ADVANTAGE SOLUTIONS INC. Earnings Presentation May 10, 2023

Disclaimer Forward-Looking Statements Certain statements in this presentation may be considered forward-looking statements within the meaning of the federal securities laws, including statements regarding the expected future performance of Advantage's business. Forward-looking statements generally relate to future events or Advantage’s future financial or operating performance. These forward-looking statements generally are identified by the words “may”, “should”, “could”, “expect”, “intend”, “will”, “would”, “estimate”, “anticipate”, “believe”, “predict”, “confident”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Advantage and its management at the time of such statements, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, market-driven wage changes or changes to labor laws or wage or job classification regulations, including minimum wage; the COVID-19 pandemic and the measures taken in response thereto; the availability, acceptance, administration and effectiveness of any COVID-19 vaccine; Advantage’s ability to continue to generate significant operating cash flow; client procurement strategies and consolidation of Advantage’s clients’ industries creating pressure on the nature and pricing of its services; consumer goods manufacturers and retailers reviewing and changing their sales, retail, marketing, and technology programs and relationships; Advantage’s ability to successfully develop and maintain relevant omni-channel services for our clients in an evolving industry and to otherwise adapt to significant technological change; Advantage’s ability to maintain proper and effective internal control over financial reporting in the future; potential and actual harms to Advantage’s business arising from the Take 5 Matter; Advantage’s substantial indebtedness and our ability to refinance at favorable rates; and other risks and uncertainties set forth in the section titled “Risk Factors” in the Annual Report on Form 10-K filed by the Company with the Securities and Exchange Commission (the “SEC”) on March 1, 2023, and in its other filings made from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Advantage assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Non-GAAP Financial Measures and Related Information This presentation includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”), Adjusted EBITDA and Net Debt. These are not measures of financial performance calculated in accordance with GAAP and may exclude items that are significant in understanding and assessing Advantage’s financial results. Therefore, the measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP, and should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Advantage’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of historical non-GAAP measures to their most directly comparable GAAP counterparts are included below. Advantage believes these non-GAAP measures provide useful information to management and investors regarding certain financial and business trends relating to Advantage’s financial condition and results of operations. Advantage believes that the use of Adjusted EBITDA and Net Debt provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing Advantage’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. Additionally, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Advantage’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Adjusted EBITDA means net income (loss) before (i) interest expense, net, (ii) (benefit from) provision for income taxes, (iii) depreciation, (iv) impairment of goodwill and indefinite-lived assets, (v) amortization of intangible assets, (vi) equity based compensation of Karman Topco L.P., (vii) change in fair value of warrant liability, (viii) stock-based compensation expense, (ix) fair value adjustments of contingent consideration related to acquisitions, (x) acquisition-related expenses, (xi) loss on disposal of assets, (xii) costs associated with COVID-19, net of benefits received, (xiii) EBITDA for economic interests in investments, (xiv) reorganization and restructuring expenses, (xv) litigation expenses, (xvi) costs associated with the Take 5 Matter and (xvii) other adjustments that management believes are helpful in evaluating our operating performance. Net Debt represents the sum of current portion of long-term debt and long-term debt, less cash and cash equivalents and debt issuance costs. With respect to Net Debt, cash and cash equivalents are subtracted from the GAAP measure, total debt, because they could be used to reduce the debt obligations. We present Net Debt because we believe this non-GAAP measure provides useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and to evaluate changes to the Company's capital structure and credit quality assessment. Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Q1 Key Messages New executive leadership team in place with broad experience across consumer, retail, and business transformation. Team is working on a strategic long-range plan over coming months to better position company for long-term profitable growth. Strong quarterly revenues of $1 billion, an increase of approximately 11% year-over-year Slow improvements in macroeconomic environment Labor-related cost pressures remain at higher than historical averages, but are moderating Made approximately 900 net new hires in the quarter Advantage will be disciplined and opportunistic in our capital allocation strategy to maximize returns for our equity holders, including deleveraging our balance sheet Made ~$2M voluntary repayment of term loan Subsequent to quarter end, Advantage executed a favorable interest rate collar, resulting in ~84% of debt being hedged or at fixed interest rate, and completed a small margin- and net leverage-accretive divestiture in our third-party reselling business Reiterating 2023 Adjusted EBITDA outlook of $400M – $420M Realization of price increases across Sales and Marketing Continued rebuild of in-store sampling and demonstration program

Note: Please see the appendix for a reconciliation of non-GAAP financial measures to most directly comparable GAAP measures. Totals may not add due to rounding. Total Advantage Sales Segment Marketing Segment Revenues Adjusted EBITDA Q1 Financial Results $ in millions. $ in millions. % margin % margin % margin (5)% (4)% (8)% 11% 4% 23% Y/Y growth Y/Y growth Y/Y growth Y/Y growth Y/Y growth Y/Y growth

