UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

COMTECH TELECOMMUNICATIONS CORP. |

(Name of Registrant as Specified in Its Charter) |

| |

OUTERBRIDGE PARTNERS, LP OUTERBRIDGE CAPITAL MANAGEMENT, LLC OUTERBRIDGE PARTNERS GP, LLC OUTERBRIDGE BARTLEBY FUND, LP OUTERBRIDGE BARTLEBY GP, LLC RORY WALLACE WENDI B. CARPENTER SIDNEY E. FUCHS |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Outerbridge Capital Management, LLC, together with the other participants named herein (collectively, “Outerbridge”), has filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the election of a slate of highly-qualified director nominees at the 2021 annual meeting of stockholders (the “Annual Meeting”) of Comtech Telecommunications Corp., a Delaware corporation (the “Company”).

Item 1: On December 15, 2021, Outerbridge issued the following press release:

Glass Lewis Joins ISS in Supporting Outerbridge’s Case for Change at Comtech

Both Glass Lewis and ISS Recommend Comtech Shareholders Vote on the WHITE Proxy Card FOR the Election of Outerbridge Nominee Sidney Fuchs

Glass Lewis Notes that Lack of Independence and Relevant Industry and Operational Experience on Comtech Board is of “Paramount concern for shareholders” and creates a “Troubling dynamic in the boardroom”

Refers to Relevant Industry, Operational and M&A Experience as “Sorely needed” and Debunks Conflicts of Interest Claims

Outerbridge Urges Shareholders to Vote on the WHITE Proxy Card FOR the Election of Highly Qualified and Fully Independent Nominees Wendi Carpenter and Sidney Fuchs

NEW YORK – December 15, 2021 – Outerbridge Capital Management, LLC (“Outerbridge”), a beneficial owner of approximately 4.9% of Comtech Telecommunications Corp.’s (NASDAQ: CMTL) (“Comtech” or the “Company”) outstanding shares of common stock, today announced that leading proxy advisory firm Glass, Lewis & Co. (“Glass Lewis”) has joined Institutional Shareholder Services Inc. (“ISS”) in recommending that shareholders vote on the WHITE proxy card for the election of Outerbridge director candidate Sidney “Sid” Fuchs to the Comtech Board of Directors (the “Board”) at the upcoming 2021 Annual Meeting of Stockholders (the “Annual Meeting”) scheduled for December 17, 2021. Outerbridge strongly encourages shareholders to vote on the WHITE proxy card to elect BOTH of its highly qualified and fully independent nominees – Wendi Carpenter and Sid Fuchs.

In its report, Glass Lewis raises concerns around the lack of independence and industry expertise on Comtech’s Board:1

| · | “[W]e believe there remains a shortage of industry and end-market experience among Comtech's independent directors. As Outerbridge points out, we believe this creates a troubling dynamic in the boardroom whereby non-executive directors are less equipped to challenge Messrs. Kornberg and Porcelain on operational and strategic matters, when appropriate, or hold them accountable when performance targets are missed or changes are potentially warranted.” |

| · | “The situation is compounded by the fact that multiple directors, including recent appointee Ms. Chambers, seem to have been added to the board primarily due to their personal connections with other directors. In our view, the lack of independence and relevant industry and operational experience on the Comtech board should be of paramount concern for shareholders.” |

| · | “Further, the board's defensive posture towards [Outerbridge’s] campaign, which manifested by temporarily reducing the size of the board by two directors, issuing votable preferred stock on not-so favorable terms to more friendly investors ahead of the proxy contest, and appointing two new directors who won't stand for shareholder election for at least one year, together with the board's inaction with respect to the takeover bid received six weeks ago, is cause for shareholder concern in our view.” |

1 Permission to quote from the Glass Lewis report was neither sought nor received. Emphases added.

Glass Lewis also highlights the relevant experience Mr. Fuchs would bring to the Board and notes that it does not consider his other current board role a conflict for his directorship at Comtech:

| · | “In our opinion, among the candidates standing for election at the annual meeting, Mr. Fuchs has the deepest and most relevant industry experience in the commercial satellite, public safety, defense and government markets in which Comtech operates and seeks to grow.” |

| · | “Although Comtech raises concerns regarding Mr. Fuchs' potential conflict stemming from his current role as the chairman of the American subsidiary of Eutelsat SA, given the minimal direct competition between the two firms and the procedures that the board has at its disposal to manage any conflicts that arise, as well as the experience of Mr. Fuchs and other directors in dealing with confidential and sensitive information, we do not believe this issue disqualifies Mr. Fuchs' candidacy for the Comtech board.” |

| · | “[W]e believe Mr. Fuchs’ relevant industry, operational and M&A experience would be an attribute for the Comtech board that is sorely needed as the Company seeks to implement a strategy that capitalizes on the growth and value-creation opportunities currently available in the Company's existing businesses and core markets.” |

| · | “[W]e believe Mr. Fuchs would provide a necessary counterbalance on the Comtech board in terms of both technical expertise and truly independent common stockholder representation.” |

