Registration File No. 333-239395

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| • | the audited consolidated financial statements of Amryt as of and for the years ended December 31, 2019 and December 31, 2018, prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”); |

| • | the audited financial statements of Aegerion as of and for the years ended December 31, 2018 and December 31, 2017 prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”); and |

| • | the unaudited interim financial statements of Aegerion as of June 30, 2019, prepared in accordance with U.S. GAAP. |

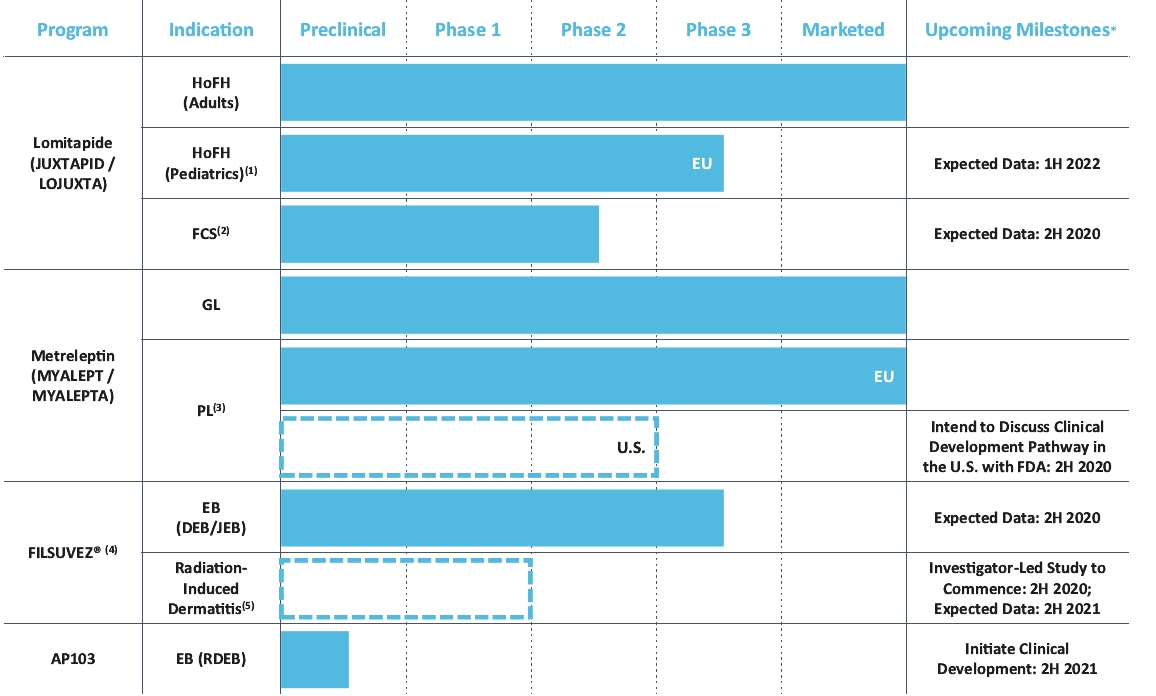

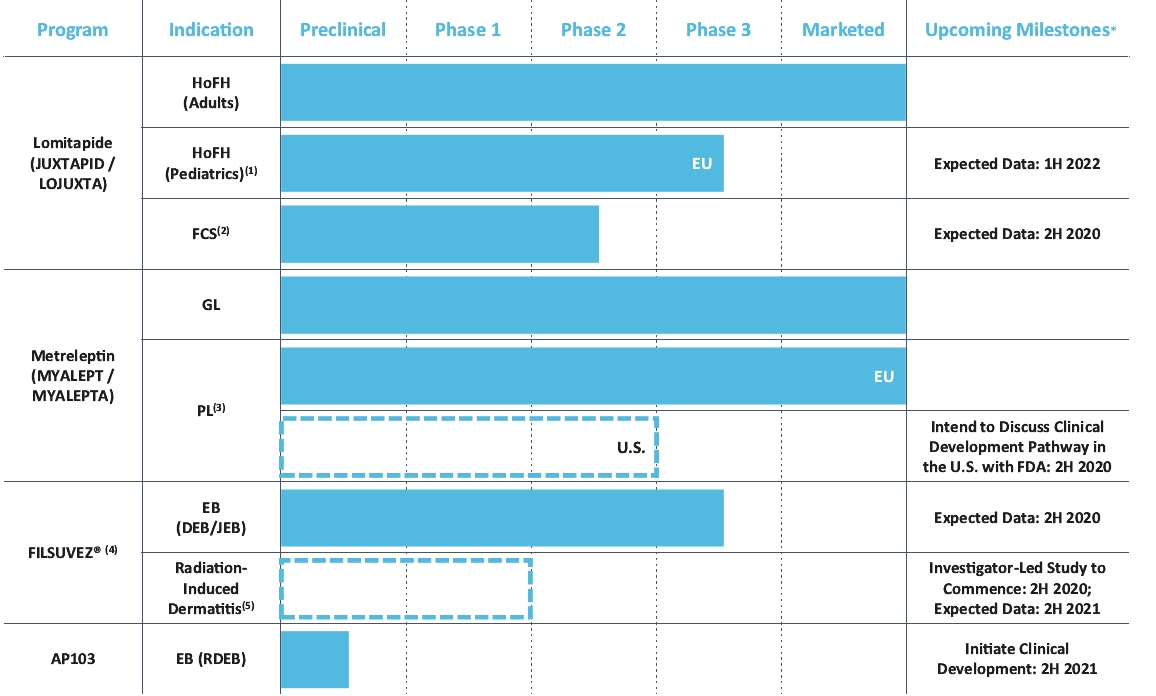

| * | Upcoming clinical milestones are subject to the impact of COVID-19 on our business. |

| (1) | We are conducting a Phase 3 study of HoFH in children and adolescents in Europe, Middle East and Africa (“EMEA”) as part of our European Medicines Agency (“EMA”) post-approval commitments. |

| (2) | The familial chylomicronemia syndrome Phase 2 trial is an open-label investigator-led study. |

| (3) | The dotted line segment indicates we have not yet commenced any clinical trials in the United States for metreleptin for the treatment of PL. |

| (4) | AP101 was approved in 2016 by the EMA for the treatment of partial thickness wounds in adults, but has not been commercially launched. |

| (5) | The dotted line segment indicates we have not yet commenced any clinical trials for radiation-induced dermatitis. This planned radiation-induced dermatitis Phase 2 trial is an investigator-led study. |

| • | Revenue-generating commercial products. We currently generate revenue, including royalties, from global sales of lomitapide and metreleptin. This revenue stream provides us with financial flexibility to fund the continued development and potential commercialization of our existing development candidates as well as the potential acquisition or in-license of additional rare disease products and late-stage product candidates. We have retained worldwide development and commercial rights to all of our programs, excluding Japan for lomitapide, where we receive royalties, and Japan, South Korea and Taiwan for metreleptin. |

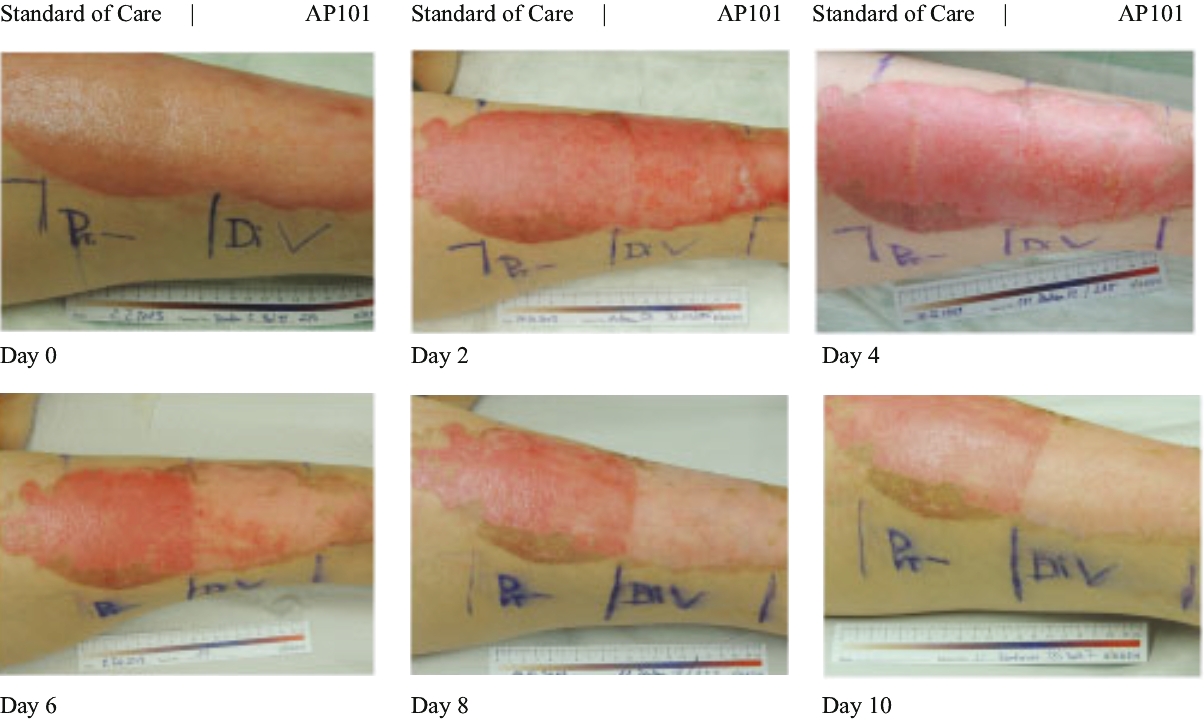

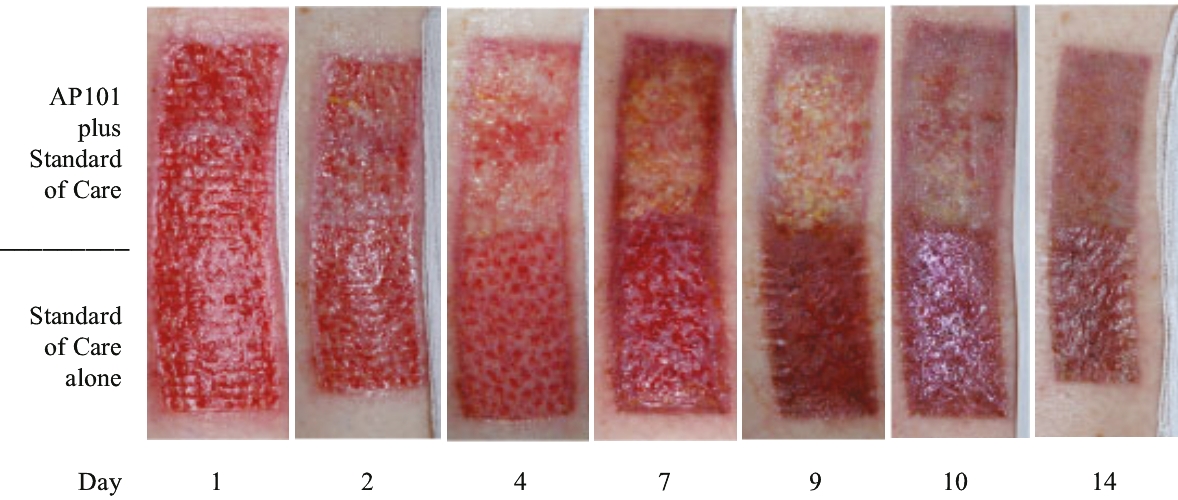

| • | Late-stage clinical program in severe EB. We are conducting a global pivotal Phase 3 trial of AP101 for the treatment of cutaneous manifestations of severe EB and we expect to report data in the second half of 2020. This Phase 3 trial is the largest EB study conducted to date. Based on our conversations with the FDA and the EMA, we believe that positive results from this trial would allow us to apply for marketing approval for AP101 in both the United States and Europe. |

| • | Existing, scalable global commercial and medical infrastructure. We sell lomitapide and metreleptin in the Americas, Europe and the Middle East through our existing rare disease commercial infrastructure. Our commercial expertise includes market access, marketing, sales managers and sales representatives and is supported by our experienced medical affairs team with medical science liaisons, patient advocates and dieticians in the field. We also leverage our network of third-party distributors in other key markets throughout the world. We believe we will be able to leverage our existing global infrastructure and expertise to efficiently and expeditiously commercialize additional products we may acquire or develop, including our lead product candidate, AP101, if approved. |

| • | Proven track record of building a diversified rare disease product portfolio. We acquired AP101 through the acquisition of Birken AG in 2016, in-licensed LOJUXTA in December 2016, in-licensed our gene therapy platform, including AP103, in March 2018 and acquired metreleptin and the remaining rights to lomitapide through the Acquisition in September 2019. |

| • | Strong patent protection and regulatory exclusivity. We believe our intellectual property portfolio as well as protection afforded by regulatory exclusivity provide us with a substantial competitive advantage in marketing our current products and also protect our development programs. Our lomitapide patent portfolio includes patents that provide protection from 2025 to 2027 in the United States and into 2025 in the European Union, with supplementary protection granted to extend patent protection in major EU countries into 2028. The metreleptin patent portfolio includes patents that provide protection from 2022 to 2027 in the United States and into 2022 in the European Union and orphan exclusivity in the European Union into 2028. The AP101 patent portfolio includes patents that provide protection in both the United States and the European Union into 2025 and 2030 and a further international patent application directed to the clinical formulation and methods of manufacturing and treatment with AP101 which, if granted, would provide worldwide protection into 2039. We have also submitted additional patent applications to further strengthen our intellectual property portfolio. |

| • | Experienced management team comprised of industry leaders in rare diseases. Our management team has extensive expertise in the acquisition, development and commercialization of rare disease assets. We believe that the breadth of experience and successful track record of our management team and our Board, combined with our broad network of established relationships with leaders in the industry and medical community, provide us with strong drug development and commercialization capabilities. |

| • | Drive revenue growth for our existing commercial products. We intend to continue to focus on growing the sales of lomitapide and metreleptin in the markets and indications we currently sell them. We also intend to expand the market opportunity by seeking approval for the use of lomitapide to treat pediatric HoFH and for the treatment of FCS and for the use of metreleptin to treat PL in the United States. |

| • | Complete development and commercialize our lead product candidate, AP101, for the treatment of severe EB. AP101 is currently in a pivotal Phase 3 trial for the treatment of cutaneous manifestations of severe EB and we expect to report data in the second half of 2020. If the trial is successful, we intend to apply for approval of AP101 and commercialize it in the United States and the European Union. If approved by the FDA, we are eligible to apply for a PRV that we can use, sell or transfer. |

| • | Leverage our global commercial and medical infrastructure. We intend to leverage our existing global infrastructure and expertise to commercialize our development-stage pipeline, including our lead product candidate, AP101, if approved, and any rare disease assets we may acquire or in-license in the future. |

| • | Continue developing our gene therapy product candidate, AP103, for the treatment of RDEB. AP103 is currently in preclinical development for the treatment of RDEB. We intend to initiate clinical development in the second half of 2021. |

| • | Continue evaluating opportunities to expand our rare disease product portfolio and pipeline. We believe we are well positioned to continue to opportunistically acquire or in-license rare disease assets that we believe we can efficiently sell through our existing commercial infrastructure. |

| • | As a result of the Acquisition, our future results are likely to differ materially from our historical performance. |

| • | We may not be successful in our efforts to build a pipeline of product candidates and develop additional marketable products. |

| • | We have significant payment obligations under the terms of our long-term debt, $206.6 million of which was outstanding as of December 31, 2019. |

| • | The terms of our debt and any requirements to incur further indebtedness or refinance our indebtedness in the future, including restrictive covenants in certain of the agreements and instruments governing our indebtedness, could have a material adverse effect on our business and results of operations. |

| • | We may be subject to ongoing financial liabilities and other obligations that we assumed upon Aegerion’s emergence from bankruptcy. |

| • | Adverse events involving any of our products and product candidates may lead the FDA, the EMA or other regulatory authorities to delay or deny clearance for our products or result in product recalls that could harm our reputation, business and financial results. |

| • | The Acquisition exposes us, and any future acquisitions we make may expose us, to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or technologies. |

| • | Our products may not gain market acceptance, in which case we may not be able to generate product revenues. |

| • | If we are unable to complete clinical development of AP101, or experience significant delays in doing so, our business could be materially harmed. |

| • | We rely on third parties for distribution services around the world, and a failure to manage these third parties could harm our business. |

| • | It may be challenging or costly for us to obtain, maintain, enforce and defend our intellectual property rights. |

| • | The outbreak of the novel strain of coronavirus disease, COVID-19, could adversely impact our business, including our preclinical studies and clinical trials. |

| • | the option to present only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus; |

| • | not being required to have our registered independent public accounting firm attest to management’s assessment of our internal control over financial reporting; |

| • | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (“PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| • | not being required to submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes;” and |

| • | not being required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

| • | the rules under the Exchange Act requiring domestic filers to issue financial statements prepared under U.S. GAAP; |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specific information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

| • | up to 48,343,750 ordinary shares that may be issued upon conversion of the $125 million aggregate principal amount of our 5% senior unsecured convertible notes (“Convertible Notes”); |

| • | ordinary shares that may be issued in full satisfaction of the contingent value rights (“CVRs”) issued to holders of ordinary shares and employee option holders prior to the Acquisition, assuming all relevant milestones are achieved; |

| • | up to 17,154,554 ordinary shares issuable upon the exercise of share options with a weighted average exercise price of £1.1721 per share; |

| • | warrants to purchase 345,542 ordinary shares at a strike price of £1.44 per share; |

| • | 4,864,656 ordinary shares held as treasury shares; and |

| • | options to purchase an aggregate of 1,320,000 ordinary shares that we intend to grant to our non-executive directors immediately after the effectiveness of the registration statement of which this prospectus forms a part. |

| • | no conversion of the Convertible Notes; and |

| • | no exercise of the warrants, CVRs or options. |

| • | Summary consolidated statements of comprehensive loss of Amryt for the years ended December 31, 2018 and 2019 and a summary consolidated statement of financial position of Amryt as of December 31, 2019, which have been derived from our audited consolidated financial statements included elsewhere in this prospectus. |

| • | Summary condensed consolidated statements of comprehensive loss of Amryt for the three-month periods ended March 31, 2020 and 2019 and a summary condensed consolidated statement of financial position of Amryt as of March 31, 2019, which have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. |

| • | Summary consolidated statements of comprehensive loss of Aegerion for the years ended December 31, 2017 and 2018, which have been derived from Aegerion’s audited consolidated financial statements included elsewhere in this prospectus. Aegerion’s audited consolidated financial statements have been prepared in accordance with U.S. GAAP. |

| • | Summary consolidated statements of comprehensive loss of Aegerion for the six months ended June 30, 2019 and a summary consolidated statement of financial position of Aegerion as of June 30, 2019, which have been derived from Aegerion’s unaudited interim consolidated financial statements included elsewhere in this prospectus. Aegerion’s unaudited interim consolidated financial statements have been prepared in accordance with U.S. GAAP. The accounting principles applied in Aegerion’s unaudited interim financial statements are consistent with those used in Aegerion’s annual audited financial statements. In the opinion of management, the unaudited financial data reflects all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial information in those statements. |

| | | Three Months Ended March 31, | | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | |

| | | (unaudited) | | | | | ||||||

| | | (In thousands, except per share data) | ||||||||||

Statement of comprehensive loss data: | | | | | | | | | ||||

Revenue | | | $44,574 | | | 4,542 | | | $58,124 | | | $17,095 |

Cost of sales | | | (32,620) | | | (1,830) | | | (42,001) | | | (6,266) |

Gross Profit | | | 11,954 | | | 2,712 | | | 16,123 | | | 10,829 |

Total administrative, selling and marketing expenses | | | (19,151) | | | (3,987) | | | (36,339) | | | (18,163) |

Research and development expenses | | | (8,934) | | | (1,505) | | | (15,827) | | | (10,703) |

Impairment charge | | | — | | | — | | | (4,670) | | | — |

Restructuring and acquisition costs | | | (853) | | | — | | | (13,038) | | | — |

Operating loss before finance expense | | | (16,984) | | | (2,780) | | | (53,751) | | | (18,037) |

Non-cash change in fair value of contingent consideration | | | (2,906) | | | (1,938) | | | (6,740) | | | (10,566) |

Non-cash contingent value rights finance expense | | | (1,448) | | | — | | | (1,511) | | | — |

Net finance expense — other | | | (9,416) | | | (661) | | | (4,759) | | | (1,841) |

Loss on ordinary activities before taxation | | | (30,754) | | | (5,379) | | | (66,761) | | | (30,444) |

Tax credit/(charge) on loss on ordinary activities | | | 1,857 | | | (6) | | | 1,226 | | | (43) |

Loss for the period/year attributable to the equity holders of the Company | | | (28,897) | | | (5,385) | | | (65,535) | | | (30,487) |

Exchange translation differences which may be reclassified through profit or loss | | | (13) | | | 80 | | | 781 | | | (77) |

Total other comprehensive (loss) / income | | | (13) | | | 80 | | | 781 | | | (77) |

Total comprehensive loss for the period/year attributable to the equity holders of the Company | | | $(28,910) | | | (5,305) | | | $(64,754) | | | $(30,564) |

Loss per share - basic and diluted | | | $(0.19) | | | (0.12) | | | $(0.86) | | | $(0.67) |

Selected Other Data (unaudited): | | | | | | | | | ||||

Adjusted EBITDA(1) | | | $5,358 | | | (2,598) | | | $(12,180) | | | $(16,849) |

| (1) | In addition to analyzing our operating results on an IFRS basis, management also reviews our results on an “Adjusted EBITDA” basis. Adjusted EBITDA is defined as net loss before income taxes, non-cash change in fair value of contingent consideration, non-cash contingent value rights finance expense, net finance expense – other, amortization expense, depreciation expense, share-based payments, impairment charges, and restructuring and acquisition costs related to the acquisition of Aegerion. Adjusted EBITDA is not a measure of performance in accordance with IFRS and should not be considered as an alternative to net income/loss or operating cash flows determined in accordance with IFRS. We believe that the inclusion of Adjusted EBITDA in this prospectus is appropriate to provide additional information to investors because securities analysts, investors and other interested parties use this non-IFRS measure to assess our operating performance across periods on a consistent basis and to evaluate the relative risk of an investment in our securities. However, Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under IFRS. Some of these limitations are: |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated or amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; |

| • | Adjusted EBITDA does not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments; |

| • | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and |

| • | Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our significant amount of indebtedness. |

| | | Three Months Ended March 31, | | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | |

| | | (unaudited) | | | ||||||||

| | | (In thousands) | ||||||||||

Loss for the year attributable to the equity holders of the Company | | | $(28,897) | | | $(5,385) | | | $(65,535) | | | $(30,487) |

Income taxes | | | (1,857) | | | 6 | | | (1,226) | | | 43 |

Non-cash change in fair value of contingent consideration | | | 2,906 | | | 1,938 | | | 6,740 | | | 10,566 |

Non-cash contingent value rights finance expense | | | 1,448 | | | 3 | | | 1,511 | | | — |

Net finance expense - other | | | 9,416 | | | 661 | | | 4,759 | | | 1,841 |

Amortization of inventory fair value step-up | | | 9,503 | | | — | | | 10,367 | | | — |

Amortization expense - other | | | 11,160 | | | 13 | | | 11,957 | | | 50 |

Depreciation expense | | | 81 | | | 78 | | | 698 | | | 317 |

Share-based payments(a) | | | 745 | | | 91 | | | 841 | | | 821 |

Impairment charge | | | — | | | — | | | 4,670 | | | — |

Restructuring and acquisition costs | | | 853 | | | — | | | 13,038 | | | — |

Adjusted EBITDA | | | $5,358 | | | $(2,598) | | | $(12,180) | | | $(16,849) |

| (a) | This is a non-cash item that represents share-based compensation expense. |

| | | As of March 31, 2020 | | | As of December 31, 2019 | |

| | | (unaudited) | | | ||

| | | (In thousands) | ||||

Statement of financial position data: | | | | | ||

Cash and cash equivalents | | | $68,067 | | | $67,229 |

Trade and other receivables | | | 41,179 | | | 36,387 |

Inventories | | | 33,904 | | | 43,623 |

Working capital(1) | | | 31,443 | | | 47,025 |

Total assets | | | 518,229 | | | 534,347 |

Secured Credit Facility | | | 82,989 | | | 81,610 |

Convertible Notes, net of equity component | | | 97,872 | | | 96,856 |

Total liabilities | | | 417,072 | | | 405,025 |

Accumulated deficit | | | 162,569 | | | 133,674 |

Total equity | | | 101,157 | | | 129,322 |

| (1) | We define working capital as current assets less current liabilities. |

| | | Six Months Ended June 30, 2019 | | | Year Ended December 31, | ||||

| | | 2018 | | | 2017 | ||||

| | | (In thousands) | |||||||

Statement of comprehensive loss data: | | | | | | | |||

Net revenues | | | $95,857 | | | $130,432 | | | $138,438 |

Cost of product sales | | | 35,364 | | | 59,697 | | | 77,220 |

Operating expenses: | | | | | | | |||

Selling, general and administrative | | | 43,424 | | | 64,437 | | | 77,793 |

Research and development | | | 13,946 | | | 38,064 | | | 44,895 |

Restructuring charges | | | — | | | 2,171 | | | 121 |

Related party expense (income), net | | | 397 | | | 942 | | | (177) |

Total operating expenses | | | 57,767 | | | 105,614 | | | 122,632 |

Income (loss) from operations | | | 2,726 | | | (34,879) | | | (61,414) |

Reorganization items, net | | | (2,145) | | | — | | | — |

Interest expense, net | | | (29,681) | | | (50,746) | | | (39,467) |

Interest expense due to Novelion | | | (1,182) | | | (2,987) | | | (1,089) |

Loss on extinguishment of debt | | | — | | | (4,333) | | | –– |

Other expense, net | | | (224) | | | (1,888) | | | (836) |

Loss before provision for income taxes | | | (30,506) | | | (94,833) | | | (102,806) |

