Exhibit 99.1

Scott Mahoney

Chief Executive Officer

____________,2019

Dear Taronis Technologies Shareholder:

We are pleased to inform you that the board of directors of Taronis Technologies, Inc. (“Taronis Technologies”) has approved a plan to pursue a separation of its gas and welding supply retail business from Taronis Technologies through a spin-off of its wholly owned subsidiary, Taronis Fuels, Inc. (“Taronis Fuels”). Taronis Technologies will distribute the shares of Taronis Fuels as a dividend to shareholders of Taronis Technologies on or about December 5, 2019. We expect the Taronis Fuels common stock to be quoted on the OTCQX of the OTC Market Group under the symbol “TRNF” at the time of the spin-off and, assuming such quotation, we expect to up list the Taronis Fuels common stock from the OTCQX to The NYSE American (“NYSE American exchange”) under the symbol “TRNF” within six months following the spin-off date.

As a current shareholder of Taronis Technologies, you will receive five (5) shares of common stock of Taronis Fuels for every one (1) share of common stock of Taronis Technologies that you own and hold as of the record date so long as you continue to hold your shares on the distribution date, as further described in the enclosed Information Statement. Shareholder approval of the distribution is not required, nor are you required to take any action to receive your shares of common stock of Taronis Fuels.

Following completion of the spin-off, common stock of Taronis Technologies, which will continue as a leading clean technology company in the renewable resources and environmental solutions industries, will continue to trade on the Nasdaq Capital Market, subject to Taronis Technologies continued compliance with the Nasdaq Listing Rules, under the symbol “TRNX.”

We invite you to learn more about Taronis Fuels by reviewing the enclosed Information Statement, which describes the spin-off and Taronis Fuels in detail and contains important information about Taronis Fuels, including historical audited and unaudited condensed combined carve-out financial statements.

Thank you for your continued support of Taronis Technologies and your future support of Taronis Fuels.

Sincerely,

Scott Mahoney

Chief Executive Officer

Enclosure

Taronis Technologies, Inc.

300 W. Clarendon Avenue, #230

Phoenix, Arizona 85013

United States

Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

Subject to Completion, dated September 30, 2019

INFORMATION STATEMENT

TARONIS FUELS, INC.

Common Stock

($0.000001 par value)

Taronis Technologies, Inc., (“Taronis Technologies”) is sending this Information Statement (“Information Statement”) to its shareholders in connection with the distribution by Taronis Technologies of 100% of the outstanding common stock of Taronis Fuels, Inc. (“Taronis Fuels”) to holders of Taronis Technologies’ common stock. As of the date of this Information Statement, Taronis Technologies owns all of Taronis Fuel’s outstanding common stock.

On June 24, 2019, Taronis Technologies’ Board of Directors approved a plan to pursue a separation of its gas and welding supply retail business from Taronis Technologies through a spin-off, which will result in the distribution of 100% of Taronis Technologies’ interest in Taronis Fuels to holders of Taronis Technologies’ common stock. Holders of Taronis Technologies’ common stock will be entitled to receive five (5) shares of Taronis Fuels common stock for every one (1) share of Taronis Technologies common stock held as of 5:00 p.m., New York City time, on the record date, November 29, 2019. The distribution date for the spin-off will be on or about December 5, 2019. Immediately after the distribution is completed, Taronis Fuels will be an independent, publicly traded company. The distribution is being conducted on a pro rata basis to the Taronis Technologies shareholders in a manner that is intended to be tax-free for United States federal income tax purposes.

You willnot be required to pay any cash or other consideration for the Taronis Fuels common stock that will be distributed to you or to surrender or exchange your Taronis Technologies common stock to receive Taronis Fuels common stock in the spin-off. The distribution will not affect the number of Taronis common stock that you hold. No approval by Taronis Technologies shareholders of the spin-off is required or being sought. You are not being asked for a proxy and you are requested not to send a proxy.

As discussed under “The Spin-off–Trading Between the Record Date and Distribution Date,”if you sell your Taronis Technologies common stock in the “regular way” marketafterthe record date,but before or on the distribution date, you will be selling your right to receive Taronis Fuels common stock in connection with the spin-off. You are encouraged to consult with your financial advisor regarding the specific implications of selling your Taronis Technologies common stock before or on the distribution date.

Taronis Fuels common stock is not publicly traded and there iscurrently no public market for its common stock.Taronis Fuels will file a Form 211 with the Financial Industry Regulatory Authority (“FINRA”) and apply to have its common stock authorized for quotation on the OTCQX market of the OTC Markets Group, Inc.but there are no assurances that its common stock will be quoted on the OTCQX or any other quotation service, exchange or trading facility. An active public market for its common stock may not develop or be sustained after the distribution. If an active public market does not develop or is not sustained, it may be difficult for its stockholders to sell their shares of common stock at a price that is attractive to them, or at all. Taronis Fuels intends to request the symbol “TRNF” to be issued in connection with the initiation of quotation on the OTCQX. Assuming Taronis Fuels’ application for quotation is approved, Taronis Fuelsexpects that a limited market, commonly known as a “when-issued” trading market, for its common stock will begin prior to the distribution date on the record date, November 29, 2019, and Taronis Fuels expects that “regular way” trading of its common stock will begin the first day of trading after the distribution date, on or about December 5, 2019. Following the distribution date, Taronis Fuels intends to apply to up list its common stock to The NYSE American (“NYSE American exchange”) exchange under the symbol “TRNF” and expects such up listing to occur within six months of the distribution date, but there is no assurance that its common stock will be listed on the NYSE American.

In reviewing this Information Statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 14 of this Information Statement.

Neither the Securities and Exchange Commission, or SEC, nor any state securities commission has approved or disapproved these securities or determined if this Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

This Information Statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Taronis Technologies first mailed or made this Information Statement available electronically to its shareholders on or about November 29, 2019.

The date of this Information Statement is ___________, 2019.

TABLE OF CONTENTS

In this Information Statement, unless the context requires otherwise or we specifically indicate otherwise, the terms “Taronis Fuels,” “we,” “our” and “us” when used in a historical context refer to Taronis Fuels, Inc., and its subsidiaries MagneGas Welding Supply – Southeast, LLC, MagneGas Welding Supply – South, LLC, MagneGas Welding Supply – West, LLC, MagneGas Real Estate Holdings, LLC, MagneGas Production, LLC, MagneGas Limited (United Kingdom) and MagneGas Ireland Limited (Republic of Ireland), individually a “subsidiary” and collectively the “subsidiaries”, and when used in the present or future tense refer to Taronis Fuels and its subsidiaries after giving effect to the spin-off. “Taronis Technologies” means Taronis Technologies, Inc., a Delaware corporation, and its subsidiaries, other than Taronis Fuels, Inc. and its subsidiaries, unless the context otherwise requires.

The transaction in which Taronis Technologies will distribute the shares of Taronis Fuels common stock to Taronis Technologies stockholders is referred to in this Information Statement as the “distribution.” The transactions in which Taronis Fuels will be separated from Taronis Technologies and Taronis Fuels will become an independent publicly-traded company, including the distribution, are referred to in this Information Statement collectively as the “spin-off.”

Except as otherwise indicated or unless the context otherwise requires, the information included in this Information Statement about Taronis Fuels assumes the completion of the spin-off.

This Information Statement is being furnished solely to provide information to Taronis Technologies’ stockholders who will receive shares of common stock of Taronis Fuels in the spin-off. It is not provided as an inducement or encouragement to buy or sell any securities of Taronis Technologies or Taronis Fuels. This Information Statement describes our business, our relationship with Taronis Technologies, and how the spin-off affects Taronis Technologies and its stockholders, and provides other information to assist you in evaluating the Taronis Fuels common stock that you will receive in the spin-off. You should not assume that the information contained in this Information Statement is accurate as of any date other than the date set forth on the front cover. Changes will occur after the date of this Information Statement, and neither we nor Taronis Technologies will update the information except in the normal course of our or Taronis Technologies’ respective public disclosure practices or to the extent required pursuant to federal securities laws.

