Filed Pursuant to Rule 424(b)(2)

Registration Statement Nos. 333-231819 and 333-231819-03

![]()

$1,056,180,000

Ford Credit Auto Lease Trust 2019-B

Issuing Entity or Trust

(CIK: 0001781819)

Ford Credit Auto Lease Two LLC Depositor (CIK: 0001519881) | Ford Motor Credit Company LLC Sponsor and Servicer (CIK: 0000038009) |

Before you purchase any notes, be sure you understand the structure and the risks. You should read carefully the risk factors beginning on page 19 of this prospectus. |

|

The notes will be obligations of the issuing entity only and will not be obligations of or interests in the sponsor, the depositor or any of their affiliates.

|

The trust will issue:

|

| Principal Amount |

| Interest Rate |

| Final Scheduled |

| |

Class A-1 notes |

| $ | 200,000,000 |

| 2.28650% |

| August 15, 2020 |

|

Class A-2a notes |

|

| 275,000,000 |

| 2.28% |

| February 15, 2022 |

|

Class A-2b notes(1)(2) |

|

| 125,000,000 |

| one-month LIBOR + 0.26% |

| February 15, 2022 |

|

Class A-3 notes |

| 325,000,000 |

| 2.22% |

| October 15, 2022 |

| |

Class A-4 notes |

| 75,000,000 |

| 2.27% |

| November 15, 2022 |

| |

Class B notes |

| 56,180,000 |

| 2.36% |

| January 15, 2023 |

| |

Class C notes(3) |

| 52,430,000 |

| 2.56% |

| March 15, 2024 |

| |

Total |

| $ | 1,108,610,000 |

|

|

|

|

|

(1) The Class A-2b notes will accrue interest at a floating rate based on a benchmark, which will initially be one-month LIBOR. However, the benchmark may change in certain situations. For more information on how one-month LIBOR is determined and the circumstances under which the benchmark may change, you should read “Description of the Notes — Payments of Interest — Floating Rate Benchmark; Benchmark Transition Event.”

(2) If the benchmark plus the spread for the Class A-2b notes is less than zero, the interest rate will be 0.00%.

(3) The Class C notes are not being offered by this prospectus.

· The notes will be backed by an exchange note, which will be backed by a reference pool of new car, light truck and utility vehicle leases and leased vehicles purchased by Ford Credit’s titling companies from dealers.

· The trust will pay interest on and principal of the notes on the 15th day of each month (or, if not a business day, the next business day). The first payment date will be August 15, 2019. The trust will pay each class of notes in full on its final scheduled payment date (or, if not a business day, the next business day) if not paid in full before that date.

· The trust will pay principal of the notes sequentially to each class of notes in order of seniority until each class is paid in full.

· The credit enhancement for the notes will be a reserve account, subordination, overcollateralization and excess spread.

The pricing terms of the offered notes are:

|

| Price to Public |

| Underwriting Discount |

| Proceeds to the |

|

Class A-1 notes |

| 100.00000% |

| 0.050% |

| 99.95000% |

|

Class A-2a notes |

| 99.99990% |

| 0.200% |

| 99.79990% |

|

Class A-2b notes |

| 100.00000% |

| 0.200% |

| 99.80000% |

|

Class A-3 notes |

| 99.98254% |

| 0.250% |

| 99.73254% |

|

Class A-4 notes |

| 99.98616% |

| 0.300% |

| 99.68616% |

|

Class B notes |

| 99.98048% |

| 0.350% |

| 99.63048% |

|

Total |

| $1,056,101,633.66 |

| $2,134,130.00 |

| $1,053,967,503.66 |

|

(1) Before deducting expenses estimated to be $950,000 and any selling concessions rebated to the depositor by an underwriter due to sales to affiliates.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

BNP PARIBAS | J.P. Morgan | SMBC Nikko | ||

|

|

|

| |

Credit Agricole Securities | Morgan Stanley | |||

Santander | US Bancorp | |||

The date of this prospectus is July 23, 2019

79 | |

82 | |

82 | |

85 | |

85 | |

85 | |

86 | |

87 | |

88 | |

88 | |

88 | |

88 | |

89 | |

89 | |

90 | |

90 | |

90 | |

91 | |

96 | |

98 | |

98 | |

99 | |

Servicer Modifications and Obligation to Reallocate Leases and Leased Vehicles | 99 |

100 | |

100 | |

101 | |

101 | |

101 | |

101 | |

102 | |

103 | |

104 | |

105 | |

105 | |

106 | |

107 | |

108 | |

109 | |

111 | |

112 | |

112 | |

112 | |

114 | |

114 | |

115 | |

115 | |

115 | |

115 | |

117 | |

Security Interests in Exchange Note and Leases and Leased Vehicles | 118 |

120 |

122 | |

122 | |

122 | |

123 | |

123 | |

126 | |

126 | |

126 | |

127 | |

128 | |

128 |

This prospectus contains information about Ford Credit Auto Lease Trust 2019-B and the terms of the notes to be issued by the trust. You should only rely on information in or referenced in this prospectus and any information incorporated by reference into the registration statement for this securitization transaction filed with the Securities and Exchange Commission, or “SEC,” that includes this prospectus. Ford Credit has not authorized anyone to provide you with different information.

This prospectus starts with the following brief introductory sections:

· Transaction Diagrams — separate diagrams show the structure of this securitization transaction, the credit enhancement available for the notes, the order in which exchange note available funds and available funds are paid on each payment date and the role of each transaction party and transaction document in this securitization transaction,

· Summary — provides an overview of the notes, the cash flows in this securitization transaction and the credit enhancement available for the notes, and

· Risk Factors — describes the most significant risks of investing in the notes.

The other sections of this prospectus contain more details about the notes and the structure of this securitization transaction. Cross-references refer you to more details about a particular topic or related information elsewhere in this prospectus. The Table of Contents contains references to key topics.

A glossary of certain terms and an index of defined terms are at the end of this prospectus.

Any projections, expectations and estimates in this prospectus are not historical in nature but are forward-looking statements based on information and assumptions Ford Credit and the depositor consider reasonable. Forward-looking statements are about circumstances and events that have not yet taken place, so they are uncertain and may vary materially from actual events. Neither Ford Credit nor the depositor is obligated to update or revise any forward-looking statements, including changes in economic conditions, portfolio or asset pool performance or other circumstances or developments, after the date of this prospectus.

THE NOTES MAY BE SOLD ONLY TO PURCHASERS IN THE PROVINCES OF ALBERTA, BRITISH COLUMBIA, ONTARIO AND QUEBEC PURCHASING, OR DEEMED TO BE PURCHASING, AS PRINCIPALS THAT ARE ACCREDITED INVESTORS, AS DEFINED IN NATIONAL INSTRUMENT 45-106 PROSPECTUS EXEMPTIONS OR SUBSECTION 73.3(1) OF THE SECURITIES ACT (ONTARIO), AND ARE PERMITTED CLIENTS, AS DEFINED IN NATIONAL INSTRUMENT 31-103 REGISTRATION REQUIREMENTS, EXEMPTIONS AND ONGOING REGISTRANT OBLIGATIONS. ANY RESALE OF THE NOTES MUST BE MADE IN ACCORDANCE WITH AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE PROSPECTUS REQUIREMENTS OF APPLICABLE SECURITIES LAWS.

SECURITIES LEGISLATION IN CERTAIN PROVINCES OR TERRITORIES OF CANADA MAY PROVIDE A PURCHASER WITH REMEDIES FOR RESCISSION OR DAMAGES IF THIS PROSPECTUS (INCLUDING ANY AMENDMENT THERETO) CONTAINS A MISREPRESENTATION, PROVIDED THAT THE REMEDIES FOR RESCISSION OR DAMAGES ARE EXERCISED BY THE PURCHASER WITHIN THE TIME LIMIT PRESCRIBED BY THE SECURITIES LEGISLATION OF THE PURCHASER’S PROVINCE OR TERRITORY. THE PURCHASER SHOULD REFER TO ANY APPLICABLE PROVISIONS OF THE SECURITIES LEGISLATION OF THE PURCHASER’S PROVINCE OR TERRITORY FOR PARTICULARS OF THESE RIGHTS OR CONSULT WITH A LEGAL ADVISOR.

PURSUANT TO SECTION 3A.3 (OR, IN THE CASE OF SECURITIES ISSUED OR GUARANTEED BY THE GOVERNMENT OF A NON-CANADIAN JURISDICTION, SECTION 3A.4) OF NATIONAL INSTRUMENT 33-105 UNDERWRITING CONFLICTS (NI 33-105), THE UNDERWRITERS ARE NOT REQUIRED TO COMPLY WITH THE DISCLOSURE REQUIREMENTS OF NI 33-105 REGARDING UNDERWRITER CONFLICTS OF INTEREST IN CONNECTION WITH THIS OFFERING.