Glass Lewis also points out Comtech’s underperformance and corporate governance concerns:

| · | “We find Comtech's total shareholder returns lagged peers across various periods prior to [Outerbridge’s] campaign and also during relevant periods prior to the announced takeover bid from Acacia. Despite notable contract wins in both of the Company's primary business segments, as well as recent actions by the board to refresh its membership and enhance the Company's corporate governance structure, the latter of which appears to have been accelerated by [Outerbridge’s] involvement, the Company's performance continues to disappoint and we see unaddressed deficiencies in the board's composition.” |

Rory Wallace, Chief Investment Officer of Outerbridge commented, “We appreciate Glass Lewis’ support of Outerbridge nominee Sid Fuchs and the case for change at Comtech. However, given the interconnected dynamics in the boardroom and recent statements made by the Company implying the Board will sideline Sid if he is elected by shareholders, it is clear that electing two new, fully independent directors is essential to effecting true change. This is exemplified by the Company’s reckless behavior over the course of this proxy contest, which demonstrates the lengths to which it will go to entrench the current Board and management team. To that end, we caution Comtech not to take any eleventh-hour steps to disenfranchise shareholders. Both Outerbridge nominees, Wendi Carpenter and Sid Fuchs, will bring the industry expertise, proven experience, and full independence needed at this critical stage to oversee the direction of the Company and protect the best interests of shareholders. We therefore urge shareholders to vote FOR these nominees on the WHITE proxy card today.”

Vote on the WHITE proxy card to elect Outerbridge’s highly qualified and fully independent nominees to the Comtech Board.

About Outerbridge Capital Management, LLC

Outerbridge Capital Management, LLC is a New York-based investment adviser that typically invests across the technology and technology-impacted sectors. As part of its investment process, Outerbridge regularly conducts significant due diligence on its portfolio companies and engages constructively with both management teams and boards where appropriate.

Investor contact:

Rory Wallace

Chief Investment Officer

Outerbridge Capital Management, LLC

(347) 493-0350

rory@outerbridgecapital.com

info@outerbridgecapital.com

OR

Harkins Kovler, LLC

Jordan Kovler / Rahsaan Wareham

(212) 468-5384 / (212) 468-5380

jkovler@harkinskovler.com / rwareham@harkinskovler.com

Media contact:

Sloane & Company

Dan Zacchei / Joe Germani

dzacchei@sloanepr.com / jgermani@sloanepr.com

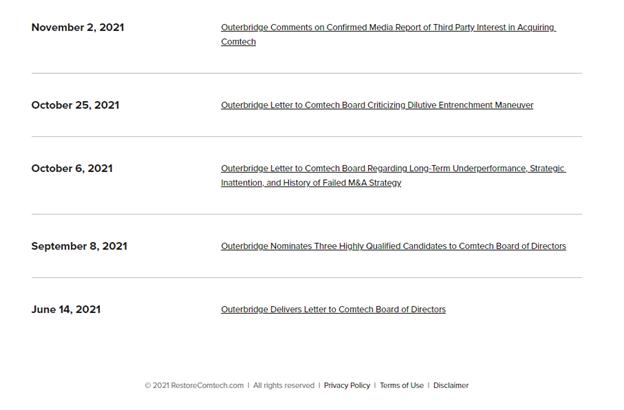

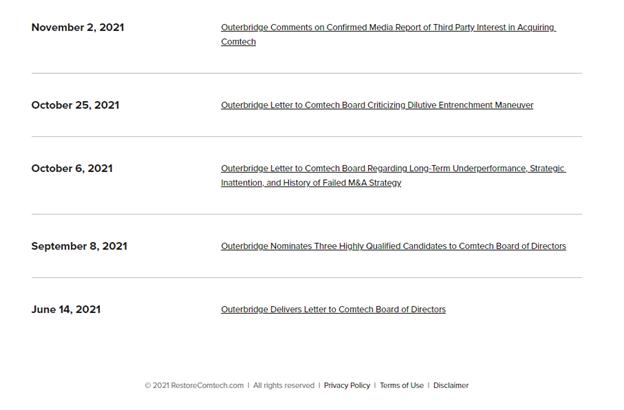

Item 2: Also on December 15, 2021, Outerbridge posted the following materials to www.restorecomtech.com: