UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended: June 30, 2023

ERC Communities 1, Inc.

(Exact name of issuer as specified in its charter)

| Delaware | | 83-2379196 |

| (State or other jurisdiction of | | (IRS Employer |

| incorporation or organization) | | Identification No.) |

650 E. Bloomingdale Ave.

Brandon, Florida 33511 | | 33511 |

| (Address of principal executive offices) | | (Zip code) |

(813) 621-5000

(Registrant’s telephone number, including area code)

Class A Preferred Stock

(Title of each class of securities issued pursuant to Regulation A)

In this semi-annual report, the term “ERC Communities,” “ERC Communities 1,” “ERC 1,” “we,” “us” “our” or “the company” refers to ERC Communities 1, Inc., (f/k/a “ERC Homebuilders 1, Inc.) a Delaware corporation and its subsidiary ERC Zephyrhills, LLC (“ERC Zephyrhills”).

The following information contains certain forward-looking statements. Forward-looking statements are statements that estimate the happening of future events and are not based on historical fact. Forward-looking statements may be identified by the use of forward-looking terminology, such as “may,” “could,” “expect,” “estimate,” “anticipate,” “plan,” “predict,” “probable,” “possible,” “should,” “continue,” or similar terms, variations of those terms or the negative of those terms. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

Item 1. Management’s discussion and analysis of financial condition and results of operations

SUMMARY

Overview

ERC Communities 1, Inc., a Delaware corporation aims to develop manufactured home rental communities (“MHR”) in Florida and then expand to other state specific locations in the United States. These communities are also often referred to as “Built for Rent” communities.

ERC 1 was incorporated in Delaware on October 24, 2018, as ERC Home Builders South Florida, Inc. On February 19, 2019, the company changed its name to ERC Homebuilders 1, Inc., and then subsequently changed its name to ERC Communities 1, Inc. on December 3, 2020. ERC 1 is a subsidiary of ERC Communities, Inc., (“ERC Parent”). ERC Communities 1 is currently the only operating subsidiary of ERC Parent.

As of September 15, 2023, ERC Communities 1 has one wholly owned subsidiary, ERC Zephyrhills, LLC (“ERC Zephyrhills”), a Florida limited liability. ERC Zephyrhills owns three parcels of land for development: (i) a 60-unit development site in Zephyrhills, Florida (“ERC Zephyrhills 1”) acquired in August 2020, (ii) a 60-unit site adjacent to the existing site (“ERC Zephyrhills 2”) was acquired in September 2022 and (iii) an additional 65-unit site adjacent to the existing sites (“ERC Zephyrhills 3”) was acquired in July 2023. Further, ERC Zephyrhills has contracted to purchase 90 unit site approximately 5 miles away from the three aforementioned sites. The company anticipates this property will close during the second or third quarter of 2023. The company is not currently profitable.

Below are approximate statistics related to each property that the company owns as of September 15, 2023.

| STATISTICS | ERC ZEPHYRHILLS 1 | ERC ZEPHYRHILLS 2 | ERC ZEPHYRHILLS 3 |

| PROPERTY INFORMATION | | | |

| Purchase Price | $750,000 | $650,000 | $550,000 |

| Development Costs | Approximately $11,150,000 | Approximately $11,350,000 | Approximately $12,500,000 |

| Funding | ERC Zephyrhills has secured: · $4,200,000 in construction financing. · $3,900,000 of manufactured home financing, and | ERC Zephyrhills has secured: · Short term mortgage funding: $500,000 at 12% interest. | ERC Zephyrhills has secured a short term mortgage funding for $367,000 at 15% for the site. |

| | · is pursuing approximately $3,050,000 of joint venture equity to be combined with share sales from the Regulation A offering. | · Shareholder advances: $113,000 and · $37,000 from the sale of shares pursuant to Regulation D | Construction financing is currently in development. |

| | A $1,200,000 mortgage loan has been secured by both properties, Zephyrhills 1 and Zephyrhills 2 which is in contract to convert to $8,500,000 of land construction financing for Zephyrhills 1 and Zephyrhills 2. | |

| | | |

| Status | The ground has been cleared and the permits are in place for site development. | The company has not yet broken ground on this project. The rezoning application is in process. | The company has not yet broken ground on this project. |

| Address | 39575 North Avenue, Zephyrhills, FL 33542 | Adjoining land next to 39575 North Avenue, Zephyrhills, FL 33542 | 6042 23rd St., Zephyrhills, FL 33542 |

| Intended Number of Units on the Property | 60 | 58 | 65 |

| Total Property Acreage | 9.34 acres | 9.77 acres | 9.75 acres |

| Approximate square foot of each manufactured home | 1,375 square feet | 1,375 square feet | 1,375 square feet |

| Number of Bedrooms | 3 | 3 | 3 |

| Number of Bathrooms | 2 | 2 | 2 |

| Backyard | Yes | Yes | Yes |

| Parking Slab | Yes | Yes | Yes |

| Community Amenities | Picnic areas | Picnic areas | Picnic areas |

*The company reserves the right to change the above estimated statistics if management believes it is in the best interest of the company.

