As filed with the U.S. Securities and Exchange Commission on January 2, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TIAN RUIXIANG Holdings Ltd

(Exact name of registrant as specified in its charter)

| Cayman Islands | | 6411 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

Room 918, Jingding Building, Xicheng District, Beijing, People’s Republic of China

(+86) 13910563795

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd St, 18th Floor

New York, NY 10168

(212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

Ying Li, Esq.

Lisa Forcht, Esq.

Hunter Taubman Fischer & Li LLC

48 Wall Street, Suite 1100

New York, NY 10022

(212) 530-2206

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

| If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. | x |

| | |

| If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | ¨ |

| If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | ¨ |

| | |

| If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | ¨ |

| | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. | |

| If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. | ¨ |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED JANUARY 2, 2025

11,494,445 Class A Ordinary Shares

Offered by the Selling Shareholders

TIAN RUIXIANG Holdings Ltd

This prospectus relates to the offer and resale, by the selling shareholders identified in this prospectus (the “Selling Shareholders”, each individually, the “Selling Shareholder”), of up to an aggregate of 11,494,445 Class A ordinary shares, par value $0.025 per share (the “Class A Ordinary Shares”), of TIAN RUIXIANG Holdings Ltd (the “Company”, “we,” “us” or “our”), consisting of (i) 5,400,000 Class A ordinary shares issued and up to 5,400,000 Class A Ordinary Shares issuable pursuant to the Subscription Agreements (as defined below); and (ii) 694,445 Class A Ordinary Shares issued to Yuefu Company Limited (the “Yuefu”) pursuant to a sale and purchase agreement (the “SPA”) dated February 12, 2024 between Yuefu and the Company’s subsidiary, TRX HongKong Investment Limited (“TRX HK”). The Selling Shareholders and their relationships with the Company, if any, are identified in the table commencing on page 22 of this prospectus.

On November 1, 2024, the Company entered into 20 subscription agreements (each, a “Subscription Agreement”, collectively, the “Subscription Agreements”) with 20 purchasers (each, a “Purchaser”, and collectively, the “Purchasers”), respectively.

Each Subscription Agreement provides that the respective Purchaser is entitled to the following: (i) one demand registration with respect to her purchased shares (such demand registration right will be terminated on the thirty six-month anniversary of the date of the Subscription Agreement, (ii) the right to purchase up to the same number of the Class A Ordinary Shares purchased at a per share price of $1.852, pursuant to an agreement which shall be entered into by the parties in a customary form reasonably acceptable to the parties, until the three-year anniversary of the date of the Subscription Agreement, if the market price of the Class A Ordinary Share, is not lower than $1.852 per share on the exercising date, and (iii) in the event that the Company further issues any Class A Ordinary Shares or any securities convertible into or exercisable for Class A Ordinary Shares in any subsequent financing after the date of the Subscription Agreements and before the first anniversary of the Subscription Agreements, at a price per share (the “New Issuance Price Per Share”) that is lower than the price per share paid by the Purchasers under the Subscription Agreements, the Company shall issue to each Purchaser an additional number of Class A Ordinary Shares such that the effective purchase prices per share paid by the Purchaser shall equal to the New Issuance Price Per Share.

On December 23, 2024, the Company and Xu Sheng Investors Co., Ltd entered into an amendment (the “Amendment”) to the subscription agreement between the Company and Xu Sheng Investors Co., Ltd. to amend the share numbers to be sold to Xu Sheng Investors Co., Ltd and the total purchase price thereof. The Subscription Agreements and the Amendment are collectively referred to as the Subscription Agreements.

On February 12, 2024, TRX HK, a wholly-owned subsidiary of the Company, entered into a SPA to acquire Peak Consulting Services Limited ("the Target"), a licensed insurance brokerage in Hong Kong, from Yuefu, the sole shareholder of the Target. Pursuant to the SPA, on May 7, 2024, the Company issued 694,445 Class A Ordinary Shares to Yuefu as consideration for the acquisition.

We are not selling any Class A Ordinary Shares under this prospectus and will not receive any proceeds from the sale of Class A Ordinary Shares by the Selling Shareholders.

Information regarding the Selling Shareholders, the number of Class A Ordinary Shares that may be sold by them, and the times and manner in which they may offer and sell the Class A Ordinary Shares under this prospectus is provided under the sections titled “Selling Shareholders” and “Plan of Distribution,” respectively, in this prospectus. We do not know when or in what amount the Selling Shareholders may offer the Class A Ordinary Shares for sale. The Selling Shareholders may sell any, all, or none of the Class A Ordinary Shares offered by this prospectus.

Our Class A Ordinary Shares are listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “TIRX.” On December 31, 2024, the last reported sale price of our Class A Ordinary Shares on Nasdaq was $1.71 per share.

We are a holding company incorporated in the Cayman Islands with no material operations of our own. We are not a Chinese operating company. Investors of our Class A Ordinary Shares will not own any equity interests in the VIE, but instead own shares of a Cayman Islands holding company. Unless otherwise stated, as used in this prospectus and in the context of describing our operations and consolidated financial information, “we,” “us,” “Company,” “TRX”, or “our,” refers to TIAN RUIXIANG Holdings Ltd, a Cayman Islands holding company, and “VIE” refers to the variable interest entity (“VIE”), Zhejiang Tianruixiang Insurance Broker Co. LTD., or TRX ZJ. Our operations are conducted in China by the VIE and its subsidiaries. We do not have any equity ownership of the VIE; instead, we control and receive the economic benefits of the VIE’s business operations through contractual arrangements, or “VIE Agreements” entered into among WFOE, TRX ZJ and TRX ZJ’s sole shareholder. The VIE Agreements are used to provide contractual exposure to foreign investment in China-based companies where Chinese law prohibits direct foreign investment in Chinese operating companies.

Under United States generally accepted accounting principles (“U.S. GAAP”), the Company is deemed to have a controlling financial interest in, and be the primary beneficiary of, the VIE, for accounting purposes, because such contractual arrangements are designed so that the operations of the VIE are solely for the benefit of WFOE and, ultimately, the Company. As such, the Company is deemed to be the primary beneficiary of the VIE for accounting purposes and must consolidate the VIE. The VIE Agreements have not been tested in a court of law and may not be effective in providing control over the VIE, and we are subject to risks due to the uncertainty of the interpretation and application of the laws and regulations of the PRC regarding the VIE and the VIE structure, including, but not limited to, regulatory review of overseas listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the contractual arrangements with the VIE. We are also subject to the risk that the PRC government could disallow the VIE structure, which would likely result in a material change in our operations and, as a result, the value of our Class A Ordinary Shares may depreciate significantly or become worthless. For a description of our corporate structure and VIE contractual arrangements, see “ITEM 4. INFORMATION ON THE COMPANY—C. Organizational Structure—VIE Agreements Between WFOE and TRX ZJ .” See also “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Our Corporate Structure.” in our Annual Report on Form 20-F for the fiscal year ended October 31, 2023 (the “2023 Annual Report”).

On December 13, 2024, through a search of publicly available information, the Company learned that all the equity shares of TRX ZJ owned by its sole shareholder, WDZG Consulting, had been judicially frozen since May 4, 2023, due to debts owed by WDZG Consulting to its creditors (the “Freezing”). As a result of the Freezing, any or all of the 18 creditors can start a judicial auction of the equity shares of TRX ZJ at any time, in accordance with PRC regulations and judicial procedures. If the equity shares of TRX ZJ were acquired by a third party at such judicial auctions, then the VIE agreements between the Company, WFOE and TRX ZJ would be terminated and become void, and we would lose control of TRX ZJ under the VIE Agreements. WDZG Consulting did not notify us of the Freezing, leading to a delay in the disclosure of the Freezing by us, see “Risk Factors - We have in the past, and may in the future, identify material weaknesses in our disclosure controls and procedures. If not remediated, our failure to establish and maintain effective disclosure controls and procedures could result in material misstatements and a failure to meet our reporting obligations, each of which could have a material adverse effect on our financial condition and the trading price of our securities.” on page 19 of this prospectus.

As advised by our PRC Counsel, Yuan Tai Law Office, as of the date of this prospectus, the Freezing has not impacted the business activities of TRX ZJ and the VIE Agreements remain valid. As a holding company, we do not engage in any substantive business operations and rely on the VIE Agreements for our business operations. TRX ZJ owns significant assets such as permits, domain names and IP rights, among others. If the VIE agreements are terminated and we lose control of TRX ZJ as a result of judicial enforcement proceedings, our PRC operating entities would not be able to continue the insurance brokerage operations and the value of our securities could decline substantially or become worthless, see “Risk Factors - The judicial freezing of the shares of the VIE, TRX ZJ, held by its sole shareholder, WDZG Consulting, by the Chinese judicial system, may cause us to lose control of TRX ZJ and terminate the VIE Agreements in judicial enforcement proceedings.” on page 19 of this prospectus.

We are also subject to legal and operational risks associated with being based in and having the majority of the Company’s operations in China. These risks may result in a material change in our operations, or a complete hindrance of our ability to offer or continue to offer our securities to investors, and could cause the value of such securities to significantly decline or become worthless. Recently, the PRC government initiated a series of regulatory actions and guidelines to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structures, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On July 10, 2021, the PRC State Internet Information Office issued the Measures of Cybersecurity Review (Revised Draft for Comments, not yet effective), which requires cyberspace operators with personal information of more than one million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review.

As of the date of this prospectus, these new laws and guidelines have not impacted the Company’s ability to conduct its business, accept foreign investments, or list on a U.S. or other foreign exchange; however, there are uncertainties in the interpretation and enforcement of these new laws and guidelines, which could materially and adversely impact our business and financial outlook. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Doing Business in China” and “Item 3. KEY INFORMATION—D. Risk Factors—Risks Relating to Our Class A Ordinary Shares and The Trading Market.” in the 2023 Annual Report.

Furthermore, as more stringent criteria have been imposed by the U.S. Securities and Exchange Commission (the “SEC”) and the Public Company Accounting Oversight Board (the “PCAOB”) recently, our securities may be prohibited from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable Act and related regulations, if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2022. As a result, an exchange may determine to delist our securities. The PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. Furthermore, the PCAOB’s report identified the specific registered public accounting firms which were subject to these determinations. On December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”), was signed into law, which reduces the number of consecutive non- inspection years required for triggering the prohibitions under the Holding Foreign Companies Accountable Act from three years to two. On August 26, 2022, the China Securities Regulatory Commission (the “CSRC”), the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”) governing inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB determined that it was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. Our auditor, RBSM LLP, the independent registered public accounting firm that issues the audit report included elsewhere in this prospectus, is a PCAOB-registered public accounting firm headquartered in Manhattan, New York. Our auditor is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess an auditor’s compliance with the applicable professional standards, and has been inspected by the PCAOB on a regular basis, with the last inspection in October 2023. As such, as of the date of this prospectus, our auditor is not affected by the Holding Foreign Companies Accountable Act and related regulations. However, there is a risk that our auditor cannot be inspected by the PCAOB in the future. The lack of inspection could cause trading in our securities to be prohibited under the Holding Foreign Companies Accountable Act, and, as a result, Nasdaq may determine to delist our securities, which may cause the value of our securities to decline or become worthless. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Doing Business in China—The joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our continued listing or future offerings of our securities in the U.S.” in the 2023 Annual Report.

Regulatory Developments on Overseas-listing

On July 6, 2021, the relevant PRC governmental authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. As these opinions are recently issued, official guidance and related implementation rules have not been issued yet and the interpretation of these opinions remains unclear at this stage.

On December 24, 2021, the China Securities Regulatory Commission, or the CSRC, issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Administration Provisions”), and the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Measures”), of which the public comment period ended on January 23, 2022. The Administration Provisions and Measures for overseas listings lay out specific requirements for filing documents and include unified regulation management, strengthening regulatory coordination, and cross-border regulatory cooperation. Domestic companies seeking to list abroad must carry out relevant security screening procedures if their businesses involve such supervision. Companies endangering national security are among those off-limits for overseas listings.

On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), (《境内企业境外发行证券和上市管理试行办法》), which has become effective on March 31, 2023. On the same date of the issuance of the Overseas Listings Rules, the CSRC circulated No.1 to No.5 Supporting Guidance Rules, the Notes on the Trial Measures, the Notice on Administration Arrangements for the Filing of Overseas Listings by Domestic Enterprises and the relevant CSRC Answers to Reporter Questions on the official website of CSRC, or collectively, the Guidance Rules and Notice. The Overseas Listings Rules, together with the Guidance Rules and Notice, reiterate the basic supervision principles as reflected in the Administration Provisions and Measures by providing substantially the same requirements for filings of overseas offering and listing by domestic companies.

Under the Trial Measures and the Guidance Rules and Notice, domestic companies conducting overseas securities offering and listing activities, either in direct or indirect form, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following submission of initial public offerings or listing applications. The companies that have already been listed on overseas stock exchanges or have obtained the approval from overseas supervision administrations or stock exchanges for its offering and listing before March 31, 2023 and completed their overseas offering and listing prior to September 30, 2023, such as us, shall be deemed to be existing issuers (the “Existing Issuers”). Existing Issuers are not required to complete the filing procedures for listing overseas immediately, but are required to file with the CSRC for any subsequent offerings in the same overseas market within 3 working days after the offering is completed. On November 22, 2024, we submitted initial filing documents to the CSRC in connection with the issuance of 5,400,000 Class A Ordinary Shares on November 18, 2024 pursuant to the Subscription Agreements. On December 13, 2024, we submitted filing documents to the CSRC in connection with the issuance of 694,445 Class A Ordinary Shares to Yuefu on May 14, 2024. The CSRC filing in connection with the 694,445 Class A Ordinary Shares issued to Yuefu on May 14, 2024 was late because we did not submit the filing documents to the CSRC within three business days after the issuance of the shares as required under the Trial Measure. Any failure by us to comply with such filing requirements under the Trial Measures may result in forced corrections, warnings, and fines against us and could materially hinder our ability to offer or continue to offer our securities. As of the date of this prospectus, both filings are currently under review of the CSRC and we have not been notified by the CSRC if there will be any penalties or consequences as a result of the late filing.

As of the date of this prospectus, neither we nor any of the PRC operating entities have been subject to any investigation, or received any warning, or sanction from the CSRC or other applicable government authorities related to the offering of our securities.

Cash Transfers and Dividend Distribution

Cash is transferred among our Company, our subsidiaries, and the VIE, in the following manners: (i) funds are transferred to our WFOE from our Company as needed through TRX HK, our Hong Kong subsidiary, in the form of capital contributions or shareholder loans, as the case may be; (ii) funds may be paid by the VIE to WFOE, as service fees according to the VIE Agreements; (iii) dividends or other distributions may be paid by WFOE, to our Company through TRX HK; and (iv) WFOE and the VIE lend to and borrow from each other from time to time for business operation purposes. As of the date of this prospectus, cash transfers and transfers of other assets between TRX, its subsidiaries, and the VIE, were as follows: During the year ended October 31, 2024, there was no cash or other assets transfer between TRX, its subsidiaries, and the VIE. During the year ended October 31, 2023, the VIE transferred cash of $15,000 to TRX, and TRX HK transferred cash of approximately $600 to TRX BJ, and TRX BJ transferred cash of approximately $700 to VIE. During the year ended October 31, 2022, there was no cash or other assets transfer between TRX, its subsidiaries, and the VIE. During the year ended October 31, 2021, TRX transferred cash of approximately $12,340,000, $12,492,000 and $7,635,000 to its subsidiary in Hong Kong, the VIE and the VIE’s subsidiary, respectively. As of the date of this prospectus, the VIE has not distributed any earnings or settled any amounts owed under the VIE Agreements, nor does it have any plan to distribute earnings or settle amounts owed under the VIE Agreements in the foreseeable future. As of the date of this prospectus, none of our subsidiaries or the VIE have made any dividends or distributions to our Company and our Company has not made any dividends or distributions to its shareholders. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future. If we determine to pay dividends on any of our Class A Ordinary Shares or Class B Ordinary Shares in the future, as a holding company, we will be dependent on receipt of funds from our Hong Kong subsidiary, TRX HK. TRX HK will rely on payments made from the VIE to our PRC subsidiary, WFOE, pursuant to the VIE Agreements, and the distribution of such payments to TRX HK. There are no laws or regulations that restrict us from providing funding to or receiving dividends from our Hong Kong subsidiary, except for the transfer of funds involving money laundering and criminal activities. To the extent cash in the business is in the PRC, the funds may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the ability of our Company, our subsidiaries, or the VIE by the PRC government to transfer cash. See “Item 3. KEY INFORMATION—D. Risk Factors—Risks Relating to Our Corporate Structure.” in the 2023 Annual Report. The Company’s management is directly supervising cash management. Our finance department is responsible for establishing the cash management policies and procedures among our subsidiaries and departments and the PRC operating entities. Each subsidiary, department, or PRC operating entity initiates a cash request by putting forward a cash demand plan, which explains the specific amount and timing of cash requested, and submitting it to designated management members of the Company, based on the amount and the use of cash requested. The designated management member examines and approves the allocation of cash based on the sources of cash and the priorities of the needs, and submit it to the cashier specialists of our finance department for a second review. Other than the above, we currently do not have other cash management policies or procedures that dictate how funds are transferred.

Current PRC regulations permit WFOE to pay dividends to TRX HK only out of its accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. Cash dividends, if any, on our Class A Ordinary Shares would be paid in U.S. dollars. The PRC government also imposes control on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from SAFE in the PRC as long as certain procedural requirements are met. Approval from appropriate government authorities is required if RMB is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders. Furthermore, if our PRC entities incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. Due to the above restrictions, if we are unable to receive payments from our PRC operating entities, we will not be able to pay dividends to our investors, should we desire to do so in the future. For further details, see “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Doing Business in China—Government control in currency conversion may adversely affect our financial condition, our ability to remit dividends, and the value of your investment”, and “Item 3. KEY INFORMATION—D. Risk Factors—Risks Related to Doing Business in China—PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from making loans or additional capital contributions to our PRC subsidiary and VIE, which could materially and adversely affect our liquidity and our ability to fund and expand our business.” in the 2023 Annual Report. In contrast, there is presently no foreign exchange control or restrictions on capital flows into and out of Hong Kong. Hence, our Hong Kong subsidiary is able to transfer cash without any limitation to our Cayman Islands holding company under normal circumstances. Cash proceeds raised from overseas financing activities, including the cash proceeds from our public offerings, may be transferred by us through TRX HK to WFOE via capital contribution and loans subject to applicable regulatory approvals, as the case may be. WFOE then may transfer funds to the VIE to meet the capital needs of its business operations.

Permissions Required from PRC Authorities

As advised by our PRC counsel, Yuan Tai Law Offices, as of the date of this prospectus, other than the CSRC filings that were initiated by us and are under review of the CSRC, our Company, our subsidiaries, and the VIE and its subsidiaries, (i) are not required to obtain additional permissions or approvals to operate their current business, (ii) are not required to obtain permission from the CSRC, the CAC, or any other Chinese authorities to issue our securities to foreign investors based on PRC laws and regulations currently in effect, and (iii) have not received or were denied such permission by any Chinese authorities. However, we cannot assure you that the PRC regulatory agencies, including the CAC or the CSRC, would take the same view as we do, and there is no assurance that the VIE and its subsidiaries are always able to successfully update or renew the licenses or permits required in a timely manner or that these licenses or permits are sufficient to conduct all of their present or future business. If the VIE or any of its subsidiaries (i) does not receive or maintain required permissions or approvals, (ii) inadvertently concludes that such permissions or approvals are not required, or (iii) applicable laws, regulations, /or interpretations change and the VIE or any of its subsidiaries is required to obtain such permissions or approvals in the future, it could be subject to fines, legal sanctions, or an order to suspend their relevant services, which may materially and adversely affect our financial condition and results of operations and cause our securities to significantly decline in value or become worthless. See “ITEM 3. KEY INFORMATION—D. Risk Factors—Risks Relating to Doing Business in China— We may be adversely affected by the complexity, uncertainties and changes in PRC regulation of the insurance industry, and any lack of requisite approvals, licenses or permits applicable to our business may have a material adverse effect on our business and results of operations” and “ITEM 3. KEY INFORMATION—D. Risk Factors—Risks Relating to Doing Business in China— The Chinese government may exert more oversight and control over overseas public offerings conducted by China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors and could cause the value of our securities to significantly decline or become worthless.” in the 2023 Annual Report.

We are an “emerging growth company” and a “foreign private issuer”, each as defined under federal securities laws, as amended, and, as such, will be subject to reduced public company reporting requirements.

Investing in our Class A Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 19 of this prospectus to read about factors you should consider before buying our Class A Ordinary Shares.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 2, 2025.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 that we filed with the U.S. Securities and Exchange Commission (the “SEC”). As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website described below under the heading “Where You Can Find More Information.”

You should rely only on the information that is contained in this prospectus or that is incorporated by reference into this prospectus. We have not authorized anyone to provide you with information that is in addition to or different from what is contained in, or incorporated by reference into, this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it.

We are not offering to sell or solicit any securities other than the Class A Ordinary Shares offered by this prospectus. In addition, we are not offering to sell or solicit any securities to or from any person in any jurisdiction where it is unlawful to make this offer to or solicit an offer from a person in that jurisdiction. The information contained in this prospectus is accurate as of the date on the front of this prospectus only, regardless of the time of delivery of this prospectus or of any sale of our Class A Ordinary Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated herein by reference as exhibits to the registration statement, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

Our financial statements are prepared and presented in accordance with U.S. GAAP. Our historical results do not necessarily indicate our expected results for any future periods.

We have not taken any action to permit a public offering of the securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the securities and the distribution of this prospectus outside of the United States.

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| | · | “Affiliated Entities” are to our subsidiaries and TRX ZJ and its subsidiaries and branch offices; |

| | · | “China” or the “PRC” are to the People’s Republic of China, including Taiwan and the special administrative regions of Hong Kong and Macau for the purposes of this prospectus only; |

| | · | “Class A Ordinary Shares” are to our Class A ordinary shares, par value $0.025 per share; |

| | · | “Class B Ordinary Shares” are to our Class B ordinary shares, par value $0.025 per share; |

| | · | “Hengbang Insurance” are to Hebei Hengbang Insurance Co. LTD, a limited liability company organized under the laws of the PRC and 99.80% of its equity interest is owned by TRX ZJ; |

| | · | “shares”, “Shares” or “Ordinary Shares” are to our Class A Ordinary Shares and Class B Ordinary Shares, collectively; |

| | · | “TRX BJ” or “WFOE” are to Guangzhou Tianruixiang Management Consulting Co. Ltd., formerly known as Beijing Tianruixiang Management Consulting Co., Ltd., a limited liability company organized under the laws of the PRC, which is wholly-owned by TRX HK; |

| | · | “TRX HK” are to the Company’s wholly owned subsidiary, TRX HONGKONG INVESTMENT LIMITED, a Hong Kong corporation; |

| | · | “TRX SX Branch”, “TRX SD Branch”, “TRX HN Branch”, “TRX BJ Branch”, “TRX Shanxi Branch”, “TRX CQ Branch”, or “TRX HB Branch” are to TRX ZJ’s respective branch offices in the PRC; |

| | · | “TRX ZJ” are to Zhejiang Tianruixiang Insurance Broker Co. LTD., a limited liability company organized under the laws of the PRC, which we control via a series of contractual arrangements between WFOE and TRX ZJ; |

| | · | “TYDW Technology” are to Tianyi Duowen (Beijing) Network Technology Co. LTD, a wholly-owned subsidiary of TRX ZJ organized under the laws of the PRC; |

| | · | “U.S. GAAP” are to generally accepted accounting principles in the United States; |

| | · | “VIE” are to a variable interest entity; |

| | · | “WDZG Consulting” are to Beijing Wandezhonggui Management Consulting Co., Ltd., a limited liability company organized under the laws of the PRC, the sole shareholder of TRX ZJ; |

| | · | “we”, “us”, “TRX”, the “Company” or the “Group” are to TIAN RUIXIANG Holdings Ltd, an exempted company limited by shares incorporated under the laws of the Cayman Islands. |

PROSPECTUS SUMMARY

The summary highlights, and should be read in conjunction with, the more detailed information contained elsewhere in this prospectus and the documents incorporated therein by reference. You should read carefully the entire documents, including our financial statements and related notes, to understand our business, the Class A Ordinary Shares, and the other considerations that are important to your decision to invest in our securities. You should pay special attention to the “Risk Factors” section of this prospectus.

Our Company

We are a holding company incorporated in the Cayman Islands with no material operations of our own. We are not a Chinese operating company. Investors of our Class A Ordinary Shares will not own any equity interests in the VIE, but instead own shares of a Cayman Islands holding company. Unless otherwise stated, as used in this prospecuts and in the context of describing our operations and consolidated financial information, “we,” “us,” “Company,” “TRX”, or “our,” refers to TIAN RUIXIANG Holdings Ltd, a Cayman Islands exempted company limited by shares, and “VIE” refers to the variable interest entity (“VIE”), Zhejiang Tianruixiang 7Insurance Broker Co. LTD., or TRX ZJ. Our operations are conducted in China by the VIE and its subsidiaries. We do not have any equity ownership of the VIE, instead, we control and receive the economic benefits of the VIE’s business operations through contractual arrangements, or “VIE Agreements” entered into among WFOE, TRX ZJ and TRX ZJ’s sole shareholder. The VIE Agreements are used to provide contractual exposure to foreign investment in China-based companies where Chinese law prohibits direct foreign investment in Chinese operating companies.

Under United States generally accepted accounting principles (“U.S. GAAP”), the Company is deemed to have a controlling financial interest in, and be the primary beneficiary of, the VIE, for accounting purposes, because such contractual arrangements are designed so that the operations of the VIE are solely for the benefit of WFOE and, ultimately, the Company. As such, the Company is deemed to be the primary beneficiary of the VIE for accounting purposes and must consolidate the VIE. The VIE Agreements have not been tested in a court of law and may not be effective in providing control over the VIE, and we are subject to risks due to the uncertainty of the interpretation and application of the laws and regulations of the PRC, regarding the VIE, and the VIE structure, including, but not limited to, regulatory review of overseas listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the contractual arrangements with the VIE. We are also subject to the risk that the PRC government could disallow the VIE structure, which would likely result in a material change in our operations and, as a result, the value of our Class A Ordinary Shares may depreciate significantly or become worthless. The shares of TRX ZJ held by its sole shareholder have been frozen by the court, if these shares disposed by judicial enforcement in the future, we may not control the VIE and its subsidiaries and lose the economic benefits of the VIE’s business operations. For a description of our corporate structure and VIE contractual arrangements, see “ITEM 4. INFORMATION ON THE COMPANY—C. Organizational Structure— VIE Agreements Between WFOE and TRX ZJ .” See also “Item 3. KEY INFORMATION—D. Risk Factors— Risks Related to Our Corporate Structure.” in the 2023 Annual Report.

The VIE, TRX ZJ, and its subsidiaries, distribute a wide range of insurance products, which are categorized into two major groups: (1) property and casualty insurance, such as commercial property insurance, liability insurance, accidental insurance, and automobile insurance; and (2) other types of insurance, such as health insurance, life insurance, and miscellaneous insurance. We act on behalf of our customers seeking insurance coverage from insurance companies and take pride in our premium customer service. Previously, our China-based operating entities provided risk management services to institutional customers based on in-depth analysis of the specific risks our clients faced and generated a small amount of revenue from such risk management services in the years ended October 31, 2022 and 2021. Beginning in November 2022, we discontinued the risk management services because of the diminished demand for this service.

As an insurance broker, TRX ZJ does not assume underwriting risks. Instead, it distributes insurance products underwritten by insurance companies operating in China to individual or institutional customers. TRX ZJ is compensated for its services by commissions paid by insurance companies, typically based on a percentage of the premium paid by the insured. Commission and fee rates generally depend on the type of insurance products, the particular insurance company and the region in which the products are sold. As of the date of this prospectus, TRX ZJ has relationships with over 25 insurance companies in the PRC, and therefore are able to offer a variety of insurance products to our customers.

Products and Services

TRX ZJ markets and sells two broad categories of insurance products: (1) property and casualty insurance products, and (2) other insurance products, both focused on meeting the insurance needs of institutions and individuals.

Property and Casualty Insurance Products

TRX ZJ’s main property and casualty insurance products are commercial property insurance, liability insurance, and accidental insurance. In addition, it also offers automobile insurance products. Commissions from property and casualty insurance products accounted for 92.6%, 85.8%, 97.0% and 98.0% of the total commissions for the fiscal years ended on October 31, 2023, 2022, 2021, and the six months ended April 30, 2024, respectively. The property and casualty insurance products TRX ZJ distributes, which are primarily underwritten by China Ping An Property Insurance Co., LTD. Hangzhou center branch company, China United Property Insurance Co., LTD. Hangzhou branch, Ltd., Huanong Property Insurance Co., LTD and Taiping Technology Insurance Co., LTD. Zhejiang branch, China Ping An Property Insurance shares limited or Shenyang center branch company, can be further classified into the following categories:

| | · | Automobile Insurance. TRX ZJ distributes both mandatory automobile insurance policies, which are required by law, and supplemental policies, which are optional. Mandatory policies were one of the main automobile insurance products in the year ended October 31, 2023, which accounted for 0.0%, 2.7%, 1.5% and 0.0% of commissions we generated for the fiscal years ended on October 31, 2023, 2022, 2021 and the six months ended April 30, 2024, respectively. Commission from supplemental policies accounted for 0.5%, 7.4%, 14.8% and 1.2% of commissions we generated for the fiscal years ended on October 31, 2023, 2022, 2021, and the six months ended April 30, 2024, respectively. The standard automobile insurance policies TRX ZJ sells generally have a term of one year and cover damages caused to the insured vehicle by collision and other traffic accidents, falling or flying objects, fire, explosion and natural disasters. TRX ZJ also sells standard third party liability insurance policies, which cover bodily injury and property damage caused by an accident involving an insured vehicle to a person not in the insured vehicle. Our customers are mainly buyers for institutional group insurance as well as some individuals. |

| | · | Accidental Insurance. The accidental insurance products TRX ZJ distributes generally provide a guaranteed benefit in the event of death or disability of the insured as a result of an accident, or a reimbursement of medical expenses to the insured in connection with an accident, during the coverage period, which usually is one year or shorter. These products typically require only a single premium payment for each coverage period. The COVID-19 pandemic has caused an increase in the demand for accidental insurance, which has become one of our top insurance products and accounted for 1.6%, 19.3%, 13.3% and 1.3% of the total commissions for the fiscal years ended on October 31, 2023, 2022, 2021, and the six months ended April 30, 2024, respectively. |

| | · | Commercial Property Insurance. The commercial property insurance products TRX ZJ distributes include basic, comprehensive and all risk policies. Basic commercial property insurance policies generally cover damage to the insured property caused by fire, explosion and thunder and lightning. Comprehensive commercial property insurance policies generally cover damage to the insured property caused by fire, explosion and certain natural disasters. Our customers with commercial property insurance include more than 180 institutions, ranging from small start-ups to established major corporations, such as Ningxia Youli Auto sales Co., Ltd., Hainan Longcheng New Energy Development Co., Ltd and etc. Commercial property insurance accounted for 12.1%, 28.9%, 8.0% and 27.4% of commissions we generated for the fiscal years ended on October 31, 2023, 2022, 2021, and the six months ended April 30, 2024, respectively. |

| | · | Liability Insurance. The liability insurance products TRX ZJ distributes are primarily product liability and employer’s liability insurance products, and guarantee insurance products. Liability insurance products generally cover losses to third parties due to the misconduct or negligence of the insured party but exclude losses due to fraud or the willful misconduct of the insured party. Liability insurance is one of our top insurance products and accounted for 78.4%, 27.5%, 59.4%, and 68.1% of our total commissions in fiscal years 2023, 2022, 2021, and the six months ended April 30, 2024, respectively. |

Life Insurance Products

Life insurance is a major component of China’s insurance market. According to the NFRA, life insurance accounted for 26.97% of the insurance market in terms of premium income in 2023. TRX ZJ began offering life insurance products in December 2016 with a focus on individual life products with periodic payment schedules. In fiscal years 2023, 2022, 2021, and six months ended April 30, 2024, commissions generated from life insurance products accounted for 0.1%, 1.5%, 2.6% and 0.1%, respectively, of the total commissions. The life insurance products we distribute can be broadly classified into various categories, as set forth below. Due to constant product innovation by insurance companies, some of the insurance products we distribute combine features of one or more of the following categories:

| | · | Individual Whole Life Insurance. The individual whole life insurance products provide insurance for the insured person’s entire life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from five to 30 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated interests, is paid upon the death of the insured. |

| | · | Individual Term Life Insurance. The individual term life insurance products provide insurance for the insured for a specified time period or until the attainment of a certain age, in return for the periodic payment of fixed premiums over a pre-determined period, generally ranging from five to 20 years. Term life insurance policies generally expire without value if the insured survives the coverage period. |

| | · | Group Life Insurance. TRX ZJ distributes several group life insurance products, including group health insurance. These group products generally have a policy period of one year and require a single premium payment. |

| | · | Individual Endowment Life Insurance. The individual endowment products generally provide maturity benefits if the insured reaches specified age, and provide, to a beneficiary designated by the insured, guaranteed benefits upon the death of the insured within the coverage period. |

Health Insurance Products

According to the NFRA, health insurance accounted for 8.82% of the insurance market in terms of premium income in 2023. TRX ZJ began offering health insurance products in 2017 with a focus on pension and supplementary health care. In fiscal year 2023, 2022, and 2021, and six months ended April 30, 2024, commissions generated from health insurance products accounted for, 4.0%, 1.9%, 0.1%, and 1.9%, respectively, of the total commissions. The health insurance products we distribute have a policy period of one year and require a single premium payment.

Institutional Risk Management Services

Beginning in December 2018, TRX ZJ started to provide risk management services to institutional customers. Based on risk characteristics of our institutional customers, we conducted an in-depth analysis of the risks that may exist in the operation of each of such institutional customers, which we use as the basis to develop a specific risk management and transfer plan for each institutional customer. For fiscal year 2022 and 2021, TRX ZJ provided institutional management to 1 and 3 institutional customers, respectively, and generated revenue of $27,254 and $115,006, respectively, which accounted for 2.0% and 4.1% of the total revenue, respectively. Beginning in November 2022, TRX ZJ discontinued the institutional risk management services due to diminished demand for this service.

Needbao: Online Insurance Center

In December 2016, TRX ZJ officially established its online insurance division by creating a wholly-owned-subsidiary, NDB Technology, which also provides information management and technical development for our insurance brokerage business. NDB Technology helped launch an online insurance center, Needbao.

In June 2019, TRX ZJ started offering a limited number of insurance products on Needbao, and generated total premium in the amount of RMB 128,639 (approximately $20,000) in fiscal year 2021. However, due to the negative impact of the COVID-19 pandemic, especially the large-scale lock-downs in China in fiscal year 2022, TRX ZJ was not able to effectively promote Needbao, and the management made the decision to stop offering insurance products on Needbao. As such, the Company impaired the intangible assets and recognized an impairment loss in the amount of $123,646.

Distribution Network and Marketing

TRX ZJ has built a distribution network that, as of December 1, 2024, consisted of 155 sales professionals, and seven branch offices in seven Chinese major cities/districts: Chongqing municipality, Taiyuan city of Shanxi province, Wuhan city of Hubei province, Changsha city of Hunan province, Xi ’an of Shaanxi province, Qingdao city of Shandong province, and Beijing municipality.

TRX ZJ uses three main approaches to market and promote products and services.

The main function of the local branches is to distribute insurance products in local markets, relying on the sales professionals in the seven branches as of the date of the prospectus. To expand distributing network, in February 2018, TRX ZJ increased its registered capital to 50 million RMB, meeting the regulatory requirements for setting up local branches across the country. Since then, TRX ZJ has opened seven new branches.

TRX ZJ places targeted online advertisements on our promotional partners’ Internet platforms to promote products and services to potential customers. Our partners are strategically selected based on their industries and propensity of generating insurance customers. As of the date of this prospectus, TRX ZJ cooperate with Zhoukou Baiyao Information Technology Co., LTDHangzhou Chengqing Hexuan Technology Co., LTD, Hangzhou Rongwang Lihe Technology Co., LTD, and also works with industry associations and financial institutions to place advertisements on their online platforms, in order to acquire more institutional customers.

| | · | Cross-industry Cooperation |

TRX ZJ collaborates with non-insurance-service companies to acquire new customers for insurance products. The cross-industry promotional partners are in various lines of businesses, including financial services, media, and car manufacturing and sales, etc. Through the business activities of these companies, TRX ZJ generates sales leads for insurance products. For example, the main customers of the commercial property and liability insurance are institutions, and TRX ZJ markets these products by participating in cultural and community events organized by media companies, providing opportunities to meet potential customers. TRX ZJ also uses other channels such as sponsoring salons and conferences organized by professional and business organizations to introduce insurance products to institutional customers.

Our Corporate Structure

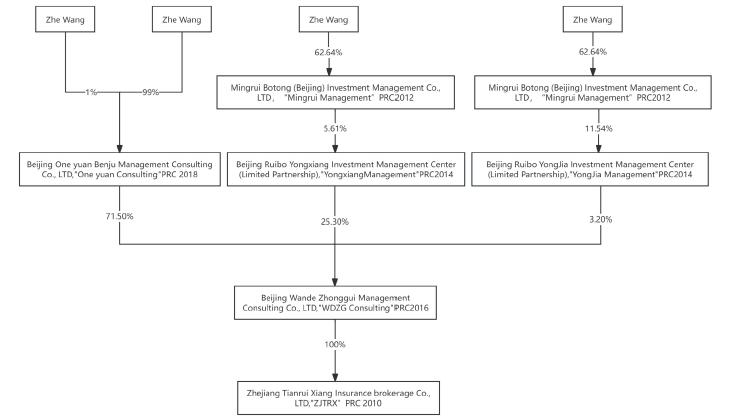

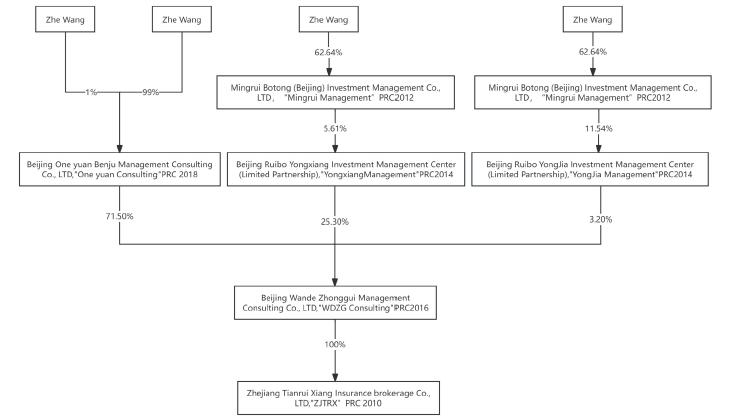

The following diagram illustrates our current corporate structure, which includes our significant subsidiaries as of the date of this prospectus:

VIE Agreements Between WFOE and TRX ZJ

Neither we nor our subsidiaries own any equity interest in TRX ZJ. Instead, we control and receive the economic benefits of TRX ZJ’s business operation through a series of contractual arrangements. WFOE, TRX ZJ, and TRX ZJ’s sole shareholder, WDZG Consulting (the “TRX ZJ Shareholder”), entered into a series of contractual arrangements, also known as the VIE Agreements, on May 20, 2019. The VIE Agreements are designed to provide WFOE with the power, rights and obligations equivalent in all material respects to those it would possess as the sole equity holder of TRX ZJ, including absolute control rights and the rights to the assets, property and revenue of TRX ZJ.

The sole direct shareholder of TRX ZJ is WDZG Consulting, which is controlled by Beijing One Yuan Benju Management Consulting Co., Ltd. (“One Yuan”). Baohai Xu, who is the father of our CEO, Sheng Xu, owns 99% equity shares of One Yuan. The following diagram illustrates the shareholding structure of TRX ZJ.

According to the Exclusive Business Cooperation and Service Agreement, TRX ZJ is obligated to pay service fees to WFOE in an amount approximately equal to the net income of TRX ZJ after deduction of the required PRC statutory reserve.

Each of the VIE Agreements is described in detail below:

Exclusive Business Cooperation and Service Agreement

Pursuant to the Exclusive Business Cooperation and Service Agreement between TRX ZJ, WFOE and the TRX ZJ Shareholder, WFOE provides TRX ZJ with technical support, consulting services, intellectual services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, TRX ZJ granted an irrevocable and exclusive option to WFOE to purchase from TRX ZJ, any or all of its assets at the lowest purchase price permitted under PRC laws. Should WFOE exercise such option, the parties shall enter into a separate asset transfer or similar agreement. For services rendered to TRX ZJ by WFOE under this agreement, WFOE is entitled to collect a service fee calculated based on the time of services rendered multiplied by the corresponding rate, the plus amount of the services fees or ratio decided by the board of directors of WFOE based on the value of services rendered by WFOE and the actual income of TRX ZJ from time to time, which is approximately equal to the net income of TRX ZJ after deduction of the required PRC statutory reserve.

The Exclusive Business Cooperation and Service Agreement shall remain in effect for twenty years, and can only be terminated earlier if one of the parties defaults or enters into liquidation process (either voluntary or compulsory), or is prohibited to conduct business by the governmental authority liquidated. WFOE is entitled to renew the agreement by providing a written notice to TRX ZJ.

The CEO of WFOE, Mr. Wang, who is also the CEO of TRX ZJ, is currently managing TRX ZJ pursuant to the terms of the Exclusive Business Cooperation and Service Agreement. WFOE has absolute authority relating to the management of TRX ZJ, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. The Company’s audit committee is required to review and approve in advance any related party transactions, including transactions involving WFOE or TRX ZJ.

Equity Interest Pledge Agreement

Under the Equity Interest Pledge Agreement between WFOE, TRX ZJ and the TRX ZJ Shareholder, the TRX ZJ Shareholder pledged all of its equity interests in TRX ZJ to WFOE to guarantee the performance of TRX ZJ’s obligations under the Exclusive Business Cooperation and Service Agreement. Under the terms of the Equity Pledge Agreement, in the event that TRX ZJ or the TRX ZJ Shareholder breach their respective contractual obligations under the Exclusive Business Cooperation and Service Agreement, WFOE, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends generated by the pledged equity interests. The TRX ZJ Shareholder also agreed that upon occurrence of any event of default, as set forth in the Equity Pledge Agreement, WFOE is entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. The TRX ZJ Shareholder further agreed not to dispose of the pledged equity interests or take any actions that would prejudice WFOE’s interest.

The Equity Interest Pledge Agreement is effective until all payments due under the Exclusive Business Cooperation and Service Agreement have been paid by TRX ZJ. WFOE shall cancel or terminate the Equity Interest Pledge Agreement upon TRX ZJ’s full payment of the fees payable under the Exclusive Business Cooperation and Service Agreement.

The purposes of the Equity Interest Pledge Agreement are to (1) guarantee the performance of TRX ZJ’s obligations under the Exclusive Business Cooperation and Service Agreement, (2) make sure the TRX ZJ Shareholder does not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice WFOE’s interests without WFOE’s prior written consent, and (3) provide WFOE control over TRX ZJ. In the event TRX ZJ breaches its contractual obligations under the Exclusive Business Cooperation and Service Agreement, WFOE will be entitled to foreclose on the TRX ZJ Shareholder’ equity interests in TRX ZJ and may (1) exercise its option to purchase or designate third parties to purchase part or all of their equity interests in TRX ZJ and WFOE may terminate the VIE Agreements after acquisition of all equity interests in TRX ZJ or form a new VIE structure with the third parties designated by WFOE; or (2) dispose of the pledged equity interests and be paid in priority out of proceed from the disposal in which case the VIE structure will be terminated.

Share Disposal and Exclusive Option to Purchase Agreement

Under the Share Disposal And Exclusive Option to Purchase Agreement, the TRX ZJ Shareholder irrevocably granted WFOE (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of its equity interests in TRX ZJ. The option price is equal to the capital paid in by the TRX ZJ Shareholder subject to any appraisal or restrictions required by applicable PRC laws and regulations. As of the date of this prospectus, if WFOE exercised such option, the total option price that would be paid to all of the TRX ZJ Shareholder would be RMB 1, or the lowest amount allowed by law. The option purchase price shall increase in case the TRX ZJ Shareholder makes additional capital contributions to TRX ZJ, including when the registered capital was increased upon TRX ZJ receiving the proceeds from public offerings.

Under the Share Disposal and Exclusive Option to Purchase Agreement, WFOE may at any time under any circumstances, purchase, or have its designee purchase, at its discretion, to the extent permitted under PRC law, all or part of the TRX ZJ Shareholder’ equity interests in TRX ZJ. The Share Disposal and Exclusive Option to Purchase Agreement, together with the Equity Pledge Agreement, Exclusive Business Cooperation and Service Agreement, and the Proxy Agreement, enable WFOE to exercise effective control over TRX ZJ.

The Share Disposal and Exclusive Option to Purchase Agreement remains effective for a term of 20 years, can only be terminated if one party defaults, and may be renewed at WFOE’s election.

Proxy Agreement

Under the Proxy Agreement, the TRX ZJ Shareholder authorized WFOE to act on its behalf as its exclusive agent and attorney with respect to all rights as shareholder, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under PRC laws and the articles of association of TRX ZJ, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of TRX ZJ.

The term of the Proxy Agreement is the same as the term of the Share Disposal and Exclusive Option to Purchase Agreement. The Proxy Agreement is irrevocable and continuously valid from the date of execution of the Proxy Agreement, so long as the TRX ZJ Shareholder is the shareholder of Company.

Corporate Information

Our principal executive office is located at Room 918, Jingding Building, Xicheng District, Beijing, The People’s Republic of China, and our phone number is +86 13910563795 and our fax number is (010) 83050570. Our registered office in the Cayman Islands is at Harneys Fiduciary (Cayman) Limited, 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman KY1-1002, Cayman Islands. Our legal name is TIAN RUIXIANG Holdings Ltd, and we operate our business under the commercial name “TRX Insurance Brokers”, which is included in our logo.

Summary of Risk Factors

Investing in our securities involves significant risks. You should carefully consider all of the information and the risks and uncertainties summarized below, the risks described under “Item 3. Key Information—D. Risk Factors” that appears in the 2023 Annual Report, which is incorporated by reference herein, the “Risk Factors” section beginning on page 19 of this prospectus, and the risk factors contained in any applicable prospectus supplement or in the other documents that are filed after the date hereof and incorporated by reference in this prospectus before making an investment in our securities. Below is a summary of the principal risks and uncertainties we face, organized under relevant headings. These risks are discussed more fully in the section titled “Risk Factors” in this prospectus and “Item 3. Key Information—D. Risk Factors” that appears in the 2023 Annual Report, which is incorporated by reference herein.

For More detailed discussions of the following risk, see “Risk Factors” on page 19 of this prospectus.

| · | The sale of a substantial amount of our Class A Ordinary Shares by the Selling Shareholders in the public market could adversely affect the prevailing market price of our Class A Ordinary Shares. |

| | · | We have in the past, and may in the future, identify material weaknesses in our disclosure controls and procedures. If not remediated, our failure to establish and maintain effective disclosure controls and procedures could result in material misstatements and a failure to meet our reporting obligations, each of which could have a material adverse effect on our financial condition and the trading price of our securities. |

| | | |

| | · | The judicial freezing of the shares of the VIE, TRX ZJ, held by its sole shareholder, WDZG Consulting, by the Chinese judicial system, may cause us to lose control of TRX ZJ and terminate the VIE Agreements in judicial enforcement proceedings. |

Risks Related to our Business and Industry

For more detailed discussions of the following risks, see “Risk Factors—Risks Related to our Business and Industry” on pages 14 through 18 of the 2023 Annual Report.

| · | Our limited operating history and our limited experience in distributing insurance products, may not provide an adequate basis to judge our future prospects and results of operations. |

| · | We are subject to all the risks and uncertainties in an industry which is still in development in China. |

| · | Because the commission revenue we earn on the sale of insurance products is based on premiums and commissions and fee rates set by insurance companies, any decrease in these premiums, commission or fee rates may have an adverse effect on our results of operation. |

| · | Competition in our industry is intense and, if we are unable to compete effectively, we may lose customers and our financial results may be negatively affected. |

| | · | Quarterly and annual variations in our commission and fee revenue may have unexpected impacts on our results of operations. |

| · | If our contracts with insurance companies are terminated or changed, our business and operating results could be adversely affected. |

| · | If our largest insurance company partners terminate or change the material terms of their contracts with us, it would be difficult for us to replace the lost commissions, which could adversely affect our business and operating results. |

| · | We may not be successful in implementing important new strategic initiatives, which may have an adverse impact on our business and financial results. |

| | · | The investment in our online platform has not been successful, and our growth, business prospects and results of operations may be materially and adversely affected. |

| | · | Any significant failure in our information technology systems could have a material adverse effect on our business and profitability. |

| | · | Our future success depends on the continuing efforts of our senior management team and other key personnel, and our business may be harmed if we lose their services. |

| | · | We do not currently have business insurance to cover our main assets and business. Any uninsured occurrence of business disruption, litigation or natural disaster could expose us to significant costs, which could have an adverse effect on our results of operations. |

| | · | Because our industry is highly regulated, any material changes in the regulatory environment could change the competitive landscape of our industry or require us to change the way we do business. The administration, interpretation and enforcement of the laws and regulations currently applicable to us could change rapidly. If we fail to comply with applicable laws and regulations, we may be subject to civil and criminal penalties or lose the ability to conduct business with our clients, which could materially and adversely affect our business and results of operations. |

| | · | Our business could be negatively impacted if we are unable to adapt our services to regulatory changes in China. |

| | · | Agent and employee misconduct is difficult to detect and deter and could harm our reputation or lead to regulatory sanctions or litigation costs. |

Risks Related to Our Corporate Structure

For more detailed discussions of the following risks, see “Risk Factors—Risks Related to our Corporate Structure” on pages 18 through 23 of the 2023 Annual Report.

| · | Because we conduct our brokerage business through TRX ZJ, a VIE entity, if the PRC government finds that the VIE Agreements that establish the structure for operating our businesses in China do not comply with PRC regulations relating to the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties and our Class A Ordinary Shares may decline in value or become worthless if we are unable to assert our contractual control rights over the assets of our PRC operating entities that conduct all of our operations. |

| · | We rely on the VIE Agreements with TRX ZJ, a VIE entity, and its shareholder for our China operations, which may not be as effective in providing operational control as direct ownership. |

| · | If any of our affiliated entities becomes the subject of a bankruptcy or liquidation proceeding, we may lose the ability to use and enjoy assets held by such entity, which could materially and adversely affect our business, financial condition and results of operations. |

| · | Our shareholders are subject to greater uncertainties because we operate through a VIE structure even though the Insurance Brokerage Industry falls within the permitted category in accordance with the Catalogue and the Negative List. |

| · | The VIE Agreements may be subject to scrutiny by the PRC tax authorities and they may determine that we or the VIE owes additional taxes, which could negatively affect our financial condition and the value of your investment. |

| · | Any failure by the VIE or its shareholder to perform their obligations under the VIE Agreements would have a material adverse effect on our business. |

| · | Our dual class share structure concentrates a high percentage of the aggregate voting power of our total issued and outstanding share capital in Ms. Mufang Gao, who is the director and the controlling shareholder of Unitrust Holdings Limited, which owns all of our Class B Ordinary Shares. |

| | · | The shareholder of the VIE may have actual or potential conflicts of interest with us, which may materially and adversely affect our business and financial condition. |

| | · | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from making loans or additional capital contributions to our PRC subsidiary and VIE, which could materially and adversely affect our liquidity and our ability to fund and expand our business. |

| · | Because we are a Cayman Island company and all of our business is conducted in the PRC, you may be unable to bring an action against us or our officers and directors or to enforce any judgment you may obtain, and the U.S. regulatory bodies may be limited in their ability to conduct investigations or inspections of our operations in China. |

| | · | We have identified several control deficiencies in our internal control over financial reporting. If we fail to maintain an effective system of internal controls over financial reporting, we may not be able to accurately report our financial results or prevent fraud. |

| | | |

Risks Related to Doing Business in China

For more detailed discussions of the following risks, see “Risk Factors—Risks Related to Doing Business in China” on pages 24 through 37 of the 2023 Annual Report.

| · | The Chinese government exerts substantial influence over the manner in which we must conduct our business, and may intervene or influence our operations at any time, which could result in a material change in our operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors and, and cause the value of our Class A Ordinary Shares to significantly decline or be worthless. |

| · | A severe or prolonged downturn in the global or Chinese economy could materially and adversely affect our business and our financial condition. |

| · | We face risks related to health epidemics, such as the COVID-19 pandemic, which could disrupt our operations and adversely affect our business, financial condition and results of operations. |

| · | Our current corporate structure and business operations may be affected by the Foreign Investment Law. |

| · | PRC laws and regulations governing our current business operations are sometimes vague and uncertain and any changes in such laws and regulations may materially and adversely affect our business and impede our ability to continue our operations. |

| · | Government control in currency conversion may adversely affect our financial condition, our ability to remit dividends, and the value of your investment. |

| · | Because our business is conducted in RMB and the price of our Class A Ordinary Shares is quoted in United States dollars, changes in currency conversion rates may affect the value of your investments. |

| · | Under the PRC Enterprise Income Tax Law, or the EIT Law, we may be classified as a “resident enterprise” of China, which could result in unfavorable tax consequences to us and our non-PRC shareholders. |

| · | We may rely on dividends and other distributions on equity paid by our PRC subsidiary to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiary to make payments to us could have a material and adverse effect on our ability to conduct our business. |

| · | There are significant uncertainties under the EIT Law relating to the withholding tax liabilities of our PRC subsidiary, and dividends payable by our PRC subsidiary to our offshore subsidiaries may not qualify to enjoy certain treaty benefits. |

| · | If we become directly subject to the scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation. |

| · | The disclosures in our reports and other filings with the SEC and our other public pronouncements are not subject to the scrutiny of any regulatory bodies in the PRC. |

| · | The failure to comply with PRC regulations relating to mergers and acquisitions of domestic entities by offshore special purpose vehicles may subject us to severe fines or penalties and create other regulatory uncertainties regarding our corporate structure. |

| · | Increases in labor costs in the PRC may adversely affect our business and our profitability. |

| · | Failure to make adequate contributions to various employee benefits plans as required by PRC regulations may subject us to penalties. |

| · | Any failure to comply with PRC regulations regarding the registration requirements for employee stock incentive plans may subject the PRC plan participants or us to fines and other legal or administrative sanctions. |