UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| ☒ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | Definitive Proxy Statement |

| |

| ☐ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material under §240.14a-12 |

New Mountain Guardian III BDC, L.L.C.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☐ | No fee required. |

| |

| ☐ | Fee paid previously with preliminary materials |

| |

| ☒ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

New Mountain Guardian III BDC, L.L.C.

1633 Broadway, 48th Floor

New York, NY 10019

(212) 720-0300

NOTICE OF CONSENT SOLICITATION

[ ], 2024

Dear Unitholders:

I am writing to you on two important matters relating to your investment in New Mountain Guardian III BDC, L.L.C., a limited liability company organized under Delaware law (the “Company”). This Notice of Consent Solicitation, the accompanying Consent Solicitation Statement and the accompanying Written Consent Form (collectively, the “Consent Solicitation”) are being furnished to all members holding limited liability company units of the Company (“Company Units”, and such members, “Unitholders”) in connection with the solicitation of written consents from Unitholders to take action without a meeting.

First, pursuant to the Company’s Fourth Amended and Restated Limited Liability Company Agreement, dated as of June 28, 2023 (the “LLC Agreement”), the Company’s investment period ended on July 15, 2023, which is the four-year anniversary of the date the Company first accepted capital commitments from Unitholders (such investment period, the “Investment Period”, and the date on which the Company first accepted capital commitments from Unitholders, the “Initial Closing Date”). The Company now seeks to amend and restate the LLC Agreement to, among other things, extend the Investment Period until August 31, 2025 for purposes of allowing the Company to retain and use the realized proceeds from the sale or repayment of its investments for making additional investments and paying Company expenses as set forth in Section 4.1(c) of the LLC Agreement (such extended period, the “Reinvestment Investment Period”) and to allow the Company to enter into financing facilities to obtain leverage for purposes of making additional investments with such realized proceeds during the Reinvestment Investment Period (such investments, the “Reinvestment Investments”). All other references to the Investment Period in the LLC Agreement, as amended and restated as described above, would remain unchanged. A form of the amended and restated LLC Agreement is attached as Annex A to this Consent Solicitation Statement and is marked to show the proposed changes against the LLC Agreement.

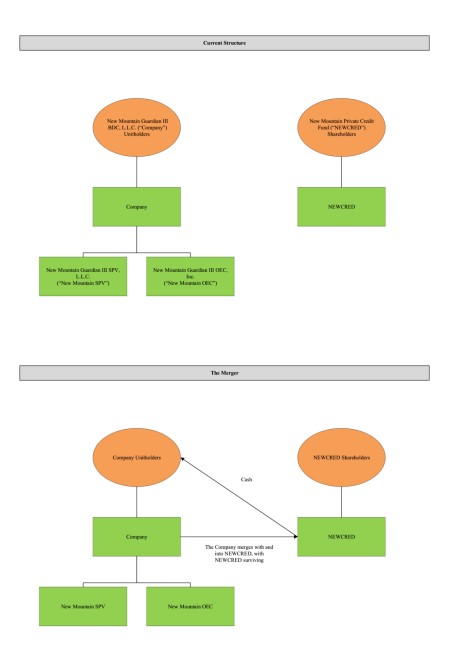

Second, pursuant to the terms of that certain Agreement and Plan of Merger, dated as of [ ], 2024 (as may be amended from time to time, the “Merger Agreement”), by and between the Company, New Mountain Private Credit Fund, a Maryland statutory trust (“NEWCRED”), and, for the limited purposes set forth therein, New Mountain Finance Advisers, L.L.C., a Delaware limited liability company and the investment adviser to the Company and NEWCRED (“NMFA”), the Company seeks to merge with and into NEWCRED, with NEWCRED continuing as the surviving company (the “Merger” and, together with the proposed amendment and restatement of the LLC Agreement and the other transactions contemplated by the Merger Agreement, the “Transactions”).

The effectiveness of the proposed amendment and restatement of the LLC Agreement as described above is contingent upon receipt of Unitholder approval of (i) the proposed amendment and restatement of the LLC Agreement and (ii) the Merger Agreement and the transactions contemplated thereby, including the Merger (such approval, the “Unitholder Approval”). Likewise, the closing of the Merger (the “Closing”) is contingent upon the receipt of the Unitholder Approval and the satisfaction of certain other conditions.

Assuming the Unitholder Approval is received, the proposed amendment and restatement of the LLC Agreement will be effective on the date such amendment and restatement is entered into by the Company, which the Company expects to occur on or shortly after the date on which the Unitholder Approval is received. The effectiveness of the proposed amendment and restatement of the LLC Agreement is not subject to any other terms and conditions.

With respect to the Merger and the other Transactions, assuming the Unitholder Approval is received, at the date and time when the Merger becomes effective as specified in the (i) certificate of merger filed with the Secretary of State of the State of Delaware and (ii) the articles of merger filed with the State Department of Assessments and

Taxation of the State of Maryland (such time, the “Effective Time”), each Company Unit issued and outstanding immediately prior to the Effective Time (other than Company Units owned by NEWCRED or any of its consolidated subsidiaries (the “Cancelled Units”)) will be converted into the right to receive an amount in cash equal to the Company Per Unit NAV (as defined below) (the “Merger Consideration”). The effectiveness of the Merger is subject to the terms and conditions set forth in the Merger Agreement.

Under the Merger Agreement, on a date which is no earlier than forty-eight (48) hours (excluding Sundays and holidays) prior to the Effective Time (the “Determination Date”), the Company will deliver to NEWCRED a calculation of its estimated net asset value (“NAV”), calculated in good faith as of the Determination Date and based on the same assumptions and methodologies, and applying the same categories of adjustments to NAV, historically used by the Company in preparing the calculation of the NAV per Company Unit (with an accrual for any dividend declared by the Company and not yet paid) (the “Closing NAV”). In addition, the Company will utilize the services of one or more third-party valuation agents in preparing the valuation of each material security or other asset of the Company that (i) does not have a readily available market quotation and (ii) has been given a risk rating below the score of “4A” based on its operating performance and underlying business characteristics as of September 30, 2024. In preparing such calculation, the estimated NAV will be reduced by any unpaid fees and expenses payable by the Company for services provided through the Closing Date in connection with the Merger Agreement, the Transactions and the organization and capitalization of NEWCRED, including legal fees and related expenses, investment banking fees and related expenses, if any, and accounting fees and related expenses (such fees and expenses, the “Company Transaction Expenses”). Using such calculation, the parties will calculate the “Company Per Unit NAV”, which means the quotient of (i) the Closing NAV divided by (ii) the number of Company Units issued and outstanding as of the Determination Date (excluding the Cancelled Units).

Separate and apart from the Transactions, Unitholders will be given the opportunity to transfer all or a portion of their Company Units to NEWCRED prior to the Closing in exchange for shares of beneficial interest of NEWCRED.

Pursuant to Section 3.6 of the LLC Agreement, whenever an action is required by applicable law or the LLC Agreement to be taken by a specified percentage in interest of Unitholders, such action shall be deemed to be valid if taken upon the written vote or written consent of those Unitholders whose Company Units represent the specified percentage of the aggregate outstanding Company Units of all Unitholders at the time. With respect to the proposed amendment and restatement of the LLC Agreement, pursuant to Section 12.1 of the LLC Agreement, such amendment and restatement requires the approval of a majority-in-interest of Unitholders. With respect to the Merger and the other Transactions, pursuant to Section 18-209 of the Delaware Limited Liability Company Act (the “Act”), the approval of the Merger Agreement and the other Transactions contemplated thereby, including the Merger, requires the approval of Unitholders who own Company Units representing more than 50% of the then-current percentage or other interest in the profits of the Company owned by all Unitholders.

The board of directors of the Company (the “Board”) has formed a special committee of the Board (the “Special Committee”), the members of which are directors of the Board who are not “interested persons”, as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), of the Company (“Independent Directors”). The Special Committee was authorized to, among other things: (1) review, evaluate, consider and negotiate the terms and conditions of the Transactions, including to determine whether the Transactions are advisable and fair to and in the best interests of all Unitholders, (2) review evaluate, consider and negotiate on behalf of the Company the terms and conditions of any agreements or arrangements proposed to be entered into by the Company, (3) determine whether the Transactions contemplated by the Merger Agreement (including the Merger) satisfy all applicable requirements of Rule 17a-8 under the 1940 Act, (4) recommend to the Board what action, if any, should be taken by the Board with respect to the Transactions and (5) take such other actions as the Special Committee may deem to be necessary or appropriate for the Special Committee to discharge its duties.

We are soliciting your approval via written consent with respect to the following proposals (each, a “Proposal” and, together, the “Proposals”):

Proposal 1 (the “LLC Agreement Amendment Proposal”): To approve the amendment and restatement of the LLC Agreement for the purposes of, among other things, (i) extending the Reinvestment Investment Period until

August 31, 2025, such that it would be defined in the amended and restated LLC Agreement as the period commencing on the Initial Closing Date and ending on August 31, 2025 and (ii) allowing the Company to enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments. A form of the amended and restated LLC Agreement is attached as Annex A to this Consent Solicitation Statement and is marked to show the proposed changes against the LLC Agreement.

Proposal 2 (the “Merger Proposal”): To approve the Merger Agreement (a form of which is attached as Annex B) and the other Transactions contemplated thereby, including the Merger.

The effectiveness of the LLC Agreement Amendment Proposal is contingent upon the approval of both of the above Proposals. Likewise, the Closing of the Merger is contingent upon the approval of both of the above Proposals and the satisfaction of certain other conditions.

After careful consideration, the Board unanimously recommends, on the recommendation of the Special Committee, that Unitholders (i) “CONSENT” to the LLC Agreement Amendment Proposal and (ii) “CONSENT” to the Merger Proposal.

The foregoing items of business are more fully described in the Consent Solicitation Statement accompanying this Notice of Consent Solicitation. The solicitation is being made on the terms and subject to the conditions set forth in the accompanying Consent Solicitation Statement and the accompanying Written Consent Form.

In accordance with Section 3.6 of the LLC Agreement, your consent to the Proposals will be deemed conclusively granted upon our receipt of your executed Written Consent Form. You may change your Written Consent Form by returning a later-dated, signed Written Consent Form, in accordance with the instructions in the Written Consent Form, so that it is received by the Company before [ ], 2024 at [ ] Eastern Time (the “Consent Deadline”). The Company reserves the right to (i) extend the Consent Deadline with respect to the Consent Solicitation or (ii) solicit and accept Written Consent Forms after the Consent Deadline.

You can submit your written consent or written objection to the Proposals in either of the following ways:

•by DocuSign; or

•by electronic mail — be sure to sign and date the enclosed Written Consent Form, then scan it and email it to the email address provided on the Written Consent Form.

Whichever method you choose, please read the enclosed Consent Solicitation Statement carefully before you submit your Written Consent Form. If you should have any questions about the Consent Solicitation materials, please contact Sara McNaughton, Vice President at New Mountain, at GIIIconsent@newmountaincapital.com or (212) 720-0300.

Failure to submit the Written Consent Form will have the same effect as a written objection to the LLC Agreement Amendment Proposal and the Merger Proposal. If you sign and send in the Written Consent Form but do not indicate how you want to vote as to either Proposal, your Written Consent Form will be treated as a “CONSENT” to that Proposal.

| | |

| By Order of the Board of Directors, |

|

| /s/ John R. Kline |

|

John R. Kline Chairman of the Board, Chief Executive Officer and President |

|

| NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE PROPOSALS OR OTHER TRANSACTIONS DESCRIBED IN THE ACCOMPANYING CONSENT SOLICITATION STATEMENT, PASSED UPON THE MERITS OR FAIRNESS OF THE PROPOSALS, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE CONSENT SOLICITATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE. |

|

New Mountain Guardian III BDC, L.L.C.

1633 Broadway, 48th Floor

New York, NY 10019

(212) 720-0300

CONSENT SOLICITATION STATEMENT

This Consent Solicitation Statement, the accompanying Notice of Consent Solicitation and the accompanying Written Consent Form (collectively, the “Consent Solicitation”) are being furnished to all members holding limited liability company units (“Company Units”, and such members, “Unitholders”) of New Mountain Guardian III BDC, L.L.C., a Delaware limited liability company (the “Company”), in connection with the solicitation of written consents authorized by the Board of Directors (the “Board” and each member thereof, a “Director” and collectively, the “Directors”) of the Company to take action without a meeting related to the proposals described herein.

First, pursuant to the Company’s Fourth Amended and Restated Limited Liability Company Agreement, dated as of June 28, 2023 (the “LLC Agreement”), the Company’s investment period ended on July 15, 2023, which is the four-year anniversary of the date the Company first accepted capital commitments from Unitholders (such investment period, the “Investment Period”, and the date on which the Company first accepted capital commitments from Unitholders, the “Initial Closing Date”). The Company now seeks to amend and restate the LLC Agreement to, among other things, extend the Investment Period until August 31, 2025 for purposes of allowing the Company to retain and use the realized proceeds from the sale or repayment of its investments for making additional investments and paying Company expenses as set forth in Section 4.1(c) of the LLC Agreement (such extended period, the “Reinvestment Investment Period”) and to allow the Company to enter into financing facilities to obtain leverage for purposes of making additional investments with such realized proceeds during the Reinvestment Investment Period (such investments, the “Reinvestment Investments”). All other references to the Investment Period in the LLC Agreement, as amended and restated as described above, would remain unchanged. A form of the amended and restated LLC Agreement is attached as Annex A to this Consent Solicitation Statement and is marked to show the proposed changes against the LLC Agreement.

Second, pursuant to the terms of that certain Agreement and Plan of Merger, dated as of [ ], 2024 (as may be amended from time to time, the “Merger Agreement”), by and between the Company, New Mountain Private Credit Fund, a Maryland statutory trust (“NEWCRED”), and, for the limited purposes set forth therein, New Mountain Finance Advisers, L.L.C., a Delaware limited liability company and the investment adviser to the Company and NEWCRED (“NMFA”), the Company seeks to merge with and into NEWCRED, with NEWCRED continuing as the surviving company (the “Merger” and, together with the proposed amendment and restatement of the LLC Agreement and the other transactions contemplated by the Merger Agreement, the “Transactions”).

The effectiveness of the proposed amendment and restatement of the LLC Agreement as described above is contingent upon receipt of Unitholder approval of (i) the proposed amendment and restatement of the LLC Agreement and (ii) the Merger Agreement and the transactions contemplated thereby, including the Merger (such approval, the “Unitholder Approval”). Likewise, the closing of the Merger (the “Closing”) is contingent upon the receipt of the Unitholder Approval and the satisfaction of certain other conditions.

Assuming the Unitholder Approval is received, the proposed amendment and restatement of the LLC Agreement will be effective on the date such amendment and restatement is entered into by the Company, which the Company expects to occur on or shortly after the date on which the Unitholder Approval is received. The effectiveness of the proposed amendment and restatement of the LLC Agreement is not subject to any other terms and conditions.

With respect to the Merger and the other Transactions, assuming the Unitholder Approval is received, at the date and time when the Merger becomes effective as specified in the (i) certificate of merger filed with the Secretary of State of the State of Delaware and (ii) the articles of merger filed with the State Department of Assessments and Taxation of the State of Maryland (such time, the “Effective Time”), each Company Unit issued and outstanding immediately prior to the Effective Time (other than Company Units owned by NEWCRED or any of its consolidated subsidiaries (the “Cancelled Units”)) will be converted into the right to receive an amount in cash equal

to the Company Per Unit NAV (as defined below) (the “Merger Consideration”). The effectiveness of the Merger is subject to the terms and conditions set forth in the Merger Agreement.

Under the Merger Agreement, on a date which is no earlier than forty-eight (48) hours (excluding Sundays and holidays) prior to the Effective Time (the “Determination Date”), the Company will deliver to NEWCRED a calculation of its estimated net asset value (“NAV”), calculated in good faith as of the Determination Date and based on the same assumptions and methodologies, and applying the same categories of adjustments to NAV, historically used by the Company in preparing the calculation of the NAV per Company Unit (with an accrual for any dividend declared by the Company and not yet paid) (the “Closing NAV”). In addition, the Company will utilize the services of one or more third-party valuation agents in preparing the valuation of each material security or other asset of the Company that (i) does not have a readily available market quotation and (ii) has been given a risk rating below the score of “4A” based on its operating performance and underlying business characteristics as of September 30, 2024. In preparing such calculation, the estimated NAV will be reduced by any unpaid fees and expenses payable by the Company for services provided through the Closing Date in connection with the Merger Agreement, the Transactions and the organization and capitalization of NEWCRED, including legal fees and related expenses, investment banking fees and related expenses, if any, and accounting fees and related expenses (such fees and expenses, the “Company Transaction Expenses”). Using such calculation, the parties will calculate the “Company Per Unit NAV”, which means the quotient of (i) the Closing NAV divided by (ii) the number of Company Units issued and outstanding as of the Determination Date (excluding the Cancelled Units).

Separate and apart from the Transactions, Unitholders will be given the opportunity to transfer all or a portion of their Company Units to NEWCRED prior to the Closing in exchange for shares of beneficial interest of NEWCRED (“NEWCRED Shares”).

Pursuant to Section 3.6 of the LLC Agreement, whenever an action is required by applicable law or the LLC Agreement to be taken by a specified percentage in interest of Unitholders, such action shall be deemed to be valid if taken upon the written vote or written consent of those Unitholders whose Company Units represent the specified percentage of the aggregate outstanding Company Units of all Unitholders at the time. With respect to the proposed amendment and restatement of the LLC Agreement, pursuant to Section 12.1 of the LLC Agreement, such amendment and restatement requires approval of a majority-in-interest of Unitholders. With respect to the Merger and the other Transactions, pursuant to Section 18-209 of the Delaware Limited Liability Company Act (the “Act”), the approval of the Merger Agreement and the other Transactions contemplated thereby, including the Merger, requires the approval of Unitholders who own Company Units representing more than 50% of the then-current percentage or other interest in profits of the Company owned by all Unitholders.

The Board has formed a special committee of the Board (the “Special Committee”), the members of which are directors of the Board who are not “interested persons”, as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), of the Company (“Independent Directors”). The Special Committee was authorized to, among other things: (1) review, evaluate, consider and negotiate the terms and conditions of the Transactions, including to determine whether the Transactions are advisable and fair to and in the best interests of all Unitholders, (2) review evaluate, consider and negotiate on behalf of the Company the terms and conditions of any agreements or arrangements proposed to be entered into by the Company, (3) determine whether the Transactions contemplated by the Merger Agreement (including the Merger) satisfy all applicable requirements of Rule 17a-8 under the 1940 Act (“Rule 17a-8”), (4) recommend to the Board what action, if any, should be taken by the Board with respect to the Transactions and (5) take such other actions as the Special Committee may deem to be necessary or appropriate for the Special Committee to discharge its duties.

We are soliciting your approval via written consent with respect to the following proposals (each, a “Proposal” and, together, the “Proposals”):

Proposal 1 (the “LLC Agreement Amendment Proposal”): To approve the amendment and restatement of the LLC Agreement for the purposes of, among other things, (i) extending the Reinvestment Investment Period until August 31, 2025, such that it would be defined in the amended and restated LLC Agreement as the period commencing on the Initial Closing Date and ending on August 31, 2025 and (ii) allowing the Company to enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments. A form of the amended and

restated LLC Agreement is attached as Annex A to this Consent Solicitation Statement and is marked to show the proposed changes against the LLC Agreement.

Proposal 2 (the “Merger Proposal”): To approve the Merger Agreement (a form of which is attached as Annex B) and the other Transactions contemplated thereby, including the Merger.

The effectiveness of the LLC Agreement Proposal is contingent upon the approval of both of the above Proposals. Likewise, the Closing of the Merger is contingent upon the approval of both of the above Proposals and the satisfaction of certain other conditions.

After careful consideration, the Board unanimously recommends, on the recommendation of the Special Committee, that Unitholders (i) “CONSENT” to the LLC Agreement Amendment Proposal and (ii) “CONSENT” to the Merger Proposal.

The Board has decided to authorize the solicitation of consent by notice rather than calling a meeting of Unitholders in order to eliminate the costs and management time involved in holding such a meeting. Pursuant to Section 18-302(d) of the Act, unless otherwise provided in a limited liability company’s operating agreement, on any matter that is to be voted on by its members, the members may take such action without a meeting and without a vote if consented to, in writing, or by electronic transmission by members having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all members of the limited liability company entitled to vote thereon were present and voted.

Section 3.6 of the LLC Agreement, in pertinent part states: “Whenever action is required by applicable law or this Agreement to be taken by a specified percentage in interest of the Members (or any class or group of Members), such action shall be deemed to be valid if taken upon the written vote or written consent of those Members (or those Members included in such class or group) whose Units represent the specified percentage of the aggregate outstanding Units of all Members (or all Members included in such class or group) at the time. Each Member shall be entitled to one vote for each Unit held on all matters submitted to a vote of the Members. For these purposes, a ‘majority-in-interest’ shall mean a percentage in interest in excess of 50%.”

Unitholders as of the close of business on [ ], 2024 (the “Company Record Date”) are entitled to submit a Written Consent Form. Unitholders representing a majority-in-interest of Unitholders must consent to the LLC Agreement Amendment Proposal, and Unitholders representing more than 50% of the then-current percentage or other interest in the profits of the Company owned by all Unitholders must consent to the Merger Proposal, in order for the Proposals to be approved. As of the Company Record Date, the Company had [ ] Company Units outstanding and approximately [ ] members holding such Company Units. There are no preferred Company Units (“Preferred Units”) outstanding. The Consent Solicitation materials (consisting of this Consent Solicitation Statement, the accompanying Notice of Consent Solicitation and the accompanying Written Consent Form) are being sent to all Unitholders on or about [ ], 2024.

Unitholders who wish to consent or object to the Proposals must submit their properly completed and executed Written Consent Forms by electronic mail or DocuSign, in each case in accordance with the instructions on the Written Consent Form. The Company reserves the right (but is not obligated) to accept any Written Consent Form received by any other reasonable means or in any form that reasonably evidences the consent or objection to the Proposals.

Your consent will be deemed effective when received. However, you may change your Written Consent Form by returning a later-dated, signed Written Consent Form to the Company, in accordance with the instructions in the Written Consent Form, so that it is received before [ ], 2024 at [ ] Eastern Time (the “Consent Deadline”). The Company reserves the right to (i) extend the Consent Deadline with respect to the Consent Solicitation or (ii) solicit and accept Written Consent Forms after the Consent Deadline.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE PROPOSALS OR OTHER TRANSACTIONS DESCRIBED IN THE ACCOMPANYING CONSENT SOLICITATION STATEMENT, PASSED UPON THE MERITS OR FAIRNESS OF THE PROPOSALS OR PASSED UPON THE

ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE CONSENT SOLICITATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

Requests for copies of the Consent Solicitation materials should be directed to Sara McNaughton, Vice President at New Mountain, at GIIIconsent@newmountaincapital.com or (212) 720-0300.

The final results of the Consent Solicitation will be published in a Current Report on Form 8-K by the Company. The Consent Solicitation and the Current Report on Form 8-K will constitute notice of taking of action without a meeting, as permitted by applicable law and Section 3.6 of the LLC Agreement.

All questions as to the form of all documents and the validity and eligibility (including time of receipt) and acceptance of Written Consent Forms and changes to Written Consent Forms will be determined by the Company in its sole discretion, which determination will be final and binding.

Changes to Written Consent Forms

Written Consent Forms may be changed by returning a later-dated, signed Written Consent Form to the Company, in accordance with the instructions in the Written Consent Form, so that it is received prior to the Consent Deadline. No Written Consent Forms may be changed after the Consent Deadline. The Company reserves the right to (i) extend the Consent Deadline with respect to the Consent Solicitation or (ii) solicit and accept Written Consent Forms after the Consent Deadline.

Solicitation of Consents

The Company is sending you this Consent Solicitation Statement in connection with its solicitation of the Unitholder Approval of the Proposals. Except as otherwise described in the section titled “Description of the Side Letter Agreement”, the cost of the Consent Solicitation will be borne by the Company. None of the Company, NEWCRED or NMFA has retained a solicitor for this purpose.

No Appraisal Rights

Under applicable Delaware law and the LLC Agreement, the Unitholders are not entitled to appraisal rights with respect to the Proposals, and the Company will not independently provide Unitholders with any such rights.

Non-Votes and Objections

Because Unitholders representing a majority-in-interest of the Unitholders must consent to the LLC Agreement Amendment Proposal, and Unitholders representing more than 50% of the then-current percentage or other interest in the profits of the Company owned by all Unitholders must consent to the Merger Proposal, in order for the Proposals to be approved, non-votes (essentially, Unitholders who do not respond) and objections have the effect of a vote against the Proposals.

SUMMARY OF THE MERGER

This summary highlights selected information contained elsewhere in this Consent Solicitation Statement and may not contain all of the information that is important to you. You should read this entire Consent Solicitation Statement carefully, including the “Risk Factors”, for a more complete understanding of the Merger. In particular, you should read the annexes attached to this Consent Solicitation Statement, including the Merger Agreement, a form of which is attached as Annex B hereto, as it is the legal document that governs the Merger. The discussion in this Consent Solicitation Statement, which includes the material terms of the Merger and the principal terms of the Merger Agreement, is subject to, and is qualified in its entirety by reference to, the Merger Agreement. See the section entitled “Where You Can Find More Information”.

The Parties to the Merger

New Mountain Guardian III BDC, L.L.C.

1633 Broadway, 48th Floor

New York, New York 10019

(212) 720-0300

The Company was formed on May 22, 2019. The Company is a closed-end, non-diversified management investment company that has elected to be regulated as a business development company (“BDC”) under the 1940 Act. The Company has elected to be treated, and intends to comply with the requirements to continue to qualify annually thereafter, for U.S. federal income tax purposes as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

The Company is managed by NMFA, a wholly-owned subsidiary of New Mountain Capital Group, L.P., a Delaware limited partnership (“NMC”). NMFA manages the Company’s day-to-day operations and provides the Company with investment advisory and management services. New Mountain Finance Administrator, L.L.C., a Delaware limited liability company (the “Company Administrator”), a wholly-owned subsidiary of NMC, provides the administrative services necessary to conduct the Company’s day-to-day operations. The Company Administrator also maintains, or oversees the maintenance of, the Company’s consolidated financial records, reports delivered to Unitholders and reports filed with the SEC. The Company Administrator performs the calculation and publication of the value of the Unitholders’ capital, the payment of expenses and oversees the performance of various third-party service providers and the preparation and filing of the Company’s tax returns.

The Company focuses on providing direct lending solutions to U.S. upper middle market companies backed by top private equity sponsors. The Company’s investment objective is to generate current income and capital appreciation through the sourcing and origination of senior secured loans and select junior capital positions to growing businesses in defensive industries that offer attractive risk-adjusted returns. The Company’s differentiated investment approach leverages the deep sector knowledge and operating resources of NMC.

The Company primarily invests in senior secured debt of U.S. sponsor-backed, middle market companies. The Company defines middle market companies as those with annual earnings before interest, taxes, depreciation and amortization (“EBITDA”) of $10.0 million to $200.0 million. The Company focus is on defensive growth businesses that generally exhibit the following characteristics: (i) acyclicality, (ii) sustainable secular growth drivers, (iii) niche market dominance and high barriers to competitive entry, (iv) recurring revenue and strong free cash flow, (v) flexible cost structures and (vi) seasoned management teams. Senior secured loans may include traditional first lien loans or unitranche loans. The Company invests a significant portion of its portfolio in unitranche loans, which are loans that combine both senior and subordinated debt, generally in a first-lien position. Because unitranche loans combine characteristics of senior and subordinated debt, they have risks similar to the risks associated with secured debt and subordinated debt. Certain unitranche loan investments may include “last-out” positions, which generally heighten the risk of loss. In some cases, the Company’s investments may also include equity interests.

New Mountain Private Credit Fund

1633 Broadway, 48th Floor

New York, New York 10019

(212) 720-0300

NEWCRED was formed on August 19, 2024. NEWCRED is a closed-end, non-diversified management investment company that [has elected to be] regulated as a BDC under the 1940 Act. NEWCRED intends to elect to be treated, and intends to comply with the requirements to continue to qualify annually thereafter, for U.S. federal income tax purposes as a RIC under Subchapter M of the Code. NEWCRED is externally managed by its investment adviser, NMFA, an affiliate of NEWCRED’s sponsor, New Mountain Capital, L.L.C., a Delaware limited liability company (“New Mountain”).

Under normal circumstances, NEWCRED anticipates to invest at least 80% of its total assets in private credit investments (i.e., loans, bonds and other credit instruments that are issued in private offerings or issued by private companies). Under normal circumstances, NEWCRED primarily expects (either directly or indirectly through one or more of NEWCRED’s subsidiaries) to make or originate debt investments in companies that NMFA believes are “defensive growth” companies in non-cyclical industry niches where NMFA has developed strong proprietary research and operational advantages. NEWCRED’s investment strategy will focus on primary originations, but it may also include secondary market purchases if opportunities arise. While the relative amount of NEWCRED’s investments in primary originations and secondary market purchase is expected to vary over time, NEWCRED expects the majority of its investments in the near future will be in primary originations.

NEWCRED will predominantly target investments in U.S. middle market businesses. NEWCRED defines middle market businesses as those businesses with annual EBITDA between $10.0 million and $200.0 million. NEWCRED’s primary focus is in defensive growth companies which NEWCRED defines as generally exhibiting the following characteristics: (i) acyclicality, (ii) sustainable secular growth drivers, (iii) nice market dominance and high barriers to competitive entry, (iv) recurring revenue and strong free cash flow, (v) flexible cost structures and (vi) seasoned management teams. The form of NEWCRED’s investments may include first liens or unitranche loans, or, to a lesser extent, second liens and passive preferred equity. NEWCRED will not invest in real property or hold equity in a U.S. real property holding company.

NEWCRED will be structured as a perpetual-life BDC, meaning it is an investment vehicle of indefinite duration whose shares are intended to be sold monthly on a continuous basis at a price generally equal to its monthly NAV per share. NEWCRED believes its structure as a perpetual-life BDC will allow it to originate, acquire, finance and manage its investment portfolio in an active and flexible manner and that such structure will be advantageous to shareholders, as NEWCRED is not limited by a pre-determined operational period and the need to liquidate assets, potentially in an unfavorable market, to satisfy a liquidity event at the end of that period.

New Mountain Finance Advisers, L.L.C.

1633 Broadway, 48th Floor

New York, New York 10019

(212) 720-0300

NMFA was formed on October 12, 2010 and is a wholly-owned subsidiary of NMC. NMC is a global investment firm with approximately $50 billion of assets under management and a track record of investing in the middle market. NMC focuses on investing in defensive growth companies across its private equity, credit and net lease investment strategies. NMFA manages the Company’s day-to-day operations and provides the Company with investment and advisory management services.