Provision for income taxes | | | (369) | | | (1,705) | | | (594) |

Net loss | | | $(30,875) | | | $(96,538) | | | $(103,400) |

| | | As of June 30, 2019 | |

| | | (In thousands) | |

Statement of financial position data: | | | |

Cash and cash equivalents | | | $36,080 |

Trade and other receivables | | | 26,408 |

Inventories | | | 51,792 |

Total assets | | | 322,634 |

Total current liabilities | | | 67,434 |

Provision for legal settlements - non-current | | | 11,962 |

Other non-current liabilities | | | 1,444 |

Total liabilities not subject to compromise | | | 80,840 |

Liabilities subject to compromise | | | 420,651 |

Total liabilities | | | 501,491 |

Total equity | | | (178,857) |

| (1) | Debtor in possession as of June 30, 2019 but not as of December 31, 2017 and 2018. |

| • | the ability to continue to maintain and grow market acceptance for lomitapide and metreleptin among healthcare professionals and patients in the United States, European Union and other key markets for the treatment of approved indications; |

| • | continuing market demand and medical need for these products; |

| • | maintaining regulatory approvals without onerous restrictions or limitations in key markets and securing regulatory approvals in additional markets on a timely basis and with commercially feasible labels, and pricing and reimbursement approvals at adequate levels, where required, on a timely basis; |

| • | side effects or other safety issues associated with the use of lomitapide and metreleptin could require us or our collaborators to modify or halt commercialization of these products or expose us to product liability lawsuits which will harm our business; |

| • | we may be required by regulatory agencies to conduct additional studies regarding the safety and efficacy of lomitapide and metreleptin, which we have not planned or anticipated; |

| • | generating revenues in markets that allow for sales of pharmaceutical products without regulatory approval based solely on the approvals of such products in the United States or European Union, and in which no promotion or commercialization activities are permitted; and |

| • | adequately investing in the manufacturing, sales, marketing, market access, medical affairs and other functions that are supportive of our commercialization efforts. |

| • | make it more difficult for us to pay or refinance debts as they become due; |

| • | require us to use a larger portion of cash flow for debt service, reducing funds available for other purposes; |

| • | limit our ability to pursue business opportunities, such as potential acquisitions, and to react to changes in market or industry conditions; |

| • | reduce the funds available for other purposes, such as implementing our strategy, funding capital expenditures and making distributions to shareholders; |

| • | increase our vulnerability to adverse economic, industry or competitive developments; |

| • | affect our ability to obtain additional financing, particularly as substantially all of our assets (including our intellectual property) are subject to liens securing indebtedness under our Secured Credit Facility; |

| • | decrease our profitability, if we become profitable, or cash flow, or require us to dispose of significant assets in order to satisfy debts and other obligations if we are not able to satisfy these obligations using cash from operations or other sources; and |

| • | disadvantage us compared to competitors. |

| • | decreased demand or coverage for our products; |

| • | impairment of our business reputation and exposure to adverse publicity; |

| • | warnings on product labels; |

| • | withdrawal of clinical trial participants; |

| • | substantial monetary awards to trial participants or patients; |

| • | significant time and costs to defend the related litigation; |

| • | distraction of management’s attention from our primary business; |

| • | substantial monetary awards to patients or other claimants; |

| • | loss of revenues; and |

| • | the inability to successfully commercialize our products. |

| • | unsuccessful and/or untimely completion of preclinical and clinical development of our product candidates and any other future candidates, as well as the associated costs, including any unforeseen costs we may incur as a result of preclinical study or clinical trial delays; |

| • | delays or difficulties in initiating, enrolling, conducting or completing our planned and ongoing clinical trials; |

| • | risk that participants enrolled in our clinical trials will acquire COVID-19 while the clinical trial is ongoing, which could impact the results of the clinical trial, including by increasing the number of observed adverse events; |

| • | existing patients with serious diseases included in our clinical trials may die as a result of contracting COVID-19 or suffer other adverse medical events for reasons that may not be related to our products or candidates; |

| • | delays or difficulties in clinical site initiation, including difficulties in recruiting clinical site investigators and clinical site staff; |

| • | healthcare budgets may be adversely affected and as a result, funding may not be available to pay for our products; |

| • | diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials; |

| • | interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel imposed or recommended by federal, state or local governments, employers and others or interruption of clinical trial subject visits and study procedures (such as pre-planned clinical trial assessments), which may impact the integrity of subject data and clinical study endpoints; |

| • | limitations in employee resources that would otherwise be focused on the conduct of our preclinical studies and clinical trials, including because of sickness of employees or their families or the desire of employees to avoid contact with large groups of people; |

| • | interruption or delays in the operations of the FDA or other regulatory authorities, which may impact review and approval timelines; |

| • | delays in receiving approval from local regulatory authorities to initiate our planned clinical trials; |

| • | delays in clinical sites receiving the supplies and materials needed to conduct our clinical trials due to staffing shortages, production slowdowns or stoppages and disruptions in delivery systems; |

| • | suspension or termination of a clinical trial by us, by the Institutional Review Boards (“IRBs”) of the institutions in which such trial is being conducted, by a DSMB for such trial or by the FDA, the EMA or comparable foreign regulatory authorities due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA, the EMA or comparable foreign regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects; |

| • | refusal of the FDA to accept data from clinical trials in affected geographies outside the United States; |

| • | changes in local regulations as part of a response to the COVID-19 pandemic which may require us to change the ways in which our clinical trials are conducted, which may result in unexpected costs, or to discontinue the clinical trials altogether; |

| • | delays in necessary interactions with local regulators, ethics committees and other important agencies and contractors due to limitations in employee resources or forced furlough of government employees; |

| • | impairment of our operations, including among others, employee mobility and productivity, availability of facilities, conduct of clinical trials, manufacturing and supply capacity, disruption of our supply chain, availability of shipping and distribution channels, restrictions on import and export regulations and the availability and productivity of third party service suppliers; |

| • | incurrence of delays in the delivery of our products or our inability to deliver products to our patients; |

| • | interruption in global shipping that may affect the transport of clinical trial materials, such as investigational drug product used in our clinical trials; and |

| • | disruption and volatility in the global capital markets, which increases the cost of capital and adversely impacts access to capital should we have specific strategic considerations which require it. |

| • | limited support and user knowledge for legacy systems of acquired companies; |

| • | problems maintaining uniform procedures, controls and policies with respect to our financial accounting systems; |

| • | difficulties in managing geographically dispersed operations, including risks associated with entering foreign markets in which we have no or limited prior experience; |

| • | underperformance of any acquired technology, product or business relative to our expectations and the price we paid; |

| • | negative near-term impacts on financial results after an acquisition, including acquisition-related earnings charges; |

| • | the potential loss of key employees, customers and strategic partners of acquired companies; |

| • | claims by terminated employees and shareholders of acquired companies or other third parties related to the transaction; |

| • | the assumption or incurrence of additional debt obligations or expenses, or use of substantial portions of our cash; |

| • | the issuance of equity securities to finance or as consideration for any acquisitions that dilute the ownership of our shareholders; |

| • | any collaboration, strategic alliance and licensing arrangement may require us to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us; |

| • | risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing products or product candidates and regulatory approvals; |

| • | diversion of management’s attention and company resources from existing operations of the business; |

| • | inconsistencies in standards, controls, procedures and policies; |

| • | the impairment of intangible assets as a result of technological advancements, or worse-than-expected performance of acquired companies; |

| • | assumption of, or exposure to, historical liabilities of the acquired business, including unknown contingent or similar liabilities that are difficult to identify or accurately quantify; |

| • | our inability to generate revenue from acquired technology or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs; and |

| • | risks associated with acquiring intellectual property, including potential disputes regarding acquired companies’ intellectual property. |

| • | whether clinicians and potential patients perceive product candidates to have better efficacy, safety, tolerability profile and ease of use, when compared with the products marketed by our competitors and the prevailing standard of care (“SOC”); |

| • | the timing and location of market introduction of any approved products; |

| • | our ability to provide acceptable evidence of safety and efficacy; |

| • | the frequency and severity and causal relationships of any side effects and a continued acceptable safety profile following approval; |

| • | relative convenience and ease of administration; |

| • | cost effectiveness; |

| • | patient diagnostics and screening infrastructure in each market; |

| • | marketing and distribution support; |

| • | the availability of healthcare coverage, reimbursement and adequate payment from health maintenance organizations and other third-party payers, both public and private; and |

| • | competition from other therapies. |

| • | we may experience a negative impact on market acceptance and increased dropout rates; |

| • | regulatory authorities may suspend, withdraw or alter their approval of the relevant product; |

| • | regulatory authorities may require the addition of labeling statements, such as warnings or contraindications or distribution and use restrictions such as, for example, the modifications to the JUXTAPID label to include language instructing patients to cease therapy upon the occurrence of severe diarrhea; |

| • | regulatory authorities may issue, or require us to issue additional specific communications such as safety alerts, field alerts, or “Dear Doctor” letters to healthcare professionals; |

| • | regulatory authorities may require us to recall, withdraw, or stop selling a product or take other enforcement action; |

| • | we may receive negative publicity; |

| • | we may be required to change the way the relevant product is administered, conduct additional preclinical studies or clinical trials or restrict the distribution or use of the relevant product; |

| • | patients could suffer harm, and we could be sued and held liable for harm caused to patients; |

| • | the regulatory authorities may require us to amend the relevant REMS program, Risk Management Plan or comparable equivalent; and |

| • | our reputation may suffer. |

| • | increasing drug rebates under state Medicaid programs for brand name prescription drugs and extending those rebates to Medicaid managed care; and |

| • | requiring drug manufacturers to provide a 50% discount on Medicare Part D brand name prescription drugs sold to Medicare beneficiaries whose prescription drug costs cause the beneficiaries to be subject to the Medicare Part D coverage cap (i.e., the so-called donut hole). |

| • | the EMA, the FDA or any other comparable regulatory agency may disagree with the design or implementation of clinical trials or interpretation of data from non-clinical trials or clinical trials; |

| • | the population studied in the clinical program may not be sufficiently broad or representative to ensure that the clinical data can be relied on safely in the full population for which we are seeking approval; |

| • | the data collected from clinical trials of our product candidates may not be sufficient to support a finding that has statistically significant clinical meaningfulness or support the submission of a new drug application or other submission, or to obtain regulatory approval in relevant jurisdictions, such as the European Union and the United States; |