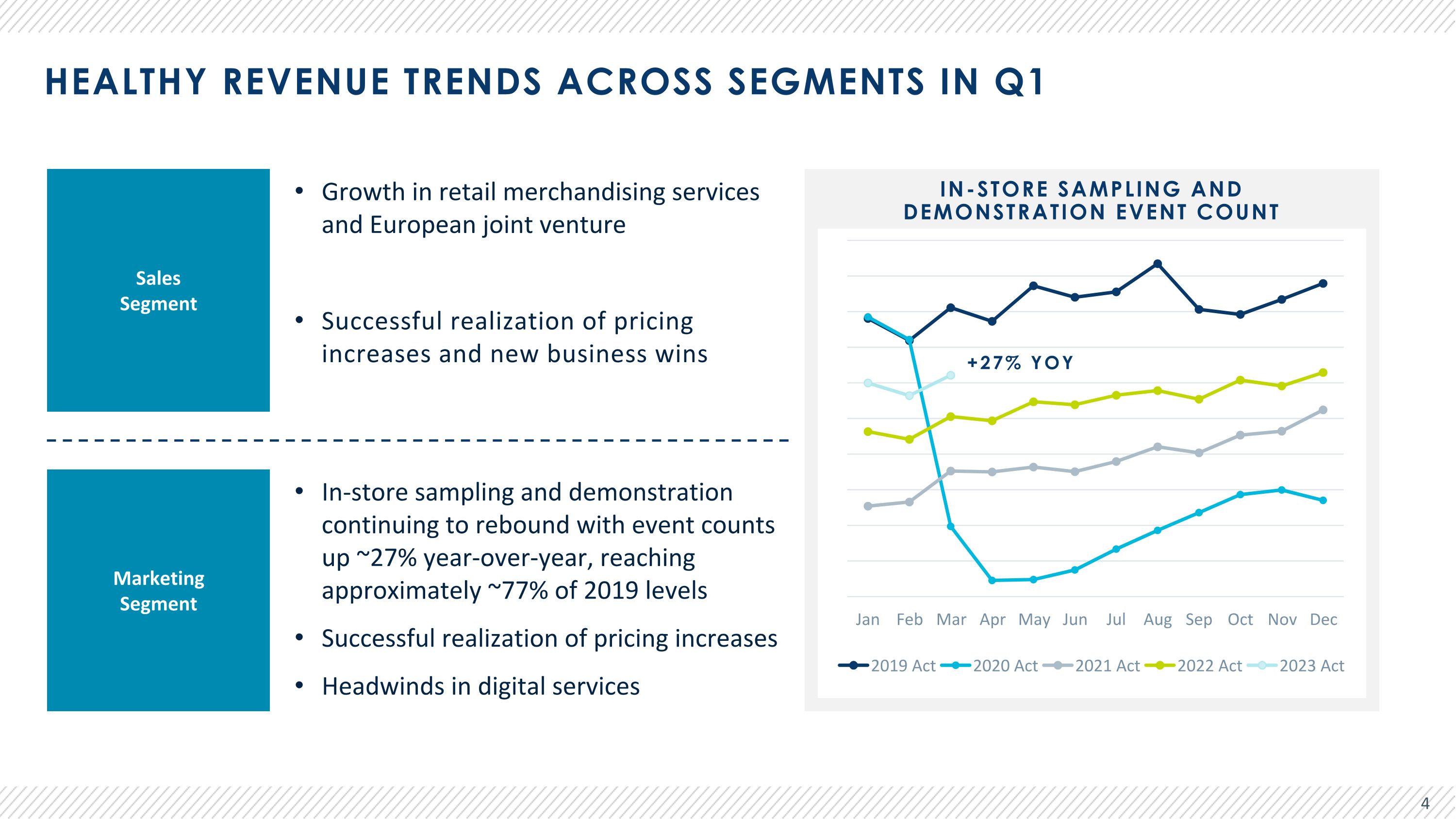

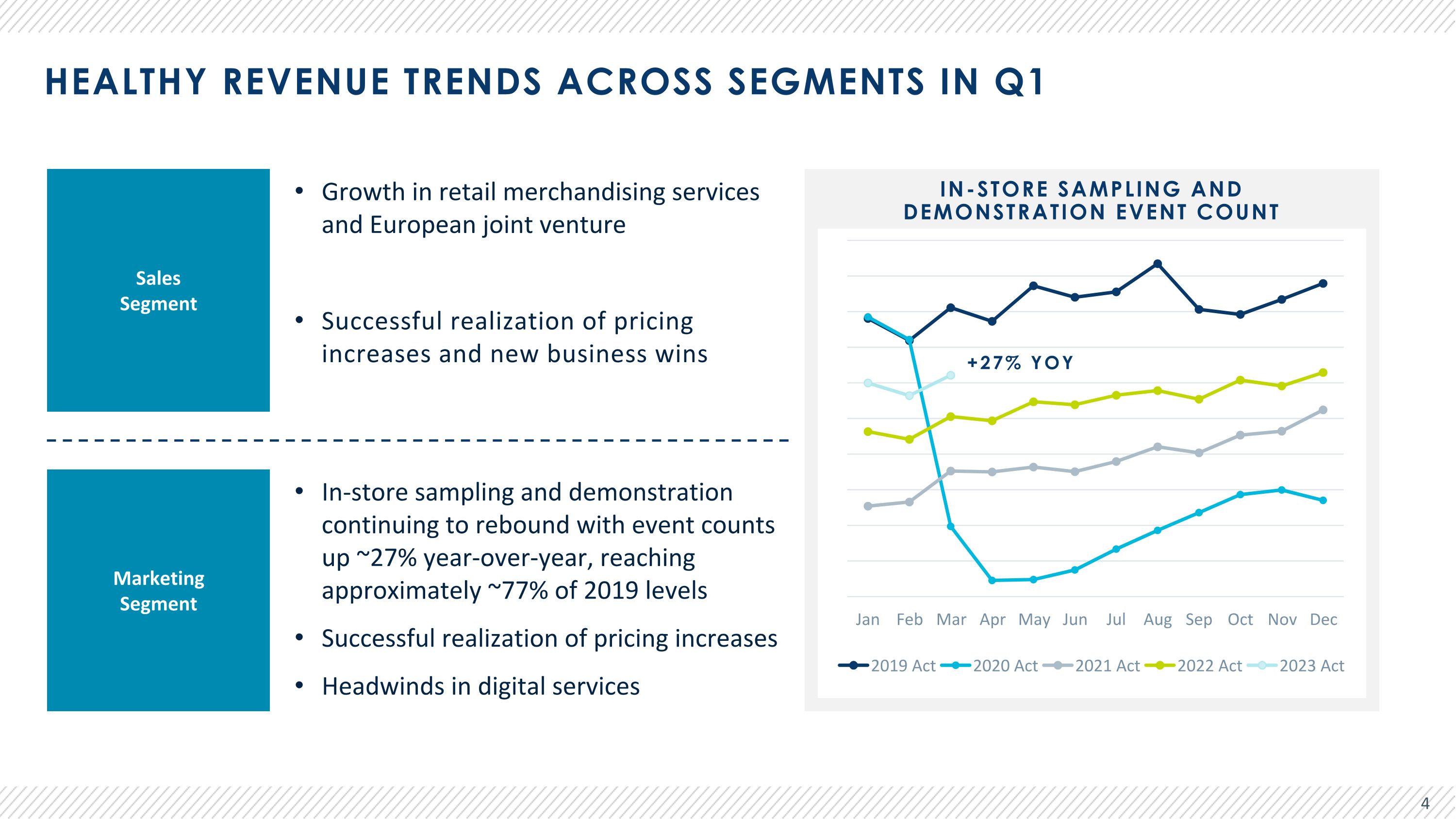

HEALTHY Revenue TRENDS ACROSS SEGMENTS IN Q1 In-Store sampling and Demonstration Event Count +27% YoY Sales Segment Marketing Segment Growth in retail merchandising services and European joint venture Successful realization of pricing increases and new business wins In-store sampling and demonstration continuing to rebound with event counts up ~27% year-over-year, reaching approximately ~77% of 2019 levels Successful realization of pricing increases Headwinds in digital services

