation or grant you any benefit beyond the end of your employment with the Company except as expressly agreed and codified in writing. If the Board of Directors makes any decision regarding your employment, compensation or benefits, you will be recused from such decision. Confidentiality, Non‐Solicitation and Invention Assignment By signing below, you represent that you have read, understand, and accept the confidentiality, non‐solicitation and assignment of invention provisions set forth in Schedule A, and have been given the opportunity to review these provisions with independent legal counsel, and you agree to be bound by such provisions. D&O Questionnaire The Company will provide you with a D&O questionnaire on the Company’s standard form. We ask that you complete and sign this questionnaire and return it to the Company at your earliest convenience. You will be provided indemnification and insurance coverage on terms no less favorable than as for any other Company officer or member of the Board. Representation and Warranty By signing below you represent and warrant that you may freely enter into this offer of employment and that you are not subject to any contract, agreement or restrictive covenant of any kind that would prevent you from accepting employment with the Company and/or beginning work for the Company, or from fully and freely performing your duties in any way that would be inconsistent with the position and duties set out in this letter. You further promise that should you become aware of any reason you cannot join or remain employed by the Company, or fully execute your responsibilities for the Company, you will immediately notify the Company of such development, in writing. Similarly, if you receive any communication from a former employer or any other person or entity claiming you cannot join or continue employment at the Company, you will immediately notify the Company in writing. You also represent that you will abide by all contractual obligations you may have to all prior employers and that you will not retain, review or utilize any other person or entity’s confidential or proprietary

6 #22010118v16 information in connection with your work for the Company or share or disclose such information to any other person or entity. Other Agreements and Governing Law Please note that this offer letter is your formal offer of employment and supersedes any and all prior or contemporaneous agreements, discussions and understandings, whether written or oral, relating to the subject matter of this letter or your employment with the Company. Your employment relationship with the Company, including the terms of this letter, will be governed by the law of the State of New York, without regard to conflict‐ of‐law principles. The Company promptly will pay your attorneys for your reasonable attorney fees and costs incurred in the negotiation of this letter and related documents, up to $100,000. Arbitration Any dispute, controversy or claim arising out of or in relation to this letter and your employment relationship with the Company, including the validity, invalidity, breach or termination thereof, shall be exclusively resolved by arbitration in accordance with the Rules of Arbitration of the International Chamber of Commerce in force on the date on which the Notice of Arbitration is submitted in accordance with these Rules. The jurisdiction of the arbitral tribunal shall be exclusive, and the state courts of any jurisdiction shall not have any competence. Should this arbitration clause be partly invalid, and the state courts have partly jurisdiction for some claims, then the arbitral tribunal shall have jurisdiction for the remainder of the claims. The number of arbitrators shall be one. The seat of the arbitration shall be New York City, New York. The arbitral proceedings shall be conducted in English. Within 15 days from receipt of the Notice of Arbitration, the Respondent shall submit to the Secretariat an Answer to the Notice of Arbitration together, in principle, with any counterclaim or set‐off defence. The time‐limit with respect to the designation of an arbitrator shall be 15 days. If the circumstances so justify, the Court may extend or shorten the above time‐limits. The Emergency Arbitrator Provisions shall apply. Notwithstanding the above, the parties may agree at any time to submit the dispute to mediation in accordance with the ICC Mediation Rules. The parties agree that the arbitration shall be kept confidential. The existence of the arbitration, any non‐public information provided in the arbitration, and any submissions, orders or awards made in the arbitration (together, the “Confidential Arbitration Information”) shall not be disclosed to any non‐party except the tribunal, the International Chamber of Commerce, the parties, their counsel, experts, witnesses, accountants and auditors, insurers and reinsurers, and any other person necessary to the conduct of the arbitration. Notwithstanding the foregoing, a party may disclose Confidential Arbitration Information to the extent that disclosure may be required to fulfill a legal duty, protect or pursue a legal right, or enforce or challenge an award in bona fide legal proceedings. This confidentiality provision survives termination of the contract and of any arbitration brought pursuant to the contract. Legal Restrictions on Compensation The Company is incorporated as a Swiss stock corporation (société anonyme) under the laws of Switzerland. If and when the Company’s shares will be listed on a stock exchange in the United States, Switzerland, or elsewhere, the Company will be subject to legislation that (i) imposes an annual binding shareholders’ “say‐on‐pay” vote with respect to the aggregate compensation of the members of the Company’s Executive Committee and of the Board of Directors, (ii) prohibits severance payments, advances, transaction premiums and similar payments to members of the Company’s Executive Committee and Board of Directors, (iii) requires the Company to specify various compensation‐related matters in its articles of association, thus requiring these matters to be approved by a shareholders’ vote, and (iv) requires the Company to specify the maximum number of positions as director and/or

7 #22010118v16 executive officer of other companies and entities that the members of the Company’s Executive Committee and Board of Directors may hold. You are expected to be a member of the Company’s Board of Directors, and thus your compensation and terms of employment will be subject to the foregoing restrictions as from the time when the Company's shares will be listed on a stock exchange. In particular, to the extent the Company or its subsidiaries will make any compensation and similar payments to you prior to approval by its shareholders, such payments will be made subject to subsequent shareholder approval. In the unlikely event that such approval cannot be obtained, the relevant payments would need to be returned to the Company or the relevant subsidiary. For clarity, the restrictions in connection with the required shareholder approval do not apply with respect to compensation granted before the listing of the Company's shares on a stock exchange, irrespective of whether such compensation vests before or after such listing. Section 409A This offer letter is intended to comply with Section 409A of the U.S. Internal Revenue Code of 1986, as amended (“Section 409A”), and shall be interpreted accordingly. If any payment or benefit provided to you by or on behalf of the Company is determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A and you are determined to be a “specified employee” within the meaning of Section 409A, then such payment or benefit shall not be paid until the first payroll date following the six‐month anniversary of the date of your “separation from service” within the meaning of Section 409A, or, if earlier, on your death (the “Delayed Payment Date”). The aggregate of any payments that would otherwise have been paid before the Delayed Payment Date shall be paid to you in a lump sum on the Delayed Payment Date and thereafter, any remaining payments shall be paid without delay in accordance with their original schedule. Your Employer Notwithstanding anything to the contrary herein, your employment with the Company hereunder may be arranged by way of a U.S. subsidiary of the Company, which would serve as your employer for all intents and purposes during the period of your employment hereunder. If the preceding applies and your employer fails to make any payments or provide any benefits when due, the Company will promptly make the payments and provide the benefits. Your technical employment by a subsidiary will not affect your authority, duties and rights as Chairman as provided in this letter. Data Protection Your personal data shall be collected and processed by the Company in accordance with Schedule B. All of us at ADC Therapeutics are thrilled about the prospect of you joining our team. If you have any questions about the above details, please call me immediately. If this letter, including the schedules hereto, correctly sets forth the terms under which you agree to be employed by the Company, please sign this letter in the space provided below along with the attached forms, and return them to me at stephen.evansfreke@auventx.com. Additional Terms The following additional terms apply to this letter, the ADC Therapeutics SA 2019 Equity Incentive Plan (the “Plan”), the Option Agreement that is attached as Schedule E (the “Option Agreement”) and the Confidentiality, Non‐Solicitation and Invention Assignment attached as Schedule A (the “CNI Agreement”). Notwithstanding any contrary provision of any other document, the provisions of this Additional Terms section supersede the relevant provisions of this letter, the Plan, the Option Agreement and the CNI Agreement, as applicable. The preceding