NOTICE TO UNITED KINGDOM RESIDENTS

THIS PROSPECTUS IS DIRECTED IN THE UNITED KINGDOM ONLY AT PERSONS WHO (I) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND WHO QUALIFY AS INVESTMENT PROFESSIONALS UNDER ARTICLE 19(5) OF THE UNITED KINGDOM FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (THE “FSMA”), OR (II) ARE HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, PARTNERSHIPS OR TRUSTEES UNDER ARTICLE 49(2) OF THE FSMA (TOGETHER, “RELEVANT PERSONS”). THIS PROSPECTUS MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS AND ONLY RELEVANT PERSONS MAY INVEST IN THE NOTES. ANY INVESTMENT ACTIVITY RELATING TO THIS PROSPECTUS OR THE NOTES WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

NOTICE TO EUROPEAN ECONOMIC AREA RESIDENTS

THIS PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSE OF THE PROSPECTUS DIRECTIVE (AS DEFINED BELOW). THIS PROSPECTUS HAS BEEN PREPARED ON THE BASIS THAT ANY OFFERS OF THE NOTES IN ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (“EEA”), WHICH HAS IMPLEMENTED THE PROSPECTUS DIRECTIVE (EACH, A “RELEVANT MEMBER STATE”) WILL ONLY BE MADE TO A PERSON OR LEGAL ENTITY WHICH IS A QUALIFIED INVESTOR UNDER THE PROSPECTUS DIRECTIVE (“QUALIFIED INVESTOR”). ACCORDINGLY, ANY PERSON OFFERING OR INTENDING TO OFFER IN A RELEVANT MEMBER STATE THE NOTES DESCRIBED IN THIS PROSPECTUS MAY ONLY DO SO WITH RESPECT TO QUALIFIED INVESTORS. NONE OF THE TRUST, THE DEPOSITOR NOR ANY UNDERWRITER HAS AUTHORIZED, NOR DO THEY AUTHORIZE, THE OFFERING OF THE NOTES OTHER THAN TO ONE OR MORE QUALIFIED INVESTORS. “PROSPECTUS DIRECTIVE” MEANS DIRECTIVE 2003/71/EC (AS AMENDED OR SUPERSEDED), AND INCLUDES ANY IMPLEMENTING MEASURE IN THE RELEVANT MEMBER STATE.

THE NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY RETAIL

INVESTOR IN THE EEA. FOR THESE PURPOSES, A RETAIL INVESTOR MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU (AS AMENDED, “MIFID II”); (II) A CUSTOMER WITHIN THE MEANING OF DIRECTIVE 2016/97/EC (AS AMENDED, KNOWN AS THE “INSURANCE DISTRIBUTION DIRECTIVE”) WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT A QUALIFIED INVESTOR AS DEFINED IN THE PROSPECTUS DIRECTIVE.

CONSEQUENTLY NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED, THE “PRIIPS REGULATION”) FOR OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO RETAIL INVESTORS IN THE EEA HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY RETAIL INVESTOR IN THE EEA MAY BE UNLAWFUL UNDER THE PRIIPS REGULATION.

This diagram is a simplified overview of the structure of this securitization transaction and the credit enhancement available for the notes. You should read this prospectus completely for more details about this securitization transaction.

(1) The titling companies will allocate a reference pool of leases and leased vehicles to the exchange note. The reference pool will have an initial total securitization value of $1,248,449,044.72 and the exchange note will have an initial note balance of $1,142,896,907.22.

(2) The reserve account will be funded on the closing date at 0.25% of the initial total securitization value.

(3) Overcollateralization is the amount by which the total securitization value exceeds the principal amount of the notes.

(4) All available funds remaining after payments of the senior fees and expenses of the trust, the interest on the notes, any required priority principal payment and any required deposits in the reserve account, including the portion of the remaining available funds that is excess spread, will be used to pay principal of the notes until the targeted overcollateralization amount is reached.

(5) Excess spread representing the excess of the collections on the reference pool over senior amounts payable from those collections will be available to pay principal on the exchange note or to offset a shortfall in payment on the notes. Excess spread representing the excess of interest payments on the exchange note over the fees and expenses of the trust, including interest payments on the notes, will be available to pay principal of the notes.

(6) All notes other than the Class C notes benefit from subordination of more junior classes to more senior classes. The order of the subordination varies depending on whether interest or principal is being paid and whether an event of default that results in acceleration has occurred. For more details about subordination, you should read “Description of the Notes — Priority of Payments,” “Description of the Notes — Post-Acceleration Priority of Payments” and “Credit Enhancement — Subordination.”

(7) The residual interest will be held initially by the depositor and represents the right to all funds not needed to make required payments on the notes, pay fees and expenses of the trust or make deposits in the reserve account.

TRANSACTION CREDIT ENHANCEMENT DIAGRAM

This diagram is a simplified overview of the credit enhancement available for the notes on the closing date and how credit enhancement is used to offset losses on the leases and leased vehicles. You should read this prospectus completely, including “Credit Enhancement,” for more details about the credit enhancement available for the notes.

(1) All notes other than the Class C notes benefit from subordination of more junior classes to more senior classes. The order of the subordination varies depending on whether interest or principal is being paid and whether an event of default that results in acceleration occurred. For more details about subordination, you should read “Description of the Notes — Priority of Payments,” “Description of the Notes — Post-Acceleration Priority of Payments” and “Credit Enhancement — Subordination.”

(2) Overcollateralization is the amount by which the total securitization value exceeds the principal amount of the notes. On the closing date, overcollateralization will equal 11.20% of the initial total securitization value. All available funds remaining after payments of the senior fees and expenses of the trust, the interest on the notes, any required priority principal payment and any required deposits in the reserve account, including the portion of the remaining available funds that is excess spread, will be used to pay principal of the notes until the targeted overcollateralization amount of 13.70% of the initial total securitization value is reached.

(3) The reserve account will be funded on the closing date at 0.25% of the initial total securitization value.

(4) Excess spread representing the excess of the collections on the reference pool over senior amounts payable from those collections will be available to pay principal on the exchange note or to offset a shortfall in payment on the notes. Excess spread representing the excess of interest payments on the exchange note over the fees and expenses of the trust, including interest payments on the notes, will be available to pay principal of the notes.

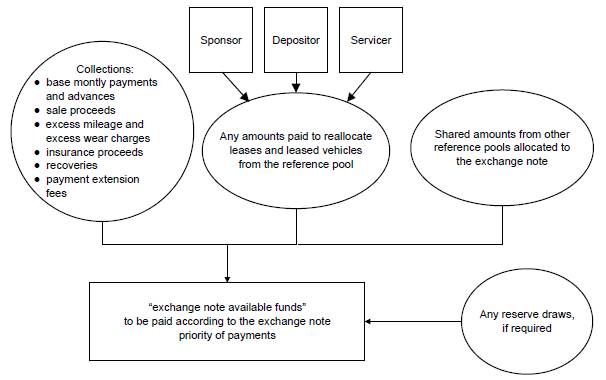

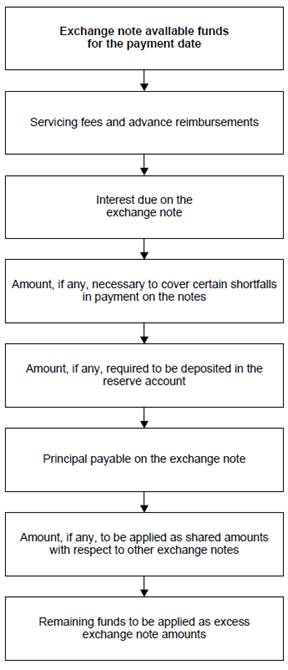

This diagram shows how exchange note available funds are paid on each payment date and how available funds are paid on each payment date. The priority of payments shown in this diagram will apply unless (a) the exchange note is accelerated after a facility default or an exchange note default or (b) the notes are accelerated after an event of default under the Indenture. You should read this prospectus completely, including “Description of Exchange Note — Priority of Payments on Exchange Note,” “Description of the Notes — Priority of Payments” and “Description of the Notes — Post-Acceleration Priority of Payments,” for more details about the priority of payments for the notes.

