About This Prospectus

The prospectus that is included in this registration statement is in two parts: first, this prospectus supplement, which sets forth the principal terms of the Up BTOX PharmaShares and the Down BTOX PharmaShares, and, second, the base prospectus, which describes PharmaShares Advisors, LLC, in its capacity as depositor and administrative agent, and the PharmaShares Trust, and includes detailed disclosure about the terms applicable to each Series of the PharmaShares Trust and the related risks and other considerations that are important for investors in any of these Series.

You should rely only on the information contained in this prospectus supplement and the base prospectus. We have not, and no Authorized Participant has, authorized any person to provide you with information that is different from that contained in this prospectus supplement and the base prospectus. We are offering to sell, and seeking offers to buy, up to the maximum registered dollar amount of Up BTOX PharmaShares and Down BTOX PharmaShares specified on the cover page of this registration statement only in states or other jurisdictions where such offers and sales are permitted.

Table of Contents

NOTE ABOUT CERTAIN INFORMATION CONTAINED IN THIS PROSPECTUS SUPPLEMENTiii

WHERE YOU CAN FIND MORE INFORMATIONiii

REPORTS TO SHAREHOLDERSiii

FORWARD-LOOKING STATEMENTSiv

REFERENCE PRODUCT OVERVIEW1

SUMMARY OF PRINCIPAL TERMS2

RISK FACTORS RELATED TO YOUR SERIES9

THE TERMS OF YOUR SERIES12

The Issuer and the Securities Offered12

Use of Proceeds13

The Administrative Agent13

The Marketing Agent13

The Trustee13

The Calculation Agent14

Daily Reporting14

The Series Assets15

The Reference Value16

The Reference Product17

The Projected Breakpoint19

Periodic Distributions24

Final Distributions27

Paired Optional Redemptions28

Paired Issuances28

Termination Triggers29

Fees and Expenses29

Form of the Shares31

Listing31

U.S. Federal Income Tax Considerations32

ERISA Considerations32

CUSIP and ISIN Numbers32

Experts32

Plan of Distribution32

Appendices

Appendix A: Hypothetical Returns Based on Broker Reporting Group Projections A-1

Appendix B: Hypothetical Underlying Value CalculationsB-1

Appendix C: Projected Breakpoint for Current Calendar QuarterC-1

Appendix F: Financial Statements for the PharmaShares TrustF-1

ii

Unless otherwise indicated, all references in this prospectus supplement to the “administrative agent,” “we,” “us,” “our,” or similar terms refer to PharmaShares Advisors, LLC.

We include cross-references in this prospectus supplement to sections where you can find further related discussions. The preceding table of contents provides the pages on which these sections begin. We also include cross-references in this prospectus supplement to sections within the base prospectus where you can find information relevant to the Up BTOX PharmaShares and the Down BTOX PharmaShares.

NOTE ABOUT CERTAIN INFORMATION CONTAINED IN THIS PROSPECTUS SUPPLEMENT

The information contained in this prospectus supplement in the sections entitled “REFERENCE PRODUCT OVERVIEW,” “SUMMARY OF PRINCIPAL TERMS — Reporting Verticals of BOTOX®” and “THE TERMS OF YOUR SERIES — The Reference Product” is based on information obtained from sources that we believe to be reliable. However, we have not independently verified the accuracy or completeness of such information.

PharmaSharesTM are not sponsored, endorsed, sold or promoted by AbbVie Inc. or any of its subsidiaries or affiliates or any other entity (referred to as a “related entity”) that is involved in the intellectual property ownership, development, production, marketing and/or sales of BOTOX®. None of AbbVie Inc., any of its subsidiaries or affiliates or any related entity has made any representation or warranty, express or implied, to the owners of a class of PharmaShares of Series BTOX, or any member of the public regarding the advisability of investing in securities generally or in any class of PharmaShares issued by Series BTOX particularly or the investor returns that may be obtained by comparing actual net revenues generated by BOTOX® over a defined period to revenue projections made by a select group of brokers. None of AbbVie Inc., its subsidiaries or affiliates or any related entity has any relationship to PharmaShares Advisors, LLC. None of AbbVie Inc., any of its subsidiaries or affiliate or any related entity is responsible for or has participated in determining the pricing, quantities or timing of any issuance or sale of Series BTOX 2020-1 or any other Series of PharmaShares by the PharmaShares Trust or the calculation of underlying value for Series BTOX 2020-1 or any other Series.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the United States Securities and Exchange Commission, or the “SEC,” a registration statement under the United States Securities Act of 1933, as amended, which we refer to as the “Securities Act,” with respect to the shares offered pursuant to the base prospectus and this prospectus supplement for the Up BTOX PharmaShares, Series BTOX-2020 and the Down BTOX PharmaShares, Series BTOX-2020. Each of the base prospectus and this prospectus supplement contains summaries of the material terms of the documents it refers to, but does not contain all of the information set forth in the registration statement of which the base prospectus and this prospectus supplement are part. For further information, we refer you to the registration statement. The SEC maintains an internet website that contains our registration statement, as well as reports, information statements and other information that we file electronically with the SEC. You may access the website at http://www.sec.gov. You may also access the registration statement and related documents at http://www.pharmashares.net.

The base prospectus and this prospectus supplement together constitute the offering document for the Up BTOX PharmaShares, Series BTOX-2020 and the Down BTOX PharmaShares, Series BTOX-2020. The base prospectus and this prospectus supplement do not constitute an offer of shares to any person in any state or other jurisdiction in which such offer would be unlawful.

You may inspect (1) copies of the master trust agreement for the PharmaShares Trust and the Series BTOX-2020 Trust Supplement to that master trust agreement, or the “Series BTOX Trust Supplement,” and (2) the records maintained by the trustee, the calculation agent and the administrative agent on behalf of Series BTOX at the office of the respective service provider during regular business hours upon two (2) business days’ prior notice. The office of the trustee and calculation agent is located at [●]. The office of the administrative agent is located at 36 Vincent Street, Chatham, New Jersey 07928.

REPORTS TO SHAREHOLDERS

We will prepare and file with the SEC, in accordance with the requirements of the United States Exchange Act of 1934, as amended, quarterly reports on Form 10-Q, annual reports on Form 10-K and current reports on Form

iii

8-K for the PharmaShares Trust and Series BTOX. You may contact your broker to obtain paper copies of these reports.

FORWARD-LOOKING STATEMENTS

The SEC encourages issuers to disclose forward-looking information so that investors can better understand the future prospects of their investments and make informed investment decisions. This prospectus supplement and the base prospectus contains these types of statements. Words such as “anticipates,” “estimates,” “expects,” “projects,” “intends,” “plans,” “believes” and words or terms of similar substance used in connection with any discussion of the future performance of the shares offered in this prospectus supplement are forward-looking statements. All forward-looking statements reflect our present expectation of future events and the realization of these future events is subject to a number of important variables that could cause actual results to differ materially from those described in the forward-looking statements. The “RISK FACTORS” section of the base prospectus and “RISK FACTORS RELATED TO YOUR SERIES” in this prospectus supplement provide examples of these variables. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus supplement and the base prospectus. Except for our ongoing obligation to disclose material information under the federal securities laws, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

iv

REFERENCE PRODUCT OVERVIEW

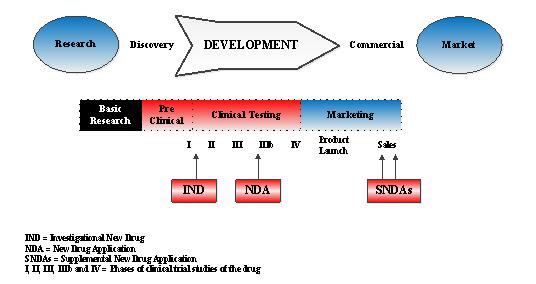

The following information is taken from historic public filings made by Allergan plc (“Allergan”) and, after Allergan was acquired by AbbVie Inc. (“AbbVie”), from public filings made by AbbVie. Additional information about BOTOX® is contained in those public filings.

Existing Indications

Product | Therapeutic Area | Active Ingredient | Therapeutic Classification |

BOTOX® Cosmetic | Facial Aesthetics | Onabotulinum Toxin A | Acetylcholine release inhibitor |

BOTOX® Hyperhidrosis | Medical Dermatology | Onabotulinum Toxin A | Acetylcholine release inhibitor |

BOTOX® Therapeutics | Neuroscience & Urology | Botulinum toxin | Musculoskeletal agent |

Potential New Indications/Delivery

Product | Therapeutic Area | Indication | Expected Launch Year | Phase |

BOTOX® | Medical Aesthetics | Platysma/Masseter | 2025/2023 | II |

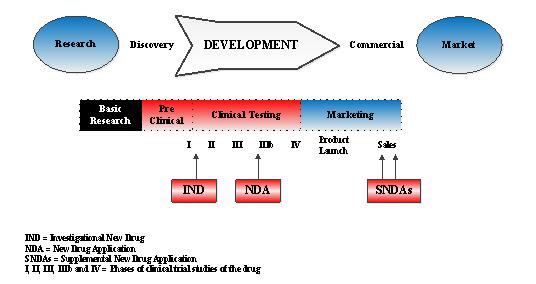

Year of United States Food and Drug Administration (FDA) approval for therapeutic application: 1989

First year of commercial sales for therapeutic application: 1990

Year of FDA approval for cosmetic application: 2002

First year of commercial sales for BOTOX® Cosmetic: 2003

Initial year of patent expiry: 11/28/2014

Drug administration: Injection

Ownership profile of drug: AbbVie ownership of intellectual property and manufacturing rights, following AbbVie’s acquisition of Allergan.

