First Quarter 2022 Earnings Presentation May 10, 2022

Disclaimer This presentation (“Presentation”) is for informational purposes only. This Presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful. No representations or warranties, express or implied, are given in, or in respect of, this Presentation. To the fullest extent permitted by law in no circumstances will Danimer Scientific, Inc. (the “Company”) or any of its subsidiaries, stockholders, affiliates, representatives, directors, officers, employees, advisers, or agents be responsible or liable for a direct, indirect, or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. The Company has not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of investigations as an investor may deem necessary. FORWARD-LOOKING STATEMENTS Please note that in this Presentation, we may use words such as “appears,” “anticipates,” “believes,” “plans,” “expects,” “intends,” “future,” and similar expressions which constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, statements regarding our expectations for full year 2022 capital expenditures and Adjusted EBITDA. Forward-looking statements are made based on management’s expectations and beliefs concerning future events impacting the Company and therefore involve a number of risks and uncertainties. The Company cautions that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. Potential risks and uncertainties that could cause the actual results of operations or financial condition of the Company to differ materially from those expressed or implied by forward-looking statements in this Presentation include, but are not limited to, the overall level of consumer demand on its products; general economic conditions and other factors affecting consumer confidence, preferences, and behavior; disruption and volatility in the global currency, capital, and credit markets; the financial strength of the Company's customers; the Company's ability to implement its business strategy, including, but not limited to, its ability to expand its production facilities and plants to meet customer demand for its products and the timing thereof; risks relating to the uncertainty of the projected financial information with respect to the Company; the ability of the Company to execute and integrate acquisitions; changes in governmental regulation, legislation or public opinion relating to its products; the Company’s exposure to product liability or product warranty claims and other loss contingencies; disruptions and other impacts to the Company’s business, as a result of the COVID-19 global pandemic and government actions and restrictive measures implemented in response; stability of the Company’s manufacturing facilities and suppliers, as well as consumer demand for its products, in light of disease epidemics and health-related concerns such as the COVID-19 global pandemic; the impact that global climate change trends may have on the Company and its suppliers and customers; the Company's ability to protect patents, trademarks and other intellectual property rights; any breaches of, or interruptions in, its information systems; the ability of its information technology systems or information security systems to operate effectively, including as a result of security breaches, viruses, hackers, malware, natural disasters, vendor business interruptions or other causes; its ability to properly maintain, protect, repair or upgrade its information technology systems or information security systems, or problems with its transitioning to upgraded or replacement systems; the impact of adverse publicity about the Company and/or its brands, including without limitation, through social media or in connection with brand damaging events and/or public perception; fluctuations in the price, availability and quality of raw materials and contracted products as well as foreign currency fluctuations; its ability to utilize potential net operating loss carryforwards; and changes in tax laws and liabilities, tariffs, legal, regulatory, political and economic risks. More information on potential factors that could affect the Company's financial results is included from time to time in the Company's public reports filed with the Securities and Exchange Commission, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. All forward-looking statements included in this Presentation are based upon information available to the Company as of the date of this Presentation and speak only as of the date hereof. The Company assumes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this presentation. USE OF PROJECTIONS This Presentation contains projected financial information with respect to the Company. Such projected financial information constitutes forward-looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward-Looking Statements” above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. FINANCIAL INFORMATION; NON-GAAP FINANCIAL MEASURES Some of the financial information and data contained in this Presentation, such as Adjusted EBITDA, Adjusted EBITDAR and Adjusted Gross Profit has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). The Company believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. A reconciliation of these non-GAAP financial measures to the closest GAAP measure is included in the Appendix to the Presentation. You should review the Company’s audited financial statements prepared in accordance with GAAP, which are included in its Annual Report on Form 10-K/A filed with the SEC. Forward-looking non-GAAP financial measures are presented without reconciliations to GAAP measures because the GAAP financial measures are not accessible on a forward-looking basis, and reconciling information is not available without unreasonable effort due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. TRADEMARKS This Presentation contained trademarks, service marks, trade names, and copyrights of, the Company, and other companies, which are the property of their respective owners. The information contained herein is as of May 10, 2022, and does not reflect any subsequent events.