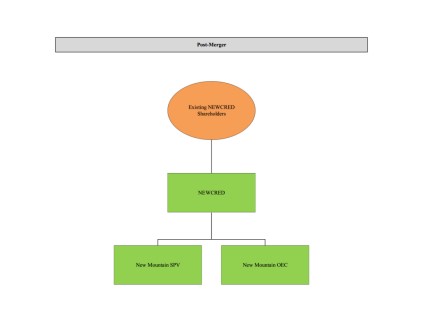

Merger Structure

Pursuant to the terms of the Merger Agreement, at the Effective Time, the Company will be merged with and into NEWCRED, with NEWCRED continuing as the surviving company. NEWCRED will continue its existence as a statutory trust under the laws of the State of Maryland. As of the Effective Time, the separate limited liability company existence of the Company will cease.

Separate and apart from the Transactions, Unitholders will be given the opportunity to transfer all or a portion of their Company Units to NEWCRED prior to the Closing in exchange for NEWCRED Shares (such transfer, the “Rollover Transaction”).

Merger Consideration

At the Effective Time, each issued and outstanding Company Unit (except for Cancelled Units) will be converted into the right to receive the Merger Consideration (i.e., an amount of cash equal to the Company Per Unit NAV).

Under the Merger Agreement, on the Determination Date, the Company will deliver to NEWCRED a calculation of its estimated Closing NAV, as reduced by any Company Transaction Expenses, calculated in good faith as of the Determination Date and based on the same assumptions and methodologies, and applying the same categories of adjustments to NAV, historically used by the Company in preparing the calculation of the NAV per share of Company Units (with an accrual for any dividend declared by the Company and not yet paid). The Company will update the calculation of the Closing NAV in the event that the Closing is subsequently materially delayed or there is a material change to the Closing NAV prior to the Closing (including any dividend declared after the Determination Date but prior to Closing) and as needed to ensure the Closing NAV is determined within forty-eight (48) hours (excluding Sundays and holidays) prior to the Effective Time. In addition, the Company will utilize the services of one or more third-party valuation agents in preparing the valuation of each material security or other asset of the Company that (i) does not have a readily available market quotation and (ii) has been given a risk rating below the score of “4A” based on its operating performance and underlying business characteristics as of September 30, 2024. The Board, including a majority of the Independent Directors, will be required to approve, and the chief financial officer of the Company will certify in writing to NEWCRED, the calculation of the Closing NAV.

Using such calculation, the parties will calculate the “Company Per Unit NAV”, which means the quotient of (i) the Closing NAV divided by (ii) the number of Company Units issued and outstanding as of the Determination Date (excluding the Cancelled Units).

Risks Relating to the Merger

The Merger and the other Transactions are subject to, among others, the following risks. Unitholders should carefully consider these risks before providing their consent to the Merger.

•Because the Company Per Unit NAV may fluctuate, Unitholders cannot be sure of the exact amount of the Merger Consideration they will receive until the date on which the Closing actually occurs (the “Closing Date”).

•The announcement and pendency of the Merger Agreement could negatively affect the Company Per Unit NAV and, therefore, the Merger Consideration that Unitholders will receive.

•If the Merger closes, the Merger Consideration that Unitholders will receive may be less than the value Unitholders would receive if they held such Company Units until the end of the term of the Company.

•If the Merger does not close, the Company will not benefit from the expenses incurred in its pursuit of the Merger.

•Litigation that may be filed against NEWCRED or the Company in connection with the Merger, regardless of its merits, could result in substantial costs and could delay or prevent the Merger from being completed.

•The termination of the Merger Agreement could negatively impact the Company.

•The Merger is subject to closing conditions, including receipt of the Unitholder Approval and NEWCRED’s ability to pay the aggregate Merger Consideration and all fees and expenses expected to be borne by NEWCRED in connection with the Merger and the other Transactions, that, if not satisfied or waived, will result in the Merger not being completed, which may result in material adverse consequences to the Company’s business and operations.

•The Company may, to the extent legally allowed, waive one or more conditions to the Merger without resoliciting the Unitholder Approval.

•The Company will be subject to operational uncertainties and contractual restrictions while the Merger is pending, including restrictions on pursuing alternatives to the Merger.

•The Merger Agreement contains provisions that could discourage or make it difficult for a third party to acquire the Company prior to the completion of the Merger.

See the section entitled “Risk Factors – Risks Relating to the Merger” below for a more detailed discussion of these factors.

Tax Consequences of the Merger

The Merger, together with the Rollover Transaction, is intended to be treated as a reorganization pursuant to Section 368(a) of the Code. However, the receipt of the Merger Consideration in the Merger is expected to be taxable to Unitholders. Unitholders who participate in the Merger will be treated as having sold their Company Units in a taxable sale and will generally recognize gain or loss equal to the difference between the cash received and the basis in such Unitholder’s Company Units. This gain or loss will generally be capital gain or loss, and will be long-term capital gain or loss if, as of the effective date of the Merger, the holding period for such Company Units is greater than one year.

You should read the section entitled “Certain Material U.S. Federal Income Tax Consequences of the Merger” for a more complete discussion of certain material U.S. federal income tax consequences of the Merger. You are also encouraged to consult your own tax advisors regarding the consequences of the Merger to you under U.S. federal, state, local and/or non-U.S. tax laws, in light of your particular circumstances.

Proposal 1 - Board Recommendation of the LLC Agreement Amendment Proposal

After careful consideration, the Board, on the recommendation of the Special Committee, unanimously recommends that Unitholders “CONSENT” to the LLC Agreement Amendment Proposal.

Proposal 2 - Board Recommendation of the Merger Proposal

After careful consideration, the Board, on the recommendation of the Special Committee, unanimously recommends that Unitholders “CONSENT” to the Merger Proposal.

Consent Required – Unitholders

Each Company Unit held by a holder of record as of the Company Record Date has one vote per Company Unit held on each Proposal to be considered.

The LLC Agreement Amendment Proposal

The LLC Agreement Amendment Proposal requires the affirmative consent of a majority-in-interest of the Unitholders as of the close of business on the Company Record Date. Abstentions will have the same effect as responding “OBJECT” to the LLC Agreement Amendment Proposal.

The Merger Proposal

The Merger Proposal requires the affirmative consent of Unitholders who own Company Units representing more than 50% of the then-current percentage or other interest in the profits of the Company owned by all Unitholders as of the close of business on the Company Record Date. Abstentions will have the same effect as responding “OBJECT” to the Merger Proposal.

Completion of the Merger

As more fully described elsewhere in this Consent Solicitation Statement and in the Merger Agreement, the completion of the Merger depends on a number of conditions being satisfied or, where legally permissible, waived. For information on the conditions that must be satisfied or waived for the Merger to occur, see the section entitled “Description of the Merger Agreement – Conditions to Closing the Merger”. While there can be no assurance as to the exact timing of the Merger, or that the Merger will be completed at all, the Company and NEWCRED are working to complete the Merger in December 2024. It is currently expected that the Merger will be completed promptly following receipt of the Unitholder Approval and the satisfaction (or, to the extent legally permitted, waiver) of the closing conditions set forth in the Merger Agreement.

Termination of the Merger

The Merger Agreement contains certain termination rights for the Company and NEWCRED, discussed below in the section entitled “Description of the Merger – Termination of the Merger Agreement”.

Reasons for the Merger

In considering the Merger and the other Transactions and the terms of the Merger Agreement, the Special Committee and the Board consulted with their legal advisors, as well as management of NMFA, and considered numerous factors.

