UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024.

Commission File Number 001-39169

Natura &Co Holding S.A.

(Exact name of registrant as specified in its charter)

Avenida Alexandre Colares, No. 1188, Sala A17-Bloco A

Parque Anhanguera

São Paulo, São Paulo 05106-000, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

NATURA &CO HOLDING S.A.

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

| | By: | /s/ Guilherme Strano Castellan |

| | Name: Guilherme Strano Castellan |

| | Title: Principal Financial Officer |

| | By: | /s/ Itamar Gaino Filho |

| | Title: Chief Legal and Compliance Officer |

Date: July 16, 2024

Q3-24

Recurring EBITDA up more than 50% YoY as a result of strong

top-line momentum and solid gross margin expansion

Avon Products Inc (“API”) deconsolidation, amid Chapter 11 context, impacted net income with a ~BRL -7.0 billion non-cash

non-operating effect on discontinued operations. Net income from continued operations reached BRL 302 million

| | Q3-24 | | 9M-24 |

| BRL million | Consolidated | Natura &Co Latam | Holding | | Consolidated | Natura &Co Latam | Holding |

| | YoY Ch. % | | YoY Ch. % | | YoY Ch. % | | | YoY Ch. % | | YoY Ch. % | | YoY Ch. % |

| Net revenue | 5,976.4 | 17.4 | 5,975.6 | 17.4 | 0.7 | 1.8 | | 16,342.4 | 8.3 | 16,334.3 | 8.3 | 8.1 | - |

| Constant Currency | | 18.5% | | 18.5% | | | | | 11.2% | | 11.2% | | - |

| Gross profit | 4,022.3 | 23.7 | 4,022.3 | 23.8 | 0.0 | (98.3) | | 10,844.8 | 11.9 | 10,843.6 | 11.9 | 1.2 | - |

| Gross Margin | 67.3% | 340 bps | 67.3% | 340 bps | - | - | | 66.4% | 220 bps | 66.4% | 220 bps | - | - |

| Reported EBITDA | 659.2 | 87.6 | 776.3 | 81.2 | (117.1) | 51.0 | | 2,016.4 | 41.3 | 2,323.3 | 39.1 | (306.9) | 25.8 |

| Reported EBITDA margin | 11.0% | 410 bps | 13.0% | 460 bps | - | - | | 12.3% | 280 bps | 14.2% | 310 bps | - | - |

| Recurring EBITDA | 870.0 | 52.0 | 913.6 | 40.6 | (43.6) | (43.8) | | 2,232.4 | 27.7 | 2,419.4 | 21.6 | (187.0) | (22.6) |

| Adjusted EBITDA margin | 14.6% | 340 bps | 15.3% | 250 bps | - | - | | 13.7% | 210 bps | 14.8% | 160 bps | - | - |

| Net income (loss) | (6,693.4) | (195.3) | - | - | - | - | | (8,491.4) | (250.6) | - | - | - | - |

| The API and its subsidiaries are not included in the operational and financial figures due to its deconsolidation |

01 Consolidated Net Revenue of BRL 6.0 billion, up 18.5% vs Q3-23 in constant currency (CC) (+11.3% ex-Argentina) and 17.4% in Brazilian Reais. The strong performance was fueled by both Natura (+19.4%) and Avon CFT (+14.4%, as a recovery from a significant drop in Q3-23) in Brazil. In Hispanic markets, Natura recorded an accelerating pace (high-single digits YoY growth ex-Argentina), which was partially offset by the Avon Home & Style performance across the region

02 Recurring EBITDA of BRL 870 million, up 52.0% YoY in Q3-24 with a 14.6% margin, a 340 basis points (bps) YoY expansion, marking another quarter of solid profitability expansion. This margin improvement was a result of:

| · | Natura &Co Latam: Solid gross margin expansion of +340 bps YoY, driven by operating leverage, a richer country mix and increased exposure to the Natura brand. This, along with efficiencies in G&A, logistics and credit & collection, was reinvested in marketing and other strategic projects (like digital, which is impacting by -130 bps YoY), driving accelerated sales momentum |

| · | Holding: 43% YoY reduction of corporate expenses mainly explained by the ongoing efforts to streamline the holding company structure (in line with previous earnings results), but also benefiting from phasing of operational expenses between Q3 and Q4-24 |

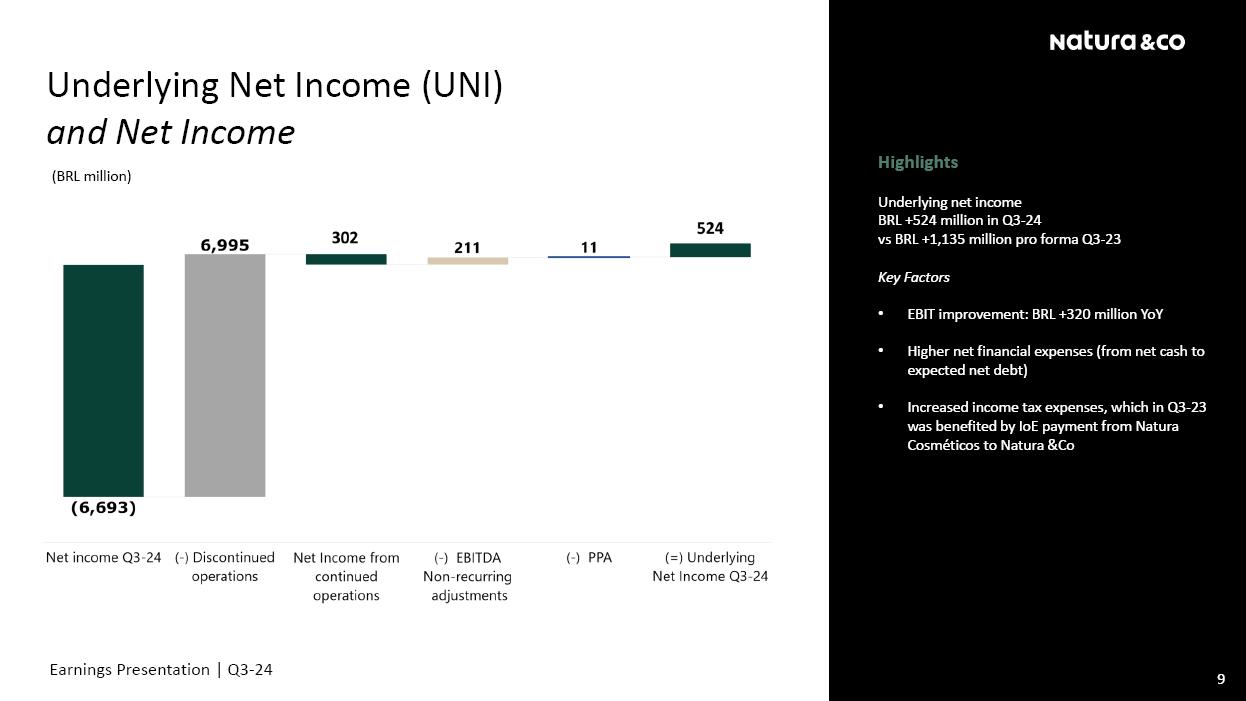

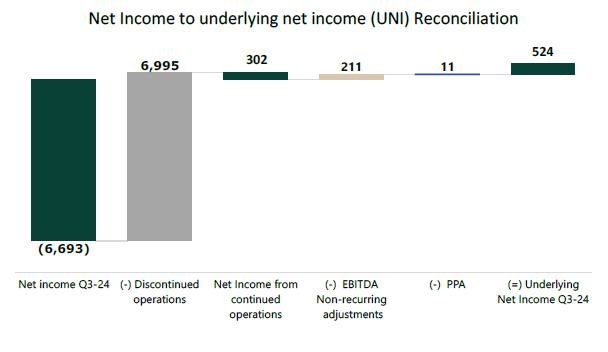

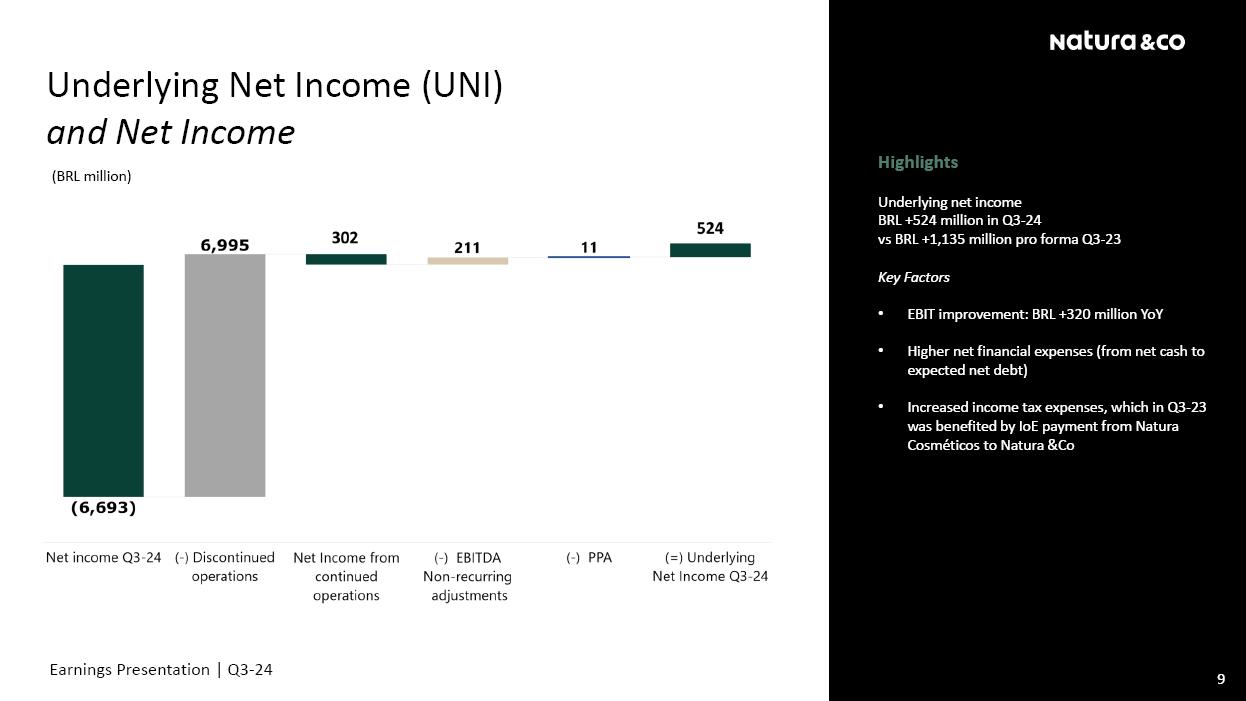

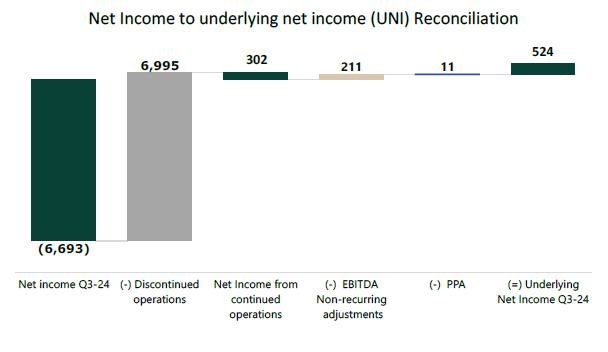

03 Q3-24 Net loss of BRL 6.7 billion compared to a net income of BRL 7.0 billion in the same period in 2023. Excluding the BRL -7.0 billion non-cash and one-off effects from API deconsolidation and other small adjustments, underlying net income was BRL +524 million, compared to pro-forma (ex API and subsidiaries) of BRL +1,135 million in the same period last year. The BRL +320 million YoY improvement in EBIT was more than offset by higher net financials and higher income taxes, which in Q3-23 were particularly benefited by Natura Cosmeticos interest over equity payment

