- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

POS AM Filing

DraftKings POS AMProspectus update (post-effective amendment)

Filed: 26 Feb 21, 12:00am

As filed with the Securities and Exchange Commission on February 26, 2021

Registration No. 333-238051

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DraftKings Inc.

(Exact name of registrant as specified in its charter)

Nevada | 7990 | 84-4052441 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

222 Berkeley Street, 5th Floor

Boston, MA 02116

(617) 986-6744

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

R. Stanton Dodge

Chief Legal Officer

DraftKings Inc.

222 Berkeley Street, 5th Floor

Boston, Massachusetts 02116

(617) 986-6744

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Scott D. Miller

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

Tel: (212) 558-4000

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

| Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On May 12, 2020, the registrant filed a Registration Statement on Form S-1 (Registration No. 333-238051), which was subsequently declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on May 13, 2020, as amended by the Post-Effective Amendment No. 1 which was filed on June 16, 2020 and subsequently declared effective by the SEC on June 18, 2020 and as further amended by the Post-Effective Amendment No. 2 which was filed on October 5, 2020 and subsequently declared effective by the SEC on October 6, 2020 (as amended, the “Registration Statement”).

This post-effective amendment is being filed to update the Registration Statement to include information contained in the registrant’s Annual Report on Form 10-K and certain other information in such Registration Statement.

No additional securities are being registered under this post-effective amendment. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED February 26, 2021

PRELIMINARY PROSPECTUS

199,000,123 Shares of Class A Common Stock

1,815,065 Warrants to Purchase Class A Common Stock

This prospectus relates to the issuance by us of up to (i) 1,815,065 shares of our Class A common stock, par value $0.0001 per share (“Class A common stock”), that may be issued upon exercise of all outstanding warrants to purchase Class A common stock at an exercise price of $11.50 per share of Class A common stock, which consist of the private placement warrants (as defined below) (ii) 6,000,000 shares of Class A common stock issued upon the satisfaction of certain triggering events (as described herein), (iii) 115,908 shares of Class A common stock issuable upon the exercise of outstanding options granted under the DraftKings Inc. 2017 Equity Incentive Plan (the “2017 Equity Incentive Plan”) and DraftKings Inc. 2012 Stock Option & Restricted Stock Incentive Plan (the “2012 Equity Incentive Plan”) held by former employees or former consultants of DraftKings Inc., a Delaware corporation, and (iv) 319,502 shares of Class A common stock issuable upon the exercise of outstanding options granted under the SBTech (Global) Limited 2011 Global Share Option Plan held by former employees or former consultants of SBTech (together with the 2017 Equity Incentive Plan and the 2012 Equity Incentive Plan, the “Plans”).

The prospectus also relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”), or their permitted transferees, of up to (i) 190,749,648 shares of our Class A common stock and (ii) 1,815,065 warrants. We will not receive any proceeds from the sale of shares of Class A common stock or warrants by the Selling Securityholders pursuant to this prospectus, except with respect to amounts received by us upon exercise of the warrants to the extent such warrants are exercised for cash. However, we will pay the expenses, other than underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities, associated with the sale of securities pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Securityholders will issue, offer or sell, as applicable, any of the securities. The Selling Securityholders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the shares in the section entitled “Plan of Distribution.”

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

Our Class A common stock is listed on The Nasdaq Global Select Market (“Nasdaq”) under the symbol “DKNG”. On February 25, 2021, the closing price of our Class A common stock was $57.81 per share.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021.

TABLE OF CONTENTS

-i-

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using a “shelf” registration process. Under this shelf registration process, we and the Selling Securityholders may, from time to time, issue, offer and sell, as applicable, any combination of the securities described in this prospectus in one or more offerings. We may use the shelf registration statement to issue (i) shares of Class A common stock upon exercise of the private placement warrants, (ii) shares of Class A common stock issued upon the satisfaction of certain triggering events (as described herein), (iii) shares of Class A common stock issuable upon the exercise of outstanding options granted under the 2017 Equity Incentive Plan and 2012 Equity Incentive Plan held by former employees or former consultants of DraftKings Inc., a Delaware corporation, and (iv) shares of Class A common stock issuable upon the exercise of outstanding options granted under the SBTech (Global) Limited 2011 Global Share Option Plan held by former employees or former consultants of SBTech, in each case up to the amounts described herein. The Selling Securityholders may use the shelf registration statement to sell shares of Class A common stock and warrants, in each case up to the amounts described in the section entitled “Selling Securityholders”, from time to time through any means described in the section entitled “Plan of Distribution.” More specific terms of any securities that the Selling Securityholders offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the Class A common stock and/or warrants being offered and the terms of the offering.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

On April 23, 2020 (the “Closing Date”), Diamond Eagle Acquisition Corp., our predecessor company (“DEAC”), consummated the business combination (the “Business Combination”) pursuant to the terms of: (i) the business combination agreement (as amended by Amendment No. 1 thereto, dated April 7, 2020, the “Business Combination Agreement”) with DraftKings Inc., a Delaware corporation (“Old DK”), SBTech (Global) Limited, a company limited by shares, incorporated in Gibraltar and continued as a company under the Isle of Man Companies Act 2006, with registration number 014119V (“SBTech”), the shareholders of SBTech (the “SBT Sellers”), Shalom Meckenzie, in his capacity as the SBT Sellers’ Representative, DEAC NV Merger Corp., a Nevada corporation and a wholly-owned subsidiary of DEAC (“DEAC NV”) and DEAC Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of DEAC (“Merger Sub”) and (ii) the agreement and plan of merger, dated as of March 12, 2020, by and among DEAC and DEAC NV. Immediately upon the completion of the Business Combination and the other transactions contemplated by the Business Combination Agreement (the “Transactions”, and such completion, the “Closing”), Old DK became a direct wholly-owned subsidiary of DEAC NV. In connection with the Transactions, DEAC NV changed its name to DraftKings Inc.

