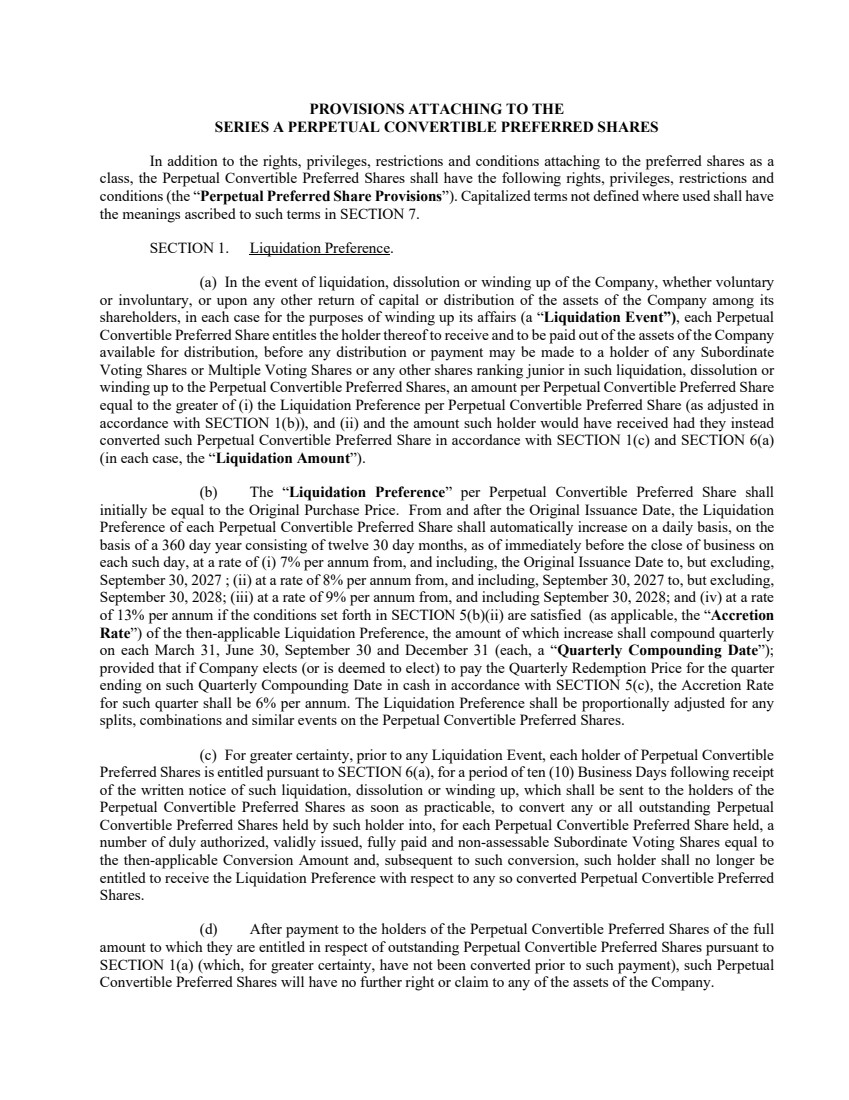

| PROVISIONS ATTACHING TO THE SERIES A PERPETUAL CONVERTIBLE PREFERRED SHARES In addition to the rights, privileges, restrictions and conditions attaching to the preferred shares as a class, the Perpetual Convertible Preferred Shares shall have the following rights, privileges, restrictions and conditions (the “Perpetual Preferred Share Provisions”). Capitalized terms not defined where used shall have the meanings ascribed to such terms in SECTION 7. SECTION 1. Liquidation Preference. (a) In the event of liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, or upon any other return of capital or distribution of the assets of the Company among its shareholders, in each case for the purposes of winding up its affairs (a “Liquidation Event”), each Perpetual Convertible Preferred Share entitles the holder thereof to receive and to be paid out of the assets of the Company available for distribution, before any distribution or payment may be made to a holder of any Subordinate Voting Shares or Multiple Voting Shares or any other shares ranking junior in such liquidation, dissolution or winding up to the Perpetual Convertible Preferred Shares, an amount per Perpetual Convertible Preferred Share equal to the greater of (i) the Liquidation Preference per Perpetual Convertible Preferred Share (as adjusted in accordance with SECTION 1(b)), and (ii) and the amount such holder would have received had they instead converted such Perpetual Convertible Preferred Share in accordance with SECTION 1(c) and SECTION 6(a) (in each case, the “Liquidation Amount”). (b) The “Liquidation Preference” per Perpetual Convertible Preferred Share shall initially be equal to the Original Purchase Price. From and after the Original Issuance Date, the Liquidation Preference of each Perpetual Convertible Preferred Share shall automatically increase on a daily basis, on the basis of a 360 day year consisting of twelve 30 day months, as of immediately before the close of business on each such day, at a rate of (i) 7% per annum from, and including, the Original Issuance Date to, but excluding, September 30, 2027 ; (ii) at a rate of 8% per annum from, and including, September 30, 2027 to, but excluding, September 30, 2028; (iii) at a rate of 9% per annum from, and including September 30, 2028; and (iv) at a rate of 13% per annum if the conditions set forth in SECTION 5(b)(ii) are satisfied (as applicable, the “Accretion Rate”) of the then-applicable Liquidation Preference, the amount of which increase shall compound quarterly on each March 31, June 30, September 30 and December 31 (each, a “Quarterly Compounding Date”); provided that if Company elects (or is deemed to elect) to pay the Quarterly Redemption Price for the quarter ending on such Quarterly Compounding Date in cash in accordance with SECTION 5(c), the Accretion Rate for such quarter shall be 6% per annum. The Liquidation Preference shall be proportionally adjusted for any splits, combinations and similar events on the Perpetual Convertible Preferred Shares. (c) For greater certainty, prior to any Liquidation Event, each holder of Perpetual Convertible Preferred Shares is entitled pursuant to SECTION 6(a), for a period of ten (10) Business Days following receipt of the written notice of such liquidation, dissolution or winding up, which shall be sent to the holders of the Perpetual Convertible Preferred Shares as soon as practicable, to convert any or all outstanding Perpetual Convertible Preferred Shares held by such holder into, for each Perpetual Convertible Preferred Share held, a number of duly authorized, validly issued, fully paid and non-assessable Subordinate Voting Shares equal to the then-applicable Conversion Amount and, subsequent to such conversion, such holder shall no longer be entitled to receive the Liquidation Preference with respect to any so converted Perpetual Convertible Preferred Shares. (d) After payment to the holders of the Perpetual Convertible Preferred Shares of the full amount to which they are entitled in respect of outstanding Perpetual Convertible Preferred Shares pursuant to SECTION 1(a) (which, for greater certainty, have not been converted prior to such payment), such Perpetual Convertible Preferred Shares will have no further right or claim to any of the assets of the Company. |