Royalties or out-licensing: BOTOX® has been exclusively sold by Allergan and it is not out-licensed for sale. The license will continue to be held by Allergan, Inc., as subsidiary of AbbVie, or may need to be transferred to AbbVie in some regions.

1

SUMMARY OF PRINCIPAL TERMS

Reference Product and Value Reference Product | BOTOX® (OnabotulinumtoxinA) |

Reference Value

Geography covered

Indications covered

Out-licensed sales not covered | Net revenue for BOTOX® reported in U.S. dollars that are generated:

worldwide

for all indications

no exclusions |

Reporting Verticals of BOTOX® | Facial Aesthetics (BOTOX® Cosmetic), Medical Dermatology (BOTOX® Hyperhidrosis) and Neuroscience & Urology (BOTOX® Therapeutics) |

Reference pharmaceutical company | AbbVie Inc. BOTOX® was developed and manufactured by Allergan plc which was acquired and merged into AbbVie Inc. as of May 8, 2020. |

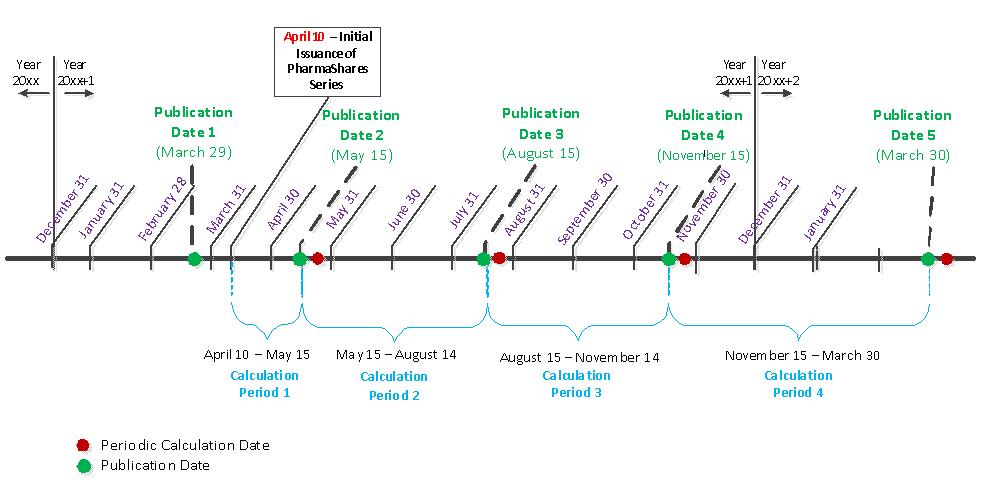

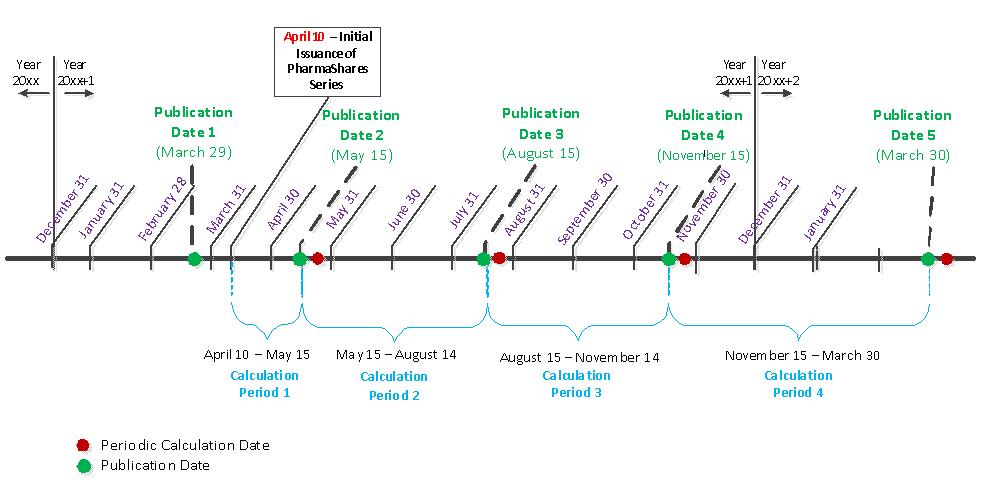

Reporting source of BOTOX® net revenue data Publication Dates | AbbVie Inc. periodic public filings on Form 10-Q and Form 10-K made with the United States Securities and Exchange Commission (“SEC”). The dates on which the reference pharmaceutical company files its periodic public reports. Historically, AbbVie Inc. has filed its 10-Q between 33 to 40 days following the end of Q1, Q2 and Q3 of each year and it has filed its 10-K between 47 to 58 days following the end of Q4. Publication dates may occur up to 45 days following the end of Q1, Q2 and Q3 and up to 90 days following the end of Q4. |

2

Calculation of Projected Breakpoints | |

Broker Reporting Group | The group of brokers who research and produce performance projections for BOTOX® and make their projections available to a market research integration service for the purpose of generating a consensus composite projection. The market research integration service will be Visible Alpha, FactSet or another investment technology firm that generates consensus models based on research models shared by participating brokers. |

Methodology for Calculating Projected Breakpoint |

The absolute value of the difference between projected net revenues for the Current Calendar Quarter and actual net revenues for the Base Calendar Quarter, divided by those actual net revenues.

Projected net revenues will be the median composite net revenues projection calculated by the market research integration service after removing the highest (maximum) and lowest (minimum) broker projections. The Projected Breakpoint will be compared against the Actual Percentage Change to determine the Up and Down Underlying Values on each Publication Date. |

Actual Percentage Change | The absolute value of the difference between the Reference Value for the Current Calendar Quarter and the Reference Value for the Base Calendar Quarter, divided by the Reference Value for the Base Calendar Quarter. |

Date of determination for each

Broker Reporting Group projection |

The median composite published most recently by the market research integration service but not earlier than two (2) business days prior to the first day of each calendar quarter.

|

Projected Breakpoint for Current Calendar Quarter |

See Appendix C.

|

3

Median composite, mean composite, standard deviation and high/low of broker projections for the Current Calendar Quarter |

See Appendix C.

|

Current Calendar Quarter | For each Publication Date and the ensuing Calculation Period, the calendar quarter for which the Reference Value was published on that Publication Date.

See Appendix C for the Current Calendar Quarter with respect to the current Projected Breakpoint. |

Base Calendar Quarter | The same calendar quarter as the Current Calendar Quarter but occurring 12 months prior.

See Appendix C for the Base Calendar Quarter with respect to the current Projected Breakpoint. |

Underlying Value Calculations | |

Up Underlying Value | The assets on deposit in Series BTOX to which the holders of the Up BTOX PharmaShares are entitled on any date of determination. On each Publication Date, the Up Underlying Value will be calculated as the product of (1) the Up Allocation Factor and (2) the Up Investment Amount. On the Periodic Calculation Date that follows each Publication Date, any increase in the Up Underlying Value will be declared as a distribution on the Up BTOX PharmaShares, together with an Equalization Payment. The Up Underlying Value will be reduced by the entire amount of this Periodic UV Performance Distribution made on the Up BTOX PharmaShares and will remain unchanged for the remainder of the current Calculation Period, except for the addition of any Up Daily Net Income Accruals. Up Daily Income Accruals will be added to the Up Underlying Value on each day of a Calculation Period if Series BTOX is earning net treasury income on its treasury securities during that Calculation Period. |

4

Down Underlying Value | The assets on deposit in Series BTOX to which the holders of the Down BTOX PharmaShares are entitled on any date of determination. On each Publication Date, the Down Underlying Value will be calculated as the product of (1) the Down Allocation Factor and (2) the Down Investment Amount. On the Periodic Calculation Date that follows each Publication Date, any increase in the Down Underlying Value will be declared as a distribution on the Down BTOX PharmaShares, together with an Equalization Payment. The Down Underlying Value will be reduced by the entire amount of this Periodic UV Performance Distribution made on the Down BTOX PharmaShares and will remain unchanged for the remainder of the current Calculation Period, except for the addition of any Down Daily Net Income Accruals. Down Daily Income Accruals will be added to the Down Underlying Value on each day of a Calculation Period if Series BTOX is earning net treasury income on its treasury securities during that Calculation Period. |

Per Share Underlying Value | For any date of determination, the Up Underlying Value divided by the number of outstanding Up BTOX PharmaShares. For any date of determination, the Down Underlying Value divided by the outstanding number of Down BTOX PharmaShares. |

Up Investment Amount | For any Calculation Period, an amount equal to one-half of all cash and treasuries on deposit in Series BTOX on the last Periodic Calculation Date.

The Up Investment Amount will always be equal to the Up Aggregate Par Amount, unless losses are realized on the treasury securities during any Calculation Period.

|

Down Investment Amount | An amount equal to one-half of all cash and treasuries on deposit in Series BTOX on the last Periodic Calculation Date. The Down Investment Amount will always be equal to the Down Aggregate Par Amount, unless losses are realized on the treasury securities during any Calculation Period.

|

5

Up Allocation Factor | A factor calculated on each Publication Date that reflects a comparison of the Projected Breakpoint to the Actual Percentage Change in net revenues from the Base Calendar Quarter to the Current Calendar Quarter. The Up Allocation Factor, when multiplied by the Up Investment Amount, will reflect the Up Underlying Value on that Publication Date.

Please see the Up Allocation Factor calculation and the Up Underlying Value formula, starting on page 21. |

Down Allocation Factor | A factor calculated on each Publication Date that reflects a comparison of the Projected Breakpoint to Actual Percentage Change in net revenues from the Base Calendar Quarter to the Current Calendar Quarter. The Down Allocation Factor, when multiplied by the Down Investment Amount, will reflect the Down Underlying Value on that Publication Date. Please see the Down Allocation Factor calculation and the Down Underlying Value formula, beginning on page 22. |

Up Daily Income Accruals and

Down Daily Income Accruals | Net treasury income for each Calculation Period, divided equally among all outstanding Up and Down BTOX PharmaShares. Net treasury income will be equal to the aggregate income earned on the treasury securities owned by Series BTOX, less the fees and expenses of Series BTOX, which will accrue at an accrual rate determined for each Calculation Period by the administrative agent, not to exceed an annual rate of 2.50% of the Series Investment Amount. |

Adjustments to Up and Down Underlying Value | Up Leverage Factor: [1]x

Down Leverage Factor: [3]x [No leverage] applies to the Up BTOX PharmaShares. The returns on the Down BTOX PharmaShares will be tripled by the Down Leverage Factor of [3]x. Up Periodic Return Cap: 15%

Down Periodic Return Cap: 15% The returns on both the Up and Down BTOX PharmaShares will be limited to 15% for each Calculation Period. The increase in the Up or Down Underlying Value, as applicable, for any Calculation Period will be reduced to equal 15% if such increase exceeds the Up or Down Periodic Return Cap. |

Distributions | |

6

Periodic Calculation Dates | Quarterly, on the fifth (5th) business day following each Publication Date. Periodic Income Distributions and Periodic UV Performance Distributions will be calculated and declared on each Periodic Calculation Date and distributed to holders two business days later. |

Calculation Period | The period that begins on but excludes the preceding Publication Date for Series BTOX and ends on and includes the next scheduled Publication Date. The first Calculation Period will begin on [●], 2020. |

Periodic Income Distributions | On each Periodic Calculation Date, a distribution equal to the sum of the Up Daily Income Accruals for the related Calculation Period will be declared on the Up BTOX PharmaShares. On each Periodic Calculation Date, a distribution equal to the sum of the Down Daily Income Accruals for the related Calculation Period will be declared on the Down BTOX PharmaShares. |

Periodic UV Performance Distributions | If an increase in the Up Underlying Value has occurred during a Calculation Period based on the actual performance of the Reference Value compared to the Projected Breakpoint, a distribution equal to that increase plus an Equalization Payment will be declared on the Up BTOX PharmaShares. If an increase in the Down Underlying Value has occurred during a Calculation Period based on the actual performance of the Reference Value compared to the Projected Breakpoint, a distribution equal to that increase plus an Equalization Payment will be declared on the Down BTOX PharmaShares. The Underlying Value of the class of PharmaShares that experienced an increase in Underlying Value will be reduced by the amount of the related Periodic UV Performance Distribution. The Underlying Value of the class of PharmaShares that experienced a decrease in Underlying Value in will be reduced by the amount of that decrease. Each Periodic UV Performance Distribution will decrease the amount of assets on deposit in Series BTOX and the potential investment returns that holders may earn in the future unless they purchase additional shares. |

7

Equalization Payments | Each Periodic UV Performance Distribution on the Up BTOX PharmaShares will consist of the increase in the Up Underlying Value for the related Calculation Period, which will be distributed out of the Down Investment Amount, and an Equalization Payment that will be equal to that increase in Underlying Value, but will be distributed out of the Up Investment Amount. Each Periodic UV Performance Distribution on the Down BTOX PharmaShares will consist of the increase in the Down Underlying Value for the related Calculation Period, which will be distributed out of the Up Investment Amount, and an Equalization Payment that will be equal to that increase in Underlying Value, but will be distributed out of the Down Investment Amount. The purpose of each Equalization Payment is to maintain the Up/Down Ratio. |

Up/Down Ratio | The proportion of the Up Investment Amount to the Down Investment Amount, which must be one to one (1:1) for so long as the Paired BTOX PharmaShares are outstanding. |

Fees and Expenses | |

Administrative Agent Fee | 1.25% per annum of the Series Investment Amount |

Trustee Fee | [●]% per annum of the Series Investment Amount |

Calculation Agent Fee | [●]% per annum of the Series Investment Amount |

Marketing Agent Fee | 0.35% of the Series Investment Amount |

Selling Commissions (initial offering) | $[●] |

Series BTOX formation costs and other fixed fees and expenses |

$[1,500,000]

|

Series Investment Amount | All assets on deposit in Series BOTX. Also, the sum of the Up and the Down Investment Amount. |

Daily Fee Accrual Rate | The daily rate determined for each Calculation Period by the administrative agent at which fees will accrue during that period, not to exceed an annualized rate of 2.50% per year. |

8

RISK FACTORS RELATED TO YOUR SERIES

An investment in the Up BTOX PharmaShares or the Down BTOX PharmaShares involves significant risks. You should carefully review the information contained in this section, as well as under “RISK FACTORS” in the base prospectus, before making an investment decision.

The acquisition of Allergan by AbbVie may affect the future net revenue performance of BOTOX®. On June 25, 2019, Allergan plc (“Allergan”), which was headquartered in Dublin, Ireland, and Abbvie Inc. (“Abbvie”), which is domiciled in the United States, announced that they had entered into an agreement pursuant to which Abbvie intended to acquire all of Allergan’s stock in exchange for stock of AbbVie and a cash payment, together reflecting a total valuation of $63 billion dollars. The acquisition was consummated on May 8, 2020, after AbbVie completed the process of obtaining regulatory approvals from all relevant government authorities, including the Federal Trade Commission and the Irish High Court. The combined company will continue to be incorporated as “AbbVie Inc.” in the State of Delaware and have its principal executive offices in North Chicago, Illinois.

It is difficult to predict how the acquisition will affect AbbVie, its developmental pipeline of drugs and the manufacturing and marketing support for AbbVie’s and Allergan’s respective on-market drugs, including BOTOX®. As with any merger of two companies, it will take significant time and effective and dedicated management efforts to integrate the operations of AbbVie and Allergan. If such integration is not successful or if AbbVie does not devote sufficient resources to support the manufacturing, market positioning or sales of BOTOX®, net revenues from BOTOX® may be adversely affected or may experience unpredictable fluctuations.

AbbVie currently publishes net revenue numbers as separate line items for 15 of its pharmaceutical products. BOTOX®, which had global net revenues of over $2.7 billion as of the nine months ended on September 30, 2019, will represent a major source of revenue for AbbVie. Accordingly, we expect that AbbVie will publish global net revenues for BOTOX® as a separate line item (or several line items that sum to equal such revenue) in its public reports on Form 10-Q and 10-K. However, if AbbVie were to cease publishing BOTOX® global net revenues on a quarterly basis as a separate line item or items for two consecutive calendar quarters, a termination trigger would occur and a final distribution equal to the Up underlying value of the Up BTOX PharmaShares and the Down underlying value of the Down BTOX PharmaShares would be distributed on the early termination date that followed the occurrence of this termination trigger.

The license to sell BOTOX® in the United States and other jurisdictions may be required to be transferred to AbbVie. During the period when that transfer is being effected, AbbVie will not be able to sell BOTOX®, which will result in a reduction in BOTOX® net revenues. If this reduction is significant enough such that there is a deviation from expected sales of more than 50% compared to the Reference Value reported on the last publication date prior to the effective date of the acquisition, it will qualify as a “major market disruption,” as described under “REFERENCE PRODUCTS AND REFERENCE VALUES” in the base prospectus. As a result, there will be deemed to be no change in the Reference Value on each publication date on which net revenues from BOTOX® indicate that a major market disruption is in effect. For so long as a major market disruption persists, the underlying value of the Up and Down BTOX PharmaShares will remain the same as it was on the last publication date prior to that disruption.

Demand for BOTOX® is seasonal. Sales of aesthetics products have historically been higher during the second and fourth quarters, presumably in advance of the summer vacation and holiday seasons. Fluctuations in BOTOX® sales are also impacted by the effect of promotional activity, which cause non-seasonal variability in sales trends. The consistent calendar quarter, year-over-year tracking method used for the Up BTOX PharmaShares and the Down BTOX PharmaShares may mitigate the impact of seasonality but may not fully eliminate the effect on your returns of seasonal fluctuations in demand for BOTOX®. It may be difficult to predict the effect of the seasonal demand for BOTOX® on the trading price of the Up BTOX PharmaShares and/or Down BTOX PharmaShares.