Trademarks, Trade Names and Service Marks

We own or have rights to use the trademarks, trade names and service marks that we use in connection with the operation of our business. Some of the more important marks that we own or have the rights to use in the United States or in other jurisdictions that appear in this Information Statement include: “MagneGas” and “Venturi”. Our rights to some of these trademarks may be limited to select markets. Each trademark, trade name or service mark of any other company appearing in this Information Statement is, to our knowledge, owned by that other company.

SUMMARY

The following is a summary of some of the information contained in this Information Statement. It does not contain all the details concerning Taronis Fuels or the spin-off transaction, including information that may be important to you. We urge you to read this entire document carefully, including “Risk Factors,” “Selected Historical Consolidated Financial Data” and the “Audited and Unaudited Condensed Combined Carve-Out Financial Statements” and the notes to those financial statements included elsewhere in this Information Statement.

References in this Information Statement to the terms “Taronis Fuels,” “we,” “our” and “us” when used in a historical context refer to Taronis Fuels, Inc., and its subsidiaries MagneGas Welding Supply – Southeast, LLC, MagneGas Welding Supply – South, LLC, MagneGas Welding Supply – West, LLC, MagneGas Real Estate Holdings, LLC, MagneGas Production, LLC, MagneGas Limited (United Kingdom) and MagneGas Ireland Limited (Republic of Ireland), individually a “subsidiary” and collectively the “subsidiaries”, and when used in the present or future tense refer to Taronis Fuels and its subsidiaries after giving effect to the spin-off. References in this Information Statement to our historical assets, liabilities, products, operations or activities of our business generally refer to the historical assets, liabilities, products, operations or activities of our business as it was historically owned, incurred or conducted by Taronis Fuels and its subsidiaries prior to the spin-off.

References in this Information Statement to “Taronis Technologies” means Taronis Technologies, Inc., a Delaware corporation, and its subsidiaries, other than Taronis Fuels and its subsidiaries, unless the context otherwise requires. The transaction in which Taronis Technologies will distribute the shares of Taronis Fuels common stock to Taronis Technologies stockholders is referred to in this Information Statement as the “distribution.” The transactions in which Taronis Fuels will be separated from Taronis Technologies and Taronis Technologies will become an independent publicly-traded company, including the distribution, are referred to in this Information Statement collectively as the “spin-off.” Unless otherwise indicated or the context otherwise requires, the information included in this Information Statement assumes the completion of the spin-off and all of the transactions referred to in this Information Statement as occurring in connection with the spin-off.

Our Company

We are a holding company of various gas and welding supply companies, including MagneGas Welding Supply – Southeast, LLC, MagneGas Welding Supply – South, LLC, MagneGas Welding Supply – West, LLC, MagneGas Limited (United Kingdom) and MagneGas Ireland Limited (Republic of Ireland), that sells and distributes gas production Venturi® units, a full line of industrial gases and welding equipment and services to the retail and wholesale metalworking and manufacturing industries.

In addition to a suite of industrial gases and welding supply equipment offerings, we also create, sell and distribute a synthetic gas called “MagneGas”, which is produced by our wholly owned subsidiary, MagneGas Production, LLC. MagneGas is comprised primarily of hydrogen and created through a patented protected process, which we license from Taronis Technologies under an exclusive worldwide license. The fuel can be used as an alternative to acetylene and other fossil-fuel derived fuels for metal cutting and other commercial uses. After production, the fuel is stored in hydrogen cylinders which are then sold to market on a rotating basis. Independent analyses performed by the City College of New York and Edison Welding Institute have verified that MagneGas cuts metal at a significantly higher temperature and faster than acetylene, which is the most commonly used fuel in metal cutting. The use of MagneGas is substantially similar to acetylene making it easy for end-users to adopt our product with limited training.

Over the last several years we have acquired and maintain a retail distribution network, which allows us to sell and transport MagneGas to customers in various metalworking industries. Since 2017, we have doubled the range we are able to distribute MagneGas and are now able to more efficiently address markets within a 500-mile radius of our production hubs in Florida and Texas. We currently have a Venturi® Plasma Arc gas production unit in Texas that is in the process of being readied for MagneGas production. Within the next year or so, we plan to add one or more production hubs in California to serve the western United States. Finally, we have and intend to continue to acquire complementary gas and welding supply distribution businesses in order to expand the distribution and use of MagneGas, other industrial gases and related equipment. We have sold to over 30,000 customers in the public and private sectors.

As of September 30, 2019, we sell industrial gas and welding equipment and services through our 22 retail locations located throughout California, Texas, Louisiana and Florida. Prior to the proposed spin-off, we have been a wholly-owned subsidiary of Taronis Technologies.

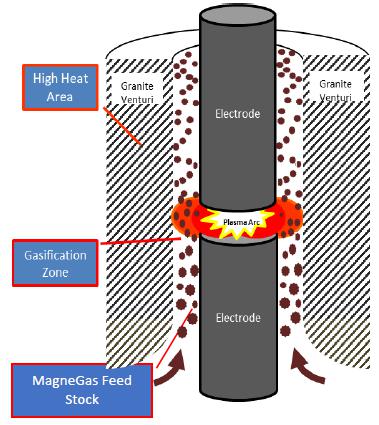

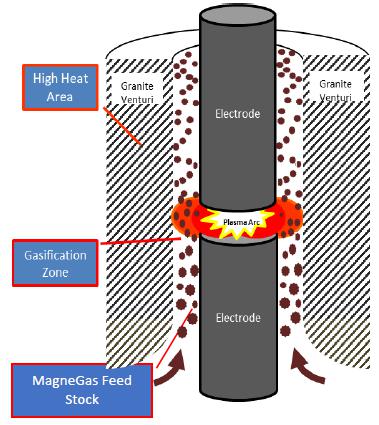

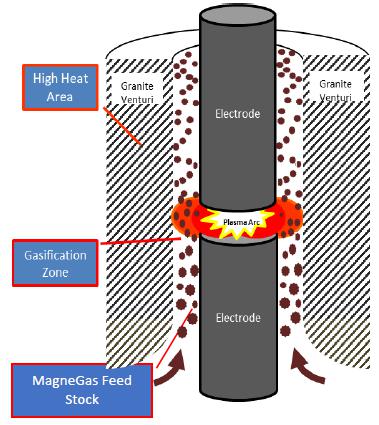

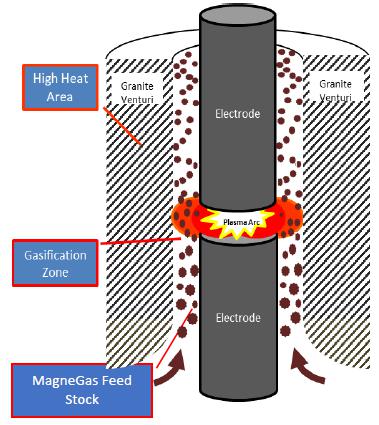

Proprietary Product – MagneGas Fuel

In addition to the other industrial gases and welding supplies we sell, we have one proprietary product that we market and sell which is derived from our core licensed technology. “MagneGas” is our clean, renewable alternative cutting fuel which is sold at our various locations to retail end users as an alternative product to acetylene. MagneGas is created by passing the MagneGas feed stock through the patented submerged Venturi® Plasma Arc System.

| ● Our patented (licensed) system enables fluid to efficiently pass through a submerged plasma arc. ● To create synthetic fuel, the fluid must contain hydrogen and oxygen – carbon supply can be facilitated by the electrodes. ● As the fluid passes through the arc, hydrogen, carbon and oxygen molecules are liberated and gasified. ● A wide range of feedstocks can produce different gases, with differing flame and heating properties ● Typically, our fuels are 40-60% ionized hydrogen and 30-40% other synthetic hydrocarbon and carbon compounds. |

Strategy

We strive to be a top independent industrial gas and welding supply company. We aim to accomplish this goal through commercialization of our existing proprietary product MagneGas, increasing marketing/sales and awareness of our MagneGas and through increasing our customer base. To help commercialize the use of MagneGas, over the last several years we have acquired and integrated a number of independent welding supply and gas distribution businesses, which now offer MagneGas as an alternative to acetylene in 22 retail locations across the United States. We have also expanded internationally and have aligned ourselves with reputable industry leaders in product application, testing and safety. Finally, we will continue to evaluate potential strategic acquisition targets to enhance our organic based growth model and to market and sell our Venturi® Plasma Arc units abroad.

