r

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Amendment No. 1)

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-38958

Karuna Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| |

Delaware | 27-0605902 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| |

99 High Street, 26th Floor Boston, Massachusetts | 02110 (Zip Code) |

(Address of principal executive offices) |

(857) 449-2244

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

Common Stock, $0.0001 Par Value | | KRTX | | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

|

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2023, the aggregate market value of the registrant’s Common Stock, $0.0001 par value per share, held by non-affiliates of the registrant, based on the last sale price of the Common Stock at the close of business on that date, was $5,872.6 million. For purposes of foregoing calculation only, all directors and executive officers of the registrant are assumed to be affiliates of the registrant.

As of March 12, 2024, there were 38,199,272 shares of the registrant’s Common Stock, $0.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

EXPLANATORY NOTE

Karuna Therapeutics, Inc., is filing this Amendment No. 1 (this “Amendment No. 1”) to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Annual Report”), filed with the Securities and Exchange Commission (the “SEC”) on February 22, 2024, only for the purpose of including the Part III information required under the instructions to Form 10-K and the general rules and regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which information was previously omitted from our 2023 Annual Report in reliance on General Instruction G(3) to Form 10-K, which permits the omitted information to be incorporated by reference in the 2023 Annual Report from our definitive proxy statement so long as such proxy statement is filed no later than 120 days after the end of the Company’s fiscal year. Except where the context otherwise requires or where otherwise indicated, the terms “Karuna,” “we,” “us,” “our,” “our company,” “the Company,” and “our business” refer to Karuna Therapeutics, Inc., a Delaware corporation, and its consolidated subsidiary.

This Amendment No. 1 amends and restates only Part III, Items 10 (Directors, Executive Officers and Corporate Governance), 11 (Executive Compensation), 12 (Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters), 13 (Certain Relationships and Related Transactions, and Director Independence) and 14 (Principal Accountant Fees and Services) of our 2023 Annual Report filed with the SEC on February 22, 2024, in their entirety as set forth herein. In addition, this Amendment No. 1 deletes the reference on the cover page of our 2023 Annual Report to the incorporation by reference of portions of our proxy statement into Part III of such 2023 Annual Report, as well as updates the outstanding share number referenced thereon. No other Items of our 2023 Annual Report filed with the SEC on February 22, 2024, have been amended or revised in this Amendment No. 1, and all such other Items shall be as set forth in such 2023 Annual Report.

In addition, pursuant to SEC rules, Item 15 of Part IV of our 2023 Annual Report filed with the SEC on February 22, 2024, is hereby amended solely to include, as Exhibits 31.3 and 31.4, new certifications of our principal executive officer and principal financial officer pursuant to Rule 13a-14(a) under the Exchange Act. Because no financial statements have been included in this Amendment No. 1, and because this Amendment No. 1 does not contain or amend any disclosure with respect to paragraphs 3, 4 and 5 of Items 307 and 308 of Regulation S-K, the corresponding certifications have been omitted. We are not including the certifications under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Amendment No. 1.

No other information has been updated for any subsequent events occurring after we filed our 2023 Annual Report with the SEC on February 22, 2024. Accordingly, this Amendment No. 1 should be read in conjunction with the 2023 Annual Report and our other filings made with the SEC subsequent to the filing of such 2023 Annual Report.

Karuna Therapeutics, Inc.

Index

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

DIRECTOR BIOGRAPHIES

The following table sets forth information concerning our directors as of March 14, 2024. The biographical description of each director includes the specific experience, qualifications, attributes and skills that the board of directors would expect to consider if it were making a conclusion currently as to whether such person should serve as a director.

| | |

CLASS I DIRECTORS – TERM EXPIRING AT THE 2026 ANNUAL MEETING OF STOCKHOLDERS | AGE | DIRECTOR SINCE |

| | |

Bill Meury has served as our President and Chief Executive Officer, and as member of our board of directors, since January 2023. Mr. Meury is currently Crown Chairman and Senior Operating Advisor at Hildred Capital Management, a private equity firm focusing on the healthcare industry, where he was a partner from May 2020 to December 2022. He previously served as Executive Vice President and Chief Commercial Officer of Allergan from May 2016 until Allergan’s acquisition by AbbVie in May 2020. Prior to this role, he served as Allergan’s President, Branded Pharma from March 2015 to May 2016, and Executive Vice President, Commercial, North American Brands from July 2014 to March 2015. Mr. Meury served as Executive Vice President, Sales and Marketing at Forest Laboratories prior to its acquisition by Allergan (then known as Actavis). He joined Forest in 1993 and held multiple roles of increasing responsibility in Marketing, New Products, Business Development, and Sales. Before joining Forest, Mr. Meury worked in public accounting for Reznick Fedder & Silverman and in financial reporting for MCI Communications. Mr. Meury serves on the board of directors of Syndax Pharmaceuticals, Inc. (Nasdaq: SNDX) and The Jed Foundation. He received a B.S. in Economics from the University of Maryland. Our board of directors believes that Mr. Meury is qualified to serve on our board of directors due to his extensive experience in the pharmaceutical industry as well as his expertise launching and commercializing medicines for psychiatric and neurological conditions. | 56 | January 2023 |

|

|

|

Laurie Olson has served as a member of our board of directors since August 2020. Ms. Olson worked at Pfizer Inc. from 1987 until 2018, serving in various roles of increasing authority during her tenure there, including Executive Vice President–Strategy and Commercial Operations from 2012 to 2018, Senior Vice President–Portfolio Management and Analysis from 2008 to 2012, Vice President–Commercial Development from 2006 to 2008 and Vice President–Worldwide Marketing from 2002 to 2006. Ms. Olson currently serves on the board of directors of Quanterix Corporation (Nasdaq: QTRX) and as a member of the Board of Trustees of the Mystic Seaport Museum in Mystic, Connecticut. Ms. Olson received a B.A. in Economics from State University of New York at Stony Brook and a Master of Business Administration in Marketing from Hofstra University. Our board of directors believes that Ms. Olson is qualified to serve on our board of directors due to her extensive experience as an executive in the pharmaceutical industry. | 61 | August 2020 |

|

|

|

David Wheadon, M.D., has served as a member of our board of directors since December 2020. Dr. Wheadon served as Senior Vice President, Global Regulatory Affairs, Patient Safety and Quality Assurance for AstraZeneca Pharmaceuticals from 2014 to 2019 and as Executive Vice President, Research and Advocacy at Juvenile Diabetes Research Foundation (JDRF) from 2013 to 2014. From 2009 to 2013, Dr. Wheadon served as Senior Vice President, Scientific and Regulatory Affairs and as a member of the Management Committee of the Pharmaceutical Research and Manufacturers of America (PhRMA). Prior to his joining PhRMA, Dr. Wheadon held senior regulatory and clinical development leader roles at Abbott Laboratories and GlaxoSmithKline plc. Dr. Wheadon began his career as a clinical research physician in neuroscience at Eli Lilly. Dr. Wheadon currently serves on the board of directors of PSKW, LLC (d/b/a ConnectiveRx), Vaxart, Inc. (Nasdaq: VXRT) and Sotera Health Company (Nasdaq: SHC), and formerly served on the board of directors of ChemoCentryx, Inc. and Assertio Holdings, Inc. (formerly Assertio Therapeutics, Inc.). Dr. Wheadon holds an A.B. from Harvard College and an M.D. from Johns Hopkins University School of Medicine. He completed his postgraduate training in Psychiatry at the Tufts, New England Medical Center. Our board of directors believes Dr. Wheadon is qualified to serve as a member of the Board due to his extensive experience as an executive in the pharmaceutical industry and expertise in regulatory affairs, government policy and clinical strategy. | 66 | December 2020 |

| | |

| | |

CLASS II DIRECTORS – TERM EXPIRING AT THE 2024 ANNUAL MEETING OF STOCKHOLDERS | AGE | DIRECTOR SINCE |

|

|

|

Christopher J. Coughlin has served as a member of our board of directors since April 2020 and as our chairman since January 2023. Previously, Mr. Coughlin served as our lead independent director from March 2022 to January 2023. Mr. Coughlin served as Senior Advisor to the Chief Executive Officer and Board of Directors of Tyco until September 2012. Prior to that, he was Executive Vice President and Chief Financial Officer of Tyco International from 2005 to 2010. During his tenure, he played a central role in the separation of Tyco into five independent, public companies. Prior to joining Tyco, he worked as the Chief Operating Officer of the Interpublic Group of Companies from June 2003 to December 2004 and as Chief Financial Officer from August 2003 to June 2004. Previously, Mr. Coughlin was Executive Vice President and Chief Financial Officer of Pharmacia Corporation from 1998 until its acquisition by Pfizer in 2003. Prior to that, he was Executive Vice President of Nabisco Holdings and President of Nabisco International. From 1981 to 1996 he held various positions, including Chief Financial Officer, at Sterling Winthrop. Mr. Coughlin currently serves on the board of directors of Centene Corporation (NYSE: CNC). Mr. Coughlin also previously served on the board of directors of Allergan plc, Alexion Pharmaceuticals, Dun & Bradstreet Corp., Hologic Inc., and Prestige Consumer Healthcare Inc. Mr. Coughlin received a B.S. in accounting from Boston College. Our board of directors believes that Mr. Coughlin is qualified to serve on our board of directors due to his extensive experience in complex financial and accounting matters, including public accounting and reporting, and his broad experience as a public company director. | 71 | April 2020 |