Demand for BOTOX® is likely to be impacted by the global pandemic. In addition to the risks discussed under “RISK FACTORS — The global pandemic may affect liquidity in the market for your shares, the ability of your Series to acquire treasuries and the performance of your reference drug” in the base prospectus, you should consider that sales of aesthetics products and drugs that are used to treat conditions which are not life-threatening

9

such as, in the case of BOTOX®, migraines, are likely to decrease during the COVID-19 global pandemic and any future pandemics. The population of certain states or countries may be required to quarantine at home and may be discouraged by government authorities or be individually fearful of seeking medical treatment, especially for conditions that are not life threatening. Further, a significant amount of B OTOX® sales and administration of the drug occurs in offices of dermatologists for aesthetic purposes. The delivery of a non-essential, injectable drug product within physician locations may be limited by city, county and state regulations during the pandemic. Additionally, the demographic of patients receiving non-essential injections may be one that voluntarily reduces certain treatments during the pandemic; thus, demand for such non-essential products may decrease during this period. After the re-opening of pandemic-related restrictions, sales of BOTOX® may experience a notable increase due to deferred demand. It may be difficult to predict the effect of these fluctuations in the demand for BOTOX® on the trading price of the Up BTOX PharmaShares and/or Down BTOX PharmaShares.

Factors that affect pricing and sale volume of BOTOX®. BOTOX® unit pricing and volume may fluctuate significantly. BOTOX® is sold for both cosmetic and therapeutic indications. A portion of BOTOX® sales for therapeutic application may be eligible for reimbursement by private or federal insurance providers, and such payment may be at a lower negotiated rate. The percentage reimbursement rate may impact the number of units sold, and the timing of sales during the course of a year due to an increasing number of beneficiaries with high deductible plans. In contrast, cosmetic indications for BOTOX® are generally not subject to pricing pressure from contracts with insurance providers. AbbVie may use rebates and other incentives during certain periods which may result in an increase in demand during those periods. General economic conditions in markets in which BOTOX® Cosmetic is sold may have an impact on both the volume of units sold and their price. Further, sales of BOTOX® for all indications are affected by competing products in the market. Some of the foregoing variables may increase sales of BOTOX® while others may reduce sales. The combined impact of these variables on net revenues from BOTOX® over time may be difficult to predict.

There are various risks associated with how BOTOX® is manufactured. Allergan manufactured BOTOX® exclusively in Ireland and it is expected that BOTOX® will continue to be manufactured there after the AbbVie acquisition. The manufacturing process utilizes sophisticated equipment, which requires a significant amount of time to obtain and install. The business would suffer if some part or all of the manufacturing facilities were to become inoperable for a period of time. This could occur for various reasons, including catastrophic events, such as natural disasters or terrorism, unexpected equipment failures or delays in obtaining spare parts, contamination by microorganisms or viruses, labor disputes or shortages, contractual disputes with suppliers and contract manufacturers, as well as construction delays or defects and other events, both within and outside of the control of AbbVie. In the event of a disruption in manufacturing processes, AbbVie may need to build or locate replacement facilities, as well as seek and obtain the necessary regulatory approvals for these facilities. The inability to manufacture BOTOX® in sufficient quantities to meet demand could have a material adverse effect on net revenues, but the magnitude and timing of such adverse effect may be difficult to predict.

Claims, consumer actions and government investigations may cause reputational harm to AbbVie and its products. As stated in their public filings, both AbbVie and Allergan, prior to its acquisition by AbbVie, have been subject to a variety of claims, proceedings, investigations and litigation related to its pharmaceutical products that have been initiated by government agencies and third parties. These claims, proceedings and investigations involve compliance matters, product regulation and safety, taxes, employee benefit plans, employment discrimination, health and safety, environmental, antitrust, customs, import/export, government contract compliance, financial controls and reporting, intellectual property, allegations of misrepresentation, false claims or false statements, commercial claims, claims regarding promotion of products and services, or other matters. With respect to BOTOX®, consumer groups and certain plaintiffs have alleged that certain uses of BOTOX®, including “off-label” uses, have caused patient injuries and death and that Allergan failed to adequately warn patients of the risks relating to BOTOX® use. Such allegations may directly adversely impact BOTOX® net revenue. Private claims and government investigations relating to other products manufactured by Allergan and AbbVie may indirectly have a negative impact on BOTOX® net revenues as a result of reputational harm suffered by AbbVie, for its own products, as well the products previously manufactured and marketed by Allergan. For example, Allergan was a manufacturer of breast implants. Reports about the quality and safety of breast implant devices are published from time to time, including reports that have suggested a link between cancer and breast implants, as well as negative reports from European regulatory authorities involving a breast implant manufacturer that was not affiliated with Allergan. Negative publicity, whether accurate or inaccurate, about the efficacy, safety or side effects of certain products or product categories, whether involving AbbVie, Allergan or a competitor, could materially reduce market acceptance of

10

AbbVie’s products, including BOTOX®, cause consumers to seek alternatives to these products and result in product withdrawals. Negative publicity could also result in an increased number of product liability claims, whether or not these claims have a basis in scientific fact. Any such claims, proceedings, investigations or litigation, regardless of the merits, might result in substantial restrictions on product use or sales, and cause volatility or cause harm to AbbVie’s business, including sales of BOTOX® the impact of which may be difficult to quantify in advance.

There has been litigation relating to BOTOX®. A class action complaint was filed in federal court in California on February 24, 2015, and amended May 29, 2015, alleging unlawful market allocation in violation of Section 1 of the Sherman Act, 15 U.S.C. § 1; agreement in restraint of trade in violation of 15 U.S.C. § 1 of the Sherman Act; unlawful maintenance of monopoly market power in violation of Section 2 of the Sherman Act, 15 U.S.C. § 2; violations of California’s Cartwright Act, Section 16700 et seq. of the California Business and Professions Code; and violations of California’s unfair competition law, Section 17200 et seq. of the California Business and Professions Code. In the complaint, plaintiffs seek an unspecified amount of treble damages. On July 19, 2016, plaintiffs filed a motion for class certification. On October 14, 2016, Allergan filed an opposition to plaintiffs’ motion for class certification. On June 13, 2017, the court granted plaintiff’s motion for class certification. In September 2017, the parties filed cross motions for summary judgment, which were heard by the court on October 27, 2017. On November 30, 2017, the parties reached a tentative settlement. Future litigation involving BOTOX® based upon drug marketing strategies or safety of product use may have an impact on sales and such impact may be difficult to quantify.

There are pending government investigations relating to certain BOTOX® indications. On April 18, 2017, Allergan received a Civil Investigative Demand (CID), dated April 12, 2017, from the United States Department of Justice seeking information relating to Allergan’s BOTOX® sales and marketing practices relating to urology practices. In its public filings, Allergan stated that it is cooperating fully with the United States Department of Justice requests. For so long as this investigation continues, its impact on the net revenues of BOTOX® may be difficult to predict.

Allergan Merger with Actavis Led to Atypical Sales Results for second and third quarters of 2015; AbbVie Acquisition May Also Result in a Temporary Disruption in Sales. On March 17, 2015, Actavis plc, or “Actavis,” acquired Allergan, Inc. for approximately $77.0 billion, including outstanding indebtedness assumed of $2.2 billion, cash consideration of $40.1 billion and equity consideration of $34.7 billion. As a result of the merger, Allergan, Inc. became a wholly-owned, indirect subsidiary of Actavis. On June 15, 2015, Actavis adopted the Allergan name and became known as Allergan plc. Following the merger, Allergan, Inc.’s existing licenses to sell its products were required to be transferred to Allergan plc. The licensing transfer process was not completed until post-merger and during this process, BOTOX® was not allowed to be sold. The inconsistent results during the period after the Actavis merger and any inconsistent results that may result during any required license transfer from Allergan to AbbVie may impact the accuracy of predictions about future BOTOX® net revenues.

11

THE TERMS OF YOUR SERIES

This is a prospectus supplement to the base prospectus for the offering of the Up BTOX PharmaShares and the Down BTOX PharmaShares. You should read this prospectus supplement in conjunction with the base prospectus, including the “RISK FACTORS” and “FORWARD-LOOKING STATEMENTS” sections in the base prospectus, before making an investment decision.

Please note that when we refer in this section to the “Underlying Value” that is represented by your Up BTOX PharmaShares or your Down BTOX PharmaShares on any date, we mean the portion of the net asset value of Series BTOX that your shares represent on that date and also the final distribution that you would be entitled to receive if that date were an early termination date or the final scheduled termination date. Such a distribution is, however, merely hypothetical and we refer to it solely for the purpose of explaining the meaning of Underlying Value.

This prospectus supplement uses defined terms. Terms are defined the first time they appear in this prospectus supplement, but you can also find definitions of important terms used in this prospectus supplement under “GLOSSARY OF DEFINED TERMS” beginning on page 105 of the base prospectus.