TRANSACTION PARTIES AND DOCUMENTS DIAGRAM

This diagram shows the role of each transaction party and each transaction document in this securitization transaction. You should read this prospectus completely, including “Transaction Parties,” “Reference Pool,” “Description of Exchange Note,” “Description of the Notes” and “Servicing,” for more details about the roles of each transaction party and each transaction document in this securitization transaction.

This summary describes the main terms of the issuance of and payments on the notes, the assets of the trust, the cash flows in this securitization transaction and the credit enhancement available for the notes. It does not contain all of the information that you should consider in making your decision to purchase any notes. To understand fully the terms of the notes and the transaction structure, you should read this prospectus completely, especially “Risk Factors” starting on page 19.

Transaction Overview

The depositor will use the proceeds from the sale of the notes to purchase an exchange note from Ford Credit. The exchange note will be issued by the titling companies and backed by a reference pool of leases and leased vehicles purchased by the titling companies from motor vehicle dealers. The trust will issue the notes to the depositor in exchange for the exchange note on the closing date. The depositor will sell the offered notes to the underwriters who will offer them to investors.

Transaction Parties

Sponsor, Servicer, Lender, Titling Company Servicer, Collateral Agent Administrator and Administrator

Ford Motor Credit Company LLC, or “Ford Credit,” is a Delaware limited liability company and a wholly-owned subsidiary of Ford Motor Company, or “Ford.”

Depositor

Ford Credit Auto Lease Two LLC, or the “depositor,” is a Delaware limited liability company and a special-purpose company wholly owned by Ford Credit.

Titling Companies

Each of CAB East LLC and CAB West LLC, or a “titling company,” is a Delaware limited liability company and is a special-purpose company wholly owned by Ford Credit.

Collateral Agent

HTD Leasing LLC, or “HTD,” is a Delaware limited liability company and a wholly-owned subsidiary of U.S. Bank National Association.

Issuing Entity or Trust

Ford Credit Auto Lease Trust 2019-B, or the “trust,” is a Delaware statutory trust established under a trust agreement between the depositor and the owner trustee.

Owner Trustee

The Bank of New York Mellon

Delaware Trustee

BNY Mellon Trust of Delaware

Indenture Trustee and Administrative Agent

U.S. Bank National Association

Asset Representations Reviewer

Clayton Fixed Income Services LLC

For more information about the transaction parties and their roles in this securitization transaction, you should read “Sponsor and Servicer” and “Transaction Parties.”

Closing Date

The trust expects to issue the notes on or about July 30, 2019, or the “closing date.”

Cutoff Date

The leases and leased vehicles will be allocated to the “reference pool” as of July 1, 2019, or the “cutoff date.” The initial total securitization value of the leases in the reference pool will be the aggregate securitization value of the leases in the reference pool as of the cutoff date. The titling companies will use collections on the leases and leased vehicles in the reference pool applied on or after the cutoff date to make payments on the exchange note, which will be used by the trust to make payments on the notes.

Notes

The trust will issue the following notes:

|

| Principal |

| Interest Rate |

Class A-1 notes |

| $ 200,000,000 |

| 2.28650% |

Class A-2a notes |

| $ 275,000,000 |

| 2.28% |

Class A-2b notes(1)(2) |

| $ 125,000,000 |

| one-month LIBOR + 0.26% |

Class A-3 notes |

| $ 325,000,000 |

| 2.22% |

Class A-4 notes |

| $ 75,000,000 |

| 2.27% |

Class B notes |

| $ 56,180,000 |

| 2.36% |

Class C notes(3) |

| $ 52,430,000 |

| 2.56% |

(1) The Class A-2b notes will accrue interest at a floating rate based on a benchmark, which will initially be one-month LIBOR . However, the benchmark may change in certain situations. For more information on how one-month LIBOR is determined and the circumstances under which the benchmark may change, you should read "Description of the Notes – Payments of Interest – Floating Rate Benchmark; Benchmark Transition Event.”

(2) If the benchmark plus the spread for the Class A-2b notes is less than zero, the interest rate will be 0.00%.

(3) The Class C notes are not being offered by this prospectus.

The Class A-1, Class A-2a, Class A-2b, Class A-3 and Class A-4 notes are collectively referred to as the “Class A notes.” The Class A and Class B notes are being offered by this prospectus and are also referred to as the “offered notes” and, together with the Class C notes, the “notes.”

The Class A-2b notes are sometimes referred to as the “floating rate notes.” The Class A-2a and Class A-2b notes are a single class with equal rights to interest and principal payments.

The depositor will initially retain the Class C notes and the residual interest in the trust.

Form and Minimum Denomination

The notes will be issued in book-entry form. The offered notes will be available in minimum denominations of $1,000 and in multiples of $1,000.

Payment Dates; Interest Accrual

The trust will pay interest on and principal of the notes on “payment dates,” which will be the 15th day of each month (or, if not a business day, the next business day). The first payment date will be August 15, 2019.

The notes, except the Class A-1 notes and the floating rate notes, will accrue interest on a “30/360” basis from the 15th day of the prior month to the 15th day of the current month (or from the closing date to August 15, 2019, for the first period).

The Class A-1 notes and the floating rate notes will accrue interest on an “actual/360” basis from the

prior payment date (or from the closing date, for the first period) to the following payment date.

The final scheduled payment date for each class of notes is listed below.

|

| Final Scheduled |

Class A-1 notes |

| August 15, 2020 |

Class A-2a notes |

| February 15, 2022 |

Class A-2b notes |

| February 15, 2022 |

Class A-3 notes |

| October 15, 2022 |

Class A-4 notes |

| November 15, 2022 |

Class B notes |

| January 15, 2023 |

Class C notes |

| March 15, 2024 |

It is expected that each class of notes will be paid in full earlier than its final scheduled payment date.

For more details about the payment of interest on and principal of each payment date, you should read “Description of the Notes — Payments of Interest,” “Description of the Notes — Payments of Principal” and “Maturity and Prepayment Considerations —Weighted Average Life.”

Calculation Agent

The “calculation agent” will be the indenture trustee. The calculation agent will determine LIBOR, which is used to calculate the interest rate for the floating rate notes.

Optional Redemption or “Clean Up Call” Option

The servicer will have a “clean up call” option to purchase the exchange note on any payment date if the principal amount of the notes on that payment date will be 5% or less of the initial principal amount of the notes. The servicer may exercise its clean up call only if the purchase price for the exchange note is sufficient to pay in full the notes and all fees and expenses of the trust. On the servicer’s exercise of its clean up call, the notes will be redeemed and paid in full.

For more information about optional redemption, you should read “Description of the Notes – Optional Redemption or ‘Clean Up Call’ Option.”

Trust Assets

The trust assets will include:

· the exchange note,

· rights to funds in the exchange note collection account, the reserve account and the collection account,

· rights under the transaction documents for the reallocation of ineligible leases and other leases and leased vehicles from the reference pool, and

· rights under the transaction documents for any servicer advances.

Exchange Note

The primary asset of the trust will be an exchange note issued by the titling companies to Ford Credit. The exchange note will be issued under a credit facility provided by Ford Credit to the titling companies to finance their purchase of leases and leased vehicles from dealers.

On the closing date, the note balance of the exchange note will be $1,142,896,907.22. The exchange note will accrue interest at a rate of 2.57% per annum.

The titling companies will use exchange note available funds received on a reference pool of leases and leased vehicles to make payments on the exchange note, including:

· payments by or on behalf of the lessees on the leases,

· net proceeds from sales of leased vehicles, and

· proceeds from claims on insurance policies covering the lessees, the leases or the leased vehicles.

For more details about the exchange note, you should read “Description of Exchange Note.”

Reference Pool

The leases in the reference pool are retail closed-end lease contracts for new cars, light trucks and utility vehicles. A lessee who meets the terms of the lease will not be responsible for the value of the leased vehicle at the end of the lease.

Each lease in the reference pool is assigned a securitization value. The “securitization value” of a lease is the sum of the present values of (1) the remaining scheduled base monthly payments plus (2) the base residual value of the related leased vehicle. The “base residual value” of a leased

vehicle is the lesser of the contract residual value and the ALG base residual value for the leased vehicle. The “total securitization value” is the aggregate securitization value of the leases in the reference pool.

For more information about the calculation of securitization value, you should read the definition of securitization value in “Glossary of Terms.”

