| Item 7.01. | Regulation FD Disclosure. |

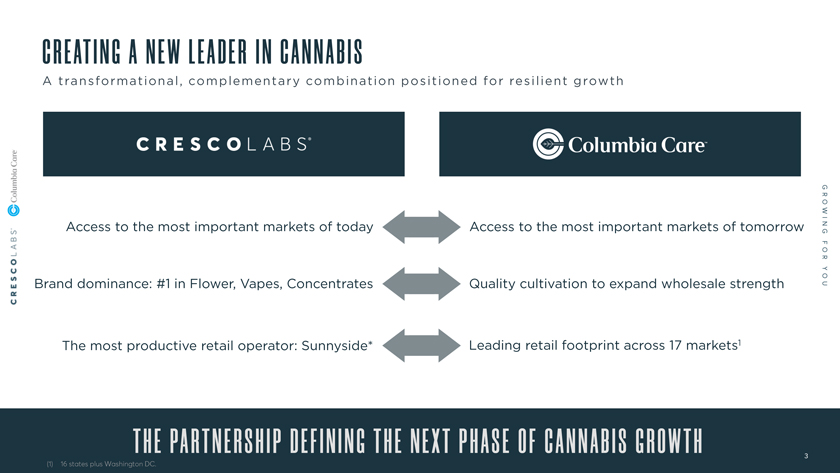

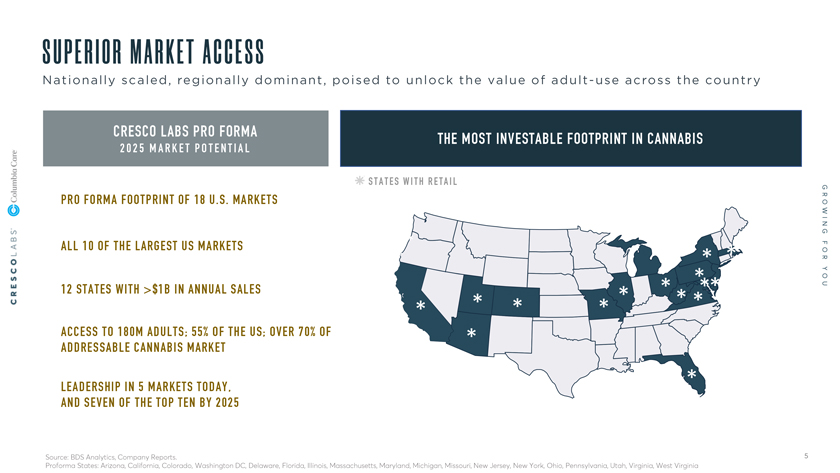

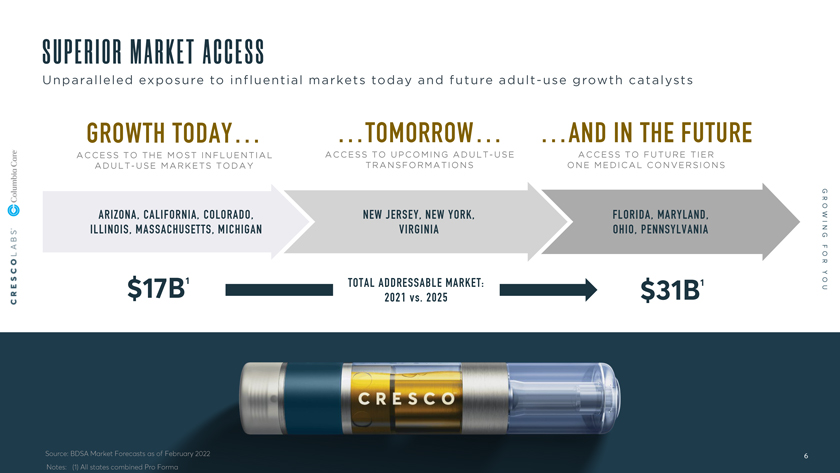

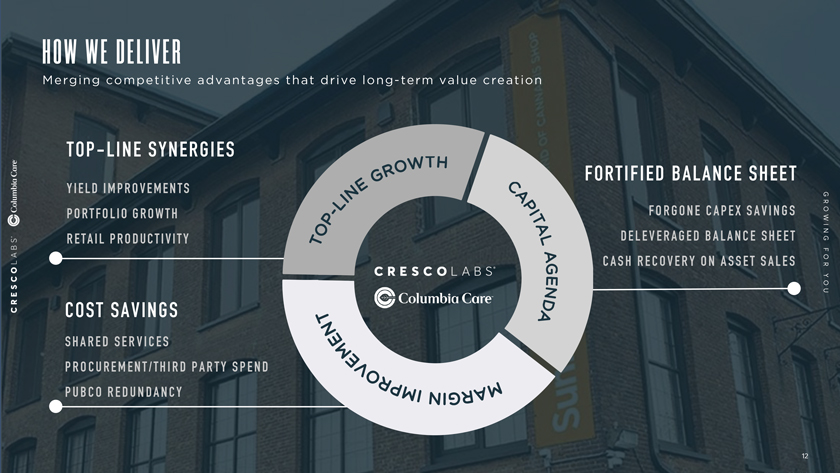

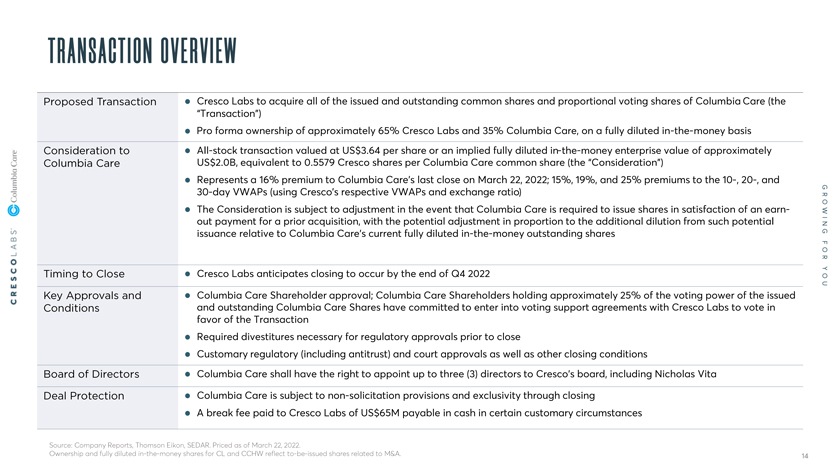

On March 23, 2022, Columbia Care Inc., a British Columbia corporation (“Columbia Care”), and Cresco Labs Inc., a British Columbia corporation (“Cresco Labs”), announced the execution of an Arrangement Agreement (the “Arrangement Agreement”), by and between Columbia Care and Cresco Labs. Furnished as Exhibit 99.1 hereto and incorporated into this Item 7.01 by reference is an investor presentation that Cresco Labs and Columbia Care issued in connection with the transaction.

The information in this Item 7.01, including Exhibit 99.1, is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

On March 23, 2022, Columbia Care and Cresco Labs issued a joint press release announcing the execution of the Arrangement Agreement, by and between Columbia Care and Cresco Labs.

A copy of the joint press release is furnished as Exhibit 99.2 hereto and is incorporated herein by reference.

Additional Information and Where to Find It

In connection with the proposed transaction, Columbia Care will file a management information circular and proxy statement on Schedule 14A containing important information about the proposed transaction and related matters. Additionally, Columbia Care and Cresco Labs will file other relevant materials in connection with the proposed transaction with applicable securities regulatory authorities. Investors and security holders of Columbia Care are urged to carefully read the entire management information circular and proxy statement (including any amendments or supplements to such documents) when such document becomes available before making any voting decision with respect to the proposed transaction because they will contain important information about the proposed transaction and the parties to the transaction. The Columbia Care management information circular and proxy statement will be mailed to Columbia Care shareholders, as well as be accessible on the EDGAR and SEDAR profile of Columbia Care.

Investors and security holders of Columbia Care will be able to obtain a free copy of the management information circular and proxy statement, as well as other relevant filings containing information about Columbia Care and the proposed transaction, including materials that will be incorporated by reference into the management information circular and proxy statement, without charge, at the Securities and Exchange Commission’s (the “SEC”) website (www.sec.gov) or from Columbia Care by going to Columbia Care’s Investor Relations page on its website at https://ir.col-care.com/.

Participants in the Solicitation

Columbia Care and certain of its respective directors, executive officers and employees may be deemed to be participants in the solicitation of Columbia Care proxies in respect of the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Columbia Care shareholders in connection with the proposed transaction will be set forth in the Columbia Care management information circular and proxy statement for the proposed transaction when available. Other information regarding the participants in the Columbia Care proxy solicitation and a description of their direct and indirect interests in the proposed transaction, by security holdings or otherwise, will be contained in such management information circular and proxy statement and other relevant materials to be filed with the SEC in connection with the proposed transaction. Copies of these documents may be obtained, free of charge, from the SEC or Columbia Care as described in the preceding paragraph.

Forward Looking Statements

This Form 8-K contains “forward-looking information” within the meaning of applicable Canadian securities legislation and may also contain statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to each party’s expectations or forecasts of business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs and include statements regarding Cresco Labs and Columbia Care’s expected financial