Danimer’s Strategic Priorities Expand Capacity to Achieve Scale 1 2 3 4 5 6 Lead with Innovation to Address a Broad Range of Customer Needs Grow Customer Partnerships and Product Volume Commitments Secure Cost-Effective Inputs Attain Favorable Unit Economics to Enhance Margins Enhance Team Capabilities to Support Growth Creating highly profitable business to supply growing unmet need for biodegradable polymers, meeting customer standards while addressing the issue of plastic waste Increase internal production capacity Increase third-party manufacturing and license agreements (Kemira & Hyundai Oilbank collaborations) Leverage our core competency of formulation and application development Execute R&D (development agreements) with customers Technology licensing (Kemira) Continue negotiating development and supply agreements with global blue-chip customers that secure future demand Continue to influence global regulatory and legislative initiatives Canola oil fixed price contracts Continue to explore alternative feedstocks Total Corbion collaboration for PLA supply Increase capacity utilization Ramp up production of Rinnovo Reduce utility costs/chemical usage Chevron Phillips collaboration for Rinnovo Deborah McRonald as Chief Corporate Development Officer Keith Edwards as VP of Business Development Mike Hajost as Chief Financial Officer Anthony Austin as Chief Human Resources Officer

Recent Business Highlights Business Highlights Continued execution of growth strategy to transform the bioplastics market PHA revenues nearly doubled driving total revenues up 12% year-over-year Expanded partnership with Kemira to commercialize biodegradable aqueous coatings Announced Hyundai Oilbank collaboration to drive global growth of PHA Secured agreement with EGO Products to develop soft lures for fishing industry Appointed Mike Hajost as CFO and Anthony Austin as Chief Human Resources Officer Kentucky Phase II capacity on track and expected to come online in June 2022

Pulp & paper market leader in aqueous coatings Global revenue of ~US$2.9 billion and 5,000 employees Kemira License & Supply Agreement Entered into exclusive license and supply agreement to commercialize PHA based aqueous coatings to be used on pulp and paper in food & beverage applications Builds on R&D collaboration since 2020 for biodegradable aqueous coating formulations Offers speed-to-market and products that serve the pulp and paper market end-to-end Danimer expected to be immediately cash flow positive with no significant capex ~$500 million relevant dispersion barrier market with expected CAGR of ~10% Pioneer in renewable and sustainable biopolymers that help create biodegradable and compostable plastic products

Customer Partnerships & Business Development Initiatives Exclusive license and supply agreement to commercialize PHA based aqueous coatings to be used on pulp and paper in food & beverage applications Collaboration to jointly develop global new market opportunities and applications for PHA, starting in South Korean and Asian markets Research & Development Development agreement to develop soft lures for the fishing industry in an effort to provide a biodegradable alternative for traditional plastic PVC lures Commercial

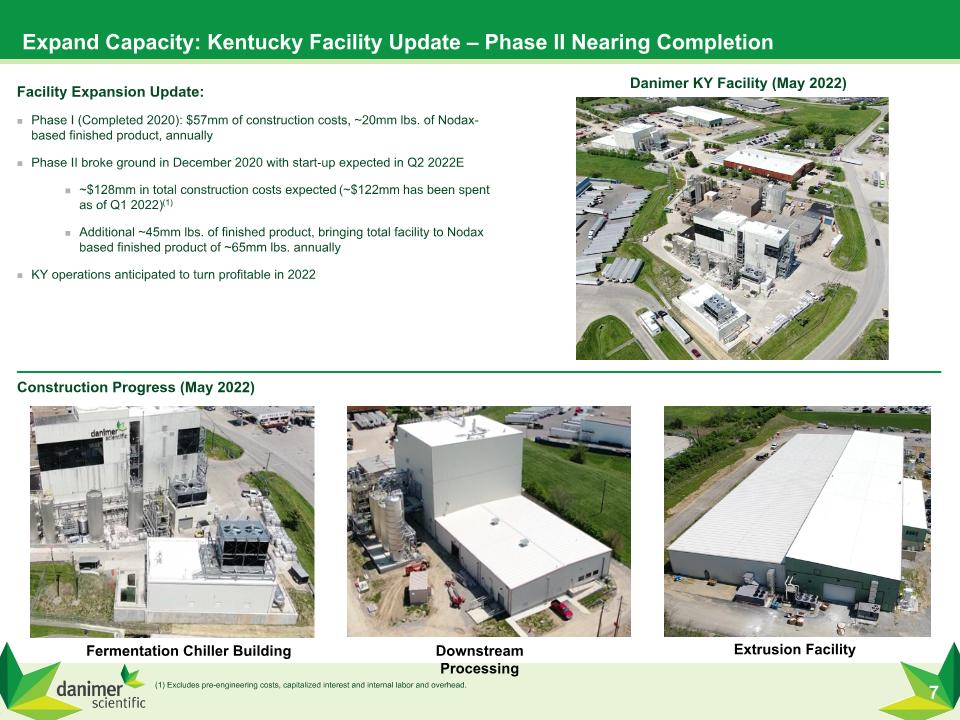

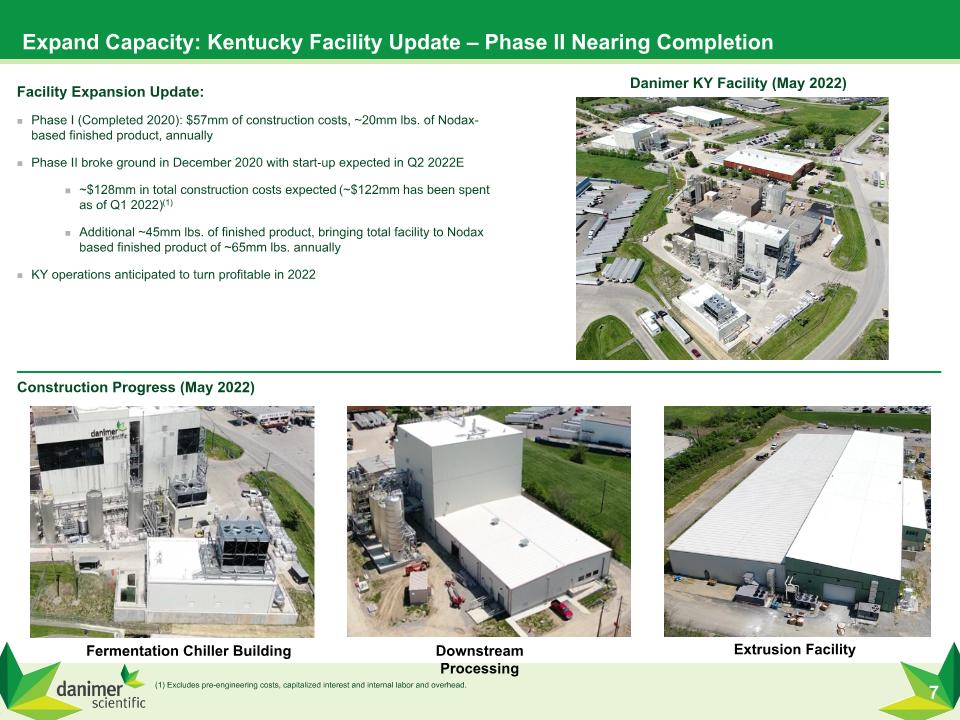

Expand Capacity: Kentucky Facility Update – Phase II Nearing Completion Facility Expansion Update: Phase I (Completed 2020): $57mm of construction costs, ~20mm lbs. of Nodax-based finished product, annually Phase II broke ground in December 2020 with start-up expected in Q2 2022E ~$128mm in total construction costs expected (~$122mm has been spent as of Q1 2022)(1) Additional ~45mm lbs. of finished product, bringing total facility to Nodax based finished product of ~65mm lbs. annually KY operations anticipated to turn profitable in 2022 Construction Progress (May 2022) Fermentation Chiller Building Downstream Processing Extrusion Facility Danimer KY Facility (May 2022) (1) Excludes pre-engineering costs, capitalized interest and internal labor and overhead.

Expand Capacity: Bainbridge Greenfield Facility Update Facility Build Out Timeline Greenfield Facility Overview Commentary Location of Greenfield site selected in Georgia due to better utilities rates and incentives Broke ground in November 2021 Some equipment has been pre-ordered to avoid higher prices, but inflation remains a concern, as does lead time for some items ordered and yet to be ordered We remain confident that there is ample customer demand for this capacity but we do not want to get caught in supply chain and inflationary unknowns given the cash flow implications We have implemented schedule changes that might mitigate potential cost over-runs and unplanned delays Facility start-up expected in 2024 Greenfield Timing Broke ground November 2021 Capacity ~125mm lbs. of Nodax-based finished products expected annually Total CapEx $500 - $612mm (~$100mm has been spent as of Q1 2022)(1) Greenfield Rendering (1) Excludes pre-engineering costs, capitalized interest and internal labor and overhead.

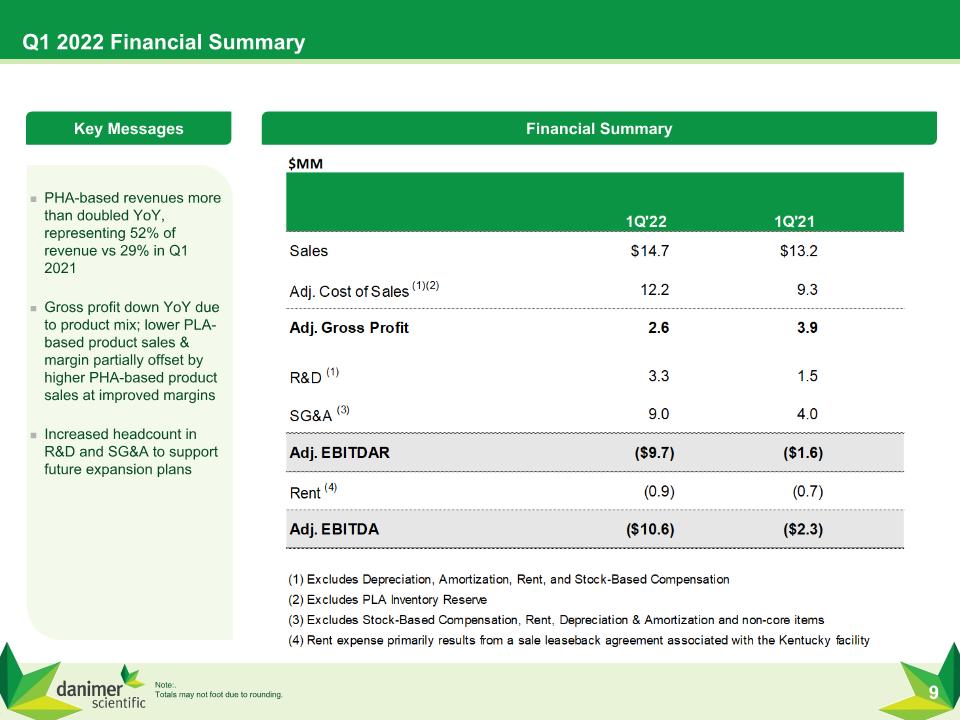

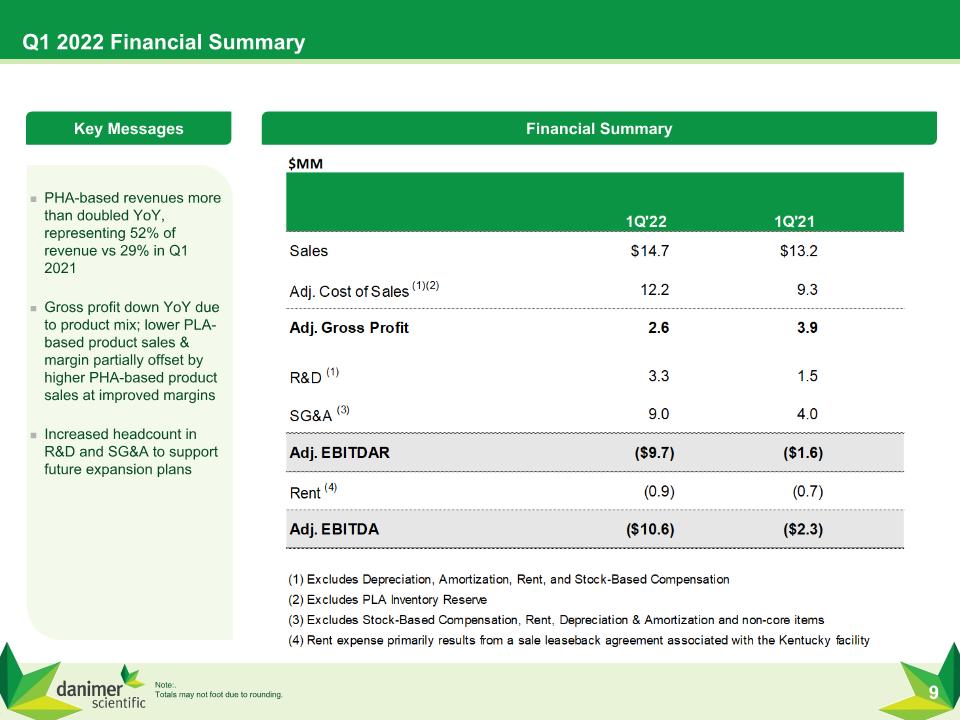

Q1 2022 Financial Summary PHA-based revenues more than doubled YoY, representing 52% of revenue vs 29% in Q1 2021 Gross profit down YoY due to product mix; lower PLA-based product sales & margin partially offset by higher PHA-based product sales at improved margins Increased headcount in R&D and SG&A to support future expansion plans Key Messages Financial Summary Note:. Totals may not foot due to rounding.

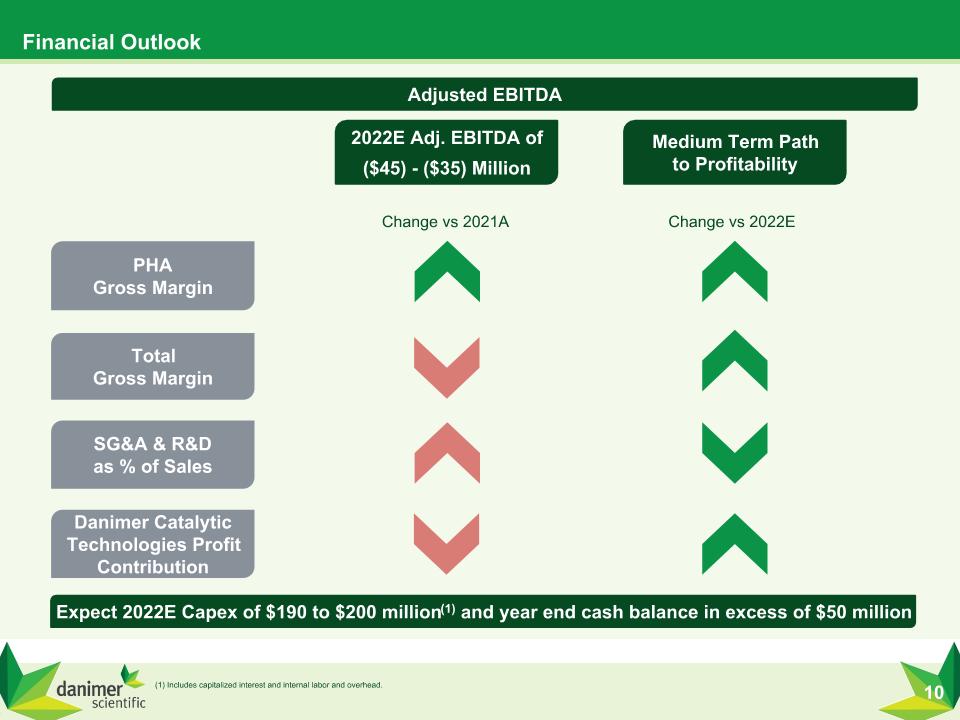

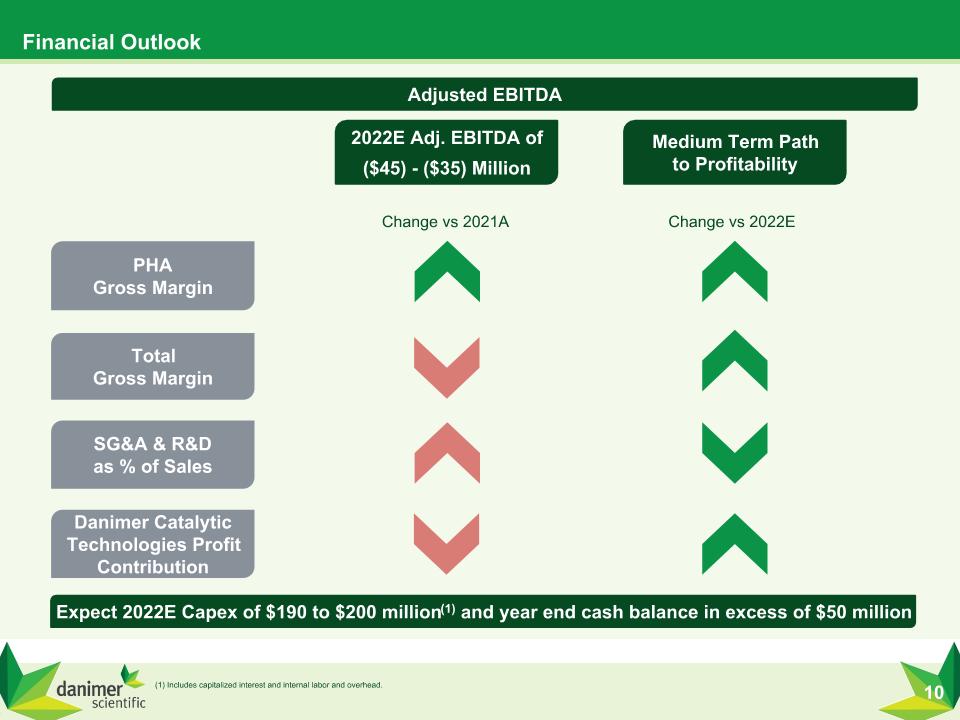

Financial Outlook 4% PHA PHA �Gross Margin Total �Gross Margin SG&A & R&D �as % of Sales Danimer Catalytic Technologies Profit Contribution Adjusted EBITDA 2022E Adj. EBITDA of ($45) - ($35) Million Expect 2022E Capex of $190 to $200 million(1) and year end cash balance in excess of $50 million Change vs 2021A Change vs 2022E (1) Includes capitalized interest and internal labor and overhead. Medium Term Path �to Profitability

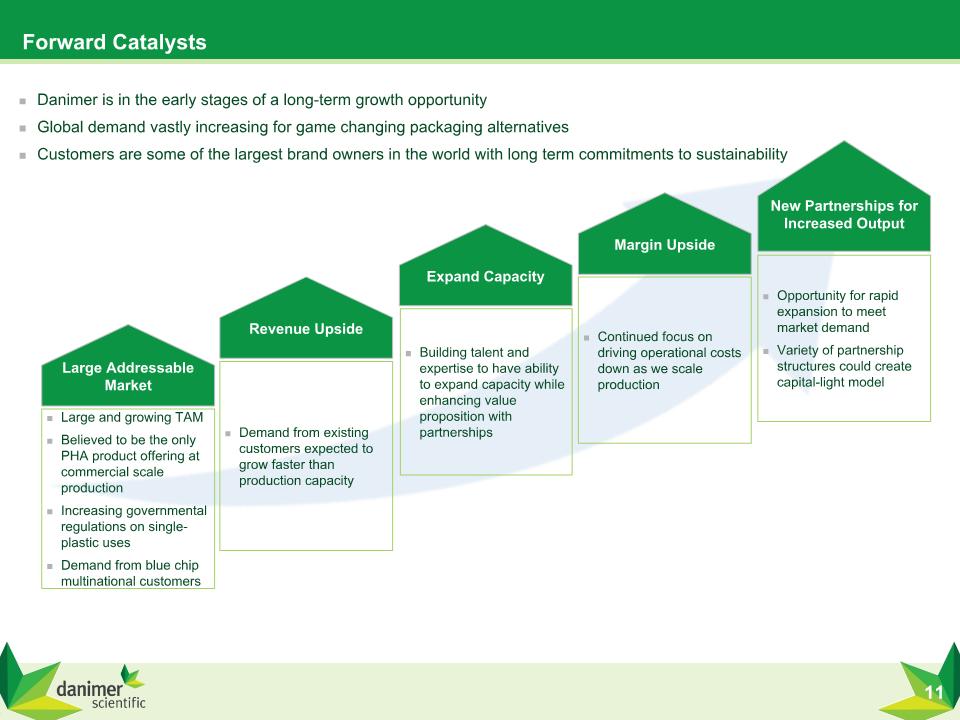

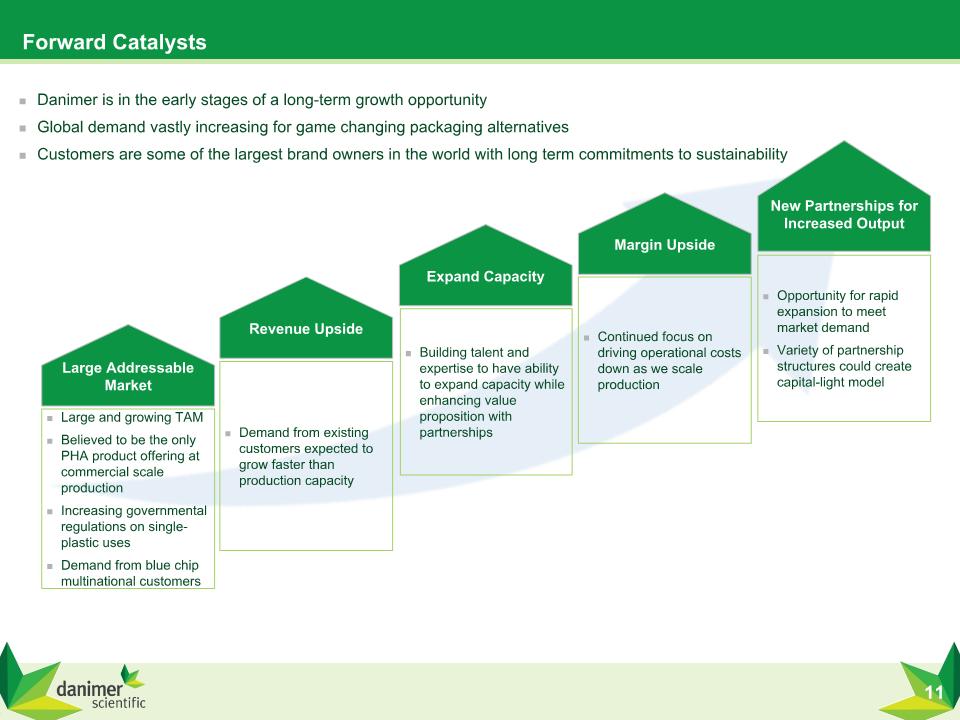

Forward Catalysts Continued focus on driving operational costs down as we scale production Large and growing TAM Believed to be the only PHA product offering at commercial scale production Increasing governmental regulations on single-plastic uses Demand from blue chip multinational customers Building talent and expertise to have ability to expand capacity while enhancing value proposition with partnerships Demand from existing customers expected to grow faster than production capacity Opportunity for rapid expansion to meet market demand Variety of partnership structures could create capital-light model Large Addressable Market Revenue Upside Margin Upside Expand Capacity New Partnerships for Increased Output Danimer is in the early stages of a long-term growth opportunity Global demand vastly increasing for game changing packaging alternatives Customers are some of the largest brand owners in the world with long term commitments to sustainability

