25. Commitments and contingencies

Contingent consideration and contingent value rights

See Note 6, Business combinations and asset acquisitions, in relation to contingent consideration and contingent value rights as a result of the acquisition of Amryt GmbH and Aegerion.

License Agreements

In connection with metreleptin, the Group has license agreements for the exclusive license and patents for the use of metreleptin to develop, manufacture and commercialize a preparation containing metreleptin. Under the license agreements the Group is required to make royalty payments on net sales on a country-by-country basis. During the year ended December 31, 2019, following the Aegerion acquisition on September 24, 2019, the Group made aggregate royalty payments of US$5,104,000 (2018: US$nil).

The Group holds a license agreement for the exclusive, worldwide license of certain know-how and a range of patent rights applicable to lomitapide. The Group is obligated to use commercially reasonable efforts to develop, commercialize, market and sell at least one product covered by the licensed patent right, such as lomitapide. Additionally, the Group is required to make royalty payments on net sales of products. During the year ended December 31, 2019, following the Aegerion acquisition on September 24, 2019, the Group recorded aggregate royalty expenses to third parties of US$803,000 (2018: US$nil).

Prior to the Aegerion acquisition, Amryt had the exclusive right to sell LOJUXTA across the licensed territories pursuant to a license agreement with Aegerion. During the year ended December 31, 2019, Amryt recorded aggregate royalty expenses to Aegerion of US$2,512,000 (2018: US$2,678,000).

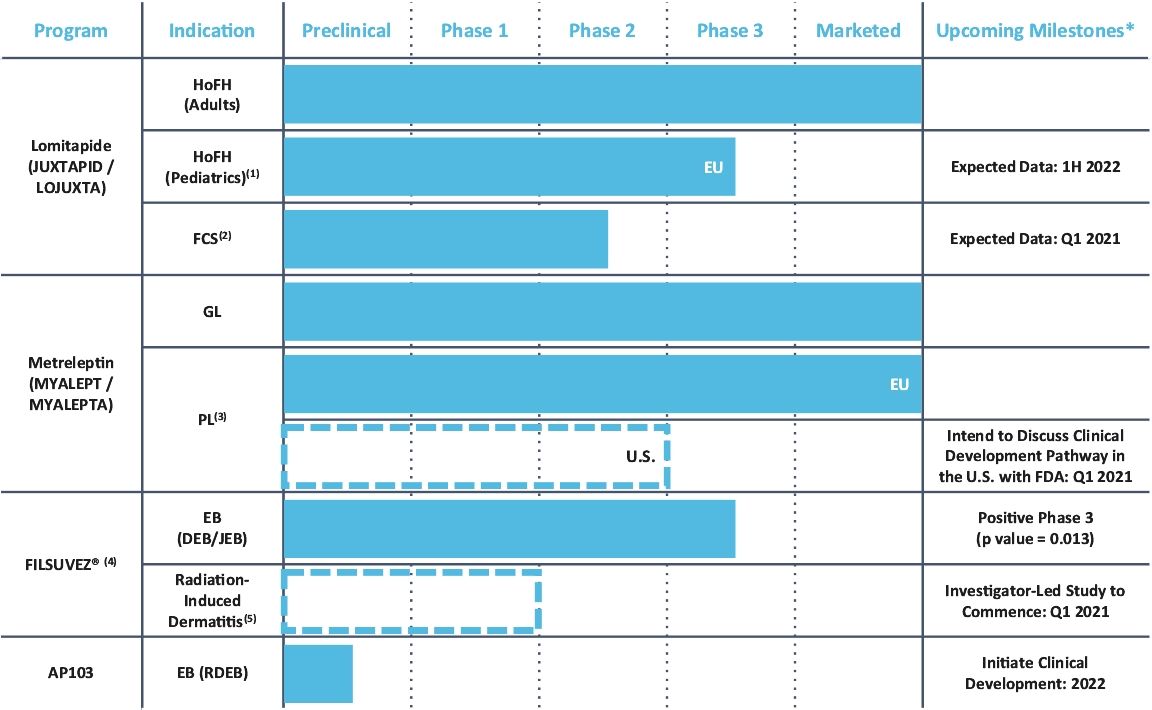

The Group entered into a license agreement for the exclusive, worldwide license to the patent rights for a novel polymer-based topical gene therapy delivery platform for potential use in the treatment of rare genetic diseases. The first product candidate utilizing this platform, AP103, is currently in preclinical development for the treatment of recessive dystrophic EB, a subset of severe EB. Under the license agreement Amryt is required to pay milestone payments and, upon the sale of product, royalty payments on net sales of products.

The Group entered into a license agreement for the non-exclusive, worldwide license to the patent rights for the design and development of gene coded therapy vectors and methods for making such vectors, in order for Amryt to develop and commercialize its genetic encoded therapies relating to AP103. Under this agreement Amryt is required to make milestone payments and royalty payments on net sales of products.

Legal matters

Prior to the acquisition of Aegerion by Amryt, Aegerion entered into settlement agreements with governmental entities including the Department of Justice (“DOJ”) and the FDA in connection with JUXTAPID investigations. The settlement agreements require Aegerion to pay specified fines and engage in regulatory compliance efforts. Subsequent to the acquisition, Aegerion made US$3,387,000 of settlement payments, including interest, and the total amount of the settlements that remains due as a current liability and a non-current liability is $15,547,000 and $3,910,000, respectively, as of December 31, 2019.

Other legal matters

The Group recognizes a liability for legal contingencies when it believes that it is both probable that a liability has been incurred and that it can reasonably estimate the amount of the loss. The Group reviews these accruals and adjusts them to reflect ongoing negotiations, settlements, rulings, advice of legal counsel and other relevant information. To the extent new information is obtained and the Group’s views on the probable outcomes of claims, suits, assessments, investigations or legal proceedings change, changes in the Group’s liability accrual would be recorded in the period in which such determination is made. At December 31, 2019 the Group had recognized liabilities of US$7,500,000 in relation to ongoing legal matters.

Lease commitments

The Group had no finance lease commitments in 2019 (2018: nil). In February 2020, the Group entered an 8-year term lease for its U.S. operational office, located in Boston, Massachusetts. The lease will commence in April 2020, and the aggregate lease payment amounts over the lease term is approximately US$2,400,000.