UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A INFORMATION

___________________

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant | | ☒ | | Filed by a Party other than the Registrant | | ☐ |

Check the appropriate box: | | | | | | |

☐ | | Preliminary Proxy Statement |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | Definitive Proxy Statement |

☐ | | Definitive Additional Materials |

☐ | | Soliciting Material under §240.14a-12 |

MEDMEN ENTERPRISES INC.

(Name of registrant as specified in its charter)

______________________________________________________________

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | | No fee required. |

| | | |

☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which the transaction applies: |

| | | | | |

| | | (2) | | Aggregate number of securities to which the transaction applies: |

| | | | | |

| | | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of the transaction: |

| | | | | |

| | | (5) | | Total fee paid: |

| | | | | |

☐ | | Fee paid previously with preliminary materials. |

☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | (3) | | Filing Party: |

| | | | | |

| | | (4) | | Date Filed: |

| | | | | |

NOTICE OF MEETING

AND

PROXY STATEMENT

FOR THE

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

OF

MEDMEN ENTERPRISES INC.

TO BE HELD ON

April 20, 2022

Dated as of March 11, 2022

MEDMEN ENTERPRISES INC.

10115 Jefferson Boulevard

Culver City, California 90232

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

To Be Held on April 20, 2022

9:00 A.M. (Pacific Time)

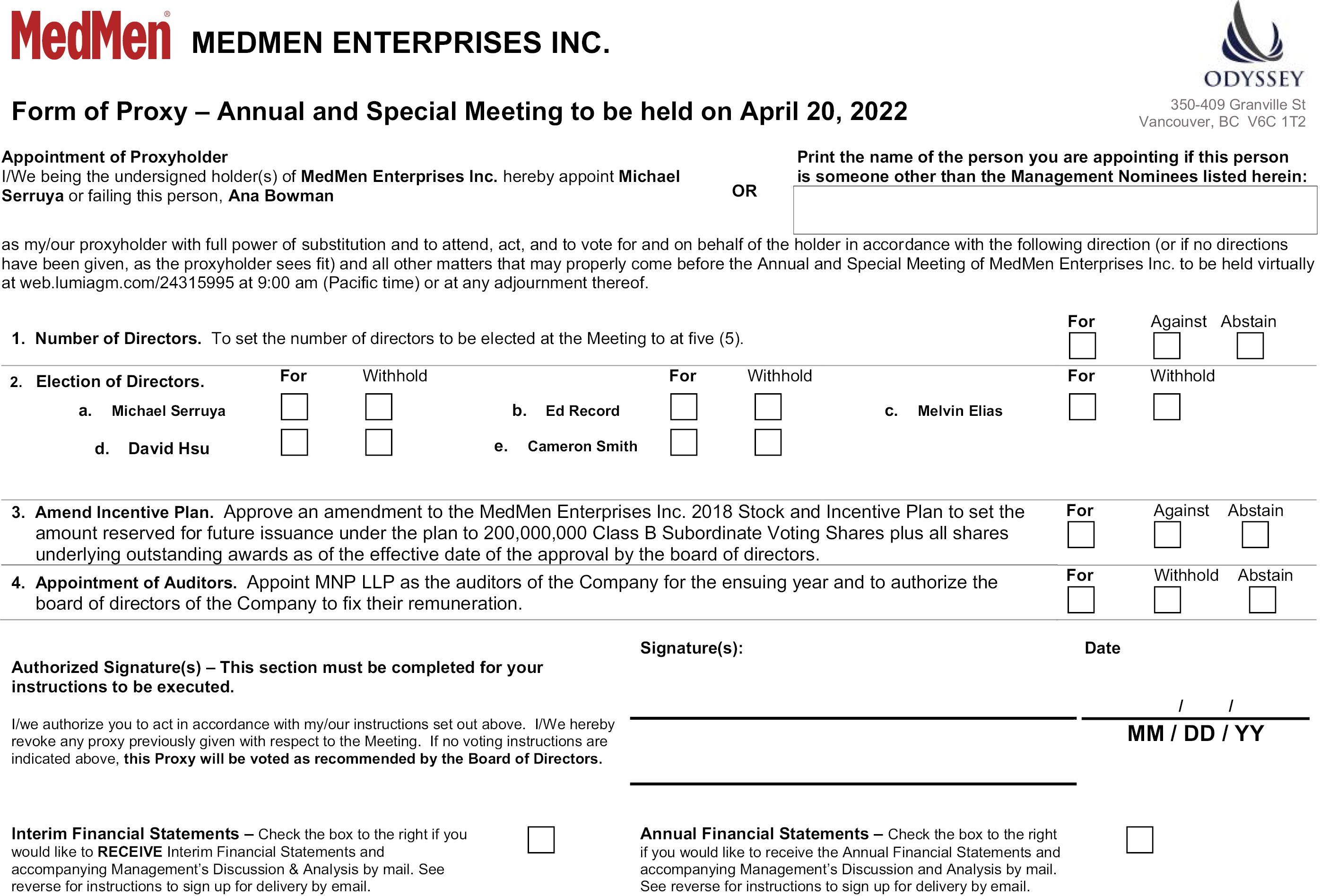

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of the Shareholders of MEDMEN ENTERPRISES INC., a British Columbia corporation (“MedMen,” “we,” “our,” “us,” or the “Company”), will held virtually via the Internet at 9:00 a.m. (Pacific Time) on April 20, 2022 for the following purposes:

1. to set the number of directors of the Company for the ensuring year at five (5), subject to permitted increases under the articles of the Company or otherwise;

2. to elect the directors to serve for the ensuing year;

3. to approve an amendment to the MedMen Enterprises Inc. 2018 Stock and Incentive Plan to set the amount reserved for future issuance under the plan to 200,000,000 Class B Subordinate Voting Shares plus all shares underlying outstanding awards as of April 1, 2021, the effective date of the approval by the board of directors;

4. to appoint MNP LLP as the auditors of the Company for the ensuing year and to authorize the board of directors of the Company to fix their remuneration; and

5. to transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

Particulars of the foregoing matters are set forth in the proxy statement for the Meeting dated March 11, 2022 (the “proxy statement”). The board of directors of the Company has fixed the close of business on March 4, 2022 as the record date for the determination of the shareholders of MedMen entitled to receive notice of, and to vote at, the Meeting (the “Record Date”). Only holders of our Class B Subordinate Voting Shares whose names have been entered in the register of shareholders as of the close of business on March 4, 2022 will be entitled to receive notice of, and to vote at, the Meeting and any postponements, adjournments or continuations thereof.

The Company is holding the Meeting as a completely virtual meeting (“Virtual Meeting”), which will be conducted via live webcast, where all shareholders regardless of geographic location and equity ownership will have an equal opportunity to participate at the Meeting. Shareholders will not be able to attend the Meeting in person. Registered shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting, or any adjournment or postponement of the Meeting, online at web.lumiagm.com/243159945. Beneficial shareholders (being shareholders who hold their shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary (a “non-registered shareholder”)) who have not duly appointed themselves as proxyholder will be able to attend as a guest and view the webcast but not be able to participate or vote at the Meeting. For further information, see “General Information About the Annual and Special Meeting — Non-Registered Shareholders”, and “General Information About the Annual and Special Meeting — Voting at the Meeting” in the proxy statement.

A shareholder who wishes to appoint a person other than the management nominees identified on the form of proxy or voting instruction form, to represent him, her or it at the Meeting may do so by inserting such person’s name in the blank space provided in the form of proxy or voting instruction form and following the instructions for submitting such form of proxy or voting instruction form. This must be completed prior to registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form. If you wish that a person other than the management nominees identified on the form of proxy or voting instruction form attend and participate at the Meeting as your proxy and vote your Shares, including if you are a non-registered shareholder and wish to appoint yourself as proxyholder to attend, participate and vote at the Meeting, you MUST register such proxyholder after having submitted your form of proxy or voting instruction form identifying such proxyholder. Failure to register the proxyholder will result in the proxyholder not receiving a Username to participate in the Meeting. Without a Username, proxyholders will not be able to attend, participate or vote at the Meeting. To register a proxyholder, shareholders MUST send an email to medmen@odysseytrust.com and provide Odyssey Trust

Company (“Odyssey”) with their proxyholder’s contact information, amount of shares appointed, name in which the shares are registered if they are a registered shareholder, or name of broker where the shares are held if a beneficial shareholder, so that Odyssey may provide the proxyholder with a Username via email.

On March 11, 2022, we mailed to our registered shareholders as of the close of business on the Record Date, an Important Notice Regarding the Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement and our Annual Report on Form 10-K for the year ended June 26, 2021 (the “Annual Report”) on the Internet and also how to vote their shares via the Internet. If you received a Notice by mail, you will not receive printed proxy materials unless you specifically request them. Both the Notice and the proxy statement contain instructions on how you can request a paper copy of the proxy statement and the Annual Report on Form 10-K for the fiscal year ended June 26, 2021.

Whether or not you are able to attend the Meeting in person, you are encouraged to provide voting instructions on the enclosed form of proxy as soon as possible. The Company’s transfer agent, Odyssey, must receive your proxy no later than April 18, 2022 at 9:00 a.m. (Pacific time), or, if the Meeting is adjourned or postponed, no later than 48 hours (excluding Saturdays, Sundays and holidays in the Province of British Columbia) before any adjourned or postponed Meeting. You must send your proxy to the Company’s transfer agent by either using the envelope provided or by mailing the proxy to Odyssey Trust Company, Proxy Department, 350 – 409 Granville Street, Vancouver, British Columbia, Canada V6C 1T2. You may vote by email at proxy@odysseytrust.com, Attention: Proxy Department. You may also vote on the internet by going to http://odysseytrust.com/Transfer-Agent/Login and following the instructions. You will need your 12 digit control number located on the form of proxy.

If you are a non-registered shareholder, you should follow the voting procedures described in the form of proxy or voting instruction form provided by your broker or intermediary or call your broker or intermediary for information as to how you can vote your shares. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients. Therefore, each non-registered shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting. Note that the deadlines set by your broker or intermediary for submitting your form of proxy or voting instruction form may be earlier than the dates described above. Shareholders should follow the instructions on the forms they receive and if they have any questions contact their intermediaries or Odyssey, the Company’s transfer agent, toll free within North America at 1.800.517.4553, at 1.587.885.0960 outside of North America or by e-mail at proxy@odysseytrust.com.

Whether or not you plan to attend the Meeting via live webcast, we encourage you to read this proxy statement and promptly vote your shares. For specific instructions on how to vote your shares, please refer to the section entitled “General Information About the Annual and Special Meeting” and to the instructions on your proxy or voting instruction card.

| | BY ORDER OF THE BOARD |

| | | /s/ Michael Serruya |

Dated: March 11, 2022 | | Michael Serruya,

Chairman and Chief Executive Officer |

MEDMEN ENTERPRISES INC.

10115 Jefferson Boulevard

Culver City, California 90232

(424) 330-2082

___________________

PROXY STATEMENT

___________________

FOR ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON

APRIL 20, 2022 AT 9:00 A.M. (PACIFIC TIME)

This proxy statement is being furnished by MedMen Enterprises Inc., a British Columbia corporation (“MedMen,” “we,” “our,” “us,” or the “Company”), in connection with the annual and special meeting (the “Meeting”) of shareholders to be held on April 20, 2022 at 9:00 a.m. (Pacific Time). The Meeting will be held in virtual form only via live webcast at web.lumiagm.com/243159945. See “General Information About the Annual and Special Meeting” for more information on how to attend, participate and vote at the Meeting. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended June 26, 2021 are being made available to our shareholders commencing on or about March 20, 2022.

The purpose of the Meeting is to consider the following proposals:

1. to set the number of directors of the Company for the ensuring year at five (5), subject to permitted increases under the articles of the Company or otherwise;

2. to elect the directors to serve for the ensuing year;

3. to approve an amendment to the MedMen Enterprises Inc. 2018 Stock and Incentive Plan to set the amount reserved for future issuance under the plan to 200,000,000 Class B Subordinate Voting Shares plus all shares underlying outstanding awards as of the effective date of the approval by the board of directors;

4. to appoint MNP LLP as the auditors of the Company for the ensuing year and to authorize the board of directors of the Company to fix their remuneration; and

5. to transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

Annual Report

Our Annual Report on Form 10-K for the fiscal year ended June 26, 2021 (“2021 Annual Report”), as filed with the U.S. Securities and Exchange Commission (the “SEC”) on September 24, 2021, except for exhibits, will be concurrently provided to each shareholder at the time we send this proxy statement and the enclosed proxy. Shareholders may also request a free copy of our 2021 Annual Report by writing to Corporate Secretary, MedMen Enterprises Inc., 10115 Jefferson Boulevard Culver City, California 90232. Alternatively, shareholders may access this proxy statement and 2021 Annual Report on our website located at investors.medmen.com the SEC’s website at www.sec.gov and SEDAR at www.sedar.com. We will also furnish any exhibit to our 2021 Annual Report, if specifically requested.

Emerging Growth Company

We are an “emerging growth company” under applicable U.S. federal securities laws and therefore permitted to conform with certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the U.S. Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the SEC or if we issue more than $1.0 billion of non-convertible debt over a three-year period.

Important Notice Regarding the Availability of Proxy Materials for the Annual and Special Meeting of Shareholders to be Held on April 20, 2022: This proxy statement and our Annual Report on Form 10-K are available for viewing, printing and downloading at https://odysseytrust.com/client/medmen-enterprises/ |

No person is authorized to give any information or to make any representation other than those contained in this proxy statement and, if given or made, such information or representation should not be relied upon as having been authorized by the Company. The delivery of this proxy statement shall not, under any circumstances, create an implication that there has been any change in the information set forth herein since the date hereof.

i

ii

GENERAL INFORMATION

ABOUT THE ANNUAL AND SPECIAL MEETING

Time and Place of Meeting

The annual and special meeting of shareholders will be a virtual meeting held via live audio webcast on the Internet on April 20, 2022 at 9:00 a.m. (Pacific Time) at web.lumiagm.com/243159945.

We are excited to embrace virtual meeting technology, which we believe provides expanded access, improved communications and cost and time savings for our shareholders and the Company. A virtual meeting enables increased shareholder attendance and participation from locations around the world. We believe the cost and time savings afforded by a virtual meeting encourages more shareholders to attend the Meeting.

Record Date

The board of directors has fixed March 4, 2022 (the “Record Date”) as the record date for the determination of the holders of Class B Subordinate Voting Shares (the “Shares”) entitled to receive the Notice of Meeting. Only registered shareholders at the close of business on the Record Date will be entitled to vote at the Meeting and at any adjournment or postponement thereof.

The authorized share capital of the Company consists of an unlimited number of Class A Super Voting Shares, an unlimited number of Class B Subordinate Voting Shares and an unlimited number of Preferred Shares, issuable in series. As of the Record Date, there were no Class A Super Voting Shares, 1,208,249,218 Class B Subordinate Voting Shares and no Preferred Shares issued and outstanding. Each Class B Subordinate Voting Share entitles the holder thereof to one vote, in each case on all matters to be acted upon at the Meeting. See “Description of Share Capital of the Company” below for further details. As of the Record Date, there were 220 holders of record (also known as registered shareholders) of the Shares.

Registered Shareholders

A “registered shareholder” means a shareholder who is in possession of a DRS Statement or a physical share certificate, or who is entitled to receive a DRS Statement or a physical share certificate, in respect of shares of the Company and whose name and address are recorded in the Company’s shareholders’ register maintained by Odyssey Trust, the registrar and transfer agent of the Company, or the Company, as applicable, in respect of such shares.

All references to shareholders in this proxy statement and the accompanying form of proxy and Notice of Meeting are to registered shareholders unless specifically stated otherwise.

Non-Registered Shareholders

Some shareholders are “Non-registered Shareholders” because the Shares they own are not registered in their names but are instead registered in the names of securities dealers, banks, trust companies, brokerage firms and banks, or their nominees a brokerage firm, bank or other intermediary or in the name of a clearing agency (collectively “intermediaries”, and each an “intermediary”). If shares are listed in an account statement provided to a shareholder by an intermediary, then in almost all cases those shares will not be registered in such shareholder’s name on the records of the Company. Such shares will more likely be registered in the name of an intermediary or an agent or nominee thereof.

Quorum

The quorum for any meeting of shareholders is two persons present at the meeting each of whom is entitled to vote at the meeting, and who hold or represent by proxy in the aggregate not less than 5% of the outstanding shares of the Company entitled to vote at the meeting, even if such shares abstain from voting or represent “broker non-votes” on non-routine matters. Such Shares will be counted only for the purpose of determining whether a quorum is present at the Meeting and not as votes cast. Quorum must be present at the commencement of the Meeting, but need not be present throughout the Meeting.

1

Postponement or Adjournment of Meeting

In the event that a quorum is not present at the time fixed for holding the Meeting, the Meeting will stand adjourned to such date and to such time and place as may be determined by the shareholders present without notice other than the announcement at the Meeting.

Proxy Materials and Solicitation of Proxies

The Notice of Meeting, this proxy statement, accompanying form of proxy and 2021 Form 10-K (collectively, the “Proxy Materials”) are being provided to both registered shareholders and non-registered shareholders. In some instances, the Company will distribute the Proxy Materials to intermediaries for onward distribution to non-registered shareholders. The intermediaries are required to forward the Proxy Materials to non-registered shareholders. Solicitation of proxies from non-registered shareholders will be carried out by intermediaries, or by the Company if the names and addresses of non-registered shareholders are provided by the intermediaries, as further discussed below under “Voting Procedures for Non-Registered Shareholders.”

Our board of directors is soliciting the enclosed proxy. We will bear the cost of this solicitation of proxies. Proxies may be solicited on our behalf by our directors, officers or employees in person or by mail, telephone, facsimile or electronic communications, but no additional compensation will be paid to them. We have also requested brokerage houses and other custodians, nominees and fiduciaries to forward soliciting material to beneficial owners and have agreed to reimburse those institutions for their out-of-pocket expenses.

Proposals to be Voted upon at the Meeting; Voting Choices and Board Recommendations

The matters to be voted on at the Meeting their respective voting choices and the voting recommendations of our board of directors are as follows:

Proposal | | Voting Choices | | Voting

Recommendation

of the Board of

Directors |

1. | | Set the number of directors of the Company for the ensuring year at five (5), subject to permitted increases under the articles of the Company or otherwise. | | You may vote FOR or AGAINST this matter or ABSTAIN. | | FOR |

2. | | Elect the directors to serve for the ensuing year. | | You may vote FOR or WITHHOLD any specific nominee. | | FOR all nominees |

3. | | Approve an amendment to the MedMen Enterprises Inc. 2018 Stock and Incentive Plan to set the amount reserved for future issuance under the plan to 200,000,000 Class B Subordinate Voting Shares plus all shares underlying outstanding awards as of the effective date of the approval by the board of directors. | | You may vote FOR or AGAINST this matter or ABSTAIN. | | FOR |

4. | | Appoint MNP LLP as the auditors of the Company for the ensuing year and to authorize the board of directors of the Company to fix their remuneration. | | You may vote FOR or AGAINST on this matter or ABSTAIN. | | FOR |

The Meeting will also transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

2

Vote Requirements for each Proposal

The vote requirements for each proposal is the following:

Proposal | | Required Vote |

1. | | Set the number of directors of the Company for the ensuring year at five (5), subject to permitted increases under the articles of the Company or otherwise. | | Majority of the votes cast on the proposal by the shareholders present in person or represented by proxy and entitled to vote at the Meeting. |

2. | | Elect the directors to serve for the ensuing year. | | Each director is elected by a plurality of votes cast. |

3. | | Approve an amendment to the MedMen Enterprises Inc. 2018 Stock and Incentive Plan to set the amount reserved for future issuance under the plan to 200,000,000 Class B Subordinate Voting Shares plus all shares underlying outstanding awards as of the effective date of the approval by the board of directors. | | A majority of the outstanding Shares entitled to vote at the Meeting, and, for purposes of applicable Canadian securities laws, a majority of the votes cast on the proposal by the shareholders present in person or represented by proxy and entitled to vote at the Meeting, other than votes attached to Shares held by certain persons who may participate in the plan. The number of Shares estimated to be excluded from this vote is 3,059,180 Shares. |

4. | | Appoint MNP LLP as the auditors of the Company for the ensuing year and to authorize the board of directors of the Company to fix their remuneration. | | A plurality of votes cast on the proposal |

Abstentions and Broker Non-Votes

An abstention is the voluntary act of not voting by a shareholder who is present, in person or by proxy, at the Meeting. Except for Proposal No. 3 (Amendment to the 2018 Plan), abstentions are not counted as votes cast and will have no effect on the outcome of the proposal

If your Shares are held through a brokerage firm, they will be voted as you instruct on the VIF provided by your broker. If you sign and return your card without giving specific instructions, your Shares will be voted in accordance with the recommendations of our board of directors. If you do not return your VIF on a timely basis and your Shares are held by a FINRA member broker, your broker will have the authority to vote your brokerage shares only on the proposal to elect our auditor (Proposal No. 4). Your broker will be prohibited from voting your shares without your instructions on the number of directors, the election of directors and on any other proposal. These “broker non-votes” will be counted only for the purpose of determining whether a quorum is present at the Meeting and not as votes cast. Except for Proposal No. 3 (Amendment to the 2018 Plan), such broker non-votes will have no effect on the outcome of the matter.

Abstentions and broker non-votes on Proposal No. 3, which also requires approval of a majority of the outstanding Shares, will have the effect as a vote against that proposal for purposes of applicable requirements of the State of California.

Voting at the Meeting

Registered shareholders may vote at the Meeting by completing a ballot online during the Meeting, as further described below. See “Attending and Participating at the Meeting”.

Beneficial shareholders who have not duly appointed themselves as proxyholder will not be able to attend, participate or vote at the Meeting. This is because the Company and its transfer agent do not have a record of the beneficial shareholders of the Company, and, as a result, will have no knowledge of your shareholdings or entitlement to vote, unless you appoint yourself as proxyholder. If you are a beneficial shareholder and wish to vote at the Meeting, you have to appoint yourself as proxyholder, by inserting your own name in the space provided on the voting instruction form sent to you and must follow all of the applicable instructions provided by your intermediary. See “Appointment of Proxy” and “Attending and Participating at the Meeting”.

3

Appointment of Proxy

The persons named in the enclosed proxy or voting instruction form are Michael Serruya, Chief Executive Officer of the Company, and Ana Bowman, Chief Financial Officer of the Company. Shareholders have the right to appoint a person to represent him, her or it at the Meeting other than the persons designated in the form of proxy or voting instructions form, as applicable, including non-registered shareholder who wish to appoint themselves as proxyholder to attend, participate or vote at the Meeting.

Shareholders who wish to appoint a third party proxyholder to attend, participate or vote at the Meeting as their proxy and vote their Shares MUST submit their proxy or voting instruction form (as applicable) appointing such third party proxyholder AND register the third party proxyholder, as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a Username to attend, participate or vote at the Meeting.

Step 1: Submit your proxy or voting instruction form: To appoint a third party proxyholder, insert such person’s name in the blank space provided in the form of proxy or voting instruction form (if permitted) and follow the instructions for submitting such form of proxy or voting instruction form. This must be completed prior to registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form. If you are a beneficial shareholder located in the United States, you must also provide Odyssey with a duly completed legal proxy if you wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as your proxyholder. See below under this section for additional details.

Step 2: Register your proxyholder: To register a proxyholder, shareholders MUST send an email to medmen@odysseytrust.com by 9:00 am (Pacific Time) on April 19, 2022 and provide Odyssey with the required proxyholder contact information, amount of shares appointed, name in which the shares are registered if they are a registered shareholder, or name of broker where the shares are held if a beneficial shareholder, so that Odyssey may provide the proxyholder with a Username via email. Without a Username, proxyholders will not be able to attend, participate or vote at the Meeting.

If you are a non-registered shareholder and wish to attend, participate or vote at the Meeting, you have to insert your own name in the space provided on the voting instruction form sent to you by your intermediary, follow all of the applicable instructions provided by your intermediary AND register yourself as your proxyholder, as described above. By doing so, you are instructing your intermediary to appoint you as proxyholder. It is important that you comply with the signature and return instructions provided by your intermediary. Please also see further instructions below under the heading “Attending and Participating at the Meeting”.

Legal Proxy — US Non-Registered Shareholders

If you are a non-registered shareholder located in the United States and wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described above and below under “ Attending and Participating at the Meeting”, you must obtain a valid legal proxy from your intermediary. Follow the instructions from your intermediary included with the legal proxy form and the voting information form sent to you, or contact your intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to Odyssey. Requests for registration from beneficial shareholders located in the United States that wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as their proxyholder must be sent by e-mail to medmen@odysseytrust.com by 9:00 am (Pacific Time) on April 19, 2022.

Attending and Participating at the Meeting

The Company is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast. Shareholders will not be able to attend the Meeting in person. In order to attend, participate or vote at the Meeting (including for voting and asking questions at the Meeting), shareholders must have a valid Username.

4

Registered shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting online at web.lumiagm.com/243159945. Such persons may then enter the Meeting by clicking “I have a login” and entering a Username and Password before the start of the Meeting:

Registered shareholders: The control number located on the form of proxy (or in the email notification you received) is the Username. The Password to the Meeting is “ medmen2022” (case sensitive). If as a registered shareholder you are using your control number to login to the Meeting and you have previously voted, you do not need to vote again when the polls open. By voting at the meeting, you will revoke your previous voting instructions received prior to voting cutoff.

Duly appointed proxyholders: Odyssey will provide the proxyholder with a Username by e-mail after the voting deadline has passed. The Password to the Meeting is “ medmen2022” (case sensitive). Only registered shareholders and duly appointed proxyholders will be entitled to attend, participate and vote at the Meeting. Non-registered shareholders who have not duly appointed themselves as proxyholder will be able to attend the meeting as a guest but not be able to participate or vote at the Meeting. Shareholders who wish to appoint a third party proxyholder to represent them at the Meeting (including beneficial shareholders who wish to appoint themselves as proxyholder to attend, participate or vote at the Meeting) MUST submit their duly completed proxy or voting instruction form AND register the proxyholder. See “Appointment of Proxy”.

How to Vote without Attending the Meeting

Whether you are a registered shareholder or a non-registered shareholder, you may direct how your shares are to be voted without attending the Meeting or any adjournment(s) or postponement(s) thereof. If you are a registered shareholder, you may vote by submitting a proxy. If you are a non-registered shareholder, you may vote by submitting voting instructions to the registered owner of your Shares, as further described below under “Voting Procedures for Non-Registered Shareholders”.

For directions on how to vote, please refer to the following instructions and those included on your proxy or voting instruction form. A proxy form will not be valid unless completed and deposited in accordance with the instructions set out in the proxy form.

The Company’s transfer agent, Odyssey Trust Company, must receive your proxy no later than April 18, 2022 at 9:00 a.m. (Pacific Time), or, if the Meeting is adjourned or postponed, no later than 48 hours (excluding Saturdays, Sundays and holidays in the Province of British Columbia) before any adjourned or postponed Meeting.

You must send your proxy to the Company’s transfer agent by using any of the following methods

By Mail

Use the envelope provided or by mailing the proxy to:

Odyssey Trust Company, Proxy Department

350 – 409 Granville Street

Vancouver, British Columbia, Canada V6C 1T2.

By Email

You may vote by email at:

proxy@odysseytrust.com

Attention: Proxy Department.

By Internet

You may vote on the internet by going to:

www.odysseytrust.com/Transfer-Agent/Login

You will need your 12-digit control number located on the form of proxy.

5

Signing of Proxy

The form of proxy must be signed by the registered shareholder or the duly appointed attorney thereof authorized in writing or, if the registered shareholder is a corporation, by an authorized officer or attorney of such corporation. A form of proxy signed by the person acting as attorney of the registered shareholder or in some other representative capacity, including an officer of a corporation which is a registered shareholder, should indicate the capacity in which such person is signing. A registered shareholder or his or her attorney may sign the form of proxy or a power of attorney authorizing the creation of a proxy by electronic signature provided that the means of electronic signature permits a reliable determination that the document was created or communicated by or on behalf of such registered shareholder or by or on behalf of his or her attorney, as the case may be.

Voting Procedures for Non-Registered Shareholders

Shares held by intermediaries (or their agents or nominees) on behalf of non-registered shareholders can only be voted (for or against resolutions) at the direction of the applicable non-registered shareholder. Without specific instructions, intermediaries and their agents or nominees are prohibited from voting shares on behalf of non-registered shareholder. Therefore, each non-registered shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

Existing regulatory policy requires Intermediaries to forward all proxy-related materials to and seek voting instructions from non-registered shareholder in advance of shareholder meetings. The various Intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by non-registered shareholder in order to ensure that their Shares are voted at the Meeting. Often the form of proxy supplied to a non-registered shareholder by an intermediary is identical to the form of proxy provided by the Company to registered shareholders. However, its purpose is limited to instructing the registered shareholder (i.e., the intermediary or agent or nominee thereof) how to vote on behalf of the non-registered shareholder. The majority of intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically prepares a machine-readable voting instruction form (a “VIF”), mails those forms to non-registered shareholders and asks non-registered shareholders to return the forms to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at a meeting. For the purposes hereof, a non-registered shareholder who receives a Broadridge VIF cannot use that form to vote Shares directly at the Meeting. The VIF must be returned to Broadridge (or instructions respecting the voting of Shares must be communicated to Broadridge) well in advance of the Meeting in order to have the Shares voted. These VIFs are to be completed and returned to Broadridge in the envelope provided or by facsimile. In addition, Broadridge provides both telephone voting and internet voting as described on the VIF itself which contains complete instructions. Broadridge will tabulate the results of the VIFs and will provide appropriate instructions to Odyssey Trust, the transfer agent of the Company, with respect to the Shares represented by the VIFs they receive. Please return your voting instructions as specified in the VIF.

Although non-registered shareholders may not be recognized directly at the Meeting for the purposes of voting Shares registered in the name of an Intermediary or an agent or nominee thereof, a non-registered shareholder may attend the Meeting as proxy holder for the registered shareholder and vote its Shares in that capacity. See “Appointment of Proxy” above.

Exercise of Discretion by Proxies

Shares represented by an appropriate form of proxy will be voted on any ballot or poll that may be conducted at the Meeting, or at any adjournment or postponement thereof, in accordance with the instructions contained on the form of proxy and, if the shareholder specifies a choice with respect to any matter to be acted on, the Shares will be voted accordingly. In the absence of instructions, such Shares will be voted FOR each of the matters described in the Notice of Meeting by the persons designated in the form of proxy.

The enclosed form of proxy, when properly completed and executed, confers discretionary authority upon the persons named therein to vote on any amendments to or variations of the matters described in the Notice of Meeting and on other matters, if any, which may properly be brought before the Meeting or any adjournment or postponement thereof, whether or not any of the amendments, variations or other matters are routine or contested. As at the date hereof,

6

management of the Company knows of no such amendments or variations or other matters to be brought before the Meeting. However, if any other matter which is not now known to management of the Company should properly be brought before the Meeting, or any adjournment or postponement thereof, the Shares represented by such proxy will be voted on such matter in accordance with the judgment of the person named as proxy thereon.

Revocation of Proxies

A registered shareholder of the Company who has given a proxy may revoke the proxy at any time prior to use by:

• attending the Meeting and voting in person;

• depositing an instrument in writing, including another completed form of proxy bearing a later date or a revocation, executed by such Registered Shareholder or by his or her attorney authorized in writing, or, if the Registered Shareholder is a corporation, by an authorized officer or attorney thereof: (a) to Odyssey Trust, at any time prior to 5:00 p.m. (Pacific Time) on the last business day preceding the day of the Meeting or any adjournment or postponement thereof; or (b) with the Chairman of the Meeting on the day of the Meeting or any adjournment or postponement thereof; or

• any other manner permitted by law.

A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation.

Any proxy given may be revoked at any time prior to its exercise by notifying the Corporate Secretary of the Company in writing of such revocation, by duly executing and delivering another proxy bearing a later date (including an Internet or telephone vote), or by attending the Virtual Meeting and voting virtually via the Internet.

For non-registered shareholders, you may change your vote by timely submitting new voting instructions to your Intermediary (which revokes your earlier instructions), or, if you have obtained a legal proxy from the nominee giving you the right to vote your shares, by attending the Meeting and voting via the live webcast.

Counting of Votes

If a proxy in the accompanying form is duly executed and returned, the shares represented by the proxy will be voted as directed. All properly executed proxies delivered pursuant to this solicitation, and not revoked, will be voted at the Meeting in accordance with the directions given. If you sign and return your proxy card without giving specific voting instructions, your shares will be voted based on the recommendations of our board of directors as set forth above under “Proposals to be Voted upon at the Meeting; Voting Choices and Board Recommendations.” Shareholders may not cumulate their votes for the election of directors.

Representatives of Odyssey will assist us in the tabulation of the votes.

Reporting of Voting Results

We expect to announce preliminary voting results at the Meeting and to publish final results in a current report on Form 8-K that we will file with the SEC and in a press release that we will file in Canada on SEDAR promptly following the Meeting. Both the Form 8-K and press release will also be available on the “Investors” section of our website at www.investors.medmen.com.

Shareholder Proposals for Inclusion in a Proxy Statement

The Company is subject to the rules of both the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and provisions of the Business Corporations Act (British Columbia) (“BCBCA”) with respect to shareholder proposals. As clearly indicated under the BCBCA and SEC rules under the Exchange Act, simply submitting a shareholder proposal does not guarantee its inclusion in the proxy materials.

Shareholder proposals submitted pursuant to SEC rules under the Exchange Act for inclusion in the Company’s proxy materials for next year’s annual meeting must be received by our Corporate Secretary no later than the close of business (Pacific Time) on November 20, 2022 and must be submitted to our Corporate Secretary at MedMen Enterprises Inc., 10115 Jefferson Boulevard Culver City, California 90232. Such proposals must also comply with all applicable provisions of Rule 14a-8 under the Exchange Act.

7

The BCBCA also sets out the requirements for a valid proposal and provides for the rights and obligations of the Company and the submitter upon a valid proposal being made. A person wishing to submit a proposal must have been, for at least 2-year period immediately prior to submission of the proposal the registered holder or the beneficial owner of either: (a) 1% of the outstanding Shares (calculated as of the day of submission of the proposal); or (b) $2,000 worth of such Shares (as determined at the close of business on the day before submission of the proposal). If the submitting shareholder does not meet minimum shareholdings requirements, the shareholder must have support of one or more other shareholders who do meet such requirements. Proposals submitted under the applicable provisions of the BCBCA that a shareholder intends to present at next year’s annual meeting and wishes to be considered for inclusion in the Company’s proxy statement and form of proxy relating to next year’s annual meeting must be received at least three (3) months before the anniversary of the Company’s last annual meeting.

Proposals that are not timely submitted or are submitted to the incorrect address or other than to the attention of our Corporate Secretary may, at our discretion, be excluded from our proxy materials. Proposals must comply with all applicable provisions of the BCBCA and the regulations thereunder.

Advance Notice Requirements for the Nomination of Director Candidates or to Present Other Business for Consideration at a Meeting

Shareholders who wish to (1) submit director nominees for election at next year’s annual meeting or at a special meeting of shareholders at which directors are to be elected or (2) present other items of business directly at next year’s annual meeting must give written notice of their intention to do so, in accordance with the deadlines described below, to our Corporate Secretary at the address set forth below under the heading “Additional Information” Any such notice also must include the information required by our notice of articles and articles (“articles”) (which may be obtained as provided below under the heading “Additional Information”) and must be updated and supplemented as provided in the articles.

The Company’s articles contain advance notice provisions setting out advance notice requirements for the nomination of directors of the Company by a shareholder (who must also meet certain qualifications outlined in such provisions) (the “Nominating Shareholder”) at any annual meeting of shareholders, or for any special meeting of shareholders if one of the purposes for which the special meeting was called was the election of directors (the “Advance Notice Provisions”). The following description is a summary only and is qualified in its entirety by the full text of the applicable provisions of the articles of the Company, which are included as Exhibit 3.1 with the Company’s 2021 Annual Report.

In addition to any other applicable requirements, for a nomination to be made by a Nominating Shareholder, the Nominating Shareholder must give timely notice of such nomination in proper written form to the secretary of the Company at the principal executive offices of the Company. To be timely, a Nominating Shareholder’s notice to the secretary must be made: (i) the case of an annual meeting of shareholders, not less than 30 nor more than 65 days prior to the date of the annual meeting of shareholders; provided, however, that in the event that the annual meeting of shareholders is to be held on a date that is less than 50 days after the date (the “Notice Date”) on which the first public announcement of the date of the annual meeting was made, notice by the Nominating Shareholder may be made not later than the close of business on the 10th day following the Notice Date; and (ii) in the case of a special meeting (which is not also an annual meeting) of shareholders called for the purpose of electing directors (whether or not called for other purposes as well), not later than the close of business on the 15th day following the day on which the first public announcement of the date of the special meeting was made. The Advance Notice Provisions also prescribe the proper written form for a Nominating Shareholder’s notice.

Notice given to the Secretary of the Company pursuant to the applicable provisions of the articles may only be given by personal delivery, facsimile transmission or by email, and shall be deemed to have been given and made only at the time it is served by personal delivery to the Secretary at the address of the principal executive offices of the Company, email (at the address as aforesaid) or sent by facsimile transmission (provided that receipt of confirmation of such transmission has been received); provided that if such delivery or electronic communication is made on a day which is a not a business day or later than 5:00 p.m. (Vancouver time) on a day which is a business day, then such delivery or electronic communication shall be deemed to have been made on the next following day that is a business day.

8

The chairperson of the applicable meeting of shareholders has the power and duty to determine whether a nomination was made in accordance with the notice procedures set forth in the Advance Notice Provisions and, if any proposed nomination is not in compliance with such provisions, to declare that such defective nomination be disregarded.

How to Recommend Candidates to Serve as Directors

Shareholders may recommend director candidates for consideration by the Board by writing to our Corporate Secretary at the address set forth below under the heading “Additional Information”. To be in proper written form, such notice must set forth the nominee’s name, age, business and residential address, and principal occupation or employment for the past five (5) years, his or her direct or indirect beneficial ownership in, or control or direction over, any class or series of securities of the Company, including the number or principal amount and such other information on the nominee and the nominating shareholder as set forth in our articles, which may be obtained in accordance with the instructions below under the heading “Additional Information.”

Interest of Executive Officers and Directors

None of the Company’s executive officers or directors has any interest in any of the matters to be acted upon at the Meeting, except with respect to each director, to the extent that a director is named as a nominee for election to the Board of Directors.

Interest of Informed Persons in Material Transactions

Except as otherwise disclosed in this proxy statement and the 2021 Annual Report, no “informed person” (as defined in National Instrument 51-102 Continuous Disclosure Obligations) of MedMen, proposed director of MedMen, or any associate or affiliate of any such Person, has or has had any material interest, direct or indirect, in any transaction since the commencement of MedMen’s most recently completed financial year or in any proposed transaction which in either such case has materially affected or will materially affect MedMen or any of its subsidiaries on a consolidated basis.

Householding

“Householding” is a program, approved by the SEC, which allows companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports by delivering only one package of shareholder proxy materials to any household at which two or more shareholders reside. This applies to the Company only in respect of non-registered shareholders that are in the United States. Accordingly, if you share an address with another shareholder, you may receive only one set of proxy materials unless you have provided contrary instructions. If you are a registered shareholder and wish to receive a separate set of the materials, please request the additional copy by contacting our Corporate Secretary at 10115 Jefferson Boulevard Culver City, California 90232.

If you are a beneficial owner of Shares and you wish to receive a separate set of proxy materials in the future, or if you have received multiple sets of proxy materials and would like to receive only one set in the future, please contact your bank or broker directly.

Contacting the Transfer Agent

If you are a registered shareholder and have questions concerning share certificates, ownership transfer or other matters relating to your share account, please contact our transfer agent at the following:

Odyssey Trust Company

350 – 409 Granville Street

Vancouver, British Columbia, Canada V6C 1T2

toll free within North America at

1.800.517.4553 | | outside of North America

1.587.885.0960 | | by e-mail at

proxy@odysseytrust.com |

9

Additional Copies of this Proxy Statement or Voting Materials

If you need additional copies of this proxy statement or voting materials, please contact us at:

MedMen Enterprises Inc.

Attn: Investor Relations

10115 Jefferson Boulevard

Culver City, California 90232

investors@medmen.com

Currency

Unless otherwise indicated, all references to “$” or “dollars” set forth in this Circular are to U.S. dollars.

10

DESCRIPTION OF SHARE CAPITAL OF THE COMPANY

The following is a summary of the rights, privileges, restrictions and conditions attached to the Class B Subordinate Voting Shares, the Class A Super Voting Shares and the Preferred Shares but does not purport to be complete. Reference should be made to the articles of the Company and the full text of their provisions for a complete description thereof, which has been filed under the Company’s profile on the SEC’s website at www.sec.gov and SEDAR at www.sedar.com.

Our latest Registration Statement on Form S-1, and any amendments thereto, provide further information regarding our securities.

On March 4, 2022, the Record Date, there were 220 shareholders of record holding 1,208,249,218 Class B Subordinate Voting Shares, and nil Preferred Shares and Class A Super Voting Shares outstanding.

Class B Subordinate Voting Shares

Holders of Class B Subordinate Voting Shares are entitled to notice of and to attend at any meeting of the shareholders of the Company, except a meeting of which only holders of another particular class or series of shares of the Company will have the right to vote. At each such meeting holders of Class B Subordinate Voting Shares are entitled to one vote in respect of each Class B Subordinate Voting Share held. As long as any Class B Subordinate Voting Shares remain outstanding, the Company will not, without the consent of the holders of the Class B Subordinate Voting Shares by separate special resolution, prejudice or interfere with any right attached to the Class B Subordinate Voting Shares. Holders of Class B Subordinate Voting Shares are entitled to receive as and when declared by the directors of the Company, dividends in cash or property of the Company. In the event of the liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, or in the event of any other distribution of assets of the Company among its shareholders for the purpose of winding up its affairs, the holders of Class B Subordinate Voting Shares are, subject to the prior rights of the holders of any shares of the Company ranking in priority to the Class B Subordinate Voting Shares (including, without restriction, the Class A Super Voting Shares as to the issue price paid in respect thereof), entitled to participate rateably along with all other holders of Class B Subordinate Voting Shares. Holders of Class B Subordinate Voting Shares are not entitled to a right of first refusal to subscribe for, purchase or receive any part of any issue of Class B Subordinate Voting Shares, or bonds, debentures or other securities of the Company.

In the event that a take-over bid is made for the Class A Super Voting Shares, the holders of Class B Subordinate Voting Shares will not be entitled to participate in such offer and may not tender their shares into any such offer, whether under the terms of the Class B Subordinate Voting Shares or under any coattail trust or similar agreement. Notwithstanding this, any take-over bid for solely the Class A Super Voting Shares is unlikely given that by the terms of the investment agreement described below, upon any sale of Class A Super Voting Shares to an unrelated third-party purchaser, such Class A Super Voting Shares will be redeemed by the Company for their issue price.

Class A Super Voting Shares

There are no Class A Super Voting Shares outstanding.

Holders of Class A Super Voting Shares are not entitled to receive dividends. They are entitled to notice of and to attend at any meeting of the shareholders of the Company, except a meeting of which only holders of another particular class or series of shares of the Company has the right to vote. At each such meeting, holders of Class A Super Voting Shares are entitled to 1,000 votes in respect of each Class A Super Voting Share held. However, if at any time the aggregate number of issued and outstanding Class B Common Shares of MM Can USA, Inc. (“MedMen Corp. Redeemable Shares”) and Common Units of MM Enterprises USA, LLC (“MedMen LLC Redeemable Units”) (or such securities of any successor to MedMen Corp. or MedMen LLC as may exist from time to time) beneficially owned, directly or indirectly, by a holder of the Class A Super Voting Shares and the holder’s predecessor or transferor, permitted transferees and permitted successors, divided by the aggregate number of MedMen Corp Redeemable Shares and MedMen LLC Redeemable Units beneficially owned, directly or indirectly, by the holder (and the holder’s predecessor or transferor, permitted transferees and permitted successors) as at the date of completion of the business combination among Ladera Ventures Corp. and MedMen LLC, pursuant to which MedMen LLC completed a reverse takeover of Ladera, being May 28, 2018, is less than 50%, the holder will from that time forward be entitled to 50 votes in respect of each Class A Super Voting Share held. The holders of Class A Super Voting Shares will, from time to time upon the request of the Company, provide to the Company evidence as to such holders’ direct and indirect

11

beneficial ownership (and that of its permitted transferees and permitted successors) of MedMen Corp Redeemable Shares and MedMen LLC Redeemable Units to enable the Company to determine the voting entitlement of the Class A Super Voting Shares. For purposes of these calculations, a holder of Class A Super Voting Shares will be deemed to beneficially own MedMen Corp Redeemable Shares held by an intermediate company or fund in proportion to their equity ownership of such company or fund.

As long as any Class A Super Voting Shares remain outstanding, the Company will not, without the consent of the holders of the Class A Super Voting Shares by separate special resolution, prejudice or interfere with any right or special right attached to the Class A Super Voting Shares. Additionally, consent of the holders of a majority of the outstanding Class A Super Voting Shares is required for any action that authorizes or creates shares of any class having preferences superior to or on a parity with the Class A Super Voting Shares. In connection with the exercise of the voting rights in respect of any such approvals, each holder of Class A Super Voting Shares has one vote in respect of each Class A Super Voting Share held.

In the event of the liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, or in the event of any other distribution of assets of the Company among its shareholders for the purpose of winding up its affairs, the Company will distribute its assets firstly and in priority to the rights of holders of any other class of shares of the Company (including the holders of the Class B Subordinate Voting Shares) to return the issue price of the Class A Super Voting Shares to the holders thereof (being US$0.10119 per Class A Super Voting Share in respect of the Class A Super Voting Shares issued to date) and if there are insufficient assets to fully return the issue price to the holders of the Class A Super Voting Shares such holders will receive an amount equal to their pro rata share in proportion to the issue price of their Class A Super Voting Shares along with all other holders of Class A Super Voting Shares. The holders of Class A Super Voting Shares are not entitled to receive, directly or indirectly, as holders of Class A Super Voting Shares any other assets or property of the Company and their sole rights are to the return of the issue price of such Class A Super Voting Shares.

No subdivision or consolidation of the Class A Super Voting Shares or the Class B Subordinate Voting Shares shall occur unless, simultaneously, the Class A Super Voting Shares and the Class B Subordinate Voting Shares are subdivided or consolidated in the same manner, so as to maintain and preserve the relative rights of the holders of the shares of each of the said classes.

The holders of Class A Super Voting Shares are not entitled to a right of first refusal to subscribe for, purchase or receive any part of any issue of Class B Subordinate Voting Shares, bonds, debentures or other securities of the Company not convertible into Class A Super Voting Shares.

The Company has the right to redeem all or some of the Class A Super Voting Shares from a holder of Class A Super Voting Shares, for an amount equal to the issue price for each Class A Super Voting Share, payable in cash to the holders of the Class A Super Voting Shares so redeemed (the exercise of which right is subject to the terms and conditions of the investment agreement described below). The Company need not redeem Class A Super Voting Shares on a pro-rata basis among the holders of Class A Super Voting Shares.

No Class A Super Voting Share is permitted to be transferred by the holder thereof without the prior written consent of the Company (which consent right is qualified by the terms and conditions of the investment agreement described below).

Preferred Shares

There are no Preferred Shares outstanding.

The Preferred Shares may be issued at any time or from time to time in one or more series. The MedMen Board may by resolution alter the articles of the Company to create any series of Preferred Shares and to fix before issuance, the designation, rights, privileges, restrictions and conditions to attach to the Preferred Shares of each series, including the rate, form, entitlement and payment of preferential dividends, the dates and place for payment thereof, the redemption price, terms, procedures and conditions of redemption, if any, voting rights and conversion rights, if any, and any sinking fund, purchase fund or other provisions attaching to the Preferred Shares of such series; provided, however, that no Preferred Shares of any series shall be issued until the Company has filed an alteration to its Notice of Articles with the British Columbia Registrar of Companies.

12

The Preferred Shares will be entitled to preference over the Class B Subordinate Voting Shares and any other shares of the Company ranking junior to the Preferred Shares with respect to the payment of dividends, if any, and in the distribution of assets in the event of liquidation, dissolution or winding-up of the Company, or any other distribution of the assets of the Company among its shareholders for the purpose of winding-up its affairs, and may also be given such other preferences over the Class B Subordinate Voting Shares and any other shares of the Company ranking junior to the Preferred Shares as may be fixed by the resolution of the MedMen Board as to the respective series authorized to be issued. The Preferred Shares of each series will rank on a parity with the Preferred Shares of every other series with respect to priority and payment of dividends and in the distribution of assets in the event of liquidation, dissolution or winding-up of the Company, exclusive of any conversion rights that may affect the aforesaid.

13

PROPOSALS TO BE VOTED UPON

PROPOSAL NO. 1 — NUMBER OF DIRECTORS

At the Meeting, it is proposed to fix the number of directors at five (5), subject to permitted increases under the articles of the Company or otherwise (the “Director Number Proposal”). Unless otherwise directed in properly completed forms of proxy, it is the intention of the individuals named in the enclosed form of proxy to vote FOR the Director Number Proposal. If you do not specify how you want your Shares to be voted at the Meeting, the persons named as proxyholders in the enclosed form of proxy will cast the votes represented by your proxy at the Meeting FOR the Director Number Proposal.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR

THE DIRECTOR NUMBER PROPOSAL. |

14

PROPOSAL NO. 2 — ELECTION OF DIRECTORS

The articles of the Company provide that the number of directors should not be fewer than three (3) directors. There are currently five (5) directors of the Company. At the Meeting, it is proposed to elect the five (5) nominees set forth below as directors until his/her successor is duly elected or appointed. MedMen’s directors are expected to hold office until its next annual general meeting of shareholders of the Company unless they resign prior thereto or are removed by the shareholders. MedMen’s directors will be elected annually and, unless re-elected, will retire from office at the end of the next annual general meeting of shareholders. The persons named as proxyholders in the accompanying proxy card intend to vote for the election of such persons at the Meeting, unless otherwise directed.

Management of the Company does not contemplate that any of the current nominees for election as a director of the Company will be unable to serve as a director.

As of the date of this proxy statement, the Company has not received any nominations under the Advance Notice Provisions.

Director Nominees

The following table and the notes thereto set out the name of each current director, each proposed by management to be nominated for re-election as a director of the Company at the Meeting, their respective positions with the Company and the period during which he/she has been a director of the Company.

Name | | Age | | Position(s) | | Board Committees | | Director Since |

Michael Serruya Toronto, Canada | | 57 | | Chief Executive Officer and Director | | Compensation Committee and Corporate Governance and Nominating Committee | | August 2021 |

Ed Record Texas, USA | | 53 | | Director | | Audit Committee, Corporate Governance and Nominating Committee | | November 2021 |

Melvin Elias California, USA | | 53 | | Director | | Audit Committee | | February 2020 |

David Hsu Washington, USA | | 39 | | Director | | Audit Committee and Compensation Committee | | November 2021 |

Cameron Smith Texas, USA | | 56 | | Director | | Compensation Committee | | February 2020 |

Biographical Information

The following is a brief overview of the education and business experience of each of our directors and executive officers during at least the past five years, including their principal occupations or employment during the period, the name and principal business of the organization by which they were employed, and certain of their other directorships:

Michael Serruya has been a director of the Company since August 2021 and was appointed interim Chief Executive Officer in November 2021. Michael Serruya was appointed to the Board in connection with a Board Nomination Rights Agreement with S5 Holdings LLC (“S5 Holdings”) pursuant to which so long as S5 Holdings’ diluted ownership percentage of MedMen (including the proportionate equity ownership of securities held by Superhero LP) is at least 9%, S5 Holdings will be entitled to designate one individual to be nominated to serve as a director of the Company. Mr. Serruya controls S5 Holdings. Mr. Serruya serves as Managing Director of Serruya Private Equity Inc. Previously, Mr. Serruya co-founded Yogen Früz Worldwide Inc., a global chain currently consisting of more than 1,400 locations, and co-founded CoolBrands International Inc. where from 1994 to 2000 he served as Chairman and Chief Executive Officer. CoolBrands was a leading consumer packaged goods company focused on frozen desserts, which included such brands as Weight Watchers, Eskimo Pie, Tropicana and Godiva Ice Cream. From 2013 to 2016, Mr. Serruya was Chairman and Chief Executive Officer of Kahala Brands, a multinational franchisor with over 1,400 stores globally. Kahala Brands owned Cold Stone Creamery, Taco Time and Blimpie Subs. From 2018 to 2021, Mr. Serruya was Chairman of Global Franchise Group, a multinational franchisor with over 800 stores globally. Global Franchise Group owned Round Table Pizza, Marble Slab Creamery, Hot Dog on a Stick, Pretzelmaker and MaggieMoo’s Ice Cream and Treatery. Mr. Serruya’s qualifications to serve on our board of directors includes his extensive business experience in the consumer and retail industry.