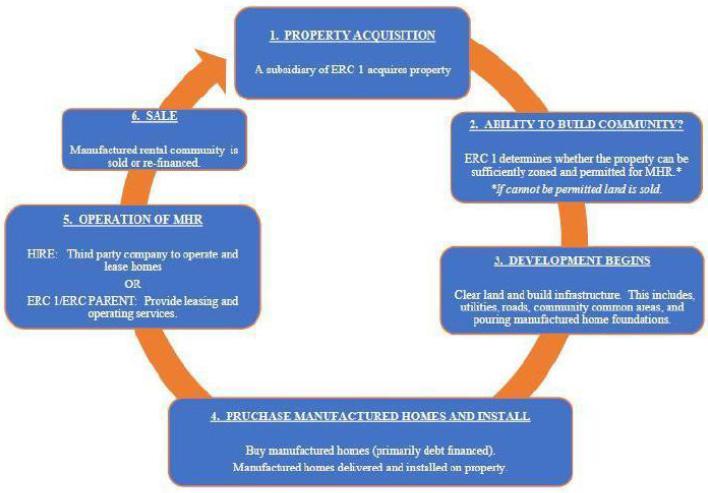

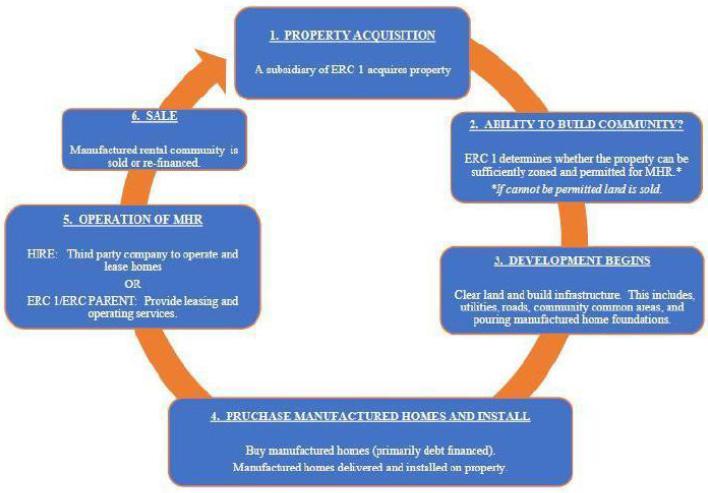

Business Process

The company intends its business process to proceed in the following manner:

Results of Operations

For the six-month period ended June 30, 2023 (“Interim 2023”) and the six-month period ended June 30, 2022 (“Interim 2022”), the company has had no revenues during the relevant periods.

Total operating expenses for the Interim 2023 decreased to $1,371 from $30,685 in Interim 2022. For Interim 2023, the company incurred $0 in professional fees compared to $27,905 in Interim 2022. During Interim 2023 the company did not acquire properties located further than a 10 mile radius from the properties that it owned. Accordingly, the company has not been required to undertake new due diligence.

As a result of the foregoing, the company generated a net loss for Interim 2023 and Interim 2022 of $1,371 and $30,685, respectively.

Liquidity and Capital Resources

As of June 30, 2023, the company’s cash and cash equivalents was $102,703.

Currently, the company is not generating a profit. Accordingly, since inception ERC Communities 1 has relied upon the cash advances from its current shareholder, ERC Parent, and management; mortgages on the properties; as well as funds raised from its Regulation A offering. The company plans to continue to try to raise additional capital through additional offerings. Absent additional capital, the company may be forced to significantly reduce expenses and could become insolvent.

Indebtedness

The company has received working capital, to cover expenses and costs while preparing for the securities offering, from ERC Parent and various of its shareholders. The total of these advances was converted to additional paid-in capital (“Additional Paid-in Capital”) in 2022 and 2023. The balance of these advances at December 31, 2022 totaled $1,931,398 and $2,006,398 as of June 30, 2023. In the future, the company anticipates that it will continue to receive working capital from ERC Parent. As these agreements are between related parties, there is no guarantee that these rates or costs are commensurate with an arm’s length arrangement.

On September 8, 2022, ERC Zephyrhills, LLC and R2R Capital – ERC Zephyrhills Lender, LLC, entered into a note payable in the amount of $1,200,000. The note is secured by the property located at Zephyrhills 1 and Zephyrhills 2. The loan is in contract to convert to a $8,500,000 note for land construction financing for the sites located at Zephyrhills 1 and Zephyrhills 2. The interest rate is prime plus 4.25%; 11.75% at December 31, 2022. The note calls for monthly interest only payments and matures March 6, 2023. Borrower is allowed to extend the maturity to March 6, 2024 by exercising two, six-month extensions. The company has extended the maturity to March 6, 2024. The outstanding balance was $1,200,000 at both December 31, 2022 and June 30, 2023.

On July 24, 2023, ERC Zephyrhills, LLC and Sierra Five Investments, LLC, entered into a short-term loan in the amount of $367,000. The loan expires on August 1, 2026.

Currently, the company is not generating a profit. Accordingly, since inception ERC Communities 1 has relied upon the cash advances from its current shareholder, ERC Parent, and management; mortgages on the properties; as well as funds raised from its 2019 Regulation A offering and 2022 Regulation A offering. The 2022 Regulation A offering closed on July 5, 2023 and raised $375,350. The company plans to continue to try to raise additional capital through additional offerings. Absent additional capital, the company may be forced to significantly reduce expenses and could become insolvent.

