Exhibit 99.2 Third Quarter Fiscal Year 2020 Supplemental Presentation August 6, 2020

Cautionary Statement Regarding Forward-Looking Statements Certain matters discussed in this presentation are forward-looking • significant volatility in the costs or availability of certain commodities statements within the meaning of the Private Securities Litigation (including raw materials and packaging used to manufacture Reform Act of 1995. These forward-looking statements are made BellRing’s products), higher freight costs or higher energy costs; based on known events and circumstances at the time of release, and • changes in economic conditions, disruptions in the United States and as such, are subject to uncertainty and changes in circumstances. global capital and credit markets, changes in interest rates and These forward-looking statements include, among others, statements fluctuations in foreign currency exchange rates; regarding BellRing Brands, Inc.’s (“BellRing,” the “Company,” “we,” • BellRing’s ability to attract key employees, loss of key employees, “us,” or “our”) prospective financial and operating performance and employee absenteeism, labor strikes, work stoppages or unionization opportunities and statements regarding the effect of the COVID-19 efforts; pandemic on BellRing’s business and BellRing's continuing response • BellRing’s high leverage, its ability to obtain additional financing to the COVID-19 pandemic. These forward-looking statements are (including both secured and unsecured debt) and its ability to service sometimes identified from the use of forward-looking words such as its outstanding debt (including covenants that restrict the operation of “believe,” “should,” “could,” “potential,” “continue,” “expect,” “project,” BellRing’s business); “estimate,” “predict,” “anticipate,” “aim,” “intend,” “plan,” “forecast,” “target,” “is likely,” “will,” “can,” “may” or “would” or the negative of • BellRing’s dependence on sales from its ready-to-drink (“RTD”) these terms or similar expressions, and include all statements protein shakes; regarding future performance, earnings projections, events or • BellRing’s dependence on a limited number of third party contract developments. There are a number of risks and uncertainties that manufacturers and suppliers for the manufacturing of most of its could cause actual results to differ materially from the forward-looking products, including one manufacturer for the substantial majority of statements made herein. its RTD protein shakes; THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT • BellRing’s operation in a category with strong competition; LIMITED TO, THE FOLLOWING: • BellRing’s reliance on a limited number of third party suppliers to • the impact of the COVID-19 pandemic, including negative impacts provide certain ingredients and packaging; on the global economy and capital markets, BellRing’s ability and • consolidation in BellRing’s distribution channels; the ability of its third party manufacturers to manufacture and • BellRing’s ability to anticipate and respond to changes in consumer deliver its products, its supply chain and its operations generally; and customer preferences and trends and to introduce new products; • disruptions or inefficiencies in the supply chain, including as a result • BellRing’s ability to maintain favorable perceptions of its brands; of BellRing’s reliance on third party suppliers or manufacturers for the manufacturing of many of its products, pandemics, changes in • BellRing’s ability to expand existing market penetration and enter into weather conditions, natural disasters, agricultural diseases and new markets; pests and other events beyond BellRing’s control; 2

Cautionary Statement Regarding Forward-Looking Statements (Cont’d) (CONTINUED FROM PRIOR PAGE): • allegations that BellRing’s products cause injury or illness, product • costs, business disruptions and reputational damage associated recalls and withdrawals and product liability claims and other with information technology failures, cybersecurity incidents litigation; and/or information security breaches; • legal and regulatory factors, such as compliance with existing • risks associated with BellRing’s public company status, laws and regulations and changes to and new laws and including BellRing’s ability to operate as a separate public regulations affecting BellRing’s business, including current and company and the additional expenses BellRing will incur to future laws and regulations regarding food safety and advertising; create the corporate infrastructure to operate as a public • BellRing’s ability to manage its growth and to identify, complete company; and integrate any acquisitions or other strategic transactions; • changes in estimates in critical accounting judgments; • fluctuations in BellRing’s business due to changes in its • impairment in the carrying value of goodwill or other intangibles; promotional activities and seasonality; • significant differences in BellRing’s actual operating results from • risks associated with BellRing’s international business; any guidance BellRing may give regarding its performance; • risks related to BellRing’s ongoing relationship with Post Holdings, • BellRing’s ability to satisfy the requirements of Section 404 of Inc. (“Post”), including Post’s control over BellRing and ability to the Sarbanes-Oxley Act of 2002; and control the direction of BellRing’s business, conflicts of interest or • other risks and uncertainties described in BellRing’s filings with disputes that may arise between Post and BellRing and BellRing’s the Securities and Exchange Commission. obligations under various agreements with Post, including under the tax receivable agreement; You should not rely upon forward-looking statements as predictions of future events. Although BellRing believes that the • the loss of, a significant reduction of purchases by or the expectations reflected in the forward-looking statements are bankruptcy of a major customer; reasonable, BellRing cannot guarantee that the future results, • the ultimate impact litigation or other regulatory matters may have levels of activity, performance or events and circumstances on BellRing; reflected in the forward-looking statements will be achieved or • the accuracy of BellRing’s market data and attributes and related occur. Moreover, BellRing undertakes no obligation to update information; publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual • economic downturns that limit customer and consumer demand results or to changes in its expectations. for BellRing’s products; • BellRing’s ability to protect its intellectual property and other assets; 3

Additional Information Prospective Information Market and Industry Data Any prospective information provided in this presentation regarding This presentation includes industry and trade association data, BellRing’s future performance, including BellRing’s plans, forecasts and information that were prepared based, in part, upon expectations, estimates and similar statements, represents BellRing data, forecasts and information obtained from independent trade management’s estimates as of August 6, 2020 only and are qualified associations, industry publications and surveys and other by, and subject to, the assumptions and the other information set independent sources available to BellRing. Some data also is based forth on the slide captioned “Cautionary Statement Regarding on BellRing management’s good faith estimates, which are derived Forward-Looking Statements.” from management’s knowledge of the industry and from independent sources. These third party publications and surveys generally state Prospective information provided in this presentation regarding that the information included therein has been obtained from sources BellRing’s plans, expectations, estimates and similar statements believed to be reliable, but that the publications and surveys can give contained in this presentation are based upon a number of no assurance as to the accuracy or completeness of such assumptions and estimates that, while they may be presented with information. BellRing has not independently verified any of the data numerical specificity, are inherently subject to business, economic from third party sources nor has it ascertained the underlying and competitive uncertainties and contingencies, including the economic assumptions on which such data are based. Similarly, COVID-19 pandemic, many of which are beyond BellRing’s control, BellRing believes its internal research is reliable, even though such are based upon specific assumptions with respect to future business research has not been verified by any independent sources and decisions, some of which will change, and are necessarily BellRing cannot guarantee its accuracy or completeness. speculative in nature. It can be expected that some or all of the assumptions of the estimates will not materialize or will vary Trademarks and Service Marks significantly from actual results. Accordingly, the information set forth herein is only an estimate as of August 6, 2020, and actual results Logos, trademarks, trade names and service marks mentioned in will vary from the estimates set forth herein. It should be recognized this presentation, including BellRing®, BellRing Brands®, Premier that the reliability of any forecasted financial data diminishes the Protein®, Dymatize®, PowerBar®, Premier Protein Clear®, farther in the future that the data is forecast. In light of the foregoing, ISO.100®, Elite Mass®, Elite Whey Protein®, Elite 100% Whey®, investors should put all prospective information in context and not Super Mass Gainer®, All9 Amino®, PREW.O®, Athlete’s BCAA®, TM TM TM rely on it. PowerBar Clean Whey , PowerBar Protein Plus , Protein Nut2 , PowerBar EnergizeTM, Joint Juice® and Supreme Protein®, are Any failure to successfully implement BellRing’s operating strategy currently the property of, or are under license by, BellRing or one of or the occurrence of the events or circumstances set forth under its subsidiaries. BellRing or one of its subsidiaries owns or has rights “Cautionary Statement Regarding Forward-Looking Statements” to use the trademarks, service marks and trade names that are used could result in the actual operating results being different than the in conjunction with the operation of BellRing or its subsidiaries’ estimates set forth herein, and such differences may be adverse and businesses. Some of the more important trademarks that BellRing or material. one of its subsidiaries owns or has rights to use that appear in this presentation may be registered in the U.S. and other jurisdictions. Each logo, trademark, trade name or service mark of any other company appearing in this presentation is owned or used under license by such company. 4

Q3 FY2020 Consumption and Key Metrics Executive Summary ● Premier Protein Q3 FY2020 ready-to-drink ("RTD") shake consumption vs. prior year is up 11%1 in tracked and untracked channels. This is mainly due to: ○ Distribution gains in food, drug and mass ○ Increased marketing and promotion ● Key metrics continue to show strong progress against our growth strategies and reaffirm a long runway for sustained growth. ○ Household penetration for Premier Protein is at 6.6%2, an increase of 22% vs. the prior year period, hitting our annual goal. The brand continues to have strong upside with household penetration of 24% in the liquid category and 55% within convenient nutrition. ○ Total distribution points ("TDPs") continue to grow, up 6%3 vs the prior year quarter with strong results in food, drug and mass. ○ Premier Protein's market share continues to grow to 18.2%3 of total liquids. Notes: 1. Nielsen xAOC+C 13 weeks ended June 27, 2020 and management estimates of untracked channels for the 13 weeks ended June 28, 2020. 2. Nielsen HH panel June 27, 2020. 5 3. Nielsen xAOC+C 13 weeks ended June 27, 2020.

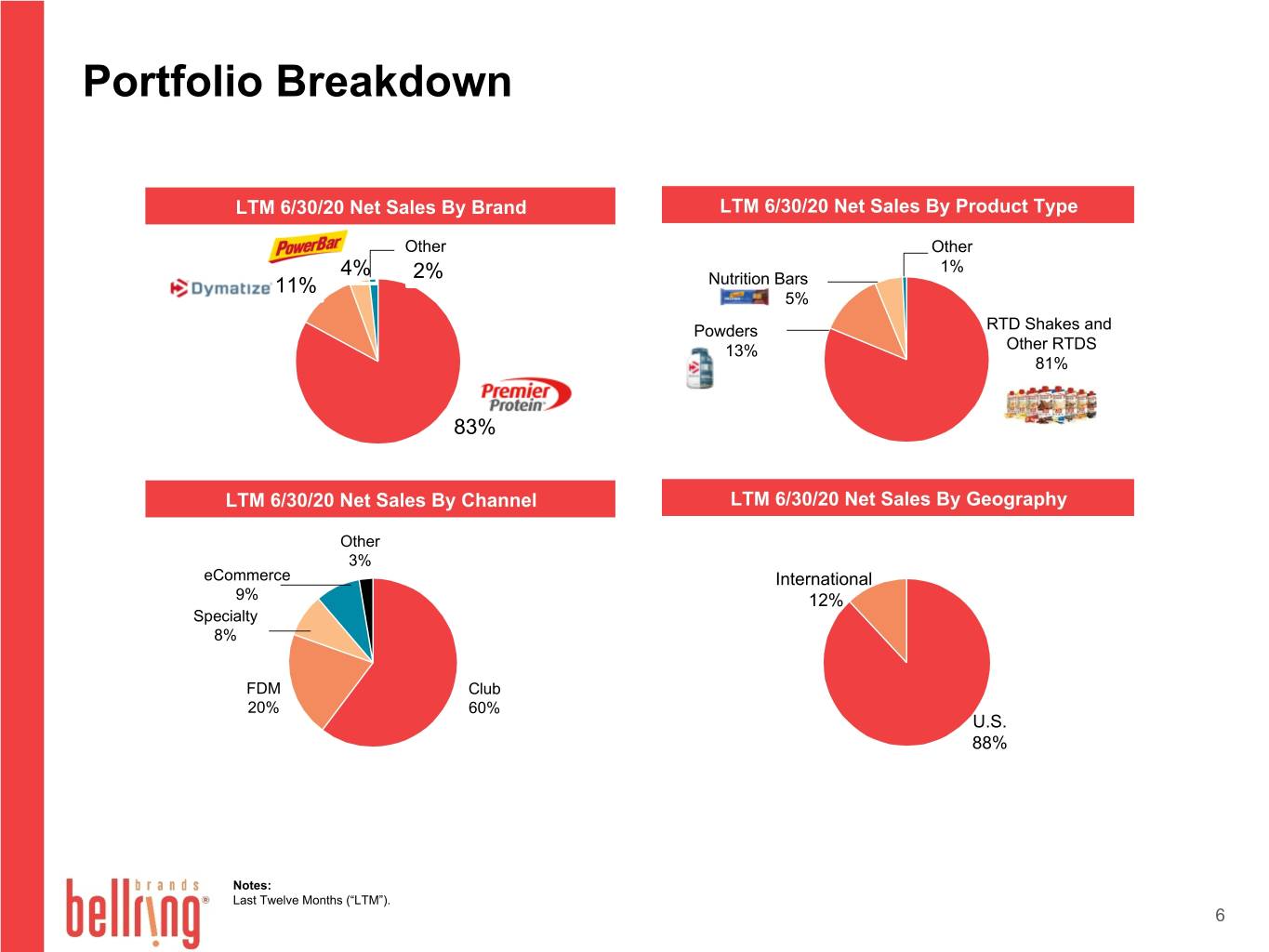

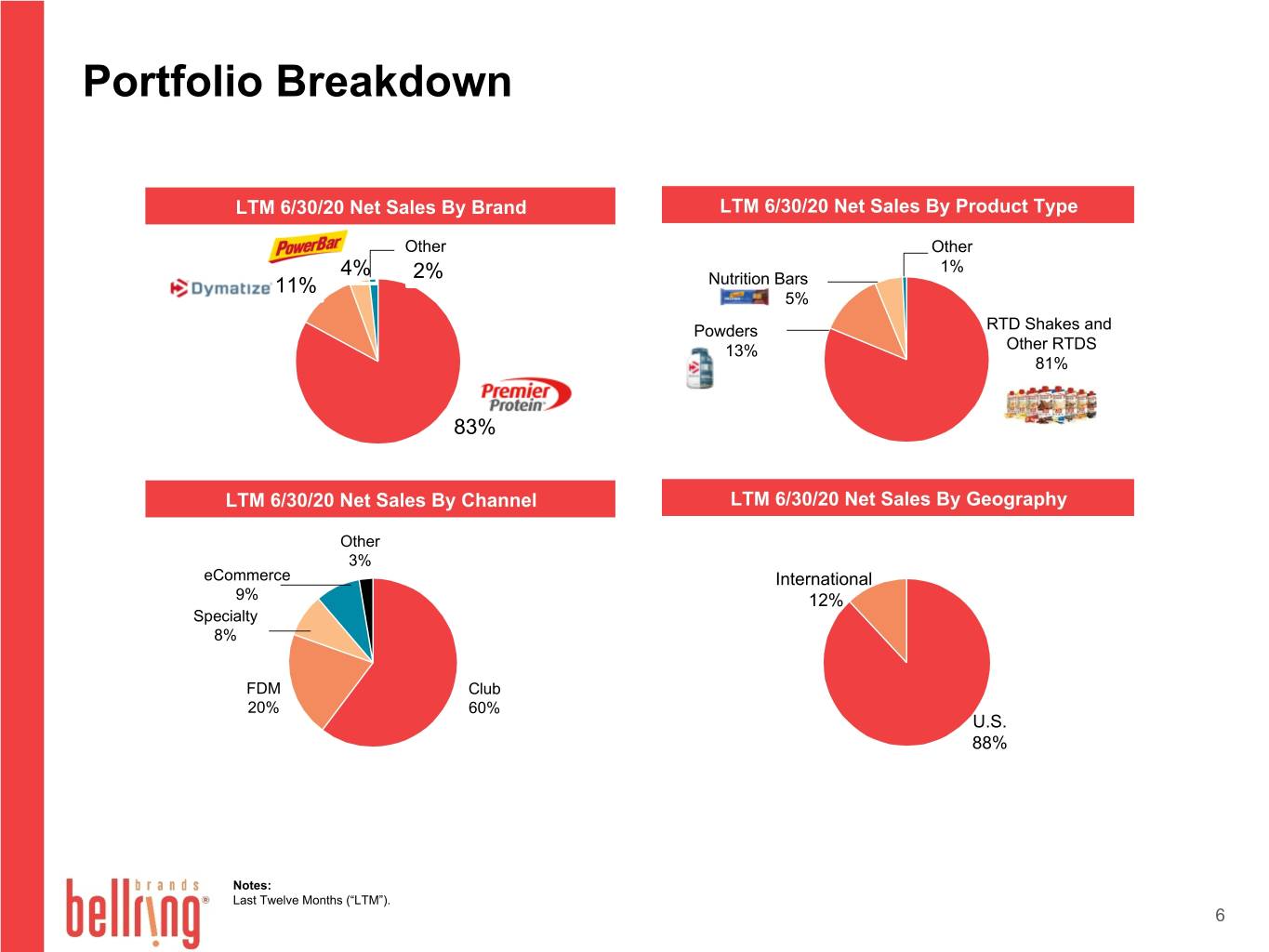

Portfolio Breakdown LTM 6/30/20 Net Sales By Brand LTM 6/30/20 Net Sales By Product Type Other Other 4% 2% 1% 11% Nutrition Bars 5% Powders RTD Shakes and 13% Other RTDS 81% 83% LTM 6/30/20 Net Sales By Channel LTM 6/30/20 Net Sales By Geography Other 3% eCommerce International 9% 12% Specialty 8% FDM Club 20% 60% U.S. 88% Notes: Last Twelve Months (“LTM”). 6

Premier Protein RTD Shakes Growing in All Channels Premier Protein RTD Shakes Sales vs. Prior Year Channel 13 Weeks 52 Weeks Club 0.1% 16.1% Mass 1.3% 33.2% Food 37.5% 43.9% Drug 33.2% 34.5% eCommerce 185.0% 144.5% Total Consumption (tracked + untracked channels) 11.0% 25.5% Total Tracked -4.5% 17.1% Total Untracked 32.5% 35.5% Notes: Nielsen xAOC+C 13 and 52 weeks ended June 27, 2020 and management estimates of untracked channels for the 13 and 52 weeks ended June 28, 2020. 7