The material factors considered by the Special Committee and the Board in concluding that the Merger and the other Transactions and the terms of the Merger Agreement are in the best interest of the Company and Unitholders included, among others:

•the combined company is expected to benefit from return advantages and enhanced liquidity to shareholders;

•the acquisition of a known and diversified portfolio of well-performing assets previously managed by NMFA;

•operational synergies and expected efficiencies of the combined company;

•NEWCRED offers an investment strategy consistent with that of the Company; and

•favorable tax treatment for Unitholders participating in the Rollover Transaction.

The foregoing list does not include all of the factors that the Special Committee and the Board considered in approving the Merger and the other Transactions and the Merger Agreement, and each member of the Special Committee and the Board may have assigned different weights to different factors. In addition, the members of the Special Committee and the Board may have individually considered factors that are not listed here, or not individually considered certain factors that are not listed here.

Management of the Combined Company

Subject to applicable law, the trustees and officers of NEWCRED immediately prior to the Merger will remain the trustees and officers of the combined company after the Effective Time, and will hold office until their respective successors are duly elected and qualify, or their earlier death, resignation, removal or adjudication of legal incompetence. Following the Merger, NMFA will continue to be the investment adviser to NEWCRED and the investment advisory agreement by and between NEWCRED and NMFA will remain in effect.

Appraisal Rights

Under applicable Delaware law and the LLC Agreement, the Unitholders are not entitled to appraisal rights with respect to the Merger Proposal, and the Company will not independently provide Unitholders with any such rights.

QUESTIONS AND ANSWERS ABOUT THE CONSENT SOLICITATION AND THE PROPOSALS

The questions and answers below highlight only selected information from this Consent Solicitation Statement regarding the Consent Solicitation and the Proposals. They do not contain all of the information that may be important to you. You should carefully read this entire Consent Solicitation Statement, as well as the Notice of Consent Solicitation, the Written Consent Form and the other documents referred to in this Consent Solicitation Statement (including the annexes), to fully understand the Consent Solicitation and the Proposals.

Questions and Answers about the Consent Solicitation

Q: Why am I receiving the Consent Solicitation materials?

A: On [ ], 2024, the Company entered into a merger agreement providing for the merger of the Company with and into NEWCRED, with NEWCRED continuing as the surviving company. A form of the Merger Agreement is attached to this Consent Solicitation Statement as Annex B and is incorporated by reference herein. The Merger Agreement also contemplates the amendment and restatement of the LLC Agreement for the purposes of, among other things, (i) extending the Reinvestment Investment Period of the Company until August 31, 2025, such that it would be defined in the amended and restated LLC Agreement as the period commencing on the Initial Closing Date and ending on August 31, 2025 and (ii) allowing the Company to enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments. A marked copy of the proposed amended and restated LLC Agreement, as described above, is attached to this Consent Solicitation Statement as Annex A and is incorporated by reference herein.

In order to complete the Merger, Unitholders must approve (i) the proposed amendment and restatement of the LLC Agreement as described above, (ii) the Merger Agreement and the transactions contemplated thereby, including the Merger and (iii) any other matters required to be approved or adopted by Unitholders in order to effect the Transactions. See the section entitled “Description of the Merger Agreement – Conditions to Closing the Merger”. You are receiving the Consent Solicitation materials in connection with the solicitation by the Board of the consent of Unitholders to these Proposals.

The Consent Solicitation materials, which you should read carefully and in their entirety, contain important information about the Merger, the Merger Agreement, the proposed amendment and restatement of the LLC Agreement, the Consent Solicitation and the Proposals to be considered therein.

Q: What am I being asked to approve?

A: Unitholders are being asked to deliver written consents to approve:

•The LLC Agreement Amendment Proposal, in which the LLC Agreement would be amended and restated to, among other things, (i) extend the Reinvestment Investment Period until August 31, 2025, such that it would be defined in the amended and restated LLC Agreement as the period commencing on the Initial Closing Date and ending on August 31, 2025 and (ii) allow the Company to enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments. A form of the amended and restated LLC Agreement is attached as Annex A to this Consent Solicitation Statement and is marked to show the proposed changes against the LLC Agreement.

•The Merger Proposal, in which the Merger Agreement (a form of which is attached as Annex B) and the other Transactions contemplated thereby, including the Merger, would be approved.

Q: What is the recommendation of the Board with respect to the LLC Agreement Amendment Proposal?

A: The Board, on the recommendation of the Special Committee, unanimously recommends that Unitholders “CONSENT” to the LLC Agreement Amendment Proposal.

Q: What is the recommendation of the Board with respect to the Merger Proposal?

A: The Board, on the recommendation of the Special Committee, unanimously recommends that Unitholders “CONSENT” to the Merger Proposal.

Q: What is the composition and purpose of the Special Committee?

A: The Special Committee consists of Messrs. Alfred F. Hurley, Jr., David Ogens and Rome G. Arnold III, each of whom are Independent Directors of the Company. Mr. Arnold is the chairman of the Special Committee. The Special Committee was authorized to, among other things: (1) review, evaluate, consider and negotiate the terms and conditions of the Transactions, including to determine whether the Transactions are advisable and fair to and in the best interests of all Unitholders, (2) review evaluate, consider and negotiate on behalf of the Company the terms and conditions of any agreements or arrangements proposed to be entered into by the Company, (3) determine whether the Transactions satisfy all applicable requirements of Rule 17a-8, (4) recommend to the Board what action, if any, should be taken by the Board with respect to the Transactions and (5) take such other actions as the Special Committee may deem to be necessary or appropriate for the Special Committee to discharge its duties.

Q: If I am a Unitholder, what is the “Company Record Date” and what does it mean?

A: The Company Record Date is [ ], 2024. The Company Record Date was established by the Board, and only holders of record of Company Units at the close of business on the Company Record Date are entitled to receive notice of, and consent or object to, the Proposals. As of the Company Record Date, there were [ ] Company Units outstanding, and no Preferred Units outstanding.

Q: If I am a Unitholder, how many votes do I have?

A: Each Unitholder is entitled to one vote for each Company Unit held by such Unitholder on the Company Record Date.

Q: If I am a Unitholder, how do I submit my written consent or objection?

A: If you are a Unitholder of record as of the Company Record Date, you can submit your written consent or objection by returning an executed Written Consent Form, in accordance with the instructions provided in the Written Consent Form, so that it is received by the Company before the Consent Deadline. You can submit your written consent or objection to the Proposals in either of the following ways:

•by DocuSign; or

•by electronic mail — be sure to sign and date the enclosed Written Consent Form, then scan it and email it to the email address provided on the Written Consent Form.

Q: What if a Unitholder does not specify a choice for a Proposal when submitting the Written Consent Form?

A: All properly executed Written Consent Forms will be counted in accordance with the directions given. If the enclosed Written Consent Form is signed, dated and returned without any directions given, the applicable Company Units will be counted as a “CONSENT” to each Proposal.

Q: May I change my Written Consent Form after I submitted it?

A: Yes. You may change your Written Consent Form by returning a later-dated, signed Written Consent Form to the Company, in accordance with the instructions in the Written Consent Form, so that it is received prior to the Consent Deadline. No submitted Written Consent Forms may be changed after the Consent Deadline. The Company reserves the right to (i) extend the Consent Deadline with respect to the Consent Solicitation or (ii) solicit and accept Written Consent Forms after the Consent Deadline.

Q: What happens if I transfer my Company Units before the Consent Deadline?

A: The Company Record Date is earlier than the Consent Deadline and the Closing. If you transfer your Company Units after the Company Record Date, but before the Consent Deadline, you will retain your right to consent to the Proposals. However, if you transfer your Company Units before the Consent Deadline, or at any other point prior to the Closing, you will not receive the Merger Consideration for the Company Units you have transferred.

Q: What is required in order for the LLC Agreement Amendment Proposal to pass?