Summary characteristics of the reference pool as of the cutoff date:

Number of leases |

| 49,787 |

Initial total securitization value |

| $ 1,248,449,044.72 |

Residual portion of securitization value |

| $ 803,526,656.45 |

Residual portion of securitization value |

| 64.36% |

Base monthly payments plus base residual value |

| $ 1,424,658,379.09 |

Base residual value |

| $ 938,862,789.57 |

Weighted average original term |

| 35.8 months |

Weighted average remaining term |

| 23.9 months |

Weighted average FICO® score |

| 754 |

Weighted average LTV |

| 90.89% |

Weighted average PTI |

| 7.26% |

Commercial use leases |

| 4.90% |

For more details about the information in this table, including how it is calculated and defined, and for more information about the characteristics of the reference pool, you should read “Composition of the Reference Pool” attached as Annex A.

Servicer

Ford Credit will be the “servicer” of the leases and leased vehicles in the reference pool and this securitization transaction. The servicer is responsible for collecting payments on the reference pool, administering payoffs, defaults and delinquencies, and repossessing and liquidating leased vehicles. The servicer will prepare monthly reports on the leases and leased vehicles, payments on the notes and the status of credit enhancement. Ford Credit will also act as custodian and maintain custody of the lease files.

The trust will pay the servicer on each payment date (1) a servicing fee for each month equal to 1/12 of 1.00% of the total securitization value at the beginning of the prior month and (2) an administration fee equal to 1/12 of 0.01% of the principal amount of the notes at the end of the prior month.

For more information about the servicer, you should read “Sponsor and Servicer.”

Priority of Payments on Exchange Note

On each payment date, the indenture trustee will use exchange note available funds for the prior month to make payments in the order of priority listed below. Exchange note available funds will consist primarily of collections on the reference pool. This priority will apply unless the exchange note is accelerated after a facility default or an exchange note default:

(1) Servicing Fee and Advance Reimbursement — to the servicer, the servicing fee and reimbursement of any outstanding servicer advances,

(2) Interest — to the trust, interest due on the exchange note,

(3) Shortfall Payments — to the trust, the amounts necessary to cover a shortfall in payments under items (1) through (7) under “— Priority of Payments on the Notes” below,

(4) Reserve Account – to the reserve account, the amount required to replenish the reserve account to its original balance, unless the payment date is on or after the final scheduled payment date for the Class C notes,

(5) Principal — to the trust, (a) principal on the exchange note equal to the excess of the principal amount of the notes over (b) the total securitization value at the beginning of the month that includes the payment date minus the targeted overcollateralization amount, which amount will be reduced by any payments of principal made in item (3) above,

(6) Shared Amounts — to be applied as shared amounts for exchange notes other than the exchange note owned by the trust if there has been a failure to pay principal or interest owed on the other exchange notes, and

(7) Remaining Amounts — to the trust, all remaining amounts to be applied as excess exchange note amounts.

For more details about what amounts are included in exchange note available funds, you should read “Description of Exchange Note — Funds Available for Payments on Exchange Note.” For more details about the priority of payments on the exchange note and the allocation of funds on each payment date, you should read “Description of Exchange Note — Priority of Payments on Exchange Note”

and “Description of Exchange Note — Shared Amounts.”

Priority of Payments on the Notes

On each payment date, the indenture trustee will use the amounts received on the exchange note on that payment date, or “available funds,” to make payments on the notes in the order of priority listed below. This priority will apply unless the notes are accelerated after an event of default under the indenture:

(1) Transaction Fees and Expenses — to the indenture trustee, the owner trustee, the Delaware trustee and the asset representations reviewer, the fees, expenses and indemnities due, and to or at the direction of the trust, any expenses of the trust, up to a maximum amount of $250,000 per year,

(2) Administration Fee — to the servicer, all unpaid administration fees,

(3) Class A Note Interest — to the Class A noteholders, interest due on the Class A notes, pro rata based on the principal amount of the Class A notes,

(4) First Priority Principal Payment — to the Class A noteholders, sequentially by class, the amount equal to the excess, if any, of (a) the principal amount of the Class A notes, over (b) the total securitization value at the beginning of the month that includes the payment date,

(5) Class B Note Interest — to the Class B noteholders, interest due on the Class B notes,

(6) Second Priority Principal Payment — to the Class A and Class B noteholders, sequentially by class, the amount equal to the excess, if any, of (a) the principal amount of the Class A and Class B notes, over (b) the total securitization value at the beginning of the month that includes the payment date, which amount will be reduced by any first priority principal payment on that payment date,

(7) Class C Note Interest — to the Class C noteholders, interest due on the Class C notes,

(8) Reserve Account — to the reserve account, the amount, if any, required to replenish the reserve account to its original balance, unless the payment date is on or after the final scheduled payment date for the Class C notes,

(9) Regular Principal Payment — to the noteholders, sequentially by class, the amount equal to the excess of (a) the principal amount of the notes over (b) the total securitization value at the beginning of the month that includes the payment date minus the targeted overcollateralization amount, which amount will be reduced by any first and second priority principal payments on that payment date,

(10) Additional Fees and Expenses — to the indenture trustee, the owner trustee, the Delaware trustee, the asset representations reviewer and the trust, all fees, expenses and indemnities due to the extent not paid in item (1) above, and

(11) Residual Interest — to the holder of the residual interest in the trust, all remaining available funds.

The trust will not pay principal of any class of notes until the principal amount of more senior classes of notes are paid in full.

For more details about the priority of payments on each payment date, you should read “Description of the Notes — Priority of Payments.” For more details about targeted overcollateralization amount and how it is used to determine the principal payable on the notes, you should read “Credit Enhancement — Overcollateralization.”

Events of Default

Each of the following will be an “event of default” under the indenture:

· the trust fails to pay interest due on the notes of the controlling class within five days after a payment date,

· the trust fails to pay the principal amount of any class of notes in full by its final scheduled payment date,

· the trust fails to observe or perform a material covenant or agreement or breaches a representation in any material respect that is not corrected within a 60-day cure period, and

· a bankruptcy or dissolution of the trust.

If an event of default occurs, other than because of a bankruptcy or dissolution of the trust, the indenture trustee or a majority of the controlling class may accelerate the notes and declare them

immediately due and payable. If an event of default occurs because of bankruptcy or dissolution of the trust, the notes will be accelerated automatically.

For more details about events of default, acceleration of the notes and other remedies available to noteholders after an event of default, you should read “Description of the Notes — Events of Default and Acceleration.” For more details about the priority of payments on each payment date after an event of default and acceleration of the notes, you should read “Description of the Notes — Post-Acceleration Priority of Payments.”

Controlling Class

Holders of the most senior class of notes outstanding, or the “controlling class,” will control the ability to make some decisions about the trust, including whether to declare or waive events of default and servicer termination events, or accelerate the notes, cause a sale of the exchange note or direct the indenture trustee to exercise other remedies after an event of default. Notes of the controlling class held by the trust, the depositor, the servicer or their affiliates are not considered outstanding for these purposes while other notes are also outstanding. Holders of notes that are not part of the controlling class will not have these rights.

Credit Enhancement

Credit enhancement provides protection for the notes against losses on the leases and leased vehicles in the reference pool and potential shortfalls in the funds available to the trust to make required payments. If the credit enhancement is not sufficient to cover all amounts payable on the notes, notes having a later final scheduled payment date will bear a greater risk of loss than notes having an earlier final scheduled payment date.

The following credit enhancement will be available to the trust.

Reserve Account

On the closing date, the depositor will deposit $3,121,122.61 in the reserve account, which is 0.25% of the initial total securitization value.

If the exchange note available funds (excluding reserve account amounts) are insufficient to cover amounts payable under items (1) through (3) under “— Priority of Payments on Exchange Note” above, the indenture trustee will use amounts in the

reserve account to cover the shortfall. The indenture trustee also will use the amounts in the reserve account if needed to pay any class of notes in full on its final scheduled payment date or to pay the notes after an event of default and acceleration of the notes.

If amounts in the reserve account are used, they will be replenished from exchange note available funds and available funds on later payment dates after the trust makes all higher priority payments.

For more details about the reserve account, you should read “Credit Enhancement — Reserve Account.” For more details about exchange note available funds and available funds, you should read “Description of Exchange Note — Funds Available for Payments on Exchange Note.”

Subordination

The trust will pay interest to all classes of the Class A notes and then will pay interest sequentially to the remaining classes of notes in order of seniority. The trust will not pay interest on a subordinate class of notes until all interest due on more senior classes of notes is paid in full.

The trust will pay principal sequentially to each class of notes in order of seniority (starting with the Class A-1 notes). The trust will not pay the principal of any class of notes until the principal amount of more senior classes of notes are paid in full.

In addition, if a priority principal payment is required on a payment date, the trust will pay the priority principal payment of the most senior class of notes outstanding before the payment of interest on the affected subordinated notes on that payment date.

