U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANY

Investment Company Act File Number 811-23447

A3 ALTERNATIVE INCOME FUND

(Exact name of registrant as specified in charter)

90 Madison Street, Suite 303

Denver, Colorado 80206

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (303) 997-9010

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

(Name and address of agent for service)

Date of fiscal year end: September 30

Date of reporting period: March 31, 2022

Item 1. Report to Shareholders

(a)

A3 ALTERNATIVE INCOME FUND

(formerly A3 ALTERNATIVE CREDIT FUND)

AAACX

Semi-Annual Report

(Unaudited)

For the Six Months Ended March 31, 2022

A3 Alternative Income Fund, (AAACX)

Table of Contents

For the Period Ended March 31, 2022 (Unaudited)

| | |

Portfolio Manager Commentary | 2 |

Schedule of Investments | 4 |

Statement of Assets and Liabilities | 8 |

Statement of Operations | 9 |

Statements of Changes in Net Assets | 10 |

Statement of Cash Flows | 11 |

Financial Highlights | 12 |

Notes to Financial Statements | 13 |

Other Information | 24 |

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees and expenses, experience of its management and other information.

www.a3.financial

1

A3 Alternative Income Fund, (AAACX)

Portfolio Manager Commentary

As of March 31, 2022 (Unaudited)

Performance

A3 Alternative Income Fund (the “Fund”) had a net return of -11.93% for the first quarter of 2022. For the period ended March 31, 2022, the Fund had a 6-month total return of -14.57% and a 12-month total return of -17.22%. Since inception on October 1, 2019, the Fund has a total return of -10.31%. By comparison, the benchmark Bloomberg Global Fixed Income Aggregate Index for the period ended March 31, 2022, had a return of -6.16% for the first quarter, a 6-month total return of -6.79%, and a 12 month return of -6.40%.

The Fund had a current 30-day yield SEC yield of 5.49% (subsidized) and 1.30% (unsubsidized) as of the end of the first quarter of 2022. The Advisor continues to subsidize the Fund for reimbursement of certain operational expenses.

Past Performance is not indicative of future results. *

Market Environment

Inflation and the inevitable increases in interest rates have been the headlines driving the fixed income and credit markets over this period. During the quarter, the yield on 10-year U.S. Treasury bonds increased from 1.52% to 2.32%, resulting in double digit declines in many bond values. This has had a damaging impact to the public fixed income markets resulting in significant declines in both equity and bond returns. Volatility was high across almost all asset classes during the 1st quarter of 2022.

The Federal Reserve has finally realized that the inflation consumers are experiencing is not transitory and it needs to take action. Consumers faced rising gasoline prices, along with increases in the prices of almost everything else due to increasing commodity prices and constrained supply chains. The Federal Reserve reacted by increasing interest rates by 0.25% in March 2022 and 0.50% in May 2022 and has signaled more significant increases during 2022. While the markets continue to place much faith in the Federal Reserve and its ability to raise interest rates to combat inflation without putting the economy in a recession, we have seen the Fed make mistakes previously.

For years, investors have become accustomed to low interest rates which have supported asset values and changed investor behavior. We anticipate there will be significant impacts to many investments as global central banks begin to raise interest rates to combat inflation. We have already seen it in the technology industry as the stocks of many technology companies are down more than 40% from their highs. As interest rates increase further and investors start to view Treasury yields as a viable alternative, we expect to see more pain in investments that were dependent on a low interest rate environment.

We remain cautious in the current environment and are focused on managing risk.

Portfolio Review

We wrote in our annual letter that we were proceeding cautiously with our capital allocations. The combination of inflation, interest rate increases and tightening of monetary conditions by central banks, spiking commodity prices, supply chain issues, pandemic-induced lockdowns in China and the Russian-Ukrainian conflict, have only reinforced our level of caution and we do not believe this is the time to take undue risk. This has led us to invest in lower duration private credit opportunities and maintain a higher-than-normal cash level to be able to invest opportunistically.

Our largest position, excluding cash, continues to be in U.S. Government Agency securities, specifically reverse mortgage securities. We partially reduced our exposure during the 1st quarter of 2022. The reverse mortgage holdings were a significant drag on performance over the past 12 months and underperformed our expectations.

The value of these holdings is largely driven by prepayments; that is, if a reverse mortgage customer takes an opportunity to refinance the reverse mortgage, that is corrosive to the value of our securities. Prepayments remained high in reverse mortgage securities, driven by high home prices and increasing limits for reverse mortgage originations. We believe increases in home mortgage rates may decrease prepayments in future months and provide some support for the value of the reverse mortgage interest-only strips in the Fund’s portfolio. Currently, 30-year mortgage rates are over 5.5%. While still low from a historical standpoint, we believe higher mortgage rates will be a factor in tempering housing price appreciation going forward.

We have considered several new private credit positions during the last several months, and deployed some capital during the quarter. The investments considered are 15 months or shorter in maturity and provide both insulation from public market volatility and offer an attractive yield. Our investment team has spent many months researching and analyzing the credit risks of these offerings and believe these to be very compelling in these turbulent times; we will continue researching and committing capital into new private credit opportunities in the months ahead.

2

A3 Alternative Income Fund, (AAACX)

Portfolio Manager Commentary

As of March 31, 2022 (Unaudited) (continued)

Our cash position increased during the quarter, as we reduced holdings of reverse mortgage securities and held off reinvestment of those funds. While this was a favorable decision during this quarter, given the decline in equity and bond markets, we will look for opportunities to deploy capital.

Our publicly traded securities in the portfolio generally followed the market; said differently, it was a difficult quarter for our positions. We opportunistically added preferred stock during the quarter at yields that we felt were attractive.

* | The Adviser and the Fund have entered into an operating expenses limitation agreement (the “Expense Limitation Agreement”) through at least January 21, 2023. Without a waiver, returns would have been lower, and any rankings / ratings might have been less favorable. |

The performance shown is net of all fees (including a monthly advisory fee of 1.50% per annum) and expenses and reflects the reinvestment of dividends and investment income. Depending on an investor’s investment date, holding period and other factors, an investor may have an overall performance that underperforms or outperforms the data shown. Returns greater than one year are annualized. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shared, when redeemed, may be worth more or less than their original cost.

3

A3 Alternative Income Fund, (AAACX)

Schedule of Investments

As of March 31, 2022 (Unaudited)

| | Number

of Shares | | | | Value | |

| | | | | BUSINESS DEVELOPMENT COMPANIES — 22.3% | | | | |

| | | 30,100 | | Ares Capital Corp. | | $ | 630,595 | |

| | | 41,000 | | Owl Rock Capital Corp. | | | 605,980 | |

| | | 73,470 | | PennantPark Investment Corp. | | | 571,597 | |

| | | | | TOTAL BUSINESS DEVELOPMENT COMPANIES | | | | |

| | | | | (Cost $1,676,071) | | | 1,808,172 | |

| | | | | | | | | |

| | | | | CLOSED-END FUNDS — 4.9% | | | | |

| | | 29,882 | | Eagle Point Credit Co., Inc. | | | 392,948 | |

| | | 3 | | OFS Credit Co., Inc. | | | 37 | |

| | | | | TOTAL CLOSED-END FUNDS | | | | |

| | | | | (Cost $415,171) | | | 392,985 | |

| | | | | | | | | |

| | | | | EXCHANGE-TRADED FUNDS — 3.5% | | | | |

| | | 7,300 | | Alerian MLP ETF | | | 279,590 | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS | | | | |

| | | | | (Cost $239,535) | | | 279,590 | |

| | | | | | | | | |

| | | | | PREFERRED STOCKS — 4.2% | | | | |

| | | | | FINANCIAL — 4.2% | | | | |

| | | 10,100 | | Oxford Lane Capital Corp. 6.250%, 2/28/2027 (Callable 2/28/2023)1 | | | 249,975 | |

