UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2022

ERC Communities 1, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 83-2379196 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 650 East Bloomingdale Avenue Brandon, FL | | 33511 |

| (Address of principal executive offices) | | (Zip Code) |

| | (813) 621-5000 | |

| | Registrant’s telephone number, including area code | |

| Preferred Stock |

| (Title of each class of securities issued pursuant to Regulation A) |

TABLE OF CONTENTS

In this annual report, the term “ERC Communities,” “we,” “us” “our” or “the company” refers to ERC Communities 1, Inc., (f/k/a“ERC Homebuilders 1, Inc.) a Delaware corporation and its subsidiary ERC Zephyrhills, LLC (“ERC Zephyrhills”).

THIS ANNUAL REPORT (THE “ANNUAL REPORT”) MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE ANNUAL REPORT, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Item 1. Business

ERC Communities 1, Inc., a Delaware corporation aims to develop manufactured home rental communities (“MHR”) in Florida and then expand to other state specific locations in the United States. These communities are also often referred to as “Built for Rent” communities. The company will purchase the land and manage the zoning, entitlement, design, construction and operation of the planned developments. The company intends to focus on manufactured homes that are approximately 1,375 square feet, three bedrooms, and two bathrooms. The company believes that these homes will rent for approximately 30% less monthly as compared to the monthly rental of a conventionally built home.

ERCCommunities, 1 was incorporated in Delaware on October 24, 2018, as ERC Home Builders South Florida, Inc. On February 19, 2019, the company changed its name to ERC Homebuilders 1, Inc., and then subsequently changed its name to ERC Communities 1, Inc. on December 3, 2021. ERC Communities 1 is a subsidiary of ERC Communities, Inc., (“ERC Parent”). ERC Communities 1 is currently the only operating subsidiary of ERC Parent.

As of December 31, 2022, ERC Communities 1 has one wholly owned subsidiary, ERC Zephyrhills, LLC (“ERC Zephyrhills”), a Florida limited liability. ERC Zephyrhills owns: (i) a 60-unit development site in Zephyrhills, Florida (“ERC Zephyrhills 1”) and (ii) an additional 58-unit site adjacent to the existing site (“ERC Zephyrhills 2”). Further, ERC Zephyrhills has contracted to purchase: (i) a 45-unit site adjacent to ERC Zephyrhills 1 and ERC Zephyrhills 2 and (ii) 90-unit site approximately 5 miles away from the three aforementioned sites. The company anticipates both properties will close during the second or third quarter of 2023. The company is not currently profitable.

Below are approximate statistics related to each property that the company has acquired as of December 31, 2022.

| STATISTICS | ERC ZEPHYRHILLS 1 | ERC ZEPHYRHILLS 2 |

| PROPERTY INFORMATION | | |

| Purchase Price | $750,000 | $650,000 |

| Development Costs | Approximately $11,150,000 | Approximately $11,350,000 |

| Funding | ERC Zephyrhills has secured: | ERC Zephyrhills has secured: |

| | · | $4,200,000 in construction financing | · | Short term mortgage funding: $500,000 at 12% interest. |

| | · | $3,900,000 of manufactured home financing, and | · | Shareholder advances: $113,000 and |

| | · | is pursuing approximately $3,050,000 of joint venture equity to be combined with share sales from the Regulation A offering. | · | $37,000 from the sale of shares pursuant to Regulation D |

| | | A $1,200,000 mortgage loan has been secured by both properties, Zephyrhills 1 and Zephyrhills 2. |

| Status | The ground has been cleared and the permits are in place for site development. | The company has not yet broken ground on this project. The rezoning application is in process. |

| Address | 39575 North Avenue, Zephyrhills, FL 33542 | Adjoining land next to 39575 North Avenue, Zephyrhills, FL 33542 |

| Intended Number of Units on the Property | 60 | 58 |

| Total Property Acreage | 9.34 acres | 9.77 acres |

| Approximate square foot of each manufactured home | 1,375 square feet | 1,375 square feet |

| Number of Bedrooms | 3 | 3 |

| Number of Bathrooms | 2 | 2 |

| Backyard | Yes | Yes |

| Parking Slab | Yes | Yes |

| Community Amenities | Picnic areas | Picnic areas |

*The company reserves the right to change the above estimated statistics if management believes it is in the best interest of the company.

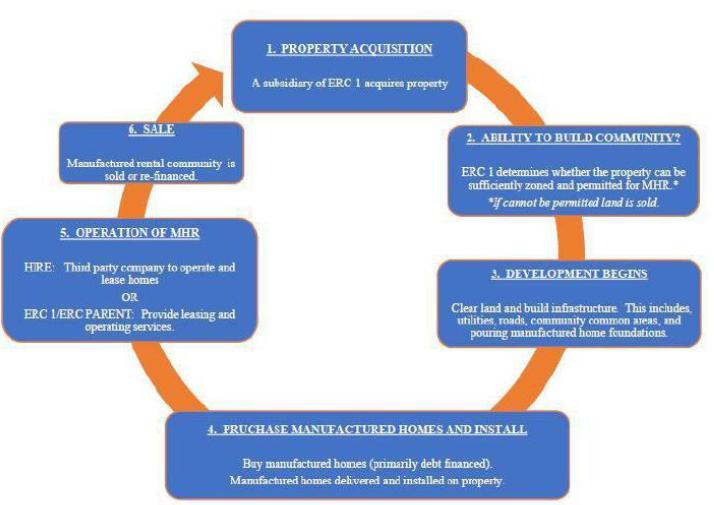

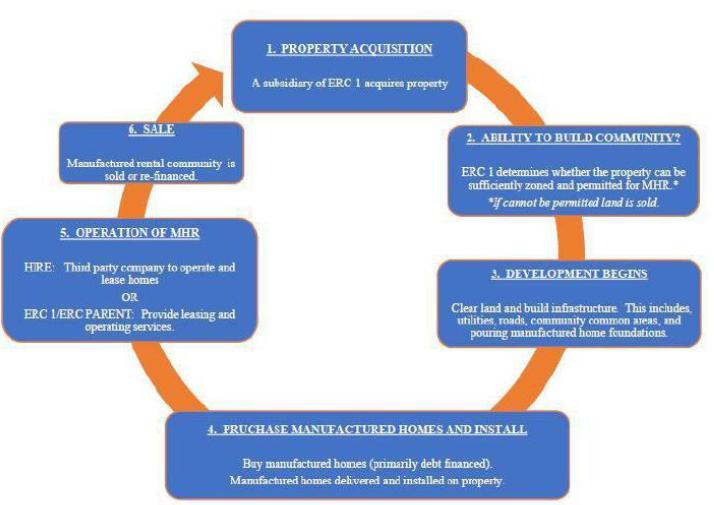

Business Process

The company intends its business process to proceed in the following manner:

Property Acquisition: Sourcing and Financing

The company intends to source properties for manufactured rental home communities from land developers, banks, homeowners, trusts and estates. The company has engaged various regional and national real estate brokerages to source its current and potential sites. The executive team has worked with various real estate brokerages since 2011.

When sourcing properties, the company looks to the following location characteristics:

| | ● | Population growth of the surrounding area. |

| | ● | Increase in a specific area for rental demand. |

| | ● | Severe shortages of affordable rental housing. |

| | ● | Market acceptance of manufactured rental homes. |

| | ● | Single-family homes sale supply. |

| | ● | Properties located just outside core urban areas where higher and better uses of land are more likely, resulting in lower land costs and faster entitlement processes. |

Currently, the company is reviewing potential properties in the following target markets located in Florida:

| | ● | Tampa Metro: Tampa, Brandon, Riverview, Seffner, Plant City, Zephyrhills, Wesley Chapel, Pasco County, Ellenton and Bradenton. |

| | ● | Central Highway 4: Lakeland and Orlando metro area. |

| | ● | Sarasota Metro: East Sarasota, Port Charlotte, North Port, Punta Gorda, Venice and Englewood. |

| | ● | South Gulf Coast: Ft. Myers, Cape Coral. |

The ability to purchase any additional properties will be dependent on the company securing funds, and though the company is reviewing these areas there is no guarantee even with funds, future properties will be located there.

To date, the company has financed the purchase of the land for the manufactured rental home communities with a combination of the proceeds from the company’s Regulation A offerings, funds advanced by ERC Parent, and mortgage financing provided by banks, private equity funds, lending-REITs and/or other financial institutions. The company intends to continue this strategy in the foreseeable future.

Determination of Whether a Manufactured Rental Home Community is Viable

Upon purchase of the property, ERC Communities 1 determines whether the applicable permits and zoning are able to be acquired for the community. In the event due diligence proves that permits and the like are unlikely to be obtained, the company will make the decision to sell the property. If on, the other hand, the company believes that permits, zoning, etc. will be acquired in a timely manner (between 6 months to 1 year) the company will work to procure the applicable permits.

Development Process

Once the company has acquired the land and determined that the property is eligible for permits the design work will commence. This will result in submissions to governmental authorities for building permits. Once permits are obtained construction will commence. At this time, the company will clear the land and begin building the infrastructure. The infrastructure build will typically include: (i) utilities, (ii) roads, (iii) community common areas such as picnic areas, and (iv) pouring of the manufactured home foundations.

The company assumes the following regarding costs and timing for a 60-unit manufactured home community:

| | ● | Approximately $11,000,000 per community. |

| | ● | Timing: 12 months from breaking ground. |

Manufactured Homes – Purchase

Manufactured homes will be built by independent third-party contractors. The company will oversee independent general contractors for much of its construction (either on site or using modular units that are built off-site), all of whom will perform under fixed-price contracts. When appropriate, the company will take delivery of manufactured homes. The company has not yet entered into any agreements with third-party providers to build the manufactured homes.

The manufactured homes will have an average square footage of 1,375 and will likely have a similar footprint of three bedrooms and two bathrooms. The manufactured homes may also include features such as:

| | ● | Senior grade insulation. |

| | ● | Full FEMA- code storm protection. |

| | ● | Optional features may include track lighting, recessed lighting and crown- molding |

Operation of the Manufactured Rental Home Communities

ERC Communities 1 will either (a) hire a third-party operating company to lease and manage the manufactured rental home communities or (b) manage the leasing and operations of each community in-house.

The company believes that they will achieve 100% occupancy of its developments that are 100 units or smaller within 12 months of rental access to tenants.

The company believes that its manufactured rental homes will attract lessors with the following demographics:

| | ● | Mid-level employees working at local and regional firms. |

| | ● | Not all have college degrees, e.g.: FedEx / UPS drivers, IT workers, mid-level medical workers, retail managers, warehouse managers. |

| | ● | We believe the average age is 35 – 45, with household income averaging $125,000, |

| | ● | Married with 1-2 children and seeking to live in a single-family residence. |

Sale of Manufactured Rental Home Communities

Pursuant to certain circumstances such as real estate market trends and additional project development opportunities, the company may determine that it is in the best interest of the company to sell a manufactured rental home community. When this determination is made, the company believes that the following strategies may be applicable:

| | ● | Utilize SVN/SFRhub.com as one of the initial channels for sales to hedge funds, private equity firms and national rental operators. |

| | ● | Direct sales to national rental operators. |

Zephyrhills Property 1 and Zephyrhills Property 2

The Zephyrhills Property 1 was acquired by the company in August 2020. It is located at 39575 North Avenue, Zephyrhills, FL 33542.

The Zephyrhills Property 2 was acquired by the Company in September 2022. It is the adjoining land next to Zephyrhills Property 1.

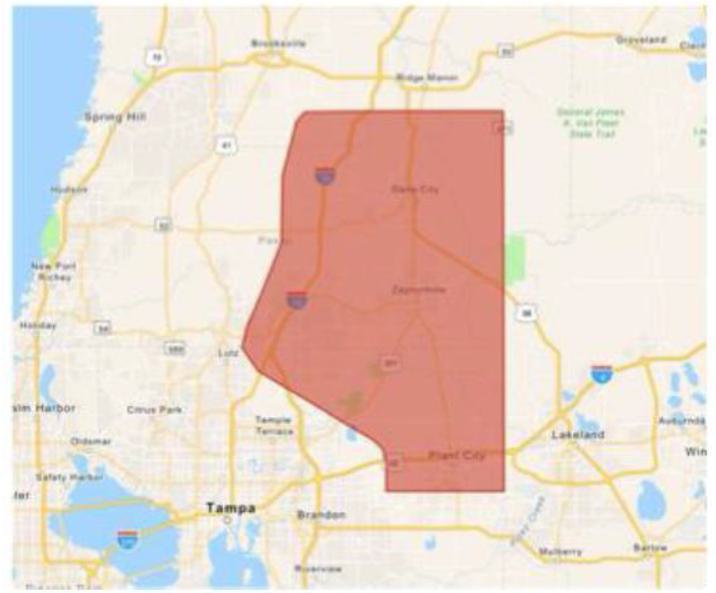

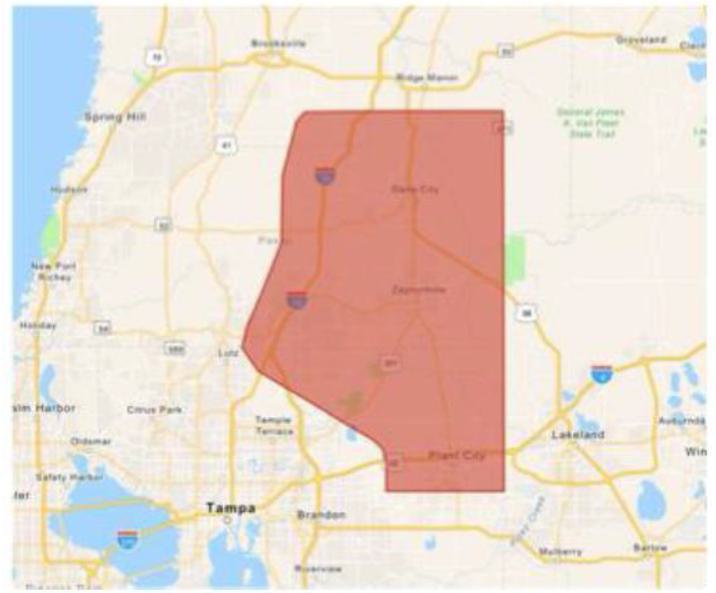

The new 60-lot single-family manufactured home rental community and the new 58-lot single-family manufactured home rental community will be located at the intersection of North Avenue and Six Star Drive in N. Zephyrhills, Florida. The location straddles Pasco and Hillsborough counties, roughly 30-45 minutes outside of the core business districts of downtown Tampa and Westshore. The company believes that there is strong projected growth of 2,220 renter households in this market through 2025.

In reliance on a market study dated May 27, 2021, performed by Hunter Housing Economics, and paid for by ERC Parent, the company estimates rental rates for the Zephyrhills Property 1 manufactured homes to be $1,500 per month or $1.08 per square foot. In this instance the company believes that this rate is 21% below new competitive site-built homes which average $1,900 per month and are located in the Zephyrhills primary market area (“PMA”).

Hunter Housing Economics and the company determined the PMA. The PMA is designated as the area from where the targeted tenants may come and in which they will search for housing. The area was designed to exclude the core of Tampa, as such an urban area is not reflective of the suburban nature of a Zephyrhills Property 1 renter. It includes areas that are higher and lower in income. US Highway 301 is a central spine for this submarket, and I-75 is an important artery as well. Protected environmental areas create a hard border on the eastern edge.

The PMA straddles Pasco and Hillsborough counties, roughly 30-45 minutes outside of the core business districts of downtown Tampa and Westshore. Historically, this area was considered a bedroom community for Tampa. However, in recent years economic development activity and accelerated growth has brought more healthcare, manufacturing, retail, and entertainment venues into Pasco County. Zephyrhills is an affordable rural community, accessed by US301.

Areas just south of I-4 and along US301 are similar in character, demographics, and work- commute times. These submarkets are expected to provide potential renters for Zephyrhills Property 1. Dade City and Plant City are important nodes in this PMA.

The company believes that population growth is robust in this area, particularly among those looking to rent a home. The area directly around the subject property is rural in character, and this is in line with the company’s strategy. The company intends to bring affordable detached housing to the market, and to target renters who prioritize space and a detached home over the aesthetics of the surrounding area.

Below is a map depicting the primary market area.

