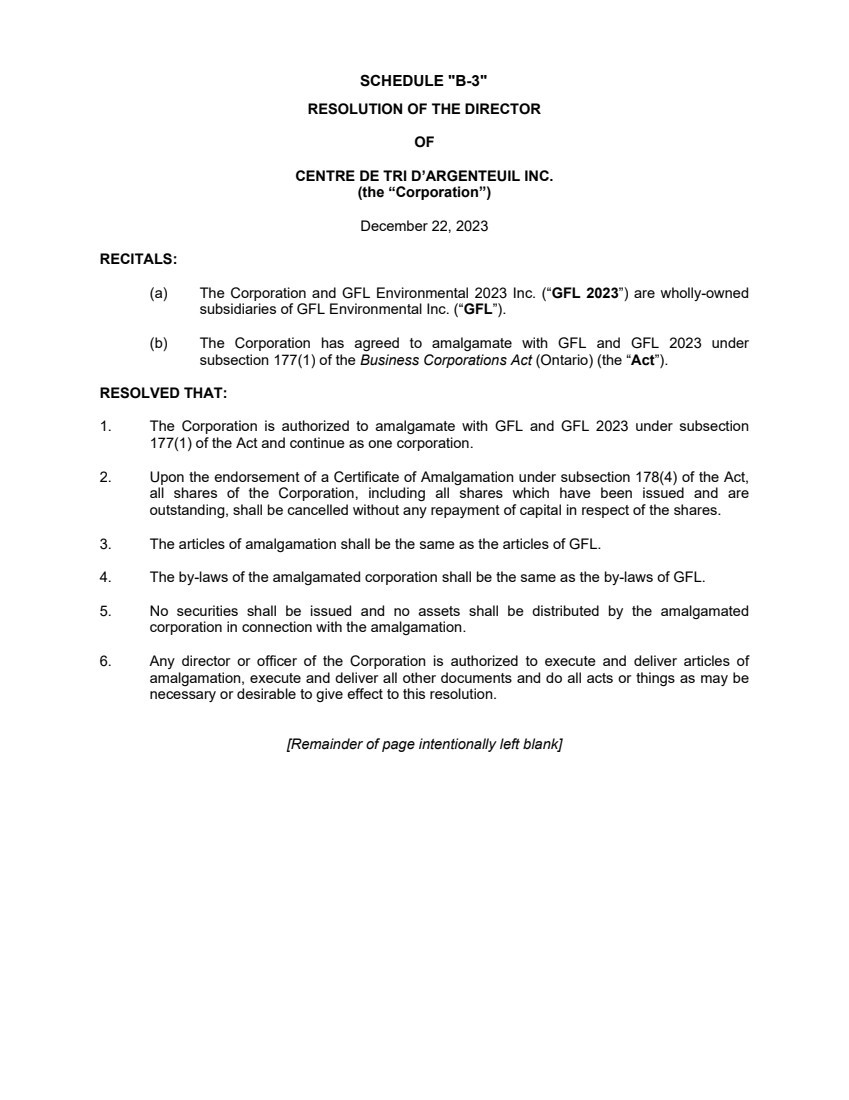

| “Permitted Holders” means Patrick Dovigi and the spouse or legal equivalent, the parents and/or the lineal descendants of Patrick Dovigi (the “Dovigi Related Persons”) or any trust, partnership, corporation, limited liability company or other estate or planning or investment vehicle in which no other Person has any legal, economic, beneficial or other interest other than such holder and/or the Dovigi Related Persons, as applicable, and with respect to which, a transfer does not result in any change in the effective control of such holder’s securities. “Person” means any individual, partnership, corporation, company, association, trust, joint venture or limited liability company. For purposes hereof, “control” (including, with correlative meanings, the terms “controlling,” “controlled by” and “under common control with”), as used with respect to any Person, shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such Person, whether through the ownership of voting securities, by agreement or otherwise. 2. Subordinate Voting Shares and Multiple Voting Shares The special rights or restrictions attached to the Subordinate Voting Shares and the Multiple Voting Shares shall be as follows: 1. Dividends; Rights on Liquidation, Dissolution or Winding-Up The Subordinate Voting Shares and the Multiple Voting Shares shall be subject to and subordinate to the special rights or restrictions attached to the Preferred Shares and the shares of any other class ranking senior to the Subordinate Voting Shares and the Multiple Voting Shares and shall rank pari passu, share for share, as to the right to receive dividends and any amount payable on any distribution of assets constituting a return of capital and to receive the remaining property and assets of the Company on the liquidation, dissolution or winding-up of the Company, whether voluntarily or involuntarily, or any other distribution of assets of the Company among its shareholders for the purposes of winding-up its affairs. For the avoidance of doubt, holders of Subordinate Voting Shares and Multiple Voting Shares shall, subject always to the rights of the holders of Preferred Shares and the shares of any other class ranking senior to the Subordinate Voting Shares and the Multiple Voting Shares, be entitled to receive (i) such dividends and any amount payable on any distribution of assets constituting a return of capital as the directors of the Company shall determine, and (ii) in the event of the liquidation, dissolution or winding-up of the Company, whether voluntarily or involuntarily, or any other distribution of assets of the Company among its shareholders for the purposes of winding-up its affairs, the remaining property and assets of the Company, in the case of (i) and (ii) an identical amount per share, at the same time and in the same form (whether in cash, in specie or otherwise) as if such shares were of one class only; provided, however, that in the event of the payment of a dividend in the form of shares, holders of Subordinate Voting Shares shall receive Subordinate Voting Shares and holders of Multiple Voting Shares shall receive Multiple Voting Shares, unless otherwise determined by the directors of the Company. 2. Meetings and Voting Rights Each holder of Subordinate Voting Shares and each holder of Multiple Voting Shares shall be entitled to receive notice of and to attend all meetings of shareholders of the Company, except meetings at which only holders of another class or of a particular series shall have the right to vote. At each such meeting, each Subordinate Voting Share shall entitle the holder thereof to one (1) vote and each Multiple Voting Share shall entitle the holder thereof to ten (10) votes. 3. Subdivision or Consolidation No subdivision or consolidation of the Multiple Voting Shares or the Subordinate Voting Shares shall be carried out unless, at the same time, the Multiple Voting Shares or the Subordinate Voting Shares, as the case may be, are subdivided or consolidated in the same manner and on the same basis so as to preserve the relative economic and voting interests of the two classes. BCA - Articles of Amalgamation - GFL ENVIRONMENTAL INC. - OCN:1000750064 - January 01, 2024 The endorsed Articles of Amalgamation are not complete without the Certificate of Amalgamation. Certified a true copy of the record of the Ministry of Public and Business Service Delivery. Director/Registrar, Ministry of Public and Business Service Delivery Page 4 of 56 |