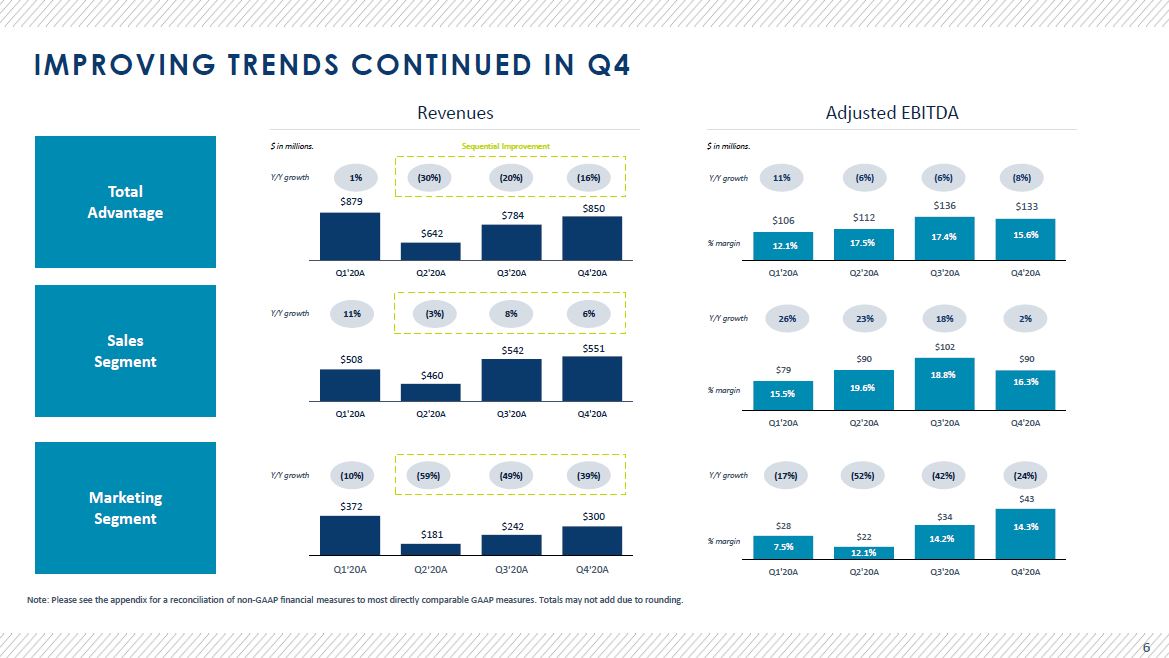

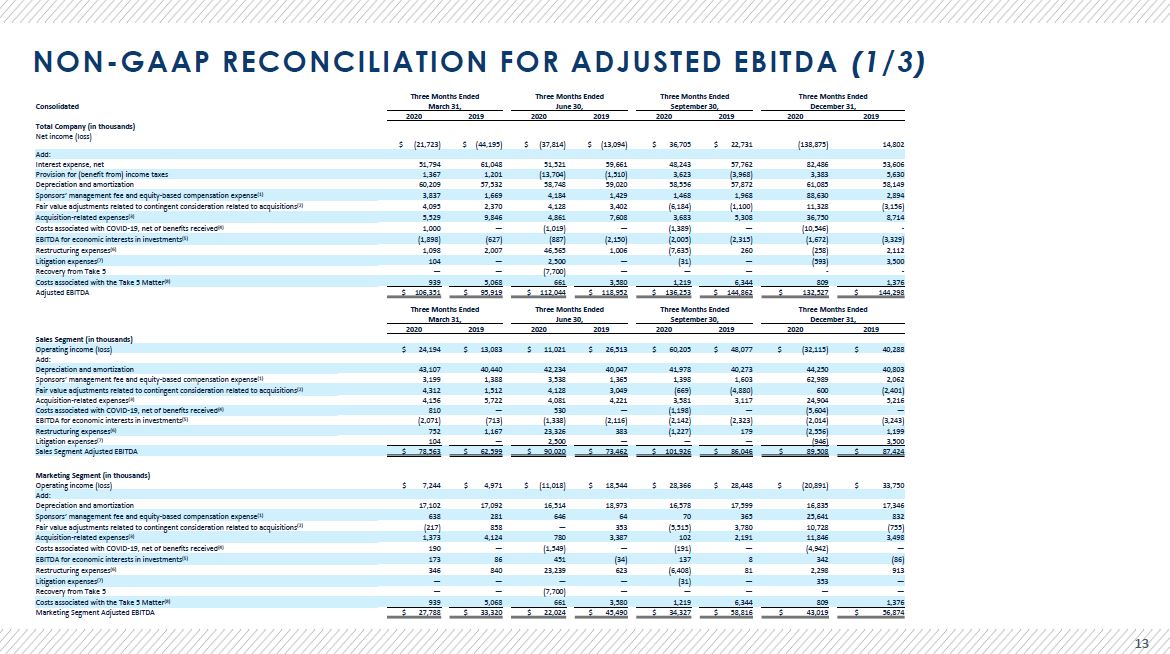

NON-GAAP RECONCILIATION FOR ADJUSTED EBITDA (1/3) Consolidated Three Months Ended Three Months Ended Three Months Ended Three Months Ended March 31, June 30, September 30, December 31, 2020 2019 2020 2019 2020 2019 2020 2019 Total Company (in thousands) Net income (loss) Add: $(21,723) $(44,195) $(37,814) $(13,094) $ 36,705 $ 22,731 (138,875) 14,802 Interest expense, net 51,794 61,048 51,521 59,661 48,243 57,762 82,486 53,606 Provision for (benefit from) income taxes 1,367 1,201 (13,704) (1,510) 3,623 (3,968) 3,383 5,630 Depreciation and amortization 60,209 57,532 58,748 59,020 58,556 57,872 61,085 58,149 Sponsors' management fee and equity-based compensation expense(1) 3,837 1,669 4,184 1,429 1,468 1,968 88,630 2,894 Fair value adjustments related to contingent consideration related to acquisitions(2) 4,095 2,370 4,128 3,402 (6,184) (1,100) 11,328 (3,156) Acquisition-related expenses(3) 5,529 9,846 4,861 7,608 3,683 5,308 36,750 8,714 Costs associated with COVID-19, net of benefits received(4) 1,000 -- (1,019) -- (1,389) -- (10,546) - EBITDA for economic interests in investments(5) (1,898) (627) (887) (2,150) (2,005) (2,315) (1,672) (3,329) Restructuring expenses(6) 1,098 2,007 46,565 1,006 (7,635) 260 (258) 2,112 Litigation expenses(7) 104 -- 2,500 -- (31) -- (593) 3,500 Recovery from Take 5 -- -- (7,700) -- -- -- - - Costs associated with the Take 5 Matter(8) 939 5,068 661 3,580 1,219 6,344 809 1,376 Adjusted EBITDA $106,351 $ 95,919 $112,044 $118,952 $136,253 $144,862 $ 132,527 $ 144,298 Three Months Ended Three Months Ended Three Months Ended Three Months Ended March 31, June 30, September 30, December 31, 2020 2019 2020 2019 2020 2019 2020 2019 Sales Segment (in thousands) Operating income (loss) $ 24,194 $ 13,083 $ 11,021 $ 26,513 $ 60,205 $ 48,077 $ (32,115) $ 40,288 Add: Depreciation