Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This preliminary proxy statement/prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

PRELIMINARY PROXY STATEMENT/PROSPECTUS SUBJECT TO COMPLETION, DATED MARCH 11, 2021

PROXY STATEMENT/PROSPECTUS FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF SILVER SPIKE ACQUISITION CORP.

PROXY STATEMENT/PROSPECTUS FOR 24,998,575 SHARES OF CLASS A COMMON STOCK AND 12,500,000 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK, IN EACH CASE OF SILVER SPIKE ACQUISITION CORP. AFTER ITS DOMESTICATION AS A CORPORATION INCORPORATED IN THE STATE OF DELAWARE, WHICH WILL BE RENAMED “ ” IN CONNECTION WITH THE BUSINESS COMBINATION).

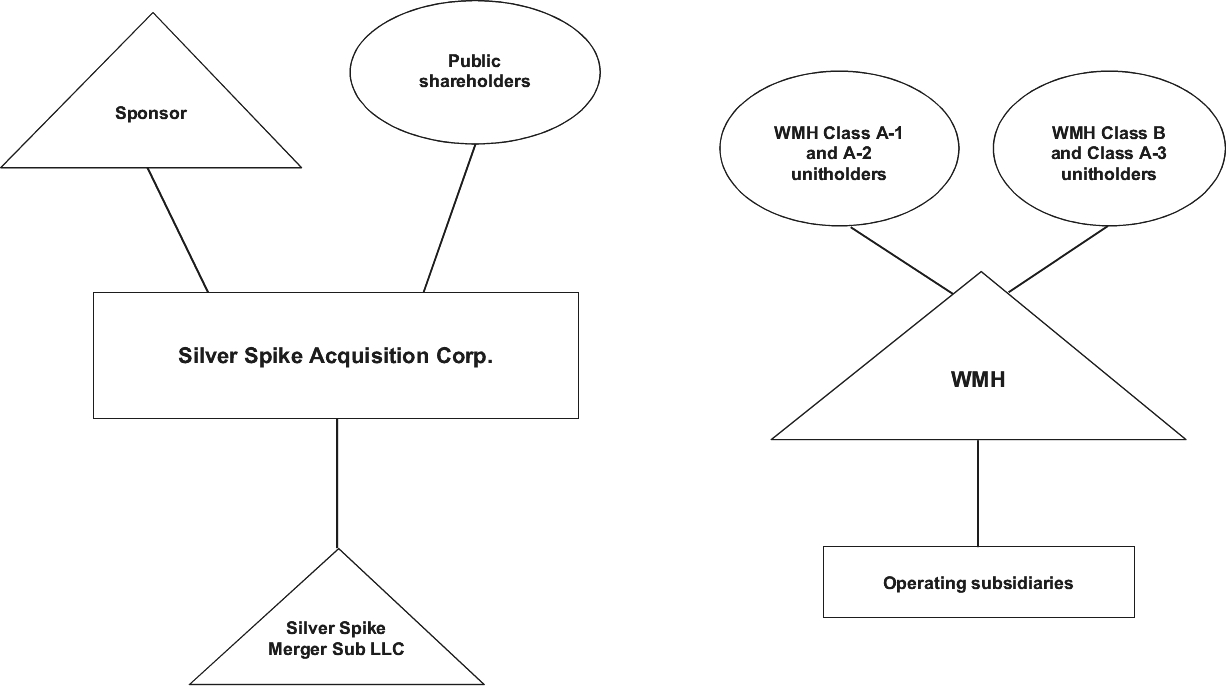

The board of directors of Silver Spike Acquisition Corp., a Cayman Islands exempted company (“Silver Spike,” “we,” “our” or “us”), has unanimously approved the agreement and plan of merger, dated as of December 10, 2020 (as amended or modified from time to time, the “merger agreement”), by and among Silver Spike, Silver Spike Merger Sub LLC, a Delaware limited liability company and a wholly owned direct subsidiary of Silver Spike (“Merger Sub”), WM Holding Company, LLC, a Delaware limited liability company (“WMH”), and Ghost Media Group, LLC, a Nevada limited liability company, solely in its capacity as the initial holder representative (the “holder representative”), pursuant to which Merger Sub will be merged with and into WMH, whereupon the separate limited liability company existence of Merger Sub will cease and WMH will be the surviving company and continue in existence as a subsidiary of Silver Spike, on the terms and subject to the conditions set forth therein (the transactions contemplated by the merger agreement, the “business combination”).

As described in this proxy statement/prospectus, Silver Spike’s shareholders are being asked to consider and vote upon (among other things) the business combination and the change of Silver Spike’s jurisdiction of incorporation from the Cayman Islands to the State of Delaware by deregistering as an exempted company in the Cayman Islands and domesticating and continuing as a corporation incorporated under the laws of the State of Delaware (the “domestication” and Silver Spike post-domestication, “New WMH”). Assuming the domestication proposal is approved, the domestication is expected to be effectuated prior to, but conditioned upon, the closing of the business combination (the “closing”). The continuing entity following the domestication will be named “ .”

