Transforming how�the world connects Business Update – Third Quarter 2024 November 14, 2024 NASDAQ: ASTS ast-science.com

ast-science.com Forward Looking Statements The information in this presentation and the oral statements made in connection therewith includes “forward-looking statements” for the purposes of federal securities laws that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical fact in this presentation and the oral statements made in connection therewith regarding AST SpaceMobile, Inc.’s, collectively with its subsidiaries (“SpaceMobile” or the “Company”), financial position, business strategy and the plans and objectives of management for future operations, are forward-looking statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,” “seek,” “plan,” “predict,” “potential,” and variations and similar words and expressions are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Such forward-looking statements relate to future events or future performance, but reflect management’s current beliefs, based on information currently available. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. For information identifying important factors that could cause actual results to differ materially from those anticipated in, or implied by, the forward-looking statements, please refer to the Risk Factors contained in AST SpaceMobile’s Annual Report on Form 10-K, filed with the SEC on April 1, 2024. The Company’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. Use of Non-GAAP Financial Measures Adjusted operating expense is an alternative financial measure used by management to evaluate our operating performance as a supplement to our most directly comparable U.S. GAAP financial measure. We define Adjusted operating expense as total operating expenses adjusted to exclude amounts of stock-based compensation expense and depreciation and amortization expense. We believe Adjusted operating expenses is a useful measure across time in evaluating the Company's operating performance as we use Adjusted operating expenses to manage the business, including in preparing our annual operating budget and financial projections. Adjusted operating expense is a non-GAAP financial measure that has no standardized meaning prescribed by U.S. GAAP, and therefore has limits in its usefulness to investors. Because of the non-standardized definition, it may not be comparable to the calculation of similar measures of other companies and are presented solely to provide investors with useful information to more fully understand how management assesses performance. This measure is not, and should not be viewed as, a substitute for its most directly comparable GAAP measure of total operating expenses. Industry and Market Data This presentation includes market data and other statistical information from sources believed to be reliable, including independent industry publications, governmental publications or other published independent sources. Although AST SpaceMobile believes these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. Trademarks and Trade Names AST SpaceMobile owns or has rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with AST SpaceMobile, or an endorsement or sponsorship by or of AST SpaceMobile. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that AST SpaceMobile will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Building the First and Only Space-Based Cellular Broadband Network ast-science.com 3

