AGENCY AGREEMENT

February 18, 2021

Juva Life Inc.

Suite 1400, 885 West Georgia Street

Vancouver, British Columbia V6C 3E8

Attention: Matthew Lee, Chief Financial Officer

Dear Sir:

Mackie Research Capital Corporation (the "Agent"), as sole lead agent and bookrunner, understands that Juva Life Inc. (the "Company") proposes to issue and sell up to 8,285,720 transferable special warrants of the Company (each, a "Special Warrant") at a price of $1.05 per Special Warrant (the "Offering Price"), for aggregate gross proceeds to the Company of up to $8,700,006 (the "Offering").

Upon and subject to the terms and conditions set forth herein, the Company hereby appoints the Agent, and the Agent hereby agrees, to act as agent to the Company to effect the Offering on a best efforts private placement basis to Purchasers (as defined herein) in the Qualifying Jurisdictions (as defined herein), the United States (as defined herein) pursuant to appropriate exemptions from the registration requirements of the U.S. Securities Act (as defined herein), and may be offered in such other jurisdictions and the Company and the Agent may agree, acting reasonably, pursuant to the terms and conditions hereof.

The parties acknowledge that the Offering Securities (as defined herein) have not been and will not be registered under the U.S. Securities Act or any state securities laws, and may not be offered or sold in the United States or to, or for the benefit or account of, any U.S. Person (as defined herein) or Person in the United States, except pursuant to exemptions from the registration requirements of the U.S. Securities Act and the applicable laws of any state of the United States, in the manner specified in this Agreement and pursuant to the representations, warranties, acknowledgments, agreements and covenants of the Company and the Agent contained in Schedule "A" hereto. All actions to be undertaken by the Agent in the United States in connection with the matters contemplated herein shall be undertaken through one or more U.S. Affiliates (as defined herein).

Each Special Warrant will entitle the holder thereof to receive, upon deemed exercise of the Special Warrants on the Automatic Exercise Date (as defined herein) and without payment of additional consideration, one unit of the Company (each a "Unit") consisting of one common share in the capital of the Company (each, a "Unit Share") and one-half of one transferable common share purchase warrant (each whole warrant, a "Warrant"), with each Warrant exercisable for the purchase of one common share in the capital of the Company (each, a "Warrant Share"), at an exercise price of $1.35 per Warrant Share for a period of 24 months from the Closing Date (as defined herein). The Warrants will be duly and validly created and issued by the Company pursuant to, and governed by, the terms of a warrant indenture (the "Warrant Indenture") to be entered into on the Closing Date between the Company and Olympia Trust Company, as warrant agent in respect of the Warrants ("Olympia"). The description of the Warrants herein is a summary only and is subject to the specific attributes and detailed provisions of the Warrants to be set forth in the Warrant Indenture. In the case of any inconsistency between the description of the Warrants in this Agreement and their terms and conditions as set forth in the Warrant Indenture, the provisions of the Warrant Indenture will govern.

Each Special Warrant will be automatically exercised, without payment of additional consideration or further action on the part of the holder thereof, into one Unit on the earlier of (the "Automatic Exercise Date"): (i) the date which is four months and a day following the Closing Date; and (ii) the Qualification Date (as defined herein). Notwithstanding the foregoing, in the event a receipt for the Final Prospectus (as defined herein) has not been issued on or before the date that is 120 days following the Closing Date, each unexercised Special

Warrant will thereafter entitle the holder to receive upon exercise thereof, for no additional consideration and without any action on the part of the holder thereof, an additional 0.10 Units (each ten such additional 0.10 Units, a "Penalty Unit"), provided, however, that any fractional entitlement to a Penalty Unit will be rounded down to the nearest whole Penalty Unit. The "Qualification Date" means the date on which a receipt for the Final Prospectus is issued by the British Columbia Securities Commission, as principal regulator, on its own behalf and on behalf of each of the other relevant securities regulators in the Qualifying Jurisdictions.

The Special Warrants will be duly and validly created and issued pursuant to, and governed by, a special warrant indenture (the "Special Warrant Indenture") to be entered into on the Closing Date between the Company and Olympia in its capacity as special warrant agent thereunder. The description of the Special Warrants herein is a summary only and is subject to the specific attributes and detailed provisions of the Special Warrants to be set forth in the Special Warrant Indenture. In the case of any inconsistency between the description of the Special Warrants in this Agreement and their terms and conditions as set forth in the Special Warrant Indenture, the provisions of the Special Warrant Indenture will govern.

The Company also hereby grants the Agent the option (the "Over-Allotment Option") to solicit and arrange for the purchase of up to an additional 1,242,858 Special Warrants (the "Additional Special Warrants") at the Offering Price, exercisable in whole or in part at any time up to 48 hours before the Closing Time, by notice in writing from the Agent, which notice shall specify the number of Additional Special Warrants to be purchased. Unless otherwise required by the context, (a) references to the "Offering" shall include the offering of any Additional Special Warrants; (b) references to the "Units", "Unit Shares", "Warrants" and "Warrant Shares" shall include any securities issued or issuable upon exercise of the Over-Allotment Option or as a result of the issuance of any Penalty Units; and (c) references to the "Compensation Options", "Advisory Options", "Agent's Units", "Agent's Shares", "Agent's Warrants" and "Agent's Warrant Shares" (as such terms are defined herein) shall include any securities issued or issuable upon exercise of the Over-Allotment Option or as a result of the issuance of any Agent's Penalty Units.

In consideration of the services to be rendered by the Agent in connection with the sale and purchase of Special Warrants under the Offering and all other services related thereto, the Company will pay to the Agent the Commission and the Advisory Fee (as defined herein) and issue to the Agent the Compensation Options (as defined herein) and the Advisory Options (as defined herein) in accordance with the provisions of

Section 2.4.

The Company acknowledges that the Agent will be under no obligation to purchase any Special Warrants. The Agent will be entitled in connection with the Offering to appoint, at its sole expense, other registered dealers acceptable to the Company (the "Selling Firms") as agents to assist in the Offering and the Agent may determine the remuneration payable to such Selling Firms, such remuneration to be the sole responsibility of the Agent.

The Offering is conditional upon and subject to the additional terms and conditions set forth below.

1. Interpretation.1.1 Definitions.

In this Agreement and the

Schedules hereto, in addition to the terms defined above, unless otherwise indicated or unless the context otherwise requires, the following terms will have the following meanings:

"affiliate" and "associate" have the respective meanings ascribed to such terms in the Securities Act (British Columbia);

"

Additional Special Warrants" has the meaning ascribed to such term above;

"Advisory Fee" has the meaning ascribed to such term in Section 2.4(c);

"Advisory Options" has the meaning ascribed to such term in Section 2.4(c);

"Agent" has the meaning ascribed to such term above;

"Agent's Penalty Unit" has the meaning ascribed to such term in Section 2.4(b);

"Agent's Shares" has the meaning ascribed to such term in Section 2.4(b);

"Agent's Units" has the meaning ascribed to such term in Section 2.4(b);

"Agent's Warrants" has the meaning ascribed to such term in Section 2.4(b);

"Agent's Warrant Shares" has the meaning ascribed to such term in Section 2.4(b);

"

Agreement" means this agreement and includes the

schedules hereto, as modified, amended and/or supplemented from time to time;

"Ancillary Documents" means all agreements (including the Subscription Agreements, the Special Warrant Indenture and the Warrant Indenture), certificates (including the global certificates representing the Special Warrants, the Compensation Options, the Advisory Options and the Underlying Securities, as applicable, in the context used), officer's certificates of the Company, notices and other documents executed and delivered, or to be executed and delivered, by the Company in connection with the Offering; "Applicable Laws" means all laws, statutes, codes, ordinances, decrees, rules, regulations, by-laws, written policies, judicial or arbitral or administrative or ministerial or departmental or regulatory judgments, orders, decisions, rulings or awards, including general principles of common and civil law, and conditions of any grant of approval, permission, authority or license of any court, governmental entity or statutory body or regulatory body (including the CSE), and includes, without limitation, Securities Laws; "Associated Entity" means any entity (corporate or otherwise), affiliate, or resulting entity pursuant to a reorganization: (i) in which the Company, has directly or indirectly controlled, directly or indirectly controls or is controlled by and which is material to the Company, and the business of the Company; or (ii) from which the Company has derived or will derive a beneficial financial or other interest, including, but not limited to, any entity with whom the Company has entered into or will enter into a business relationship (for example, via a management agreement, via a loan agreement, etc.); "Automatic Exercise Date" has the meaning ascribed to such term above;

"Business Day" means a day which is not a Saturday, a Sunday or a statutory or civic holiday, or a day on which commercial banks are not open for business, in Vancouver, British Columbia;

"

CDS" means CDS Clearing and Depository Services Inc.;

"

Claims" has the meaning ascribed to such term in

Section 13(a);

"Closing" means each completion of the issue and sale by the Company, and the purchase by the Purchasers, of the Special Warrants on the Closing Date pursuant to this Agreement and the Subscription Agreements;

"

Closing Date" means February 18, 2021;

"Closing Fees" has the meaning ascribed to such term in Section 2.4(c);

"Closing Time" means 9:00 a.m. (Vancouver time) on the Closing Date or such other time as the Company and the Agent may agree;

"

Commission" has the meaning ascribed to such term in Section 2.4(a);

"Common Share" means a common share without par value in the capital of the Company;

"

Company" has the meaning ascribed to such term above;

"Compensation Options" has the meaning ascribed to such term in Section 2.4(b);

"

CSE" means the Canadian Securities Exchange;

"Disclosure Documents" means all information regarding the Company (including any predecessors) that has been filed on SEDAR since the incorporation of the Company, or that is filed on SEDAR on or prior to the Automatic Exercise Date, including the Financial Statements, press releases, material change reports and information circulars;

"distribution" means distribution or distribution to the public, as the case may be, as such terms are defined in Securities Laws; "Documents Incorporated by Reference" means all financial statements, management's discussion and analysis, management information circulars, annual information forms, business acquisition reports, material change reports or other documents filed by the Company, whether before or after the date of this Agreement, that are required to be incorporated by reference, or that are deemed to be incorporated by reference, under Securities Laws in the Preliminary Prospectus, the Final Prospectus or any Supplementary Material, as applicable;

"Final Prospectus" means the final short form prospectus of the Company, including all of the Documents Incorporated by Reference, prepared by the Company and certified by the Company and the Agent qualifying the distribution of the Qualified Securities in the Qualifying Jurisdictions; "Financial Statements" means, collectively, the unaudited condensed consolidated financial statements of the Company as at, and for the period ended September 30, 2020 and 2019, filed on SEDAR; and the audited consolidated financial statements of the Company as at, and for the years ended December 31, 2019 and 2018, and the notes thereto, together with the report of Davidson & Company LLP thereon, as included in the Company's final long form non-offering prospectus dated October 8, 2019, filed on SEDAR;

"Governmental Authority" means any governmental authority and includes, without limitation, any national or federal government, province, state, municipality or other political subdivision of any of the foregoing, any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government and any corporation or other entity owned or controlled (through stock or capital ownership or otherwise) by any of the foregoing; "IFRS" means International Financial Reporting Standards, as issued by the International Accounting Standards Board and as adopted by the Chartered Professional Accountants of Canada in Part I of The Chartered Professional Accountants Canada Handbook – Accounting, as amended from time to time; "

including" means "including without limitation";

"

Indemnified Parties" has the meanings ascribed to such term in

Section 13(a);

"

Intellectual Property" has the meaning ascribed to such term in Section 7(kk);

"Lien" means any mortgage, charge, pledge, encumbrance, hypothec, security interest, prior claim or lien (statutory or otherwise), in each case, whether contingent or absolute;

"

Losses" has the meaning ascribed to such term in Section 13(a);

"Material Adverse Effect" means any change, fact, event, circumstance or state of being which could reasonably be expected to have a material and adverse effect (actual or anticipated, whether financial or otherwise) on the business, affairs, operations, properties, assets, liabilities (contingent or otherwise), capital, results of operations or condition (financial or otherwise) of the Company and the Subsidiaries, taken as a whole;

"Material Subsidiaries" means the Subsidiaries other than 1177988 B.C. Ltd.;

"

misrepresentation", "

material fact" and "

material change" have the respective meanings ascribed to them in the

Securities Act (British Columbia);

"NI 45-106" means National Instrument 45-106 – Prospectus Exemptions;

"notice" has the meaning ascribed to such term in Section 15;

"NP 11-202" means National Policy 11-202 – Process for Prospectus Reviews in Multiple Jurisdictions;

"Offering" has the meaning ascribed to such term above;

"

Offering Price" has the meaning ascribed to such term above;

"Offering Securities" means, collectively, the Special Warrants, the Units, the Penalty Units, the Unit Shares, the Warrants, the Warrant Shares, the Compensation Options, the Advisory Options, the Agent's Units, the Agent's Shares, the Agent's Warrants and the Agent's Warrant Shares, includes any of the foregoing issuable in connection with any exercise of the Over-Allotment Option or as a result of the issuance of any Penalty Units or Agent's Penalty Units;

"Olympia" has the meaning ascribed to such term above;

"Over-Allotment Option" has the meaning ascribed to such term above;

"Penalty Units" has the meaning ascribed to such term above;

"Person" includes an individual, a firm, a corporation, a body corporate, a syndicate, a partnership, a trust, an association, an unincorporated organization, a joint venture, an investment club, a government or an agency or political subdivision thereof and every other form of legal or business entity of any nature or kind whatsoever;

"Personally Identifiable Information" means any information that alone or in combination with other information held a Person or entity can be used to specifically identify a Person including but not limited to a natural Person's name, street address, telephone number, e-mail address, photograph, social insurance number, driver's license number, passport number, credit or debit card number or customer or financial account number or any similar information that is treated as "Personally Identifiable Information" under Applicable Laws;

"Preliminary Prospectus" means the preliminary short form prospectus of the Company, including all of the Documents Incorporated by Reference, prepared by the Company and certified by the Company and the Agent relating to the distribution of the Qualified Securities in the Qualifying Jurisdictions;

"President's List" has the meaning ascribed to such term in Section 2.4(a);

"Purchasers" means the Persons who are purchasers in the Qualifying Jurisdictions who, as purchasers or beneficial purchasers acquire Special Warrants by duly completing, executing and delivering the Subscription Documents; "

Qualification Date" has the meaning ascribed to such term above;

"Qualified Securities" means, the Units, the Unit Shares and the Warrants issuable upon exercise or deemed exercise of the Special Warrants, including any of the foregoing issuable in connection with any exercise of the Over-Allotment Option or as a result of the issuance of any Penalty Units;

"Qualifying Jurisdictions" means each of the Provinces of Canada, other than Québec;

"Regulation S" means Regulation S as promulgated by the U.S. Securities and Exchange Commission under the U.S. Securities Act;

"Securities Commissions" means the applicable securities commissions or securities regulatory authorities in the Qualifying Jurisdictions;

"Securities Laws" means all applicable securities laws in each of the Qualifying Jurisdictions and the United States and the respective rules and regulations made thereunder, together with applicable published policy statements, instruments, orders and rulings of the securities regulatory authorities in such Provinces of Canada and the rules, policies and requirements of the CSE; "SEDAR" means the System for Electronic Document Analysis and retrieval established by National Instrument 13-101 – System for Electronic Document Analysis and Retrieval (SEDAR); "Selling Firm" has the meaning ascribed to such term above;