A: Pursuant to Section 12.1 of the LLC Agreement, the LLC Agreement Amendment Proposal requires the approval of a majority-in-interest of Unitholders. Section 3.6 of the LLC Agreement defines “majority-in-interest” as a percentage in interest in excess of 50%.

Q: What will happen if the LLC Agreement Amendment Proposal being considered is not consented to by the required threshold?

A: If Unitholders do not approve the LLC Agreement Amendment Proposal, the LLC Agreement would not be revised to, among other things, (i) extend the Reinvestment Investment Period or (ii) allow the Company to enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments. Thus, the Company would make distributions on the sale or repayment of its current investments rather than reinvesting such amounts into additional investment opportunities, and would not enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments.

Further, the closing of the Merger is contingent on the approval by Unitholders of the LLC Agreement Amendment Proposal. If the Merger is not completed for any reason (including the failure of Unitholders to approve the LLC Agreement Amendment Proposal), the Company will continue to operate independently under the management of NMFA, and the Company’s Directors and officers will continue to serve in such roles until their respective successors are duly elected and qualify, or their earlier death, resignation or removal. Unless sooner dissolved in accordance with the LLC Agreement, the Company will be dissolved and its affairs wound up in an orderly manner beginning July 15, 2026 in accordance with Sections 11.1 and 11.2(b) of the LLC Agreement. However, unless the Company is sooner dissolved in accordance with the LLC Agreement, the Board may, in its sole discretion and in accordance with Section 1.4 of the LLC Agreement, extend the term of the Company for one (1) additional year until July 15, 2027. In addition, the Company will not benefit from the expenses incurred in its pursuit of the Merger.

Q: What is required in order for the Merger Proposal to pass?

A: Pursuant to Section 18-209 of the Act, the Merger Proposal requires the approval of Unitholders who own Company Units representing more than 50% of the then-current percentage or other interest in the profits of the Company owned by all Unitholders.

Q: What will happen if the Merger Proposal being considered is not consented to by the required threshold?

A: If the Merger is not completed for any reason (including the failure of Unitholders to approve the Merger Proposal), the Company will continue to operate independently under the management of NMFA, and the Company’s Directors and officers will continue to serve in such roles until their respective successors are duly elected and qualify, or their earlier death, resignation or removal. Unless sooner dissolved in accordance with the LLC Agreement, the Company will be dissolved and its affairs wound up in an orderly manner beginning July 15, 2026 in accordance with Sections 11.1 and 11.2(b) of the LLC Agreement. However, unless the Company is sooner dissolved in accordance with the LLC Agreement, the Board may, in its sole discretion and in accordance with Section 1.4 of the LLC Agreement, extend the term of the Company for one (1) additional year until July 15, 2027. In addition, the Company will not benefit from the expenses incurred in its pursuit of the Merger.

Further, the effectiveness of the LLC Agreement Amendment Proposal is contingent on the approval by Unitholders of the Merger Proposal. If Unitholders do not approve the Merger Proposal, the LLC Agreement

would not be revised to, among other things, (i) extend the Reinvestment Investment Period or (ii) allow the Company to enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments. Thus, the Company would make distributions on the sale or repayment of its current investments rather than reinvesting such amounts into additional investment opportunities, and would not enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments.

Q: When will the final results of the consent be announced?

A: The final results of the Consent Solicitation will be published in a Current Report on Form 8-K by the Company.

Q: Will the Company incur expenses in soliciting written consents?

A: Except as otherwise described in the section entitled “Description of the Side Letter Agreement”, the Company will bear the cost of preparing, printing and mailing this Consent Solicitation Statement and the accompanying Notice of Consent Solicitation and Written Consent Form. None of the Company, NEWCRED or NMFA has retained a solicitor for this purpose. For more information regarding expenses related to the Merger and the other Transactions, see “Questions and Answers about the Merger — Who is responsible for paying the expenses relating to completing the Merger?”

Q: What does it mean if I receive more than one Written Consent Form?

A: Some of your Company Units may be registered differently or held in different accounts. You should execute a Written Consent Form to vote the Company Units in each of your accounts and return such Written Consent Form to the Company by electronic mail or DocuSign. If you execute one or more Written Consent Forms, please sign, date and return each form to guarantee that all of your Company Units are counted.

Q: Will my consent make a difference?

A: Yes. Your consent is needed to ensure that the Proposals can be acted upon. Your consent is very important. Your immediate response will help avoid potential delays associated with soliciting Unitholder consents.

Q: Whom can I contact with any additional questions about the Written Consent Form?

A: Unitholders can contact Sara McNaughton, Vice President at New Mountain, by calling collect at (212) 720-0300, by sending an email to GIIIconsent@newmountaincapitcal.com or by writing to the Company at 1633 Broadway, 48th Floor New York, NY 10019, Attention: Investor Relations.

Q: Where can I find more information about NEWCRED and the Company?

A: You can find more information about NEWCRED and the Company in the documents described under the section entitled “Where You Can Find More Information”.

Q: What do I need to do now?

A: The Company urges you to carefully read this entire document, including the annexes. You should also review the documents referenced under the section entitled “Where You Can Find More Information” and consult with your accounting, legal and tax advisors. If desired, you should then complete and return your Written Consent Form prior to the Consent Deadline in accordance with the instructions set forth herein and on the Written Consent Form.

Questions and Answers about the Proposals

Q: Prior to the consummation of the Merger, what effect will the LLC Agreement Amendment Proposal have on the Company’s investment objective or fees borne by Unitholders?

A: None. Prior to the consummation of the Merger, the Company’s investment objective and any fees borne by the Unitholders will not be affected by consenting to the LLC Agreement Amendment Proposal.

Q: Would the LLC Agreement Amendment Proposal have any adverse effect on Unitholders prior to the consummation of the Merger?

A: The Board believes that the LLC Agreement Amendment Proposal has the potential to improve the total return of the Company’s investments and the resulting return of Unitholders by allowing the Company to reinvest realized proceeds from the sale or repayment of its current investments into additional potentially profitable investment opportunities prior to the consummation of the Merger. However, Unitholders should understand that there can be no assurances that NMFA can reinvest such realized proceeds profitably.

Q: What will happen in the Merger?

A: At the Effective Time, the Company will be merged with and into NEWCRED in the Merger. As of the Effective Time, the separate limited liability company existence of the Company will cease. NEWCRED will be the surviving company of the Merger and will continue its existence as a statutory trust under the laws of the State of Maryland.

Separate and apart from the Transactions, Unitholders will be given the opportunity to transfer all or a portion of their Company Units to NEWCRED prior to the Closing in exchange for NEWCRED Shares.

Q: What will Unitholders receive in the Merger?

A: At the Effective Time, each issued and outstanding Company Unit will be converted into the right to receive the Merger Consideration.

Q: How will the Closing NAV of the Company be determined?

A: Under the Merger Agreement, on the Determination Date, the Company will deliver to NEWCRED a calculation of the Closing NAV, as reduced by any Company Transaction Expenses. The Company will update the calculation of the Closing NAV in the event that the Closing is subsequently materially delayed or there is a material change to the Closing NAV prior to the Closing (including any dividend declared after the Determination Date but prior to Closing) and as needed to ensure the Closing NAV is determined within forty-eight (48) hours (excluding Sundays and holidays) prior to the Effective Time. In addition, the Company will utilize the services of one or more third-party valuation agents in preparing the valuation of each material security or other asset of the Company that (i) does not have a readily available market quotation and (ii) has been given a risk rating below the score of “4A” based on their operating performance and underlying business characteristics as of September 30, 2024. The Board, including a majority of the Independent Directors, will be required to approve, and the chief financial officer of the Company will certify in writing to NEWCRED, the calculation of the Closing NAV.

Q: Who is responsible for paying the expenses relating to completing the Merger?