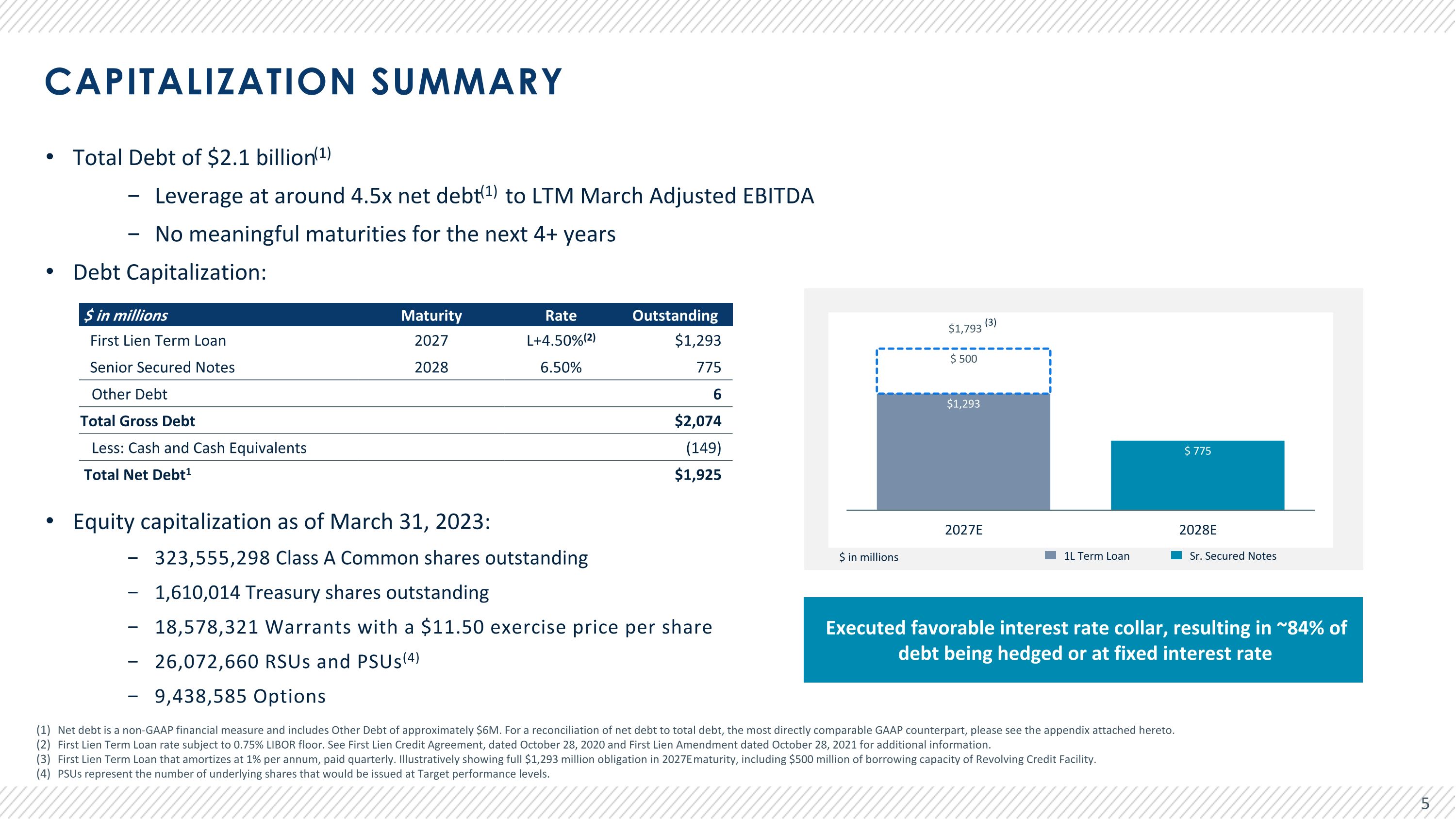

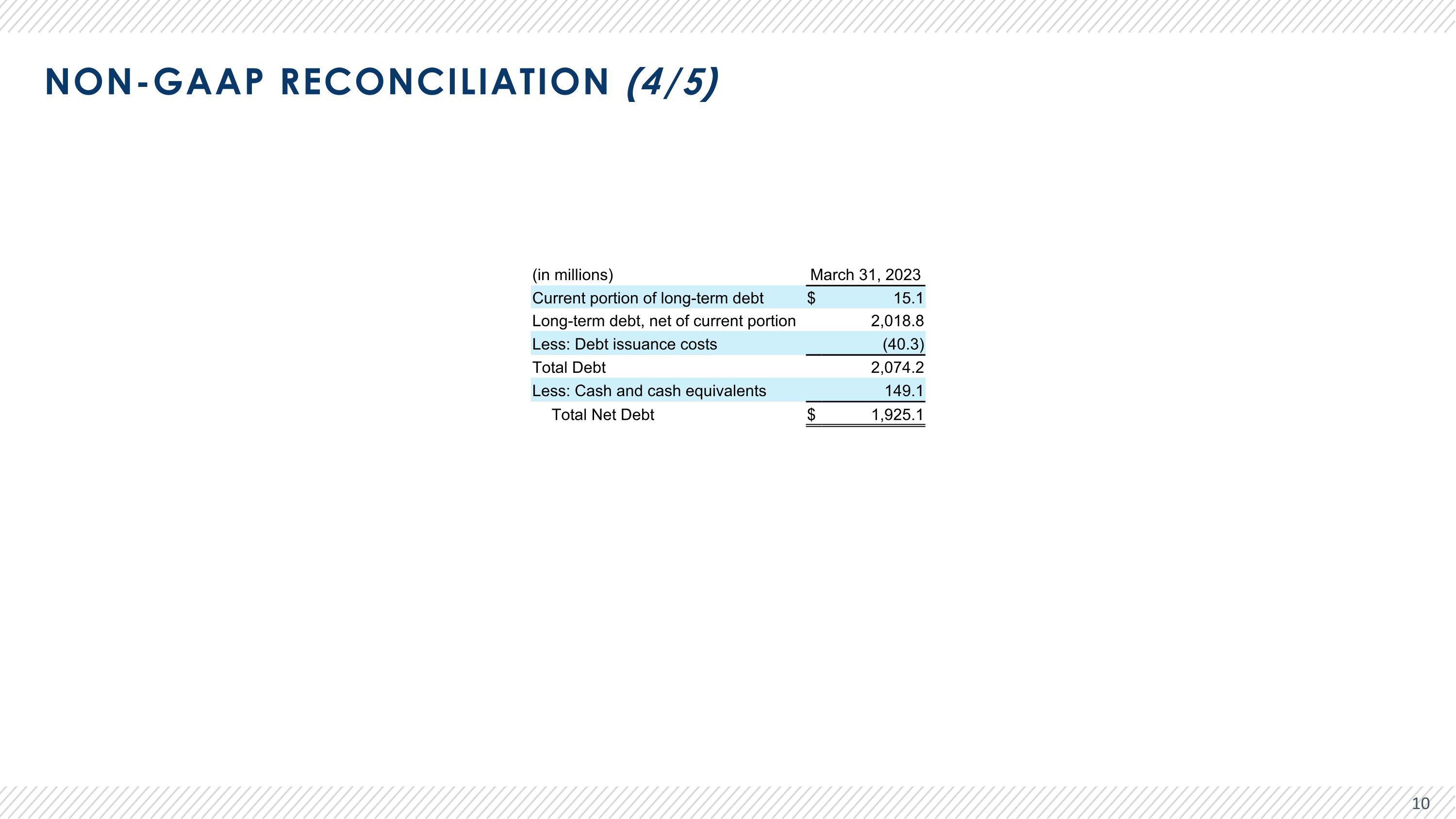

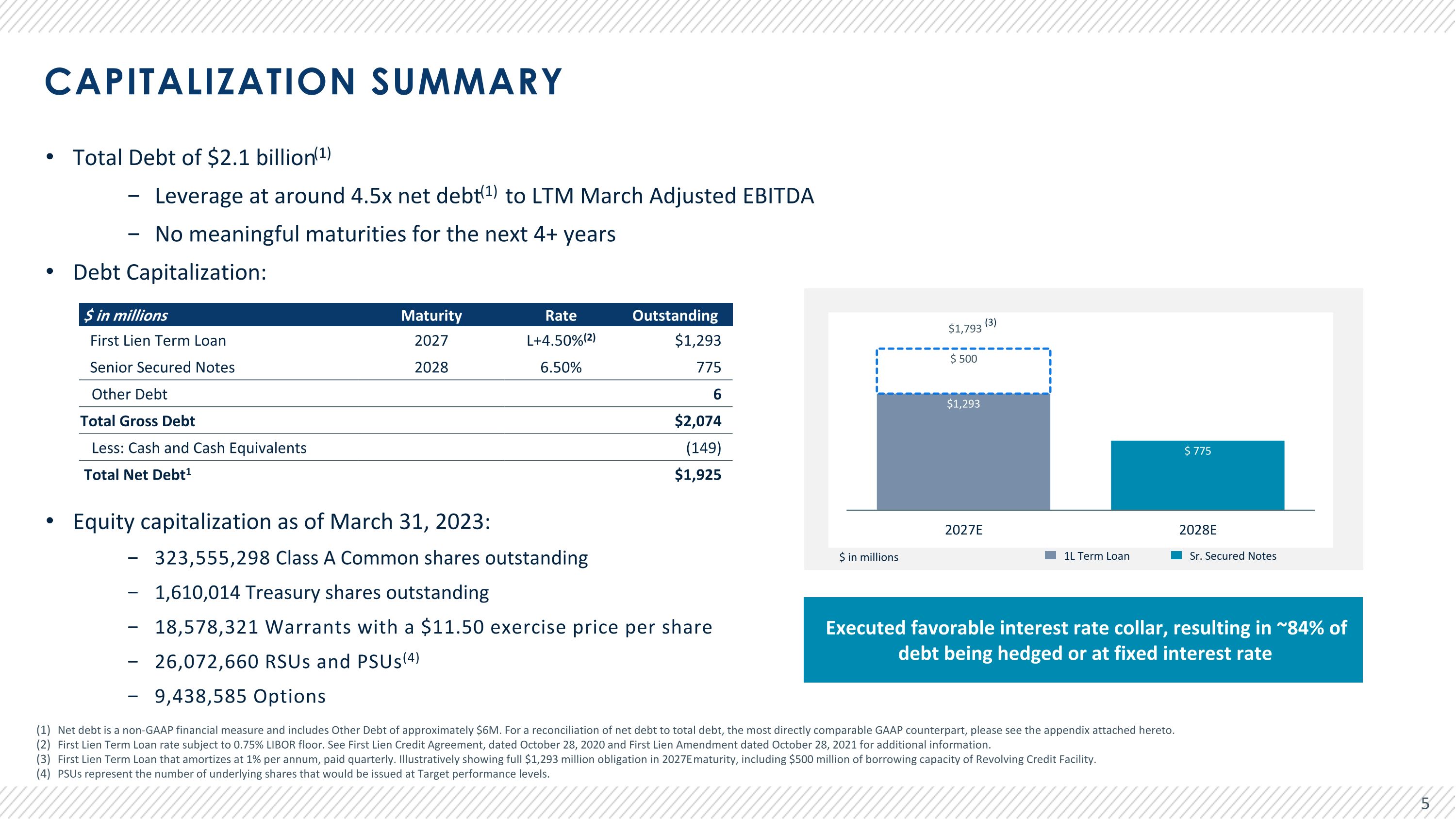

Total Debt of $2.1 billion(1) Leverage at around 4.5x net debt(1) to LTM March Adjusted EBITDA No meaningful maturities for the next 4+ years Debt Capitalization: Equity capitalization as of March 31, 2023: 323,555,298 Class A Common shares outstanding 1,610,014 Treasury shares outstanding 18,578,321 Warrants with a $11.50 exercise price per share 26,072,660 RSUs and PSUs(4) 9,438,585 Options Capitalization Summary Net debt is a non-GAAP financial measure and includes Other Debt of approximately $6M. For a reconciliation of net debt to total debt, the most directly comparable GAAP counterpart, please see the appendix attached hereto. First Lien Term Loan rate subject to 0.75% LIBOR floor. See First Lien Credit Agreement, dated October 28, 2020 and First Lien Amendment dated October 28, 2021 for additional information. First Lien Term Loan that amortizes at 1% per annum, paid quarterly. Illustratively showing full $1,293 million obligation in 2027E maturity, including $500 million of borrowing capacity of Revolving Credit Facility. PSUs represent the number of underlying shares that would be issued at Target performance levels. $ in millions Maturity Rate Outstanding First Lien Term Loan 2027 L+4.50%(2) $1,293 Senior Secured Notes 2028 6.50% 775 Other Debt 6 Total Gross Debt $2,074 Less: Cash and Cash Equivalents (149) Total Net Debt1 $1,925 1L Term Loan Sr. Secured Notes (3) $1,793 Executed favorable interest rate collar, resulting in ~84% of debt being hedged or at fixed interest rate $ in millions