04 Q3-24 Net Debt (excluding leasing) was BRL 3.7 billion (from BRL 2.2 billion in Q2-24), impacted by BRL 1.3 billion from API and its subsidiaries' deconsolidation, which is the main driver of the net debt increase. That said, positive cash flow from operations during the quarter, was offset by cash outflow from strategic projects (consultant and legal fees and Avon financing, including the Debtor-in-possession)

| Fábio Barbosa Group CEO of Natura &Co, stated “As a consequence of Avon Products Inc.’s (“API”) voluntary Chapter 11 announced in August, Natura &Co is deconsolidating the results from API and its subsidiaries during this quarter. As a result of this action, a non-cash / non-recurring -BRL 7.0bn loss was booked in Discontinued Operations in Q3, erasing the positive net income results from Continued Operations in the period. Any net loss that may exist in our year-end results could potentially be offset by our capital reserve with shareholder approval to allow our company to resume dividend distribution. On the operational side, the third quarter results showed that the integration of Natura and Avon in Latin America (the Wave 2), is progressing well, while it also attests that the reinvestments carried out since the project’s inception are now starting to drive a more robust top-line performance. The strong top-line results (highly driven by Brazil), alongside another quarter of solid gross margin expansion, resulted in 250bps of recurring EBITDA expansion in Latam, amid accelerating investments in digital and marketing to support the good momentum. The Wave 2 initiative has been rolled out in most of the region and is expected to be completed by the end of next year. Mexico and Argentina’s integration in 2025 will be key to drive our margin recovery agenda, and we will continue to use the learnings that we had in 2023 and 2024 to minimize disruptions in those countries. Our triple bottom line fundamentals have also evolved, and as we celebrated a decade as a B Corporation, Natura excelled in the Community pillar of its B Corp recertification with investments of BRL 43 million in 2023 to support Amazonian agro-extractive communities. We also advanced our Climate Transition Plan by adding 20 biogas-powered trucks, which now handle 35% of our heavy freight reducing emissions by 82%, and by launching a pioneering collaboration with Nestlé Nespresso to repurpose aluminum from coffee capsules into Natura Ekos packaging. These actions demonstrate our commitment to regeneration and a sustainable, circular economy.” | |

01 Results Summary

| | Profit and Loss by Business |

| BRL million | Consolidateda | Natura &Co Latamc | Holdingb |

| Q3-24d | Q3-23d | Ch. % | Q3-24d | Q3-23d | Ch. % | Q3-24d | Q3-23d | Ch. % |

| Gross revenue | 7,901.4 | 6,763.4 | 16.8 | 7,900.7 | 6,762.7 | 16.8 | 0.7 | 0.7 | 1.8 |

| Net revenue | 5,976.4 | 5,090.0 | 17.4 | 5,975.6 | 5,089.2 | 17.4 | 0.7 | 0.7 | 1.8 |

| Constant Currency | | | 18.5% | | | 18.5% | | | |

| COGS | (1,954.0) | (1,839.3) | 6.2 | (1,953.3) | (1,839.1) | 6.2 | (0.7) | (0.2) | 279.1 |

| Gross profit | 4,022.3 | 3,250.7 | 23.7 | 4,022.3 | 3,250.1 | 23.8 | 0.0 | 0.5 | (98.3) |

| Selling, marketing and logistics expenses | (2,623.9) | (2,216.0) | 18.4 | (2,623.9) | (2,216.0) | 18.4 | - | - | - |

| Administrative, R&D, IT and projects expenses | (734.2) | (616.6) | 19.1 | (733.3) | (613.5) | 19.5 | (0.9) | (3.1) | (70.9) |

| Corporate expenses | (42.8) | (74.7) | (42.7) | - | - | - | (42.8) | (74.7) | (42.7) |

| Other operating income / (expenses), net | (58.0) | (26.5) | 118.6 | 4.6 | (26.2) | (117.4) | (62.5) | (0.3) | 21,098.7 |

| Transformation / Integration / Group restructuring costs | (132.1) | (205.9) | (35.8) | (121.1) | (206.5) | (41.3) | (11.0) | 0.6 | (2,055.8) |

| EBIT | 431.4 | 111.0 | 288.8 | 548.6 | 188.0 | 191.8 | (117.2) | (77.6) | 51.1 |

| Depreciation | 227.9 | 240.4 | (5.2) | 227.8 | 240.4 | (5.3) | 0.1 | - | - |

| EBITDA | 659.2 | 351.3 | 87.6 | 776.3 | 428.4 | 81.2 | (117.1) | (77.6) | 51.0 |

| Non-recurring adjustments | 210.8 | 220.9 | (4.6) | 137.3 | 221.5 | (38.0) | 73.5 | (0.0) | (668,067.3) |

| Recurring EBITDA | 870.0 | 572.3 | 52.0 | 913.6 | 649.8 | 40.6 | (43.6) | (77.6) | (43.8) |

| EBIT | 431.4 | 111.0 | 288.8 | | | | | | |

| Financial income / (expenses), net | (170.5) | (851.5) | (80.0) | | | | | | |

| Earnings before taxes | 260.9 | (740.5) | (135.2) | | | | | | |

| Income tax and social contribution | 41.1 | 1,003.2 | (95.9) | | | | | | |

| Net Income from continued operations | 302.0 | 262.7 | 15.0 | | | | | | |

| Discontinued operationse | (6,995.4) | 6,761.7 | (203.5) | | | | | | |

| Consolidated net (loss) income | (6,693.4) | 7,024.4 | (195.3) | | | | | | |

| Non-controlling interest | - | - | - | | | | | | |

| Net income (loss) attributable to controlling shareholders | (6,693.4) | 7,024.4 | (195.3) | | | | | | |

| Gross margin | 67.3% | 63.9% | 340 bps | 67.3% | 63.9% | 340 bps | - | - | - |

| Selling, marketing and logistics as % net revenue | (43.9)% | (43.5)% | -40 bps | (43.9)% | (43.5)% | -40 bps | - | - | - |

| Admin., R&D, IT and projects exp. as % net revenue | (12.3)% | (12.1)% | -20 bps | (12.3)% | (12.1)% | -20 bps | - | - | - |

| EBITDA margin | 11.0% | 6.9% | 410 bps | 13.0% | 8.4% | 460 bps | - | - | - |

| Recurring EBITDA margin | 14.6% | 11.2% | 340 bps | 15.3% | 12.8% | 250 bps | | | |

| Net margin | (112.0)% | 138.0% | -25000 bps | - | - | - | - | - | - |

| | | | | | | | | | |

| a Consolidated results include Holding and Natura &Co Latam |

| b Holding results include Natura &Co International (Luxembourg) and TBS Shanghai |

| c Natura &Co Latam: includes all the brands in Latin America (Excluding CARD), &Co Pay, as well as the Natura subsidiaries in the U.S., France and the Netherlands. |

| d Includes PPA – Purchase Price Allocation effects |

| e Related to Avon Products Inc and its subsidiaries |

| | Profit and Loss by Business |

| BRL million | Consolidateda | Natura &Co Latamc | Holdingb |

| 9M-24d | 9M-23d | Ch. % | 9M-24d | 9M-23d | Ch. % | 9M-24d | 9M-23d | Ch. % |

| Gross revenue | 21,911.2 | 20,097.3 | 9.0 | 21,903.1 | 20,094.8 | 9.0 | 8.1 | 2.5 | 225.1 |

| Net revenue | 16,342.4 | 15,089.6 | 8.3 | 16,334.3 | 15,087.1 | 8.3 | 8.1 | 2.5 | 225.2 |

| Constant Currency | | | 11.2% | | | 11.2% | | | |

| COGS | (5,497.7) | (5,396.4) | 1.9 | (5,490.7) | (5,395.9) | 1.8 | (6.9) | (0.5) | 1,235.4 |

| Gross profit | 10,844.8 | 9,693.2 | 11.9 | 10,843.6 | 9,691.3 | 11.9 | 1.2 | 2.0 | (38.9) |

| Selling, marketing and logistics expenses | (7,025.4) | (6,351.3) | 10.6 | (7,025.4) | (6,349.6) | 10.6 | (0.0) | (1.6) | (100.0) |

| Administrative, R&D, IT and projects expenses | (2,119.1) | (2,050.9) | 3.3 | (2,110.5) | (2,038.8) | 3.5 | (8.7) | (12.2) | (28.9) |

| Corporate expenses | (180.1) | (228.5) | (21.2) | - | - | - | (180.1) | (228.5) | (21.2) |

| Other operating income / (expenses), net | 56.2 | 2.0 | 2,765.2 | 163.7 | 3.2 | 5,072.8 | (107.5) | (1.2) | 8,830.9 |

| Transformation / Integration / Group restructuring costs | (242.0) | (333.7) | (27.5) | (229.7) | (331.2) | (30.6) | (12.3) | (2.4) | 402.7 |

| EBIT | 1,334.4 | 730.9 | 82.6 | 1,641.7 | 974.8 | 68.4 | (307.4) | (243.9) | |

| Depreciation | 682.0 | 695.8 | (2.0) | 681.5 | 695.8 | (2.0) | 0.5 | - | - |

| EBITDA | 2,016.4 | 1,426.7 | 41.3 | 2,323.3 | 1,670.6 | 39.1 | (306.9) | (243.9) | 25.8 |

| Non-recurring adjustments | 216.1 | 320.9 | (32.7) | 96.1 | 318.4 | (69.8) | 119.9 | 2.4 | 4,809.7 |

| Recurring EBITDA | 2,232.4 | 1,747.5 | 27.7 | 2,419.4 | 1,989.0 | 21.6 | (187.0) | (241.5) | (22.6) |

| EBIT | 1,334.4 | 730.9 | 82.6 | | | | | | |

| Financial income / (expenses), net | (627.0) | (1,353.2) | (53.7) | | | | | | |

| Earnings before taxes | 707.4 | (622.3) | (213.7) | | | | | | |

| Income tax and social contribution | (1,125.3) | 805.7 | (239.7) | | | | | | |

| Net Income from continued operations | (418.0) | 183.5 | (327.8) | | | | | | |

| Discontinued operationsd | (8,073.5) | 5,456.7 | (248.0) | | | | | | |

| Consolidated net (loss) income | (8,491.4) | 5,640.1 | (250.6) | | | | | | |

| Non-controlling interest | - | - | - | | | | | | |

| Net income (loss) attributable to controlling shareholders | (8,491.4) | 5,640.1 | (250.6) | | | | | | |

| Gross margin | 66.4% | 64.2% | 220 bps | 66.4% | 64.2% | 220 bps | - | - | - |

| Selling, marketing and logistics as % net revenue | (43.0)% | (42.1)% | -90 bps | (43.0)% | (42.1)% | -90 bps | - | - | - |

| Admin., R&D, IT and projects exp. as % net revenue | (13.0)% | (13.6)% | 60 bps | (12.9)% | (13.5)% | 60 bps | - | - | - |

| EBITDA margin | 12.3% | 9.5% | 280 bps | 14.2% | 11.1% | 310 bps | - | - | - |

| Recurring EBITDA margin | 13.7% | 11.6% | 210 bps | 14.8% | 13.2% | 160 bps | | | |

| Net margin | (52.0)% | 37.4% | -8940 bps | - | - | - | - | - | - |

| | | | | | | | | | |

| a Consolidated results include Holding and Natura &Co Latam |

| b Holding results include Natura &Co International (Luxembourg) and TBS Shanghai |

| c Natura &Co Latam: includes all the brands in Latin America (Excluding CARD), &Co Pay, as well as the Natura subsidiaries in the U.S., France and the Netherlands. |

| d Includes PPA – Purchase Price Allocation effects |

| e Related to Avon Products Inc and its subsidiaries |

02 Operating Highlights

Channel Performance

| · | In keeping with Q2-24 trends, the average available consultants was stable in Latin America QoQ (-0.3%) while YoY it registered a -17.6% decline. This reflects a -21.9% YoY decrease in Brazil to 1.6 million and a -12.8% YoY decline in Hispanic countries. As expected, and in line with previous earnings results, regions where Wave 2 has already been implemented (Chile, Brazil, Colombia and Peru) continue to be impacted by the planned exit of the least productive consultants, but are showing for another quarter a stable consultant base compared to both Q1 and Q2-24 |

| Natura &Co Latam | Net revenue change (%) | | Operational KPIs change(%) |

| Q3-24 vs. Q3-23 | | Q3-24 vs. Q3-23 |

| CFT Natura | CFT Avon | Home & Style | | Beauty Consultanta |

| Δ% CC | Δ% CC | Δ% CC | | Δ% |

| Brazil | 19.4% | 14.4% | -29.8% | | -21.9% |

| Hispanic | 34.7% | 19.8% | -13.5% | | -12.8% |

| Total | 23.4% | 17.0% | -19.1% | | -17.6% |

| a Considers the Average Available Beauty Consultants in the quarter |

Wave 2 Status

| · | Brazil update – Logistics integration from Wave 2 was implemented in Brazil this quarter, but we will continue to pursue additional efficiencies in our routes and structures. That said, this progress in logistics enabled the implementation of a single checkout for both Avon and Natura which, coupled with better level of services, resulted in higher productivity and efficiencies that are starting to flow through to the region’s P&L |

| · | Hispanic Latam update – Peru, Colombia and Chile continue to deliver significant YoY profitability improvements, while revenues are also showing a recovery trend (attested by Hispanic ex-Argentina market top-line performance). Mexico has begun integrating the commercial platform and the Wave 2 roll-out will continue throughout 2025. Finally, the Natura brand entered Ecuador, where the Avon brand already had a presence, and a new ERP system was implemented in the country |

Natura Brand in Latam

| · | Natura Brazil reported a 19.4% YoY revenue increase in CC in Q3-24, accelerating from 14.8% YoY growth posted in Q2-24, benefiting from productivity and volume gains particularly boosted after the single checkout implementation (as mentioned in the “Wave 2 Status” section). Product innovation, like the Todo Dia hair product line, has already started to contribute to the brand’s growth in the region |

| · | Q3-24 retail sales in Brazil showed robust growth, fueled by solid same-store sales specially from own stores and a still strong pace of store openings. The brand expanded to 128 own stores (+23 compared to Q3-23) and 815 franchised stores (+100 compared to Q3-23) |

| · | Q3-24 digital sales were up by 12.5% YoY, reverting the downward trend from last quarter. Following the launch of the new digital platform on the brand’s website (www.natura.com.br), own e-commerce platform sales were boosted and, in mid-October, the official Natura brand virtual store was also launched in Mercado Livre Brasil, providing another path to growth with sustainable and healthy profitability |

| · | Natura Hispanic Latam reported a 34.7% YoY revenue increase in CC in Q3-24. Ex-Argentina, the YoY increase was in the high single digits, reflecting an acceleration in the YoY revenue growth performance from Q2-24 coming from the Wave 2 rolled-out countries, as well as a similar top-line growth in Mexico |

compared to last quarter’s trend, despite the platform changes implemented in the region, as mentioned above in the “Wave 2 Status” section

Avon Brand in Latam (Beauty Category Only)

| · | Avon Brazil revenue growth accelerated to 14.4% YoY from -0.8% YoY in Q2-24 in a soft comp base

(-24.8% YoY in Q3-23 vs. -1.8% in Q2-23) reflecting increased productivity that more than offset the YoY channel decline. Similar to the Natura brand in the region, productivity jumped especially after the implementation of the single checkout. Skincare and make-up showed the best top-line performances within the categories |

| · | Avon Hispanic Latam revenue was up 19.8% YoY, but -2.7% YoY ex-Argentina. While the region is still impacted by the planned channel reduction related to the roll-out of Wave 2 in Peru, Colombia and Chile, the business continued to show a lesser decline if we look at the top-line performance recorded in those countries (also benefiting from a softer comp base) |

Home & Style in Latam

| · | Home & Style recorded a -19.1% YoY revenue decrease split between -29.8% in Brazil and -13.5% in the Hispanic market. The revenue decrease was lower compared to Q2-24 performance (-27.8%) given the lower comp base and underscoring the third consecutive quarter of broadly QoQ stable revenues from the category. As mentioned in previous earnings results, it is important to highlight the category’s overall improving profitability and ROIC, which are not dilutive to Latam business unit levels anymore |

Emana Pay

| · | The platform has secured nearly 1,012,000 accounts since its inception, and recorded a 55% YoY growth in TPV, reaching BRL 16.1 billion in Q3-24. Cash-in more than doubled, leveraged by consultants’ receivables tools (e.g. payment link, tap to phone and pix) and accounts bearing interests. Within the franchise network, the &Co Pay was already integrated with 660 stores (or 80% of the total Natura franchised stores in Brazil) |

| · | In addition, in October/24 Emana Pay concluded its credit rights investment fund (“FIDC”) of BRL 250 million with an inflow of BRL 175 million from senior investors and BRL 75 million from Natura Cosméticos S.A. as subordinated investor |

Distribution Channel Breakdown

| · | Digital sales, which include online sales and social selling, accelerated slightly in the quarter. Natura reported a 2 percentage point (p.p.) increase to 7% of total sales, which, combined with the solid retail channel performance of 5% of total sales, brings omnichannel to represent 12% of the brand revenues in Q3-24. Avon Latam digital sales were stable at 1p.p. of total sales. The penetration of digital tools in the consultant base reached 81.8% in Q3-24 for Natura &Co Latam from 73.9% in Q3-23 |

03 Results Analysis

Net Revenues

| · | Q3-24 Revenue was up 18.5% YoY in CC (+11.3% ex-Argentina) and 17.4% in BRL, driven by the performance of both brands in Brazil, along with the accelerating pace in Natura Hispanic markets. This acceleration was partially offset by Avon adjustments across the Hispanic region, coupled with the Home & Style category, which recorded a slower YoY revenue decline vs. prior quarter and to which the Company has a shrinking exposure as a percentage of total revenues |

Gross Margin

| · | Gross margin reached 67.3% in Q3-24, +340 bps YoY, boosted by operating leverage amid accelerating sales momentum and a BRL +19 million phasing from tax credits. Gross margin has also benefited from a richer country mix, a higher Natura brand contribution to total sales and improved execution of price/ promotion dynamics |

| · | Q3-24 already shows a very healthy level of gross margin for both Natura and Avon (after portfolio optimization), especially in the countries where Wave 2 was already implemented |

| · | Ex-Argentina margin was higher than the reported one, reflecting the negative impact of hyperinflation accounting effects (for more details please see “Appendix” section) |

Q3-24 Gross Margin

| BRL million | Consolidated | Natura &Co Latam | Holding |

| Q3-24 | Q3-23 | Ch. % | Q3-24 | Q3-23 | Ch. % | Q3-24 | Q3-23 | Ch. % |

| Net revenue | 5,976.4 | 5,090.0 | 17.4 | 5,975.6 | 5,089.2 | 17.4 | 0.7 | 0.7 | 1.8 |

| COGS | (1,954.0) | (1,839.3) | 6.2 | (1,953.3) | (1,839.1) | 6.2 | (0.7) | (0.2) | 279.1 |

| Gross profit | 4,022.3 | 3,250.7 | 23.7 | 4,022.3 | 3,250.1 | 23.8 | 0.0 | 0.5 | - |

| Gross margin | 67.3% | 63.9% | 340 bps | 67.3% | 63.9% | 340 bps | - | - | - |

9M-24 Gross Margin

| BRL million | Consolidated | Natura &Co Latam | Holding |

| 9M-24 | 9M-23 | Ch. % | 9M-24 | 9M-23 | Ch. % | 9M-24 | 9M-23 | Ch. % |

| Net revenue | 16,342.4 | 15,089.6 | 8.3 | 16,334.3 | 15,087.1 | 8.3 | 8.1 | 2.5 | 225.2 |

| COGS | (5,497.7) | (5,396.4) | 1.9 | (5,490.7) | (5,395.9) | 1.8 | (6.9) | (0.5) | 1,235.4 |

| Gross profit | 10,844.8 | 9,693.2 | 11.9 | 10,843.6 | 9,691.3 | 11.9 | 1.2 | 2.0 | (38.9) |

| Gross margin | 66.4% | 64.2% | 220 bps | 66.4% | 64.2% | 220 bps | - | - | - |

Operating Expenses

| · | Selling expenses in the quarter were positively impacted by logistics costs driven by the Wave 2 integration and credit & collection costs from the Emana Pay initiatives, which were reinvested in marketing initiatives (e.g. Rock in Rio and Natura’s “Alta Perfumaria” campaign launch), consistent with the last couple of quarters. Selling expenses were also impacted by BRL -17 million of royalties from the Avon brand distribution agreement in Latin America |

| · | G&A expenses rose 19% YoY, benefited by administrative efficiencies more than offset by strategic investments particularly focusing on omni and digital initiatives. New IT and systems investments based on as a service contracts have been mostly classified as Opex (instead of Capex) according to IAS 38, which also impacts the SG&A level. This impact was BRL -109 million YTD and BRL -78 million (-130 bps) in Q3-24 |

| · | Corporate expenses in Q3-24 reached BRL 43 million, down 43% YoY mainly explained by the ongoing efforts to streamline the Holding company structure (in line with previous earnings results), but also benefiting from phasing of operational expenses |

| · | Other operating income/expenses in Q3-24 were an expense of BRL 58 million, compared to BRL 27 million in Q3-23, mainly driven by BRL 63 million of incurred costs from the Holding related to legal and other fees from strategic projects |

| · | Transformation / integration / group restructuring costs were BRL 132 million in the quarter, split between BRL 121 million from Latam and BRL 11 million from the Holding, the latter mostly related to severance expenses on the back of further group streamlining efforts. Natura &Co Latam’s integration costs are comprised of HR (~15%), IT (~40%) and logistics investments (~10%), with the remainder being Opex investments and some legal expenses |

Q3-24 Operating Expenses

| BRL million | Consolidated | Natura &Co Latam | Holding |

| Q3-24 | Q3-23 | Ch. % | Q3-24 | Q3-23 | Ch. % | Q3-24 | Q3-23 | Ch. % |

| Selling, marketing and logistics expenses | (2,623.9) | (2,216.0) | 18.4 | (2,623.9) | (2,216.0) | 18.4 | 0.0 | 0.0 | - |

| Administrative, R&D, IT and project expenses | (734.2) | (616.6) | 19.1 | (733.3) | (613.5) | 19.5 | (0.9) | (3.1) | (70.9) |

| Corporate expenses | (42.8) | (74.7) | (42.7) | - | - | - | (42.8) | (74.7) | (42.7) |

| Other operating income / (expenses), net | (58.0) | (26.5) | 118.6 | 4.6 | (26.2) | (117.4) | (62.5) | (0.3) | 21,098.7 |

| Transformation / integration / group reestructuring costs | (132.1) | (205.9) | (35.8) | (121.1) | (206.5) | (41.3) | (11.0) | 0.6 | (2,055.8) |

| Operating expenses | (3,591.0) | (3,139.7) | 14.4 | (3,473.8) | (3,062.2) | 13.4 | (117.2) | (77.6) | 51.1 |

| Selling, marketing and logistics expenses (% NR) | (43.9)% | (43.5)% | -40 bps | (43.9)% | (43.5)% | -40 bps | - | - | - |

| Administrative, R&D, IT and project expenses (% NR) | (12.3)% | (12.1)% | -20 bps | (12.3)% | (12.1)% | -20 bps | - | - | - |

| Corporate expenses (% NR) | (0.7)% | (1.5)% | 80 bps | - | - | - | - | - | - |

| Other operating income / (expenses), net (% NR) | (1.0)% | (0.5)% | -50 bps | 0.1% | (0.5)% | 60 bps | - | - | - |

| Transformation/integration/group reestructuring costs (% NR) | (2.2)% | (4.0)% | 180 bps | (2.0)% | (4.1)% | 210 bps | - | - | - |

| Operating expenses (% NR) | (60.1)% | (61.7)% | 160 bps | (58.1)% | (60.2)% | 210 bps | - | - | - |

9M-24 Operating Expenses

| BRL million | Consolidated | Natura &Co Latam | Holding |

| 9M-24 | 9M-23 | Ch. % | 9M-24 | 9M-23 | Ch. % | 9M-24 | 9M-23 | Ch. % |

| Selling, marketing and logistics expenses | (7,025.4) | (6,351.3) | 10.6 | (7,025.4) | (6,349.6) | 10.6 | (0.0) | (1.6) | (100.0) |

| Administrative, R&D, IT and project expenses | (2,119.1) | (2,050.9) | 3.3 | (2,110.5) | (2,038.8) | 3.5 | (8.7) | (12.2) | (28.9) |

| Corporate expenses | (180.1) | (228.5) | (21.2) | - | - | - | (180.1) | (228.5) | (21.2) |

| Other operating income / (expenses), net | 56.2 | 2.0 | 2,765.2 | 163.7 | 3.2 | 5,072.8 | (107.5) | (1.2) | 8,830.9 |

| Transformation / integration / group reestructuring costs | (242.0) | (333.7) | (27.5) | (229.7) | (331.2) | (30.6) | (12.3) | (2.4) | 402.7 |

| Operating expenses | (9,510.4) | (8,962.3) | 6.1 | (9,201.8) | (8,716.4) | 5.6 | (308.6) | (245.9) | 25.5 |

| Selling, marketing and logistics expenses (% NR) | (43.0)% | (42.1)% | -90 bps | (43.0)% | (42.1)% | -90 bps | - | - | - |

| Administrative, R&D, IT and project expenses (% NR) | (13.0)% | (13.6)% | 60 bps | (12.9)% | (13.5)% | 60 bps | - | - | - |

| Corporate expenses (% NR) | (1.1)% | (1.5)% | 40 bps | - | - | - | - | - | - |

| Other operating income / (expenses), net (% NR) | 0.3% | 0.0% | 30 bps | 1.0% | 0.0% | 100 bps | - | - | - |

| Transformation/integration/group reestructuring costs (% NR) | (1.5)% | (2.2)% | 70 bps | (1.4)% | (2.2)% | 80 bps | - | - | - |

| Operating expenses (% NR) | (58.2)% | (59.4)% | 120 bps | (56.3)% | (57.8)% | 150 bps | - | - | - |

Recurring and Consolidated EBITDA

Q3-24 Recurring EBITDA was BRL 870 million, up 52% from BRL 572 million in Q3-23, with a recurring EBITDA margin of 14.6% (+340 bps YoY). This is the seventh consecutive quarter of YoY profitability expansion. Q3-24 margin reflected:

| · | Solid gross margin expansion of +340 bps YoY driven by operating leverage, improved execution of price/ promotion dynamics, richer country and brand mix and, to a lesser extent, a +30 bps tax credit phasing effect |

| · | G&A, logistics and credit & collection efficiencies, reinvested in marketing and other strategic projects that led to accelerating sales momentum |

| · | And a 43% YoY reduction of corporate expenses |

Q3-24 Recurring EBITDA

| BRL million | Consolidated | Natura &Co Latam | Holding |

| Q3-24 | Q3-23 | Ch. % | Q3-24 | Q3-23 | Ch. % | Q3-24 | Q3-23 | Ch. % |

| Consolidated EBITDA | 659.2 | 351.3 | 87.6 | 776.3 | 428.4 | 81.2 | (117.1) | (77.6) | 51.0 |

| Transformation / Integration / Group Reestructuring costs | 132.1 | 205.9 | (35.8) | 121.1 | 206.5 | (41.3) | 11.0 | (0.6) | (2,055.8) |

| Net non-recurring other (income) / expenses1 | 78.7 | 15.0 | 424.1 | 16.2 | 15.0 | 7.8 | 62.5 | - | - |

| Recurring EBITDA | 870.0 | 572.3 | 52.0 | 913.6 | 649.8 | 40.6 | (43.6) | (77.6) | (43.8) |

| Recurring EBITDA margin % | 14.6% | 11.2% | 340 bps | 15.3% | 12.8% | 250 bps | - | - | - |

9M-24 Recurring EBITDA

| BRL million | Consolidated | Natura &Co Latam | Holding |

| 9M-24 | 9M-23 | Ch. % | 9M-24 | 9M-23 | Ch. % | 9M-24 | 9M-23 | Ch. % |

| Consolidated EBITDA | 2,016.4 | 1,426.7 | 41.3 | 2,323.3 | 1,670.6 | 39.1 | (306.9) | (243.9) | 25.8 |

| Transformation/Integration/Group reestructuring costs | 242.0 | 333.7 | (27.5) | 229.7 | 331.2 | (30.6) | 12.3 | 2.4 | 402.7 |

| Net non-recurring other (income) / expenses1 | (25.9) | (12.8) | 102.9 | (133.6) | (12.8) | 944.9 | 107.6 | (0.0) | - |

| Recurring EBITDA | 2,232.4 | 1,747.5 | 27.7 | 2,419.4 | 1,989.0 | 21.6 | (187.0) | (241.5) | (22.6) |

| Recurring EBITDA margin % | 13.7% | 11.6% | 210 bps | 14.8% | 13.2% | 160 bps | - | - | - |

1 Net non-recurring other (income)/expenses: related to non-operational expenses from portfolio adjustments of Natura &Co Latam and expenses related to strategic projects and legal fees from the Holding company

Financial Income and Expenses

The table below details the main changes in financial income and expenses:

| BRL million | Q3-24 | Q3-23 | Ch. % | 9M-24 | 9M-23 | Ch. % |

| 1. Financing, short-term investments and derivatives gains (losses) | (125.6) | (789.9) | (84.1) | (91.9) | (865.5) | (89.4) |

| 1.1 Financial expenses | (107.5) | (222.8) | (51.8) | (372.3) | (636.0) | (41.5) |

| 1.2 Financial income | 54.8 | 237.4 | (76.9) | 272.9 | 583.1 | (53.2) |

| 1.3 Foreign exchange variations from financing activities, net | (93.7) | (95.1) | (1.5) | (10.3) | 255.9 | (104.0) |

| 1.4 Gain (losses) on foreign exchange derivatives from financing activities, net | 20.8 | (709.4) | (102.9) | 17.8 | (1,068.5) | (101.7) |

| 2. Judicial contingencies | (9.6) | (21.3) | (54.9) | (18.6) | (58.5) | (68.2) |

| 3. Other financial income and (expenses) | (35.3) | (40.2) | (12.2) | (516.5) | (429.2) | 20.3 |

| 3.1 Lease expenses | (21.7) | (14.1) | 53.9 | (69.0) | (43.8) | 57.5 |

| 3.2 Other | (56.7) | (40.9) | 38.6 | (144.2) | (281.4) | (3,313.5) |

| 3.3 Other gains (losses) from exchange rate variation | 76.1 | 91.5 | (19.3) | (118.9) | 3.7 | (48.8) |

| 3.4 Hyperinflation gains (losses) | (33.0) | (76.7) | (26.1) | (184.4) | (107.7) | 71.2 |

| Financial income and expenses, net | (170.5) | (851.4) | (80.0) | (627.0) | (1,353.2) | (53.7) |

Total net financial expenses were BRL -171 million in Q3-24, compared to BRL -851 million in Q3-23, when the line was impacted by non-underlying impacts of BRL -896 million from liability management. The main drivers this quarter were:

| · | Item 1.1 Financial expenses and Item 1.2 Financial income of BRL -53 million (BRL-108 million +

BRL+55 million) from a net debt of BRL 3.7 billion in Q3-24 compared to BRL +15 million from a net cash position in the same period last year |

| · | Item 3.2. Other which this quarter was BRL -57 million (vs. BRL -41 million in same period last year) mostly driven by BRL -46 million in expenses related to liability management |

| · | Item 3.4. Hyperinflation gains (losses) of BRL -33 million related to lower inflation impact from Argentina compared to same period last year |

Discontinued Operations

In Q3-24, discontinued operations landed at BRL 6,995 million (or BRL 8,073 million for 9M-24) mainly impacted by the non-cash non-operating effect from the deconsolidation of Avon Products Inc. (“API”) and its subsidiaries. The main impacts were the following:

· BRL +3,811 million from the deconsolidation of API negative shareholder’s equity

· BRL -10,710 in write-offs from receivables1 against API and Avon Cosmetics Ltd (“ACL”) amid the non-operational U.S. entities Chapter 11 context

· BRL -97 million related to Avon International loss from July/24 to mid-August/24 and other effects such as fiscal impacts and legal expenses

| 9M-24 discontinued operations were also impacted by Q1 and Q2 losses from API and its subsidiaries and by the write-off of receivables related to the earn-out portion of The Body Shop sale |

Underlying Net Income (UNI) and Net Income

| · | Q3-24 reported net loss was BRL -6,693 million, compared to a net income of BRL +7,024 million in Q3-23. This was mainly caused by the one-off non-cash event of BRL -6,995 million that impacted the Discontinued Operations line, as mentioned in the section above |

| · | Excluding this and other non-operating impacts, Q3-24 underlying net income was BRL +524 million, compared to a pro forma BRL +1,135 million in same period last year (or BRL+745 million reported in Q3-23) as the BRL+320 million EBIT YoY improvement was more than offset by higher net financials (from a net cash to an expected net debt position) and higher income tax expenses |

| · | Income tax expenses landed at BRL +41 million, mainly benefited by Group Holding phasing from Q2-24 to Q3-24. In Q3-23, the underlying tax line (excluding the BRL+305 million benefit from liability management impacts) was BRL+698 million, driven by the interest on equity payment from Natura Cosméticos and phasing of Group Holding expenses |

