UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1−K

ANNUAL REPORT PURSUANT TO REGULATION A

OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2021

Oracle Health, Inc.

(Exact name of issuer as specified in its charter)

| Delaware | | 84-1730527 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

910 Woodbridge Court, Safety Harbor, FL 34695

(Full mailing address of principal executive offices)

(727) 470-3466

(Issuer’s telephone number, including area code)

Common Stock

Title of each class of securities issued pursuant to Regulation A

TABLE OF CONTENTS

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to “we,” “us,” “our,” “our company” or “Future Cardia” refer to Oracle Health, Inc., a Delaware corporation.

Special Note Regarding Forward Looking Statements

Certain information contained in this report includes forward-looking statements. The statements herein which are not historical reflect our current expectations and projections about our company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to our company and our management and our interpretation of what is believed to be significant factors affecting the businesses, including many assumptions regarding future events.

Forward-looking statements are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Item 1. Business─Risk Factors” below, and matters described in this report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

ITEM 1. BUSINESS

Overview

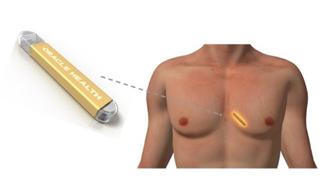

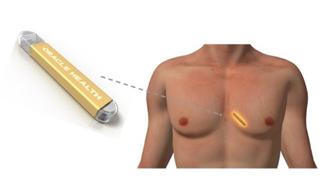

Founded in May 2019, we are a medical device technology startup focusing on the development of a tiny insertable cardiac monitoring device to monitor heart failure. Our monitoring device is designed to detect signs of heart failure early enough so that non-hospital treatments can be administered and, thus, hospitalizations that typically result from heart failure can be reduced and prevented. Our tiny insertable cardiac monitor utilizes a multi-sensor approach and cloud-based pattern recognition (machine learning) to monitor chronic heart failure. We filed a provisional patent application that covers the technology related to our insertable cardiac device, software dashboard, smartphone app and data accumulation techniques in May 2019, and a non-provisional utility patent application in May 2020 (Patent application No. 62/853,899). We expect to submit our insertable cardiac device to the FDA for review under the FDA’s 510k framework around mid-2023, and we are on schedule for a patient ready insertable cardiac device for human implant under the first in man clinical study by December 2022.

Our tiny insertable monitoring device, which has not yet been cleared by the FDA, will offer a long-term solution to heart failure monitoring that, we believe, features simplicity, improved accuracy, high patient protocol compliance and hospital economics. Our device is equipped with multi-sensors to track trending changes in heart performance, including heart rhythms, electrocardiogram (ECG or EKG), and heart and lung sounds and activities, to monitor heart failure using telemedicine and machine learning technology.

Our Industry

The U.S. boasts the largest medical device market in the world, with Select USA reporting that the market reached $156 billion in size in 2017. By 2023, industry experts project the U.S. market to grow to $208 billion. The market is comprised of articles, instruments, apparatuses, or machines that are used for preventative, diagnostic, or treatment purposes. According to Select USA, this industry includes nearly two million direct and indirect jobs in the U.S., with over 80% of medical devices companies operating at under 50 employees.

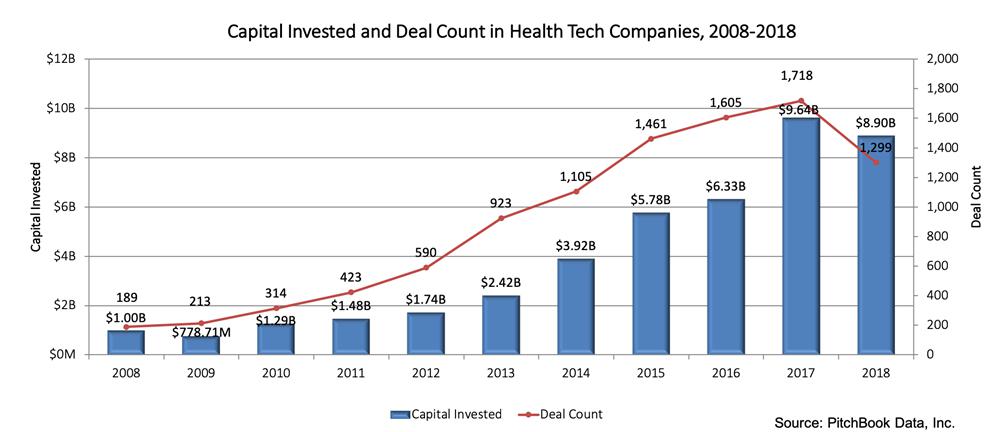

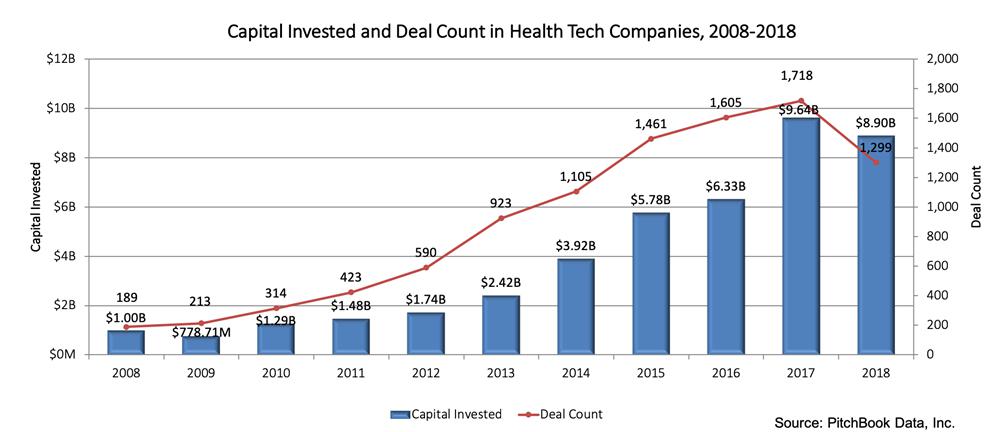

In 2018, venture capital in health tech companies reached $8.9 billion across 1,299 total deals. Health tech companies received record highs in investment amount ($9.64 billion) and deal count (1,718) in 2017. From 2016 to 2017, there was a 52% year-over-year increase in capital invested. According to PitchBook Data, between 2008 and 2018, more than $43 billion was invested across 9,840 venture capital deals in health tech companies.

The U.S. Center for Disease Control and Prevention, or the CDC, estimates that roughly 5.7 million adults in the U.S. have heart failure, which is defined as a chronic, progressive condition in which the heart cannot pump enough blood and oxygen to support other organs in the body. The CDC also reported that heart failure costs the U.S. approximately $30.7 billion each year in health care services, medications, and missed days of work from patients with this condition. An Emory University study shows that there are nearly 550,000 new cases of heart failure diagnosed in the U.S. each year. According to the Emory University Study, this condition is responsible for 11 million physician visits each year, and even more hospitalizations than all forms of cancer combined.

According to St. Jude Medical, heart failure market revenue exceeded $4 billion in 2016.