Trends

The company is now planning to include the use of manufactured homes in its development plans, to both increase the volume of units that the company will be able to development as well as to lower the costs of eventual rents.

The company believes that COVID-19 has sharpened renters’ desire and demand for separate living. The increase pricing and interest rates continue to make home rentals more attractive for families.

None.

| Item 3. | Financial Statement |

The accompanying semiannual consolidated financial statements are unaudited and have been prepared in accordance with the instructions to Form 1-SA. Therefore, they do not include all information and footnotes necessary for a complete presentation of financial position, results of operations, cash flows, and stockholders’ equity in conformity with accounting principles generally accepted in the United States of America. Except as disclosed herein, there has been no material change in the information disclosed in the notes to the consolidated financial statements included in the Company’s Annual Report on Form 1-K for the year ended December 31, 2022. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included, and all such adjustments are of a normal recurring nature. Operating results for the six months ended June 30, 2023, are not necessarily indicative of the results that can be expected for the year ending December 31, 2023.

ERC Communities 1, Inc.

and Subsidiaries

Consolidated Financial Statements

As of, and for the Six Months Ended June 30, 2023 and 2022

UNAUDITED - NO ASSURANCE GIVEN

ERC Communities 1, Inc.

and Subsidiaries

Consolidated Financial Statements

As of, and for the Six Months Ended June 30, 2023 and 2022

UNAUDITED - NO ASSURANCE GIVEN

ERC Communities 1, Inc. and Subsidiaries

Consolidated Balance Sheets

As of June 30, 2023, December 31, 2022, and June 30, 2022

UNAUDITED - NO ASSURANCE GIVEN

| | | June | | | December | | | June | |

| | | 2023 | | | 2022 | | | 2022 | |

| ASSETS | | | | | | | | | | | | |

| Current assets | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 102,703 | | | $ | 187,558 | | | $ | 477 | |

| Property, plant and equipment | | | | | | | | | | | | |

| Land | | | 1,802,098 | | | | 1,697,641 | | | | 1,071,268 | |

| Construction-in-progress | | | 674,089 | | | | 590,547 | | | | 3,995 | |

| Total property, pland and equipment | | | 2,476,187 | | | | 2,288,188 | | | | 1,075,263 | |

| Other assets | | | | | | | | | | | | |

| Advances to ERC Communities, Inc. (parent company) | | | 185,868 | | | | - | | | | - | |

| Other assets | | | - | | | | - | | | | 25,000 | |

| Total other assets | | | 185,868 | | | | - | | | | 25,000 | |

| TOTAL ASSETS | | $ | 2,764,758 | | | $ | 2,475,746 | | | $ | 1,100,740 | |

| | | | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | |

| Notes payable, current portion | | $ | - | | | $ | - | | | $ | 500,000 | |

| Non-current Liabilities | | | | | | | | | | | | |

| Notes payable, long-term portion | | | 1,200,000 | | | | 1,200,000 | | | | - | |

| Advances from shareholders of ERC Communities, Inc. (parent company) | | | - | | | | - | | | | 328,000 | |

| Advances from ERC Communities, Inc. (parent company) | | | - | | | | - | | | | 1,171,058 | |

| Total non-current liabilities | | | 1,200,000 | | | | 1,200,000 | | | | 1,499,058 | |

| TOTAL LIABILITIES | | | 1,200,000 | | | | 1,200,000 | | | | 1,999,058 | |

| | | | | | | | | | | | | |

| Shareholders' equity | | | | | | | | | | | | |

| Common stock, Class A: 134,000,000 shares authorized, $0.00001 par, 35,020 shares issued and outstanding | | | - | | | | - | | | | - | |

| Common stock, Class B: 16,000,000 shares authorized, $0.00001 par, 16,000,000 shares issued and outstanding | | | 160 | | | | 160 | | | | 160 | |

| Additional paid-in capital | | | 2,006,398 | | | | 1,931,398 | | | | - | |

| Preferred stock, Class A: 8,333,333 shares authorized, 140,222 shares issued and outstanding | | | 1,221,713 | | | | 673,010 | | | | 384,266 | |

| Preferred stock, other: 41,666,667 shares authorized, no shares issued and outstanding | | | - | | | | - | | | | - | |

| Retained deficit, net of distributions | | | (1,663,513 | ) | | | (1,328,822 | ) | | | (1,282,744 | ) |

| TOTAL STOCKHOLDERS' EQUITY | | | 1,564,758 | | | | 1,275,746 | | | | (898,318 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 2,764,758 | | | $ | 2,475,746 | | | $ | 1,100,740 | |

The accompanying notes are an integral part of these financial statements.