"Special Warrants" has the meaning ascribed to such term above;

"Special Warrant Indenture" has the meaning ascribed to such term above;

"Subscription Agreements" means the subscription agreements, in the form agreed upon by the Company and the Agent, pursuant to which Purchasers agree to subscribe for and purchase Special Warrants; "Subscription Documents" means, with respect to a Purchaser, a Subscription Agreement duly completed by the Purchaser together with all applicable duly completed schedules to the Subscription Agreement in the forms attached thereto and any other forms or documents required under Securities Laws or any other Applicable Laws; "Subsequent Disclosure Documents" means any annual and/or interim financial statements, management's discussion and analysis, information circulars, annual information forms, material change reports, business acquisition reports or other documents issued by the Company after the date of this Agreement that are required to be incorporated by reference into the Preliminary Prospectus, the Final Prospectus or any Supplementary Material; "subsidiary" has the meaning ascribed to such term in the Securities Act (British Columbia);

"Subsidiaries" means the subsidiaries of the Company, as listed in Schedule "B" hereto;

"Supplementary Material" means, collectively, any amendment to or amendment and restatement of, the Preliminary Prospectus and/or the Final Prospectus, and any further amendment, amendment and restatement or supplemental prospectus thereto or ancillary materials that may be filed by or on behalf of the Company under Securities Laws relating to the qualification of the distribution of the Qualified Securities; "Taxes" has the meaning ascribed to such term in Section 7(r); "Underlying Securities" means, collectively, the Units, the Penalty Units, the Unit Shares, the Warrants, the Warrant Shares, the Agent's Units, the Agent's Penalty Units, the Agent's Shares, the Agent's Warrants and the Agent's Warrant Shares, including any of the foregoing issuable in connection with any exercise of the Over-Allotment Option or as a result of the issuance of any Penalty Units or Agent's Penalty Units; "Unit" has the meaning ascribed to such term above;

"Unit Share" has the meaning ascribed to such term above;

"United States" or "U.S." means, as the context requires, the United States of America, its territories and possessions, any state of the United States, and the District of Columbia;

"U.S. Affiliate" means the United States registered broker-dealer affiliate of the Agent;

"U.S. Person" has the meaning ascribed to such term in Rule 902(k) of Regulation S;

"

U.S. Securities Act" means the United States Securities Act of 1933, as amended;

"Warrant" has the meaning ascribed to such term above;

"Warrant Indenture" has the meaning ascribed to such term above;

"Warrant Share" has the meaning ascribed to such term above; and

"Work Fee" has the meaning ascribed to such term in Section 2.4(a).

1.2 Knowledge.Where any representation or warranty contained in this Agreement or any Ancillary Document is expressly qualified by reference to the "knowledge" of the Company, or where any other reference is made herein or in any Ancillary Document to the knowledge of the Company, it will be deemed to refer to the actual knowledge of the Chief Executive Officer and the Chief Financial Officer of the Company, after having made reasonable enquiry of appropriate and relevant Persons. 1.3 Business Days.Where any action or step is to be taken or completed on or by a specified date, and such date is not a Business Day in the applicable jurisdiction, then such action or step may be taken or completed on the next following Business Day.

1.4 Plural and Gender.Whenever used in this Agreement, words importing the singular number only will include the plural and vice versa and words importing the masculine gender will include the feminine gender and neuter.

Unless otherwise specified, references to "$" are to Canadian.

2.1 Offering.Upon and subject to the terms and conditions set forth herein, the Agent hereby agrees to act, and upon acceptance hereof, the Company hereby appoints the Agent, as the Company's exclusive agent, to offer for sale by way of private placement on a best efforts basis, without underwriter liability, the Special Warrants to be issued and sold pursuant to the Offering and the Agent agrees to arrange for purchasers of the Special Warrants in the Qualifying Jurisdictions. Notwithstanding anything to the contrary contained herein or any oral representations or assurances previously or subsequently made by the parties hereto, this Agreement does not constitute a commitment by, or legally binding obligation of, the Agent or any of its affiliates to act as underwriters, initial purchasers, arrangers and/or placement agents in connection with any offering of securities of the Company or to provide or arrange any financing, other than the appointment as agents in connection with the Offering in accordance with the prior sentence and otherwise on the terms set forth herein. 2.2 Legal Compliance.The Company undertakes to file or cause to be filed, within the time periods stipulated by Applicable Laws, all forms, undertakings and other documents required to be filed by the Company under Applicable Laws in connection with the offer and sale of the Special Warrants in order that the distribution of the Offering Securities may lawfully occur without the necessity of filing a prospectus, registration statement or similar document in Canada or any other jurisdiction where Special Warrants are offered and sold by the Agent. The Company further agrees to comply with Securities Laws in connection with the distribution of the Offering Securities.

2.3 Legends – Securities Laws.

Each Offering Security issued prior to the date that is four months and one day following the Closing Date and prior to the Qualification Date shall have attached to them, whether through the electronic deposit system of CDS, an ownership statement issued under a direct registration system or other electronic book-entry system, or on certificates that may be issued, as applicable, any legends as may be prescribed by CDS in addition to a legend substantially in the following form:

"UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE JUNE 19, 2021."

| 2.4 | Agent's CompensationIn consideration for the services rendered by the Agent hereunder, the Company will pay a cash commission (the " Commission") at Closing to the Agent equal to 5.0% of the gross proceeds from the sale of the Special Warrants sold pursuant to the Offering, including any proceeds received pursuant to any exercise of the Over-Allotment Option but excluding any gross proceeds raised from certain Purchasers identified on the Company's president's list (the " President's List Purchasers"), as well as a work fee of $30,000 (the " Work Fee").In addition to the Commission, the Company agrees to issue and deliver to the Agent that number of non-transferable warrants of the Company (the " Compensation Options") as is equal to 5.0% of the Special Warrants sold under the Offering, including any Additional Special Warrants issued pursuant to any exercise of the Over-Allotment Option but excluding any Special Warrants sold to President's List Purchasers. Each Compensation Option is exercisable for the purchase of one unit of the Company (an " Agent's Unit") at an exercise price of $1.05 per Agent's Unit for a period of 24 months from the Closing Date. Each Agent's Unit consists of one Common Share (an " Agent's Share") and one-half of one common share purchase warrant (each whole warrant, an " Agent's Warrant"). Each Agent's Warrant is exercisable for the purchase of one Common Share (an " Agent's Warrant Share") at an exercise price of $1.35 per Agent's Warrant Share for a period of 24 months from the Closing Date. In the event a receipt for the Final Prospectus has not been issued on or before the date that is 120 days following the Closing Date, each unexercised Compensation Option will thereafter entitle the holder to receive, for no additional consideration and without any action on the part of the holder thereof, an additional 0.10 Agent's Units (each ten such 0.10 Agent's Units, an " Agent's Penalty Unit") upon the due exercise of the Compensation Options, provided, however, that any fractional entitlement to an Agent's Penalty Unit will be rounded down to the nearest whole Agent's Penalty Unit. |

| (c) | As additional consideration for the advisory services rendered by the Agent in connection with the Offering, the Company shall, at the Closing Time, pay to the Agent an advisory fee (the " Advisory Fee" and collectively with the Commission and the Work Fee, the " Closing Fees") equal to 2.0% of the gross proceeds from the sale of the Special Warrants sold pursuant to the Offering, including any proceeds received pursuant to any exercise of the Over-Allotment Option and to issue and deliver to the Agent that number of non-transferable warrants of the Company (the " Advisory Options") as is equal to 2.0% of the Special Warrants sold under the Offering, including any Additional Special Warrants issued pursuant to any exercise of the Over-Allotment Option. Each Advisory Option is exercisable for the purchase of one Agent's Unit at an exercise price of $1.05 per Agent's Unit for a period of 24 months from the Closing Date. In the event a receipt for the Final Prospectus has not been issued on or before the date that is 120 days following the Closing Date, each unexercised Advisory Option will thereafter entitle the holder to receive, for no additional consideration and without any action on the part of the holder thereof, an additional 0.10 of an Agent's Penalty Unit upon the due exercise of the Advisory Options, provided, however, that any fractional entitlement to an Agent's Penalty Unit will be rounded down to the nearest whole Agent's Penalty Unit. |