Distribution

We distribute and sell our MagneGas fuel, other gases and welding supplies at our retail locations in California, Texas, Louisiana and Florida and through our subsidiaries and in some cases through a select network of independent welding supply distributors. We primarily sell our Venturi® Plasma Arc units directly for commercial application of MagneGas production outside the United States.

Competitive Business Conditions

The competitive landscape in which our welding supply and gas distribution businesses operates is comprised of several major international conglomerates, such as Airgas, Linde, Air Products and Praxair, to name a few, and a number of smaller independent distributors which compete for market share in certain geographical areas. We believe that the superior qualities of MagneGas and our dedicated staff are a market differentiator which allows us to compete with both large conglomerates and smaller distributors.

Governmental Approval

Most of our welding supply products and the applications for which they are used are not subject to governmental approval, although we are subject to state and local licensing requirements.

Governmental Regulations

We are regulated by the United States Department of Transportation and state transportation agencies in the method of storage and transportation of the gases we make and sell. We believe that our current operations are fully compliant with applicable local, state and federal regulations.

Key Factors Affecting Performance

Sales of Gases and Welding Supplies

We generate substantially all of our revenue through the sale of industrial gases and welding equipment for the retail and wholesale metalworking and manufacturing industries. In some cases, we generate revenue from the sale of services.

Utilization of Our Products

We believe there is significant opportunity to increase awareness and the use of MagneGas as an alternative to acetylene and propane. Our product is green, renewable and burns clean. We believe that as more of our present and future customers realize the potential of MagneGas, as well as the greater market, our sales will continue to grow and diversify.

Investment in Infrastructure and Growth

Our ability to increase our sales of industrial gases and welding equipment and the ancillary services we offer and to further penetrate our target markets is dependent in large part on our ability to invest in our infrastructure and in our sales and marketing efforts. We continue to invest in value-add infrastructure, such as gas fill plants and gas cylinders. In order to drive future growth, we plan to hire additional sales personnel and invest in marketing our products to our target customers both in the United States and internationally. We believe this will lead to corresponding increases in our operating expenses, and thus may negatively impact our operating results in the short term, although we believe that these investments will grow and improve our business and financial condition over the long term.

Increased System Efficiency for Greater Fuel Output

We continue to conduct ongoing research to discover methods to increase efficiency and reduce the cost of the production of our fuels. Since 2012, we have reduced our production costs by 88% and are working diligently to reduce costs by another 50% in the next 12 months, which we believe will enable us to out-price acetylene producers. During the last two fiscal years, we typically had 3 to 6 full-time employees working on research and development projects. We will receive the benefit of continued research and development results and initiatives pursuant to our intellectual property license with Taronis Technologies. For more information, see the section entitled “Material Agreements Between Taronis Technologies and Us”.

Employees

As of September 30, 2019, we employed approximately 145 full-time employees. We have occasionally used temporary employees and independent contractors to perform production and other duties. We consider our relationship with our employees to be excellent.

Properties

In the spring of 2019, we transitioned our executive team to new corporate headquarters located at 16165 N. 83rd Avenue, Suite 200, Peoria, Arizona 85382. We also have a research and development facility located at 11885 44th Street North, Clearwater, Florida.

Nearly all of our retail locations are subject to lease arrangements, some of which provide us the option to purchase the subject real estate in the future. We are planning to or are otherwise in the process of purchasing parcels of real estate encompassing one or more of our retail locations.

Risk Factors

Our business is subject to numerous risks and uncertainties, including those described in “Risk Factors” immediately following this Information Statement summary and elsewhere in this Information Statement. These risks represent challenges to the successful implementation of our strategy and to the growth and future profitability of our business. These risks include, but are not limited to, the following:

| | ● | our history of operating losses; |

| | | |

| | ● | the state of the metal working and manufacturing industries; |

| | | |

| | ● | competition in the gas and welding supply retail and wholesale markets; |

| | | |

| | ● | the fluctuation in prices of the products we supply and distribute; |

| | | |

| | ● | product shortages and relationships with key suppliers; |

| | | |

| | ● | product liability and warranty claims, and other claims related to our business; and |

| | | |

| | ● | our ability to attract key employees; and |

| | | |

| | ● | general economic and financial conditions. |

In addition, the report of our independent registered public accounting firm for the years ended December 31, 2018 and 2017 contains a statement with respect to substantial doubt as to our ability to continue as a going concern as a result of recurring losses from operations and negative cash flows.

The Spin-Off

We are a wholly-owned subsidiary of Taronis Technologies. On July 15, 2019, Taronis Technologies announced that it intended to spin-off Taronis Fuels and its gas and welding supply business from the remainder of its businesses through a tax-free distribution of 100% of the issued and outstanding shares of common stock of Taronis Fuels to the stockholders of Taronis Technologies on a pro rata basis. The entity being spun-off is composed of Taronis Fuels and its subsidiaries. On June 24, 2019, Taronis’ Board of Directors approved the distribution of the issued and outstanding shares of Taronis Fuels common stock in the spin-off on a 1 for 1 basis. On August 21, 2019, the Board of Directors of Taronis Technologies, Inc., in anticipation of the 1:5 reverse split that was effected on August 22, 2019, revised and increased the Taronis Fuels, Inc. dividend ratio to 5:1, such that Taronis Technologies shareholders will receive five (5) shares of Taronis Fuels common stock for every one (1) share of Taronis Technologies common stock held as of the close of business on November 29, 2019, the record date for the spin-off. The purpose of the increase was to provide Taronis Technologies’ shareholders with the same number of shares they would have received if not for the reverse split. All common share numbers in this Form 10 as it relates to Taronis Technologies, Inc. have been retroactively restated for the 1:5 reverse split that was effected on August 22, 2019 as if it was in effect for all periods presented.

Our Post Spin-Off Relationship with Taronis Technologies

In connection with the spin-off, we and Taronis Technologies will enter into a number of agreements that will govern our future relationship. As a result of these agreements, among other things, following the spin-off (i) we and Taronis Technologies will indemnify the other’s past and present directors, officers and employees, and each of their successors and assigns, against certain liabilities incurred in connection with the spin-off and our and Taronis Technologies’ respective businesses, (ii) we will be liable for all pre-distribution U.S. federal income taxes, foreign income taxes and non-income taxes attributable to our business as well as for all other taxes attributable to us after the distribution, (iii) we and Taronis Technologies will provide and/or make available various administrative services and assets to each other, and (iv) we and Taronis Technologies will lease or sublease certain office space to each other. For more information, see the section entitled “Relationship with Taronis Technologies After the Spin-off–Material Agreements between Taronis Technologies and Us.”