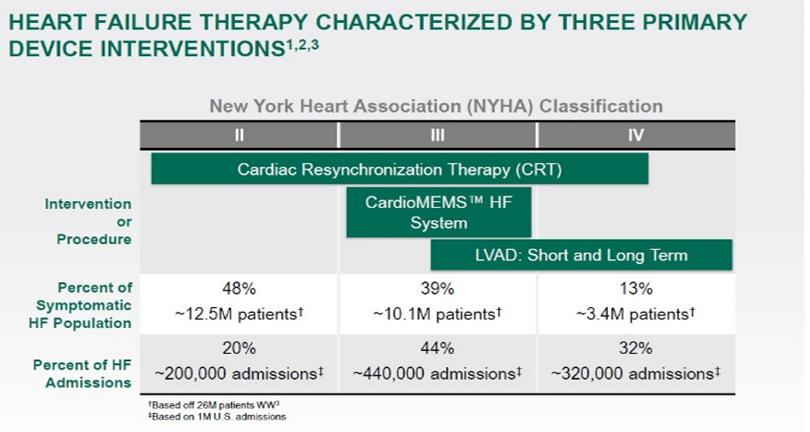

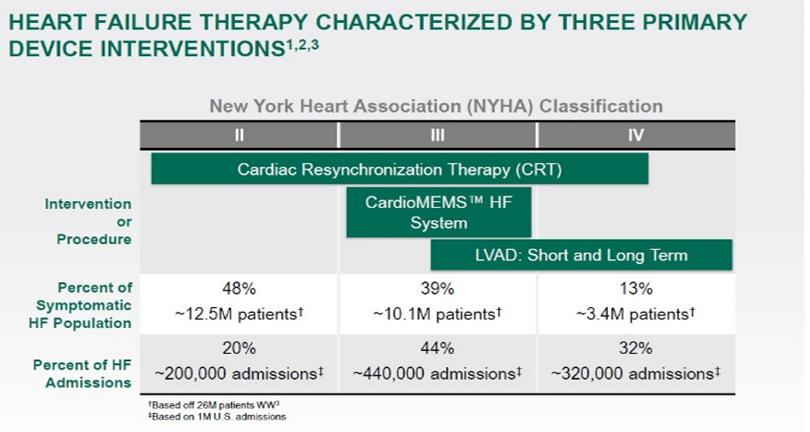

The chart below, presented at the St. Jude Medical 2016 Analyst and Investor Meeting, shows certain measurements relating to the effect of two types of device intervention therapies and one monitoring solution, the CardioMEMS HF System (then owned by St. Jude) on the three classifications of heart failure established by the New York Heart Association, or NYHA (i.e., Class II, mild symptoms of cardiac disease resulting in slight limitation on physical activities, Class III, moderate symptoms, and Class IV, severe symptoms).

With the cardiac resynchronization, or CRT, therapy, specialized pacemakers or defibrillators with three wires (or leads) were implanted in the chests of patients to restore the normal timing pattern of the heartbeat; with left ventricular assist device, or LVAD, therapy, mechanical pumps were implanted inside patients’ chests to help weakened hearts pump blood; and with the CardioMEMS HF System, a small pressure-sensing device was implanted directly into the patients’ pulmonary arteries and, without needing to visit the hospital of doctor’s office, information was regularly sent wirelessly to the patients’ care teams.

Based on the NYHA’s data, it can be seen from the chart that approximately 25 million heart failure patients, across the three heart failure classifications, were symptomatic and could benefit from some type of therapy. However, despite the three referenced available therapy solutions, of the symptomatic patients, approximately one million still needed to be hospitalized - 20% of whom were categorized as Class II, 44% as Class III and 32% as Class IV, we believe, due to lack of viable monitoring solutions. The conclusion that we draw from this chart is that there is a need for additional monitoring solutions for the three classes of cardiac disease patients.

Reducing heart failure related hospital visits through the use of implantable cardiac monitors is a first step in addressing this national health problem (Multi-Sense and CardioMems data). Research and Markets reports that the global implantable cardiac monitors market is projected to reach $682 million by 2023, growing at a 7.6% compound annual growth rate, or CAGR, from 2017 to 2023 (this report only focused on arrhythmia monitoring devices). According to Research and Markets, growth is expected to be driven by the miniaturization of these devices, as well as the growing demand for cardiac monitors that can continuously monitor heart health and detect any abnormalities.

Wearable devices have grown in popularity among consumers for their ability to simply monitor activity and heart rates for fitness purposes. Transparency Market Research valued the global wearable medical devices market at $6.8 billion in 2017. According to Transparency Market Research, the market is forecasted to grow at a CAGR of 17% from 2018 to 2026, in part due to the expansion of the health care industry, government initiatives that promote wearables, additional health care expenditure, and increased product approvals.

In addition, consumers have grown increasingly comfortable with digital health services and technologies. Not only are consumers going digital out of curiosity or for general fitness and well-being, but with the intention to address and treat real, concrete health needs. According to Rock Health, these consumers are using digital health solutions to manage diagnoses, connect with providers, and make critical healthcare decisions. We expect that this trend might accelerate as a result of the COVID-19 pandemic.

88% of respondents to a Rock Health survey reported using a digital health tool in 2018, up from 80% in 2015. The most widely used digital health tools – online health information, online provider reviews, mobile tracking, wearables, and live video telemedicine – also saw increased adoption year-over-year in 2018. In particular, live video telemedicine surged in 2018, increasing more than 100% year-over-year from 2017 to 2018 according to Rock Health. The chart below presents this data in graphic form.

According to the Rock Health survey results, the following number of patients/users were surveyed: in 2015, 4,017 patients; in 2016, 4,015 patients; in 2017, 3,997 patients; and in 2018, 4,000 patients.

Our Market

Heart failure is a major public health problem affecting more than 6 million patients in the United States and more than 23 million patients worldwide. Patients with heart failure have high morbidity and mortality rates. According to the American Heart Association, one in five persons in the U.S. will develop heart failure in their lifetime and 50% of those who develop heart failure will die within 5 years. The projected cost to the U.S. healthcare system is expected to reach $70 billion by 2030 and the burden of heart failure related hospitalizations represents 80% of costs attributed to heart failure care. Thus, accurate monitoring and timely detection of worsening heart failure may reduce heart failure admissions.

Current Approaches

Patients’ self-tracking of daily weights, a lagging indicator of impending heart failure decompensation (that is, the inability of the heart to maintain adequate circulation) has not proven to be effective in preventing episodes of decompensation (See Figure 1, below). Traditional physiologic markers such as abnormal increases in patient weight (that is, fluid accumulation and/or swelling of the lower extremities) occur late in the decompensation process (approximately five days prior to hospitalization, according to Figure 1 below) and leave little time to react before hospitalization. The ineffectiveness of self-tracking of daily weight changes is due to the reactive nature of having to act quickly on late-in-the-cycle data that is represented by the weight gain information. By the time the patient is presented with notable weight gain, the patient is already at the heart failure decompensation stage, requiring immediate intervention.

Numerous studies that evaluated the decompensation parameter’s ability to reduce heart failure related hospitalizations have indicated that this methodology has failed. Traditional clinical observations, and intrathoracic impedance monitoring (measuring the liquid accumulation in the lungs) have also failed to provide sufficient insight into patient decompensation and have not led to a decrease in hospital readmissions according to Link-HF (study 1, 2 and 3).

The development of wearable monitors, which have gained in popularity in recent years and have been thought to provide a simple to implement heart monitoring solution, have not resulted in an improvement in patient outcomes. Although a few of the devices have shown promise in the short-term (days to weeks), these devices have not proven beneficial for the long-term chronic management of heart failure as they suffer from low accuracy, poor patient compliance, lack of sustainability and lack of physician adoption. Additionally, despite improved accuracy, invasive catheterization, or Cardiac Cath Lab, procedures are complex and expensive and have suffered from low adoption by physicians and hospitals.

Figure 1. Adapted from Emani. Current Heart Failure Rep. 2017:14(1):40-7

Note: The dotted white lines in Figure 1 represent the points in time prior to hospitalization that the indicated biomarkers begin to show.

It has been hypothesized that the development of physiological parameters, while associated with more variations in a population, may provide improved sensitivity and specificity, given that an individual’s baseline measurements are used to evaluate future events. Studies (e.g., Characterization of Cardiac Acoustic Biomarkers in Patients with Heart Failure (the “Burkhoff Study”) - https://onlinelibrary.wiley.com/doi/full/10.1111/anec.12717) have shown that early detection of signs related to acute worsening of heart failure through the use of heart sounds as a cardiac acoustic biomarker may provide insight regarding the timing of treatment interventions, leading to a decrease in hospitalizations. In the Burkhoff study, 1060 patients with heart failure were tested using a wearable cardioverter defibrillator (WCD). This WCD device recorded ECG and cardiohemic vibrations (i.e., heart sounds) as well other notable cardiac data that can be algorithmically combined to provide cardiac acoustic biomarkers of heart failure patients. The Burkhoff Study provided critical information about typical values in heart failure patients, intra-subject variability, circadian rhythms, and changes over time of these parameters. The Burkhoff Study concluded that short term noninvasive cardiac acoustic biomarkers offer the possibility to assess parameters associated with heart function, clinical status, and other aspects of cardiovascular physiology that differ between normal and heart failure states.

A recent Multi-Sense clinical trial, which enrolled 900 patients suffering from heart failure, who each received a cardiac resynchronization therapy implantable cardioverter defibrillator device provided the initial proof that a multi-parameter approach in an implantable device improved the care of the heart failure patient and reduced future heart failure admissions. The HeartLogic (Boston Scientific) index, which combines data from multiple implantable cardioverter defibrillator (ICD)-based sensors, was able to detect 70% of the impending heart failure events with a median 34 days’ warning. Additional evidence for physiologic (hemodynamic) assessment of the heart failure patient was demonstrated in the CHAMPION trial where one-year remote monitoring of a CardioMEMS Champion heart failure monitoring system resulted in an $11,260 reduction for Heart failure related hospitalizations compared with the year before the device implant trial. These two successful trials clearly demonstrated that the use of the “physiologic data” approach is superior to that of patient weights and intrathoracic impedance.

The burden of employing devices such as those referenced above lies in the cost and invasive placement procedure and the complexities of addressing the needs of different heart failure populations. Patient populations include those requiring correction of left bundle branch block, or LBBB, with a low ejection fraction, or EF (a measurement, expressed as a percentage, of how much blood the left ventricle pumps out with each contraction), those who suffered a myocardial infarction (a heart attack), or MI, or who are thought to be at risk for this event and those patients with heart failure and normal conduction physiology and no previous MI, that is, heart failure with preserved (or normal) ejection fraction, or HFpEF. Currently these devices are not indicated for patients with HFpEF.

Our Solution

The market for insertable cardiac monitors needs a solution that brings simplicity, improved accuracy, high patient protocol compliance and hospital economics to heart failure monitoring. Based on the criteria discussed below and equipped with strong clinical evidence on heart sounds as a biomarker, we are developing a subcutaneously (SQ, under the skin) insertable device with multi-sensors to check for trending changes in heart performance to monitor heart failure using telemedicine and machine learning technology.

Our insertable cardiac monitoring device will monitor the following heart related functions with the indicated tools:

| ● | heart rhythms (electrocardiogram (ECG)); |

| ● | heart and lung sounds (phonocardiogram (PCG)); and |

| ● | body motion, activity and orientation (three axis accelerometer) |

The current unmet need in the HFpEF market segment is significant and growing in terms of patient numbers and heart failure admissions. Along with this current unmet need is the issue of “treatment solutions for HFpEF.” Segments or phenotypes of the HFpEF population may be served with similar algorithms to those that treat heart failure with reduced (that is, abnormal) ejection fraction, or HFrEF (also referred to as systolic heart failure). However, the disease process associated with HFpEF is very distinct from that associated with HFrEF.

The development of solutions for HFpEF has led investigators to take a look at the phenotypes that may present. A meeting of experts in this space took place at National Institute of Health, the NIH, in June 2017. Several key insights developed. First, should clinical trials enrolling HFpEF patients focus on all HPpEF patients or focus on smaller subpopulations (phenotypes). Most clinical trials adopt broad inclusion criteria, to ensure that the primary objective of the trial has adequate statistical power. The downside of this approach, to enroll all patients with the HFpEF but presenting with a variety of phenotypes, is the resulting uncertainty as to the primary factor(s) causing heart failure in each phenotype. This may lead to trials that include additional variables, that while well understood for the HFrEF population, remain to be evaluated in the HFpEF segment. For instance, elevated B-type natriuretic peptide (BNP) levels are prognostic for HFpEF but are lower in the HFrEF population for any level of this specific heart failure. Including BNP in a broad inclusion HFpEF trial may lead to data that cannot be quantified and analyzed, without a very large sample size. Similarly, the phenomenon of patients with HFrEF that does not respond to cardiac resynchronization therapy (CRT) has resulted in more than 500 published papers. These papers have focused on possible mechanisms responsible for the non-responder issue. As a result of this effort, new pre-implant and post-implant solutions have been successfully identified and solutions have been developed during the 19 years that CRT has been on the market. At the time of the CRT launch, insufficient knowledge into the complex nature of heart failure with LBBB prevented “phenotype” based tools from being used to improve the responder rate. In regard to HFpEF, the scientific knowledge specific to the phenotype is more mature than that known for HFrEF and CRT. It is reasonable that the use of a multi-sensor device such as our insertable cardiac monitor will allow greater care of the HFpEF population compared to the early days of device management in the HFrEF population.

More than 35 trials have been developed to evaluate a possible “solution” for HFpEF. These studies and other investigations have concluded that the unique pathophysiology may include a variety of phenotypes; 1) at-risk metabolic disorders, 2) pulmonary vascular disease, 3) elevated atrial pressure 4) those presenting with coronary microvascular dysfunction, and alterations in titin physiology, to name a few. These phenotypes may or may not confound a trial’s primary objective.

Many HFrEF trials included improvements in quality of life and functional capacity as primary or secondary endpoints. These measures were not necessarily correlated with morbidity and mortality. The improvements in quality of life and/or functional capacity did not lead to a similar reduction in morbidity and mortality rate. The HFrEF population may have “lived” more comfortably but did not live longer. The HFpEF disease appears at a later age than the HFrEF and improvements addressing this population appear to be focused on an improvement in functional capacity. As current pharmaceutical treatments for cardiovascular disease (CVD) do not improve this group’s functional capacity, reducing the impact of the disease variables on this functional capacity parameter is key. Symptoms commonly observed in the HFpEF population, including reduced exercise tolerance (impacting daily activities), dyspnea (impacting respiratory rate) and declining cardiac function (heart sounds) are the focus on the Future Cardia device. A combination of pharmaceutical therapies tailored to these “physiologic markers” may reduce the need for heart failure admissions. The number one goal for health care providers is to prevent morbidity and mortality. From a patient perspective, their goal, while to stay alive, is really to live with a reasonable functional capacity. We believe that our insertable cardiac monitoring device can help achieve this objective.

Our Product Features

Future Cardia’s insertable cardiac monitor is designed to be a super-minimally invasive solution that can effectively help cardiologists monitor and treat their heart failure patients. Our insertable cardiac monitor is comprised of the following features:

| ● | Under the skin insertable device transmits secured data to a smartphone with advanced antenna and sensor technologies; |

| ● | Smartphone automatically pushes the data up to cloud-based pattern recognition software (machine learning); and, |

| ● | Clinicians log on to a portal to assess cardiac performance. |

The diagram below illustrates this structure.

Insertion Procedure

Future Cardia’s insertable cardiac monitor utilizes commonly used insertion procedure. This is a 2-minute office-based procedure commonly used by thousands of cardiologists every day.

|

| | | | | |

Cardiologist numbs a small region and

then makes ¼ inch incision. | | Cardiologist inserts the device,

just under the skin. | | After device is inserted, physician then

covers the incision area with

a special sterile bandage. |

Heart Monitoring

After the minimally invasive insertion process, our insertable cardiac monitor is able to listen to heart sounds and record electrocardiography (ECG). Based on currently available batter technology and longevity, which we intend to incorporate into our monitoring device, we expect our device to be able to continuously transmit monitoring signals for up to three years. Cardiologists can monitor patient data and trends in heart performance using our proprietary software dashboard. Our insertable cardiac monitoring platform will use cloud-based machine learning to analyze all of a patient’s data and help cardiologists efficiently determine the next steps in patient care.

Our Competition

Our primary competitors are Abbott, Medtronic, Sensible Medical Innovations, VitalConnect and ReThink Medical. The following is a description of each of these competitors.

Abbott Laboratories (NYSE: ABT): Abbott Laboratories is an Illinois-based healthcare company that sells medical devices, diagnostics, medicines, and nutritional products to treat a wide range of health problems, including cardiovascular diseases. The cardiovascular disease division at Abbott has many internal divisions that are designed to solve specific heart problems. Organizations within the cardiovascular disease division include structural heart, heart failure, cardiac rhythm management, electrophysiology, peripheral intervention, vessel closure, carotid intervention, and coronary intervention. The heart failure organization has over five products that are designed to help physicians and patients more effectively monitor and manage heart failure. The CardioMems HF System is a monitoring device that is implanted directly into a patient’s pulmonary artery that then sends information wirelessly to the patient’s doctor. Abbott reports that this device has been clinically proven to reduce hospital admission by 58% over an average of 12 months. In 2018, Abbott Laboratories reported that its Heart Failure division earned $646 million in total revenue, of which about 72% came from sales made in the U.S.

Medtronic (NYSE: MDT): Founded in 1949, Medtronic is a medical device company that designs and sells devices for a range of medical uses. Heart failure and cardiac rhythm is one such medical issue that Medtronic sells devices to treat, with the company offering implantable cardiac pacemakers, implantable cardioverter defibrillators, implantable cardiac resynchronization therapy devices, AF ablation product, insertable cardiac monitoring systems, and mechanical circulatory support products. The Medtronic LINQ is the company’s flagship Insertable Cardiac Monitoring system product, which is designed to record the heart’s electrical activity before, during, and after transient symptoms, as well as assist in diagnosis. In the 2019 fiscal year (which ended on April 26, 2019), Medtronic reported $5.84 billion in revenue from its cardiac rhythm and heart failure group, down from $5.94 billion in 2018.

Sensible Medical Innovations: Sensible Medical Innovations is an Israeli company that aims to lead a new standard of care in heart failure. Initially used in the military, the company’s medical radar (ReDS) monitoring technology has been adapted for medical use to help physicians deliver a non-invasive solution to heart failure patients. By implementing this product, Sensible Medical claims that healthcare professionals are able to measure a patient’s lung fluid, which is a key data point for heart failure patients. Additionally, Sensible Medical’s solution can be used both at home and in a clinic. In May 2019, Sensible Medical entered into an agreement with Bayer for the use of Sensible’s ReDS technology. Sensible Medical raised a $20 million financing round led by Boston Scientific in November 2013, which was the company’s last disclosed funding.

VitalConnect: Headquartered in Silicon Valley, California, VitalConnect is developing an external sticky patch device to monitor cardiac functions. The company was founded in 2011, has received total funding of $86 million and has completed a 100 patient clinical trial of its sticky patch device in the U.S. (LINK HF).

ReThink Medical: San Francisco-based ReThink Medical is a health tech startup that has designed medical devices to help monitor heart failure. The company’s wrist-worn monitoring device is equipped with technology that is designed to predict and prevent heart failure hospitalizations. The device uses machine learning, artificial intelligence, and continuous physiologic monitoring to detect worsening symptoms. In May 2017, ReThink Medical raised a $3 million Series A round led by Emergent Medical Partners.

Currently there are several medical device companies competing in this field. However, we believe our product will bring simplicity, improved accuracy, high patient protocol compliance and hospital economics to the monitoring of heart failure compared to other devices in the market.

Our Competitive Advantages

We believe that the following characteristics of our product will provide us with a competitive advantage once our implantable monitoring device is fully developed and FDA cleared:

| ● | Simple Procedure – Our monitoring device, which can be inserted under the skin in a two minute office visit procedure, features a simpler approach than other devices currently on the market that require femoral vein access or a sensor implantation inside the heart or pulmonary artery. |

| ● | More Accurate Data and Comprehensive Diagnostics – Our heart monitoring device utilizes a unique set of multi-sensors (ECG, acoustic sensor for heart & lung sounds, and activity sensor/accelerometer), and it has been shown that heart failure monitoring with multiple sensors yields improvements in accuracy (sensitivity) of up to 70% (based on clinical data provided in Boston Scientific’s Multi-Sense clinical trial) compared to more traditional methods of monitoring. We expect that our multiple sensor heart monitoring device will also display such improved accuracy. |

| ● | High Patient Protocol Compliance – Patients do not need to wear any equipment or worry about following a detailed or cumbersome long term regiment such as those that are required in connection with the use of currently available wearable or implantable heart monitoring solutions. |

| ● | Telemedicine – Using smartphone, WiFi and cellular networks, all device output data is securely transmitted by the inserted device to a smartphone, then to a cloud based AI system for data analytics. |

| ● | Existing Healthcare Reimbursements – Our device leverages existing Current Procedural Terminology (CPT code 33285) to streamline the healthcare reimbursement process. |

Our Development Highlights

2019

| ● | Completed ZeroTo510 Med Tech Accelerator (GAN Accelerator) |

| ● | Proof of concept device developed in August 2019 for animal lab and human testing |

| ● | Accepted to Johnson & Johnson’s life sciences incubator, or JLABS, in November 2019 |

| ● | Signed research agreement with Maastricht University for animal and human testing |

2020

| ● | 8 heart failure patient data studies completed (Maastricht University study- proof of concept device that records ECG and measures heart sounds through an acoustic sensor in a non-invasive, external approach) |

| ● | Non-provisional utility patent filed in May 2020 |

| ● | Accepted to Tampa Bay Wave Accelerator (GAN Accelerator) in May 2020 |

| ● | In discussions with nationally recognized heart failure clinics for planned human trials |

| ● | Hardware and software team identified |

| ● | Dr. Dan Burkhoff, MD, PhD, and Dr. Kevin Heist, MD, PhD, joined our advisory team in July 2020 |

| ● | In discussions with a leading medical microelectronics development, design and manufacturing company for the acquisition of our implantable battery solution |

| ● | In contract discussions with ISO certified medical device manufacturer with expertise in implantable cardiac devices for the manufacture of our heart failure device |

| ● | Accepted to four week “Boot Camp” at the TMCx Accelerator of the Texas Medical Center, in October 2020. |

2021

| ● | In January 2021, we started feasibility testing of our technology and upon positive review, we proceeded to R&D phase for human implant. |

| ● | In February 2021, we obtained a key battery technology to expedite our development. |

| ● | In July 2021, we filed for a second patent that encompasses the wireless antenna technology (Patent application No. 17/443,899). We commenced engineering related to this patent in January 2021 with a contract design firm that specializes in implantable cardiac devices. |

| ● | In summer 2021, we were accepted into the “YCombinator – Summer Batch 2021.” However, we declined participation in favor of our capital raise with investors on the Republic platform then and other venture firms and potential strategic partners. |

| ● | By September 2021, we had identified and made arrangements with engineering and data analysis partners for the commercialization of our device. |

2022 Q1

| ● | In January 2022, we were accepted into the Stanford StartX accelerator program. Stanford StartX is the premier accelerator program in the world with one of the highest success rates, with ten (10) startups achieving unicorn status in the past 12 years. StartX companies have a combined valuation of over $30 billion and 92% survival rate. Over 300 Silicon Valley mentors participate in the program to create one of the most powerful networks of entrepreneurs, professors, scientists and investors. |

| ● | In January 2022, we had selected our key engineering and manufacturing facilities. |

| ● | In February 2022, we had identified a principal investigator who will lead the first in human implant clinical trial. |

| ● | In March 2022, we had successfully implanted our prototype device in animal lab to demonstrate near real world scenario. This testing showed the device’s embodied antenna and sensor technology as well as data acquisitions and analytics capabilities. This will allow us to conduct additional testings before expected human implant in December 2022. |

Our Maastricht University Research Collaboration

On September 21, 2019, we entered into a research collaboration agreement with Maastricht University, more specifically with the Faculty of Health, Medicine and Life Sciences/School for Cardiovascular Diseases, or CARIM, to investigate to what extent the analysis of heart sounds is comparable or complementary to standard care non-invasive assessments in diagnosing HFpEF and whether heart sounds may contribute to better classification within the HFpEF population. This research collaboration entails a study of a proof of concept model of our heart monitoring device in 30 patients referred to the HFpEF outpatient clinic at Maastricht University Medical Center. The Maastricht proof of concept device is about the size of a 9V battery and is equipped with an ECG recorder and an acoustic sensor to monitor and measure heart rhythm and heart sounds. Data that is externally recorded by the device during a treadmill test is wirelessly transmitted to a smartphone for analysis. This testing has enabled us to acquire heart failure patients’ cardiac data (ECG and heart sounds in a digital format) for input into a non-proprietary, generally available machine learning analysis program.

Although information provided by the testing of eight heart failure individuals is only anecdotal, after treadmill exercises and the recording of ECG and heart sounds, we were able to observe, as hypothesized, acute cardiac performance changes in this test group that are not seen in persons with normal heart function. Shortly after the treadmill exercise, the diseased heart showed that it is not able to pump effectively. The pumping amplitude was reduced, and the frequency of each pumping (width) was widened in contrast to healthy hearts.

The term of the Maastritch agreement is for one year; however, the agreement will remain in effect, upon written agreement between the parties, until the study, in progress, is completed. To date we have collected data for over 35 patients and are analyzing this data for publication of the findings. Under the terms of this collaboration, we have agreed to pay CARIM a fee of 5,000 Euro for the execution of the study and the transfer of the study output data to us. All rights resulting from developments connected to the research project as performed by us will vest in us, and ownership of any invention, modification or improvement developed during the research project and relating to our device will vest in us as well. We will be responsible for all patent process costs if we determine to file any patent applications based on the research project outcomes.

Our Product Launch Roadmap

We plan to launch our product as soon as practicable by taking the following steps:

| ● | complete patient ready device development (design and engineering) for an early feasibility study and first in man implant; |

| ● | complete 30 implants along with data analysis - Because our heart monitor is a 510k Class II device, we are not required to show effectiveness in humans in order to obtain 510k clearance. In the resubmission meeting with the FDA, FDA staff suggested conducting an observational clinical trial with a small number of clinic centers; |

| ● | submit Pre-Sub to FDA followed by obtaining FDA 510k clearance; |

| ● | penetrate Texas and Florida accounts (two of the highest implant volume states in the US); |

| ● | commercialize and expand to other high-volume regions outside of Texas and Florida, and further refine the product; and |

| ● | solidify commercialization and earn market share from competitors and explore the application of our device in respiratory space. |

Our Sales and Marketing

We intend to operate a multi-distribution model for the sales of our device. We will use internal sales managers who will work directly with hospitals and independent pacer representatives who then sell medical devices to cardiologists. Initially, we expect to focus on cardiologists in Texas and Florida where we already have pre-existing relationships.

Our Product Engineering

In January 2021, we entered into a confidentiality agreement with a top U.S. medical device manufacturer for the manufacturing design and production process for our implantable medical device. We estimate a per unit manufacturing cost of approximately $1,000, and we anticipate that our device will retail for approximately $5,300.

In January 2022, we established an engineering design team and selected implantable medical devices manufacturing firms to solidify our development for human implant.

Our Intellectual Property

We acquired the intellectual property for our implantable heart failure monitoring device from our founder and CEO, Jaeson Bang for consideration of $100. On April 19, 2021, we entered into an assignment agreement with Mr. Bang, pursuant to which Mr. Bang transferred all of his right, title and interest in the intellectual property assets, including the patent applications listed in the table below and the inventions described and embodied therein to Oracle Health, Inc. for $100 in cash. The foregoing description of the assignment agreement does not purport to be complete and is qualified in its entirety by reference to Exhibit 6.1 to this annual report on Form 1-K.

| Docket Number | | Title | | Application No. | | Patent No. | | Status |

| OCL-001-PCT | | Implantable Cardiac Monitor* | | 62/853,899 | | N/A | | Pending |

| OCL-001-PR1 | | Implantable Cardiac Monitor* | | PCT/US20/35171 | | N/A | | Pending |

| * | In May 2019, a provisional patent application that covers the technology related to our implantable cardiac device, software dashboard, smartphone app and data accumulation techniques was filed by Jaeson Bang with the United States Patent and Trademark Office, or USPTO. In October 2019, we completed a patentability assessment. In May 2020, Jaeson Bang, R. Maxwell Flaherty, and J. Christopher Flaherty, the inventors, filed a non-provisional utility patent application with the USPTO under the PCT (patent cooperation treaty). On June 19, 2020, the inventors entered into an assignment agreement, under which they assigned the entire right, title and interest in this patent application to our company. On September 9, 2020 we entered into an assignment agreement assigning all of these rights to our founder, Jaeson Bang. On April 19, 2021, Jaeson Bang assigned all of these rights back to our company pursuant to an assignment agreement as described above. |

In July 2021, our company, as the applicant, filed for a patent that encompasses the wireless antenna technology, as shown in the table below. David Nghiem and Jaeson Bang were listed as inventors in the application for this patent.

| Docket Number | | Title | | Application No. | | Patent No. | | Status |

| 5886.001US1 | | Implantable Antenna and Sensor Configurations | | 17/443,899 | | N/A | | Pending |

We and Mr. Bang intend to file additional patent applications to strengthen our intellectual property portfolio.

On February 18, 2020, we filed a trademark application with the USPTO for the mark “Voice of the Heart.” On June 9, 2020, this application was published for opposition.

On September 14, 2021, we registered “Future Cardia” as our trade name or “d/b/a” with the State of Florida where our principal executive officers are located.

We also own the URL https://futurecardia.com/.

Employees and Advisors

We currently have one (1) full-time employee, our Chief Executive Officer and ten (10) part-time employees. We are also working with two contract engineering firms.

In addition, we have engaged the following team of distinguished industry experts and researchers with substantive experience and extensive credentials as our advisors:

Dr. Dan Burkhoff MD PhD. Dr. Burkhoff is a renowned heart failure expert with multiple medical tech startup experience. He has participated in one medical tech company’s $1.1 billion exit to Medtronic. He is currently the director of the Cardiovascular Research Foundation.

Randolph Armstrong. Mr. Armstrong has more than 30 years of experience in medical device development. He has participated in a medical tech company’s $1.3 billion exit to Boston Scientific. He has executive-level experience gained at multiple medical tech companies such as Boston Scientific and Medtronic, and he also worked for NASA.

Dimitrios Georgakopoulous PhD. Dr. Georgakopoulous has been the chief science officer at multiple venture-backed biotechnology companies. He completed his post-doctoral fellowship in Cardiology at Johns Hopkins Hospital and has authored numerous public research papers. He received a PhD in Cardiovascular Physiology and Biomedical Engineering from Johns Hopkins University.

Dr. Kevin Heist MD PhD. Dr. Heist works at Massachusetts General Hospital. He is an associate professor of Medicine at Harvard Medical School. He received a PhD and an MD from the Stanford University School of Medicine.

Dr. Toshimasa Okabe MD. Dr. Okabe works at the Department of Clinical Cardiac Electrophysiology and Cardiovascular Disease at the Ohio State University Medical Center. He received an MD from the University of Tokyo.

Professor Frits Prinzen PhD. Dr. Prinzen is a Professor of Physiology, with a focus on “Electro-mechanics of the heart,” at Maastricht University, The Netherlands. He received his Medical Biology degree from University of Utrecht.

Dr. David Kraus MD. Dr. Kraus works at Stern Cardiovascular in Memphis, TN. He is an associate director at Cardiac Laboratories at Baptist Memorial Hospital. He received an MD from the University of Tennessee Center for the Health Sciences.

Anatoly Yakovlev PhD. Dr. Yakovlev received a PhD in Electrical Engineering from Stanford University and is an expert in machine learning.

Properties

Our main office is located at 910 Woodbridge Court, Safety Harbor, FL 34695. Our operational offices are located at the Johnson & Johnson JLABS facility at the Texas Medical Center in Houston, Texas. We pay the Texas Medical Center an annual rental rate of approximately $6,000 to utilize the JLABS space which rate increases by 3% annually.

We lease the JLABS space under a license agreement with the Texas Medical Center. Under this license, we are allowed to conduct laboratory research in a dedicated workstation area using laboratory facilities and equipment provided by the Texas Medical Center in their laboratory building located at 2450 Holcombe Boulevard, Houston, Texas 77021-2040.

We believe that all our properties are adequately maintained, are generally in good condition, and are suitable and adequate for our business.

We do not currently lease or own any other real property.

Government Regulation and the FDA Review Process

Government regulations can stimulate or slow growth of medical technology companies based on how governmental agencies evaluate products. The breadth of government regulations is comprehensive, governing areas such as medical device design and development, clinical testing, premarket clearance and approval, listing, manufacturing, labeling, advertising, storage, promotions, sales and distribution, and post-market surveillance.

In the U.S., the Food and Drug Administration, or FDA, typically oversees many of these regulations. Two pathways exist to propose a new medical device, the investigative device exemption, or IDE, requiring a premarket approval application, or PMA, and the 510k premarket submission. The 510k process requires the manufacturer to show that a device is “substantially equivalent” to an existing device that is already legally marketed. We are now in the process of completing that analysis. The FDA occasionally requires clinical data in a 510k application review, and often takes between ninety days to one year to complete the application process. We plan to submit our insertable cardiac device for FDA review under a pre-submission filing, or Pre-Sub, in the first quarter of 2021. Currently, we are working with regulatory experts to prepare the required documents to submit the Pre-Sub to the FDA for their opinion and guidance. We are also working to complete the development and engineering of our device. Following the receipt of FDA guidance which we should receive sometime after the Pre-Sub filing, we expect to set an appointment with the FDA for a Pre-Sub meeting, to gain clarification regarding their guidance, so that we can then proceed with their recommendations. We intend to file our application for FDA clearance under the 510k framework following completion of this Pre-Sub process. We expect that when we file our 510k application, although our device will not be fully developed, we will be ready to start the “pilot phase” of our product development, which will include animal testing of our device for safety and functionality, with a focus on quality and biocompatibility testing, the operability of device management systems, and risk control and effectiveness validation and verification procedures as mandated by the FDA. Following this pilot phase and prior to FDA 510k clearance, we will enter into a “release phase” in which we plan to conduct an additional risk management review of or device and “release” our device for an in-human early feasibility study clinical trial (although not required for 510k clearance). Once expected 510k clearance is obtained, we will begin the commercial sale of our device.

We believe we are in compliance with all material government regulations which apply to our product and operations. However, we are not able to predict the nature of any future laws, regulations, interpretations or applications, nor can we predict what effect future changes would have on our business.

Legal Proceedings

We know of no existing or pending legal proceedings against us, nor are we involved as a plaintiff in any proceeding or pending litigation. There are no proceedings in which any of our directors, officers or any of their respective affiliates is an adverse party or has a material interest adverse to our interest.

Risk Factors

Investing in our securities involves a significant degree of risk. In evaluating our company and an investment in our securities, careful consideration should be given to the following risk factors, in addition to the other information included in this report. Each of these risk factors could materially adversely affect our business, operating results or financial condition, as well as adversely affect the value of an investment in our securities. The following is a summary of the most significant factors. We are still subject to all the same risks that all companies in our industry, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as cyber-security). Additionally, early-stage companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to our Business and Industry

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

We were incorporated in May 2019 and accordingly, we have a limited history upon which an evaluation of our prospects and future performance can be made. Our proposed operations are subject to all business risks associated with new enterprises. The likelihood of our creation of a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the inception of a business, operation in a competitive industry, and the continued development of advertising, promotions, and a corresponding client base. In order to succeed, our company will need to attract additional capital and additional personnel, and there can be no assurances that our company will be able to attract the needed capital and personnel.

We have a history of operating losses and there can be no assurance that we can achieve or maintain profitability.

We have experienced net losses since inception. As of December 31, 2021, we had an accumulated deficit of $2,556,048. We had net losses in the amount of $1,738,609 and $727,320 for the years ended December 31, 2021 and 2020, respectively. There can be no assurance that we will achieve or maintain profitability. If we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Failure to become and remain profitable would impair our ability to sustain operations and adversely affect the price of our common stock, once trading, and our ability to raise capital. Our operating expenses may increase as we spend resources on growing our business, and if our revenue does not correspondingly increase, our operating results and financial condition will suffer. You must consider our business and prospects in light of the risks and difficulties we will encounter as business with an early-stage technology in a new and rapidly evolving industry. We may not be able to successfully address these risks and difficulties, which could significantly harm our business, operating results and financial condition.

The COVID-19 pandemic may have an adverse impact on our business.

The COVID-19 pandemic has negatively impacted the U.S. economy, disrupted supply chains, created significant volatility and disruption in financial markets, increased unemployment levels and decreased consumer confidence generally. In addition, the pandemic has resulted in temporary closures of many businesses and the enforcement of social distancing in many states and communities.

The extent of the impact of the COVID-19 pandemic on our business, operations, and prospects will depend on a number of evolving factors, including:

| ● | The duration, extent, and severity of the pandemic. COVID-19 has not been contained and could affect significantly more households and businesses. The duration and severity of the pandemic continue to be impossible to predict. |

| ● | The response of governmental and nongovernmental authorities. Many of the actions taken by authorities have been directed at curtailing personal and business activity to contain COVID-19 while simultaneously deploying fiscal-and monetary-policy measures to assist in mitigating the adverse effects on individuals and businesses. These actions are not consistent across jurisdictions but, in general, have been evolving in scope and intensity. |

| ● | The effect on our targeted markets. COVID-19 and its associated consequences and uncertainties may affect individuals, households, and businesses differently and unevenly. In the near term if not longer, we generally expect that our targeted market may be adversely impacted. We also cannot predict if the impact will be short-lived or long-lasting. |

The duration of these business interruptions and related impacts on our proposed business and operations, which will depend on future developments, are highly uncertain and cannot be reasonably estimated at this time. Even after COVID-19 has subsided, we may continue to experience materially adverse impacts to our business as a result of the virus’s global economic impact, including the availability of credit, adverse impacts on our liquidity and any recession that has occurred or may occur in the future.