ERC Communities 1, Inc. and Subsidiaries

Consolidated Statement of Operations

For the Six Months Ended June 30, 2023 and 2022

UNAUDITED - NO ASSURANCE GIVEN

| | | 2023 | | | 2022 | |

| Revenues | | $ | - | | | $ | - | |

| Cost of revenues | | | - | | | | - | |

| Gross profit | | | - | | | | - | |

| Operating expenses | | | | | | | | |

| Advertising and marketing | | | - | | | | - | |

| Salaries | | | | | | | | |

| Operational | | | - | | | | - | |

| Corporate | | | - | | | | - | |

| Property lease and affiliated costs | | | - | | | | - | |

| Equipment and repairs | | | - | | | | - | |

| Utilities and telephone | | | - | | | | - | |

| Insurance | | | - | | | | - | |

| Professional fees | | | - | | | | 27,905 | |

| Property and local taxes | | | - | | | | 2,600 | |

| Other selling, general and administrative | | | 1,371 | | | | 180 | |

| Total operating expenses | | | 1,371 | | | | 30,685 | |

| Operating loss | | | (1,371 | ) | | | (30,685 | ) |

| Other expenses | | | | | | | | |

| Interest expense | | | - | | | | - | |

| Total other expenses | | | - | | | | - | |

| Net loss | | $ | (1,371 | ) | | $ | (30,685 | ) |

| | | | | | | | | |

| Basic loss per common share | | $ | (0.00009 | ) | | $ | (0.00192 | ) |

| Diluted loss per common share | | $ | (0.00008 | ) | | $ | (0.00191 | ) |

In the opinion of management all adjustments necessary in order to make the interim financial statements not misleading have been included.

The accompanying notes are an integral part of these financial statements.

ERC Communities 1, Inc. and Subsidiaries

Consolidated Statement of Stockholders' Equity (Deficit)

For the Six Months Ended June 30, 2023 and 2022

UNAUDITED - NO ASSURANCE GIVEN

| | | Class A | | | Class B | | | Additional | | | Class A | | | Other | | | Retained

Earnings, | | | Total | |

| | | Common Stock | | | Common Stock | | | Paid-in | | | Preferred Stock | | | Preferred Stock | | | Net of | | | Stockholders' | |

| | | Shares | | | Value | | | Shares | | | Value | | | Capital | | | Shares | | | Value | | | Shares | | | Value | | | Distributions | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2021 | | | - | | | $ | - | | | | 16,000,000 | | | $ | 160 | | | $ | - | | | | 64,318 | | | $ | 384,266 | | | | - | | | $ | - | | | $ | (1,166,656 | ) | | $ | (782,230 | ) |

| Share issuance | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (30,685 | ) | | | (30,685 | ) |

| Reg A share sale costs | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (65,777 | ) | | | (65,777 | ) |

| Dividends | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (19,626 | ) | | | (19,626 | ) |

| Balance as of June 30, 2022 | | | - | | | | - | | | | 16,000,000 | | | | 160 | | | | - | | | | 64,318 | | | | 384,266 | | | | - | | | | - | | | | (1,282,744 | ) | | | (898,318 | ) |

| Share issuance | | | - | | | | - | | | | - | | | | - | | | | - | | | | 26,354 | | | | 288,744 | | | | - | | | | - | | | | - | | | | 288,744 | |

| Contributed capital | | | - | | | | - | | | | - | | | | - | | | | 1,931,398 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,931,398 | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (2,095 | ) | | | (2,095 | ) |

| Reg A share sale costs | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (14,927 | ) | | | (14,927 | ) |

| Dividends | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (29,056 | ) | | | (29,056 | ) |

| Balance as of December 31, 2022 | | | - | | | | - | | | | 16,000,000 | | | | 160 | | | | 1,931,398 | | | | 90,672 | | | | 673,010 | | | | - | | | | - | | | | (1,328,822 | ) | | | 1,275,746 | |

| Share issuance | | | 35,020 | | | | - | | | | - | | | | - | | | | 75,000 | | | | 49,550 | | | | 548,703 | | | | - | | | | - | | | | - | | | | 623,703 | |

| Net loss | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,371 | ) | | | (1,371 | ) |

| Reg A share sale costs | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (297,015 | ) | | | (297,015 | ) |

| Dividends | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (36,305 | ) | | | (36,305 | ) |

| Balance as of June 30, 2023 | | | 35,020 | | | $ | - | | | | 16,000,000 | | | $ | 160 | | | $ | 2,006,398 | | | | 140,222 | | | $ | 1,221,713 | | | | - | | | $ | - | | | $ | (1,663,513 | ) | | $ | 1,564,758 | |

The accompanying notes are an integral part of these financial statements.

ERC Communities 1, Inc. and Subsidiaries

Consolidated Statement of Cash Flows

For the Six Months Ended June 30, 2023 and 2022

UNAUDITED - NO ASSURANCE GIVEN

| | | 2023 | | | 2022 | |

| Cash Flows from Operating Activities | | | | | | | | |

| Net loss | | $ | (1,371 | ) | | $ | (30,685 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | | |

| Changes in operating assets and liabilities | | | | | | | | |

| Other assets | | | - | | | | - | |

| Net cash used in operating activities | | | (1,371 | ) | | | (30,685 | ) |

| | | | | | | | | |

| Cash Flows from Investing Activities | | | | | | | | |

| Property, plant and equipment acquisitions | | | (187,999 | ) | | | (52,500 | ) |