The single family manufactured homes on the Zephyrhills Property 1 and Zephyrhills Property 2 will likely have the following attributes:

| Approximate square foot of each manufactured home | 1,375 square feet |

| Number of Bedrooms | 3 |

| Number of Bathrooms | 2 |

| Backyard | Yes |

| Parking concrete slab | Yes |

| Access to Community Amenities | Yes |

| Hard-surfaced floors | Yes |

| Senior grade insulation | Yes |

| Full FEMA- code storm protection | Yes |

| Optional features may include track lighting, recessed lighting, and crown- molding. | Yes |

Market

The global manufactured housing market size was valued at $27,188 million in 2019 and is projected to reach $38,848 million by 2027. Manufactured housing is a revolutionary solution for the problem of affordable and quality accommodation globally. According to Manufactured Housing Institute (“MHI”) based in U.S., cost of construction per square foot is considerably less for manufactured housing units as compared to site build traditional homes.

Further, there is scant competition in the manufactured home rental space, as traditional manufactured home communities sell their homes to homeowners. The company, on the other hand, intends to rent the homes to tenants. Rents for similarly sized conventionally built homes can be $1,000 per month greater.

Several manufactured home communities have homes that are rented to tenants for prices consistent with what the company plans to charge, but for homes that are 30 years + old. All of the homes that the company intends to build will be brand new. In in-migration states such as Florida and others in the Southeast, rental demand is very strong, driving up considerably the rental cost of conventionally built homes, causing demand for more affordable rental housing. We believe the manufactured home fills this gap.

The 2008 financial crisis launched one of the largest distressed-buying opportunities in American history. By 2013, major institutional investors were buying homes through poorly disguised subsidiaries. Tens of thousands of homes built for homeowner sale were instead going into rental pools of regional and national rental operators.

As these large pools of undervalued homes began to disappear toward the end of the recession, institutional investors began searching around the country for new home product. Today, they have not abandoned their existing home acquisitions; however, they are showing acute interest in amassing large inventories of homes that carry with them the trait – “everything is new.” Build-For-Rents with new finishes and the latest appliances are in high demand, as are replacement properties for renters seeking to trade up.

The company believes that institutional investors prefer these new Build-For-Rents with standard builder warranty attributes that insulate them from significant operating expenses. With “new” homes, the rental operators can easily predict property taxes and property insurance as their primary, if not sole costs of operation.

Cultural and Generational Shifts in Housing

In addition to the post-recession impact on the Build-For-Rent market, there is an ongoing cultural/demographic shift impacting the affordable single-family residential sector in the US. There has been strong mid-level employment growth in Florida that has expanded the population and increased demand for rental properties in the company’s initial market.

More American families are renting homes now than ever before. This is a reversal from the Baby-Boomer generation that was dedicated to home ownership as a fundamental part of the “American Dream” between WWII and the end of the century. Baby-Boomers saw homes in the ‘70’s, ‘80’s and ‘90’s rapidly multiply in value. Those growth rates no longer exist in most US regions. Interestingly, many Baby-Boomers are also seeking rentals now.

Millennials in many cases don’t have the financial means to purchase a home. They also generally favor renting or leasing items instead of owning them as they are more focused on experiences than material goods. Furthermore, their joint family standard deduction on their annual tax returns of $24,000 competes with the itemized interest and property tax deductions for homes $400,000 or less in price. The lack of opportunity for capital appreciation and the loss of some of the tax deduction benefits are tipping the balance in the rent vs. buy equation.

Traditional garden apartments and townhomes have gotten expensive with rents approaching the $1,750 to $2,000 range in most growing metropolitan service areas. The company believes that renters are increasingly interested in detached living in homes and can achieve that with little or no increase in monthly rental cost.

As demographics have changed, cultural shifts have occurred and new tax laws have been implemented, the company believes that there has been a rush into rental housing. In turn, this has stoked acute demand among institutional investors for Build-For-Rent’s and created large opportunities for the company’s offerings.

Market Segment Size and Growth

Single Family Rental homes are the company’s target market:

| · | 3.9 million new rental units are forecast for 2016-2020, of which 1.5 million are expected to be homes. |

| | |

| · | 9.2% increase in home rental units from 2016-20. |

| | |

| · | Total target market is 17.2 million home rental units. |

Much of this growth is being fueled by the under-supply of rental housing inventory. Purchases of Build-For-Rent homes, to satisfy this demand, are being driven by large scale orders and requests for proposals from institutional investors. The company estimates that hundreds of billions of dollars are currently being invested in the single-family rental sector over the next five years.

Competition

There are numerous developers, private equity funds, and other home builders competing with the company in the development of manufactured home rental communities. Those competitors include, but are not limited to the following:

| | · | Toll Brothers |

| | · | Taylor Morrison |

| | · | NexMetro |

| | · | AHV Communities |

| | · | BB Living |

| | · | Christopher Todd Communities |

| | · | Camillo Homes. |

Further, we believe large developers like Lennar are likely to pursue this Build-For-Rent market in the near future. The company may differentiate itself from these other Build-For-Rent developers in a number of ways including the following:

| | · | Adding Eco Living options: |

| | o | Environmentally friendly alternatives that can potentially lower renters’ costs and/or allow landlords to increase rents. |

| | o | Features may include low e-impact windows, ISO insulation, venting, etc. These additions can be achieved for as low as $5-8 per square foot and make the home more appealing. |

| | · | Employ highly qualified land/entitlement/zoning executives to aggressively pursue and manage the bidding process. The company believes the bidding process will be the most competitive aspect with regards to the process of acquiring and developing manufactured rental home communities. |

Management Services from ERC Parent

ERC Communities 1 has entered into a revised management services agreement with ERC Parent effective as of August 5, 2019 (the “Management Services Agreement”). Under that agreement, ERC Parent will provide management services to ERC Communities 1. ERC Communities 1 will pay ERC Parent a monthly management fee of 3.0% of “assets under development”. “Assets under development” is calculated as the total amount of development assets in process, which would include the total costs of land, development and entitlement costs, all construction costs, and contractor fees. The monthly fee for each quarter will be determined by the amount of assets under development determined for the most recently completed quarter. ERC Parent may suspend or defer the management fee in its discretion if such management fee would cause the company financial hardship or negative cash flow.

The initial term of the agreement is for ten years. Upon expiration of the agreement, it will automatically renew for another two years. Either party can terminate the agreement provided 120 days written notice has been given to the other party. The agreement may also be terminated upon certain events of default, including material breaches of the agreement and also if one party files for bankruptcy or otherwise liquidates. In the event ERC Parent were to file for bankruptcy or otherwise liquidate, the company would have to seek another provider of management services or make arrangements for such services to be provided in-house, including the hiring of additional personnel.

The management team members of ERC Parent who will provide services to ERC Communities 1 currently are Gerald Ellenburg, and Ryan Koenig. The management team of the company consists of Gerald Ellenburg, and Ryan Koenig. See “Interest of Management and Others in Certain Transactions — Relationship with ERC Parent.”

While the company intends to have sufficient equity to procure mortgages on its own, in some cases it may have to rely on guarantees from other entities, including ERC Parent. There are currently no arrangements for such guarantees from any party, and the Management Services Agreement does not commit ERC Parent to make any such guarantees if the company has insufficient equity.

Employees

The company currently has no employees. Currently, three employees at ERC Parent dedicate all of their time to the company and two employees at ERC Parent spend half of their time working on matters related to ERC Communities 1. ERC Parent pays the employees.

Pursuant to the Management Services Agreement, ERC Parent intends to oversee the development and construction of our first projects. During the initial year of development and as the development nears completion, the ERC Parent executives will commence hiring the full-time direct staff that ERC Communities will then employ.

Regulation

It is likely that various licenses and permits will be required to operate our business, such as construction permits, county resale tax certificate, “Doing Business As” certificate and elevator and fire department certificates. As of December 31, 2022, the land clearing permit for ERC Zephyrhills 1 has been obtained. Other applicable permits for the ERC Zephyrhills 1 and ERC Zephyrhills 2 have not yet been acquired.

Litigation

We are not aware of any pending or threatened legal actions that we believe would have a material impact on our business.

Property

In August 2020, a subsidiary of the company, ERC Zephyrhills, acquired land in Zephyrhills, Florida for the development of a 60 unit manufactured home rental community located at 39575 North Avenue, Zephyrhills, FL 33542.

In September 2022, a subsidiary of the company, ERC Zephyrhills, acquired land in Zephyrhills, Florida for the development of a 58 unit manufactured home rental community located adjacent to 39575 North Avenue, Zephyrhills, FL 33542.

