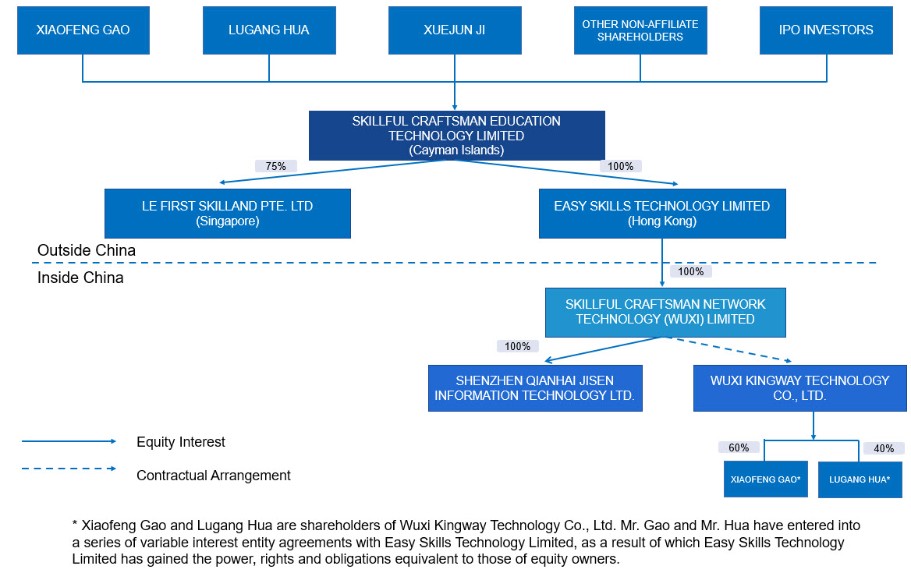

We began operations in China in 2013 and currently conduct the business through our subsidiaries and variable interest entity, Wuxi Kingway Technology Co., Ltd. In 2013, Wuxi Kingway Technology Co., Ltd., or Wuxi Wangdao, was formed under the laws of the PRC to primarily engage in the business of online education and technology services. Due to restrictions imposed by PRC law on foreign ownership of companies engaged in the online value-added telecommunications business, we do not own any equity interest in the operations of Wuxi Wangdao. Instead, Skillful Craftsman relies on a series of VIE Agreements among Craftsman Wuxi, Wuxi Wangdao and Wuxi Wangdao’s nominee shareholders to consolidate the financial results of Wuxi Wangdao in the consolidated financial statements in accordance with U.S. GAAP. Skillful Craftsman relies on dividends and other distributions paid to it by Craftsman Wuxi, the WFOE, which in turn depends on the service fees paid to the WFOE from Wuxi Wangdao pursuant to the VIE Agreements. If Wuxi Wangdao and its shareholders fail to perform their obligations under the VIE Agreements, we could be limited in our ability to enforce the VIE Agreements and lose our ability to consolidate Wuxi Wangdao’s financial results in our consolidated financial statements in accordance with U.S. GAAP. Wuxi Wangdao contributed to 100%, 97.2% and 94.0% of our consolidated revenue for the fiscal years ended March 31, 2021, 2022 and 2023, respectively. It contributed to 87% of the consolidated assets and 93% of the consolidated liabilities as of March 31, 2021, 86% of the consolidated assets and 90% of the consolidated liabilities as of March 31, 2022, 86% of the consolidated assets and 88% of the consolidated liabilities as of March 31, 2023. We do not have unfettered access to revenue of the WFOE and variable interest entity due to PRC legal restrictions on the payment of dividends by PRC companies, foreign exchange control restrictions, and the restrictions on foreign investment.

On July 27, 2020, we closed our initial public offering of 3,000,000 ordinary shares, US$0.0002 par value per share, at an offering price of $5.00 per share, for a total of $15,000,000 in gross proceeds. After deducting the total expenses, we received net proceeds of approximately US$13.36 million from our initial public offering.

On May 25, 2021, Wuxi Wangdao acquired 100% equity interest in Jisen Information, an integrated financial education and service provider in China, for a total consideration of 2,900,000 newly issued ordinary shares of our company. The transaction was unanimously approved by our board of directors and closed in June 2021. On June 10, 2022, Wuxi Wangdao transferred 100% equity interest in Jisen Information to the Craftsman Wuxi for a nominal consideration as a step of our internal re-organization.

On January 28, 2022, Wuxi Wangdao entered into an equity transfer agreement, or the Wuxi Talent Agreement to acquire 60% equity interest in Wuxi Talent Home Information Technology Co., Ltd., or Wuxi Talent Home, a flexible staffing platform, for a consideration consisting of RMB15 million (approximately US$2.37 million) in cash and 791,667 ordinary shares that are to be newly issued by Skillful Craftsman. On February 23, 2022, Craftsman Wuxi entered into a supplementary agreement with Wuxi Wangdao, Wuxi Talent Home and certain of its shareholders. Pursuant to the supplementary agreement, Craftsman Wuxi became the new transferee, replacing the Wuxi Wangdao, to acquire 60% equity interest in Wuxi Talent Home under the Wuxi Talent Agreement. The transaction has been unanimously approved by our board of directors and closed in May 2022. On July 21, 2023, Skillful Craftsman Network Technology (Wuxi) Limited (“Craftsman Wuxi”), a wholly owned subsidiary of Skillful Craftsman Education Technology Limited (the “Company”), Wuxi Talent Home Information Technology Co., Ltd. (“Talent Home”) and certain shareholders of Talent Home (the “Shareholders”) entered into an Amendment Agreement (“Amendment Agreement”) to the Equity Transfer Agreement, which was originally entered by the parties on January 28, 2022 and supplemented by a Supplementary Agreement on February 23, 2022. Pursuant to the Amendment Agreement, parties agreed that: (i) the cash transfer price that has been paid by Craftsman Wuxi shall be used as investment in Talent Home for 35% of all equity interest of Talent Home; (ii) the Shareholders will not transfer any of their equity interest of Talent Home to Craftsman Wuxi; and (iii) all the ordinary shares issued by the Company to the Shareholders as a part of the purchase price stipulated in the original Equity Transfer Agreement shall be returned to the Company for cancellation which was completed by transfer agent of the Company on July 27, 2023.

On March 8, 2022, Skillful Craftsman issued to Tadpole Investing Carnival Limited, a British Virgin Islands company, a warrant to purchase the ordinary shares of Skillful Craftsman for an aggregate exercise price of no more than $10,000,000. Subject to certain limitations that are described below in this paragraph, up until January 3, 2025, the holder may exercise the warrant at the exercise price, which will be (x) $1.80 per share for any part of the warrant that is exercised between March 8, 2022 and January 3, 2023, (y) $2.50 per share for any part of the warrant that is exercised between January 4, 2023 and January 3, 2024, and (z) $3.00 per share for any part of the warrant that is exercised between January 4, 2024 and January 3, 2025, by delivering required documents to Skillful Craftsman. Without the prior written consent of Skillful Craftsman, the holder may not exercise the warrant for more than (i) $4,000,000 up until January 3, 2023, (ii) $7,000,000 up until January 3, 2024, and (iii) $10,000,000 up until January 3, 2025. As of the date of this annual report, no exercise of warrant has occurred.