| | | | | | | | | |

| Cash Flows from Financing Activities | | | | | | | | |

| Proceeds from notes payable | | | - | | | | - | |

| Capital contribution | | | - | | | | - | |

| Advances from shareholders of ERC Communities, Inc. (parent company) | | | - | | | | - | |

| Advances (to) from ERC Communities, Inc. (parent company) | | | (185,868 | ) | | | 166,559 | |

| Issuance of common stock | | | 75,000 | | | | - | |

| Issuance of preferred stock | | | 548,703 | | | | - | |

| Dividends | | | (36,305 | ) | | | (19,626 | ) |

| Reg A share sale costs | | | (297,015 | ) | | | (65,777 | ) |

| Net cash provided by financing activities | | | 104,515 | | | | 81,156 | |

| Net Change In Cash and Cash Equivalents | | | (84,855 | ) | | | (2,029 | ) |

| Cash and Cash Equivalents, Beginning of Period | | | 187,558 | | | | 2,506 | |

| Cash and Cash Equivalents, End of Period | | $ | 102,703 | | | $ | 477 | |

The accompanying notes are an integral part of these financial statements.

ERC Communities 1, Inc. and Subsidiaries

Consolidating Balance Sheets

As of June 30, 2023, December 31, 2022, and June 30, 2022

UNAUDITED - NO ASSURANCE GIVEN

| | | ERC | | | ERC | | | | | | | | | Consolidated | |

| | | Communities | | | Zephyrhills, | | | | | | | | | June | | | December | | | June | |

| | | 1, Inc. | | | LLC | | | Combined | | | Eliminations | | | 2023 | | | 2022 | | | 2022 | |

| ASSETS | | | | | | | | | | | | | | | | | | | | | |

| Current assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 102,661 | | | $ | 42 | | | $ | 102,703 | | | $ | - | | | $ | 102,703 | | | $ | 187,558 | | | $ | 477 | |

| Property, plant and equipment | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Land | | | - | | | | 1,802,098 | | | | 1,802,098 | | | | - | | | | 1,802,098 | | | | 1,697,641 | | | | 1,071,268 | |

| Construction-in-progress | | | - | | | | 674,089 | | | | 674,089 | | | | - | | | | 674,089 | | | | 590,547 | | | | 3,995 | |

| Total property, pland and equipment | | | - | | | | 2,476,187 | | | | 2,476,187 | | | | - | | | | 2,476,187 | | | | 2,288,188 | | | | 1,075,263 | |

| Other assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other assets | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 25,000 | |

| Intercompany advances | | | 1,276,678 | | | | - | | | | 1,276,678 | | | | (1,276,678 | ) | | | - | | | | - | | | | - | |

| Total other assets | | | 1,276,678 | | | | - | | | | 1,276,678 | | | | (1,276,678 | ) | | | - | | | | - | | | | 25,000 | |

| TOTAL ASSETS | | $ | 1,379,339 | | | $ | 2,476,229 | | | $ | 3,855,568 | | | $ | (1,276,678 | ) | | $ | 2,578,890 | | | $ | 2,475,746 | | | $ | 1,100,740 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Notes payable, current portion | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 500,000 | |

| Non-current Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Notes payable, long-term portion | | | - | | | | 1,200,000 | | | | 1,200,000 | | | | - | | | | 1,200,000 | | | | 1,200,000 | | | | - | |

| Advances from shareholders of ERC Communities, Inc. (parent company) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 328,000 | |

| Advances from ERC Communities, Inc. (parent company) | | | (185,868 | ) | | | | | | | (185,868 | ) | | | | | | | (185,868 | ) | | | - | | | | 1,171,058 | |

| Intercompany advances | | | - | | | | 1,276,678 | | | | 1,276,678 | | | | (1,276,678 | ) | | | - | | | | - | | | | - | |

| Total non-current liabilities | | | (185,868 | ) | | | 2,476,678 | | | | 2,290,810 | | | | (1,276,678 | ) | | | 1,014,132 | | | | 1,200,000 | | | | 1,499,058 | |

| TOTAL LIABILITIES | | | (185,868 | ) | | | 2,476,678 | | | | 2,290,810 | | | | (1,276,678 | ) | | | 1,014,132 | | | | 1,200,000 | | | | 1,999,058 | |

| Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Member equity | | | - | | | | (449 | ) | | | (449 | ) | | | 449 | | | | - | | | | - | | | | - | |

| Common stock, Class A | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Common stock, Class B | | | 160 | | | | - | | | | 160 | | | | - | | | | 160 | | | | 160 | | | | 160 | |

| Additional paid-in capital | | | 2,006,398 | | | | - | | | | 2,006,398 | | | | - | | | | 2,006,398 | | | | 1,931,398 | | | | - | |

| Preferred stock, Class A | | | 1,221,713 | | | | - | | | | 1,221,713 | | | | - | | | | 1,221,713 | | | | 673,010 | | | | 384,266 | |

| Preferred stock, other | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Retained earnings | | | (1,663,064 | ) | | | - | | | | (1,663,064 | ) | | | (449 | ) | | | (1,663,513 | ) | | | (1,328,822 | ) | | | (1,282,744 | ) |

| TOTAL EQUITY | | | 1,565,207 | | | | (449 | ) | | | 1,564,758 | | | | - | | | | 1,564,758 | | | | 1,275,746 | | | | (898,318 | ) |

| TOTAL LIABILITIES AND EQUITY | | $ | 1,379,339 | | | $ | 2,476,229 | | | $ | 3,855,568 | | | $ | (1,276,678 | ) | | $ | 2,578,890 | | | $ | 2,475,746 | | | $ | 1,100,740 | |

The accompanying notes are an integral part of these financial statements.