-ii-

This document contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

| · | “BCA” or “Business Combination Agreement” refers to the Business Combination Agreement, dated as of December 22, 2019, as amended on April 7, 2020, by and among DEAC, Old DK, SBT, the SBT Sellers party thereto, the SBT Sellers’ Representative, DEAC NV and Merger Sub. |

| · | “Board” or “board of directors” refers to our board of directors. |

| · | “Business Combination” refers to the transactions contemplated by the BCA. |

| · | “Charter” refers to our amended and restated articles of incorporation. |

| · | “Class A common stock” refers to the Class A common stock, par value $0.0001 per share, of the Company. |

| · | “Class B common stock” refers to the Class B common stock, par value $0.0001 per share, of the Company. |

| · | “Closing” refers to the closing of the Business Combination. |

| · | “Closing Date” refers to April 23, 2020, the date on which the Closing occurred. |

| · | “Continental” refers to Continental Stock Transfer & Trust Company, the transfer agent, warrant agent and escrow agent of DEAC. |

| · | “Convertible Notes” refers to those certain subordinated convertible notes, issued by Old DK on or after December 16, 2019 to certain investors in an aggregate principal amount of approximately $109.2 million. |

| · | “DEAC” refers to Diamond Eagle Acquisition Corp., a Delaware corporation. |

| · | “DEAC Class A common stock” refers to the shares of Class A common stock, par value $0.0001 per share, of DEAC. |

| · | “DEAC Class B common stock” refers to the shares of Class B common stock, par value $0.0001 per share, of DEAC. |

| · | “DEAC NV” refers to DEAC NV Merger Corp., a Nevada corporation, which was renamed DraftKings Inc. in connection with the Closing. |

| · | “DEAC Shares” refers to shares of DEAC Class A common stock and shares of DEAC Class B common stock. |

| · | “DEAC Stockholders” refers to, collectively, holders of shares of DEAC Class A common stock and holders of shares of DEAC Class B common stock, but does not include the PIPE Investors or the holders of the Convertible Notes. |

| · | “DEAC warrants” refers to the public warrants, the private placement warrants and the PIPE Warrants, each of which was exercisable for one share of DEAC Class A common stock at an exercise price of $11.50 per share, in accordance with its terms, and upon the Closing, became warrants to acquire shares of DraftKings Class A common stock on the same terms as DEAC’s previously outstanding warrants. |

| · | “dollars” or “$” refers to U.S. dollars. |

| · | “DraftKings” refers to, prior to the Business Combination, DraftKings Inc., a Delaware corporation, and following the Business Combination, DraftKings Inc., a Nevada corporation, and its consolidated subsidiaries. |

-iii-

| · | “DraftKings Class A common stock” refers to the shares of Class A common stock, par value $0.0001 per share, of DraftKings. |

| · | “DraftKings Class B common stock” refers to the shares of Class B common stock, par value $0.0001 per share, of DraftKings. |

| · | “earnout shares” refers to the (i) 5,388,000 shares of DraftKings Class A common stock that were delivered and deposited into a custodian account and (ii) 612,000 shares of DraftKings Class A common stock that were delivered to I.B.I. Trust Management, the trustee, in each case, to be released pro-rata to the recipients thereof only upon the occurrence of certain triggering events that relate to the achievement of certain stock price thresholds based upon the volume weighted average share price of our Class A common stock ranging from $12.50 to $16.00 at any time during a four-year period commencing on the Closing Date. On May 21, 2020, the triggering events for the issuance of all earnout shares occurred, as the volume weighted average share price of our Class A common stock had been greater than or equal to $16.00 over the previous 20 trading days. |

| · | “founder shares” refers to shares of DEAC Class B common stock initially purchased by our Sponsor and Harry Sloan in a private placement prior to DEAC’s initial public offering and the shares of Class A common stock that were issued upon the automatic conversion of those shares in connection with the Closing. |

| · | “Merger Sub” refers to DEAC Merger Sub Inc., a Delaware corporation. |

| · | “Nasdaq” refers The Nasdaq Global Select Market. |

| · | “Old DK” refers to, prior to the Business Combination, DraftKings Inc., a Delaware corporation. |

| · | “Old DK Warrants” refers to the 180,103 warrants initially issued by Old DK to certain institutional investors and which were assumed by the Company. |

| · | “PIPE Investors” refers to certain institutional and accredited investors who are party to the Subscription Agreements. |

| · | “PIPE Warrants” refers to the 3.0 million redeemable warrants issued in the Private Placement, each of which was exercisable for one share of DEAC Class A common stock at an exercise price of $11.50 per share, in accordance with its terms, and upon the Closing, became warrants to acquire shares of DraftKings Class A common stock on the same terms as DEAC’s previously outstanding warrants. All PIPE Warrants were exercised or redeemed in full as of July 2, 2020. |

| · | “Private Placement” refers to the issuance of an aggregate of 30,471,352 shares of DEAC Class A common stock and the PIPE Warrants pursuant to the Subscription Agreements to the PIPE Investors immediately before the Closing, at a purchase price of $10.00 per share. |

| · | “private placement warrants” refers to the 3,333,332 warrants initially issued to DEAC’s Sponsor and Harry Sloan in a private placement simultaneously with the closing of DEAC’s initial public offering, each of which is exercisable for one share of our Class A common stock at an exercise price of $11.50 per share, in accordance with its terms, and does not include the PIPE Warrants. |

| · | “Proxy Statement” refers to the definitive proxy statement/prospectus filed with the SEC by the Company on April 15, 2020 in connection with the Business Combination. |

| · | “public shares” refers to shares of DEAC Class A common stock sold as part of the units in DEAC’s initial public offering (whether they were purchased in that offering or thereafter in the open market), which became shares of Class A common stock in connection with the Closing. |

| · | “public warrants” refers to the warrants to purchase shares of DEAC Class A common stock sold as part of the units in DEAC’s initial public offering, each of which, until July 7, 2020 when we redeemed all of our outstanding public warants that had not been exercised as of July 2, 2020, was exercisable for one share of DEAC Class A common stock at an exercise price of $11.50 per share, in accordance with its terms (whether they were purchased in that offering or thereafter in the open market), and upon the Closing, became warrants to acquire shares of Class A common stock on the same terms as DEAC’s public warrants. |

-iv-

| · | “reincorporation” refers to the change of DEAC’s jurisdiction of incorporation from Delaware to Nevada in connection with the Business Combination through the merger of DEAC with and into DEAC NV, with DEAC NV surviving the merger, pursuant to the terms and subject to the conditions of the Reincorporation Merger Agreement. |

| · | “Reincorporation Merger Agreement” refers to the Agreement and Plan of Merger, dated as of March 12, 2020, by and between DEAC and DEAC NV. |

| · | “SBT” or “SBTech” refers to SBTech (Global) Limited, a company limited by shares, originally incorporated in Gibraltar and continued as a company under the Isle of Man Companies Act 2006, with registration number 014119V. |

| · | “SBT Sellers” refers to each of the holders of capital stock of SBT party to the BCA. |

| · | “SBT Sellers’ Representative” refers to Shalom Meckenzie in his capacity as representative of the SBT Sellers under the BCA. |

| · | “SBT shares” refers to the ordinary shares, par value $0.10 per share, of SBT. |

| · | “SEC” refers to the U.S. Securities and Exchange Commission. |

| · | “Sponsor” refers to Eagle Equity Partners, LLC, a Delaware limited liability company controlled by Jeff Sagansky and Eli Baker. |

| · | “Stock Consideration Shares” refers to the shares of Class A common stock issued to the stockholders of Old DK and SBT as stock consideration pursuant to the transactions contemplated by the BCA. |

| · | “Subscription Agreements” refers to the subscription agreements, dated December 22, 2019, between DEAC and the PIPE Investors, pursuant to which DEAC agreed to issue an aggregate of 30,471,352 shares of DEAC Class A common stock plus 3.0 million PIPE Warrants to the PIPE Investors immediately before the Closing at a purchase price of $10.00 per share. In connection with the Closing of the Business Combination, the previously issued and outstanding shares of DEAC Class A common stock were exchanged, on a one-for-one basis, for shares of DraftKings Class A common stock and all of DEAC’s outstanding warrants became warrants to acquire shares of DraftKings Class A common stock on the same terms as DEAC’s warrants. |

-v-

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this prospectus that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. Forward-looking statements include statements relating to our expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

| · | factors relating to our business, operations and financial performance, including: |

| · | our ability to effectively compete in the global entertainment and gaming industries; |

| · | our ability to successfully acquire and integrate new operations; |

| · | our ability to obtain and maintain licenses with gaming authorities; |

| · | our inability to recognize deferred tax assets and tax loss carryforwards; |

| · | market and global conditions and economic factors beyond our control, including the potential adverse effects of the ongoing global coronavirus (“COVID-19”) pandemic on capital markets, general economic conditions, unemployment and our liquidity, operations and personnel; |

| · | intense competition and competitive pressures from other companies worldwide in the industries in which we operate; |

| · | our ability to raise financing in the future; |

| · | our success in retaining or recruiting officers, key employees or directors; and |

| · | litigation and the ability to adequately protect our intellectual property rights. |

These forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Important factors could cause actual results to differ materially from those indicated or implied by forward-looking statements such as those contained in documents we have filed with the U.S. Securities and Exchange Commission. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. For a discussion of the risks involved in our business and investing in our common stock, see the section entitled “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

-vi-

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including the information under “Risk Factors,” “DraftKings’ Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “SBT’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Combined Financial Information” and the financial statements included elsewhere in this prospectus.

The Company

We are a digital sports entertainment and gaming company. We provide users with daily fantasy sports, sports betting and iGaming opportunities, and we are also involved in the design and development of sports betting and casino gaming platform software for online and retail sportsbook and casino gaming products.

Our mission is to make life more exciting by responsibly creating the world’s favorite real-money games and betting experiences. We accomplish this by creating an environment where our users can find enjoyment and fulfillment through daily fantasy sports contests, sports betting and iGaming.

We seek to innovate and to constantly improve our games and product offerings. Our focus is on creating unique and exciting experiences for our users. We are also highly focused on our responsibility as stewards of this new era in real-money gaming. Our ethics guide every decision we make, both in respect for the tradition of sports and in our investment in regulatory compliance and consumer protection that have guided our company.

Background

DraftKings Inc., a Nevada corporation (the “Company”), was originally known as DEAC NV Merger Corp. (“DEAC NV”), a wholly-owned subsidiary of our predecessor Diamond Eagle Acquisition Corp. (“DEAC”), a special purpose acquisition company, which completed its initial public offering in May 2019. DEAC was incorporated for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, and, prior to the Business Combination, the Company was a “shell company” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), because it had no operations and nominal assets consisting almost entirely of cash. On April 23, 2020, DEAC consummated the Business Combination. In connection with the Closing of the Business Combination, (i) DEAC changed its jurisdiction of incorporation to Nevada by merging with and into DEAC NV, with DEAC NV surviving the merger and changing its name to “DraftKings Inc.”, (ii) following the reincorporation, DEAC Merger Sub Inc., a wholly-owned subsidiary of DEAC, merged with and into Old DK, with Old DK surviving the merger (the “DK Merger”) and (iii) immediately following the DK Merger, the Company acquired all of the issued and outstanding share capital of SBT (the “SBTech Acquisition”). Upon consummation of the foregoing transactions, Old DK and SBT became wholly-owned subsidiaries of the Company. In connection with the Closing of the Business Combination, the issued and outstanding shares of DEAC’s Class A common stock were exchanged, on a one-for-one basis, for shares of DraftKings Class A common stock. Similarly, all of DEAC’s outstanding warrants became warrants to acquire shares of DraftKings Class A common stock on the same terms as DEAC’s warrants.

Our Class A common stock is currently listed on Nasdaq under the symbol “DKNG”.

The rights of holders of our Class A common stock and warrants are governed by our Charter, our bylaws and the Nevada Revised Statutes, and in the case of the warrants, the Warrant Agreement, dated May 10, 2019, by and between DEAC and Continental, as warrant agent (as assigned pursuant to the Assignment and Assumption Agreement, dated April 23, 2020, by and among DraftKings Inc., DEAC, Continental, Computershare Trust Company, N.A. and Computershare Inc.). See the sections entitled “Description of Securities” and “Selling Securityholders.”

Corporate Information

Our principal executive offices are located at 222 Berkeley Street, 5th Floor, Boston, MA 02116. Our telephone number is (617) 986-6744, and our website address is www.draftkings.com. Information contained on our website or connected thereto is provided for textual reference only and does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

-1-

THE OFFERING

We are registering the issuance by us of (i) shares of our Class A common stock that may be issued upon exercise of all outstanding warrants to purchase Class A common stock at an exercise price of $11.50 per share of Class A common stock, which consist of the private placement warrants, (ii) shares of Class A common stock issued upon the satisfaction of certain triggering events (as described herein), (iii) shares of Class A common stock issuable upon the exercise of outstanding options granted under the DraftKings Inc. 2017 Equity Incentive Plan (the “2017 Equity Incentive Plan”) and DraftKings Inc. 2012 Stock Option & Restricted Stock Incentive Plan (the “2012 Equity Incentive Plan”) held by former employees or former consultants of DraftKings Inc., a Delaware corporation,, and (v) shares of Class A common stock issuable upon the exercise of outstanding options granted under the SBTech (Global) Limited 2011 Global Share Option Plan held by former employees or former consultants of SBTech. As of February 1, 2021, there were 1,815,065 private placement warrants outstanding, 6,000,000 earnout shares outstanding, 115,908 outstanding options granted under the 2017 Equity Incentive Plan and 2012 Equity Incentive Plan as to which underlying shares of Class A common stock are being registered and 319,502 outstanding options granted under the SBTech (Global) Limited 2011 Global Share Option Plan as to which underlying shares of Class A common stock are being registered.

We are also registering the resale by the Selling Securityholders or their permitted transferees of shares of Class A common stock and warrants, in each case up to the aggregate amounts listed under the section entitled “Selling Securityholders”.

On July 7, 2020, we redeemed all of our outstanding public warrants that had not been exercised as of July 2, 2020, which resulted in the exercise of 17.6 million warrants for proceeds to us of $201.5 million and the redemption of 78,156 public warrants at a redemption price of $0.01 per warrant.

Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” on page 9 of this prospectus.

Issuance of Class A Common Stock

The following information is as of February 1, 2021 and does not give effect to issuances of our Class A common stock or warrants after such date, or the exercise of warrants after such date.

| Shares of our Class A common stock to be issued upon exercise of all outstanding private placement warrants and Old DK Warrants | 1,815,065 shares |

| Shares of our Class A common stock outstanding prior to exercise of all warrants | 396,892,115 shares(1) |

| Use of proceeds | We will receive up to an aggregate of approximately $20.9 million from the exercise of all outstanding private placement warrants, assuming the exercise in full of all such warrants for cash.

We will receive up to an aggregate of approximately $284.8 thousand from the exercise of stock options under the 2017 Equity Incentive Plan and the 2012 Equity Incentive Plan, and $28.8 thousand from the exercise of stock options under the SBTech (Global) Limited 2011 Global Share Option Plan.

We do not receive any proceeds from the issuance of the earnout shares.

Unless we inform you otherwise in a prospectus supplement or free writing prospectus, we intend to use the net proceeds from the exercise of such warrants and stock options for general corporate purposes which may include acquisitions or other strategic investments or repayment of outstanding indebtedness. |

-2-

| Resale of Class A common stock and warrants | |

| Shares of Class A common stock offered by the Selling Securityholders (including 1,815,065 shares of Class A common stock that may be issued upon exercise of the private placement warrants) | 190,749,648 shares |

| Warrants offered by the Selling Securityholders (representing the private placement warrants) | 1,815,065 warrants |

| Exercise price | $11.50 per share, subject to adjustment as described herein |

| Redemption | The warrants are redeemable in certain circumstances. See “Description of Securities—Warrants” for further discussion. |

| Use of proceeds | We will not receive any proceeds from the sale of the Class A common stock and warrants to be offered by the Selling Securityholders. With respect to shares of Class A common stock underlying the warrants, we will not receive any proceeds from such shares except with respect to amounts received by us upon exercise of such warrants to the extent such warrants are exercised for cash. |

| Ticker symbols | “DKNG” for the Class A common stock. |

| 1 | Represents the number of shares of Class A common stock outstanding as of February 1, 2021. The number of issued and outstanding shares of Class A common stock also does not include (i) the shares of Class A common stock reserved for issuance under the DraftKings Inc. 2020 Incentive Plan (ii) the shares of Class A common stock reserved for issuance under the DraftKings Employee Stock Purchase Plan (“ESPP”), (iii) shares of Class A common stock issuable upon the exercise of outstanding options to purchase shares of Class A common stock, (iv) shares of Class A common stock issuable upon exercise of outstanding restricted stock units and (v) shares of Class A common stock underlying our private placement warrants. |

-3-

Risk Factors

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below and in the section of this prospectus entitled “Risk Factors” as well as the other information included in this prospectus, including “Cautionary Note Regarding Forward-Looking Statements,” “Selected Consolidated Historical Financial Information,” “DraftKings’ Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “SBT’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included elsewhere in this prospectus, before making an investment decision. These risks include, but are not limited to, the following:

| · | Competition within the global entertainment and gaming industries is intense and our existing and potential users may be attracted to competing forms of entertainment such as television, movies and sporting events, as well as other entertainment and gaming options on the Internet. If our offerings do not continue to be popular, our business could be harmed. |

| · | Reductions in discretionary consumer spending could have an adverse effect on our business, financial condition, results of operations and prospects. |

| · | Our projections are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding future legislation and changes in regulations, both inside and outside of the United States. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations. |

| · | The success, including win or hold rates, of existing or future sports betting and iGaming products depends on a variety of factors and is not completely controlled by us. |

| · | We rely on information technology and other systems and services, and any failures, errors, defects or disruptions in our systems or services could diminish our brand and reputation, subject us to liability, disrupt our business, affect our ability to scale our technical infrastructure and adversely affect our operating results and growth prospects. Our games and other software applications and systems, and the third-party platforms upon which they are made available could contain undetected errors. |

| · | We rely on other third-party sports data providers for real-time and accurate data for sporting events, and if such third parties do not perform adequately or terminate their relationships with us, our costs may increase and our business, financial condition and results of operations could be adversely affected. |

| · | If Internet and other technology-based service providers experience service interruptions, our ability to conduct our business may be impaired and our business, financial condition and results of operations could be adversely affected. |

| · | We rely on strategic relationships with casinos, tribes and horse-tracks in order to be able to offer our products in certain jurisdictions. If we cannot establish and manage such relationships with such partners, our business, financial condition and results of operations could be adversely affected. |

| · | Our growth prospects may suffer if we are unable to develop successful offerings or if we fail to pursue additional offerings. In addition, if we fail to make the right investment decisions in our offerings and technology, we may not attract and retain key users and our revenue and results of operations may decline. |

| · | Our business model depends upon the continued compatibility between our app and the major mobile operating systems and upon third-party platforms for the distribution of our product offerings. If Google Play or the Apple App Store prevent users from downloading our apps or block advertising from being delivered to our users, our ability to grow our revenue, profitability and prospects may be adversely affected. |

| · | We may invest in or acquire other businesses, and our business may suffer if we are unable to successfully integrate acquired businesses into our company or otherwise manage the growth associated with multiple acquisitions. |

| · | Our business is subject to a variety of U.S. and foreign laws, many of which are unsettled and still developing and which could subject us to claims or otherwise harm our business. Any change in existing regulations or their interpretation, or the regulatory climate applicable to our products and services, or changes in tax rules and regulations or interpretation thereof related to our products and services, could adversely impact our ability to operate our business as currently conducted or as we seek to operate in the future, which could have a material adverse effect on our financial condition and results of operations. |

| · | Our growth prospects depend on the legal status of real-money gaming in various jurisdictions, predominantly within the United States, and legalization may not occur in as many states as we expect, or may occur at a slower pace than we anticipate. Additionally, even if jurisdictions legalize real money gaming, this may be accompanied by legislative or regulatory restrictions and/or taxes that make it impracticable or less attractive to operate in those jurisdictions, or the process of implementing regulations or securing the necessary licenses to operate in a particular jurisdiction may take longer than we anticipate, which could adversely affect our future results of operations and make it more difficult to meet our expectations for financial performance. |

-4-

| · | Our growth prospects and market potential will depend on our ability to obtain licenses to operate in a number of jurisdictions and if we fail to obtain and subsequently maintain such licenses our business, financial condition, results of operations and prospects could be impaired. |

| · | We have been, and continue to be, the subject of governmental investigations and inquiries with respect to the operation of our businesses and we could be subject to future governmental investigations and inquiries, legal proceedings and enforcement actions. Any such investigation, inquiry, proceeding or action, could adversely affect our business. |

| · | Negative events or negative media coverage relating to, or a declining popularity of, daily fantasy sports, sports betting, the underlying sports or athletes, online sports betting or iGaming in particular, or other negative coverage may adversely impact our ability to retain or attract users, which could have an adverse impact on our business. |

| · | Due to the nature of our business, we are subject to taxation in a number of jurisdictions and changes in, or new interpretations of, tax laws, tax rulings or their application by tax authorities could result in additional tax liabilities and could materially affect our financial condition and results of operations. We are also subject to periodic audits and examinations by the Internal Revenue Service (the “IRS”), as well as state and local taxing authorities, the results of which may materially impact our financial statements in the period in which the audit or examination occurs. |

| · | While we work to integrate the DraftKings and SBT businesses and operations, management’s focus and resources may be diverted from operational matters and other strategic opportunities. |

| · | Although we expect that the Business Combination will produce substantial synergies, the integration of the two companies, incorporated in different countries, with geographically dispersed operations, and with different business cultures and compensation structures, presents management challenges. There can be no assurance that this integration, and the synergies expected to result from that integration, will be achieved as rapidly or to the extent currently anticipated. |

| · | Our business now includes a B2B business model, primarily in international jurisdictions, which business depends on the underlying financial performance of our direct operators and its resellers. As a material part of SBT’s revenue is currently generated through resellers and direct sales to operators, a decline in such resellers’ or direct operators’ financial performance or a termination of some or all of the agreements with such resellers or operators could have a material adverse effect on our business. |

| · | SBT’s business, which includes significant international operations, is likely to expose us to foreign currency transaction and translation risks. As a result, changes in the valuation of the U.S. dollar in relation to other currencies could have positive or negative effects on our profit and financial position. |

| · | The trading price of our Class A common stock has been, and will likely continue to be, volatile and you could lose all or part of your investment. |

| · | Because we are a “controlled company” under The Nasdaq Stock Market listing standards, our stockholders may not have certain corporate governance protections that are available to stockholders of companies that are not controlled companies. |

| · | Our dual class structure has the effect of concentrating voting power with our Chief Executive Officer and Co-Founder, which limits an investor’s ability to influence the outcome of important transactions, including a change in control. |

The summary risk factors described above should be read together with the text of the full risk factors in the section of this prospectus entitled “Risk Factors” and in the other information set forth in this prospectus, including our consolidated financial statements and the related notes. If any such risks and uncertainties actually occur, our business, prospects, financial condition and results of operations could be materially and adversely affected. The risks summarized above or described in full below in the section entitled “Risk Factors” are not the only risks that we face. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial may also materially adversely affect our business, financial condition, results of operations and prospects.

-5-

SELECTED consolidated historical financial information

The following tables provide our historical selected consolidated financial and other data for the periods indicated. We have derived the selected consolidated statement of operations data for the fiscal years ended December 31, 2020, 2019, and 2018 and the selected consolidated balance sheet data as of December 31, 2020 and 2019 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the selected consolidated statements of operations data for the fiscal year ended December 31, 2017 and the selected consolidated balance sheet data as of December 31, 2018 from our audited consolidated financial statements, which are not included in this prospectus. The following selected consolidated financial data should be read in conjunction with “Draftkings’ Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “SBT’s Management's Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included elsewhere in this prospectus. The selected consolidated financial data in this section are not intended to replace our audited financial statements. Our historical results are not necessarily indicative of our results in any future period.

| Year | ||||||||||||||||

| (in thousands, except per share data) | 2020 (1) | 2019 | 2018 | 2017 | ||||||||||||

| Consolidated Statements of Operations Data: | ||||||||||||||||

| Revenue | $ | 614,532 | $ | 323,410 | $ | 226,277 | $ | 191,844 | ||||||||

| Loss from operations | $ | (843,256 | ) | $ | (146,545 | ) | $ | (76,781 | ) | $ | (73,198 | ) | ||||

| Interest (expense) income, net | $ | (1,070 | ) | $ | 1,348 | $ | 666 | $ | (1,541 | ) | ||||||

| Net loss | $ | (844,270 | ) | $ | (142,734 | ) | $ | (76,220 | ) | $ | (75,556 | ) | ||||

| Loss per share attributable to common stockholders: | $ | (2.76 | ) | $ | (0.77 | ) | $ | (0.45 | ) | $ | (0.51 | ) | ||||

| Consolidated Statements of Cash Flows Data: | ||||||||||||||||

| Net cash used in operating activities | $ | (337,875 | ) | $ | (78,880 | ) | $ | (45,579 | ) | $ | (88,437 | ) | ||||

| Net cash used in investing activities | $ | (227,341 | ) | $ | (42,271 | ) | $ | (26,672 | ) | $ | (7,715 | ) | ||||

| Net cash provided by financing activities | $ | 2,306,299 | $ | 79,776 | $ | 140,892 | $ | 118,531 | ||||||||

| (in thousands) | Year | |||||||||||

| 2020 (1) | 2019 | 2018 | ||||||||||

| Consolidated Balance Sheets Data: | ||||||||||||

| Total assets | $ | 3,439,329 | $ | 330,725 | $ | 299,393 | ||||||

| Total liabilities (2) | $ | 742,540 | $ | 380,305 | $ | 223,343 | ||||||

| Total stockholders’ equity (deficit) (3) | $ | 2,696,789 | $ | (49,580 | ) | $ | 76,050 | |||||

(1) On April 23, 2020, the business combination with SBTech and DEAC was completed. The consolidated statements of operations data for the fiscal year ended December 31, 2020 does not give pro forma effect to the impact of the Business Combination (i.e., does not include SBTech’s results for 2018, 2019, and January 1, 2020 through April 23, 2020) and, as a result, the results reflected in this section may not be indicative of our results going forward. See the section entitled “Unaudited Pro Forma Condensed Combined Financial Information”.

(2) Beginning in 2019, DraftKings issued subordinated convertible promissory notes to certain investors. Upon the consummation of the Business Combination, the mandatory conversion feature was triggered. All outstanding convertible promissory notes were converted to equity in 2020.

(3) In 2020, as part of the Business Combination, Class A common stock was issued in relation to DEAC shares being recapitalized, and Class B common stock was issued to our Chief Executive Officer. In addition, we issued Class A common stock resulting from two public offerings and the exercise of warrants in 2020.

-6-

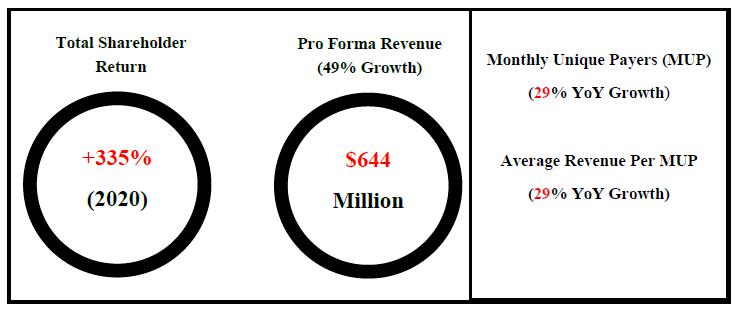

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following summary unaudited pro forma condensed combined financial data (the “summary pro forma data”) gives effect to the Business Combination described in the section entitled “Unaudited Pro Forma Condensed Combined Financial Information.” The merger between DraftKings and Merger Sub was accounted for as a reverse recapitalization, with no goodwill or other intangible assets recorded, in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Under this method of accounting, DEAC was treated as the “acquired” company for financial reporting purposes. Accordingly, for accounting purposes, the reverse recapitalization for which Old DK has been determined to be the accounting acquirer (the “Reverse Recapitalization”) was treated as the equivalent of Old DK issuing stock for the net assets of DEAC, accompanied by a recapitalization. The net assets of DEAC are stated at historical cost, with no goodwill or other intangible assets recorded. DraftKings’ acquisition of all of the issued and outstanding share capital of SBTech (the “SBTech Acquisition”) was treated as a business combination under Financial Accounting Standards Board’s ASC 805, and was accounted for using the acquisition method of accounting. We recorded the fair value of assets acquired and liabilities assumed from SBTech. The summary unaudited pro forma condensed combined statement of operations data for the year ended December 31, 2020 give pro forma effect to the Business Combination and the related transactions as if they had occurred on January 1, 2020.

The summary pro forma data have been derived from, and should be read in conjunction with, the unaudited pro forma condensed combined financial information of the combined company and the related notes appearing elsewhere in this prospectus. The unaudited pro forma condensed combined financial information is based upon, and should be read in conjunction with, the historical consolidated financial statements of Old DK and SBTech and related notes included in this prospectus. The summary pro forma data have been presented for informational purposes only and are not necessarily indicative of what the combined company’s results of operations actually would have been had the Business Combination and the related transactions been completed as of the dates indicated. In addition, the summary pro forma data do not purport to project the future operating results of the combined company.

The following table presents summary pro forma data after giving effect to the Business Combination and the related transactions.

| Pro Forma Combined | ||||

| (in thousands, except share and per share data) | ||||

| Summary Unaudited Pro Forma Condensed Combined Statement of Operations Data for the Year Ended December 31, 2020 | ||||

| Revenue | $ | 643,502 | ||

| Net loss per share – basic and diluted | $ | (2.46 | ) | |

| Weighted-average Class A shares outstanding - basic and diluted | 347,224,928 | |||

-7-

MARKET PRICE, TICKER SYMBOL AND DIVIDEND INFORMATION

Market Price and Ticker Symbol

Our Class A common stock is currently listed on Nasdaq under the symbol “DKNG”.

The closing price of the Class A common stock on February 25, 2021, was $57.81.

Holders

As of February 1, 2021, there were 860 holders of record of our Class A common stock and 95 holders of record of our warrants. Such numbers do not include beneficial owners holding our securities through nominee names. There is no public market for our Class B common stock.

Dividend Policy

We have not paid any cash dividends on our Class A common stock to date. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition. The payment of any cash dividends will be within the discretion of the Board at such time.

-8-

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below as well as the other information included in this prospectus, including “Cautionary Note Regarding Forward-Looking Statements,” “Selected Consolidated Historical Financial Information,” “DraftKings’ Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “SBT’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included elsewhere in this prospectus, before making an investment decision. Our business, prospects, financial condition, or operating results could be harmed by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our securities could decline due to any of these risks, and, as a result, you may lose all or part of your investment.

Competition within the global entertainment and gaming industries is intense and our existing and potential users may be attracted to competing forms of entertainment such as television, movies and sporting events, as well as other entertainment and gaming options on the Internet. If our offerings do not continue to be popular, our business could be harmed.

We operate in the global entertainment and gaming industries with our business-to-consumer offerings such as DFS, Sportsbook and iGaming, and our business-to-business offerings. Our users face a vast array of entertainment choices. Other forms of entertainment, such as television, movies, sporting events and in-person casinos, are more well established and may be perceived by our users to offer greater variety, affordability, interactivity and enjoyment. We compete with these other forms of entertainment for the discretionary time and income of our users. If we are unable to sustain sufficient interest in our recently launched sports betting and iGaming offerings in comparison to other forms of entertainment, including new forms of entertainment, our business model may not continue to be viable.

The specific industries in which we operate are characterized by dynamic customer demand and technological advances, and there is intense competition among online gaming and entertainment providers. A number of established, well-financed companies producing online gaming and/or interactive entertainment products and services compete with our offerings, and other well-capitalized companies may introduce competitive services. Such competitors may spend more money and time on developing and testing products and services, undertake more extensive marketing campaigns, adopt more aggressive pricing or promotional policies or otherwise develop more commercially successful products or services than ours, which could negatively impact our business. Our competitors may also develop products, features, or services that are similar to ours or that achieve greater market acceptance. Such competitors may also undertake more far-reaching and successful product development efforts or marketing campaigns, or may adopt more aggressive pricing policies. Furthermore, new competitors, whether licensed or not, may enter the iGaming industry. There has also been considerable consolidation among competitors in the entertainment and gaming industries and such consolidation and future consolidation could result in the formation of larger competitors with increased financial resources and altered cost structures, which may enable them to offer more competitive products, gain a larger market share, expand offerings and broaden their geographic scope of operations. If we are not able to maintain or improve our market share, or if our offerings do not continue to be popular, our business could suffer.

