EMAIL: mneidell@olshanlaw.com

DIRECT DIAL: 212.451.2230

July 16, 2019

VIA EDGAR AND ELECTRONIC MAIL

Kathleen Krebs, Esq.

Special Counsel

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Telecommunications

Mail Stop 3720

100 F Street, N.E.

Washington, D.C. 20549

| Re: | PowerFleet, Inc. | |

| Amendment No. 1 to Registration Statement on Form S-4 | ||

| Filed on July 1, 2019 | ||

| File No. 333-231725 |

Dear Ms. Krebs:

We acknowledge receipt of the letter of comment dated July 11, 2019 (the “Comment Letter”) from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with regard to the above-referenced matter. We have reviewed the Comment Letter with I.D. Systems, Inc. (“I.D. Systems”) and PowerFleet, Inc. (“Parent”) and provide the following responses on their behalf. Unless otherwise indicated, the page references below are to the attached changed pages to the Registration Statement on Form S-4 (the “Form S-4”). Capitalized terms used herein and not separately defined have the meanings given to them in the Form S-4. To facilitate the Staff’s review, we have reproduced the text of the Staff’s comments in italics below, and our responses appear immediately below each comment.

Amendment No. 1 to Form S-4

What are the Agreements and the Transactions?, page 2

| 1. | Please revise at page 3, and in the related disclosures at pages 86 and 87, to indicate why Nasdaq requested modifications to the terms of the Series A Preferred Stock in connection with the listing of Parent Common Stock on Nasdaq, which led to the Second Amendment to the Investment Agreement. |

The applicable disclosure in the Form S-4 has been revised in response to the Staff’s comment. Please see pages 3 and 87 of the Form S-4.

July 16, 2019

Page 2

The Parent Charter will provide that the Court of Chancery of the State of Delaware will be the exclusive forum for certain legal actions..., page 47

| 2. | We note that, in response to prior comment 18, you revised the exclusive forum provision in the amended and restated certificate of incorporation of PowerFleet to state that the provision will not apply to claims arising under the Securities Act, the Exchange Act or other federal securities laws for which there is exclusive federal or concurrent federal and state jurisdiction. Please revise your risk factor regarding the exclusive forum provision so that this is clear. In particular, we note the following disclosure: “Accordingly, the exclusive forum provision will not apply to actions arising under federal securities law or any other claim for which there is exclusive federal jurisdiction. The exclusive forum provision may be found unenforceable or inapplicable by a court in an action arising under federal securities law in which there is concurrent state and federal jurisdiction.” |

The applicable disclosure in the Form S-4 has been revised in response to the Staff’s comment. Please see pages 47, 64 and 172 of the Form S-4.

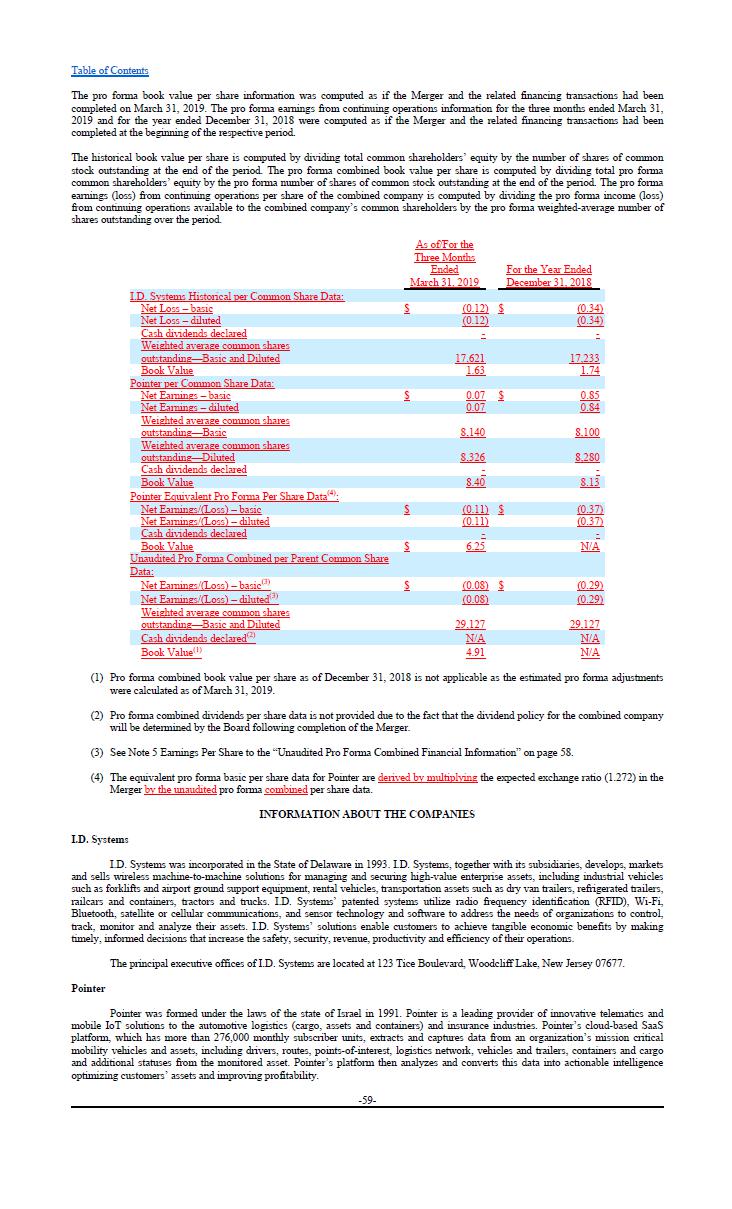

Comparative Per Share Information, page 58

| 3. | The Pointer equivalent pro forma earnings/(loss) per share data should be calculated by multiplying the pro forma earnings/(loss) per share by the exchange ratio. Please revise accordingly. |

The applicable disclosure in the Form S-4 has been revised to reflect the calculation of the Pointer equivalent pro forma earnings/(loss) per share data as the pro forma earnings/(loss) per share multiplied by the exchange ratio. Please see page 59 of the Form S-4.

| 4. | We note your response to comment 15. Clarify in footnote (4) how the equivalent per share amounts were calculated. Also, please remove the second sentence of this footnote or explain to us how potential shares should have an impact on the equivalent per share disclosures. |

The applicable disclosure in the Form S-4 has been revised to remove the second sentence in footnote (4) and to clarify the equivalent per share amounts. Please see page 59 of the Form S-4.

Tax Consequences to U.S. Holders and Non-U.S. Holders of I.D. Systems Common Stock, page 122

| 5. | Please revise to indicate that it is the opinion of named tax counsel that the I.D. Systems Merger, the Pointer Merger and the Preferred Investment, taken together, will be treated as a transaction described in Section 351 of the Code and that the I.D. Systems Merger qualifies as a reorganization within the meaning of Section 368(a) of the Code. Remove language here and on pages 14 and 24 that it is “intended” that the transactions so qualify or that you are assuming this tax treatment. Please refer to Staff Legal Bulletin 19, Legality and Tax Opinions in Registered Offerings, Section III.C.3 addressing assumptions within tax opinions. Lastly, clarify that the resulting material tax consequences to I.D. Systems shareholders that you describe constitute counsel’s opinion. Refer to Staff Legal Bulletin 19, Section III.B.2 addressing short-form tax opinions. |

The applicable disclosure in the Form S-4 has been revised in response to the Staff’s comment. Please see pages 14, 24, 121 and 122 of the Form S-4.

* * * * *

July 16, 2019

Page 3

The Staff is invited to contact the undersigned with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments.

| Sincerely, | |

| /s/Michael R. Neidell | |

| Michael R. Neidell |

cc: Ned Mavrommatis