Transforming how�the world connects Business Update – First Quarter 2022 May 16, 2022 NASDAQ: ASTS

ast-science.com Forward Looking Statements The information in this presentation and the oral statements made in connection therewith includes “forward-looking statements” for the purposes of federal securities laws that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical fact in this presentation and the oral statements made in connection therewith regarding AST SpaceMobile, Inc.’s, collectively with its subsidiaries (“SpaceMobile” or the “Company”), financial position, business strategy and the plans and objectives of management for future operations, are forward-looking statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,” “seek” and variations and similar words and expressions are intended to identify such forward-looking statements. Such forward-looking statements relate to future events or future performance, but reflect management’s current beliefs, based on information currently available. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors contained in AST SpaceMobile’s Annual Report on Form 10-K, filed with the SEC on March 31, 2022. The Company’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. Use of Non-GAAP Financial Measures (UNAUDITED) This presentation contains certain non-GAAP measures, including cash operating expense. Cash operating expense is equal to total operating expense less non-cash operating expense such as depreciation and amortization and stock-based compensation expense. The Company believes that these non-GAAP measures, when presented in conjunction with comparable GAAP measures, provide useful information about the Company’s operating results and liquidity and enhance the overall ability to assess the Company’s financial performance. The Company uses these measures, together with other measures of performance under GAAP, to compare the relative performance of operations in planning, budgeting and reviewing the performance of its business. Industry and Market Data This presentation includes market data and other statistical information from sources believed to be reliable, including independent industry publications, governmental publications or other published independent sources. Although AST SpaceMobile believes these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. Trademarks and Trade Names AST SpaceMobile owns or has rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with AST SpaceMobile, or an endorsement or sponsorship by or of AST SpaceMobile. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that AST SpaceMobile will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

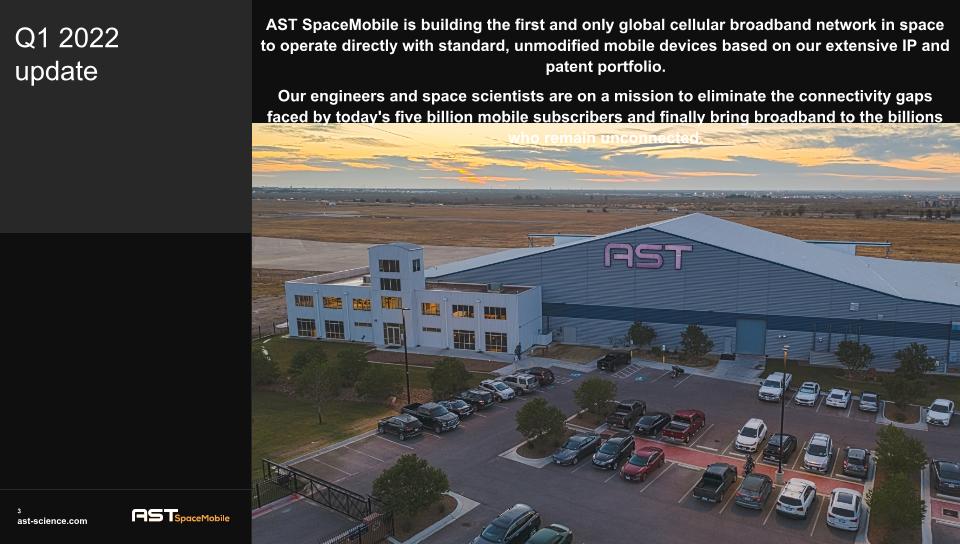

Q1 2022 �update AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today's five billion mobile subscribers and finally bring broadband to the billions who remain unconnected.