| | | 4,000 | | U.S. Bancorp 4.500% (Callable 4/15/2027)1,2 | | | 90,240 | |

| | | | | | | | 340,215 | |

| | | | | TOTAL PREFERRED STOCKS | | | | |

| | | | | (Cost $334,204) | | | 340,215 | |

| | | | | | | | | |

| | Principal

Amount | | | | | | |

| | | | | Promissory Notes — 0.5% | | | | |

| | $ | 42,508 | | DSC Trading, LLC 11.00%, 7/31/20233,4,5,6 | | | 42,508 | |

| | | | | TOTAL Promissory Notes | | | | |

| | | | | (Cost $42,508) | | | 42,508 | |

| | | | | | | | | |

| | Number

of Shares | | | | | | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 6.2% | | | | |

| | | 16,400 | | Ares Commercial Real Estate Corp. | | | 254,528 | |

| | | 16,700 | | Ready Capital Corp. | | | 251,502 | |

| | | | | TOTAL REAL ESTATE INVESTMENT TRUSTS | | | | |

| | | | | (Cost $494,532) | | | 506,030 | |

See accompanying Notes to Financial Statements.

4

A3 Alternative Income Fund, (AAACX)

Schedule of Investments

As of March 31, 2022 (Unaudited) (continued)

| | Principal

Amount | | | | Value | |

| | | | | U.S. GOVERNMENT AND AGENCIES — 22.3% | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 22.3% | | | | |

| | | | | Government National Mortgage Association | | | | |

| | $ | 1,307,677 | | 1.901%, 11/20/2067 (Callable 9/20/2031)1,6,7 | | $ | 75,994 | |

| | | 1,238,315 | | 2.186%, 1/20/2068 (Callable 6/20/2031)1,6,7 | | | 98,753 | |

| | | 479,821 | | 2.142%, 10/20/2067 (Callable 5/20/2030)1,6,7 | | | 43,690 | |

| | | 2,220,752 | | 0.786%, 9/20/2069 1,6,7,8 | | | 113,036 | |

| | | 2,408,798 | | 0.724%, 7/20/2069 1,6,7,8 | | | 86,671 | |

| | | 1,037,344 | | 2.130%, 10/20/2066 (Callable 5/20/2030)1,6,7 | | | 69,295 | |

| | | 763,780 | | 2.223%, 4/20/2066 (Callable 11/20/2028)1,6,7 | | | 46,319 | |

| | | 1,240,691 | | 1.157%, 8/20/2063 (Callable 7/20/2029)1,6,7 | | | 31,671 | |

| | | 649,965 | | 1.734%, 4/20/2065 (Callable 9/20/2032)1,6,7 | | | 29,838 | |

| | | 518,216 | | 2.110%, 1/20/2067 (Callable 7/20/2032)1,6,7 | | | 29,492 | |

| | | 1,394,233 | | 1.850%, 10/20/2066 (Callable 7/20/2033)1,6,7 | | | 69,562 | |

| | | 378,549 | | 1.866%, 7/20/2065 (Callable 8/20/2033)1,6,7 | | | 32,290 | |

| | | 864,750 | | 1.905%, 9/20/2065 (Callable 2/20/2031)1,6,7 | | | 51,626 | |

| | | 645,680 | | 1.612%, 9/20/2065 (Callable 4/20/2033)1,6,7 | | | 31,500 | |

| | | 952,106 | | 1.833%, 4/20/2067 (Callable 5/20/2032)1,6,7 | | | 42,430 | |

| | | 1,473,210 | | 1.867%, 8/20/2067 (Callable 6/20/2031)1,6,7 | | | 69,783 | |

| | | 1,405,746 | | 1.470%, 5/20/2064 (Callable 7/20/2032)1,6,7 | | | 72,203 | |

| | | 945,499 | | 2.199%, 6/20/2066 (Callable 7/20/2031)1,6,7 | | | 58,481 | |

| | | 1,893,040 | | 2.421%, 2/20/2068 (Callable 5/20/2034)1,6,7 | | | 118,328 | |

| | | 425,384 | | 1.758%, 10/20/2062 (Callable 11/20/2031)1,6,7 | | | 17,600 | |

| | | 624,071 | | 2.210%, 8/20/2067 (Callable 12/20/2032)1,6,7 | | | 43,655 | |

| | | 1,183,365 | | 1.530%, 10/20/2064 (Callable 8/20/2034)1,6,7 | | | 51,219 | |

| | | 2,431,387 | | 1.087%, 6/20/2069 (Callable 3/20/2033)1,6,7 | | | 114,032 | |

| | | 2,326,421 | | 1.655%, 5/20/2063 (Callable 8/20/2030)1,6,7 | | | 93,444 | |

| | | 1,467,565 | | 1.310%, 6/20/2063 (Callable 8/20/2030)1,6,7 | | | 62,130 | |

| | | 1,495,807 | | 1.641%, 9/20/2066 (Callable 10/20/2032)1,6,7 | | | 66,718 | |

| | | 1,751,282 | | 0.891%, 11/20/2069 1,6,7,8 | | | 59,119 | |

| | | 1,388,787 | | 2.194%, 10/20/2067 (Callable 10/20/2031)1,6,7 | | | 105,354 | |

| | | 660,969 | | 1.707%, 3/20/2068 (Callable 2/20/2036)1,6,7 | | | 24,840 | |

| | | | | | | | 1,809,073 | |

| | | | | TOTAL U.S. GOVERNMENT AND AGENCIES | | | | |

| | | | | (Cost $3,012,298) | | | 1,809,073 | |

| | | | | | | | | |

See accompanying Notes to Financial Statements.

5

A3 Alternative Income Fund, (AAACX)

Schedule of Investments

As of March 31, 2022 (Unaudited) (continued)

| | Number

of Shares | | | | Value | |

| | | | | SHORT-TERM INVESTMENTS — 34.2% | | | | |

| | | 2,778,383 | | Fidelity Investments Money Market Government Portfolio - Institutional Class, 0.12%9 | | $ | 2,778,383 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $2,778,383) | | | 2,778,383 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 98.1% | | | | |

| | | | | (Cost $8,992,702) | | | 7,956,956 | |

| | | | | Other Assets In Excess Of Liabilities — 1.9% | | | 157,407 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 8,114,363 | |

ETF – Exchange-Traded Fund

LLC – Limited Liability Company

2 | Perpetual security. Date shown is next call date. |

3 | Level 3 securities fair valued under procedures established by the Board of Trustees. The total value of these securities is $42,508, which represents 0.5% of total net assets of the Fund. |

4 | The maturity date listed is an estimate of the anticipated timing of full repayment. |

5 | Restricted security. The total value of these securities is $42,508, which represents 0.5% of total net assets of the Fund. |

6 | Variable rate security. Rate shown is the rate in effect as of period end. |

8 | Call date not available. |

9 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

6

A3 Alternative Income Fund, (AAACX)

Summary of Investments

As of March 31, 2022 (Unaudited)

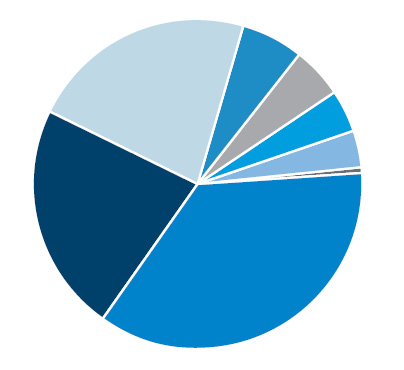

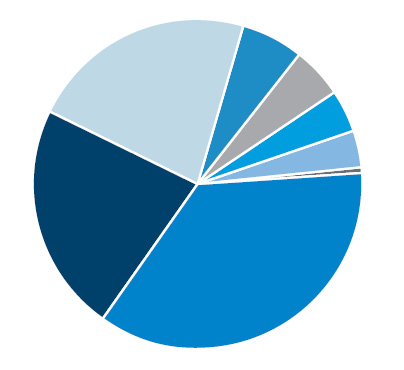

| | Security Type/Sector | Percent of Total

Net Assets |

| Cash and Other Assets and Liabilities | 36.1% |

| U.S. Government and Agencies | 22.3% |

| Business Development Companies | 22.3% |

| Real Estate Investment Trusts | 6.2% |

| Closed-End Funds | 4.9% |

| Preferred Stocks | 4.2% |

| Exchange-Traded Funds | 3.5% |

| Promissory Notes | 0.5% |

| | Total Net Assets | 100.0% |

| | | |

See accompanying Notes to Financial Statements.