Free Cash Flow and Indebtedness Ratios

The table below details the main changes in cash position:

| R$ million | Q3-24 | Q3-23 | Ch. % | 9M-24 | 9M-23 | Ch. % |

| Net income (loss) | (6,693.4) | 7,024.4 | (195.3) | (8,491.4) | 5,640.1 | (250.6) |

| Depreciation and amortization | 227.9 | 240.4 | (5.2) | 682.0 | 695.8 | (2.0) |

| Non-cash adjustments to net income | 566.6 | 310.8 | 82.3 | 2,697.6 | 1,731.3 | 55.8 |

| Discountinued Operations Results | 6,995.4 | (6,761.7) | (203.5) | 8,073.5 | (5,456.7) | (248.0) |

| Adjusted net income | 1,096.5 | 421.5 | 160.2 | 2,961.7 | 2,610.6 | 13.4 |

| Decrease / (increase) in working capital | 380.4 | 76.1 | 399.6 | (1,520.1) | (1,213.6) | 25.3 |

| Inventories | (226.6) | (147.3) | 53.8 | (1,107.1) | (572.8) | 93.3 |

| Accounts receivable | 271.9 | (7.7) | (3,616.7) | (1,093.1) | (577.8) | 89.2 |

| Accounts payable | 165.1 | (178.3) | (192.6) | 791.6 | (303.0) | (361.3) |

| Other assets and liabilities | 170.0 | 409.5 | (58.5) | (111.6) | 240.0 | (146.5) |

| Income tax and social contribution | (46.1) | (100.7) | (54.2) | (417.1) | (259.3) | 60.9 |

| Interest on debt and derivative settlement | 27.5 | (1,497.4) | (101.8) | (372.8) | (2,373.7) | (84.3) |

| Lease payments | (79.1) | (56.4) | 40.3 | (237.1) | (167.9) | 41.2 |

| Other operating activities | (43.1) | (0.3) | 14,075.6 | (116.4) | 13.9 | (936.3) |

| Cash from continuing operations | 1,335.9 | (1,157.2) | (215.4) | 298.2 | (1,390.0) | (121.5) |

| Capex | (42.8) | (92.6) | (53.8) | (289.8) | (470.4) | (38.4) |

| Sale of assets | (9.4) | 2.7 | (441.3) | 0.0 | 16.7 | - |

| Exchange rate variation on cash balance | 16.3 | (62.9) | (126.0) | 51.2 | (36.4) | (240.7) |

| Free cash flow - continuing operations | 1,300.1 | (1,309.9) | (199.3) | 59.6 | (1,880.0) | (103.2) |

| Other financing and investing activities | 722.7 | (9,924.3) | (107.3) | 1,207.3 | (9,140.0) | (113.2) |

| Operating activities - discontinued operations | (1,576.7) | (392.4) | 301.8 | (3,145.3) | (1,866.2) | 68.5 |

| Capex - discontinued operations | (11.0) | 12,229.0 | (100.1) | 0.0 | 11,983.3 | - |

| Cash and cash equivalents - discop | (773.3) | 0.0 | - | (654.5) | 0.0 | - |

| Cash balance variations | (338.2) | 602.3 | (156.1) | (2,532.9) | (903.0) | 180.5 |

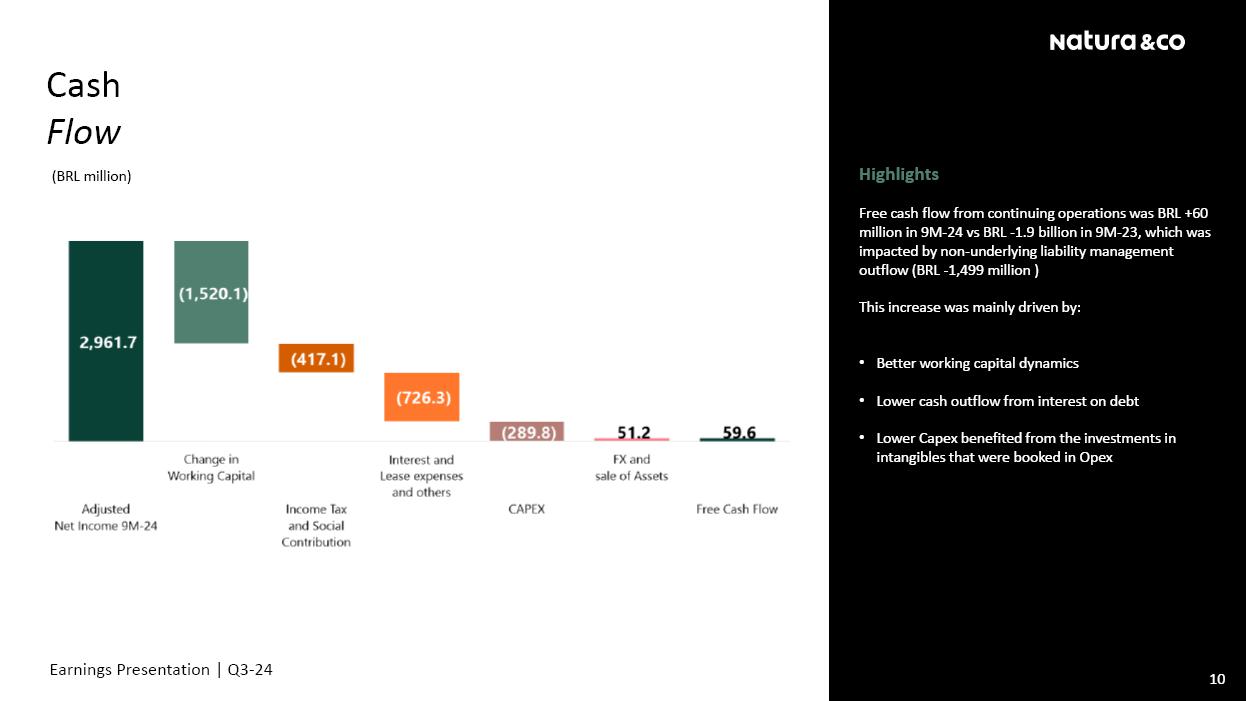

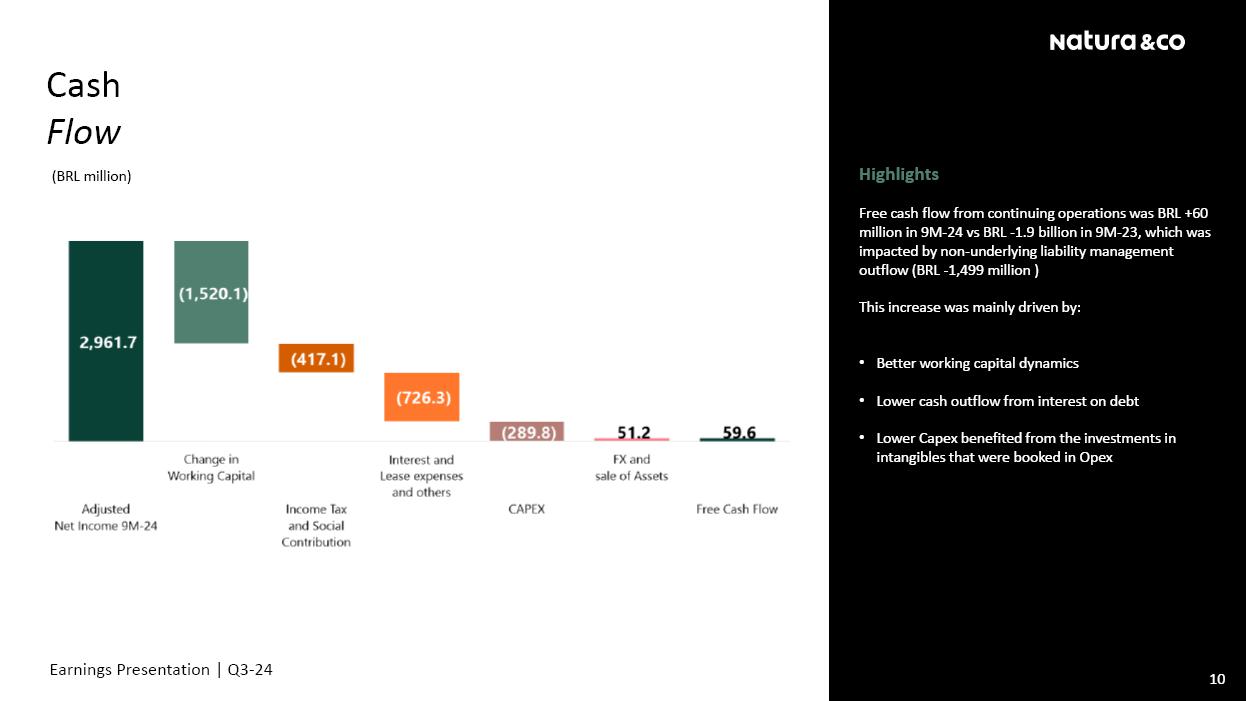

Free cash flow from continuing operations was BRL +60 million during 9M-24 as compared to BRL- 1.9 billion in 9M-23, when it was impacted by the non-underlying cash outflow of BRL -1,499 million related to liability management.

The main drivers of the improvement during the period were:

| · | Operational working capital cash consumption of BRL 1.5 billion in 9M-24, was partially offset by cash relief during Q3-24 of BRL 380 million explained by phasing of receivables (impacted in 6M-24) and continuing improvement from payables |

| · | Lower cash outflow from interest on debt and derivative settlement driven by lower leverage during the period |

| · | Lower Capex by BRL 181 million and landing at BRL -290 million given the BRL -109 million of investments in digital and systems YTD that were booked as OPEX (as explained in the “operating expenses” section) and that will continue to be impacted by such effect going forward |

On working capital, it is worth mentioning that the on-us credit portfolio from Emana Pay reached BRL 340 million with a counterpart of BRL 237 million on payables (related to brand credit cards) and positioning the Company’s credit arm as the main issuing bank for the Natura &Co sales channels while reducing default rates and optimizing capital allocation.

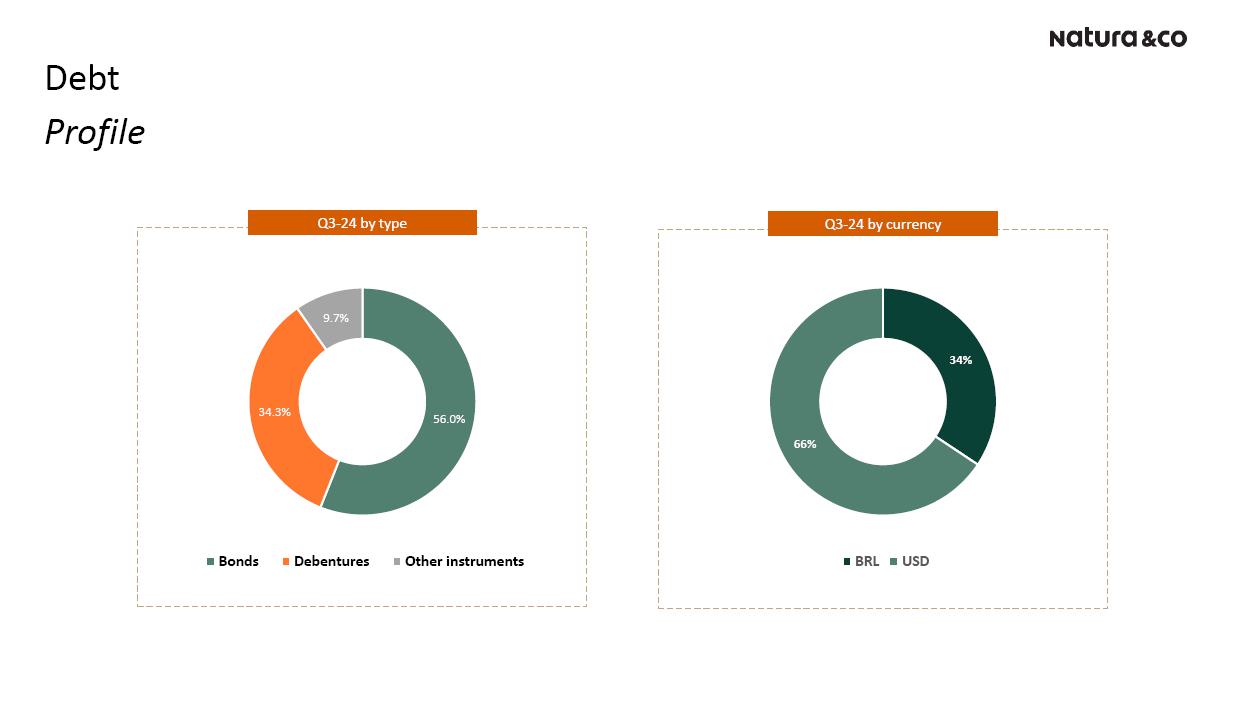

Indebtedness Ratios at both Natura &Co Holding and Natura Cosméticos

| R$ million | Natura Cosméticos S.A. | Natura &Co Holding S.A. |

| Q3-24 | Q3-23e | Q3-24 | Q3-23e |

| Short-Term | 75.0 | 98.4 | 813.6 | 141.1 |

| Long-Term | 2,351.5 | 2,352.2 | 6,251.0 | 6,046.5 |

| Gross Debta | 2,426.5 | 2,450.6 | 7,064.6 | 6,187.6 |

| Foreign currency and/or Interest hedging (Swaps)b | (36.1) | (49.6) | (32.5) | (110.8) |

| Total Gross Debt | 2,390.4 | 2,401.0 | 7,032.2 | 6,076.8 |

| (-) Cash, Cash Equivalents and Short-Term Investmentc | (3,237.9) | (4,489.1) | (3,299.5) | (6,773.4) |

| (=) Net Debtd | (847.6) | (2,088.1) | 3,732.7 | (696.5) |

| | | | | |

| Indebtedness ratio excluding IFRS 16 effects | | | | |

| Net Debt/EBITDA | -0.29x | -1.03x | 1.73x | -0.66x |

| Total Debt/EBITDA | 0.82x | 1.19x | 3.27x | 5.73x |

| | | | | |

| Indebtedness ratio including IFRS 16 effects | | | | |

| Net Debt/EBITDA | -0.27x | -0.79x | 1.50x | -0.37x |

| Total Debt/EBITDA | 0.77x | 0.91x | 2.83x | 3.21x |

| | | | | |

| a Gross debt excludes PPA impacts of R$23,3 million in Q3-23 and exclude lease agreements |

| b Exchange rate and interest rate hedging instruments |

| c Short-Term Investments excludes non current balances |

| d Impacted in Q3-24 by BRL 1.3 billion from API and its subsidiaries desconsolidation. Excluding such effect Net Debt to EBITDA ratio would be 1.5x (including IFRS16) |

| E Historical values and ratios were presented as reported in the periods |

The graph below shows the indebtedness quarterly trajectory since Q3-23.

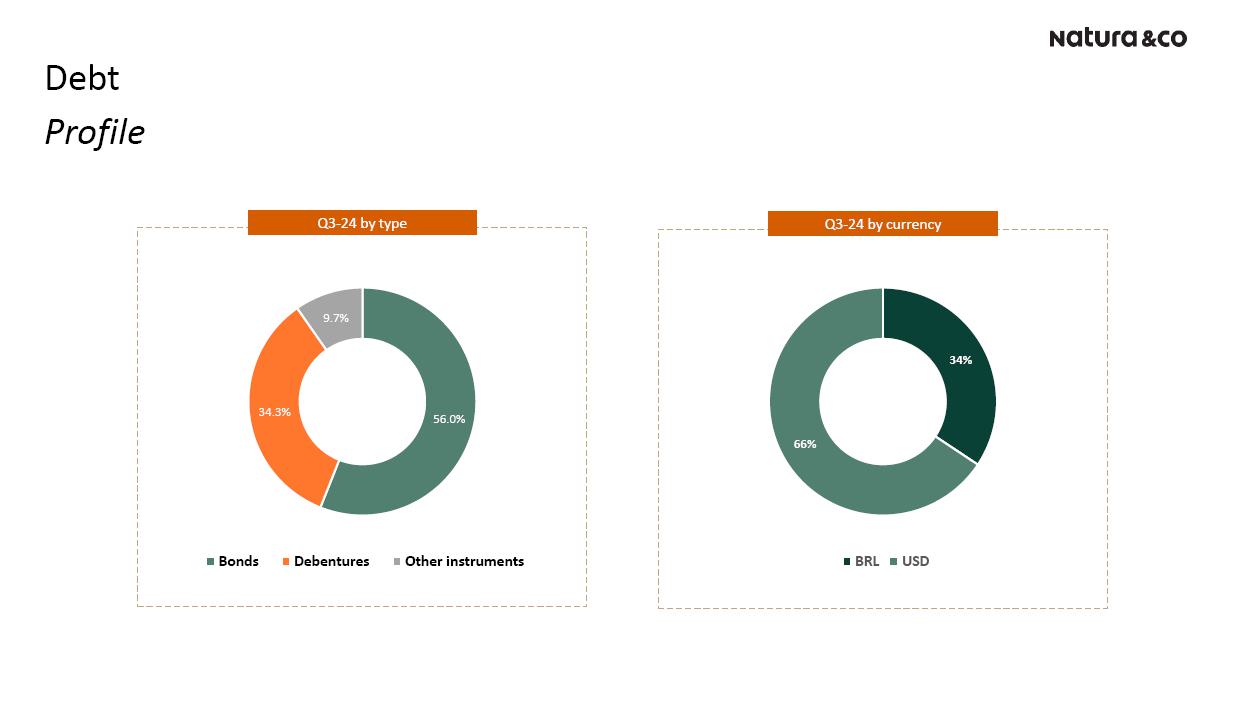

Liability Management

On July 3, Natura Cosméticos repurchased BRL 500 million of its 1st issuance of commercial notes that would mature in September 2025.

To finance this repurchase and the BRL 826 million repurchase completed by the end of Q2-24, on July 5, Natura Cosméticos issued BRL 1,326 million in its 13th issuance of debentures maturing in July 2029. This 13th issuance includes key performance indicators linked to the development of bio-ingredients from the Amazon region, making it the first Sustainability-Linked instrument issued by Natura Cosméticos in Brazil.

04 Social and Environmental Performance

(all actions refer to Natura &Co Group unless stated otherwise)

Celebrating 10 years as a B Corporation, Natura was recertified by B Lab for the fourth consecutive time and named the Best Company in Brazil’s Pharmaceutical and Cosmetics sector by Valor 1000. This ranking, developed with FGV (Fundação Getúlio Vargas) and Serasa Experian, highlights our financial strength and continued leadership in ESG.

Key Initiatives

This quarter, we took significant steps in our Climate Transition Plan, with 20 biogas-powered trucks now transporting 35% of our heavy freight in Brazil, reducing emissions by 82%. In partnership with Nestlé Nespresso, we introduced a breakthrough in circular innovation by repurposing over two tons of aluminum from recycled coffee capsules into packaging for our Natura Ekos line.

In response to Brazil's most severe drought in 70 years, we activated our Emergency Protocol, committing R$5.00 per unit of the Ekos Ryos perfume sold to local NGOs. Full transparency will be ensured as we will disclose all funds raised and allocations made.

Natura &Co Latin America

In 2024, Natura stood out in the Community pillar of its B Corp recertification with the allocation of R$43 million in 2023 to agro-extractive communities in the Amazon. This is a key example of our ongoing commitment to fostering social justice, economic development, and biodiversity preservation.

Our green fleet and collaboration for packaging innovations are critical in our journey to net zero by 2030. These initiatives not only enhance our environmental efficiency but also contribute to our operational resilience and competitive advantage.

As of this quarter, we have become ambassadors of the UN Global Compact’s Living Wage Movement in Brazil, leading efforts to elevate living wage standards across Latin America. This sets a new benchmark for corporate responsibility and further strengthens trust with our stakeholders.

At the Climate Week 2024, we presented strategic proposals on decarbonization and regeneration, advancing our Integrated Profit & Loss agenda and reinforcing our role in shaping the future of sustainable business globally. Our approach remains focused on delivering long-term shareholder value.

05 Capital Markets and Stock Performance

NTCO3 share price on the Brazilian Stock Exchange (B3) reached BRL 14.05 at the end of Q3-24, -9.6% in the quarter. Average Daily Trading Volume (ADTV) for the quarter was BRL 113.5 million, -32.2% vs Q3-23.

On September 30, 2024, the Company’s market capitalization was BRL 19.5 billion, and the Company’s capital was comprised of 1,386,848,066 common shares.

06 Fixed Income

Below is a table detailing all public debt instruments outstanding per issuer as of September 30, 2024:

Ratings

07 Appendix

Natura &Co Latam Revenue Breakdown

| Natura &Co Latam | Net Revenue change (%) |

| Q3-24 vs. Q3-23 |

| | Reported (R$) | Constant Currency |

| Natura Latama | 20.7% | 23.4% |

| Natura Brazil | 19.4% | 19.4% |

| Natura Hispanic | 24.0% | 34.7% |

| Avon Beauty + Home & Style | 9.8% | 6.5% |

| Avon Brazil | 5.1% | 5.1% |

| Avon Hispanic | 12.8% | 7.7% |

| a Natura Latam includes Natura Brazil, Hispanic and others | |

Hyperinflation Impact

| · | The macro scenario in Argentina remains uncertain and volatile. Recurring EBITDA margin ex-Argentina was 14.8% and expanded 380 bps YoY. In addition, the table below shows the accounting effects related to the hyperinflation impact (IAS 29) in Q3-24: |

Free Cash Flow Reconciliation

The correspondence between Free Cash Flow and Statements of Cash Flow is shown below:

| R$ million | | Free Cash Flow Reconciliation | | Free Cash Flow | | Cash Flow Reconciliation |

| CASH FLOW FROM OPERATING ACTIVITIES | | | | | | | Net income (loss) | | (a) |

| Net (loss) income for the period | | (a) | Net income | | Depreciation and amortization | | (b) |

| Adjustments to reconciliate net (loss) income for the period with net cash used in operating activities: | | | | | | | Non-cash Adjustments to Net Income | | (c) |

| Depreciation and amortization | | (b) | Depreciation/amortization | | Operating activities - discontinued operations | | (m) |

| Interest and exchange variation on short-term investments | | (c) | Non-cash adjustments to net income | | Adjusted Net income | | |

| Loss from swap and forward derivative contracts | | (c) | | Decrease / (Increase) in Working Capital | | (d) |

| Increse (reversion) of provision for tax, civil and labor risks | | (c) | | Inventories | | (d1) |

| Monetary adjustment of judicial deposits | | (c) | | Accounts receivable | | (d2) |

| Monetary adjustment of provision for tax, civil and labor risks | | (c) | | Accounts payable | | (d3) |

| Income tax and social contribution | | (c) | | Other assets and liabilities | | (d4) |

| Income from sale and write-off of property, plant and equipment and intagible | | (c) | | Income tax and social contribution | | (e) |

| Interest and exchange rate variation on leases | | (c) | | Lease payments | | (g) |

| Interest and exchange rate variation on borrowings, financing and debentures, net of acquisition costs | | (c) | | Other operating activities | | (h) |

| Adjustment and exchange rate variation on other assets and liabilities | | (c) | | Cash from Operations | | |

| Provision (reversal) for losses on property, plant and equipment, intangible assets and leases | | (c) | | Capex | | (j) |

| Increase (reversion) of provision for stock option plans | | (c) | | Sale of Assets | | (i) |

| Provision for losses with trade accounts receivables, net of reversals | | (c) | | Exchange rate variation | | (k) |