ERC Communities 1, Inc. and Subsidiaries

Consolidating Statement of Operations

For the Six Months Ended June 30, 2023 and 2022

UNAUDITED - NO ASSURANCE GIVEN

| | | ERC | | | ERC | | | | | | | | | | | | | |

| | | Communities 1, | | | Zephyrhills, | | | | | | | | | Consolidated | |

| | | Inc. | | | LLC | | | Combined | | | Eliminations | | | 2023 | | | 2022 | |

| Revenues | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Cost of revenues | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Gross profit | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| Advertising and marketing | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Salaries | | | | | | | | | | | | | | | | | | | | | | | | |

| Operational | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Corporate | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Property lease and affiliated costs | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Equipment and repairs | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Utilities and telephone | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Insurance | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Professional fees | | | - | | | | - | | | | - | | | | - | | | | - | | | | 27,905 | |

| Property and local taxes | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,600 | |

| Other selling, general and administrative | | | 1,291 | | | | 80 | | | | 1,371 | | | | - | | | | 1,371 | | | | 180 | |

| Total operating expenses | | | 1,291 | | | | 80 | | | | 1,371 | | | | - | | | | 1,371 | | | | 30,685 | |

| Operating income (loss) | | | (1,291 | ) | | | (80 | ) | | | (1,371 | ) | | | - | | | | (1,371 | ) | | | (30,685 | ) |

| Other expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Total other expenses | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Net loss | | $ | (1,291 | ) | | $ | (80 | ) | | $ | (1,371 | ) | | $ | - | | | $ | (1,371 | ) | | $ | (30,685 | ) |

In the opinion of management all adjustments necessary in order to make the interim financial statements not misleading have been included.

The accompanying notes are an integral part of these financial statements.

ERC Communities 1, Inc.

Notes to Financial Statements

As of June 30, 2023

NO ASSURANCE GIVEN

NOTE 1 - NATURE OF OPERATIONS

ERC Communities 1, Inc. (which may be referred to as “ERC 1”, the “Company,” “we,” “us,” or “our”) is an early-stage company devoted to the development of residential real estate in the Florida area of the United States. The Company incorporated in 2018 in the state of Delaware.

ERC 1 has previously sold shares of its Preferred Stock under an offering statement qualified under Regulation A (“Reg A”). As of June 30, 2023 holders of our Preferred Stock owned 140,222 convertible preferred shares, which can be converted on a one-to-one basis for common shares, at any time.

In July 2020 ERC 1 formed a limited liability company – ERC Zephyrhills, LLC, a Florida limited liability company (“Zephyrhills”) which now owns three parcels for development – a 60-unit site was acquired in August 2020, an adjacent 60-unit site was acquired in September 2022, and an adjacent 65-unit site was acquired in July 2023.

There currently exists a $1,200,000 mortgage on the two owned sites, which is in contract to convert to $8,500,000 of land construction financing for the two owned sites. Additionally, the same lender is in contract to provide mortgage financing for the third site, as well as construction financing for those sites. Another lender has provided mortgage financing for the third site totaling $367,000.

Since inception, the Company has relied on advances from affiliates to fund its operations. As of June 30, 2023, the Company had little working capital and will likely incur losses prior to generating positive working capital. These matters raise substantial concern about the Company’s ability to continue as a going concern (see Note below). During the next 12 months, the Company intends to fund its operations with funding from a securities offering campaign and funds from revenue producing activities, if and when such operations and offerings can be realized. If the Company cannot secure additional short-term capital, it may cease operations. These financial statements and related notes thereto do not include any adjustments that might result from these uncertainties.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America ("GAAP"). The Company has adopted December 31 as the year end for reporting purposes.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the footnotes thereto. Actual results could differ from those estimates. It is reasonably possible that changes in estimates will occur in the near term.

Risks and Uncertainties

The Company has a limited operating history. The Company's business and operations are sensitive to general business and economic conditions in the United States. A host of factors beyond the Company's control could cause fluctuations in these conditions. Adverse conditions may include: recession, economic downturn, local competition or changes in consumer taste. These adverse conditions could affect the Company's financial condition and the results of its operations. As of June 30, 2023 the Company is operating as a going concern.

Cash and Cash Equivalents

The Company considers short-term, highly liquid investments with original maturities of three months or less, at the time of purchase, to be cash equivalents. Cash consists of currency held in the Company’s checking account. As of June 30, 2023 the Company had Cash and Cash Equivalents of $102,703.

Receivables and Credit Policy

Trade receivables from customers are uncollateralized customer obligations due under normal trade terms. Trade receivables are stated at the amount billed to the customer. Payments of trade receivables are allocated to the specific invoices identified on the customer’s remittance advice or, if unspecified, are applied to the earliest unpaid invoice. The Company, by policy, routinely assesses the financial strength of its customers. As a result, the Company believes that its accounts receivable credit risk exposure is limited and it has not experienced significant write-downs in its accounts receivable balances. As of June 30, 2023 the Company did not have any outstanding accounts receivable.