Appendix

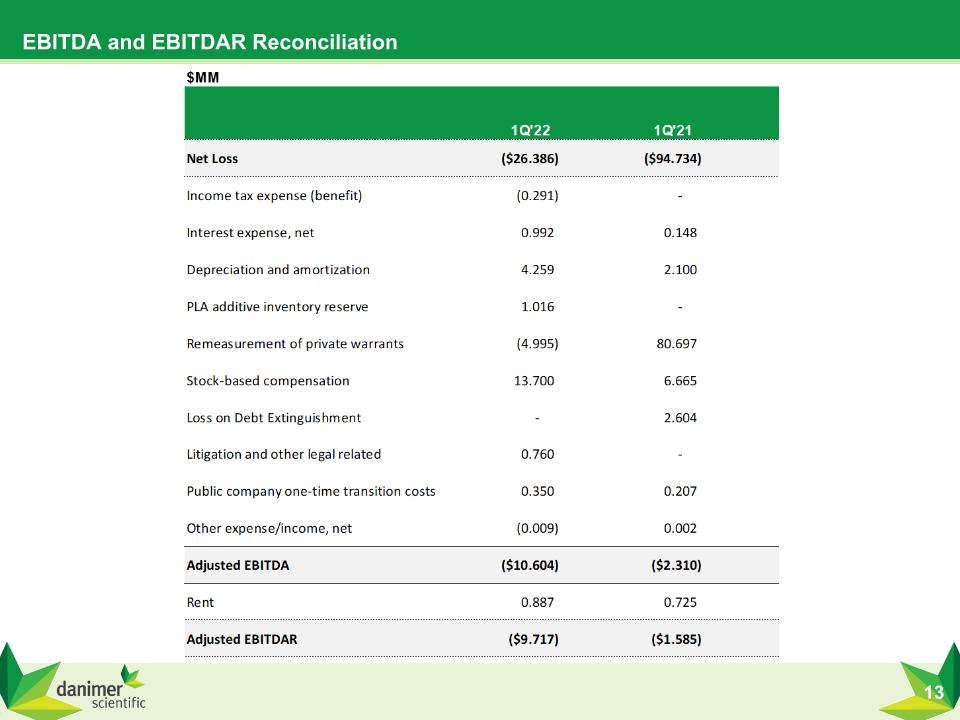

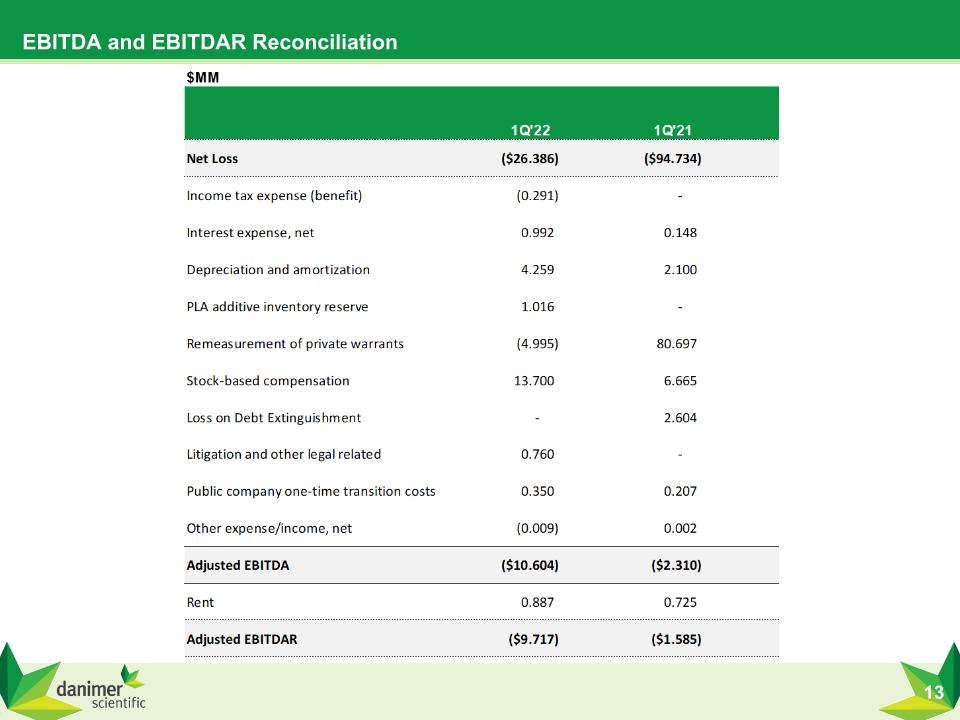

EBITDA and EBITDAR Reconciliation

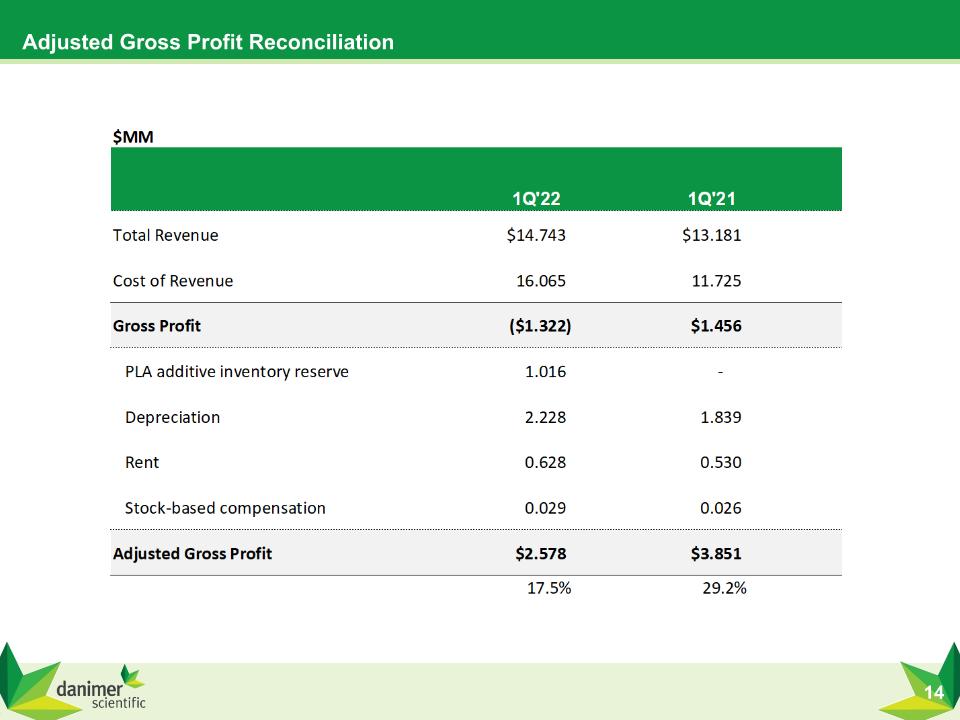

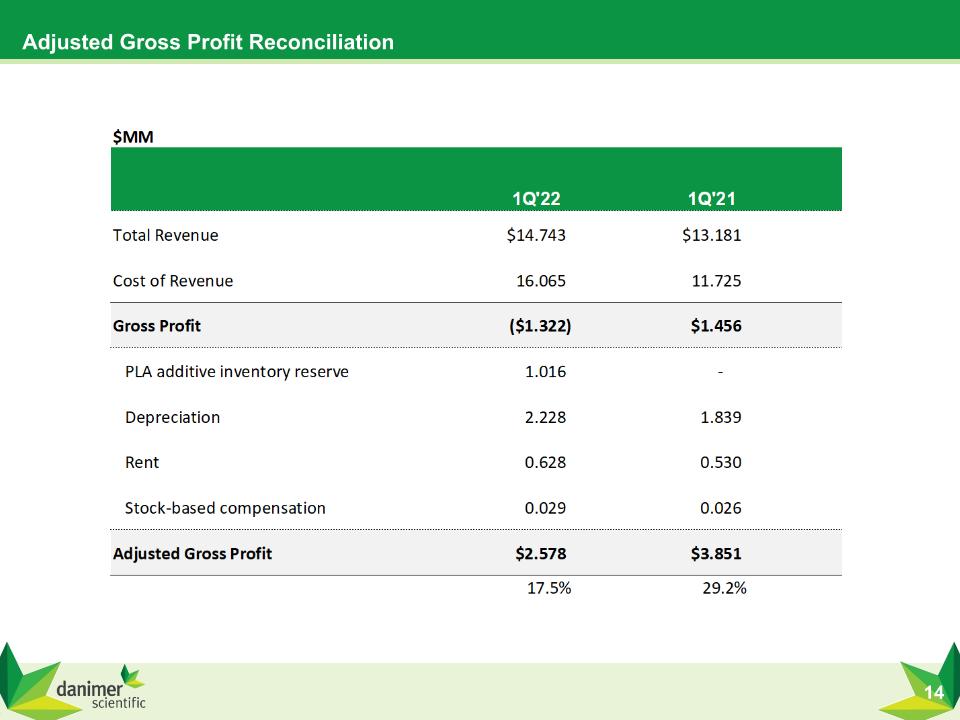

Adjusted Gross Profit Reconciliation