| Provision for inventory losses, net of reversals | | (c) | | Free Cash Flow | | |

| Provision for carbon credits | | (c) | | Other financing and investing activities | | (l) |

| Effect from hyperinflationary economy | | (c) | | Payment of lease - principal discountinued operation | | (n) |

| | | | | | | | Capex - discountinued operation | | (o) |

| Increase (Decrease) in: | | | | | | | Cash Balance Variation | | |

| Trade accounts receivable and related parties | | (d2) | Accounts receivable | | | | |

| Inventories | | (d1) | Inventories | | | | |

| Recoverable taxes | | (d4) | Other Assets and Liabilities | | | | |

| Other assets | | (d4) | Other Assets and Liabilities | | | | |

| Domestic and foreign trade accounts payable and related parties | | (d3) | Accounts payable | | | | |

| Payroll, profit sharing and social charges, net | | (d4) | Other Assets and Liabilities | | | | |

| Tax liabilities | | (d4) | Other Assets and Liabilities | | | | |

| Other liabilities | | (d4) | Other Assets and Liabilities | | | | |

| OTHER CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Payment of income tax and social contribution | | (e) | Income Tax and Social Contribuion | | | | |

| Release of judicial deposits | | (h) | Other Operating Activities | | | | |

| Payments related to tax, civil and labor lawsuits | | (h) | | | | |

| (Payments) proceeds due to settlement of derivative transactions | | (f) | Interest on Debt and derivative settlement | | | | |

| Payment of interest on lease | | (g) | Lease Payments | | | | |

| Payment of interest on borrowings, financing and debentures | | (f) | Interest on Debt and derivative settlement | | | | |

| Operating Activities Discontinued Operations | | (m) | Operating activities - discountinued operations | | | | |

| NET CASH (USED IN) OPERATING ACTIVITIES | | | | | | | | | |

| | | | | | | | | | |

| CASH FLOW FROM INVESTING ACTIVITIES | | | | | | | | | |

| Cash from acquisition of subsidiary | | (m) | Discountinued operations | | | | |

| Additions of property, plant and equipment and intangible | | (j) | Capex | | | | |

| Proceeds from sale of property, plant and equipment and intangible | | (i) | Capex | | | | |

| Short-term acquisition | | (j) | Sale of Assets | | | | |

| Redemption of short-term investments | | (l) | Other financing and investing activities | | | | |

| Redemption of interest on short-term investments | | (l) | | | | |

| Investing activities - discontinued operations | | (o) & (l) | Capex - discountinued operations

& Other financing and investing activities | | | | |

| | | | | | | | | | |

| NET CASH GENERATED BY (USED IN) INVESTING ACTIVITIES | | | | | | | | | |

| | | | | | | | | | |

| CASH FLOW FROM FINANCING ACTIVITIES | | | | | | | | | |

| Repayment of lease - principal | | (g) | Lease payments | | | | |

| Repayment of borrowings, financing and debentures – principal | | (l) | Other financing and investing activities | | | | |

| New borrowings, financing, and debentures | | (l) | | | | |

| Payment of dividends and interest on equity | | (l) | | | | |

| Receipt (payment) of funds due to settlement of derivative transactions | | (l) | | | | |

| Capital Increase | | (l) | | | | |

| Financing activities - discontinued operations | | (n) | Payment of lease - discountinued operations | | | | |

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | | | | | | | | | |

| Effect of exchange rate variation on cash and cash equivalents | | (k) | Exchange Rate Effect | | | | |

| DECREASE IN CASH AND CASH EQUIVALENTS | | | | | | | | | |

| Opening balance of cash and cash equivalents | | | | | | | | | |

| Closing balance of cash and cash equivalents | | | | | | | | | |

| DECREASE IN CASH AND CASH EQUIVALENTS | | | | | | | | | |

Consolidated Balance Sheet

| ASSETS (R$ million) | Sep-24 | Dec-23 | | LIABILITIES AND SHAREHOLDER'S EQUITY (R$ million) | Sep-24 | Dec-23 |

| | | | | | | |

| CURRENT ASSETS | | | | CURRENT LIABILITIES | | |

| Cash and cash equivalents | 1,218.0 | 3,750.9 | | Borrowings, financing and debentures | 813.6 | 163.8 |

| Short-term investments | 2,081.5 | 4,024.1 | | Lease | 168.4 | 298.6 |

| Trade accounts receivable | 4,227.0 | 3,524.4 | | Trade accounts payable and reverse factoring operations | 5,368.3 | 5,302.5 |

| Accounts receivable - sale of subsidiary | - | 22.9 | | Dividends and interest on shareholders' equity payable | 40.1 | 294.2 |

| Inventories | 3,257.8 | 3,087.4 | | Payroll, profit sharing and social charges | 735.3 | 1,019.7 |

| Recoverable taxes | 689.8 | 608.5 | | Tax liabilities | 495.1 | 634.8 |

| Income tax and social contribution | 141.8 | 175.6 | | Income tax and social contribution | 81.6 | 908.4 |

| Derivative financial instruments | 183.6 | 189.0 | | Derivative financial instruments | 190.3 | 329.7 |

| Other current assets | 385.8 | 604.4 | | Provision for tax, civil and labor risks | 11.4 | 491.3 |

| Assets held for sale | - | - | | Other current liabilities | 429.0 | 970.5 |

| Total current assets | 12,185.3 | 15,987.2 | | Total current liabilities | 8,333.1 | 10,413.5 |

| | | | | | | |

| NON CURRENT ASSETS | | | | NON CURRENT LIABILITIES | | |

| Accounts receivable - sale of subsidiary | 396.3 | 806.6 | | Borrowings, financing and debentures | 6,251.0 | 5,947.9 |

| Recoverable taxes | 732.8 | 1,112.4 | | Lease | 503.9 | 851.8 |

| Deferred income tax and social contribution | 1,649.0 | 2,200.7 | | Payroll, profit sharing and social charges | 68.9 | 16.1 |

| Judicial deposits | 425.2 | 408.0 | | Tax liabilities | 167.1 | 127.2 |

| Derivative financial instruments | 76.2 | 89.5 | | Deferred income tax and social contribution | 410.1 | 328.1 |

| Short-term investments | 44.9 | 36.7 | | Provision for tax, civil and labor risks | 781.7 | 1,255.5 |

| Other non-current assets | 4,137.6 | 1,027.7 | | Other non-current liabilities | 306.9 | 686.5 |

| Total long term assets | 7,461.9 | 5,681.5 | | Total non-current liabilities | 8,489.5 | 9,213.1 |

| Property, plant and equipment | 2,439.2 | 3,457.6 | | SHAREHOLDERS' EQUITY | | |

| Intangible | 9,492.9 | 16,569.9 | | Capital stock | 12,484.5 | 12,484.5 |

| Right of use | 776.2 | 1,050.8 | | Treasury shares | (30.6) | (164.2) |

| Total non-current assets | 20,170.3 | 26,759.8 | | Capital reserves | 10,476.2 | 10,466.5 |

| | | | | Profit Reserves | 50.3 | 780.3 |

| | | | | Accumulated Losses | (8,491.4) | - |

| | | | | Other comprehensive income | 1,044.0 | (463.8) |

| | | | | Equity attributable to owners of the Company | 15,533.0 | 23,103.2 |

| | | | | Non-controlling interest in shareholders' equity of subsidiaries | 0.0 | 17.2 |

| | | | | | | |

| TOTAL ASSETS | 32,355.6 | 42,747.0 | | TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | 32,355.6 | 42,747.0 |

Consolidated Income Statement- Including Purchase Price Allocation (PPA) Amortization

| | Profit and Loss by Business |

| BRL million | Consolidated | Natura &Co Latam | Holding |

| Q3-24 | PPA | Q3-24

ExPPA | | Q3-23 | PPA | Q3-23

Ex PPA | Q3-24 | PPA | Q3-24

Ex PPA | | Q3-23 | PPA | Q3-23

Ex PPA | Q3-24 | Q3-23 | Ch. % |

| Gross revenue | 7,901.4 | - | 7,901.4 | | 6,763.4 | - | 6,763.4 | 7,900.7 | - | 7,900.7 | | 6,762.7 | - | 6,762.7 | 0.7 | 0.7 | 1.8 |

| Net revenue | 5,976.4 | - | 5,976.4 | | 5,090.0 | - | 5,090.0 | 5,975.6 | - | 5,975.6 | | 5,089.2 | - | 5,089.2 | 0.7 | 0.7 | 1.8 |

| COGS | (1,954.0) | (5.7) | (1,948.4) | | (1,839.3) | (1.7) | (1,837.6) | (1,953.3) | (5.7) | (1,947.6) | | (1,839.1) | (1.7) | (1,837.4) | (0.7) | (0.2) | 279.1 |

| Gross profit | 4,022.3 | (5.7) | 4,028.0 | | 3,250.7 | (1.7) | 3,252.3 | 4,022.3 | (5.7) | 4,028.0 | | 3,250.1 | (1.7) | 3,251.8 | 0.0 | 0.5 | (98.3) |

| Selling, marketing and logistics expenses | (2,623.9) | (33.5) | (2,590.4) | | (2,216.0) | (61.6) | (2,154.4) | (2,623.9) | (33.5) | (2,590.4) | | (2,216.0) | (61.6) | (2,154.4) | - | - | - |

| Administrative, R&D, IT and projects expenses | (734.2) | (1.1) | (733.1) | | (616.6) | (70.7) | (545.8) | (733.3) | (1.1) | (732.2) | | (613.5) | (70.7) | (542.7) | (0.9) | (3.1) | (70.9) |

| Corporate expenses | (42.8) | - | (42.8) | | (74.7) | - | (74.7) | - | - | - | | - | - | - | (42.8) | (74.7) | (42.7) |

| Other operating income / (expenses), net | (58.0) | 4.4 | (62.4) | | (26.5) | (36.9) | 10.4 | 4.6 | 4.4 | 0.2 | | (26.2) | (36.9) | 10.7 | (62.5) | (0.3) | 21,098.7 |

| Transformation / Integration / Group restructuring costs | (132.1) | - | (132.1) | | (205.9) | - | (205.9) | (121.1) | - | (121.1) | | (206.5) | - | (206.5) | (11.0) | 0.6 | (2,055.8) |

| Depreciation | 227.9 | 40.3 | 187.6 | | 240.4 | 134.0 | 106.3 | 227.8 | 40.3 | 187.5 | | 240.4 | 134.0 | 106.3 | 0.1 | - | - |

| EBITDA | 659.2 | 4.4 | 654.8 | | 351.3 | (36.9) | 388.2 | 776.3 | 4.4 | 771.9 | | 428.4 | (36.9) | 465.2 | (117.1) | (77.6) | 51.0 |

| Depreciation | (227.9) | (40.3) | (187.6) | | (240.4) | (134.0) | (106.3) | | | | | | | | | | |

| Financial income / (expenses), net | (170.5) | (4.9) | (165.5) | | (851.5) | 205.7 | (1,057.2) | | | | | | | | | | |

| Earnings before taxes | 260.9 | (40.8) | 301.7 | | (740.5) | 34.8 | (775.3) | | | | | | | | | | |

| Income tax and social contribution | 41.1 | 30.0 | 11.1 | | 1,003.2 | (94.8) | 1,098.0 | | | | | | | | | | |

| Discontinued operationse | (6,995.4) | 5,193.0 | (12,188.4) | | 6,761.7 | - | 6,761.7 | | | | | | | | | | |

| Consolidated net (loss) income | (6,693.4) | 5,182.1 | (11,875.5) | | 7,024.4 | (60.0) | 7,084.4 | | | | | | | | | | |

| Non-controlling interest | - | - | - | | - | - | - | | | | | | | | | | |

| Net income (loss) attributable to controlling shareholders | (6,693.4) | 5,182.1 | (11,875.5) | | 7,024.4 | (60.0) | 7,084.4 | | | | | | | | | | |

Consolidated Statement of Cash Flow

| R$ million | Set - 24 | Set - 23 | | Free Cash Flow Reconciliation |

| CASH FLOW FROM OPERATING ACTIVITIES | | | | | | | |

| Net (loss) income for the period | (8,491.4) | 5,639.9 | | (a) | Net income |

| Adjustments to reconciliate net (loss) income for the period with net cash used in operating activities: | | | | | | | |

| Depreciation and amortization | 682.0 | 695.8 | | (b) | Depreciation/amortization |

| Interest and exchange variation on short-term investments | (221.5) | (642.3) | | (c) | Non-cash adjustments to net income |

| Loss from swap and forward derivative contracts | 20.0 | 1,741.8 | | (c) |

| Increse (reversion) of provision for tax, civil and labor risks | 56.6 | 24.6 | | (c) |

| Monetary adjustment of judicial deposits | (21.9) | (20.5) | | (c) |

| Monetary adjustment of provision for tax, civil and labor risks | 38.4 | 58.5 | | (c) |

| Income tax and social contribution | 1,125.3 | (673.5) | | (c) |

| Income from sale and write-off of property, plant and equipment and intagible | 49.6 | (163.6) | | (c) |

| Interest and exchange rate variation on leases | 69.0 | 51.3 | | (c) |

| Interest and exchange rate variation on borrowings, financing and debentures, net of acquisition costs | 314.8 | 349.1 | | (c) |

| Adjustment and exchange rate variation on other assets and liabilities | 0.0 | 2.2 | | (c) |

| Provision (reversal) for losses on property, plant and equipment, intangible assets and leases | 0.0 | 14.7 | | (c) |

| Increase (reversion) of provision for stock option plans | 47.6 | 78.2 | | (c) |

| Provision for losses with trade accounts receivables, net of reversals | 363.4 | 445.7 | | (c) |

| Provision for inventory losses, net of reversals | 171.4 | 231.0 | | (c) |

| Provision for carbon credits | (0.9) | (11.2) | | (c) |

| Effect from hyperinflationary economy | 685.7 | 245.5 | | (c) |

| | | | | | | | |

| Increase (Decrease) in: | | | | | | | |

| Trade accounts receivable and related parties | (1,093.1) | (577.8) | | (d2) | Accounts receivable |

| Inventories | (1,107.1) | (572.8) | | (d1) | Inventories |

| Recoverable taxes | 216.6 | 36.8 | | (d4) | Other Assets and Liabilities |

| Other assets | (174.4) | 483.8 | | (d4) | Other Assets and Liabilities |

| Domestic and foreign trade accounts payable and related parties | 791.6 | (303.0) | | (d3) | Accounts payable |

| Payroll, profit sharing and social charges, net | 67.7 | (66.9) | | (d4) | Other Assets and Liabilities |

| Tax liabilities | (12.2) | (135.1) | | (d4) | Other Assets and Liabilities |

| Other liabilities | (209.2) | (78.7) | | (d4) | Other Assets and Liabilities |

| OTHER CASH FLOWS FROM OPERATING ACTIVITIES | (6,631.9) | 6,853.4 | | | | | |

| Payment of income tax and social contribution | (417.1) | (259.3) | | (e) | Income Tax and Social Contribuion |

| Release of judicial deposits | 4.7 | 23.6 | | (h) | Other Operating Activities |

| Payments related to tax, civil and labor lawsuits | (121.1) | (9.7) | | (h) |

| (Payments) proceeds due to settlement of derivative transactions | (26.8) | (1,520.6) | | (f) | Interest on Debt and derivative settlement |

| Payment of interest on lease | (69.0) | (47.0) | | (g) | Lease Payments |

| Payment of interest on borrowings, financing and debentures | (346.0) | (853.1) | | (f) | Interest on Debt and derivative settlement |

| Operating Activities Discontinued Operations | 4,928.2 | (7,322.9) | | (m) | Operating activities - discountinued operations |

| NET CASH (USED IN) OPERATING ACTIVITIES | (2,679.0) | (3,135.6) | | | | | |

| | | | | | | | |

| CASH FLOW FROM INVESTING ACTIVITIES | | | | | | | |

| Cash from acquisition of subsidiary | 61.9 | 0.0 | | (m) | Discountinued operations |

| Additions of property, plant and equipment and intangible | (289.8) | (470.4) | | (j) | Capex |

| Proceeds from sale of property, plant and equipment and intangible | 0.0 | 16.7 | | (i) | Capex |

| Short-term acquisition | (21,607.0) | (12,220.6) | | (j) | Sale of Assets |

| Redemption of short-term investments | 23,554.1 | 10,625.5 | | (l) | Other financing and investing activities |

| Redemption of interest on short-term investments | 190.7 | 101.2 | | (l) |

| Investing activities - discontinued operations | (654.5) | 11,983.3 | | (o) & (l) | Capex - discountinued operations

& Other financing and investing activities |

| | | | | | | | |

| NET CASH GENERATED BY (USED IN) INVESTING ACTIVITIES | 1,255.4 | 10,035.6 | | | | | |

| | | | | | | | |

| CASH FLOW FROM FINANCING ACTIVITIES | | | | | | | |

| Repayment of lease - principal | (168.1) | (120.9) | | (g) | Lease payments |

| Repayment of borrowings, financing and debentures – principal | (1,465.5) | (8,185.9) | | (l) | Other financing and investing activities |

| New borrowings, financing, and debentures | 1,460.3 | 1,506.7 | | (l) |

| Payment of dividends and interest on equity | (984.2) | (0.0) | | (l) |

| Receipt (payment) of funds due to settlement of derivative transactions | (3.0) | (367.8) | | (l) |

| Capital Increase | 0.0 | 0.1 | | (l) |

| Financing activities - discontinued operations | 0.0 | (599.2) | | (n) | Payment of lease - discountinued operations |

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | (1,160.5) | (7,766.9) | | | | | |

| Effect of exchange rate variation on cash and cash equivalents | 51.2 | (36.4) | | (k) | Exchange Rate Effect |

| DECREASE IN CASH AND CASH EQUIVALENTS | (2,532.9) | (903.2) | | | | | |

| Opening balance of cash and cash equivalents | 3,750.9 | 4,195.7 | | | | | |

| Closing balance of cash and cash equivalents | 1,218.0 | 3,292.5 | | | | | |

| DECREASE IN CASH AND CASH EQUIVALENTS | (2,532.9) | (903.2) | | | | | |

08 Conference Call and Webcast

09 Glossary

APAC: Asia and Pacific

ARS: the foreign exchange market symbol for the Argentine peso

Avon representatives: Self-employed resellers who do not have a formal labor relationship with Avon

B3: Brazilian Stock Exchange

BPS: Basis Points; a basis points is equivalent to one percentage point * 100

Brand Power: A methodology used by Natura &Co to measure how its brands are perceived by consumers, based on metrics of significance, differentiation and relevance.

BRL: Brazilian Reais

CDI: The overnight rate for interbank deposits

CEE: Central and Eastern Europe

CFT: Cosmetics, Fragrances and Toiletries Market (CFT = Fragrances, Body Care and Oil Moisture, Make-up (without Nails), Face Care, Hair Care (without Colorants), Soaps, Deodorants, Men’s Grooming (without Razors) and Sun Protection

COGS: Costs of Goods Sold

Constant currency (“CC”) or constant exchange rates: when exchange rates used to convert financial figures into a reporting currency are the same for the years under comparison, excluding foreign currency fluctuation effects

CO2e: Carbon dioxide equivalent; for any quantity and type of greenhouse gas, CO2e signifies the amount of CO2 which

would have the equivalent global warming impact.

EBITDA: Earnings Before Interests, Tax, Depreciation and Amortization

EMEA: Europe, Middle East and Africa

EP&L: Environmental Profit & Loss

Foreign currency translation: conversion of figures from a foreign currency into the currency of the reporting entity

FX: foreign exchange

FY: fiscal year

G&A: General and administrative expenses

IAS 29: “Financial Reporting in Hyperinflationary Economies' requires the financial statements of any entity whose functional currency is the currency of a hyperinflationary economy to be restated for changes in the general purchasing power of that currency so that the financial information provided is more meaningful

IBOV: Ibovespa Index is the main performance indicator of the stocks traded in B3 and lists major companies in the Brazilian capital market

IFRS – International Financial Reporting Standards

Hispanic Latam: Often used to refer to the countries in Latin America, excluding Brazil

NYSE: New York Stock Exchange

P&L: Profit and loss

PP: Percentage point

PPA: Purchase Price Allocation - effects of the fair market value assessment as a result of a business combination

Profit Sharing: The share of profit allocated to employees under the profit-sharing program

Quarter on quarter (“QoQ”): is a measuring technique that calculates the change between one fiscal quarter and the previous fiscal quarter

Recurring EBITDA: Excludes effects that are not considered usual, recurring or not comparable between the periods under analysis

SG&A: Selling, general and administrative expenses

TBS: The Body Shop.

Task Force on Climate-Related Financial Disclosures (“TCFD”): climate-related disclosure recommendations enable stakeholders to understand carbon-related assets and their exposures to climate-related risks

Task force on Nature-related Financial Disclosures (“TNFD”): The TNFD Framework seeks to provide organisations and financial institutions with a risk management and disclosure framework to identify, assess, manage and report on nature-related dependencies, impacts, risks and opportunities ("nature-related issues"), encouraging organisations to integrate nature into strategic and capital allocation decision making

TPV: Total Payment VolumeUNI: Underlying Net Income, which is net income excluding transformation costs, restructuring costs, discontinued operations and PPA effects

Year-over-year (“YOY”): is a financial term used to compare data for a specific period of time with the corresponding period from the previous year. It is a way to analyze and assess the growth or decline of a particular variable over a twelve-month period

Year to date (“YTD”): refers to the period of time beginning the first day of the current calendar year or fiscal year up to the current date. YTD information is useful for analyzing business trends over time or comparing performance data to competitors or peers in the same industry

10 Disclaimer

EBITDA is not a measure under BR GAAP and does not represent cash flow for the periods presented. EBITDA should not be considered an alternative to net income as an indicator of operating performance or an alternative to cash flow as an indicator of liquidity. EBITDA does not have a standardized meaning and the definition of EBITDA used by Natura may not be comparable with that used by other companies. Although EBITDA does not provide under BR GAAP a measure of cash flow, Management has adopted its use to measure the Company’s operating performance. Natura also believes that certain investors and financial analysts use EBITDA as an indicator of performance of its operations and/or its cash flow.

This report contains forward-looking statements. These forward-looking statements are not historical fact, but rather reflect the wishes and expectations of Natura’s management. Words such as “anticipate,” “wish,” “expect,” “foresee,” “intend,” “plan,” “predict,” “project,” “desire” and similar terms identify statements that necessarily involve known and unknown risks. Known risks include uncertainties that are not limited to the impact of price and product competitiveness, the acceptance of products by the market, the transitions of the Company’s products and those of its competitors, regulatory approval, currency fluctuations, supply and production difficulties and changes in product sales, among other risks. This report also contains certain pro forma data, which are prepared by the Company exclusively for informational and reference purposes and as such are unaudited. This report is updated up to the present date and Natura does not undertake to update it in the event of new information and/or future events.

Investor Relations Team

ri@natura.net