Property and Equipment

Property and equipment are recorded at cost. Expenditures for renewals and improvements that significantly add to the productive capacity or extend the useful life of an asset are capitalized. Expenditures for maintenance and repairs are expensed as incurred. When equipment is retired or sold, the cost and related accumulated depreciation are eliminated from the balance sheet accounts and the resultant gain or loss is reflected in income.

Depreciation is provided using the straight-line method, based on useful lives of the assets. As of June 30, 2023 the Company had no depreciable assets. Therefore, no depreciation expense is reported in the financial statements.

The Company reviews the carrying value of property and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition, and other economic factors. As of June 30, 2023, the Company’s assets include land for development (including capitalized carrying costs) and construction-in-process.

Income Taxes

Income taxes are provided for the tax effects of transactions reporting in the financial statements and consist of taxes currently due plus deferred taxes related primarily to differences between the basis of receivables, inventory, property and equipment, intangible assets, cryptocurrency valuation and accrued expenses for financial and income tax reporting. Deferred tax assets and liabilities represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all the deferred tax assets will not be realized.

The Company is taxed as a C Corporation for federal and state income tax purposes. Due to its startup position, no tax benefits have been recorded to reflect net operating loss carry forwards. When the Company becomes profitable, the tax loss benefit will be recorded.

The Company evaluates its tax positions that have been taken or are expected to be taken on income tax returns to determine if an accrual is necessary for uncertain tax positions. As of June 30, 2023, December 31, 2022, and June 30, 2022, no accruals were needed for uncertain tax positions.

The Company is current with its foreign, US federal and state income tax filing obligations and is not currently under examination from any taxing authority.

Revenue Recognition

In 2019, the Company adopted ASC 606, Revenue from Contracts with Customers, as of inception. There was no transition adjustment recorded upon the adoption of ASC 606. Under ASC 606, revenue is recognized when a customer obtains control of promised goods or services, in an amount that reflects the consideration which the entity expects to receive in exchange for those goods or services.

To determine revenue recognition for arrangements that an entity determines are within the scope of ASC 606, the Company performs the following steps: (i) identify the contract(s) with a customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations in the contract and (v) recognize revenue when (or as) the entity satisfies a performance obligation. At contract inception, once the contract is determined to be within the scope of ASC 606, the Company assesses the goods or services promised within each contract and determines those that are performance obligations and assesses whether each promised good or service is distinct. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when (or as) the performance obligation is satisfied.

Advertising Expenses

The Company expenses advertising costs as they are incurred.

Organizational Costs

In accordance with GAAP, organizational costs, including accounting fees, legal fees, and costs of incorporation, are expensed as incurred.

Earnings per Share

Earnings per share amounts are calculated based on the weighted-average number of shares of common stock outstanding in each year. The basic loss per share is based only on the weighted-average of common shares outstanding. The diluted loss per share is based on the weighted-average of common shares outstanding plus Class A preferred shares, which are convertible to one share of common stock.

Concentration of Credit Risk

The Company maintains its cash with a major financial institution located in the United States of America, which it believes to be credit worthy. The Federal Deposit Insurance Corporation insures balances up to $250,000. At times, the Company may maintain balances in excess of the federally insured limits.

Recent Accounting Pronouncements

In February 2016, FASB issued ASU No. 2016-02, Leases, that require organizations that lease assets, referred to as "lessees", to recognize on the balance sheet the assets and liabilities for the rights and obligations created by those leases with lease terms of more than 12 months. ASU 2016-02 will also require disclosures to help investors and other financial statement users better understand the amount, timing, and uncertainty of cash flows arising from leases and will include qualitative and quantitative requirements. The new standard for nonpublic entities became effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. The Company implemented ASU No. 2016-02 for lease accounting for 2020.

The FASB issues ASUs to amend the authoritative literature in ASC. There have been a number of ASUs to date, including those above, that amend the original text of ASC. Management believes that those issued to date either (i) provide supplemental guidance, (ii) are technical corrections, (iii) are not applicable to us or (iv) are not expected to have a significant impact our balance sheet.

NOTE 3 – INCOME TAX PROVISION

As described above, the Company was recently formed and has only incurred costs of its start-up operations and capital raising. As such, no material tax provision yet exists.

NOTE 4 – COMMITMENTS AND CONTINGENCIES

Legal Matters

The Company is not currently involved with and does not know of any pending or threatening litigation against the Company or founders.

NOTE 5 – EQUITY

The Company has authorized 134,000,000 shares of Class A Common Stock and 16,000,000 shares of Class B Common Stock, each with a par value of $0.00001 per share. As of June 30, 2023 there were 35,020 shares of Class A common stock issued and outstanding; all Class B common stock is issued, outstanding and held by ERC, the Company’s parent company. In 2022 ERC contributed $1,931,398 to ERC 1 that is shown on the balance sheet as Additional Paid-in Capital. The Company has authorized 50,000,000 shares of preferred stock, of which 8,333,333 shares are designated as Class A preferred stock which is convertible into Class A Common Stock. As of June 30, 2023, December 31, 2022 and June 30, 2022, 140,222, 90,672 and 64,318 shares, respectively, of Class A Preferred Stock have been issued. The company is offering to sell up to 8,333,333 shares of Class A Preferred Stock as part of a Regulation A offering (discussed more below).