The merger consideration (the “merger consideration”) received by holders of the limited liability company interests of WMH (each, a “WMH equity holder”) at the closing of the business combination (the “Closing”) pursuant to the merger agreement will have a value of $1,310,000,000 and will be paid in a mix of cash and equity consideration.

Financing for the business combination and for related transaction expenses will consist of (i) $250,000,000 of proceeds from Silver Spike’s initial public offering (the “IPO”) and certain related transactions on deposit in the trust account (plus interest income accrued thereon since the IPO), net of any redemptions of Silver Spike’s Class A ordinary shares in connection with the shareholder votes to be held at the extraordinary general meeting of Silver Spike shareholders to be held in connection with the business combination (the “general meeting”) and held at the extraordinary general meeting in lieu of annual general meeting on January 13, 2021 in connection with a proposal to amend Silver Spike’s existing organizational documents (“the extension meeting”) and (ii) $325,000,000 of proceeds from the purchase by certain accredited investors, pursuant to subscription agreements entered into in connection with the entry into the merger agreement (the “subscription agreements”), of an aggregate of 32,500,000 shares of Class A common stock of New WMH for a purchase price of $10.00 per share of Class A common stock of New WMH in a private placement to close immediately prior to the closing, each as described more fully in this proxy statement/prospectus.

Upon the consummation of the domestication, each of Silver Spike’s currently issued and outstanding Class A ordinary shares and Class B ordinary shares, par value $0.0001 per share (“Class B ordinary shares” or the “founder shares”) will automatically convert by operation of law, on a one-for-one basis, into shares of Class A common stock, par value $0.0001 per share, of New WMH (“Class A common stock”). Similarly, all of Silver Spike’s outstanding warrants will become warrants to acquire the shares of Class A common stock, and no other changes will be made to the terms of any outstanding warrants as a result of the domestication.

This proxy statement/prospectus covers the following securities of New WMH to be issued in the domestication: (i) 24,998,575 shares of Class A common stock, representing our currently issued and outstanding public shares and (ii) 12,500,000 warrants to acquire shares of Class A common stock, representing our currently issued and outstanding public warrants.

Following the business combination, we will have two classes of common stock, Class A common stock and Class V common stock. The rights of the holders of Class A common stock and Class V common stock are identical, except with respect to dividend rights, rights upon liquidation, dissolution and winding-up and preemptive rights. The holders of Class V common stock will not participate in any dividends of New WMH, will not be entitled to receive any assets of New WMH in any liquidation, dissolution or winding up, and do not have preemptive, subscription, redemption or conversion rights. Each share of Class A common stock and Class V common stock is entitled to one vote per share. Upon completion of the business combination, there will be 149,748,575 shares of Class A common stock outstanding and approximately 65,984,049 shares of Class V common stock outstanding, based upon certain assumptions stated in this proxy statement/prospectus. See the section entitled “Summary Term Sheet” for more information.

Our units, Class A ordinary shares originally sold as part of the units, and warrants originally sold as part of the units are currently listed on The Nasdaq Stock Market LLC (the “Nasdaq”) under the symbols “SSPKU,” “SSPK” and “SSPKW,” respectively. The Class A ordinary shares and warrants comprising the units began separately trading on January 14, 2020. Upon the closing, we intend to apply to continue the listing of our Class A common stock and warrants on the Nasdaq under the symbols “ ” and “ ,” respectively. Our units will not be traded following the closing.

This business combination is being accomplished through what is commonly referred to as an “Up-C” structure, which is often used by partnerships and limited liability companies undertaking an initial public offering. The Up-C structure allows the current WMH equity holders to retain their equity ownership in WMH, an entity that is classified as a partnership for U.S. federal income tax purposes, in the form of post-merger WMH units and provides potential future tax benefits for both New WMH and the post-merger WMH equity holders when they ultimately exchange their pass-through interests for shares of Class A common stock. New WMH will be a holding company, and immediately after the consummation of the business combination, its principal asset will be its ownership interests in WMH. At the closing, New WMH will become the managing member of WMH with control over the affairs and decision making of WMH, and will own approximately 42.6% of the economic interest in WMH, assuming no redemptions, and 25.9% of the economic interest in WMH, assuming maximum redemptions. See the section entitled “Summary of the Proxy Statement/Prospectus—The Business Combination” for more information. We do not believe that the Up-C organizational structure will give rise to any significant business or strategic benefit or detriment. We will consolidate the financial results of WMH in our combined financial statements.

This proxy statement/prospectus provides you with detailed information about the business combination. domestication and other matters to be considered at the general meeting. We urge you to read the accompanying proxy statement/prospectus and the documents incorporated therein by reference carefully. In particular, you should review the matters discussed under the caption “Risk Factors” beginning on page

56 of the proxy statement/prospectus.

Neither the Securities Exchange Commission nor any state securities commission has approved or disapproved of the transactions described in the accompanying proxy statement/prospectus, passed upon the merits or fairness of either of the merger agreement or the transactions contemplated thereby, or passed upon the adequacy or accuracy of the accompanying proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated , 2021, and is first being mailed to Silver Spike shareholders on or about , 2021.