7

A3 Alternative Income Fund, (AAACX)

Statement of Assets and Liabilities

As of March 31, 2022 (Unaudited)

Assets: | | | | |

Investments, at value (cost $8,992,702) | | $ | 7,956,956 | |

Cash | | | 414,550 | |

Cash deposited with broker for futures contracts | | | 284 | |

Receivables: | | | | |

Dividends and interest | | | 84,576 | |

Due from Adviser | | | 18,234 | |

Prepaid expenses | | | 22,321 | |

Total assets | | | 8,496,921 | |

| | | | | |

Liabilities: | | | | |

Payables: | | | | |

Fund shares redeemed | | | 334,160 | |

Audit and tax fees | | | 13,922 | |

Fund administration fees | | | 7,689 | |

Trustees’ fees and expenses | | | 3,564 | |

Fund accounting fees | | | 3,297 | |

Chief Compliance Officer fees | | | 2,500 | |

Custody fees | | | 1,146 | |

Transfer agent fees and expenses | | | 293 | |

Accrued other expenses | | | 15,987 | |

Total liabilities | | | 382,558 | |

| | | | | |

Net Assets | | $ | 8,114,363 | |

| | | | | |

Components of Net Assets: | | | | |

Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | | $ | 11,517,503 | |

Total accumulated deficit | | | (3,403,140 | ) |

Net Assets | | $ | 8,114,363 | |

| | | | | |

Shares of beneficial interest issued and outstanding | | | 1,111,305 | |

Net asset value, offering, and redemption price per share | | $ | 7.30 | |

See accompanying Notes to Financial Statements.

8

A3 Alternative Income Fund, (AAACX)

Statement of Operations

For the Six Months Ended March 31, 2022 (Unaudited)

Investment income: | | | | |

Dividends | | $ | 127,375 | |

Interest | | | 237,278 | |

Total investment income | | | 364,653 | |

| | | | | |

Expenses: | | | | |

Advisory fees | | | 73,249 | |

Transfer agent fees and expenses | | | 36,823 | |

Chief Compliance Officer fees | | | 27,551 | |

Fund administration fees | | | 23,589 | |

Legal fees | | | 23,469 | |

Audit and tax fees | | | 15,202 | |

Registration fees | | | 15,092 | |

Fund accounting fees | | | 10,081 | |

Custody fees | | | 8,796 | |

Insurance fees | | | 8,269 | |

Trustees’ fees and expenses | | | 7,355 | |

Shareholder reporting fees | | | 5,980 | |

Miscellaneous fees | | | 3,149 | |

Total expenses | | | 266,021 | |

Advisory fees waived and other expenses absorbed | | | (170,797 | ) |

Net expenses | | | 95,224 | |

Net investment income | | | 269,429 | |

| | | | | |

Realized and Unrealized Gain (Loss): | | | | |

Net realized loss on: | | | | |

Investments | | | (2,347,856 | ) |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | 601,394 | |

Net realized and unrealized loss | | | (1,746,462 | ) |

| | | | | |

Net Decrease in Net Assets from Operations | | $ | (1,477,033 | ) |

See accompanying Notes to Financial Statements.

9

A3 Alternative Income Fund, (AAACX)

Statements of Changes in Net Assets

| | For the

Six Months

Ended

March 31,

2022

(Unaudited) | | | For the

Year Ended

September 30,

2021 | |

Increase (Decrease) in Net Assets from: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 269,429 | | | $ | 563,928 | |

Net realized gain (loss) on investments and future contracts | | | (2,347,856 | ) | | | 1,066,137 | |

Net change in unrealized appreciation/depreciation on investments | | | 601,394 | | | | (2,026,801 | ) |

Net decrease in net assets resulting from operations | | | (1,477,033 | ) | | | (396,736 | ) |

| | | | | | | | | |

Distributions to shareholders: | | | | | | | | |

Total distributions to shareholders | | | (970,011 | ) | | | (567,136 | ) |

| | | | | | | | | |

Capital Transactions: | | | | | | | | |

Net proceeds from shares sold | | | 63,746 | | | | 1,574,842 | |

Reinvestment of distributions | | | 445,646 | | | | 432,852 | |

Cost of shares redeemed | | | (893,197 | ) | | | (640,604 | ) |

Net increase (decrease) in net assets from capital transactions | | | (383,805 | ) | | | 1,367,090 | |

| | | | | | | | | |

Total increase (decrease) in net assets | | | (2,830,849 | ) | | | 403,218 | |

| | | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of period | | | 10,945,212 | | | | 10,541,994 | |

End of period | | $ | 8,114,363 | | | $ | 10,945,212 | |

| | | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Shares sold | | | 8,339 | | | | 155,275 | |

Shares reinvested | | | 54,518 | | | | 44,285 | |

Shares redeemed | | | (112,063 | ) | | | (67,041 | ) |

Net increase (decrease) in capital share transactions | | | (49,206 | ) | | | 132,519 | |

See accompanying Notes to Financial Statements.

10

A3 Alternative Income Fund, (AAACX)

Statement of Cash Flows

For the Six Months Ended March 31, 2022 (Unaudited)

Cash flows provided by (used in) operating activities: | | | | |

Net decrease in net assets from operations | | $ | (1,477,033 | ) |

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: | | | | |

Purchases of investments | | | (677,580 | ) |

Sales of investments | | | 1,952,039 | |

Net amortization on investments | | | 343,881 | |

Net realized loss on investments | | | 2,347,856 | |

Return of capital dividends received | | | 20,621 | |

Net change in unrealized appreciation/depreciation on investments | | | (601,394 | ) |

Change in short-term investments, net | | | (40,005 | ) |

(Increase)/Decrease in assets: | | | | |

Dividends and interest | | | 87,110 | |

Due from Adviser | | | 76,015 | |

Prepaid expenses | | | 1,244 | |

Increase/(Decrease) in liabilities: | | | | |

Audit and tax fees | | | (15,578 | ) |

Custody fees | | | 216 | |

Transfer agent fees and expenses | | | (4,107 | ) |

Fund administration fees | | | 80 | |

Chief Compliance Officer fees | | | (1,616 | ) |

Trustees’ fees and expenses | | | (145 | ) |

Fund accounting fees | | | 23 | |

Tax expense | | | (66,033 | ) |

Other accrued expenses | | | (13,337 | ) |

Net cash provided by operating activities | | | 1,932,257 | |

| | | | | |

Cash flows provided by (used in) financing activities: | | | | |

Proceeds from shares sold, net of receivable for fund shares sold | | | 63,746 | |

Cost of shares repurchased | | | (1,054,112 | ) |

Distributions paid to shareholders, net of reinvestments | | | (524,365 | ) |

Net cash (used in) financing activities | | | (1,514,731 | ) |

| | | | | |

Net Increase in Cash and Restricted Cash | | | 417,526 | |

| | | | | |

Cash and Restricted Cash: | | | | |

Cash, beginning of period | | | (2,692 | ) |

End of period1 | | $ | 414,834 | |

Non-cash financing activities not included herein consist of $445,646 of reinvested dividends.