Class A common stockholders are entitled to a single vote per share and have equal dividend and liquidation preferences as Class B common stockholders. Class B common stockholders have five votes per share and shares of Class B common stock can be converted into shares of Class A common stock at the option of the holder. Class A preferred stockholders are entitled to a single vote per share and to an 8 percent annual dividend, which will accrue if funds are not legally available to distribute, in addition to a liquidation preference. Shares of Class A preferred stock can be converted into shares of Class A common stock at the option of the holder and shares will be automatically converted in the event of a qualified public offering, as defined in the Amended and Restated Certificate of Incorporation.

On October 4, 2021, the Company filed a Certificate of Designations for Class B Preferred Stock and Series A Participating Equity with the state of Delaware. No shares of Class B Preferred Stock or Series A Participating Equity have been issued.

NOTE 6 – NOTES PAYABLE

Notes payable at June 30, 2023, December 31, 2022 and June 30, 2022 consists of the following debt instruments.

| | | 2023 | | | 2022 | |

| | | June 30 | | | December 31 | | | June 30 | |

| Zephyrhills - Note payable, dated September 8, 2022, secured by a mortgage on land with an interest rate of prime plus 4.25%; 11.75% at December 31, 2022. The note calls for monthly interest only payments and matures March 6, 2023. Borrower is allowed to extend the maturity to March 6, 2024 by exercising two, six month extensions. The notes were extended to March 6, 2024. Therefore, the balance at December 31, 2022 is classified as long-term. | | $ | 1,200,000 | | | $ | 1,200,000 | | | $ | - | |

| Total | | $ | 1,200,000 | | | $ | 1,200,000 | | | $ | - | |

Interest on the Zephyrhills mortgage has been capitalized as development costs and is included in Land on the balance sheet.

NOTE 7 – RELATED PARY TRANSACTIONS

The Company has received working capital, to cover expenses and costs while preparing for the securities offering, from ERC and various of its shareholders. The advances totaled $1,931,398 and was converted to Additional Paid-in Capital in 2022 (see Note 5 – Equity, above).

NOTE 8 – GOING CONCERN

These financial statements are prepared on a going concern basis. The Company began operation in 2018 and has limited operating history. The Company’s ability to continue is dependent upon management’s plan to raise additional funds and achieve and sustain profitable operations. The financial statements do not include any adjustments that might be necessary if the Company is not able to continue as a going concern.

NOTE 9 – SUBSEQUENT EVENTS

Management’s Evaluation

Management has evaluated subsequent events through the date these financial statements were issued. Based on this evaluation, no material subsequent events were identified which would require adjustment or disclosure in the financial statements of June 30, 2023.

The documents listed in the Exhibit Index of this report are incorporated by reference, in each case as indicated below.

| 2.1 | Amendment to the Amended and Restated Certificate of Incorporation (1) |

| 2.2 | Amended and Restated Certificate of Incorporation (1) |

| 2.3 | Certificate of Amendment to the Amended and Restated Certificate of Incorporation, dated October 4, 2021(2) |

| 2.4 | Certificate of Designations of Class B Preferred Stock and Series A Participating Equity, dated October 4, 2021(2)* |

| 2.5 | Certificate of Amendment to the Amended and Restated Certificate of Incorporation dated March 3, 2022(2) |

| 2.6 | Bylaws (1) |

| 6.1 | Management Services Agreement between ERC Homebuilders 1, Inc. and ERC Homebuilders, Inc. effective as of August 5, 2019 (1) |

| 6.2 | Promissory Note with ERC Homebuilders, Inc. dated November 10, 2018 reimbursement due on or before December 31, 2019, with annual interest of 3% (1) |

| 6.3 | Agreement of Sale and Purchase dated August 5, 2021(2) |

| 6.4 | Promissory Note dated September 8, 2022, between ERC Zephyrhills, LLC and R2R Capital – ERC Zephyrhills Lender, LLC, in the amount of $1,200,000 (1) |

| 6.5 | Promissory Note with Sierra Five Investments LLC, dated July 24, 2023 in the amount of $367,000 |

| (1) Filed as an exhibit to the ERC Communities 1, Inc. Regulation A Offering Statement on Form 1-A (Commission File No. 024-10987) |

(2) Filed as an exhibit to the ERC Communities 1, Inc. Form 1-K/A dated May 1, 2023 (Commission File No. 24R-0027) |

SIGNATURE

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in Riverview, State of Florida, on September 27, 2023.

| ERC Communities 1, Inc. | |

| | |

| /s/ Gerald Ellenburg | |

| | |

| By Gerald Ellenburg | |

| CEO of ERC Communities 1, Inc. | |

Pursuant to the requirements of Regulation A, this report has been signed below by the following persons on behalf of the issuer and in the capacities and on the dates indicated.

Gerald Ellenburg, Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer

Date: September 27, 2023