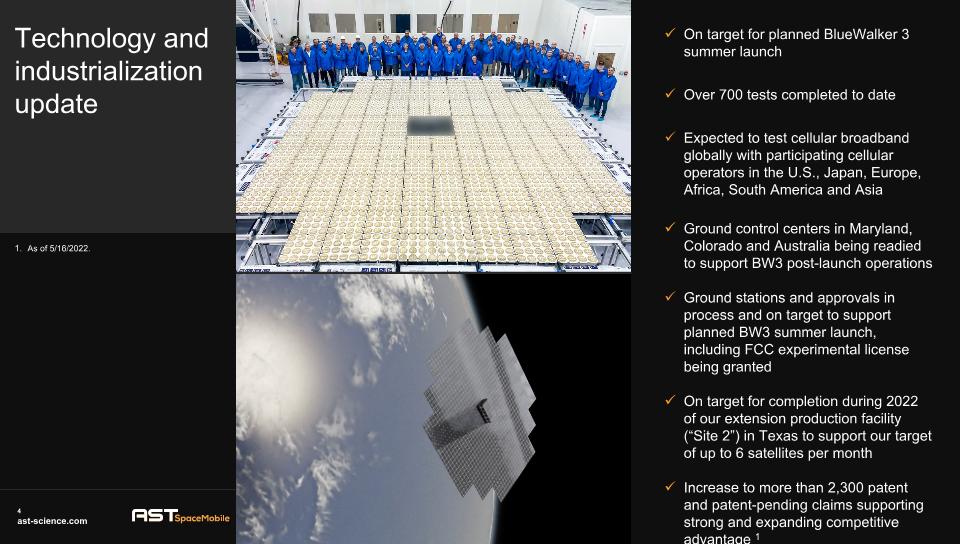

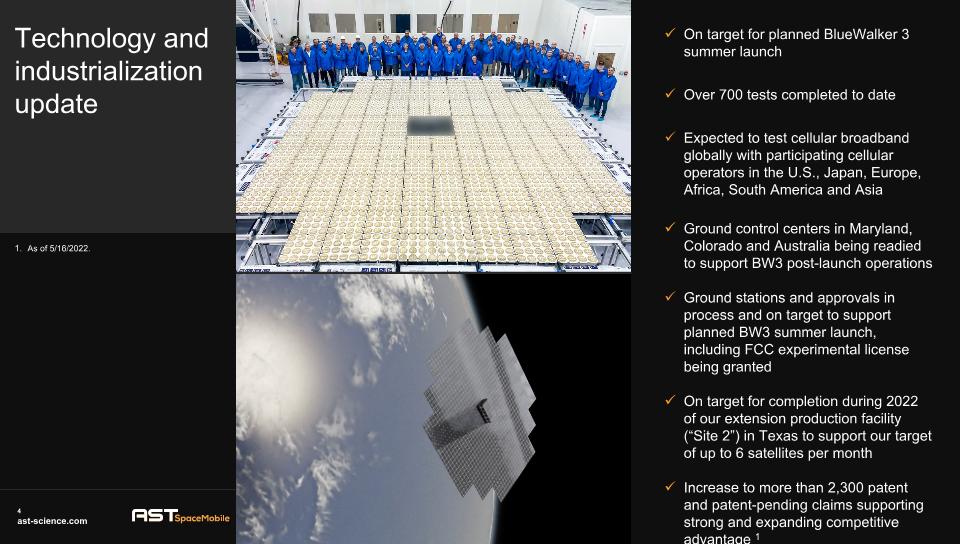

Technology and industrialization update As of 5/16/2022. On target for planned BlueWalker 3 summer launch Over 700 tests completed to date Expected to test cellular broadband globally with participating cellular operators in the U.S., Japan, Europe, Africa, South America and Asia Ground control centers in Maryland, Colorado and Australia being readied to support BW3 post-launch operations Ground stations and approvals in process and on target to support planned BW3 summer launch, including FCC experimental license being granted On target for completion during 2022 of our extension production facility (“Site 2”) in Texas to support our target of up to 6 satellites per month Increase to more than 2,300 patent and patent-pending claims supporting strong and expanding competitive advantage 1

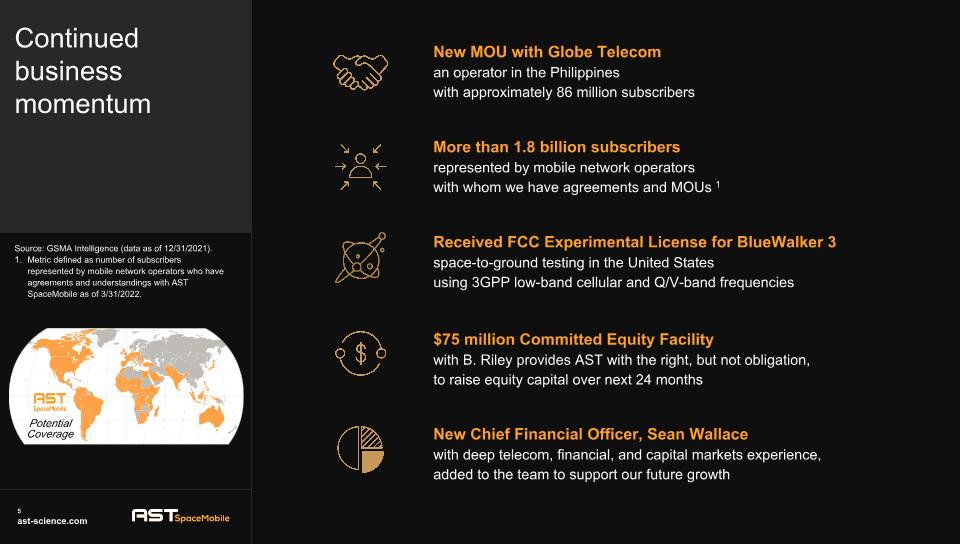

Continued business momentum New MOU with Globe Telecom an operator in the Philippines with approximately 86 million subscribers More than 1.8 billion subscribers represented by mobile network operators with whom we have agreements and MOUs 1 $75 million Committed Equity Facility with B. Riley provides AST with the right, but not obligation, to raise equity capital over next 24 months Source: GSMA Intelligence (data as of 12/31/2021). Metric defined as number of subscribers represented by mobile network operators who have agreements and understandings with AST SpaceMobile as of 3/31/2022. Received FCC Experimental License for BlueWalker 3 space-to-ground testing in the United States using 3GPP low-band cellular and Q/V-band frequencies Potential Coverage New Chief Financial Officer, Sean Wallace with deep telecom, financial, and capital markets experience, added to the team to support our future growth