For more details about the priority of payments, including changes to the priority after an event of default and acceleration of the notes, you should read “Description of the Notes — Priority of Payments,” “Description of the Notes — Post-Acceleration Priority of Payments” and “Credit Enhancement — Subordination.”

Overcollateralization

Overcollateralization is the amount by which total securitization value exceeds the principal amount of the notes. It is composed of (i) the excess of the total securitization value over the balance of the exchange note and (ii) the excess of the balance of the exchange note over the principal amount of the

notes. Overcollateralization means there will be additional leases and leased vehicles generating collections that will be available to offset losses on the reference pool. The initial amount of overcollateralization for the notes will be $139,839,044.72, or 11.20% of the initial total securitization value.

This securitization transaction is structured to use all available funds remaining after payments of the senior fees and expenses of the trust, the interest on the notes, any required priority principal payments and any required deposits in the reserve account, including the portion of the remaining available funds that is excess spread, to pay principal of the notes until the targeted overcollateralization amount is reached. After reaching the targeted overcollateralization amount, the regular principal payment will be used to maintain the overcollateralization at the targeted level. The targeted overcollateralization amount for the notes will be $171,037,519.13, or 13.70% of the initial total securitization value.

For more details about the targeted overcollateralization amount, you should read “Credit Enhancement — Overcollateralization.”

Excess Spread

For a payment date, there are two types of excess spread. First, there is excess spread representing the excess of collections on the reference pool over the sum of the servicing fee, the interest payments on the exchange note and the reduction in the total securitization value. This excess spread will be available to pay principal on the exchange note or to cover a shortfall in payments on the notes. Second, there is excess spread representing the excess of the interest payments on the exchange note received by the trust over senior fees and expenses of the trust and interest payments on the notes. This excess spread will be available to pay principal of the notes. In general, excess spread provides a source of funds to offset losses on the reference pool.

For more details about the use of excess spread as credit enhancement, you should read “Credit Enhancement — Excess Spread.”

Reallocation of Leases and Leased Vehicles from the Reference Pool

Reallocation of Leases and Leased Vehicles for Breach of Representations

Ford Credit will make representations about the origination, characteristics, terms and status of each lease and leased vehicle. If a representation is later determined to be untrue, then the lease and leased vehicle were not eligible to be included in the reference pool. If a breach of a representation has a material adverse effect on a lease or leased vehicle, Ford Credit must reallocate the lease and leased vehicle from the reference pool and make a corresponding payment to the collection account unless it corrects the breach before the date it is required to reallocate the lease and leased vehicle.

For more details about the representations made about the leases and leased vehicles and Ford Credit’s reallocation obligation if these representations are breached, you should read “Reference Pool — Representations About Reference Pool” and “Reference Pool — Obligation to Reallocate Ineligible Leases and Leased Vehicles.” For information about when the asset representations reviewer may review certain leases for compliance with the representations, you should read “Reference Pool — Asset Representations Review.”

Reallocation of Leases and Leased Vehicles for Servicer Actions

If Ford Credit as servicer materially impairs a lease, it must reallocate the lease and leased vehicle unless it corrects the impairment. In addition, Ford Credit as servicer must reallocate a lease and leased vehicle from the reference pool if it makes specific kinds of modifications to the lease and leased vehicle, including if it:

· changes the amount of the base monthly payment, or

· grants payment or term extensions that extend the lease’s term beyond the final scheduled payment date of the Class C notes.

Ford Credit must make a corresponding payment to the collection account for any reallocated leases and leased vehicles.

For more details about the servicer’s obligation to reallocate leases and leased vehicles if the servicer takes certain actions, you should read “Servicing —

Servicer Modifications and Obligation to Reallocate Leases and Leased Vehicles.”

Ratings

The depositor expects that the offered notes will receive credit ratings from two nationally recognized statistical rating organizations, or “rating agencies.”

The ratings of the notes will reflect the likelihood of the timely payment of interest on, and the ultimate payment of principal of, the notes according to their terms. Each rating agency rating the notes will monitor its ratings under its normal surveillance process. Ford Credit has agreed to provide ongoing information about the notes and the reference pool to each rating agency. A rating agency may change or withdraw an assigned rating at any time. A rating action taken by one rating agency may not necessarily be taken by another rating agency. No transaction party will be responsible for monitoring any changes to the ratings on the notes.

Tax Status

If you purchase a note, you agree by your purchase that you will treat your note as debt for U.S. federal, state and local income and franchise tax purposes.

Katten Muchin Rosenman LLP will deliver its opinion that, for U.S. federal income tax purposes:

· the offered notes will be treated as debt to the extent they are treated as beneficially owned by a person other than the sponsor or its affiliates for such purposes, and

· the trust will not be classified as an association or publicly traded partnership taxable as a corporation.

For more information about the application of tax laws, you should read “Tax Considerations.”

ERISA Considerations

The offered notes generally will be eligible for purchase by employee benefit plans.

For more information about the treatment of the notes under ERISA, you should read “ERISA Considerations.”

Credit Risk Retention

The risk retention regulations in Regulation RR of the Securities Exchange Act of 1934 require the sponsor, either directly or through its majority-owned affiliates, to retain an economic interest of at least 5% in the credit risk of the leases and leased vehicles. The sponsor will satisfy this credit risk retention requirement by the depositor retaining an “eligible horizontal residual interest” having a fair value equal to at least 5% of the sum of the fair value, as of the closing date, of the notes to be issued by the trust and the residual interest in the trust.

For more information about the manner in which the risk retention requirements will be satisfied, you should read “Credit Risk Retention.”

Investment Considerations

The trust is not registered or required to be registered as an “investment company” under the Investment Company Act of 1940 and, in making this determination, is relying on the exemption in Rule 3a-7 of the Investment Company Act of 1940, although other exclusions or exemptions may also be available to the trust. The trust is structured not to be a “covered fund” under the regulations adopted to implement Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly known as the “Volcker Rule.”

The Class A-1 notes will be structured to be eligible for purchase by money market funds under Rule 2a-7 under the Investment Company Act of 1940. A money market fund should consult its legal advisors regarding the eligibility of the Class A-1 notes under Rule 2a-7 and whether an investment in the Class A-1 notes satisfies the fund’s investment policies and objectives.

For more information about Rule 2a-7 under the Investment Company Act of 1940, you should read “Investment Considerations.”

Contact Information for the Depositor

Ford Credit Auto Lease Two LLC

c/o Ford Motor Credit Company LLC

c/o Ford Motor Company

World Headquarters, Suite 802

One American Road

Dearborn, Michigan 48126

Attention: Ford Credit SPE Management Office

Telephone number: (313) 594-3495

Email address: FSPEMgt@ford.com

Contact Information for the Servicer

Ford Motor Credit Company LLC

c/o Ford Motor Company

World Headquarters, Suite 802

One American Road

Dearborn, Michigan 48126

Attention: Securitization Operations Manager

Telephone number: (313) 206-7860

Email address: FDSecops@ford.com

Website: www.fordcredit.com

CUSIP Numbers

|

| CUSIP |

Class A-1 notes |

| 34528D AA1 |

Class A-2a notes |

| 34528D AB9 |

Class A-2b notes |

| 34528D AC7 |

Class A-3 notes |

| 34528D AD5 |

Class A-4 notes |

| 34528D AE3 |

Class B notes |

| 34528D AF0 |

You should consider the following risk factors in deciding whether to purchase any notes.

The assets of the trust are limited and are the only source of payment for your notes |

| The trust will not have assets or sources of funds other than amounts received on the exchange note and related property it owns. Credit enhancement is limited. Your notes will not be insured or guaranteed by Ford Credit or any of its affiliates or anyone else. If these assets or sources of funds are insufficient to pay your notes in full, you will incur losses on your notes. |

|

|

|

Payments on the notes depend on collections on the leases, the number of leases that default and proceeds from the sale of the leased vehicles |

| The trust will pay the notes only with amounts received on the exchange note. The amounts received on the exchange note will primarily depend on the collections on the leases in the reference pool, the number of leases that default and the proceeds from the sale of the leased vehicles on scheduled termination, early termination or default. If there are decreased collections, increased defaults or the net sale proceeds from the leased vehicles are less than the base residual values of the leased vehicles, you may have delayed payments or losses on your notes. |

|

|

|

|

| The market value of a leased vehicle may not be greater than or equal to its base residual value at the end of the lease. If the market value of a leased vehicle is less than the price at which the lessee may purchase the vehicle under the lease, the lessee will be more likely to return it. If the net sale proceeds from returned leased vehicles are less than their base residual values, you may have delayed payments or losses on your notes. |

|

|

|

The timing of principal payments on your notes is uncertain |

| Faster than expected rates of prepayments on the reference pool will cause the trust to pay principal of your notes earlier than expected and will shorten the maturity of your notes. Prepayments on the reference pool will occur if: |

|

|

|

|

| · the related leased vehicles are purchased under the leases prior to the scheduled termination dates, |

|

|

|

|

| · lessees participate in early termination programs sponsored by Ford, |

|

|

|

|

| · lessees terminate leases early and the returned vehicles are sold more quickly than expected, |

|

|

|

|

| · lessees default on their leases and proceeds are received from the sale of the leased vehicles, |

|

|

|

|

| · the servicer receives proceeds from physical damage, credit life or other insurance policies covering the leased vehicles or lessees, |

|

|

|

|

| · the depositor or Ford Credit reallocates ineligible leases and leased vehicles from the reference pool due to a breach of representations, or |

|

| · the servicer reallocates modified or impaired leases and leased vehicles from the reference pool. |

|

|

|

|

| A variety of economic, social and other factors will influence the rate of prepayments on the reference pool. No prediction can be made about the actual prepayment rates that will occur for the reference pool. |

|

|

|

|

| In addition, the timing of principal payments may be affected by the level of interest rates. If interest rates fall below the rates at the time of issuance of the floating rate notes, there will be additional excess spread available to pay principal of the notes on each payment date. If interest rates rise above the rates at the time of issuance of the floating rate notes, there will be less excess spread available to pay principal of the notes on each payment date. |

|

|

|

|

| If principal of your notes is paid earlier than expected due to faster rates of prepayments on the reference pool, and interest rates at that time are lower than interest rates at the time principal would have been paid had those prepayments occurred as expected, you may not be able to reinvest the principal at a rate of return that is equal to or greater than the rate of return on your notes. Alternatively, if principal of your notes is paid later than expected due to slower rates of prepayments on the reference pool, and interest rates at that time are higher than interest rates at the time principal would have been paid had those prepayments occurred as expected, you may lose reinvestment opportunities and, if your notes were purchased at a discount, your yield may be reduced. You will bear all reinvestment risk resulting from principal payments on your notes occurring earlier or later than expected. |

|

|

|

|

| In addition, your notes will be paid in full before maturity if the servicer exercises its clean up call when the principal amount of the notes is 5% or less of the initial principal amount of the notes. |

|

|

|

|

| For more information about the timing of payment on the reference pool, you should read “Maturity and Prepayment Considerations.” |

|

|

|

The Class B and Class C notes will be subject to greater risk because of subordination |

| The Class B notes will bear greater risk than the Class A notes because no interest will be paid on the Class B notes on any payment date until all interest on the Class A notes is paid in full on that payment date, and no principal will be paid on the Class B notes until the principal amount of the Class A notes is paid in full. The Class C notes will bear even greater risk because of similar subordination to more senior classes of notes. Failure to pay interest on subordinated notes that are not part of the controlling class will not be an event of default. |

|

|

|

Overcollateralization may not increase as expected |

| Overcollateralization is expected to increase to the targeted overcollateralization amount as excess spread is used to pay principal of the notes in an amount greater than the decrease in the total securitization value of the reference pool over time. It is not certain that the targeted overcollateralization amount will be reached or maintained, or that the reference pool will generate sufficient collections to pay your notes in full. |

|

| For more information about overcollateralization as a form of credit enhancement for your notes, you should read “Credit Enhancement — Overcollateralization.” |

|

|

|

An event of default and acceleration of the notes may result in earlier than expected payment of your notes or losses on your notes |

| An event of default may result in an acceleration of payments on your notes. If principal of your notes is paid earlier than expected, you may not be able to reinvest the principal at a rate of return that is equal to or greater than the rate of return on your notes. If the notes are accelerated after an event of default, the trust will not pay interest on or principal of any notes that are not part of the controlling class until all interest on and principal of the notes of the controlling class are paid in full. If collections on the reference pool and the proceeds of any sale of the leases and leased vehicles or the exchange note are insufficient to pay the amounts owed on your notes, you will have losses on your notes. |

|

|

|

|

| For more details about events of default and acceleration of the notes, you should read “Description of the Notes — Events of Default and Acceleration.” For more details about the change in the priority of payments after events of default and acceleration of the notes, you should read “Description of the Notes — Priority of Payments” and “Description of the Notes — Post-Acceleration Priority of Payments.” |

|

|

|

Bankruptcy of Ford Credit may result in delayed payments or losses on your notes |

| If Ford Credit becomes subject to a bankruptcy proceeding, you may have delayed payments or losses on your notes. A bankruptcy court could conclude that Ford Credit effectively still owns the exchange note because the transfer of the exchange note by Ford Credit to the depositor was viewed as a financing and not a “true sale” or that the assets and liabilities of the titling companies, the holding companies that own membership interests in the titling companies and the depositor, should be consolidated with those of Ford Credit for bankruptcy purposes. If a court were to reach either of these conclusions, you may have delayed payments or losses on your notes due to: |

|

|

|

|

| · the “automatic stay” of the U.S. federal bankruptcy laws that prevents secured creditors from exercising remedies against a debtor in bankruptcy without permission from the bankruptcy court and other U.S. federal bankruptcy laws that permit substitution of collateral in limited circumstances, |

|

|

|

|

| · tax or government liens on Ford Credit’s property that were existing before the transfer of the exchange note to the trust having a claim on collections that are senior to your notes, or |

|

|

|

|

| · the trust not having a perfected security interest in the exchange note or any cash collections held by Ford Credit at the time the bankruptcy proceeding starts. |

|

| If a court were to decide that the transfer was not a “true sale” or that the depositor should be consolidated with Ford Credit for bankruptcy purposes, the trust would benefit from a security interest in the exchange note but the exchange note would be owned by Ford Credit and payments may be delayed, collateral substituted or other remedies may be imposed by the bankruptcy court that may cause delayed payments or losses on your notes. |

|

|

|

|

| Any bankruptcy proceeding involving Ford Credit may also adversely affect the rights and remedies of the trust and payments on your notes in other ways, whether or not the transfer of the exchange note is considered a “true sale” or the depositor is consolidated with Ford Credit for bankruptcy purposes. For example: |

|

|

|

|

| · as noted above, the “automatic stay” may prevent the exercise by the trust and others of their rights and remedies against Ford Credit and others, including the right to replace Ford Credit as servicer or the right to require it to reallocate leases and leased vehicles based on a breach of a representation, and/or |

|

|

|

|

| · Ford Credit may be permitted to reject some agreements to which it is a party, including the sale and servicing agreement, and not be required to perform its obligations under those agreements. |

|

|

|

|

| For more information about the effects of a bankruptcy of Ford Credit on your notes, you should read “Important Legal Considerations — Bankruptcy Considerations.” |

|

|

|

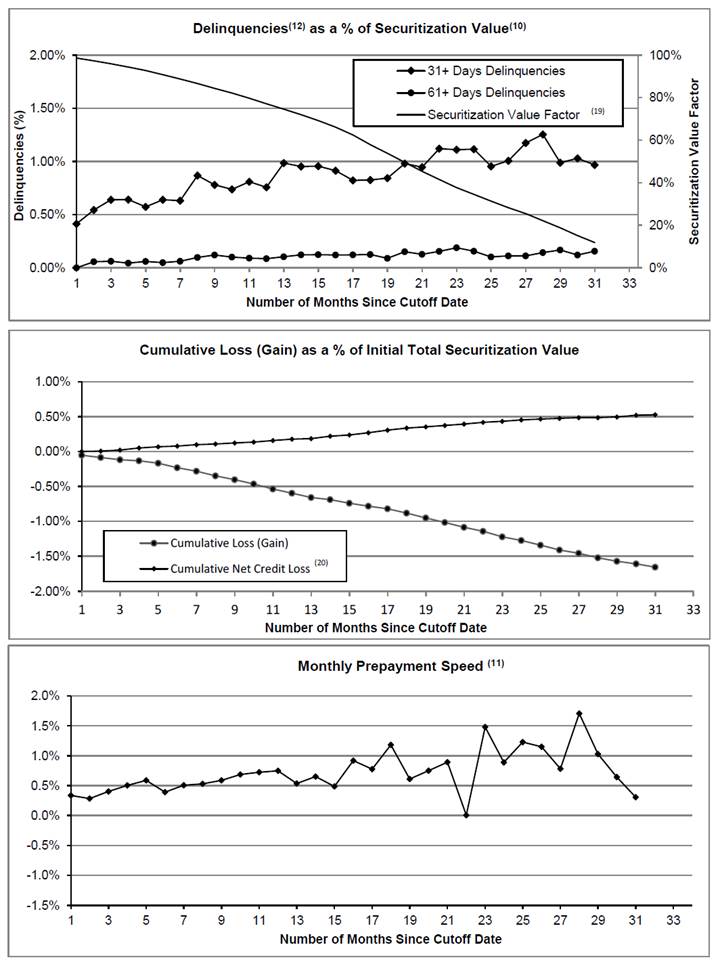

Performance of the reference pool is uncertain and depends on many factors and may worsen in an economic downturn |