(d)

| The Company covenants that the certificates representing the Compensation Options and the Advisory Options will, among other things, include provisions for the appropriate adjustment in the class, number and price of the Agent's Units issuable upon exercise of the Compensation Options and the Advisory Options upon the occurrence of certain events, including any subdivision, consolidation or reclassification of the Common Shares and the payment of stock dividends with respect thereto.Filing of Preliminary Prospectus and Final Prospectus |

| (a) | Preliminary Prospectus. The Company covenants and agrees to use its commercially reasonable efforts to: (i) prepare and file the Preliminary Prospectus and obtain a receipt therefor from the Securities Commissions and obtain a receipt therefor from the Securities Commissions as soon as reasonably practicable after the Closing Date; and (ii) promptly resolve all comments received or deficiencies raised by the Securities Commissions in respect of the Preliminary Prospectus as expeditiously as possible; provided, however, that the Company will provide to the Agent copies of all correspondence received by the Company from the Securities Commissions relating to such comments or deficiencies and will afford the Agent and its counsel a reasonable opportunity to review and provide input on the Company's responses to such correspondence.Final Prospectus. The Company covenants and agrees to use its commercially reasonable efforts to, as soon as practicable after all comments of the Securities Commissions have been satisfied with respect to the Preliminary Prospectus, prepare and file the Final Prospectus. The Company will promptly take, or cause to be taken, all commercially reasonable steps and proceedings that may from time to time be required under Securities Laws to qualify the distribution of the Qualified Securities in the Qualifying Jurisdictions and will use commercially reasonable efforts to ensure that such requirements (including the issuance of a receipt for the Final Prospectus) will be fulfilled before the Automatic Exercise Date. Commercial Copies. The Company will cause commercial copies of the Final Prospectus and any Supplementary Material to be delivered to the Agent without charge, in such numbers and in such Qualifying Jurisdictions as the Agent may reasonably request. Such delivery will be effected as soon as practicable and, in any event, within two Business Days after the filing thereof in the Qualifying Jurisdictions. The Agent will cause to be delivered to the Purchasers copies of the Final Prospectus and any Supplementary Material required to be delivered to them pursuant to Applicable Laws. Representation as to Final Prospectus and Supplementary Material. Each delivery to any Agent of the Preliminary Prospectus, the Final Prospectus and/or any Supplementary Material by or on behalf of the Company will constitute the representation and warranty of the Company to the Agent that:all information and statements (except information and statements relating solely to and provided in writing by the Agent) contained and incorporated by reference in the Preliminary Prospectus or the Final Prospectus or any Supplementary Material, as the case may be, are, at the respective dates of delivery thereof, true and correct and contain no misrepresentation or untrue, false or misleading statement of a material fact and, on the respective dates of delivery thereof, the Preliminary Prospectus, the Final Prospectus or any Supplementary Material provide full, true and plain disclosure of all material facts relating to the Company (on a consolidated basis) and the Offering Securities, as required by Securities Laws of the Qualifying Jurisdictions; |

(i)

| no material fact has been omitted from any Preliminary Prospectus, the Final Prospectus or any Supplementary Material (except information and statements relating solely to and provided in writing by the Agent) which is required to be stated therein or is necessary to make the statements therein not misleading in light of the circumstances in which they were made; and |

(iii)

| each of such documents complies with the requirements of Securities Laws in the Qualifying Jurisdictions, |

| and such delivery will also constitute the Company's consent to the Agent's and any Selling Firm's use of the Preliminary Prospectus, the Final Prospectus and any Supplementary Material in connection with the distribution of the Qualified Securities in the Qualifying Jurisdictions in compliance with the provisions of this Agreement.Review of Prospectuses. The form and substance of the Preliminary

|

| Prospectus, the Final Prospectus and any Supplementary Material will be in form and substance satisfactory to the Agent and its legal counsel, acting reasonably.Contractual Right of Rescission. In the event that a Purchaser who acquires Qualified Securities upon deemed exercise of the Special Warrants is or becomes entitled under Securities Laws to the remedy of rescission by reason of a misrepresentation in the Preliminary Prospectus, the Final Prospectus or any Supplementary Material, qualifying the Qualified Securities for distribution in the Qualifying Jurisdictions, the Company hereby agrees that such holder shall, subject to available defences and any limitation period under Securities Laws, be entitled to rescission not only of the holder's deemed exercise of its Special Warrants, but also of the private placement transaction under this Agreement pursuant to which the Special Warrants were initially acquired under the Offering, and shall be entitled in connection with such rescission to a full refund of all consideration paid to the Company on the acquisition of Special Warrants. In the event that such holder is a permitted assignee of the interest of the original purchaser of the Special Warrants, the Company hereby agrees that such permitted assignee shall be permitted to exercise the rights of rescission and refund granted hereunder as if such permitted assignee was such original purchaser. The Company hereby agrees that the foregoing right, which is extended by the Company in respect of the Special Warrants issued by the Company pursuant to accepted subscriptions at the Closing Time on the Closing Date, is in addition to any other right or remedy available to a holder of Special Warrants, under Securities Laws or otherwise at law, and is subject to the defences and limitations described under such Securities Laws. The Company agrees that the foregoing rights shall be described in the Preliminary Prospectus, the Final Prospectus and any Supplementary Material, and the Company agrees to and shall comply with such contractual right of rescission. |

(g) Due Diligence. The Company will permit the Agent and its counsel to participate in the preparation of the Preliminary Prospectus, the Final Prospectus and any Supplementary Material, to discuss the Company's business with its corporate officials, auditors, legal counsel and other advisors and to conduct such full and comprehensive review and investigation of the Company's business, affairs, capital and operations as the Agent will consider to be necessary to establish a due diligence defence under Applicable Laws to an action for misrepresentation or damages and to enable the Agent to responsibly execute the Agent's certificate in the Preliminary Prospectus, the Final Prospectus and any Supplementary Material. The Company also covenants to use its commercially reasonable efforts to secure the cooperation of the Company's professional advisors (including its legal advisors and auditors) and the officers and directors to participate in any due diligence conference calls required by the Agent, and the Company consents to the use and the disclosure of information obtained during the course of the due diligence investigation where such disclosure is required by Applicable Laws.Deliveries. The Company will deliver to the Agent prior to the filing of the Preliminary Prospectus and Final Prospectus, as applicable, unless otherwise indicated:a copy of the Preliminary Prospectus and the Final Prospectus signed on behalf of the Company, by the persons and in the form required by Applicable Laws;a copy of any other document filed with, or delivered to, the Securities Commissions by the Company under Applicable Laws in connection with the filing of the Preliminary Prospectus or Final Prospectus; andin the case of the Final Prospectus, a "long-form" comfort letter dated the date of the Final Prospectus, in form and substance satisfactory to the Agent and its legal counsel, acting reasonably, from the Company's auditors and based on a review completed not more than two Business Days prior to the date of the letter, with respect to certain financial and accounting information relating to the Company included and incorporated by reference in the Final Prospectus, which letter will be in addition to the auditors' report contained in the Final Prospectus and any auditors' comfort letter addressed to or filed with the Securities Commissions under Securities Laws.Supplementary Material. If applicable, the Company will prepare and deliver promptly to the Agent copies of all Supplementary Material. Concurrently with the delivery of any Supplementary Material or the incorporation by reference in the Preliminary Prospectus or the Final Prospectus of any Subsequent Disclosure Document, the Company will deliver to the Agent, with respect to such Supplementary Material or Subsequent Disclosure Document, documents substantially similar to those referred to in Section 3(g).Covenants of the Company.In addition to the covenants of the Company set out in the other Sections of this Agreement, the Company hereby covenants to and for the benefit of the Agent and the Purchasers, and acknowledges that each of them is relying on such covenants in connection with the purchase of the Special Warrants, that:

| (a) | the Company will comply, in all material respects, with its obligations under Applicable Laws; |

| (b) | the Company will duly execute and deliver the Special Warrant Indenture on or before the Closing Date in form and substance satisfactory to the Agent and its legal counsel, acting reasonably, and the Company will comply with its covenants contained in the Special Warrant Indenture; |

| (c) | the Company will duly execute and deliver the Warrant Indenture on or before the Closing Date in form and substance satisfactory to the Agent and its counsel, acting reasonably, and the Company will comply with its covenants contained in the Warrant Indenture; |

| (d) | the Company will duly execute Subscription Agreements on or before the Closing Date which have been duly completed by the Purchasers, and will duly and punctually perform all obligations to be performed by it under this Agreement and the Ancillary Documents; |

| (e) | not, directly or indirectly, without the prior written consent of the Agent (such consent not to be unreasonably withheld or delayed) issue, offer, sell, contract to sell, secure, pledge, grant any option, right or warrant to purchase or otherwise lend, transfer or dispose of (or announce any intention to do so) any equity or debt securities of the Company or any securities convertible into, or exchangeable or exercisable for, equity or debt securities of the Company for a period commencing on the Closing Date and ending 120 days from the Closing Date except in conjunction with the grant or exercise of stock options and other similar issuances pursuant to any stock option plan or similar share compensation arrangements in place prior to the date of this Agreement or the issuance of Common Shares of the Company upon the exercise of convertible securities, warrants, options or obligations outstanding prior to the date of this Agreement; |

| (f) | the Company will fulfil or cause to be fulfilled, at or prior to the Closing Date, each of the conditions required to be fulfilled by it set out in Section 10 hereof that are within its control (unless waived by the Agent); |

| (g) | the Company will use its commercially reasonable efforts to cause the Unit Shares, Warrant Shares, Agent's Shares and Agent's Warrant Shares to be listed and posted for trading on the CSE from and after the Automatic Exercise Date; |

| (h) | the Company will file with the Securities Commissions, the CSE and the SEC all forms, notices and certificates required to be filed by the Company pursuant to Securities Laws in the time required by Securities Laws, including, for greater certainty, Form 45-106F1 of NI 45-106 in the applicable Qualifying Jurisdictions and Form D under the U.S. Securities Act, and any other forms, notices and certificates set forth in the opinions delivered to the Agent pursuant to the closing conditions set forth in Section 10 hereof, as are required to be filed by the Company; |

| (i) | the Company will ensure that, at all times prior to the Automatic Exercise Date, a sufficient number of Common Shares are duly and validly allotted and reserved for issuance upon the due exercise of the Special Warrants, Warrants, Compensation Options, Advisory Options and Agent's Warrants, and the Company will ensure that such Unit Shares, Warrant Shares, Agent's Shares and Agent's Warrant Shares, upon issuance, will be duly issued as fully paid and non-assessable Common Shares and will have the attributes corresponding in all material respects to the description thereof set forth in this Agreement and the Subscription Agreements; |

| (j) | the Company will fulfil all legal requirements to permit the creation, offering, issuance, sale, delivery, allotment and reservation, as applicable, of the Offering Securities, all as contemplated in this Agreement and file or cause to be filed all documents, applications, forms or undertakings required to be filed by the Company and take or cause to be taken all action required to be taken by the Company in connection with the creation, offering, issuance, sale, delivery, allotment and reservation, as applicable, of the Offering Securities, so that the distribution of the Offering Securities may lawfully occur without the necessity of filing a prospectus in Canada, a registration statement in the United States or a similar document in any other jurisdiction; |

| (k) | the Company shall use the net proceeds from the sale of the Special Warrants for working capital and general corporate purposes; |

| (l) | the Company will, until the date of the completion of the distribution of the Qualified Securities, use commercially reasonable efforts to ensure the Preliminary Prospectus and Final Prospectus comply at all times with Securities Laws; |

| m) | the Company will, during the period from the date hereof until the date of the completion of the distribution of the Qualified Securities, promptly inform the Agent of the full particulars of any request of any Securities Commission for any information, or the receipt by the Company of any communication from any Securities Commissions or any other competent authority relating to the Company or which may be relevant to the distribution of the Qualified Securities; |

| (n) | the Company will comply with each of the covenants of the Company set out in the Ancillary Documents; |

| (o) | at all times prior to the completion of the distribution of the Qualified Securities, the Company will continue to operate its business in compliance with Applicable Laws and in the ordinary course; |

| (p) | the Company will forthwith notify the Agent of any breach of any covenant of this Agreement or any Ancillary Document by any party thereto, or upon it becoming aware that any representation or warranty of the Company contained in this Agreement or any Ancillary Document is or becomes untrue or inaccurate in any material respect; |

| (q) | the Company will use its commercially reasonable efforts to make the Offering Securities issuable to holders resident in Canada eligible for deposit in CDS; |

| (r) | the Company will advise the Agent, promptly after receiving notice thereof, of the time when the Preliminary Prospectus, the Final Prospectus and any Supplementary Material have been filed and receipts therefor have been obtained pursuant to NP 11-202 and will provide evidence reasonably satisfactory to the Agent of each such filing and copies of such receipts; |

| (s) | the Company will advise the Agent, promptly after receiving notice or obtaining knowledge of any of the following: |

| (i) | the issuance by any Securities Commission of any order suspending or preventing the use of the Preliminary Prospectus, the Final Prospectus or any Supplementary Material; |

| (ii) | the institution, threatening or contemplation of any proceeding for any such purposes; |

| (iii) | any order, ruling, or determination having the effect of suspending the sale or ceasing the trading in any securities of the Company (including the Special Warrants and the Underlying Securities) having been issued by any Securities Commissions or the institution, threatening or contemplation of any proceeding for any such purposes; or |

| (iv) | any requests made by any Securities Commissions to amend or supplement the Preliminary Prospectus or the Final Prospectus or to provide additional information, and will use its commercially reasonable efforts to prevent the issuance of any order referred to in Section 4(s)(i) above and, if any such order is issued, to obtain the withdrawal thereof as quickly as possible; |

| (t) | the Company will, other than in connection with a merger, amalgamation, arrangement, takeover bid, going private transaction or other similar transaction involving the purchase or sale of all of the outstanding Common Shares and following which the Company is not a "reporting issuer", use its commercially reasonable efforts to maintain its status as a "reporting issuer" (or the equivalent thereof) not in default of the requirements of Securities Laws of British Columbia and Ontario for 24 months following the Closing Date; and |

| (u) | the Company will, other than in connection with a merger, amalgamation, arrangement, takeover bid, going private transaction or other similar transaction involving the purchase or sale of all of the outstanding Common Shares and following which the Company is not listed on the CSE, use its commercially reasonable efforts to maintain the listing of the Common Shares on the CSE or such other recognized stock exchange or quotation system to the date that is 24 months following the Closing Date. |

In addition to the covenants of the Company set out in the other Sections of this Agreement, the Company hereby further covenants to and for the benefit of the Agent and the Purchasers, and acknowledges that each of them is relying on such covenants in connection with the purchase of the Special Warrants, that following the Closing:

| (v) | the Company will allow the Agent to participate in the preparation of the Preliminary Prospectus, the Final Prospectus and any Supplementary Material that the Company is required to file under Securities Laws relating to the Offering; |

| (w) | the Company will deliver to the Agent, without charge, contemporaneously with, or prior to the filing of, the Final Prospectus, unless otherwise indicated: |

| (i) | a copy of any document filed with, or delivered to, the Securities Commissions by the Company under Securities Laws with the Final Prospectus; |

| (ii) | a certificate dated the date of the Final Prospectus, addressed to the Agent and signed by the Chief Executive Officer and Chief Financial Officer of the Company, certifying for and on behalf of the Company, and not in their personal capacities, after having made due inquiries, with respect to the following matters: |

| (A) | the Company having complied with all of the covenants and satisfied all of the terms and conditions of this Agreement on its part to be complied with and satisfied at or prior to the date of the Final Prospectus; |

| (B) | no order, ruling or determination having the effect of ceasing or suspending trading in any securities of the Company or prohibiting the issue of the Special Warrants or the Underlying Securities or any Company's issued securities having been issued and no proceeding for such purpose being pending or, to the knowledge of such officers, threatened; |

| (C) | the representations and warranties of the Company contained in this Agreement and in any certificates of Company delivered pursuant to or in connection with this Agreement being true and correct as at the date of the Final Prospectus, with the same force and effect as if made on and as at the date of the Final Prospectus, after giving effect to the transactions contemplated by this Agreement; and |

| (D) | since the Closing Time there having been no material adverse change, financial or otherwise, in the assets, liabilities (contingent or otherwise), capital, business or results of operations of the Company; and |

| (x) | the Company will, until the earlier of the Qualification Date and the Automatic Exercise Date, deliver to the Agent copies of all correspondence and other written communications between the Company and any Securities Commission or other Governmental Authority relating to the Offering and will generally keep the Agent apprised of the status of, including all developments relating to, the Offering. |

| 5. | Agent's Representations, Warranties and Covenants. |

The Agent hereby represents and warrants to and covenants with the Company that:

| (a) | it is duly qualified and registered to carry on business as a securities dealer in each of the jurisdictions where the sale of the Special Warrants requires such qualification and/or registration in a manner that permits the sale of the Special Warrants on a basis described in Section 5(b); |

| (b) | it will, and will ensure any Selling Firm will, offer and solicit offers for the purchase of the Special Warrants in compliance with Securities Laws and only from such Persons and in such manner that no prospectus, registration statement or similar document will need be delivered or filed, other than any prescribed reports of the issue and sale of the Special Warrants and, in the case of any jurisdiction other than the Qualifying Jurisdictions, no continuous disclosure obligations will be created; |

| (c) | it will, and will ensure any Selling Firm will, make any offers or sales of Special Warrants in accordance with the terms of this Agreement; |

| (d) | it will conduct and will cause its affiliates. any Selling Firm and any Person acting on its behalf to conduct activities in connection with arranging for the offer and sale of the Special Warrants in compliance with Securities Laws; |

| (e) | it will obtain from each Purchaser a completed and executed Subscription Agreement, together with all Subscription Documents as may be necessary in connection with subscriptions for Special Warrants to ensure compliance with Securities Laws; and |

| (f) | it will refrain from advertising the Offering in: (i) printed media of general and regular paid circulation; (ii) radio; (iii) television; or (iv) telecommunication (including electronic display and the Internet) and not make use of any green sheet or other internal marketing without the consent of the Company, such consent to be promptly considered and not to be unreasonably withheld. |

| 6. | Material Changes During Distribution. |

| (a) | During the period from the date of this Agreement until the Automatic Exercise Date, the Company will, upon becoming aware of same, promptly notify the Agent (and, if requested by the Agent, confirm such notification in writing) of: (a) any material change (actual, anticipated, contemplated or threatened) in the business, operations, assets, liabilities (contingent or otherwise) or capital of the Company; (b) any material fact which has arisen or has been discovered following the Closing Date and is required to be stated in the Preliminary Prospectus, the Final Prospectus or any Supplementary Material or which would have been required to have been stated in the Preliminary Prospectus, the Final Prospectus or any Supplementary Material had the fact arisen or been discovered on, or prior to, the date of such document; and (c) any change in any material fact (which for the purposes of this Agreement will be deemed to include the disclosure of any previously undisclosed material fact) contained in the Disclosure Documents, the Preliminary Prospectus, the Final Prospectus or any Supplementary Material which change is, or may be, of such a nature as to render any statement in the Disclosure Documents, the Preliminary Prospectus, the Final Prospectus or any Supplementary Material misleading or untrue in any material respect or which would result in a misrepresentation in the Disclosure Documents, the Preliminary Prospectus, the Final Prospectus or any Supplementary Material or which would result in the Disclosure Documents, the Preliminary Prospectus, the Final Prospectus or any Supplementary Material not complying with Securities Laws. |

| (b) | The Company will promptly, and in any event within any applicable time limitation, comply with all applicable filing and other requirements under Securities Laws as a result of such fact or change; provided, however, that the Company must not file any Supplementary Material or other document without first advising the Agent with respect to the form and content thereof, it being understood and agreed that no such Supplementary Material or document may be filed with any Securities Commissions prior to advising the Agent. The Company must in good faith discuss with the Agent any fact or change in circumstance which is of such a nature that there is or could be reasonable doubt whether notice need be given under this Section 6. |

7. Representations and Warranties and Additional Covenants of the Company.The Company represents and warrants to, and covenants with, the Agent and the Purchasers, and acknowledges that each of them is relying upon such representations and warranties and covenants in entering into this Agreement and completing the Closing, that as of the date hereof and the Closing Time or as of such other time as is contemplated by any representation, warranty or covenant set forth below:

| (a) | the Company is validly existing under the laws of British Columbia and has all requisite corporate power, capacity and authority to: (i) own, lease and operate its assets and conduct its business as currently conducted or proposed to be conducted and to execute, deliver and carry out its obligations under this Agreement and all Ancillary Documents, and to do all acts and things and execute and deliver all documents as are required hereunder and thereunder in accordance with the terms hereof and thereof; and (ii) create, offer, issue and sell, as applicable, the Offering Securities in accordance with this Agreement; |

| (b) | each Material Subsidiary has been duly incorporated and is validly existing under the laws of its jurisdiction of incorporation and has all requisite corporate power, capacity and authority to own, lease and operate its assets and conduct its business as currently conducted or proposed to be conducted; |

| (c) | the Company and each Material Subsidiary is duly registered to do business and is in good standing in each jurisdiction in which the character of its properties, owned or leased, or the nature of its activities make such registration necessary; |

| (d) | the Subsidiaries are the only subsidiaries of the Company. The Company has no material direct or indirect subsidiaries nor any material investment in any Person or any agreement, option or commitment to acquire any such investment, and the Company does not beneficially own or exercise control or direction over 10% or more of the outstanding voting shares of any Person that holds assets or conducts operations, other than the Subsidiaries. The Company is the direct or indirect registered and/or beneficial owner of all of the issued and outstanding shares of or interests in each Subsidiary (and such ownership is evidenced by definitive documentation in the possession of the Company or the applicable Subsidiary), in each case, free and clear of all mortgages, liens, charges, pledges, security interests, encumbrances, claims, demands or adverse interests of any kind whatsoever, and no Person, firm, corporation or entity has any agreement, option, right or privilege (whether pre-emptive or contractual) capable of becoming an agreement or option, for the purchase from the Company or any Subsidiary of any of the shares or other securities of any Subsidiary. The securities of the Subsidiaries indicated in Schedule "B" constitute all of the issued and outstanding securities in the capital of each Subsidiary and have been duly authorized and are validly issued and, in the case of shares, are fully paid and non-assessable shares; |

| (e) | no proceedings have been taken, instituted or are pending for the dissolution, winding-up or liquidation of the Company or any Subsidiary, and no approval has been given to commence any such proceedings; |