Non-GAAP Reconciliation

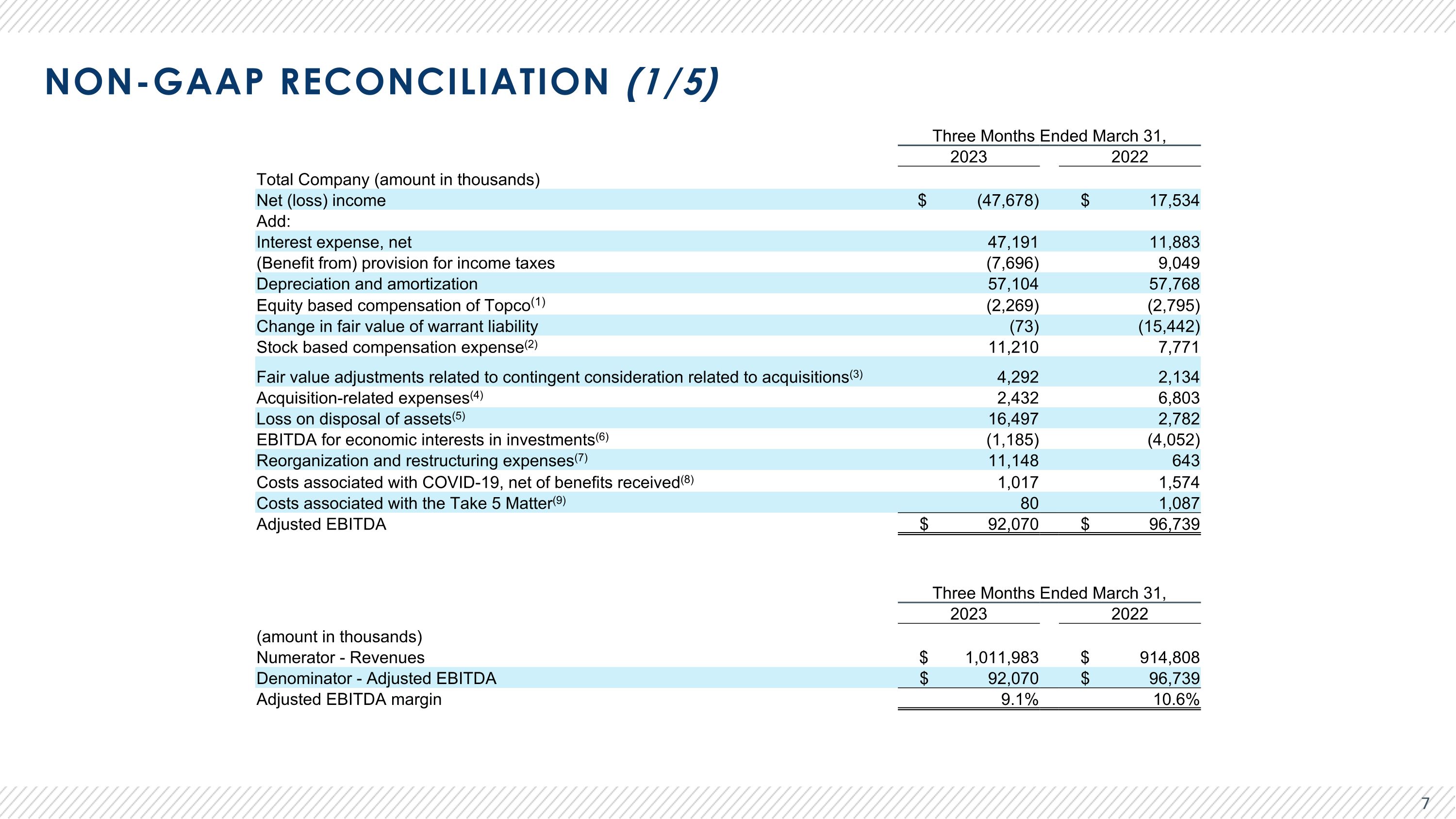

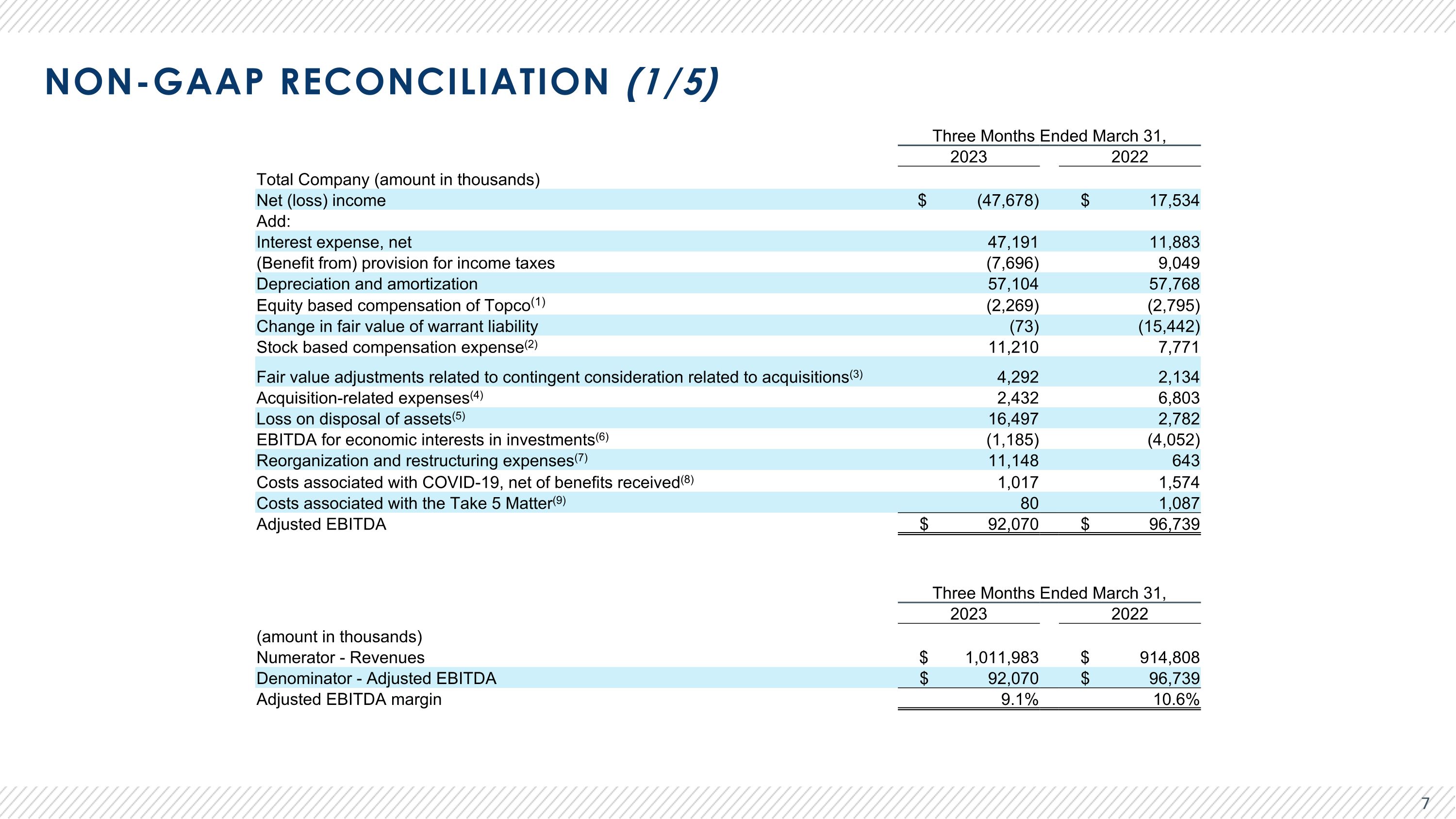

Non-GAAP Reconciliation (1/5) Three Months Ended March 31, 2023 2022 Total Company (amount in thousands) Net (loss) income $ (47,678) $ 17,534 Add: Interest expense, net 47,191 11,883 (Benefit from) provision for income taxes (7,696) 9,049 Depreciation and amortization 57,104 57,768 Equity based compensation of Topco(1) (2,269) (2,795) Change in fair value of warrant liability (73) (15,442) Stock based compensation expense(2) 11,210 7,771 Fair value adjustments related to contingent consideration related to acquisitions(3) 4,292 2,134 Acquisition-related expenses(4) 2,432 6,803 Loss on disposal of assets(5) 16,497 2,782 EBITDA for economic interests in investments(6) (1,185) (4,052) Reorganization and restructuring expenses(7) 11,148 643 Costs associated with COVID-19, net of benefits received(8) 1,017 1,574 Costs associated with the Take 5 Matter(9) 80 1,087 Adjusted EBITDA $ 92,070 $ 96,739 Three Months Ended March 31, 2023 2022 (amount in thousands) Numerator - Revenues $ 1,011,983 $ 914,808 Denominator - Adjusted EBITDA $ 92,070 $ 96,739 Adjusted EBITDA margin 9.1% 10.6%

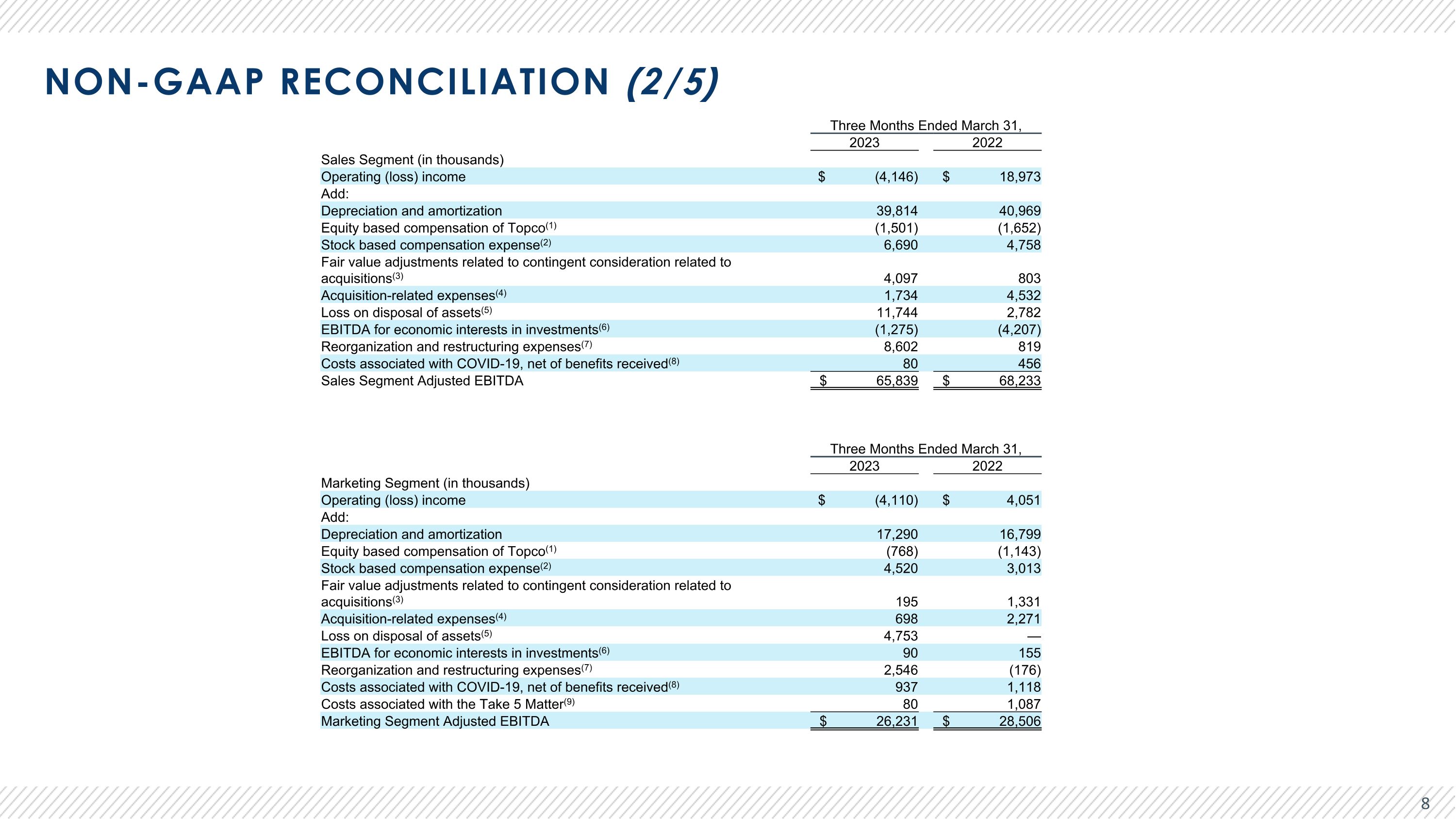

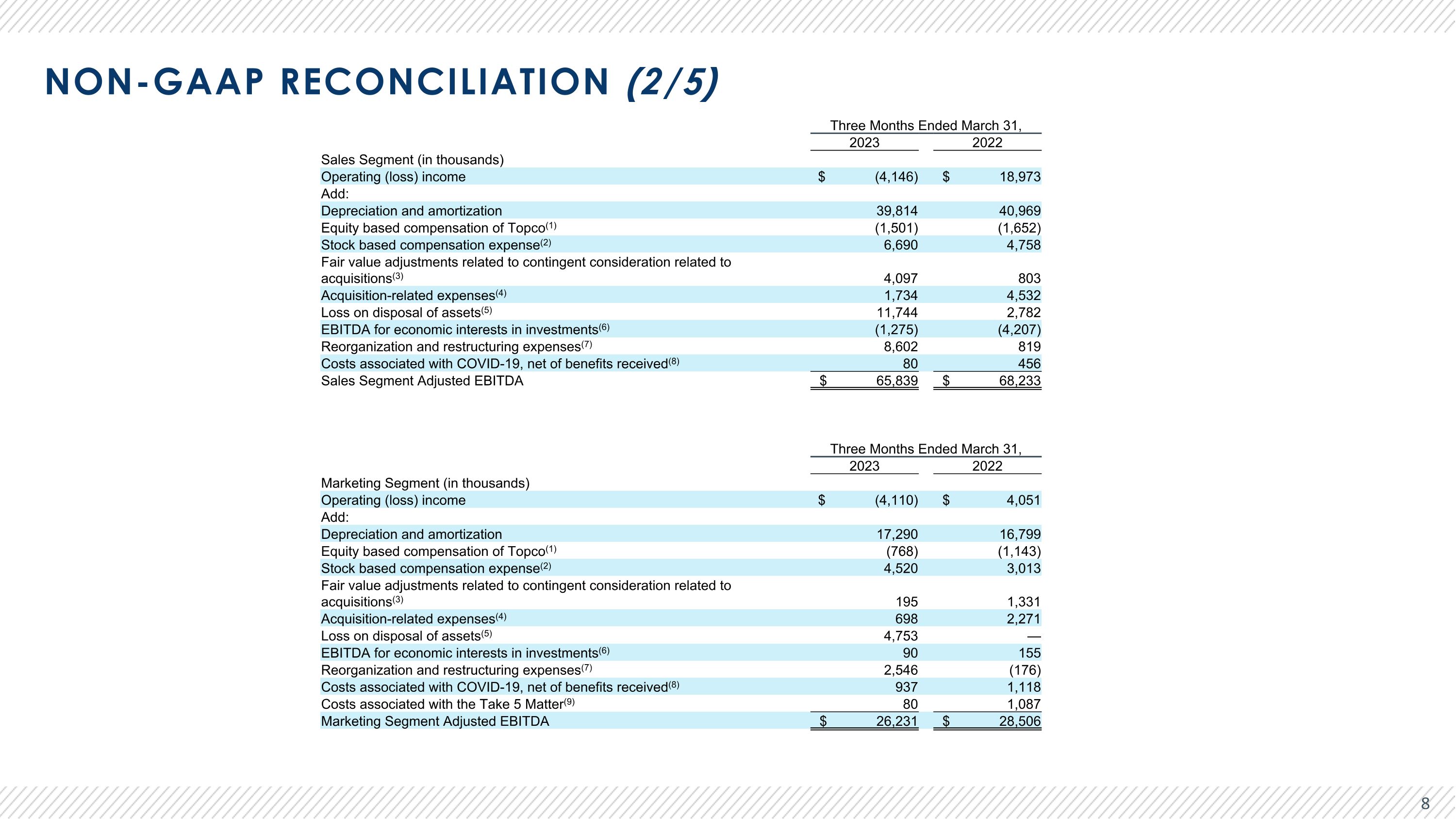

Non-GAAP Reconciliation (2/5) Three Months Ended March 31, 2023 2022 Sales Segment (in thousands) Operating (loss) income $ (4,146) $ 18,973 Add: Depreciation and amortization 39,814 40,969 Equity based compensation of Topco(1) (1,501) (1,652) Stock based compensation expense(2) 6,690 4,758 Fair value adjustments related to contingent consideration related to acquisitions(3) 4,097 803 Acquisition-related expenses(4) 1,734 4,532 Loss on disposal of assets(5) 11,744 2,782 EBITDA for economic interests in investments(6) (1,275) (4,207) Reorganization and restructuring expenses(7) 8,602 819 Costs associated with COVID-19, net of benefits received(8) 80 456 Sales Segment Adjusted EBITDA $ 65,839 $ 68,233 Three Months Ended March 31, 2023 2022 Marketing Segment (in thousands) Operating (loss) income $ (4,110) $ 4,051 Add: Depreciation and amortization 17,290 16,799 Equity based compensation of Topco(1) (768) (1,143) Stock based compensation expense(2) 4,520 3,013 Fair value adjustments related to contingent consideration related to acquisitions(3) 195 1,331 Acquisition-related expenses(4) 698 2,271 Loss on disposal of assets(5) 4,753 — EBITDA for economic interests in investments(6) 90 155 Reorganization and restructuring expenses(7) 2,546 (176) Costs associated with COVID-19, net of benefits received(8) 937 1,118 Costs associated with the Take 5 Matter(9) 80 1,087 Marketing Segment Adjusted EBITDA $ 26,231 $ 28,506

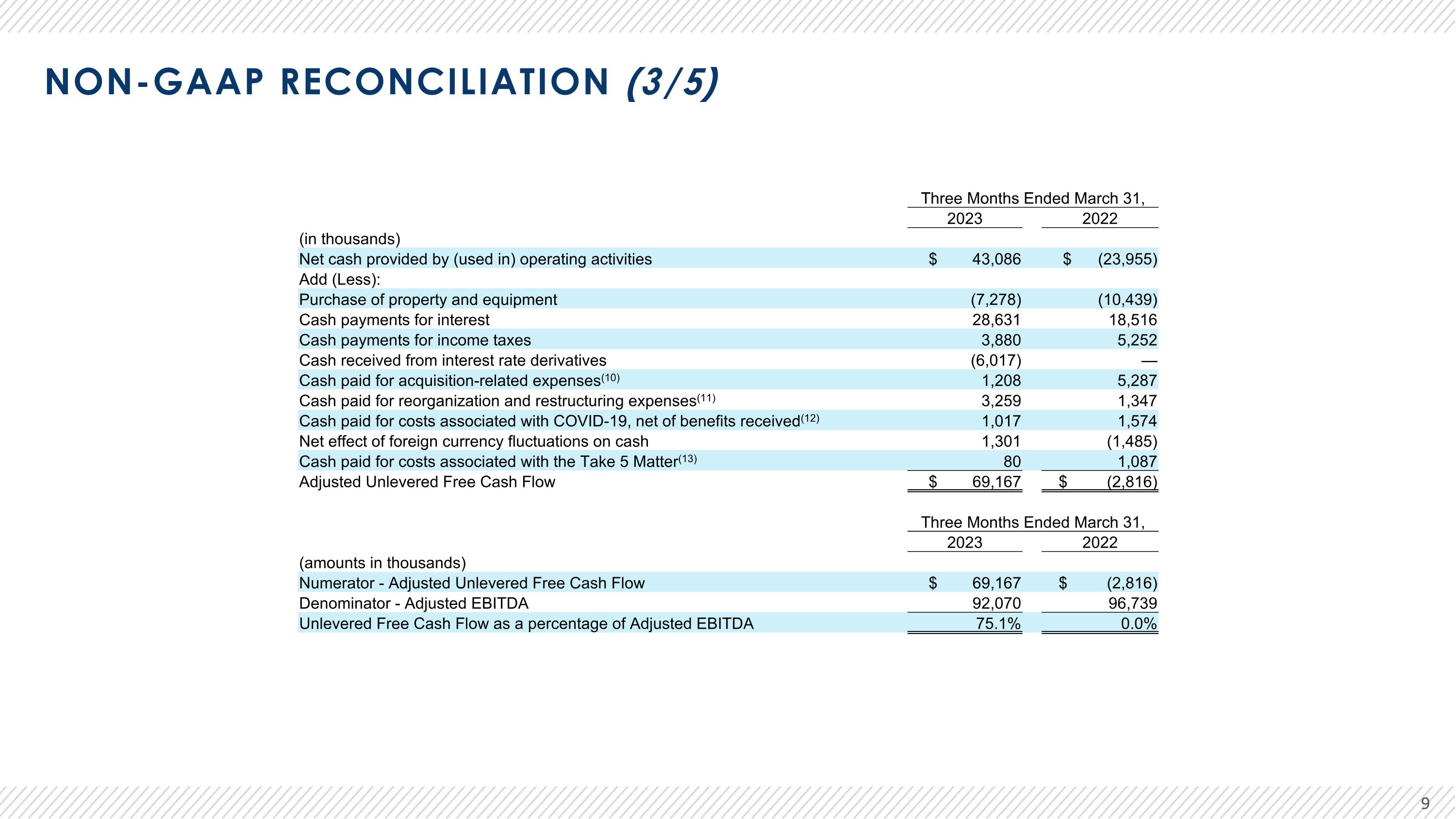

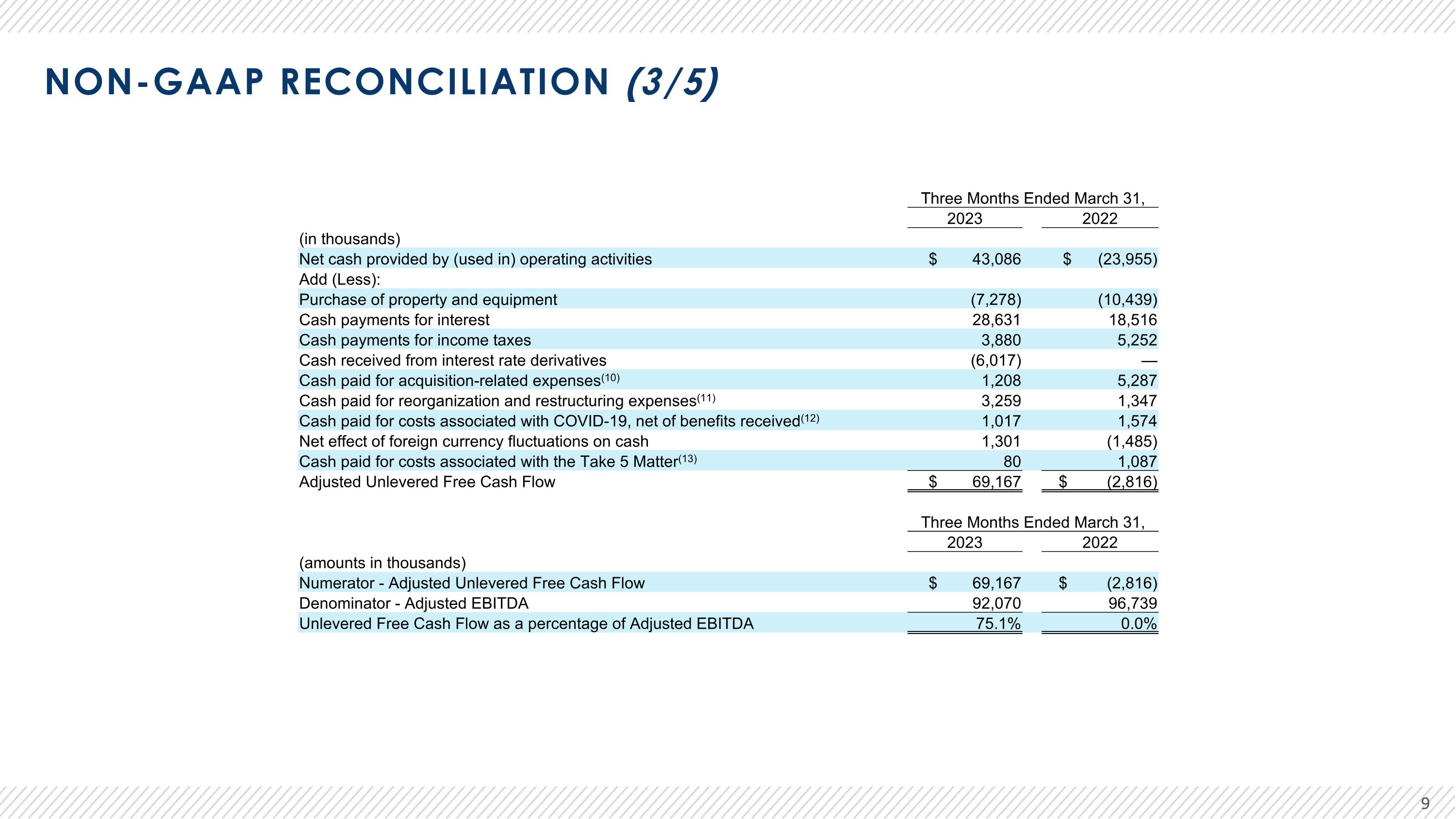

Non-GAAP Reconciliation (3/5) Three Months Ended March 31, 2023 2022 (in thousands) Net cash provided by (used in) operating activities $ 43,086 $ (23,955) Add (Less): Purchase of property and equipment (7,278) (10,439) Cash payments for interest 28,631 18,516 Cash payments for income taxes 3,880 5,252 Cash received from interest rate derivatives (6,017) — Cash paid for acquisition-related expenses(10) 1,208 5,287 Cash paid for reorganization and restructuring expenses(11) 3,259 1,347 Cash paid for costs associated with COVID-19, net of benefits received(12) 1,017 1,574 Net effect of foreign currency fluctuations on cash 1,301 (1,485) Cash paid for costs associated with the Take 5 Matter(13) 80 1,087 Adjusted Unlevered Free Cash Flow $ 69,167 $ (2,816) Three Months Ended March 31, 2023 2022 (amounts in thousands) Numerator - Adjusted Unlevered Free Cash Flow $ 69,167 $ (2,816) Denominator - Adjusted EBITDA 92,070 96,739 Unlevered Free Cash Flow as a percentage of Adjusted EBITDA 75.1% 0.0%

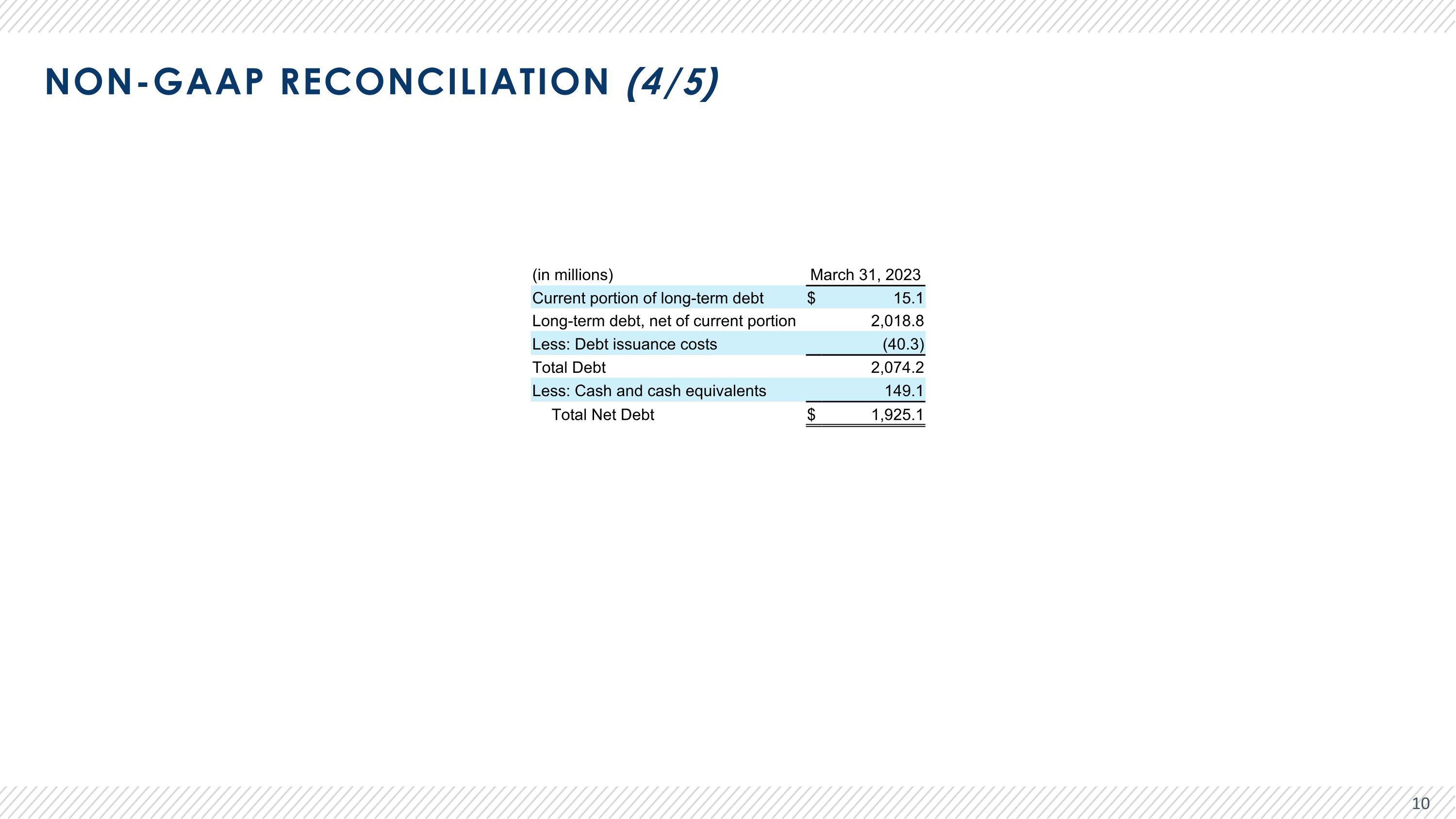

Non-GAAP Reconciliation (4/5) (in millions) March 31, 2023 Current portion of long-term debt $ 15.1 Long-term debt, net of current portion 2,018.8 Less: Debt issuance costs (40.3) Total Debt 2,074.2 Less: Cash and cash equivalents 149.1 Total Net Debt $ 1,925.1

Non-GAAP Reconciliation (5/5) Note: Numerical figures included in this slide have been subject to rounding adjustments Represents expenses related to (i) equity-based compensation expense associated with grants of Common Series D Units of Karman Topco L.P. (“Topco”) made to one of the equity holders of Topco and (ii) equity-based compensation expense associated with the Common Series C Units of Topco. Represents non-cash compensation expense related to the 2020 Incentive Award Plan and the 2020 Employee Stock Purchase Plan. Represents adjustments to the estimated fair value of our contingent consideration liabilities related to our acquisitions. Represents fees and costs associated with activities related to our acquisitions and reorganization activities including professional fees, due diligence, and integration activities. Represents losses on disposal of assets related to divestitures and losses on sale of businesses and classification of assets held for sale, less cost to sell. Represents additions to reflect our proportional share of Adjusted EBITDA related to our equity method investments and reductions to remove the Adjusted EBITDA related to the minority ownership percentage of the entities that we fully consolidate in our financial statements. Represents fees and costs associated with various internal reorganization activities, including professional fees, lease exit costs, severance, and nonrecurring compensation costs. Represents (a) costs related to implementation of strategies for workplace safety in response to COVID-19, including additional sick pay for front-line associates and personal protective equipment; and (b) benefits received from government grants for COVID-19 relief. Represents costs associated with the Take 5 Matter, primarily, professional fees and other related costs. Represents cash paid for fees and costs associated with activities related to our acquisitions and reorganization activities including professional fees, due diligence, and integration activities. Represents cash paid for fees and costs associated with various reorganization activities, including professional fees, lease exit costs, severance, and nonrecurring compensation costs. Represents cash paid or (cash received) for (a) costs related to implementation of strategies for workplace safety in response to COVID-19, including additional sick pay for front-line associates and personal protective equipment; and (b) benefits received from government grants for COVID-19 relief. Represents cash paid for costs associated with the Take 5 Matter, primarily, professional fees and other related costs.

Thank You