Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

On April 4, 2022, upon the completion of the mergers (“Mergers”) pursuant to that certain Agreement and Plan of Merger, by and among Skillsoft Corp. (the “Company”), Ryzac, Inc., a Delaware corporation (“Codecademy”), Skillsoft Finance II, Inc., a Delaware corporation (the “Borrower”), Skillsoft Newco I, Inc., a Delaware corporation and direct wholly-owned subsidiary of Borrower (“Merger Sub I”), Skillsoft Newco II, LLC, a Delaware limited liability company and direct wholly-owned subsidiary of Borrower (“Merger Sub II”), and Fortis Advisors LLC, a Delaware limited liability company, solely in its capacity as the representative of the equity holders of Codecademy. Pursuant to the completion of the Mergers, the Company acquired Codecademy. The Codecademy acquisition was completed on April 4, 2022 for total consideration of approximately $386.0 million, consisting of the issuance of 30.4 million common shares and a net cash payment of $203.4 million.

In connection with the Mergers, the Borrower entered into Amendment No. 1 to the Credit Agreement, dated as of April 4, 2022 (the “First Amendment”), among Skillsoft Finance II, Holdings, certain subsidiaries of Skillsoft Finance II, as guarantors, Citibank N.A., as administrative agent, and the financial institutions parties thereto as Term B-1 Lenders, which amended the Credit Agreement (as amended by the First Amendment, the “Amended Credit Agreement”). The senior secured incremental term loan is referred to as the “Codecademy Financing Transaction.”

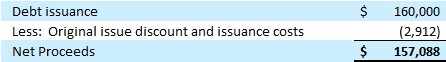

The First Amendment provides for the incurrence of up to $160 million of Term B-1 Loans (the “Term B-1 Loans”) under the Amended Credit Agreement. In addition, the First Amendment, among other things, (a) provides for early opt-in to the Secured Overnight Financing Rate (SOFR) for the existing term loans under the Credit Agreement (such existing term loans together with the Term B-1 Loans, the “Initial Term Loans”) and (b) provides for the applicable margin for the Initial Term Loans at 4.25% with respect to base rate borrowings and 5.25% with respect to SOFR borrowings.

Prior to the maturity thereof, the Initial Term Loans will be subject to quarterly amortization payments of 0.25% of the principal amount. The Amended Credit Agreement requires that any prepayment of the Initial Term Loans in connection with a repricing transaction shall be subject to (i) a 2.00% premium on the amount of Initial Term Loans prepaid if such prepayment occurs prior to July 16, 2022 and (ii) a 1.00% premium on the amount of Initial Term Loans prepaid in connection with a Repricing Transaction (as defined in the Amended Credit Agreement), if such prepayment occurs on or after July 16, 2022 but on or prior to January 16, 2023. The proceeds of the Term B-1 Loans were used by the Company to finance, in part, the Codecademy acquisition, and to pay costs, fees, and expenses related thereto.

The unaudited pro forma condensed combined financial information (“Unaudited Pro Forma Financial Information”) included herein presents the unaudited pro forma condensed combined balance sheet (“Pro Forma Balance Sheet”) and unaudited pro forma condensed combined statement of operations (“Pro Forma Statement of Operations”) based upon the historical financial statements of Skillsoft and Codecademy, after giving effect to the Mergers and the Codecademy Financing Transaction (collectively, the “Codecademy Transaction”), and the adjustments described in the accompanying notes.

The Pro Forma Balance Sheet as of January 31, 2022 gives effect to the Mergers and the Codecademy Financing Transaction as if each of them had occurred on January 31, 2022. The Pro Forma Statements of Operations give effect to the Mergers and the Codecademy Financing Transaction as if each of them had occurred on February 1, 2021.

The Unaudited Pro Forma Financial Information set out below has been prepared in accordance with Article 11 of Regulation S-X, as amended by the SEC Final Rule Release No. 33 10786, Amendments to Financial Disclosures About Acquired and Disposed Businesses (“Regulation S-X”), using accounting policies in accordance with GAAP.

The Unaudited Pro Forma Financial Information reflects Codecademy Transaction accounting adjustments that Skillsoft management believes are necessary to present fairly the Pro Forma Balance Sheet and Pro Forma Statement of Operations.

The Unaudited Pro Forma Financial Information has been prepared for illustrative purposes only. The hypothetical financial position included in the Unaudited Pro Forma Financial Information may differ from Skillsoft’s actual financial position following the Mergers. The Unaudited Pro Forma Financial Information has been prepared on the basis set out in the notes below and has been prepared in a manner consistent with the accounting policies applied by Skillsoft in its historical financial statements for the year ended January 31, 2022. In preparing the Unaudited Pro Forma Financial Information, no adjustments have been made to reflect the potential operating synergies, dis-synergies, and administrative cost savings or the costs of integration activities that could result from the combination of Skillsoft and Codecademy.