and amortization 43,107 40,440 42,234 40,047 41,978 40,273 44,250 40,803 Sponsors' management fee and equity-based compensation expense(1) 3,199 1,388 3,538 1,365 1,398 1,603 62,989 2,062 Fair value adjustments related to contingent consideration related to acquisitions(2) 4,312 1,512 4,128 3,049 (669) (4,880) 600 (2,401) Acquisition-related expenses(3) 4,156 5,722 4,081 4,221 3,581 3,117 24,904 5,216 Costs associated with COVID-19, net of benefits received(4) 810 -- 530 -- (1,198) -- (5,604) -- EBITDA for economic interests in investments(5) (2,071) (713) (1,338) (2,116) (2,142) (2,323) (2,014) (3,243) Restructuring expenses(6) 752 1,167 23,326 383 (1,227) 179 (2,556) 1,199 Litigation expenses(7) 104 -- 2,500 -- -- -- (946) 3,500 Sales Segment Adjusted EBITDA $ 78,563 $ 62,599 $ 90,020 $ 73,462 $101,926 $ 86,046 $ 89,508 $ 87,424 Marketing Segment (in thousands) Operating income (loss) $ 7,244 $ 4,971 $(11,018) $ 18,544 $ 28,366 $ 28,448 $ (20,891) $ 33,750 Add: Depreciation and amortization 17,102 17,092 16,514 18,973 16,578 17,599 16,835 17,346 Sponsors' management fee and equity-based compensation expense(1) 638 281 646 64 70 365 25,641 832 Fair value adjustments related to contingent consideration related to acquisitions(2) (217) 858 -- 353 (5,515) 3,780 10,728 (755) Acquisition-related expenses(3) 1,373 4,124 780 3,387 102 2,191 11,846 3,498 Costs associated with COVID-19, net of benefits received(4) 190 -- (1,549) -- (191) -- (4,942) -- EBITDA for economic interests in investments(5) 173 86 451 (34) 137 8 342 (86) Restructuring expenses(6) 346 840 23,239 623 (6,408) 81 2,298 913 Litigation expenses(7) -- -- -- -- (31) -- 353 -- Recovery from Take 5 -- -- (7,700) -- -- -- -- -- Costs associated with the Take 5 Matter(8) 939 5,068 661 3,580 1,219 6,344 809 1,376 Marketing Segment Adjusted EBITDA $ 27,788 $ 33,320 $ 22,024 $ 45,490 $ 34,327 $ 58,816 $ 43,019 $ 56,874 13