Conflicts of Interest

We are subject to various conflicts of interest arising out of our relationship with ERC Parent. We discuss these conflicts below.

General

ERC Parent is the parent company of ERC Communities 1 and currently holds all of the issued Common Stock of ERC Communities 1. ERC Parent is also affiliated with GolfSuites, and GolfSuites subsidiaries, many if not all of the executives are the same for ERC Parent, ERC Communities , GolfSuites, and GolfSuites subsidiaries.

The owners and executives of the company have legal obligations with respect to ERC Parent, GolfSuites, and GolfSuites subsidiaries that are similar to their obligations to us. In the future, these persons and other affiliates of these companies may organize/acquire for their own account real estate-related or debt-related investment programs. While ERC Parent and the company is not in direct competition with GolfSuites and GolfSuites subsidiaries since GolfSuites and its subsidiaries are focusing on developing commercial properties and ERC Communities is focusing on residential developments, there is a chance that certain of GolfSuites acquisitions could have been suitable for us.

Allocation of Our Affiliates’ Time

ERC Communities 1 currently relies on ERC Parent’s executive officers and other professionals who act on behalf of ERC Parent, for the day-to-day operation of our business. As the business matures, our intent is for our company to develop its own management team to take over the day-to-day operations of business.

Until that occurs and as a result of the executives competing responsibilities, their obligations to other investors and the fact that they will continue to engage in other business activities on behalf of themselves and others, they will face conflicts of interest in allocating their time to ERC Communities 1 and other entities and other business activities in which they are involved. However, the company believes that the executive officers and investment professionals have sufficient depth to fully discharge their responsibilities to the company and the other entities for which they work, see “The Company’s Business – Management Services from ERC Parent.”

Receipt of Fees and Other Compensation by ERC Parent and its Affiliates

ERC Parent and its affiliates will receive substantial fees from the company, which fees will not be negotiated at arm’s length. These fees could influence ERC Parent’s advice to the company as well as the judgment of the affiliated executives of ERC Parent and ERC Communities 1 (which are one in the same). For additional information see “The Company’s Business – Management Services from ERC Parent” for conflicts relating to the payment structure between ERC Parent and ERC Communities 1.

Item 2.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and the related notes included elsewhere in this Annual Report on Form 1-K. The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ significantly from those discussed in the forward-looking statements. Unless otherwise indicated, the latest results discussed below are as of December 31, 2022.

Overview

ERC Communities 1, Inc. is an early-stage company devoted to the development of residential real estate in the Florida area of the United States. The company incorporated in 2018 in the state of Delaware.

The company anticipates that its revenues will come from the following activities:

| | · | Sale of Build-For-Rent real estate |

| | · | Rental of Build-For-Rent real estate |

The company will collect revenue upon sale of a property and recognize the revenue when the sale is made. Operating expenses currently consist of advertising and marketing expenses and general administrative expenses.

Results of Operations

For the period ended December 31, 2022 (“Fiscal 2022”) the company had revenues in the amount of $0 compared to $660,000 for the period ended December 31, 2021 (“Fiscal 2021”). The Fiscal 2021 revenues were attributable to the sale of the land previously expected to be developed by Wesley Chapel.

The company’s cost of revenues decreased to $0 for Fiscal 2022 compared to $654,349 in Fiscal 2021 due cost of the Wesley Chapel property.

Total operating expenses for the year ended December 31, 2022, decreased to $32,780 from $53,702 for the year ended December 31, 2021, a decrease of $20,994 (39%). Professional fees related to the annual audit, accounting, and legal accounted for $27,905 in Fiscal 2022 and $52,000 in Fiscal 2021.

Other income (expense) includes Reg A share sale costs and interest expense. The company spent $80,704 in Fiscal 2022 and $51,966 in Fiscal 2021 in other expenses. These expenses were incurred due to the Reg A share sale costs.

As a result of the foregoing, the company generated a net loss for Fiscal 2022 in the amount of $113,484 compared to a net loss for Fiscal 2021 in the amount of $100,047.

Liquidity and Capital Resources

As of December 31, 2022, the company’s cash and cash equivalents was $187,558.

Currently, the company is not generating a profit. Accordingly, since inception ERC Homebuilders 1 has relied upon the cash advances from its current shareholder, ERC Parent, and management; mortgages on the properties; as well as funds raised from its Regulation A offering. The company plans to continue to try to raise additional capital through additional offerings. Absent additional capital, the company may be forced to significantly reduce expenses and could become insolvent.

Indebtedness

| · | Additional Paid-in Capital and Shareholder Advances in the amount of $1,931,398 as of December 31, 2022 |

| o | Since inception the company has relied upon the cash advances from its current shareholder, ERC Parent, and management. As of December 31, 2021 those advances totaled $1,004,499. |

| o | Since inception the company has relied upon the cash advances from shareholders of ERC Parent. As of December 31, 2021, those advances totaled $328,000. |

| o | During 2022 the total of these advances were converted to Additional Paid-in Capital in the amount of $1,931,398. |

| o | As these agreements are between related parties, there is no guarantee that these rates or costs are commensurate with an arm’s length arrangement. |

| · | On September 8, 2022, ERC Zephyrhills, LLC and R2R Capital – ERC Zephyrhills Lender, LLC, entered into a note payable in the amount of $1,200,000. The note is secured by the property located at Zephyrhills 1 and Zephyrhills 2. The loan is in contract to convert to a $8,500,000 note for land construction financing for the sites located at Zephyrhills 1 and Zephyrhills 2. The interest rate is prime plus 4.25%; 11.75% at December 31, 2022. The note calls for monthly interest only payments and matures March 6, 2023. Borrower is allowed to extend the maturity to March 6, 2024 by exercising two, six-month extensions. |

Trends

The company is now planning to include the use of manufactured homes in its development plans, to both increase the volume of units that the company will be able to development as well as to lower the costs of eventual rents.

The company believes that COVID-19 has sharpened renters’ desire and demand for separate living. The increase pricing and interest rates continue to make home rentals more attractive for families.

Going Concern

The company’s independent auditor, Artesian CPA, LLC audited the company’s consolidated financial statements as of December 31, 2022, assuming that the company will continue as a going concern. The company began operation in 2018 and has limited operating history. The company’s ability to continue is dependent upon management’s plan to raise additional funds and achieve and sustain profitable operations. The financial statements do not include any adjustments that might be necessary if the company is not able to continue as a going concern.

Item 3.

Directors, Executive Officers and Significant Employees

The table below sets forth the officers and directors of the company as of April 28, 2023.

| Name | | Position | | Employer | | Age | | Term of Office (If

indefinite give date

of appointment) |

| Gerald Ellenburg | | Director, Chairman and CEO | | ERC Communities, Inc. | | 74 | | November 8, 2018 - Present |

| Ryan Ellenburg | | Director | | ERC Communities, Inc. | | 41 | | January 6, 2023 - Present |

| Ryan Koenig | | President and COO | | ERC Communities, Inc. | | 45 | | November 8, 2018 - Present |

The table below sets forth the officers and directors of ERC Communities, Inc., (“ERC Parent”) as of April 28, 2023.

| Name | | Position | | Employer | | Age | | Term of Office (If

indefinite give date

of appointment) |

| Gerald Ellenburg | | Director

Chairman

Chief Executive Officer | | ERC Communities, Inc. | | 74 | | November 8, 2018 |

| Ryan Koenig | | Director

Chief Development Officer | | ERC Communities, Inc. | | 45 | | November 8, 2018 |

| Ryan Ellenburg | | Director | | ERC Communities, Inc. | | 41 | | January 6, 2023 |

| David A. Morris III | | Consulting CFO | | ERC Communities, Inc. | | 63 | | November 8, 2018 |

Gerald Ellenburg

Gerald Ellenburg (“Jerry”) is the Chairman and Chief Executive Officer of ERC Parent since August 2016. Jerry also serves as the Chairman and Chief Executive Officer of GolfSuites, Inc. since October 2018. Jerry has a total of 35 years of experience in the following areas:

| | · | management and the financing of multi-family properties and |

| | · | management of over $750 million in debt and equity financings. |

This includes Jerry’s work with Ryan Koenig at ERC Homes, LLC. They worked together at ERC Homes, LLC from 2011 until the present time. ERC Homes is a home renovation and new-construction development company that developed approximately 175 homes during this time-period. The primary activity of ERC Homes was the acquisition and renovation of bank-foreclosed single-family residences.

Jerry graduated from the University of California, Berkeley in 1971, and is a California-licensed CPA (inactive).

Ryan Koenig

Ryan Koenig is the President and Chief Operating Officer of ERC Communities, Inc., a position he has held since December 2018. From March 2011 until the present, he has been the Chief Development Officer at eResidential and Commercial LLC (ERC Homes), where he worked with Jerry Ellenburg. Ryan has over 20 years of experience in real estate development and construction with the following companies: Wood Partners Camden Properties, Turner Construction and Zaremba Development. Ryan has overseen approximately $500 million in completed construction projects.

David A. Morris III

David Morris is the Consulting Chief Financial Officer at ERC Communities, Inc. since March 2011 until present. David was also the Consulting Chief Financial Officer of GolfSuites since August 2016. David has over 30 years of experience in finance and financial forensics. During his tenure at ERC Parent, David will oversee the following:

David’s’ career has included the Vice-Presidency of Finance at Belz Enterprises, a large real estate development and management company from. David graduated from the University of Wisconsin, La Crosse, in 1980 and is a Tennessee-licensed CPA.

Ryan Ellenburg

Ryan Ellenburg was appointed as member of the Board of Directors of the company on January 6, 2023. Ryan Ellenburg has been consulting with the capital markets team for ERC Communities, Inc., ERC Communities 1, Inc., GolfSuites, Inc., and GolfSuites 1, Inc. since June 2019. In January 2023, Ryan joined the board of directors for ERC Communities, Inc., and ERC Communities 1, Inc. Previously, from September 2017 until June 2019, Ryan was employed by Allied Universal as a security contractor. During that time frame his primary clients were PG&E and ServiceNow. Ryan is no stranger to technology and finance and has been improving systems since value engineering construction projects in college and then overseeing standard upgrades for worldwide Silicon Valley accounts. Mr. Ellenburg is a graduate of the Georgia Institute of Technology in 2004.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

ERC Parent paid certain officers and directors of the company the following amounts as of December 31, 2022, for the services they provided to the company.

| Executive Officer or Director | | Total Amount

Received | |

| Gerald Ellenburg | | $ | 129,520 | |

| Ryan Koenig | | $ | 186,601 | |

In the future, the company will have to pay its officers, directors and other employees, which will impact the company’s financial condition and results of operations, as discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The company may choose to establish an equity compensation plan for its management and other employees in the future. Further, as the company grows, the company intends to add additional executives, including but not limited to, a General Manager and other vice presidents for operations, finance and administration.

Item 4. Security Ownership of Management and Certain Securityholders

The following table sets out, as of December 31, 2022, ERC Communities 1 voting securities that are owned by our executive officers, directors and other persons holding more than 10% of the company’s voting securities.

| Title of class | | Name and address of

beneficial owner | | Amount and nature

of beneficial

ownership | | | Amount and nature

of beneficial

ownership

acquirable | | Percent of class | |

| Class B Common Stock | | ERC Home Builders, Inc.

650 East Bloomingdale Avenue, Brandon, FL 33511 | | | 16,000,000 | | | N/A | | | 100 | % |

There are currently no outstanding shares of our Class A Common Stock and 64,318 outstanding shares of Class A Preferred Stock, where no person owners more than 10%.

The following table sets out, as of December 31, 2022, ERC Parent’s voting securities that are owned by our executive officers, directors and other persons holding more than 10% of ERC Parent’s voting securities.

| Title of class | | Name and address of

beneficial owner | | Amount and nature

of beneficial ownership | | | Amount and nature

of beneficial

ownership acquirable | | Percent of class | |

| Class B Common Stock | | Gerald Ellenburg | | | 63,800,000 | | | N/A | | | 30.4 | % |

| | | Ryan Koenig | | | 39,300,000 | | | N/A | | | 18.7 | % |

| (1) | The address for all the executive officers, directors, and beneficial owners is c/o ERC Communities, Inc. 650 East Bloomingdale Avenue, Brandon, FL 33511. |

Item 5. Interest of Management and Others in Certain Transactions

Relationship with ERC Parent

The company has received working capital, to cover expenses and costs while preparing for the securities offering, from ERC Parent and various of its shareholders. The total of these advances was converted to Additional Paid-in Capital in 2022 the balance of these advances at December 31, 2021 totaled $1,332,499.See “Management’s Discussion and Analysis of Financial Condition and Results of Operations– Liquidity and Capital Resources – Indebtedness.” In the future, the company anticipates that it will continue to receive working capital from ERC Parent. As these agreements are between related parties, there is no guarantee that these rates or costs are commensurate with an arm’s length arrangement.

The company has issued 16,000,000 shares of Class B Common Stock to ERC Parent, at par, in exchange for $160.

The company has received working capital to cover expenses and costs while preparing for the securities offering from shareholders of ERC Parent in the amount of $328,000 as of December 31, 2021. The balance of these covered costs is recorded as a liability of the company. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations– Liquidity and Capital Resources – Indebtedness.”

Additional Paid-in Capital and Shareholder Advances in the amount of $1,931,398 as of December 31, 2022

| · | Since inception the company has relied upon the cash advances from its current shareholder, ERC Parent, and management. As of December 31, 2021 those advances totaled $1,004,499. |

| · | Since inception the company has relied upon the cash advances from shareholders of ERC Parent. As of December 31, 2021, those advances totaled $328,000. |

| · | During 2022 the total of these advances were converted to Additional Paid-in Capital in the amount of $1,931,398. |

| · | As these agreements are between related parties, there is no guarantee that these rates or costs are commensurate with an arm’s length arrangement. |

Management Services Agreement

The company has entered into a Management Services Agreement with ERC Parent. Pursuant to this agreement, ERC Parent provides services to ERC Communities 1 including:

| | · | Supervision the operations of ERC Communities 1, and |

| | · | Management of all necessary negotiations relating to the business, personnel, etc. |

In return for the aforementioned services ERC Communities 1 has agreed to pay ERC Parent a monthly management fee of 3.0% of the assets under development. The initial term of the agreement is for ten years. See “The Company’s Business – Management Services from ERC Parent”.

Some of the parties involved with the operation and management of the company, including two of our three directors, Gerald Ellenburg and Ryan Koenig, are also officers and directors in ERC Parent. These persons have legal obligations with respect to ERC Parent that are similar to their obligations to us.

Relationship with GolfSuites, Inc.

Some of the parties involved with the operation and management of the company, including Gerald Ellenburg, David Morris, Ryan Koenig, and Scott Smylie, have other relationships that may create disincentives to act in the best interest of the company and its investors. These parties are also involved with KGEM Golf, Inc. in similar capacities. While the company will not be competing for the same real estate interests as KGEM Golf, Inc., there is no guarantee that these conflicts may inhibit or interfere with the sound and profitable operation of the company.

Item 6. Other Information

None.

Item 7.

FINANCIAL STATEMENTS

| ERC Communities 1, Inc. |

| and Subsidiaries |

Consolidated Financial Statements

As of, and for the Years Ended December 31, 2022 and 2021

INDEPENDENT AUDITOR’S REPORT

April 25, 2023

To: Board of Directors, ERC Communities 1, Inc.

Re: 2022 Consolidated Financial Statement audit

We have audited the accompanying consolidated financial statements of ERC Communities 1, Inc. and subsidiaries (the “Company”), which comprise the balance sheet as of December 31, 2022 and 2021, and the related statements of loss and comprehensive loss, changes in shareholders’ equity, and cash flows for the calendar year periods ended 2021 and 2020, and the related notes to such consolidated financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of the Company’s financial statements in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion.

An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of its operations, shareholder equity and its cash flows for the calendar years ended 2022 and 2021 and in accordance with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in the notes to the financial statements, the Company has stated that substantial doubt exists about the Company's ability to continue as a going concern. Management's evaluation of the events and conditions and management's plans regarding these matters are also described in the Notes to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to this matter.

Sincerely,

IndigoSpire CPA Group IndigoSpire CPA Group |

IndigoSpire CPA Group, LLC

Aurora, Colorado

April 25, 2023

| ERC Communities 1, Inc. |

| and Subsidiaries |

| Consolidated Financial Statements |

| As of, and for the Years Ended December 31, 2022 and 2021 |

Table of Contents

| ERC Communities 1, Inc. and Subsidiaries |

| Consolidated Balance Sheets |

| As of December 31, 2022 and 2021 |

| | | 2022 | | | 2021 | |

| ASSETS |

| Current assets |

| Cash and cash equivalents | | $ | 187,558 | | | $ | 2,506 | |

| Property, plant and equipment |

| Land | | | 1,697,641 | | | | 1,018,768 | |

| Construction-in-progress | | | 590,547 | | | | 3,995 | |

| Total property, plant and equipment | | | 2,288,188 | | | | 1,022,763 | |

| Other assets | | | - | | | | 25,000 | |

| TOTAL ASSETS | | $ | 2,475,746 | | | $ | 1,050,269 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| |

| Liabilities |

| Current liabilities |

| Notes payable, current portion | | $ | - | | | $ | 500,000 | |

| Non-current Liabilities |

| Notes payable, long-term portion | | | 1,200,000 | | | | - | |

| Advances from shareholders of ERC Communities, Inc. (parent company) | | | - | | | | 328,000 | |

| Advances from ERC Communities, Inc. (parent company) | | | - | | | | 1,004,499 | |

| Total non-current liabilities | | | 1,200,000 | | | | 1,332,499 | |

| TOTAL LIABILITIES | | | 1,200,000 | | | | 1,832,499 | |

| Shareholders' equity |

| Common stock, Class A: 134,000,000 shares authorized, $0.00001 par, 0 shares issued and outstanding | | | - | | | | - | |

| Common stock, Class B: 16,000,000 shares authorized, $0.00001 par, 16,000,000 shares issued and outstanding | | | 160 | | | | 160 | |

| Additional paid-in capital | | | 1,931,398 | | | | - | |

| Preferred stock, Class A: 8,333,333 shares authorized, 90,672 and 64,318 shares issued and outstanding, respectively | | | 673,010 | | | | 384,266 | |

| Preferred stock, other: 41,666,667 shares authorized, no shares issued and outstanding | | | - | | | | - | |

| Retained deficit, net of distributions | | | (1,328,822 | ) | | | (1,166,656 | ) |

TOTAL STOCKHOLDERS' EQUITY | | | 1,275,746 | | | | (782,230 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 2,475,746 | | | $ | 1,050,269 | |

The accompanying notes are an integral part of these financial statements.

| ERC Communities 1, Inc. and Subsidiaries |

| Consolidated Statement of Operations |

| For the Years Ended December 31, 2022 and 2021 |

| | | 2022 | | | 2021 | |

| Revenues | | $ | - | | | $ | 660,000 | |

| Cost of revenues | | | - | | | | 654,349 | |

| Gross profit | | | - | | | | 5,651 | |

| Operating expenses | | | | | | | | |

| Advertising and marketing | | | - | | | | - | |

| Salaries | | | | | | | | |

| Operational | | | - | | | | - | |

| Corporate | | | - | | | | - | |

| Property lease and affiliated costs | | | - | | | | - | |

| Equipment and repairs | | | - | | | | - | |

| Utilities and telephone | | | - | | | | - | |

| Insurance | | | - | | | | - | |

| Professional fees | | | 27,905 | | | | 52,000 | |

| Property and local taxes | | | 2,600 | | | | 1,038 | |

| Other selling, general and administrative | | | 2,275 | | | | 664 | |

| Total operating expenses | | | 32,780 | | | | 53,702 | |

| Operating loss | | | (32,780 | ) | | | (48,051 | ) |

| Other expenses | | | | | | | | |

| Reg A share sale costs | | | 80,704 | | | | 51,996 | |

| Interest expense | | | - | | | | - | |

| Total other expenses | | | 80,704 | | | | 51,996 | |

| Net loss | | $ | (113,484 | ) | | $ | (100,047 | ) |

| | | | | | | | | |

| Basic loss per common share | | $ | (0.00709 | ) | | $ | (0.00625 | ) |

| Diluted loss per common share | | $ | (0.00706 | ) | | $ | (0.00623 | ) |

The accompanying notes are an integral part of these financial statements.

| ERC Communities 1, Inc. and Subsidiaries |

| Consolidated Statement of Stockholders' Equity (Deficit) |

| For the Years Ended December 31, 2022 and 2021 |

| | | | | | | | | | | | | | | | | | Retained | | | | |

| | | Class A | | | Class B | | | Additional | | | Class A | | | Other | | | Earnings, | | | Stockholders' | |

| | | Common Stock | | | Common Stock | | | Paid-in | | | Preferred Stock | | | Preferred Stock | | | Net of | | | Equity | |

| | | Shares | | | Value | | | Shares | | | Value | | | Capital | | | Shares | | | Value | | | Shares | | | Value | | | Distributions | | | (Deficit) | |

| Balance as of December 31, 2020 | | | - | | | $ | - | | | | 16,000,000 | | | $ | 160 | | | $ | - | | | | 64,318 | | | $ | 384,266 | | | | - | | | $ | - | | | $ | (1,033,623 | ) | | $ | (649,197 | ) |

| Share issuance and contributed capital | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (100,047 | ) | | | (100,047 | ) |

| Dividends | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (32,986 | ) | | | (32,986 | ) |

| Balance as of December 31, 2021 | | | - | | | | - | | | | 16,000,000 | | | | 160 | | | | - | | | | 64,318 | | | | 384,266 | | | | - | | | | - | | | | (1,166,656 | ) | | | (782,230 | ) |

| Share issuance and contributed capital | | | - | | | | - | | | | - | | | | - | | | | 1,931,398 | | | | 26,354 | | | | 288,744 | | | | - | | | | - | | | | - | | | | 2,220,142 | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (113,484 | ) | | | (113,484 | ) |

| Dividends | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (48,682 | ) | | | (48,682 | ) |

| Balance as of December 31, 2022 | | | - | | | $ | - | | | | 16,000,000 | | | $ | 160 | | | $ | 1,931,398 | | | | 90,672 | | | $ | 673,010 | | | | - | | | $ | - | | | $ | (1,328,822 | ) | | $ | 1,275,746 | |

The accompanying notes are an integral part of these financial statements.

| ERC Communities 1, Inc. and Subsidiaries |

| Consolidated Statement of Cash Flows |

| For the Years Ended December 31, 2022 and 2021 |

| | | 2022 | | | 2021 | |

| Cash Flows from Operating Activities | | | | | | | | |

| Net loss | | $ | (113,484 | ) | | $ | (100,047 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | | |

| Changes in operating assets and liabilities | | | | | | | | |

| Other assets | | | 25,000 | | | | (9,000 | ) |

| Reg A share sale costs | | | 80,704 | | | | 51,996 | |

| Net cash used in operating activities | | | (7,780 | ) | | | (57,051 | ) |

| | | | | | | | | |

| Cash Flows from Investing Activities | | | | | | | | |

| Property, plant and equipment acquisitions | | | (1,265,425 | ) | | | (192,248 | ) |

| | | | | | | | | |

| Cash Flows from Financing Activities | | | | | | | | |

| Proceeds from notes payable | | | 1,200,000 | | | | - | |

| Capital contribution | | | 1,931,398 | | | | - | |

| Principal payments on notes payable | | | (500,000 | ) | | | - | |

| Advances from shareholders of ERC Communities, Inc. (parent company) | | | (328,000 | ) | | | - | |

| Advances from ERC Communities, Inc. (parent company) | | | (1,004,499 | ) | | | 332,105 | |

| Issuance of preferred stock | | | 288,744 | | | | - | |

| Dividends | | | (48,682 | ) | | | (32,986 | ) |

| Reg A share sale costs | | | (80,704 | ) | | | (51,996 | ) |

| Net cash provided by financing activities | | | 1,458,257 | | | | 247,123 | |

| Net Change In Cash and Cash Equivalents | | | 185,052 | | | | (2,176 | ) |

| Cash and Cash Equivalents, Beginning of Period | | | 2,506 | | | | 4,682 | |

| Cash and Cash Equivalents, End of Period | | $ | 187,558 | | | $ | 2,506 | |

The accompanying notes are an integral part of these financial statements.

ERC Communities 1, Inc.

Notes to Financial Statements

As of December 31, 2022

NOTE 1 - NATURE OF OPERATIONS

ERC Communities 1, Inc. (which may be referred to as “ERC 1”, the “Company,” “we,” “us,” or “our”) is an early-stage company devoted to the development of residential real estate in the Florida area of the United States. The Company incorporated in 2018 in the state of Delaware.