| • | we may be unable to demonstrate to the EMA, the FDA or any other comparable regulatory agency that a product candidate’s risk-benefit ratio for its proposed indication is acceptable; |

| • | the EMA, the FDA or any other comparable regulatory agency may fail to approve the manufacturing processes, test procedures and specifications or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; and |

| • | the approval policies or regulations of the EMA, the FDA or any other comparable regulatory agency may significantly change in a manner rendering clinical data insufficient for approval. |

| • | product, composition of matter, formulation and method of use patents in the European Union, the United States and other key global markets for existing and future products; |

| • | Orphan Drug exclusivity granted to our products because they aim to treat rare diseases and conditions, which entitle us to exclusivity protections for a period of up to seven years after approval in the United States (although metreleptin should also qualify for a 12-year period of exclusivity from biosimilar or interchangeable products) and up to ten years in the European Union and Japan as well as certain financial incentives. The ten-year Orphan Drug exclusivity period in the European Union can be extended a further two years upon successful completion of a PIP. Conversely, the ten-year exclusivity period may be reduced to six years, if at the end of the fifth year, it is established that a product no longer fulfills the criteria for Orphan Drug Designation; |

| • | medicinal products granted a marketing authorization in the European Union entitles us to eight years’ data exclusivity after approval, and up to ten years’ market exclusivity protection which can be extended for a further year if a new indication is granted; and |

| • | available extensions to the terms of our Orphan Drug exclusivity, product and methods of use patents in the European Union and United States. |

| • | put one or more of our patents at risk of being invalidated, rendered unenforceable or interpreted narrowly; |

| • | adversely impact the patentability of our inventions relating to our products; |

| • | result in monetary damages, injunctive relief or otherwise harm our competitive position, including by limiting marketing and selling activities, increasing the risk for generic competition, limiting development and commercialization activities or requiring us to obtain licenses to use the relevant technology (which licenses may not be available on commercially reasonable terms, if at all); and |

| • | otherwise negatively impact the enforceability, validity or scope of protection offered by the patents relating to the products. |

| • | incur substantial monetary damages; |

| • | encounter significant delays in expanding the market of our products; and |

| • | be precluded from manufacturing or selling any products; |

| • | we will be able to successfully develop or commercialize our product before some or all of the relevant patents or regulatory exclusivity expire, or in countries where we do not have patent protection or exclusivity; |

| • | we or our licensors were the first to make the inventions covered by each of the pending patent applications and patents; |

| • | we or our licensors were the first to file patent applications for these inventions; |

| • | others will not independently develop similar or alternative technologies or duplicate any of our technologies; |

| • | any of our pending patent applications or those that we have licensed will result in issued patents; |

| • | any of our patents or those we have licensed will be valid or enforceable; |

| • | we will be able to license the patents or pending patent applications necessary or desirable to enforce or protect our patent rights on commercially reasonable terms or at all; |

| • | any patents issued to us or our licensors or collaborators will provide a basis for any additional commercially viable products, will provide us with any competitive advantages or will not be challenged by third parties; |

| • | we will be able to develop additional proprietary technologies that are patentable; |

| • | Orphan Drug exclusivity marketing rights for our products in the United States will be maintained, if, for example, the FDA determines in the future that the request for Orphan Drug Designation was materially defective or if the manufacturer is unable to assure sufficient quantity of the drug to meet the needs of patients with the rare disease or condition. In addition, the FDA, and the EMA for the European Union, may subsequently approve products with the same active moiety for the same condition if the FDA or the EMA concludes that the later drug is safer, more effective, or makes a major contribution to patient care. Orphan Drug Designation neither shortens the development time nor regulatory review time of a drug nor gives the drug any advantage in the regulatory review or approval process; or |

| • | the patents of others will not have an adverse effect on our business. |

| • | actual or anticipated variations in our financial condition and operating results; |

| • | actual or anticipated changes in our growth rate relative to our competitors; |

| • | announcements of technological partnerships, innovations or new products by us or our competitors; |

| • | the success of competitive products or technologies; |

| • | changes in management and members of our Board; |

| • | changes in financial estimates or recommendations by securities analysts; |

| • | changes in the trading volume of our ADSs on the Nasdaq and of our ordinary shares on AIM and EGE; |

| • | sales of our ADSs or ordinary shares by executive officers or future holders of our equity securities; |

| • | announcements or expectations of additional debt or equity financing efforts; |

| • | unanticipated losses or gains due to unexpected events, including events related to the success of our clinical trials or regulatory approvals; |

| • | significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving us or our competitors; |

| • | changes in our accounting policies or practices; |

| • | disputes or other developments related to proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our technologies; |

| • | failure to integrate successfully the Aegerion business with ours or to realize anticipated benefits from the integration; |

| • | changes in government regulations, including any changes that may affect pricing or reimbursement; and |

| • | conditions in the financial markets or changes in general economic conditions. |

| • | only being required to present two years of audited financials and related discussion in Management’s Discussion & Analysis; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| • | not being required to comply with any requirement that may be adopted by the PCAOB regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

| • | the last day of the fiscal year during which we have total annual gross revenues of $1.07 billion (as such amount is indexed for inflation every five years by the SEC) or more; |

| • | the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; |

| • | the date on which we are deemed to be a “large accelerated filer,” as defined in Rule 12b-2 of the Exchange Act, which would occur if the market value of our ordinary shares and ADSs that are held by non-affiliates exceeds $700 million as of the last day of our most recently completed second fiscal quarter; and |

| • | the last day of the fiscal year following the fifth anniversary of the completion of our first sale of common equity securities pursuant to this registration statement under the Securities Act, or December 31, 2025. |

| • | We do not intend to follow Nasdaq Rule 5620(c) regarding quorum requirements applicable to meetings of shareholders. Such quorum requirements are not required under English law. In accordance with generally accepted business practice, our Articles of Association provide alternative quorum requirements that are generally applicable to meetings of shareholders. |

| • | We do not intend to follow Nasdaq Rule 5605(b)(2), which requires that independent directors regularly meet in an executive session, where only independent directors are present. The independent directors may choose to meet in an executive session at their discretion. |

| • | at least 75% of its gross income is “passive income,” or |

| • | at least 50% of the value, determined on the basis of a quarterly average, of its gross assets is attributable to assets that produce or are held for the production of “passive income.” |

| • | As an ADS holder, we will not treat you as one of our shareholders and you will not be able to exercise shareholder rights, except through the depositary as permitted by the deposit agreement. |

| • | Distributions on the ordinary shares represented by your ADSs will be paid to the depositary, and before the depositary makes a distribution to you on behalf of your ADSs, any withholding taxes that must be paid will be deducted. Additionally, if the exchange rate fluctuates during a time when the depositary cannot convert the foreign currency, you may lose some or all of the value of the distribution. |

| • | We and the depositary may amend or terminate the deposit agreement without the ADS holders’ consent in a manner that could prejudice ADS holders. |

| • | our significant operating losses since our inception and ability to obtain and maintain profitability in the future; |

| • | our commercial products, including statements regarding the expected strategies and profitability thereof; |

| • | our product candidates, including statements regarding the expected initiation, timing, progress and availability of data from clinical trials, all of which may be adversely impacted by the rapidly evolving COVID-19 global pandemic; |

| • | our ability to successfully commercialize, or enter into strategic relationships with third parties to commercialize, our products or product candidates, if approved; |

| • | our ability to acquire or in-license new product candidates; |

| • | our competition, most of whom have far greater resources than we have, which may make it more difficult for us to achieve significant market penetration; |

| • | the size of our addressable markets and market trends; |

| • | potential strategic relationships; |

| • | our ability to obtain and maintain intellectual property rights; |

| • | the impact of potential fluctuations in foreign currency exchange rates; |

| • | estimates regarding expenses, future revenues, capital requirements and the need for additional financing; and |

| • | risks associated with the COVID-19 pandemic, which may adversely impact our business, preclinical studies and clinical trials. |

| | | As of March 31, 2020 | |

| | | (in thousands) | |

Cash and cash equivalents | | | $68,067 |

Long-term debt | | | |

Secured Credit Facility | | | $82,989 |

Convertible Notes, principal amount | | | 125,000 |

Total long-term debt | | | 207,989 |

Equity: | | | |

Share capital | | | 11,918 |

Share premium | | | 2,422 |

Other reserves | | | 249,386 |

Accumulated deficit | | | (162,569) |

Total equity | | | 101,157 |

Total capitalization | | | $309,146 |

| • | Selected consolidated statements of comprehensive loss of Amryt for the years ended December 31, 2018 and 2019 and a selected consolidated statement of financial position of Amryt as of December 31, 2019, which have been derived from our audited consolidated financial statements included elsewhere in this prospectus. |

| • | Selected condensed consolidated statements of comprehensive loss of Amryt for the three-month periods ended March 31, 2020 and 2019 and a selected condensed consolidated statement of financial position of Amryt as of March 31, 2019, which have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. |

| • | Selected consolidated statements of comprehensive loss of Aegerion for the years ended December 31, 2017 and 2018, which have been derived from Aegerion’s audited consolidated financial statements included elsewhere in this prospectus. Aegerion’s audited consolidated financial statements have been prepared in accordance with U.S. GAAP. |

| • | Selected consolidated statements of comprehensive loss of Aegerion for the six months ended June 30, 2019 and a selected consolidated statement of financial position of Aegerion as of June 30, 2019, which have been derived from Aegerion’s unaudited interim consolidated financial statements included elsewhere in this prospectus. Aegerion’s unaudited interim consolidated financial statements have been prepared in accordance with U.S. GAAP. The accounting principles applied in Aegerion’s unaudited interim financial statements are consistent with those used in Aegerion’s annual audited financial statements. In the opinion of management, the unaudited data reflects all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial information in those statements. |

| | | Three Months Ended March 31 | | | Year Ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | |

| | | (unaudited) | | | | | ||||||

| | | (In thousands, except per share data) | ||||||||||

Statement of comprehensive income/(loss) data: | | | | | | | | | ||||

Revenue | | | $44,574 | | | 4,542 | | | $58,124 | | | $17,095 |

Cost of sales | | | (32,620) | | | (1,830) | | | (42,001) | | | (6,266) |

Gross profit | | | 11,954 | | | 2,712 | | | 16,123 | | | 10,829 |

Total administrative, selling and marketing expenses | | | (19,151) | | | (3,987) | | | (36,339) | | | (18,163) |

Research and development expenses | | | (8,934) | | | (1,505) | | | (15,827) | | | (10,703) |

Impairment charge | | | — | | | — | | | (4,670) | | | — |

Restructuring and acquisition costs | | | (853) | | | — | | | (13,038) | | | — |

Operating loss before finance expense | | | (16,984) | | | (2,780) | | | $(53,751) | | | $(18,037) |

Non-cash change in fair value of contingent consideration | | | (2,906) | | | (1,938) | | | (6,740) | | | (10,566) |

Non-cash contingent value rights finance expense | | | (1,448) | | | — | | | (1,511) | | | — |

Net finance expense — other | | | (9,416) | | | (661) | | | (4,759) | | | (1,841) |

Loss on ordinary activities before taxation | | | (30,754) | | | (5,379) | | | $(66,761) | | | $(30,444) |

Tax credit/(charge) on loss on ordinary activities | | | 1,857 | | | (6) | | | 1,226 | | | (43) |

Loss for the period/year attributable to the equity holders | | | (28,897) | | | (5,385) | | | (65,535) | | | (30,487) |

Total other comprehensive (loss)/income | | | (13) | | | 80 | | | 781 | | | (77) |

Total comprehensive loss for the period/year attributable to the equity holders | | | $(28,910) | | | (5,305) | | | $(64,754) | | | $(30,564) |

Loss per share — basic and diluted | | | $(0.19) | | | (0.12) | | | $(0.86) | | | $(0.67) |

| | | As of March 31, 2020 | | | As of December 31, 2019 | |

| | | (unaudited) | | | ||

| | | (In thousands) | ||||

Statement of financial position data: | | | | | ||

Cash and cash equivalents | | | $68,067 | | | $67,229 |

Trade and other receivables | | | 41,179 | | | 36,387 |

Inventories | | | 33,904 | | | 43,623 |

Working capital(1) | | | 31,443 | | | 47,025 |

Total assets | | | 518,229 | | | 534,347 |

Secured Credit Facility | | | 82,989 | | | 81,610 |

Convertible Notes, net of equity component | | | 97,872 | | | 96,856 |

Total liabilities | | | 417,072 | | | 405,025 |

Accumulated deficit | | | 162,569 | | | 133,674 |

Total equity | | | 101,157 | | | 129,322 |

| (1) | We define working capital as current assets less current liabilities. |

| | | Six Months Ended June 30, 2019 | | | Year Ended December 31, | ||||

| | | 2018 | | | 2017 | ||||

| | | (In thousands) | |||||||

Statement of comprehensive loss data: | | | | | | | |||

Net revenues | | | $95,857 | | | $130,432 | | | $138,438 |

Cost of product sales | | | 35,364 | | | 59,697 | | | 77,220 |

Operating expenses: | | | | | | | |||

Selling, general and administrative | | | 43,424 | | | 64,437 | | | 77,793 |

Research and development | | | 13,946 | | | 38,064 | | | 44,895 |

Restructuring charges | | | — | | | 2,171 | | | 121 |

Related party expense (income), net | | | 397 | | | 942 | | | (177) |

Total operating expenses | | | 57,767 | | | 105,614 | | | 122,632 |

Loss from operations | | | 2,726 | | | (34,879) | | | (61,414) |

Reorganization items, net | | | (2,145) | | | — | | | — |

Interest expense, net | | | (29,681) | | | (50,746) | | | (39,467) |

Interest expense due to Novelion | | | (1,182) | | | (2,987) | | | (1,089) |

Loss on extinguishment of debt | | | — | | | (4,333) | | | — |

Other expense, net | | | (224) | | | (1,888) | | | (836) |

Loss before provision for income taxes | | | (30,506) | | | (94,833) | | | (102,806) |

Provision for income taxes | | | (369) | | | (1,705) | | | (594) |

Net loss | | | $(30,875) | | | $(96,538) | | | $(103,400) |

| | | As of June 30, 2019 | |

| | | (In thousands) | |

Statement of financial position data: | | | |

Cash and cash equivalents | | | $36,080 |

Trade and other receivables | | | 26,408 |

Inventories | | | 51,792 |

Total assets | | | 322,634 |

Total current liabilities | | | 67,434 |

Provision for legal settlements - non-current | | | 11,962 |

Other non-current liabilities | | | 1,444 |

Total liabilities not subject to compromise | | | 80,840 |

Liabilities subject to compromise | | | 420,651 |

Total liabilities | | | 501,491 |

Total equity | | | (178,857) |

| (1) | Debtor in possession as of June 30, 2019 but not as of December 31, 2017 and 2018. |

| • | Prior to consummation of the Acquisition, we conducted a private placement of ordinary shares to certain accredited investors, which generated gross proceeds of approximately $8 million. Proceeds from this issuance were used primarily to pay for transaction costs incurred in connection with the Acquisition. |

| • | Prior to consummation of the Acquisition, we also issued the CVRs to holders of ordinary shares and to employee option holders entitling them to proceeds of up to $85 million upon the occurrence of specified milestones related to the regulatory approval and commercialization of AP101. |

| • | On September 24, 2019, we completed a $60 million fundraising by way of the issue of (i) new ordinary shares at a price of $1.79 per ordinary share, and (ii) zero cost warrants to new and existing investors, and certain creditors of Aegerion. Proceeds from this issuance were used to fund development of our product pipeline and potential new indications for our late stage product candidates and for general corporate purposes. |

| • | On September 24, 2019, Aegerion issued $125 million in aggregate principal amount of the Convertible Notes, to certain of its pre-bankruptcy creditors. The Convertible Notes were issued in satisfaction of the creditors’ claims against Aegerion pursuant to Section 1145 of the Bankruptcy Code. |

| • | On September 24, 2019, we entered into a new five-year $81 million first-lien Secured Credit Facility guaranteed by certain of our subsidiaries and bearing an interest rate of (x) 11% per annum paid in cash, or (y) 6.5% per annum paid in cash plus 6.5% per annum paid in kind, in each case, on a quarterly basis. |

| | | Amryt consolidated loss for the year ended December 31, 2019 | | | Aegerion consolidated loss for the period to June 30, 2019 | | | Aegerion consolidated profit for the period from July 1 to September 24, 2019 | | | Adjustments | | | Notes | | | Pro forma consolidated loss for the year ended December 31, 2019 | |

| | | IFRS | | | U.S. GAAP | | | U.S. GAAP | | | | | IFRS | |||||

| | | (In thousands, except per share data) | ||||||||||||||||

Net revenues | | | $58,124 | | | $67,362 | | | $33,742 | | | $(2,463) | | | 3a | | | $156,765 |

Upfront license fee | | | — | | | 28,495 | | | — | | | — | | | | | 28,495 | |

Total Revenues | | | 58,124 | | | 95,857 | | | 33,742 | | | (2,463) | | | | | 185,260 | |

Cost of product sales | | | (19,803) | | | (22,209) | | | (11,127) | | | 2,463 | | | 3a | | | (50,676) |

Amortization of acquired intangibles | | | (11,831) | | | (12,548) | | | (5,856) | | | (9,772) | | | 3b | | | (40,007) |

Amortization of inventory fair value step-up | | | (10,367) | | | (607) | | | (1,359) | | | — | | | | | (12,333) | |

Total cost of sales | | | (42,001) | | | (35,364) | | | (18,342) | | | (7,309) | | | | | (103,016) | |

Gross profit | | | 16,123 | | | 60,493 | | | 15,400 | | | (9,772) | | | | | 82,244 | |

Selling, general and administrative expenses | | | (35,498) | | | (45,607) | | | (29,244) | | | 50,172 | | | 3c | | | (60,177) |

Research and development expenses | | | (15,827) | | | (13,676) | | | (8,628) | | | 5 | | | | | (38,126) | |

Restructuring and acquisition costs | | | (13,038) | | | — | | | — | | | 13,038 | | | 3d | | | — |

Shared based payment expense | | | (841) | | | (703) | | | 20 | | | (704) | | | 3e | | | (2,228) |

Impairment of intangible assets | | | (4,670) | | | — | | | — | | | — | | | | | (4,670) | |

Operating (loss)/profit before finance expense | | | (53,751) | | | 507 | | | (22,452) | | | 52,739 | | | | | (22,957) | |

Net finance (expense)/income | | | (4,759) | | | (31,012) | | | 77,281 | | | (60,382) | | | 3f | | | (18,872) |

Non-cash change in fair value of contingent consideration | | | (6,740) | | | — | | | — | | | — | | | | | (6,740) | |

Non-cash contingent value rights finance expense | | | (1,511) | | | — | | | — | | | (3,860) | | | 3g | | | (5,371) |

(Loss)/profit on ordinary activities before taxation | | | (66,761) | | | (30,505) | | | 54,829 | | | (11,503) | | | | | (53,940) | |

Tax credit/(charge) on ordinary activities | | | 1,226 | | | (369) | | | 26 | | | — | | | | | 883 | |

(Loss)/profit for the year attributable to the equity holder of the company | | | $(65,535) | | | $ (30,874) | | | $54,855 | | | $(11,503) | | | | | $(53,057) | |

Loss per share – basic and diluted, attributable to ordinary equity holders of the parent (US$) | | | $(0.86) | | | — | | | — | | | — | | | | | $(0.34) | |

Weighted average number of ordinary shares in issue | | | 75,871,562 | | | — | | | — | | | — | | | | | 154,498,887 | |

| 1. | Basis of preparation |

| 2. | Accounting policy conformity change |

| 3. | Pro forma adjustments |

| a) | Adjustment to eliminate inter-company transactions between Amryt and Aegerion. Revenues have been reduced to reflect the royalty income of $2.4 million recognized by Aegerion prior to the Acquisition, and cost of product sales has been reduced by the same amount to reflect the cost in Amryt’s historical financial statements. |

| b) | Adjustment to amortization of acquired intangibles of $9.8 million consists of: |

| i) | amortization expense in the historical financial statements of Aegerion converted to IFRS, resulting in a reduction in amortization expense of $0.6 million; |

| ii) | elimination of the historical amortization expense on the Aegerion intangible assets acquired by Amryt, including the IFRS adjustment above, of $18.4 million; and |

| iii) | recognition of a revised amortization expense of $28.2 million, based on the fair value of intangible assets acquired. Amortization is calculated on a straight-line basis. |

| c) | Adjustment to selling, general and administrative expenses of $50.2 million consists of: |

| i) | the elimination of Aegerion non-recurring restructuring, acquisition, severance and bankruptcy expenses, totalling $50.4 million. These costs were incurred by Aegerion prior to the Acquisition and are excluded on the basis that they are not expected to have a continuing impact on our combined results following the Acquisition; and |

| ii) | additional selling, general and administrative expenses of $0.2 million arising from reclassification of $0.7 million of expenses and $0.5 million of income from finance expenses to selling, general and administrative expenses. |

| d) | Adjustment to restructuring and acquisition expenses to eliminate Amryt’s non-recurring restructuring and acquisition expenses. These expenses are excluded on the basis that they are not expected to have a continuing impact on our combined results following the Acquisition. |

| e) | Increase in share based payment expenses of $0.7 million to reflect the increase in Aegerion’s share based payment expenses under IFRS 2. |

| f) | Adjustment made for the following: |

| i) | elimination of finance charges, unamortized debt discounts and debt issuance costs totalling $39.4 million and gains on the extinguishment of debt of $86.2 million, recognized by Aegerion in its historical financial statements; |

| ii) | elimination of finance charges of $2.8 million relating to the EIB loan facility held by Amryt which was fully repaid in connection with the Acquisition; |

| iii) | inclusion of interest expenses of $8.1 million relating to the new Secured Credit Facility and $7.6 million relating to the Convertible Notes, assuming that these liabilities were incurred on January 1, 2019; |

| iv) | reclassification of $0.5 million included in interest income in the historical financial statements of Aegerion to selling, general and administrative expenses; and |

| v) | additional net finance charges of $0.1 million to reflect $0.8 million booked as an IFRS adjustment for amortization of Aegerion’s debt issuance costs, partially offset by a reclassification of $0.7 million to selling, general and administrative expenses relating to interest expense on prepetition claims and interest on liability settlements in Aegerion’s historical financial statements. |

| g) | Adjustment for non-cash financing expenses, assuming that the CVRs were issued on January 1, 2019. |

| 4. | Exclusion from Pro Forma Adjustments |

| • | lomitapide, an approved treatment in the United States and the European Union for adult patients with HoFH; |

| • | metreleptin, an approved treatment in the United States for GL and in the European Union for GL and PL; |

| • | AP101, our lead development asset, which is currently in a pivotal Phase 3 trial as a potential treatment for severe EB (if AP101 is approved for this indication, we intend to market it under the name FILSUVEZ); |

| • | AP103, our first product candidate utilizing our novel polymer-based topical gene therapy delivery platform, which is in preclinical development as a potential treatment for patients with EB and other topical indications; and |

| • | Imlan, a range of derma-cosmetic products marketed solely in Germany as a treatment for sensitive, allergy-prone and dry skin. |

| • | Prior to consummation of the Acquisition, we conducted a private placement of ordinary shares to certain accredited investors, which generated gross proceeds of approximately $8 million. Proceeds from this issuance were used primarily to pay for transaction costs incurred in connection with the Acquisition. |

| • | Prior to consummation of the Acquisition, we also issued the CVRs to holders of ordinary shares and to employee option holders entitling them to proceeds of up to $85 million upon the occurrence of specified milestones related to the regulatory approval and commercialization of AP101. |

| • | On September 24, 2019, we completed a $60 million fundraising by way of the issue of (i) new ordinary shares at a price of $1.79 per ordinary share, and (ii) zero cost warrants to new and existing investors, and certain creditors of Aegerion. Proceeds from this issuance are being used to fund development of our product pipeline and potential new indications for our late stage product candidates and for general corporate purposes. |

| • | On September 24, 2019, we issued $125 million in aggregate principal amount of the Convertible Notes, to certain of Aegerion’s pre-bankruptcy creditors. The Convertible Notes were issued in satisfaction of the creditors’ claims against Aegerion pursuant to Section 1145 of the Bankruptcy Code. |

| • | On September 24, 2019, we entered into a five-year $81 million Secured Credit Facility, guaranteed by certain of our subsidiaries and bearing an interest rate of (x) 11% per annum paid in cash, or (y) 6.5% per annum paid in cash plus 6.5% per annum paid in kind, in each case, on a quarterly basis. |

| | | Three months ended March 31, | ||||

Statement of comprehensive loss data: | | | 2020 | | | 2019 |

| | | (Unaudited) | ||||

| | | (In thousands, except per share data) | ||||

Revenue | | | $44,574 | | | $4,542 |

Cost of sales | | | (32,620) | | | (1,830) |

Gross profit | | | 11,954 | | | 2,712 |

Research and development expenses | | | (8,934) | | | (1,505) |

Selling, general and administrative expenses | | | (18,406) | | | (3,896) |

Acquisition and severance related costs | | | (853) | | | — |

Share based payment expenses | | | (745) | | | (91) |

Operating loss before finance expense | | | (16,984) | | | (2,780) |

Non-cash change in fair value of contingent consideration | | | (2,906) | | | (1,938) |

Non-cash contingent value rights finance expense | | | (1,448) | | | — |

Net finance expense — other | | | (9,416) | | | (661) |

Loss on ordinary activities before taxation | | | (30,754) | | | (5,379) |

Tax credit / (charge) on loss on ordinary activities | | | 1,857 | | | (6) |

Loss for the period attributable to the equity holders of the Company | | | (28,897) | | | (5,385) |

Exchange translation differences which may be reclassified through profit or loss | | | (13) | | | 80 |

Total other comprehensive (loss)/income | | | (13) | | | 80 |

Total comprehensive loss for the period attributable to the equity holders of the Company | | | $(28,910) | | | $(5,305) |

Loss per share – basic and diluted, attributable to ordinary equity holders of the parent | | | $(0.19) | | | $(0.12) |

| | | Three months March 31, | | | Increase / (Decrease) | |||||||

Revenues: | | | 2020 | | | 2019 | | |||||

| | | Unaudited | | | Unaudited | | | | | |||

| | | $000 | | | $000 | | | % | ||||

Metreleptin | | | $26,927 | | | $— | | | $26,927 | | | 100% |

Lomitapide | | | 17,421 | | | 4,419 | | | 13,002 | | | 294.2% |

Other | | | 26 | | | 123 | | | 103 | | | 83.7% |

Total revenues | | | $44,574 | | | $4,542 | | | $40,032 | | | 881.4% |

| • | maintain existing patients on therapy; |

| • | continue to build market acceptance for metreleptin in the United States; |

| • | build market acceptance in the European Union following the approval by the EMA in July 2018, and continue to obtain pricing and reimbursement approvals in key markets in the European Union; |

| • | secure regulatory approval from the FDA for the treatment of PL in the United States; and |

| • | obtain regulatory approvals for metreleptin in new markets for the treatment of GL and PL based on the data package which secured approval in Europe. |

| • | maintain existing patients on therapy; |

| • | continue to build market acceptance for lomitapide in existing markets; |

| • | continue to support patient access programs in all territories; |

| • | obtain pricing and reimbursement approvals in new markets in the European Union; and |

| • | secure regulatory approval for lomitapide in Brazil and other key markets. |

| | | Three months ended March 31, | | | Increase / (Decrease) | |||||||

Cost of Sales: | | | 2020 | | | 2019 | | | | | ||

| | | Unaudited | | | | | ||||||

| | | $000 | | | $000 | | | % | ||||

Cost of product sales | | | $6,247 | | | $1,053 | | | $5,194 | | | 493.3% |

Amortization of acquired intangibles | | | 11,092 | | | — | | | 11,092 | | | 100% |

Amortization of inventory fair value step-up | | | 9,503 | | | — | | | 9,503 | | | 100% |

Royalty expenses | | | 5,778 | | | 777 | | | 5,001 | | | 643.6% |

Total cost of sales | | | $32,620 | | | $1,830 | | | $30,790 | | | 1682.5% |

| | | Year ended December 31, | ||||

Statement of comprehensive loss data: | | | 2019 | | | 2018 |

| | | (In thousands, except per share data) | ||||

Revenue | | | $58,124 | | | $17,095 |

Cost of sales | | | (42,001) | | | (6,266) |

Gross profit | | | 16,123 | | | 10,829 |

Research and development expenses | | | (15,827) | | | (10,703) |

Selling, general and administrative expenses | | | (35,498) | | | (17,342) |

Restructuring and acquisition costs | | | (13,038) | | | — |

Share based payment expenses | | | (841) | | | (821) |

Impairment charge | | | (4,670) | | | — |

Operating loss before finance expense | | | (53,751) | | | (18,037) |

Non-cash change in fair value of contingent consideration | | | (6,740) | | | (10,566) |

Non-cash contingent value rights finance expense | | | (1,511) | | | — |

Net finance expense — other | | | (4,759) | | | (1,841) |

Loss on ordinary activities before taxation | | | (66,761) | | | (30,444) |

Tax credit/(charge) on ordinary activities | | | 1,226 | | | (43) |

Loss for the year attributable to the equity holders of the Company | | | (65,535) | | | (30,487) |

Total other comprehensive profit/(loss) | | | 781 | | | (77) |

Total comprehensive loss for the year attributable to the equity holders of the Company | | | $(64,754) | | | $(30,564) |

Loss per share – basic and diluted, attributable to ordinary equity holders of the parent | | | $(0.86) | | | $(0.67) |

| | | Year ended December 31, | | | Increase / (Decrease) | |||||||

Revenues: | | | 2019 | | | 2018 | | |||||

| | | $000 | | | $000 | | | % | ||||

Metreleptin | | | $25,088 | | | $— | | | $25,088 | | | 100% |

Lomitapide | | | 32,260 | | | 16,110 | | | 16,150 | | | 100.2% |

Other | | | 776 | | | 985 | | | (209) | | | (21.2%) |

Total revenues | | | $58,124 | | | $17,095 | | | $41,029 | | | 240.0% |

| • | maintain existing patients on therapy; |

| • | continue to build market acceptance for metreleptin in the United States; |

| • | build market acceptance in the European Union following the recent approval by the EMA in July 2018, and continue to obtain pricing and reimbursement approvals in key markets in the European Union; |

| • | secure regulatory approval from the FDA for the treatment of PL in the United States; and |

| • | obtain regulatory approvals for metreleptin in new markets for the treatment of GL and PL based on the data package which secured approval in Europe. |

| • | maintain existing patients on therapy; |

| • | continue to build market acceptance for lomitapide in existing markets; |

| • | continue to support patient access programs in all territories; |

| • | obtain pricing and reimbursement approvals in new markets in the European Union; and |

| • | secure regulatory approval for lomitapide in Brazil and other key markets. |

| | | Year ended December 31, | | | Increase / (Decrease) | |||||||

Cost of Sales: | | | 2019 | | | 2018 | | |||||

| | | $000 | | | $000 | | | % | ||||

Cost of product sales | | | $11,384 | | | $3,588 | | | $7,796 | | | 217.3% |

Amortization of acquired intangibles | | | 11,831 | | | — | | | 11,831 | | | 100.0% |

Amortization of inventory fair value step-up | | | 10,367 | | | — | | | 10,367 | | | 100.0% |

Royalty expenses | | | 8,419 | | | 2,678 | | | 5,741 | | | 214.3% |

Total cost of sales | | | $42,001 | | | $6,266 | | | $35,735 | | | 570.3% |

| | | Six Months Ended June 30, | | | $ Increase / (Decrease) | ||||

| | | 2019 | | | 2018 | | |||

| | | (in thousands) | |||||||

Net revenues | | | $95,857 | | | $59,388 | | | $36,469 |

Cost of product sales | | | 35,364 | | | 29,208 | | | 6,156 |

Operating expenses: | | | | | | | |||

Selling, general and administrative | | | 43,424 | | | 38,568 | | | 4,856 |

Research and development | | | 13,946 | | | 21,113 | | | (7,167) |

Related party expense, net | | | 397 | | | 617 | | | (220) |

Total operating expenses | | | 57,767 | | | 60,298 | | | (2,531) |

Income (loss) from operations | | | 2,726 | | | (30,118) | | | (32,844) |

Reorganization items, net | | | (2,145) | | | — | | | 2,145 |

Interest expense, net | | | (29,681) | | | (22,628) | | | 7,053 |

Interest expense due to Novelion | | | (1,182) | | | (1,406) | | | (224) |

Other expense, net | | | (224) | | | (1,054) | | | (830) |

Loss before provision for income taxes | | | (30,506) | | | (55,206) | | | (24,700) |

Provision for income taxes | | | (369) | | | (1,205) | | | (836) |

Net loss | | | $(30,875) | | | $(56,411) | | | $(25,536) |

| | | Six Months Ended June 30, | | | Increase / (Decrease) | ||||

Revenues: | | | 2019 | | | 2018 | | ||

| | | (in thousands) | |||||||

Metreleptin | | | $38,915 | | | $29,751 | | | $9,164 |

Lomitapide | | | 56,942 | | | 29,637 | | | 27,305 |

Total net revenues | | | $95,857 | | | $59,388 | | | $36,469 |

| | | Year ended December 31, | | | $ Increase / (Decrease) | ||||

| | | 2018 | | | 2017 | | |||

| | | (in thousands) | |||||||

Net revenues | | | $130,432 | | | $138,438 | | | $(8,006) |

Cost of sale | | | 59,697 | | | 77,220 | | | (17,523) |

Operating expenses: | | | | | | | |||

Selling, general and administrative expenses | | | 64,437 | | | 77,793 | | | (13,356) |

Research and development expenses | | | 38,064 | | | 44,895 | | | (6,831) |

Restructuring charges | | | 2,171 | | | 121 | | | 2,050 |

Related party expenses (income), net | | | 942 | | | (177) | | | 1,119 |

Total operating expenses | | | 105,614 | | | 122,632 | | | (17,018) |

Loss from operations | | | (34,879) | | | (61,414) | | | (26,535) |

Interest expense, net | | | (50,746) | | | (39,467) | | | 11,279 |

Interest expense due to Novelion | | | (2,987) | | | (1,089) | | | 1,898 |

Loss on extinguishment of debt | | | (4,333) | | | — | | | 4,333 |

Other expense, net | | | (1,888) | | | (836) | | | 1,052 |

Loss before provision for income taxes | | | (94,833) | | | (102,806) | | | (7,973) |

Provision for income taxes | | | (1,705) | | | (594) | | | 1,111 |

Net loss | | | $(96,538) | | | $(103,400) | | | $(6,862) |

| | | Year ended December 31, | | | $ Increase / (Decrease) | ||||

| | | 2018 | | | 2017 | | |||

| | | (in thousands) | |||||||

Metreleptin | | | $71,360 | | | $66,308 | | | $5,052 |

Lomitapide | | | 59,072 | | | 72,130 | | | (13,058) |

Total net revenues | | | $130,432 | | | $138,438 | | | $(8,006) |

| | | Three months ended March 31, | | | Year ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | |

| | | Unaudited | | | Unaudited | | | | | |||

| | | (in thousands) | ||||||||||

Net cash flow from / (used in) operating activities | | | $6,187 | | | $(5,441) | | | $(37,497) | | | $(15,454) |

Net cash used in investing activities | | | (13) | | | (4) | | | 24,425 | | | (229) |

Net cash (used in) / flow from financing activities | | | (1,506) | | | 5,675 | | | 65,942 | | | 3,265 |

Exchange and other movements | | | (3,830) | | | (74) | | | 3,133 | | | (767) |

Net change in cash and cash equivalents | | | $838 | | | $156 | | | $56,003 | | | $(13,185) |

| | | Payments due by period | |||||||||||||

(in thousands) | | | Less than 1 year | | | 1 to 3 years | | | 3 to 5 years | | | More than 5 years | | | Total |

Principal debt obligations | | | $11,957 | | | $24,796 | | | $136,927 | | | $128,125 | | | $301,805 |

Operating leases obligations | | | 969 | | | 916 | | | 143 | | | 20 | | | 2,048 |