Exhibit 2.1

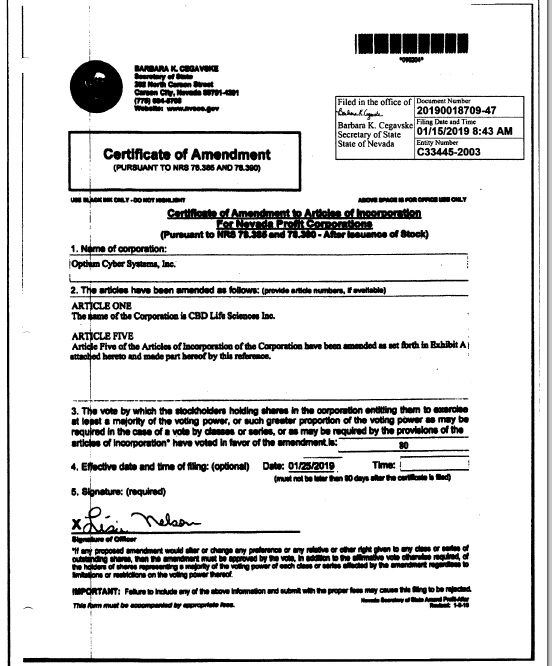

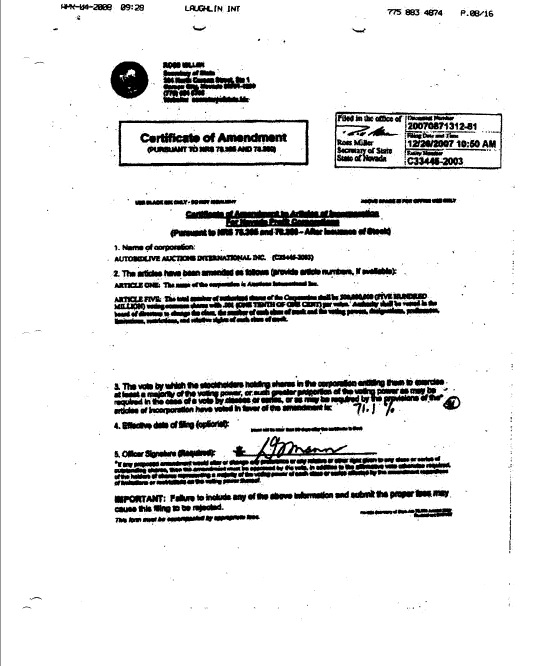

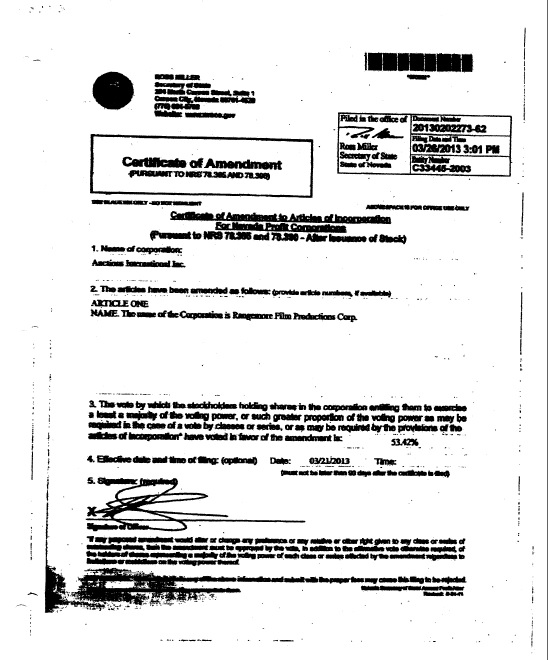

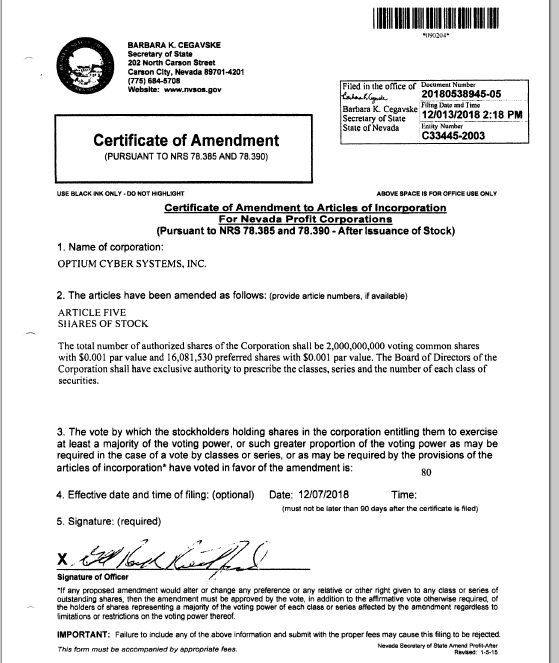

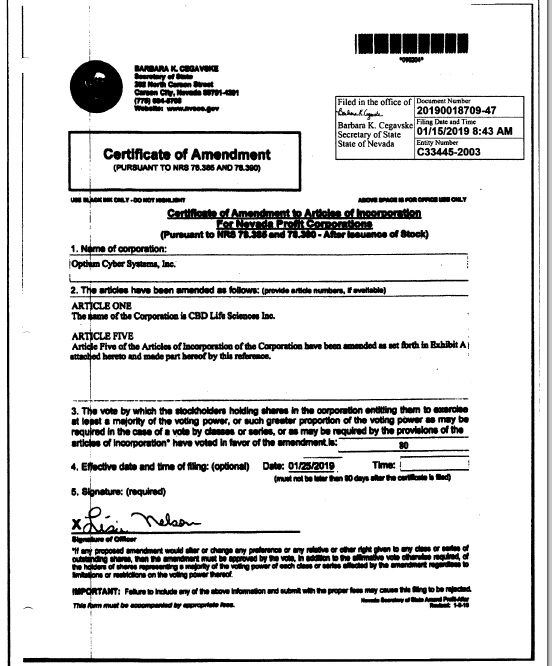

OPTIUM CYBER SYSTEMS, INC.

FINRA

Issuer Company Related Action Notification

January 17, 2019

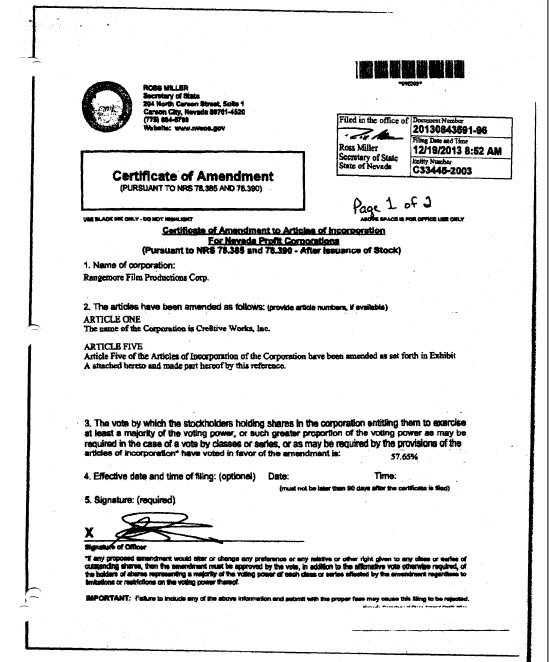

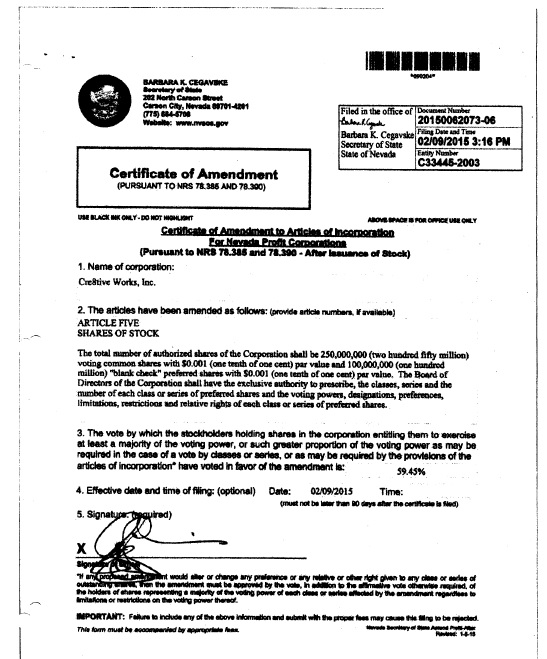

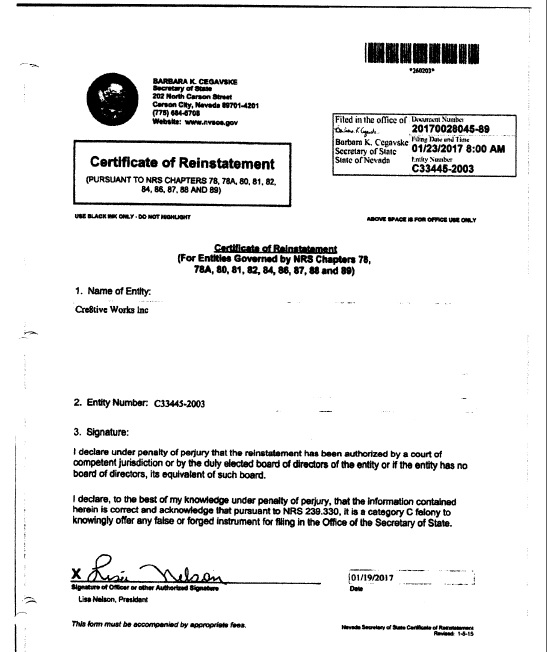

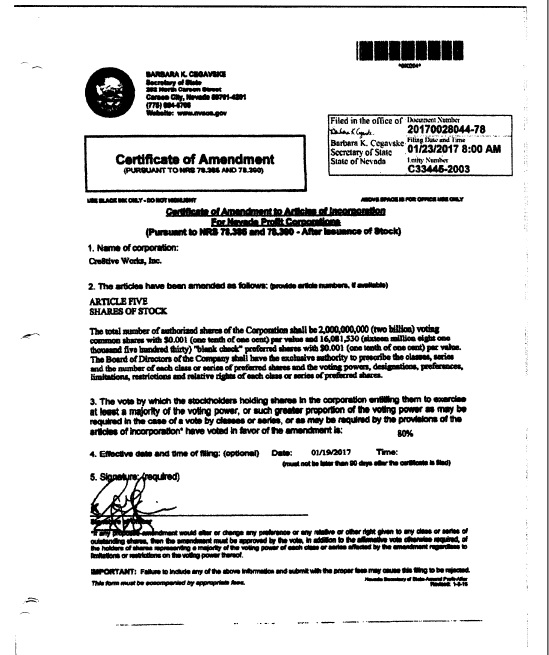

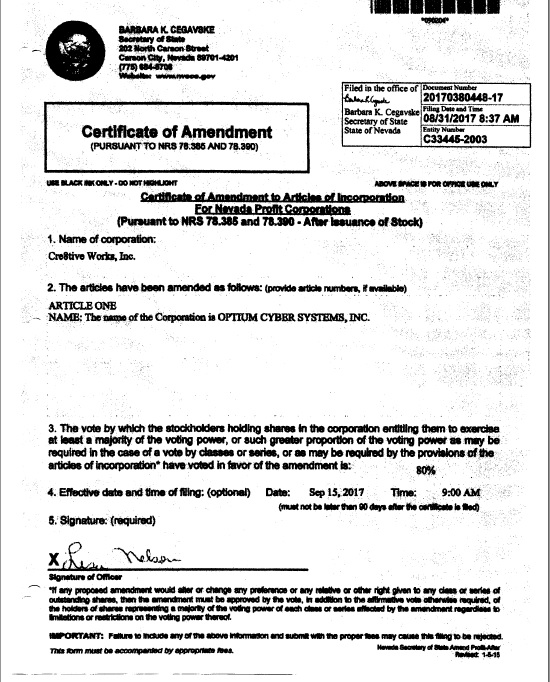

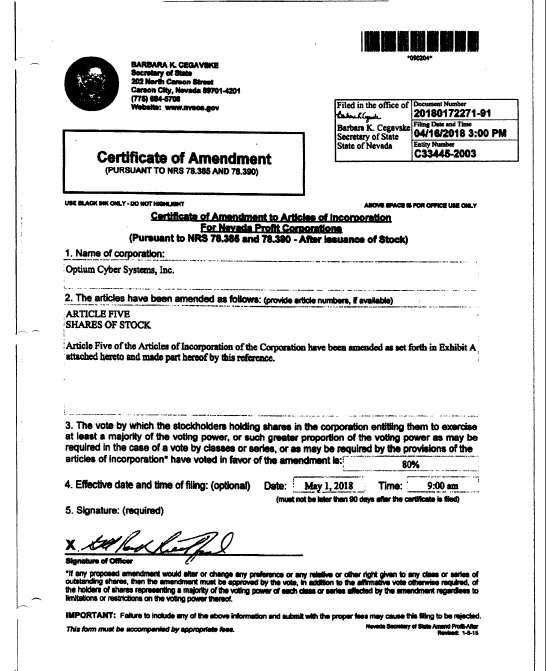

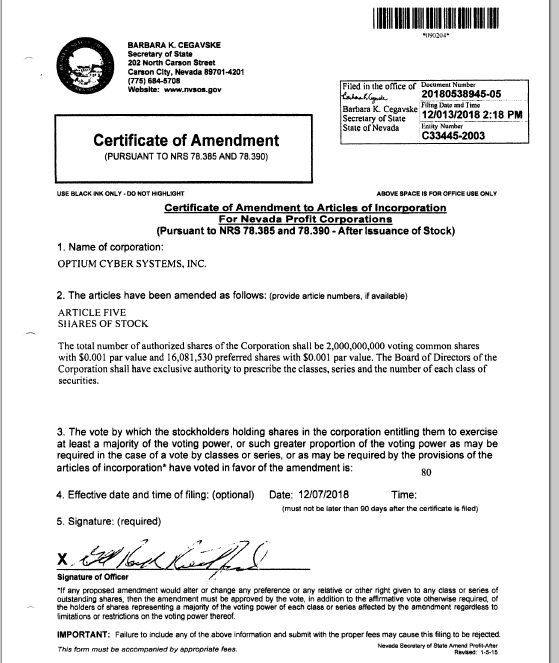

File stamped Articles of Incorporation from the time the company began using its current name.

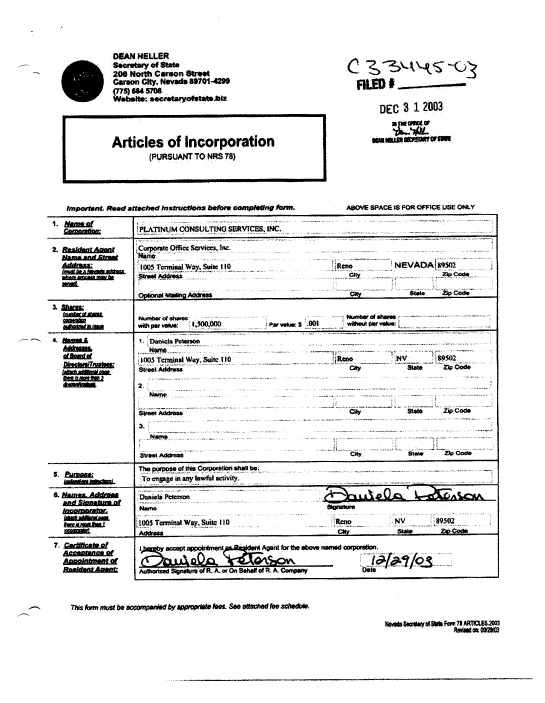

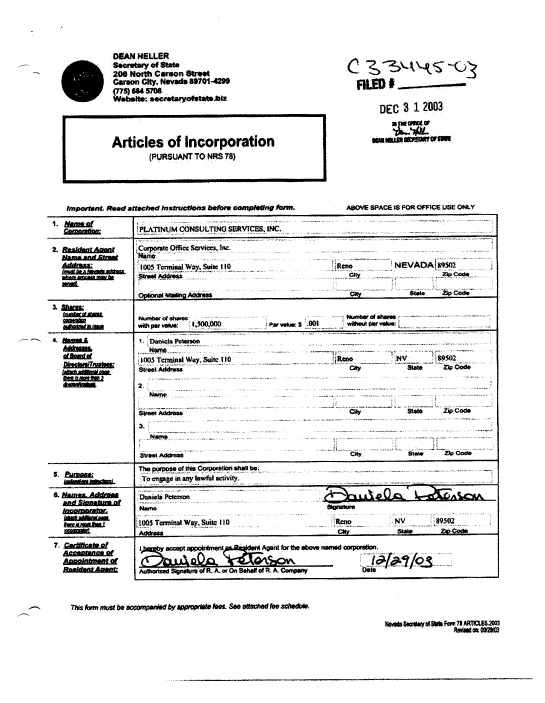

Articles of Incorporation

of

PLATINUM CONSULTING SERVICES, INC.

The undersigned natural person, who is at least eighteen (18) years of age, for the purpose of forming a Private Corporation, under and subject to the provisions of NRS 78.010, et seq, hereby adopts the following Articles of Incorporation:

ARTICLE ONE

NAME. The name of the Corporation is PLATINUM CONSULTING SERVICES, INC.

ARTICLE TWO

REGISTERED OFFICE AND RESIDENT AGENT. The registered office of the Corporation shall be located at 1005 Terminal Way, Suite 110: Reno, Nevada 89502. The initial Resident Agent at such address is CORPORATE OFFICE SERVICES, INC. The Board of Directors may establish, from time to time, other places of business within and without the State of Nevada for the conduct of its business.

ARTICLE THREE

DURATION. The Corporation shall have perpetual existence.

ARTICLE FOUR

PURPOSES. The purpose, object and nature of the business for which this Corporation is organized are:

(a) To engage in any lawful activity,

ARTICLE FIVE

SHARES OF STOCK. The total nurnber of authorized shares of the Corporation shall be 1,500,000 (ONE MILLION FIVE HUNDRED THOUSAND) voting common shares with ..001 (ONE TENTH OF ONE CENT) par value. Authority shall be vested in the board of directors to change the class, the number of each class of stock and the voting powers, designations, preferences, limitations. restrictions, and relative rights of each class or stock.

ARTICLE SIX

DIRECTOR. The business and affairs of the Corporation shall be conducted by a Board of Directors. The number of directors constituting the initial Board of Directors is one (I), and the name and address of the person who is to serve as sole Director until the first Annual Meeting or until his successor(s) arc elected and qualified is

| | NAME | ADDRESS |

| | Daniela Peterson | 1005 Terminal Way, Suite 110 |

| | | Reno, Nevada 89502 |

The Directors may, at any time prior to the first meeting of the Board of Directors, elect or appoint additional Directors, not exceeding the number set forth in the by-laws, to serve until his successors are elected and qualified. Thereafter, vacancies on the Board of Directors, however arising, may be filled from time to time by the remaining Directors.

The successors of the first Board of Directors shall be elected at the Annual Meeting of the Shareholders to be held on the date and at the time provided in the by-laws. The Directors shall hold office for one year or until they are removed or their successors have been duly qualified, as provided in the bylaws.

The Board of Directors shall elect or appoint a President, a Secretary, a Treasurer, a Resident Agent and such other Officers or Agents for the administration of the business of the Corporation as it shall from time to time determine. Such persons need not be shareholders of the Corporation or members of the Board of Directors.

ARTICLE SEVEN

LIMITED LIABILITY OF OFFICERS AND DIRECTORS. No officer or Directors of the Corporation shall be liable to the Corporation or its shareholders for the damages for the breach of a fiduciary duty as a Director or Officer other than: (a) acts or omissions which involve intentional misconduct, fraud or a known violation of the law: or (b) the payment of dividends in violation of NRS 78.300.

The Corporation may purchase or maintain insurance or make other financial arrangements on behalf of any person who is or was a Director, Officer, Employee, or Agent of the Corporation, or is or was serving at the request of the Corporation as a Director, Officer, Employee or Agent of another corporation, partnership, joint venture, trust or other enterprise for any liability asserted against him and liability and expenses incurred by him in his capacity as Director, Officer, Employee or Agent, or arising of his status as such, whether or not the Corporation has the authority to indemnify him against such liability or expense.

The Corporation shall indemnify all of its Officers and Directors past, present, and future against any and all expenses incurred by them, and each of them, including, but not limited to, legal fees, judgment and penalties which may be incurred, rendered or levied in any legal action or administrative proceeding brought against them for any act or omission alleged to have been committed while acting within the scope of their duties as Officers or Directors of the Corporation. The expenses of Officers and Directors incurred in defending any legal action or administrative proceeding must be paid by the Corporation as they are incurred and in advance of the final disposition of the action or proceeding upon receipt of an undertaking by or on behalf of the Officer or Director to repay the amount if it is ultimately determined by a court of competent jurisdiction that he/she is not entitled to be indemnified by the Corporation. Such right of indemnification shall not be exclusive of any other rights of indemnification which the Officers and Directors may have or hereafter acquire. Without limitation of the foregoing, the Board of Directors may adopt by-laws from time to time to provide the fullest indemnification permitted by the Laws of the State of Nevada.

ARTICLE EIGHT

ASSESSMENTS. To the extent permitted by law, the private property of each and every Stockholder, Officer, and Director of the Corporation, real or personal, tangible or intangible, now owned or hereafter acquired by any of them, is and shall forever be exempt from all debts and obligations of the Corporation. Stocks are not assessable.

ARTICLE NINE

NO PREEMPTIVE RIGHTS. Except as may otherwise be provided by the Board of Directors of the Corporation, no holder of any shares of the stock of the Corporation shall have any preemptive right to purchase, subscribe for or otherwise acquire any shares of the stock of the Corporation of any class now or hereafter authorized, or any securities exchangeable for or convertible into any such shares, or other instruments evidencing rights or options to subscribe for purchase or otherwise acquire such shares.

ARTICLE TEN

NO CUMULATIVE VOTING, Election of Directors of the Corporation shall be by majority vote of the shareholders. There shall be no cumulative voting.

ARTICLE ELEVEN

INCORPORATOR. The name and address of the Incorporator executing these Articles of Incorporation is as follows:

| | NAME | ADDRESS |

| | Daniela Peterson | 1005 Terminal Way, Suite 110 |

| | | Reno, Nevada 89502 |

ARTICLE TWELVE

AMENDMENT. These Articles of Incorporation may be amended by the affirmative vote of a majority of the Shareholders entitled to vote on each such amendment

IN WITNESS WHEREOF, the undersigned Incorporator has executed these Articles of Incorporation on this 29th day of December, 2003.

/s/ Daniela Peterson

Daniela Peterson

Corporate Office Services, Inc.

1005 Terminal Way, Suite 110

Reno, Nevada 89502

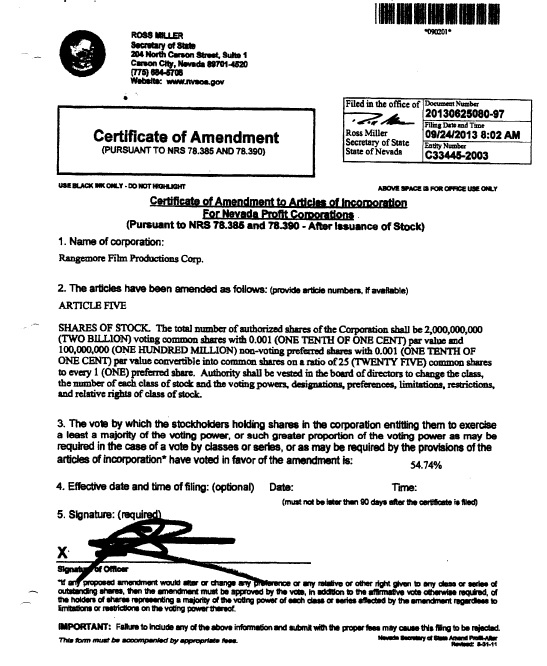

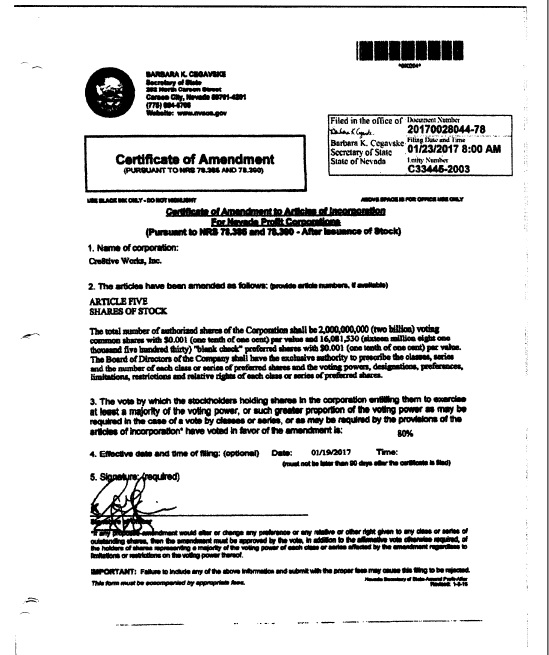

EXHIBIT A

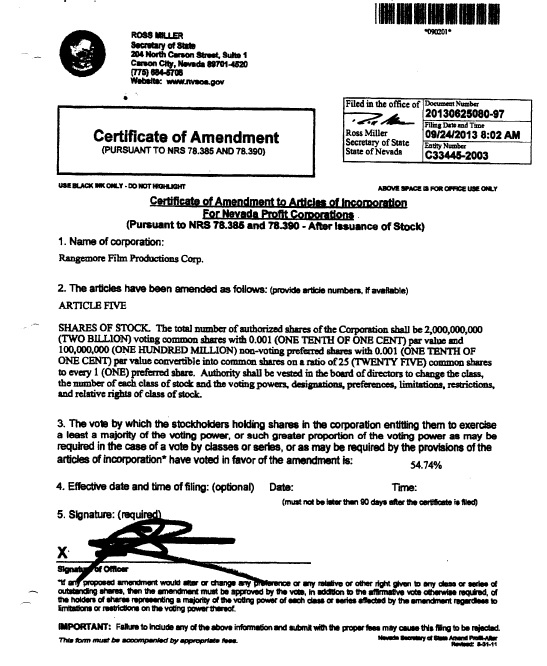

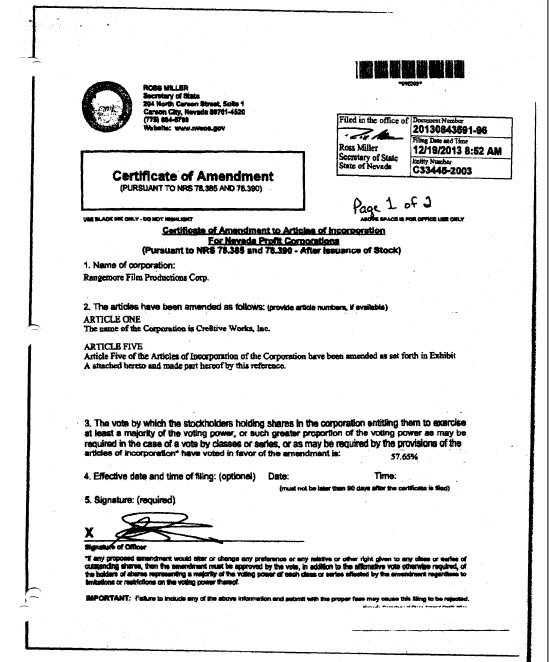

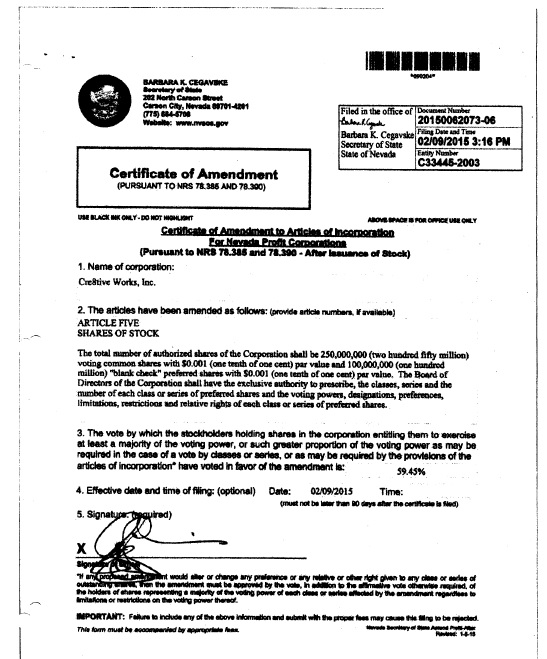

SHARES OF STOCK. The total number of authorized shares of the Corporation shall be 2,000,000,000 (TWO BILLION) voting common shares with $0.001 (ONE TENTH OF ONE CENT) par value and 100,000,000 (ONE HUNDRED MILLION) non-voting preferred shares with $0.001 (ONE TENTH OF ONE CENT) par value convertible into common shares on a ratio of 25 (TWENTY FIVE) common shares to every 1 (ONE) preferred share. Authority shall be vested in the board of directors to change the change the class, the number of each class of stock and the voting powers, designations, preferences, limitations, restrictions, and relative rights of each class. As of the effective date of the filing of this Certificate of Amendment with the Nevada Secretary of State (the "Effective Date"), every 250 (TWO HUNDRED FIFTY) (the "Reverse Split Factor") outstanding shares of Common Stock shall without further action by this Corporation or the holder thereof be combined and automatically become 1 (ONE) share of Common Stock (the "Reverse Stock Split"). No fractional shares will be issued In connection with the Reverse Stock Split. A shareholder of record who otherwise would be entitled to receive a fractional share will be entitled to receive on whole share. As of the Effective Date, the total number of authorized shares of the Corporation shall be reduced to 250,000,000 (TWO HUNDRED FIFTY MILLION) voting common shares with $0.001 (ONE TENTH OF ONE CENT) par value and 100,000,000 (ONE HUNDRED MILLION) non-voting preferred shares with $0.001 (ONE TENTH OF ONE CENT) par value convertible into common shares on a ratio of 1 (ONE) common shares to every 10 (TEN) preferred share.

Exhibit A

CERTIFICATE OF THE DESIGNATIONS, POWERS,

PREFERENCES AND RIGHTS OF THE

SERIES A NON-CONVERTIBLE PREFERRED STOCK

($0.001 PAR VALUE PER SHARE)

OF

CRE8TIVE WORKS,

A NEVADA CORPORATION

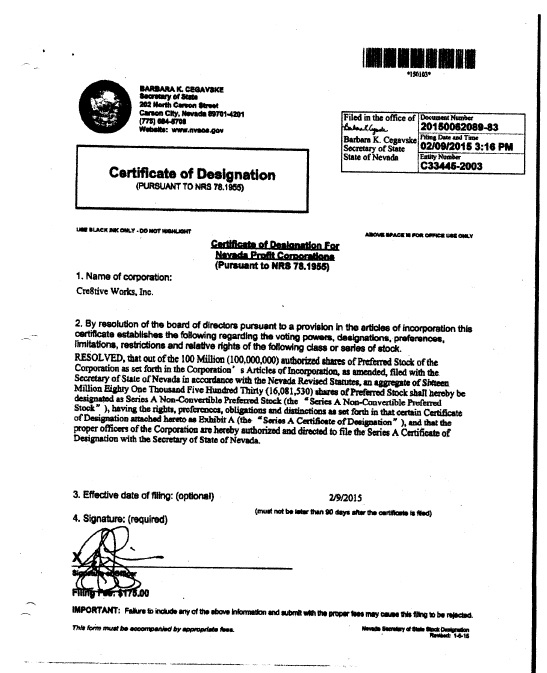

Pursuant to Section 79.1955 of Chapter 78 of the. Nevada Revised Statutes, CRE8TIVE WORKS, INC., corporation organized and existing under the State of Nevada (the "Corporation"), in accordance with the provisions thereof, does hereby submit the following:

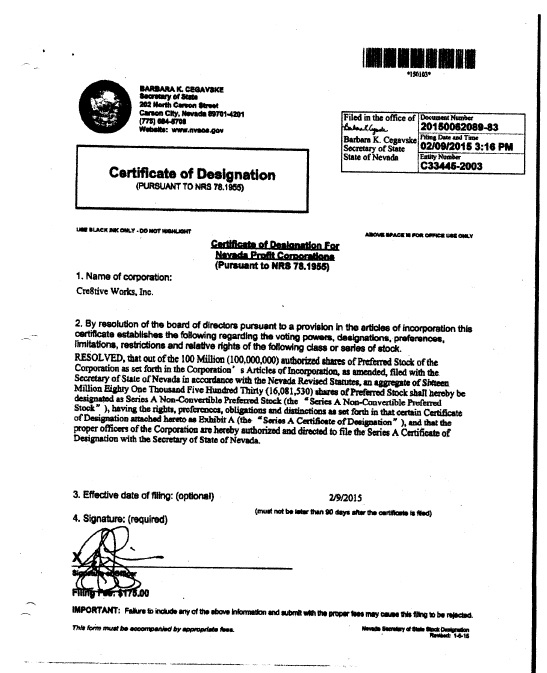

WHEREAS, the Articles of Incorporation of the Corporation (the "Articles of Incorporation") authorizes the issuance of up to 100 Million (100,000,000) shares of preferred stock, par value $0.001 per share, of the Corporation ("Preferred Stock") in one or more series, and expressly authorizes the Board of Directors of the Corporation (the "Board"), subject to limitations prescribed by law, to provide, out of the unissued shares of Preferred Stock, for series of Preferred Stock, and, with respect to each such series, to establish and fix the number of shares to be included in any series of Preferred Stock and the designation, rights, preferences, powers, restrictions and limitations of the shares of such series; and

WHEREAS, it is the desire of the Board to establish and fix the number of shares to be included in a new series of Preferred Stock and the designation, rights, preferences and limitations of the shares of such new series.

NOW, THEREFORE, BE IT RESOLVED, that the Board does hereby provide for the issue of a series of Preferred Stock and does hereby in this Certificate of Designation (the "Certificate of Designation") establish and fix and herein state and express the designation, rights, preferences, powers, restrictions and limitations of such series of Preferred Stock as follows:

1. Designation and Amount

This series of Preferred Stock shall be designated "Series A Non-Convertible Preferred Stock" and the authorized number of shares constituting such series shall beSixteen Million Eighty One Thousand Five Hundred Thirty (16,081,530). The par value of the Series A Non-Convertible Preferred Stock shall be $0.001 per share. Shares of the Series A Non-Convertible Preferred Stock shall have a stated value of $0.001 per share (the "Stated Value").

2.Dividends.

The holders of shares of Series A Non-Convertible Preferred Stock shall not be entitled to receive any dividends.

3.Preferences on Liquidation.

Subject to the provisions of Section 6(b) below, in the event of any voluntary or involuntary dissolution, or winding up of the Corporation, the holders of shares of the Series A Non-Convertible Preferred Stock then outstanding shall be entitled to be paid, out of the assets of the Corporation available for distribution to its stockholders, whether from capital, scruples or earnings, an amount equal to one dollar ($1.00) per share.

4.Voting Rights.

Except as otherwise required by law or by the Articles of Incorporation and except as set forth in Section 6(b) below, the outstanding shares of Series A Non-Convertible Preferred Stock shall vote together with the shares of Common Stock and other voting securities of the Corporation as a single class and regardless of the number of shares of Series A Non-Convertible Preferred Stock outstanding and as long as at least one of such shares of Series A Non-Convertible Preferred Stock is outstanding, shall represent eighty percent (80%) of all votes entitled to be voted at any annual or special meeting of shareholders of the Corporation or action by written consent of shareholders. Each outstanding share of the Series A Non-Convertible Preferred Stock shall represent its proportionate share of the 80% which is allocated to the outstanding shares of Series A Non-Convertible Preferred Stock.

5.Negative Covenants.

The Corporation will not, by amendment of the Articles of Incorporation or through any reorganization, transfer of assets, consolidation,-merger, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation, but will at all times in good faith assist in the carrying out of all the provisions of this Articles of Incorporation and in the taking of all such action as may be necessary or appropriate in order to protect the rights of the holders of the Series A Non-Convertible Preferred Stock against impairment.

6.Ranking: Changes Affecting Series.

| (a) | The Series A Non-Convertible Preferred Stock shall, with respect to distribution rights on liquidation, winding up and dissolution, (i) rank senior to any of the shares of Common Stock of the Corporation, and any other class or series of stock of the Corporation which by its terms shall rank junior to the Series A Non-Convertible Preferred Stock, and (ii) rank junior to any other series or class of preferred stock of the Corporation and any other class or series of stock of the Corporation which by its term shall rank senior to the Series A Non-Convertible Preferred Stock. |

| (b) | So long as any shares of Series A Non-Convertible Preferred Stock are outstanding, the Corporation shall not (i) alter or change any of the powers, preferences, privileges or rights of the Series A Non-Convertible Preferred Stock, or (ii) amend the provisions of this Section 6; in each case, without first obtaining the approval by vote or written consent, in the manner provided by law, of the holders of at least a majority of the outstanding shares of Series A Non-Convertible Preferred Stock, as to changes affecting the Series A Non-Convertible Preferred Stock. |

7.No Redemption.

The shares of the Series A Non-Convertible Preferred Stock are not redeemable.

8.Protection Provisions.

So long as any shares of Series A Non-Convertible Preferred Stock are outstanding, the Corporation shall not, without first obtaining the approval (by vote or written consent, as provided by the Nevada Business Corporation Act) of the Holders of at least a majority of the then outstanding shares of Series A Non-Convertible Preferred Stock;

| | (a) | alter or change the rights, preferences or privileges of the Series A Non-Convertible Preferred Stock; |

| | | |

| | (b) | alter or change the rights, preferences or privileges of any capital stock of the Corporation so as to affect adversely the Series A Non-Convertible Preferred Stock; |

| | | |

| (c) | create any new class or series of capital stock having a preference over the Series A Non-Convertible Preferred Stock as to distribution of assets upon liquidation, dissolution or winding up of the Corporation (as previously defined, "Senior Securities"); |

| (d) | create any new class or series of capital stock rankingpari passuwith the Series A Non-Convertible Preferred Stock an to distribution of assets upon liquidation, dissolution or winding up of the Corporation (as previously defined, "Pari Passu Securities"); |

| | | |

| | (e) | increase the authorized number of shares of Series A Non-Convertible Preferred Stock; |

| | | |

| | (f) | issue any shares of Series A Non-Convertible Preferred Stock other than pursuant to the Securities Purchase Agreement with the original parties thereto; |

| | | |

| | (g) | issue any additional shares of Senior Securities; or |

| | | |

| | (h) | redeem, or declare or pay any cash dividend or distribution on, any Junior Securities. |

If holders of at least a majority of the then outstanding shares of Series A Non-Convertible Preferred Stock agree to allow the Corporation to alter or change the rights, preferences or privileges of the shares of Series A Non-Convertible Preferred Stock pursuant to subsection (a) above, then the Corporation shall deliver notice of such approved change to the Holders of the Series A Non-Convertible Preferred Stock that did not agree to such alteration or change (the "Dissenting Holders").