A: Except as otherwise described in the section entitled “Description of the Side Letter Agreement”, all fees and expenses incurred in connection with the Merger will be paid by the Company. It is estimated that the Company will bear expenses of approximately $2.0 million in connection with the Merger, if consummated, or approximately $2.0 million if the Merger is not consummated.

Q: Will NMFA waive any fees prior to completing the Merger?

A: No. NMFA will not be waiving any fees prior to completing the Merger.

Q: Will Unitholders receive distributions after the Merger?

A: No. All Unitholders who hold Company Units at the Effective Time will have the right to receive the Merger Consideration for each Company Unit outstanding immediately prior to the Effective Time. At the Closing, all Company Units will no longer be outstanding and will be cancelled and retired and will cease to exist.

Q: How does the Company’s investment objective, strategy and risks differ from NEWCRED’s?

A: NEWCRED’s investment objective, risks and strategies are substantially similar to those of the Company. NEWCRED’s investment objective, risks and strategies will not change following the Merger.

Q: How will NEWCRED be managed following the Merger?

A: NEWCRED has a five-member board of trustees, three of whom are not “interested persons” (as that term is defined in Section 2(a)(19) of the 1940 Act) of NEWCRED. Each trustee will hold office until their respective successors are duly appointed and qualify, or their earlier death, resignation, removal or adjudication of legal incompetence. Following the Merger, NEWCRED will continue to be managed by NMFA pursuant to an investment advisory agreement by and between NEWCRED and NMFA.

Q: Are Unitholders able to exercise appraisal rights?

A: No. Unitholders will not be entitled to exercise appraisal rights with respect to either of the Proposals. If a Unitholder wishes to object to a Proposal, the Unitholder may abstain from consenting or respond “OBJECT” to the Proposal.

Q: When does the Company expect the proposed amendment and restatement of the LLC Agreement to be effective?

A: Assuming the Unitholder Approval is received, the proposed amendment and restatement of the LLC Agreement will be effective on the date such amendment and restatement is entered into by the Company, which the Company expects to occur on or shortly after the date on which the Unitholder Approval is received.

Q: When do the parties expect to complete the Merger?

A: While there can be no assurance as to the exact timing, or that the Merger will be completed at all, the Company and NEWCRED are working to complete the Merger in December 2024. It is currently expected that the Merger will be completed shortly following the receipt of the Unitholder Approval, along with the satisfaction (or, to the extent legally permissible, waiver) of the other closing conditions set forth in the Merger Agreement.

Q: Is the Merger expected to be taxable to Unitholders?

A: Yes. The receipt of the Merger Consideration in exchange for Company Units pursuant to the Merger will be a taxable transaction for U.S. federal income tax purposes.

If you are a U.S. Holder (as defined in the section entitled “Certain Material U.S. Federal Income Tax Consequences of the Merger”), you will generally recognize capital gain or loss equal to the difference, if any, between the aggregate amount of the Merger Consideration you receive in the Merger and your adjusted tax basis of your Company Units exchanged in the Merger. If you are a Non-U.S. Holder (as defined in the section entitled “Certain Material U.S. Federal Income Tax Consequences of the Transaction”), the receipt of the Merger Consideration in exchange for Company Units pursuant to the Merger will generally not be taxable to you for U.S. federal income tax purposes unless you have certain connections to the United States or the Company is or has been a USRPHC (as defined in the section entitled “Certain Material U.S. Federal Income Tax Consequences of the Transaction”) and certain other conditions are met.

You should read the section entitled “Certain Material U.S. Federal Income Tax Consequences of the Merger” for a more complete discussion of certain material U.S. federal income tax consequences of the Merger. You are also encouraged to consult your own tax advisors regarding the consequences of the Merger to you under U.S. federal, state, local and/or non-U.S. tax laws, in light of your particular circumstances.

Q: What happens if the Merger is not consummated?

A: If the Merger is not consummated as a result of the failure to obtain Unitholder approval of the LLC Agreement Amendment Proposal or the Merger Proposal or for any other reason, the Company and NEWCRED will not

consummate the Merger, and the Unitholders will not receive any payment for their Company Units in connection with the Merger. Instead, unless the Company is sooner dissolved in accordance with the LLC Agreement, the Company will remain an independent company until the Company is dissolved and its affairs are wound up in an orderly manner beginning July 15, 2026 in accordance with Section 11.2(b) of the LLC Agreement. However, unless the Company is sooner dissolved in accordance with the LLC Agreement, the Board may, in its sole discretion and in accordance with Section 1.4 of the LLC Agreement, extend the term of the Company for one (1) additional year until July 15, 2027.

In addition, the LLC Agreement would not be revised to, among other things, (i) extend the Reinvestment Investment Period or (ii) allow the Company to enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments. Thus, the Company would make distributions on the sale or repayment of its current investments rather than reinvesting such amounts into additional investment opportunities, and would not enter into financing facilities to obtain leverage for purposes of making Reinvestment Investments.

Q: Is the Merger subject to any third-party consents?

A: As more fully described in this Consent Solicitation Statement and in the Merger Agreement, the Company and NEWCRED have agreed to cooperate with each other and use reasonable best efforts to take, or cause to be taken, in good faith, all actions, and to do, or cause to be done, all things necessary, including to promptly prepare and file all necessary documentation, to effect all applications, notices, petitions and filings to obtain as promptly as practicable all permits of all governmental entities and all permits, consents, approvals, confirmations and authorizations of all third parties, in each case, that are necessary or advisable, to consummate the Transactions (including the Merger) in the most expeditious manner practicable, and to comply with the terms and conditions of all such permits, consents, approvals and authorizations of all such third parties and governmental entities. There can be no assurance that any permits, consents, approvals, confirmations or authorizations will be obtained or that such permits, consents, approvals, confirmations or authorizations will not impose conditions or requirements that, individually or in the aggregate, would or could reasonably be expected to have a material adverse effect on the financial condition, results of operations, assets or business of the combined company following the Merger.

RISK FACTORS

In addition to the other information included in this Consent Solicitation Statement, Unitholders should carefully consider the general risks of the Company described below in determining whether to approve the Proposals. The information in “Risk Factors” in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 is incorporated herein by reference for general risks related to the Company. The risks set out below are not the only risks that NEWCRED and the Company and, following the Merger, the combined company, face. Additional risks and uncertainties not currently known to NEWCRED or the Company or that they currently deem to be immaterial also may materially adversely affect their or, following the Merger, the combined company’s, business, financial condition or operating results. If any of the following events occur, NEWCRED or the Company or, following the Merger, the combined company’s, business, financial condition or results of operations could be materially adversely affected. See also the sections entitled “Incorporation by Reference for the Company” and “Where You Can Find More Information” in this Consent Solicitation Statement.

RISKS RELATING TO THE MERGER

Because the Company Per Unit NAV may fluctuate, Unitholders cannot be sure of the exact amount of the Merger Consideration they will receive until the Closing Date.

The exact amount of Merger Consideration may vary from the Company Per Unit NAV on the date the Merger was announced, on the date that this Consent Solicitation Statement was made available to Unitholders and on the date that the Merger is completed. Any change in the Company Per Unit NAV prior to completion of the Merger will affect the amount of Merger Consideration that Unitholders will receive upon completion of the Merger.

Changes in the Company Per Unit NAV may result from a variety of factors, including, among other things:

•changes in the business, operations or prospects of the Company;

•the financial condition of current or prospective portfolio companies of the Company; and

•interest rates or general market or economic conditions.

See the section entitled “Special Note Regarding Forward-Looking Statements” for other factors that could cause the Company Per Unit NAV to change.

These factors are generally beyond the control of the Company. The range of high and low Company Per Unit NAV for the period between January 1, 2023 and June 30, 2024 was a low of $8.00 to a high of $9.65. However, historical prices are not necessarily indicative of future performance.

The announcement and pendency of the Merger Agreement could negatively affect the Company Per Unit NAV and the Merger Consideration that Unitholders will receive.