| (f) | the Company has taken all necessary corporate action to authorize the execution, delivery and performance of this Agreement and each Ancillary Document and to observe and perform the provisions of this Agreement and each Ancillary Document in accordance with the provisions hereof |

| and thereof, including the creation, offering, issuance, sale, delivery, allotment and reservation, as applicable, of the Offering Securities upon the terms and conditions set forth herein and in the applicable Ancillary Documents, and the creation, offering, issuance, sale, delivery, allotment and reservation, as applicable, of the Offering Securities; |

| (g) | neither the Company nor any Subsidiary has committed an act of bankruptcy and is insolvent, has proposed a compromise or arrangement to any of its creditors, has had a petition or a receiving order in bankruptcy filed against it, has made a voluntary assignment in bankruptcy, has taken any action with respect to a compromise or arrangement, has taken any action to have itself declared bankrupt or wound-up, has taken any action to have a receiver appointed for any of its property or has had any execution or distress become enforceable or levied upon any of its property or assets; |

| (h) | the Company and each Material Subsidiary has conducted and is conducting its business in compliance in all material respects with all applicable laws and regulations of each jurisdiction in which it carries on business and the Company and each Material Subsidiary holds all requisite licences, registrations, qualifications, permits and consents necessary or appropriate for carrying on its business as currently carried on and all such licences, registrations, qualifications, permits and consents are valid and subsisting and in good standing in all respects, other than as could not result in a Material Adverse Effect. Without limiting the generality of the foregoing, neither the Company nor any Material Subsidiary has received a written notice of non-compliance, nor does it know of, nor have reasonable grounds to know of, any facts that could give rise to a notice of non-compliance with any such laws, regulations or permits; |

| (i) | the Company and each Subsidiary is the absolute legal and beneficial owner of, and has good and marketable title to, all of the material properties and assets thereof, free and clear of any Liens and no other property or assets are necessary for the conduct of the business of the Company and the Subsidiaries as currently conducted. Any and all of the agreements and other documents and instruments pursuant to which the Company and each Subsidiary holds the property and assets thereof are valid and subsisting agreements, documents and instruments in full force and effect, enforceable in accordance with the terms thereof, and such properties and assets are in good standing under the applicable statutes and regulations of the jurisdictions in which they are situated, and all material leases, licenses and other agreements pursuant to which the Company or any Subsidiary derives the interests thereof in such property are in good standing. The Company does not know of any claim or the basis for any claim that might or could materially and adversely affect the right of the Company or any Subsidiary to use, transfer or otherwise exploit their respective assets, and neither the Company nor any Subsidiary has any responsibility or obligation to pay any commission, royalty, licence fee or similar payment to any Person with respect to the property and assets thereof; |

| (j) | no legal or governmental proceedings or inquiries are pending to which the Company or any Subsidiary is a party or to which the property thereof is subject that would result in the revocation or modification of any certificate, authority, permit or license necessary to conduct the business now owned or operated by the Company or any Subsidiary and, to the knowledge of the Company, no such legal or governmental proceedings or inquiries have been threatened against or are contemplated with respect to the Company or any Subsidiary or with respect to the properties or assets thereof; |

| (k) | the Company has provided to the Agent copies of (including all material correspondence relating to) all material licenses and permits held by it, the Subsidiaries and any of their Associated Entities, and any renewals thereof as of the date hereof. As at the date hereof, the Company and each Subsidiary has all licenses, permits, authorizations, certifications, consents and orders necessary for the conduct of its business as presently conducted, other than as disclosed in the Disclosure Documents in respect of certain U.S. federal laws, statutes and/or regulations, as applicable, relating to the cultivation, processing, extraction, tracking, distribution or possession of cannabis and cannabis related products and substances in the U.S. and other related orders, judgements, or decrees (collectively, the "U.S. Cannabis Laws"). Neither the Company nor any Subsidiary has |

| received any penalty, enforcement action or public notice violation or notice thereof from any state, municipal or local government in respect of such licenses and/or permits nor, to the knowledge of the Company, are there any facts that could give rise to any such material penalty, enforcement action or public notice violation. The Company and each Subsidiary is not in breach or violation of any judgment, order or decree of any Governmental Authority or court having jurisdiction over the Company or any Subsidiary, as applicable; |

| (l) | other than in respect of U.S. Cannabis Laws, the Company and each Subsidiary has conducted and is conducting its business in compliance in all material respects with all Applicable Laws of each jurisdiction in which it carries on business and with all Applicable Laws, tariffs and directives material to its operations, including all applicable federal, state, municipal, and local laws and regulations and other lawful requirements of any governmental or regulatory body that governs all aspects of the Company's and each Subsidiaries' business, including, but not limited to, permits and/or licenses to grow, process, and dispense cannabis and cannabis-derived products and, each of the Company and the Subsidiaries has implemented regulatory compliance regimes designed to ensure compliance with such applicable laws and regulations; |

| (m) | there are no actions, suits, judgments, investigations or proceedings of any kind whatsoever outstanding or, to the best of the Company's knowledge, pending or threatened against or affecting the Company or any Subsidiary the result of which could have a Material Adverse Effect on the Company, or the directors, officers or employees thereof, at law or in equity or before or by any commission, board, bureau or agency of any kind whatsoever and, to the best of the Company's knowledge, there is no basis therefor and neither the Company nor any Subsidiary is subject to any judgment, order, writ, injunction, decree, award, rule, policy or regulation of any Governmental Authority; |

| (n) | neither the Company nor any Subsidiary is in violation of its constating documents or in default in the performance or observance of any material obligation, agreement, covenant or condition contained in any contract, indenture, trust deed, mortgage, loan agreement, note, lease, licence or other agreement or instrument to which it is a party or by which it or its property or assets may be bound; |

| (o) | to the knowledge of the Company, no counterparty to any obligation, agreement, covenant or condition contained in any contract, indenture, trust deed, mortgage, loan agreement, note, lease or other agreement or instrument to which the Company or any Subsidiary is a party is in default in the performance or observance thereof, except where such violation or default in performance could not result in a Material Adverse Effect; |

| (p) | since December 31, 2019, neither the Company nor any Subsidiary has approved, or has entered into any agreement in respect of: (i) the purchase of any material property or assets or any interest therein or the sale, transfer or other disposition of any material property or assets or any interest therein currently owned, directly or indirectly, by the Company whether by asset sale, transfer of shares or otherwise; (ii) the change in control (by sale, transfer or other disposition of shares or sale, transfer, lease or other disposition of all or substantially all of the property and assets of the Company or any Subsidiary) of the Company; or (iii) a proposed or planned disposition of shares by any shareholder who owns, directly or indirectly, 10% or more of the outstanding shares of the Company; |