Economic downturns and political and market conditions beyond our control could adversely affect our business, financial condition and results of operations.

Our financial performance is subject to global and U.S. economic conditions and their impact on levels of spending by users and advertisers. Economic recessions have had, and may continue to have, far reaching adverse consequences across many industries, including the global entertainment and gaming industries, which may adversely affect our business and financial condition. In the past decade, global and U.S. economies have experienced tepid growth following the financial crisis in 2008 – 2009 and there appears to be an increasing risk of a recession due to international trade and monetary policy, the global COVID-19 pandemic and other changes. If the national and international economic recovery slows or stalls, these economies experience another recession or any of the relevant regional or local economies suffers a downturn, we may experience a material adverse effect on our business, financial condition, results of operations or prospects.

In addition, changes in general market, economic and political conditions in domestic and foreign economies or financial markets, including fluctuation in stock markets resulting from, among other things, trends in the economy as a whole may reduce users’ disposable income and advertisers’ budgets. Any one of these changes could have a material adverse effect on our business, financial condition, results of operations or prospects.

-9-

Reductions in discretionary consumer spending could have an adverse effect on our business, financial condition, results of operations and prospects.

Our business is particularly sensitive to reductions from time to time in discretionary consumer spending. Demand for entertainment and leisure activities, including gaming, can be affected by changes in the economy and consumer tastes, both of which are difficult to predict and beyond our control. Unfavorable changes in general economic conditions, including recessions, economic slowdowns, sustained high levels of unemployment, and rising prices or the perception by consumers of weak or weakening economic conditions, may reduce our users’ disposable income or result in fewer individuals engaging in entertainment and leisure activities, such as daily fantasy sports, sports betting and iGaming. As a result, we cannot ensure that demand for our offerings will remain constant. Adverse developments affecting economies throughout the world, including a general tightening of availability of credit, decreased liquidity in certain financial markets, increased interest rates, foreign exchange fluctuations, increased energy costs, acts of war or terrorism, transportation disruptions, natural disasters, declining consumer confidence, sustained high levels of unemployment or significant declines in stock markets, as well as concerns regarding pandemics, epidemics and the spread of contagious diseases, could lead to a further reduction in discretionary spending on leisure activities, such as daily fantasy sports and gaming.

For example, the outbreak of COVID-19, a virus originating in China causing potentially deadly respiratory tract infections, has negatively affected economic conditions regionally as well as globally, and has caused a reduction in consumer spending. Efforts to contain the effect of the virus have included travel restrictions and restrictions on public gatherings. Many businesses have eliminated non-essential travel and canceled in-person events to reduce instances of employees and others being exposed to large public gatherings, and state and local governments across the United States have restricted business activities and strongly encouraged, instituted orders or otherwise restricted individuals from leaving their home.

The direct impact on our business beyond disruptions in normal business operations in several of our offices has been primarily through the suspension, postponement and cancellation of major sports and sporting events. Although many major sports seasons and sporting events have recommenced in recent months, COVID-19 could have a continued material adverse impact on economic and market conditions and trigger a period of continued global economic slowdown, especially in light of potential subsequent waves or new strains of the virus. The rapid development and fluidity of this situation precludes any prediction as to the ultimate impact of COVID-19, which remains a material uncertainty and risk with respect to DraftKings, our performance, and our financial results and could adversely affect our financial results. In particular, these changes have reduced customers’ use of, and spending on, our product offerings, and have caused us to issue refunds for canceled events, and some retail casinos where we have a branded sportsbooks and DFS have reduced their capacity. Cancellation of March Madness, the delay in the Major League Baseball (“MLB”) season, the truncated National Basketball Association (“NBA”) playoffs, and other events affected by COVID-19 has had an adverse impact on our revenue. Our revenue continues to depend on major sports seasons and sporting events, and we may not generate as much revenue as we would have without the cancellation or postponements in the wake of COVID-19. If a large number of our employees and/or a subset of our key employees and executives are impacted by COVID-19, our ability to continue to operate effectively may be negatively impacted. The ultimate severity of the COVID-19 outbreak is uncertain at this time and therefore we cannot predict the full impact it may have on our end markets and our operations; however, the effect on our results could be material and adverse. Any significant or prolonged decrease in consumer spending on entertainment or leisure activities could adversely affect the demand for our offerings, reducing our cash flows and revenues, and thereby materially harming our business, financial condition, results of operations and prospects.

We may experience fluctuations in our operating results, which make our future results difficult to predict and could cause our operating results to fall below expectations.

Our financial results have fluctuated in the past and we expect our financial results to fluctuate from quarter to quarter in the future. These fluctuations may be due to a variety of factors, some of which are outside of our control and may not fully reflect the underlying performance of our business.

Our financial results in any given quarter may be influenced by numerous factors, many of which we are unable to predict or are outside of our control, including the impact of seasonality and our betting results, and the other risks and uncertainties set forth herein. In particular, our betting operations have significant exposure to, and may be materially impacted by, sporting events and seasons, which can result in short-term volatility in betting win margins and user engagement, thus impacting revenues. While we have been able to forecast revenues from our daily fantasy sports business with greater precision than for new offerings, we cannot provide assurances that consumers will engage with our DFS offerings on a consistent basis. Consumer engagement in our daily fantasy sports, sports betting and iGaming services may decline or fluctuate as a result of a number of factors, including the popularity of the underlying sports, the user’s level of satisfaction with our offerings, our ability to improve and innovate, our ability to adapt our offerings, outages and disruptions of online services, the availability of live sporting events, the services offered by our competitors, our marketing and advertising efforts or declines in consumer activity generally as a result of economic downturns, among others. Any decline or fluctuation in the recurring portion of our business may have a negative impact on our business, financial condition, results of operations or prospects.

-10-

In our iGaming product offering, operator losses are limited per stake to a maximum payout. When looking at bets across a period of time, however, these losses can potentially be significant. Our quarterly financial results may also fluctuate based on whether we may pay out any jackpots to our iGaming users during the relevant quarter. As part of our iGaming offering, we may offer progressive jackpot games. Each time a progressive jackpot game is played, a portion of the amount wagered by the user is contributed to the jackpot for that specific game or group of games. Once a jackpot is won, the progressive jackpot is reset with a predetermined base amount. While we maintain a provision for these progressive jackpots in the event we choose to offer them, the cost of the progressive jackpot payout would be a cash outflow for our business in the period in which it is won with a potentially significant adverse effect on our financial condition and cash flows. Because winning is underpinned by a random mechanism, we cannot predict with absolute certainty when a jackpot will be won. In addition, we do not insure against random outcomes or jackpot wins.

Our projections are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding future legislation and changes in regulations, both inside and outside of the United States. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations.

We operate in rapidly changing and competitive industries and our projections are subject to the risks and assumptions made by management with respect to our industries. Operating results are difficult to forecast because they generally depend on our assessment of the timing of adoption of future legislation and regulations by different states, which are uncertain. Furthermore, if we invest in the development of new products or distribution channels that do not achieve significant commercial success, whether because of competition or otherwise, we may not recover the often substantial “up front” costs of developing and marketing those products and distribution channels, or recover the opportunity cost of diverting management and financial resources away from other products or distribution channels.

Additionally, as described above under “—Reductions in discretionary consumer spending could have an adverse effect on our business, financial condition, results of operations and prospects,” our business may be affected by reductions in consumer spending from time to time as a result of a number of factors which may be difficult to predict. This may result in decreased revenue levels, and we may be unable to adopt measures in a timely manner to compensate for any unexpected shortfall in income. This inability could cause our operating results in a given quarter to be higher or lower than expected. If actual results differ from our estimates, analysts may react negatively and our stock price could be materially impacted.

We have a new business model, which makes it difficult for us to forecast our financial results, creates uncertainty as to how investors will evaluate our prospects, and increases the risk that we will not be successful.

DraftKings was incorporated in 2011 and began offering the DFS products in 2012. DraftKings expanded from its DFS product offering to include Sportsbook and iGaming product offerings in 2018. Following the consummation of the Business Combination, we have a new business model and new offerings, including sports betting technology. Accordingly, it will be difficult for us to forecast our future financial results, and it will be uncertain how our new business model will affect investors’ perceptions and expectations of our prospects. Additionally, as the only vertically integrated U.S.-based sports betting and online gaming company, it may be difficult for investors to evaluate our business due to the lack of similarly situated competitors. Furthermore, our new business model may not be successful. You should not rely upon our historical financial results as indicators of our future financial performance, and our financial results and stock price may be volatile.

DraftKings has a history of losses and we may continue to incur losses in the future.

Since DraftKings was incorporated in 2011, it has experienced net losses and negative cash flows from operations. We experienced net losses of $844.3 million and $142.7 million in the years ended December 31, 2020 and 2019, respectively. We may continue to experience losses in the future, and we cannot assure you that we will achieve profitability. We may continue to incur significant losses in future periods. We expect our operating expenses to increase in the future as we expand our operations. Furthermore, as a public company, we have incurred and expect to continue to incur additional legal, accounting and other expenses that Old DK did not incur as a private company. If our revenue does not grow at a greater rate than our expenses, we will not be able to achieve or maintain profitability. We may incur significant losses in the future for many reasons, including those described in the other risks and uncertainties described in this prospectus. Additionally, we may encounter unforeseen expenses, operating delays, or other unknown factors that may result in losses in future periods. If our expenses exceed our revenue, our business may be negatively impacted and we may never achieve or maintain profitability.

-11-

Our results of operations may fluctuate due to seasonality and other factors and, therefore, our periodic operating results will not be guarantees of future performance.

Our DFS and Sportsbook operations may fluctuate due to seasonal trends and other factors. We believe that significant sporting events such as the playoffs and championship games, tend to impact, among other things, revenues from operations, key metrics and customer activity, and as such, DraftKings’ historical revenues generally have been highest in the fourth quarter when most of those games occur. A majority of our current sports betting and DFS revenue is and will continue to be generated from bets placed on, or contests relating to, the National Football League (“NFL”) and the NBA, each of which have their own respective off-seasons, which may cause decreases in our future revenues during such periods. Our revenues may also be affected by the scheduling of major sporting events that do not occur annually, such as the World Cup, or the cancellation or postponement of sporting events and races, such as the postponement of the 2020 Summer Olympic Games that were supposed to take place this past summer. In addition, certain individuals or teams advancing or failing to advance and their scores and other results within specific tournaments, games or events may impact our financial performance.

The success, including win or hold rates, of existing or future sports betting and iGaming products depends on a variety of factors and is not completely controlled by us.

The sports betting and iGaming industries are characterized by an element of chance. Accordingly, we employ theoretical win rates to estimate what a certain type of sports bet or iGame, on average, will win or lose in the long run. Net win is impacted by variations in the hold percentage (the ratio of net win to total amount wagered), or actual outcome, on our iGames and sports betting we offer to our users. We use the hold percentage as an indicator of an iGame’s or sports bet’s performance against its expected outcome. Although each iGame or sports bet generally performs within a defined statistical range of outcomes, actual outcomes may vary for any given period. In addition to the element of chance, win rates (hold percentages) may also (depending on the game involved) be affected by the spread of limits and factors that are beyond our control, such as a user’s skill, experience and behavior, the mix of games played, the financial resources of users, the volume of bets placed and the amount of time spent gambling. As a result of the variability in these factors, the actual win rates on our online iGames and sports bets may differ from the theoretical win rates we have estimated and could result in the winnings of our iGame’s or sports bet’s users exceeding those anticipated. The variability of win rates (hold rates) also have the potential to negatively impact our financial condition, results of operations, and cash flows.

Our success also depends in part on our ability to anticipate and satisfy user preferences in a timely manner. As we will operate in a dynamic environment characterized by rapidly changing industry and legal standards, our products will be subject to changing consumer preferences that cannot be predicted with certainty. We will need to continually introduce new offerings and identify future product offerings that complement our existing technology, respond to our users’ needs and improve and enhance our existing technology to maintain or increase our user engagement and growth of our business. We may not be able to compete effectively unless our product selection keeps up with trends in the digital sports entertainment and gaming industries in which we compete, or trends in new gaming products.

We rely on information technology and other systems and services, and any failures, errors, defects or disruptions in our systems or services could diminish our brand and reputation, subject us to liability, disrupt our business, affect our ability to scale our technical infrastructure and adversely affect our operating results and growth prospects. Our games and other software applications and systems, and the third-party platforms upon which they are made available could contain undetected errors.