|

|

|

James Healy, M.D., Ph.D., has served on our board of directors since June 2019. Dr. Healy has been a General Partner of Sofinnova Investments (formerly Sofinnova Ventures), a biotech investment firm, since June 2000. Prior to June 2000, Dr. Healy held various positions at Sanderling Ventures, Bayer Healthcare Pharmaceuticals (as successor to Miles Laboratories) and ISTA Pharmaceuticals, Inc. Dr. Healy is currently on the board of directors of of ArriVent BioPharma, Inc. (Nasdaq: AVBP), Bolt Biotherapeutics, Inc. (Nasdaq: BOLT), Natera, Inc. (Nasdaq: NTRA), Y- mAbs Therapeutics, Inc. (Nasdaq: YMAB) and three private companies. Previously, he served as a board member of Ascendis Pharma A/S, Amarin Corporation, Auris Medical Holding AG, CinCor Pharma Inc., Coherus BioSciences, Inc., Edge Therapeutics, Inc., Hyperion Therapeutics, Inc., InterMune, Inc., Iterum Therapeutics plc, Anthera Pharmaceuticals, Inc., Durata Therapeutics, Inc., CoTherix, Inc., Movetis NV, NuCana plc, ObsEva SA and several private companies. In 2011, Dr. Healy won the IBF Risk Innovator Award and was named as one of the industry’s top leading Life Science investors in 2013 by Forbes Magazine. Dr. Healy holds an M.D. and a Ph.D. in Immunology from Stanford University School of Medicine and holds a B.A. in Molecular Biology and a B.A. in Scandinavian Studies from the University of California, Berkeley. He was previously a Director on the Board of the National Venture Capital Association (NVCA) and the Board of the Biotechnology Industry Organization (BIO). Our board of directors believes that Dr. Healy is qualified to serve as a director due to his significant medical background, extensive experience investing and working in the life science industry and his extensive service on the boards of directors of other life sciences companies. | 59 | June 2019 |

|

|

|

Jeffrey Jonas, M.D., has served as a member of our board of directors since October 2018. Dr. Jonas has been a Partner at Cure Ventures, a life sciences venture capital firm, since January 2024. Prior to that, Dr. Jonas served as the Chief Executive Officer of ABio-X from November 2022 to September 2023. From December 2020 to November 2022, he was the Chief Innovation Officer of Sage Therapeutics, Inc., or Sage, and from August 2013 to December 2020 he served as Sage's Chief Executive Officer and President. From November 2012 to August 2013, Dr. Jonas served as the President of the Regenerative Medicine Division of Shire plc, or Shire, and from July 2008 to November 2012 as Senior Vice President of Research and Development, Pharmaceuticals at Shire. From February 2007 to July 2008, Dr. Jonas served as the Executive Vice President of Ionis Pharmaceuticals, Inc., formerly known as ISIS Pharmaceuticals, Inc., from January 2002 to January 2007 as Chief Medical Officer and Executive Vice President of Forest Laboratories, Inc., and from 1991 to 1996 in senior-level positions at Upjohn Laboratories. Dr. Jonas also founded AVAX Technologies, Inc. and SCEPTOR Industries, Inc., where he served as the Chief Executive Officer, President and a Director. Dr. Jonas is currently on the board of directors of Generation Bio Co. (Nasdaq: GBIO), Sage (Nasdaq: SAGE), Kenai Therapeutics and Noema Pharma. Dr. Jonas received his B.A. from Amherst College and M.D. from Harvard Medical School. He completed a residency in psychiatry at Harvard Medical School, and he served as Chief Resident in psychopharmacology at McLean Hospital, Harvard Medical School. Our board of directors believes that Dr. Jonas is qualified to serve on our board of directors due to his more than 30 years of experience on both the scientific and business sides of the pharmaceutical and healthcare industries, particularly in the Central Nervous System field. | 71 | October 2018 |

| | |

CLASS III DIRECTORS – TERM EXPIRING AT THE 2025 ANNUAL MEETING OF STOCKHOLDERS | AGE | DIRECTOR SINCE |

Steven Paul, M.D., has served as a member of our board of directors since March 2018. From January 2023 to January 2024, he served as our Chief Scientific Officer and President of Research and Development. Prior to that, he served as our President, Chief Executive Officer and Chairman from August 2018 to January 2023. Previously, Dr. Paul was the President and Chief Executive Officer of Voyager Therapeutics, Inc. from September 2014 to August 2018. Dr. Paul also serves as a venture partner at Third Rock Ventures, LLC, a life sciences venture capital firm. Together with Third Rock, Dr. Paul co-founded Sage Therapeutics, Inc. and Voyager Therapeutics, Inc. From August 2010 to September 2014, Dr. Paul was a professor of neuroscience, psychiatry and pharmacology at Weill Cornell Medical College. Prior to that, from 1993 to 2010, Dr. Paul held several key positions at Eli Lilly, including Executive Vice President for Science and Technology, President of the Lilly Research Laboratories, Vice President of Neuroscience (CNS) Research, and Group Vice President of Discovery Research. Prior to Eli Lilly, from 1988 to 1993, Dr. Paul served as the Scientific Director of the National Institute of Mental Health, or NIMH. From 1982 to 1988 Dr. Paul served as a laboratory branch chief and tenured investigator at NIMH. Dr. Paul also served as Medical Director in the Commissioned Corps of the United States Public Health Service. Dr. Paul is an elected fellow of the American Association for the Advancement of Science and a member of the National Academy of Medicine. Dr. Paul is currently on the board of directors of Sage Therapeutics, Inc. (Nasdaq: SAGE) and serves as chairman of the board of Rapport Therapeutics, Inc. Dr. Paul is also on the board of the Foundation for the National Institutes of Health, or NIH. Dr. Paul previously served on the board of Alnylam Pharmaceuticals, Inc., Voyager Therapeutics, Inc. and Sigma Aldrich Corporation. Dr. Paul was appointed by the Secretary of the Department of Health and Human Services as a member of the advisory committee to the Director of the NIH from 2001 to 2006. Dr. Paul was also a member of the National Advisory Mental Health Council (2008-2012) and is board certified by the American Board of Psychiatry and Neurology. Dr. Paul received his B.A. in Biology and Psychology from Tulane University, and his M.S. and M.D. degrees from the Tulane University School of Medicine. Our board of directors believes that Dr. Paul is qualified to serve on our board of directors due to his extensive career in neuroscience and his leadership and managerial experiences at various pharmaceutical and biotechnology companies and healthcare organizations. | 73 | August 2018 |

| | |

Atul Pande, M.D., has served on our board of directors since June 2019. Dr. Pande served as Chief Medical Advisor of PureTech Health plc from 2018 to 2020, and previously served as its Chief Medical Officer from February 2017 to 2018 and as a Senior Advisor from July 2016 through February 2017. Dr. Pande has also served as President and Chief Executive Officer of Verity BioConsulting LLC, a drug development consulting firm, since 2014. He previously served as Chief Medical Officer of Tal Medical, Inc., a clinical-stage medical device company, from December 2014 to December 2017. From 2007 to April 2014, Dr. Pande was Senior Vice President and Senior Advisor, Pharmaceutical R&D at GlaxoSmithKline plc, a pharmaceutical company. He has also held senior roles at Pfizer Inc., Parke-Davis/Warner-Lambert, a subsidiary of Pfizer Inc., and Lilly Research Laboratories, a division of Eli Lilly, all of which are pharmaceutical companies. Dr. Pande is also a non-executive board member of Autifony Therapeutics Limited, Immunovant Sciences Ltd. (Nasdaq: IMVT) and Pangea Bio. He was previously a non-executive board member of Sio Gene Therapies (Nasdaq: SIOX) and Perception Neurosciences. He serves on the Scientific Advisory Board of MMS Holdings, a private CRO, and previously served as an advisor to Centrexion Corporation. Dr. Pande received his MBBS (Bachelor of Medicine, Bachelor of Surgery) and his M.D. from the University of Lucknow, India. He completed his research fellowship training in psychiatry at the University of Michigan Medical School and his postgraduate specialty training and psychiatry residency program at Western University. Our board of directors believes that Dr. Pande is qualified to serve on our board of directors due to his significant medical background and extensive experience in the life science industry. | 69 | June 2019 |

| | |

Denice Torres has served on our board of directors since December 2020. Ms. Torres is the founder and Chief Executive Officer of The Ignited Company, which she founded in November 2017. Ms. Torres is also the founder of The Mentoring Place, which she founded in 2017. From December 2004 to December 2017, Ms. Torres served in roles of increasing authority at Johnson & Johnson, ultimately serving as chief strategy and business transactions officer, medical device. Prior to that, from 1990 to 2004, Ms. Torres held various senior commercial leadership roles at Eli Lilly, including executive director of global neuroscience and director of U.S. women’s health. Ms. Torres currently serves on the board of directors of 2seventy bio, Inc. (Nasdaq: TSVT), Glaukos Corp. (Nasdaq: GKOS), Thirty Madison, and National Resilience Inc. Ms. Torres previously served on the boards of bluebird bio, Inc. and Surface Oncology, Inc. Ms. Torres holds an M.B.A. from the University of Michigan, a J.D. from Indiana University School of Law, and a B.S. in Psychology from Ball State. Our board of directors believes Ms. Torres is qualified to serve on our board of directors due to her extensive experience as an executive in the pharmaceutical industry. | 64 | December 2020 |

EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers, as of March 14, 2024:

| | |

Name | Age | Position(s) |

|

|

|

Bill Meury (1) | 56 | President and Chief Executive Officer |

Andrew Miller, Ph.D. | 42 | President of Research and Development |

Jason Brown | 36 | Chief Financial Officer |

Stephen Brannan, M.D. | 66 | Chief Medical Officer |

William Kane | 61 | Chief Commercial Officer |

_______________

(1) Mr. Meury is also a director of the Company and his biographical information appears on page 4.

Andrew Miller, Ph.D., has served as our President of Research and Development since January 2024. Prior to that, he served as our Chief Operating Officer from August 2018 to January 2024 and served as a member of our board of directors from April 2012 to March 2019. Dr. Miller was our founder and prior to serving as our Chief Operating Officer, he was our President and Chief Executive Officer from July 2016 to August 2018. From August 2008 to July 2016, Dr. Miller held several positions at PureTech Health plc, last serving as a Vice President, Venture Partner, and in such capacity served as Chief Operating Officer of Tal Medical and acting Chief Operating Officer of Entrega, Inc. He is currently a member of the board of directors of Entrega, Inc. Dr. Miller received a B.S. in Chemical Engineering from the University of Illinois with highest honors and completed his Ph.D. in Chemical Engineering at the Massachusetts Institute of Technology.

Jason Brown has served as our Chief Financial Officer since September 2023. Prior to that, he served as our Senior Vice President, Finance, from January 2022 to September 2023, and as our Vice President, Finance, from August 2018 to January 2022. Mr. Brown worked at PureTech Health plc from 2016 to 2018 in corporate finance, and, prior to that, held multiple roles of increasing responsibility in financial planning and analysis at Novartis AG. Mr. Brown received a bachelor’s degree in Economics from Hamilton College and an MBA from Boston College.

Stephen Brannan, M.D., has served as our Chief Medical Officer since March 2017. From July 2016 to February 2017, Dr. Brannan was an independent consultant. Prior to that, he served as the Vice President Clinical Research and Medical Affairs at Forum Pharmaceuticals Inc. from August 2015 to June 2016. From May 2011 to August 2015, Dr. Brannan served as the Therapeutic Head of Neuroscience at Takeda Pharmaceutical Company. Dr. Brannan has been active in the development of multiple important central nervous system treatments, including Cymbalta, Exelon Patch, Trintellix, and VNS for Treatment Resistant Depression, while holding various roles at Forum, Takeda, Novartis, Cyberonics and Eli Lilly. Prior to joining the pharmaceutical industry, Dr. Brannan worked on the faculty at the University of Texas Health Science Center at San Antonio, or UTHSCSA. Dr. Brannan trained in psychiatry at UTHSCSA, received his A.B. from Harvard College and holds a M.D. degree from the University of Texas Health Science Center at Dallas (Southwestern Medical School).

William Kane has served as our Chief Commercial Officer since February 2023. From November 2021 to December 2022, Mr. Kane was an independent consultant. From June 2020 to October 2021, Mr. Kane was Executive Vice President and Chief Commercial Officer of BioXcel Therapeutics, Inc. Prior to that, he served in multiple leadership roles at Allergan plc, most recently as Senior Vice President, U.S. General Medicine, from January 2017 to May 2020, and prior to that, as Vice President, Internal Medicine Brands, from July 2014 to December 2016 and Vice President, CNS Marketing, from October 2013 to June 2014. Mr. Kane has also held senior level commercial positions at leading biopharma companies, including Pfizer and Sepracor (now Sumitomo Pharma). Mr. Kane holds a B.A. in Government from Connecticut College and an M.B.A. from the Wharton School at the University of Pennsylvania.

CORPORATE GOVERNANCE

Board Composition

We currently have nine directors and the terms of office of the directors are divided into three classes:

•Class I, whose term will expire at the Annual Meeting of Stockholders to be held in 2026;

•Class II, whose term will expire at the Annual Meeting of Stockholders to be held in 2024; and

•Class III, whose term will expire at the Annual Meeting of Stockholders to be held in 2025.

Class I consists of Bill Meury, Laurie Olson and David Wheadon, M.D., Class II consists of Christopher Coughlin, James Healy, M.D., Ph.D. and Jeffrey Jonas, M.D., and Class III consists of Atul Pande, M.D., Steven Paul, M.D. and Denice Torres. At each Annual Meeting of Stockholders, the successors to directors whose terms will then expire shall serve from the time of election and qualification until the third Annual Meeting following election and until their successors are duly elected and qualified. A resolution of the board of directors may change the authorized number of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. This classification of the board of directors may have the effect of delaying or preventing changes in control or management of our company.

Board Independence

Our board of directors has determined that each of our directors, except for Bill Meury, who serves as our President and Chief Executive Officer, Steven Paul, M.D., who served as our Chief Scientific Officer and President of Research and Development from January 2023 to January 2024, and Jeffrey Jonas, M.D., who formerly served as the Chief Innovation Officer of Sage Therapeutics, Inc., or Sage, where Dr. Paul formerly served as a member of the compensation committee, has no relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and is independent within the meaning of the director independence standards of the Nasdaq Stock Market, or Nasdaq, rules and the SEC.

At least annually, our board of directors will evaluate all relationships between us and each director in light of relevant facts and circumstances for the purposes of determining whether a material relationship exists that might signal a potential conflict of interest or otherwise interfere with such director’s ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, our board of directors will make an annual determination of whether each director is independent within the meaning of Nasdaq and SEC independence standards.

Board Meetings and Attendance

Our board of directors held fourteen meetings during the fiscal year ended December 31, 2023. Each of the directors attended at least 75% of the meetings of the board of directors and the committees of the board of directors on which he or she served during the fiscal year ended December 31, 2023 (in each case, which were held during the period for which he or she was a director and/or a member of the applicable committee). The Company encourages its directors to attend the Annual Meeting of Stockholders. Each of our directors then in office attended our 2023 annual meeting of stockholders.

Board Committees

Our board of directors has established four standing committees: the audit committee, the compensation committee, the nominating and corporate governance committee, and the science and technology committee, each of which is described more fully below. Each of the audit committee, compensation committee and nominating and corporate governance committee is comprised solely of independent directors. Each of the audit committee, the compensation committee, the nominating and corporate governance committee, and the science and technology committee operates pursuant to a written charter and, on an annual basis, each committee reviews and assesses the adequacy of its charter and submits any proposed changes to its charter to the board of directors for approval. The charters for the audit committee, compensation committee, nominating and corporate governance committee, and science and technology committee are all available on our website at www.karunatx.com under “Investors & Media” at “Corporate Governance” and “Charters and Governance.”

Audit Committee

Our audit committee is currently composed of Christopher Coughlin, James Healy, M.D., Ph.D. and Laurie Olson, with Mr. Coughlin serving as chair of the committee. Our board of directors has determined that each member of the audit committee meets the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the applicable listing standards of Nasdaq. Our board of directors has determined that each of Mr. Coughlin and Dr. Healy is an “audit committee financial expert” within the meaning of the SEC regulations and applicable listing standards of Nasdaq. During the fiscal year ended December 31, 2023, the audit committee met five times. The audit committee’s responsibilities include:

•appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm;

•pre-approving auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm;

•reviewing the overall audit plan with our independent registered public accounting firm and members of management responsible for preparing our financial statements;

•reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us;

•coordinating the oversight and reviewing the adequacy of our internal control over financial reporting;

•establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns;

•recommending based upon the audit committee’s review and discussions with management and our independent registered public accounting firm whether our audited financial statements should be included in our Annual Report on Form 10-K;

•monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters;

•preparing the audit committee report required by SEC rules to be included in our annual proxy statement;

•reviewing all related person transactions for potential conflict of interest situations and approving all such transactions;

•reviewing quarterly earnings releases; and

•reviewing the Company’s risk assessment and risk management processes, including with respect to information security risks.

Compensation Committee

Our compensation committee is currently composed of Atul Pande, M.D., Christopher Coughlin and Denice Torres, with Dr. Pande serving as chair of the committee. Our board of directors has determined that each current member of the compensation committee is “independent” as defined under the applicable listing standards of Nasdaq. During the fiscal year ended December 31, 2023, the compensation committee met four times. The compensation committee’s responsibilities include:

•annually reviewing and recommending for approval by the board the corporate goals and objectives relevant to the compensation of our chief executive officer;

•evaluating the performance of our chief executive officer in light of such corporate goals and objectives and recommending the compensation of our chief executive officer for approval by the board;

•reviewing and approving the compensation of our other executive officers;

•reviewing and establishing our overall management compensation structure, philosophy and policy;

•overseeing and administering our compensation and similar plans;

•reviewing and making recommendations to our board of directors about our policies and procedures for the grant of equity-based awards;

•evaluating and assessing potential and current compensation advisors in accordance with the independence standards identified in the applicable Nasdaq rules;

•retaining or obtaining the advice of compensation consultants, legal counsel and other advisors;

•appointing, compensating and overseeing the work of any compensation consultant, legal counsel or other adviser it retains;

•evaluating and making recommendations to the board of directors about director compensation;

•preparing the compensation committee report required by SEC rules to be included in this Amendment No. 1;

•reviewing and discussing with our board of directors corporate succession plans for our CEO and executive officers;

•overseeing and monitoring our strategies, programs, initiatives and actions related to human capital management within our workforce; and

•administering our compensation recovery policy.

Historically, our compensation committee has made most of the adjustments to annual cash compensation for the executive team, determined executive bonus and equity awards, and established new performance objectives at the chief executive officer and Company levels. Additionally, our compensation committee considers matters related to the overall effectiveness of the Company’s compensation strategy, and potential modifications to that strategy in relation to market trends, plans or approaches to compensation. Generally, the compensation committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the chief executive officer, our compensation committee solicits and considers evaluations and recommendations submitted to the compensation committee by the chief executive officer. In the case of the chief executive officer, the compensation committee is responsible for recommending his compensation for approval by the board.

For all executives and directors, as part of its deliberations, the compensation committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, the total mix of executive and director compensation, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and analyses of executive and director compensation paid at a peer group of other companies approved by our compensation committee. The compensation committee also retains Aon’s Human Capital Solutions practice, a division of Aon plc (formerly known as Radford), or Aon, as its external compensation consultant and considers Aon’s input on certain compensation matters as it deems appropriate. No other fees were paid to Aon except fees related to determining or recommending compensation.

The compensation committee may establish and delegate authority to one or more subcommittees consisting of one or more of its members when the committee deems it appropriate. Additionally, the compensation committee may delegate its authority to one or more officers of the Company, including our chief executive officer, to grant certain equity awards to employees that are not executive officers, and in 2023 it delegated such authority to our chief executive officer, our chief financial officer, and our then vice president of legal affairs and secretary.