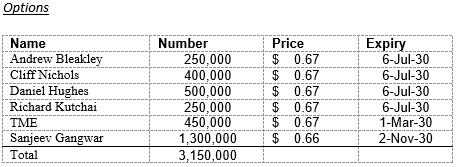

| (q) | the authorized capital of the Company consists of an unlimited number of Common Shares, of which as of the date hereof, [151,352,878] Common Shares were issued and outstanding as fully paid and non-assessable shares. As of the date hereof, other than as set out in Schedule "C", no Person has any agreement, option, right or privilege (whether pre-emptive, contractual or otherwise) capable of becoming an agreement for the purchase, acquisition, subscription for or issue of any unissued Common Shares or other securities of the Company; |

| (r) | all taxes (including income tax, capital tax, payroll taxes, employer health tax, workers' compensation payments, property taxes, custom and land transfer taxes), duties, royalties, levies, imposts, assessments, deductions, charges or withholdings and all liabilities with respect thereto including any penalty and interest payable with respect thereto (collectively, " Taxes") due and payable by the Company and each Subsidiary have been paid. All tax returns, declarations, remittances and filings required to be filed by the Company have been filed with all appropriate Governmental Authorities and all such returns, declarations, remittances and filings are complete and accurate and no material fact or facts have been omitted therefrom which would make any of them misleading. No examination of any tax return of the Company or any Subsidiary is currently in progress to the knowledge of the Company and there are no issues or disputes outstanding with any Governmental Authority respecting any taxes that have been paid, or may be payable, by the Company or any Subsidiary in any case; |

| (s) | no material labour dispute with current and former employees of the Company or any Subsidiary exists or is imminent and the Company has no knowledge of any existing, threatened or imminent labour disturbance by the employees of any of the principal suppliers, manufacturers or contractors of the Company or any Subsidiary; |

| (t) | there has not been and there is not currently any labour disruption or conflict which is adversely affecting the Company or the Subsidiaries or could have a Material Adverse Effect; |

| (u) | no officer, consultant, insider or other non-arm's length party to the Company or any Subsidiary (or any associate or affiliate thereof) has any right, title or interest in (or the right to acquire any right, title or interest in) any royalty interest, carried interest, participation interest or any other interest whatsoever which are based on revenue from or otherwise in respect of any assets of the Company or any Subsidiary; |

| (v) | the Company and each Subsidiary hold all material authorizations required under any applicable environmental laws in connection with the operation of its business and the ownership and use of its assets, and neither the Company nor any Subsidiary nor any of their assets is the subject of any investigation, evaluation, audit or review not in the ordinary and regular course by any Governmental Entity to determine whether any violation of environmental laws has occurred or is occurring, and neither the Company nor any Subsidiary is subject to any known environmental liabilities; |

| (w) | the Company and each Subsidiary has security measures and safeguards in place to protect Personally Identifiable Information it collects from patients, clients and customers, as applicable, and other parties from illegal or unauthorized access or use by its personnel or third parties or access or use by its personnel or third parties in a manner that violates the privacy rights of third parties. The Company and each Subsidiary has complied in all material respects with all applicable privacy and consumer protection laws and neither has collected, received, stored, disclosed, transferred, used, misused or permitted unauthorized access to any information protected by privacy laws, whether collected directly or from third parties, in an unlawful manner. The Company and each Subsidiary has taken all reasonable steps to protect Personally Identifiable Information against loss or theft and against unauthorized access, copying, use, modification, disclosure or other misuse; |

| (x) | the Company is eligible to file a short form prospectus in each of the Qualifying Jurisdictions under National Instrument 44-101 – Short Form Prospectus Distributions; |

| (y) | the forms and terms of the certificates representing the Common Shares have been approved and adopted by the board of directors of the Company and the form and terms of the certificates representing the Common Shares do not and will not conflict with any Applicable Laws or the rules of the CSE; |

| (z) | the forms and terms of the certificates representing each of the Special Warrants, the Warrants, the Compensation Options, the Advisory Options and the Agent's Warrants have been approved and adopted by the board of directors of the Company do not and will not conflict with any Applicable Laws; |

| (aa) | Olympia, at its principal offices in Vancouver, British Columbia, has been duly appointed as the registrar and transfer agent for the Common Shares, as the special warrant agent under the Special Warrant Indenture and as the warrant agent under the Warrant Indenture; |

| (bb) | the business and material property and assets of the Company and the Subsidiaries conform in all material respects to the descriptions thereof contained in the Disclosure Documents; |

| (cc) | all services provided to customers, in whole or in part, by the Company or any Subsidiary are provided in full compliance with and meet industry specific standards set by all applicable organizations which pertain to the business of the Company and each Subsidiary; |

| (dd) | all forward-looking information and statements of the Company contained in the Disclosure Documents, including any forecasts and estimates, expressions of opinion, intention and expectation have been based on assumptions that are reasonable in the circumstances; |

| (ee) | the statistical, industry and market related data included in the Disclosure Documents are derived from sources which the Company reasonably believes to be accurate, reasonable and reliable, and such data agrees with the sources from which it was derived; |

| (ff) | all information which has been prepared by the Company relating to the Company or any of the Subsidiaries and the business, property and liabilities thereof and provided or made available to the Agent, and all financial, marketing, sales and operational information provided to the Agent is, as of the date of such information, true and correct in all material respects, taken as whole, and no fact or facts have been omitted therefrom which would make such information misleading in any material respect; |

| (gg) | (i) the responses given by the Company and its directors and officers at all oral due diligence sessions conducted by the Agent in connection with the Offering, as they relate to matters of fact, have been and shall continue to be true and correct in all material respects as at the time such responses have been or are given, as the case may be, and such responses taken as a whole have not omitted any fact or information necessary to make any of the responses not misleading in any material respect in light of the circumstances in which such responses were given or shall be given, as the case may be; and (ii) where the responses reflect the opinion or view of the Company or its directors and officers (including responses or portions of such responses which are forward-looking or otherwise relate to projections, forecasts, or estimates of future performance or results (operating, financial or otherwise)), such opinions or views have been and will be honestly held and believed to be reasonable in the circumstances as at the date on which they are given; |

| (hh) | the Company has not completed any "significant acquisition" or "significant disposition", nor is it proposing any "probable acquisitions" (as such terms are used in NI 44-101), that would require the inclusion of any additional financial statements or pro forma financial statements in the Preliminary Prospectus or the Final Prospectus pursuant to Securities Laws; |

| (ii) | to the best of the Company's knowledge, no Person or group of Persons who are "joint actors" (within the meaning of Securities Laws) legally or beneficially owns, or has control or direction over, 10% or more of the outstanding voting securities of the Company; |

| (jj) | except for Douglas Chloupek, there is no Person or Persons who are "promoter(s)" (within the meaning of Securities Laws) of the Company; |

| (kk) | the Company and each Subsidiary owns or has all proprietary rights provided in law and at equity to all patents, trademarks, copyrights, industrial designs, software, trade secrets, know-how, concepts, information and other intellectual and industrial property (collectively, " Intellectual Property") necessary to permit the Company and each Subsidiary to conduct their respective business as currently conducted. Neither the Company nor any Subsidiary has received any notice nor is the Company aware of any infringement of or conflict with asserted rights of others with respect to any Intellectual Property or of any facts or circumstances that would render any Intellectual Property invalid or inadequate to protect the interests of the Company or any Subsidiary therein and which infringement or conflict (if subject to an unfavourable decision, ruling or finding) or invalidity or inadequacy could not result in a Material Adverse Effect; |

| (ll) | there are no material restrictions on the ability of the Company or any Subsidiary to use and explore all rights in the Intellectual Property required in the ordinary course of the business of the Company and the Subsidiaries, as applicable. None of the rights of the Company and the Subsidiaries in the Intellectual Property will be impaired or affected in any way by the transactions contemplated by this Agreement; |

| (mm) | the Company and each Subsidiary has taken all reasonable steps to protect its Intellectual Property in those jurisdictions where the Company and the Subsidiaries carry on a sufficient business to justify such filings; |

| (nn) | any and all of the agreements and other documents and instruments pursuant to which the Company and each Subsidiary holds the property and assets thereof (including any interest in, or right to earn an interest in, any Intellectual Property) are valid and subsisting agreements, documents or instruments in full force and effect, enforceable in accordance with the terms thereo; neither the Company nor any Subsidiary is in default of any material provisions of any such agreements, documents or instruments nor has any such default been alleged; such properties and assets are in good standing under the applicable statutes and regulations of the jurisdictions in which they are situated; and all material leases, licences and other agreements pursuant to which the Company and each Subsidiary derives their interests in such property and assets are in good standing and there has been no material default under any such lease, licence or agreement. None of the properties (or any interest in, or right to earn an interest in, any property) of the Company or any Subsidiary is subject to any right of first refusal or purchase or acquisition right; |