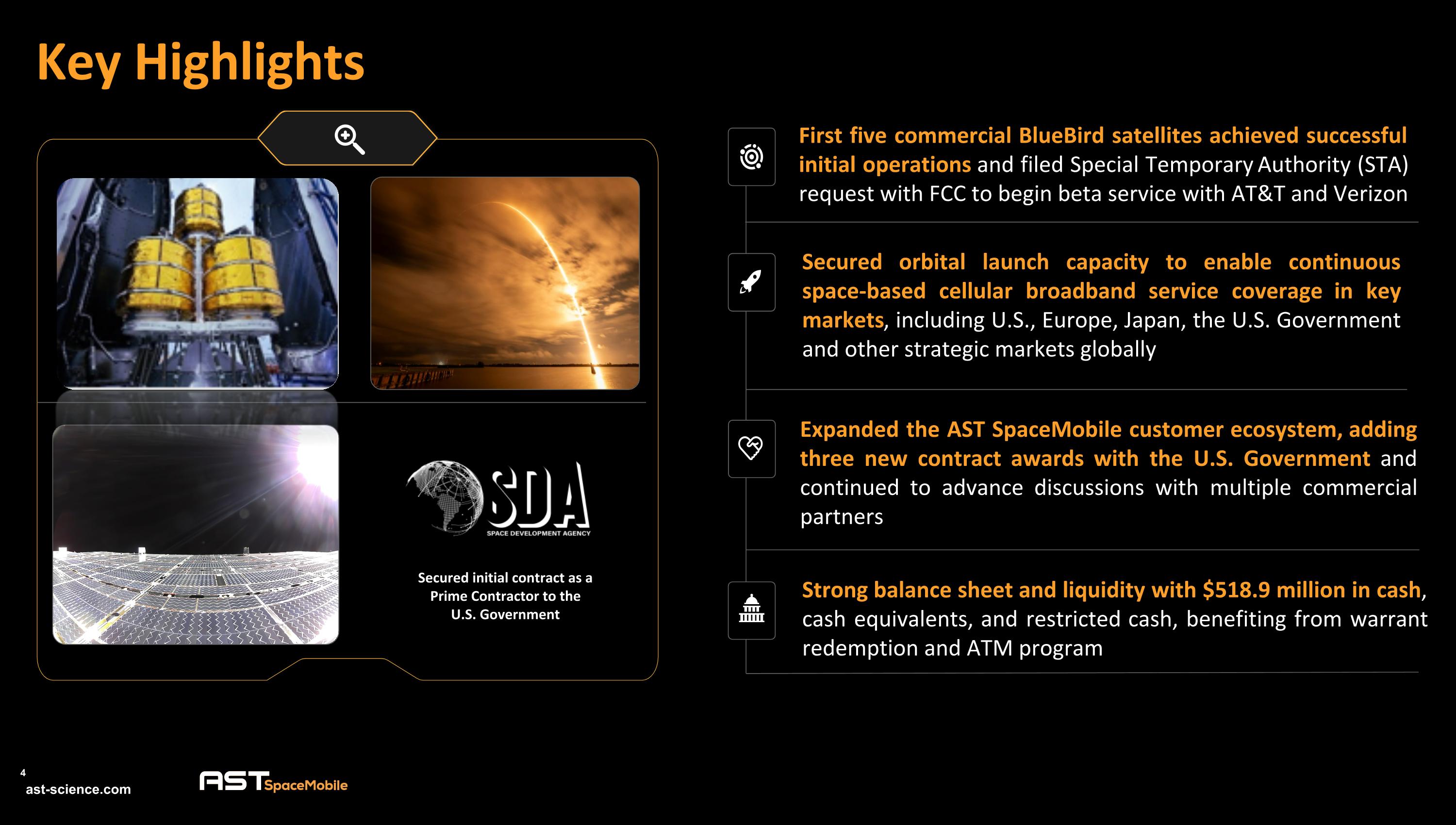

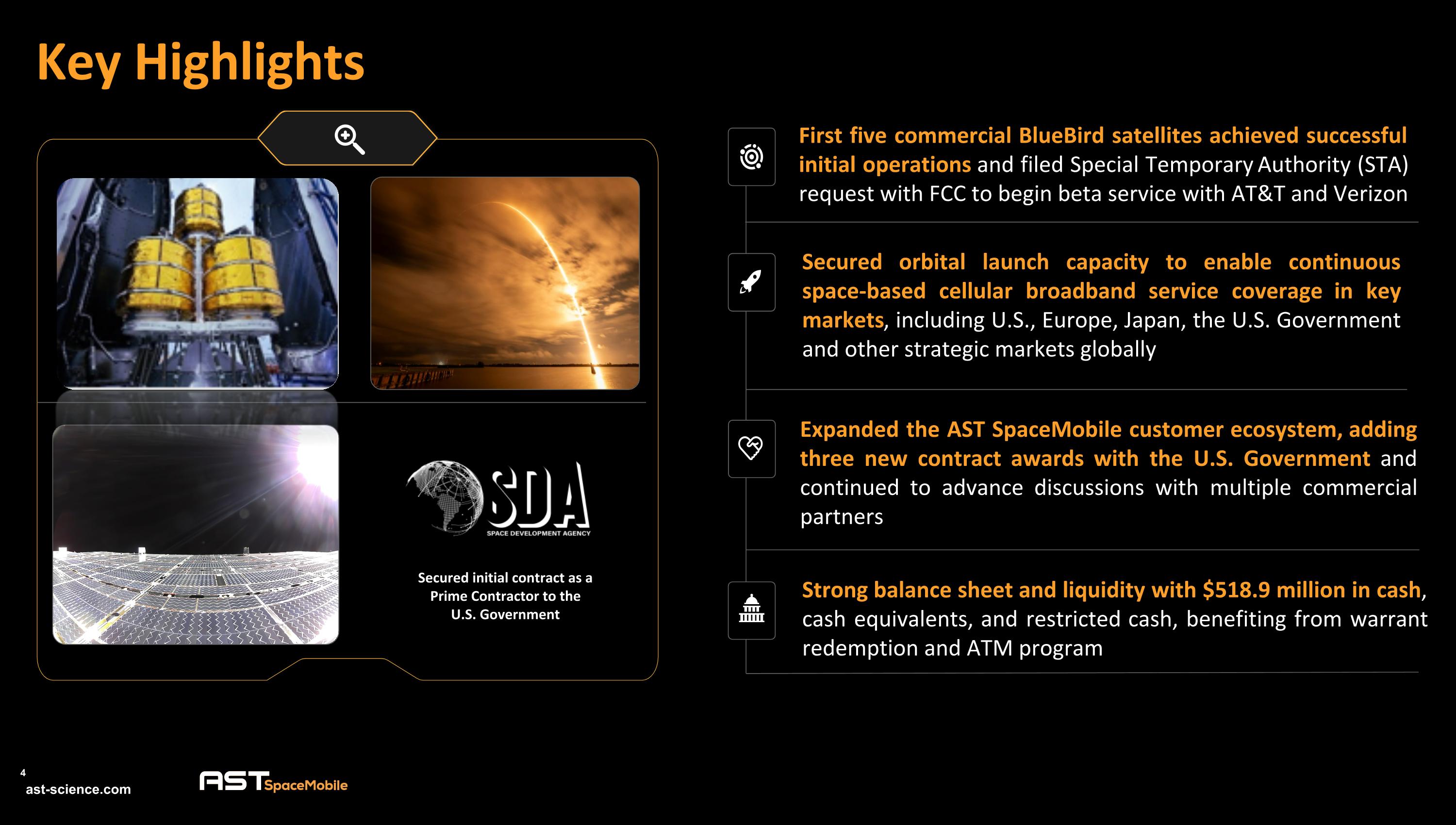

Key Highlights 4 Secured initial contract as a Prime Contractor to the U.S. Government First five commercial BlueBird satellites achieved successful initial operations and filed Special Temporary Authority (STA) request with FCC to begin beta service with AT&T and Verizon Secured orbital launch capacity to enable continuous space-based cellular broadband service coverage in key markets, including U.S., Europe, Japan, the U.S. Government and other strategic markets globally Expanded the AST SpaceMobile customer ecosystem, adding three new contract awards with the U.S. Government and continued to advance discussions with multiple commercial partners Strong balance sheet and liquidity with $518.9 million in cash, cash equivalents, and restricted cash, benefiting from warrant redemption and ATM program

First 5 commercial BlueBird satellites successfully unfolded BlueBird array unfold #2 BlueBird array unfold #1 First Five Commercial BlueBird Satellites Achieved Successful Initial Operations 5 Mission launch September 12th

Secured Orbital Launch Capacity to Enable Continuous Space-Based Cellular Broadband Service Coverage Announced launch agreements with Blue Origin, ISRO, and SpaceX to deliver AST SpaceMobile’s next-generation Block 2 BlueBirds Launch campaigns from Cape Canaveral Florida Space Force Station planned during 2025 and 2026 Blue Origin to become the third launch services provider in AST SpaceMobile history 6 Targeting continuous coverage in U.S., Europe, Japan, the U.S. Government and other strategic markets globally

Expanded the AST SpaceMobile Customer Ecosystem, Adding Three New Contract Awards With U.S. Government Selection by the Space Development Agency (SDA) to compete directly as a prime contractor under the Hybrid Application for proliferated low Earth orbit (HALO) program Growing pipeline of government opportunities for non-commercial applications demonstrates significant advantages of AST SpaceMobile’s dual-use technologies 7

When operational, SpaceMobile Service will be available to MNOs on a wholesale basis, with existing relationships spanning nearly all large countries (ex. China/Russia) potential coverage These MNOs have 2.8+ billion Subscribers globally 45+�MNOs Strategic Partners Selected MNO Partners 8 Continued Commercial Progress with Our Global Partners