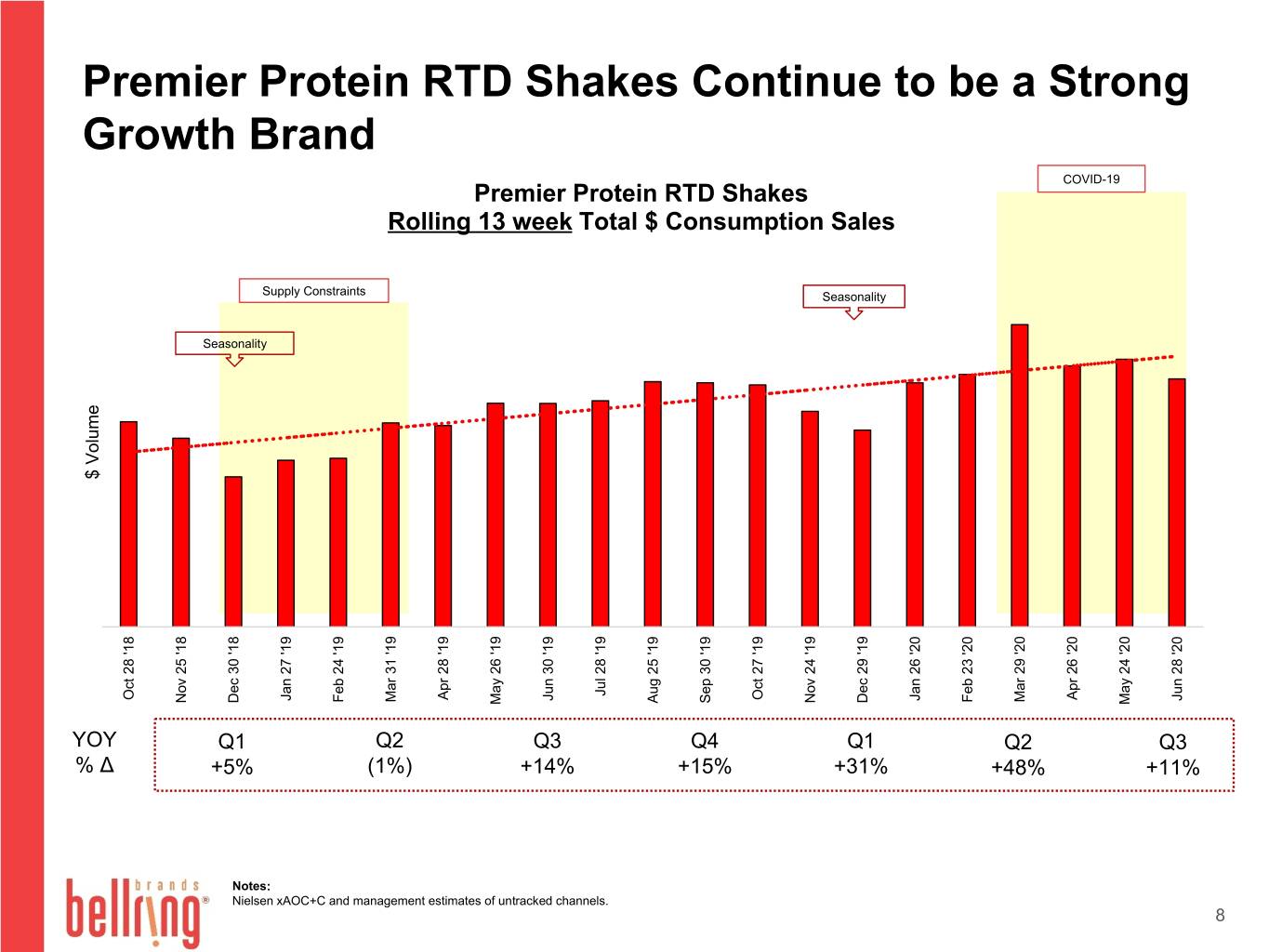

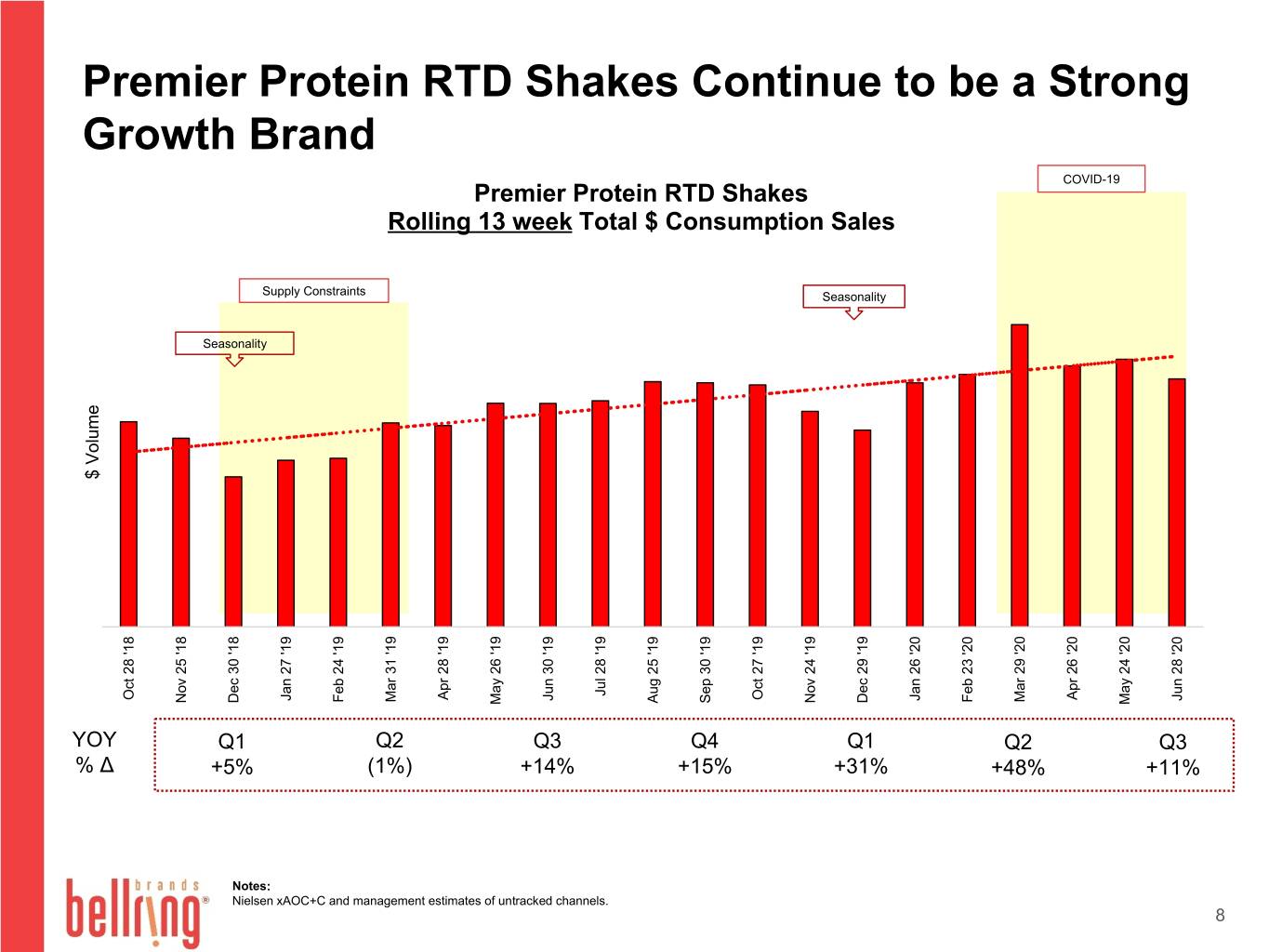

Premier Protein RTD Shakes Continue to be a Strong Growth Brand COVID-19 Premier Protein RTD Shakes Rolling 13 week Total $ Consumption Sales Supply Constraints Seasonality Seasonality $ Volume Jul 28 '19 Oct 28 '18 Apr 28 '19 Oct 27 '19 Apr 26 '20 Jun 30 '19 Jan 27 '19 Jan 26 '20 Jun 28 '20 Mar 31 '19 Mar 29 '20 Feb 24 '19 Feb 23 '20 Dec 30 '18 Dec 29 '19 Nov 25 '18 Nov 24 '19 Sep 30 '19 Aug 25 '19 May 26 '19 May 24 '20 YOY Q1 Q2 Q3 Q4 Q1 Q2 Q3 % Δ +5% (1%) +14% +15% +31% +48% +11% Notes: Nielsen xAOC+C and management estimates of untracked channels. 8

Premier Protein RTD Shake Shipments Can Vary by Quarter Due to Major Promotional Events But Grow Over Time Premier Protein RTD Shakes Consumption vs Shipments1 (13 Week Quarters) Promotional De-Load; Promotional Promotional Promotional Promotional Promotional Promotional De-Load Offset by offset by COVID-19 and COVID-19 Load-In and Flavor Load-in2 De-Load Load-In Flavor Load-in2 Inventory Build De-Load Total Units Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Premier Consumption Premier Shipments Linear(Premier Consumption) Notes: 1. Nielsen xAOC+C and management estimates of untracked channels. 2. Flavor Load-In refers to the pipeline fill following supply constraints in early fiscal 2019. 9

Media is Driving Household Penetration Premier Protein Total Brand & RTD Shakes Penetration Liquids 23.6 HH Pen 8.0 6.6 7.0 6.2 5.7 6.0 5.4 5.3 Liquids 19.5 HH Pen 4.8 5.0 4.7 3.8 3.9 4.0 2.8 3.0 2.0 +24% +39% +15% +23% +6% +10% +22% +27% 1.0 0.0 CY 2016 CY 2017 CY 2018 CY 2019 52 w/e June 2020 HH Pen - PP Premier Protein Brand HH Pen - Premier Protein RTD Shakes 30g Shake Repeat 51% 56% 57% 52% 49% Rates Notes: Nielsen HH panel June 27, 2020. Liquids refers to the liquid sub-category of the convenient nutrition category. Calendar Year (“CY”). 10

Grow Premier Protein RTD Shakes TDPs & ACV Continue to TDPs 100 150 200 250 300 350 400 450 50 0 173 52 01/14/17 02/11/17 03/11/17 Nielsen xAOC+C June 27, 2020. Notes: 04/08/17 05/06/17 06/03/17 07/01/17 07/29/17 08/26/17 09/23/17 10/21/17 11/18/17 12/16/17 01/13/18 02/10/18 03/10/18 04/07/18 05/05/18 06/02/18 06/30/18 Nielsen xAOC+C TDP 07/28/18 08/25/18 09/22/18 10/20/18 constraints %ACV 11/17/18 Supply 12/15/18 01/12/19 02/09/19 03/09/19 04/06/19 05/04/19 06/01/19 06/29/19 07/27/19 08/24/19 09/21/19 10/19/19 11/16/19 12/14/19 01/11/20 02/08/20 03/07/20 04/04/20 05/02/20 05/30/20 415 06/27/20 72 ACV 10 20 30 40 50 60 70 80 0 11

Share Growth Premier Protein RTD Shakes Strong Track Record of 13.5 18.0 22.5 0.0 4.5 9.0 8.7% 12/31/2016 Nielsen xAOC+C June 27, 2020. Notes: 1/28/2017 2/25/2017 4/1/2017 4/29/2017 5/27/2017 7/1/2017 7/29/2017 8/26/2017 9/30/2017 10/28/2017 11/25/2017 12/30/2017 Monthly $ Share% xAOC+C Liquids 1/27/2018 2/24/2018 3/31/2018 4/28/2018 5/26/2018 6/30/2018 07/28/18 08/25/18 Supply constraints 9/29/2018 10/27/2018 11/24/18 12/29/2018 01/26/19 2/23/2019 03/30/19 04/27/19 05/25/19 6/29/2019 7/27/2019 8/24/2019 9/28/2019 10/26/2019 11/23/2019 12/28/19 1/25/2020 2/22/2020 03/28/20 4/25/2020 5/23/2020 18.2% 6/27/2020 12