| The performance of the leases and leased vehicles in the reference pool depends on a number of factors, including general economic conditions, unemployment levels, the circumstances of individual lessees, the terms of the leases, Ford Credit’s underwriting standards at origination, the accuracy of Ford Credit’s residual value forecasts, the success of Ford Credit’s servicing, collection and vehicle remarketing strategies and used vehicle prices. |

|

|

|

|

| For more information about factors which could affect the performance of the leases and the value of the leased vehicles, you should read “— Declines in the resale value of the leased vehicles may adversely affect the performance of the leases and your notes,” “— Vehicle recalls may adversely affect the performance of the leases and your notes” and “— High vehicle model or vehicle type concentrations may adversely affect the performance of the leases and your notes” below. |

|

|

|

|

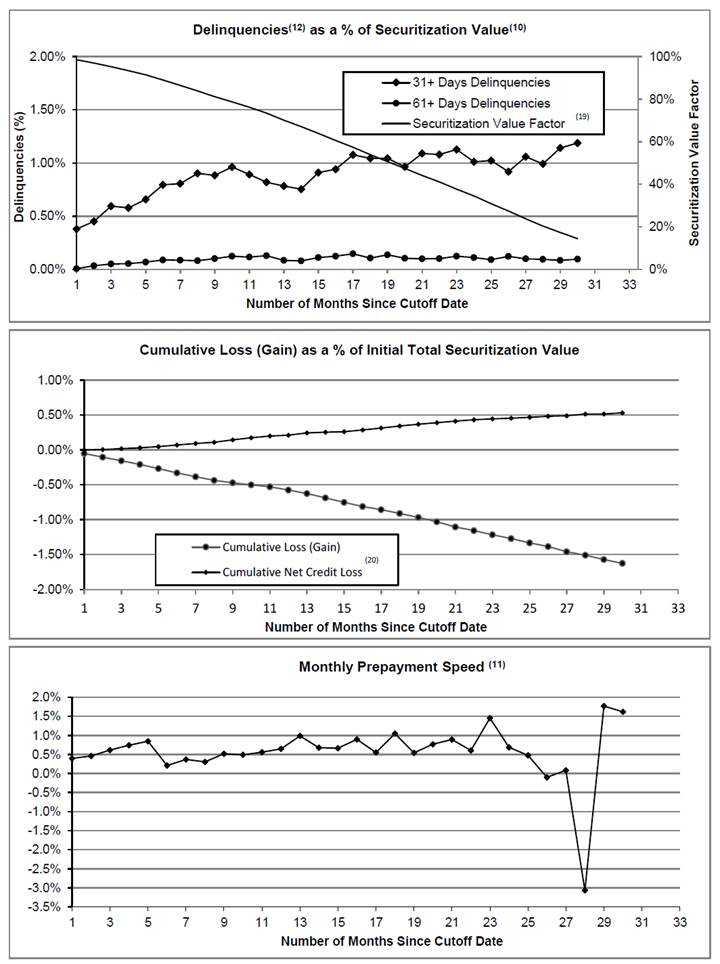

| For more information about residual performance, delinquencies, repossessions and credit losses for Ford Credit’s portfolio of U.S. leases, you should read “Sponsor and Servicer — Portfolio Residual Performance, Delinquency, Repossession and Credit Loss Information.” |

Declines in the resale value of the leased vehicles may adversely affect the performance of the leases and your notes |

| The used vehicle market is affected by supply and demand for vehicles, which is influenced by many factors, including:

· consumer tastes and preferences, which are influenced by many factors, including changes in technology and changes in fuel prices, |

|

|

|

|

| · the availability of financing to consumers and dealers for their purchase of used vehicles, |

|

|

|

|

| · vehicle manufacturer decisions, including those on pricing and incentives offered for the purchase of new vehicles, on the introduction and pricing of new models or on whether to sell a brand or to discontinue a model or brand, |

|

|

|

|

| · government actions, including actions that encourage consumers to purchase some types of vehicles, |

|

|

|

|

| · severe weather conditions that create delays in vehicle transportation or selling vehicles at auction, |

|

|

|

|

| · high volumes of lease terminations concentrated in specific locations, concentrated during specific periods of time or caused by fleet or vehicle rental companies that, in each case, cause an excessive volume of used vehicles to enter the market, and |

|

|

|

|

| · other factors including significant vehicle recalls and labor strikes. |

|

|

|

|

| None of these factors can be predicted with certainty. Some of these factors are impossible to quantify and may be significantly impacted by unanticipated events. Changes in various factors could have disproportionate effects on the supply or demand for some vehicle types or models. For example, increases in fuel prices could disproportionately reduce the resale value of larger, less fuel efficient vehicles, like full-sized trucks and SUVs and a decrease in fuel prices could disproportionately reduce the resale value of more fuel efficient vehicles such as hybrid electric, plug-in hybrid electric and battery electric vehicles. Similarly, introduction of a new model by Ford may impact the resale value of similar, but older, models. Consequently, the performance of the reference pool cannot be predicted with accuracy and may result in losses on your notes. |

|

|

|

|

| These impacts may be more pronounced if they relate to vehicle models or vehicle types that represent a high percentage of the leased vehicles in the reference pool. |

|

|

|

|

| For more information about the distribution by vehicle model and vehicle type of the leases, you should read “— High vehicle model or vehicle type concentrations may adversely affect the performance of the leases and your notes” below, and “Composition of the Reference Pool — Distribution of the Leases by Vehicle Model” and “Composition of the Reference Pool — Distribution by Vehicle Type of Leases” attached in Annex A. |

Vehicle recalls may adversely affect the performance of the leases and your notes |

| Vehicle recalls that apply to the leased vehicles in the reference pool, including recalls resulting from government or regulatory investigations or other actions, may adversely affect the residual value, delinquencies, repossessions and credit losses on the related leases and leased vehicles. A recall of a vehicle model or vehicle type may increase the likelihood that lessees return those leased vehicles at the end of the lease, reduce the residual value of those leased vehicles and the price at which those leased vehicles are sold at auction at the end of the lease term or following repossession, or delay the timing of disposition of those leased vehicles. A decrease in the residual value and the proceeds from the sale of leased vehicles at the end of the lease term or following repossession may result in accelerated, delayed or reduced payments on your notes. | |||||

|

|

| |||||

|

| For more information about residual performance, delinquencies, repossessions and credit losses for Ford Credit’s portfolio of U.S. leases, you should read “Sponsor and Servicer — Portfolio Residual Performance, Delinquency, Repossession and Credit Loss Information.” | |||||

|

|

| |||||

|

| These impacts may be more pronounced if a vehicle recall applies to vehicle models or vehicle types that represent a high percentage of the leased vehicles in the reference pool. | |||||

|

|

| |||||

|

| For more information about the distribution by vehicle model and vehicle type of the leases, you should read “— High vehicle model or vehicle type concentrations may adversely affect the performance of the leases and your notes” below, and “Composition of the Reference Pool — Distribution of the Leases by Vehicle Model” and “Composition of the Reference Pool — Distribution by Vehicle Type of Leases” attached in Annex A. | |||||

|

|

| |||||

High vehicle model or vehicle type concentrations may adversely affect the performance of the leases and your notes |

| If a specific vehicle model or vehicle type of the leased vehicles represents a significant percentage of the total securitization value, any adverse change in the value of that specific vehicle model or vehicle type of the leased vehicles may adversely impact the performance of the related leases or reduce the residual value of those leased vehicles and could result in delayed payments or losses on your notes. | |||||

|

|

| |||||

|

| As of the cutoff date, the vehicle models and vehicle types of the leased vehicles in the reference pool are concentrated by initial total securitization value as follows: | |||||

