| O L S H A N | 1325 AVENUE OF THE AMERICAS ● NEW YORK, NEW YORK 10019

TELEPHONE: 212.451.2300 ● FACSIMILE: 212.451.2222 |

EMAIL: MREDA@OLSHANLAW.COM

DIRECT DIAL: 212.451.2260

October 7, 2019

VIA EDGAR AND ELECTRONIC MAIL

Daniel F. Duchovny

Special Counsel

Office of Mergers and Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 3628

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Progenics Pharmaceuticals, Inc. (the “Company”)

PRRN14A preliminary consent statement filing made on Schedule 14A

Filed on October 3, 2019 by Velan Capital, L.P.,et al.

File No. 000-23143 |

Dear Mr. Duchovny:

We acknowledge receipt of the comment letter of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission, dated October 4, 2019 (the “Staff Letter”), with regard to the above-referenced matter. We have reviewed the Staff Letter with our client, Velan Capital, L.P. (together with the other participants in the solicitation, “Velan”), and provide the following responses on its behalf. For ease of reference, the comments in the Staff Letter are reproduced in italicized form below. Terms that are not otherwise defined have the meanings ascribed to them in the preliminary consent statement filed by Velan on October 3, 2019 (the “Consent Statement”).

Preliminary Consent Statement

Cover Page

| 1. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Provide support for your statements referencing alternately the company’s decision to sell the company in a transaction that “substantially undervalues” the company and “at a massive discount.” |

Velan acknowledges the Staff’s comment and advises the Staff on a supplemental basis that it believes the Company’s announced transaction “substantially undervalues” Progenics and was priced at a “massive discount” for the reasons outlined below.

| | |

| | |

| O L S H A N F R O M E W O L O S K Y L L P | WWW.OLSHANLAW.COM |

October 7, 2019

Page 2

| A. | Company’s Past Statements. |

In its June 2019 investor presentation, the Company referenced equity research analyst price targets, recommendations and net sales opportunities as justification for why the Company was on the path to success. These analyst price targets ranged from $7.00 per share to $14.00 per share with all six analysts rating Progenics as “buy”.

In the same presentation, the Company touted the net sales and market potential for RELISTOR, AZEDRA and PyL. The Company noted RELISTOR and AZEDRA sales estimates of $59-79 million and $130-230mm, respectively. The Company also noted PyL was well positioned within a $500 million market. Per the Company’s filings, only $50 million was originally borrowed (collateralized solely by RELISTOR royalties) out of an eligible amount of $100 million, which further supports the value of RELISTOR.

At the time of the Company’s announcement of the merger with Lantheus, the transaction valued Progenics at ~$6.00 per share, or an equity value of ~$520 million (enterprise value of ~$480 million), well below the analyst price targets referenced above or the potential implied behind the peak net sales and market opportunity figures provided (which in Velan’s view are even further understated as they do not include future revenue from 1095 or any of the Company’s out-licensed assets).

At market close on October 2, 2019, the date the transaction was announced, the market-implied deal price for Progenics should the transaction be consummated was $4.76 per share (equity consideration of ~$410 million, enterprise value of ~$370 million). This represents a 20%+ decline in the implied transaction value for Progenics stockholders as a result of Lantheus’ stock price decline in reaction to the transaction. So, the actual consideration to be received by Progenics stockholders might be worth even less than implied by the headline deal announcement.

Conversely, Progenics actual stock price closed at $5.50 on October 2, 2019, which might imply that stockholders believe the current transaction will not be consummated either because the stand-alone opportunity has more value potential or because an improved or superior offer is expected.

Additionally, both the headline and market-implied deal price are well below the 52-week high trading price as well as the pricing of the Company’s follow-on equity offering last year.

| C. | Precedent Transactions. |

Two recent transactions consummated within the last year indicate that the current transaction substantially undervalues Progenics and is priced at a massive discount to the Company’s true potential.

In June 2019, Bracco Imaging S.p.A. signed a definitive agreement to acquire Blue Earth Diagnostics, a U.K.-based molecular imaging company, for $450 million plus an additional closing adjustment of approximately $25 million. Blue Earth has one approved imaging product for prostate cancer which (according to published reports) is expected to have revenue of $140 million this year. Compare this to PyL which, based on conversations Velan has had with physicians, is a superior product and expected to capture a significant portion of its $500 million market.

In December 2018, Novartis acquired Endocyte for $2.1 billion. Endocyte had recently completed a Phase 2 program for its PSMA therapeutic prostate agent, which is a very similar product to Progenics’ 1095 program which is currently in a Phase 2 clinical trial.

October 7, 2019

Page 3

Viewed either independently or collectively, these comparables (which would only represent a portion of Progenics’ product portfolio) indicate the current Progenics transaction does not fairly value the potential of its products.

| D. | Value of Financial Benefits to Lantheus. |

As part of the transaction, Lantheus expects cost synergies of $15-$20 million and is acquiring over $700 million in Progenics NOLs. Assuming the change of control limits the annual NOL usage to $15 million currently and assuming a 25% tax rate and a 10% discount rate, the value of these financial assets alone are $250+ million, or more than half the value of the implied transaction (~$425 million as of October 4, 2019). Additionally, upon Velan’s inquiry, PGNX CFO Patrick Fabbio (on October 4th, 2019) acknowledged that restrictions on usage of the NOLs were relatively limited and that the Company’s tax advisors would be conducting further work on this matter.

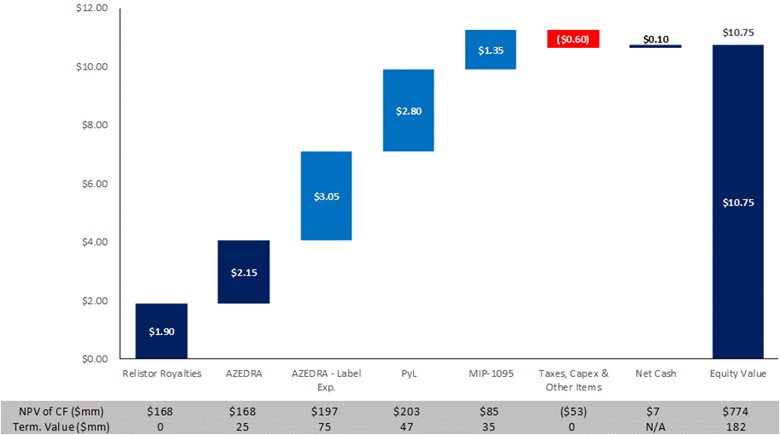

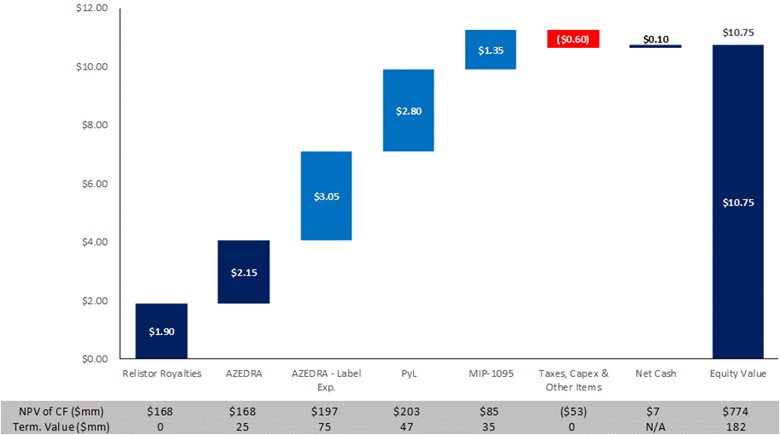

Below is a summary of Velan’s current view on Progenics’ value. Detailed product assumptions are listed directly below.

| § | RELISTOR, currently marketed by Bausch Health, generates ~$100 million in annual sales currently |

| ― | 15-19% royalties payable to Progenics |

| ― | Net sales milestone payments range from $10-75 million and are payable upon certain milestones |

| ― | Velan conservatively assumes no terminal value post-2030 |

| § | 7.5% annual net sales growth until then |

| § | AZEDRA represents pheochromocytoma and paraganglioma opportunity andexcludes all other potential indications |

| ― | 5% annual WAC price increase |

| ― | Peak market share of 65% in 2025 |

| § | Conservatively assumed eligible population of 400 patients in 2019 increasing throughout forecast but remaining below top of Company guidance (800 patients) |

| § | Conservatively assumed 2026 generic entry (reducing both market share and pricing) |

| § | Conservatively assumed <2 doses per patient |

| ― | SG&A expenses allocated to AZEDRA |

| ― | Terminal value of 3x EBITDA |

| ― | Assumes market is 3x size of existing indications to account for both larger patient population and different dosing (could have material upside) |

| § | As an example, patients with neuroblastoma are treated with 18mCi/kg, so a patient that weighs 28+ kg would need higher dose than current standard for AZEDRA |

| ― | 75% probability of success |

| ― | 2023 launch with seven-year orphan exclusivity and no longer-term patent coverage |

| ― | Product-specific R&D and SG&A incorporated |

| ― | Terminal value of 3x EBITDA |

October 7, 2019

Page 4

| ― | Endocyte assumed adjusted net sales of $1+bn |

| § | Velan assumes $220 million in peak adjusted net sales even though pre-chemo indication could be more lucrative |

| ― | Conservative 40% probability of success |

| ― | Product-specific R&D and SG&A incorporated |

| ― | Terminal value of 3x EBITDA |

| § | PyL represents a significant opportunity where Progenics has the front-runner that is desperately needed in the marketplace |

| ― | Completed Phase 3 enrollment in August 2019 |

| ― | Top-line results expected in Q4 2019 with NDA submission in 2H 2020 |

| § | 2022 commercial launch with peak probability-adjusted net sales of $250+ million |

| § | Assumes 75% probability of success |

| § | No longer-term patent coverage |

| § | Product-specific R&D and SG&A incorporated |

| § | Terminal value of 3x EBITDA |

| ― | Under these assumptions and a 11-13% discount rate, PyL’s value corresponds to $2.60-3.05 per share |

Furthermore, there are other conservative assumptions and additional upsides not incorporated in the forecast, as detailed below.

October 7, 2019

Page 5

| ― | SG&A reduced by approximately one-third to $22 million in 2020 |

| § | Additional savings could be available, but this is not a “buyout scenario” model |

| ― | SG&A increased as additional indications / products progress in the clinic |

| ― | Cumulative R&D expense of $190 million |

| ― | Assumes 50% of NOLs pre-2018 ($713mm in total as of 12/31/2018) are utilized; meaningful upside if all NOLs are incorporated in model |

| ― | Excludes any potential payout from ongoing 617 litigation efforts |

| ― | Does not factor in potential business development (M&A or out-licensing) |

| ― | Excludes potential royalties / milestones from products out-licensed to Bayer, Curium, CytoDyn and ROTOP |

| ― | Does not factor in potential upside from future ex-U.S. partnerships for remaining products |

Proposal 5 – The Election Proposal

| 2. | Please provide us support for your belief that company’s loan can be “refinanced or replaced, perhaps with an even higher principal balance” |

Velan acknowledges the Staff’s comment and advises the Staff on a supplemental basis that Velan has had preliminary discussions with multiple financing parties, including Healthcare Royalty Partners (the Company’s current lender), Royalty Pharma, NovaQuest and Athyrium – all seasoned and well-respected lenders in the pharmaceutical industry. While these conversations have been based only on publicly available information, each lender has indicated a willingness to, at a minimum, refinance the existing debt outstanding and multiple lenders have indicated an interest to increase the principal amount of the loan in return for additional royalty consideration.

Velan believes this statement is further supported as the Company’s original loan agreement included $100 million in principal available, of which only $50 million was called by the Company (see page 6 of the Company’s 2016 10-K). This illustrates that prior lenders were willing to loan more than the principal amount of the loan and based on Velan’s conversations (along with favorable litigation developments related to the underlying product royalties collateralizing such loans), Velan believes this holds true today.

* * * * *

The Staff is invited to contact the undersigned with any additional comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments. Thank you for your assistance.

Sincerely,

/s/ Meagan M. Reda

Meagan M. Reda