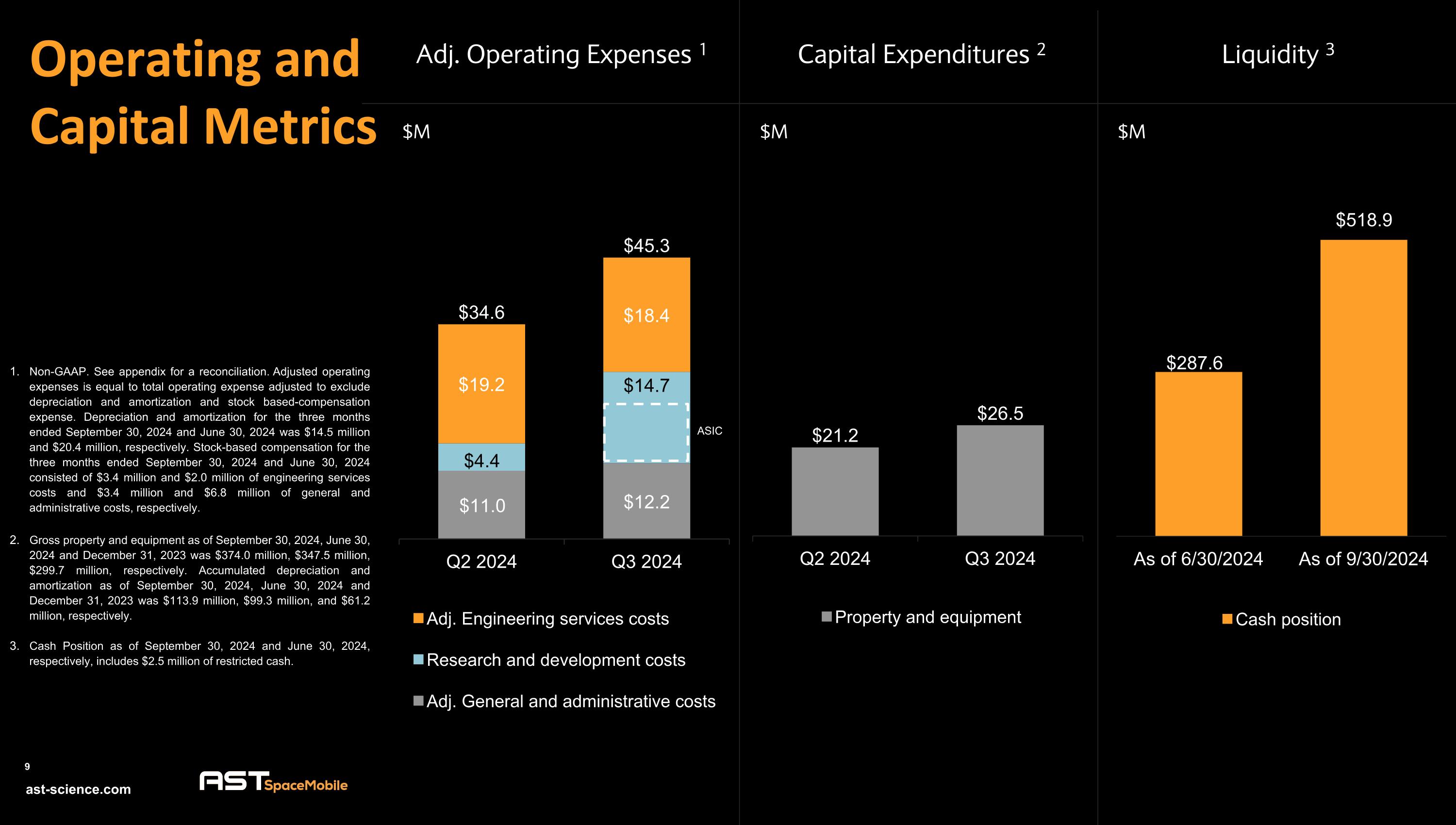

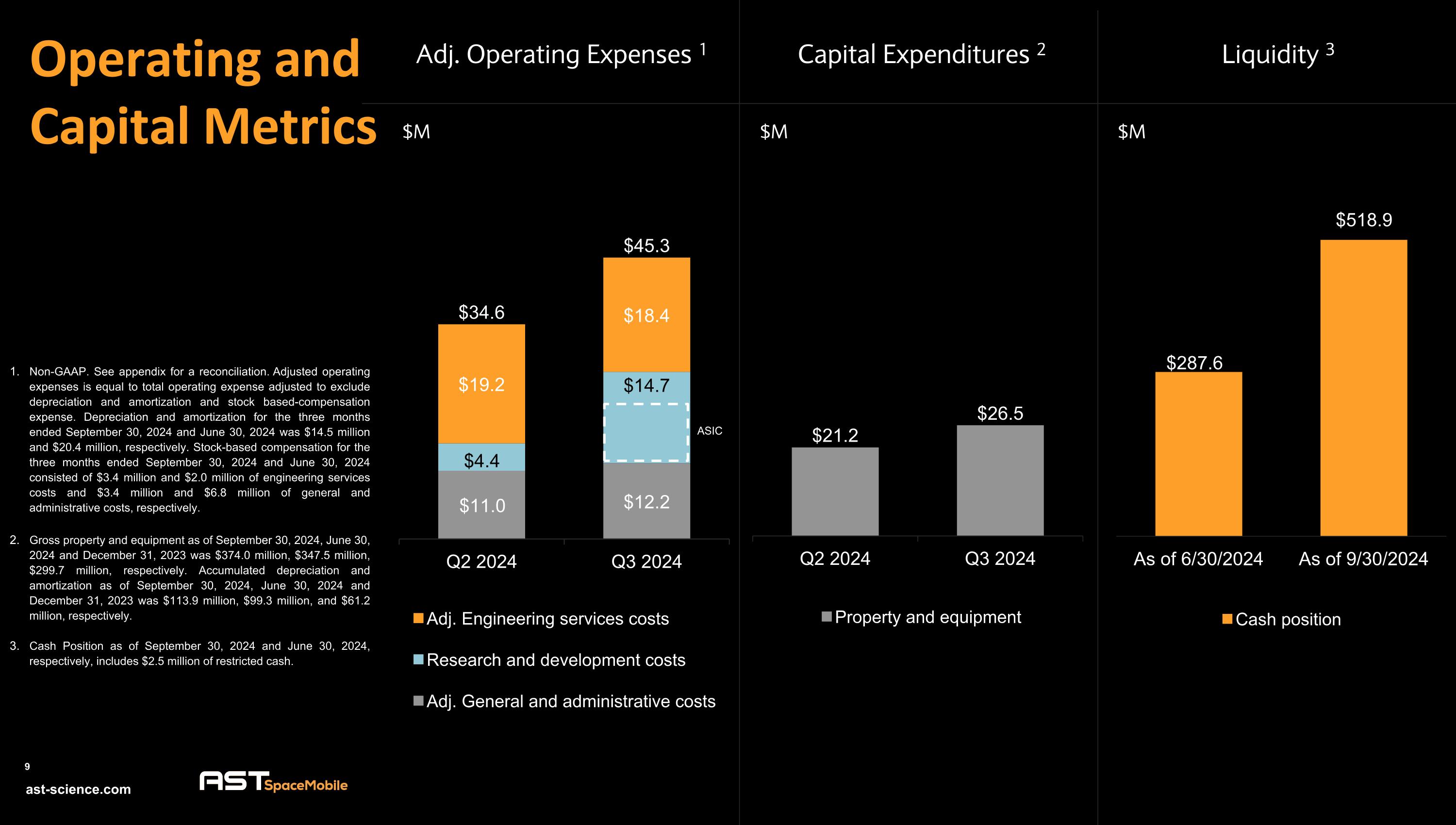

Operating and�Capital Metrics Adj. Operating Expenses 1 Liquidity 3 $M $M Non-GAAP. See appendix for a reconciliation. Adjusted operating expenses is equal to total operating expense adjusted to exclude depreciation and amortization and stock based-compensation expense. Depreciation and amortization for the three months ended September 30, 2024 and June 30, 2024 was $14.5 million and $20.4 million, respectively. Stock-based compensation for the three months ended September 30, 2024 and June 30, 2024 consisted of $3.4 million and $2.0 million of engineering services costs and $3.4 million and $6.8 million of general and administrative costs, respectively. Gross property and equipment as of September 30, 2024, June 30, 2024 and December 31, 2023 was $374.0 million, $347.5 million, $299.7 million, respectively. Accumulated depreciation and amortization as of September 30, 2024, June 30, 2024 and December 31, 2023 was $113.9 million, $99.3 million, and $61.2 million, respectively. Cash Position as of September 30, 2024 and June 30, 2024, respectively, includes $2.5 million of restricted cash. Capital Expenditures 2 $M ASIC