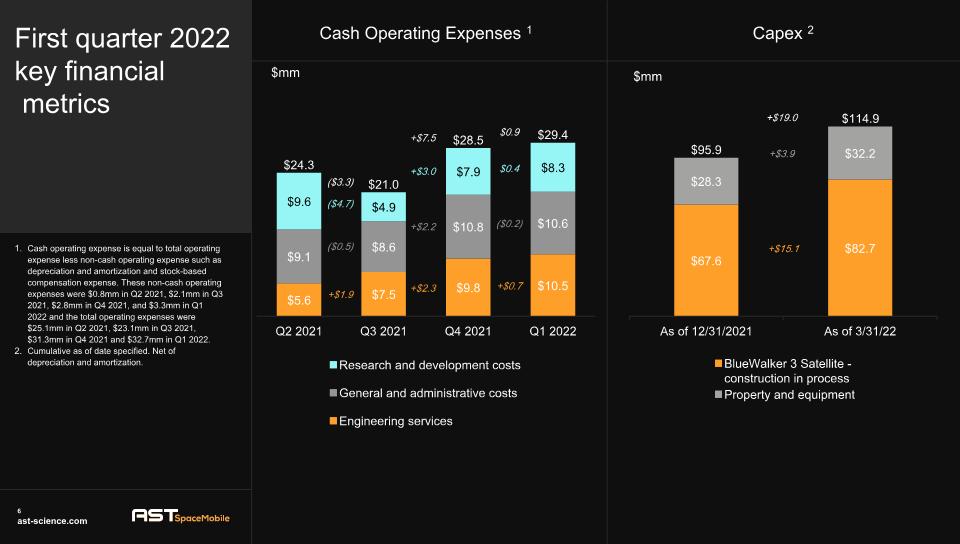

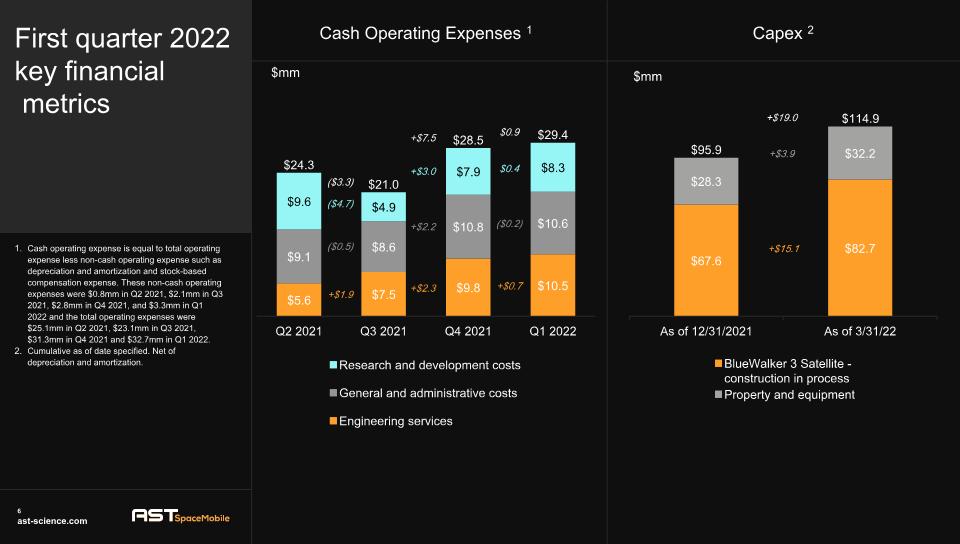

First quarter 2022�key financial� metrics Cash Operating Expenses 1 Capex 2 $mm $mm ($4.7) ($0.5) +$1.9 ($3.3) +$3.0 +$2.2 +$2.3 +$7.5 +$15.1 +$3.9 Cash operating expense is equal to total operating expense less non-cash operating expense such as depreciation and amortization and stock-based compensation expense. These non-cash operating expenses were $0.8mm in Q2 2021, $2.1mm in Q3 2021, $2.8mm in Q4 2021, and $3.3mm in Q1 2022 and the total operating expenses were $25.1mm in Q2 2021, $23.1mm in Q3 2021, $31.3mm in Q4 2021 and $32.7mm in Q1 2022. Cumulative as of date specified. Net of depreciation and amortization. +$19.0 $0.4 ($0.2) +$0.7 $0.9

NASDAQ: ASTS