The Issuer and the Securities Offered

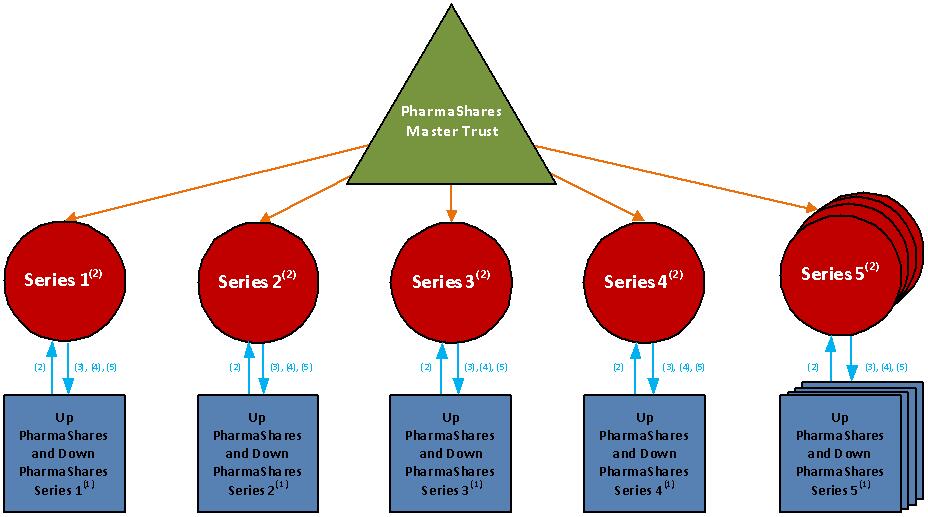

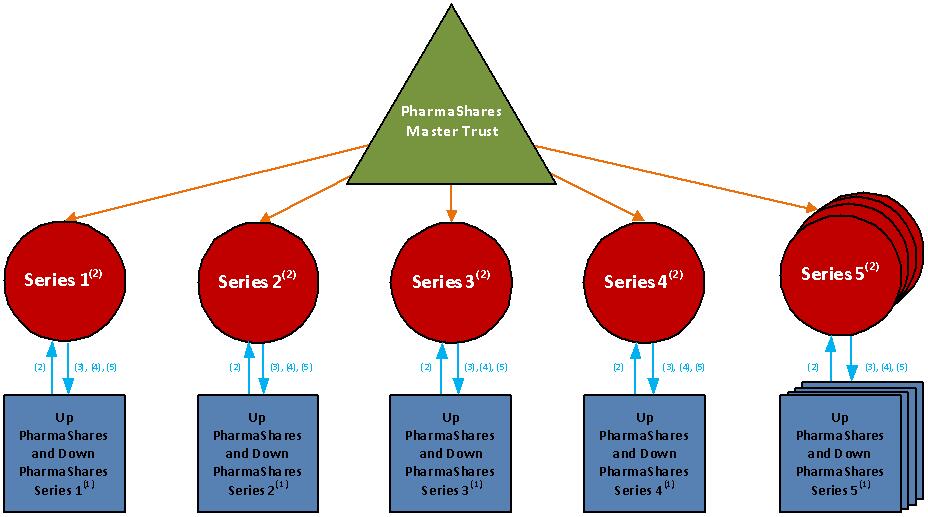

We are PharmaShares Advisors, Inc. and we have formed Series BTOX-2020 of the PharmaShares Trust, which is referred to in this prospectus supplement as “Series BTOX,” for the purpose of issuing the Up BTOX PharmaShares, Series BTOX-2020, or the “Up BTOX PharmaShares,” and the Down BTOX PharmaShares, Series BTOX-2020, or the “Down BTOX PharmaShares.” As a holder of Up BTOX PharmaShares or a holder of Down BTOX PharmaShares, your rights will be governed by the “Master Trust Agreement” entered into among us, as depositor and administrative agent, [●], as trustee and calculation agent, and [●], as marketing agent, pursuant to which we formed the PharmaShares Trust on [●], 2020, and the “Series BTOX Trust Supplement” to that agreement, pursuant to which we formed Series BTOX on [●], 2020.

For more information about the PharmaShares Trust, see “THE PHARMASHARES TRUST” in the base prospectus. For a description of the terms of the Master Trust Agreement and the Series BTOX Trust Supplement, see “DESCRIPTION OF THE TRUST AGREEMENT” in the base prospectus.

The Up BTOX PharmaShares and the Down BTOX PharmaShares are referred to as the “Paired BTOX PharmaShares” and represent undivided beneficial interests in the assets of Series BTOX. The trustee will deposit the proceeds of the initial sale and each subsequent issuance of the Paired BTOX PharmaShares in a segregated Series account and hold those funds for the exclusive benefit of the shareholders of Series BTOX, separate from the assets and liabilities of all other Series of the PharmaShares Trust. Pursuant to the Master Trust Agreement and the Series BTOX Trust Supplement, the assets of Series BTOX will not be available to satisfy the liabilities of, or to make distributions on the shares issued by, any other Series, and the assets of other Series of the PharmaShares Trust will not be available to make distributions on the Paired BTOX PharmaShares.

The Paired BTOX PharmaShares must be created and redeemed concurrently in PharmaShares Units consisting of an Aggregate Par Amount of Up BTOX PharmaShares equal to $1,000,000 and an Aggregate Par Amount of Down BTOX PharmaShares equal to $1,000,000. These ongoing paired creations are referred to as “Paired Issuances” and the paired redemptions as “Paired Optional Redemptions.” The Aggregate Par Amount of the Up BTOX PharmaShares and the Aggregate Par Amount of the Down BTOX PharmaShares will be equal to, as of any date of determination, respectively:

·the product of (1) the aggregate number of issued Up BTOX PharmaShares that remain outstanding on that date and (2) the par amount of one Up BTOX PharmaShare on that date; and

·the product of (1) the aggregate number of issued Down BTOX PharmaShares that remain outstanding on that date and (2) the par amount of one Down BTOX PharmaShare on that date.

12

Periodic distributions consisting of increases in the Up or Down Underlying Value will decrease the amount of assets in Series BTOX. As a result, the par amount of each Up BTOX PharmaShare and each Down BTOX PharmaShare will be recalculated on each Periodic Calculation Date after any Periodic UV Performance Distribution is made on those shares. The new par amount per Up BTOX PharmaShare will be the Up Investment Amount after the distribution has been made, divided by the number of outstanding Up BTOX PharmaShares. The new par amount per Down BTOX PharmaShare will be the Down Investment Amount after the distribution has been made, divided by the number of outstanding Down BTOX PharmaShares.

The declining par amount of your Up BTOX PharmaShares or Down BTOX PharmaShares reflects the decreasing amount of your investment in those shares as a result of Periodic UV Performance Distributions. The only way to maintain a consistent level of investment in your Up or Down BTOX PharmaShares is to purchase additional shares, as discussed under “RISK FACTORS — The amount of your investment in your PharmaShares and your potential gains will decline over time” in the base prospectus.

Use of Proceeds

The trustee will apply the proceeds received by Series BTOX in connection with the initial and each subsequent Paired Issuance to acquire, in accordance with the directions of the administrative agent and on behalf of Series BTOX, U.S. treasury securities and overnight repurchase agreements collateralized by United States Treasury securities, of the type and tenor described under “THE PHARMASHARES TRUST — United States Treasury Obligations” in the base prospectus. PharmaShares Advisors, LLC will pay all of the costs associated with the formation of Series BTOX and the issuance, registration, marketing and offering of the Paired BTOX PharmaShares. PharmaShares Advisors, LLC will reimburse itself for these costs out of the treasury income realized by Series BTOX, subject to a maximum fee rate, as discussed under “— Fees and Expenses” in this prospectus supplement.

The Administrative Agent

We are PharmaShares Advisors, LLC, a Delaware limited liability company, and we are acting as “administrative agent” for the PharmaShares Trust and Series BTOX pursuant to the Master Trust Agreement and the Series BTOX Trust Supplement. Our duties as administrative agent are described in the base prospectus under “DESCRIPTION OF THE TRUST AGREEMENT — The Administrative Agent.” For performing our duties as administrative agent for Series BTOX, we will receive a fee equal to an annual rate of 1.25% accrued on the Series Investment Amount on each calendar day, which will be payable in arrears on each Periodic Calculation Date.

The Marketing Agent

[●], a [●], will act as “marketing agent” for Series BTOX pursuant to the terms of the Master Trust Agreement and the Series BTOX Trust Supplement. Its duties as marketing agent are described under “DESCRIPTION OF THE TRUST AGREEMENT — The Marketing Agent” in the base prospectus. For performing the duties of marketing agent for Series BTOX, [●] will receive a fee equal to an annual rate of 0.35% accrued on the Series Investment Amount on each calendar day, which will be payable in arrears on each Periodic Calculation Date. [●] may engage other parties from time to time to act as additional marketing agents for Series BTOX. [●] will compensate these parties from the fee payable to it as a marketing agent.

The Trustee

[●], a [●], is acting as “trustee” for the PharmaShares Trust and Series BTOX pursuant to the terms of the Master Trust Agreement and the Series BTOX Trust Supplement. The trustee will perform, on behalf of Series BTOX, the duties described in the base prospectus under “DESCRIPTION OF THE TRUST AGREEMENT — Duties of the Trustee and the Calculation Agent.”

For performing its duties as trustee for Series BTOX, the trustee will receive a fee equal to an annual rate of [●]% accrued on the Series Investment Amount on each calendar day, or an annual minimum fee of $[●], whichever is greater, which will be payable in arrears on each Periodic Calculation Date.

13

The Calculation Agent

[●] will also act as “calculation agent” for the PharmaShares Trust and Series BTOX pursuant to the terms of the Master Trust Agreement and the Series BTOX Trust Supplement. The calculation agent will perform, on behalf of Series BTOX, the duties described in the base prospectus under “THE PHARMASHARES TRUST — Daily Reporting” and “DESCRIPTION OF THE TRUST AGREEMENT — Duties of the Trustee and the Calculation Agent” and under “ — Daily Reporting” below.

For performing its duties as calculation agent for Series BTOX, the calculation agent will receive a fee equal to an annual rate of [●]% accrued on the Series Investment Amount on each calendar day, which will be payable in arrears on each Periodic Calculation Date.

Daily Reporting

The calculation agent will calculate (1) the Per Share Underlying Value of the Up BTOX PharmaShares and the Per Share Underlying Value of the Down BTOX PharmaShares on each Publication Date after a new Reference Value is published, (2) the Per Share Underlying Value of the Up BTOX PharmaShares and the Down BTOX PharmaShares on each Periodic Calculation Date, after any increase in the Up or Down Underlying Value has been distributed as a Periodic UV Performance Distribution, and (3) on each day of a Calculation Period that follows the Periodic Calculation Date, the Up and Down Underlying Value plus the Up or Down Daily Net Income Accruals for each day, if any. At the close of each business day, the calculation agent will perform these calculations for that business day or, if that business day is followed by one or more intervening non-business days, for that business day and each such intervening non-business day. It will provide these calculations to the administrative agent for posting on the website maintained by the administrative agent at http://www.pharmashares.net not later than one hour prior to the commencement of trading on NYSE Arca on the next business day that follows the day of calculation. The administrative agent will also calculate and post on its website on each business day, not later than one hour prior to commencement of trading on NYSE Arca, (1) the premium or discount of the midpoint of the bid/offer price spread for one Up BTOX PharmaShare at the close of the preceding trading day over the Per Share Underlying Value of one Up BTOX PharmaShare on that day and (2) the premium or discount of the midpoint of the bid/offer price spread for one Down BTOX PharmaShare at the close of the preceding trading day over the Per Share Underlying Value of one Down BTOX PharmaShare on that day.

The calculation agent will base its calculation of the Up Underlying Value and the Down Underlying Value on each Publication Date on the Reference Value that was reported on that Publication Date and the Projected Breakpoint for the preceding calendar quarter. On the Periodic Calculation Date that follows each Publication Date, the calculation agent will calculate the Periodic UV Performance Distribution that will be made on the class which experienced an increase in its Underlying Value. The calculation agent will also calculate the Up and Down Underlying Values after that Periodic UV Performance Distribution has been made, decreasing the Underlying Value of the class that receives that distribution by the entire amount of the distribution. On each remaining calendar day of the Calculation Period, the Up and Down Underlying Value will remain the same, except that the calculation agent will add any Up Daily Net Income Accruals to the Up Underlying Value and any Down Daily Net Income Accruals to the Down Underlying Value. All treasury income earned on the assets in Series BTOX, less the fees and expenses of Series BTOX, will be allocated equally among the Up and Down BTOX PharmaShares.

Public companies are required to report their earnings on a quarterly basis and, accordingly, Publication Dates for the Reference Value will occur no more frequently than quarterly. As a result, the Underlying Value of the Up BTOX PharmaShares and the Underlying Value of the Down BTOX PharmaShares will remain the same throughout each Calculation Period except for the addition of Up Daily Net Income Accruals and Down Daily Net Income Accruals to that Underlying Value.

Information reported by or about AbbVie or BOTOX® during the course of each calendar quarter, including third party data and information services that provide prescription trend data on a weekly or monthly basis for various pharmaceutical products, may affect the expected Underlying Value of the Up and Down BTOX PharmaShares on the next Publication Date. In anticipation of that future impact on Underlying Value, the current trading price of the Up and/or the Down BTOX PharmaShares during the current Calculation Period may be affected. However, such market knowledge and expectations will not be reflected in the current Up Underlying

14

Value or Down Underlying Value calculation. See “RISK FACTORS — Fluctuations in the per share underlying value of your PharmaShares and other factors may affect their trading price” in the base prospectus.

The Projected Breakpoint Increase or Projected Breakpoint Decrease for each calendar quarter will be calculated and disclosed not later than 8 p.m. E.T. on the last business day preceding the first day of each calendar quarter by means of the filing of an updated registration statement. The following variables required to calculate the Projected Breakpoint will also be disclosed: (1) the median composite projection, calculated after eliminating the highest and lowest projections, that was published by the market research integration service most recently, but not later than the second business date prior to the beginning of each calendar quarter, (2) the list of all brokers whose projections are eligible to be included by the market research integration service in any composite, based upon such service’s established guidelines, (3) the subset of brokers who made projections for the Current Calendar Quarter and are included in the current composite, and (4) actual net revenues reported for the applicable Base Calendar Quarter. The Projected Breakpoint and its related inputs will be disclosed for each calendar quarter in an updated Appendix C to this prospectus supplement.

The Series Assets

Series BTOX will hold its assets in segregated accounts solely for the benefit of its shareholders and will not make such assets available to the creditors or shareholders of any other Series. Series BTOX will have no rights with respect to the assets held by any other Series of the PharmaShares Trust.

The assets of Series BTOX consist of:

·U.S. treasury securities of the type and tenor described in the base prospectus under “THE PHARMASHARES TRUST — United States Treasury Obligations,” and what we refer to as “income” on those securities, consisting of stated interest on treasury notes and bonds and the discount that is realized when the par amount received on a treasury bill, note or bond at maturity exceeds the purchase price at which that treasury security was acquired on behalf of Series BTOX;

·treasury repurchase agreements with the characteristics described in the base prospectus under “THE PHARMASHARES TRUST — United States Treasury Obligations,” and what we refer to as “income” on those agreements consisting of the difference between the purchase price and the repurchase price for the treasury securities borrowed under those agreements;

·the rights of Series BTOX under the Master Trust Agreement and the Series BTOX Trust Supplement to rely on the services provided by the trustee, the calculation agent, the administrative agent and the marketing agent;

·a securities account into which all of the treasury securities acquired from time to time on behalf of Series BTOX are deposited for the benefit of its shareholders;

·a distribution account into which all income and maturity proceeds realized on the treasury securities are deposited and used to make (1) required deposits into the fee payment account and (2) periodic distributions to the holders of the Up and Down BTOX PharmaShares; and

·a fee payment account into which all or a portion of the income realized on the treasury securities will be deposited on each Periodic Calculation Date and applied to pay the fees and expenses of Series BTOX.

The treasury securities and treasury repurchase agreements, referred to generically as “treasury securities,” purchased on behalf of Series BTOX in connection with each Periodic Calculation Date or each issuance will have the terms described in the base prospectus, including that each treasury security must mature or terminate prior to the next scheduled Periodic Calculation Date. The procedures that must be followed by the administrative agent and the trustee in acquiring treasury securities for Series BTOX and selecting treasury securities for delivery in redemptions are described in the base prospectus. See “THE PHARMASHARES TRUST — United States Treasury Obligations” in the base prospectus.

15

The Reference Value

The Paired BTOX PharmaShares track (x) the projected change in the Reference Value from the Base Calendar Quarter to the Current Calendar Quarter, calculated based upon projections for the Reference Value that were made by the Broker Reporting Group for the Current Calendar Quarter, compared to (y) the actual change in the Reference Value between the same two calendar quarters. The “Reference Value,” is the net revenue generated by worldwide sales of BOTOX® for all indicated uses of the drug, as reported by AbbVie on each Publication Date in its income statement prepared in accordance with U.S. GAAP and filed with the SEC as part of AbbVie’s periodic public reports under the Exchange Act. The sole reporting source of BOTOX® net revenue data will be AbbVie’s quarterly reports on Form 10-Q and its annual reports on Form 10-K.

Series BTOX uses year-over-year net revenue tracking, from the Current Calendar Quarter to the same quarter of the preceding year, which is referred to as the “Base Calendar Quarter.” The “Publication Date” for each calendar quarter will occur within 45 days, or, in the case of the fourth quarter of each year, within 90 days, following the last day of that calendar quarter. AbbVie typically files its periodic reports between 33 to 40 days after the end of each of the first three (3) calendar quarters and 47 to 58 days following year end, but it may elect at any time to file its reports for a particular quarter at some earlier or later date that occurs prior to the expiration of the 45 or 90 days, as applicable, that is permitted under the Exchange Act. Each “Calculation Period” for Series BTOX will begin on and include a Publication Date and end on but exclude the following Publication Date. Accordingly, the length of each Calculation Period may vary.