1 | Cash and restricted cash include cash segregated at custodian for futures contracts, cash deposited with broker and cash due to custodian, as outlined further on the Statement of Assets and Liabilities. |

See accompanying Notes to Financial Statements.

11

A3 Alternative Income Fund, (AAACX)

Financial Highlights

Per share operating performance.

For a capital share outstanding throughout each period.

| | | For the Six

Months Ended

March 31, 2022 | | | For the Year Ended

September 30, | |

| | | (Unaudited) | | | 2021 | | | 2020* | |

Net asset value, beginning of period | | $ | 9.43 | | | $ | 10.25 | | | $ | 10.00 | |

Income from Investment Operations: | | | | | | | | | | | | |

Net investment income1 | | | 0.23 | | | | 0.49 | | | | 0.68 | |

Net realized and unrealized gain (loss) | | | (1.52 | ) | | | (0.81 | ) | | | 0.16 | |

Total from investment operations | | | (1.29 | ) | | | (0.32 | ) | | | 0.84 | |

| | | | | | | | | | | | | |

Less Distributions: | | | | | | | | | | | | |

From net investment income | | | (0.28 | ) | | | (0.50 | ) | | | (0.59 | ) |

From net realized gain | | | (0.56 | ) | | | — | | | | — | |

Total distributions | | | (0.84 | ) | | | (0.50 | ) | | | (0.59 | ) |

| | | | | | | | | | | | | |

Net asset value, end of period | | $ | 7.30 | | | $ | 9.43 | | | $ | 10.25 | |

| | | | | | | | | | | | | |

Total return2 | | | (14.57 | )%3 | | | (3.25 | )%4 | | | 8.52 | % |

| | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 8,114 | | | $ | 10,945 | | | $ | 10,542 | |

| | | | | | | | | | | | | |

Ratio of expenses to average net assets (including brokerage fees): | | | | | | | | | | | | |

Before fees waived | | | 5.45 | %5 | | | 5.66 | %6,7 | | | 7.99 | %6 |

After fees waived | | | 1.95 | %5 | | | 1.95 | %6 | | | 1.95 | %6 |

Ratio of net investment income to average net assets (including brokerage fees): | | | | | | | | | | | | |

Before fees waived | | | 2.02 | %5 | | | 1.24 | %8 | | | 0.53 | % |

After fees waived | | | 5.52 | %5 | | | 4.95 | % | | | 6.57 | % |

| | | | | | | | | | | | | |

Portfolio turnover rate | | | 10 | %3 | | | 132 | % | | | 89 | % |

* | The Fund was organized with 10,000 shares of beneficial interest on August 29, 2019 for $100,000, which represents the seed investment made by the Principals of the Adviser. The Fund commenced operations on October 1, 2019. |

1 | Based on average shares outstanding for the period. |

2 | Total returns would have been lower had expenses not been waived by the investment advisor. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares. |

4 | 0.62% of the Fund’s total return consists of a voluntary reimbursement by the adviser for tax expense. Excluding this item, total return would have been (3.87)%. |

6 | Ratio of brokerage fees to average net assets was less than 0.005%. |

7 | Includes tax expense. If this expense was excluded, the ratio of expenses to average net assets before fees waived would have been 5.09%. |

8 | Includes tax expense. If this expense was excluded, the ratio of net investment income to average net assets before fees waived would have been 1.82%. |

See accompanying Notes to Financial Statements.

12

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited)

1. Organization

The A3 Alternative Income Fund (the “Fund”), formerly known as the A3 Alternative Credit Fund, is a continuously offered, non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and organized as a Delaware statutory trust on May 9, 2019. The Fund operates as an interval fund. A3 Financial Investments, LLC serves as the investment adviser (the “Adviser”) of the Fund. The Fund’s investment objective is to seek total return through investments that offer regular income or the potential for price and capital appreciation. The Fund commenced operations on October 1, 2019.

The Fund expects to invest primarily in income-generating assets and will seek the best available risk-adjusted opportunities in fixed income that offer the potential for both stable, regular cash flows and price appreciation.

2. Significant Accounting Policies

Basis of Preparation and Use of Estimates

The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies and Accounting Standards Update 2013-08. The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Investment Transactions and Related Investment Income

Investment transactions are accounted for on a trade-date basis. However, for daily net asset value (“NAV”) determination, portfolio securities transactions are reflected no later than in the first calculation on the first business day following trade date. Interest income is recognized on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount using the effective interest method.

Realized gains and losses on investment transactions are determined using cost calculated on a specific identification basis. Paydown gains and losses are recorded as an adjustment to interest income in the Statement of Operations. Dividends are recorded on the ex-dividend date. Distributions from private investments that represent returns of capital in excess of cumulative profits and losses are credited to investment cost rather than investment income.

Federal Income Taxes

The Fund intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. As so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required. Management of the Fund is required to determine whether a tax position taken by the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. Based on its analysis, there were no tax positions identified by management of the Fund that did not meet the “more likely than not” standard as of March 31, 2022.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. As of March 31, 2022, the Fund did not have any interest or penalties associated with the underpayment of any income taxes.

Distributions to Shareholders

Distributions are paid at least quarterly on the Fund’s shares of beneficial interest (“Shares”) in amounts representing substantially all of the Fund’s net investment income, if any, earned each year. The Fund determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses (including capital loss carryover); however, it may distribute any excess annually to its shareholders. Distributions to shareholders are recorded on ex-date.

13

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

The exact amount of distributable income for each fiscal year can only be determined at the end of the Fund’s fiscal year. Under Section 19 of the Investment Company Act, the Fund is required to indicate the sources of certain distributions to shareholders. The estimated distribution composition may vary from quarter to quarter because it may be materially impacted by future income, expenses and realized gains and losses on securities and fluctuations in the value of the currencies in which Fund assets are denominated.

Reverse Mortgages

The Fund may invest in securities that reflect an interest in reverse mortgages, including Collateralized Mortgage Obligations (“CMOs”). Investments of this type may be accrual in nature and may be insured by the Government National Mortgage Association. In a reverse mortgage, a lender makes a loan to a homeowner based on the homeowner’s equity in his or her home. While a homeowner must be age 62 or older to qualify for a reverse mortgage, reverse mortgages may have no income restrictions. Repayment of the interest or principal for the loan is generally not required until the homeowner dies, sells the home, or ceases to use the home as his or her primary residence. Reverse mortgages are subject to different risks than traditional mortgages because the repayment for the loans is uncertain and may occur sooner or later than anticipated based on the life-span of the homeowner.

CMOs are typically privately offered and sold, which means that less information about the security may be available as compared to publicly offered securities or exchange listed securities and only certain institutions may buy and sell them. As a result, investments in CMOs may be characterized by the Fund as illiquid securities. The Fund invested in CMOs during the six months ended March 31, 2022.

Collateralized Loan Obligations and Collateralized Debt Obligations

The Fund may invest in or gain exposure to Collateralized Loan Obligations (“CLOs”) and Collateralized Debt Obligations (“CDOs”). CLOs and CDOs are created by the grouping of certain private loans and other lender assets/collateral into pools. A sponsoring organization establishes a special purpose vehicle to hold the assets/collateral and issue securities. Interests in these pools are sold as individual securities. Payments of principal and interest are passed through to investors and are typically supported by some form of credit enhancement, such as a letter of credit, surety bond, limited guaranty, or senior/subordination. Payments from the asset pools may be divided into several different tranches of debt securities, offering investors various maturity and credit risk characteristics. Some tranches entitled to receive regular installments of principal and interest, other tranches entitled to receive regular installments of interest, with principal payable at maturity or upon specified call dates, and other tranches only entitled to receive payments of principal and accrued interest at maturity or upon specified call dates. Different tranches of securities will bear different interest rates, which may be fixed or floating.

CLOs and CDOs are typically privately offered and sold, and thus, are not registered under the securities laws, which means less information about the security may be available as compared to publicly offered securities and only certain institutions may buy and sell them. As a result, investments in CLOs and CDOs may be characterized by the Fund as illiquid securities. An active dealer market may exist for CLOs and CDOs that can be resold in Rule 144A transactions, but there can be no assurance that such a market will exist or will be active enough for the Fund to sell such securities. The Fund invested in CLOs and CDOs via dedicated strategy closed end funds during the six months ended March 31, 2022.

Syndicated Participations

The Fund may invest in syndicated participations, which are typically loans or advances to corporate entities originated by one or more lenders, and then traded in the secondary market. The primary risk of a syndicated participations is the creditworthiness of the corporate borrower. The market for syndicated participations may not be highly liquid and the Fund may have difficulty selling them. These investments primarily expose the Fund to the credit risk of the underlying borrower, but they also expose the Fund to certain risks associated with the loan agent. Syndicated participations settle on a delayed basis, potentially leading to the sale proceeds of such participation not being available to meet redemptions for a substantial period of time after the sale of the investment. Certain syndicated participations may not be considered “securities,” and purchasers, such as the Fund, therefore may not be entitled to rely on the protections of federal securities laws, including anti-fraud provisions. The Fund invested in syndicated participations during the six months ended March 31, 2022.

14

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

Valuation of Investments

The Fund’s Valuation Committee (“Valuation Committee”) oversees the valuation of the Fund’s investments on behalf of the Fund. The Board of Trustees of the Fund (the “Board”) has approved the valuation policies and procedures for the Fund (the “Valuation Procedures”). Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded on a day the Fund will calculate its net asset value as of the close of business on each day that the New York Stock Exchange is open for business and at such other times as the Board shall determine (each a “Determination Date” or at approximately 4:00 pm U.S. Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the Determination Date, the mean between the closing bid and asked prices and if no asked price is available, at the bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price (which is the last trade price at or before 4:00:02 p.m. U.S. Eastern Time adjusted up to NASDAQ’s best offer price if the last trade price is below such bid and down to NASDAQ’s best offer price if the last trade is above such offer price) will be used.

Fixed income securities with a remaining maturity of 60 days or more for which accurate market quotations are readily available will normally be valued according to dealer supplied mean quotations or mean quotations from a recognized pricing service. The independent pricing agents may employ methodologies that utilize actual market transactions (if the security is actively traded), broker-dealer supplied valuations, or matrix pricing. Matrix pricing determines a security’s value by taking into account such factors as security prices, yields, maturities, call features, ratings and developments relating to comparable securities. Debt obligations with remaining maturities of sixty days or less when originally acquired will be valued at their amortized cost, which approximates fair market value.

CMOs are not traded on a national securities exchange and instead may be valued utilizing a market approach. The market approach is a method of determining the valuation of a security based on the selling pricing of similar securities. The types of factors that may be taken into account in pricing CMOs, such as reverse mortgages, include: the yield and spread of similar CMOs where pricing is available in the market; the riskiness and characteristics of the underlying pool of loans; features of the CMO, including weighted average life, investment size and weighted average spread of the underlying loans.

CLOs are not traded on a national securities exchange and instead are valued utilizing a market approach. The market approach is a method of determining the valuation of a security based on the selling price of similar securities. The types of factors that may be taken into account in pricing CLOs include: the yield of similar CLOs where pricing is available in the market; the riskiness of the underlying pool of loans; features of the CLO, including weighted average life test, liability pricing, management fees, covenant cushions, weighted average spread of underlying loans and net asset value.

Unlike publicly traded common stock which trades on national exchanges, there is no central place or exchange for loans or other non-exchange traded instruments. Due to the lack of centralized information and trading, the valuation of loans and other non-exchange traded instruments carries more risk than that of publicly traded common stock. Uncertainties in the conditions of the financial market, unreliable reference data, lack of transparency and inconsistency of valuation models and processes may lead to inaccurate asset pricing. In addition, other market participants may value instruments differently than the Fund. As a result, the Fund may be subject to the risk that when a non-exchange traded instrument is sold in the market, the amount received by the Fund is less than the value that such security is carried at on the Fund’s books.

The values of some of the assets in the Fund’s portfolio are not readily determinable. The Adviser values these assets at fair value, as determined in good faith by the Adviser, subject to the oversight of the Board. Because such valuations are inherently uncertain, may fluctuate over short periods of time and may be based on estimates, the Adviser’s determinations of fair value may differ from the values that would have been used if a ready market for these assets existed or from the prices at which trades occur. Furthermore, the Adviser may not obtain third-party valuations for all of the Fund’s assets. Changes in the fair value of the Fund’s assets directly impact the Fund’s net income and the Fund’s NAV through recording unrealized appreciation or depreciation of its investments and derivative instruments, and so the Adviser’s determination of fair value has a material impact on the Fund’s net income and the Fund’s NAV.

While in many cases the Adviser ‘s determination of the fair value of the Fund’s assets is based on valuations provided by third-party dealers and pricing services, the Adviser can and does value assets based upon its judgment and such valuations may differ from those provided by third-party dealers and pricing services. Valuations of certain assets are often difficult to obtain or are unreliable. In general, dealers and pricing services heavily disclaim their valuations. Additionally, dealers may claim to furnish valuations only as an accommodation and without special compensation, and so they may disclaim any and

15

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

2. Significant Accounting Policies (continued)

all liability for any direct, incidental, or consequential damages arising out of any inaccuracy or incompleteness in valuations, including any act of negligence or breach of any warranty. Depending on the complexity and illiquidity of an asset, valuations of the same asset can vary substantially from one dealer or pricing service to another. Higher valuations of the Fund’s assets have the effect of increasing the amount of management fees the Fund pays to the Adviser. Therefore, conflicts of interest exist because the Adviser is involved in the determination of the fair value of the Fund’s assets.

The prices provided by a pricing service or independent dealers or the fair value determinations made by the Valuation Committee of the Board of Trustees may be different from the prices used by other funds or from the prices at which securities are actually bought and sold. The prices of certain securities provided by pricing services may be subject to frequent and significant change and will vary depending on the information that is available. Pricing services that value fixed-income securities generally utilize a range of market-based and security specific inputs and assumptions, as well as considerations about general market conditions, to establish a price. Investments may transact in a negotiated manner via appointment, auction, offer or bid wanted in competition. Transaction price and valuation may vary by position size, asset type, investment holding period constraints and modeled cash flow assumptions. The Fund’s ability to value its investments may also be impacted by technological issues and/or errors by pricing services or other third-party service providers. Pricing services generally value debt securities assuming orderly transactions of an institutional size, but such securities may be held, or transactions may be conducted in such securities in smaller sizes. Investment size can influence price in negotiated markets and result in the same security having a wide range of prices. Standalone smaller investment positions often trade at lower prices than larger institutional positions. The Fund’s investments in certain fixed-income instruments purchased in smaller sized transactions may contribute positively to the Fund’s performance. As Fund asset levels increase, similar smaller sized transactions, if any, may not have the same relative impact on the Fund’s performance and are not anticipated to have the same relative impact on the Fund’s future performance.

Repurchase Offers

The Fund is a closed-end investment company structured as an interval fund and, as such, has adopted a fundamental policy to make quarterly repurchase offers, at NAV, of no less than 5% of the Fund’s outstanding Shares on the repurchase request deadline. The Fund will offer to purchase only a small portion of its Shares each quarter, and there is no guarantee that shareholders will be able to sell all of the Shares that they desire to sell in any particular repurchase offer. Under current regulations, such offers must be for not less than 5% nor more than 25% of the Fund’s Shares outstanding on the repurchase request deadline. If shareholders tender for repurchase more than the repurchase offer amount for a given repurchase offer, the Fund will repurchase the shares on a pro rata basis. However, the Fund may accept all shares tendered for repurchase by shareholders who own less than one hundred shares and who tender all of their shares, before prorating other amounts tendered. In addition, the Fund will accept the total number of shares tendered in connection with required minimum distributions from an IRA or other qualified retirement plan. It is the shareholder’s obligation to both notify and provide the Fund supporting documentation of a required minimum distribution from an IRA or other qualified retirement plan.

Derivatives and Hedging Disclosures

GAAP requires enhanced disclosures about the Fund’s derivative and hedging activities, including how such activities are accounted for and their effects on the Fund’s financial position, performance, and cash flows. As of March 31, 2022, the Fund had no open derivative instruments and therefore there was no impact to the Statement of Assets and Liabilities and Statement of Operations.

3. Principal Risks

Non-Diversified Status

The Fund is a “non-diversified” management investment company. Thus, there are no percentage limitations imposed by the Investment Company Act on the Fund’s assets that may be invested, directly or indirectly, in the securities of any one issuer. Consequently, if one or more securities are allocated a relatively large percentage of the Fund’s assets, losses suffered by such securities could result in a higher reduction in the Fund’s capital than if such capital had been more proportionately allocated among a larger number of securities. The Fund may also be more susceptible to any single economic or regulatory occurrence than a diversified investment company.

16

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

3. Principal Risks (continued)

Limited Liquidity

Shares in the Fund provide limited liquidity since shareholders will not be able to redeem Shares on a daily basis. A shareholder may not be able to tender its Shares in the Fund promptly after it has made a decision to do so. In addition, with very limited exceptions, Shares are not transferable, and liquidity will be provided only through repurchase offers made quarterly by the Fund. Shares in the Fund are therefore suitable only for investors who can bear the risks associated with the limited liquidity of Shares and should be viewed as a long-term investment.

Credit Risk

There is a risk that debt issuers will not make payments, resulting in losses to the Fund. In addition, the credit quality of a debt instrument by the Fund may be lowered if an issuer’s financial condition changes. Lower credit quality may lead to greater volatility in the price of a debt instrument and thereby in shares of the Fund. Lower credit quality also may affect liquidity and make it difficult to sell the debt instrument. Default, or the market’s perception that an issuer is likely to default, could reduce the value of a debt instrument, thereby reducing the value of your investment in Fund shares. In addition, default may cause the Fund to incur expenses in seeking recovery of principal or interest on its portfolio holdings.

Market and Geopolitical Risk

The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region, or financial market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, climate change and climate related events, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, climate change and climate related events, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. It is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund’s portfolio. The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, has had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment. Therefore, the Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. During a general market downturn, multiple asset classes may be negatively affected. Changes in market conditions and interest rates can have the same impact on all types of securities and instruments. In times of severe market disruptions, you could lose your entire investment.

Interest Rate Risk

Typically, a rise in interest rates causes a decline in the value of debt securities and loans, and as a result the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of debt securities and loans. In general, the market price of debt securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. Other risk factors include credit risk (the debtor may default), prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments) and extension risk (the debtor may pay its obligation later than expected, increasing a securities maturity). These risks could affect the value of a particular investment, possibly causing the Fund’s NAV and total return to be reduced and fluctuate more than other types of investments

Asset-Backed and Mortgage-Backed Security Risk

Prepayment risk is associated with mortgage-backed and asset-backed securities including CMOs. If interest rates fall, the underlying debt may be repaid ahead of schedule, reducing the value of the Fund’s investments. If interest rates rise, there may be fewer prepayments, which would cause the average bond maturity to rise, increasing the potential for the Fund to lose money. The value of these securities may be significantly affected by changes in interest rates, the market’s perception of issuers, and the creditworthiness of the parties involved. The ability of the Fund to successfully utilize these

17

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

3. Principal Risks (continued)

instruments may depend on the ability of the Fund’s Adviser to forecast interest rates and other economic factors correctly. These securities may have a structure that makes their reaction to interest rate changes and other factors difficult to predict, making their value highly volatile. Certain mortgage-backed securities may be secured by pools of mortgages on single-family properties, multi-family properties, and/or commercial properties. Similarly, asset-backed securities may be secured by pools of loans, such as student loans, automobile loans and credit card receivables. The credit risk on such securities is affected by homeowners or borrowers defaulting on their loans. The values of assets underlying mortgage-backed and asset-backed securities may decline and, therefore, may not be adequate to cover underlying investors. Mortgage-backed securities and other securities issued by participants in housing and commercial real estate finance, as well as other real estate-related markets experienced extraordinary weakness and volatility in the aftermath of the 2007-2008 financial crisis. Possible legislation in the area of residential mortgages, credit cards and other loans that may collateralize the securities in which the Fund may invest could negatively impact the value of the Fund’s investments. To the extent the Fund focuses its investments in particular types of mortgage-backed or asset-backed securities, the Fund may be more susceptible to risk factors affecting such types of securities. Certain ABS and MBS that the Fund acquires are subordinated in cash flow priority to other more “senior” securities of the same securitization. The exposure to defaults on the underlying mortgages is severely magnified in subordinated securities. Certain subordinated securities (“first loss securities”) absorb all losses from default before any other class of securities is at risk. Such securities therefore are considered to be highly speculative investments.

Syndicated Loans and Participations Risk

The Fund’s investment program may include significant amounts of syndicated loans and participations. These obligations are subject to unique risks, including (i) the possible avoidance of an investment transaction as a “preferential transfer,” “fraudulent conveyance” or “fraudulent transfer,” among other avoidance actions, under relevant bankruptcy, insolvency and/or creditors’ rights laws, (ii) so-called “lender liability” claims by the issuer of the obligations, (iii) environmental liabilities that may arise with respect to collateral securing the obligations, (iv) limitations on the ability of the Fund to directly enforce its rights with respect to participations and (v) the contractual nature of participations where the Fund takes on the credit risk of the agent bank rather than the actual borrower.

The Fund may acquire interests in loans or advances either directly (by way of assignment) or indirectly (by way of participation). The purchaser of an assignment typically succeeds to all the rights and obligations of the assigning institution and becomes a contracting party under the loan agreement with respect to the loan; however, its rights can be more restricted than those of the assigning institution. Participations in a portion of a loan or advance typically result in a contractual relationship only with the institution participating out the interest and not with the obligor. The Fund would, in such a case, have the right to receive payments of principal and interest to which it is entitled only from the institution selling the participation, and not directly from the obligor, and only upon receipt by such institution of such payments from the obligor. As the owner of a participation, the Fund generally will have no right to enforce compliance by the obligor with the terms of the agreement or to vote on amendments to the agreement, nor any rights of set-off against the obligor, and the Fund may not directly benefit from collateral supporting the loan in which it has purchased the participation. In addition, in the event of the insolvency of the selling institution, the Fund may be treated as a general creditor of such selling institution, and may not have any exclusive or senior claim with respect to the selling institution’s interest in, or the collateral with respect to, the applicable loan. Consequently, the Fund will assume the credit risk of both the obligor and the institution selling the participation to the Fund. As a result, concentrations of participations from any one selling institution subject the Fund to an additional degree of risk with respect to defaults by such selling institution.

The Fund may be subject to risks associated with syndicated loans and participations. Under the documentation for syndicated loans, a financial institution or other entity typically is designated as the administrative agent and/or collateral agent. This agent is granted a lien on any collateral on behalf of the other lenders and distributes payments on the indebtedness as they are received. The agent is the party responsible for administering and enforcing the loan and generally may take actions only in accordance with the instructions of a majority or two-thirds in commitments and/or principal amount of the associated indebtedness. In most cases for the Fund’s syndicated loan investments, the Fund does not expect to hold a sufficient amount of the indebtedness to be able to compel any actions by the agent. Consequently, the Fund would only be able to direct such actions if instructions from the Fund were made in conjunction with other holders of associated indebtedness that together with the Fund compose the requisite percentage of the related indebtedness then entitled to take action. Conversely, if holders of the required amount of the associated indebtedness other than the Fund desire to take certain actions, such actions may be taken even if the Fund did not support such actions. Furthermore, if a syndicated loan is subordinated to one or more senior loans made to the applicable obligor, the ability of the Fund to exercise such rights may be subordinated to the exercise of

18

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

3. Principal Risks (continued)

such rights by the senior lenders. Whenever the Fund is unable to direct such actions, the parties taking such actions may not have interests that are aligned with us, and the actions taken may not be in the Fund’s best interests. In addition, the Fund’s ability to direct such actions may be limited by the tax rules governing publicly traded partnerships.

If an investment is a syndicated revolving loan or delayed drawdown loan, other lenders may fail to satisfy their full contractual funding commitments for such loan, which could create a breach of contract, result in a lawsuit by the obligor against the lenders and adversely affect the fair market value of the Fund’s investment.

There is a risk that a loan or participation agent may become bankrupt or insolvent. Such an event would delay, and possibly impair, any enforcement actions undertaken by holders of the associated indebtedness, including attempts to realize upon the collateral securing the associated indebtedness and/or direct the agent to take actions against the related obligor or the collateral securing the associated indebtedness and actions to realize on proceeds of payments made by obligors that are in the possession or control of any other financial institution. In addition, the Fund may be unable to remove the agent in circumstances in which removal would be in the Fund’s best interests. Moreover, agented loans typically allow for the agent to resign with certain advance notice, and the Fund may not find a replacement agent on a timely basis, or at all, in order to protect its investment.

LIBOR Risk

Certain of the Fund’s investments, payment obligations and financing terms may be based on floating rates, such as LIBOR, Euro Interbank Offered Rate and other similar types of reference rates (each, a “Reference Rate”). On March 5, 2021, the United Kingdom’s Financial Conduct Authority, which regulates LIBOR, announced the timeline for the cessation of all LIBOR benchmarks. All LIBOR benchmarks related to sterling, euro, Swiss franc and Japanese yen and the 1-week and 2-month US dollar settings will permanently cease immediately after December 31, 2021, and the remaining US dollar settings will cease immediately after June 30, 2023. The transition away from Reference Rates may lead to increased volatility and illiquidity in markets that are tied to such Reference Rates and reduced values of Reference Rate-related instruments. This announcement and any additional regulatory or market changes that occur as a result of the transition away from Reference Rates may have an adverse impact on a Fund’s investments, performance, or financial condition.

4. Investment Advisory and Other Agreements

A3 Financial Investments, LLC serves as the Fund’s investment adviser pursuant to a management agreement with the Fund that has an initial two-year term and is subject to annual renewal thereafter by the Fund’s Board of Trustees (the “Board”). The Adviser is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Adviser is entitled to receive a monthly fee at the annual rate of 1.50% of the Fund’s average daily net assets (the “Advisory Fee”).

The Adviser and the Fund have entered into an operating expenses limitation agreement (the “Expense Limitation Agreement”) under which the Adviser has agreed, until at least January 31, 2023, to pay or absorb the ordinary operating expenses of the Fund (excluding (i) interest expenses and dividends on short sales, and any fees and expenses incurred in connection with credit facilities including any commitment fees on borrowings, if any, obtained by the Fund; (ii) transaction costs and other expenses incurred in connection with the acquisition, financing, maintenance, and disposition of the Fund’s investments and prospective investments, including without limitation bank and custody fees, brokerage commissions, legal, data, consulting and due diligence costs, servicing and property management costs, collateral valuations, liquidation and custody costs; (iii) acquired fund fees and expenses; (iv) taxes; and (v) extraordinary expenses including but not limited to litigation costs) to the extent that its management fees plus applicable distribution and shareholder servicing fees and the Fund’s ordinary operating expenses would otherwise exceed, on a year-to-date basis, 1.95% per annum of the Fund’s average daily net assets.

For the six months ended March 31, 2022, the Adviser waived fees and reimbursed expenses totaling $170,797. For a period not to exceed three years from the date on which advisory fees are waived or Fund expenses were absorbed by the Adviser, the Adviser may recoup amounts waived or absorbed, provided it is able to effect such recoupment and remain in compliance

19

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

4. Investment Advisory and Other Agreements (continued)

with (a) the limitation on Fund expenses in effect at the time of the relevant reduction in advisory fees or payment of the Fund’s expenses, and (b) the limitation on Fund expenses at the time of the recoupment. At March 31, 2022 the amount of these potentially recoverable expenses is $944,782 expiring on the dates below:

August 29, 2022 | | $ | 23,003 | |

September 30, 2023 | | | 393,984 | |

September 30, 2024 | | | 356,998 | |

September 30, 2025 | | | 170,797 | |

Total | | $ | 944,782 | |

Foreside Financial Services, LLC serves as the Fund’s distributor (the “Distributor”) and Foreside Fund Officer Services, LLC provides Chief Compliance Officer (“CCO”) services to the Fund; UMB Fund Services, Inc. (“UMBFS”) serves as the Fund’s fund accountant, transfer agent and administrator; UMB Bank, n.a., an affiliate of UMBFS, serves as the Fund’s custodian. The Fund’s allocated fees incurred for services provided for the six months ended March 31, 2022, are reported on the Statement of Operations.

Certain officers and a Trustee of the Fund are employees of the Adviser or affiliated with the Distributor.

5. Control Ownership

The beneficial ownership, either directly or indirectly, of more than twenty-five percent (25%) of the voting securities creates a presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. As of March 31, 2022, Anthony R. Bosch, a Trustee of the Fund, had ownership in the Fund in the amount of 29.3%. Shareholders owning voting securities in excess of 25% may determine the outcome of any matter affecting and voted on by Shareholders of the Fund.

6. Fair Value of Investments

The Fund uses a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

| | ● | Level 1 – Valuations based on unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. |

| | ● | Level 2 – Valuations based on inputs, other than quoted prices included in Level 1, that are observable either directly or indirectly. |

| | ● | Level 3 – Valuations based on inputs that are both significant and unobservable to the overall fair value measurement. |

The availability of valuation techniques and observable inputs can vary from investment to investment and are affected by a wide variety of factors, including type of investment, whether the investment is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, determining fair value requires more judgment. Because of the inherent uncertainly of valuation, estimated values may be materially higher or lower than the values that would have been used had a ready market for the investments existed. Accordingly, the degree of judgment exercised by the Adviser in determining fair value is greatest for investments categorized in Level 3.

20

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

6. Fair Value of Investments (continued)

The Fund’s assets recorded at fair value have been categorized based on a fair value hierarchy as described in the Fund’s significant accounting policies. The following table presents information about the Fund’s assets and liabilities measured at fair value as of March 31, 2022:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments | | | | | | | | | | | | | | | | |

Business Development Companies | | $ | 1,808,172 | | | $ | — | | | $ | — | | | $ | 1,808,172 | |

Closed-End Funds | | | 392,985 | | | | — | | | | — | | | | 392,985 | |

Exchange-Traded Funds | | | 279,590 | | | | — | | | | — | | | | 279,590 | |

Preferred Stocks | | | 340,215 | | | | — | | | | — | | | | 340,215 | |

Promissory Notes | | | — | | | | — | | | | 42,508 | | | | 42,508 | |

Real Estate Investment Trusts | | | 506,030 | | | | — | | | | — | | | | 506,030 | |

U.S. Government and Agencies | | | — | | | | 1,809,073 | | | | — | | | | 1,809,073 | |

Short-Term Investments | | | 2,778,383 | | | | — | | | | — | | | | 2,778,383 | |

Total Investments | | $ | 6,105,375 | | | $ | 1,809,073 | | | $ | 42,508 | | | $ | 7,956,956 | |

All transfers between fair value levels are recognized by the Fund at the end of each reporting period.