|

|

| |||||

|

|

| Model | Vehicle Type | Percentage of Total |

| |

|

|

|

|

|

|

| |

|

|

| F-150 | Truck | 27.27% |

| |

|

|

| Explorer | CUV | 16.80% |

| |

|

|

| Escape | CUV | 14.46% |

| |

|

|

| Edge | CUV | 8.23% |

| |

|

|

| Fusion | Car | 6.27% |

| |

|

|

| |||||

|

| No other vehicle model represents more than 5% of the initial total securitization value as of the cutoff date. | |||||

|

| For more information about the distribution by vehicle model and vehicle type of the leases, you should read “Composition of the Reference Pool — Distribution of the Leases by Vehicle Model” and “Composition of the Reference Pool — Distribution by Vehicle Type of Leases” attached in Annex A. |

|

|

|

Residual value losses may result in losses on your notes |

| Because the leases in the reference pool are closed-end leases, you will bear the risk that the leased vehicles are worth less than their base residual values at the end of the leases. The aggregate base residual value of the leased vehicles equals 65.90% of the sum of the base monthly payments plus the base residual value. This is the amount that will be available to pay your notes assuming each base monthly payment is made as scheduled and each leased vehicle is returned and sold for an amount equal to its base residual value. The base residual value used in this securitization transaction is the lower of the contract residual value stated in the lease and the ALG base residual value. The base residual value of 92.85% of the leased vehicles by securitization value equals the ALG base residual value of the leased vehicles. |

|

|

|

|

| In order to establish residual values, Ford Credit and ALG each make predictions about a number of factors that may affect the supply and demand for used vehicles, including changes in consumer tastes and economic factors, vehicle manufacturer decisions and government actions, as described in “— Performance of the reference pool is uncertain and depends on many factors and may worsen in an economic downturn” above. In making forecasts of the value of used vehicles in the future, Ford Credit and ALG each also make predictions about a number of factors that affect used vehicle pricing, including housing prices, commodity prices, wage growth, consumer sentiment, interest rates, gas and oil prices and new vehicle sales. None of these factors can be predicted with certainty. Some of these factors are impossible to quantify and may be significantly impacted by unanticipated events. |

|

|

|

|

| In addition, nearly every lease in the reference pool was originated under Ford-sponsored marketing programs. Under these programs, the contract residual values of the leased vehicles were set higher than the contract residual values Ford Credit would otherwise have set. As a result, the price at which a lessee may purchase one of these leased vehicles was also set higher than it would otherwise have been set, making it more likely that the purchase price will exceed the market value of the leased vehicle at the time of lease termination and less likely that a lessee will purchase one of these leased vehicles. Consequently, a large portion of the leased vehicles will likely be returned at lease termination and the net sales proceeds on these returned leased vehicles may be less than their base residual values. Finally, you may not receive the full benefit if the market value is greater than the base residual value because the lessee has the right to purchase the leased vehicle. The lessee may purchase the leased vehicle at lease end by paying the purchase price stated in the lease, which equals the contract residual value plus a fee of up to $500 and other amounts owed under the lease. |

|

| Because residual values cannot be predicted with certainty and you will bear the risk if the leased vehicles are worth less than their base residual values and may not receive the full benefit if they are worth more than their base residual values, you may have delayed payments or losses on your notes. |

|

|

|

The trust will issue floating rate notes, but will not enter into interest rate hedges, which may result in losses on your notes if interest rates rise |

| The leases in the reference pool require level monthly payments and the exchange note will accrue interest at a fixed rate, while the floating rate notes will accrue interest at a floating rate based on a benchmark, which will initially be one-month LIBOR, plus a spread. Even though the trust will issue floating rate notes, it will not enter into interest rate hedges or other derivatives contracts to mitigate this interest rate risk. |

|

|

|

|

| The trust will pay interest on the floating rate notes from available funds and not solely from funds that are dedicated to the floating rate notes. Therefore, an increase in the benchmark would reduce the amounts available for payments to all the notes, not just to the floating rate notes. |

|

|

|

|

| If the benchmark increases to the point at which the amount of interest and principal due on the notes, together with fees and expenses of the trust, exceeds the available funds, the trust may not have sufficient funds to pay interest and principal due on the notes. If the trust does not have sufficient funds to make these payments, you may have delayed payments or losses on your notes. |

|

|

|

Uncertainty about the future of LIBOR and the potential discontinuance of LIBOR and change to a benchmark replacement for the floating rate notes could adversely affect the market value of the floating rate notes or the holders of the floating rate notes and/or limit your ability to resell the floating rate notes |

| The chief executive of the United Kingdom Financial Conduct Authority, or the “FCA,” which regulates LIBOR, announced in July 2017 that the FCA intends to stop compelling banks to submit rates for the calculation of LIBOR after 2021. It is unknown whether any banks will continue to voluntarily submit rates for the calculation of LIBOR after 2021 or whether LIBOR will continue to be published by its administrator based on these submissions or on any other basis. It is not possible to predict the effect of these changes, other reforms, the establishment of alternative benchmark rates or a change to a benchmark replacement for the floating rate notes in the United States, United Kingdom or elsewhere. The resulting uncertainty could adversely affect the market value of the floating rate notes and/or limit your ability to resell them. |

|

| The trust will issue floating rate notes that will accrue interest based on a benchmark. The benchmark will initially be one-month LIBOR, although it may be changed following the occurrence of a benchmark transition event. Due to the uncertainty regarding the future of LIBOR, we cannot provide any assurances that that rate will be representative of market interest rates or consistent with previously published one-month LIBOR during the life of the floating rate notes. If a published one-month LIBOR is unavailable at any time prior to the occurrence of a benchmark transition event and its related benchmark replacement date, one-month LIBOR will be determined using the alternative methods stated in “Description of the Notes — Payments of Interest — Floating Rate Benchmark; Benchmark Transition Event.” These alternative methods may result in lower interest payments or interest payments that do not otherwise correlate over time with payments that would have been made if one-month LIBOR were available in its current form. The alternative methods may also be subject to factors that make one-month LIBOR impossible or impracticable to determine. If a published one-month LIBOR is unavailable at any time prior to the occurrence of a benchmark transition event and its related benchmark replacement date and banks are unwilling to provide quotations, the rate of interest on each floating rate note for an interest period will be the same as the immediately preceding interest period, and could remain the rate of interest for the life of the floating rate notes. |

|

|

|

|

| In addition, as described under “Description of the Notes — Payments of Interest — Floating Rate Benchmark; Benchmark Transition Event,” one-month LIBOR will be replaced as the benchmark for the floating rate notes following the occurrence of a benchmark transition event and its related benchmark replacement date. The benchmark transition events generally include the making of public statements or publication of information by the administrator of the benchmark, its regulatory supervisor or certain other governmental authorities that the benchmark will no longer be provided or is no longer representative of underlying market or economic reality. However, we cannot provide any assurances that these events will be sufficient to trigger a change in the benchmark at all times when the then-current benchmark is no longer representative of market interest rates, or that these events will align with similar events in the market generally or in other parts of the financial markets, such as the derivatives market. |

|

| Further, as described under “Description of the Notes — Payments of Interest — Floating Rate Benchmark; Benchmark Transition Event,” the benchmark replacement will depend on the availability of various alternative benchmarks, the first of which is term SOFR, the second of which is compounded SOFR and the last two of which are not currently specified. The Secured Overnight Financing Rate, or “SOFR,” was selected by the Alternative Reference Rates Committee, or “ARRC,” of the Federal Reserve Bank of New York, or the “FRBNY,” as the replacement for LIBOR. However, because SOFR is a secured, risk-free rate, while LIBOR is an unsecured rate reflecting counterparty risk, SOFR is not representative of LIBOR.

Moreover, one-month LIBOR is a forward-looking term rate. Term SOFR, which is expected to be a similar forward-looking term rate which will be based on SOFR, is the first alternative among the several benchmark replacements, but is currently being developed under the sponsorship of the FRBNY, and we cannot provide any assurances that the development of term SOFR will be completed. If term SOFR is not available as of the benchmark replacement date, the next available benchmark replacement is compounded SOFR. Compounded SOFR is a backward-looking rate generally calculated using actual rates during the interest accrual period, and may be even less representative of one-month LIBOR. Finally, if a benchmark replacement other than term SOFR is chosen because term SOFR is not initially available, term SOFR will become the benchmark replacement if it later becomes available, which could lead to further volatility in the interest rate on the floating rate notes.

|

|

| It is intended that the replacement of the benchmark will not be a taxable event for noteholders of the floating rate notes. However, we cannot provide any assurances that the IRS will not take a contrary view. If the IRS treats the replacement of the benchmark as a taxable event, noteholders of the floating rate notes may be required to recognize taxable gain or loss at that time. |

|

|

|

|