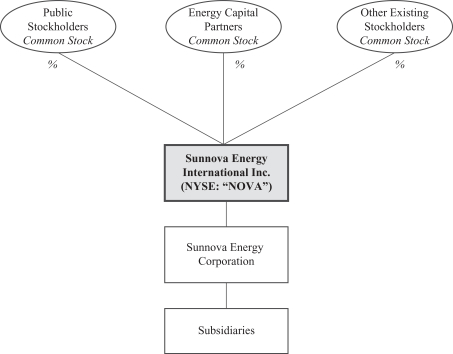

13,514,630 shares of our Series A convertible preferred stock upon exchange of $72.0 million representing principal amount, PIK interest and make-whole amounts under the AP5H Mezzanine Facility and we issued 16,315,880 shares of our Series A convertible preferred stock upon exchange of all outstanding shares of Series A preferred stock and Series B preferred stock. For additional information on our Series A convertible preferred stock and the Capital Stock Conversions, please read the section entitled “Description of Our Capital Stock—Series A Convertible Preferred Stock” and “Corporate Reorganization.”

From November 2017 through January 2018, Sunnova Energy Corporation sold an aggregate of 10,723,861 shares of its Series B convertible preferred stock to accredited investors at a purchase price of $3.73 per share, for an aggregate purchase price of $40.0 million.

From March 2018 through November 2018, Sunnova Energy Corporation sold an aggregate of 30,344,827 shares of its Series C convertible preferred stock to accredited investors at a purchase price of $5.80 per share, for an aggregate purchase price of $176.0 million.

Exchanges of Preferred Stock

On March 16, 2016, all outstanding shares of Sunnova Energy Corporation’s Series A preferred stock and Series B preferred stock were exchanged for an aggregate of 16,315,880 newly issued shares of Sunnova Energy Corporation’s Series A convertible preferred stock.

On March 29, 2018, all outstanding shares of Sunnova Energy Corporation’s Series B convertible preferred stock were exchanged for an aggregate 11,112,285 newly issued shares of Sunnova Energy Corporation’s Series A convertible preferred stock.

Conversion of Preferred Stock to Common Stock

Immediately prior to or contemporaneously with the completion of this offering, the Registrant will issue 135,164,486 shares of its common stock upon conversion of outstanding shares of convertible Series A preferred stock and Series C preferred stock.

Option Grants and Common Stock Issuances

Since January 1, 2016, Sunnova Energy Corporation has granted to its officers, employees and consultants options to purchase an aggregate of 13,744,791 shares of its common stock under its equity compensation plans at exercise prices ranging from approximately $5.33 to $11.64 per share.

Since January 1, 2016, Sunnova Energy Corporation has issued and sold to its officers, employees and consultants an aggregate of 54,918 shares of its common stock upon the exercise of options under its equity compensation plans at an exercise price of $0.79 per share, for aggregate consideration of approximately $50,000.

Senior Convertible Notes

On April 24, 2017, Sunnova Energy Corporation issued and sold an aggregate principal amount of $80.0 million of our 12.00% senior secured notes in a private placement to a total of three institutional accredited investors for an aggregate purchase price of $78.4 million. In May 2018 and January 2019, the terms of these senior secured notes were amended to extend the maturity date from October 2018 to January 2019 and from January 2019 to July 2019, respectively. In April 2019, the terms of the remaining $44.9 million aggregate principal amount of these senior secured notes were amended so that, among other things, (i) the interest rate on the notes decreased from 12.00% per annum to 9.50% per annum, (ii) the maturity date was extended fromJuly 2019 to March 2021 and (iii) a conversion feature was added such that the notes will be convertible into common

II-3