8 #22010118v16 sentence may be overridden only in a document signed by both you and the Company that specifically references such preceding sentence and states that it is specifically agreed that such preceding sentence is to be overridden. In addition, the Company agrees that the Company will not impose any new or additional non‐competition or other restrictive covenant on any equity award made to you beyond such restrictions agreed to under this letter, taken together with the CNI Agreement, unless it is contained in a document signed by both you and the Company that specifically references the Additional Terms sections of this letter and specifies that you agree to the new or additional restrictive covenant notwithstanding this section of this letter. The governing law for all of the documents described in this paragraph (other than the Plan) shall be New York and the place of jurisdiction for any dispute arising out of any such document (including the Plan) shall be New York. Section 10(d) of the Plan will be superseded by the Option CoC Arrangement set forth above to the extent that the Option CoC Arrangement applies according to its terms. Sections 11(g) and 11(h) of the Plan will not apply to the Grant. Section 11(i) of the Plan may be applied to you only to the extent that the “clawback” policies and procedures referenced therein apply equally (for any claw‐back of compensation paid to you as an employee) to all executive officers of the Company or (for any claw‐back of compensation paid to you as a member of the Board) to all the members of the Board. For purposes of the Option Agreement, you will be entitled to use any of the exercise methods described in Section 2(d) of the Option Agreement and, if elected by you, you will be entitled to cover any withholding taxes from the grant, vesting or exercise of an award through the method described in Section 2(d)(ii)(B). The meaning of “Good Leaver” in Section 3(iv) of the Option Agreement shall be revised to mean you, in the event that you experience a Termination of Service (as defined in the Plan) as a result of either (i) the Company’s terminationof your employment without Cause (as defined in Schedule D), or (ii) your resignation of your employment for Good Reason (as defined in Schedule D) at any time. For avoidance of doubt, the requirement in the “Good Leaver” definition in Section 3(iv) of the Option Agreement that a Termination of Service (as defined in the Option Agreement) must occur upon or within 18 months following a Change in Control (as defined in the Plan) shall not apply. Section 7 of the Option Agreement may be applied to you only to the extent that the “clawback” policies and procedures referenced therein apply equally (for any claw‐back of compensation paid to you as an employee) to all executive officers of the Company or (for any claw‐back of compensation paid to you as a member of the Board) to all the members of the Board. Section 4 of the CNI Agreement shall be inapplicable to you. You agree that during your employment and the 12 months thereafter, you will not hire, employ, solicit for employment, or attempt to hire, employ or solicit for employment any employee of the Company, provided that the following will not be a violation of this sentence (a) the solicitation, hire or employ of any employee by an entity with which you are affiliated so long as you were not directly and materially involved with such solicitation or hire (for example, without limitation, it will not be a violation if an entity for which you serve as Chief Executive Officer or a director were to solicit or hire a Company employee and you were not materially involved in such solicitation or hire), or (b) a general advertisement not directed specifically at employees of the Company. The Company plans to revisit its compensation and benefit plans with due consideration for your input as soon as practicable after your election as Chairman, and the Company will use its best efforts to promulgate such amendments before granting any Incremental OptionGrant.

9 #22010118v16 Conclusion Ron, we speak for the entire Board in saying that we are thrilled to have you joining us on this exciting journey to bring the Company’s life‐saving cancer drugs to patients in the US and around the world. We believe that, working with Chris Martin and the rest of the Company’s management team, you will bring great value to all the Company’s endeavors. We look forward to working with you on the Company’s Board and to helping you in whatever way we can to promote the Company’s interests. Sincerely, For ADC Therapeutics SA /s/ Stephen Evans‐Freke By: Stephen Evans‐Freke Date: March 18, 2020 Director & Chairman of the Nomination and Corporate Governance Committee The foregoing correctly sets forth the terms of my at‐will employment with ADC Therapeutics SA and I am not relying on any representations other than those set forth above. Signed: /s/ Ron Squarer Ron Squarer Date: March 18, 2020 Schedule A: Confidentiality, Non‐Solicitation and Assignment of Invention Provisions Schedule B: Data Protection Notice to Employees Schedule C: Swiss Payroll Tax Considerations Schedule D: Definitions of Cause, Competitive Business and Good Reason Schedule E: Form of Option Agreement

10 #22010118v16 Schedule A Confidentiality, Non‐Solicitation and Assignment of Invention Provisions In consideration of your employment or continued employment by ADC Therapeutics SA (the “Company”), you hereby agree to be bound by the following terms and conditions set forth in this Schedule A (this “Schedule”), which relate to confidentiality, non‐solicitation and assignment of inventions, referring to yourself in the first person: 1. PURPOSE OF THIS SCHEDULE. 1.1 Purpose. I understand that part of the Company’s business is to create, develop and market products and provide certain services, and that it is essential for the Company to protect its Inventions, Intellectual Property and Confidential Information (each as defined below). Accordingly, I agree to be bound by the terms and conditions set forth in this Schedule as a condition of my employment with the Company, whether or not I am expected to create any Inventions or Intellectual Property for the Company. 2. DISCLOSURE AND OWNERSHIP OF INVENTIONS AND INTELLECTUAL PROPERTY. 2.1 Definitions. As used in this Schedule: (a) “Intellectual Property” means all patents, invention disclosures, invention registrations, trademarks, service marks, trade names, trade dress, logos, domain names, copyrights, mask works, trade secrets, know‐ how and all other intellectual property and proprietary rights recognized by any applicable law of any jurisdiction, and all registrations and applications for registration of, and all goodwill associated with, the foregoing. (b) “Inventions” means all inventions, discoveries, concepts, information, works, materials, processes, methods, data, software, programs, apparatus, designs and the like. 2.2 Disclosure. I will disclose promptly in writing to the Company any and all Inventions and Intellectual Property, in each case that I conceive, develop, create or reduce to practice, either alone or jointly with others, during the period of my employment that (a) are conceived, created or developed using any equipment, supplies, facilities, trade secrets, know‐how or other Confidential Information of the Company, (b) result from any work performed by me for the Company and/or (c) otherwise relate to the Company’s business or actual or demonstrably anticipated research or development (collectively, “Company Intellectual Property”). 2.3 Ownership and Assignment. I acknowledge and agree that the Company will have exclusive title and ownership rights in and to all Company Intellectual Property. To the extent that exclusive title and/or ownership rights may not originally vest in the Company as contemplated herein, I hereby assign, transfer, convey and deliver to the Company all right, title and interest in and to all Company Intellectual Property. I acknowledge and agree that, with respect to any Company Intellectual Property that may qualify as a Work Made For Hire as defined in 17 U.S.C. § 101 or other applicable law, such Company Intellectual Property is and will be deemed a Work Made for Hire and the Company will have the sole and exclusive right to the copyright (or, in the event that any such Company Intellectual Property does not qualify as a Work Made for Hire, the copyright and all other rights thereto are automatically assigned to the Company as above). 2.4 Prior Inventions. Set forth in Exhibit A (Prior Inventions) attached hereto is a complete list of all Inventions that I have, alone or jointly with others, conceived, developed created or reduced to practice prior to the commencement of my employment with the Company, that are my property, and that the Company acknowledges and agrees are excluded from the scope of the agreement set forth in this Schedule (collectively, “Prior Inventions”). If disclosure of any such Prior Invention would cause me to violate any prior confidentiality agreement, I understand that I am not to list such Prior Inventions in Exhibit A but am only to disclose where indicated a cursory name for each such Prior Invention, a listing of each person or entity to whom it belongs, and the fact that full disclosure as to such Prior Inventions has not been made for that reason (it being understood that, if no Invention or disclosure is provided in Exhibit A, I hereby represent and warrant that there are no Prior Inventions). If, in the course of my employment with the Company, I incorporate any Prior Invention into any Company product, process or machine or otherwise use any Prior Invention, I hereby grant to the Company a worldwide, non‐exclusive, irrevocable, perpetual, fully paid‐up and royalty‐free license (with rights to sublicense through multiple tiers of sublicensees) to use, reproduce, modify, make derivative works of, publicly perform, publicly display, make, have made, sell, offer for sale, import and otherwise exploit such Prior Invention for any purpose. 2.5 Non‐Assignable Inventions. If I am an employee whose principal work location is in California, Illinois, Kansas, Minnesota or Washington State, the provisions regarding my assignment of Company Intellectual Property to the Company in Section 2.3 of this Schedule do not apply to certain Inventions (“Non‐Assignable Inventions”) as specified in the statutory code of the applicable state. I acknowledge

11 #22010118v16 having received and reviewed notification regarding such Non‐ Assignable Inventions pursuant to such states’ codes. 2.6 Waiver of Moral Rights. To the extent I may do so under applicable law, I hereby waive and agree never to assert any Moral Rights that I may have in or with respect to any Company Intellectual Property, even after termination of any work on behalf of the Company. As used in this Schedule, “Moral Rights” means any rights to claim authorship of a work, to object to or prevent the modification or destruction of a work, or to withdraw from circulation or control the publication or distribution of a work, and any similar right, existing under any applicable law of any jurisdiction, regardless of whether or not such right is denominated or generally referred to as a “moral right.” 3. CONFIDENTIALITY. 3.1 Confidential Information. As used in this Schedule, the term “Confidential Information” means any and all non‐public, proprietary or other confidential information of the Company disclosed to me, to which I have access, or of which I otherwise becomes aware, in each case whether in oral, written, graphic or machine readable form, including: (a) the Company’s know‐how, trade secrets, and Inventions, (b) information regarding the Company’s business, including its products, services, plans for research and development, marketing and business plans, budgets, contracts, prices, suppliers, and customers, (c) information regarding the skills and compensation of the Company’s employees, contractors, and any other service providers of the Company, (d) the existence of any business discussions, negotiations, or agreements between the Company and any third party, (e) all documents and other work product generated by me which contain, comment upon, or relate in any way to any information disclosed by the Company, (f) all third party information held in confidence by the Company, and (g) the terms and conditions of the agreement set forth in this Schedule. I acknowledgeand agree that the confidentiality restrictions set forth herein shall apply to any and all Confidential Information disclosed to me or of which I have otherwise become aware, whether before, on or after the date hereof. 3.2 Restrictions; Recognition of Company’s Rights. At all times, both during my employment and after its termination, I will keep all Confidential Information strictly confidential and I will not disclose, publish, use, transfer or otherwise disseminate any Confidential Information to any person or entity without the Company’s express prior written consent, except as may be necessary to perform my duties as an employee of the Company for the benefit of the Company. 3.3 Ownership of Confidential Information. All Confidential Information shall remain the sole and exclusive property of the Company. No license or other right to any Intellectual Property is granted to me under the agreement set forth in this Schedule. To the extent that I acquire any right, title or interest in or to any Confidential Information, I hereby assign, transfer, convey and deliver to the Company all such right, title and interest in and to such Confidential Information. 3.4 Legal Exception. I may disclose Confidential Information to the extent it is in response to a valid order of a court or other governmental authority or to otherwise comply with applicable law; provided that, subject to Section 3.5, I shall first give notice to the Company and reasonably cooperate with the Company to obtain a protective order or other measures preserving the confidential treatment of such Confidential Information and requiring that the information or documents so disclosed be used only for the purposes for which the order was issued or is otherwise required by applicable law. 3.5 Defend Trade Secrets Act. Notwithstanding anything in this Schedule to the contrary, pursuant to the Defend Trade Secrets Act of 2016, the parties acknowledge and agree that I shall not have criminal or civil liability under any Federal or state trade secret law for the disclosure of any trade secret that (a) is made (i) in confidence to a Federal, state, or local government official, either directly or indirectly, or to an attorney and (ii) solely for the purpose of reporting or investigating a suspected violation of law, or (b) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. In addition and without limiting the preceding sentence, if I file a lawsuit for retaliation by the Company for reporting a suspected violation of law, I may disclose the trade secret to my attorney and may use the trade secret information in the court proceeding, if I (x) file any document containing the trade secret under seal and (y) do not disclose the trade secret, except pursuant to court order. 3.6 Whistleblower Protection. Notwithstanding anything in this Schedule or otherwise, it is understood that I have the right under Federal law to certain protections for cooperating with or reporting legal violations to the Securities and Exchange Commission (the “SEC”) and/or its Office of the Whistleblower, as well as certain other governmental authorities and self‐regulatory organizations, and as such, nothing in this Schedule nor otherwise is intended to prohibit me from disclosing the agreement set forth in this Schedule to, or from cooperating with or reporting violations to, the SEC or any other such governmental authority or self‐regulatory organization, and I may do so without notifying the Company. The Company may not retaliate against me for any of these activities, and nothing in this Schedule or otherwise would require me to waive any monetary award or other payment that I might become entitled to from the SEC or any other governmental authority.

12 #22010118v16 3.7 Disposition of Confidential Information. Upon any termination of my employment or at the Company’s written request, I shall return to the Company all copies of Confidential Information in my custody, possession or control. Alternatively, with the Company’s prior written consent, I may destroy such Confidential Information, in which case I will certify in writing to the Company that all such Confidential Information has been so destroyed. 4. NON‐SOLICITATION 4.1 I understand and acknowledge that the Company has expended and continues to expend significant time and expense in recruiting and training its employees and that the loss of employees would cause significant and irreparable harm to the Company. I agree and covenant not to directly or indirectly solicit, hire, recruit, or attempt to solicit, hire, or recruit, any employee of the Company (“Covered Employee”), or induce the termination of employment of any Covered Employee during the period of my employment with the Company, and for the period of 12 (twelve) months beginning on the last day of my employment with the Company, regardless of the reason for the employment termination. 4.2 This non‐solicitation provision explicitly covers all forms of oral, written, or electronic communication, including, but not limited to, communications by email, regular mail, express mail, telephone, fax, instant message, and social media, whether or not in existence at the time of entering into this Agreement. 5. GENERAL PROVISIONS. 5.1 Governing Law. The agreement set forth in this Schedule is governed by and construed in accordance with the law of the State of New York, without regard to the conflicts of law rules of such state. 5.2 Notices. All notices, requests and other communications to either party hereunder will be in writing and will be given to the other party at the applicable address listed on the signature page hereto, or such other address as such party may hereafter specify for the purpose by notice to the other party. All such notices, requests and other communications will be deemed received on the date of receipt by the recipient thereof if received prior to 5:00 p.m. in the place of receipt and such day is a business day in the place of receipt. Otherwise, any such notice, request or communication will be deemed not to have been received until the next succeeding business day in the place of receipt. 5.3 Further Assurances. I will give the Company all reasonable assistance and execute all documents necessary to assist with enabling the Company to prosecute, perfect, register, record, enforce and defend any of its rights in any Company Intellectual Property and Confidential Information. 5.4 No Breach of Prior Agreements; No Improper Use of Prior Employer or Third Party Information. I hereby represent and warrant that (a) my performance under the agreement set forth in this Schedule and my duties as an employee of the Company will not breach any confidentiality, invention assignment or similar agreement with any former employer or other party and (b) there is no other agreement or duty on my part now in existence that would conflict with any provision contained herein. During my employment by the Company, I will not improperly make use of, or disclose, any information or trade secrets of any former employer or other third party, nor will I bring onto any premises of the Company or use any unpublished documents or any property belonging to any former employer or other third party, in violation of any agreements with such former employer or third party. 5.5 Severability. If any provision of the agreement set forth in this Schedule is held by a court of competent jurisdiction or other governmental authority to be invalid, void or unenforceable, the other provisions of such agreement will remain in full force and effect and will in no way be affected, impaired or invalidated so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner materially adverse to the Company or me. 5.6 Survival; Successors and Assigns. The agreement set forth in this Schedule will survive any termination of my employment. Such agreement, and the rights and obligations of the parties hereunder, will be binding upon and inure to the benefit of their respective successors, assigns, heirs, executors, administrators and legal representatives. The Company may assign any of its rights and obligations under such agreement without my prior consent. 5.7 Injunctive Relief. I understand that in the event of any breach or threatened breach of the agreement set forth in this Schedule by me, the Company may suffer irreparable harm and will therefore be entitled to injunctive relief and specific performance in connection with the enforcement of this Agreement. 5.8 Not Employment Contract. I understand that the agreement set forth in this Schedule does not separately constitute a contract of employment and does not obligate the Company to employ me for any stated period of time or at all. 5.9 Amendments and Waiver. Any provision of the agreement set forth in this Schedule may be amended or waived if, but only if, such amendment or waiver is in writing and is signed, in the case of an amendment, by each party, or in the case of a waiver, by the party against whom the waiver is to

13 #22010118v16 be effective. No failure or delay by any party in exercising any right, power or privilege hereunder will operate as a waiver thereof nor will any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The rights and remedies provided under such agreement are cumulative and not exclusive of any rights or remedies provided by applicable law. [Remainder of page intentionally left blank]