Reasons for the Spin-Off

As a result of a comprehensive evaluation process performed by Taronis Technologies’ Board of Directors, Taronis Technologies’ Board of Directors believes that separating Taronis Technologies into two independent, publicly traded companies is in the best interests of Taronis Technologies and its shareholders, and has concluded that the spin-off will provide each company with certain opportunities and benefits. Such opportunities and benefits include:

| | - | Investor Perspectives. Improving the market’s understanding of the unique industry-leading business and financial characteristics of both Taronis Technologies and Taronis Fuels and facilitating independent valuation assessments for each company. This is expected to provide investors with a more targeted investment opportunity. |

| | | |

| | - | Strategic Focus. Enhancing the flexibility of the management team of each company to implement its distinct corporate strategy and make business and operational decisions that are in the best interests of its independent business and shareholders and to allocate capital and corporate resources in a manner that focuses on achieving its own strategic priorities independent of varying business cycles. |

| | | |

| | - | Management & Employee Incentives. Incentivizing management performance through equity-based compensation that is aligned with the performance of its own operations and designed to attract and retain key employees. |

| | | |

| | - | Access to Capital. Removing the competition for capital between the businesses. Instead, both companies will have direct access to the debt and equity capital markets to fund their respective growth strategies and to establish an appropriate capital structure for their business needs. |

| | | |

| | - | Flexibility. Providing each independent company increased strategic and financial flexibility to pursue acquisitions, unencumbered by considerations of the potential impact on the business of the other company. |

The Taronis Technologies Board of Directors also considered the probability of successful execution of the spin-off and the risks associated therewith, including the: potential loss of synergies from operating as a consolidated entity; potential loss of joint purchasing power; potential disruptions to the businesses as a result of the spin-off, including information technology or other disruptions; risk of being unable to achieve the benefits expected to be attained by the spin-off; risk that the spin-off might not be completed; potential impact on both companies’ ability to continue to demonstrate civic and charitable leadership in their respective communities; and one-time costs of executing the spin-off. The Taronis Technologies Board of Directors concluded that, notwithstanding these potentially negative factors, the spin-off would be in the best interests of its shareholders. For more information, see the section entitled “The Spin-Off – Reasons for the Spin-off” included elsewhere in this information statement.

Reason for Furnishing this Information Statement

This Information Statement is being furnished solely to provide information to stockholders of Taronis Technologies who will receive shares of Taronis Fuels common stock in the spin-off. It is not, and is not to be construed as, an inducement or encouragement to buy or sell any of Taronis Technologies’ or Taronis Fuels’ shares of common stock or other securities. The information contained in this Information Statement is believed by Taronis Fuels to be accurate as of the date on the cover. Changes may occur after that date, and neither we nor Taronis Technologies will update the information except in the normal course of our and Taronis Technologies’ respective disclosure practices or to the extent required pursuant to federal securities laws.

Corporate History

We were initially organized as a Delaware limited liability company on February 1, 2017, under the name MagneGas Welding Supply, LLC, to be a holding company for Taronis Technologies welding supply companies, including our subsidiaries. On April 9, 2019, the Company was converted from a limited liability company to a corporation in accordance with the Delaware General Corporation Law. In conjunction with the conversion, we changed the name of the Company to Taronis Fuels, Inc.

Company Information

After the spin-off, our principal office will be located at 16165 N. 83rd Avenue, Suite 200, Peoria, Arizona 85382 and our phone number will be 866-370-3835. Our corporate website address iswww.taronisfuels.com.Information contained on, or accessible through, our website is not a part of, and is not incorporated by reference into, this Information Statement.

Emerging Growth Company Status

We are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We have elected to take advantage of all of these exemptions.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay compliance with new or revised accounting standards until those standards are applicable to private companies. We have elected to take advantage of the benefits of this extended transition period.

We will be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although we will lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any three-year period or if we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act.

Summary of the Spin-off

The following is a brief summary of the terms of the spin-off. Please see the section entitled “The Spin-Off” for a more detailed description of the matters described below.

| Distributing Company | | Taronis Technologies, which is the parent company of Taronis Fuels. After the distribution, Taronis Technologies will not retain any of the issued and outstanding shares of Taronis Fuels’ common stock. |

| | | |

| Distributed Company | | Taronis Fuels, which is currently a wholly owned subsidiary of Taronis Technologies. After the distribution, Taronis Fuels will be an independent, publicly traded company. |

| | | |

| Shares to be Distributed | | Approximately 90,280,000 shares of common stock of Taronis Fuels, subject to adjustment on the record date. Our common stock to be distributed on a pro rata basis will constitute 100% of our issued and outstanding common stock immediately after the spin-off. |

| | | |

| Distribution Ratio | | Each holder of existing Taronis Technologies common stock will receive five (5) shares of Taronis Fuels common stock for every one (1) share of Taronis Technologies common stock held on the record date and retained by the shareholder up to the distribution date. |

| Distribution Procedures | | On or about the distribution date, the distribution agent identified below will distribute our common stock by crediting those shares to book-entry accounts established by the transfer agent for persons who were existing shareholders of Taronis Technologies as of 5:00 p.m., New York City time, on the record date. Shareholders may also participate in the spin-off if they purchase Taronis Technologies common stock in the “regular way” market after the record date and retain the Taronis Technologies common stock through the distribution date. Taronis Technologies shareholders will not be required to make any payment or surrender or exchange their Taronis Technologies common stock or take any other action to receive our common stock. |

| | | |

| Distribution Agent, Transfer Agent and Registrar for our Common Stock | | Corporate Stock Transfer, Inc., which currently serves as the transfer agent and registrar for Taronis Technologies’ common stock. |

| | | |

| Record Date | | November 29, 2019, which will be the effective date of the registration statement on Form 10 of which this Information Statement forms a part. Holders of record of Taronis Technologies common stock on the record date will become entitled to receive Taronis Fuels common stock as outlined above. In addition, their rights as holders of common stock of Taronis Technologies will continue. |

| | | |

| Distribution Date | | 5:00 p.m., New York city time, on or about December 5, 2019. |

| | | |

| Assets and Liabilities Transferred to the Distributed Company | | Before the distribution date, we and Taronis Technologies will enter into separation and distribution agreements that will contain key provisions relating to the separation of our business from Taronis Technologies and the distribution of our common stock. The separation and distribution agreements will identify the assets to be transferred (if any), liabilities to be assumed and contracts to be assigned to us by Taronis Technologies in the spin-off and describe when and how these transfers, assumptions and assignments will occur. See “Relationship with Taronis Technologies Following the Spin-off–Material Agreements Between Taronis Technologies and Us–Separation and Distribution Agreement.” |

| | | |

| Relationship with Taronis Technologies after the Spin-Off | | Before the distribution date, we and Taronis Technologies will enter into several agreements to govern our relationship following the distribution, including a tax sharing agreement, a transition services agreement and other agreements governing other ongoing commercial relationships. See “Relationship with Taronis Technologies Following the Spin-off–Material Agreements Between Taronis Technologies and Us.” |

| | | |

| Indemnities | | The separation and distribution agreements to be entered into in connection with the spin-off will provide for cross-indemnification between Taronis Technologies and us. See “Relationship with Taronis Technologies Following the Spin-off–Material Agreements Between Taronis Technologies and Us–Separation and Distribution Agreement.” In addition, we will indemnify Taronis Technologies under the tax sharing agreement that we will enter into in connection with the spin-off for the taxes resulting from any acquisition or issuance of our shares that triggers the application of Section 355(e) of the U.S. Internal Revenue Code of 1986, as amended, the “Code”. We will also indemnify Taronis Technologies for certain taxes incurred before and after the distribution date. See “Relationship with Taronis Technologies Following the Spin-off–Material Agreements Between Taronis Technologies and Us-Tax Sharing Agreement.” |

| Conditions to the Spin-Off | | We expect that the spin-off will be completed on the distribution date, provided that the conditions set forth under the caption “The Spin-off Conditions and Termination” have been satisfied in Taronis’ Technologies sole and absolute discretion. |

| | | |

| Reasons for the Spin-Off | | Taronis Technologies’ Board of Directors and management believe that our separation from Taronis Technologies will provide the following benefits: (i) improving the market’s understanding and valuation of both principal businesses; (ii) enhancing the ability of the management team of each company to pursue more focused strategies that are in the best interests of its business and shareholders, respectively; (iii) providing the ability to better align incentive compensation with the financial performance of each business, as well as the ability to attract and retain key employees; (iv) creating the opportunity to employ appropriate capital structures within each business adhering to their respective financial profiles and optimal fiscal policies; and (v) increasing the flexibility to independently evaluate and finance organic and inorganic growth opportunities without limitations of operating as a consolidated entity. See “The Spin-off–Reasons for the Spin-off.” |

| | | |

| Stock Exchange Listing | | Currently there is no public market for our common stock.Wewill file a Form 211 with the Financial Industry Regulatory Authority (“FINRA”) and apply to have our common stock authorized for quotation on the OTCQX market of the OTC Markets Group, Inc.but there are no assurances that our common stock will be quoted on the OTCQX or any other quotation service, exchange or trading facility. Assuming our application for quotation is approved, we anticipate that trading will commence on a “when-issued” basis approximately two trading days before the record date. When-issued trading refers to a transaction made conditionally because the security has been authorized but not yet issued. Generally, common stock may trade on the OTCQX on a when-issued basis after they have been authorized but not yet formally issued, which is often initiated by the OTCQX prior to the record date relating to the issuance of such common stock. When-issued transactions are settled after our common stock have been issued to Taronis Technologies’ shareholders. On the first trading day following the distribution date, when-issued trading in respect of our common stock will end and regular way trading will begin. “Regular way” trading refers to trading after a security has been issued. We cannot predict the trading price for our common stock following the spin-off. Following the distribution date, we intend to apply to up list our common stock to NYSE American exchange under the symbol “TRNF” and expect such up listing to occur within six months of the distribution date, but there is no assurance that our common stock will be listed on the NYSE American. In addition, following the spin-off, Taronis Technologies common stock will remain outstanding and will continue to trade on the Nasdaq Capital Market under the symbol “TRNX”, subject to Taronis Technologies continued compliance with the Nasdaq Listing Rules. |

| | | |

| Dividend Policy | | We expect to pay dividends on our common stock at the discretion of our board of directors and dependent upon then-existing conditions, including our operating results and financial condition, capital requirements, contractual restrictions, business prospects and other factors that our board of directors may deem relevant. See “Dividend Policy.” |

| | | |

| Risk Factors | | You should review the risks relating to the spin-off, our industry and our business and ownership of our common stock described in “Risk Factors.” |

QUESTIONS AND ANSWERS ABOUT THE SPIN-OFF

| A: | The spin-off is the method by which Taronis Fuels will separate from Taronis Technologies. To complete the spin-off, Taronis Technologies will distribute, as a dividend, to its shareholders on a pro rata basis 100% of the common stock of Taronis Fuels that it owns. Following the spin-off, we will be an independent, publicly traded company. You do not have to pay any consideration or give up any portion of your Taronis Technologies common stock to receive our common stock in the spin-off. |

| Q: | What is the expected date for the completion of the spin-off? |

| A: | The completion and timing of the spin-off is dependent on a number of conditions, but if such conditions are timely met, we expect the spin-off to be completed on or about December 5, 2019. See “The Spin-off Conditions and Termination.” |

| Q: | What are the reasons for and benefits of separating from Taronis Technologies? |

| A: | Taronis Technologies’ Board of Directors and management believe that our separation from Taronis Technologies will provide the following benefits: (i) improving the market’s understanding and valuation of the principal businesses, respectively; (ii) enhancing the ability of the management team of each company to pursue more focused strategies that are in the best interests of its business and shareholders; (iii) providing the ability to better align incentive compensation with the financial performance of each business, as well as the ability to attract and retain key employees; (iv) creating the opportunity to employ appropriate capital structures within each business adhering to their respective financial profiles and optimal fiscal policies; and (v) increasing the flexibility to independently evaluate and finance organic and inorganic growth opportunities without limitations of operating as a consolidated entity. For a more detailed discussion of the reasons for the spin-off, see “The Spin-Off-Reason for Spin-Off.” |

| A: | Taronis Fuels, Inc. is a Delaware corporation that was initially formed as a Delaware limited liability company called MagneGas Welding Supply, LLC on February 1, 2017. On April 9, 2019, the Company was converted to a Delaware corporation and the name of the Company was changed to Taronis Fuels, Inc. |

| Q: | Who will manage Taronis Fuels after the separation? |

| A: | We will be led by Scott Mahoney, who will be our Chief Executive Officer and President, and will oversee the rest of our experienced management team, including Tyler Wilson, our Chief Financial Officer, General Counsel and Secretary;and Eric Newell, our Treasurer and Vice President of Corporate Operations as well as certain other key employees. We will also benefit from the knowledge, experience and skills of our board of directors. For more information regarding our management team and our board of directors following the separation, see “Management.” |

| Q: | What is being distributed in the Spin-Off? |

| A: | Taronis Technologies will distribute five (5) shares of Taronis Fuels common stock for every one (1) share of Taronis Technologies common stock outstanding as of the record date for the spin-off. The number of shares of Taronis Technologies you own and your proportionate interest in Taronis Technologies will not change as a result of the spin-off. Immediately following the spin-off, your proportionate interest in Taronis Fuels will be identical to your proportionate interest in Taronis Technologies (as adjusted for any fractional shares). |

| Q: | What is the record date for the Spin-Off, and when will the Spin-Off occur? |

| A: | The record date is November 29, 2019, and ownership is determined as of 5:00 p.m., New York City time, on that date. Taronis Fuels common stock will be distributed on or about December 5, 2019, which we refer to as the distribution date. |

| Q: | Can Taronis Technologies decide to cancel the Spin-Off even if all the conditions have been met? |

| A: | Yes. The spin-off is subject to the satisfaction or waiver by Taronis Technologies of certain conditions, including, among others, approval of the Taronis Technologies Board of Directors, effectiveness of our registration statement on Form 10 of which this Information Statement is a part and receipt of an opinion from our tax counsel, regarding the tax-free nature of the spin-off. See “The Spin-off Conditions and Termination.” Even if all such conditions are met, Taronis Technologies has the right to cancel the spin-off if, at any time prior to the distribution, the Board of Directors of Taronis Technologies determines, in its sole discretion, that the spin-off is not in the best interests of Taronis Technologies or its shareholders, that a sale or other alternative is in the best interests of Taronis Technologies or its shareholders, or that market conditions or other circumstances are such that it is not advisable to separate the welding supply and gas distribution business from Taronis Technologies at that time. In the event the Taronis Technologies Board of Directors waives a material condition or amends, modifies or abandons the spin-off, Taronis Technologies will notify its shareholders in a manner reasonably calculated to inform them of such modifications with a press release, Current Report on Form 8-K or other similar means. |

| Q: | As a holder of Taronis Technologies common stock as of the record date, what do I have to do to participate in the Spin-Off? |

| A: | Nothing. You are not required to take any action to participate in the spin-off, although you are urged to read this entire document carefully. You will receive five (5) shares of Taronis Fuels common stock for every one (1) share of Taronis Technologies common stock you hold as of the record date and retain through the distribution date. You may also participate in the spin-off if you purchase Taronis Technologies common stock in the “regular way” market after the record date and retain your Taronis Technologies common stock through the distribution date. See “The Spin-off–Trading Between the Record Date and Distribution Date.” |

| Q: | If I sell my Taronis Technologies common stock before or on the distribution date, will I still be entitled to receive Taronis Fuels common stock in the Spin-Off? |

| A: | Potentially not. If you sell your Taronis Technologies common stock in the “regular way” market after the record date and before or on the distribution date, you may also be selling your right to receive Taronis Fuels common stock. See “The Spin-off–Trading Between the Record Date and Distribution Date.” You are encouraged to consult with your financial advisor regarding the specific implications of selling your Taronis Technologies common stock before or on the distribution date. |

| Q: | How will fractional shares be treated in the Spin-Off? |

| A: | The distribution agent will not distribute any fractional shares of our common stock in connection with the spin-off. When calculating the shares to distribute, all fractional shares will be deleted from the shareholders total issuance, creating a “round down” effect. |

| Q: | Will the Spin-Off affect the trading price of my Taronis Technologies common stock? |

| A: | Most likely. The trading price of Taronis Technologies common stock immediately following the spin-off is expected to be lower than immediately prior to the spin-off because the trading price of Taronis Technologies’ common stock will no longer reflect the value of the combined businesses. However, we cannot provide you with any guarantees as to the prices at which the Taronis Technologies common stock or Taronis Fuels common stock will trade following the spin-off. |

| Q: | Will my Taronis Technologies common stock continue to trade on a stock market? |

| A: | Yes, Taronis Technologies common stock will continue to be listed on the Nasdaq Capital Market under the symbol “TRNX”, subject to Taronis Technologies’ continued compliance with the Nasdaq Listing Rules. |

| Q: | What are the U.S. federal income tax consequences of the distribution of our common stock to U.S. shareholders? |

| A: | Taronis Technologies expects to obtain an opinion of counsel that the distribution of Taronis Fuels common stock to Taronis Technologies shareholders in the spin-off will qualify as a tax-free distribution for United States federal income tax purposes. Taronis Technologies will provide its U.S. shareholders with information to enable them to compute their tax basis in both Taronis Technologies and Taronis Fuels common stock, but such shareholders will not be parties to or be permitted to rely on the tax opinion. This information will be posted on Taronis Technologies’ website, www.taronistech.com, promptly following the distribution date. Certain U.S. federal income tax consequences of the spin-off are described in more detail under “The Spin-off–Material U.S. Federal Income Tax Consequences of the Spin-off.” You should consult your own tax advisor as to the application of the tax basis allocation rules and the particular consequences of the spin-off to you, including the applicability and effect of any U.S. federal, state, local and foreign tax laws, which may result in the spin-off distribution being taxable to you in whole or in part. |

| Q: | When will I receive my Taronis Fuels common stock? Will I receive a stock certificate for Taronis Fuels common stock distributed as a result of the spin-off? |

| A: | Registered holders of Taronis Technologies common stock who are entitled to participate in the spin-off will receive a book-entry account statement reflecting their ownership of Taronis Fuels common stock. For additional information, registered shareholders in the United States, Canada or Puerto Rico should contact Taronis Technologies’ transfer agent, Corporate Stock Transfer, Inc., at 3200 Cherry Creek South Drive, Suite 430, Denver, Colorado 80209 or through its website atwww.corporatestock.comor by calling (303) 282-4800. If you would like to receive physical certificates evidencing your Taronis Fuels common stock, please contact Taronis Fuels’ transfer agent. See “The Spin-off–When and How You Will Receive Taronis Fuels Shares.” |

| Q: | What if I hold my common stock through a broker, bank or other nominee? |

| A: | Taronis Technologies shareholders who hold their common stock through a broker, bank or other nominee will have their brokerage account credited with Taronis Fuels common stock. For additional information, those shareholders should contact their broker or bank directly. |

| Q: | What if I have stock certificates reflecting my Taronis Technologies common stock? Should I send them to the transfer agent or to Taronis Technologies? |

| A: | No, you should not send your stock certificates to the transfer agent or to Taronis Technologies. You should retain your Taronis Technologies stock certificates. |

| Q: | Why is the separation of the two companies structured as a Spin-Off as opposed to a sale? |

| A: | A U.S. tax-free distribution of shares in Taronis Fuels is an efficient way to separate the gas and welding supply retail business in a manner that is expected to create long-term value for Taronis Technologies, Taronis Fuels and their respective shareholders. |

| Q: | What are the conditions to the Spin-Off? |

| A: | The spin-off is subject to a number of conditions, including, among others, the effectiveness the registration statement of which this Information Statement forms a part. See “The Spin-off Conditions and Termination.” |

| Q: | Will Taronis Fuels incur any debt prior to or at the time of the Spin-Off? |

| A: | We currently expect that on the distribution date we will have approximately an aggregate of $6,345,253 of borrowings and other long-term debt. Based on historical performance and current expectations, we believe that the cash generated from our operations and available cash and cash equivalents will be sufficient to service this debt. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations–Liquidity and Capital Resources.” |

| Q: | Are there risks to owning common stock of Taronis Fuels? |

| A: | Yes. Taronis Fuels’ business is subject both to general and specific business risks relating to its operations. In addition, the spin-off presents risks relating to Taronis Fuels being an independent, publicly traded company. See “Risk Factors.” |

| Q: | Does Taronis Fuels intend to pay cash dividends? |

| A: | Potentially. We expect to pay dividends on our common stock at the discretion of our board of directors and dependent upon then-existing conditions, including our operating results and financial condition, capital requirements, contractual restrictions, business prospects and other factors that our board of directors may deem relevant. See “Dividend Policy.” |

| Q: | Will Taronis Fuels common stock trade on a stock market? |

| A: | There iscurrently no public market for our common stock. We will file a Form 211 with the Financial Industry Regulatory Authority (“FINRA”) and apply to have our common stock quoted on the OTCQX market of the OTC Markets Group, Inc.but there are no assurances that our common stock will be quoted on the OTCQX or any other quotation service, exchange or trading facility. An active public market for our common stock may not develop or be sustained after the distribution. If an active public market does not develop or is not sustained, it may be difficult for our stockholders to sell their shares of common stock at a price that is attractive to them, or at all. We intend to request the symbol “TRNF” to be issued in connection with the initiation of quotation on the OTCQX.Following the distribution date, we intend to apply to up list our common stock to NYSE American exchange under the symbol “TRNF” and expect such up listing to occur within six months of the distribution date, but there is no assurance that our common stock will be listed on the NYSE American. |

| Q: | What will happen to Taronis Technologies stock options, restricted stock, performance shares, restricted stock units and deferred share awards? |

| A: | Each outstanding Taronis Technologies stock option, restricted share, performance share, restricted stock unit and deferred share award will generally be treated in a manner similar to that experienced by Taronis Technologies shareholders with respect to their Taronis Technologies common stock. More specifically, each of these awards will generally be deemed bifurcated into two separate awards: (1) a modified award covering Taronis Technologies common stock; and (2) a new award of the same type covering Taronis Fuels common stock. Strategic performance shares (performance-based restricted stock units) will not be bifurcated. Instead, performance under the applicable metrics will be determined by the Compensation Committee of the board of directors of Taronis Technologies, or the Taronis Technologies Compensation Committee, and will be settled in cash at the time the award would have otherwise been settled. See “The Spin-off–Stock-Based Plans.” |

| Q: | What will the relationship between Taronis Technologies and Taronis Fuels be following the Spin-Off? |

| A: | In connection with the spin-off, we and Taronis Technologies will enter into a number of agreements that will govern our future relationship. As a result of these agreements, among other things, following the spin-off (i) we and Taronis Technologies will indemnify the other’s past and present directors, officers and employees, and each of their successors and assigns, against certain liabilities incurred in connection with the spin-off and our and Taronis Technologies’ respective businesses, (ii) we will be liable for all pre-distribution U.S. federal income taxes, foreign income taxes and non-income taxes attributable to our business as well as for all other taxes attributable to us after the distribution, (iii) we and Taronis Technologies will provide and/or make available various administrative services and assets to each other and (iv) we and Taronis Technologies will lease or sublease certain office space to each other. In addition, we have entered into an exclusive license agreement, whereby we and Taronis Technologies will exclusively license the intellectual property related to the creation of “MagneGas” and the production and sale of Venturi® Plasma Arc units. See “Relationship with Taronis Technologies After the Spin-off–Material Agreements between Taronis Technologies and Us.” |

| Q: | Will I have appraisal rights in connection with the Spin-Off? |

| A: | No. Holders of Taronis Technologies common stock are not entitled to appraisal rights in connection with the spin-off. |

| Q: | Who is the transfer agent for your common stock? |

| A: | Corporate Stock Transfer, Inc. |

| Q: | Who is the distribution agent for the Spin-Off? |

| A: | Corporate Stock Transfer, Inc. |

| Q: | Who can I contact for more information? |

| A: | If you have questions relating to the mechanics of the distribution of Taronis Fuels common stock, you should contact the distribution agent: |

Corporate Stock Transfer, Inc.

3200 Cherry Creek South Drive, Suite 430

Denver, Colorado 80209

Telephone: (303) 282-4800

Toll Free: (877) 309-2764

Before the spin-off, if you have questions relating to the spin-off, you should contact Taronis at:

Taronis Technologies, Inc.

16165 N. 83rd Avenue, Suite 200

Peoria, Arizona 85382

Attention: Michael Khorassani – Investor Relations

Telephone: 866-370-3835

After the spin-off, if you have questions relating to Taronis Fuels, you should contact us at:

Taronis Fuels Inc.

16165 N. 83rd Avenue, Suite 200

Peoria, Arizona 85382

Attention: Michael Khorassani – Investor Relations

Telephone: 866-370-3835

RISK FACTORS

The following are certain risk factors that could affect our business, financial condition and results of operations. The risks that are highlighted below are not the only ones that we face. You should carefully consider each of the following risks and all of the other information contained in this Information Statement. Some of these risks relate principally to our spin-off from Taronis Technologies, while others relate principally to our business and the industry in which we operate or to the securities markets generally and ownership of our common stock. If any of the following risks actually occur, our business, financial condition or results of operations could be negatively affected.

Risks Relating to the Spin-Off

We may not realize the potential benefits from the spin-off.

We may not realize the potential benefits that we expect from our spin-off from Taronis Technologies. We have described those anticipated benefits elsewhere in this Information Statement. See “The Spin-off–Reasons for the Spin-off.” In addition, we expect to incur one-time transaction costs of approximately $250,000 or less (Taronis Technologies is expected to bear substantially all of the estimated one-time transaction costs to effectuate the spin-off). We will incur additional ongoing costs related to the transition to becoming an independent public company and replacing the services previously provided by Taronis Technologies, which may exceed our estimates, and we will likely incur some negative effects from our separation from Taronis Technologies.

Our historical audited and unaudited condensed combined carve-out financial information is not necessarily indicative of our future financial condition, results of operations or cash flows nor do they reflect what our financial condition, results of operations or cash flows would have been as an independent public company during the periods presented.

The historical audited and unaudited condensed combined carve-out financial information we have included in this Information Statement does not reflect what our financial condition, results of operations or cash flows would have been as an independent public company during the periods presented and is not necessarily indicative of our future financial condition, future results of operations or future cash flows. This is primarily a result of the following factors:

| | ● | our historical audited and unaudited condensed combined carve-out financial results reflect allocations of expenses for services historically provided by Taronis Technologies, Inc. and those allocations may be significantly lower than the comparable expenses we would have incurred as an independent company; |

| | | |

| | ● | our working capital requirements and capital expenditures historically have been satisfied as part of Taronis Technologies’ corporate-wide capital allocation and cash management programs; as a result, our debt structure and cost of debt and other capital may be significantly different from that reflected in our historical audited and unaudited condensed combined carve-out financial statements; |

| | | |

| | ● | the historical audited and unaudited condensed combined carve-out financial information may not fully reflect the increased costs associated with being an independent public company, including significant changes that will occur in our cost structure, management, financing arrangements and business operations as a result of our spin-off from Taronis Technologies; and |

| | | |

| | ● | the historical audited and unaudited condensed combined carve-out financial information may not fully reflect the effects of certain liabilities that will be incurred or assumed by us and may not fully reflect the effects of certain assets that will be transferred to, and liabilities that will be assumed by, Taronis Technologies, Inc. |

We have no history operating as an independent public company. We will incur additional expenses to create the corporate infrastructure necessary to operate as an independent public company and we will experience increased ongoing costs in connection with being an independent public company.

We have historically used Taronis Technologies’ corporate infrastructure to support our business functions. The expenses related to establishing and maintaining this infrastructure were spread among all of the Taronis Technologies businesses. Except as described under the caption “Relationship with Taronis Technologies Following the Spin-off,” we will no longer have access to Taronis Technologies’ infrastructure after the distribution date, and we will need to establish our own. We expect to incur costs beginning in 2019 to establish the necessary infrastructure.

Taronis Technologies performs many important corporate functions for us, including some treasury, tax administration, accounting, financial reporting, human resource services, marketing and communications, information technology, incentive compensation, legal and other services. We currently pay Taronis Technologies for many of these services on a cost-allocation basis. Following the spin-off, Taronis Technologies will continue to provide some of these services to us on a transitional basis pursuant to a transition services agreement we will enter into with Taronis Technologies. For more information regarding the transition services agreement, see “Relationship with Taronis Technologies Following the Spin-off–Material Agreements Between Taronis Technologies and Us – Transition Services Agreement.” However, we cannot assure you that all these functions will be successfully executed by Taronis Technologies during the transition period or that we will not have to expend significant efforts or costs materially in excess of those estimated in the transition services agreement. Any interruption in these services could have a material adverse effect on our financial condition, results of operation and cash flows. In addition, at the end of this transition period, we will need to perform these functions ourselves or hire third parties to perform these functions on our behalf. It is currently estimated that the additional ongoing costs to be incurred after the spin-off related to the transition to becoming an independent public company and replacing the services previously provided by Taronis Technologies will range from approximately $250,000 to $500,000. The costs associated with performing or outsourcing these functions may exceed the amounts reflected in our historical combined carve-out financial statements or that we have agreed to pay Taronis Technologies during the transition period. A significant increase in the costs of performing or outsourcing these functions could materially and adversely affect our business, financial condition, results of operations and cash flows.

We will be subject to continuing contingent liabilities of Taronis Technologies following the Spin-Off.

After the spin-off, there will be several significant areas where the liabilities of Taronis Technologies may become our obligations. The separation and distribution agreements generally provide that we are responsible for substantially all liabilities that may exist that relate to our gas and welding supply retail business activities, whether incurred prior to or after the spin-off, as well as those liabilities of Taronis Technologies specifically assumed by us. See “Relationship with Taronis Technologies Following the Spin-off–Material Agreements Between Taronis Technologies and Us.” In addition, under the Code and the related rules and regulations, each corporation that was a member of the Taronis Technologies consolidated tax reporting group during any taxable period or portion of any taxable period ending on or before the completion of the spin-off is jointly and severally liable for the federal income tax liability of the entire Taronis Technologies consolidated tax reporting group for that taxable period. In connection with the spin-off, we will enter into a tax sharing agreement with Taronis Technologies that will allocate the responsibility for prior period taxes of the Taronis Technologies consolidated tax reporting group between us and Taronis Technologies. See “Relationship with Taronis Technologies Following the Spin-off–Material Agreements Between Taronis Technologies and Us–Tax Sharing Agreement.” However, if Taronis Technologies is unable to pay any prior period taxes for which it is responsible, we could be required to pay the entire amount of such taxes. Other provisions of federal law establish similar liability for other matters, including laws governing tax-qualified pension plans as well as other contingent liabilities.

If the spin-off does not qualify as a tax-free transaction, Taronis Technologies could be subject to material amounts of taxes and, in certain circumstances, we could be required to indemnify Taronis Technologies for material taxes pursuant to indemnification obligations under the tax sharing agreement.

The spin-off is conditioned on Taronis Technologies’ receipt of an opinion from our special tax counsel to Taronis Technologies (or other nationally recognized tax counsel), in form and substance satisfactory to Taronis Technologies, that the distribution of Taronis Fuels common stock in the spin-off will qualify as tax-free to us, Taronis Technologies and Taronis Technologies shareholders for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) and related provisions of the Code. Such opinion is expected to be delivered to us by special tax counsel prior to the spin-off. The opinion will rely on, among other things, various assumptions and representations as to factual matters made by Taronis Technologies and us which, if inaccurate or incomplete in any material respect, could jeopardize the conclusions reached by such counsel in its opinion. Neither we nor Taronis Technologies are aware of any facts or circumstances that would cause the assumptions or representations that will be relied on in the opinion of counsel to be inaccurate or incomplete in any material respect. The opinion will not be binding on the Internal Revenue Service, or IRS, or the courts, and there can be no assurance that the qualification of the spin-off as a transaction under Sections 355 and 368(a) of the Code will not be challenged by the IRS or by others in court, or that any such challenge would not prevail.

If, notwithstanding receipt of the opinion of counsel, the spin-off were determined not to qualify under Section 355 of the Code, each U.S. holder of Taronis Technologies common stock who receives our common stock in the spin-off would generally be treated as receiving a taxable distribution of property in an amount equal to the fair market value of our common stock received. That distribution would be taxable to each such shareholder as a dividend to the extent of such shareholder’s share of Taronis Technologies’ current and accumulated earnings and profits. For each such shareholder, any amount that exceeded its share of Taronis Technologies’ earnings and profits would be treated first as a non-taxable return of capital to the extent of such shareholder’s tax basis in his or her or its Taronis Technologies common stock with any remaining amount being taxed as a capital gain. Taronis Technologies would be subject to tax as if it had sold common stock in a taxable sale for their fair market value and would recognize taxable gain in an amount equal to the excess of the fair market value of such shares over its tax basis in such shares.

With respect to taxes and other liabilities that could be imposed on Taronis Technologies in connection with the spin-off (and certain related transactions) under the terms of the tax sharing agreement we will enter into with Taronis Technologies prior to the spin-off, we will be liable to Taronis Technologies for any such taxes or liabilities attributable to actions taken by or with respect to us, any of our affiliates, or any person that, after the spin-off, is an affiliate thereof. See “Relationship with Taronis Technologies Following the Spin-off–Material Agreements Between Taronis Technologies and Us – Tax Sharing Agreement.” We may be similarly liable if we breach specified representations or covenants set forth in the tax sharing agreement. If we are required to indemnify Taronis Technologies for taxes incurred as a result of the spin-off (or certain related transactions) being taxable to Taronis Technologies, it could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Potential liabilities associated with certain assumed obligations under the tax sharing agreement cannot be precisely quantified at this time.

Under the tax sharing agreement with Taronis Technologies, we will be responsible generally for all taxes paid after the spin-off attributable to us or any of our subsidiaries, whether accruing before, on or after the spin-off. We have also agreed to be responsible for, and to indemnify Taronis Technologies with respect to, all taxes arising as a result of the spin-off (or certain internal restructuring transactions) failing to qualify as transactions under Sections 368(a) and 355 of the Code for U.S. federal income tax purposes (which could result, for example, from a merger or other transaction involving an acquisition of our shares) to the extent such tax liability arises as a result of any breach of any representation, warranty, covenant or other obligation by us or certain affiliates made in connection with the issuance of the tax opinion relating to the spin-off or in the tax sharing agreement. As described above, such tax liability would be calculated as though Taronis Technologies (or its affiliate) had sold its common stock of our company in a taxable sale for their fair market value, and Taronis Technologies (or its affiliate) would recognize taxable gain in an amount equal to the excess of the fair market value of such shares over its tax basis in such shares. That tax liability could have a material adverse effect on our company. For a more detailed discussion, see “Relationship with Taronis Technologies Following the Spin-off – Material Agreements Between Taronis Technologies and Us – Tax Sharing Agreement.”

We may not be able to engage in desirable strategic or equity raising transactions following the Spin-Off. In addition, under some circumstances, we could be liable for any adverse tax consequences resulting from engaging in significant strategic or capital raising transactions.

Even if the spin-off otherwise qualifies as a tax-free distribution under Section 355 of the Code, the spin-off may result in significant U.S. federal income tax liabilities to Taronis Technologies under applicable provisions of the Code if 50% or more of Taronis Technologies’ shares or our shares (in each case, by vote or value) are treated as having been acquired, directly or indirectly, by one or more persons (other than the acquisition of our common stock by Taronis Technologies shareholders in the spin-off) as part of a plan (or series of related transactions) that includes the spin-off. Under those provisions, any acquisitions of Taronis Technologies shares or our shares (or similar acquisitions), or any understanding, arrangement or substantial negotiations regarding an acquisition of Taronis Technologies shares or our shares (or similar acquisitions), within two years before or after the spin-off are subject to special scrutiny. The process for determining whether an acquisition triggering those provisions has occurred is complex, inherently factual and subject to interpretation of the facts and circumstances of a particular case. If a direct or indirect acquisition of Taronis Technologies shares or our shares resulted in a change in control as contemplated by those provisions, Taronis Technologies (but not its shareholders) would recognize taxable gain. Under the tax sharing agreement, there are restrictions on our ability to take actions that could cause the separation to fail to qualify as a tax-free distribution, and we will be required to indemnify Taronis Technologies against any such tax liabilities attributable to actions taken by or with respect to us or any of our affiliates, or any person that, after the spin-off, is an affiliate thereof. We may be similarly liable if we breach certain other representations or covenants set forth in the tax sharing agreement. See “Relationship with Taronis Technologies Following the Spin-off – Material Agreements Between Taronis Technologies and Us – Tax Sharing Agreement.” As a result of the foregoing, we may be unable to engage in certain strategic or capital raising transactions that our shareholders might consider favorable, including use of Taronis Fuels common stock to make acquisitions and equity capital market transactions, or to structure potential transactions in the manner most favorable to us, without adverse tax consequences, if at all.

Potential indemnification liabilities to Taronis Technologies pursuant to the separation and distribution agreements could materially and adversely affect our business, financial condition, results of operations and cash flows.

We will enter into a separation agreement and a distribution agreement with Taronis Technologies that will provide for, among other things, the principal corporate transactions required to effect the spin-off, certain conditions to the spin-off and provisions governing the relationship between our company and Taronis Technologies with respect to and resulting from the spin-off. For a description of the separation and distribution agreements, see “Relationship with Taronis Technologies Following the Spin-off – Material Agreements Between Taronis Technologies and Us – Separation and Distribution Agreements.” Among other things, the separation and distribution agreement provides for indemnification obligations designed to make us financially responsible for substantially all liabilities that may exist relating to our gas and welding supply retail business activities, whether incurred prior to or after the spin-off, as well as those obligations of Taronis Technologies assumed by us pursuant to the separation and distribution agreement. If we are required to indemnify Taronis Technologies under the circumstances set forth in the separation and distribution agreement, we may be subject to substantial liabilities.

In connection with our separation from Taronis Technologies, Taronis Technologies will indemnify us for certain liabilities. However, there can be no assurance that the indemnity will be sufficient to insure us against the full amount of such liabilities, or that Taronis Technologies’ ability to satisfy its indemnification obligations will not be impaired in the future.