Appendix ast-science.com 11

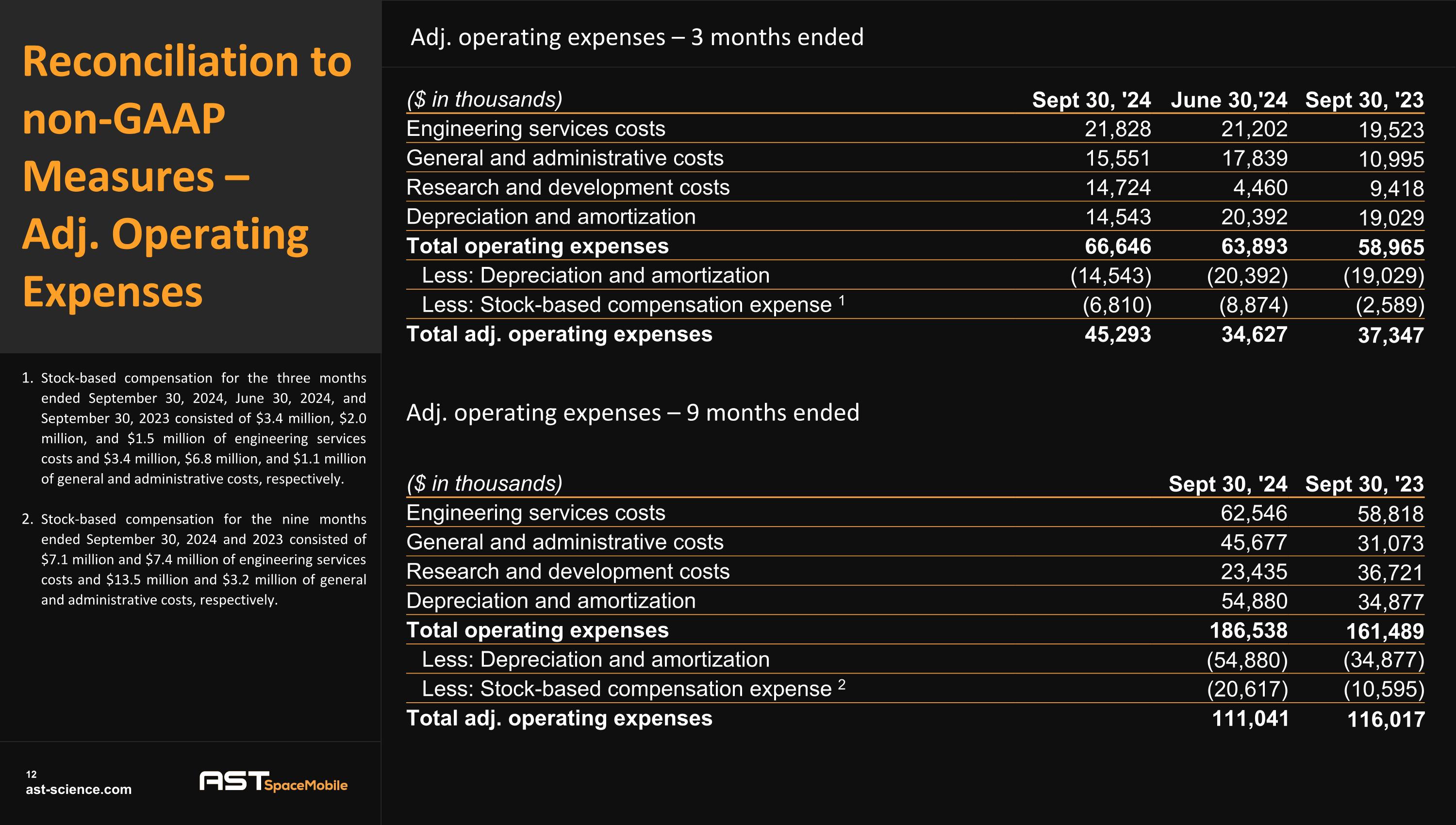

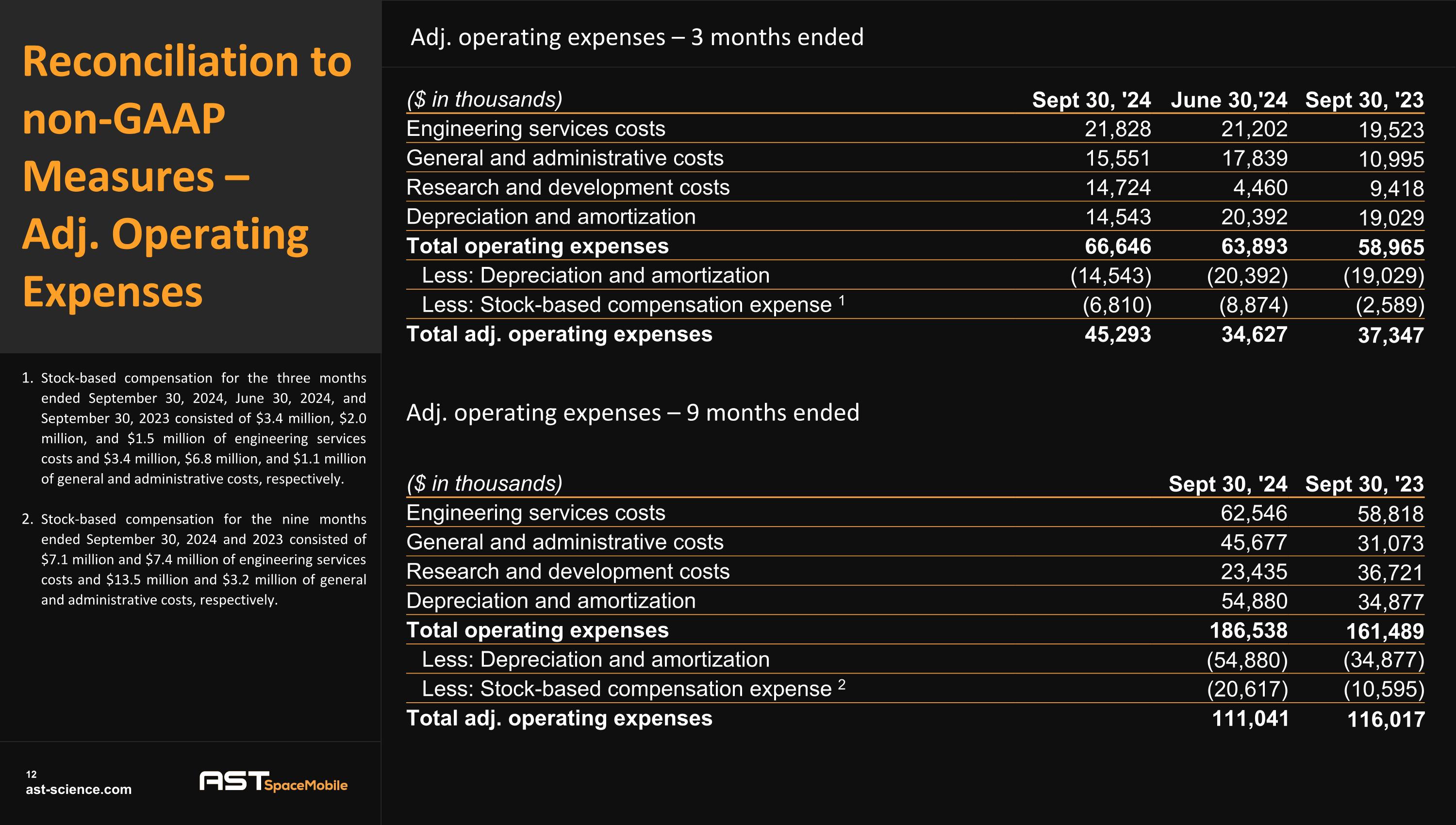

Reconciliation to �non-GAAP �Measures –�Adj. Operating Expenses Adj. operating expenses – 9 months ended ($ in thousands) Sept 30, '24 June 30,'24 Sept 30, '23 Engineering services costs 21,828 21,202 19,523 General and administrative costs 15,551 17,839 10,995 Research and development costs 14,724 4,460 9,418 Depreciation and amortization 14,543 20,392 19,029 Total operating expenses 66,646 63,893 58,965 Less: Depreciation and amortization (14,543) (20,392) (19,029) Less: Stock-based compensation expense 1 (6,810) (8,874) (2,589) Total adj. operating expenses 45,293 34,627 37,347 Stock-based compensation for the three months ended September 30, 2024, June 30, 2024, and September 30, 2023 consisted of $3.4 million, $2.0 million, and $1.5 million of engineering services costs and $3.4 million, $6.8 million, and $1.1 million of general and administrative costs, respectively. Stock-based compensation for the nine months ended September 30, 2024 and 2023 consisted of $7.1 million and $7.4 million of engineering services costs and $13.5 million and $3.2 million of general and administrative costs, respectively. Adj. operating expenses – 3 months ended ($ in thousands) Sept 30, '24 Sept 30, '23 Engineering services costs 62,546 58,818 General and administrative costs 45,677 31,073 Research and development costs 23,435 36,721 Depreciation and amortization 54,880 34,877 Total operating expenses 186,538 161,489 Less: Depreciation and amortization (54,880) (34,877) Less: Stock-based compensation expense 2 (20,617) (10,595) Total adj. operating expenses 111,041 116,017