Compensation Committee Interlocks and Insider Participation

For the 2023 fiscal year, Atul Pande, M.D., Christopher Coughlin and Denice Torres served as members of our compensation committee. None of the members of our compensation committee is, or has ever been, an officer or employee of our company. During the 2023 fiscal year, no executive officer of our company served as: (i) a member of the compensation committee (or other committee of the board of directors performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our compensation committee; (ii) a director of another entity, one of whose executive officers served on our compensation committee; or (iii) a member of the compensation committee (or other committee of the board of directors performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as a director of our company.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is composed of Laurie Olson, Atul Pande, M.D. and David Wheadon, M.D., with Ms. Olson serving as chair of the committee. Our board of directors has determined that each current member of our nominating and corporate governance committee is “independent” as defined under the applicable listing standards of Nasdaq. During the fiscal year ended December 31, 2023, the nominating and corporate governance committee met four times. The nominating and corporate governance committee’s responsibilities include:

•developing and recommending to the board of directors criteria for board and committee membership;

•establishing procedures for identifying and evaluating board of director candidates, including nominees recommended by stockholders;

•reviewing the size and composition of the board of directors to ensure that it is composed of members containing the appropriate skills and expertise to advise us;

•identifying individuals qualified to become members of the board of directors;

•recommending to the board of directors the persons to be nominated for election as directors and to each of the board’s committees;

•developing, recommending to the board of directors for approval, and annually reviewing and reassessing the adequacy of, the Company's code of business conduct and ethics and corporate governance guidelines;

•overseeing and making recommendations to the Board regarding the Company’s environmental, social and governance, or ESG, initiatives; and

•overseeing the evaluation of our board of directors.

Science and Technology Committee

In August 2023, our board of directors established a science and technology committee as a standing committee of the board of directors. Our science and technology committee is composed of Jeffrey Jonas, M.D., Atul Pande, M.D., Steven Paul, M.D. and David Wheadon, M.D., with Dr. Paul serving as chair of the committee. During the fiscal year ended December 31, 2023, the science and technology committee met one time. The science and technology committee’s responsibilities include:

•reviewing, evaluating, and advising the board of directors and management regarding the Company’s research and development plans and strategy;

•reviewing, evaluating, and advising the board of directors and management regarding the quality, direction and competitiveness of the Company’s research and development programs;

•reviewing, evaluating, and advising the board of directors and management regarding the scientific and medical aspects of proposed transactions, including significant business development transactions, that require approval by the board of directors;

•reviewing and considering management’s decisions regarding the allocation, deployment and utilization of, and investment in, the Company’s scientific assets;

•monitoring progress of the Company’s research and development pipeline;

•reviewing and assessing the Company’s intellectual property portfolio and strategy; and

•identifying and discussing emerging science and technology trends and issues with potential relevance to the Company’s current or future research and development programs.

Our board of directors may from time to time establish other committees.

Identifying and Evaluating Director Nominees

Our board of directors is responsible for selecting its own members. The board of directors delegates the selection and nomination process to the nominating and corporate governance committee, with the expectation that other members of the board of directors, and of management, will be requested to take part in the process as appropriate.

Generally, our nominating and corporate governance committee identifies candidates for director nominees in consultation with management, through the use of search firms or other advisors, through the recommendations submitted by stockholders or through such other methods as the nominating and corporate governance committee deems to be helpful to identify candidates. Once candidates have been identified, our nominating and corporate governance committee confirms that the candidates meet all of the minimum qualifications for director nominees established by the nominating and corporate governance committee. The nominating and corporate governance committee may gather information about the candidates through interviews, detailed questionnaires, background checks or any other means that the nominating and corporate governance committee deems to be appropriate in the evaluation process. The nominating and corporate governance committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of our board of directors. Based on the results of the evaluation process, the nominating and corporate governance committee recommends candidates for the board of directors’ approval as director nominees for election to the board of directors.

Director Qualifications and Diversity

Our nominating and corporate governance committee’s priority in selecting board members is the identification of persons who will further the interests of our company through their established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, and professional and personal experiences and expertise relevant to our growth strategy. They will consider, among other things, the following qualifications, skills and attributes when recommending candidates for the Board’s selection as director nominees for the Board and as candidates for appointment to the Board’s committees: a nominee shall have experience at a strategic or policymaking level in a business, government, non-profit or academic organization of high standing; a nominee shall be highly accomplished in his or her respective field, with superior credentials and recognition; a nominee shall be well regarded in the community and shall have a long-term reputation for high ethical and moral standards; a nominee shall have sufficient time and availability to devote to our affairs, particularly in light of the number of boards of directors on which such nominee may serve; and, to the extent a nominee serves or has previously served on other boards, the nominee shall have a demonstrated history of actively contributing at board meetings.

Our board of directors also believes that diversity of viewpoints, background, experience and other characteristics, such as gender, race, ethnicity, culture, nationality and sexual orientation, are an important part of its makeup. When evaluating candidates for nomination as new directors, our board of directors will:

(1) Consider candidates with diverse backgrounds in terms of knowledge, experience, skills and other characteristics in the context of the needs of the Company at that point in time with a view to creating a Board with a diversity of experience and perspectives; and

(2) Include in the pool from which new director nominees are chosen candidates with a diversity of gender, race, ethnicity, culture, nationality or sexual orientation (and any third-party engaged to identify candidates for such pool will be asked to do the same).

The nominating and corporate governance committee will consider candidates recommended by stockholders. The policy adopted by the nominating and corporate governance committee provides that candidates recommended by stockholders are given appropriate consideration in the same manner as other candidates.

| | | | |

Board Diversity Matrix (As of March 14, 2024) |

Board Size: | | | | |

Total Number of Directors | 9 |

| Female | Male | Non-Binary | Did not Disclose

Gender |

Gender: | | | | |

Directors | 2 | 7 | — | — |

Number of Directors who identify in Any of the Categories Below: | | | | |

African American or Black | — | 1 | — | — |

Alaskan Native or Native American | — | — | — | — |

Asian | — | 1 | — | — |

Hispanic or Latinx | — | — | — | — |

Native Hawaiian or Pacific Islander | — | — | — | — |

White | 1 | 5 | — | — |

Two or More Races or Ethnicities | 1 | — | — | — |

LGBTQ+ | 3 |

Did not Disclose Demographic Background | — |

Persons with Disabilities | — |

Non-Management Director Meetings

In addition to the meetings of the committees of the board of directors described above, in connection with the board of directors’ meetings, the non-management directors met six times in executive session during the fiscal year ended December 31, 2023.

Communication with the Directors of Karuna Therapeutics

Any interested party with concerns about our company may report such concerns to the board of directors or the chair of our board of directors or nominating and corporate governance committee, by submitting a written communication to the attention of such director at the following address:

c/o Karuna Therapeutics, Inc.

99 High Street, 26th Floor

Boston, Massachusetts 02110

United States

You may submit your concern anonymously or confidentially by postal mail. You may also indicate whether you are a stockholder, supplier, or other interested party.

A copy of any such written communication may also be forwarded to the Company’s legal counsel and a copy of such communication may be retained for a reasonable period of time. The director may discuss the matter with the Company’s legal counsel, with independent advisors, with non-management directors, or with the Company’s management, or may take other action or no action as the director determines in good faith, using reasonable judgment, and applying his or her own discretion.

Communications may be forwarded to other directors if they relate to important substantive matters and include suggestions or comments that may be important for other directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances, and matters as to which we receive repetitive or duplicative communications.

The audit committee oversees the procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or audit matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting, internal accounting controls or auditing matters.

Leadership Structure and Risk Oversight

The leadership structure of our board of directors currently separates the positions of chief executive officer and chair of the board of directors, although we do not have a corporate policy requiring that structure. Separating these positions allows our chief executive officer, who is also a member of our board of directors, to focus on our day-to-day business operations and strategic direction, while allowing our board chair, who is an independent member of the board of directors, to focus on matters related to corporate governance, including management oversight and strategic guidance. While the board of directors believes that this is the most appropriate structure at this time, the nominating and corporate governance committee evaluates the board leadership structure from time to time, and may recommend alterations to this structure in the future.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including risks relating to our financial condition, development and commercialization activities, operations, strategic direction and intellectual property as more fully discussed under “Risk Factors” in our 2023 Annual Report and in our subsequent filings with the SEC. Management is responsible for the day-to-day management of risks we face, while our board of directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The role of the board of directors in overseeing the management of our risks is conducted primarily through committees of the board of directors, as disclosed in the descriptions of each of the committees above and in the charters of each of the committees. The full board of directors (or the appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management our major risk exposures, their potential impact on us, and the steps we take to manage them. When a board committee is responsible for evaluating and overseeing the management of a particular risk or risks, the chairman of the relevant committee reports on the discussion to the full board of directors during the committee reports portion of the next board meeting. This enables the board of directors and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Environmental, Social, and Governance Efforts

Our board of directors and management believe that ESG matters are central to the success of the Company and have made the furtherance of ESG initiatives a priority. Our board of directors exercises oversight over ESG issues primarily through the nominating and corporate governance committee, which is actively involved in ESG initiatives across the Company and makes recommendations to our board of directors regarding the Company’s ESG initiatives. Our board of directors oversees ESG issues more broadly to ensure that ESG risks and opportunities are being appropriately addressed by management. In order to appropriately incentivize our executive officers to prioritize ESG matters, we include an ESG metric tied to employee satisfaction, diversity and inclusion in our corporate goals.

Our ESG program is centered around patients, our employees, and our communities.

Patients

At Karuna, our goal is to discover and develop medicines with the potential to make a difference for people living with psychiatric and neurological conditions. As such, we invest in innovation on behalf of such patients, including those living with schizophrenia and psychosis in Alzheimer's disease, or AD. In furtherance of this goal, in 2023 and 2022 we incurred research and development expenses of $364.1 million and $224.2 million, respectively. We also engage with and support patients through our work with patient advocacy organizations, key opinion leaders, and other patient stakeholders to improve the understanding of, and reduce stigma surrounding, mental illnesses such as schizophrenia and AD-related psychosis.

Our Employees

We believe that our employees are critical to the success of our mission, and that our future success will depend in large part on our continued ability to attract, hire and retain qualified personnel. We continuously strive to ensure that employee morale remains strong, and conduct employee engagement satisfaction surveys and monitor employee turnover rates as part of this process.

Compensation and Benefits

We offer robust compensation packages, including competitive base pay, incentive compensation and equity programs, and provide a broad range of benefits, including a 401(k) plan, healthcare and insurance benefits, a health savings account, paid time off, paid family and medical leave, and various health and wellness programs. Through our equity incentive plan, we aim to attract, retain and reward personnel through the granting of equity-based compensation awards

in order to increase shareholder value and the success of our Company by motivating such individuals to perform to the best of their abilities and achieve our objectives.

Growth and Wellness

We are committed to the professional development of our employees, who can take advantage of various learning opportunities and training programs. As part of our development program, we provide our employees with reimbursement for certain external training programs that are related to their current work or career development. In addition, aligned with our mission and to support our employees’ mental health, we offer employees online resources to assist with professional and financial coaching, wellness courses, and therapy services. Employee-led committees focused on learning and development as well as recognition and wellness play a critical role in improving our offerings in these areas.

Diversity, Equity and Inclusion

We are committed to cultivating and preserving a culture of diversity, equity and inclusion, and aim to foster an inclusive environment through respect, collaboration, and open communication. All employees receive non-discrimination training, and those involved in the talent recruitment process receive behavioral interviewing training to avoid bias in hiring. We also embrace and encourage the differences among our employees that make them unique, and believe that these differences, as well as corresponding diversity of opinions and thought, contribute to our success as a company. Our efforts are driven by an employee-led diversity, equity and inclusion committee with support and guidance from the executive team.

Our Communities

We take our responsibility as a member of our local community seriously. Our employee-led community, outreach and giving committee helps to guide our strategy and approach for community engagement and partnerships with various non-profit organizations. For example, we sponsor certain non-profit organizations whose missions align closely with our own, such as This Is My Brave, which aims to reduce stigma in serious mental illness, and Clubhouse International, which provides support for those living with mental illness. We are also involved with other non-profit organizations, such Life Science Cares and Catie's Closet, that seek to improve the lives of disadvantaged individuals in the Boston area and surrounding communities.

We are committed to continued improvement with respect to ESG matters across the organization, and will continue to assess and implement changes as we examine our policies and practices and identify areas for improvement.

Code of Business Conduct and Ethics

We are committed to the highest standards of integrity and ethics in the way we conduct our business. Our board of directors adopted a Code of Business Conduct and Ethics, which applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. Our Code of Business Conduct and Ethics establishes our policies and expectations with respect to a wide range of business conduct, including the preparation and maintenance of our financial and accounting information, our compliance with laws, and possible conflicts of interest.

Under our Code of Business Conduct and Ethics, each of our directors and employees is required to report suspected or actual violations to the extent permitted by law. We maintain a third-party whistleblower hotline, available 24 hours a day, seven days a week, that can be used to anonymously report suspected violations of our Code of Business Conduct and Ethics or illegal activities in good faith without fear of retaliation. Any whistleblower reports received would be reviewed with our audit committee. In addition, we have adopted separate procedures concerning the receipt and investigations of complaints relating to accounting or audit matters. These procedures have been adopted by the board of directors and are administered by our audit committee.

A current copy of our Code of Business Conduct and Ethics is posted on our website at www.karunatx.com. If we make any substantive amendments to, or grant any waivers from, the Code of Business Conduct and Ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Overview

Our compensation committee is responsible for reviewing and approving, or recommending for approval by the board of directors, the compensation of our named executive officers, including base salary, cash and equity incentive compensation levels, severance arrangements, change in control benefits and other forms of executive compensation. The compensation committee is also responsible for evaluating our company’s performance against its goals and making related recommendations to our board of directors, assessing the performance of our named executive officers, and ensuring our compensation program is aligned with the objectives described below and competitive with those of other companies in our industry that compete with us for talent. This section discusses the principles underlying our compensation committee’s policies and decisions with respect to the compensation of our named executive officers.

For 2023, our named executive officers were as follows:

•Bill Meury, our President and Chief Executive Officer;

•Steven Paul, M.D., our former President and Chief Executive Officer, and former Chief Scientific Officer and President of Research and Development(1);

•Jason Brown, our Chief Financial Officer;

•Troy Ignelzi, our former Chief Financial Officer(2);

•Andrew Miller, Ph.D., our President of Research and Development(3);

•Stephen Brannan, M.D., our Chief Medical Officer; and

•William Kane, our Chief Commercial Officer.

_______________

(1)Effective January 3, 2023, Dr. Paul resigned as President and Chief Executive Officer and was appointed Chief Scientific Officer and President of Research and Development. Effective January 16, 2024, Dr. Paul resigned as Chief Scientific Officer and President of Research and Development but remains a member of the Company's board.

(2)Mr. Ignelzi departed from his position as Chief Financial Officer effective September 29, 2023.

(3)Dr. Miller served as Chief Operating Officer from August 2018 until his appointment as President of Research and Development effective upon Dr. Paul's departure from that position on January 16, 2024.

Executive Summary and Company Background

We are a clinical-stage biopharmaceutical company driven to create and deliver transformative medicines for people living with psychiatric and neurological conditions. Our pipeline is primarily built on the broad therapeutic potential of our proprietary lead product candidate, KarXT (xanomeline-trospium), an oral modulator of muscarinic receptors that are located both in the central nervous system, or CNS, and various peripheral tissues. KarXT combines xanomeline, a novel muscarinic agonist, with trospium, an approved muscarinic antagonist, to preferentially stimulate muscarinic receptors in the CNS. We are initially developing KarXT for the treatment of acute psychosis in adults with schizophrenia, as well as for the treatment of psychosis in Alzheimer's disease, or AD.

On December 22, 2023, we entered into an agreement and plan of merger, or the Merger Agreement, with Bristol-Myers Squibb Company, or Bristol Myers Squibb, pursuant to which Bristol Myers Squibb has agreed to acquire the Company for $330 per share in cash, for a total equity value of approximately $14.0 billion, on the terms and subject to the conditions set forth therein. The transaction is expected to close in the first half of 2024, subject to customary closing conditions, including approval of our stockholders and receipt of required regulatory approvals. See Part I, Item 1A, “Risk Factors,” Part II, Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations,” and Note 1 of the Notes to Consolidated Financial Statements included in our 2023 Annual Report for additional information regarding the transaction.

Key 2023 Achievements

Research and Development

•Submitted our New Drug Application, or NDA, for KarXT for the treatment of schizophrenia in adults to the U.S. Food and Drug Administration, or FDA, which accepted the NDA for review with a Prescription Drug User Fee Act (PDUFA) action date of September 26, 2024;

•Announced positive topline results from our Phase 3 EMERGENT-3 trial evaluating the efficacy, safety and tolerability of KarXT compared to placebo for the treatment of acute psychosis in adults with schizophrenia;

•Announced positive results from our Phase 1b Ambulatory Blood Pressure Monitoring trial of KarXT in schizophrenia;

•Completed enrollment in EMERGENT-5, our second open-label extension study evaluating the long-term safety and tolerability of KarXT in schizophrenia in support of the KarXT NDA;

•Initiated our Phase 3 ADEPT-2 trial evaluating the efficacy and safety of KarXT compared to placebo in up to 400 adults with moderate to severe psychosis related to AD, and our related open-label extension study, ADEPT-3; and

•Completed a Phase 1 multiple ascending dose study of an advanced oral formulation of KarXT.

Commercialization

•Hired William Kane as Chief Commercial Officer, and hired our Head of Sales; and

•Continued to grow and scale our commercial organization and advance preparations for a potential commercial launch.

Corporate

•Acquired exclusive license to Goldfinch Bio, Inc.'s investigational transient receptor potential canonical 4 and 5 (TRPC4/5) channel candidates, including the lead clinical-stage TRPC4/5 candidate, KAR-2618;

•Completed a follow-on public offering with aggregate net proceeds to the Company of $436.7 million;

•Operated within 10% of our approved budget to support research, development, commercial and long-term corporate objectives;

•Grew headcount from 194 to 317 to support clinical, commercial and other development goals; and

•Maintained high employee satisfaction, low turnover and positive diversity, equity and inclusion outcomes and ESG initiatives.

Chief Executive Officer Transition

In December 2022, as a result of a thoughtful succession plan initiated by Dr. Paul, our former President, Chief Executive Officer, and chairman of the board, we announced the appointment of Mr. Meury as our President and Chief Executive Officer, and as a member of the Company's board of directors, effective January 3, 2023. Dr. Paul transitioned to the role of Chief Scientific Officer and President of Research and Development, and Christopher Coughlin, our former lead independent director, assumed the role of chairman of the board.

New Chief Executive Officer Compensation Package

To determine Mr. Meury's compensation package in connection with his appointment, the compensation committee, with input from Aon, its compensation consultant, considered the compensation paid to chief executive officers, including

recent new hire chief executive officers, at our peer companies described below. Mr. Meury's on-hire compensation consisted of the following elements:

Annual Compensation

•Annual Base Salary: $750,000 per year

•Bonus Target: 75% of annual base salary

•Equity Award: Mr. Meury did not receive an annual equity award for 2023. He was first eligible for, and received, an annual equity award in 2024.

On-Hire Compensation

oIncentive stock options with a value of $8,000,000 and an exercise price equal to the closing price of our common stock as reported on the Nasdaq Global Market on the date of grant

oRestricted stock units, or RSUs, with a value of $8,000,000

In determining the value of Mr. Meury's annual cash compensation, the compensation committee targeted the 50th percentile of the market, in line with the compensation committee's general philosophy of targeting the 50th percentile of our peer group with respect to base salary and annual cash incentive award opportunities. The number of shares subject to Mr. Meury’s on-hire equity awards were calculated using the average closing price of the Company’s common stock during the 30-day period up to and including the date of grant. Mr. Meury's on-hire equity awards are greater in value than he would typically receive as part of his annual compensation because the award is intended to provide Mr. Meury with an immediate and meaningful ownership stake in the Company that will align his interests with those of our stockholders.

2023 “Say-on-Pay” Vote

At our 2023 annual meeting of stockholders, our stockholders were provided with the opportunity to cast a non-binding advisory vote on the compensation of our named executive officers for the 2022 fiscal year (a “say-on-pay” proposal). The stockholders approved, on an advisory basis, the compensation of our named executive officers, as disclosed in our 2023 proxy statement, with support from 65.1% of the votes cast. In the second half of 2023, we undertook an extensive shareholder engagement campaign to better understand our shareholders' perspectives regarding our executive compensation and corporate governance programs.

2023 Shareholder Engagement

Our Engagement Process

We believe that engaging with stockholders is fundamental to the Company's success and our commitment to good governance. We have historically reached out to a majority of our largest shareholders in advance of our annual meeting of stockholders to answer any questions and obtain shareholder feedback regarding our governance and compensation practices as disclosed in that year’s proxy statement, and any related topics that they wish to discuss. In 2023, we also contacted our shareholders in the second half of the year after the annual meeting of stockholders had taken place to understand their views of our business, corporate governance and compensation practices, and related matters.

Since our 2023 annual meeting of stockholders, we have contacted holders of approximately 70% of our outstanding shares for potential engagement. Such shareholders comprised the majority of our top 25 shareholders, and included shareholders who voted against our most recent "say on pay" proposal. Seven shareholders representing approximately 55% of our outstanding shares, accepted our offer to engage, and we participated in a discussion with four of these shareholders, representing approximately 40% of our outstanding shares. Calls with the remaining three of these seven shareholders were postponed before they took place in light of the pending merger transaction with Bristol Myers Squibb. The shareholders with which we held calls comprised four of our top five shareholders, and included a shareholder who voted against our most recent "say on pay" proposal.

Our engagement team consisted of members of management from our legal, investor relations, corporate affairs and finance functions. As part of our outreach, we communicated that our independent Board Chair would be available to participate in the discussion upon request; no shareholders that we ultimately spoke with requested his participation. Topics discussed included executive compensation, corporate governance and our environmental, social and

governance, or ESG, program. Management relayed stockholder feedback to the Compensation Committee in the fourth quarter of 2023.

Shareholder Feedback and our Response

Our shareholders provided feedback on several topics, including our long-term incentive equity compensation program, certain corporate governance matters and additional information that we could disclose to shareholders in our filings to better enable them to make informed voting decisions. Management spoke with our compensation committee to discuss potential changes to our compensation and governance practices based on this feedback, and certain shareholder input regarding our disclosure has been reflected in this filing.

Unless and until the proposed merger with Bristol Myer Squibb closes, the board of directors and management intend to continue improving upon our engagement with our shareholders through a year-round regular engagement process to better understand their views of our business, corporate governance practices and compensation program.

Key Aspects of 2023 Executive Compensation: Strong Performance Orientation

Delivered Very Strong Stock Price Performance and Total Shareholder Return

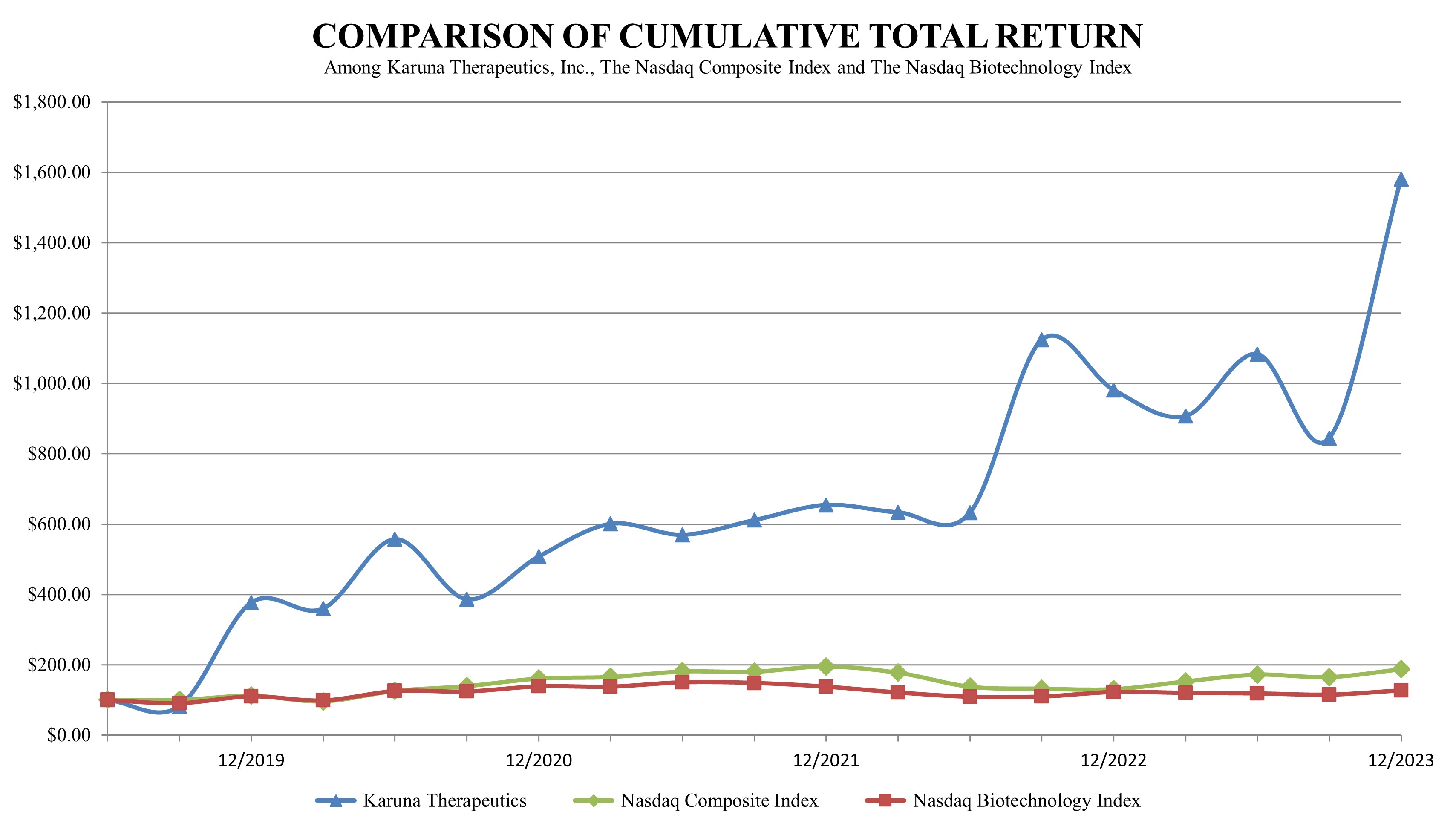

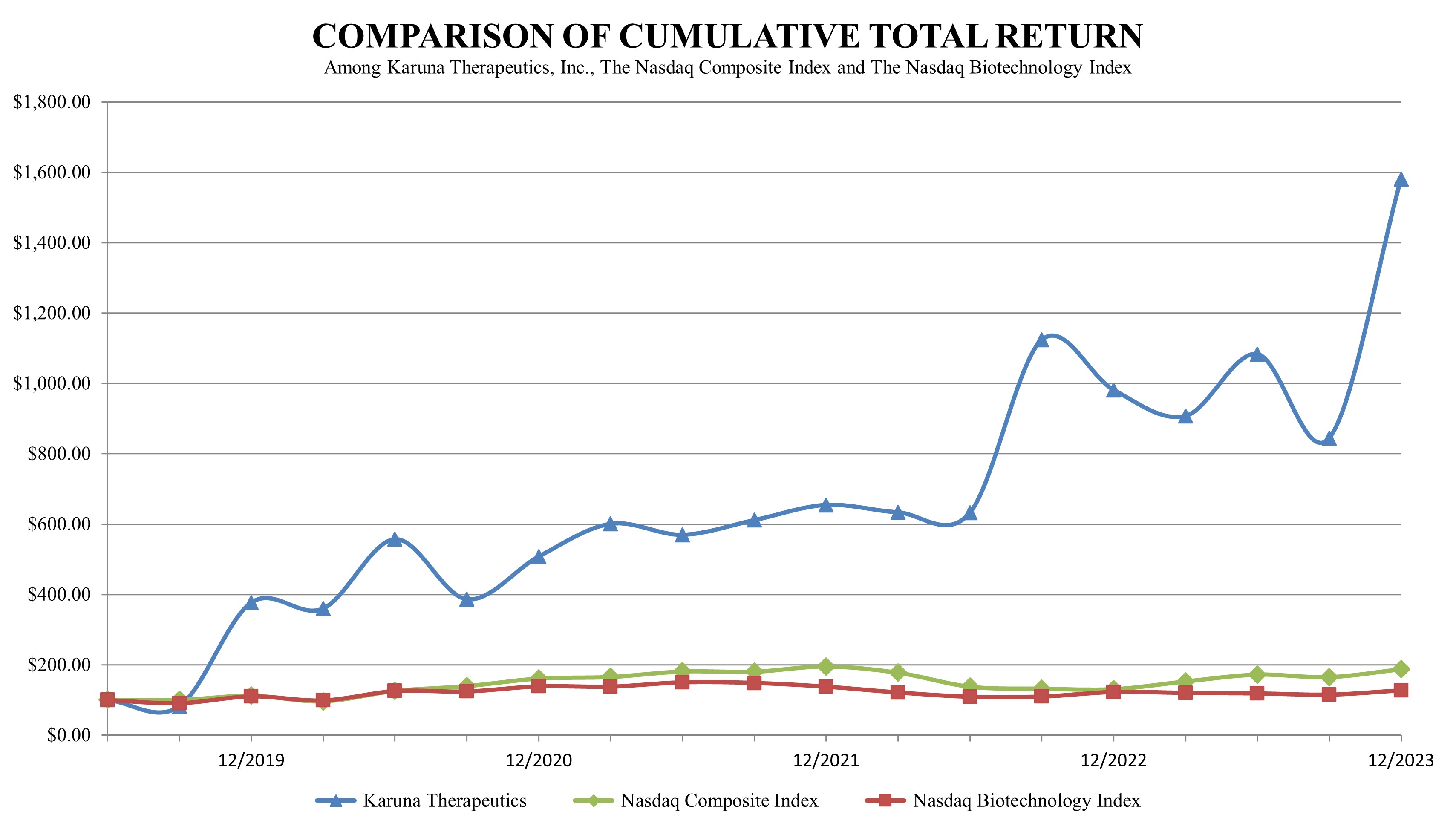

We completed our initial public offering in June 2019. Our Total Shareholder Return, or TSR, for 2023 was 61%, and our cumulative TSR since our June 2019 IPO through the end of 2023 was 1,481%, outperforming relevant indices.

Substantial Majority of CEO and other NEO Compensation, Total and Equity, is Variable and At-Risk

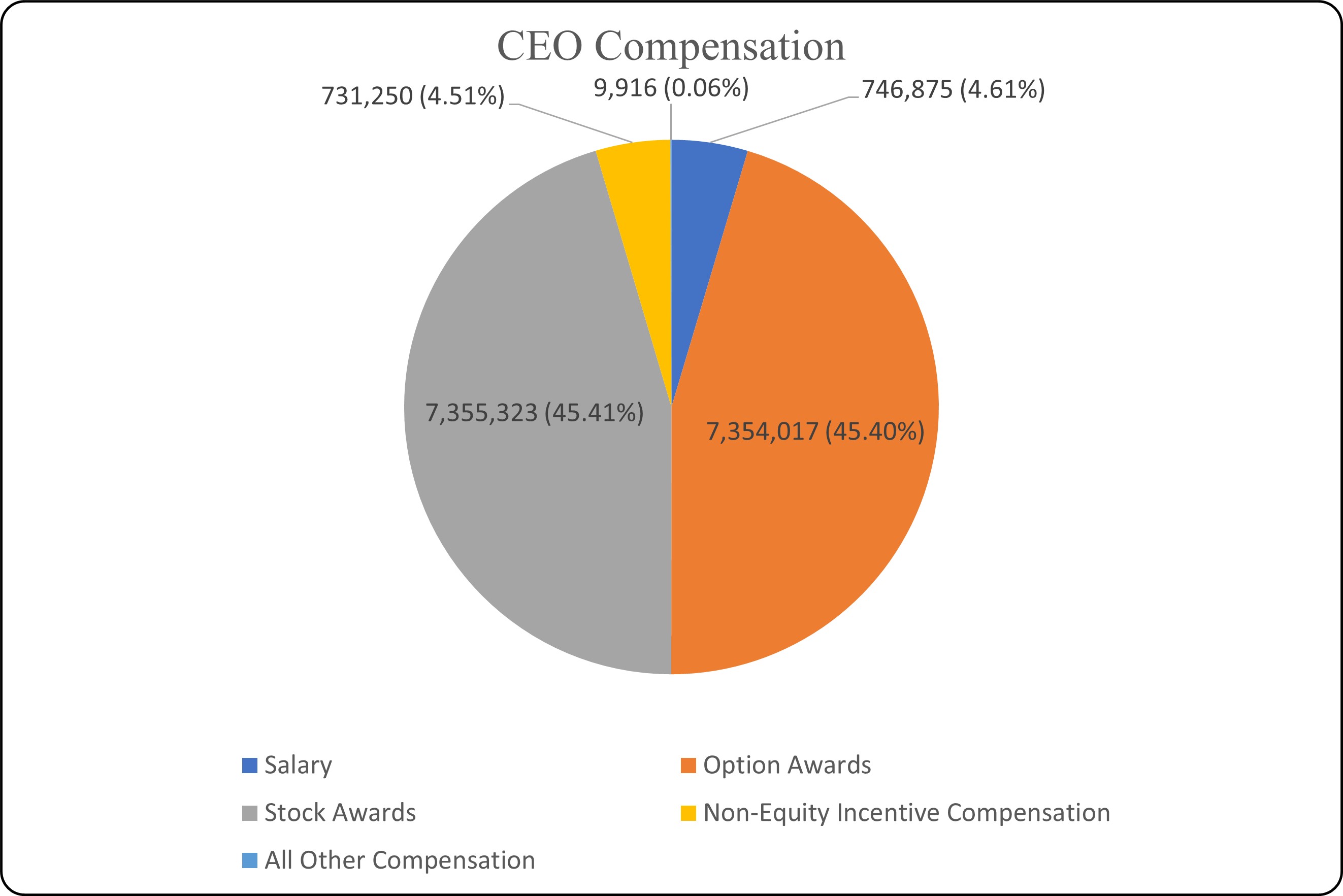

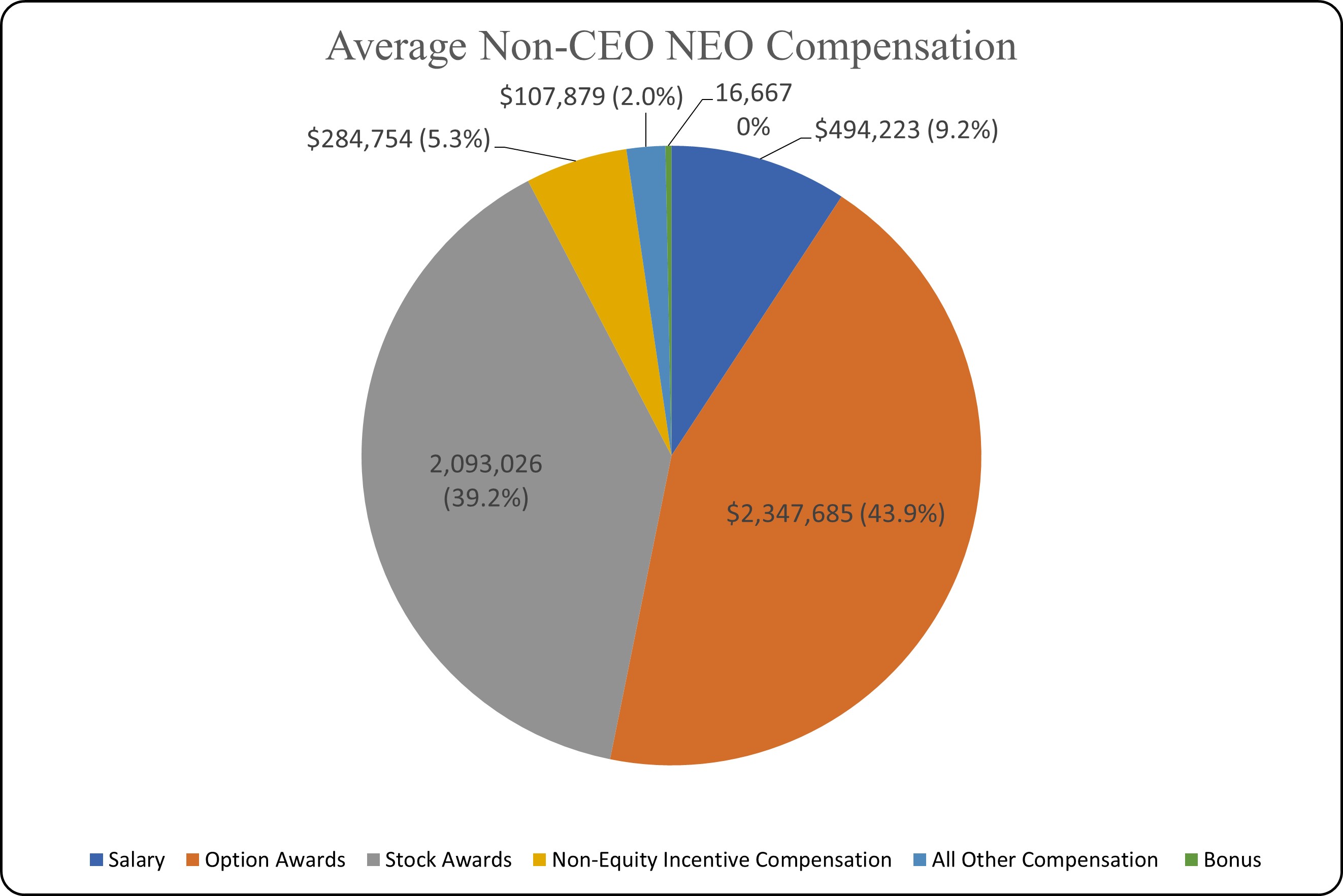

Approximately 95% of our chief executive officer’s 2023 total compensation, and 100% of the long-term incentive equity component, were variable and at risk. Our compensation philosophy is performance-based and focuses on aligning the financial interests of our executive officers with those of our shareholders. Generally, this is accomplished by placing a substantial portion of our executive officers’ total compensation “at risk.” We consider compensation to be “at-risk” if it is subject to achievement of meaningful pre-set, objective financial or operating goals, such as in our annual cash incentive program, or if it depends on stock price appreciation or value, as in our long-term incentive program.

Until December 31, 2022, consistent with the market practice of similar, recently-public companies in our industry, and in order to focus executives on growth and increasing shareholder value at this early stage of our development, equity

grants consisted solely of options, which are appreciation awards that only have value if the stock price increases. In our view, stock options are inherently performance-based, requiring stock price appreciation before there is any real value earned, and are simple. No amount of time will make a stock option deliver any value unless the company’s stock price increases. In addition, stock options reward our named executive officers for increasing shareholder value over the lengthier term of the option, relative to other equity compensation, which we believe is consistent with the longer pharmaceutical development cycle.

In January 2023, our board of directors began utilizing grants of RSUs in addition to stock options for the purpose of rewarding our executive officers. Grants of RSUs encourage executive ownership of Karuna shares, provide balance to stock option grants, which only have value if the stock appreciates, and align the incentives of our executives with the interests of our stockholders. These awards also provide executives with some certainty regarding the value of the compensation they are receiving during periods of stock market volatility, which furthers our fundamental goal of awarding compensation that helps attract and retain highly skilled employees. In addition, awarding full-value shares in the form of RSUs in the long-term portion of total compensation is less dilutive than stock option grants and consistent with the compensation practices of a majority of our peer group.

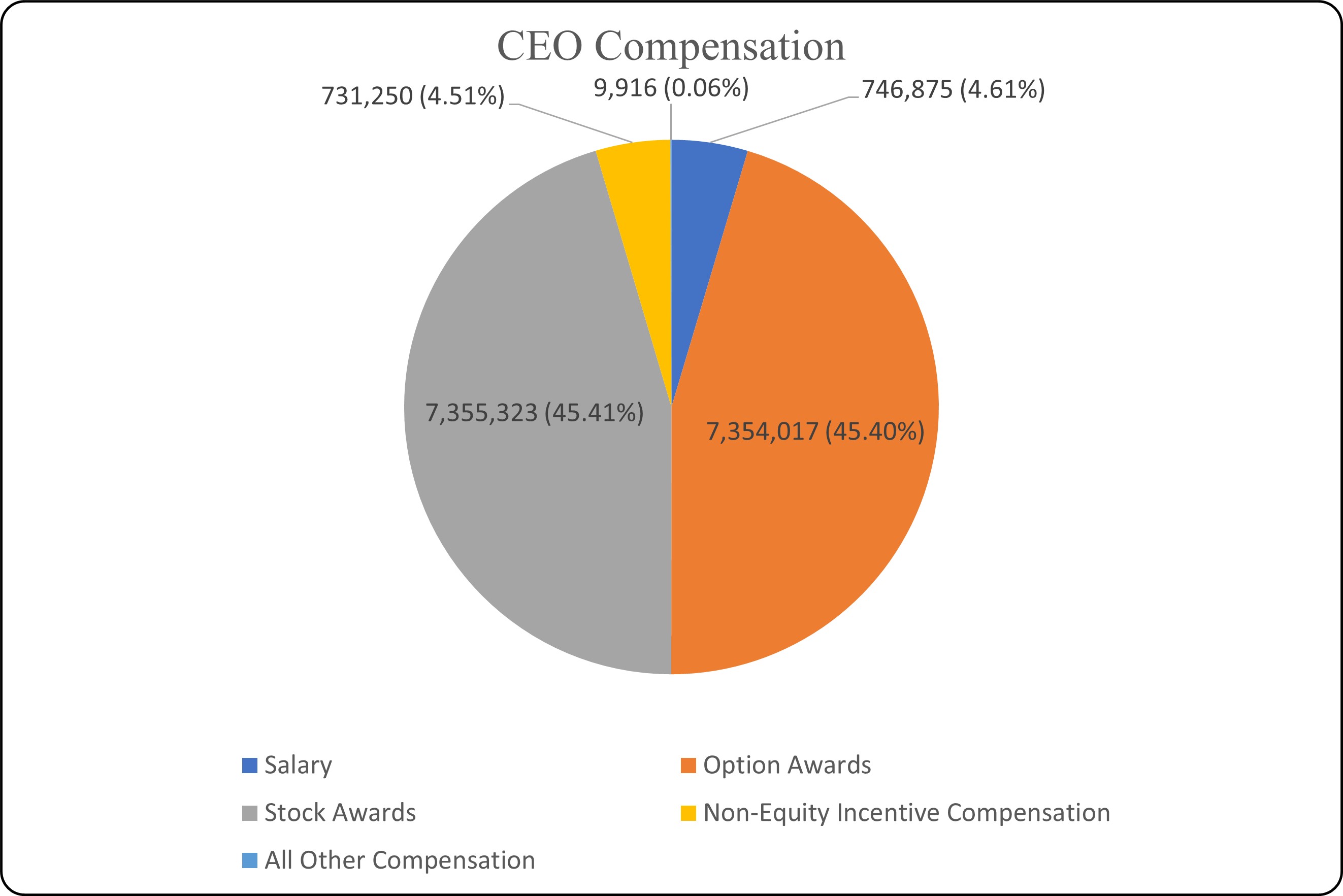

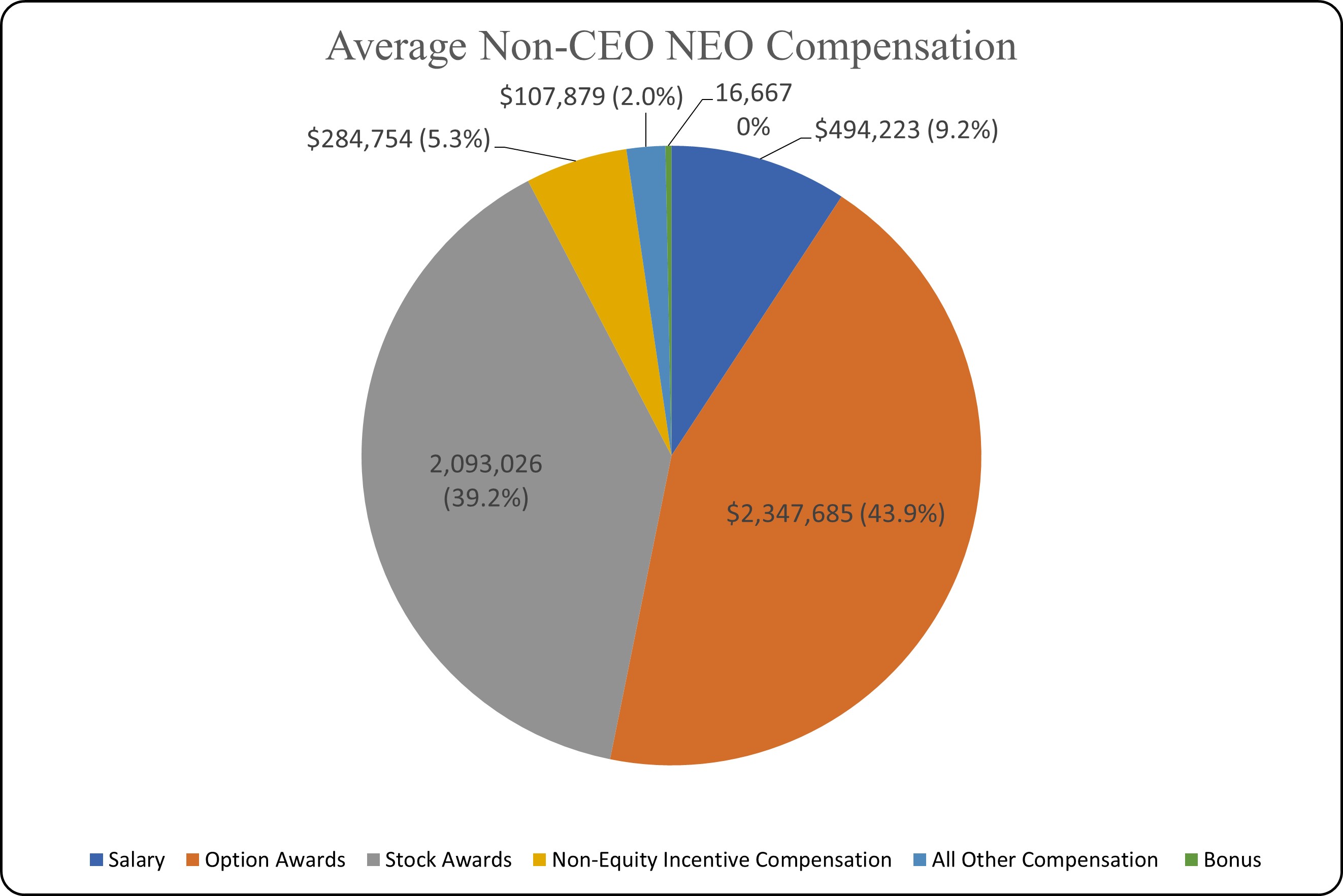

The graphics below illustrate the mix of fixed base salary, annual incentive and long-term target incentive compensation we provided in 2023 to our chief executive officer and, on an average basis, to our other named executive officers, and the high proportion that is variable and at-risk.

The performance-based metrics and the proportion of total compensation that was variable and at-risk further enhanced the link between pay and performance for the former chief executive officer and our other named executive officers and strengthened the alignment of the interests of the executive officers with those of our shareholders.

Short-Term Annual Cash Incentive: Rigorous, Pre-Set Clinical and Other Development and Corporate Goals

At the outset of 2023, we established research and development, regulatory, operational and financial objectives under our annual cash incentive program. These objectives were rigorous, aggressive and challenging, attainable only with strong performance, and took into account the relevant opportunities and risks. The compensation committee evaluated performance achievement relative to the goals as described in the section of this Amendment No.1 titled "Elements of our Compensation Program - Annual Cash Incentive Bonuses".

Peer Group: Assessed and Updated Peer Group to Reflect Current Market Capitalization

Consistent with best practices for corporate governance, the compensation committee annually reassesses the group of peer companies used as a reference point for evaluating executive compensation. In connection with determining the compensation of the chief executive officer and other executive officers, in the second half of 2022, the compensation committee conducted a review of our peer group to ensure its continued appropriateness, and updated the peer group utilized by our compensation committee with respect to compensation decisions for 2023.