The forecasts of market growth included in this report may prove to be inaccurate, and even if the markets in which we compete achieve the forecasted growth, we cannot assure you our business will grow at similar rates, if at all.

Growth forecasts are subject to significant uncertainty and are based on assumptions and estimates that may not prove to be accurate. The forecasts contained in this report, some of which reflecting pre-COVID-19 data, may prove to be inaccurate. Even if these markets experience the forecasted growth described in this report, we may not grow our business at similar rates, or at all. Our growth is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties, including our ability to raise sufficient capital. Accordingly, the forecasts of market growth included in this report should not be taken as indicative of our future growth.

Our future profitability is uncertain.

We have incurred losses since the beginning of our operations and we will continue to have losses in the future as we incur additional expenses to execute our business plan, fuel our potential growth and conduct further research and development. We expect to make significant expenditures to commercialize our product and further develop our business. We will have to begin to generate and sustain and increase revenues to achieve or maintain profitability. We may not generate sufficient revenues to achieve or maintain profitability in the future. We may incur significant losses in the future for a number of reasons, including those discussed in other risk factors and factors that we cannot foresee.

We will need additional financing to execute our business plan which we may not be able to secure on acceptable terms, or at all.

We currently rely on external financing to fund our operations. We expect capital outlays and operating expenditures to increase over the next few years as we expand our infrastructure, commercial operations, development activities and establish offices.

Our future funding requirements will depend on many factors, including but not limited to the following:

| ● | The cost of expanding our operations; |

| ● | The financial terms and timing of any collaborations, licensing or other arrangements into which we may enter; |

| ● | The rate of progress and cost of development activities; |

| ● | The need to respond to technological changes and increased competition; |

| ● | The costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; |

| ● | The cost and delays in product development that may result from changes in regulatory requirements applicable to our products; |

| ● | Sales and marketing efforts to bring our products to market; |

| ● | Unforeseen difficulties in establishing and maintaining an effective sales and distribution network; and |

| ● | Lack of demand for and market acceptance of our products and technologies. |

We may have difficulty obtaining additional funding and we cannot assure you that additional capital will be available to us when needed, if at all, or if available, will be obtained on terms acceptable to us. If we raise additional funds by issuing additional debt securities, such debt instruments may provide for rights, preferences or privileges senior to our equity securities. In addition, the terms of debt securities that we might issue could impose significant restrictions on our operations. If we raise additional funds through collaborations and licensing arrangements, we might be required to relinquish significant rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. If adequate funds are not available, we may have to delay, scale back, or eliminate some of our operations or our research development and commercialization activities. Under these circumstances, if our company is unable to acquire additional capital or is required to raise it on terms that are less satisfactory than desired, it may have a material adverse effect on its financial condition.

In order for us to compete and grow, we must attract, recruit, retain and develop the necessary personnel who have the needed experience.

Recruiting and retaining highly qualified personnel is critical to our success. These demands may require us to hire additional personnel and will require our existing management personnel to develop additional expertise. We face intense competition for personnel. The failure to attract and retain personnel or to develop such expertise could delay or halt the sales and licensing of our product. If we experience difficulties in hiring and retaining personnel in key positions, we could suffer from delays in our development, loss of customers and sales and diversion of management resources, which could adversely affect operating results. Our future consultants may be employed by third parties and may have commitments under consulting or advisory contracts with third parties that may limit their availability to us.

Our success depends on the services of our founder and Chief Executive Officer, the loss of whom could disrupt our business; although we rely on this individual, we do not have key man life insurance.

We depend to a large extent on the services of our founder and Chief Executive Officer, Jaeson Bang. Given his knowledge and experience, he is important to our future prospects and development as we rely on his expertise in developing our business strategies and maintaining our operations. Because we are a start-up dependent on the vision of our founder, it will be critical to our prospects and successful development that he remains with us to help establish, develop and grow our business. The loss of the service of Mr. Bang and the failure to find timely replacements with comparable experience and expertise could disrupt and adversely affect our business. Additionally, we have not purchased an insurance policy with respect to Mr. Bang in the event of his death or disability. Therefore, if Mr. Bang dies or becomes disabled, we will not receive any compensation to assist us with such person’s absence.

Our internal control over financial reporting may be ineffective.

We do not have the internal infrastructure necessary, and are not required, to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes-Oxley Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of our financial controls. We expect to incur additional expenses and diversion of management’s time when it becomes necessary to perform the system and process evaluation, testing and remediation required to comply with the management certification and auditor attestation requirements.

We rely on various intellectual property rights, including patents and trademarks in order to operate our business.

Such intellectual property rights, however, may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We may also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights.

As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

We will be subject to income taxes as well as non-income based taxes, such as payroll, sales, use, value-added, net worth, property and goods and services taxes in the U.S.

Significant judgment is required in determining our provision for income taxes and other tax liabilities. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although we believe that our tax estimates are reasonable: (i) there is no assurance that the final determination of tax audits or tax disputes will not be different from what is reflected in our income tax provisions, expense amounts for non-income based taxes and accruals and (ii) any material differences could have an adverse effect on our financial position and results of operations in the period or periods for which determination is made.

The development and commercialization of our insertable cardiac monitor is highly competitive.

We face competition in the cardiac monitors market. Our competitors may have significantly greater financial, technical and human resources than we have and superior expertise in research and development and thus may be better equipped than us to develop and commercialize cardiac monitoring technologies. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. Accordingly, our competitors may commercialize products more rapidly or effectively than we are able to, which would adversely affect our competitive position.

Industry consolidation may result in increased competition.

Some of our competitors have made or may make acquisitions or may enter into partnerships or other strategic relationships to offer more comprehensive services than they individually had offered or achieve greater economies of scale. In addition, new entrants not currently considered to be competitors may enter our market through acquisitions, partnerships or strategic relationships. We expect these trends to continue as companies attempt to strengthen or maintain their market positions. The potential entrants may have competitive advantages over us, such as greater name recognition, longer operating histories, more varied services and larger marketing budgets, as well as greater financial, technical and other resources. The companies resulting from combinations or that expand or vertically integrate their business to include the market that we address may create more compelling product offerings and may offer greater pricing flexibility than we can or may engage in business practices that make it more difficult for us to compete effectively, including on the basis of price, sales and marketing programs, technology or service functionality.

Successful development of our products is uncertain.

Our development of current and future product candidates is subject to the risks of failure and delay inherent in the development of new products and products based on new technologies, including:

| ● | delays in product development, clinical testing, or manufacturing; |

| ● | unplanned expenditures in product development, clinical testing, or manufacturing; |

| ● | failure to receive regulatory approvals; |

| ● | inability to manufacture on our own, or through any others, product candidates on a commercial scale; |

| ● | failure to achieve market acceptance; and |

| ● | emergence of superior or equivalent products. |

Because of these risks, our research and development efforts may not result in any commercially viable products. If a significant portion of these development efforts are not successfully completed, required regulatory approvals are not obtained, or any approved products are not commercially successfully, our business, financial condition, and results of operations may be materially harmed.

We could be adversely affected by health care reform legislation.

Third-party payers for medical products and services, including state, federal and foreign governments, are increasingly concerned about escalating health care costs and can indirectly affect the pricing or the relative attractiveness of our products by regulating the maximum amount of healthcare reimbursement they will provide for our products. Following years of increasing pressure, during 2010 the U.S. government enacted comprehensive health care reform with the enactment of the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, which made changes that significantly impact the pharmaceutical and medical device industries. The Protecting Access to Medicare Act of 2014 imposes additional limitations on Medicare reimbursement rates. These statutes may restrict Medicare reimbursement rates for our products, which may adversely affect our business, financial condition and results of operations. If healthcare reimbursement amounts for our products decrease further in the future, such decreases may reduce the amount that will be reimbursed to hospitals or physicians and consequently, could place constraints on the levels of overall pricing, which could have a material effect on our revenues.

The 2.3% medical device tax originally established as part of the U.S. health care reform legislation through December 31, 2015 is now repealed. We are unable to predict any future legislative changes or developments related to this excise tax or any other excise tax. Additional state and federal health care reform measures may be adopted in the future, any of which could have a material adverse effect on our ability to successfully commercialize our products and on our industry in general. For example, the United States government has in the past considered, is currently considering and may in the future consider, health care policies and proposals intended to curb rising health care costs, including those that could significantly affect both private and public reimbursement for health care services. Further, state and local governments are also considering or have adopted similar types of policies. Future significant changes in the health care system in the United States or elsewhere, and current uncertainty about whether and how changes may be implemented, could have a negative impact on the demand for our products. We are unable to predict whether health care policies, including policies stemming from legislation or regulations affecting our business, may be proposed or enacted in the future, what effect such policies would have on our business, or the effect that ongoing uncertainty about these matters will have on the purchasing decisions of our customers.

Changes to government health care programs that reduce payments under Medicare and Medicaid may negatively impact our revenues.

Previous legislative changes have resulted in, and future legislative changes may result in, limitations on and reduced levels of payment and healthcare reimbursement for a substantial portion of hospital procedures and costs. Current or future health care reform and deficit reduction efforts, changes in laws or regulations regarding government health care programs, other changes in the administration of government health care programs and changes to commercial third-party payers in response to health care reform and other changes to government health care programs could have a material, adverse effect on our financial position and results of operations.

If third-party payors do not provide adequate coverage and healthcare reimbursement for the use of our products, our revenues will be negatively impacted.

Our success in marketing our products depends in large part on whether U.S. and international government health administrative authorities, private health insurers and other organizations will adequately cover and reimburse customers for the cost of our products. In the United States, a third-party payor’s decision to provide coverage for our products does not imply that an adequate healthcare reimbursement rate will be obtained. Further, one third-party payor’s decision to cover our products does not assure that other payors will also provide coverage for the products or provide coverage at an adequate healthcare reimbursement rate. Healthcare reimbursement systems in international markets vary significantly by country and by region within some countries, and healthcare reimbursement approvals must be obtained on a country-by-country basis. In many international markets, a product must be approved for healthcare reimbursement before it can be approved for sale in that country. Further, many international markets have government-managed healthcare systems that control healthcare reimbursement for new devices and procedures. In most markets there are private insurance systems as well as government-managed systems. If sufficient coverage and healthcare reimbursement is not available for our current or future products, in either the United States or internationally, the demand for our products and our revenues will be adversely affected.

Privacy laws and regulations could restrict our ability or the ability of our customers to obtain, use or disseminate patient information, or could require us to incur significant additional costs to re-design our products.

State, federal and foreign laws, such as the federal Health Insurance Portability and Accountability Act of 1996 (HIPAA), regulate the confidentiality of sensitive personal information and the circumstances under which such information may be released. These and future laws could have an adverse impact on our results of operations. Other health information standards, such as regulations under HIPAA, establish standards regarding electronic health data transmissions and transaction code set rules for specified electronic transactions, for example transactions involving claims submissions to third party payors. These also continue to evolve and are often unclear and difficult to apply. In addition, under the federal Health Information Technology for Economic and Clinical Health Act (HITECH Act), which was passed in 2009, many businesses that were previously only indirectly subject to federal HIPAA privacy and security rules became directly subject to such rules because the businesses serve as “business associates” to our customers. On January 17, 2013, the Office for Civil Rights of the Department of Health and Human Services released a final rule implementing the HITECH Act and making certain other changes to HIPAA privacy and security requirements. Compliance may increase the requirements applicable to our business. Failure to maintain the confidentiality of sensitive personal information in accordance with the applicable regulatory requirements, or to abide by electronic health data transmission standards, could expose us to breach of contract claims, fines and penalties, costs for remediation and harm to our reputation.

The healthcare industry is highly regulated.

We are subject to regulation in the U.S. at both the federal and state levels. In addition, the U.S. federal and state governments have allocated greater resources to the enforcement of these laws. If we fail to comply with these regulatory requirements, or if allegations are made that we failed to comply, our results of operations and financial condition could be adversely affected.

Products that we will manufacture, source, distribute or market are required to comply with regulatory requirements.

To lawfully operate our business, we are required to hold permits, licenses and other regulatory approvals from, and to comply with operating and security standards of, governmental bodies. Failure to maintain or renew necessary permits, licenses or approvals, or noncompliance or concerns over noncompliance may result in suspension of our ability to distribute or manufacture products, product recalls or seizures, or criminal and civil sanctions and could have an adverse effect on our results of operations and financial condition.

The manufacture, distribution, marketing and use of our products are subject to extensive regulation and increased scrutiny by the Food and Drug Administration (FDA) and other regulatory authorities.

Any new product must undergo lengthy and rigorous testing and other extensive, costly and time-consuming procedures mandated by the FDA and foreign regulatory authorities. Changes to current products may be subject to vigorous review, including additional 510(k) and other regulatory submissions, and approvals are not certain. Once we start manufacturing, failure to comply with the requirements of the FDA or other regulatory authorities, including a failed inspection or a failure in our adverse event reporting system, could result in adverse inspection reports, warning letters, product recalls or seizures, monetary sanctions, injunctions to halt the manufacture and distribution of products, civil or criminal sanctions, refusal of a government to grant approvals or licenses, restrictions on operations or withdrawal of existing approvals and licenses. Any of these actions could cause a loss of customer confidence in us and our products, which could adversely affect our sales and results of operations.

The sales, marketing and pricing of products and relationships that pharmaceutical and medical device companies have with healthcare providers are under increased scrutiny by federal and state government agencies.

Compliance with the Anti-Kickback Statute, False Claims Act, Food, Drug and Cosmetic Act (including as these laws relate to off-label promotion of products) and other healthcare related laws, as well as competition, data and patient privacy and export and import laws is under increased focus by the agencies charged with overseeing such activities, including FDA, Office of Inspector General (OIG), Department of Justice (DOJ) and the Federal Trade Commission. The DOJ and the Securities and Exchange Commission have also increased their focus on the enforcement of the U.S. Foreign Corrupt Practices Act (FCPA), particularly as it relates to the conduct of pharmaceutical companies, which may adversely impact our future global expansions.

Federal and state laws pertaining to healthcare fraud and abuse could adversely affect our business.

We are subject to various federal and state laws targeting fraud and abuse in the healthcare industry, including anti-kickback laws, false claims laws, laws constraining the sales, marketing and other promotional activities of manufacturers of medical devices by limiting the kinds of financial arrangements we may enter into with physicians, hospitals, laboratories and other potential purchasers of medical devices, laws requiring the reporting of certain transactions between us and healthcare professionals and HIPAA, as amended by HITECH, which governs the conduct of certain electronic healthcare transactions and protects security and privacy of protected health information. Violations of these laws are punishable by criminal or civil sanctions, including substantial fines, imprisonment and exclusion from participation in government healthcare programs such as Medicare and Medicaid. Many of the existing requirements are new and have not been definitively interpreted by state authorities or courts, and available guidance is limited. Unless and until we are in full compliance with these laws, we could face enforcement action and fines and other penalties, and could receive adverse publicity, all of which could materially harm our business. In addition, changes in or evolving interpretations of these laws, regulations, or administrative or judicial interpretations, may require us to change our business practices or subject our business practices to legal challenges, which could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to educate physicians on the safe and effective use of our products, we may be unable to achieve our expected growth.