9.Merger, Consolidation. Etc.

| | (a) | if at any time or from time to time there shall be (i) a merger, or consolidation of the Corporation with or into another corporation, (ii) the sale of all or substantially all of the Corporation's capital stock or assets to any other person, (iii) any other form of business combination or reorganization in which the Corporation shall not be the continuing or surviving entity of such business combination or reorganization, or (iv) any transaction or series of transactions by the Corporation in which in excess of 50 percent of the Corporation's voting power is transferred (each, a "Reorganization") then as a part of such Reorganization, provision shell be made so that the holders of the Series A Non-Convertible Preferred Stock shall thereafter be entitled to receive the same kind and amount of stock or other securities or property (including cash) of the Corporation, or of the successor corporation resulting from such Reorganization. |

| | (b) | The provisions of this Section 9 are in addition to and not in lieu, of the provisions of Section 2 hereof. |

10. No Impairment.

The Corporation will not, by amendment of its Articles of incorporation or through any reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation, but will at all times in good faith assist in the carrying out of all the provisions of this Certificate of Designation and in the taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the holders of the Series A Non-Convertible Preferred Stock against impairment.

11. Lost or Stolen Certificates.

Upon receipt by the Corporation of (i) evidence of the loss, theft, destruction or mutilation of any Preferred Stock Certificate(s) and (ii) (y) in the case of loss, theft or destruction, of indemnity reasonably satisfactory to the Corporation, or (z) in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Corporation shall execute and deliver new Preferred Stock Certificate(s) of like tenor and date.

IN WITNESS WHEREOF, this Certificate of Designation is executed on behalf of the Corporation by its Authorized Officer this 9th day of February 2015.

Creative Works, Inc.

By:/s/ Andrew McLaughlin

Name: Andrew McLaughlin

Title: Chief Executive Officer, President,

Secretary, Treasurer and Director

WRITTEN CONSENT

IN LIEU OF A MEETING

OF

THE SOLE DIRECTOR

OF

CRESTIVE WORKS, INC.

___________________

DESIGNATION OF SERIES A NON-CONVERTIBLE PREFERRED STOCK

___________________

The undersigned, being the sole member of the Board of Directors (the "Board") of Cre8tive Works, Inc., a Nevada corporation (the "Corporation"), in accordance with the provisions of Chapter 78 of the Nevada Revised Statues (the "NRS"), hereby adopt the following resolutions with the same force and effect as if presented to and adopted at a meeting of the Board of the Corporation, duly called and held on February 9, 2015:

WHEREAS,the Articles of Incorporation of the Corporation (the "Articles of Incorporation") authorizes the issuance of up to 100 Million (100,000,000) shares of preferred stock, par value $0.001 per share, of the Corporation ("Preferred Stock") in one or more series, and expressly authorizes the Board of Directors of the Corporation (the "Board"), subject to limitations prescribed by law, to provide, out of the unissued shares of Preferred Stock, for series of Preferred Stock, and, with respect to each such series, to establish and fix the number of shares to be included in any series of Preferred Stock and the designation, rights, preferences, powers, restrictions and limitations of the shares of such series; and

WHEREAS,it is the desire of the Board to establish and fix the number of shares to be included in a new series of Preferred Stock and the designation, rights, preferences and limitations of the shares of such new series,

NOW, THEREFORE, BE IT RESOLVED,that the Board does hereby provide for the issue of a series of Preferred Stock and does hereby establish and fix and herein state and express the designation, rights, preferences, powers, restrictions and limitations of such series of Preferred Stock as follows:

1. Designation and Amount

This series of Preferred Stock shall be designated "Series A Non-Convertible Preferred Stock" and the authorized number of shares constituting such series shall be Sixteen Million Eighty One Thousand Five Hundred Thirty (16,081,530). The par value of the Series A Non-Convertible Preferred Stock shall be $0.001 per share. Shares of this Series A Non-Convertible Preferred Stock shall have a stated value of $0.001 per share (the "Stated Value").

2. Dividends

The holders of shares of Series A Non-Convertible Preferred Stock shall not be entitled to receive any dividends.

3. Preferences on Liquidation

Subject to the provisions of Section 6(a) below, in the event of any voluntary or involuntary liquidation, dissolution, or winding up of the Corporation, the holders of shares of the Series A Non -Convertible Preferred Stock then outstanding shall be entitled to be paid, out of the assets of the Corporation available for distribution to its stockholders, whether from capital, surplus or earnings, an amount equal to one dollar ($1.00) per share.

4.Voting Rights

Except as otherwise required by law or by the Articles of Incorporation and except as set forth in Section 6(b) below, the outstanding shares of Series A Non-Convertible Preferred Stock shall vote together with the shares of Common Stock and other voting securities of the Corporation as a single class and, regardless of the number of shares of Series A Non-Convertible Preferred Stock outstanding and as long as at least one of such shares of Series A Non-Convertible Preferred Stock is outstanding, shall represent eight percent (80%) of all votes entitled to be voted at any annual or special meeting of shareholders of the Corporation or action by written consent of shareholders. Each outstanding share of the Series A Non-Convertible Preferred Stock shall represent its proportionate share of the 80% which is allocated to the outstanding shares of Series A Non-Convertible Preferred Stock.

5.Negative Covenants

The Corporation will not, by amendment of the Articles of Incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms lo be observed or performed hereunder by the Corporation, but will at all times in good faith assist in the carrying out of all the provisions of this Articles of Incorporation and in the taking of all such action as may be necessary or appropriate in order to protect the rights of the holders of the Series A Non-Convertible. Preferred Stock against impairment.