The entity that manufactured and sold BOTOX® worldwide was Allergan, Inc., which was a wholly-owned, indirect subsidiary of Allergan plc. Allergan plc was acquired by, and merged into, by AbbVie on May 8, 2020. BOTOX®, its indicated uses, AbbVie, as its new manufacturer and sales agent, and other facts about the reference drug that may be relevant to you as an investor in the Up or Down BTOX PharmaShares are described below under “ — The Reference Product.”

After a Periodic UV Performance Distribution has been declared on any Periodic Calculation Date, neither the Reference Value nor the calculation of Underlying Value will be retroactively adjusted to take into account any revisions made to the calculation of BOTOX® net revenues by AbbVie.

We, the PharmaShares Trust, Series BTOX, any other Series created from time to time, our affiliates and our respective directors, managers, officers, members, trustees, employees, attorneys and advisors are not liable for (a) any losses to you resulting from, the methodologies used in calculating, and the actual calculation of, net revenues of BOTOX®, or the resulting Reference Value, or (b) any losses to you for any revisions to the methodology for calculating net revenues, any subsequent revisions made to published net revenues, any alleged or actual inaccuracies or inherent limitations of the net revenues calculation, any delays in net revenue reporting or publication, any errors in the underlying data used to calculate net revenues, or the impact of any of the foregoing factors on the yield realized by you as a holder of Up BTOX PharmaShares or Down BTOX PharmaShares.

None of (1) AbbVie, (2) the brokers included in the Broker Reporting Group from time to time, (3) the market research integration service, or (4) the respective affiliates and respective directors, officers, members, trustees, employees, attorneys and advisors of any of the entities listed in (1), (2) and (3), are affiliated with us and no such entity or person has been or will in any way be involved with the PharmaShares Trust, Series BTOX, any other Series created from time to time or the issuance of the Paired BTOX PharmaShares and will not be liable for (a) any disclosure contained in the base prospectus or this prospectus supplement, (b) any losses to you resulting from, the methodologies used in calculating, and the actual calculation of, net revenues of BOTOX®, the resulting Reference Value, the Projected Breakpoint or the Underlying Value of the Up or Down BTOX PharmaShares, or (c) any losses to you for any revisions to the methodology for calculating net revenues, any subsequent revisions made to published net revenues, any alleged or actual inaccuracies or inherent limitations of the net revenue calculation, any delays in net revenue reporting or publication, any errors in the underlying data used to calculate net revenues, or the impact of any of the foregoing factors on the yield realized by you as a holder of Up BTOX PharmaShares or Down BTOX PharmaShares.

16

The Reference Product

BOTOX® is the Reference Product for Series BTOX. BOTOX®, also known as Onabotulinum Toxin A, is an acetylcholine release inhibitor and a neuromuscular blocking agent. It is delivered by injection for intramuscular, intradetrusor, or intradermal use.

BOTOX® Medical

BOTOX® is available by prescription only for the following indicated conditions:

·to treat overactive bladder symptoms such as a strong need to urinate with leaking or wetting accidents (urgent urinary incontinence), a strong need to urinate right away (urgency), and urinating often (frequency) in adults 18 years and older when another type of medicine (anticholinergic) does not work well enough or cannot be taken;

·to treat leakage of urine (incontinence) in adults 18 years and older with overactive bladder due to neurologic disease who still have leakage or cannot tolerate the side effects after trying an anticholinergic medication;

·to prevent headaches in adults with chronic migraine who have 15 or more days each month with headache lasting four (4) or more hours each day in people 18 years or older;

·to treat increased muscle stiffness in elbow, wrist, finger, thumb, ankle, and toe muscles in people 18 years and older with upper and lower limb spasticity;

·to treat the abnormal head position and neck pain that happens with cervical dystonia (CD) in people 16 years and older;

·to treat certain types of eye muscle problems (strabismus) or abnormal spasm of the eyelids (blepharospasm) in people 12 years and older; and

·to treat the symptoms of severe underarm sweating (severe primary axillary hyperhidrosis) in people 18 years and older when topical medicines used on the skin do not work well enough.

It is not known whether BOTOX® and BOTOX® Cosmetic are safe or effective to prevent headaches in patients with migraines who have 14 or fewer headache days each month (episodic migraine).

It is not known whether BOTOX® is safe or effective to treat increased stiffness in upper limb muscles other than those in the elbow, wrist, fingers, and thumb, or in lower limb muscles other than those in the ankle and toes. BOTOX® has not been shown to help people perform task-specific functions with their upper limbs or increase movement in joints that are permanently fixed in position by stiff muscles. BOTOX® is not meant to replace existing physical therapy or other rehabilitation that may have been prescribed.

It is not known whether BOTOX® and BOTOX® Cosmetic are safe or effective for severe sweating anywhere other than in the armpits.

BOTOX® Cosmetic

BOTOX® Cosmetic is available by prescription only for the following cosmetic indications in adults:

·to temporarily improve the look of moderate to severe frown lines between the eyebrows (glabellar lines);

·to temporarily improve the look of moderate to severe crow’s feet lines (lateral canthal lines); and

·to temporarily improve the look of forehead lines.

17

Patent History on BOTOX®

Patent Number | Priority Date | Use |

US6667041B2 | 7/15/1997 | Use of neurotoxin therapy for treatment of urologic and related disorders |

US7001602B2 | 7/15/1997 | Use of botulinum toxin therapy for urinary incontinence and related disorders |

US7429387B2 | 7/15/1997 | Use of botulinum toxin therapy for treatment of recalcitrant voiding dysfunction |

US7449192B2 | 7/15/1997 | Use of neurotoxin therapy for treatment of urologic and related disorders related to neurogenic bladder dysfunction |

US7968104B2 | 7/15/1997 | Use of neurotoxin therapy for treatment of urologic and related disorders |

US8057807B2 | 7/15/1997 | Use of botulinum toxin therapy for treatment of recalcitrant voiding dysfunction |

US8062643B2 | 7/15/1997 | Use of neurotoxin therapy for treatment of urologic and related disorders |

US8501195B2 | 3/30/2010 | Injection paradigm for administration of botulinum toxins |

Reference Pharmaceutical Company

Until it was acquired by AbbVie, Allergan, Inc. manufactured and sold BOTOX®. Allergan, Inc. was formed in 1948, incorporated in 1950 and became a public company in 1970. Allergan, Inc. operated as a global pharmaceutical company focused on eye care, neurosciences, medical dermatology, medical aesthetics, breast enhancement, obesity intervention and urologics. On March 17, 2015, Actavis plc, a global pharmaceutical company, acquired Allergan, Inc. in a merger transaction. As a result of the merger, Allergan, Inc. became a wholly-owned, indirect subsidiary of Actavis plc, or “Actavis.” On June 15, 2015, Actavis adopted the “Allergan” name and became known as Allergan plc. In connection with the merger, Allergan, Inc.’s existing licenses to sell its products were required to be transferred to Allergan plc. The licensing transfer process was not completed until post-merger and during this process, BOTOX® was not allowed to be sold. The inconsistent results during this historical period may impact the accuracy of predictions of BOTOX® future net revenue.

AbbVie completed its acquisition of Allergan plc on May 8, 2020. AbbVie is a research-based bio-pharmaceutical company that was established in January of 2013, when Abbott Laboratories spun off its drug division to concentrate on its medical devices business. AbbVie has announced its intention to market the cosmetic indications of BOTOX® under a new global subsidiary, Allergan Aesthetics, while integrating medical BOTOX® directly into AbbVie. The final structure of AbbVie as Allergan and its subsidiaries are merged into it will be determined over the course of the remainder of 2020 and possibly beyond. Depending upon how Allergan is merged into AbbVie, the license to market BOTOX® may not need to be transferred to a new entity or may need to be transferred only in certain regions of the world.

For a discussion of the risks related to the AbbVie acquisition, see “RISK FACTORS — The acquisition of Allergan by AbbVie may affect the future net revenue performance of BOTOX®.”

Net Revenue for the Reference Product

“Net revenue” means the gross worldwide sales of BOTOX® for all indicated uses of the drug, adjusted for sales-related deductions, including, but not limited to, chargebacks, trade discounts, sale returns and allowances, commercial and government rebates, customer loyalty programs and fee-for-service arrangements with certain distributors, collectively referred to as “sales allowances.” For a discussion of how sales allowances are applied to adjust net revenue, see “REFERENCE PRODUCTS AND REFERENCE VALUES” in the base prospectus.

18

The Projected Breakpoint

The Up Underlying Value and Down Underlying Value will determine the amount of distributions that will be declared on each Periodic Calculation Date on the Up or Down BTOX PharmaShares and the final distribution that will be made in redemption of the Up and Down BTOX PharmaShares. The Up and Down Underlying Value will be calculated by comparing

·the Projected Breakpoint Increase or Projected Breakpoint Decrease from the Base Calendar Quarter to the Current Calendar Quarter, to

·the actual percentage increase or decrease in BOTOX® net revenues from the Base Calendar Quarter to the Current Calendar Quarter.