ERC 1 is an SEC registered entity under Regulation A Plus – Tier 2 (“Reg A”). As of December 31, 2022 preferred shareholders owned 177,584 convertible preferred shares, which can be converted on a one-to-one basis for common shares, at any time.

In July 2020 the Company formed a limited liability company – ERC Zephyrhills, LLC, a Florida limited liability company (“Zephyrhills”) which now owns two parcels for development and is in contract for two additional parcels – a 60-unit site was acquired in August 2020, an adjacent 60- unit site was acquired in September 2022, and two additional sites are in contract – a 45-unit site adjacent to the two referenced sites and a 90-unit site approximately 5 miles away from the three referenced sites, both of which are scheduled to close escrow in the second and third quarters of 2023.

There currently exists a $1,200,000 mortgage, on the two owned sites, which is in contract to convert to $8,500,000 of land construction financing for the two owned sites. Additionally, the same lender is in contract to provide mortgage financing for the third and fourth sites, as well as construction financing for those sites.

On January 27, 2021, the Company formalized the formation of ERC Wesley Chapel, LLC (“Wesley Chapel”), a Florida limited liability company. Wesley Chapel acquired land with a cost of $548,500 for the development of a 40-unit manufactured home development. The land was secured by a mortgage of $355,000. In December 2021, the plans for Wesley Chapel were terminated, the land was sold, and the mortgage was paid off.

Since inception, the Company has relied on advances from affiliates to fund its operations. As of December 31, 2022, the Company had little working capital and will likely incur losses prior to generating positive working capital. These matters raise substantial concern about the Company’s ability to continue as a going concern (see Note below). During the next 12 months, the Company intends to fund its operations with funding from a securities offering campaign and funds from revenue producing activities, if and when such operations and offerings can be realized. If the Company cannot secure additional short-term capital, it may cease operations. These financial statements and related notes thereto do not include any adjustments that might result from these uncertainties.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America ("GAAP"). The Company has adopted December 31 as the year end for reporting purposes.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the footnotes thereto. Actual results could differ from those estimates. It is reasonably possible that changes in estimates will occur in the near term.

Risks and Uncertainties

The Company has a limited operating history. The Company's business and operations are sensitive to general business and economic conditions in the United States. A host of factors beyond the Company's control could cause fluctuations in these conditions. Adverse conditions may include: recession, economic downturn, local competition or changes in consumer taste. These adverse conditions could affect the Company's financial condition and the results of its operations. As of December 31, 2022 the Company is operating as a going concern.

Cash and Cash Equivalents

The Company considers short-term, highly liquid investments with original maturities of three months or less, at the time of purchase, to be cash equivalents. Cash consists of currency held in the Company’s checking account. As of December 31, 2022 and 2021 the Company had Cash and Cash Equivalents of $187,558 and $2,506, respectively.

Receivables and Credit Policy

Trade receivables from customers are uncollateralized customer obligations due under normal trade terms. Trade receivables are stated at the amount billed to the customer. Payments of trade receivables are allocated to the specific invoices identified on the customer’s remittance advice or, if unspecified, are applied to the earliest unpaid invoice. The Company, by policy, routinely assesses the financial strength of its customers. As a result, the Company believes that its accounts receivable credit risk exposure is limited and it has not experienced significant write-downs in its accounts receivable balances. As of December 31, 2022 and 2021 the Company did not have any outstanding accounts receivable.

Property and Equipment

Property and equipment are recorded at cost. Expenditures for renewals and improvements that significantly add to the productive capacity or extend the useful life of an asset are capitalized. Expenditures for maintenance and repairs are expensed as incurred. When equipment is retired or sold, the cost and related accumulated depreciation are eliminated from the balance sheet accounts and the resultant gain or loss is reflected in income.

Depreciation is provided using the straight-line method, based on useful lives of the assets. As of December 31, 2022 and 2021 the Company had no depreciable assets. Therefore, no depreciation expense is reported in the financial statements.

The Company reviews the carrying value of property and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition, and other economic factors. As of December 31, 2022, the Company’s assets include land for development (including capitalized carrying costs) and construction-in-process.

Income Taxes

Income taxes are provided for the tax effects of transactions reporting in the financial statements and consist of taxes currently due plus deferred taxes related primarily to differences between the basis of receivables, inventory, property and equipment, intangible assets, cryptocurrency valuation and accrued expenses for financial and income tax reporting. Deferred tax assets and liabilities represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all the deferred tax assets will not be realized.

The Company is taxed as a C Corporation for federal and state income tax purposes. Due to its startup position, no tax benefits have been recorded to reflect net operating loss carry forwards. When the Company becomes profitable, the tax loss benefit will be recorded.

The Company evaluates its tax positions that have been taken or are expected to be taken on income tax returns to determine if an accrual is necessary for uncertain tax positions. As of December 31, 2022 and 2021, no accruals were needed for uncertain tax positions.

The Company is current with its foreign, US federal and state income tax filing obligations and is not currently under examination from any taxing authority.

Revenue Recognition

In 2019, the Company adopted ASC 606, Revenue from Contracts with Customers, as of inception. There was no transition adjustment recorded upon the adoption of ASC 606. Under ASC 606, revenue is recognized when a customer obtains control of promised goods or services, in an amount that reflects the consideration which the entity expects to receive in exchange for those goods or services.

To determine revenue recognition for arrangements that an entity determines are within the scope of ASC 606, the Company performs the following steps: (i) identify the contract(s) with a customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations in the contract and (v) recognize revenue when (or as) the entity satisfies a performance obligation. At contract inception, once the contract is determined to be within the scope of ASC 606, the Company assesses the goods or services promised within each contract and determines those that are performance obligations and assesses whether each promised good or service is distinct. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when (or as) the performance obligation is satisfied.

In December 2021 $660,000 of revenue was recognized from the sale of the land previously expected to be developed as Wesley Chapel.

Advertising Expenses

The Company expenses advertising costs as they are incurred.

Organizational Costs

In accordance with GAAP, organizational costs, including accounting fees, legal fees, and costs of incorporation, are expensed as incurred.

Earnings per Share

Earnings per share amounts are calculated based on the weighted-average number of shares of common stock outstanding in each year. The basic loss per share is based only on the weighted- average of common shares outstanding. The diluted loss per share is based on the weighted- average of common shares outstanding plus Class A preferred shares, which are convertible to one share of common stock.

Concentration of Credit Risk

The Company maintains its cash with a major financial institution located in the United States of America, which it believes to be credit worthy. The Federal Deposit Insurance Corporation insures balances up to $250,000. At times, the Company may maintain balances in excess of the federally insured limits.

Recent Accounting Pronouncements

In February 2016, FASB issued ASU No. 2016-02, Leases, that require organizations that lease assets, referred to as "lessees", to recognize on the balance sheet the assets and liabilities for the rights and obligations created by those leases with lease terms of more than 12 months. ASU 2016- 02 will also require disclosures to help investors and other financial statement users better understand the amount, timing, and uncertainty of cash flows arising from leases and will include qualitative and quantitative requirements. The new standard for nonpublic entities became effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. The Company implemented ASU No. 2016-02 for lease accounting for 2020.

The FASB issues ASUs to amend the authoritative literature in ASC. There have been a number of ASUs to date, including those above, that amend the original text of ASC. Management believes that those issued to date either (i) provide supplemental guidance, (ii) are technical corrections,

(iii) are not applicable to us or (iv) are not expected to have a significant impact our balance sheet.

NOTE 3 – INCOME TAX PROVISION

As described above, the Company was recently formed and has only incurred costs of its start-up operations and capital raising. As such, no material tax provision yet exists.

NOTE 4 – COMMITMENTS AND CONTINGENCIES

Legal Matters

The Company is not currently involved with and does not know of any pending or threatening litigation against the Company or founders.

NOTE 5 – EQUITY

The Company has issued 16,000,000 shares of Class B Common Stock to its parent company, at par, in exchange for $160. In 2022 ERC also contributed $1,931,398 to ERC 1 that is shown on the balance sheet as Additional Paid-in Capital. The Company has authorized 134,000,000 shares of Class A common stock and 50,000,000 shares of preferred stock, of which 8,333,333 shares are designated as Class A preferred stock which is convertible into Class A common stock. None of the Class A common stock has been issued. As of December 31, 2022 and 2021, 90,672 and 64,318 shares, respectively, of Class A preferred stock have been issued. The company is offering to sell up to 8,333,333 shares of Class A preferred stock as part of a Regulation A offering (discussed more below).

Class A common stockholders are entitled to a single vote per share and have equal dividend and liquidation preferences as Class B common stockholders. Class B common stockholders have five votes per share and shares of Class B common stock can be converted into shares of Class A common stock at the option of the holder. Class A preferred stockholders are entitled to a single vote per share and to an 8 percent annual dividend, which will accrue if funds are not legally available to distribute, in addition to a liquidation preference. Shares of Class A preferred stock can be converted into shares of Class A common stock at the option of the holder and shares will be automatically converted in the event of a qualified public offering, as defined in the Amended and Restated Certificate of Incorporation.

NOTE 6 – NOTES PAYABLE

Notes payable at December 31, 2022 and 2021 consists of the following debt instruments.

| | | 2022 | | | 2021 | |

| Zephyrhills - Note payable, dated September 8, 2022, secured by a mortgage on land with an interest rate of prime plus 4.25%; 11.75% at December 31, 2022. The note calls for monthly interest only payments and matures March 6, 2023. Borrower is allowed to extend the maturity to March 6, 2024 by exercising two, six month extensions. Therefore, the balance at December 31, 2022 is classified as long-term. | | $ | 1,200,000 | | | $ | - | |

| Zephyrhills - Note payable secured by a mortgage on land with an interest rate of 12%. Interest only payments are due monthly. The note matures September 30, 2022. | | | - | | | | 500,000 | |

| Total | | $ | 1,200,000 | | | $ | 500,000 | |

Interest on the Zephyrhills mortgage has been capitalized as development costs and is included in Land on the balance sheet.

NOTE 7 – RELATED PARY TRANSACTIONS

The Company has received working capital, to cover expenses and costs while preparing for the securities offering, from ERC and various of its shareholders. The total of these advances was converted to Additional Paid-in Capital in 2022 (see Note 5 – Equity, above); the balance of these advances at December 31, 2021 totaled $1,332,499.

NOTE 8 – GOING CONCERN

These financial statements are prepared on a going concern basis. The Company began operation in 2018 and has limited operating history. The Company’s ability to continue is dependent upon management’s plan to raise additional funds and achieve and sustain profitable operations. The financial statements do not include any adjustments that might be necessary if the Company is not able to continue as a going concern.

NOTE 9 – SUBSEQUENT EVENTS

Management’s Evaluation

Management has evaluated subsequent events through April 25, 2023, the date these financial statements were issued. Based on this evaluation, no material subsequent events were identified which would require adjustment or disclosure in the financial statements of December 31, 2022.

| ERC Communities 1, Inc. and Subsidiaries |

| Consolidating Balance Sheets |

| As of December 31, 2022 and 2021 |

| | | ERC | | | ERC | | | | | | | | | | |

| | | Communities 1, | | | Zephyrhills, | | | | | | | | | Consolidated | |

| | | Inc. | | | LLC | | | Combined | | | Eliminations | | | 2022 | | | 2021 | |

| ASSETS | | | | | | | | | | | | | | | | | | | | | | | | |

| Current assets | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 160,124 | | | $ | 27,434 | | | $ | 187,558 | | | $ | - | | | $ | 187,558 | | | $ | 2,506 | |

| Property, plant and equipment | | | | | | | | | | | | | | | | | | | | | | | | |

| Land | | | - | | | | 1,697,641 | | | | 1,697,641 | | | | - | | | | 1,697,641 | | | | 1,018,768 | |

| Construction-in-progress | | | - | | | | 590,547 | | | | 590,547 | | | | - | | | | 590,547 | | | | 3,995 | |

| Total property, pland and equipment | | | - | | | | 2,288,188 | | | | 2,288,188 | | | | - | | | | 2,288,188 | | | | 1,022,763 | |

| Other assets | | | | | | | | | | | | | | | | | | | | | | | | |

| Other assets | | | - | | | | - | | | | - | | | | - | | | | - | | | | 25,000 | |

| Intercompany advances | | | 1,115,991 | | | | - | | | | 1,115,991 | | | | (1,115,991 | ) | | | - | | | | - | |

| Total other assets | | | 1,115,991 | | | | - | | | | 1,115,991 | | | | (1,115,991 | ) | | | - | | | | 25,000 | |

| TOTAL ASSETS | | $ | 1,276,115 | | | $ | 2,315,622 | | | $ | 3,591,737 | | | $ | (1,115,991 | ) | | $ | 2,475,746 | | | $ | 1,050,269 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

| Notes payable, current portion | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 500,000 | |

| Non-current Liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

| Notes payable, long-term portion | | | - | | | | 1,200,000 | | | | 1,200,000 | | | | - | | | | 1,200,000 | | | | - | |

| Advances from shareholders of ERC Communities, Inc. (parent company) | | | - | | | | - | | | | - | | | | - | | | | - | | | | 328,000 | |

| Advances from ERC Communities, Inc. (parent company) | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,004,499 | |

| Intercompany advances | | | - | | | | 1,115,991 | | | | 1,115,991 | | | | (1,115,991 | ) | | | - | | | | - | |

| Total non-current liabilities | | | - | | | | 2,315,991 | | | | 2,315,991 | | | | (1,115,991 | ) | | | 1,200,000 | | | | 1,332,499 | |

| TOTAL LIABILITIES | | | - | | | | 2,315,991 | | | | 2,315,991 | | | | (1,115,991 | ) | | | 1,200,000 | | | | 1,832,499 | |

| Equity | | | | | | | | | | | | | | | | | | | | | | | | |

| Member equity | | | - | | | | (369 | ) | | | (369 | ) | | | 369 | | | | - | | | | - | |

| Common stock, Class A | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Common stock, Class B | | | 160 | | | | - | | | | 160 | | | | - | | | | 160 | | | | 160 | |

| Additional Paid-in Capital | | | 1,931,398 | | | | - | | | | 1,931,398 | | | | - | | | | 1,931,398 | | | | - | |

| Preferred stock, Class A | | | 673,010 | | | | - | | | | 673,010 | | | | - | | | | 673,010 | | | | 384,266 | |

| Preferred stock, other | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Retained earnings | | | (1,328,453 | ) | | | - | | | | (1,328,453 | ) | | | (369 | ) | | | (1,328,822 | ) | | | (1,166,656 | ) |

| TOTAL EQUITY | | | 1,276,115 | | | | (369 | ) | | | 1,275,746 | | | | - | | | | 1,275,746 | | | | (782,230 | ) |

| TOTAL LIABILITIES AND EQUITY | | $ | 1,276,115 | | | $ | 2,315,622 | | | $ | 3,591,737 | | | $ | (1,115,991 | ) | | $ | 2,475,746 | | | $ | 1,050,269 | |

The accompanying notes are an integral part of these financial statements.

| ERC Communities 1, Inc. and Subsidiaries |

| Consolidating Statement of Operations |

| For the Years Ended December 31, 2022 and 2021 |

| | | ERC | | | ERC | | | | | | | | | | |

| | | Communities | | | Zephyrhills, | | | | | | | | | Consolidated | |

| | | 1, Inc. | | | LLC | | | Combined | | | Eliminations | | | 2022 | | | 2021 | |

| Revenues | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 660,000 | |

| Cost of revenues | | | - | | | | - | | | | - | | | | - | | | | - | | | | 654,349 | |

| Gross profit | | | - | | | | - | | | | - | | | | - | | | | - | | | | 5,651 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| Advertising and marketing | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Salaries | | | | | | | | | | | | | | | | | | | | | | | | |

| Operational | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Corporate | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Property lease and affiliated costs | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Equipment and repairs | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Utilities and telephone | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Insurance | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Professional fees | | | 27,905 | | | | - | | | | 27,905 | | | | - | | | | 27,905 | | | | 52,000 | |

| Property and local taxes | | | 2,600 | | | | - | | | | 2,600 | | | | - | | | | 2,600 | | | | 1,038 | |

| Other selling, general and administrative | | | 2,275 | | | | - | | | | 2,275 | | | | - | | | | 2,275 | | | | 664 | |

| Total operating expenses | | | 32,780 | | | | - | | | | 32,780 | | | | - | | | | 32,780 | | | | 53,702 | |