15

Ed Record has been a director since November 2021. Mr. Record previously served as Executive Vice President and Chief Financial Officer at Hudson’s Bay Company from 2017 to January 2021. From 2014 until July 2017, he served as Executive Vice President and Chief Financial Officer of JC Penney. Prior to joining JC Penney, Mr. Record served in positions of increasing responsibility with Stage Stores, Inc. (apparel retailer), including Executive Vice President and Chief Operating Officer from 2010 to 2014, Chief Financial Officer from 2007 to 2010 and Executive Vice President and Chief Administrative Officer from May 2007 to September 2007. Mr. Record also served as Senior Vice President of Finance of Kohl’s Corporation (department store retailer) from 2005 to 2007. Prior to that, he served with Belk, Inc. (department store retailer) as Senior Vice President of Finance and Controller from April 2005 to October 2005 and Senior Vice President and Controller from 2002 to 2005. Mr. Record received his Bachelor of Arts in Economics from Princeton University in 1990 and an MSIA from Carnegie Mellon University in 1995. Mr. Record’s qualifications to serve on our board of directors include his operational and financial experience with retail companies.

Melvin Elias has been a director since February 2020. Mr. Elias is an active investor, entrepreneur and developer in Los Angeles. He has past and present board experience in CPG and consumer facing businesses both in the US and internationally. Since October 2019, Mr. Elias has been actively involved with DivergentIP, LLC, a start-up he recently co-founded, which will be launching a coffee capsule system in the U.S., and is currently an advisor to various venture funds and businesses. He was President and CEO of The Coffee Bean & Tea Leaf for six years, until it was sold to private equity in 2013 where he was responsible for almost 1,000 stores and a global omni-channel business in excess of $500 million in systemwide sales. He remained on the board of The Coffee Bean & Tea Leaf with additional advisory duties until the company was recently sold again in September 2019. Prior to his career in coffee retail, Mr. Elias was the Managing Director of the Tower Records Franchise in Malaysia and practiced law in Singapore for two years. Mr. Elias graduated from the London School of Economics and served in the Singapore Military for two and a half years. Mr. Elias’s qualifications to serve on our board of directors includes leadership and transactional experience, as well as special expertise with respect to large retail business and operations.

David Hsu has been a director since November 2021. Mr. Hsu has served on the Board of Directors of Urban-Gro, Inc. (Nasdaq: UGRO), where he is a member of the Audit and Compensation committees, since June 2021. Mr. Hsu completed a Certification in Financing and Deploying Clean Energy from Yale University in 2021. Prior to that, Mr. Hsu served as the Chief Operating Officer of The Cronos Group, a leading global cannabinoid company (“Cronos”), from 2016 to 2019. While at Cronos, Mr. Hsu’s primary duties included overseeing all of Cronos’s operations including construction, cultivation, and manufacturing. Prior to joining Cronos, from 2006 to 2016, Mr. Hsu served in various roles with CRG Partners (“CRG”), and later Deloitte upon Deloitte’s acquisition of CRG in 2012, including as Vice President, where he operated and managed distressed companies with revenues of more than $500.0 million. Mr. Hsu received his Bachelor of Science in Business Management from Babson College in 2003 and holds a Certification in Artificial Intelligence: Business Strategies and Applications from the University of California Berkley, which he received in 2020. Ms. Hsu’s qualifications to serve on our board of directors includes his experience with the cannabis industry and related associations.

Cameron Smith has been a director since February 2020. Since July 2017, Mr. Smith has operated a private angel investment and advisory fund that focuses on better-for-you foods. Prior to his investment and advisory business, since October 2007, Mr. Smith was the President of Quantlab Financial, a Houston based quantitative trading company that trades globally in multiple asset classes. Mr. Smith came to Quantlab after working for various electronic markets that pioneered the introduction of fair, open, transparent stock exchanges in the United States, Europe and Canada. Mr. Smith began his career at the United States Securities and Exchange Commission and was the General Counsel for Island ECN, Inc. Mr. Smith’s qualifications to serve on our board of directors includes experience engaging with regulators, government and the media as an executive at various high profile companies in the heavily regulated securities industry.

Unless otherwise directed in properly completed forms of proxy, it is the intention of the individuals named in the enclosed form of proxy to vote FOR all of the director-nominees. If you do not specify how you want your Shares to be voted at the Meeting, the persons named as proxyholders in the enclosed form of proxy will cast the votes represented by your proxy at the Meeting FOR all director nominees.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR

THE ELECTION OF ALL DIRECTOR NOMINEES. |

16

Cease Trade Orders, Bankruptcies and Penalties

To the Company’s knowledge, none of the nominees for election as a director of the Company is as at the date of this proxy statement, or has been, within the 10 years prior to the date of this proxy statement, a director, chief executive officer or chief financial officer of any company (including the Company) that:

(a) was the subject of a cease trade or similar order, or an order that denied the other company access to any exemptions under applicable securities legislation that was in effect for a period of more than 30 consecutive days that was issued while the proposed director was acting as director, chief executive officer or chief financial officer; or

(b) was the subject of a cease trade or similar order, or an order that denied the other company access to any exemptions under applicable securities legislation that was in effect for a period of more than 30 consecutive days that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that Person was acting in the capacity as director, chief executive officer or chief financial officer.

To the Company’s knowledge, none of the nominees for election as a director of the Company is as at the date of this proxy statement, or has been, within the 10 years prior to the date of this proxy statement, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of that company.

To the Company’s knowledge, none of the nominees for election as a director of the Company is as at the date of this proxy statement, or has been, within the 10 years prior to the date of this proxy statement, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of that person.

To the Company’s knowledge, none of the nominees for election as a director of the Company has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority or been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

Certain Relationships and Related Transactions

Transactions with Related Parties

All related party balances due to the Company as of June 26, 2021 and June 27, 2020 did not have any formal contractual agreements regarding payment terms or interest. As of June 27, 2020, amounts due from MMOF GP II (“Fund LP II”) and MedMen Opportunity Fund GP, LLC (“Fund LP”) were $1,820,204 and $1,289,513, respectively, were recorded in the Consolidated Balance Sheets. As of December 25, 2021 and June 26, 2021, other amounts due to related parties was $1,476,921 and $1,476,921, respectively, were recorded in the unaudited interim Condensed Consolidated Balance Sheets. As of June 27, 2020, amounts due to Fund LP II, Fund LP and other related parties were $1,093,896, $1,986,697 and $1,476,221, respectively, were recorded in the Consolidated Balance Sheets.

Senior Secured Convertible Credit Facility

In April 2019, the Company entered into a senior secured convertible credit facility (the “Convertible Facility”) to provide up to $250.0 million in gross proceeds, arranged by Gotham Green Partners LLC (“GGP”). The Convertible Facility is accessed through issuances by the Company to the lenders of convertible senior secured notes with an interest rate equal to LIBOR plus 6.0% per annum (“Facility Notes”). In connection with the Convertible Facility, the Company has also issued share purchase warrants (the “Facility Warrants”) to purchase Shares. During fiscal years ended June 27, 2020 and June 26, 2021, the Convertible Facility was amended at various times modifying certain covenants, amending the conversion and exercise prices of securities issued pursuant to the Convertible Facility, cancelling and issuing new Facility Warrants and providing additional financing with the issuance of Facility Notes. As

17

of June 26, 2021, there was outstanding $219.6 million of Facility Notes, including accrued interest, with a weighted average conversion price of approximately $0.24 per share and an aggregate of 208,102,561 Facility Warrants with a weighted average exercise price of $0.37 per share.

Second Restatement