The "Projected Breakpoint Increase" or "Projected Breakpoint Decrease" (also generically referred to as the "Projected Breakpoint") is the percentage change calculated by subtracting actual net revenues for BOTOX® for the Base Calendar Quarter from projected net revenues for the Current Calendar Quarter and dividing the absolute value of the result by actual net revenues. If projected revenues for the Current Calendar Quarter exceed actual revenues for the Base Calendar Quarter, there will be a Projected Breakpoint Increase. If projected revenues for the Current Calendar Quarter are less than actual revenues for the Base Calendar Quarter, there will be a Projected Breakpoint Decrease.

For Series BTOX, the projected net revenues for each calendar quarter will be calculated based on the revenue projections made by a Broker Reporting Group.

The “Broker Reporting Group” for Series BTOX will consist of the group of brokers who make their research models for BOTOX® available to Visible Alpha, FactSet or a similar company, referred to in this prospectus supplement as a “market research integration service.” Each broker is registered with FINRA and employs analysts who have historically published and continue to publish net revenue projections for BOTOX®. Members of the Broker Reporting Group are generically referred to as “brokers.”

Not all broker projections will be included in the composite number for any particular calendar quarter, because a projection may be stale, as defined by the market research integration service, or a broker may not have published a BOTOX® projection for the Current Calendar Quarter. Due to the seasonal demand for BOTOX®, many brokers publish projections for only the higher-demand second and fourth calendar quarters.

The hypothetical returns in Appendix A to this prospectus supplement illustrate the performance of the Up and Down BTOX PharmaShares over several consecutive calendar quarters based on historical BOTOX® net revenue performance and historical composite numbers published by a market research integration service. The historical composite numbers are based on a Broker Reporting Group consisting of the brokers who reported for BOTOX® for each past calendar quarter that is shown. The hypothetical returns are based on no leverage (1x) on the Up BTOX PharmaShares and tripled (3x) returns on the Down BTOX PharmaShares. The actual leverage applicable to each class of the PharmaShares will be determined at closing and reflect investor demand for each class of the PharmaShares and the requirement that an equal number of Up and Down BTOX PharmaShares must be issued.

The Broker Reporting Group for the Paired BTOX PharmaShares must at all times have the following characteristics:

·there must be at least five (5) brokers in the Broker Reporting Group who make their projections available to the market research integration service for the purpose of allowing it to generate the composite projection; however, so long as there are at least five (5) brokers, the market research integration service may add, remove or substitute brokers in the group at any time in its sole discretion;

·at least three (3) projections from brokers in the Broker Reporting Group must be used by the market research integration service to calculate the composite for each calendar quarter; and

19

·if fewer than five (5) brokers are included in the Broker Reporting Group during any calendar quarter or fewer than three (3) projections are used for any composite calculation, then the Underlying Values of the Paired BTOX PharmaShares will remain unchanged at the end of the affected calendar quarter.

The composite generated by the same market research integration service will be used to calculate the Projected Breakpoint throughout the term of the Paired BTOX PharmaShares unless the service ceases to generate a composite for BOTOX®. A Termination Trigger will occur if, on two consecutive calendar quarters, the market research integration service fails to generate the composite projection for BOTOX® and we are unable to identify and appoint a replacement market research integration service.

Average Revenue Projection Methodology

The market research integration service will calculate and publish, for each calendar quarter, (1) the median of the broker projections (both with the highest and lowest projections included and after removing them), (2) the mean of the broker projections (both with the highest and lowest projections included and after removing them), and (3) the standard deviation of the broker projections. If there is an even number of projections made for any calendar quarter, the median will be calculated as the average of the two middle projections. For Series BTOX, the Projected Breakpoint will be calculated using the median of the Broker Reporting Group projections (after high/low projections are removed).

The calculation agent will use the composite median projection published by the market research integration service on the most recent date that precedes but is not less than two (2) business days prior to the beginning of the Current Calendar Quarter. The calculation agent will calculate the Projected Breakpoint for the Current Calendar Quarter by subtracting actual net revenues for the Base Calendar Quarter from the composite median projection and dividing the absolute value of the result by those actual net revenues.

Reporting

The Projected Breakpoint Increase or Decrease for each calendar quarter will be calculated and announced not later than 8 p.m. EST on the business day preceding each calendar quarter by means of the filing of an updated registration statement. The Projected Breakpoint will be disclosed in an updated Appendix C to this prospectus supplement. The mean, median, high, low and standard deviation published by the market research integration service for BOTOX® net revenues and the number of brokers whose projections were used in those calculations will also be disclosed. Revised guidance from any broker who is a member of the Broker Reporting Group after the start of any calendar quarter will not be used to recalculate any previously determined Projected Breakpoint.

As noted above, the composite projection may include only that subset of the brokers in the Broker Reporting Group for any particular calendar quarter that actually published projections for that quarter. Neither the identity of the brokers in this subset nor their respective projections will be disclosed for any calendar quarter. However, if the market research integration service adds or removes any members of its broker group as a whole, the updated group will be disclosed in Appendix C. The actual projections published by each broker as part of its research on BOTOX® may be accessed by subscription to various financial information services and platforms, including Bloomberg, FactSet, Eikon and PitchBook.

Calculation of Underlying Value

To calculate Underlying Value on any Publication Date in this year-over-year tracking Series, the calculation agent first determines the “Actual Percentage Change” by subtracting the Reference Value for the Base Calendar Quarter from the Reference Value for the Current Calendar Quarter that was published on the most recent Publication Date and dividing the absolute value of the result by the Reference Value for the Base Calendar Quarter. The resulting Actual Percentage Change is then compared against the Projected Breakpoint Increase or Decrease that was calculated at the beginning of the Current Calendar Quarter based on actual results for the Base Calendar Quarter and projected revenues for the Current Calendar Quarter. The formulas for calculating the Up Underlying Value and the Down Underlying Value are described below.

The Up Underlying Value and Down Underlying Value calculated on each Publication Date will determine the amount of the Periodic UV Performance Distributions that will be declared on the next Periodic Calculation

20

Date. If the Up Underlying Value has increased, the Up BOTX PharmaShares will receive a Periodic UV Performance Distribution equal to that increase plus an Equalization Payment. Conversely, if the Down Underlying Value has increased, the Down BTOX PharmaShares will receive a Periodic UV Performance Distribution equal to that increase plus an Equalization Payment.

After a Periodic UV Performance Distribution is made on the Up BTOX PharmaShares, the Up Underlying Value will be reduced by the entire amount of that distribution. Conversely, after a Periodic UV Performance Distribution is made on the Down BTOX PharmaShares, the Down Underlying Value will be reduced by the entire amount of that distribution. After each Periodic UV Performance Distribution has been made, the Up and Down Underlying Values will be the same and will remain unchanged during the ensuing Calculation Period, except for the addition to those values of Up and Down Daily Net Income Accruals, if any.

On each Periodic Calculation Date, the “Up Leverage Factor” of [1]x reflects that [no leverage] will be applied to returns on the Up BTOX PharmaShares and the “Down Leverage Factor” of [3]x reflects that returns on the Down BTOX PharmaShares will be [tripled]. On each Periodic Calculation Date, if the returns on the Up BTOX PharmaShares or the Down BTOX PharmaShares exceed 15% based on the performance of the Reference Value, those returns, as reflected in the increase in the Up Underlying Value or the increase in the Down Underlying Value, as applicable, will be reduced to equal not more than 15%, calculated based on the aggregate par amount of the Up and Down BTOX PharmaShares at the beginning of the related Calculation Period. These caps on returns are referred to as the “Up Periodic Return Cap” and the “Down Periodic Return Cap,” and either may generically be referred to as a “Periodic Return Cap.” The application of the Down Periodic Return Cap may eliminate the effect of the Down Leverage Factor.

The “Up Underlying Value” for the Up BTOX PharmaShares will be equal, on each Publication Date, to:

·the Up Investment Amount multiplied by the Up Allocation Factor that was calculated based on the Reference Value published on that Publication Date and the Projected Breakpoint for the preceding calendar quarter

plus

·the sum of the Up Daily Net Income Accruals for each day that has elapsed during the current Calculation Period, up to and including the current calendar day.

The “Down Underlying Value” for the Down BTOX PharmaShares will be equal, on each Publication Date, to:

·the Down Investment Amount multiplied by the Down Allocation Factor that was calculated based on the Reference Value published on that Publication Date and the Projected Breakpoint for the preceding calendar quarter

plus

·the sum of the Down Daily Net Income Accruals for each day that has elapsed during the current Calculation Period, up to and including the current calendar day.

After the Periodic UV Performance Distribution is made on the Periodic Calculation Date that follows each Publication Date, the “Up Underlying Value” will equal, for the remainder of the current Calculation Period:

·the Up Underlying Value on the last Publication Date, as reduced by either the Periodic UV Performance Distribution made on the Up BTOX PharmaShares or the increase in the Down Underlying Value distributed on the Down BTOX PharmaShares

plus

·the sum of the Up Daily Net Income Accruals for each day that has elapsed during the current Calculation Period, up to and including the current calendar day,

21

and the “Down Underlying Value” will equal, for the remainder of the current Calculation Period: