KIMMERIDGE MINERAL FUND, LP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019

Revenue Recognition

Mineral and royalty interests represent the right to receive revenues from the sale of oil, natural gas and NGL, less production taxes and post-production expenses. The prices of oil, natural gas, and NGL from the properties in which we own a mineral or royalty interest are primarily determined by supply and demand in the marketplace and can fluctuate considerably. As an owner of mineral and royalty interests, we have no working interest or operational control over the volumes and methods of sale of the oil, natural gas, and NGL produced and sold from our properties. We do not explore, develop, or operate the properties and, accordingly, do not incur any of the associated costs.

Oil, natural gas, and NGL revenues from our mineral and royalty interests are recognized when control transfers at the wellhead. Water sales are recognized when control of the water is transferred to an E&P operator and collectability is reasonably assured.

The Partnership also earns revenue related to lease bonuses. The Partnership earns lease bonus revenue by leasing its mineral interests to E&P companies. The Partnership recognizes lease bonus revenue when the lease agreement has been executed and payment is determined to be collectible.

See Note 3 for additional disclosures regarding revenue recognition.

Concentration of Revenue

Collectability of the Partnership’s royalty revenue is dependent upon the financial condition of the Partnership’s operators as well as general economic conditions in the industry.

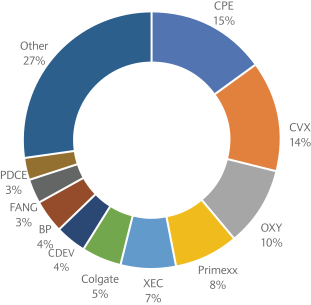

For the year ended December 31, 2020, in the Oil and Gas Producing Activities segment, revenue from Diamondback Energy, Inc, Cimarex Energy, and Oxy USA Inc represented approximately 15%, 12% and 10% of total revenue, respectively. These figures are the same as total revenues due to the fact that revenues attributable to the Water Services Operations segment for the year ended December 31, 2020 were de minimis.

For the year ended December 31, 2019, in the Oil and Gas Producing Activities segment, revenue from Cimarex Energy, Oxy USA Inc and PDC Energy represented approximately 16%, 10% and 10% of total revenue, respectively. In the Water Services Operations segment PDC Energy, WPX Energy, OXY USA Inc. and BTA Oil Producers represented 37%, 24%, 20% and 16% of total revenue, respectively. Combining both the Water Services Operations and Oil and Gas Producing Activities segments, Cimarex Energy, PDC Energy, and Oxy USA Inc represented approximately 15%, 12% and 11% of total revenue, respectively.

Although the Partnership is exposed to a concentration of credit risk, the Partnership does not believe the loss of any single purchaser would materially impact the Partnership’s operating results as crude oil and natural gas are fungible products with well-established markets and numerous purchasers. If multiple purchasers were to cease making purchases at or around the same time, we believe there would be challenges initially, but there would be ample markets to handle the disruption. Additionally, recent rulings in bankruptcy cases involving the Partnership’s operators have stipulated that royalty owners must still be paid for oil, natural gas and NGLs extracted from their mineral acreage during the bankruptcy process. In light of this, the Partnership does not expect the entry of one of our operators into bankruptcy proceeding to materially affect our operating results.

Financial Instruments

The carrying amounts of financial instruments including cash and cash equivalents, restricted cash, accounts receivable, accrued expenses, and other liabilities approximate fair value, as of December 31, 2020 and 2019.

F-28