6.Ranking, Changes Affecting Series

| (a) | The Series A Non-Convertible Preferred Stock shall, with respect to distribution rights on liquidation, winding up and dissolution, (i) rank senior to any of the shares of Common Stock of the Corporation. and any other class or series of stock of the Corporation which by its terms shall rank junior to the Series A Non-Convertible Preferred Stock, and (ii) rank junior to any other series or class of preferred stock of the Corporation and any other class or series of stock of the Corporation which by its term shall rank senior to the Series A Non-Convertible Preferred Stock. |

| (b) | So long as any shares of Series A Non-Convertible Preferred Stock are outstanding, the Corporation shall not, (i) alter or change any of the powers, preferences, privileges or rights of the Series A Non-Convertible Preferred Stock, or (ii) amend the provisions of this Section 6; in each case, without first obtaining the approval by vote or written consent. in the manner provided by law, of the holders of at least a majority of the outstanding shares of Series A Non-Convertible Preferred Stock, as to changes affecting the Series A Non-Convertible Preferred Stock. |

7.No Redemption

The shares of the Series A Non-Convertible Preferred Stock are not redeemable.

8.Protection Provisions

So long as any shares of Series A Non-Convertible Preferred Stock are outstanding, the Corporation shall not, without first obtaining the approval (by vote or written consent, as provided by the Nevada Business Corporation Act) of the holders of at least a majority of the then outstanding shares of Series A Non-Convertible Preferred Stock:

| | (a) | alter or change the rights, preferences or privileges of the Series A Non-Convertible Preferred Stock; |

| | | |

| | (b) | alter or change the rights, preferences or privileges of any capital stock of the Corporation so as to affect adversely the Series A Non-Convertible Preferred Stock; |

BE IT FURTHER RESOLVEDthat:

| 1. | The Directors of the Corporation are hereby authorized and directed for and on behalf of the Corporation to do all such acts and things and to prepare, execute and deliver all documentation determined necessary or desirable to give effect to the foregoing resolutions. |

| 2. | These resolutions may be executed by fax or email and said copies will be deemed to be originals for all purposes including filing in the Corporation's minute book. |

IN WITNESS WHEREOF, the undersigned has executed this written consent as of the date hereof.

DATED AT Miami Beach, Florida, this the 9th day of February, 2015.

DIRECTOR

/s/ Andrew McLaughlin

Andrew McLaughlin

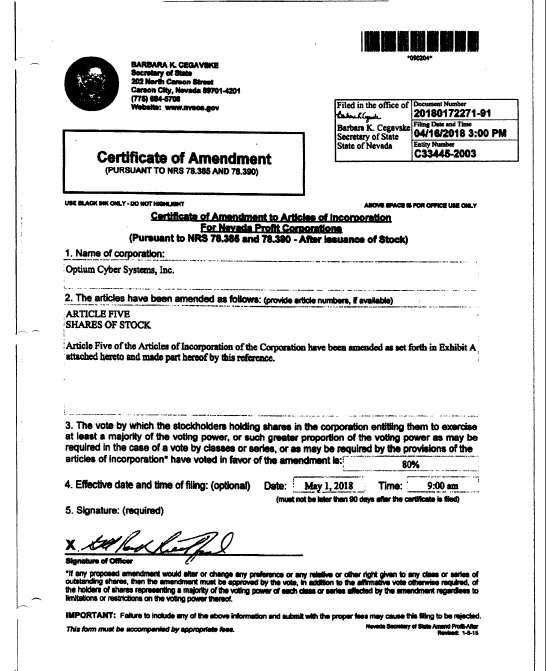

EXHIBIT A

The total number of authorized shares of the Corporation shall be 7,000,000,000 (seven billion) voting common shares with $0.001 (one tenth of one cent) par value and 16,081,530 (sixteen million eighty one thousand five hundred thirty) "blank check" preferred shares with $0.001 (one tenth of one cent) par value. As of the May 1, 2018 (the "Effective Date"), every 500 (five hundred) outstanding shares of Common Stock shall, without further action by the Corporation or the holder thereof, be combined and automatically become 1 (one) share of Common Stock (the "Reverse Stock Split"). No fractional shares will be issued in connection with the Reverse Stock Split. A shareholder of record who otherwise would be entitled to receive a fractional share will be entitled to receive one whole share. As of the Effective Date, the total number of authorized shares of the Corporation shall be reduced to 500,000,000 (five hundred million) voting common shares with $0.001 (one tenth of one cent) par value and 16,081,530 (sixteen million eighty one thousand five hundred thirty) "blank check" preferred shares with $0.001 (one tenth of one cent) par value. Authority shall be vested in the Board of Directors of the Corporation to change the class, the number, the voting power, designations, preference, limitation, restrictions and relative rights of each class of stock.

EXHIBIT A

The total number of authorized shares of the Corporation shall by 2,000,000,000 (two billion) voting common shares with $0.001 (one tenth of one cent) par value and 16,081,530 (sixteen million eighty-one thousand five hundred thirty) preferred shares with $0.001 (one tenth of one cent) par value. As of the January 18, 2019 (the "Effective Date"), every 100 (one hundred) outstanding shares of Common Stock shall, without further action by the Corporation or the holder thereof be combined and automatically become 1 (one) share of Common Stock (the "Reverse Stock Split"). No fractional shares will be issued in connection with the Reverse Stock Split. A shareholder of record who otherwise would be entitled to receive a fractional share will be entitled to receive one whole share. As of the Effective Date, the total number of authorized shares of the Corporation shall be reduced to 500,000,000 (five hundred million) voting common shares with $0.001 (one tenth of one cent) par value and 16,081,530 (sixteen million eighty-one thousand five hundred thirty) Series A non-convertible preferred shares with $0.001 (one tenth of one cent) par value. Authority shall be vested in the Board of Directors of the Corporation to change the class, the number, the voting power, designations, preference, limitation, restrictions and relative rights of each class of stock.

EXHIBIT A

The total number of authorized shares of the Corporation shall by 2,000,000,000 (two billion) voting common shares with $0.001 (one tenth of one cent) par value and 16,081,530 (sixteen million eighty-one thousand five hundred thirty) preferred shares with $0.001 (one tenth of one cent) par value. As of the January 18, 2019 (the "Effective Date"), every 100 (one hundred) outstanding shares of Common Stock shall, without further action by the Corporation or the holder thereof be combined and automatically become 1 (one) share of Common Stock (the "Reverse Stock Split"). No fractional shares will be issued in connection with the Reverse Stock Split. A shareholder of record who otherwise would be entitled to receive a fractional share will be entitled to receive one whole share. As of the Effective Date, the total number of authorized shares of the Corporation shall be reduced to 500,000,000 (five hundred million) voting common shares with $0.001 (one tenth of one cent) par value and 16,081,530 (sixteen million eighty-one thousand five hundred thirty) Series A non-convertible preferred shares with $0.001 (one tenth of one cent) par value. Authority shall be vested in the Board of Directors of the Corporation to change the class, the number, the voting power, designations, preference, limitation, restrictions and relative rights of each class of stock.