The following table presents the changes in assets and transfers in and out which are classified in Level 3 of the fair value hierarchy for the six months ended March 31, 2022:

| | | Syndicated

Loans and

Participations | | | Promissory

Notes | |

October 1, 2021 | | $ | 40,776 | | | $ | — | |

Transfers In | | | — | | | | — | |

Transfers Out | | | — | | | | — | |

Purchases | | | — | | | | 43,402 | |

Sales | | | — | | | | — | |

Principal paydowns | | | (3,326 | ) | | | (894 | ) |

Realized gains (losses) | | | (195,948 | ) | | | — | |

Change in unrealized appreciation (depreciation)* | | | 158,498 | | | | — | |

Amortization | | | — | | | | — | |

March 31, 2022 | | $ | — | | | $ | 42,508 | |

* Includes unrealized depreciation of $0 for investments held as of March 31, 2022.

The following table summarizes the valuation techniques and significant unobservable inputs used for the Fund’s investments that are categorized in Level 3 of the fair value hierarchy as of March 31, 2022.

Investments | | Fair Value | | Valuation

Technique | Unobservable

Inputs | Range of

Inputs |

Promissory Notes | | $ | 42,508 | | Income Approach | Collateral Control | N/A |

21

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

7. Capital Stock

The Fund is authorized as a Delaware statutory trust to issue an unlimited number of Shares. The minimum initial investment in the Fund by any investor is $100,000. However, there are no initial or subsequent investment minimums for accounts maintained by financial institutions (such as registered investment advisers and trusts) for the benefit of their clients who purchase shares through investment programs such as (1) fee-based advisory programs; (2) employee benefit plans (e.g., 401(k) or 457(b) retirement plans; (3) mutual fund platforms; and (4) consulting firms. In addition, there is no initial or subsequent investment minimum for Trustees or officers of the Fund, directors, officers and employees of the Adviser or Distributor or any of their affiliates. Minimum investment amounts may be waived in the discretion of the Fund or the Adviser. The Distributor is not required to sell any specific number or dollar amount of the Fund’s shares, but will use commercially reasonable efforts to sell the shares.

A substantial portion of the Fund’s investments will be illiquid. For this reason, the Fund is structured as a closed-end interval fund, which means that the shareholders will not have the right to redeem their Shares on a daily basis. In addition, the Fund does not expect any trading market to develop for the Shares. As a result, if investors decide to invest in the Fund, they will have very limited opportunity to sell their Shares. For each repurchase offer the Board will set an amount between 5% and 25% of the Fund’s Shares based on relevant factors, including the liquidity of the Fund’s positions and the shareholders’ desire for liquidity. A shareholder whose Shares (or a portion thereof) are repurchased by the Fund will not be entitled to a return of any sales charge that was charged in connection with the shareholder’s purchase of the Shares.

Pursuant to Rule 23c-3 under the Investment Company Act, on a quarterly basis, the Fund offers to repurchase at NAV per share determined as of the close of regular trading on the New York Stock Exchange no later than the 14th day after the repurchase offer ends, or the next business day if the 14th day is not a business day. The results of the repurchase offers conducted for the six months ended March 31, 2022 are as follows:

Commencement Date | November 16, 2021 | February 15, 2022 |

Repurchase Request | December 17, 2021 | March 17, 2022 |

Repurchase Pricing date | December 31, 2021 | March 31, 2022 |

| | | | | | | | | |

Net Asset Value as of Repurchase Offer Date | | $ | 8.45 | | | $ | 7.30 | |

Amount Repurchased | | $ | 550,788 | | | $ | 334,160 | |

Percentage of Outstanding Shares Repurchased | | | 5.42 | % | | | 3.96 | % |

8. Federal Income Taxes

At March 31, 2022, gross unrealized appreciation and depreciation on investments, based on cost for federal income tax purposes were as follows:

Cost of investments | | $ | 8,992,702 | |

Gross unrealized appreciation | | | 194,300 | |

Gross unrealized depreciation | | | (1,230,046 | ) |

Net unrealized depreciation on investments | | $ | (1,035,746 | ) |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing difference in recognizing certain gains and losses in security transitions.

As of September 30, 2021, the components of distributable earnings on a tax basis were as follows:

Undistributed ordinary income | | $ | 571,966 | |

Undistributed long-term capital gains | | | 109,691 | |

Accumulated capital and other losses | | | — | |

Organizational costs deferral | | | (613 | ) |

Unrealized depreciation on investments | | | (1,637,140 | ) |

Total accumulated deficit | | $ | (956,096 | ) |

22

A3 Alternative Income Fund, (AAACX)

Notes to Financial Statements

March 31, 2022 (Unaudited) (continued)

8. Federal Income Taxes (continued)

The tax character of distributions paid during the fiscal years ended September 30, 2021 and September 30, 2020 was as follows:

| | 2021 | | | 2020 | |

Distribution paid from: | | | | | | | | |

Ordinary income | | $ | 567,136 | | | $ | 396,121 | |

Net long-term capital gains | | | — | | | | — | |

Total distributions paid | | $ | 567,136 | | | $ | 396,121 | |

The A3 Alternative Income Fund utilized $382,118 of its capital loss carryforwards during the year ended September 30, 2021.

9. Investments in Restricted Securities

Restricted securities include securities that have not been registered under the Securities Act of 1933, as amended, and securities that are subject to restrictions on resale. The Fund may invest in restricted securities that are consistent with the Fund’s investment objectives and investment strategies. Investments in restricted securities are valued at fair value as determined in good faith in accordance with procedures adopted by the Board of Trustees. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material.

Additional information on each restricted security held by the Fund on March 31, 2022 is as follows:

Security | | Initial

Acquisition Date | | | Amount or

Units | | | Cost | | | Fair

Value | | | % of

Net Assets | |

DSC Trading, LLC, 11.00%, 7/31/2023 | | | 1/14/2021 | | | | 42,508 | | | $ | 42,508 | | | $ | 42,508 | | | | 0.05 | % |

10. Investment Transactions

For the six months ended March 31, 2022, purchases and sales of investments, excluding short-term investments, were $677,580 and $1,952,039, respectively.

11. Indemnifications

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

12. Subsequent Events

In preparing these financial statements, management has evaluated subsequent events through the date of issuance of the financial statements included herein.

The Fund commenced a repurchase offer May 16, 2022 as follows:

Commencement Date | May 16, 2022 |

Repurchase Request | June 16, 2022 |

Repurchase Pricing date | June 30, 2022 |

There have been no other subsequent events that occurred during such period that would require disclosure or would be required to be recognized in the financial statements.

23

A3 Alternative Income Fund, (AAACX)

Other Information

March 31, 2022 (Unaudited)

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the 12 months ended June 30, no later than August 31. The Fund’s Form N-PX filing and a description of the Fund’s proxy voting policies and procedures are available: (i) without charge, upon request, by calling the Fund at (877) 774-7724 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available, without charge and upon request, on the SEC’s website at www.sec.gov.

24

This page intentionally left blank.

Investment Adviser

A3 Financial Investments, LLC

90 Madison Street, Suite 303

Denver, Colorado 80206

www.a3.financial

Custodian

UMB Bank, n.a.

928 Grand Boulevard, 5th Floor

Kansas City, Missouri 64106

Fund Administrator, Transfer Agent, and Fund Accountant

UMB Fund Services