14 #22010118v16 Schedule B Data Protection Notice to Employees ADC Therapeutics (the “Company”), as your employer, processes your personal data in the frame of your employment. Personal data processed by the Company may include your name, date of birth, gender, address, phone, email, CV, diploma copies, salary, bank account number, social security number, tax information, work authorization and permits, sickness absence and holidays, performance review, passport and ID card copies and/or numbers, family composition, religious beliefs, health conditions (i.e. food restrictions and preferences, medical check‐up to verify your capacity to perform the job, etc.), as well as the contact details of a person you trust and to be contacted in case of emergency (ensure you have obtained his/her consent). The Company processes your personal data for all purposes relating to the management of your employment (e.g. salary payment, performance review, employer communication, health and safety management, benefits plan, insurance, retirement plan, taxes, immigration and other working authorization matters) and to conduct its business under applicable laws. To achieve these purposes, the Company may transfer your personal data within the ADCT group of companies, as well as, to third parties (e.g. external counsels, insurers, brokers, payroll service providers), and to public authorities as required under applicable laws. These third parties may be located worldwide, and the Company will take the required measures, to ensure continued compliance with applicable laws. Subject to any legal restrictions, you have the right, to access your personal data and receive a copy of the same; have your personal data corrected; request for the deletion or transfer of your personal data; object to the processing of your personal data; restrict the processing of your personal data; file a complaint with the competent supervisory authority according to applicable law. The processing of your personal data by the Company will continue throughout the duration of your employment and for five (5) years thereafter, unless prohibited by applicable laws or otherwise requested by you in accordance with your rights described above. Should you have any questions, please contact the Company’s Data Protection Officer at: privacy@adctherapeutics.com.

15 #22010118v16 Schedule C Swiss Payroll Tax Considerations For purposes of Swiss board member payroll tax, each current component of your compensation (base salary, discretionary bonus, if any, stock options, benefits) and any future component of your compensation is allocated 20% to your role as chairman and member of the Company’s Board of Directors, and 80% to your responsibilities as an employee and executive officer of the Company.

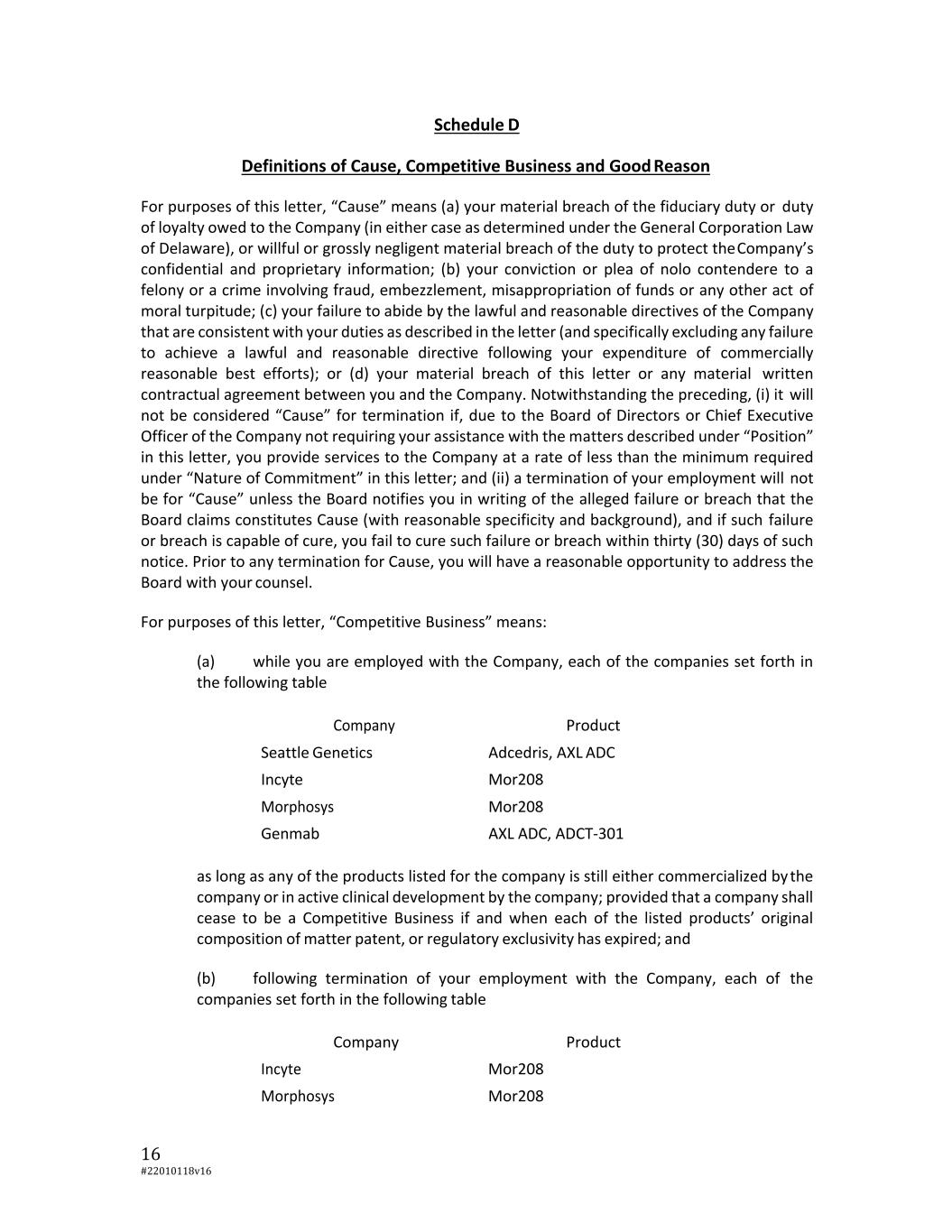

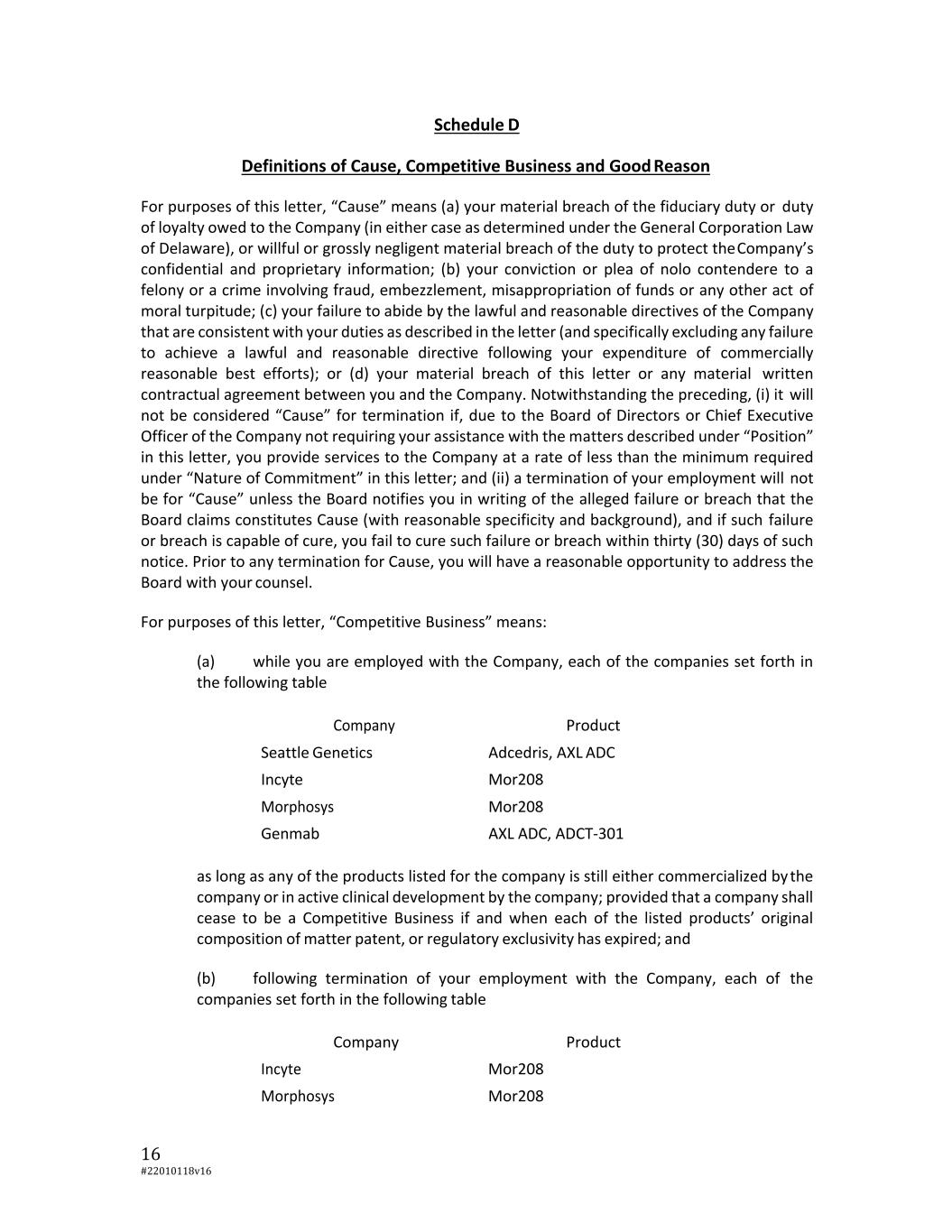

16 #22010118v16 Schedule D Definitions of Cause, Competitive Business and Good Reason For purposes of this letter, “Cause” means (a) your material breach of the fiduciary duty or duty of loyalty owed to the Company (in either case as determined under the General Corporation Law of Delaware), or willful or grossly negligent material breach of the duty to protect the Company’s confidential and proprietary information; (b) your conviction or plea of nolo contendere to a felony or a crime involving fraud, embezzlement, misappropriation of funds or any other act of moral turpitude; (c) your failure to abide by the lawful and reasonable directives of the Company that are consistent with your duties as described in the letter (and specifically excluding any failure to achieve a lawful and reasonable directive following your expenditure of commercially reasonable best efforts); or (d) your material breach of this letter or any material written contractual agreement between you and the Company. Notwithstanding the preceding, (i) it will not be considered “Cause” for termination if, due to the Board of Directors or Chief Executive Officer of the Company not requiring your assistance with the matters described under “Position” in this letter, you provide services to the Company at a rate of less than the minimum required under “Nature of Commitment” in this letter; and (ii) a termination of your employment will not be for “Cause” unless the Board notifies you in writing of the alleged failure or breach that the Board claims constitutes Cause (with reasonable specificity and background), and if such failure or breach is capable of cure, you fail to cure such failure or breach within thirty (30) days of such notice. Prior to any termination for Cause, you will have a reasonable opportunity to address the Board with your counsel. For purposes of this letter, “Competitive Business” means: (a) while you are employed with the Company, each of the companies set forth in the following table Company Product Seattle Genetics Adcedris, AXL ADC Incyte Mor208 Morphosys Mor208 Genmab AXL ADC, ADCT‐301 as long as any of the products listed for the company is still either commercialized by the company or in active clinical development by the company; provided that a company shall cease to be a Competitive Business if and when each of the listed products’ original composition of matter patent, or regulatory exclusivity has expired; and (b) following termination of your employment with the Company, each of the companies set forth in the following table Company Incyte Mor208 Morphosys Mor208 Product

17 #22010118v16 as long as Mor208 is still either commercialized by the company or in active clinical development by the company; provided that a company shall cease to be a Competitive Business if and when Mor208’s original composition of matter patent, or regulatory exclusivity has expired. For purposes of this letter, “Good Reason” means your termination of employment within 60 days following the expiration of any cure period (discussed below) following the occurrence, without your express written consent, of one or more of the following: (a) a material reduction in your duties, authority or responsibilities (including, but not limited to, a failure to nominate you to the Board or as Executive Chairman for as long as you are employed under the terms of this letter); (b) a material reduction of your annual base compensation or target bonus opportunity (expressed as a percentage of annual salary) in either case as in effect on your start date (or if higher, as of any later date), other than a one‐time uniform reduction applicable to all senior executives of the Company of 10% or less; (c) the relocation of your principal work location by more than 35 miles; (d) the failure of the Company to obtain the assumption of this letter byany successor; or (e) the Company’s material breach of this letter or any material written contractual agreement between the Company and you. In order for an event to qualify as Good Reason, you must provide the Company with written notice of the acts or omissions constituting the grounds for Good Reason within 90 days of your knowledge of the initial existence of the grounds for Good Reason and allow the Company a period of 30 days following the date of such notice to cure the grounds identified as the basis for Good Reason.

18 #22010118v16 Schedule E Form of Option Agreement

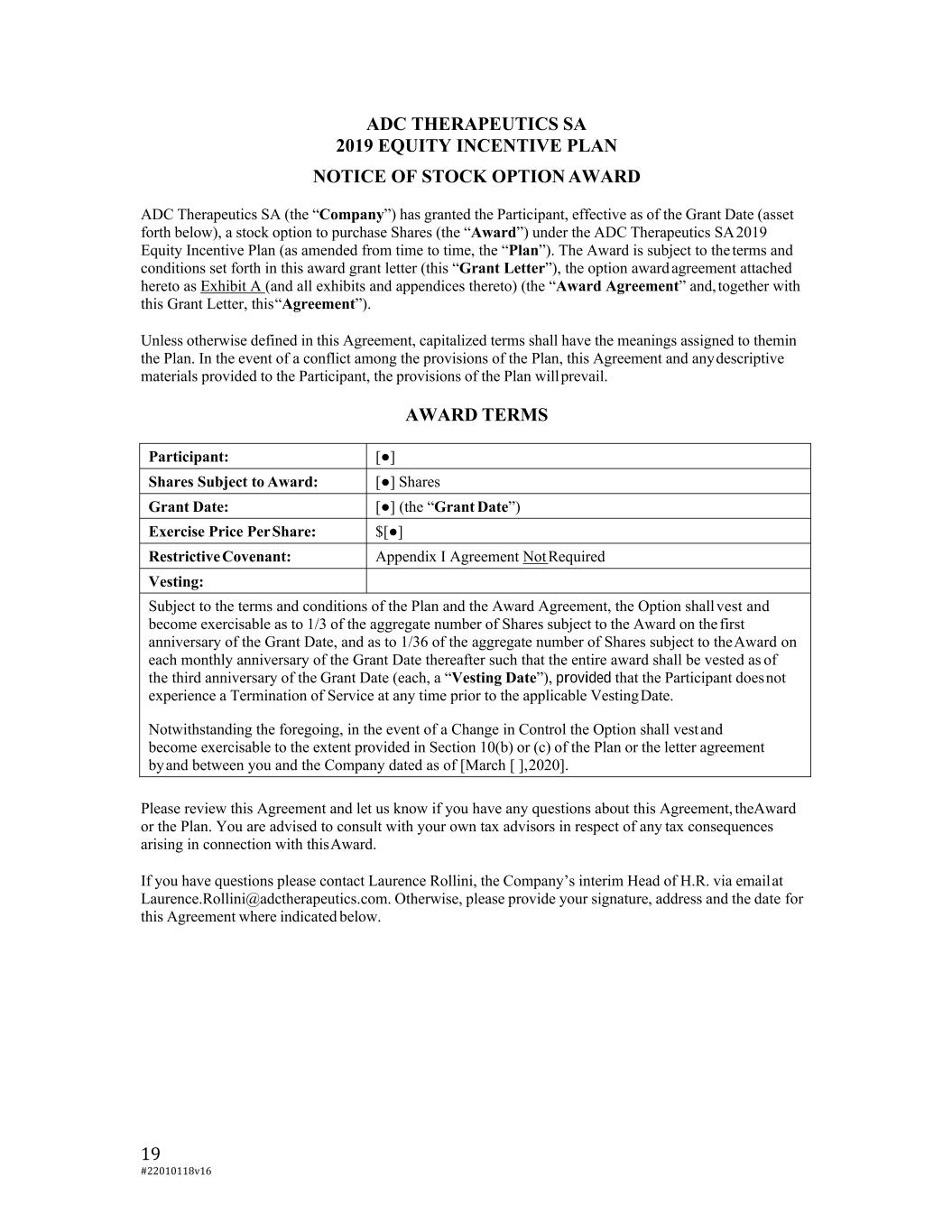

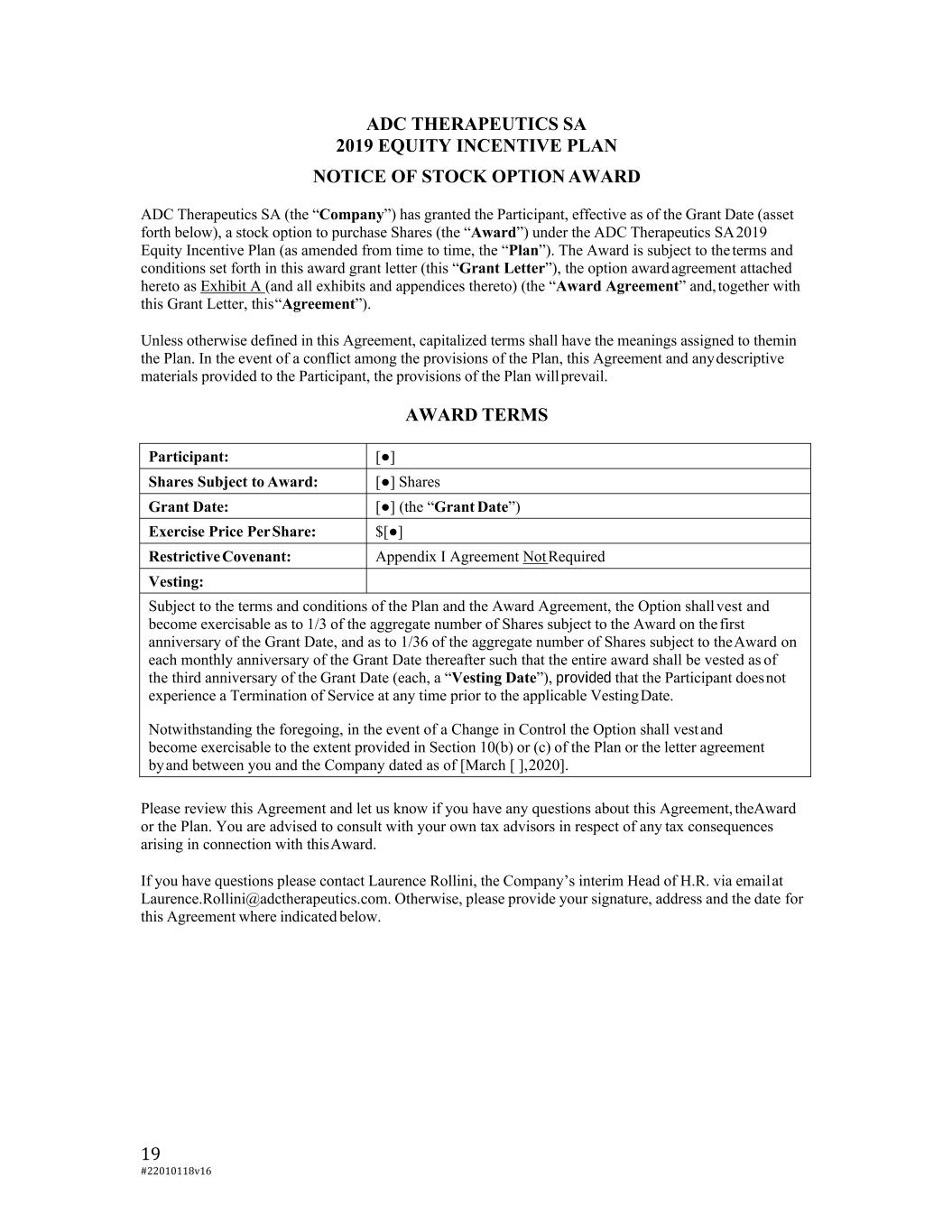

19 #22010118v16 ADC THERAPEUTICS SA 2019 EQUITY INCENTIVE PLAN NOTICE OF STOCK OPTION AWARD ADC Therapeutics SA (the “Company”) has granted the Participant, effective as of the Grant Date (asset forth below), a stock option to purchase Shares (the “Award”) under the ADC Therapeutics SA 2019 Equity Incentive Plan (as amended from time to time, the “Plan”). The Award is subject to the terms and conditions set forth in this award grant letter (this “Grant Letter”), the option award agreement attached hereto as Exhibit A (and all exhibits and appendices thereto) (the “Award Agreement” and, together with this Grant Letter, this “Agreement”). Unless otherwise defined in this Agreement, capitalized terms shall have the meanings assigned to themin the Plan. In the event of a conflict among the provisions of the Plan, this Agreement and any descriptive materials provided to the Participant, the provisions of the Plan will prevail. AWARD TERMS Participant: [●] Shares Subject to Award: [●] Shares Grant Date: [●] (the “Grant Date”) Exercise Price Per Share: $[●] Restrictive Covenant: Appendix I Agreement Not Required Vesting: Subject to the terms and conditions of the Plan and the Award Agreement, the Option shall vest and become exercisable as to 1/3 of the aggregate number of Shares subject to the Award on the first anniversary of the Grant Date, and as to 1/36 of the aggregate number of Shares subject to the Award on each monthly anniversary of the Grant Date thereafter such that the entire award shall be vested as of the third anniversary of the Grant Date (each, a “Vesting Date”), provided that the Participant does not experience a Termination of Service at any time prior to the applicable Vesting Date. Notwithstanding the foregoing, in the event of a Change in Control the Option shall vest and become exercisable to the extent provided in Section 10(b) or (c) of the Plan or the letter agreement by and between you and the Company dated as of [March [ ], 2020]. Please review this Agreement and let us know if you have any questions about this Agreement, theAward or the Plan. You are advised to consult with your own tax advisors in respect of any tax consequences arising in connection with this Award. If you have questions please contact Laurence Rollini, the Company’s interim Head of H.R. via email at Laurence.Rollini@adctherapeutics.com. Otherwise, please provide your signature, address and the date for this Agreement where indicated below.

1 #22010118v16 EXHIBIT A ADC THERAPEUTICS SA 2019 EQUITY INCENTIVE PLAN STOCK OPTION AWARD AGREEMENT This Stock Option Award Agreement (together with all exhibits and appendices hereto, this “Award Agreement”), dated as of the date of the Grant Letter, is by and between the Company, and the individual listed in the Grant Letter as the Participant. WHEREAS, the Company hereby grants the Award to the Participant under the Plan, and the Participant hereby accepts the Award, in each case, subject to the terms and conditions of the Plan and this Agreement; and WHEREAS, by accepting the Award and entering into this Agreement, the Participant acknowledges having received and read a copy of the Plan and agrees to comply with it, this Agreement and all applicable laws and regulations. NOW, THEREFORE, in consideration of the promise and mutual covenants contained herein, and for other good and valuable consideration, the parties hereto agree as follows. 1. GRANT OF OPTION. THE COMPANY HEREBY GRANTS TO THE PARTICIPANT ON THE GRANT DATE AN OPTION (“OPTION”) TO PURCHASE ALL OR ANY PART OF THE NUMBER OF SHARES SET FORTH IN THE GRANT LETTER AT THE PER SHARE EXERCISE PRICE SET FORTH IN THE GRANT LETTER (THE “EXERCISE PRICE”), SUBJECT TO THE TERMS AND CONDITIONS OF THE PLAN AND THIS AGREEMENT. THE OPTION IS GRANTED UNDER THE PLAN, THE PROVISIONS OF WHICH ARE INCORPORATED HEREIN BY REFERENCE AND MADE A PART OF THIS AGREEMENT. 2. TERMS AND CONDITIONS. IT IS UNDERSTOOD AND AGREED THAT THE AWARD EVIDENCED HEREBY IS SUBJECT TO THE FOLLOWING TERMS AND CONDITIONS: (a) Vesting of Award. Subject to Sections 3 and 7, the Option shall vest and become exercisable in accordance with the vesting schedule set forth in the Grant Letter. (b) Term of Option. The term of the Option shall expire at 4:00 pm local New York City time on the tenth (10th) anniversary of the Grant Date (the “Expiration Date”), unless terminated earlier in accordance with the Plan and this Agreement. In no event may any portion of the Option be exercised after 4:00 p.m. local New York City time on the Expiration Date. (c) Manner of Exercise. Subject to the terms of this Agreement and the Plan, the Participant may, at any time and from time to time prior to the Expiration Date, exercise all orany portion of the Option that has become vested and exercisable. In order to exercise the Option, the Participant must deliver to the Company a notice in the form prescribed by the Committee specifying the number of whole Shares to be purchased (the “Exercise Notice”), together with payment in full of (i) the aggregate Exercise Price applicable to such Shares and (ii) any required tax withholding and contributions to social security to be borne by the Participant, as applicable (collectively, the “Payment Amount”). The date on which the Participant delivers the Exercise Notice pursuant to this Section 2(c) shall be referred to herein as the “Exercise Date”. If the Committee allows for an electronic exercise or the Plan provides for an automatic or deemed exercise of the Option, the Participant hereby exercises his or her Option in writing, but with effect as of his electronic exercise or the relevant automatic or deemed exercise. Irrespective of the foregoing sentence, following any electronic exercise by the Participant, the Company may request the Participant to deliver a confirmatory Exercise Notice in writing within the period

2 #22010118v16 demanded by the Company (which can end after the lapse of the Exercise Period, which would be deemed extended accordingly). (d) Method of Exercise. The Participant may pay the Payment Amount to the Company by any of the following means (or by a combination thereof), at the election of the Participant: (i) in cash, by check or wire transfer; or (ii) if permitted by the Committee, in its sole discretion, pursuant to such procedures as the Committee may require, by the Participant’s (A) transferring to the Company, effective as of the Exercise Date, a number of vested Shares owned and designated by the Participant having an aggregate Fair Market Value as of the Exercise Date equal to the Payment Amount, (B) by electing to have the Company retain a portion of the Shares purchased upon exercise of the Option having an aggregate Fair Market Value as of the Exercise Date equal to the Payment Amount or (C) delivering irrevocable instructions to a broker tosell Shares obtained upon the exercise of the Option and to deliver promptly to the Company an amount out of the proceeds of such sale equal to the Payment Amount; or (iii) by any other method acceptable to the Committee. (e) No Rights as a Shareholder. The Participant shall have no voting rights or any other rights as a shareholder of the Company with respect to the Option unless and until Shares are actually settled and delivered to the Participant and upon entry of the Participant into the share register of the Company as shareholder of such Shares with voting rights. (f) No Right to Continued Service. The grant of an Award shall not be construed as giving the Participant the right to be retained in the employ of, or to continue to provide services to, the Company or any of its Affiliates. The receipt of any Award under the Plan is not intended to confer any rights on the receiving Participant except as set forth in the applicable Agreement. (g) No Right to Future Awards. Any Award granted under the Plan shall be a one- time Award that does not constitute a promise of future grants. The Company, in its sole discretion, maintains the right to make available future grants under the Plan. 3. TERMINATION OF SERVICE; RESTRICTIVE COVENANT VIOLATION. IN THE EVENT OF THE PARTICIPANT’S (a)TERMINATION OF SERVICE FOR ANY REASON OR (b)VIOLATION OF ANY OF THE RESTRICTIVE COVENANTS (AS DEFINED BELOW), THEN, AFTER GIVING EFFECT TO ANY PROVISION FOR ACCELERATED VESTING EFFECTIVE UPON SUCH EVENT (IF A TERMINATION OF SERVICE) UNDER THE TERMS OF THE AWARD, THE PLAN (INCLUDING SECTIONS 10(B) AND (C) OF THE PLAN) OR AS MAY BE DETERMINED BY THE COMMITTEE, (X) ANY PORTION OF THE OPTION THAT WAS UNVESTED AS OF THE DATE OF SUCH TERMINATION OF SERVICE OR RESTRICTIVE COVENANT VIOLATION SHALL BE IMMEDIATELY FORFEITED AND CANCELLED IN ITS ENTIRETY UPON SUCH TERMINATION OF SERVICE OR RESTRICTIVE COVENANT VIOLATION, WITHOUT ANY PAYMENT OR CONSIDERATION BEING DUE TOTHE PARTICIPANT, AND (Y) ANY PORTION OF THE OPTION THAT WAS VESTED AS OF THE DATE OF SUCH TERMINATION OF SERVICE OR RESTRICTIVE COVENANT VIOLATION SHALL BE SUBJECT TO THE FOLLOWING PROVISIONS: (i) Termination due to Death or Disability or as a Good Leaver. In the event of the Participant’s Termination of Service due to the Participant’s death or Disability or as a Good Leaver, any vested portion of the Option will remain outstanding and exercisable until the earlier of (A) the 12-month anniversary of the later of (i) the date of such Termination of Service if the Shares are publicly traded on an established stock exchange or national market system(“Publicly Listed”) as of such date; or (ii) the day after such Termination of Service when the Shares become Publicly Listed and (B) the Expiration Date. (ii) Termination other than due to Death, Disability, as a Good Leaver or for Cause. In the event of the Participant’s Termination of Service for any reason other than due to the Participant’s death, Disability, as a Good Leaver or for Cause, any vested portion of the Option

3 #22010118v16 will remain outstanding and exercisable until the earlier of (A) the 3-month anniversary of the later of (i) the date of such Termination of Service if the Shares are Publicly Listed as of such date; or (ii) the day after such Termination of Service when the Shares become Publicly Listed and (B) the Expiration Date. (iii) Termination for Cause; Restrictive Covenant Violation. In the event of the Participant’s (A) Termination of Service by the Company or any of its Affiliates for Cause or (B) violation of any of the Restrictive Covenants, any vested portion of the Option shall be immediately forfeited and cancelled in its entirety upon such Termination of Service or Restrictive Covenant violation, without any payment or consideration being due to the Participant. (iv) Good Leaver means, for purposes of this Agreement, a Participant who experiences a Termination of Service upon or within 18 months following a Change in Control, (A) for a Participant who is a Non-Employee Director, for any reason, and (B) for a Participant who is not a Non-Employee Director, as a result of (i) the Company’s termination of the Participant’s employment without Cause, or (ii) the Participant’s resignation of his or her employment for Good Reason. 4. RESTRICTIVE COVENANTS. AS A CONDITION PRECEDENT TO RECEIVING THE OPTION GRANTED PURSUANT TO THIS AGREEMENT, (I) THE PARTICIPANT ACKNOWLEDGES AND AGREES THAT HE OR SHE SHALL BE LIABLE FOR COMPLIANCE WITH ALL OBLIGATIONS OF CONFIDENTIALITY, INTELLECTUAL PROPERTY DISCLOSURE, USE AND ASSIGNMENT, NON-COMPETE, NON-SOLICITATION, NON-DISTURBANCE AND NON-DISPARAGEMENT OBLIGATIONS CONTAINED IN HIS OR HER EMPLOYMENT AGREEMENT OR EMPLOYMENT LETTER AND (II) THE PARTICIPANT ACKNOWLEDGES AND AGREES THAT HE OR SHE SHALL BE LIABLE FOR COMPLIANCE WITH THE COMPANY CODE OF BUSINESS CONDUCT AND ETHICS AND OTHER POLICIES OF THE COMPANY; THEREIN (COLLECTIVELY, THE“RESTRICTIVE COVENANTS”). ANY LIABILITY OF THE PARTICIPANT FOR BREACH OF A RESTRICTIVECOVENANT UNDER HIS OR HER EMPLOYMENT AGREEMENT OR EMPLOYMENT LETTER, STATUTORY LAW AND/ORTHE APPENDIX I, AS APPLICABLE, SHALL IN NO WAY BE LIMITED BY THE TERMS OF THIS AGREEMENT, AND THE CONSEQUENCES SET FORTH IN SECTION 3 OF THIS AGREEMENT SHALL APPLY IRRESPECTIVE OF, AND IN ADDITION TO, ANY SUCH LIABILITY UNDER HIS OR HER EMPLOYMENT AGREEMENT OR EMPLOYMENT LETTER, STATUTORY LAW AND/OR THE APPENDIX I, ASAPPLICABLE. 5. SETTLEMENT OF SHARES. SUBJECT TO THE PROVISIONS OF THIS AGREEMENT, PROVIDED THAT THE EXERCISE NOTICE AND PAYMENT AMOUNT ARE IN FORM AND SUBSTANCE SATISFACTORY TO THE COMPANY, THE COMPANY SHALL DELIVER TO THE PARTICIPANT, AS SOON AS REASONABLY PRACTICABLE AFTER THE APPLICABLE EXERCISE DATE, THE NUMBER OF SHARES SPECIFIED INTHE EXERCISE NOTICE. UPON SUCH DELIVERY, SUCH SHARES SHALL BE FULLY ASSIGNABLE, SALEABLE, TRANSFERABLE AND OTHERWISE ALIENABLE BY THE PARTICIPANT, PROVIDED THAT ANY SUCH ASSIGNMENT, SALE, TRANSFER OR OTHER ALIENATION WITH RESPECT TO SUCH SHARES SHALL BE IN ACCORDANCE WITH APPLICABLE SECURITIES LAWS AND ANY APPLICABLE COMPANY POLICY. [TO THE EXTENT THAT THE SHARES ISSUED TO THE PARTICIPANT UPON THE EXERCISE OF THE OPTION ARE NOT REGISTERED UNDER THE SECURITIES ACT OF 1933, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT, THE STOCK CERTIFICATES EVIDENCING SUCH SHARES MAY BEAR SUCH RESTRICTIVE LEGEND AS THE COMPANY DEEMS TO BE REQUIRED OR ADVISABLE UNDER APPLICABLE LAW.] 6. TAX LIABILITY; WITHHOLDING REQUIREMENTS. THE EXERCISE OF AN OPTION AND DISTRIBUTIONS UNDER THIS AWARD AGREEMENT MAY BE SUBJECT TO TAX WITHHOLDING OBLIGATIONS AND CONTRIBUTIONS TO SOCIAL SECURITY TO BE BORNE BY THE PARTICIPANT, AS APPLICABLE, AND THE COMMITTEE MAY CONDITION THE EXERCISE OF THE OPTION AND/OR DELIVERY OF SHARES OR OTHER BENEFITS UPON SATISFACTION OF ALL APPLICABLE WITHHOLDING REQUIREMENTS. THE PARTICIPANT IS ADVISED TO CONSULT WITH HIS OR HER OWN TAX ADVISORS IN RESPECT OF ANY TAX CONSEQUENCES ARISING IN CONNECTION WITH THE OPTIONS.

4 #22010118v16 7. RECOUPMENT/CLAWBACK. THIS AWARD (INCLUDING ANY AMOUNTS OR BENEFITS ARISING FROM THIS AWARD) SHALL BE SUBJECT TO RECOUPMENT OR “CLAWBACK” AS MAY BE REQUIRED BY APPLICABLE LAW, STOCK EXCHANGE RULES OR BY ANY APPLICABLE COMPANY POLICY OR ARRANGEMENT THE COMPANY HAS IN PLACE FROM TIME TO TIME. 8. REFERENCES. REFERENCES HEREIN TO RIGHTS AND OBLIGATIONS OF THE PARTICIPANT SHALL APPLY, WHERE APPROPRIATE, TO THE PARTICIPANT’S LEGAL REPRESENTATIVE ORESTATE WITHOUT REGARD TO WHETHER SPECIFIC REFERENCE TO SUCH LEGAL REPRESENTATIVE OR ESTATE IS CONTAINED IN A PARTICULAR PROVISION OF THIS AGREEMENT. 9. MISCELLANEOUS. (a) Notices. Any notice required or permitted to be given under this Award Agreement shall be in writing and shall be deemed to have been given when delivered via email or personally or by courier, or sent by certified or registered mail, postage prepaid, return receipt requested, duly addressed to the Participant at his or her last known address on the books of the Company or, in the case of the Company, to its principal office, or to such other address as either party may have furnished to the other in writing in accordance with the Plan, subject to the right of either party to designate some other address at any time hereafter in a notice satisfying the requirements of this Section 9(a). (b) Entire Agreement. This Award Agreement, the Plan and any other agreements, schedules, exhibits and other documents referred to herein or therein constitute the entire agreement and understanding between the parties in respect of the subject matter hereof and supersede all prior and contemporaneous arrangements, agreements and understandings, both oral and written, whether in term sheets, presentations or otherwise, between the parties with respect to the subject matter hereof, provided that the restrictions set forth in this Award Agreement are in addition to, not in lieu of, any other obligation and/or restriction that the Participant may have with respect to the Company or any of its Affiliates, whether by operation of law, contract, or otherwise, including, without limitation, any non-solicitation obligations contained in an employment agreement, consulting agreement or other similar agreement entered into by and between the Participant and the Company or one of its Affiliates, which shall survive the termination of any such agreements, and be enforceable independently of such other agreements. (c) Severability. If any provision of this Award Agreement is or becomes or is deemed to be invalid, illegal or unenforceable in any jurisdiction, or would disqualify the Plan or this Award Agreement under any law deemed applicable by the Board, such provision shall be construed or deemed amended to conform to applicable laws, or if it cannot be so construed or deemed amended without, in the determination of the Board, materially altering the intent oft his Award Agreement, such provision shall be stricken as to such jurisdiction, and the remainder of this Award Agreement shall remain in full force and effect. (d) Amendment; Waiver. No amendment or modification of any provision of this Award Agreement that has a material adverse effect on the Participant shall be effective unless signed in writing by or on behalf of the Company and the Participant; provided that the Company may amend or modify this Award Agreement without the Participant’s consent in accordance with the provisions of the Plan or as otherwise set forth in this Award Agreement. No waiver of any breach or condition of this Award Agreement shall be deemed to be a waiver of any other or subsequent breach or condition, whether of like or different nature. Any amendment or modification of or to any provision of this Award Agreement, or any waiver of any provision of this Award Agreement, shall be effective only in the specific instance and for the specific purpose for which made or given.

5 #22010118v16 (e) Assignment. Neither this Award Agreement nor any right, remedy, obligation or liability arising hereunder or by reason hereof shall be assignable by the Participant. (f) Successors and Assigns; No Third-Party Beneficiaries. This Award Agreement shall inure to the benefit of and be binding upon the Company and the Participant and their respective heirs, successors, legal representatives and permitted assigns. Nothing in this Award Agreement, express or implied, is intended to confer on any Person other than the Company and the Participant, and their respective heirs, successors, legal representatives and permitted assigns, any rights, remedies, obligations or liabilities under or by reason of this Agreement. (g) Governing Law; Jurisdiction. The formation, existence, construction, performance, validity and all aspects whatsoever of this Award Agreement and the Option granted hereunder, including any rights and obligations arising out of or in connection with the same, shall be governed by, and construed in accordance with, the substantive laws of Switzerland (with the exception of the conflict of law rules). The exclusive place of jurisdiction for any dispute arising out of or in connection with this Award Agreement and the Option granted hereunder shall be Epalinges, Switzerland. (h) Participant Undertaking; Acceptance. The Participant agrees to take whatever additional action and execute whatever additional documents the Company may deem necessary or advisable to carry out or give effect to any of the obligations or restrictions imposed on either the Participant or the Option pursuant to this Award Agreement. The Participant acknowledges receipt of a copy of the Plan and this Award Agreement and understands that material definitions and provisions concerning the Option and the Participant’s rights and obligations with respect thereto are set forth in the Plan. The Participant has read carefully, and understands, the provisions of this Award Agreement and the Plan. (i) Section 409A and 457A. It is the intent of the Company and the Participant that this Award Agreement shall comply with the requirements of Section 409A and 457A of the Code, to the extent applicable to an Option granted to a Participant who is subject to income taxation in the United States, and the provisions of the Agreement shall be interpreted in a manner that satisfies the requirements of Section 409A and 457A of the Code. If any provision of the Agreement would otherwise frustrate or conflict with this intent, the provision, term or condition will be interpreted and deemed amended so as to avoid this conflict. Notwithstanding the foregoing, the tax treatment of the benefits provided under the Plan or any Award Document is not warranted or guaranteed, and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by the Participant on account of non-compliance with Section 409A and 457A of the Code. (j) Captions. Captions provided herein are for convenience only and shall not affect the scope, meaning, intent or interpretation of the provisions of this Award Agreement. (k) Counterparts. This Agreement may be executed in two counterparts, each of which shall constitute one and the same instrument. [Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Award Agreement as of the day and year first written above. ADC THERAPEUTICS SA By: Name: Title: By: Name: Title: AGREED AND ACCEPTED: PARTICIPANT By: Name: Address Address